In relationship to GDP, the balance sheet will continue to shrink until some magic unknown point is reached.

The Fed has a new plan for what to do with its balance sheet and today announced several major components of it:

- Begin tapering the “runoff” of Treasury securities in May.

- End the runoff of Treasury securities on September 30.

- Continue shedding mortgage-backed securities (MBS) at the current maximum of $20 billion a month, essentially until they’re gone.

- After September, reinvest MBS principal payments into Treasury securities.

- Chair Jerome Powell said during the press conference that the balance sheet will by then be “a bit above $3.5 trillion.”

- The balance sheet will remain at this level even as the economy grows, thus slowly shrinking in relationship to GDP.

- The Fed may sell MBS outright to speed up the process of getting rid of them.

- No decision has been made on the delicate issue of the maturity composition of the balance sheet – which would require buying short-term bills for the first time in years to replace longer-term notes and bonds.

The stated balance-sheet doctrine now is that the Fed wants to have sufficient reserves (money that banks deposit at the Fed) to conduct monetary policy efficiently. The interest it pays the banks on those reserves is one of its major tools to manage short-term interest rates.

Treasury securities.

Currently the amount of Treasury securities allowed to roll off the balance sheet is capped at $30 billion a month. This cap will shrink to $15 billion a month in May.

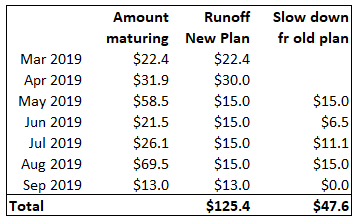

Only Treasuries that mature in that month can roll off. The table below shows the bonds, notes, TIPS, and Floating Rate Notes (FRN) on the Fed’s balance sheet that are maturing through September. By reducing the cap from $30 billion to $15 billion, the Fed slows the runoff by a total of $48 billion. Instead of shedding $173 billion in Treasuries under the old plan, it will instead shed $125 billion:

Currently, the Fed holds $2.175 trillion in Treasury securities. By the end of September, this will be down to about $2.05 trillion.

But MBS will roll off or be sold until they’re gone.

The Fed will continue to allow MBS (and the small amount of Agency debt it still holds) to roll off at a rate of up to $20 billion a month.

Starting in October, it will still allow MBS to roll off at that rate. But it will reinvest up to $20 billion of principal payments it receives in Treasury securities. In other words, it will gradually replace its MBS with Treasuries, “consistent with the aim of holding primarily Treasury securities in the longer run.”

The maturities of these replacement Treasuries will go across the range, including bills (one year or less), of which it holds none currently.

And a kicker: It may sell some MBS outright: “Limited sales of agency MBS might be warranted in the longer run to reduce or eliminate residual holdings.”

In relationship to GDP, the balance sheet will continue to shrink.

Come end of September, the Fed will likely find that the level of reserves is still higher than “necessary to efficiently and effectively implement monetary policy.” So the plan is to reduce these reserves further, but gradually.

The reserves are liabilities. The other major liability on the balance sheet is currency in circulation (actual paper dollars stuffed into mattresses around the world). Currency in circulation is rising persistently, as a function of demand for dollars through the banking system.

Keeping total liabilities flat, even as one part of liabilities (currency in circulation) increases means that the other major part (reserves) will decrease further. That’s the intent of keeping the balance sheet flat: Slowly whittling down the amount of reserves.

Before the onset of QE, the Fed’s balance sheet rose as a function of currency in circulation and reserves. In relationship to GDP, the growing balance sheet stayed roughly in a range between 4.5% and 6% of GDP. During peak QE at the end of 2014, its assets reached around 25% of GDP, according to Powell at the press conference today; and he expects them to be down to 17% of GDP at the end of September.

As the size of the balance sheet remains flat after September, and as the economy grows, the balance sheet as percent of GDP will shrink further. That’s the plan. During the press conference Powell was asked when this slow shrinkage would go on. And he said, “The truth is, we don’t know.”

Once the reserves drop to this still unknown magic minimum “necessary for efficient and effective policy implementation” – so next year or in 10 years – the Fed will go back to growing its balance sheet in line with the economy, as it had done before the onset of QE.

During the Q&A at the press conference, Chair Powell’s clarified several hot-button issues concerning the balance sheet and monetary policy:

The balance sheet treatment is not related to monetary policy, he said. “We think of the interest-rate tool as the principal tool of monetary policy. And we think of ourselves as returning the balance sheet to a normal level over the course of the next six months. We’re not really thinking of those as two different tools of monetary policy.

He was asked about a “rate cut” by year end. And he said: “The data that we’re seeing are not currently sending a signal which suggests moving in either direction, which is really why we’re being patient. We feel our policy rate is in the range of neutral, the economy is growing at about trend, inflation is close to target, unemployment is under 4%…. It’s a great time for us to be patient, and watch, and wait and see how things evolve.”

Not yet “grappling” with a decision on the maturities: Switching some of its holdings from longer-term notes and bonds to short-term bills could put upward pressure on long-term yields, raise mortgage rates, and steepen the yield curve. In other words, a delicate decision. “We really haven’t begun to have a serious series of discussions over a series of meetings to grapple with that,” he said. “This is the next big decision we’ll face. I don’t think we’re going to be in a rush to resolve it.”

The albatross of $617 billion in bonds that mature in over 10 years hangs around the Fed’s neck. Read… Fed’s QE Unwind Reaches $501 Billion, Balance Sheet Falls Below $4 Trillion. “Autopilot” Engaged

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Today the Fed utterly destroyed whatever tattered shreds of credibility it had left after ten years of Keynesian monetary malpractice. Powell has cravenly capitulated to Wall Street, but in doing so has confirmed the Fed’s panic that the long-deferred financial reckoning day is stalking its Ponzi markets and asset bubbles, and it’s arrival, when extend-and-pretend runs out of road, is going to dwarf the 2008 global financial crisis.

Heckova job, central bankers.

He capitulated to the realty on growth and inflation. Try to deal with facts Gershon instead of emotional opinions. It will help you deal with realty in an adult world.

Next move will be a cut. Said so back in December. 180 degrees in a few months. Not impressed.

On Bloomberg today, a guest claims that the Federal Reserve owns 50% of all Treasury debt with maturities of ten years and longer.

It does own a lot of them: The average maturity of its Treasury holdings is over 8 years. And $617 billion of its Treasuries have maturities of over 10 years.

But there is a little quirk: if you own a 10-year Treasury note that has three years left before it matures, it’s like owning a three-year note. And it trades like a three-year note too. During QE, the Fed bought 10-year notes in the market that had maybe 5 years or 6 years or 4 years left; and when they matured, it replaced them with fresh 10-year notes, and so the average maturity kept ticking up.

The Fed doesn’t own them, they hold them. The taxpayers own them, or the obligations, the Fed is a GSE, as are most of the charter banks. There is no business left in their business. What went on yesterday between Powell’s remarks and the statement should raise some eyebrows.

No, the taxpayer doesn’t own them. The taxpayer OWES them :-]

Treasury securities are a debt owed by the taxpayers to investors.

These investors that own them include the Fed, the Chinese, the Japanese, and US banks.

As taxpayer, I OWE my share of federal debt; and as investor I can own some of this debt in my brokerage account, paying myself the interest, so to speak.

Wolf your page is being hijacked by full screen blocking pop ups that I can’t close and have given up reading several post now. I am near Toronto. The ads involve slot machine games saying I’ve won something.

Can you send me a screenshot? You’re seeing something that is NOT supposed to be there.

It could be on your computer (try to clean the cache of your browser) or it could be some ads gone haywire on my site. If anyone sees this, please take a screenshot and send it to howlatwolfstreet@gmail.com

Small pop-up appearing lower screen for me again, dissappeared for a couple of days, but so far the full-psycho your settings are ours has not been around lately… I don’t own a chainsaw but recommend lock and key to anyone who does.

I’m in the Toronto area and don’t see blocking popups using four different browsers. I allow all ads on your site.

Hope this helps in the analysis.

I get well targeted adds for Seattle area condominiums selling for $1,000,000 to $5,000,000.

I’m thinking I should form a private real estate trust, float several hundred billion in corporate bonds and buy the entire advertised supply. The interest I would pay is apparently dirt cheap and the rents I could collect from stupid Amazon employees sky high. If the whole thing went pear shaped on me I can just walk away and let the trust go bk (ala Donald Trump) heads I win, tails the Fed covers the losses for the bond holders.

So, as I said, Mr Wolf’s adds are well targeted to me – the one percenter living in his van. Now all I have to do is convince the SEC and the investment banks that I’m a true pedigreed one percenter or I wont be able to float the bonds – perhaps it would work better if I change my name to Trump.

Time we all stop taking this whole monetary system seriously, after all the Fed runs it and they are pretty slap-dash reckless. It’s all just electronic credits typed into various accounts – worth something today, worth nothing tomorrow so lighten up everyone.

They should have dumped MBS years ago. Now we will all get to see what they are really worth. I hear that foreclosure rates are rising in a few states, with Florida being number one, interesting timing. They don’t want to be long and they don’t want to be in housing, umm…

They never should have purchased MBS to begin with. Especially at full face value. Biggest reward for irresponsible lending – banks were just too eager to sell those to the Fed. Borrowers on the other hand were on their own. One of the biggest moral hazards of our times.

Well, in the abstract, poorly regulated, private MBSs were the cause of the Great Recession. Having made a decision to take a hands-off approach to regulation, I don’t think the Fed had any other choice than to take that garbage off the hands of the banks at par. And it worked at the cost of some pretty severe moral hazard. The banking system didn’t collapse like it did in the early ’30’s.

Of course, we would all like to see the system cleaned up, but I can’t see how that can given the dynamics of the American political system. Given what it had to work with, I think the Fed did a pretty good job.

I agree Fed was successful in achieving its goal – stop big banks from failing (several hundred small banks did fail in 2008) and to legitimize all future bank bailouts.

It has been a decade and all that Fed could do is stress tests. Passing stress test doesn’t strengthen a bank to withstand a big crisis coming from left field. It only makes the bank’s claim stronger for a bailout (“see, I had passed all the stress tests but still ran out money. Please give me liquidity and free money”).

@GP

“Please give me liquidity and free money”).”

& A Get Out Of Jail Free Card

I wonder how many mortgages the FED has that were signed off by Linda Green. The “paid” par for the same junk that Markit had pegged at 30%-50% of par.

I am quite concerned with the Agency residential MBS issuance which has recently slowed down a lot. If the Fed gets rid of its 1.6 trillion of Agency MBS, then it remains to be seen who will hold the rest of the about 7.3 trillion outstanding agency RMBS? It looks like foreigners will hold them if they care to still offer 30 year mortgages to Americans. Is this an unjustifiable privilege?

Plenty of retirees and pension funds happy to own those federally-guaranteed bonds.

Mr. Richter, I was wondering if you had any particular thoughts regarding the ramifications and consequences long term of the fed moving from a corridor based system that manipulates fed funds to a floor based system using ioer? It doesn’t feel right to me that the fed member banks get risk free yield from excess reserves created out of thin air and hqla for the Liquidity coverage ratio.

I agree with you. The Fed can keep all the bank reserves it wants BUT why pay interest on them? That’s the root of the unfairness which makes AOC look like an angel.

Bank reserves are a liability to the fed but an asset to member banks. But member banks have a matching liability themselves — customer deposits. Therefore member banks need to earn a yield on those monies. If there was no ioer banks would lend that money out and we would have inflation of epic proportions. QE is terrible. Fed is incentivizing increases in budget deficit and essentially allocating credit which is the job of the private sector.

For LSAPs the Fed bought from the open market. These could be securities owned by the primary dealers themselves or the customers of the primary dealers (they acted like agents).

So are you saying that the banks paid for these securities by increasing the deposits of their customers ? And they need to pay them interest? Doubt that is true and definitely not 2.4%

Adam – no, that’s not how it worked back when the Fed had gazillions in Excess Reserves and yet did NOT pay interest on them.

The amount of Excess Reserves is set by a Fed decision on how much to pump into the system. The Fed creates reserve credit by “buying” Treasuries with that credit. The seller of the Treasuries gets the credit. The credit stays somewhere in the banking system because there’s nowhere else it can go, the banks are the sole habitat for dollar credits.

The interest paid on these surplus reserves is purely a handout to the banks, who do nothing to earn it.

How is a customer deposit a liability? I have a bit of a sum in our local Credit Union and deposits are listed at assets at the time of public accounting. They could take a rolling average, yearly average, but deposits are definitely not liabilities. Sure, they can be removed, nevertheless, the willingness to deposit and work with a banking organization is their foundation of existence. I submit it is not just the ability to issue debt.

regards

There seems to be some confusion concerning Adammu’s comment.

“Bank reserves are a liability to the fed but an asset to member banks. But member banks have a matching liability themselves — customer deposits.” This is true. Here’s what a bank balance sheet looks like.

https://positivemoney.org/wp-content/uploads/2012/04/Bank-Run-step-1.jpg

Excess reserves for a given bank are those reserves held by the Fed that are not required to back that bank’s loans. About 10% of total loan value must be backed by cash / cash equivalents including reserves at the Fed.

Without IOER, banks might decide to use their excess reserves to back new loans, at a rate of $10 in loans for every $1 in reserves. So the current $1.5T in excess reserves could theoretically be used to back $15T in new loans.

I have a Fed paper explaining this. I’ll see if I can find the link.

Dale, I saw two flaws in Adammu’s comment.

The first was here: “banks have a matching liability themselves — customer deposits”

When dealing with Excess Reserves, we’re not talking about “customer deposits” like Grandma’s checking account. The deposit in this case comes from some other major entity within the system. The original “deposit” is in fact just the surplus bank credit created by the Fed itself, and handed to the bank in exchange for the Treasuries or MBS that the Fed has on its balance sheet. And there are many other forms of bank liability that are not the deposits of individual customers.

The second flaw was here: “Therefore member banks need to earn a yield on those monies.”

Why should a bank earn interest on money handed to it by the Fed in exchange for an MBS or Treasury? That’s ludicrous. Anyway, there are many deposits within the federal reserve and US banks that pay no interest, and therefore do not need to earn interest.

IOER killed the fed funds overnight lending business. When they stop IOER, overnight lending will kick in to insure adequate bank reserves. Getting out of MBS, agency paper, and IOER, will normalize banking operations at the fed.

Wont happen until QE is fully reversed which maybe never again. Wolf is saying feds plan is to wait for economy to grow into the balance sheet. Sounds great in theory…until we have the next recession and next thing we know the balance sheet is more like $6 trillion. Smh in disgust.

CBs are playing a confidence game.

Works until investors decide not to invest in USD because return is isht.

Then watch the Fed print money.

And watch the rush for hard assets to avoid the inflation tsunami.

Recall inflation can be caused by either increasing money supply against constant economy OR maintaining constant money supply against a shrinking economy.

they’re not getting out of MBS read the fine print

What the IOER does for the banks is this: it gives banks a choice of buying Treasury bills or depositing their excess cash at the Fed. They make the decision based on which way they make more money. They’re either going to make this money lending to the USG or lending to the Fed. So in terms of income to the banks, it’s not a big difference.

Unfortunately this is not solely the banks choice. The primary dealers barely kept more than 250 billion of Treasuries. But since the Fed created reserves out of thin air, Treasuries top 2 trillion. So unless the banks can do similar magic, the amount they are able to hold ain’t that big.

The second reason is for LCR and RLAP, reserves are much better (more efficient) than treasuries as an HQLA.

Iamafan is correct. Treasuries may not have credit risk but have duration and market risk — even if its miniscule. Excess reserves are like transaction accounts for the big banks, except with yields more analgous with a high yield savings account and just as good as treasuries without the risk. This is why the Fed has to manage monetary policy with IOER. If banks had a better risk/reward trade-off, excess reserves would be deployed and there would be a functioning fed funds market.

The fed chooses how much government debt to hold on its books, the effect of doing so is to ultimately redeem the previous private purchase of that debt, so expanding broad money and lowering yields on government debt. Banks do not choose between reserves or treasuries for use of their cash. The order is important as it explains who is driving the market. The use of IOER as policy tool I think must have a ceiling of fed earnings, which would be set by the return on previous purchases of government debt, so would be rear looking. By lowering IOER the fed would be encouraging banks to leverage those reserves as they back lending. So I just see an overall downward momentum in rates/yield policy from this, which probably reflects an already saturated market in debt and a slowing economy that will need eased government spending to add some balance. If they want to reverse this they will return government debt to the open market as yields on it are indicative of the true market rate, which they are now further controlling by transmission mechanisms.

That’s not entirely accurate, Wolf.

Without the IOER, the banks would have to compete with the private markets for Treasuries, which means the interest they earn would be set by the market, based on global demand for dollar assets. No one but member banks has access to IOER, which means that their terms are set only by the Fed. We can talk about lots of the details WRT how IOER subsidies play out (no maturity risks like there would be with treasuries, stable, predictable interest rates, etc.). But suffice it to say, if the private market was willing to offer as good a deal as the IOER program does, then no bank would take part in the IOER. The fact that they’ve bought >$1 tril worth of IOER indicates that they’ve decided (accurately) that the terms offered by the Fed are better than the terms offered by the private market. This is, therefore, by definition, a public subsidy. When we’re talking about $1 tril worth, even a few basis points of subsidy mean a massive amount of free money going to the banks.

Furthermore, the fact that the IOER rate is set *higher* than the overnight fed funds rate essentially guarantees free money. Treasure bills have always paid more than the overnight rate, but again, entailed certain risks (e.g. maturity risk, mark-to-market losses, etc.) that made it not worthwhile for banks to borrow from the overnight market just to re-invest in Treasuries. OTOH, since the IOER program entails no such risks, the excess interest rate it pays is free money beyond the privately-set risk-adjusted rate of return and serves no other purpose than to re-capitalize banks by stealth with public funds.

Furthermore, if the IOER didn’t exist, the banks would be forced to balance the cost of borrowing at the Fed Funds rate vs. seeking customer deposits. This means banks would be incentivized to compete for customer deposits by offering better interest rates (until you get to an interest rate that represents the same risk-adjusted return as borrowing from the Fed). And again, the banks would be forced to seek their required reserves in the private market, this time, providing an interest rate that makes it worthwhile for private customers to deposit their money with them rather than invest or spend it themselves.

With the IOER making the cost of borrowing from the Fed not only zero, but actually a net *positive*, is it any wonder that customer deposits basically earned zero for all these years? What that means is that not only have the banks benefited from direct cash payments from the Fed, but also from a direct transfer from private savers who have been forced to forgo interest since the Fed deliberately underpriced the cost of Federal funds to outbid private savers. While you could argue that the interest paid on Treasuries doesn’t make a difference because it’s paid by the govt anyway (a point I disagreed with above), you can’t deny that the suppression of interest rates is a direct transfer from private savers.

Finally, I’d ask, if it doesn’t make a difference, why continue to do it? This is not interest on *required* reserves. It’s interest on *excess* reserves. By definition, these reserves are not the basis for any lending, and therefore, aren’t doing any good to the general economy. They’re also not [privately-held] treasuries, which means they’re not helping fund the public deficit. So exactly what good is it doing? Why not get rid of it? Indeed, before the financial crisis, excess reserves were almost always at zero, because without interest being paid, there was no reason for banks to accumulate reserves they couldn’t profitably use to lend. The economy managed to do fine, and the Fed managed fine with only setting interest rates.

If the Fed really wants to normalize monetary conditions, the first step it should take is to shut down the absolutely scandalous IOER program. Lower the interest paid, and you’ll see a flood of reserves paid back to the Fed. You could lower the Fed balance sheet by $1tril without actually affecting any part of the private money supply. The only thing it would do is reduce bank profits (last year IOER payments *exceeded* the net profits of the entire financial sector) while forcing them to finally start paying savers for the privilege of using their capital, which, after all, is what capitalism is supposed to be about.

Anyway, Wolf, I strongly disagree that the IOER program doesn’t make a big difference. And regardless, if that’s true, then there should be no problem with getting rid of it. Let’s see if the banks make a hue and cry. That will tell us whether it “makes a big difference” or not…

Lune,

I’ll just respond to one thing you said (3rd para):

“Furthermore, the fact that the IOER rate is set *higher* than the overnight fed funds rate essentially guarantees free money.”

No. The federal funds rate is NOT set by the Fed. The federal funds rate is a market rate. The Fed is trying to manipulate it to keep it within its target range. The most effective tool it has to keep the federal funds rate in its target range (currently 2.25% to 2.50%) is the IOER, which the Fed does set.

The IOER is set by the Fed at 2.40%. The federal funds rate, as a market rate, follows the IOER tightly. Yesterday, the federal funds rate ranged from 2.35% to 2.60%, with the midpoint (“effective federal funds rate”) at 2.41% day-before-yesterday, the EFFR was 2.40%.

The Fed has had trouble last year keeping the federal funds rate within its target range, which kept bumping into and sometimes exceed the top of the Fed’s target range. So the Fed last year raised the IOER rate less than its upper limit of the target range. That’s why the upper limit of the target range is 2.50% and the IOER is 2.4%. During the first part of the rate-hike cycle, the upper limit of the target range and the IOER were the same. The change brought the federal funds rate back down into the target range, but it is still near the upper end of the target range.

Lune,

IOER is not only welfare for the banks but it places a cap on lending. The fed is paying the banks not to lend, not to take on risk. That’s what it means to me.

Another possible reason for the move from MBS to treasuries is that as their percentage of treasuries rises, akin to BOJ, real investors are pushed to more risky bonds. Somebody has to trade in all those BBBs. What better way to force them than to take away all the good collateral.

Wolf-

You’re right. The Fed funds rate is a private rate. But it is essentially controlled by the Fed since they announce the Target and actively buy/sell to maintain the target. It does appear they’re having difficulty as of late in maintaining their expected band, but it is still essentially under their control.

Regardless, the main point I was making was that banks earn a riskless positive rate of return in the arbitrage between the funds rate and the IOER, and this is true. Check out this graph from the St. Louis Fed comparing the IOER vs the federal funds effective rate. The difference has been consistently positive since it started.

https://fred.stlouisfed.org/graph/?g=kfRh

However it does appear to be rapidly approaching zero in the past year. If so, kudos to Powell for effectively ending this program. That said, it used to be that we didn’t pay *any* interest in reserves either excess or required, which means banks had to pay the private cost for their capital needs, just like any other private company. We are a long way to go from that historical norm.

I have been totally unimpressed with the FED’s blurbish nonsense for over 10 years, now. It matters not what they say today because it will always change in the months ahead. The only solution is to abolish the Fed completely. Central banks no longer serve any useful purpose for the economies of their respective countries, they only bailout failing banks plus stock and bond markets at the expense of the common working people.

Indeed. There is too much debt everywhere. The FED has not choice. It has to be dovish. Their signalling and jawboning is nauseating at this point.

The odds (Futures) of a 25bp rate cut within 12 months is now 50/50.

Iamafan I here you but if u look at the large banks who own the primary dealers balance sheets, their securities portfolios didn’t grow very much during QE. If dealer replenishes inventory of securities by also making a purchase in open market to replace security bought by fed, then a deposit was created. M2 would have cratered without QE in my opinion.

Of course, it was the Fed’s balance sheet that grew by just more than 4 trillion. At the same time, take a look at what the NY Fed held for foreigners. It’s off balance sheet and more than tripled to more than 3 trillion.

I don’t think we are debating what happened 10 years ago. We are discussing what is good to do today and in the near future.

To me it looks like the Fed wants trading with collateral it controls. So the huge bank Reserves are now house money. Libor has been replaced by SFOR and Treasuries are the collateral there.

Who knows where this will all end? Will the foreigners play nice?

Effective March 21, 2019, the Federal Open Market Committee directs the Desk to undertake open market operations as necessary to maintain the federal funds rate in a target range of 2-1/4 to 2-1/2 percent, including overnight reverse repurchase operations

Will the Desk sell agency MBS if the monthly cap exceeds monthly principal payments from agency debt and agency MBS?

No.

When monthly principal payments from agency debt and agency MBS fall below the cap, will the Desk conduct any agency MBS purchases?

Yes.

It was very confusing that (*)monetary20190320a1.htm (Implementation Note, IN) contained no mention of tapering, but rather continuing the -30-20B (-UST-MBS) runoff regime. In contrast, (**)monetary20190320c1.pdf (Balance Sheet Normalization Principles and Plan, BSNPP), laid out that -30-20B would be tapered to -15-20B in May, followed by another step down to +20-20B from Sep 30 (the +20-20B is intended to mean that the 20B MBS runoff essentially will be reinvested in UST securities).

Given that the next FOMC meeting is on April/May 30-1, and that a new Implementation Note will then be issued, the apparent disagreement between (*) and (**) above perhaps are not technically incorrect, but it sure was confusing. I looked at (*) first and got the impression that QE-unwind was still on the same old -30B-20B autopilot setting.

What isn’t mentioned or talked about at all it the real news.

Lower highs and lower lows has been replaced by Higher Highs and Higher Lows. Dow 30K, 35K, here we come.

The bubble is in stocks, and Mr Market has commanded Uber Ultra Dove Jerome Powell boot licker Deluxe of Mr Market, to fund it’s forever bubble, and Uber Ultra Boot Licking Deluxe Jerome Powell has obediently Obeyed.

What the MBS machinations mean:

Right now the housing market is in a relatively slow-motion bust. FRB wants to unload as much MBS as possible before the bust accelerates to avalanche speed.

When the big bust happens in earnest, FRB will this time around have their hands full rescuing banks that are overexposed to the corporate debt bubble. They want MBS to be the problem of USG, which in many ways it already is, because USG essentially owns and therefore guarantees the dominant MBS-issuers FannieMae and FreddieMac since the ~2009 conservatorship takeover.

Exactly why FRB deems MBS to be less savory than UST is hard to say, given MBS are mostly guaranteed by USG, but I think this may rather be a way of signaling to the housing market that there is a bubble in housing and that FRB wants to put downward pressure on prices and upward pressure on mortgage interest rates, while maintaining low 10T UST rates.

Shorthand: FRB= Federal Reserve Bank, USG = US Goverment, UST = US Treasury Bonds, MBS = Mortage-Backed Securities.

Re: “why FRB deems MBS to be less savory than UST”

1) FRB is only legally able to purchase US-government guaranteed debt. Treasuries are the only debt that is necessarily government guaranteed.

2) The MBS purchased during the crisis were NOT US-government guaranteed debt at the time – the legal docs said so right on the front page. What Fed did was blatantly illegal. But it was a crisis action. Retrospectively, policymakers deemed it a necessary action and legitimized the crime.

3) Backstopping the mortgage markets is not an essential function of Fed Gov’t. Many think it’d be better to wind down Fannie and Freddie etc. and get FedGov out of the crooked business. Federal Reserve needs to be out of MBS in order to enable that.

4) There are plenty of Treasuries for executing monetary policy. No need to complicate the Fed’s balance sheet with MBS.

“Exactly why FRB deems MBS to be less savory than UST is hard to say,”

The FED brought the MBS initially to stabilize a “Market” in “Free fall”. Buying MBS also became a way to push money into the economy post 2008 as the Banks and other still had the cash they would normally have put into MBS.

Owning MBS is akin to being in the bond and stock market, directly.

Something the FED is not supposed to be directly in.

Hence they want out without causing “Market Disruption”

Let’s be clear.

The policy implications f Powell’s performance today is…interest ratedcuts and more QE.

Low interest and big QE are proven failures at helping the economy these past 10 years, and proven winners at helping the rich get richer at everyone else’s expense.

Cutting interest rates and QE didn’t help in fact hurt the economy these past 10 years.

Cutting them again now will only do the same.

Andy yet, anyone with a brain can see that Powell today and elsewhere earlier, and the Fed, are setting it up to cut rates and expanded QE.

NO ONE at the Fed is talking about QE and rate cuts. But some dreamers on Wall Street are.

However, if the economy goes into a tail spin later this year with real job losses and the like — of which there are no signs yet that it will — a rate cut might be possible. The Fed always cuts rates when the economy goes into a tailspin.

The dot plot suggests one rate hike next year.

QE is off the table unless a crisis happens.

10th year of an expansion and no signs of the economy going into a tailspin.

Now that’s what I call a whopper of a Bull Market. Risk assets rock !!

Good work Wolf. This is a pretty major shift from autopilot. OF course, if GDP stalls, the balance sheet as a % of GDP will increase.

Inflation on a Ford Taurus has been zero over a 22 year period. GDP has been positive for 10 years.

Sure sure sure…

More like QT is off the table. No one at the Fed is mentioning QE, but actions speak louder than (no) words. JP capitulated. It all changed in January and the trend holds.

How is the purchase of UST with left over MBS principal not just a poorly hidden and arbitrary rate cut/QE repeat? There is a lot to say about this.

– It seems the public is marching into the next recession without reliable market indicators. If you cannot trust the yield curve, what can you trust?

– Seems sloppy. If the Fed board perseverate over 25 bp interest rate moves, why are they implementing an arbitrary interest rate change at an arbitrary time point for arbitrary reasons?

– The fed has spoken. Weak dollar lives > diminished consumer purchasing power with continued asset inflation > continued disparities between asset rich and asset poor peoples > continued social upheaval. I am very worried.

“How is the purchase of UST with left over MBS principal not just a poorly hidden and arbitrary rate cut/QE repeat?”

It’s neither a rate cut nor QE. It’s a shift from one asset (MBS) to another (Treasury). Instead of re-investing the principal payment in MBS (as it would do otherwise), the Fed will be investing it in Treasury securities.

The move from MBS to Treasury (prob focusing on the shorter maturity) could it be a move to avoid inverting yield 10y-2y by providing support for the shorter offernings?

At work and living in LA, all i’m hearing is ppl buying or renovating houses in the “up and coming” neighborhoods. From what i’m hearing, and this is very narrow view, its still a sellers market out here with houses flying on multiple offers and mortgage rates can still be found at upper 3%.

What has really changed in the last few years, aside from the boost in treasury yields this past winter, doesn’t seem like much?

I wonder if we’ll ever

√

You are astute and correct and right to be worried.

Bernanke’s tenure at the Fed was like giving a child matches to play with at a gas station, he created an enormous mess and only the very wealthy, who have spent the last decade buying up society’s assets with almost free money, will escape unscathed.

I hear this Bernanke character has been lauded as a “hero” (at least by himself) and is now paid handsomely by a High-Frequency-Trading outfit (Citadel Cap). What value does HFT bring to the economy? Many believe HFT are involved in manipulating price action and skimming profits from investors. Why would a nation allow the former head of its central bank be rewarded with largesse from an HFT outfit – welcome to justice as practiced in today’s world.

Has the term “conflict of interest” lost all meaning? Societies that turn a blind eye to corruption don’t usually fair well, invest accordingly.

The doctor is in. All of these parlor games at the fed are as worthless as tits on a boar hog and will do nothing useful such as help young people form households or lead to pay increases .The banks will get their skim and anything of real market value will be sucked up by the criminals who were the cause of it all a decade ago. The only cure is collapse of the fiat system. If we could have had price discovery and Mark to market a decade ago the carnage would be behind us.Wall street also took all the growth from pensions. In the Great Depression states could not meet pension payments and deflating assets killed property tax collection. We ain’t out of the woods yet,we barely have entered.Neither a lender nor a borrower you be.This mantra saved my family.

Well, OK, the Fed’s balance sheet is 17% of GDP, the ECB’s is over 40% of GDP, and the Bank of Japan’s balance sheet is over 100% of GDP. The US is the cleanest dirty shirt.

Foreign official they doin states laundry at four trillion more also, panda not so grizzly so campers they not even runnin an they thinkin they tame the bear, tst tst.

Don’t hold your breath about that mantra of the cleanest shirt my friend!

Japan is a homogeneous and very resilient society, a trait that doesn’t apply to the EU nor the US.

Germany will drop the EU like hot potato when the going gets tough.

The German people cannot sustain a marked decline to their quality of life in order to support Brussels!

As for “ the cleanest shirt” ! In The Next election you won’t need to worry about ( the Russian hackers ) as the incumbent and opposition will tear the country to shreds i e a ( cold civil war).

It’s unfortunate but it will happen, the like of Trump or Obama’s had their chance and acquiesced to the lowest common denominator of the Farce and theatric that goes by the name of democracy in Washington.

Bernie and the Spanish Chick won’t save your Economy with their Utopian cliché .

That washing machine will need to spin really hard Wolf, really hard.

and we all have to pray that the shirt comes out usable again.

I like the way you dragged the metaphor of the “cleanest dirty shirt” to the next level by proposing a washing machine that spins really hard to get out the dirt…. Pretty funny!

As a light hearted reply, may I say that by applying the basic economic principal of relative value to either clean shirts or dirty shirts I will choose neither as I have no basis to compare until they are both cleaned . The detergent of choice is the despiesed element of the fiat system that Wall Street refers to as a “rock”: GOLD. The doctors prescription is therefore muti-faceted but begins with an initial dose of Basel 3. The patient is comatose,but hope abounds.

Yes, it is the cleanest dirty shirt as far as the FED is portrayed, yet: “Government Debt to GDP in the United States is expected to be 108.00 percent by the end of this quarter, according to Trading Economics global macro models and analysts expectations.”

Canada’s is projected to be 89%

EU is projected to be 81.6%

Debt is debt when the bills are supposed to be paid as far as I’m concerned.

regards

How clean are the shirts in Singapore? No matter, you need a lot of money to pay for those laundry services so most of us are stuck with the dirty shirts from our own households.

“Neither a lender nor a borrower you be.”

“you” is “me”.

Me says: Amen!

For us small-timers, there’s no reason to succumb to WHATEVER happens big-time. But we need to understand it, as best we can, for avoidance purposes.

“Excuse me, while I disappear” – Frank Sinatra

Dr. Doom:

“If we could have had price discovery and Mark to market a decade ago the carnage would be behind us.Wall street also took all the growth from pensions.”

Thank you. That has been my mantra since April 2009 when MtoM was taken off the table. I thought that was a crime of huge proportions against the “commons”. The market began to rise and hasn’t looked back.

Sierra7, along with opiods a quite devastation has been foisted on the people here in Appalachia.

so the Fed totally punts on rate hikes for the year. Boy, thats a ‘good sign’. (not)

So tell me how does whatever data they have get so bad, in less than a few months from December, that they put a hold on something as long term related as Fed interest rates ????

Well, it doesn’t, and it can’t. They dont have that kind of ‘visibility’ from ANY data, so clearly this is all political. Just like it always has been. Trump wanted the dovishness Obama got, and he wants it long before the economy turns south.

Its gonna be hysterical when the yield curve inverts. Trump will crap all over Powell for not acting sooner. (i.e. stopping hikes a year ago)

Mike R, the Treasury yield curve is already inverted out to the 7 year maturities. And as of right now the 10 year yield is only 0.1% above 90-day yield. There was a huge down shift in yields yesterday. Bond market is smelling something.

Maybe the Fed determined interest rates are actually restrictive right now because economic growth is so awful.

Big banks are reporting a 3% net interest margin, which is the difference between loan interest receipts and cost of funds. Assuming cost of funds is 2%, this means the average interest on a bank loan is 5%.

Economic players in a highly leveraged economy won’t take out new loans at 5% when the economy can’t return at least 5% nominal GDP growth. The additional debt would be too difficult to service and would not provide any financial leverage. Note, current nominal GDP growth is currently running at only 4% and may be as low as 2% this quarter. From this standpoint, a 2.5% fed funds rate can be viewed as restrictive.

If I had to bet, I’d say the over-leveraging relative to economic growth will put us into a recession soon. I wouldn’t be surprised to see the Fed drop the rate back down to zero in a few years. Apparently the bond market agrees with me, given the measly 2.5% interest rate we are seeing on the 10-year bond.

The entire problem, of course, is the result of BS trickle down theory that created a huge amount of wealth concentration. Spending and demand can’t grow when .1% of the population hoards 40% of the wealth. Corporations know it, and that’s why they pursue buybacks and mergers rather than organic business expansion which will not be supported by current or future demand until after the bubble pops.

Does any of this FED planning have anything to do with the Treasury reaching its debt ceiling later this year? Sometimes it seems the national ‘candle’ is lit on both ends.

This is a very good question. Can the Treasury issue more debt if the debt cieling isn’t raised?

Can the Fed exchange MBS for UST without the debt cieling being raised? At some point, the Treasury needs NEW money and the foreigners are not buying much more.

“Can the Treasury issue more debt if the debt cieling isn’t raised?”

No. But we have a Republican President now who is creating debt on a scale never before seen. So raising the debt ceiling will not be a problem.

“Can the Fed exchange MBS for UST without the debt cieling being raised?”

Absolutely. Trading assets has no effect on the debt ceiling.

“At some point, the Treasury needs NEW money and the foreigners are not buying much more.”

The primary dealer banks are required by law to purchase any unsold treasury debt. And they will do it at whatever interest rate the Fed tells them to buy it at. And the Fed will provide them the funds to purchase it if necessary by increasing their reserves.

The beauty of our fiat system.

Before QT, the Fed was reinvesting UST’s after maturity but now they’re adding gov debt to the balance sheet with the proceeds from MBS sales. While not out-right monetization (i.e current printing), I don’t see how this isn’t QE? Also, I hear the Fed will now be buying all dated UST’s to suppress the entire yield curve aka BoJ.

The key phrase in QE is ‘easing’, and increasing the size and amt of gov debt purchased is clearly the beginning of QE Infinity from my perspective. 3mo thru 7yr has already dropped to 2.3% and will likely be 0% during even the next shallow ‘market’ recession.

Being that much of the USD strength has been due to the purchase of Dollars by foreign entities to buy UST’s in search of yield, I think the Fed gets their inflation and then some.

Good you brought this up:

Quantitative Easing had 5 parts. Read: https://www.stlouisfed.org/publications/regional-economist/third-quarter-2017/quantitative-easing-how-well-does-this-tool-work

QE1, QE2, QE3, and Operation Twist are over.

But a bastardation of the Reinvestment Policy still exists.

Originally it was full reinvestment, then rollover was limited with normalization caps which is to end Sept., then Powell announced MBS to UST exchanges …

Therefore, a part of Quantitative Easing still exists.

“Therefore, a part of Quantitative Easing still exists.”

Nah. Swapping MBS for Treasuries is just an asset swap. It’s like replacing 10-year notes with 3-year bills. It may have some impact on the markets in some way, but overall it’s neither QE nor QT.

Also, replacing MBS with Treasuries could push up mortgage rates, opposite effect of QE.

Wolf,

Just the thought of equating treasuries produced by the US government, with MBS’s that are packaged with their unknown share or ROT, just makes me want to puke! Just what have we been suckered into to make us believe in this concept?

DawnsEarlyLight,

I hate to tell you this, but these MBS securities are guaranteed by the government — and therefore by taxpayers. If the underlying mortgages fail, the government is going to make the Fed (and all other investors who own them) whole. These days, the US government guarantees or insures the majority of mortgages. I would like to see the government walk away from this role, and there are some efforts in Congress in that direction, but those efforts seem to be going nowhere.

Rollover:

To help support the economic recovery in a context of price stability, the Committee will keep constant the Federal Reserve’s holdings of securities at their current level by reinvesting principal payments from agency debt and agency mortgage-backed securities in longer-term Treasury securities.1 The Committee will continue to roll over the Federal Reserve’s holdings of Treasury securities as they mature.

I guess we can call it QE-roll over

Iamafan,

I think you may misunderstand the term QE. It means INCREASING the balance of the Fed’s SOMA portfolio of securities. QT means DECREASING that balance. The SOMA portfolio contains the Treasury securities, Agency securities, and MBS the Fed acquired since QE and that is has been shedding since Oct 2017.

Just holding on to the securities and rolling them over when they mature, or swapping one type or maturity for another without changing the total balance is neither QE nor QT.

The Fed has a third not so hidden mandate, supporting the cost of empire. War is the primary concern of banks. Somewhere in the bowels of government, they are plotting the incremental cost of distant body count. Mortgages are less important than treasuries.

=>War is the primary concern of banks.

Philip defeated the Templars but Napoleon was defeated by Rothschild and Wellington got the credit. They’re organised like the Mafia, like the Vatican, but on a larger scale. Money rules the world, and bankers rule the money. It’s not as if it’s a secret.

=> Somewhere in the bowels of government, they are plotting the incremental cost of distant body count.

That’s something they delegate because it’s not that important.

Quite so: the early Italian bankers bought full warehouses of arms and armour, to hire out when wars started – just by chance, you understand…..

I do not recall Wellington in Russia, the place where the Grande Armee disappeared.

Rothschild lent England money, he did not donate it.

Nick Kelly:

Ah but the Rothchilds had carrier pigeons in their employ!! LOL!

When the Fed removed those toxic MBS from the banks balance sheets they were only worth pennies on the dollar but the Fed paid 100% of their value. So now the Fed wants to sell them at 100% of value. Also many of these MBS ar not tied to mortgages as many were foreclosed. Saying they will unload $20 billion a month, yet this is an inflated price. How did they increase in value? Fed created fiat to buy them and now will sell them, but who would buy them at this inflated price? How is this all not fraud?

=>How is this all not fraud?

Fraud is legal Laughing Eagle.

If something they want to do is not legal, they have their minions legalise it for them. It should have been one whopping signal to all that Obama did not have millions of cases of conveyance fraud prosecuted.

Was that a rhetorical question?

I’d guess the Fed has let the worst one’s roll off, and will sell the best (with the fewest foreclosures). The Fed doesn’t have to make a profit, so I don’t know that it matters.

And fraud is when you something illegal. The Fed is doing what it was designed to do: back stop bank asset values during panics.

The government is guarantor of 100% of the MBS on the Fed’s balance sheet and the Fed is 100% guarantor of government funds used to cover MBS loses. Look up circle in the dictionary if you are having trouble following the path.

Debts are being monetized, what does debt monetizing always lead to eventually?

Ok, ok – that’s my last one.

The Fed must believe that residential real estate is a bad investment. The capping of the SALT deduction? I wonder if a lot of this (eg SALT cap) is a money laundering crackdown.

Sifma reported a (minus) -28.7% YTD growth of Agency and -82.% YTD growth of non-Agency (a decrease) in new issuance of Residential MBS.

If you think all MBS is bad, then think again. Who will be buying mortgage debt for younger Americans building their families? A disaster in the making?

=>A disaster in the making?

It’s on the list, yes, middle of page 18.

Are you going to take on a mortgage at 0% even if you think the price of a property is way overpriced, or if you cannot even afford principal repayment now, or in the future ? MBS just brings the cost lower to a new high no ?

Soon Powell will be giving everyone the timetable or time-frame for absolute zero interest rates like Japan or negative interest rates.

Here’s a 2 minute video from Douglas Duncan, Fannie Mae’s chief economist in 2017, re: who buys MBS when Fed sells. He says:

1. impact of gradual Fed sales will be 25-40 basis points addnl interest rate, since Fed doesn’t own MBS to make money, and other buyers will want more risk premium

2. big driver is mortgage rates is Fed 10 year rate (morts based on this). Who other buyers are is less of a factor in mortgage rates

3. Fed is doing Gradualism to allow new buyers to emerge, and rates to set. Fed is watching impact of MBS sales to make how-fast-to-sell-MBS portfolio decisions

4. Future buyers of MBS are investors and sovereign wealth funds

5. Increases in HH income will happen co-incident with increases in mort rates, so no one will notice much

Here’s the link :

https://asreport.americanbanker.com/video/when-the-fed-unwinds-its-mbs-holdings-who-buys

This is the hoped-for strategy. I can’t find any recent numbers on who is issuing and buying MBS (and in what volume). If others have insights, pls share.

You can start here:

https://www.sifma.org/wp-content/uploads/2018/01/MBS_FactSheet.pdf

Laughing Eagle, Yes, I’ve been curious about the MBS (Mortgage Backed Securities) that the Fed purchased after the Sub-prime lending crisis of 07-08. Those bad bonds are what caused the crisis, because their value depended on bad loans that were, for a time, (2004 to 2006) originated by almost the entire mortgage industry. It was fraud on an unprecedented scale and if you wanted to keep your job you had to participate. (I remember one testimonial on the Mortgage Lender Implodometer Site, by a woman who had been writing mortgages for Washington Mutual for decades, who was then having to quit because she just couldn’t bring herself to do the fraud.) The FBI even warned of the fraud epidemic, but no politicians or regulators did anything to stop it. Lowering lending standards is very stimulative and no one wants to be blamed for shutting down a boom.

Was bailing out the whole corrupt mortgage industry the right thing for the US government to do? It certainly protected the wrongdoers from justice, but that may have been inevitable because there were so many wrongdoers. Anyway, I am curious about how much value is still in those bonds. It wouldn’t be zero, because some of the underlying mortgages were probably legit to start and others only overvalued with a claim on property still intact. Have to admit I’m way over my head thinking about this.

” …the fraud epidemic … no politicians or regulators did anything to stop it.

Memories are short,

Dodd in the Senate and Frank in the House were bullying lenders for lending standards which excluded racial minority borrowers.

Later Dodd- Frank legislation implied lenders needed to be punished for it.

RD Blakesee, I’m sort of reluctant to get back into this, because it was a long time ago, and we’re getting off the thread topic, but NO the banks weren’t forced to write enough bad mortgages to bring down the whole system by bleeding heart politicians insisting that they make bad loans to minorities. The lenders are the sophisticated party. They are very hard to defraud. By minority borrowers? Come on. Admittedly some of the borrowers must have thought it was too good to be true, but they weren’t the masterminds.

Powell is screwed: Flattening the yield curve, tossing off the dollar, and calling fiscal policy a secondary concern. I see “cause” enough. Meanwhile the amazing money machine makes everyone look good, thanks to Merkel, Abe and Ping. Special shoutout to the SNB.

XLF is in a downtrend with lower highs and lower lows, since Jan 2018.

The UST yield curve inversion is spreading

6M @ 2.492 is higher than :

1Y @ 2.478 / 2Y @ 2.404 / 3Y @ 2.342 / 5Y @ 2.333 and 7Y @ 2.41. The the long duration from 10Y are higher than the 6M

Gravity with Germany is lifting the German long duration up. bringing

them together.

Investors trust UST, staying away from Europe and Germany.

As long as Dat Fed insist on using it’s 100% fake, 100% fraud, 100% propaganda inflation measures and refuses to see inflation it is causing in non-measured data, Dat Fed will always always see low inflation, thus Dat Fed will always always see reason to keep interests suppressed so as to benefit the rich.

I’ve been following this for only a few months, and if someone not so bright as me can figure that out, you gotta wonder about the IQ of Powell and folks on the Fed.

Timbers:

Correct. All anyone has to do to make out the reality of this economy/inflation is go grocery shopping regularly!! But, of course those stats are too “volatile” to include in the “official” stats!

Thx again Mr. R. for a really good subject. I have some difficulty understanding it all but it is educational. I can’t believe there are so many different “perceptions” on one subject!!

So… does anyone else thinks mortages are gonna crash?

To avoid any confusion look at the chart of the NY Fed:

https://www.newyorkfed.org/markets/opolicy/operating_policy_190320

Treasury 30B rolloff same till April, then $15 bil from May to Sept.

Beginning October, no more ($0) rolloff.

MBS is different. Rolloff of $20 billion will continue. But in October, that rolloff up to $20 bil will be exchanged for Treasuries (so SOMA Amounts in Reinvests will go higher). Anything beyond $20 bil that matures will be reinvested again in MBS. So the only change for MBS is the $20 billion cap exchange for USTs a month.

Considering that the Treasury is auctioning at least $1 trillion a month in securities, the share of Fed SOMA Roll Overs will be:

2019: about $273 billion or about 23%

2020: about $291 billion or about 24%

– of all auctioned treasury securities.

Hello Q.E. It’s nice to see you again.

At least you might have read it here first.

(QE + 100):

Respectfully Wolf

I believe that the article found at the following link is more punctilious in its perceptions of the Fed’s real perceptions. See:

https://www.marketwatch.com/story/the-feds-total-capitulation-is-a-bad-omen-for-the-stock-market-2019-03-21?mod=mw_theo_homepage

While the words “total capitulation” seem to be a little “forward looking”, the Fed has lost the Tiger and bravado it had 180 days ago. While employment and stock averages are nearly equal, what is the something that is REALLY DIFFERENT now?

Cheap click-bait headline. Very appealing, though. But THINK for a moment: What SHOULD the Fed do with Q1 GDP coming in lousy? Last year, the economy ran hot. So far this year, not so much. Late last year, already not so much.

Q2 is likely going to be better than Q1, but the economy is no longer running hot. So the Fed stopped raising rates for now. And it’s going to watch the data. I listened to Powell yesterday. He kept saying the same thing: no reason to raise, no reason to cut. The economy is doing OK, but the heat is gone. And there are some weak spots. And we’re going to watch it.

I agree with that. The federal funds rate is above CPI, which is not all that common. The goods-based sector has clearly slowed down; the bigger services sector is still strong. And Fed doesn’t want to trigger a recession by raising rates further. If goods pull out of their funk, it’ll show up in the data.

I just posted an article on services, which are about three-quarters of the economy. Very strong in Q4. There CANNOT be a recession in the US without service-sector growth dropping to near zero. But that’s far from happening at the moment:

https://wolfstreet.com/2019/03/21/finance-insurance-hits-it-out-of-the-ballpark-no-slowdown-in-the-huge-services-sector/

$700 billion for a bailout, and 4 trillion for QE in Fed’s balance sheet and then the secret $16 trillion the Fed loaned out and what do we have. NOTHING. The Fed created excess fiat dollars and now they are worried that all this extra fiat has not produced any true recovery.

But we will see higher prices for everything as the Fed inflated our currency. All to save the TBTF banks of which some should have failed.

Wolf!

I’ve hear all sorts of discussion about the treatment of the principal payments made to the Fed, but what about the interest payments they collect on said securities? Are they extinguished upon payment to the Fed or are they reinvested?

Thanks!