Breath-taking differences in a vast country.

The Census Bureau released another data trove today for 2016, based on the American Community Survey. Among many other data points, the survey details median household incomes by geographic location, such as by metro area, county, or state. And they show just how enormous the income differences in the US are from city to city.

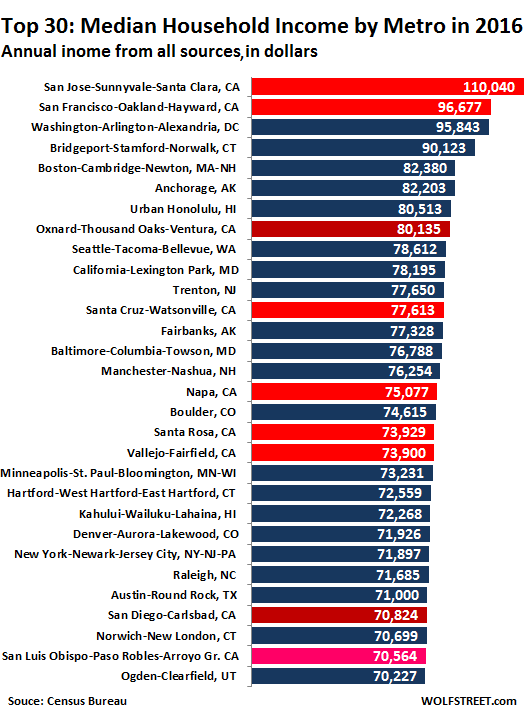

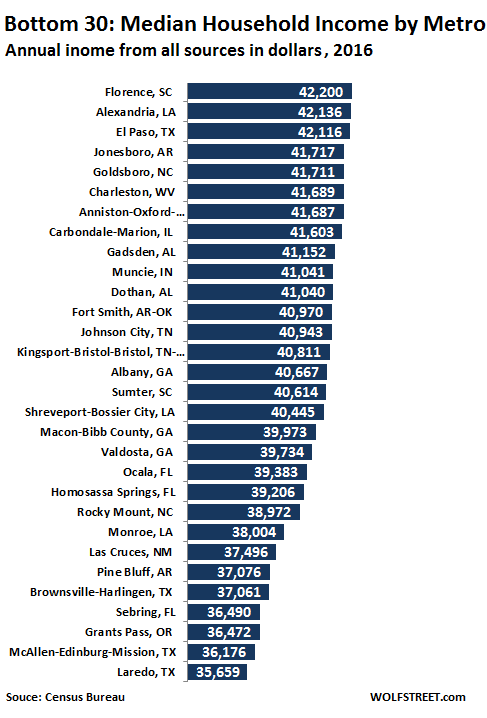

Of the 382 metropolitan statistical areas (MSA) that the US government recognizes, the median income of $110,000 in Silicon Valley is over three times the median income of $35,600 in Laredo, TX.

These MSAs can be large. For example, the extended San Francisco Bay Area is divided in several metros including the two biggest:

- San Jose-Sunnyvale-Santa Clara, which is the southern portion of Silicon Valley and includes Palo Alto.

- San Francisco-Oakland-Hayward, which includes five counties (San Francisco, Alameda, Marin, Contra Costa, and San Mateo) that make up the northern part of Silicon Valley, San Francisco, parts of the East Bay, and a part of the North Bay.

These two are also the metros that had the highest median household incomes in the US in 2016, of $110,040 and $96,677 respectively.

“Household income” is income by all household members and from all sources of money, including “earnings” (wages, salaries, and the like) and investment income such as interest, dividends, and rents (#11-#13):

- Earnings

- Unemployment compensation

- Workers’ compensation

- Social security

- Supplemental security income

- Public assistance

- Veterans’ payments

- Survivor benefits

- Disability benefits

- Pension or retirement income

- Interest

- Dividends

- Rents, royalties, and estates and trusts

- Educational assistance

- Alimony

- Child support

- Financial assistance from outside of the household

- Other income

Below are the 30 metros in the US with the highest household incomes. Those in California are color-coded: bright red for the extended Bay Area, burgundy (sort of) for Southern California, and neon-pink for the Central Coast.

In total, nine of the 30 metros with the highest median incomes are in California. There are many up and down the East Coast and a number of them in the middle of the country. Hawaii has two metros on the list, as has Alaska. But even within the top 30, the median household income of Number One is 57% higher than that of Number 30:

Below here are the 30 of the 382 metros with the lowest median household incomes. Note these lists represent the extremes in the US. There are 322 MSAs in between the two lists, and their income levels cluster closely around the national median household income:

The comparison shows just how vast the income differences by geographical regions are in a vast country, and it also explains a host of other differences, such as home prices and rents, where $1.2 million, for example, buys a median condo in San Francisco (these are nothing special) or a palatial house in Laredo, TX.

But “median household income” is an aggregate number that hides as much as it reveals. Here are some details. Read… The Chilling Fact “Record Median Household Income” is Hiding

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Interesting how Los Angeles doesn’t figure on the map. Lots of extremes here, very poor and very rich with little in between. Lots of poor immigrants and George Clooney, so I guess there goes the median. Thousand Oaks is a very wealthy and far flung suburb of LA. I don’t think the poor are even allowed to visit.

It’s #45 with a median household income of $66K

BradK – I think the same is true for the San Jose area. Yeah some rich people but just masses and masses of poor.

Small typo in 2nd bullet point… San Francisco and rest are not ‘countries’ even if they feel that important.

Oops :-]

Once Calexit happens it WILL be another country

But will it have an army to defend it from the unwashed masses from the rest of Trumpville. Oh, CA will welcome OR and WA to the fold as too. Well, more WA than OR, as long as those guys adapt our state laws.

Then we can collectively build a wall along with our friends North and south to contain those people from the East.

p.s. We will claim Reno too.

Wha, wha, wait a minute ! … What about the Duchy of Marin! … don’t they count ??

‘;]

These stats are questionable. You’ve listed Trenton NJ as 77,650?

Trenton is a blighted city that fired many of their police because they could not pay them. It is a seriously depressing place.

https://en.wikipedia.org/wiki/Trenton,_New_Jersey#Economy

https://datausa.io/profile/geo/trenton-nj/

Yet NJ has many of the wealthiest counties in the country, which are absent from the list.

https://en.wikipedia.org/wiki/List_of_highest-income_counties_in_the_United_States

The numbers are for the Trenton MSA, which is Mercer County.

Which makes it kind of skewed as a frame of reference. I’ve worked in Princeton, also in Mercer County; and I can say that Princeton and neighboring Industrial Parks, Office Complexes, and Bedroom Communities are set in a completely different World.

Trenton should be sectioned off by itself; but that’s just my opinion.

And Bridgeport, Connecticut is in a even more similar situation.

But in many ways, these disparities within MSAs make Wolf’s point even greater.

https://en.wikipedia.org/wiki/List_of_Connecticut_locations_by_per_capita_income

According to my quick calculations, total income in the City of Bridgeport is $2.9 billion while in New Canaan (23 miles away) is $2.1 billion, despite Bridgeport having seven times as many people.

Hi,

can anyone explain the difference between family income and household income?

Are divorced parents still counted as a family unit?

This data is by address — so the revenues coming in to whoever lives at this address. For a divorced parent with kids living at that address, it would include child support from his or her ex. That’s why the lingo always calls it “household income,” not family income.

The people living at this address might not even be a “family” but just room mates, and it would still be “household income.”

Thanks for the elaboration, and the explanation of roommates as a mechanism causing difference between family and household incomes, however, my question is about the wikipedia example, not the census metro area described in article:

https://en.wikipedia.org/wiki/List_of_Connecticut_locations_by_per_capita_income

where both family and household income is listed, and famil;y income is persistently 10-15% higher than household income. Here, if roommates are counted in household income, but are not counted as family, this would skew the family vs, household income towards household exceeding family income.

How about child support, would that be double counted, since it is not tax deductible, and there is no indication that there are deductions in the sum of income.

These statistics are dubious. I see that West Hartford-Hartford-East Hartford are lumped together. West Hartford is an affluent town. It is 6% black with an median household income of over $80,000. Crime rate is very low.

Hartford is one of the poorest cities in America, 62% black and Puerto Rican with a high violent crime rate. The West Hartford police sit on the town line and try to pull over any car from Hartford. They are not welcome.

East Hartford is a blue collar town with its best days behind it since most of Pratt & Whitney has moved out. Its median household income is $48,000.

However, this article treats them as one city.

look at the whole article with this in mind.

The data is based on MSAs. They’re well defined and used by the government and other institutions. They’re also commonly used in real estate. MSAs can be large and can include poor and rich neighborhoods. Nothing wrong with that.

Government and other institutions use them, but people in real life know they are just an imaginary concept. I was a Realtor in that area for many years. We and the people buying homes knew that you can’t throw them all together and pretend they are one.

I chose to use them because they’re broader than cities. I could have chosen cities or I could have chosen states. I pulled the data based on MSAs because it made sense for what I was trying to do. You could also compare the city of San Francisco to Oakland. But what about the guy that lives in Oakland and works in San Francisco? This data is based on addresses where people live, not where they work. Lots of people live in Oakland and work in San Francisco (just try to get across the Bay Bridge during rush hour). So their income stats are mixed to some extent and it makes sense to look at them together. So I chose MSA.

The data is available in other configurations. It’s not the big bad US government that is trying to pull a bag over my head. It was my decision.

Even if Wolf pulled the data for Oakland, it could distort the reality on the ground. there’s a huge range of income levels by neighborhood in that city.

It’s typical of people from outside the area making assumptions from statistics. West Hartford residents mingle with residents from the towns of Avon, Simsbury, Farmington, and Canton. These Farmington River Valley towns are safe and affluent. Hartford is somewhere you only go if you work for an insurance company. It is a violent ghetto. The Connecticut River separates East Hartford from the two other towns with “Hartford” in its name.

While I understand what you’re saying looking at the all but irrelevant to the point of laughable clumping of Aurora ( Arapahoe County ) in with Denver and Lakewood while leaving out areas such as Cherry Hills ( .1-1% Nirvana ) Greenwood Village , Denver Tech etc shows both the irrelevancy of their MSA’s as well as just how blatantly dated and out of touch they are with reality when it comes to specific areas . So well defined ? Not hardly . Not even close in fact .

And pardon me but there is something ” …wrong with that ” .. when it comes to real estate especially here in the Greater Metro Denver area ( which is what the MSA should be including ) where the most expensive homes and neighborhoods are gentrifying and pulling up the values in the poorest to ludicrous heights ( $500k for an 800 sq ft postage stamp Wow Factor Flip* in a relatively bad area ) driving those living in the poorer areas out as property taxes etc go up accordingly

* Wow Factor Flip ( WFF ) – When the flipper /investors puts all the time and money into the aesthetics while ignoring the substance , mechanicals and bones of the home as well as taking out walls , structural changes with zero inspection or adherence to local building codes . My term . Coined it in 2014 and its been making the rounds ever since so feel free to use it yourself .

The Denver MSA includes the counties of Adams, Arapahoe, Broomfield, Denver, Douglas, and Jefferson. So Cherry Hills, which is in Arapahoe County, is included.

Do these stats account for differences in local income tax?

“Earnings” and “household income” are before federal and state income tax deductions and other payroll deductions, such as FICA.

There are large income differences but the differences in actual lifestyle are not quite as large. Property taxes for example can vary widely. We live in NW Florida on 121 acres with a 1800 sf house and the property tax is $800 a year. Compare this to some high income areas.There may be no state income tax and living expenses in general may be lower in some low income areas.

I lived in a 1400 sf cape on a quarter acre and mine were 8k in Sag Harbor NY but some of my neighbors were Billy Joel Christy Brinkley and Ron Browns widow You pay when you live there believe me

What I find fascinating is that some of the highest median income areas are in some of the states with the highest income tax rates i.e. CT, CA. But also interesting how Anchorage and Fairbanks AK are in the high income list and yet are in a no income tax state. Maybe AK has something going for it?

State income taxes are hardy ever the issue . Property taxes on the other hand are

Just visit in December. AK companies have always had to pay big bucks to convince workers from the lower 48 to take jobs there. I remember my mom pointing out ads in the paper for registered nurses making 3x what she made.

That’s not because of taxes. The vast majority of people have a very poor grasp of the impact income taxes have on them. Mainly because they worry about what comes out of each paycheck instead total tax burden after the end of year calculation is done.

Cali has to pay more because most people gasp at the very high rents amd home prices.

I live in AK.

When you live in a “remote” location – it builds in lots of costs as far as living or operating a business. Pull out a map and figure out how to truck a lot of goods from Washington state to Anchorage. Ok, so you barge instead – for how many miles and how many people? 2,000 miles and 300,000 people. There might be a few stops on the way – towns of 10k to 30k people at best.

This is a market size that is closer to a rounding error for any distributor operating in a small metro area or larger.

But, there are businesses up there that have legitimate models – oil field service, government, fishing, tourism to name a few – and those workers have to be paid enough to compensate for the high cost of food, energy, and such.

All that money gets spent on cost of living – trust me. I drop 14 bucks on a cheese burger and fries (no drink) and that is a good deal for where I live. When I visit family down south – I can easily get the same meal for half the cost.

Regards,

Cooter

My uncle worked the in an Alaskan cannery during the summer seasons back in the 70-80’s. It was a 24/7 job for 2 or 3 months and he made an entire year’s salary, somewhere in the $30K+ range.

Most of the wealthy districts have well-known universities, often several of them. The poorer districts don’t. Those universities are attracting the brightest young people from around the country, who often will remain in those districts and become the professionals and entrepreneurs who raise the median income.

My district ( Sag Harbor NY) had no universities but what we do have is a lot of celebrities and Wall Street types making the cost of living unbearable for the regular folks Those who are left anyway and there aren’t many believe me Six dollars for a baguette has a way of draining you I suppose we are the part of the NY NJ Pa region that makes our average pretty high

Not “breath-taking” if you’ve ever been to these places.

Take a look at the survey questionnaire in the link Wolf provided. It would take lots of time and very detailed records to fill out in any meaningful way. Most people have neither. Many won’t even understand the questions asked. I’d expect that most people are just “estimating” all the financial information. But it is fascinating to see how the government finely slices and dices such unreliable data…

In the richest areas of the country, like NYC and LA, the highest earners may not even be counted because they are foreign. NYC probably is a part time home to most of the billionaires or merely rich on the planet, yet many would never show up on any of these lists.

In Florida even moderately well off foreigners wouldn’t be counted. I doubt all the Canadian snowbirds show up, even though they live there at least 30%+ of the time.

This data is collected by address, regardless of origin of the people at this address.

Wolf, you think the Russian mobsters with apartments in Trump Tower and other high-end buildings are going to answer these questions at all, let alone honestly?!?

Unlikely, but with 98,000 addresses surveyed across the US, what are the chances that a statistically significant number would be Russian mobsters in Manhattan that refuse to answer questions about their incomes? Same with homeless people. These surveys don’t usually catch the extremes – and don’t need to.

Absolutely true, but just emphasizes the point that we are a profoundly class-riven (and, given some of the responses here about various areas, class-conscious) society. The stats are most ugly to me because the endlessly bleated ideology, government and media line is that these gross disparities don’t mean anything because we are all equal here in the good old US of A. This is the cover story to retain in cement an organization of society that we used to scoff at as common in “banana republics” and which was once frowned upon and disparaged.

James Levy – it comes up again and again, that a rich kid who’s a dumbass will still do better in life than a really sharp poor kid who manages to get a college degree. Yes there are exceptions which the press takes delight in shoving in our faces but as a rule, wealth and class, and don’t forget race, matter more than individual characteristics.

Leadership ability is important My son had pretty good grades in HS but it was his leadership of his basketball team and foreign travel that got him accepted at Georgetown He was NOT accepted at 9 of 10 schools he applied to i.e. William and Mary, Amherst and Dartmouth

Frederick – So, because you had the several thousand a year for your kid to be that involved in basketball, and the several more thousand for your kid to do foreign travel, he was “in”.

Well, obviously your kid had talent, where talent == parental money.

I rest my case. (no slam on your kid, and I can’t blame you for doing your best for him; I’m just pointing out how our system works.)

These numbers need to be normalized for housing. just sayin.

With $41k in Muncie, IN you’d live a comfortable, but obviously non-flashy life, compared to $97k in San Francisco. but to each their own

The states, DC and other territories are listed below in order of the amount of dollars, from high to low, that DoD contractors within their states have received from the Department of Defense from 2000 to 2016. The amounts are in TENS of billions of dollars, rounded to the nearest 10 million dollars (for example, $643.70 equals $643,704,763,989). The second amount is the first amount divided by 16, giving the average amount over those 16 years. This annual average is in billions of dollars per year. (Should I have divided by 17?) The rightmost number is the estimated population of the state in 2017. You decide for yourself if there is a relationship between the metros with the highest median incomes and DoD contract awards in perhaps those same areas.

Virginia $643.70 $40.23 8,492,783

California $568.21 $35.51 39,849,872

Texas $511.11 $31.94 28,449,186

Maryland $200.67 $12.54 6,068,511

Florida $184.78 $11.55 21,002,678

Mass. $174.47 $10.90 6,873,018

Connecticut $170.51 $10.66 3,583,134

Arizona $152.99 $9.56 7,026,629

Pennsylvania $150.43 $9.40 12,819,975

Missouri $147.79 $9.24 6,123,362

Alabama $111.55 $6.97 4,884,115

New York $109.59 $6.85 19,889,657

Colorado $94.08 $5.88 5,658,546

New Jersey $93.08 $5.82 8,996,351

Georgia $91.33 $5.71 10,450,316

Ohio $88.33 $5.52 11,646,273

D of C $85.97 $5.37 697,012

Illinois $85.45 $5.34 12,815,607

Washington $83.17 $5.20 7,384,721

Kentucky $67.57 $4.22 4,450,042

Michigan $62.91 $3.93 9,935,116

Indiana $60.02 $3.75 6,663,280

Wisconsin $54.31 $3.39 5,795,147

Mississippi $51.75 $3.23 2,990,113

Tennessee $44.28 $2.77 6,705,339

Minnesota $42.58 $2.66 5,554,532

Oklahoma $41.37 $2.59 3,974,794

S. Carolina $41.09 $2.57 5,030,118

Alaska $36.64 $2.29 741,204

Louisiana $35.97 $2.25 4,714,192

N. Carolina $29.18 $1.82 10,247,632

Utah $28.74 $1.80 3,098,761

Maine $23.55 $1.47 1,327,472

Hawaii $22.47 $1.40 1,454,295

Iowa $20.11 $1.26 3,152,735

New Hamp. $19.03 $1.19 1,335,832

Nevada $17.24 $1.08 2,995,973

Kansas $16.03 $1.00 2,929,909

New Mexico $15.44 $0.97 2,084,193

Oregon $12.67 $0.79 4,144,527

Vermont $9.41 $0.59 624,592

Nebraska $9.39 $0.59 1,922,610

Arkansas $6.80 $0.43 3,000,942

Idaho $6.45 $0.40 1,695,178

Rhode Island $6.27 $0.39 1,059,080

Puerto Rico $4.47 $0.28 3,679,086

South Dakota $4.21 $0.26 868,799

Guam $3.86 $0.24 174,214

Montana $3.24 $0.20 1,052,343

West Virginia $3.11 $0.19 1,834,882

North Dakota $2.53 $0.16 790,701

Delaware $1.96 $0.12 965,866

Wyoming $0.68 $0.04 589,713

Virgin Islands $0.15 $0.01 106,574

N. Mariana Isl. $0.02 $0.00 55,603

Marshall Islands $0.01 $0.00 63,066

Well, “population”.

The ordering would change radically if you divided by population.

(I suppose I’d vote for considering NET transfers of tax dollars but that’s not necessary for the list to have meaning.)

For instance, you know that, per capita, Guam must be raking it in. But they look short-changed on this list.

Wolf, How can Watsonville-Santa Cruz be 12th in the nation in income? It is essentially strawberries-farming and surfing-tourism economy. Now I understand that alot people commute to the Silicon Valley…

But still how can it be ?

Oh.. I see it’s “household income” meaning all the people that have income in one house…That explains why. most likely 2 families sharing a house or 4-5 working people in unit.

Ever been to Santa Cruz? Plenty of people who couldn’t afford a $2.5 million starter shack in Palo Alto moved there to buy a $1.5 million starter shack.

Some senior people even live and work in Santa Cruz, commuting over the hills every so often.

not only does the income divide grow, but, in tandem, the north-south divide grows as well. bad economic news and at least as bad political news.

This is one of the advantages of the USA. If you want to, you can move away from someplace that doesn’t have what you need or want.

People who have a reasonably similar income – say upper middle class, no matter where they live, often move to a lower cost of living city to be able to save something- assuming that’s important to them.

There are lots of big companies that pay their technical people about the same no matter where they are- “national” job market (sometimes there a hardship subsidy for moving to CA, for example).

California’s economy to me has gone completely crazy. It has the most expensive cities, and the highest poverty rate. That, in my opinion, is a very bad economy. That’s how a lot of socialist (old= communist) countries look. (I lived in or had ancestors/family living in CA for over 100 years now). It didn’t used to be that way.

Interesting that the Twin Cities Metro is the only representative of the Midwest in the top 30 list even though Minnesota (and Delaware) are the least federally dependent states and Minnesota gets very little per capita from the DoD compared to the top twenty states.