Even the Fed put commercial real estate on its financial-stability worry list.

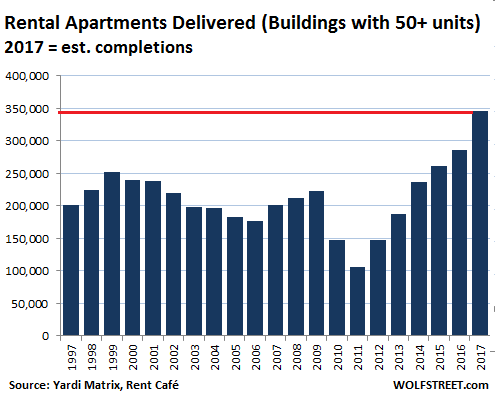

No, the crane counters were not wrong. In 2017, the ongoing apartment building-boom in the US will set a new record: 346,000 new rental apartments in buildings with 50+ units are expected to hit the market.

How superlative is this? Deliveries in 2017 will be 21% above the prior record set in 2016, based on data going back to 1997, by Yardi Matrix, via Rent Café. And even 2015 had set a record. Between 1997 and 2006, so pre-Financial-Crisis, annual completions averaged 212,740 units; 2017 will be 63% higher!

These numbers do not include condos, though many condos are purchased by investors and show up on the rental market. And they do not include apartments in buildings with fewer than 50 units. This chart shows just how phenomenal the building boom of large apartment developments has been over the past few years:

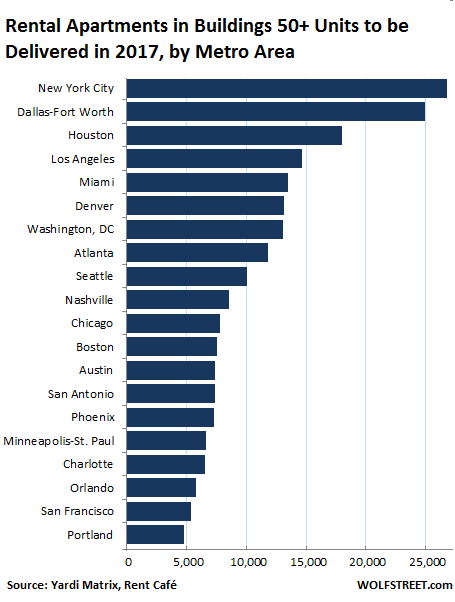

The largest metros are experiencing the largest additions to the rental stock. The chart below shows the number of rental apartments to be delivered in those metros in 2017. But caution in over-interpreting the chart – the population sizes of the metros differ enormously.

The New York City metro includes Northern New Jersey, Central New Jersey, and White Plains and is by far the largest metro in the US. So the nearly 27,000 apartments it is adding this year cannot be compared to the 5,400 apartments for San Francisco (near the bottom of the list). The city of San Francisco is small (about 1/10th the size of New York City itself), and is relatively small even when part of the Bay Area is included.

Other metros on this list are vast, such as the Dallas-Fort Worth metro which includes the surrounding cities such as Plano. Driving through the area on I-35 East gives you a feel for just how vast the metro is. However, I walk across San Francisco in less than two hours:

Special note: Chicago is adding 7,800 apartments even though the population has begun to shrink. So this isn’t necessarily going to work out.

This building boom of large apartment buildings is starting to have an impact on rents. In nearly all of the 12 most expensive rental markets, median asking rents have fallen from their peaks, and in several markets by the double digits, including Chicago (-19%!), Honolulu, San Francisco, and New York City.

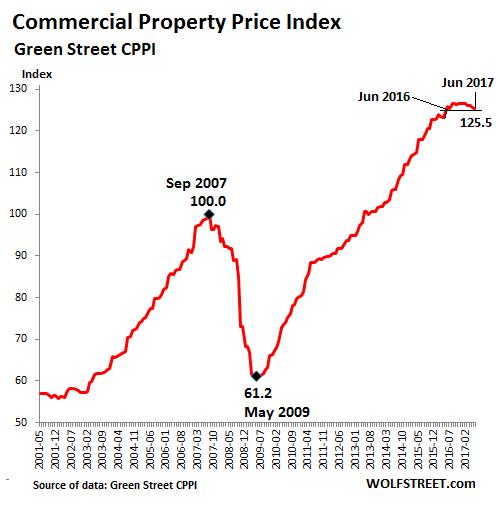

And it has an impact on the prices of these buildings. Apartments are a big part of commercial real estate. They’re highly leveraged. Government Sponsored Enterprises such as Fanny Mae guarantee commercial mortgages on apartment buildings and package them in Commercial Mortgage-Backed Securities. So taxpayers are on the hook. Banks are on the hook too.

This is big business. And it is now doing something it hasn’t done since the Great Recession. The Commercial Property Price Index (CPPI) by Green Street, which tracks the “prices at which commercial real estate transactions are currently being negotiated and contracted,” plateaued briefly in December through February and then started to decline. By June, it was below where it had been in June 2016 – the first year-over-year decline since the Great Recession:

Some segments in the CPPI were up, notably industrial, which rose 9% year over year, benefiting from the shift to ecommerce, which entails a massive need for warehouses by Amazon [Is Amazon Eating UPS’s Lunch?] and other companies delivering goods to consumers.

But prices of mall properties fell 5%, prices of strip retail fell 4%, and prices of apartment buildings fell 3% year-over-year.

So for renters, there is some relief on the horizon, or already at hand – depending on the market. There’s nothing like an apartment glut to bring down rents. See what the oil glut in the US has done to the price of oil.

Investors in apartment buildings, lenders, and taxpayers (via Fannie Mae et al. that guarantee commercial mortgage-backed securities), however, face a treacherous road. Commercial real estate goes in cycles as the above chart shows. Those cycles are not benign. Plateaus don’t last long. And declines can be just as sharp, or sharper, than the surges, and the surges were breath-taking.

Even the Fed has put commercial real estate on its financial-stability worry list and has been tightening monetary policy in part to tamp down on the multi-year price surge. The Fed is worried about the banks, particularly the smaller banks that are heavily exposed to CRE loans and dropping collateral values.

But the new supply of apartment units hitting the market in 2018 and 2019 will even be larger. In Seattle, for example, there are 67,507 new apartment units in the pipeline. Read… Crane-Counting in Seattle: Something Has to Give

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Does this translate lower rents?

An excess supply of apartments will force landlords to offer incentives to encourage tenants to sign leases such as one month free rent for committing to a full-year lease. Some will accept pets or lower credit score standards. They try to avoid lowering rents if they can but will eventually if they have too many empty units.

That will be good news for the renters.

Some apartment complexes regularly have empty apartments. It all depends on how the management positions itself in the market. If it positions itself as a high end and enough people exist to pay the asking rents, the apartments left empty can be subsidized by the occupied ones. For example, if I have 10 apartments and I rent them all out for 1000$ each, I will have netted 10k per month. Otoh, if I rent them out at 1600$ each and fill only 7 of them, I will actually make more at 11.2k per month even though 3 apartments are empty.

This is the strategy followed by some of the complexes owned by Essex people in Bay Area.

The point is that even with an excess supply not all rents will move. To confuse the renter, the management can give deals that are valid only for a limited period, may be the day. These deals will be for shorter durations than the standard ones so that the renter can be pushed to higher rents if population goes up in the next few months. The larger complexes employ MBAs who will create complex pricing strategies.

Your best bet is to look for smaller complexes that don’t have deeper pockets and are usually priced by somebody who is not an MBA with a spreadsheet to optimize. In such places, rents will reflect the market.

I first moved to the Bay Area in 03, into a huge complex on Mathilda and Maude in Sunnyvale. I moved there because I’d lived in a complex owned by the same company in Newport Beach, and the price was competitive, and I felt they’d know they’d had a good track record with me.

The 2nd month was free, and when I renewed my lease, the rent went *down*.

That soon changed, though, as the economy recovered. In 06 they wanted to raise my rent by some $400 a month and I was outta there. I moved to another nearby complex – as people always assumed, “Not The Daisy, but around the corner from The Daisy”.

For 30 years, I have owned and rented apartments in duplex and triplex buildings. The name of the game is zero vacancy and ideally zero turnover. I have some tenants for more than 10 years.

To achieve this result, I rent at about 5% under market. Everyone in the area knows that I take care of my buildings. Many tenants prefer to repaint themselves and do not ask me to pay for the paint. I do not bother with written leases. Most people renting are judgment-proof. You can not throw children out on the street.

You need good will with your tenants. Good tenants will take care of the property for you because they want a nice place to live. If there is ever a problem, I see to it that it gets fixed immediately.

It has been a very good investment for me. I never mortgaged my properties. Too many small landlords are over-leveraged and stressed out with almost no positive cash flow and few reserves to handle big contingencies ( new roof or new boiler). They wind up with bad tenants, uncollectible rents, eviction situations and poorly maintained properties.

Yes. They are building thousands of apartments, town homes, condos, and single family homes along my entire commute route. Wolf has addressed this before.

I think it is crowding out the markets right now. Lots of projects are still on the pipeline and over building properties across the country will be empty or like in China where they build lots of high rise apartment and nobody lives in it.

In my area (San Jose California) they’re building apartments, condos, all sorts of high-density housing. Old houses are being rebuilt, often to house more people. Some are simply wrecked and a whole new house/condo building put up.

Plus tons of commercial buildings. A huge one just up from me, and all over the place. Plus buildings that are mixed use, commercial at the bottom floor and apartments in the upper floors.

I don’t know how many people they think are going to pack into my area.

Yes – that’s already happening in San Francisco, New York, Boston, Chicago, Oakland, Honolulu and a bunch of other cities, though in many less expensive markets, rents are soaring. It’s very local and goes city by city…

http://wolfstreet.com/2017/06/29/apartment-rents-drop-as-commercial-real-estate-sours/

Hi Wolf:

Do you know the cap rates for each market you mentioned? I am very curious about it. Do you think the cap rates will go higher?

No, I don’t know the cap rates for each market.

Yes, they’re going higher in a number of markets though not in all markets and for all property types.

In San Francisco for example: for multifamily 5+ unit buildings, the cap rate was 3.8% in 2015 (the low point), 3.9% in 2016, and 4.0% as of June.

This is just the beginning. So I think cap rates will move higher from here. And more markets will sell higher cap rates.

Starting next year, there’ll be an additional wrinkle. When the QE unwind starts having an effect on long-term Treasury rates, cap rates will move higher still. If you can get 3.5% 10-year Treasury yield, why would you risk your shirt with a cap rate of 4% or less?

In SoCal/San Diego, rents are rising every month.

A 2BR/2BA small apartment close to my place in a decent neighborhood cost $2k/month.. in nice places $2600/month.

No sign of slowing down..

I totally agree. Even living by the Border in San Ysidro is very expensive too. Might as well living in Mexico. $500 per month for entire house. Of course, there is trade off i.e., border crossing.

they will give free rent or other concession. The projects were likely financed with aggressive proforma rents, so the owners will do like 2 months free at a $3,000/month contract rate… Net effective rate is lower, but they will front load the concessions – then for takeout financing they will provide a rent roll showing $3,000/Mo rent not the $2,500 net effective rent.

My son just did such a deal in NYC on a new project. Got free utilities for a year too.

Jim C – It soon will, as the bubble pops with a loud bang, and all the knuckleheads will be scrambling for the exits like lemmings over the cliffs…..along with all the various pinheads toys up for sale on the by owner toys available at drastic discounts……ya’ know, just like last time (07-08)

I am just waiting to buy commercial properties in the near future. I do not know much about the markets like San Francisco. San Diego is still very decent and rents are very high too but not as high as San Francisco.

Don’t see much future for commercial properties..

In next few years, I can see a glut of empty stores, malls and office stores…

Not too hopeful about commercial properties..

My employer wants to buy a building, so maybe he’ll get a chance to. I’ve told him if he goes a little big on size, I’ll likely end up renting part of it from him.

Trump going to beg the illegals to come back please and rent these places!

Maybe it will push some lobbyists to okay the doubling of the standard deduction to give families a bit more monthly cash to sink into all those empty luxury apartments. Assuming that idea still makes the cut into a GOP tax plan…

Didn’t see San Diego on that list… I think we are only adding 3000 apartments this year. Apparently that’s up 56% from 2016, but they still claim it doesn’t meet our needs. But not sure I can trust that analysis.

I think there still room for San Diego to grow. Residential properties like in Carlsbad and Coronado are way too expensive. I wonder they will be going to have red tag sale on those property on the beach.

“to grow”…gosh, all anyone talks about, writes about is growth. How about quality of life, got that too? Doesn’t sound like it from reading the article or the comments. Hours on the road, to expensive, to small, shared space, congestion, no sunlight, no air, no beauty….but we got growth. Yep, we got growth.

Got growth and not a square inch for a weed to grow or a kid to play ball in his own neighborhood.

Great.

Yeah, have the illegals come back, collect welfare (someone else’s money) and rent. Good idea.

You have to consider the legal visa holders that are occupying those apartments and condos.

For investments either sell now or only buy in highly desirable areas where little to no building is taking place. Niches like small select beach communities, or South Orange county, CA where there’s just no more land to build on and zoning is super strict. These are the areas that will keep rising in value and in turn are the safest re investments.

It is my understanding that the state is going to start overriding the strict local zoning laws which characterize many California communities. Decades of no-growth sentiment (NIMBYism) has run smack into an expanding population and prosperous economy to produce a massive housing crisis in much of the state.

During the last downturn, even these so called niche areas close to beaches were not sparred.. so be aware…

The last down turn took the entire country. This next one will be much more local and location based.

“Fanny Mae guarantee commercial mortgages on apartment buildings and package them in Commercial Mortgage-Backed Securities. So taxpayers are on the hook.”

That means taxpayers are doubly on the hook. Fanny guaranties the commercial mortgage, and then the individual mortgages, too?

yes , fannie mae , per their own web site, listen to the segment on the NY metro area . They admit to over supply.

https://www.fanniemae.com/multifamily/

Taxpayers on the hook for Fannie Mae, taxpayers on the hook for student loans and coming soon, taxpayers on the hook for the next round of bank and auto company bailouts.

I think Mr. Taxpayer may have other ideas about this!

I think you forgot credit card debts; pretty soon they are going to ask Mr. Taxpayer to chip in for credit card debts as well.

After all, it is not my fault I am a too dumb with my credit card; tax payers should chip in and bail me out.

These are different mortgages. Fannie guarantees commercial mortgages if they’re used to fund multi-family apartment buildings. People who live in those buildings are renters. They don’t own, and they don’t have a mortgage.

Fannie also guarantees individual mortgages for single family homes.

Condos have special requirements to qualify for Fannie guarantees, including that more than 50% of the condos in the building must be owner-occupied. So if 60% of the condos in a building are investor-owned and are rented out, and you buy a condo in this building, you may not get a qualifying mortgage. There are other limitations.

My favorite is from a social worker. They LOVE housing booms, because when defaults happen and no one wants the building, it goes to a government entity and becomes public housing. She said that in this way, urban slums will make a comeback after decades of suburbanization. In fact, she said the social welfare world actually counts on booms and busts for public housing, since governments don’t build it anymore. Shows you how roundabout and screwed up America is. We can never face issues directly, such an individually enforceable right to housing. Contrast this ridiculous boom and bust housing nonsense with the primitive state of our housing law: Lindsey v. Normet (housing still enjoys only minimum scrutiny) is STILL good law.

What we are really facing is social deterioration based on the fact that we are an individually enforceable rights-poor nation. Only catastrophe leads us to more rights: of course, it is well known that this is what we are waiting for in order to get an individually enforceable right to medical care.

By the way, we are also seeing the collapse of the scrutiny Constitutional regime, which says that almost all power over almost all facts (such as housing and medical care) is in the political system. Check out West Coast Hotel and Carolene Products, the two cases which established our current regime, which are on their way out.

Social worker may love the housing boom/bust cycle, but is clueless about government building housing – every development nowadays usually has to have some set aside for “workforce” housing or some other nonsense, where you qualify if your salary is under 60% of median income or there abouts. Because land prices are so high in a lot of areas the only way to make a profit is to do high end development (with the workforce housing requirement), so very little for the middle class gets built.

Its plantation economics in the 21st century.

But that’s what you get when you have the scrutiny regime: more of the plantation society with its plantation economics. Things would change very much for the better if people had more rights. But Americans are peasants: they have that quasi-psychotic, myopic mindset of the peasant. Only utter catastrophe, happening to themselves, makes them think. Sad! as Donald would say.

Quite right.

Civil liberties – originating in Europe and England and then transplanted to North America – were created by two distinct groups:

1/ Landed aristocrats.

2/ Bourgeosie, above all wealthy merchants and manufacturers.

Both groups found it be be in their best interests to defeat the claims of Absolutist monarchs and their tendency to tax and imprison just as they pleased, and both groups had much to lose.

Security of property and life under the rule of law came from these groups, certainly not from the peasantry – who at best resisted new taxes.

On the whole, the masses tend to put new dictators into power, being politically unsophisticated and emotional.

As James Madison stated, “The rights of persons, and the rights of property, are the objects, for the protection of which Government was instituted.”

“”Only utter catastrophe, happening to themselves, makes them think. Sad! as Donald would say.””

When the guy across the street loses his job, it is a recession.

When YOU lose your job it is a depression….

I bought my first condo in Staten Island, NY when the city offered 10 year tax abatement thru the developers. My real estate taxes went up 10% every year until they reached full assessment. The first year my RE tax was about $100. The city just made the housing affordable and people bought the properties.

Workforce housing doesn’t work because the high end buyer doesn’t want to live with the riff raff. In NYC these buildings remain mostly empty. In some cases they segregate the riff raff with separate entrances to the lower cost units.

The city made housing affordable… geeez!

Petunia, put down the crack pipe. What would the price be w/o property tax concessions?

QQQNoBalls,

The city of NY often gives tax abatements to builders when the economy and building are down, not just residential but commercial as well. Most of the skyline in midtown in the 70’s and 80’s was built that way. That’s why NY is the biggest city in the world. They make up the lost real estate taxes in increased wages and economic activity.

In London, it has emerged that developers are paying the authorities -quite legally – so that they can evade the obligation to build a ‘social housing ‘ element in their developments.

And quite right too: who wants to pay a lot in order to end up living next to people with all the social, alcohol, anger and drug-related issues we are all too familiar with…..?

The solution is so simple. Chinese investors should buy American properties and Americans should buy Chinese properties.

What could go wrong?

Sorry to tell you, many Canadians bought property in the US with our lofty home equity lines of credit big enough to buy condos and houses at 3.5%, without thorough applications or approval stress tests like the ones that have to be completed when getting a mortgage.

https://sc.cnbcfm.com/applications/cnbc.com/resources/files/2017/07/18/NAR%202017%20International%20Profile%20Infographic.jpg

The UK also bought lots of American homes, but I’m sure having a Canadian as the Governor of the Bank of England, couldn’t have possibly influenced people in the UK, to buy 1, 2 or 3 homes with cheap credit. I’m sure Mark Carney would have warned people that buying homes with no plans to rent them out and only paying the minimum interest payments on large loans is a bad idea – like he did in Canada.

I don’t see any unintended consequences from any of these actions.

http://www.cnbc.com/2017/07/18/foreigners-snap-up-record-number-of-us-homes.html

It’s not Mark Carney’s job either in the UK or when in Canada to tell people what to buy.

Of course, he like all other central banks with strong currencies (not Russia, Mexico, .etc) can be faulted for keeping interest rates very low, but that is another topic.

If the imputation is that Mark Carney introduced some kind of Canadian virus into the London and South of England RE markets, which were poster children for RE inflation before he was even the Governor in Canada, that is too absurd to pursue further.

You’re right I should not make assumptions about how banking and political systems work in the UK. And it’s not the job of the Canadian government or the governor of the Bank of Canada to tell people what to buy. But they can easily change buyer behaviour by altering existing legislation and policies by making it harder for people to buy homes with lots of debt.

In Canada, high level discussions do not happen in isolation. Everyone has a broad idea of what every level of government plans to do to mitigate risks from having policies that do not work together.

http://www.theprovince.com/Finance+Minister+Bill+Morneau+right+chats+with+Bank+Canada+Governor+Stephen+Poloz+they+start+meeting+with+provincial+territorial+counterparts+Ottawa+Monday+2015+CANADIAN+PRESS+Fred+Chartrand/11605096/story.html

They usually talk months in advance about changes to policies and/or legislation.

“Last year starting around March (2016), the federal finance department began meeting with high-level officials at the banks, alternative lenders and mortgage insurers to float the idea of risk-sharing, according to several people in the industry.”

http://business.financialpost.com/personal-finance/mortgages-real-estate/canada-banks-insurers-rally-opposition-to-new-housing-rules/wcm/2858cf7c-cfb8-4227-9aeb-3652173dfb41

Sometimes, their discussions take place only weeks in advance of major policy changes.

“The federal finance minister is set to meet with his Ontario counterpart and the mayor of Toronto next week to discuss the hot housing market in the Greater Toronto Area.”

http://www.citynews.ca/2017/04/13/finance-minister-hold-meeting-toronto-house-prices/

Someone from every level government is always watching and listening, to ensure major policies or events do not make their department look bad or hurt their chances for re-election. And with the rapid change to how fast people receive the news through social media, people are aware of events sooner and ask to be made up-to-date on situations within days – not weeks or months. Sometimes departments have to drop everything they are doing to provide certain levels of government information right away.

Canadian politicians and government workers are paranoid people, if you start to work on a new legislation/policy or a crisis occurs that affects another department or worse higher level of government indirectly, they can make life difficult by asking to be updated on the policy or crisis daily. Then you may require several meetings with every department that is under that government official because they too will ask questions. They can get internal auditors to review your work or special interest groups/lobbyists can bother the ombudsman to annoy you on their behalf. Your department may decide not to go through with their policy changes because too many people are asking questions.

The influence of different levels of government can change major policy if or when they want to. Politely of course, it’s still Canada.

Americans cannot buy Chinese properties out right. It must 50/50 or (51 percent for the Chinese vs. 49 percent for the American) partnership i.e., married with the local. May be in theory you are correct but in reality the rules are impediment and plus the rule of law in China is weak.

You cannot buy land in China. No one can, no foreigner, no Chinese citizen. The government owns it. You can only lease the land. So this solution would be somewhat out of balance, no?

If the federal government is insuring loans taken out by developers to build apartments, that’s obviously the next catastrophe. That explains why so many new apartments are being built. It’s a no lose proposition for the developer. Who at the government is monitoring these loans? Hopefully not the same team that was monitoring mortgage loans during the last housing crisis. It’s infuriating.

I don’t think they guarantee the types of construction loans that developers need – or at least not just yet :-)

But when the completed building gets financed with a proper commercial mortgage, Fannie is happy to help out.

I can’t help but think this will be good for me in Los Angeles … rents are way too high here. I’m renting off-grid but I look at apartments occasionally as it would be nice to get one – though I’m picky on one thing … for the money they ask I’d want to have assigned parking still be able to invite a friend or two to come by and be able to park when they visit.

I am nervous about a potential bust though – I always will be after 2009 – but it seems we got work going a few years out still (I’m in construction).

The visitors are supposed to come and visit you in a smart car. There…… I fixed your assigned parking dilemma.

Lots of others forgot that lesson. Good for you.

Apartments are small and usually don’t have an enclosed garage, so apartment dwellers often rent storage units for their extra stuff. Building storage units has been a strong (though small) component of CRE for years. It’s now well over 2 billion square feet.

I follow the auction scene because I’m always on the lookout for uncommon pieces of farm equipment, and I’m amazed at the number of auctions of the contents of storage units where the renter is behind on payments and the facility owner auctions the contents for back rent. There were 155,000 such auctions in 2016. Most of what is in those units is just junk–certainly not worth $80 per month to store it–a microcosm of our national material culture.

Self-storage was booming (past tense). In fact it soared 80% above the peak of the prior bubble, higher than any other segment. But it too peaked. It’s down 2% over the past three months and flat year-over-year, according to Green Street data.

All the new apartments being built in Plano/Frisco/Lewisville area have garages.

Occupancy is 100% due to the number of companies relocating to the area and population growth. It is not uncommon to need to find a new apartment 2 months out.

The current units do not have enough space for the multiple occupants, hence, they rent a storage units.

I’ve got a storage unit, my boss and his family have at least two and I believe one of their sons has one, and a homeless guy I know has one. Storage units are big in my area.

I’m paying about $70 a month for 25 square feet with an 8-foot or so ceiling. They don’t need painting, carpeting, a working toilet, A/C, nuttin’ like that. They get to charge the tenant if they leave stuff when they leave or even if they haven’t swept it out.

When I got my unit, in the whole place there were only two available ones of any size, two 25-square-footers.

(I got the thing because I was supposed to be given a lot of lab equipment. It looks like I might get a trickle of lab equipment anyway, and I may need some storage for my proposed startup, which is actually not a fart app.)

One of the big construction equipment rental companies in Miami, Neff Corp., recently sold itself to a gulf coast area company. It looks like the demand for its heavy equipment in south Florida is trending down.

Right here in my ‘hood, this listing blows me away. $5k per freakin’ month. Unbelievable:

https://hotpads.com/11162-exposition-blvd-los-angeles-ca-90064-ty5z2b/201/pad

Oh, I just looked at the listing. Rent has been reduced by $1,000 it says. So how long has that been on the market?

Wolf,

They just finished building the place within the last month. I think one of the other units listed for $5k and got rented at $3,500. So, I think they’re just listing high. But still, I can’t believe the gall of a $5k/mo 2 bedroom with tandem parking.

And by the way, I meant to mention in my previous comment that my ‘hood isn’t to be confused with Beverly Hills or Santa Monica. It’s not bad, but it’s not very upscale. I find $5k/mo insane.

Even the south Bronx in NYC is getting expensive. In the 80’s it was so blighted the local police station was called Fort Apache, now its unaffordable.

a few years ago–five or so– when i was on tour back in the city, there was some falderal about a tasteless upscale party in the south bronx with some upscale famous arty people “discovering” the bronx– they had champagne and centerpiece was a burned out car and they had curated graffiti inside the walls.

KL,

I had to look up falderal, but I graduated from a Bronx college.

You’re thinking of Jose Falderal, noted lightweight boxer of the 1940s and 1950s, some called him “The Mexican Willie Pep”.

Not much fol-de-rol about classic boxers these days.

Wilbur58,

I lust looked at the listing and all the pictures. For $5000? Even $4000? It makes me want to cry. Squalid in a modern industrial kind of way, like an upscale halfway house. The concrete everywhere makes it hose-down ready for the next tenant. The heavy auto traffic off the patio makes it even worse. Even looking at the pictures is depressing.

I live in the heartland. You can buy 5000 square feet on a highly improved lot on several acres, very upscale, yet not a McMansion for maybe $750,000. In Califiornia, you might get a hot mess for that price.

I would someday like to rent a 2nd home in Las Vegas on the Strip. It will never happen but I like to dream. I like the heat. In a very upscale place called Turnberry Place, for $5,000 you could rent a palace.

http://www.luxrealestateadvisors.com/turnberry-place-condos-rent-2/

cdr,

My wife and I are still on the lookout for the best combo of jobs, schools, and affordable housing in the US. We just visited Denver and we liked two areas, up towards Boulder and south of Denver.

We’re open to the southeast, Dallas, Kansas City, Denver, etc. We like Phoenix, but I’m worried it’s really too hot for me.

Where do you like?

Look at zillow or realtor.com in areas of interest for you. To me, California is hell, although it’s probably ok in the fringe areas out in the boonies, assuming away the goofy California government.

Where are the jobs for you? Look there first.

Just about everywhere is less expensive than much of California. From watching HGTV, to me, I see homes that would go for $80000 in some markets selling for nearly $1million in California. Goofy.

And there are many more projects coming on line in 2017 and 2018 .(?)

If the warning signs are already here……. ?

Well, at least there will be no excuse for homeless people to not have a home in near future.

In many of the cities listed above there is simply no inventory, I mean nada of reasonably priced apartments.

There may be a record boom but there are millions of millenials and foreign nationals who will fight tooth and nail to get into those apartments. The millenials may stack up 4 to a 2 bedroom, but they’ll get the money somehow. As long as interest rates are near zero, people will use their credit cards to pay the rent. They may eventually default but under current conditions there will always be another person to pick up where one runner falls.

Even college kids with no jobs and no income get 5k -10k credit limit cards from Capital One and Bank of America. I’m shocked to see my students wip out wallets with 3 or 4 major credit cards.

No, there is no crisis until people have restricted access to credit. I don’t see any political leaders out there willing to undermine what passes for an economy these days. Who would stop low rates?

No one!

I may have missed it mentioned somewhere, if so apologies, but is there a demographic aspect to all this construction in the US?

In Europe and Britain, for instance, real estate is under huge pressure, but the population is only really rising among immigrants, most of whom are lower-tier workers or on welfare, (in some communities 50% +)so not much point in building for them commercially….

Natives are barely reproducing, and ,mostly below replacement level.

If I recall correctly, the US has a rising population, but among what income groups?

Is a sharply rising lower-tier pushing prices up further up the chain, making all this building potentially viable?

Regardless of demographics, in the hottest construction markets in the US, most of the construction of apartments and condos is high end. Why? Because that’s where the money is, on paper.

Then you have the issue of plenty of vacancies in high-end apartments and condos, but the people who need to live somewhere cannot afford them. In places like San Francisco, these “people” who cannot afford these apartments are middle class with good incomes who cannot pay $5,000 in rent for a new tiny two-bedroom apartment. That’s a real disconnect in today’s inflated housing market. It’s called the “Housing Crisis” in San Francisco.

Thanks Wolf.

Same disconnect between need and cost in the growth spots in Britain.

A friend of mine is a surgeon, an Iranian, and with a large extended family he thought of upgrading to a house with an extra ,bedroom (taking him to 5) in a new development right beside the hospital.

No way! Less actual space per room than the current house, and practically no garden which one needs for 2 small children,and a crazy price which he could afford but seemed such poor value.

Similarly, the apartments intended for the nurses at the hospital were beyond what they could pay.

I believe Chinese investors are snapping them up…..

Sam thing in socal..

Most of the average apartment complexes have been dressed up with new pain appliances interior and rents have been increased drastically

Harder to pencil deals in South Central LA versus West LA when the fees and city requirements are considered, even with higher land values on the Westside. Although quality varies, it makes no sense to build new in South Central after considering construction costs… also, city requires a % of affordable units – more cost effective to amortize those over more valuable project.

If you look back before the post war suburban housing boom, you’ll find only about 50% of Americans owned their house. We reached 2/3s being owner occupiers at the peak of the housing bubble. Now we have fallen back to about 63%.

For a variety of reasons, high prices, lack of inventory, fewer secure job positions we may see home ownership drift back toward that historic 50% level. If so absorbing the new rental units should not be a problem in a world of tightening credit and higher interest rates.

“For a variety of reasons, high prices, lack of inventory, fewer secure job positions we may see home ownership drift back toward that historic 50% level. If so absorbing the new rental units should not be a problem in a world of tightening credit and higher interest rates.”

The problem is that with fewer secure jobs, many of those renters won’t have jobs or money to pay for those rentals.

Also, there is no lack of inventory. Many buildings have 20%-30% vacancies in the SF Bay area. The thing is that landlords after years of gauging the tenants can’t accept the fact that they can’t command rents anymore. So, they keep using gimmicks such a free 1 to 2 month rent free to keep the rents up. But this will collapse once the renters can’t simply use their credit cards to pay for rent.

Last year my landlord was so picky about who rents the apartments, but right now, they let the kind people in that would have been unimaginable last year. That’s because there is no one with good credit and good job who would rent the units, so they have to give it to anyone they can. I’ll be laughing my ass off when these people can’t use their credit cards to pay the rent anymore.

Even in non recourse states like California, getting rid of a deadbeat tenant is a lot easier than foreclosing on a home so landlord’ risk is less than lending someone $500,000 to buy a house. People got to live somewhere so if they can’t qualify for a mortgage they will have to rent and, my guess is, we will see fewer people buying homes in the future than we had in the past so the rental market should be generally strong overall though there maybe be temporary gluts in individual markets.

Rental market have gone through the roof..

Matter of time to crash..

Need to see what brings it..

A guy making 4k a month.. can’t expect him to pay 3k for rent

Rental market in Bay are are far softer than a year ago; and they will keep sliding as more and more apartments come to the market, and more and more unicorns fail. The same story in all major rental markets as Wolf has covered that already.

And if you are hoping to bring in people from Mexico to rent them out, I think it was last year that there was a net outflow of Mexicans. So, that plan doesn’t work either :).

– If you own a dozen apartments, raise rent enough to cover break

even cost, on 2/3 of them, so you can put a 1/3 , or 4 apartments in the market, for a quick sale, at slightly beyond peak prices and take profit, stay liquid, because prices will not recover for decades.

– Once you do that you can manage debt and adjust rent (dividends)

on your existing inventory.

– The best, easy to sell inventory, will be target for sale first.

– You have to give a potential BUYER an incentive.

– The losers will stay with you for a long time.

– You have to give a potential RENTER an incentive, so you can

get rent (dividends) in a bad market with 15% vacancy rate.

– The best apartments will be targeted for the highest rental hike, in

order to force tenants out and escape the greedy/stupid landlord.

– You have to play defense, shuffle goods as a winner, before the bear takeover.

In respect to Wolf’s comment above that would probably explain a recent fire (arson) where a residential/commercial construction was burned to the ground in Oakland. Rents are being pushed up by the people and businesses escaping San Francisco costs. The less influential native population striking back.

i doubt it was the “less influential native population,” and wonder if it’s an insurance fire. even the “more influential populations” are shocked at how “docile” the “less influential native populations” are in getting evicted and such. me, too. even though i was raised quaker, i must admit that i truly wish there was more hostility and graffiti and phone snatching so people would be too afraid to take over but no dice.

Some random thoughts:

Wait until we see the glut of off campus high end student housing coming online.

This is a good website for apartment glut stats in general: http://thehousingbubbleblog.com/index.php?s=chicago

Interesting precedent as the City of London buys 68 luxury condo units to house some of the Grenfell survivor families. I would sure be pissed if I had paid 10M for mine. https://www.nytimes.com/2017/06/21/world/europe/luxury-complex-will-house-some-survivors-of-grenfell-tower-fire.html

The “Poor Door” apartheid conundrum Petunia touched on: http://nypost.com/2016/01/17/poor-door-tenants-reveal-luxury-towers-financial-apartheid/

I agree with the Social worker who mentioned some of this glut will be quietly taken over by Section 8.

The single family home mega landlords are already renting to section 8 families. These people can afford higher rents than any working family with a median income. The reason for the single family homes being more accessible is the regulations covering section 8 vouchers. Once a landlord rents a property to a section 8 tenant, that property is captured by the system. The landlord must continue give priority to another section 8 tenant the next time the property comes up for rent. This is harder to do in a condo with an HOA that may have other ideas about renters.

Petunia,

you are genius. i love that you are here. i can NEVER get enough of anything you say and i LOVE that because i can barely stand regular people anymore.

you’re like a wildly famous person to me in my own world. i feel like if you go anywhere there should be press asking you questions and an audience waiting for you to sign SOMEONE else’s book.

that you went to fordham university or a bronx college is proof to me that you are the future goddess voice in secret. SOME know, i’m sure. some here, and those who’ve secretly wanted to kiss your rhinestone flip flops.

i came of age in the bronx and that is the girl who’s grown up and is dancing in the STREETS NOW. remember that? i thought it was happening in the streets EVERYWHERE. ha!

it was too beautiful then to let die now. so i dance for what i loved about the bronx then and when i heard about the “falderal” in the new south bronx, i knew there’d be no going home. that if they discovered and didn’t fear the south bronx, then it’s all over.

The aftermath of the truly terrible fire in London is turning into a farce, as the tenants are manipulated by radical political interests milking the situation.

The fire was in the ‘poor’ north of the K&C Borough: tenants have been offered nice housing in the ‘rich’ south, but are refusing to move there – it’s a small borough – because they want to be in ‘their’ lovely ‘poor’ northern part. Given the distances, it’s nonsense!

Trying to move them to the rich south is being represented as callous and insensitive, a ‘trampling on the poor’, etc, etc……

This political circus is very disrespectful to the dead.

Low income people rely on networks of support from other low income people, baby sitters, money lenders, people with transportation, language barriers, etc. This is why they prefer to stay in their own areas. You are looking at this from the outside and not understanding that the attachment is practical.

oh my god… Petunia! you punched me in the GUT with your disclosure of the Truth of Poverty out in the open and people with stuff don’t get or need because they can just pay people to service them.

when katrina happened and mrs bush said they’d all be better off in houston, what’s the prob? i shuddered because this is what kills us… no community… i feel like the last generation that grew up with community among blacks whites latinos… i could run away everywhere/anywhere, and while there were dangers of protecting my hymen as a young woman on her own, PARENTS were EVERYWHERE: a newly wed couple smoking pot in the back of the greyhound tutored me and watched me. teachers protected me. now i hear only about neglect and loneliness and people “staying in their own lane” (minding their own business)… which is Death.

—-

“Low income people rely on networks of support from other low income people, baby sitters, money lenders, people with transportation, language barriers, etc. This is why they prefer to stay in their own areas. You are looking at this from the outside and not understanding that the attachment is practical.”

When I was in Sunnyvale (which I call Slummyvale because of the much higher crime rate than makes the papers) I had a problem living in the apartment next door.

My nice Indian neighbors moved out and what moved in, apparently, was an older man who was not always there, but had a high-school-age boy living there, who didn’t go to school and was supplied with bottles of vodka and cigarettes and things like that. He looked like a young Eminem. I called him “Q-tip” but not to his face, naturally. He had a bunch of other young punk friends who’d “barricade” my front door and were always on the brink of breaking into my place.

I did not want to put a few hundred dollars into a gun I hoped I’d not have to use, so I invested in some pepper spray, both a larger unit with a wall mount I installed right next to my computer desk in the living room, and a smaller one in a holder that I kept on my belt. I figured when the rush came, I’d nail at least the one in front with the pepper spray, and then work on breaking joints – fingers, elbows. Generally when you get one in a group screaming in pain, the rest run off.

These kids were also threatening my older Asian upstairs neighbors, and the wife of the guy across the street.

I contacted Child Protective Services because shouldn’t Q-Tip be in school? They forwarded me to the Slummyvale PD’s “Crime Prevention” dept., and I got in contact with The Most Excellent Cop Ever, who like in those Army Reserve commercials, get more done before 9AM than most people do all day. He got Q-tip back into juvie or some sort of box, and his gang of white punks were still seen around, but not around my place and much more subdued.

But! – I got talking with a black guy a few doors down and he’d had the same problems. Stuff stolen out of his car, and one night one of the female white punks tried to force her way right into his apartment when he answered the door.

He and his family had moved to Slummyvale from East Palo Alto, yeah, the place we all joke about being so bad. But, in “the EPA” he had neighbors who watched his place when he was on vacation, everyone knew everyone, and he was astounded how “nobody knows each other” in Slummyvale.

Pre. 2008 GFC – Governments of the Western world hounded us with this scary story –

“The Hordes of The Aged Are Descending Upon Us – The Vastness of Their Numbers Will Decimate the Global Economy in Their Wake.”

As a result of the beat up by governments utilizing main stream media –

gullible minds were sucked in to invest in the developing of more retirement villages & nursing homes.

Today – in Australia – those retirement villages are a failed development.

Radio National – Life Matters – host Amanda Smith – spoke with Janet Large CEO running pilot – reg., Women’s Initiative Housing -Shared Equity Scheme – as an alternative for women who have superannuation &/or savings to purchase a home.

Women with money are being targeted – there is no shame on the part of the con artist.

It is to relieve these older women in Australian society of their wad of cash only.

Online there are so many stories about the British Shared Equity Scams & Con’s.

We have a glut of empty apartments – a glut of empty retirement villages ( where everyone lost their shirts – the greedy church – local councils lost our rates – invested retirement monies vanished )

But they are relentless & their greed is insatiable & the homeless still sleep in the streets at night.

Housing prices have risen by A$100.000-300.000 over the last 3 years.

North Frankston, Victoria is a for the most part a Public Housing Estate

.

No one in their right mind would actually purchase a house there, such is the reputation of the area & yet A$500.000 price tag is being placed on houses that have been given a cheap cosmetic fix & are only fit to be bulldozed. But the big puzzle is – this is public housing – government owned – how did these houses end up on the real estate market ?

& we still have Australian families sleeping on the streets.

p.s. Banks are lending real monies based on the cheap make over of these derelict houses –

things that need to be replaced & upgraded = pluming / electrical wiring / roof repairs & guttering & down pipes replaced / re-stumping – some houses are sitting on the ground & are rotting from the bottom up & the banks are still lending with enthusiasm. Everyone is a Brain-Storming Maverick Gun standing on the precipices of their next killing.

You say the tax payer & the banks will foot the bills – & therefore the banks need to be regulated to within an inch of their ignorant lives.

The Stringer Independent News.

article title – ‘Affordable’ housing arguments will never address chronic & acute homelessness by Gerry Georgatos – June 16th 2016.

Only to show that this lucky country has a problem.

One of the very worst areas of London – large immigrant population, drug gangs, knife-crime among children, etc – now regularly features property in the £750-1,000 k range.

Not far from one such, an innocent person had their head blown off by a black gangster while waiting for a bus – a case of ‘mistaken identity.’ Poor devil. ‘Mothers against Gun Crime’ posters are an interesting new feature of the London landscape.

A lot of urban commuters in London take the surface train to work – this area is not one in which a decently-dressed person would feel safe in arriving home late on a dark winter’s night.

These people are really just borrowing huge sums relative to pays to land themselves in trouble one day.

‘Gentrification’ in London often means that you are still living among violent drugged-up trash with a higher risk of a nasty encounter…..

I should dd that these London properties are mostly c 1900 and examples of the cheap speculative building of the day – poor quality yellow brickwork with wide mortaring, etc – but are sought because the modern developments at this level are both rare and very shoddy and cramped.

As our industrial civilisation declines – due to resource and ecological depletion and degradation, debt -overload, etc, etc, – everyone who can will become parasitical, in order to maintain their own standard of living.

Conscience will become a thing of yesterday: the vulnerable will be asset-stripped.

What better than to target the elderly among whom assets have accumulated in the decades of prosperity ? At the other end of the scale, get idiot students into vast debt in order to pay your academic salary. Cynical, but it pays for the time being….

This happened under Rome, and it is happening to us now.

History might well not repeat itself, but human nature always does.

Sure hope all you Wolfers took advantage of the sale on GOLD and backed up your trucks Things are looking good for the shiny metal as of late When it starts you will be unable to get physical at ANY price

I’ve stated here before on several occassions. This apartment boom was set up by Obama and Mel Watt. The boom will continue until a major bust (I give it until ’18). The boom started early in upswing, before single family got going strong. So it helped jump statr the construction economy.

If the bust is severe like 2008/9, and the Fed is requried to step in with QE, these properties will be bought by the Fed and then transferred to HUD for low income subsidized housing.

So, no the taxpayers will not pay. But the dollar will be inflated again by Fed QE. Only this time at least, the constuction will go to a decent end use.

Remember: The moral hazard has been crossed. Future QE will occur.

Rents are crashing for sure. At least here in SoCal.

I live in SD and own a condo in South OC. rents are absolutely NOT crashing. Just the opposite in fact. Esp in South OC. There is no building going on there. Supply is choked. Demands keeps rising.

You must be in a bad part of oc because they’re falling here. Check the price reductions.

I’m in the best part of OC….Aliso Viejo, Laguna Niguel, RSM… Rents have sky rocketed over the past year also….i check prices all the time and look at available inventory. There’s not one place for sale in my 250 unit complex. No supply. Lots of demand. No building happening really.

You’re not paying attention then because there is new construction and half empty buildings everywhere.

Half empty buildings in the South part of Orange county, CA? Please lay off the drugs dude.

Lots of housing builds and development in El Toro/Great Park — maybe not your specific area but not far away.

yeah not far away but not very desireable areas tbh. aliso, rsm, niguel are in a league of their own.

Half empty and a bunch of new unoccupied condos. I have a real estate agent in the family in Sacramento and he’s seeing the same there.

It is what it is.

Existing home sales fall as prices hit new record highs.

Think there’s a connection?

http://www.marketwatch.com/story/existing-home-sales-fall-in-june-as-market-retrenches-after-hot-spring-season-2017-07-24