What then is driving prices at the moment?

By Dan Dicker, Oil & Energy Insider:

2017 hasn’t seen much volatility in oil prices, something we might not have expected with a new administration, a change in Fed policy, Brexit and a hundred other smaller events this year. So, what’s left to move oil prices, if the most common inputs aren’t having much impact?

Normally large global trends of production, OPEC plans, rumors of war, and actual hostilities will have a significant impact on prices. In recent days, however, we’ve seen a large tomahawk missile strike on Syria and a use of the “Mother of all Bombs” in Afghanistan, with nary a quiver out of oil prices.

What tends to impact oil prices more than anything else – at least when other inputs are being discounted – is the movement of money in and out of futures markets. Those bets represent what players with a real financial interest think about future oil prices. Further, those bets are not just an indication of how financial players are thinking, they can be a primary indicator of what the next intermediate (and even long-term) move on oil prices will be.

This was one of the main theses of my first book – Oil’s Endless Bid. At the time of its publication, this idea was scoffed at by virtually every oil analyst out there. Today, measuring the financial motion of speculative money in and out of oil futures is considered a necessary tool for anyone trying to gauge oil’s next move.

But take care: Intense bets that oil will rise (going long) are often more likely a sign that oil prices are soon headed DOWN. Similarly, a relative lack of interest in being long can be useful in timing oil’s next move UP.

In any case, with oil prognosticators waiting for oil to rebalance (a long road) and OPEC to either continue or abandon production restrictions in June (an equally long road), the market has become almost singularly focused on speculative interest in driving prices.

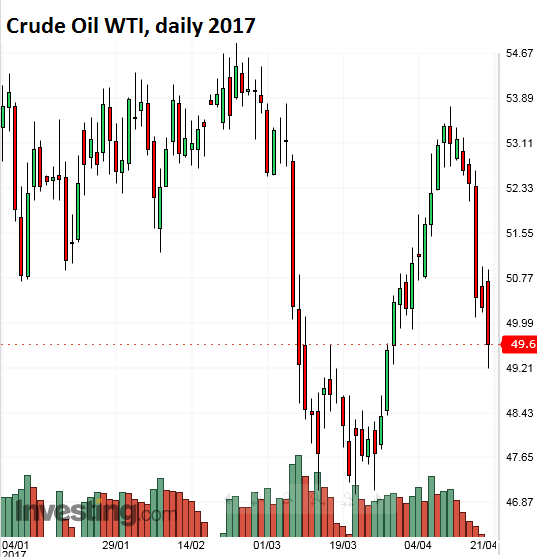

Take a look at this chart, particularly the red line at two recent moments: Early March of this year and the last entry of April 17th. In early March, long positions were reaching historically high levels…

Ultimately this resulted in the mini crash of prices from $55 to $48 in early March. The move in that red line back up shows again strong speculative long positions in the last few weeks which may have contributed to the mini crash back below $50 by Friday.

Another caution: Don’t think you’ve found the holy grail of predicting oil prices just because the indicator was so on the money recently. Sometimes longs can accumulate for months without a negative reaction in the futures. And the many other factors we highlighted early in this piece that most oil analysts harp upon can be as important or more important at other moments.

For today, however, as rebalancing and OPEC production meetings remain far in the future, we need to maintain contact with these financial inputs to understand the most recent moves we’ve seen in oil prices. By Dan Dicker, Oil & Energy Insider

“I feel like I’ve created a Frankenstein,” says Daniel Dicker. Read… Stop Counting On Oil Contangos

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

>>In early March, long positions were reaching historically high levels…

In futures, as well as traded options, for every long there must be an equal short, namely the entity or person that created and sold the naked position in the first place.

The real question is whether the short is an actual oil producer that can deliver the commodity in the future, or just a naked futures writer. (Yes, yes, there is cash-settled futures but the basic principle still applies, IMO). That is useful information, but cannot be deduced from the charts in the article.

No, no, no–this time is different. LOL! Oil prices have plummeted because there are more 18 to 34-year-old Millennials living at their parents pad eating Fruit Loops and cheap, microwave hot-pockets. This is mthe worst economy in many decades and all you have to do is judge with oil prices. Is a gallon milk more expensive than fuel? I would be the contrarian, now.

NYMEX and Intercontinental Exchange publish gross and net positions for commercials and non-commercials every Monday. The non-commercial, i.e. net speculative length reached more than one billion barrels in February, much more than I have ever seen since I joined the market two decades ago. On the other side of the trade you find hedging producers, who simply deliver oil.

RE : Those bets represent what players with a real financial interest think about future oil prices.

—–

The problem is defining “a real financial interest.”

It appears the majority of the oil futures speculators/market manipulators are neither significant producers or consumers of petroleum or petroleum based products such as fuel, but rather are gamblers, in large part with other people’s money, i. e. leverage/margin.

This being the case, the most prudent course of action would appear to be to re-instate the futures requirement that the amount of futures contracts you control cannot exceed your projected annual consumption/production. This would still allow classical “hedging,” but would minimize speculation.

Another useful step to minimize speculation would be to limit the use of leverage/margin, and prohibit governmentally insured banks and other financial institutions from lending into the futures markets.

Any estimates of how much QE capital is driving this market?

Major oil producer all need the money, so production cuts seem unlikely. Geopolitical events that should have raised prices had little to no effect. What could change this?

“Major oil producer all need the money, so production cuts seem unlikely”

Yet what is the sense [ or the profit/gain ] of producing more oil than you’re selling ?

Defence of market share from Iran and Saudi. Desperation for cash, from Venezuela.

oil,all markets bein propped by central bank money printing and nothin else,oil fundamentals look like crap,collapsing demand,soaring costs, soaring dept,fed know if earl prices collapse agin,they’ll need fresh bank bailout packages,they’ll need to bailout the banks eventually anyway but proppin up commodities with trillion in freshly printed cash buys them time

Unemployed people in our so-faux “recovery” that benefits only Wall Street and corporate CEOs aren’t doing much driving.

Exactly. I’ve not owned a car since the crash of 08, and for a while had a small (250cc) motorcycle and got rid of that in 2011 or so. Where I live, anything with a motor is simply not affordable for a huge portion of the people. They walk, bike, take the bus, etc.

This area is full of people who make a poverty-line income, maybe, and then there are the mirrored towers where the few per cent who make the “official” tech pay go to work – they then get into their cars and go to their gated communities/condos and never mix with the proles.

I’ve seen a big increase in recent years in people riding scooters. Can’t be explained by high gas prices…it’s starting to feel like we’ve become a Third World economy.

Think of traffic jams as good reason to ride anything with two wheels. It allows you to go through between cars.

Word – Yes, but trust me, no one in the US really wants a scooter if they can have a car.

By the way your name is Word Richter now. Hope you like it because if not, tough.

I love my scooter. Can’t stand riding in a car. I feel claustrophobic. Riding a scooter turns a chore into a vacation. True I live in a rural area and can take back roads, another plus. It’s hilly where I live and riding a scooter is like having your own personal roller coaster. A car is no so much useful as an enormous status symbol and an enormous planet killer. I ride year round here in the northeast. I can afford a fancy car, but who needs it. You can have your status symbols quaking conformists.

I think this oil price rise was a coordinated effort between the Central Banks & OPEC to keep the stock markets from cratering and pump a few more dollars of income into their failing economies. Once the housing bubble burst starts accelerating, the only option the CB’s have is printing more fiat, and weakening their currencies to avoid a collapse.

That’s why it is called the petro-dollar. The more the world converts to renewable energy, the quicker the world of finance and all its evils will shrink, hence the opposition in certain circles. You can’t toll gate the sun, or can you. Elon Musk is certainly trying.

Real supply and real demand ultimately drives the price .the rest is distractions

Real demand for carbon based fuels was also increased by the fact of Japan turning off their nuclear power plants after the earthquake and tsunami in 2011

This caused a surge in demand for coal, NG, and to a lesser extent oil from Japan. The figures for Japan’s trade balance show the surge in demand.

As the number of nuke plants comes back online in Japan and other energy sources are used for producing electricity, real demand will fall further. For example, commercial projects for solar in Hokkaido have been huge and at times there is too much solar electricity being produced.

Typically of Japan the cost for domestic installation of roof top solar systems costs 3 to 5 times as much in the domestic market as the same products cost overseas. IF the prices of these products were to ever fall to reasonable prices of the number of systems in Japan would surge and there would be an even further fall in the needed for imported fuel.

Combined with the fall in Japan’s population the demand for energy will also fall.

President Trump, a war with KimsonIII, is not to his liking @ all.

Some mathematician had built a two parameters formula for

oil price ;

-Price should be above break even of extraction.

-The real wages of the lower 90% should enable them to afford the

cost of energy.

If both inputs are not satisfied, soon, we find ourselves in

the turbulence of a waterfall.

That’s the future of oil price from the savant.

I don’t think that the lower 90% dominate events in the world.

They rarely do.

An example :

If a major & powerful oil producer think that a war between two

other major oil producers is a good idea, for some reason,

and if a forth, very powerful & a major oil producer will be

neutral about it, losing prestige, gaining from price, oil can shoot

up, in a climactic event, in total disregard to the needs wishes of

the lower 90% consumers.

OPEC wishes don’t matter, too !!!

Cash strapped producers meet cash strapped consumers meet massive amounts of LNG meet ever-rising energy efficiency and alternative energy.

Low oil prices, you don’t say?

Supply and demand economics?? Say WHAT???? That’s why Dudley has a trading desk in New York–if we actually had to consume on supply and demand characteristics, the Federal government would spiral out of control (literally). They MUST control prices or lose power. Prices can’t go too low, nor too high. Maybe we should thank the Fed…???