And where the heck is Dow 20,000?

Over the last ten days, the markets have been jinxed, and nearly everything changed direction. Stocks fell. Treasury yields backed off as beaten-down Treasury prices recovered a little bit. The much maligned dollar, after surging to a decade high, couldn’t quite get to parity with the euro, and then fell against the euro and yen. Banks got bruised. Even oil was down except over the last few hours Friday afternoon. And everyone has been feverishly waiting all month for the Dow to finally hit 20,000 any moment now. And everyone is still waiting….

The Dow peaked on December 20 at 19,975, a ridiculously small 25 points away from party-hat time. Everyone knew it would happen. In fact, it would have to happen because it was just a few decent trading moments away. But since then, Dow 20,000 slipped through the fingers like dry sand. It closed the year at 19,719, so 281 points below, after having been for a big part of the month within a hair of nailing it.

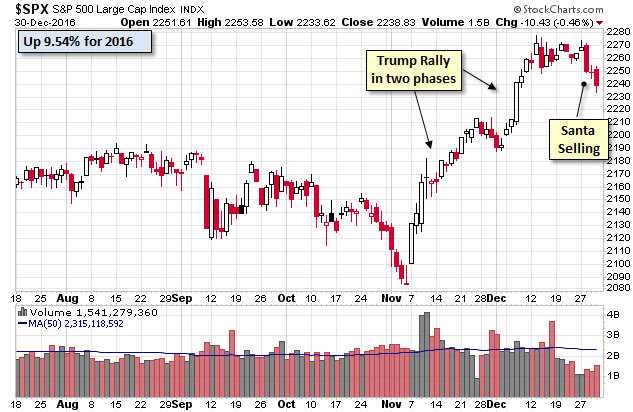

The S&P 500, after falling 0.5% on Friday, is now down 1.5% from its high on December 13. The rip-roaring Trump Trade since the Election has started to unwind (chart by Doug Short at Advisor Perspectives):

Did the master-communicator himself give the signal in his contrarian manner when he tweeted on December 26?

The world was gloomy before I won – there was no hope. Now the market is up nearly 10% and Christmas spending is over a trillion dollars!

Did the contrarian in him mean to signal to the rest of the world that the Trump Trade was over, even before the inauguration – the date at which a lot of pundits figured the Trump Trade would begin to unwind?

But what a year it was!

The S&P 500, after having ended 2015 down 0.7%, ended 2016 up 9.5%, including a big swoon early in the year. From February 11, when it bottomed out at 1,810, it has surged 23.6%.

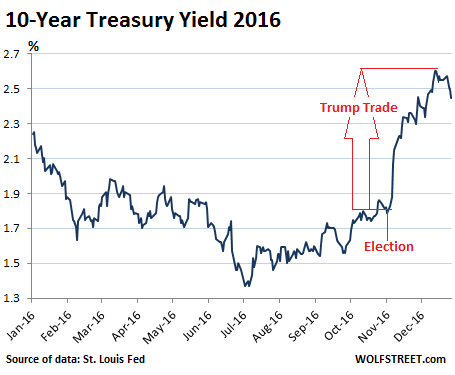

And bonds went on a wild ride. The 10-year Treasury yield ended 2016 at 2.445% up from 2.273% at end of 2015. It hit 2.57% at peak Trump Trade, up over a full percentage point from the summer. Over the fourth quarter, the yield jumped 84 basis points, the largest quarterly jump since 1994. And prices, which move inverse to yields, clobbered bondholders. But note the decline in yield since December 20:

And stocks partied. Since the election, financials surged, bringing the gain for the year to 29.1%, the best-performing sector in the S&P 500. Goldman Sachs, whose ex-executives are now heavily represented in the Trump administration, shot up 36% since the election and 51% since the beginning of October when Trump’s victory became more than just a possibility. GS was one of the best Trump Trades out there.

Alas, it too has started to peter out. GS is now down 2.5% from peak Trump-Trade, and other banks have followed. Insiders at the banks were preparing for it, it seems, because on December 9, just before bank stocks started losing ground, we found… If Everything is so Bullish, Why Are Bank Insiders Dumping Their Shares at Record Pace?

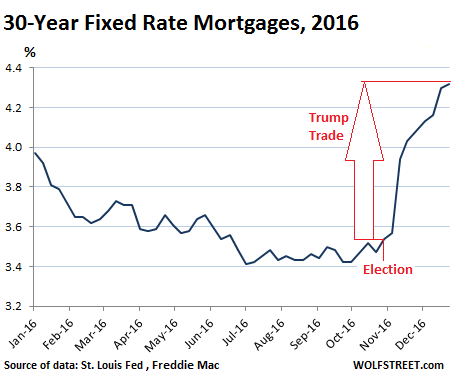

Mortgage rates have soared from around 3.4% for much of the summer to 4.32%, according to Freddie Mac. This is now reverberating through the housing market in multiple ways, with some people rushing to buy to lock in the rates before they go even higher, and others waiting for rates to come down and not buying, and still others being completely priced out by mortgage rates that are nearly a percentage point higher than they’d been a few months ago, and the first red flags on home sales are now cropping up:

The oil & gas sector had a crazy year. West Texas Intermediate settled at $53.72 (New York Mercantile Exchange), up 45% from the end of 2015, and up 105% from the low in February, but it is still about half of where it had been before the oil bust.

Alas, the glut – despite breathless jabbering about production cuts by OPEC and non-OPEC oil producers – isn’t going away anytime soon as US shale drillers, however teetering they may have been, are now once again getting doused with new money, and they’ve started up their rigs again, and production is once again rising, and crude oil in storage keeps setting records for this time of the year.

Energy stocks surged as if the price of WTI had returned to la-la land, with the S&P 500 energy sector up 23.7% for the year, the second-best performer of all sectors, with many of the individual stocks surging more than 40%, including Continental Resources which soared 124%. You’d think oil is back at $90 a barrel.

The US Natural gas spot price (Henry Hub) surged 93% over the year, from $1.93 per million BTU at the end of 2015 to $3.74 today. Exports via pipeline to Mexico, exports as LNG to the rest of the world, and consumption within the US have been rising even as the 8-year collapse in price has finally sapped production. This has whittled down the magnificent glut. But in the winter, natural gas is a bet on the weather, and it has gotten, as pundits would say, “unexpectedly” cold in much of the country.

All this happened as the US government and Congress (which has the power of the purse) provided a giant stimulus package, without calling it that, by spending a lot more in 2016 than it took in. As a consequence, the US gross national debt ballooned by nearly $1 trillion ($957 billion) over the course of 2016, to nearly $20 trillion (to $19.879 trillion, to be precise). And this process may yet accelerate under Trump’s plan.

As things are up in the air for 2017, and as pundits are trying to figure out how it will all turn out, one thing appears to become clearer. Read… Is the 2nd Half of 2017 when Sears Finally Kicks the Bucket?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Dear Readers and Commenters,

In 2016, WOLF STREET has grown 38%, compared to 2015 (in the number of “page views,” a standard measure of internet traffic). This is because of YOU!

Without YOU, it would not have been possible. So I want to thank YOU for coming to my site, reading and commenting and spreading the word. I’m proud of you all, and of your comments, and what you have made of my humble site.

I wish a happy, healthy, and prosperous New Year to all of you, and your families and loved ones.

In a world of a lot of fake news I enjoy reading your very insiteful information. There are not many websites that I trust anymore. Wolf may God bless you and your family in 2017. Keep sharing the truth even when it may not always be well received. We need more truth in this world and less false news. God bless.

A very very Happy 2017 New Year to Wolf and his pack!!!

Wolf-as someone who would probably be regarded as one who just fell off of the turnip truck regarding economics I want to thank you for your blog as well as all of the commenters-at least I think i’ll have the number of the truck(s) that hit me, even if there may not always be much recourse beyond that. In the words of author Rob’t A. Heinlein: “…self-deception is the root of all evil…”. Keep up the good works, a better year and luck to us all.

Mr. Richter,

Thank you for your refreshing, honest & insightful publication. It really stands out from all the noise by the so called “professionals” out there..

Thx for all the hard work, Wolf. The result: I visit your site on a daily basis.

All the best for 2017 for yourself and for all your loved ones.

Thank you so much for your well researched and well written articles . It’s a crucial source of information for me for both news and analysis that is hard to get anywhere else..wolf street and don quinones are extremely valuable for so many of us.. happy new year

You put forth a lot of very relevant material. Thank you for that!

And a very Happy and Prosperous New Year to you.

Mr. Richter:

I like your ‘humble’ site because you stick with the financial facts and present a balanced commentary when writing about politics. Hard to find these days. Happy New Year!

Thank you, Wolf for the factual website. Best to your loved ones, in what shapes up to be a rather peculiar year.

Regarding what happened in the past not being a reliable reflection of what’s going to happen in the future, it may be true within a cycle, but it may also be false, depending how far into the past you’re willing to look into. There’s plenty of rabbit-hole to dive into if you keep asking “but why?!” :)

This will paint a *BIG* picture view for everybody so simple and to the point without any fluff or double speak.

The global debt clock Our interactive overview of government debt across the planet

The clock is ticking. Every second, it seems, someone in the world takes on more debt. The idea of a debt clock for an individual nation is familiar to anyone who has been to Times Square in New York, where the American public shortfall is revealed. Our clock shows the global figure for almost all government debts in dollar terms. Does it matter?

http://www.economist.com/content/global_debt_clock

You think this is bad, wait till you see the worldwide corporate debt clock, makes you think the public debt clock looks much elegant.

And corporate debt is the biggie, when corporate/s cant refi, their employees generally loose job’s, then many other thing’s.

Happy 2017 to Wolf and his flock

10 trading days over the holiday season are thin and not a reliable reflection.

Great website and wish you all the best in the new year

Correct. In the markets, nothing that happened in the past is a “reliable reflection” of what’s going to happen in the future :-)

Thanks for all your analysis. Great stuff. But, I think the trend we’re seeing is not over yet.

Jan 3rd, 2017 is when a new animal spirit will be unleashed. Dow 20K for sure. Heck 30K for next year.

I expect we’ll see a typical “tiger economy” in the US: fueled by deregulation, the grifters will pour in like seagulls – eat up all the resources, liberally decorate the markets with guano, and leave with the profits – expecting the taxpayers to clean up the mess.

We’re more likely to see Dow 3K rather than Dow 30K, especially once the Italian banks fold and take the Eurozone down the tubes.

Never going to happen. The EU would rather have a continent full of zombie banks rather than to let even the smallest one fail. The complete lack of political will in Europe is even worse than in the U.S.

Yikes! 30,000??

Is that before or after Sears and several other tapped out big retailers go blooey, the European banks likewise, the Australian/Vancouver/San Francisco/London/New York/Chinese property bubble pops, the rest of the worlds oil producers start using the production enhancement technologies developed in the US — resulting in an even larger oil glut, the “Austrians” in the person of Paul Ryan who are about to give the US a big dose of the austerity purgative proceed to destroy demand and drive up unemployment one more time, etc., etc..\

You need to review Dr. Schiller’s book, Animal Spirits. I also note that his long term P/E is ALREADY 67% higher than the long term mean. Private debt to GDP ratios are also in the danger zone again.

I certainly can’t predict the future, and neither can you. But considering the above I can confidently say the time for caution is here.

30k youre delusional Only if the FED does QE4 and that would tank the dollar so the 30k wouldnt mean much If they actually do as they said and hike again look for a big drop maybe to 15k by April 1st in my opinion

Happy New Year Everybody!

As far as the Dow not hitting 20K, it’s probably a blessing because everybody would have bailed out, and the year could have ended lower. Now we have something to look forward to, more drama.

So now they will bail after Jan 1st Count on it Got gold?

Happy new year to you and your love ones Wolf.

Thanks for a great, insightful site which presents factual information. I learn not only from your articles, but also from many great comments which are posted.

With regard to the stock market, my crystal ball refuses to show what happens after January, but I suspect that many who wanted to sell stocks didn’t since they expect to pay lower capital gain in 2017. So, at least in January, I would say the market will be down at least 5%, but perhaps even up to 8%. Let’s see if my crystal ball gets it right or that I need a new crystal ball.

The only “free” site to which I donate my hard earned money. Well worth the price. Wolf is too modest to say this, but I hope other readers of sufficient means donate too. This site is a gem to be preserved. Happy new year.

Thank you, Curious Cat!!

Here’s how:

http://wolfstreet.com/how-to-donate-to-wolf-street/

I started reading you on other websites e.g. BusinessInsider. Enjoyed your writing and your insights. Heck, I might as well go to your website and see what else you are thinking. Read you every morning and follow any up-dates throughout the day. Thanks, Wolf. All the best in ’17.

Happy New Year, Wolf and his readers.

The Dow is very happy !!

P/E for the Dow is : $INDU:!GAAPDOW=145.68

Too many central banks love components of the Dow.

&INDU:$SPX soared lately, coming from behind.

P/E for the S&P500 is $SPX:!GAAPSPX=25.13

Both, pretty high.

Some warning signals :

When $NYSI turn down before reaching 500, combine with

$NYA150R turn down before reaching 70, there is a potential

for a severe downturn.

$NYSI is NYSE Mcclellan Summation Index @462

$NYA150R is NYSE percent of stocks above ma(150) @61.99

Good luck in 2017 !!!

In the words of my Grandaddy: It’s nice to listen to someone who can separate the BS from the buckwheat.

Something tells me 2017 is going to be one hell of an interesting year !

Merry Xmas and Happy New year to Wolf and all the readers of this great site.

The election outcome basically was a signal of change vs. continuation of the status quo. The markets believed that the upcoming change was going to be a growth scenario. Accordingly, the markets quickly priced in a growth scenario that, using rigorous mathematical analysis, is probably arithmetically impossible.

Eventually, the fantasy valuations will be flushed out of the markets and, at some unknown point, valuations will reflect reality. It would not surprise me a bit to see a huge waterfall drop in the stock market sometime in the first half of the year, perhaps on the order of 40-55%. On the other hand, given HFT manipulation of the markets, it would not surprise me to see the markets trade in a very narrow range throughout most of 2017.

Happy New Year to all!

Market action is in who’s favor? Expect the unexpected and trade accordingly, I expect volatility might be high.

Being serious I expect volatility for the entire P45 Administration.

As nothing is guaranteed or a certainty when dealing with mr Flip Flop’s administration..

Not unusual for the markets to quieten whilst majority of Christian professional traders do their religious things.

I’ll hold you to that assessment, at least you put it out there but then again so have the peddlers of fiction.

“I’ll hold you to that assessment, at least you put it out there but then again so have the peddlers of fiction.”

I have a better average than the peddlers of fiction, so long term I make money over costs as a trader.

I do frequently have timing issues. Normally quitting profitable trades trades to early. Must learn to reduce into a profitable situation and tighten stops, instead of just quitting when in a profitable situation.

Thanks Wolf and signore Don Quijone. Certainly some

Of the best journalism out there (for the most part). Wolf, I also pay by clicking lots of your adverts, although I am yet to purchase anything. Hope it all helps. I’m a regular donor to Naked Capitalism, but I may put you on next year. Stay fearless and true and I feel many more will join me.

Thank you!!

Wolf, a great periodic article would be one that summarises your:

A) past predictions which have turned out correct

B) past predictions/info that turned out incorrect – and how/why

You speak with such clarity and certainty, and with all due respect, I find myself rarely doubting you. But, because if the sheer volume of articles and info it’s hard to keep track of it all.

Would be a very interesting theme..

I personally try to stay away from predictions, particularly predictions of that kind: “Dow will crash 30% by the end of 2017.” I don’t believe in them. I have some contributors who strongly believe in making predictions, but I don’t like to.

I like show the data, analyze them, and put them in perspective. I also like to share my doubts (as in this article). And I quote other people’s predictions when I find them interesting and well thought-out (the Sears article is one of them … the quoted analyst put a time stamp on a Sears restructuring – after July 2017 – for an excellent legal reason inherent in federal bankruptcy law). To me that thought process and info is crucial.

I also like to show that not everything that is pictured as rosy is actually rosy. This can serve as a warning bell for investors. Something that says, watch out, tread carefully if you go there!

I also indirectly point at what I believe might be opportunities. But I don’t give investment advise, so I don’t spell out the opportunity (for example, I will never say, “this is a good buy at this price” or “why this will go up 30%…”). Some of my contributors may (rarely), but I don’t.

The way I think of my own analysis, it’s something readers can use, along with many other data points, to arrive over time at their own vision and course of action.

“The way I think of my own analysis, it’s something readers can use, along with many other data points, to arrive over time at their own vision and course of action.”

That’s wright, when you “buy” (or take), an analysis, you buy all the annalists biases and flawed perception’s.

If you are simply going to go and buy analysis you may just as well be in a fund or with a broker.

Much more important then the what, is the when.

Thanks, Wolf. We have had our share of run-ins over theories but as a rule your commentary is sound, unlike 90% of economists.

If and when you next come to Sydney let us locals know so we can catch up, face to face?

Would love to meet face to face. But as long as I run WS, I don’t even have time to take any unnecessary breaths. So my traveling days are somewhat limited for the moment (to approximately zero). But it’s on my list.

I stayed in Kings Cross, which was the sleazy and cheaper part of Sydney at the time (’96). Probably won’t recognize it anymore.

Thanks for everyhing Wolf,

I have been a lurker on your site for a long time, this seems like a good occasion to tell you how much I am impressed by the contents of this site and your comments. Please keep up the good work and accept my best wishes from France

I Do enjoy your site and your very thoughtful analysis, however how come all your comments are to the Gloomy side…. there must be some sunshine in the economy somewhere someplace….

It’s just that the “sunshine” part (even if it is artificial) is getting covered profusely and exuberantly in the financial media. No need for me to add to it :-)

“Although X and Y have improved, Z has deteriorated and XX is slipping further into bankruptcy.”

Be sure to eat your black eye peas or other legumes, cabbage or greens and cone bread for good luck in the new year.

Bids poured in after Friday mornings dollar flash crash in Asia?

Ball of hot yuan about to blow off shore toward the fed?

Janet inhaling merlot!

Beware of the FED-contained prophecies!

Happy new year to all.

The market’s in the normal timing band of its cycle for a correction. Under Obama, the PPT didn’t allow those corrections to happen. Now that the Dems lost the election, why support the market as Trump takes over? My guess is we’ll see a healthy correction.

Happy New Year to Wolf, readers and contributors. From the Asia part of the world. I do not visit WS every day. But at least once a week. Not so regular contributing. As there are better and more learned folks from all parts of the world. I learn from all of you. A big thank you.

dow 20,000 WHO CARES! ?

The” Dow index is a FRAUD! — It is a constantly redefined metric, Editors of the Journal drop loser stocks in favor of up-and-coming stocks, making any multi-year chart of “the” Dow utterly meaningless as a measure of TRUE overall long-term stock market performance.

The notion that you can take the price of 30 stocks and add all of the prices to come up with a meaningful average is mathematical nonsense.

For example, I added the closing prices from Dec-20-2016 and got 2,903.35

If you multiply that total by 6.8798 you get 19,974.62

On Oct-12-2016 the ‘dow’ closed at 18,176.32

The 30 DJI stocks totaled 2,652.87

A factor of 6.85157 would have shown the ‘correct’ total, 40 trading days earlier.

The usefulness of non-Gaap reporting is far greater than the nonsense that this “important” index is based on.

Those that focus on the SP500 are getting a better view of the market. At least it’s focused on Market-Cap which means the ‘adjustments’ are done daily by the market and not by some scrivener.

I hate to disappoint you: but losers are dropped from the S&P 500 as well, replaced by winners. And M&A brings in new companies, even foreign companies (!) that weren’t in it before….

Thus we should strive to own the new additions b/c those are the up and coming companies?

Thank you so much for your insightful pieces. You are a bright light in the dark days of financial repression.

Happy New Year to Wolf and all of you! It is a pleasure to be able to read not only Wolf’s pieces but the interaction of such a wonderful group of commenters. Peace be with you all!

ask me how i feel come june 2017.

as to right now, back to work tomorrow.

i like the site because it reinforces my belief that the future belongs to optimists, but now and then too many of them feels like a crowd.

Peace, Prosperity and joy to you Old Gray Wolf, and to your cubs and mate for the new journey around the Sun!

It has truly been a pleasure to know you. ^,..,^