“Distress” in Bonds Spirals into Financial Crisis Conditions

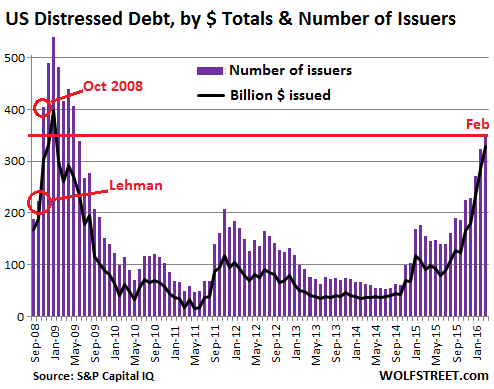

The pile of toxic corporate bonds in the US, euphemistically called “distressed” debt, ballooned 15% in the single month of February to $327.8 billion, up 265% from a year ago, according to S&P Capital IQ. The number of S&P rated US companies with distressed debt rose 9% in February to 353, up 128% from a year ago.

The last time the pile of distressed debt had soared to this level was in November 2008, and the last time the number of distressed issuers had shot up to these levels was in October 2008; Lehman had declared bankruptcy in September.

These “distressed” junk bonds sport yields that are at least 10 percentage points above US Treasury yields, according to S&P Capital IQ’s Distressed Debt Monitor. Put into a chart, the fiasco in terms of dollars (in billions, black line) and number of distressed issuers (purple columns) looks like this:

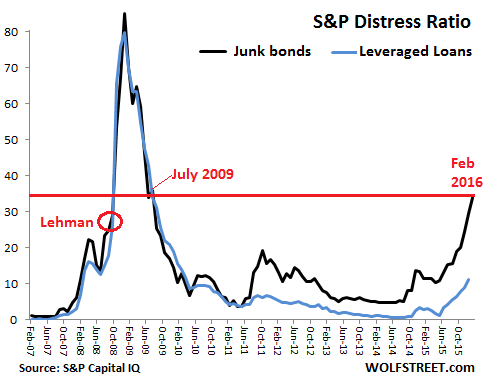

And so Standard & Poor’s US Distress Ratio for junk bonds soared to 33.9 in February, from 29.6 in January, having increased relentlessly for nine months straight, nearly tripling from a year ago!

The ratio hit the highest level since July 2009, when it was coming down from the Financial Crisis. But this is the spine-chilling part: Back in September 2008, before the Lehman bankruptcy had fully registered in the ratio, but when the Financial Crisis was already gaining a good amount of momentum, and when stocks were crashing left and right and prudent people were wearing hardhats while out on the sidewalk, the distress ratio was “only” 28.9:

The distress ratio measures the extent to which risk is being priced into the bonds. A rising ratio is “typically a precursor to more defaults,” the report explains.

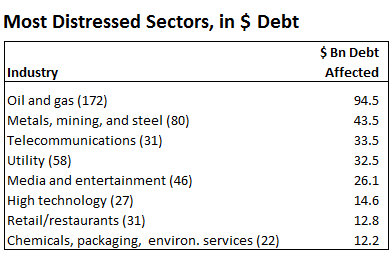

And it’s not just the oil-and-gas and the minerals-and-mining sectors that are getting crushed. Of the 607 distressed bond issues in the ratio, 172, or 28%, are oil-and-gas related and 80 bond issues, or 13%, are minerals-and-mining related. The remaining 59% are spread across other the spectrum.

“Spillover effect,” is what S&P Capital IQ calls this. It has contaminated “the speculative-grade spectrum as a whole.”

In terms of total debt, the third largest sector on the distressed list is Telecom with 31 S&P rated issuers and $33.5 billion in distressed debt, followed by Utilities, where distressed debt has soared 58% in just one month (!) to $32.5 billion, spread over 37 distressed issues. The table shows to top eight distressed sectors in dollar terms (the number in parenthesis is the number of companies):

These are some of the companies with the most distressed debt, in the top five sectors:

Oil-and-gas: Chesapeake with $6.4 billion in distressed debt; Linn Energy with $6.9 billion, and Continental Resources with $4.1 billion.

Mining and Metals: the three entities of Freeport-McMoRan with a total of $15.8 billion; Peabody Energy, $4.8 billion; Cliffs Natural Resources, $2.9 billion.

Telecom: the three Sprint entities with a total of $20.8 billion; Frontier, $5.5 billion.

Utilities: NRG Energy, $4.4 billion; Targa Resources $3.7 billion; Talen Energy Supply, $2.6 billion.

Media and Entertainment: iHeartCommunications, $8.7 billion; the two entities of Scientific Games with a total of $3.2 billion; Clear Channel Worldwide with $2.2 billion.

When distressed bonds default, bondholders can’t expect much of a recovery of interest or principal: 76% of all distressed issues are either unsecured or subordinated, and their claims to the assets are behind secured creditors. And 47% are dogged by S&P’s lowest recovery ratings of “5” or “6”, promising “only modest to negligible recovery.”

That the distress in junk bonds is worse today than it was when Lehman filed for bankruptcy, and that it is predicting a higher rate of defaults than it predicted at that time is interesting in a number of ways.

Today, still, no one is panicking. The Fed is talking about raising rates. There is no sign of QE or bailouts. The big three US stock indices, while down, haven’t crashed and offer a feel of eerie calm.

Part of this eerie calm on the surface is the still-widespread and ceaselessly propagated notion that all this is contained somehow, that it’s only the oil-and-gas sector, and well, the minerals-and-mining sector that got obliterated. And yet, beneath the fading gloss on the surface, all heck has broken lose.

These junk bonds are precursors. Hundreds of stocks hidden in the bowels of the big indices have gotten totally crushed as that “spillover effect” is doing its magic. And that’s what it looks like when a central-bank induced mega-credit bubble is left to its own devices and starts unraveling from the bottom up.

That spillover effect is spreading. Read… It Starts: Subprime Auto Loans Implode (in Your Bond Fund)

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Interesting as I clearly remember Dick Fuld of Lehman denying the impending collapse day before the implosion…

So we have some good historical data points closely mirroring late 2008 and the banksters are in full denial while the RE and stock market is in full swings tad below all time high. Yep something tells me it’s not going to end well.

As for me I’ve been gorging on double short ETFs (SDS, QID) and buying gold coin below spot since late Oct.

I remember reading an article in a magazine, late 2009 or 2010. i think it was News Week. In the interview with Mr. Fuld he described the flow of events to the collapse of Lehman. The senior management had a meeting and came up with a plan to recover from the financial disaster unfolding for Lehman. They had 5 billion dollars in their account at JP Morgan bank. Mr Fuld called JP Morgan and requested the money to be returned to Lehman immediately. JP Morgan refused. MR Fuld called the Federal Reserve bank, they said they would not intervene . He then called the treasury department to have the government order the return of of their 5 billion dollars. They refused to help. At that point he said he realized all of the other parties were working together to collapse Lehmam Brothers. JP Morgan kept the 5 billion dollars. I guess that was the first bail-in during a financial crisis.

You should read the book, “A Colossal Failure of Common Sense” by Lawrence MacDonald, who was inside Lehman Brothers. Fuld recklessly ruined the company, despite month upon month of pleadings by employees to reverse the tragic steps that Fuld and his buddies “on the top floor” had put together. Most of those pleaders were fired for their trouble.

For what Fuld did, in my opinion, he should have been flown fifty miles offshore in a helicopter, and dropped nekkid into the Atlantic Ocean. It was insanely stupid, and ruined so many lives.

This was very interesting to read, thanks.

Me think, why would a bank have 5B just sitting at another bank? If it was a loan, it has a repayment date, so that’s why nobody intervened.

Nice!

I closed my 30IS 3x WTI a bit early but whatever. I’m done with energy.

Next: USDCNY. Up, up, and away….

Here is the trick to get gold coins near spot thru eBay – be sure to sign up for eBay bucks where you get up tp 8% or $100 max per gold coins under world currency category (NOT bullion).

Picked up 3 in Jan and 2 early Feb and got 1 more today (Canadian Maple for $1,201 or $1,301 minus $100 cash back)

Details here (thread started by me):

http://www.fatwallet.com/forums/hot-deals/1481300/

The rating agencies have only started to downgrade bad debt recently. After 2008 everybody knew the ratings were worthless, so it is hard to feel bad for anybody who bought any themselves. I feel bad for the people who are not aware their pension plans are stuffed with this garbage.

Jeb stuffed the Florida State pension plan with Lehman junk after he left the state. He couldn’t get elected dog catcher here. The situation is so bad, they are trying to pass legislation to allow workers to contribute to a 401K, so state employees don’t have to rely on the state pension plan.

Yeah, because the rating agencies did such a wonderful job back then on subprime that their word still means anything.

The whole financial sector is such a complete sham through and through, that used car salesmen and drug dealers are Jesus in comparison.

“The whole financial sector is such a complete sham through and through, that used car salesmen and drug dealers are Jesus in comparison.”

Quote of the week.

I’m persuaded that we do not actually have an ‘economy’ so much as a collection of racketeering operations, and that it was probably a mistake to put a bunch of pirates in charge of everything.

Walter map has it nailed. That’s the best comment today Walter thank you.

While on the subject of shams: the entire election system is a sham too. Electoral college. Digital ballots without an audit trail. It’s really nuts.

Why? Because a long as this nation has TV, a car and a bed, nobody will start the revolution. That’s why this stuff works. The plebis rather stick their head in VR goggles and ignore the mess than do something as inconvenient as changing the stays quo.

I have zero expectation n that anything will change in the big scheme of things. Not ever.

Couple of years back I happened to catch a segment of a .fl.gov show (can’t remember the exact name of the show). It was a meeting of various city & county officials from around Florida discussing their pension plans & the huge funding shortfalls. They were all discussing the millions of dollars in loans they had or were seeking to ‘shore up the pensions’. I wish I had a recording of it because so few ever watch these meetings & most of the people I tried to enlighten on this topic would just look at me like I was an alien.

It will probably go full MIRA at some point.

Capital Dateline is probably the show you saw. They cover FL politics on tv and have a web site.

You might be onto something, but ZIRP times are desperate times. Every pension fund has to produce that 5-7 percent return to stay solvent. But looking past junk bonds, the pension funds I follow are now deep in stocks. Sure at the top of the list are AAPL, a GOOG, but hey, just yesterday it was Nortel, and Nokia.

And apple is cooking their books already. Creative accounting abound. Read their annual report. It’s funny revenue and capex.

I think the junk bond implosions/defaults may be tiny compared to the web of junk bonds re-packaged into CDO/CDS by the banksters into different tranches as derivative market is often many times over the bond market and bring the once very liquid market to its knees as somebody (those at bottom of the tranches) has to pay for the wrong bets since such CDOs are backed by assets of dubious value.

So back in 2007/8 was the subprime mortgages and this time it is the cesspool of subprime auto loans and commodity junk bonds (oil, gas, metal, etc)?

The problem with derivatives is that they sell the entire income stream from debt whether or not it can be prepaid. Even if the borrowers pay off the debt the paper can become worthless.

EX: Borrower with subprime auto loan at 25% interest prepays 2 years early by rolling over the debt into a new lower rate car purchase. The paper sold based on those 2 years of disappearing income is now worth a lot less. Even if they get a slice of the prepayment money they are probably out of the money big time. Some of those derivatives may not even qualify to get back principle until some tranches get principal and interest first. Even though the borrower paid in full, some tranches may never get any money or only part of their money back. The whole thing is a scam.

I’m truly surprised this game is still on. We know it can’t go on forever, and in future history books it will look as if it quickly collapsed, but living through it everyday is a chore.

Perhaps they could even add a few years to this corpse by implementing helicopter money. My god.

Hopefully Deutsche Bank collapses first.

Yes DB and slew of Italian banks are probably ready to fall but there will be mother of all bailout of some kind by super Mario to save EU and his country only to delay the inevitable.

It’s like giving drug/alcohol to junkie so he remains in drunken stupor only to delay and nasty hangover…

These derivatives are a relatively small slice of the pie compared to CDS which are the dominant derivative. They reported $192 trillion for Q3 2015 with the 4 largest banks holding 90% of these contracts. When you peruse the data it’s also VERY clear who controls the metals-futures market. Here is a link to 2015-Q3 derivatives as reported at the OCC. For anyone wanting to see what the total derivative$ exposure is (as reported) here is the link to OCC

http://www.occ.treas.gov/topics/capital-markets/financial-markets/trading/derivatives/dq315.pdf

Clear, useful explanation of this aspect of derivatives. Thank you.

“Sell in May and go away” could be great advice this year.

I see things getting ultra volatile this Summer.

Bears will be having a feast this year.

Great article, Wolf.

I keep refreshing sites like this waiting for the biggest Minsky Moment of all times. I know one day we’ll wake up and stocks will be falling like stones on a lake. I just can feel it. The suspense is killing me. All it takes is a turning point –we are lacking a new Lehman to officially declare things are bad.

C’mon, Deutsche Bank, you can do it. Do it. Do it now. Fall. You won’t be remembered.

I hate to disappoint you, Álvaro: If something happens to DB, it’s going to get bailed out. Stockholders and some bondholders, particularly the CoCo bondholders, may get “bailed in,” as they should be, but the German government, whoever is in power, will not allow for DB to collapse Lehman-like, ever!

And if it violates the EU’s new banking rules and the old state-aid rules, so be it.

Yes, those bail in rules were carefully thought out.

The banks will survive to be consolidated. Less the majority of their debts.

Last time round, the Socialization of bank debts cost tax payers. Particularly German ones.

Germany aims to come out of this, on the up side of the ledger this time.

Quiet a few of those bailed in banks will end up with large German state shareholdings. Or share holding’s that will later pass to the German state as arranged in exchange for (Nicely circumventing the state aid laws)X,Y,or Z. Once bailed in, and debt restructured, many of them will be quiet financially attractive.

Wolfgang and Mutti, keep talking reform, some of that, will be the elimination of NPL’S from many euro banks.

They can see as we do now, Failure to do this this was the main Japanese error.

DB’S crisis will set the Euro bank bail in ball rolling, the southern banks are the ones that will be eliminated.

A “new” DB will arise from bail-in statutory management. As you Predict.

I tend to agree with that view.

The last I checked DB had in excess of $55 trillion in derivatives. If it sinks, the surrounding vortex would start pulling in bank after interconnected bank. There does seem to be a massive blowup just over the horizon. I just wonder how it will be handled, who gets sacrificed, & what controls/different systems are put in place.

The aha moment for me 98′ with LTCM blowing up. When I saw the rescue by the fed & a couple of the big sharks because they were concerned about the cross contagion collapsing the whole shebang- yeah, a real eye opener. I believe LTCM had +/- 1 $trillion in derivatives.

I went & checked the OCC numbers for total bank derivative exposure in Q3 of 1998. It was approx. $ 32.5 trillion.

http://www.occ.treas.gov/topics/capital-markets/financial-markets/trading/derivatives/dq398.pdf

The OCC numbers for Q3 2015 derivative exposure of the 4 largest banks

JPM – $51.9 T

CITI – $51.2 T

GS – $43.6 T

BOA – $27.8

http://www.occ.treas.gov/topics/capital-markets/financial-markets/trading/derivatives/dq398.pdf

To me, this puts a huge exclamation mark on the bogus stamp re money/banking. I trill, 100 trill, 50 quad trill????-seems to make no real difference. Most of the financial shenanigans are hidden in the CDS’s.

I understand the rationale people have in cheering for these large banking vampires to collapse but I can’t understand why they think something less corrupt will take it’s place. For a little historical perspective, here’s a good place to start for the uninitiated.

http://www.xat.org/xat/moneyhistory.html

I like the Graphs but why is one number 353 and one 607? maybe only 353 are rated by s&p and 607 are rated by s&p, fitch, moody’s and others?

thanks

Glad to help you with this:

353 = the number of “companies” (or “issuers”) with distressed bonds in the index.

607 = the number of distressed “bond issues” in the index.

Some companies with distressed debt have more than one bond issue that is in distress, such as Chesapeake, which has a whole bunch of bond issues in this index. But it also has some bond issues that are not in distress (I haven’t checked lately, but I assume that its bonds that mature in the near future trade that way, along with some of its senior secured debt).

A “bond issue” is for example $500 million of 10-year notes, due 2023 with a coupon of 5%. The same company may also have issued $350 million in 5-year notes, due 2018 with a coupon of 4%. If the company has since fallen on hard times, and if these bonds trade with a yield of 10% above Treasury yields, the company would be included in the “353” and the two bond issues would be included in the “607.”

Based upon the charts, It looks we have about 5 or 6 months of this nonsense until this thing goes critical mass. Its going to be a fun summer.

In a liquidity crisis, or a broader financial crisis, are there market sectors that are relatively safe, or is it the nature of these things to have extremely broad-based effects? Are companies with good cash flow and positive books reasonably safe, or do they get wiped out too?

I’m asking because I’ve come into a chunk of money I’d like to invest, and I’m curious if there are a few simple principles for eliminating extreme risk. So far, the main one I’ve come across is ‘don’t invest in a bear market or when earnings are going down’ which is probably true, but unsatisfying.

Most people in this kind of websites will tell you to buy physical gold. Others will tell you to buy land or property. And others will just tell you to stockpile food and guns. You won’t find any definite answer.

own things that make money or will make money.

own things that make you happy.

own things that do some good.

and have a manageable vice or two.

Keep the money right there for a few months and see how things evolve.

These days there’s simply too much volatility afoot to suggest any true low-risk investment.

Unless you plan to spend the next three-four months in front of a computer screen with your hand on the “Buy” and “Sell” buttons, there’s very little to buy right now.

Most stuff these days is either overpriced (sometimes egregiously so) or subject to wild volatility. Unless you know how to hold to your hat or how to hedge risks, cash is a safe bet these days.

The fundamental question you should ask yourself first is this: is your number one priority to hang on to this capital? Or is your number one priority to produce capital gains and/or income and risk losing some or even a big part of this capital? That requires some soul-searching in these crazy times of ours. But once you have the answer to this question, it’s easier to move forward in the direction you want to go.

Thank you, I’ll consider those things. Looking at macro issues is a lot like soothsaying — you can see things that are out of whack, but they have the ability to persist for longer than one thinks. It’s frustrating — I’m Canadian, and would really like the housing bubble to resolve itself so I can settle down and buy bank stocks, but it’s demonstrated some real staying power over the past few years.

Large amounts of cash/deposits are not safe, they are not insured. That is, you don’t want to be over the FDIC insurance level. Now also bail in risk. CDs are also no good.

Word from a finance/banking guy I’ve heard, was, in a crisis, “you want to be as close to the sovereign as possible”. Learn this by heart. He’s talking about US treasuries. You can put them into an account that rolls them over automatically.

‘Eliminating extreme risk’ = preservation of capital. Treasuries, no corporates.

Stocks, no way. Equity always gets smacked. Real estate, US real estate is among the most over leveraged in the world. Will be big problems there. But generally real estate is an area that is used with big caveats, for wealth preservation. It’s the biggest category in any mixed economy. Wait til after the crash, incorporate, get an accountant.

With US treasuries, you can park money there until you learn for yourself what you need to know.

Remember, sell side is always talking their book.

For the market, wait til there is congressional action to increase the deficit. Then you’ll know that revenues will be supported by the government. (Otherwise don’t play the market, unless you really know something about it.) The government acts to keep corporations alive. Read some economists/finance people.

For the US. Adjust for other jurisdictions. Also remember, FX risk. Learn what hedging your transactions means.

I might suggest a mix of short-term t-bills and cash. With NIRP looming, cash deposits would likely take any hits later than bonds. The bail-in risk, however, can’t be overstated, and with FDIC being worthless in a systemic event, NIRPY t-bills might still be less risky. Torn between a rock and a hard place.

If I recall, two years ago (at Christmas as usual) Congress passed and our President signed a bill that limits recovery of accounts to

$250,000 PER Social Security number…NOT account. That means one time recovery. I don’t know if that spreads out to include other types of accounts or not.

Perhaps Wolf can answer this.

Bud, I don’t know where you heard this, but that was a hoax.

Here are the rules for deposit insurance, from the FDIC: “The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.”

https://www.fdic.gov/deposit/deposits/

So, for example, you can go to your broker and buy 10 different CDs, each for $250,000, each from a different bank, and hold those in your brokerage account, and you have $2.5 million that is FDIC insured.

It gets a little more complicated if you want to have more than $250,000 insured at the same bank. You need to make sure you understand “account ownership category.” So read the fine print if you want to have more than $250K insured at a single bank.

Does America have like some Euro States.

A a fine print that state accounts in parent and subsidiary banks are considered as 1 account for the purposes of insurance.

The definition is “per insured bank.” The FDIC website allows you to check out which bank is insured. In the US, when one bank takes over another bank, the resulting bank is considered one bank. So when Wells Fargo took over Washington Mutual during the Financial Crisis, if you had CDs in both banks, suddenly they fell under the one-bank rule. However, they made exceptions for these kinds of situations and kept the original insurance intact.

But don’t listen to me on this. I’m not authorized to speak for the FDIC. Go to the FDIC website for final answers.

Thank you.

Doesnt effect me, does effect other US readers perceptions, and understandings of FDIC.

FDIC is of course, only as strong as the Federal Government.

In a full system implosion, they will pay out how many decades later, if ever?

In a full system implosion, all bets are off.

:-]

Wolf, perhaps you have an opinion on this regarding the FDIC aspect.

I would venture to guess that a failed bank is going to be restructured by the government as a new entity.

The recent changes to law make it look like derivatives based obligations will be paid off first, and deposits later. So once the cash is gone, depositors will be looking at IOU’s from the new entity.

But that’s not cash. It’s stock in end. And there is my question: if you’re a creditor in a banking entity where you’re owed stock not cash, does the FDIC not simply say: “sayonara, buddy. We only insure cash, not stock. Good luck!”

Thanks.

If the account falls within the deposit guarantee by the FDIC, it is guaranteed and remains available to the customers (either at the failed bank now run by the FDIC or at another bank that bought the deposits from the FDIC). This happened to me over a weekend during the Financial Crisis. I couldn’t actually tell the difference. By Monday morning, the only thing that changed was the name of the bank.

To the extent that deposits are uninsured, the uninsured amounts get in line with the other creditors.

So your insured deposits are fine. But you might get a haircut on your uninsured deposits.

Invest or store securely possibly generating a return.

The places not to have that money is gold, unless you buy it at Around $200.00 as that’s all its worth.

A Bank or a Bank controlled safety deposit facility.

Read the fine print in “A Bank” you are not a depositor, Thye are not caring fro your money, You simply another unsecured creditor that lent them money, the second you hand over your money.

This sort of thing has potential as with this one, you own the trees and the carbon credits, although they want too much for it. http://www.trademe.co.nz/Browse/Listing.aspx?id=943050409

Average pine harvest cycle is 30+ Years.

I would strongly encourage anyone desiring to understand how the FDIC scheme might be actually implemented in a full-blown crisis to take a moment to digest the chilling information provided by Ellen Brown three years ago. It provides a shockingly rude awakening to anyone still imagining their bank deposits are ultimately safe and in their control:

http://ellenbrown.com/2013/03/28/it-can-happen-here-the-confiscation-scheme-planned-for-us-and-uk-depositors/

The FDIC deposit insurance has worked my entire life, just fine, without a hitch, as the FDIC closed thousands of banks.

Sure, if the sun suddenly refuses to rise, even the FDIC can’t cope with it. But neither can your stocks or bonds or real estate. And even gold becomes utterly useless. And not much later, everyone will be dead. But that scenario is unlikely, and I think it’s silly to prepare for it.

And if the entire financial system collapses? Well it did collapse during the Financial Crisis. And the FDIC didn’t miss a beat.

Wrong question! Where to invest money when there are black swans circling overhead? Don’t!

Where do you want to be if there is a systemic system collapse? Or the the US bumbling interventions in the sectarian civil war in Syria bring the US and Russia to the inevitable head to head confrontation? Or the Euro experiment collapses back into its natural state?

Like warm weather and no snow? Buy a modest house for 80k on a friendly Caribbean island off the path of industrial tourism like Bequia. Or if you like mountains, by a small farm/vinyard in Chile.

Like sheep and have more capital? New Zealand. Living on a small pension? Ecuador

I’ll give you an old man’s advice:

Pay off ALL DEBTS. In todays Zero Interest world, any debt you pay is a terrific return. Have a 5% house note? Well when you pay it off you just got 5% on your money. Pay all of it and DON”T GO BACK EVER INTO DEBT.

If you have children, pay off one of these College Pre-Payment Plans.

What is left, invest in YOURSELF in terms of more education (if you can make more money from it) YOUR business, etc.

Why put money into any thing you don’t really know? Why? You must have some type of job and if you are self-employed improve YOUR business.

Sometimes having no financial stress is the best investment of all. Have One Full year of cash, in your hands, to pay ALL bills.

Then, buy silver coin, guns and ammo, food just in case. You need food for 6 months since if it gets that bad you only have to wait until 80% of the pop has starved off or killed each other. That will protect that extreme.

Work less? Very healthy. Start working out? Very healthy. Money is for peace, happiness, health, not some “RETURN” or more junk.

Enjoy peace and your good fortune. There is a point where it isn’t going to get any better for you and what you have may be it. Wisdom is knowing when you have it made.

Great comment.

Regards,

Cooter

If things are bad enough that the population is “starving off”, then people after coming after your food and your stuff, plain and simple, guns or no guns.

If you want to really prepare properly, you need to plan a community, so people can look out for each other.

I wonder if cities would tend to get naturally self organized in these situations. After all you tend to have the organizational structures already in place, a population that would suddenly have a lot of time on their hands, motivated to get useful things done, like eating regularly.

Written in one of the post nuclear apocalypse SF book’s.

In California they ate everything that looked like food, then they ate the rats, then they ate each other.

That’s what will happen in big city’s, as the predominant skill-set, that will rise to the top, is gang warfare.

It’s not the inevitable recession that concerns me so much as the likelihood that there may be no means of recovery from the coming recession.

As predicted, there was no real recovery from the last recession – just giveaways to the banksters. And the Fed is facing the very real prospect of having the economy go down even as they have used up their policy options.

Saving the banksters won’t be possible this time because there’s nothing left to bail them out with. Bail-ins will merely crush the real economy, leaving the banksters no better off than they were.

My new prediction is that if a Republican is elected president the U.S. will resort to a right-wing dictatorship.

It can only get worse from there, but you get the idea.

Walter – My concern goes beyond the failure you mention to subsequent civil unrest. I think that’s one of the reasons President Xi is cracking down in China. He doesn’t want a billion peasants marching in the streets. I don’t think there is a near term danger here, but I’m not so sure about Europe.

Fortunately we live in civilized times, so purges are unlikely to become an issue.

“My new prediction is that if a Republican is elected president the U.S. will resort to a right-wing dictatorship.”

What do you call what we have now, DOJ is just getting around to investigating white collar crimes committed a decade ago? Surely this tells us where the priorities lie?

They wouldn’t do that. Why, that would be wrong.

One wonders how much corruption a system can tolerate before it becomes totally dysfunctional and collapses under the weight of its own iniquities. This might be our big chance to find out.

Call it a learning experience.

You have one of those already

Wolf,

Isnt D Banks derivitives many multiples of the German GDP. How could they realistically bailout a hole that big?

Yes, well, derivative are kind of funny. If none of the counter-parties of DB fails, or if it is decreed by fiat that they don’t fail, derivatives just exist. They’re zero-sum. One entity’s gain is another’s loss, in theory. I mean even Greece, when it defaulted, didn’t trigger much of a ripple in the world of derivatives because it was decided that it shouldn’t. So I’m really uncertain about the whole super-shadowy and highly manipulated scheme. However I doubt that derivatives will be allowed to take down DB.

Maybe. Probably. It seems to me that the problem with derivatives is that being unregulated, and therefore particularly opaque, is that there’s no way to know if they will fall, or how they will fall if they do, or what the downstream effects would be. I think the lack of information by itself increases risk.

I’d put more thought into it, but I simply don’t have enough information, and lack of information about such a large issue makes me nervous.

Wolf,

Not sure I understand your point “They’re zero-sum. One entity’s gain is another’s loss, in theory.”

It is my understanding that the $700-800 trillion in global derivatives do not cancel – otherwise no one would profit from making them. It is my understanding that the residual loss is $20+ trillion – which could take down the global economy.

This is similar to the MBS fiasco where the subprime market was only ~ $2 trillion. The problem was the ~ $60 trillion in derivatives based on the MBSs which didn’t cancel and amounted to way more than underlying subprime market – this is what brought down the banks.

Interest rate swaps cancel (i.e zero sum), but credit default swaps do not (i.e not zero sum). And there are many complexities and variations – and these are just two of the common species.

There are other vectors, such as CDS, which are regulated by ISDA – if they say it isn’t a default, then it isn’t (even if it is).

So, it depends, if I am not mistaken.

Cooter

Simply stated, they are a wealth transfer mechanism. If you know how they work and how they’re structured you have the ability to confiscate someone’s wealth.

It’s hard too believe a DB crash won’t take German economy down, bail or no bail. It’s hard too believe those derivatives just will cancel each other.

Also: RBS, Bankia, Unicredit, HSBC. You name it. It’s all ready.

Oh, I agree, if there’s a big problem at DB that bubbles chaotically into the open and the government and/or the central banks (ECB, Bundesbank) have to deal with it, such as a bailout of DB, it will hit the real economy somewhat, but it will eviscerate financial markets in a messy way, and not just in Germany.

Realistically, it is the magnitude of the pile that is frightening. If there is a loss of just 1% of 50T, it is more than Deutsche Bank’s capital. At that point it is bankrupt, and the Deutsche Regierung will have to bail it out. But who will bail out the incompetence the German establishment?

Cold hard numbers.

Estimated 2015 German GDP: €3.84 trillion

Estimated 2015 EU GDP: €19.18 trillion

Real Deutsche Bank derivatives as of December 2015: €54.74 trillion

Germans have been constantly bailing out their banking system since 2010 but, given these are most local banks, it hardly makes financial news even if they are often quite large by all standards.

They’ve been allowed to get away with it not so much because their economy is large, but because the bulk of these banks are owned by Lander and municipalities. As the main shareholders, they “simply” transfer troubled assets on their books, hence saving the fiction these are bail-in’s while in reality taxpayers are on the hook for billions in cities like Hamburg alone.

German banks got massacred without mercy in 2014 by the final implosion of Austrian toxic waste dump Hypo-Alpe-Adria Bank by betting on a Federal bailout which never came. It was a truly asinine decision and only one of the countless taken by German banks.

If Italian banks are plagued by an unknown number of NPL’s, German banks are plagued by serial bad calls. Had I not taken a peek into how Deutschland AG works, I would be surprised, for no other reason German companies usually give the impression of being so well run.

I won’t go in detail because it would turn this into an even longer run, but given the opprotunity I always choose to work with Japan Incorporated over Deutschland AG. This is not because the Japanese are honorable samurai in business suits but because compared to Germany, understanding what goes on in a Japanese company and who sits in front of you is a breeze.

Watch treasury rates, if the economy is shrinking or panicking treasuries become a popular place to stash cash. Cash itself represents return OF capital as opposed to return ON capital, either of these can fall into negative territory depending on which way things go.

Dutch, German and Swiss treasuries are all already in negative territory. Sure, asinine monetary policies have a hand in it but normally nobody would lend money for free to any government, let alone pay for the privilege.

The panic/shrinkage already started last May and hasn’t subsided yet. In fact it seems to be getting worse by the month. There’s a definite very slow but steady economic contraction afoot masked by a variety of methods (see Italy and France, where government spending accounts for over 55% of the GDP).

The fact the G20 seems so eager (almost too eager) for a worldwide stimulus package in spite of the continuous narrative about a “robust recovery” (now entering its seventh year) or “weaker than expected but fundamentally solid growth” is both telling and troubling. Troubling not so much because we may have an economic correction, something that has always happened and will always happen, but because I do not want to think about what shape this stimulus may take.

If China is already warming up the escavators and construction cranes for yet another round of mindless building, the West and Japan have no such luxury. Unless central banks start buying big stashes of junk rated IOU’s, there’s very little that can be done. Lowering the cost of debt has created a number of highly localized housing bubbles worldwide (Sydney, San Francisco, Vancouver, Geneva, Copenhagen etc) but did little for those not living there. I know for sure my house has not increased in value, otherwise I would have cashed my check in already.

Ferocious financial supression has caused an extremely dangerous reversal of the post-2008 trend toward household deleveraging. Families and individuals are merrily getting into debt again, but they start from a weaker position: in real world terms their wages have contracted, they have less savings and their houses are on the average worth less.

Those new subprime auto loans Mr Richter has written and spoken about are just the vanguard: like in corporate, the bottom will fall off household debt again.

Can it be ignored? The ECB QE program has long included selected corporate bonds rated BBB or better. Financial junk starts at BB.

This is opening a widening gap in yields between issuers at the receiving end of the ECB’s largesse (and those who could be) and those left out in the cold. But I am sure if issuers and their lobbysts beat on their pans loud enough, the requisite will be lowered to BBB- or even BB+. Far from the ECB “disappointing” the markets.

There will be no such luxury for households.

Falling knives everywhere.Time to duck and cover .

Personally, I would bet that the Democrats will go out of their way to contain the financial ruin that has prefaced common sense and good financial management. My guess is that after the election all the major defaults start occurring. As numerous other folks commenting we all know that the financial markets are nothing more than financial engineering feats that never seem to end. When they do end it wont be well.. So when your debit or credit cards get denied consistenly you know that the banks are “mitigating” withdrawals. My guess is that the credit bubble collapses after this election.. What do I know really I earn my money and learned 10 x 10 is 100, not 1232 or what the heck these valuations have become.

Or maybe the powers that be make it happen right before election. Make the plebis scared and this maybe another incompetent poster child ends up in office, dependent on advisors and consultants to make any policy decision, and the circus and the magic show just continues.

Treasuries and gold are indicating high stress. Time for a real correction.

I heard a theory about the way the bond market bull would turn to a bear: incremental/slow selling down the quality scale. Junk bonds start, and then the near investment/junk start selling, and so on down to the safest of the safe: US Govt Bonds. So, there would be a spread bulge which over time would move to higher quality. At the end all bond interest would be higher, i.e. bond prices lower.

I don’t know if this is practical/reasonable scenario or not.

Wolf,

Your commonsense intervention at various points in the comments–excellent. You won’t let your website be used to disseminate hysterical rumors or harmful misinformation.

Thanks

(This place to leave comments should be at the very top of the comment section)

Anyway. Just think, all the bad economic news is all coming out BEFORE bad news. In 2008, etc, we had the bad news about bad home loans and then everything went down. Today, all has gone down to 2008-9 levels and the Bad News is not even out yet.

Just wait. We can consider this the TOP of the chart and we have yet to go down. And out TOP today is at the DOWN of the last crisis. This is almost going to be fun.

I am such a huge fan of this website and Wolf Richter in particular.. I repost columns nearly everyday so my FB friends can prepare for whatever they believe is coming.. Most are working class so my advice to them is pay down credit cards as fast as possible and not get caught like in 2008 when cards were raised to 29% even on the best holders.. I personally think we are on the cusp of something awful but I also don’t think we’ll have another Lehman because that lesson was learned.. All of the small politically insignificant companies are SOL. I’m amazed you take the time to respond, Wolf.. Thanks..

Thank YOU!

Wolf,

Perhaps you can answer this question. What happened in July of 2011?

Looking at the S&P Distress Ratio chart, Junk bonds and Leveraged loans pretty much overlapped one another from 2007 all the way through the Financial Crisis and up to the summer of 2011. From that point on they split? What are we seeing here? Oil patch junk bonds starting to sour as early as 2011? Or are the Leveraged loans artificially being held down, manipulated? This caught my eye and I am very curious as to what I am looking at.

Cheers!

Great question, Jeff. I don’t have a good answer. But I have a bad guess.

Leveraged loans are often secured and higher up in the capital structure than the low end of junk bonds. So this makes investors less leery about a default since they have better chances of recovery.

In mid-2011, the euro debt crisis started doing its job on global bonds. Hence the spike in bond yields that you see in the chart. But leveraged loans were spared that fate because of the better position in the capital structure, and because they don’t flow through the bond markets. They flow through banks. So the dynamics are different.

That might explain why leveraged loan yields didn’t spike. But it doesn’t explain why the gap continues to this day. I think leveraged loans are overpriced compared to junk bonds, and I think there will be some bad “surprises that no one saw coming” when they get repriced to the level of junk bonds.

Well your bad guess makes pretty good sense to me! Keep up the great work, love the site. Been a fan since the “Testosterone pit” days!

Since the US govt has made it clear it will bail out anyone and everyone (i.e Bank Holding companies, QE to the moon, etc), it’s concievable that there will be no collapse.

The markets have made it clear that bad news is good news (more QE) so, has anyone considered the fact that in the face of calamity equities and real estate will soar?

This is not a closed physical system, it is a man-made artifice.

Should the Treasury dept deem Avacodos to be worth their weight in gold, so it will be done.

“Since the US govt has made it clear it will bail out anyone and everyone (i.e Bank Holding companies, QE to the moon, etc), it’s concievable that there will be no collapse.”

You can’t do that indefinitely. You just can’t. At best, Government loses all credibility and companies are encouraged to malfunction. At worst, currency loses all its value and no country accepts your nonsensical dollars, so you can’t import any goods.

Having watched the financial crisis since 2008 and as a retired school teacher I have come to this conclusion: Like someone holding over their head a barbell beyond their strength, either the weight will be dropped all at once or the weight will be lowered slowly. In either case, gravity (debt) will relentlessly cause the weight lifter to eventually release the weight to the floor. I personally expect that the US economic decline will be peppered with black swan events and eventually a dramatic and permanently lower standard of living with higher prices for the most basic goods and services. Both economically and politically John Kasick appears to be the most competent and well adjusted person out there. But, it appears the voting public is more attracted to glamorous exploiters and fault finding debaters. In paraphrasing James Madison, he said that a nation continually at war eventually loses its civil rights.

Third option – spotter steps in, helps bang out a few more reps, then the weights come down at ‘controlled velocity’.

Fourth option – Weights come down but end up slowly choking the life out of said weightlifter before hitting the floor.

I believe similar to you regarding probable economic direction & outcome. I’m taking as many steps as I can to diminish the negatives I see forthcoming. “Detaching can be hard” :)

Is this the John Kasich fellow you speak of?

http://rethinkecon.org/2011/03/07/john-kasich-and-the-temple-of-state-pension-funds/

http://www.prwatch.org/news/2016/02/13045/ohio-charter-school-scandal-grows-while-john-kasich-ascends-national-stage

Kasich was 100% for Persian Gulf war & invading Afghanistan, supported Clintons assault weapons ban, 1 term senate, 9 term congress, 2nd term OH gov, 8 years at Lehman Bros right up to their bankruptcy, wants to expand mil spending, believes we need ‘boots on the ground’ to fight isis, supported health care mandate that would have made it mandatory for employees to purchase health care through employers >>>>>>>>>>>>>>>>>http://time.com/3968801/hillary-clinton-john-kasich-healthcare/

Please note, I am biased, hate em ALL