The Government’s strange and awesome powers

By Larry Kummer, Editor of the Fabius Maximus website:

Six years after the recession ended, we are due for another recession. Many experts say that the government is “out of bullets” to fight the next severe downturn. That’s quite false because 2008 marked the start of a new era in which our leaders manage the business cycles using strange and awesome tools. We’ll learn the long-term effects of these tools slowly, probably only decades later.

“All is not lost until you run out of airspeed, altitude, and ideas.” — Pilots’ wisdom.

Expect the next recession

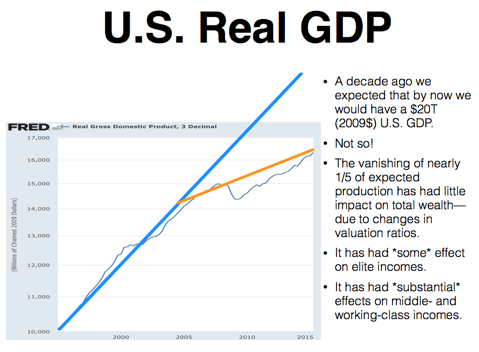

Free market economic systems produce greater growth than any other system yet tried. Business cycles — and recessions — are a price we pay for the growth. They’re unpredictable, literally so: the consensus of economists has never predicted one. They can destroy years of growth, and change the course of nations. The 2008 crash did both, as shown by this slide from a typically excellent analysis by Brad DeLong.

Six years of slow growth have not restored the US to the vigorous health desirable before a recession, especially since we seldom see the weakness before a downturn cracks them open (e.g., the good news in 2007 was that our banks were in the strongest condition ever before a recession). The Fed’s economists have slowly abandoned hopes for a fast recovery; they now foresee continued slow growth.

Another recession could arrive soon and get ugly, fast — as many of the world major financial institutions have warned, including the IMF. We should consider what that means, since this is the 4th longest expansion since WWII, now 75 months long. And we’re due for another one.

What can the government do during a severe recession to shorten its duration and minimize its magnitude? Many people believe the “Fed is out of bullets”. They’re very wrong. A new era began with the 2008 crash, giving the government and the Fed strange and awesome powers.

“… the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.” — Ben Benanke, speech in November 2002.

Lower interest rates!

On 16 December 2008 the Federal Reserve lowered their target rate for Federal Funds to 0 – 0.25%. The US Treasury just issued three-month Treasury Bills, for the first time ever at a yield of zero. After seven years of running a zero interest rate policy (ZIRP) bolder steps will be needed.

Another tool is quantitative easing (QE). Long experience in the US, Europe, and Japan has proven its value during a crisis. To push down the rates of other securities, starting in 2008 the Fed (and Treasury) made large scale purchases of Treasury and government-guaranteed securities. The Fed also purchased Commercial Paper (short-term corporate debt). These programs proved quite effective during the 2008 crisis, at no net cost, the Fed claims, though they wiped out income streams of savers and caused all kinds of other distortions.

Subsequent rounds (QE2, QE3) proved far less effective. Expect the Fed to do more QE during the next recession — on an even larger scale, if necessary. There are no obvious limits to this tool. As Bernanke explained in that 2002 speech …

Therefore a second policy option, complementary to operating in the markets for Treasury and agency debt, would be for the Fed to offer fixed-term loans to banks at low or zero interest, with a wide range of private assets (including, among others, corporate bonds, commercial paper, bank loans, and mortgages) deemed eligible as collateral. … the Fed {also} has the authority to buy foreign government debt …

The only monetary tool that remains unused by the US is lowering rates below zero. There are precedents for charging (rather than paying) interest on bank deposits. Among them:

- Nineteenth century banks often went bust, solvent banks charged depositors for their safety.

- Modern banks, with their large infrastructure and heavy regulatory requirements, can charge for deposits if they can no longer earn sufficient rates on those funds.

- Investors’ demand for safe government debt can push yields below zero, as seen since the crash on some eurozone bonds and the US Treasury’s inflation-protected bonds.

- Today Denmark, Sweden and Switzerland have already implemented negative rates on commercial banks’ excess reserves deposited at the central bank (the Fed pays 0.25% to banks on reserves).

These are just toe-in-the-water steps to negative interest rates compared to what I expect to see during the next recession, much as early examples of quantitative easing were dwarfed by what major central banks have done since the crash — with consequences impossible to foresee.

Guarantee much; buy the rest

Since 1873 Central Banks have followed Bagehot’s Rule when acting as the lender of last resort: lend freely at a high rate of interest on good securities. During the crash the Fed wrote a new rule: “privatize profits, socialize risks.”

The Troubled Asset Relief Program allowed the Treasury to purchase or insure up to $700 billion of “troubled assets.” Also, the government wielded its “Guarantee” stamp with abandon. Goldman Sachs, Morgan Stanley, and GMAC (GM’s finance subsidiary) became bank holding companies, and so eligible for TARP funds and FDIC coverage. Also, the Treasury guaranteed money market funds.

The government nationalized Fannie Mae and Freddie Mac to prevent their bankruptcy (as investors expected, but government officials had long claimed that would not happen).

In order to protect the profits of Goldman Sachs, the government nationalized the AIG holding company. Very different treatment than that given to Goldman and Morgan Stanley, as The Wall Street Journal pointed out:

Key decision makers at the Fed and Treasury arbitrarily determined which companies should become wards of the federal government (AIG) and which should be permitted to live on (Goldman Sachs and Morgan Stanley). Goldman Sachs was permitted to live by enjoying markedly lower interest rates and access to credit facilities amounting over time to approximately $600 billion.

And it was probably illegal.

The scope for the government and the central bank guaranteeing and buying financial assets during a crisis is almost unlimited, assuming Congress is sufficiently panicked to agree. Insiders will reap vast fortunes, as they did from the previous crash.

Suspending accounting standards

During the crash Wall Street exerted their political power, and Congress moved to protect their patrons. In September 2008 and October 2008 the SEC and the Financial Standards Accounting Board (FASB) in effect suspended Statement of Financial Accounting Standard No. 157 — “Fair Value Measurements”, which “defines fair value, establishes a framework for measuring fair value in U.S. generally accepted accounting principles (“GAAP”), and requires expanded disclosures about fair value measurements”. On 2 April 2009, FASB did so more decisively.

This allowed banks the freedom to value assets at will and avoid disclosing that some had negative net worth. John Hussman believes that these were the most effective — and the most precedent-breaking — measures taken during the crash. Reliable accounting standards provide the information on which free markets rely. Suspending them (in concert with other measures, described below) created the managed markets government and industry leaders desire during a crisis.

The SEC staff later issued a white paper pouring whitewash on their actions.

Fiscal Policy

History shows that fiscal policy (deficit spending) is one of the most effective tools to fight a downturn.

The US government had no difficulty financing deficits. The US government’s public debt remains relatively low as a percent of GDP compared to its peers, so there’s no reason to expect that to change during a crisis — as a “flight to safety” provides more buyers for Treasury securities. If managing the debt becomes a problem in the future, the Bank of Japan and other central banks have proven that they can monetize government debt with no obvious limits (i.e., they can print money to buy government debt).

We can expect government spending to set new records during the next severe downturn. Who knows, perhaps we’ll use the recession as an opportunity to repair our rotting infrastructure.

Momentous Change

During the great recession, the government took actions with few precedents in the kinds of measures used — and no precedents in their scale. During the next severe downturn we can expect many of these actions to be repeated, even in a much smaller crisis.

Investors know this, even if only implicitly — which is why valuations of many risk assets are high by historical standards. They believe the government has put a safety net not just under the economy, but under asset prices as well (chopping off the left tail of the bell curve). They will be correct until the day comes when this policy either changes or catastrophically breaks.

This momentous change in our government’s management of the economy occurred without long thought, without serious analysis, and without public discussion. It served, above all, the interests of a financial sector that has grown to dominate the US economy — generating vast fortunes for speculators and the upper tier of the sector’s workers (especially the senior executives). For America, the benefits of the financial sector’s growth and security are probably zero, or less.

We can only guess how this all will end. The essential thing to know is that we have begun a new era. Expect the unexpected. By Larry Kummer, Editor of the Fabius Maximus website.

And what might spark a crisis? Read… US Economy Flies into “Coffin Corner,” But We Don’t Mind!

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Next recession? I think many people will agree that we never really got out of the last Great Recession from late 2008 – just ask the ranks of millions stop looking for work, part-time employees barely getting by and ever growing ranks on food stamps (it has been increasing since 2008).

That said the mountains of inventory at level not seen since 2008 does point to next leg down and the stock/bond/real estate market is once again trading near peaks.

We learn history so as not to repeat it…

The only history that has been learned is that “moral hazard” is alive and well. The other ancillary lessons are that 1) it’s okay to default on your obligations because there are no long-term ramifications (housing loans) and 2) The bigger and more systemic your business operations are, the less likely you are to go out of business, regardless of how you run your operations.

It’s a shame, really. If the Fed/Treasury didn’t want to see the large banks fail, there should have been long-term wind down plans. I would be very happy to see a return to sound money principles, even if it meant a couple lean years.

TBTF (too big to fail) prevaileth and the TBTF banks shall be made whole no matter what with TARP II and the Feds will once again to rescue mini AIGs of the world via bailout of wrong bets made on derivatives as Feds and politician will NOT allow TBTF banks to fail.

Funny that the banksters are allowed to PLUNDER with Fed’s help wth millions in bonus yet won’t lose a dime if they made wrong bet – worse of crony capitalism at play here.

That’s because the implied opposite to recession is growth. But it’s only implied, not guaranteed.

Since 2009 the only “growth” has been through deficit spending “stimulus”, in other words, smoke and mirrors. The foundations of the American economy have been steadily deconstructed and shipped overseas while the non-productive components (financial institutions of all sorts) leverage their arbitrage to profit and expand from the exodus of wealth.

TPP will give this flow a turbocharge and accelerate the hollowing out of this once great nation, further establishing the financial and governing elite as the only winners in the game. The remainder of America will continue it’s slide into the third world.

We have no one to blame but ourselves.

HA! we are in the middle of a DEPRESSION…why not come right out and say it?

An it will get 10 times worse-when the dam breaks

A terrific article.

I’ve always maintained 2008/09 was a watershed event after which nothing will be or can be the same. In typical fashion, the economists are late to the party in forecasting ‘continued slow growth’. As anyone who lives in the real world knows, virtually nothing that means anything to the middle class has improved at all or has become worse.

It’s more like there is now an unbending tendency for things to stay mediocre, with nearly nothing to stop it should it suddenly (or slowly) decide to go to hell in a hand-basket. AFAIC, we are now in the 6th year of our first lost decade and most likely there are more to come.

“Business cycles — and recessions — are a price we pay for the growth” I think it was Mises that pointed out pretty clearly how economy wide business cycles are not the result of the free market. I think it is not accidental that the writer chose as his nom de plume the name of someone who thought that sacrificing the harvest was a sound strategy for averting disaster.

Even if Mises was right … let’s face it, there is no “free market.” There hasn’t been a “free market” in this or the last millennium. But we’ve always had recessions. And sometimes worse. Theory is one thing. Reality is another.

.

Just keep stealing 4 % a year from all deposit accounts of savers

and give that money to the banks or some other rediculous use to get a vote.

.

. My taxes are large, and I am being taxed an additional 4% on all my savings accounts.

.

. and for what

there is no fiscal responsibility, morals or ethics

Was remarking with a friend the other day that in the past 20 years of “bubble economics”, the only time we’ve seem market prices was that short period of time in 2009/2010 when homes, stocks, and commodities were fairly and truly priced as to their respective income producing streams. This ended in late 2010 with the start of QEII. IMO, the main problem in the economy right now is no one knows the true pricing of any asset class, due to the end of “mark to market” and the potential of further QE and Fed interventions.

The potential for fed propping up asset pricing has created the current domain where “good news is good news” and “bad news is good news”, which does no one any favors when the tide turns and the market participants demand “true market pricing”, if that ever happens again.

Thats rite. To have summer you got to have winter

And here is the first trial balloon sent up concerning negative interest rates:

http://www.marketwatch.com/story/fed-officials-seem-ready-to-deploy-negative-rates-in-next-crisis-2015-10-10?link=MW_popular

As we see in Japan, the government monetary policies are enriching the corporations and the well connected while causing the disappearance of the middle class. This has continued for a period of over 20 years.

If the FED enacts this same policy of buying up government bonds and short term interest rate instruments along with negative interest rates, we can probably expect the same here.

No loud crashes, just a general malaise settling over the economy, the well connected corporate and political class getting richer, and the middle class slowly blending into the lower class of poor people living on some kind of government assistance.

There seems to be no other option from here on out.

Japan is worse than that.

Earlier this month Seven & I Holdings (owners, among many other things, of the ubiquitous 7-Eleven convenience stores) announced yet another drop in revenues and yet another drop in profits, leading to its shares missing last week’s phenomenal (and frankly worrying) Nikkei rally.

Consumer spending in Japan, already on a long slide since 2000, has dropped like a stone last year and is not coming back.

Of course everybody sees and acknowledges what the problem is: real wages aren’t keeping up with real price inflation. And with close to 40% of Japan’s workforce now composed of part-time and “irregular” workers this is getting worse by the minute. I won’t even go into what Abenomics are doing to the once legendary Japanese savers.

Everybody lamenting we haven’t got enough inflation should be forced to study Japan’s case. They have inflation (real world one, meaning including food, is around 7.5%, dangerously close to double digit mass inflation) but no growth to speak of and even their once legendary trade surplus has evaporated despite the commodity carnage amid disappointing export figures and slumping factory orders.

Even the big keiretsu are wary of the situation: their present trend is to keep their money abroad, chiefly in their US and Chinese operations, where it won’t get chewed away at the same pace as the yen they hold at home. Call the dollar and the yuan the less dirty shirts in the laundry.

Like politicians everywhere, Shinzo Abe and his allies are promising more miracle cures, for example an expansion of welfare benefits and a general increase on infrastructure spending which in Japan has become almost standard political fare for over two decades now. This doesn’t bode well, as that same public spending is now fueled by about half its value by the Bank of Japandemonium.

One may wonder why the Japanese people continue voting for these people, who are effectively selling the country at the side of the road for a handful of (debased) coins. The reasons are two and very similar to what goes on in Europe.

First is that Shinzo Abe is the lesser of two evils. Believe it or not, his political opponents are even wackier than he is.

Second is most Japanese are extremely disenchanted with politics as a whole. Even during the 60’s and 70’s boom years, voter turnout rarely exceeded 70%. At the last “snap election” voter turnout was an astonishingly meager 52%, the lowest on books.

OR…they can stop the counterfeiting.

Quit faking valuations. End deficit spending. Stop printing money to “buy” bonds and ABS. Cease propping up zombie entities and let them go under.

In other words, they could try something they haven’t tried before. Capitalism.

“There are no obvious limits to this tool.”

Really.

So we’ve invented a perpetual economic motion machine — someone tell Ethiopia all they need is a printing press and they can all live large.

That’s seems to be what the CBs and governments think. But there are always consequences.

I have long maintained that when things get bad enough in the economic sectors the problems will become political & social!

the fault is in believing that all of these financial problems can be contained & manipulated within the financial sector without overflowing into the rest of society. This will supposedly keep the financial games going on & on like a perpetual motion machine .Third world overpopulated nations & their people are not going to quietly starve to death because of some inflation inducing financial tricks devised by some Central Bankers. We will not see that much of it in America which is still relatively wealthy.

by contrast,in the third world the social order will break down & chaos will ensue! This can be seen in the case of nations like Russia & China,which aren’t third world & have histories of autocratic rule.

If they are pressed too hard by the bankers & threatened with financial ruin they will leave the western financial system & return to militarism & dictatorship.We see it in Syria where Russia which is supposedly in bad economic straits has thumbed it’s nose at the western bankers &reverted to military adventures.If they can’t purchase what they need they will just take what they need by military means!

Sorry this illusion has an expiration date. The 10% can lie to itself until the 90% have had enough. The 10% cannot support this debt economy.

I am sure it will not be too long until the pension funds self explode. At that point the 10% better find higher ground to hide,

Regarding negative interest rates, If there would be any reason to start a bank run that would be the catalyst.

Time for the FED to increase the rates on overnight lending, and for gosh sake get those rate’s off the floor! Where is the incentive to SAVE anything?

Hey if 12% is good enough for the “average” VISA or MASTERCARD debtor, why isn’t half of that adequate to charge overnight lending?

Time to start looking at DEBT as something to repay, or get ready to file the country’s re-organization. Maybe CHINA wants to buy what it doesn’t already own?

Recession might actually be the norm. But the lack of action leads to taking risks in order to boost the level of excitement. The resultant stimulation drives momentum. Until the oiint at which is all comes crashing down again.

Time is a river and no river runs straight. The current conditions will change whether we can foresee it or not. Like the rest of you though, I doubt any change will be for the better. As long as our fellow Americans insist on voting crazy or stupid or are too apathetic to vote, things can only get worse. The current situation reminds me of a poem that W.B.Yeats wrote right after WWI and proved horribly prophetic; “The Second Coming”.

(By U.S. law, this poem is in the public domain but I will only quote the beginning and end:)

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

The darkness drops again; but now I know

That twenty centuries of stony sleep

Were vexed to nightmare by a rocking cradle,

And what rough beast, its hour come round at last,

Slouches towards Bethlehem to be born?

My brother, who is a civil engineer and manages huge projects, has told me the Chinese are investing many billions of dollars creating huge housing developments in Dallas and North Dakota for the oil workers. They have unimaginable amounts of wealth to invest in the U.S. The Chinese have been around a very long time. In their history, they have experimented with absolute totalitarianism(it ended very badly) and, long before the 20th Century, with socialism(that ended badly too). The Chinese have an unimaginably ambitious plan called the New Silk Road to transform the economy of the entire world. They have the long term vision that our leaders have utterly abandoned. I really think they are on to something. The Chinese have always believed that there are better ways to deal with a would be enemy than with anything so crude as warfare. They can no longer invest in their own country without dangerously distorting the economy, but as decayed as our industrial base and infrastructure are over here, the sky is pretty much the limit for investing in America. They may end up owning most of it. Anyway, keep your eye on them!

Keep in mind that I have a B.A. in Asian Studies Chinese and I spent a year in Taiwan able to speak and read the language. I have special insights that most of the rest of you may not have. I would like to say that Mandarin is substantially easier for English speakers to learn than you may have heard. The structure of the language has many strong parallels with that of English and most of the sounds are familiar. The writing system is not really any more difficult than dealing with English spelling and the characters are beautiful, evocative and artistic and are actually rather fun to learn.

Anyway, you would find it fascinating to learn something about this vibrant land and its rich and ancient culture and history.

Yours Truly,

Sz Ma Jyun ^,..,^

I do not know any Japanese, but it uses Chinese ‘picture writing’ imported around 1200-1400 AD.

Although spoken Japanese and Chinese are completely different, they are roughly similar in their written form and can be partly understood.

However I have read a fair amount about Japan and Japanese and it is a cliche that Western speakers of Japanese grossly overestimate their proficiency. So called ‘kitchen Japanese’ is one thing, basic literacy is another. A factor is that the Japanese are very reluctant to correct errors.

There is a reason that Japanese kids come home, eat supper and then do two hours of homework. Mainly, they are learning Japanese, beginning with the 1200 core symbols which are put together to form more complicated ones.

One American author who arrived in Japan after WWII, married a Japanese woman and went into business there, thought that two years of full time study was required to become reasonably literate. BTW- by full time he meant 8 hours a day.

There are probably only a few thousand Westerners, who were not born into a Japanese- speaking family who are truly literate in Japanese.

Among serious scholars of the language, there is disagreement over whether

the vagueness of Japanese is inherent or intentional. The most famous

example is the Japanese ‘yes’ which can mean ‘yes’ or ‘just I hear you’

One tragic example: after the German surrender but before the A-bomb, the Allies issued the Potsdam Declaration, which said to Japan, ‘Surrender or be destroyed’

The Japanese Prime Minster, Suzuki, had been appointed by Hirohito to negotiate a peace. He was in his 80’s and spoke an elegant almost archaic Japanese. His reply was translated into English as ‘rejection’ but the same word can also mean ‘no comment’

Here is the strange thing: Japanese newspapers weren’t sure what he meant.

As interesting as picture writing is, I think one is lucky to have any phonetic system. Compared to Japanese or Mandarin, phonetics could be called language for the lazy.

You have just described perfectly the magician’s secrets. It’s nothing more than an illusion.

All they are doing is protecting big business and hollowing out the middle classes. Eventually, it has to fail, there are simply too many downward pressures on society. Inequality rising at record pace, lower real wages, technological unemployment, poor demographics, finite resources and slowing demand will all add to a toxic mix of social unrest.

It will break just a matter of when.

Very comprehensive article, but consider the possibility that Main Street America is, and has been, experiencing a recession, or is, and has been, experiencing something even worse.

A record 93 million working age Americans are no longer participating in the workforce. It is estimated that over 75% of Americans are living paycheck to paycheck. One out of four children are on food stamps (SNAP). The poverty rate has stood at 15 percent for three consecutive years, the first time that has happened since the mid-1960s. Since 2012 almost 8,500 medium or large retail businesses have shut down. And 22% of the GDP is comprised of Defense spending and healthcare dollars, most of which suck the Main Street economy dry.

Negative interest rates are going to require draconian measures. Zero Hedge had a story yesterday where Greece has limited the amount of cash government employees and pensioners can withdraw each month. Cash is the obvious way around NIRP so some form of ‘time limit’ on currency is going to have to be created to prevent people from pulling their bank deposits and holding cash.

Years ago a man I knew was trying to conceal his assets from his wife. If his Visa balance was $1000 he sent them a check for $50,000 and his bank account was empty but he had a positive balance on that Visa card. The government is going to be playing ‘whack a mole’ as it tries to close off these techniques. If my electric bill is $200 per month what does the utility do if I send them $5000? Everyone will be trying to pre pay their expenses and how this affects an economy will be interesting.

Unit472

I always have paid the utilities bills in advance. I normally maintain a months billing paid in advance. However, if you forget to pay a bill on time the utilities will reward you with an interest charge at 18% on the balance.

“If his Visa balance was $1000 he sent them a check for $50,000 and his bank account was empty but he had a positive balance on that Visa card.”

Clever, but I wonder what will happen if that becomes common which would then make compromised credit cards even juicier targets for thieves. Since there’s no FDIC guarantee on those “stored” funds, you’d have to wait for a refund of the stolen funds after the completion of a fraud investigation by the CC company at least, that is, until they change their rules in some to remove their responsibility for huge positive balances.

The Chinese have the same problem as the Japanese. They are an upside down pyramid. I.e., too many seniors and not enough people at the base to hold it all up.

Demographics is destiny, folks.

We’ve had so many decades of supply side trickle down junk economics, and anti-government rhetoric, we’ve forgotten that the consumer drives the US economy. So try stimulating the consumer this time around instead of stimulating stock buybacks, and see what happens.

“For America, the benefits of the financial sector’s growth and security are probably zero, or less.”

Probably?! Simply considering the methods described in this column by which they achieved that growth, it’s “obviously” far LESS than zero. Instead of productive investment, we have speculative skimming by parasites on a vast and growing scale.

Purchasing power = capital available to purchase.

Capital = non-renewable resources.

As capital is ‘consumed’ so is purchasing power. At the end of the day there is no available capital, no more purchasing power either. It matters not how much ‘money’ is available or the rate of interest.

Growth itself is the problem, not the inability to restart it. Growth = consumption of capital. We’re doing it to ourselves.

When Henry Ford approached a school teacher to invest in his company to produce a ‘universal car’ he used her capital. However as a result the purchasing power of millions increased because of huge time savings.

Innovation and its implementation require capital. All persons using computers benefit from the use of capital. As a older person I remember

typing term papers- being able to correct before printing to me ranks way up there.

The question is how do we save classical capitalism, which puts idle resources to work, from the weird insanity of high speed trading, derivatives, etc.