The ECB started its €60-billion-a-month QE bonanza earlier this year and was expected to run it through September 2016, but already the Big Money is clamoring for more. Shook up by what’s happening in China, the ECB said it might accommodate them.

Now Standard and Poor’s warned or recommended – whichever – that the ECB could double the size of the QE program, to €2.4 trillion and extend it “until mid-2018.” That the Big Money is clamoring for more is no surprise: despite the ECB’s QE and negative deposit rates, stock prices have plunged, with the German DAX down 23% in six months.

So here comes Peter Praet, ECB Executive Board Member and Chief Economist, with an amazing presentation at the BVI Asset Management conference in Germany, showing one devastating chart after another on how the euro has failed the Eurozone economy.

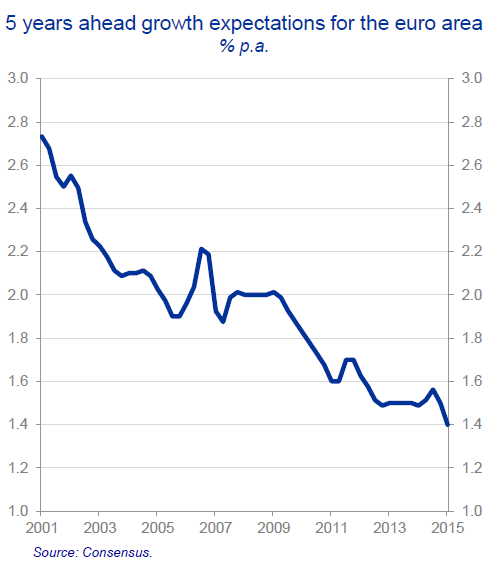

Optimism, when published by economists, is usually designed to hype what needs to be hyped at the moment. This is universal. But in the Eurozone, even economists are dialing back their optimism. In the chart below, Praet shows how expectations of economic growth for five years ahead have dropped over the 15 years that the euro has been around:

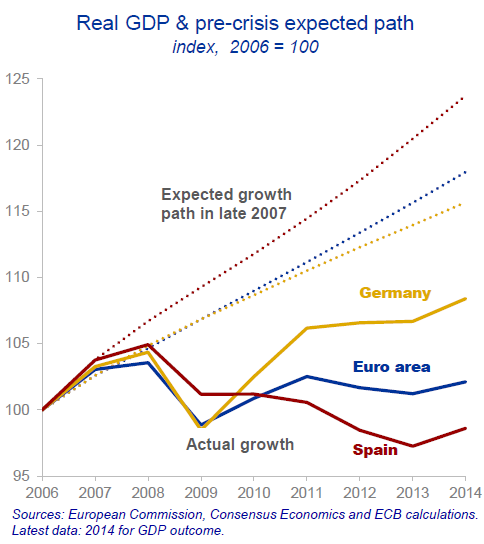

And another picture of hope v. reality: Growth as private-sector economists had envisioned it in October 2007 (dotted lines). At the time, no-questions-asked money was plentiful, even for Greece, and the sky was the limit. And this is how it turned out. Mercifully, Greece is not shown; its line would fall off the chart:

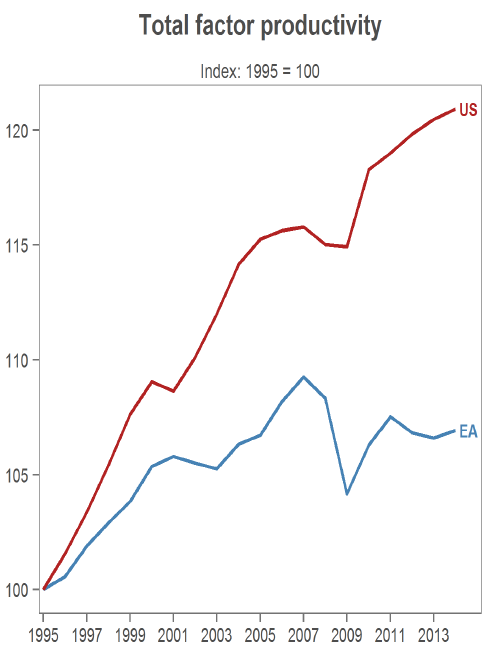

How deep are the problems? Rising productivity is a sign that an economy is technologically dynamic, that it doesn’t sit still. The chart below compares productivity in the US to the euro area (EA) over the past 20 years. Productivity in the pre-euro period rose but not as steeply as in the US. Once the euro became the currency, productivity languished and after the Financial Crisis actually fell. Today, productivity in the Eurozone is lower than it was in 2007:

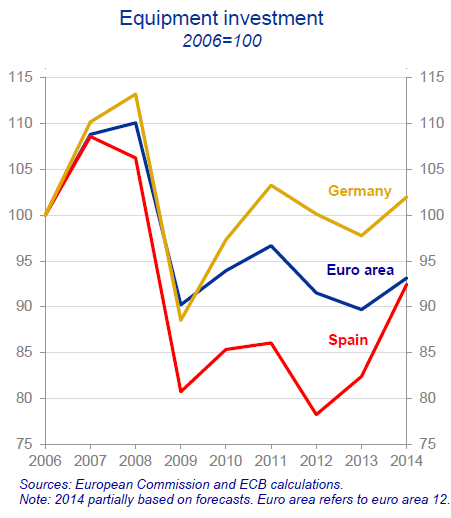

Part of this is a result of dismal investment in equipment. Despite nearly free money and knee-deep liquidly, companies aren’t investing for productive purposes. It was never high in the newfangled Eurozone, but it plunged in 2008. It is just now recovering a smidgen in Germany, but it’s still declining in the Eurozone overall. And look how far Spain has fallen. Again we’re grateful that the chart doesn’t show Greece:

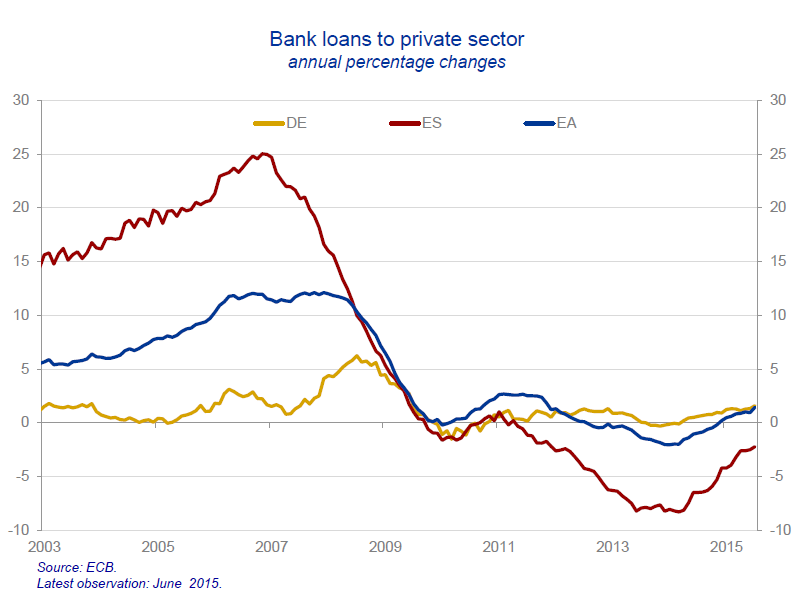

And bank loans to the private sector shriveled. Whatever banks were doing with the liquidity, they weren’t lending it out. At one end of the lending spectrum, there was no demand because the economy was withering. At the other end, businesses that needed the loans didn’t get them. In Spain, total bank loans actually started declining in 2011, in part because bad loans were being written off ever so slowly, though many of them are still on the books of the banks to be dealt with later.

The chart below, with data through June 2015, shows that bank loans have inched up this year for the first time since 2011. Germany (DE) is lumbering along. But Spain (ES) is still in the hole.

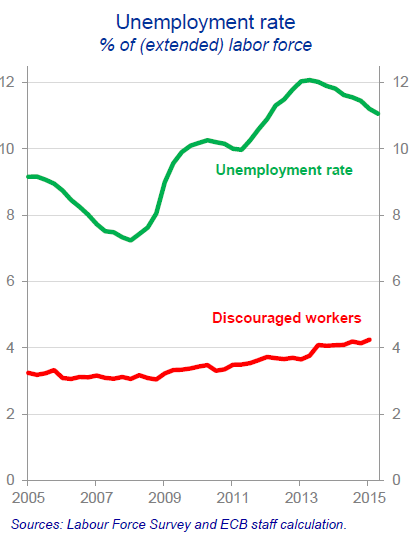

As a result, unemployment in a number of Eurozone countries has been an unmitigated fiasco, with unemployment rates of 25% in Greece and 22% in Spain, and with youth unemployment rates that are over twice that. But Germany, Austria, Luxembourg, and some other countries have very low unemployment rates. So the average looks far better than the reality in “vulnerable countries,” as the ECB calls Cyprus, Greece, Ireland, Spain, Italy, Portugal, and Slovenia.

The overall unemployment rate (green line in the chart below) is still in the double digits. That’s where France is today (10.5%). The masses of “discouraged workers” – those who’re available to work but after having beaten their head against the wall for a few years have stopped looking – just keeps growing (red line):

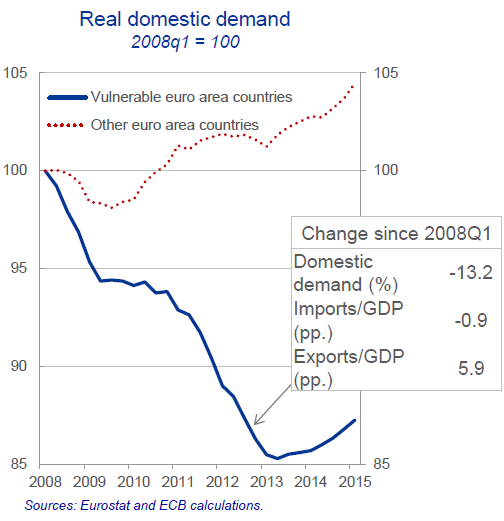

And this is how the Eurozone has split in two: On one side, countries that benefited from a (relatively) hard currency; and on the other, countries like Greece, Spain, Italy, etc. – and France – that have always had banana-republic currencies that they devalued frequently and sharply to solve whatever fiscal and other problems they had without actually solving anything. But now that they can’t devalue, they’re “vulnerable.” These two parts of the Eurozone have done nothing but diverge:

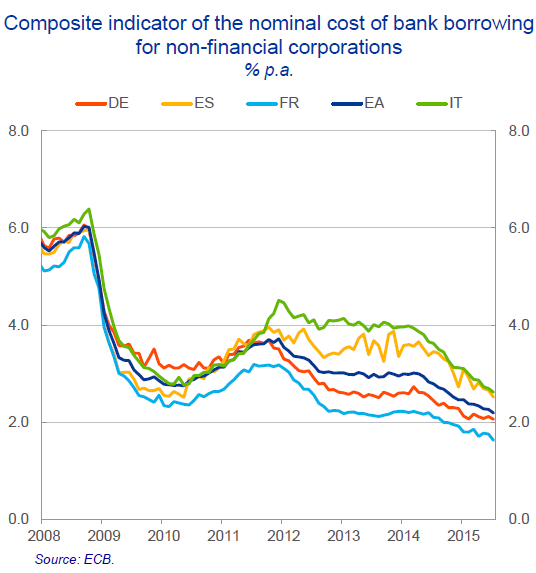

And yet, the cost of borrowing from banks has never been cheaper. This is the ECB’s indicator for the total cost of bank borrowing, based on aggregated short- and long-term rates using a 24-month moving average of new loan volumes, through July 2015:

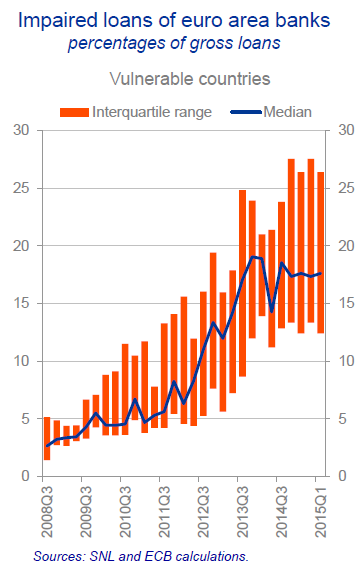

And bad loans in “vulnerable countries” have never been greater. Or rather, there is now more of an effort underway to arm-twist banks into disclosing more of them rather than sweeping them under the rug, though plenty of them remain under the rug. This chart, based on an “unbalanced sample” of 32 Eurozone banks for vulnerable countries, shows the ratios of gross impaired loans to total loans.

These charts are a – perhaps unwitting – demonstration that the euro doesn’t work for so many diverse economies and political environments, that “vulnerable countries” would have been better off sticking to their banana-republic francs, liras, pesos, etc., and that devaluations and defaults by individual countries would have been better overall than the current international taxpayer-funded bailout and “austerity” circus.

But it’s not as if the US were out of the woods. “It feels like someone just flipped the switch to ‘off’ without any concrete reasoning,” one of the executives commented. Read… US Manufacturing Recession Draws Eerie References to 2009

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

A devastating set of graphs, but as they all seem to show bad stuff happening after the GFC, maybe the problem is not the Euro, but European governments’ responses to the GFC. I would agree that the common currency prevented countries from responding by devaluing (or in some cases revaluing – e.g. Germany) their currencies, but the “one size fits all” approach of the ECB was surely partly to blame?

I totally agree. Taxes, bureocracy, welfare, legislation,…. These are European’s problems

Yes makes sense.

All euro periphery (including France) struggling and… of course the onus is on what they do not have in common (the local government), not on what they share (the currency, the EU governance).

It’s also beautifully counter-intuitive that everyone was more or less fine before the eurozone experiment, is in trouble now and… for some reason, is not the fault of the euro.

But, come on, currency unions between different countries always work very well. For example… well, has someone an example?

The “one size fits all” is not an “approach of the ECB”, it’s simply inevitable within the €: the ECB cannot set different rates for different countries and it actually favored the core countries:

– http://macromarketmusings.blogspot.it/2015/03/the-origins-of-eurozone-monetary-policy.html

– http://macromarketmusings.blogspot.it/2015/03/fool-me-once-shame-on-you-fool-me-twice.html

– http://macromarketmusings.blogspot.it/2015/02/the-eurozone-counterfactual.html

The euro (basically the German mark), until recently, had worked very well for the West German industrial economy. Germany’s domination of Europe, that it was not able to accomplish with WWII, it came close to accomplishing with the EU. It could be said that the German mark became something like an EU reserve currency.

Wolf, I’d love to see a parallel set of graphs between the various states in the U.S. juxtaposing the ‘Germany’ states vs. the ‘PIIGS’ states. I bet they’d be similar, and demonstrate that the common denominator would be the work ethic per capita in each state.

Good one . . . Compare average hours worked across Europe, the answer might surprise you.

I understand and accept the allure of currency devaluation for a quick fix and to restore markets. But isn’t it really just another relay race to the bottom similar to Globilization destroying the wealth of manufacturing workers in favour of owners and investors? “I know, lets beat the market on price by using captive or economic slave labour. Screw Unions and working conditions”)

If eveyone ‘beggars’ everyone else without really changing structural problems, the bottom looms for all, doesn’t it?

Every economic decision privileges some groups over another group. Devaluation chooses to punish people who save money, but would benefit people who are employed in industries that export. Whether that makes sense depends on an estimation of the entire situation, it can’t be said to be generically ‘good’ or ‘bad’.

You’re right.

Currency devaluations are terrible. Countries that use them never get their economies in shape. But in countries that cannot reform, that refuse to reform, and that refuse to compete and invest and do the right things, it’s one of the “solutions.” The last currency deval Italy did helped Italy out of its funk for about a year, then it was back in the mire.

And the costs of currency devals are huge. They’re not free. But now the ECB has embarked on a currency deval for all euro countries…

Correct me if I am wrong, but while devaluations are common in history, most of history used asset backed money and when fiat really took over it wasn’t as predominant as it is now. In short, nearly every country in existence has a central bank that pumps out fiat, usually backed by debt (i.e. borrowing money into existence). Further, this global set of fiats is used to balance trade between nations among many other complicated relationships which are exacerbated by technology (i.e. when the accountants had pencils, complexity was greatly limited).

These are uncharted waters.

If everyone devals in a sort of lock-step dance, RELATIVELY they don’t look so bad. I kind of think that is the strategy. And some commodities are tanking, so that helps offset the devaluations. But the distribution is very uneven, that hurts. And nothing has really burned down yet, and that is going to REALLY hurt.

Anyone that tells you they know how this plays out, is full of “used pasture”. That said, I will venture a guess this plays out badly, but how I couldn’t begin to tell you how.

Best of luck to all!

Regards,

Cooter

Having a currency adequate to your economy is not “beggar thy neighbour”, it’s what is needed to keep your current accounts in balance, i.e. to live within your means. With a too strong currency you are destroying our economy.

Inside a Monetary Union with a 2% inflation target, the outlier and beggar was Germany: “The euro was supposed to put an end to competitive currency devaluations, and with it ‘unfair competition’. But this has not been the case. Germany was often portrayed (wrongly) as the victim of other countries’ competitive devaluations before the introduction of the euro. But contrary to received wisdom, Germany’s real exchange rate – which takes into account differing inflation trends in Germany and its trading partners – did not rise in the run-up to the introduction of the single currency. And it has fallen steeply during the 15 years of the euro’s existence. This has handed German firms a competitive advantage of the kind the euro was supposed to eradicate. What is more, Germany is not under pressure to do anything about it. In fact, other eurozone countries are being encouraged to follow suit. …”

http://www.cer.org.uk/insights/eurozones-ruinous-embrace-competitive-devaluation

1) Europe is sclerotic

2) Taxes are insane

3) Regulations are insane

4) Out of control Ponzi Finance

5) Cultural Marxists and Economic Marxists run everything

6) …..and now they let in 20 million Muslims who won’t work and will slit their throats. This is after killing all their Jews 70 years ago.

Oh and then there is the Euro.

The changing relative percentages of EURO reserve and transaction is directly correlated to the drop in the EU/USD in the last two years. Other than the Draghi(GS) managed devaluation of the EURO, one other factor is the USA led sanctions on Russia and Iran, which have severely damaged Europe’s natural markets. The USA acts as a systematic parasite on the body of Europe via NATO and the USD and its control of key monetary, academic, and government personnel.