Currencies had a wild year in 2014. The dollar, for a change, didn’t get mangled, but gained against most major currencies. Hallelujah. But other currencies got mangled.

There were allegations that some countries were escalating the currency war over the past two years, particularly Japan. Abenomics, its economic religion, calls for devaluing the yen. So the Bank of Japan has been printing money at a terrific pace, compared to the size of the economy, with the purpose of monetizing the deficit, forcing down yields, and devaluing the yen.

While the first two are considered “bold actions” in today’s crazy world, the latter is considered a beggar-thy-neighbor policy. And Japan caught some heat from the nervous G-20 over it; they considered it tantamount to admitting that it wanted to escalate the currency war. So devaluing the yen disappeared from official discourse, even while the BoJ sped up the printing presses.

Switzerland too has been doing the same thing – printing money, selling francs, and buying mostly euros with it – but the nuance was different, and more acceptable by G-20 standards; the Swiss National Bank has been trying to keep a lid on the franc since 2011. That lid has held so far, while the SNB has blown its balance sheet out of all proportion.

One currency stood out because it was maligned by official organs and pooh-poohed by central banks and disparaged by pundits: gold. After all the lousy press it got, some folks think it lost a ton of value against the dollar in 2014. But it didn’t. On New Year’s Eve, as I’m writing this, it dropped 1%. That was about its loss against the dollar for the year. So it didn’t make the chart below.

From a broader perspective, gold booked big gains against a number of other currencies. And today, 1 troy ounce of gold buys about 22 barrels of West Texas Intermediate, up from 13 barrels six months ago.

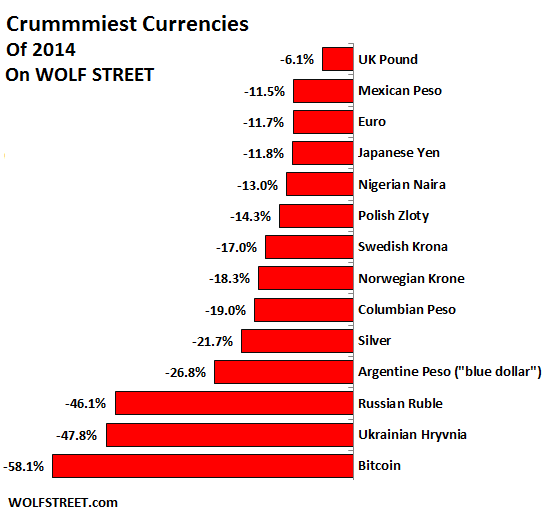

But gold’s counterpart, silver, made the list; it got mangled in 2014.

There are plenty of folks who contend that gold and silver aren’t currencies and shouldn’t be part of a currency list. To which I reply: fine, argue about that somewhere else; I’m including them anyway.

My chart of the worst currencies in 2014 doesn’t include all currencies that crumbled against the dollar – that list would be long. I included only those currencies that were mentioned on WOLF STREET.

A word about my special friend, the Argentine peso. The government sets official exchange rates as part of its system of capital controls, import and export controls, and inflation obfuscation. Then there is the black market exchange rate, or the “blue dollar,” as it’s called. It’s set by real buyers and sellers on the street. This is the exchange rate that really matters. Websites track it, and everybody uses it. So that’s the rate I used for my chart.

Every currency has its own problems, usually a mix of central-bank inflicted punishment, market forces, market manipulation by big players, the price of oil, and so on. But the rising and falling trust people have in it is key. The fact that the stability of fiat currencies is largely based on this “trust” is one of their big structural flaws. It’s easy to squander trust.

But bitcoin has its own set of problems. This isn’t the place to dive into them. Nor do I want to point out – though I will – that I just transferred some money overseas via PayPal, and that PayPal will sit on this money for two or three weeks before delivering it to the person I paid, and that for the privilege of sitting on it, PayPal will also pay itself a tidy sum out of the amount I transferred. PayPal is ridiculously slow. And what it charges can be more expensive than a wire transfer through a regular TBTF bailed-out despicable bank, which can do an international transfer in a day or two.

Bitcoin got both of them beat. There is no fee, and when a transfer takes half an hour, people start getting impatient.

Whatever its benefits as a payment method for legitimate commerce, bitcoin was a lousy store of value in 2014, leaving terrible destruction in its wake. It got smashed down 58%. As such, it’s the worst of the bunch on my list, beating even – by a pretty solid margin – the Russian ruble and Ukrainian hryvnia.

So here is my chart of the crummiest currencies on WOLF STREET in 2014:

And in 2015? For the greenback, all arrows point up. Dollar bulls abound. It’s a no-brainer. But BlackRock, the largest asset manager in the world, warns: “Whenever a consensus is so unanimous, our gut tells us it’s wrong.” Read… Elegantly Soaring Dollar to Hit “Air Pocket” in 2015, Slated for Long-Term Decline

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

All fiat currencies will die, but the dollar will die last, because no one will ever say, “Oh well, my dollars are worthless, but I still trust my pounds/euros/yen/renminbi!”. The dollar will surge as it absorbs each new wave of currency refugees, and the Fed will print so much that Washington could, for a while, double its budget and stop collecting taxes.

A concise and useful synopsis, Wolf. Your insights and the comments posted by your regular readers are a wonderful sounding board in these chaotic times. I rarely read comments posted to the handful of other sites I follow, unless I’m feeling particularly masochistic. When wrestling with a pig in the mud not only does one get filthy but the pig enjoys it. My best to you in the New Year and thanks for all you do. Excelsior!

Thanks, Julian. Music to my ears. I wish you and all WOLF STREET readers an awesome 2015.

Excellent analysis. Best wishes for a great 2015.

Silver – argh – down . Also the once safe haven of the Norw. krone is down due to the fall in oil prices – it has done worse than a lot of currencies. The interesting thing is that while the NOK was a perceived safe haven a few years ago, this year is fell a lot. How quickly things and the narrative change. I just hope silver will rally this year. I am all loaded up on it.

Bitcoin is too small and too new for such a small market cap of less than 7 billion USD.

Many forces can f*ck up a national currency. If trust is lost in a central bank it’s issued currency will go down the drain as well. Such a weakness does bitcoin not have. There is no central bank to trust, just the trust of the man using and accepting it.

Well how about the Australian dollar?

We started the year around 89.5 cents to the US$ and went up to around 95 cents only to fall to just under 81 cents at the end of the year or about a 10% fall for the year.

I guess that is not bad, but considering that at the height of the so called “mining boom” we were around $1.10 to the US dollar, we have lost a lot of value against the US$.

Gasoline here is sill about double the price in the USA at US$3.40 a gallon, electricity prices are up gain this year with the monthly service fee up about 20% and the cost per kWh at 37 australian cents up about 10% (US 30 cents) during peak times.

The central bank here has kept rates unchanged for over a year now despite worsening economic stats because it is now afraid of the boogie man in the form of increasing house prices. (Before it was the mining boom). It has kept jawboning the A$ down at every opportunity and is trying to get the fall in the value of the Australian

dollar to get it to do its work for them.

You know ‘unleash the animal spirits of the economy’ as one bigwig at the bank put it. However, the interest rates increases and the increase in the value of the Australian dollar during the mining boom destroyed many domestic businesses. They disappeared or are so weak now that they can not much heavy lifting.

Variable mortgage rates are still higher than during the GFC as the commercial banks here piled on bigger increases when the rates were increased and failed to reduce them as much when rates were cut. Guess which comapnies have been the darlings of the share market here in terms of gains? That hasn’t stopped the high end of town in the real estate markets or the huge demand from rich immigrants pushing up prices in or near the CBD.

Are they (The central bank) so dumb to think that a 1/4 point cut or increase means anything to a person that is paying a $2,000,000 or $3,000,000 for a house? (Well, yes…………………) The median price of most houses in the near CBD areas here in Melbourne are well over $1 million now with many 50% higher than that.

And just to show you that Australia continues to be a high cost country regardless of the value of its currency, I’ll give two examples:

1. Retail outlets here are still calling for the tax free threshold on overseas purchases to be reduced from A$1000. (The Tax is 10%). With a 30% fall in the value of the A$ against the US$ it is still cheaper to buy many things overaseas and have them sent here even paying for the postage.

2. Japan with all its energy problems still has cheaper electricity than the lucky country. A basic plan in the Kansai area of Japan will set you back about A$4.00 a month for the service fee and 15 kWh’s of electricity. Here that same monthly service fee and 15 kWh’s will set me back…………………………….are you ready………………A$46.65 or about 12 times as much.