Clothing & general merchandise online retailers are the biggie.

By Wolf Richter for WOLF STREET.

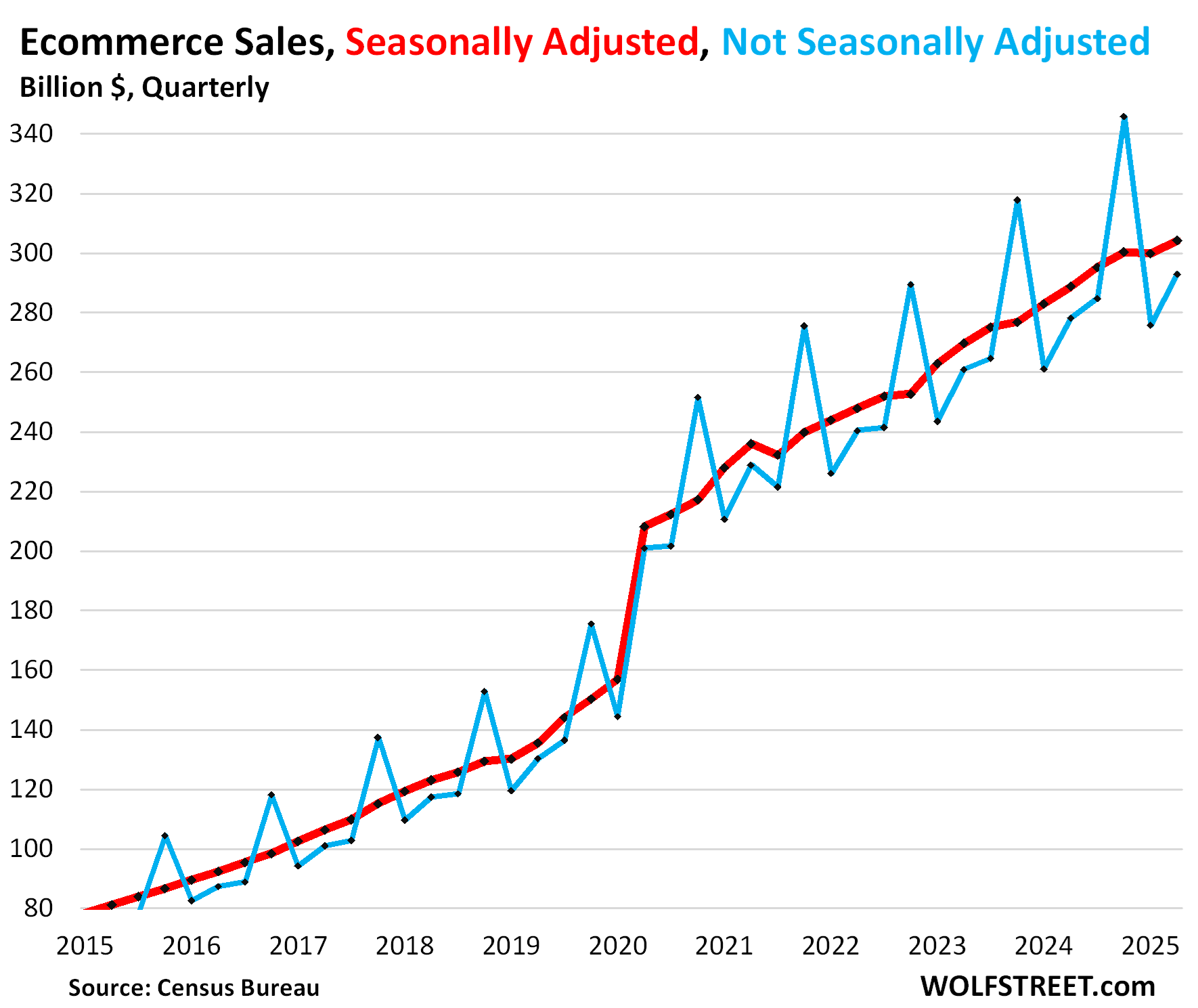

Ecommerce sales rose by 1.4% in Q2 from Q1, seasonally adjusted, to $304 billion, according to the Census Bureau today. Year-over-year, ecommerce sales were up by 5.3% (red in the chart).

Not seasonally adjusted, ecommerce sales rose to $293 billion (blue).

Over the past four quarters, ecommerce sales reached $1.2 trillion, not seasonally adjusted, up by 6.9% from the prior four-quarter period.

The Census Bureau’s quarterly retail sales and ecommerce data for Q2, released today, is based not only on surveys sent to retailers, but also on administrative records from other government agencies in anonymized form, such as the IRS.

So this quarterly data set is more complete and accurate than the monthly “advance retail sales” (July retail sales were released last Friday), which is based on the first batch of surveys and no administrative data.

The purpose of the monthly “advance retail sales” is to get it out quickly for a first look as to how that month went. But then it gets revised heavily as more surveys come in (Friday’s report substantially revised upward the growth rates of the prior two months), which is why it’s called “advance retail sales.”

Even the quarterly retail sales and ecommerce data — based on surveys and on administrative data — is still labeled “preliminary” for one quarter, and is also revised as more data comes in, but the revisions aren’t that huge. The quarterly data also lags a little and therefore doesn’t get the blazing-headline treatment of the monthly “advance retail sales.”

Ecommerce sales are sales by retailers where the product was ordered online. It doesn’t matter how the merchandise gets into the home, whether delivered to the home, or picked up at a locker or at a store. Ecommerce sales are sales by retailers, such as Amazon, Walmart, BestBuy, including small operations with employees, but don’t include operations that sell plane tickets, concert tickets, hotel bookings, Uber or Waymo rides, insurance, etc.

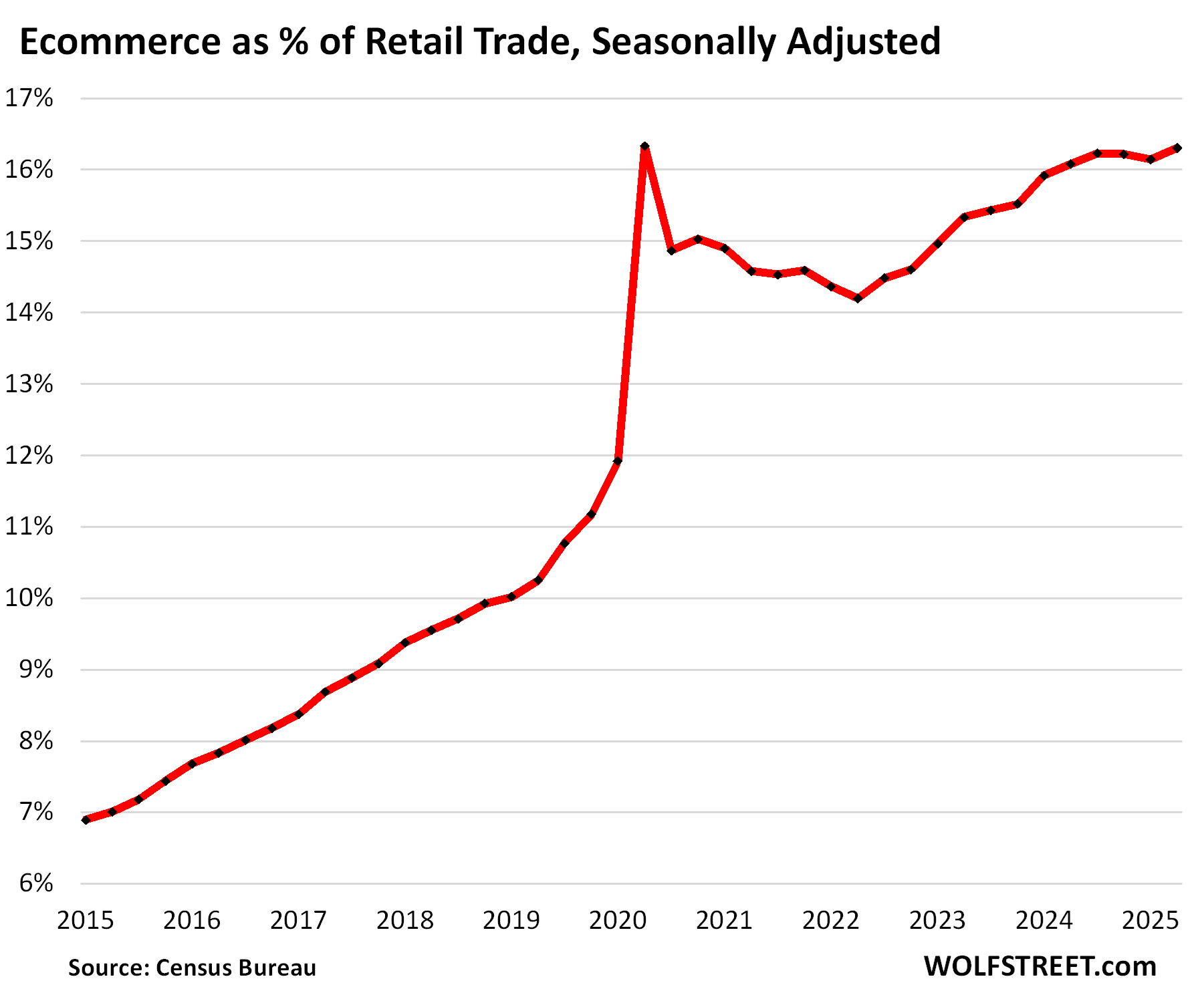

By comparison, overall retail sales, including ecommerce, rose by 0.4% in Q2 from Q1 seasonally adjusted and by 3.9% year-over-year, to $1.87 trillion, according to the Census Bureau data today.

Since Q2 2019:

- Total retail sales: +41%

- Ecommerce sales: +125%

The share of ecommerce sales rose to 16.3% of total retail sales, seasonally adjusted, matching the record set in Q2 2020 (16.3%), when many brick-and-mortar stores were closed and lots of shopping shifted to ecommerce.

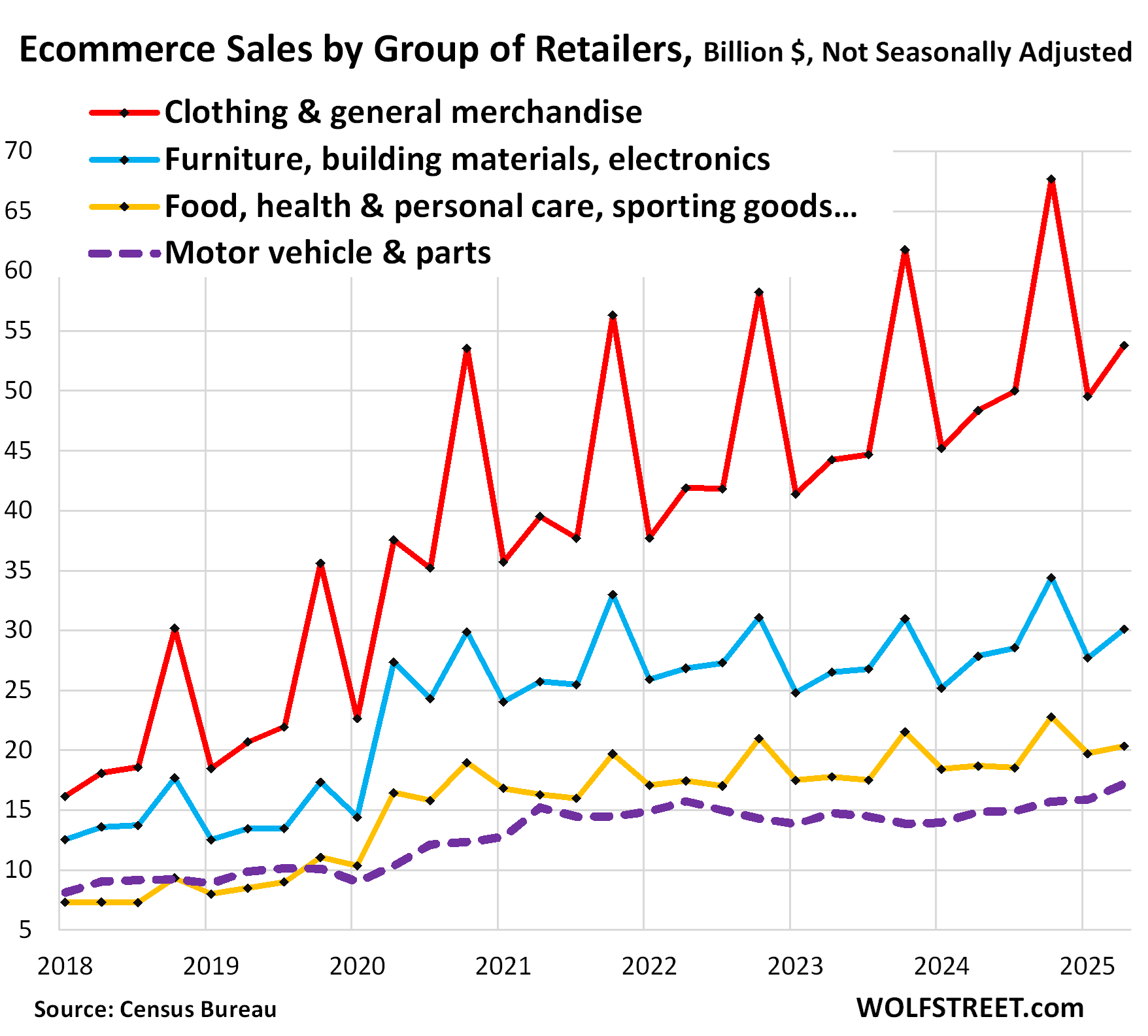

Ecommerce by major category of retailers.

The quarterly ecommerce data also includes sales by major category of retailers. This was an “experimental” data set that the Census Bureau launched in 2019, along with lots of caveats, with by-category data going back to 2018. But this data has gaps when it doesn’t “meet publication quality,” as Census explains, it is not seasonally adjusted, and it has a lot of variability in addition to the strong seasonality effects. So with these caveats, here we go.

Census provides data on four major groups of retailers covering about 41% of total ecommerce sales. The rest of ecommerce sales are spread over other retailers. So this is not a complete list of what is all included in ecommerce sales.

- Clothing & general merchandise retailers: +160% since Q2 2019, +11.2% year-over-year, $54 billion in Q2. Sales in this category spike massively during the holiday shopping season in Q4 (red).

- Furniture, building materials, and electronics retailers: +124% since Q2 2019, +8.1% year-over-year, $30 billion in Q2 (blue).

- Food, health & personal care, sporting goods, etc. retailers: +139% since Q2 2019, +8.8% year-over-year, $20 billion in Q2 (yellow).

- Motor vehicle & parts retailers: +74% since Q2 2019, +16% year-over-year, $17 billion in Q2.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yep….I just ordered some underware today at Temu. I hope they fit. I got a good deal. Real cotton…or so they say.

The word is UNDERWEAR not ‘underware.’ I buy Hanes but it was just purchased by GILDAN of Canada last week. Gildan T-shirts are sold at Michael’s for only around $4.99 each and are terrific T-shirts.

When I was wearing a suit and tie every day in the 90’s and wearing undershirts under my dress shirts, I would buy 100% cotton Hanes Beefy T undershirts from a guy I know that owned a screen printing company. He bought the shirts by the gross and would sell them to me a half dozen at a time at his cost.

AI,

A pretty impressive financial move there, although I have come to expect them from you.

“Underware” is a newer (and increasing in management usage popularity, especially in electronics) supply chain logistical term. And it’s easy to misspell those words that sound the same. That is why they use them in a sentence at a Spelling Bee, where it is very important. You obviously got the meaning or you wouldn’t have corrected him.

That aside, it’s always nice to hear about ever more of modern management’s “designed in confusion” (primarily a legal and media defensive verbal wall or moat) from someone who likes t-shirts.

By buying from Temu, you are killing American jobs.

Ha, you really deliver when you’re curious Wolf. I remember us discussing the possible breakdown of these spending categories on an article a while back. Cheers!

I certainly have upped my online percentage of purchases in the last year. Always wanted to try clothes on. Such a swing in sizes by manufacturers. Then there’s shoes… Other things never had a second thought about. But I will have to be incapacitated to order groceries online. Sure a box of cereal is a box of cereal. But produce?? And ice cream? Anyway, slowly ordering some clothes. But I still right about 15 checks a month to the utilities and such. Towards the back of the Boomer classification…lol

“But produce??”

For two decades we thought, no way Jose. And then we did it once, and here we are, every week or two, from a regional online-only grocer. Cheaper, often better, and you can get stuff you cannot get in a normal supermarket. We also buy frozen fish, a lot of which you cannot get at a supermarket, which normally carry only a few kinds of fish. We also buy some bulk-stuff online, such as big bags of various kinds of rice, beans, lentils, etc. Next-day free delivery is via their staff drivers, or contractors sometimes. But this kind of regional service may not be available everywhere. So by now, brick-and-mortar grocers have lost maybe 20% of our business, and that part is growing as our comfort-level grows.

I buy ALL my clothes and shoes online – and have been for a long time, I absolutely detest going into a clothing store or department store. There are so many better things to do in life. And even before the internet, I bought a lot of my clothes by mail-order just avoid these stores. My better half buys much of her clothes and shoes online.

We buy most everything online… appliances, electronics, all our furniture, medications (through our HMO’s online pharmacy), doodads, gizmos, etc., almost anything — other than gasoline, groceries (partial), and used cars. And we’re by no means early adapters. We’re a stuck-in-a-rut not-so-young-anymore couple LOL

Brick-and-mortar retailers have been in a very tough world for a long time, and many have already collapsed, from the biggest one down.

Here is what I mean:

Brick and mortar stores still account for around 84% of all retail sales in the US and are still a very much desired form of commerce in the US including for leisure shopping for enjoyment.

OK, now take gasoline out of it; it will never be purchased online; and take new vehicles out of it because their brick-and-mortar stores are protected by state franchise laws and other regulations. And take ecommerce out. And that’s half of total retail sales that’s left over. And that half is shrinking every day.

Grocery store sales are still growing because of price increases and population growth, the combined pace of which exceeds the sales shift to ecommerce.

The rest is in deep trouble. People have said the same thing you said for 20 years, oh ecommerce is nothing, it’s 5% of total retail sales, oh it’s nothing it’s 7% of total retail sales, oh it’s nothing it’s 12% of total retail sales, right here in the comments while I documented in article after article the demise of big retailers, all under the category of Brick-and-Mortar Meltdown.

You can see the results by looking at the fate of malls, many of which have become zombie malls. And those among the zombie that are well located are being redeveloped by bulldozing everything and building housing on these huge pieces of land.

@SoCalBeachDude I know more people under 40 than most people my age since I am very involved with the management of my apartments and personally reach out when there is problem. The number of people that respond to a message to call me with “can we talk via text or email is increasing every year”. These young people have no desire to “shop for leisure in a store where a stranger will come up and try to talk to them…

ApartmentInvestor…your anecdotal observation is likely very accurate.

There is a flip side to all of this: can’t speak for the rest of you, but the volume of phishing attacks, financial fora drama “contact us before a horrific calamity takes place in in two weeks – we have a path to make on it”, id skimming, dark net privacy info wholesalers/retailers, etc., bank account hacks, has grown exponentially IMO. I use phone blockers, white lists, etc., those alone have become an entire cottage industry.

Like most here my on-line commerce has grown substantially. It arrives with an attack space that has to be personally monitored. Tedious expense of time I’ld prefer to avoid.

Btw…I have ordered cases of wine on-line from a CA vineyard whose Zin I liked back in the day. Never had a problem. Main frustration was the wait!

Dude, if I could have a trustworthy robot deliver my gasoline while I slept, that would be most efficient!

EV

phillip j- good observation (…seems sometimes that the digital age has made cybercrime an easier, vastly-more target-rich, and remunerative, option than going through the hassle and dangers of acquiring a Saturday-night-special and taking off the corner liquor store…).

may we all find a better day.

Interesting anecdote to your points Wolf. In the early days of e-commerce, I had a friend who vehemently argued that “brick and mortar clothing and shoe stores will never be replaced by the internet.” He thought few people would be comfortable buying either of those items without trying them on first.

Wrong. Like yourself, the items I now purchase online continues to expand, and it includes clothing and shoes. The only thing I’ve used a retail shoe store for was to check that my shoe size had not changed. Apparently feet can either get wider and/or longer as one ages (and mine did, so that was a worthwhile trip.)

Other than that one brief visit, I’ll continue to avoid brick and mortar retail stores – including clothing and shoe retailers. Never did like those places and I’ve yet to have a bad experience with buying online. Just pay attention to the sizing information that is usually listed on the retailer’s web site.

That was meant to be for Wolf.

I want to add that porch piracy wold be only part of my “jobs” and that for entertainment (and perhaps sales income?) I would breadboard up small no risk devices to torment self crashing cars and their occupants….I really dig learning about and playing with new versions of old sensors…(a photon is still a photon…whatever they REALLY are)…..always have.

Wonder if DigiKey still has and informative catalogue?

OK, so you are current and fearlessly advancing with the times. But having complete control over when someone is going to be home is something few have……I do, but I’m a frugal poor stubborn Luddite, which makes it a wasted social perk on me.

But you are in a prime pickings area, (thinking like a porch pirate)….which I’d probably do if I were a kid nowadays. They have it tough and it won’t get any easier.

San Francisco is the capital of working from home. And they let you know when the package arrives, and when its out for delivery, you can track it… 6 stops away, better put on some clothes LOL

Folks who ‘right’ [sic: WRITE] checks to utilities apparently do not comprehend that any and all utility bills can easily be paid online at the web sites of those utilities every month eliminating any need to ‘right’ checks for those bills. As to groceries, you can order online and then pickup the items at your local store such as Pavilions so the concept of something being frozen doesn’t even enter the equation and Amazon has highly effective cold storage bags for the same purpose.

My city charges a fee for online billpay. Until that changes, they’ll get a check in the mail.

I don’t know of a single utility that charges a fee to debit the payment using an e-check. Some like SoCalGas and SCE charge a small fee if you pay using a credit card as does the CA DMV.

You might get a small discount if you set up automatic payment via ACH through your bank.

@ShortTLT most banks have a “bill pay” system that will mail a paper checks for free (saving you the $0.78 cost of the first class stamp to mail the check youself).

Last time I checked they even charged for ACH. It was just a few bucks – not a % of the bill like the credit card fee – but I pay this damn city enough of my money already.

It’s extra stupid because they’re almost certainly just using the account & routing numbers on my check to do an ACH transfer.

Damn straight.

Check “re-cooking” is the largest scam running right now thanks to people like you. Does it effect me? No. However you do fuel the main stream crime trend. Referred to as “Stemmies” or Stems.

The post office workers pluck the envelopes with checks and then sell them for 10% of the value. The buyer takes the check, recooks it using check printers and photoshop, then re writes the name using the (mostly drug users or desperately poor young men and women) mule.

Mules are required to have a pay check deposited directly for 6 months minimum, an account open for more then 1 year, and often the same bank the check is written from. This increases the chance that the check is cashed instantly vs deposited. They then take 50-80% of the value and the mule receives the rest.

It took my cousin (54 yrs old NY resident) 4 months to get her $2,000.00 insurance payment back that was cashed in Virginia. You may say big deal, until the PRO scammer who has an “innie” at a local bank branch that will clear the transaction, looks you up on facebook and estimates your wealth and cleans you out nicely for up to 500k they then wire to multiple online bank accounts like chime and anonymous cash apps.

Anyways, pretty foolish if you ask me.

WOW…..$0.78…..I worked there 20 years and never could tell anyone what a stamp cost when asked.

Anyway, all I can say about mail stealing is Postal Inspectors (or their many busted stoolies) are EVERYONE and NO ONE….(like in the Matrix) and were really hi-tech when I left maybe 20 years ago.

I’ve seen one big bust……20-25 of them appeared out of nowhere and people were cuffed and gone and a big area taped off and they were going thru mail before I knew it was a bust.

Some people were grabbing little Johnnies Xmas cash from gramma.

Yes so I realized that I rote right instead of wrote write in my haste. Didn’t feel the need to correct as many people no the difference in the English language and make similar mistakes all the time. I didn’t feel the need to correct. I’ve been a victim of multiple security breeches. Taken some write positive actions to try and mitigate. For now I still right a few checks. I guess mail can be stolen as well.

Slowly buying more things online. Still want to pick my own produce and keep the cold things cold. Enjoy your beach, dude.

Ther ar peeple that see the forest and thos that just sea the treas.

AMZN definitely gets the vast majority of my consumer dollars. Misc food (like Italian pasta), books, wayyy too many vitamins, and in and on.

I genuinely feel for the small retailers but it’s hard to convince myself to go running around by auto when 95% of what I need will get dropped off in a day or three.

eBay gets my book purchases and occasional other higher end used musical instruments.

Walmart gets some food deliveries as well.

Agreed Dano. Skipping the auto trip also means no chance of involvement in an accident and less wear and tear on your car. Along with lower gas expense and avoidance of using poorly maintained roads.

I’m wondering if new cars will eventually be retailed online and delivered directly, bypassing the dealership. From what I’ve read (it actually may have been here on Wolf’s site that I saw this) it is illegal now due to state franchise laws. This is for new cars only.

Some of the auto manufacturers offer online configuration of a specific model (paint color, options, delivery time, etc.) but one still must go through a dealership for delivery.

Which is a shame because the auto dealerships are, IMHO, a terrible consumer experience. Even worse than the typical retail store. My last experience at a local Honda dealership was beyond belief it was so bad.

Maybe that will change over time. SOME people (not everyone) would order a new car online and take delivery directly. I certainly would. Others would still go to the dealership and take a test drive, etc. I wish both options were available.

About auto dealerships. On average about half of the typical dealership’s profit is generated by their service department.

I had a bad experience at the Ford dealership in Bridgman, MI twenty years ago. Shoulda known; the owner (now deceased) was well known for cheating at golf.

Swapped to Toyotas. Been on good terms with the owner and his staff ever since. On occasion I’ll stop by to socialize, coffee and cookies.

My wife’s 2023 RAV4 PHEV has hardly depreciated since new. The Tacoma they sold me now has 285,000 miles on the clock and just made the 4000 mile drive from Anchorage to Berrien County, MI without using any oil.

Toyotas are the best.

They say the Corolla is beating the Tesla!

lol /s

My old argument that you could buy 2 corollas for 1 Tesla. Hehe

My old argument is that people who compare a Corolla to a Tesla (any model) are already braindead.

It has to happen at some point. It’s infuriating to shop for a new vehicle when you know *exactly* what you want and the dealerships all have lots full of whey guessed you might want (or options that are high revenue, no matter if you want them).

It makes me just want to wait and purchase used, I still won’t get exactly what I want but at least I won’t pay an extra $5k for the privilege.

Eventually, one state is going to crack and customers from nearby states will flock there in able to order direct. It’s the sensible evolution and protectionism will eventually fall due to consumer demand.

Not as long as they are all “Right to Sell” States……

But it is an interesting form of “rebellion”.

Maybe on reservations at first?

Plenty of small businesses have websites you can order from.

eBay vendors have gone totally crazy on shipping costs. Very often a small $5 item will have 20 or 30 dollars shipping cost. DVDs are a good example of that (yes, many people still want to watch DVDs).

I guess they hope somebody won’t notice and just hit the button, or they are spending someone else’s money.

Just filter by ‘lowest cost including shipping’.

AMZN mostly imposes more reasonable shipping costs on their vendors.

I think they do this so they show up higher when you sort by price.

I recently bought an item on Reverb (ebay for music/audio gear)… seller charged $35 to ship which would have been fine for a UPS label, but then they sent it USPS ground advantage which wouldn’t have cost them more than $10. I suspect the seller was trying to pocket the difference.

Wow and I bet the seller found them at a goodwill for $2

This is a small (e-commerce) business model. It relies on selling the item at cost (or small loss) but doubling or tripling up on the shipping. Take the common Instagram clothing brand model for instance. Brand sells the $5.00 T-shirt (one color screen print on 4oz t shirt) when you purchase you will be charged $10 for shipping that was purchased using sites like pirate ship or from telegrams that offer 50% off shipping labels fueled by dark web acquired zip files containing 100’s of Card numbers and matching credentials. Very common. I ran an ecommerce for 5 years, I profited at least 50% on every shipping expense using pirate ship.

I see Amazon prime members can now buy from Amazon Grocery for no delivery charges or fees with same day delivery, I think a $30 minimum. Same with Amazon Fresh but with a $50 minimum. It would be nice if they merged the two. My point is this will thump Instacart, where merchants add ten percent to their prices, plus service and delivery fees. I buy everything on line except gas, which is impossible to buy on line.

So what brick and mortar shops will be around in ten years? Liquor stores, gas stations with their mini-marts, services that work on your body (like dentists, nail salons), auto repair, fronts for criminal activity, some entertainment venues, and restaurants. I use Zoom for almost all my doctor visits now. It is very convenient and I avoid getting poked, prodded, and probed, and not getting sick from others waiting in the waiting room.

@thurd I wish there was a way to buy gas online since I just looked at the “Gas Buddy” app and regular is $2.34/gal at Costo in Texas compared to $4.05/gal at the Costco near me in Northern CA (regular is $6.29/gallon at the Menlo Park Chevron not far from the Costco).

One small problem, that could become a big one, is what will you all do when the Internet disappears for a while? Marks & Spencer here in the UK, a very big company, stopped all Internet purchases for weeks after a very effective spiderware attack. Britain is far more vulnerable to undersea cable cutting than US, which would effectively shut our Internet down. I followed the Government recommendation that we keep enough cash at home to buy food and other essentials for a few weeks. A very good idea, because our Labour Party government seems to be very enthusiastic about going to war with Putin, who has been practising disruptive Irish Sea and other major cable routes for years.

Wait a minute, that’s ONE store getting hacked. That happens. But there are thousands of stores on the internet. You just buy from another store. That’s the beauty of the internet.

Yeah I think the rollout of Starlink would be a backup for any American cables getting cut.

Also like 11 carrier groups and 100 submarines. Doubt they would get away with it, without their whole crew drowning.

Interesting data well presented as usual. And I am not very surprised by the numbers.

But what kind of surprised me was the data was collected and reported by the Census bureau. In my naivety I thought the Census bureau was tasked with counting human beings once every ten years. But a few quick searches showed that of course like everything else in our Federal Government the Census Bureau has grown into a larger entity with more tasks. I would question why this is all necessary? I don’t think the information is used by “our fearless leaders “ (the people our Drunken Sailors allow to screw things up by repeatedly voting them back in office?) to make informed decisions for the betterment of our country.

Don’t get me started on the accuracy of “surveys “ or the need for these kinds of reports, but I do think this is one area where big data and AI can improve the accuracy and usefulness of these reports while reducing the bloated Federal bureaucracy.

As for my personal experience, yes I definitely shop online for much more than I used to for a variety of reasons. But I have not ordered groceries yet. However I do have some “boomer” neighbors who have embraced the whole online grocery experience and shop that way regularly, including for things like produce and other perishable items. I have resisted online grocery shopping so far because I work from home and most of my human interaction seems to be on Zoom calls. Grocery shopping lets me get out and see and interact with actual live human beings- for the good and bad of all that – it does make me feel more connected to the world around me.

Really?!?!?

Because all this information is really useful to lots of people for lots of reasons? And it costs a grand total of $50/person each year, or less than 0.02% of the federal budget?

And how exactly is AI going to generate this data magically without spending money?

You people are wild.

The AI crowd is a religious cult.

🤷🏻♂️

I saw on a YouTube recently a lawyer fact check a neurologist real time, while the neurologist denied the accusation as false. Then the lawyer said , “hmmm maybe I typed it into ChatGPT wrong.” Like ummm wtf.

AI believers are bonkers, it’s a very very flawed tech

Just to add that if this data allowed the economy to grow even 0.01% faster it would pay for itself.

I’m old,

Footware and attire I like seeing what I am purchasing..Feel it, try it on and such.

I physically want to know what I am buying.

It took three buy and return attempts to buy my last pair of high end athletic shoes online before I got the pair that fits right. All these shoes are made in Asia and correct sizing must be a mystery to them. These are $175 – $200 shoes, not cheap junk.

But I know the folks at the local UPS store by first name now.

Buying motorcycle pants online has been challenging. The sizes aren’t consistent and sometimes the knee & hip pads mean you need a size up vs what you wear in regular pants.

On the other hand, I’ve been wearing the same size & style of shoe for over a decade, and now order replacements from the manufacturer’s website rather than visiting their outlet store.

Somehow, “Athletic” and “Golf” just don’t fit together well.

Is that why you left the “sport” involved out?

Pool is considered a sport, as is “Cornhole”. (still laugh at that name, as it is not the meaning it had in 4th grade in the Central Valley)

Anyway, High end clothing is a MUST for all athletes, increases your physical prowess…somehow…..I guess.

How much practice would $200 buy….especially on a cheap course, assuming you wanted to improve your skill….not impress anyone?

I have had some major issues w/ that giant online retailer in the last year. One purchase was a laptop computer which basically turned out to be near-junk (like a $250 model you would see at

Wally). It came with an EXTERNAL hard drive (huge disappointment). The small print and trickery used in some ads is deceptive. Also – clothes – some have been great, others not – you can’t see (or touch) them before buying – size can be off, other issues…it can be a pain to return items – sometimes not worth the time, effort and energy to do a return.

At this point, I’m disillusioned with buying many things online. As far as THAT ONE monstrous online retailer- it’s a MONOPOLY that has decimated many smaller businesses. It should be fractured into dozens or hundreds of smaller businesses.

In the end, just having ONE MAIN online retailer will prove to be a DISASTER.

Oh – another joke about that online seller – their rating system is deceptive- most things get good or excellent ratings, but many things I have bought have been mediocre, or even poor quality. This is rarely reflected in their ratings system.

My experience doesn’t match yours at all. Of all the products I bought online over the past 30 years, two turned out to be junk: a handheld vac with a battery that wouldn’t hold a charge; and an electric kettle that leaks but that we still use.

And you have to buy from a reputable seller — Amazon is a platform where anyone can sell anything. You have to understand that Amazon might not be the seller. There are fraudster and fake-product vendors on Amazon. But Amazon tells you who the seller is. I would never buy electronics from some seller on Amazon (that’s the lesson I learned with the vac), though T-shirts fine. There are reputable companies selling on Amazon, and that’s fine. But don’t trust the fly-by-nights on Amazon.

Also, you can buy directly from lots of brands, such as Dell, HP, Apple, many others, or you can buy that stuff at BestBuy online, etc.

I have bought ALL electronic equipment online since the late 1990s, and by telephone before then (Dell). You have to carefully read the specs. You cannot be sloppy. None of my recent laptops have hard drives with disks, they hard-drives with chips (Solid State Hard Drives), that are lightning fast when they boot up (just a few seconds) and throughout. If you need over 1 terabyte of storage, you can get an external hard drive. An SSHD is expensive, it’s a plus, it’s faster and more stable than a disk drive, the bigger, the more expensive. So I think you have some misconception here with your complaint about it needing an external hard drive. So you need to read the specs and understand what they mean. Don’t blame this on the internet.

In terms of the ratings on a place like Amazon: read the 1-star and 2-star ratings and skip the 5-star ratings. And take everything with a grain of salt.

@Wolf thanks for the good advice. My parents in their 90’s know that the “in person retailer” selling watches from the pocket of his jacket in a tough part of town is not a good person to buy an “authentic” watch from and as the world transitions to online retailing we all need to learn to recognize the less reputable online retailers.

Doesn’t not being able to tell the real luxury item from the fake one sorta defeat the purpose of showing it off?

Wolf… I’m going to up my donation so that you can buy a non-leaking electric kettle.

Cuisinart 1.7-Liter Stainless Steel Cordless Electric Kettle with 6 Preset Temperatures.

That one is so fantastic, especially if you like to make tea sometimes and other times you’d want to just boil water.

Thank you! But I have a Krups (old German appliance manufacturer, known well to all Germans) with stainless-steel liner and stainless-steel spout, inside a plastic shell, cordless, very convenient, very fast, and the two-wall insulated design keeps the water hot, nice German design.

What leaks is the seam between the stainless-steel spout and the stainless-steel liner. After pouring, some water leaks down on the inside between the stainless-steel liner and the plastic shell and exits at the bottom. When it’s sitting on the base plate, the water leaks onto the base place, and I except to sue Krups and Amazon for several million dollars after I get electrocuted.

Nice German design, made-in-China workmanship.

@Wolf I’ve got a 30+ year old Krups espresso machine that I bought for something like 30 bucks at the time. Use it with a Peugeot coffee grinder (yes, same brothers as the cars). Great German-French engineering combo.

I was an early adapter. I thought banking on line, no more check registers and pay bills on line was great. I thought Amazon was the greatest company since sliced bread. Bought the stock at 22 and sold it at 20 when I was a market trader(gambler) Had to stop that insanity.

My purchases in the last year have been auto parts/oils ect. and ammo.

My only complaint is one auto part supplier that used to be great dropping the ball a bit,have settled issues to my satisfaction but keeps up will move on.

My ammo supplier thru the decade great as always and the auto oils ect. also great,fair price and reasonably quick delivery on both.

I will if needed buy clothes online but have sizes/brands already in me wardrobe so if needed hope it goes well.

Check out Rock Auto if you don’t already use them.

Once you see their prices you realize how much the parts stores mark things up…

Thanx Short,they are one of me suppliers and actually got a set of leaf springs and shackles from them this week,mending a friends Ranger.

Check SG ammo if you are into the shooting sports/hunting.

I get parts stores need to mark stuff up to have brick and mortar and employees,do occasionally buy from them but only in a “need it today” situation.

MW: Target hires a veteran as its new CEO, as it tries to turn itself around. Some say the move lacks ‘pop.’

TGT -6.33%

Didn’t they hire their COO?

Their stock fell a ton this past year as well.

Honestly I think they are doing ok, just expectations are high for them.

Younger generations absolutely love Target. They will spend like bonkers the rest of their lives. I do most of my shopping there. They offer great savings. I saved about 11% this last month and just joined their target circle 360 for free.

They need to close their underperforming stores in bad parts of cities and focus on the suburban customer. I visit several here in Raleigh and they have gone down hill a ton. The nice ones are great. Also they have out mini Ulta beauty centers in them.

Brick and mortar business is in a lot more trouble than just the competition from online shopping. I see people on the news just walking in and clearing places out. People walking in and shooting people. Malls in my area have to pay law enforcement because security guards don’t cut it. Upkeep, taxes and insurance are expensive. For instance I process certificates of insurance for a company that has contracts with the large real estate conglomerates that own mall properties but if the cert isn’t exactly as requested they won’t let my workers on the roof to fix the HVAC. Many times what they ask for isn’t even legal in the state where the work is being done and they have AI systems rejecting the certs – it’s an endless loop of insanity.