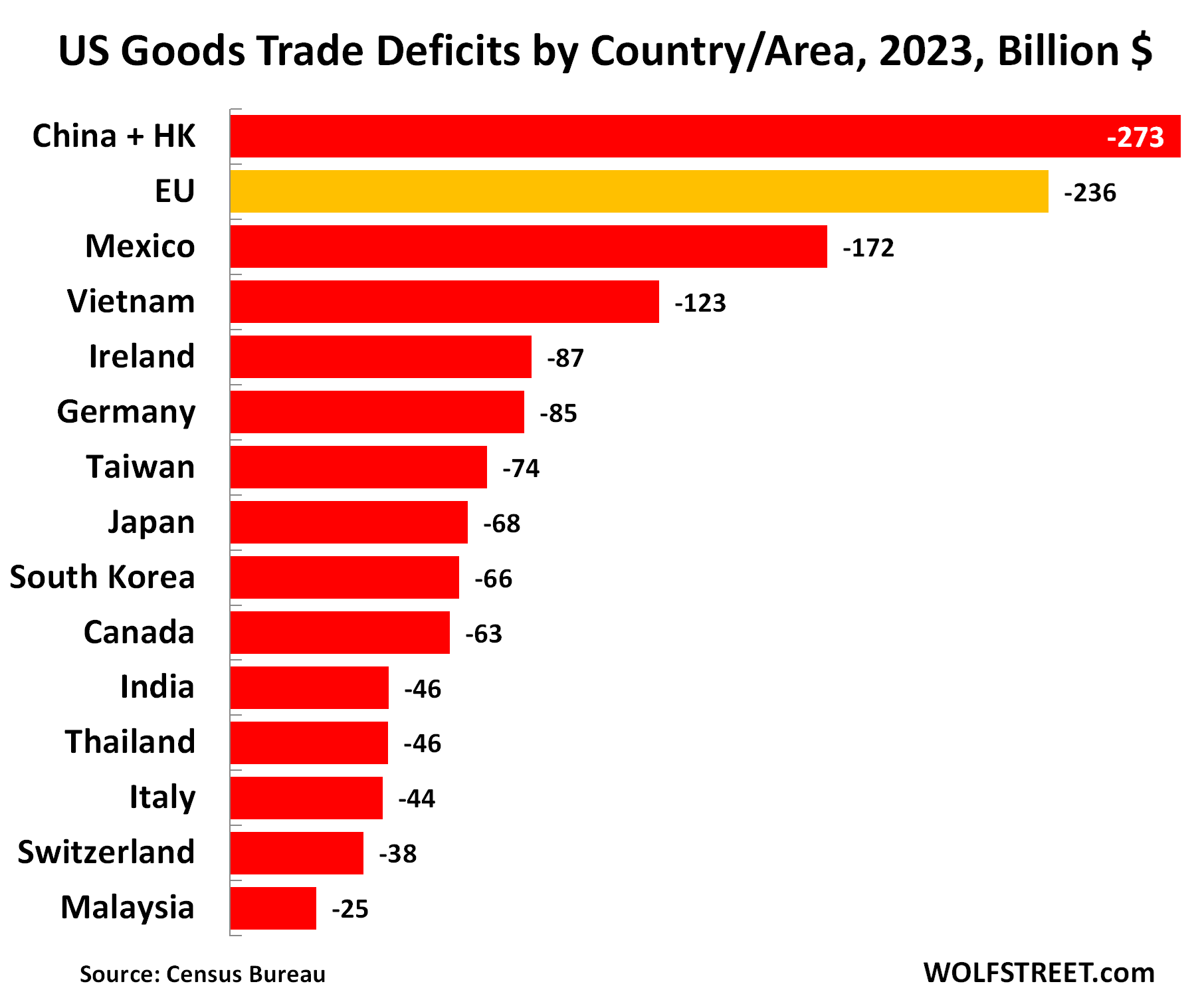

Goods deficits & Corporate America: Vietnam jumps to #3 on transshipments from China to dodge tariffs. Tiny Ireland jumps to #4 on trade invoicing to dodge US corporate income taxes.

By Wolf Richter for WOLF STREET.

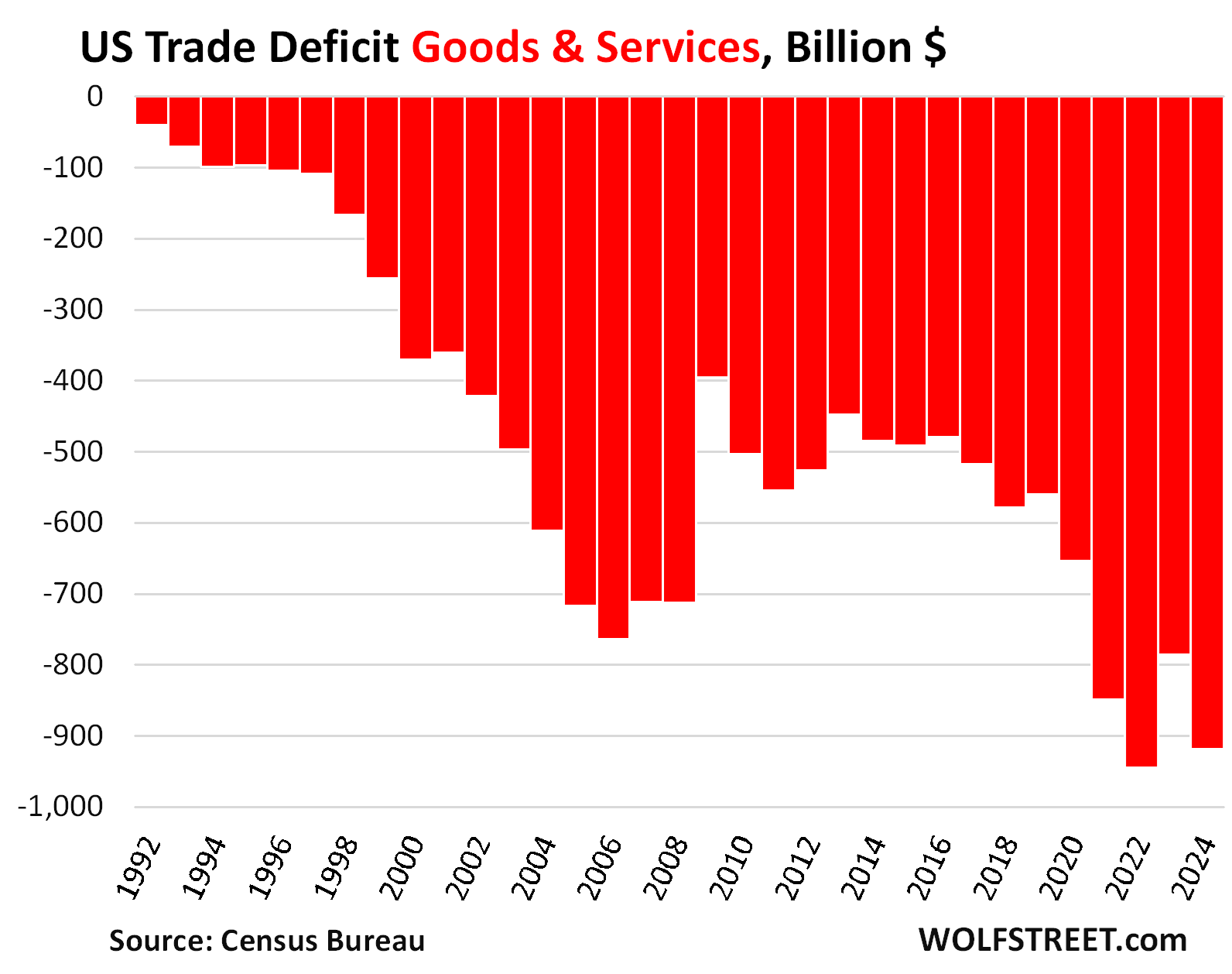

The US trade deficit (exports minus imports) in goods and services in the year 2024 exploded by 17% from the prior year, to $918 billion, the second-worst year ever, behind only the 2022 deficit, according to trade data from the Census Bureau today.

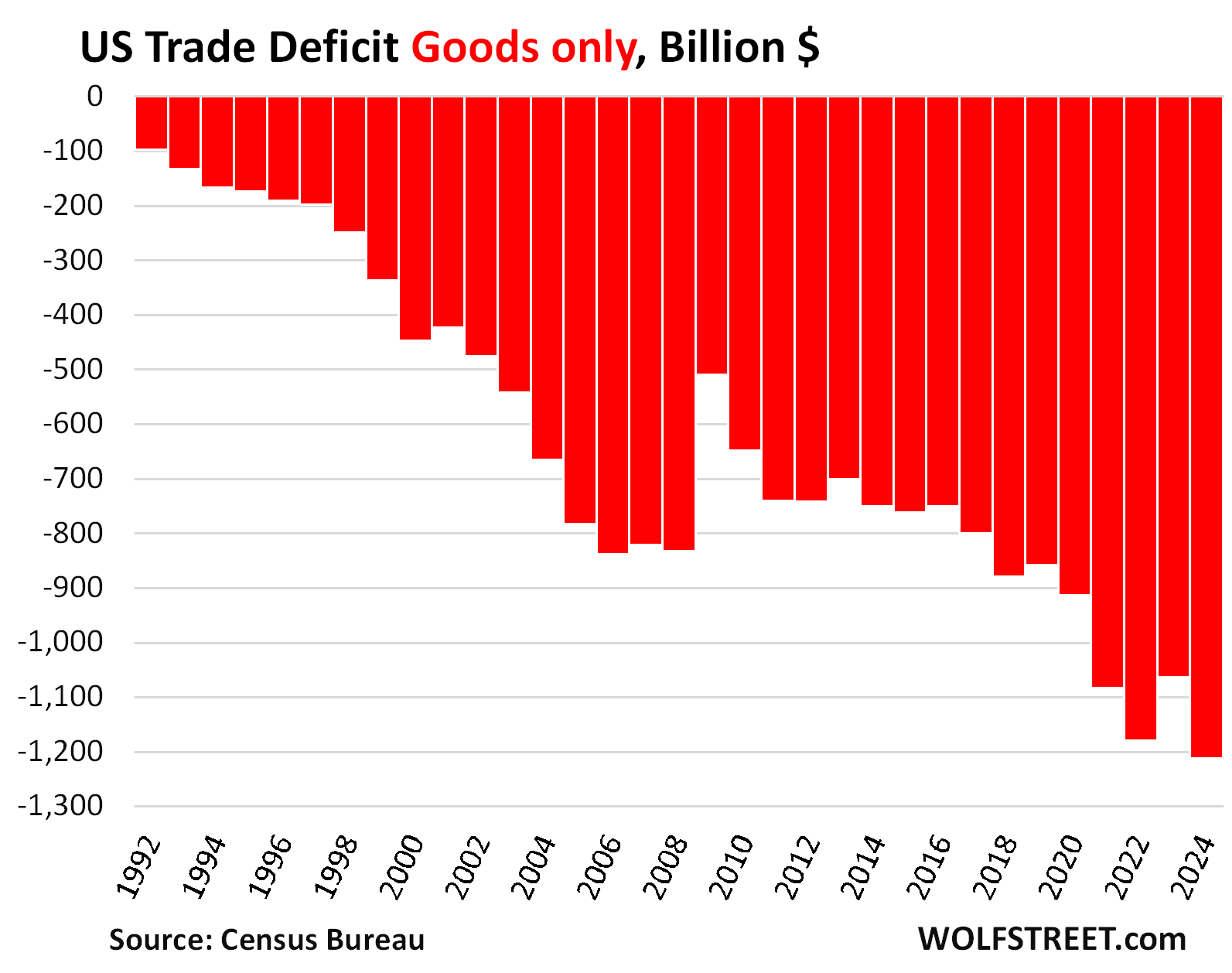

The trade deficit in goods without services worsened in 2024 to a new all-time worst record, after a spike in December as Corporate America tried to front-run Trump’s tariffs. The small surplus in services improved, but was still smaller than in 2018 and 2019.

The trade deficit (“net exports”) is a negative for GDP. Exports are added to GDP, imports are subtracted from GDP. And this huge trade deficit has been the reason for decades why US economic growth hasn’t been better. For all of 2024, GDP grew by 2.8%, adjusted for inflation. It would have grown by 3.2% if trade had been balanced.

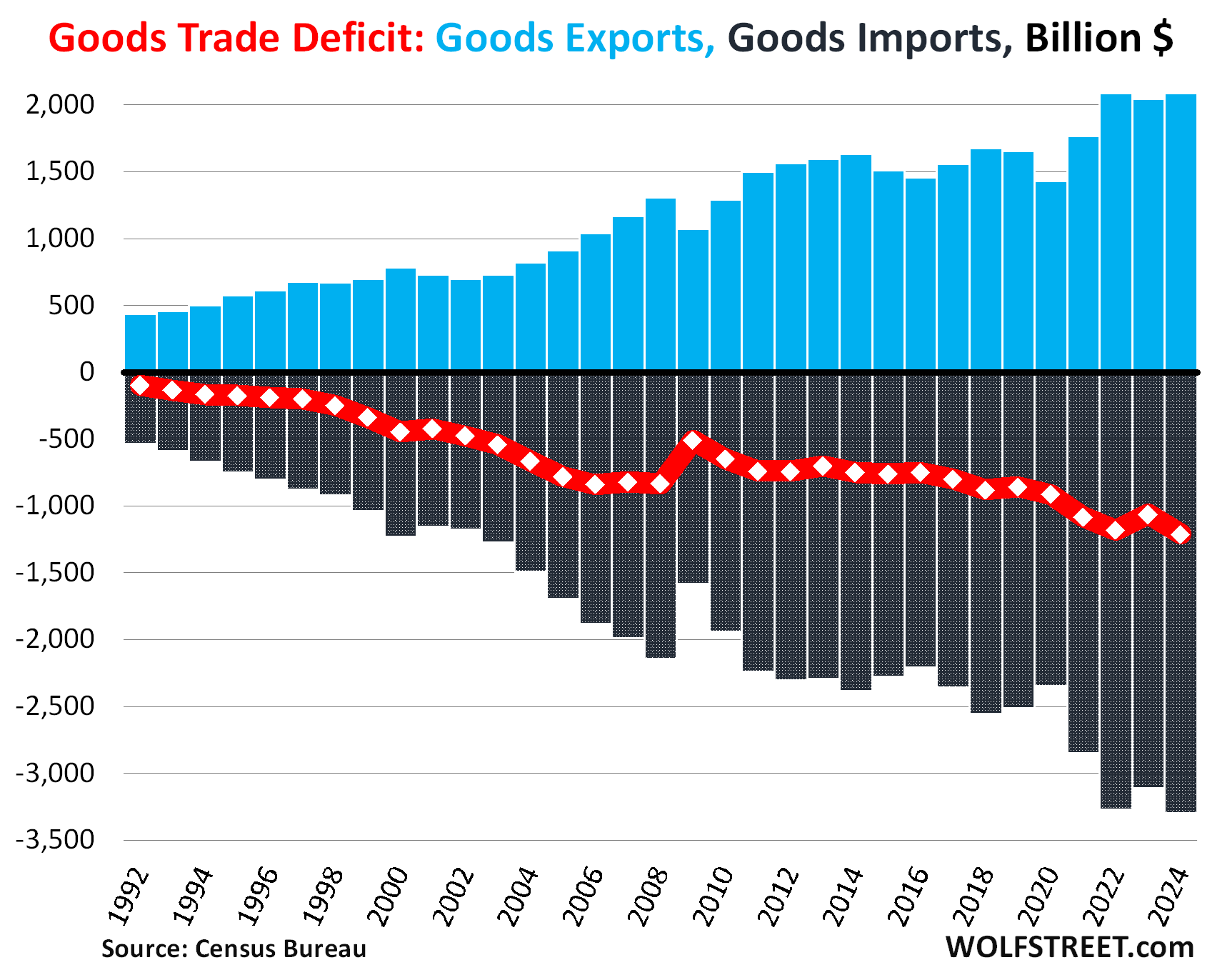

The goods trade deficit worsened by 14%, or by $148 billion, to a new All-Time Worst (ATW) of $1.21 trillion.

- Exports of goods ticked up by 1.9% (or by $39 billion) to $2.08 trillion, below 2022.

- Imports of goods worsened by 6% (or by $187 billion) to a new ATW of $3.30 trillion.

Three decades of connivance by the US government – which bridged with ease any political divide – and Corporate America, under the failed doctrine of globalization, have destroyed much of the manufacturing base so that corporate profit margins could fatten by chasing cheap labor, lax environmental laws, and preferential treatments in US and foreign tax codes.

In return, they sacrificed the most important economic sector – manufacturing – with its huge primary, secondary, and tertiary impact on employment, on household incomes, on federal, state, and local tax receipts, on knowhow in automation and manufacturing technology, on engineering and engineering education, and on infrastructure. In the process, they shifted much of this activity and expertise to other countries.

The US is still the second largest manufacturing country by output in the world, with a share of 15.9% of global manufacturing output, and larger than the next three combined – Japan 6.5%, Germany 4.8%, and India 2.9%. But China’s manufacturing output is nearly twice that of the US, with a share of 31.6% of global output (World Bank data).

That this mess was encouraged to happen over the past three-plus decades under the doctrine of “globalization” and “free trade” is a huge scandal that spanned the political parties. And those globalization-mongers are still at it today, preaching the same failed doctrine.

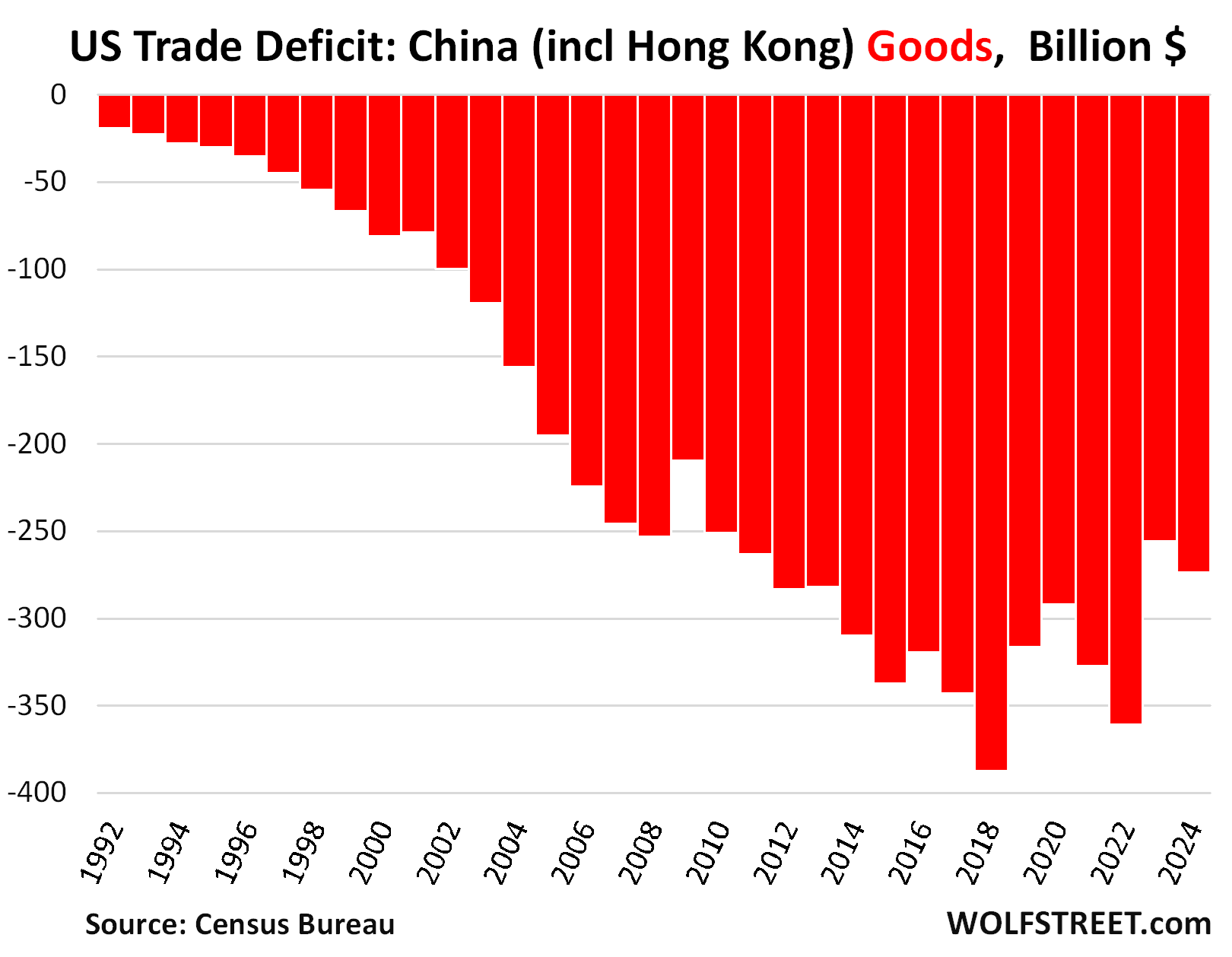

With China (incl. Hong Kong), the trade deficit in goods worsened in 2024 by 7%, to $273 billion. In reality, the trade deficit with China is much worse because a portion of the imports were routed through other countries, particularly Vietnam and Mexico (more in a moment), to bypass and subvert the tariffs imposed on goods from China in 2018 (more in a moment).

- Exports of goods to China worsened by 2.4% to $171 billion, fourth year in a row of declines.

- Imports of goods from China worsened by 3% to $445 billion.

In overview: US goods exports (blue columns), US goods imports (black columns), and the resulting goods trade deficit of $1.21 trillion (red line):

The services trade surplus rose by 5% (or by $15 billion) to $293 billion, below where it had been in 2018 and 2019.

Trade in services includes international tourism. Americans traveling overseas and spending US-earned money overseas on lodging, restaurants, tickets, etc., counts as imports of services. Foreign tourists, foreign students, foreign business people, etc. spending foreign-earned money in the US on lodging, restaurants, tuition, tickets, etc., counts as exports of services.

International travel slowed dramatically during the pandemic, which caused a big drop in both imports of services (Americans traveling overseas) and exports of services (foreigners traveling in the US). By 2022, most of the travel restrictions were lifted or loosened, and travel in both directions rebounded. 2023 was the year of “revenge travel,” and that trend continued in 2024, which caused the rebound in exports and imports of services.

- Exports of services (blue) rose by 7.9% (or by $81 billion) to a record $1.11 trillion.

- Imports of services (black) worsened by 8.9% (or by $66 billion), to $814 billion.

- As a result, the trade surplus in services (red line) rose but remained below 2018 and 2019.

This services surplus of $293 billion (red line) is dwarfed by the goods deficit of $1.21 trillion.

The US goods trade deficit, by country/region.

The opaque nature of international trade to dodge tariffs, US corporate income taxes, trade restrictions, etc., produces some curious effects.

Transshipments through third countries, such as from China through Vietnam, with minimal additional processing in Vietnam, allow Corporate America to dodge US tariffs. We see this in the ballooning trade deficit the US has with Vietnam: In 2024, it worsened by 18% to $123 billion; since 2019, following the tariffs on Chinese goods, Vietnam has shot up from nowhere to #3, behind China and Mexico

Chinese and US companies have been busy setting up shop in Mexico to use Mexico as entry point – such as by importing components from China and assembling them in Mexico and exporting the product to the US, to dodge tariffs on Chinese goods. The goods trade deficit with Mexico has continued to balloon and in 2024 shot up by another 12% to $172 billion.

Trade invoicing through third countries, such as those with low corporate income-tax rates, allow US corporations to dodge US corporate income taxes by keeping their profits in, for example, a mailbox entity in Ireland, and paying a lower corporate income tax on those profits in Ireland. This is why the goods trade deficits with Ireland continues to balloon, and in 2024 worsened by another 38%, to $87 billion, putting tiny Ireland in #4 position, ahead of export powerhouses Germany, Taiwan, and Japan.

The EU (yellow), an economic region some of whose members are also on this list, is closing in on China, as many imports originally from China are now showing up under Vietnam, Mexico, and other countries, including some European countries. The goods trade deficit with the EU worsened by 13% in 2024 to $235 million, a new ATW.

The 15 “trade partners” with which the US has the worst goods trade deficits.

At some point over the next few days, I will dive into imports and exports by category of goods and services, which is fascinating, so stay tuned.

Meanwhile, the globalization-mongers hate tariffs because they’re a tax on the gross profit margins of the importers among Corporate America and hit stocks because passing that cost on to consumers in a competitive market isn’t easily possible. I watched it last time, amazed by the lack of inflation. Sure, “This time it’s different,” the four most costly words on Wall Street. Here are the details, including how tariffs actually work: What Trump’s Tariffs Did Last Time (2018-2019): No Impact on Inflation, Doubled Receipts from Customs Duties, and Hit Stocks

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Apple’s gross margin in 2024 Q4 was 46.9%, and they did over $100 billion in stock buybacks in 2024. Apple pays a dividend with annual yield of 0.43%.

I think they can afford to cover a 10% tariff, but I am betting they will increase their prices.

Always amazed me that Apple vs. Android has not turned out the exact same way as Apple vs. PC.

Market share wise, Android may be trending toward PC like dominance…but Apple still manages to sell hundreds of billions in very overpriced phones.

Why? How?

Maybe it is simply the sheer annual turnover/sales in phones relative to PCs.

Their marketing works – these are “Apple users” not just people with iPhones etc.

I remember when the very first 40GB iPod was released. Sure it was just an overpriced MP3 player but it was trendy – that was the key to its success.

All the 3rd party accessories were called iSomething, e.g. the iHome speaker dock.

And now the iPod generation can afford their own cell phones.

“Their marketing works”

Okay…but it didn’t have anywhere near the success in staving off PC/Windows encroachment in the 90’s (keeping a tight cap on Apple revenues then) – so why/how does Apple’s ultra high margin “Hipster Doofus” marketing work 30 years later?

Very true. Apple almost disappeared in the late 1990s but then a very cool and edgy CEO came back and turned the whole thing around. I think they’ll be able to put a third guy in a black turtleneck and get 10-15 more years from this brand image.

Of course you want to see an American company doing well. Apple probably needs to bring production back to the US, innovate more than ever before, and hold the line on pricing. Basically what General Motors should have done in the 1970s but didn’t.

Another part of it is the Apple cameras. Generally, they seem superior to cameras in Android phones. If you can ditch your $1000 mirror less camera by buying an iPhone, the value is attractive.

Bobber, not sure about Samsung or other manufacturers, but the Pixel pro phones (even as far back as 6 and 7) are competitive with Apple’s. Anecdotally I would say they are noticeably better.

I’m the Ipod generation and am 38, still can’t afford a iPhone 16+…

2 years ago I bought an iphone for $150 ( se2020) and a new Ipad for $270. And I use the low budget straight talk ($37/month) so it was not subsidized by a $100/month bill. So if you don’t buy the top of the line it can be affordable.

Cas127,

Good question. My guess is that pangs of nostolgia for that 40GB iPod are partly responsible for the brand loyalty today.

But I don’t understand it – I kept my Nokia 3410 for awhile.

Elizabeth Holmes had that Steven Yobs turtleneck and presentation stage strut thing going for her, which was nice

Apple people have turned it into a weird social phenomena. Young men get denied dates for being “too broke” to afford an iphone. Even though some Android devices run even more pricey then iphones, it’s such a status symbol for people. Plus they now do 3year payment plans on cellphones anymore. Eventually we are going to finance phones like we do cars.

Many Android phones have better camera than iPhones.

iPhones have become more of a status symbol.

My friends who are dating, have Android Phones say having Android Phone is a good filter about whom to date as many people are to shallow to date anyone not having iPhones.

Apple is the great marketing company.

“Young men get denied dates for being “too broke” to afford an iphone.”

Ah…sure. This sounds like it originated in the Apple PR dept.

🤣❤️

“Young men get denied dates for being “too broke” to afford an iphone.”

I carry both an iphone and a flip phone on dates. If it so happens that she’s into me but I’m not into her, I break out the flip phone to show her some pics or whatever. I make sure to note her immediate reaction. After the date has ended, I never hear from them again. Works every time.

The difference is that phones are more like jewelry, they confer status. They mark you as being part of an exclusive club and people will pay for that.

Ecosystem also matters. Both Android and Apple have robust ecosystems where everything plays together and once you are committed to the ecosystem it’s harder to switch to a competing one – similar to how hard it is to leave a social platform where you’ve invested years in curating content and building relationships.

This is by design, but you knew that :)

Emotional investment is very, very powerful. It’s hard enough to walk away from a financial investment, an emotional one is much harder.

“It’s hard enough to walk away from a financial investment, an emotional one is much harder.”

Apparently not…if he doesn’t have an iPhone…

By the way, tariffs from China applied during Trump1 was 25% and still is 25%. Then new tariffs of 10% (if fully applied) will be ADDED to the 25%, therefore a total of 35%

Yep, somehow the MSM vastly under-reported how Biden more or less kept those evil Trump 1 tariffs in place.

Shocker.

And yet I read multiple times in the msm during the Biden administration that he kept most of the tariffs in place. Some of us only see what we want to see.

No the main stream shocker is Trump’s tariffs were retaliated with grain tariffs from China. 40% of Illinois soybeans used to go to China. China went to Brazil and Argentina to supply them, while U.S. Congress passed a bail out Bill to the tune of billions to save the U S. Farmer. Farmers don’t want a handout they want a competitive open market. Trump took that away from them.

LOL, the farmers again!!! They’re totally on the government’s payroll. The get paid to not plant, they get paid to plant, they get this that and the other…

So, soybeans are a global commodity. If China shifts its purchases from the US to Brazil, that part of Brazil’s production goes to China, instead of to somewhere else, and that somewhere else still needs soybeans, and so they buy from wherever they can get it, which is the US. Same with oil, LNG, and other global commodities. If China doesn’t buy, someone else will, and the US will sell to them. And that’s precisely how it worked out. The farmers sold their soybeans just fine, just not to the Chinese. That’s the whole thing about global commodities.

The whole thing was a massive vote-buying effort by the government and an anti-tariff shitshow that farmers and their lobbyists used to rake in even more billions of dollars from the taxpayer. Farmers are the most powerful lobby out there.

It’s worse. This time around they are getting rid of de minimis, which means that packages from China that are worth less than $800 are now paying 25%.

The local radio station (owned by Cumulus Media group) said that Donnie Boy’s USPS will no longer deliver any packages from China (letters only).

I haven’t heard that anywhere else.

It was all over the mainstream media. And the USPS then reserved the decision the next day, which was also all over the mainstream media.

25% tarriff on china does NOT apply across the board. only certain goods like steel and aluminum.

I’m scratching my head at the current politics and new policies, and whether that altogether represents a sensible answer. But it shines a strange light on what came before, which had such a well-crafted veneer of normality for decades, as meanwhile, the domestic risks and costs piled up like kindling. So here we are.

The US has a trade deficit with China, the EU, Canada, Mexico, etc….

Mathematically speaking, I’m not sure the US can lose by imposing tariffs, even if it starts a trade war.

From a strict trade balance point of view, I think you are probably right (prices higher because of tariffs = less intl trade = lower US trade deficits)

But the traditional argument is that the US *consumer* will suffer (because of higher prices on the many, many, many imported goods and/or shift to US produced goods with higher prices).

But decades of failure of US goods trade to remotely balance and millions and millions of dislocated manufacturing workers who became baristas instead of promised bio-technologists,,,has caused the “received wisdom” to be re-examined.

Europe is up next.

What is interesting is look at the stock markets for China and Mexico. They are lower than they were 10 years ago. Somehow the trade deficit is working out for the U.S.? I have no idea why. You would think China and Mexico with trade surpluses, the companies in those countries would be doing good and the U.S. would not.

I am guessing they cannot match the FED and all of its financial engineering tools. Or maybe a lot of the profits from services from Microsoft, Google, Meta go to their respective countries HQs and are not seen as surplus. I have no idea. I am just guessing.

Globalization was good for stocks. Did you read the article? Driving up stock prices is the purpose of globalization. Under the second chart:

“Three decades of connivance by the US government – which bridged with ease any political divide – and Corporate America, under the failed doctrine of globalization, have destroyed much of the manufacturing base so that corporate profit margins could fatten by chasing cheap labor, lax environmental laws, and preferential treatments in US and foreign tax codes.

In return, they sacrificed the most important economic sector – manufacturing – with its huge primary, secondary, and tertiary impact on employment, on household incomes, on federal, state, and local tax receipts, on knowhow in automation and manufacturing technology, on engineering and engineering education, and on infrastructure. In the process, they shifted much of this activity and expertise to other countries.”

I wouldn’t put too much faith in the US equity markets – they’ve been increasingly overvalued for close to a decade now (Wiley-Coyote-Holding-a-ZIRP-brand-anvil).

It has been said before – escalator up, elevator (shaft) down…that is the intermediate term history of US equity valuations. (See 2008 especially)

PE ratios have been expanding for a decade – absent ZIRP bayonets or AI hallucinations it is hard to see why.

Even enormous buybacks have to be paid for out of something…if PE ratios expand and actual cash profits erode, even that particular form of self-dealing runs out of gas, as there is less and less means to prop up higher and higher prices.

I was just talking about this mass of kindling.

Also that it’s a good thing there’s no possibility for any ignition source. (See So. Cal).

All is well, nothing to see.

/s

I can invent a way to dodge tariff. Factories in China sell goods to US importers at a super low price and at a loss. Tariff is calculated based on this low price so is very cheap. Then US importers buy a “right-to-use” license of the product from the factory. It is not a physical good so tariff does not apply.

With this, US consumers can continue to enjoy cheap Chinese goods, US corporates can keep the lucrative deindustrialization route, and Trump can keep increasing tariff to 200% to keep his election promise without hurting anyone. Kill three birds with one stone.

To get around tariffs, route a product through a non-tariffed country, e.g. China routes a product through Vietnam, and then Vietnam sells product to US. Of course it has to be a product not easily identifiable as made in China, like rice, and something that could possibly be made in Vietnam, like rice.

Why would US importers pay to license designs that were probably stolen from them? As Wolf has mentioned, IP theft is a big issue with Chinese mfgrs.

I have seen first hand how US cos operate in China as they are forced to transfer their tech to local China partners.

WRT China: R&D is Receive and Duplicate :-)

Interesting fact on foreign travel being an import of services.. strong dollar being a negative factor. The work around tariffs through Mexico and Vietnam is of great concern. Thanks, Wolf.

Good lord, that first graph.

Ross Perot was right.

Ross Perot was the last Presidential candidate I voted for. It was obvious then the direction we were heading. I really feel for people who are voting in many countries for populist candidates, willing to tolerate absolutely distasteful people just to change the status quo. We all crave a new order. But I’m afraid that only comes with an even greater price to pay.

Random Guy 62 had a great comment the other day about his hope for change in slapping the tariff on Mexico. Hours later it was removed in exchange for symbolic gestures on immigration and drug controls. The curtain on the Wizard now pulled back, all we see is more of the same.

I’m still checking in from time to time. Generally a lurker in the comments but this issue hits close to home.

The boss has been making it a personal mission to make this case to anyone who will listen in government while it is fresh in the national consciousness. We just might have a meeting lined up with our representative next week, who said he has been following the issue closely, and would like to hear our case. Fingers crossed.

We are pestering the NTEA by asking if they are work on behalf of American truck equipment or North American truck equipment causes. (Its supposed to be American)

Maybe I’ll just send our rep this article, and save myself the time building our argument.

“I really feel for people who are voting in many countries for populist candidates, willing to tolerate absolutely distasteful people just to change the status quo.”

India is one among them. We have to choose between a bunch of guys with many having innumerable criminal cases against them (attributed to political conspiracy) . And we have an Election Commission which dismisses any votes cast for NOTA (None of the above). In some cases the winner wins with lesser votes than NOTA. A farce of an election with the propaganda that it is the biggest election exercise in the world – called dance of democracy.

Gosh, I can’t imagine having an elected official who has been convicted of several dozen felonies.

What kind of country would allow such a thing?

/S

Right after his second run in ‘96 the hockey stick curve really went downhill.

By not imposing the tariffs on Canada and Mexica, Trump showed that he is weak. Now Canada has united behind Trudeau. The liberals were very unpopular before last week. Now it looks like they might even win the election thanks to Trump.

wait what? Trudeau has resigned nobody is united behind him your comments are BS! Not that PP is any better but still…

Not only that, some of the provinces are surgically targeting products coming from GOP states and cancelling orders. I can see that strategy catching on as it’s relatively easy to execute and the data is all public.

This is stupid because not everyone in “GOP states” supports what the GOP or president are doing.

You could have a company exec in Idaho or Utah that’s fiercely opposed to tariffs and hates the president, yet now you’re punishing that company and its employees just because of their geographical location.

Agreed STLT, but this seems to be the rhetoric of the current US administration as well. It’s not America, it’s red states or blue states.

What color did Utah and Idaho vote again?

The stated purpose of the tariffs was to get concessions on border security. Trump got what he asked for and provided a 30 day pause on the tariffs to verify Canada and Mexico do what they said they would do.

Its funny the number of people who lambasted Trump for starting a trade war and are now calling him weak for suspending the tariffs after he got what he wanted.

I don’t like the guy either but he is doing exactly what he said he would do.

I don’t believe the Trump tariffs were EVER about border security, especially for Canada. It was an attempt to gain leverage.

Yes, the stated purpose with all that fentanyl and illegal immigration coming through the Canadian border. Very strategic and beneficial imposition and rescinding of that tariff…

If there was any noticeable impact to Canadian consumption of US products at all, with literally no impactful benefits, it was a poor strategy. He laid his cards on the table and Canada trumped him.

Trump told us he was planning on using tariffs to control the fentanyl when he was running for office. This extremely deadly drug (2 milligrams will kill the average adult) is killing about 100.000 young healthy adults is the US annually who have no idea that the drug they think they are taking is laced with it. This is a war. We know discovered Canadian fentanyl labs are producing millions of doses beyond any possible Canadian use. Blackhawks flying over the border forests might have difficulty seeing a hiding hiker with a backpack.

There is very little Fentanyl coming from Canada. You read too much right wing media.

Federal statistics show US border authorities seized 21,889 pounds of fentanyl in the 2024 fiscal year. Of that amount, 43 pounds were seized at the Canadian border — about 0.2% — compared with 21,148 pounds at the Mexican border, about 96.6%.

Oldguy – fent is active at doses measured in micrograms. Several pounds is enough to kill the entire population of a large city.

And it sure isn’t mexican fent that killed my friends up in Maine. They share a pretty large border with Canada.

Just saying.

Oldguy – “There is very little Fentanyl coming from Canada.” You don’t know that.

As Harry Houndstooth said: “This is a war. We know discovered Canadian fentanyl labs are producing millions of doses beyond any possible Canadian use. ”

The RCMP have been raiding and shutting down labs and finding “millions of doses beyond any possible Canadian use”. So where is this excess going? Are these labs, who are in the business of making money, just producing this excess for fun and then destroying it? No, they’re producing it in excess of the Canadian market because they do have a market for it – the U.S. market.

You’ve posted this a couple times so I decided to look.

From the CBC Poll Tracker February 3:

“Liberals make progress but Conservatives still dominant”

The conservatives were down 1% to 43.4% and the liberal was up 1% to 23.4%. The conservatives were given a 92% chance of winning a majority and a further 7% chance of winning the most seats without a majority. I don’t profess to follow Canadian politics, and maybe the CBC isn’t a reliable source, but the liberals appear to need a lot more help from someone.

I sat in on a policy meeting of a manufacturers association the other day regarding the tariffs. Prez is getting pressure in both directions.

Farmers are against tariffs for obvious reasons. They are already basically just government contractors at this point anyway, so they will take whatever the government gives them, but they sure whine about it the whole way.

Automotive seems to be carefully lobbying against them, but not too hard cuz they know things like the pickup truck tariffs actually butter their bread.

What cracks me up is no one asks “why would Mexico and Canada care if those manufacturing jobs leave?” They care cuz they are vitally important to their economy! You know…Just like they were here!

Do they try to export that horrible fries gravy cheese poontang thing over here?

I hope Trump imposes the tariffs on Canada after 30 days. That is the only way liberals and Justin Trudeau will be defeated.

Weird, I am seeing that it would guarantee a Conservative loss, as Canadians don’t like being played.

So, Canadians elections are primarily determined by US politics? Sounds like a ’51st state’ argument. /sarc

Sarc you say?

8.2 billion peeps welcome that place and it’s people.

As oppose to a handful of…wrt the place south…you get my drift?

The math doesn’t work for the scenario, but then again math is foreign to most 😆

John, if that is your wish, then “Be careful what you wish for”.

The P**** stated he would bring peace to the mid east, instead they are getting pieces.

Everyone now regrets about how they casted the little check mark.

Do your homework. PP is made in his image.

Trade is a very complicated issue, and I don’t pretend to know every facet of it. But I know our business like the back of my hand. My family has been bending metal in the American Midwest for four generations, in many different business ventures and products. I started sweeping floors and cleaning bathrooms at age 14. Some of our operations have been shuttered. Others are thriving. We are holding our own, clinging to an ever smaller slice of the market.

Listen to the song “we can’t make it here” by James McMurtry. He paints the picture of my home town and hundreds of towns like it across the Midwest. “Hollowed out” is an accurate way to describe it.

I argue that it is in our country’s best interest to have a diversified economy. Manufacturing is a cornerstone of that.

Society keeps asking more and more of us as an employer. More benefits, more paid time off, higher wages, cleaner processes, better products. That’s all fine. But when I try to pass those costs onto the product, Mr Market says no. Market says no because buyers have wide open access to products made by workers without those same standards of living. Can’t have it both ways in the long run.

There is a big plant across the road that used to be a union shop with good wages. About a decade ago they went belly up and were bought by a foreign investor. The new owners gutted the place, and they are booming -Never seen so much product out the door. That sounds great, but the problem is they pay poverty wages now. It is a horrible place to work. Everyone in their shop is a temp with no benefits. It is a microcosm of our country.

We need to wake up and have some standards for ourselves. If a tariff can nudge things the right direction, sign me up.

Where I am we have the same problems. But we have to hire legal work out and before Covid we were paying about 300 per hour. Now we are paying 900 per hour for the same amount of work. Is that increase caught in the GDP numbers? Eight years ago I needed a new screw in tooth. It was about 900 dollars all in. The same dentist with the same tooth now is charging me 7000 dollars. I am leaving my gap toothed smile as it is. Is that increase shown in the GDP numbers. Is an economy with 900 dollar per hour lawyers more productive than one with 300 dollar per hour lawyers?

“Is that increase caught in the GDP numbers?”

Yes, legal services is part of the PPI for services, which I report on, and it’s hot, and it’s part of the GDP deflator that is used to adjust GDP for inflation.

Yes, dental work inflation is also in the GDP deflator, except, LOL, I paid $7,000 for a dental implant in 2009 (back molar), and it lasted 12 years before it came lose. So maybe I don’t believe your $900-$7,000 screw story because I know better.

There are about 1.5 million lawyers – you might want to *really* shop around.

Fewer major league corporate law firms…but still a ton. More than enough to wield as a very big board (with a nail sticking out of it) to hit any incumbent law firm trying to triple rates.

Ditto dentists.

Clark Howard – “Is medical tourism right for you?”

search – alternative countries for dental care

meanwhile, try some xylitol (search – xylitol dental benefits)

Travel to Croatia, get our implants and a very nice vacation for that money

Right. It’s not just comporate connivance… It’s what consumers want. They’ll happily ignore the “made in” tag if it saves them 10%.

Globalization isn’t inherently bad because there are upsides, too:

– It frees workers is advanced countries to work on greater projects.

– It helps advance the world economy by bringing poorer countries up-to-speed which helps, you know, the whole world.

– Cheaper prices let’s people afford more stuff which makes them happier.

It’s a balance. Globalization is just like every other technology: some jobs go away and others are created. Everybody laments what is lost while quietly enjoying what is gained.

We’ve only had globalization for the last 50 years. Human societies have existed for 10,000+ years.

Globalization is the anomaly, not the norm. Kind of like ZIRP. Future generations will only see it occupy a tiny slice of history.

ShortTLT – There is a reason Babylon fell.

“It frees workers is advanced countries to work on greater projects.”

That definitely was the Econ 101 pitch circa 1990…

But 30 years later, millions and millions of displaced manufacturing workers didn’t become biotechnologists or aerospace engineers or astronauts – they became part-time baristas struggling survive – now barely barely surviving, having to pay rents that soared 25% in 2 years.

(And the US had rendered itself incapable of manufacturing g*ddamn paper masks during the Pandemic – don’t count on modern day Liberty ships defeating China off Taiwan…)

All the ideological drum beating in the world won’t undo empirical reality.

This trend became extremely clear circa 2003-4…the US never really emerged strongly from the prior recession – but DC used ZIRP (expropriating US dollar savers) to paper over that reality by artificially and unsustainably inflating asset prices.

In the long run, I actually do agree with the Econ 101 position – productive efficiency is going to win out in the international economic marketplace.

But – American “leadership’s” response hasn’t been to address that mortal challenge over 30 years, it has been to lie (“Things have never been better”), steal (ZIRP…), and scuttle off in search of hookers and blow.

@guy, while I trust your experiences, in many industries there’s also a trend of stagnant wages while corporate profits and executive bonuses balloon.

To understand this properly you need to understand the extremes of tax avoidance by major US corporates. In summary much of the deficits arise from selling intellectual property to low tax regions, then bumping up the price of exports from other countries into the US to move profits. Tariffs will work wonders in unravelling this, assuming those corporates don’t have the power to stop Trump killing their golden goose. This article touches on it, for a detailed deep dive see here.

https://www.cfr.org/blog/when-services-trade-data-tells-you-more-about-tax-avoidance-about-actual-trade

“assuming those corporates don’t have the power to stop Trump killing their golden goose.“

Politics 101: Dumptruck has NO intention of killing the golden goose whose eggs he’s feasting on.

Rather he’s going to fatten it up through the back door while handwringing and jawboning at the front.

That’s the “art” of the steal.

The ones who cheer the loudest for him are getting beaten the worst.

“on knowhow in automation and manufacturing technology, on engineering and engineering education,”

One small hope is that in the era of the Internet, things (anythings) can be be taught (re-taught…) faster than previously, without all the rent-seeking impedimenta.

I hope.

Then again, I don’t know if the Pandemic production crisis (mask/ventilator/etc) really illustrated this.

Decades of ZIRP temporarily (and deceptively) papered over an ongoing crisis in the true wellspring of American wealth – domestic productive capacity.

We need to on-shore our important industries, for both economic and defense reasons. It is going to take a while, and the consumer might pay a little more, but it must be done. “Buy American!”, I shout optimistically, as if anybody will buy anything but the cheapest.

BTW, I would never have pegged Wolf for being an anti-globalist, given some of his comments in earlier posts. My mistake, glad I was wrong. Economic reality always wins, it may take some time. The USSR tried to defy it for almost eighty years. I like lots of countries in the world, reasonably independent, each working in its own self-interest. Also lots of different cultures, not polluted by other cultures. Nothing worse than going to Oogooboogoo in Africa and seeing a MacDonalds.

In WW2, the war resources board tapped private industry to divert the USAs massive industrial capacity toward the war effort. Could they mobilize the same now? I’m sure someone studies that right?

What do you do if China decides they are tired of us and turn those big bicycle plants into tank factories?

Meanwhile we long since mothballed every metal bender from Pittsburgh to Davenport. All the welders retired to the villages to swing their last few years away, and their kids moved to Phoenix to sell each other overpriced houses, and drive for uber. Sounds like a recipe for a win.

I appreiate your comments and perspective, RG62

Ross Perot predicted that this would happen 32 years ago. Karl Marx predicted that this would occur 160 years ago. Globalization has been good for the Chinese peasants. Great for our corporate overlords. Not good for the Generation X Americans that can’t find a good job, or afford to buy a house.

True. Also, it has been great for U.S. company profits but not good for the Chinese company profits. I am guessing WMT and Costco are good at squeezing the foreign manufacturers profit margins. But Walmart and Costco have healthy markups? Walmart and Costco stocks have double in 1 year. China stocks go sideways or down. (But maybe China companies’ profits are being siphoned off by the Chinese government or execs). They should be doing much better considering the companies that sell their products are doing great.

President Reagan had this all figured out decades ago. I still remember he said we are going to be an economy with high paid service jobs and the manufacturing work will be offshored. So we are right on course. Remember in the 1970s the statement that 9 out of 10 millionaires made their money in real estate, that and the financial services including the Federal Reserve that turned that “millionaire” into “billionaires” with no extra work or product. Soon everyone is going to be a millionaire, so these charts are no problem.

Fair enough read on the 80’s (Where is Richard Gephardt?).

The real travesty is not the ideological blindness (see below) but the utter failure of US political/corporate leadership to course correct (at all) once it became manifestly clear that China was thoroughly kicking our ass competitively (2006? 2007?) with a huge assist from China’s domestic financial restrictions (forced USD export proceeds into Yuan conversion) which ensured that US/China trade was never going to be within a million miles of remotely balancing.

But…that said…and just to be perverse…tariffs could easily just become corporate America’s latest opium (first ZIRP, now trade barriers).

If China sells the world $10k cars and tariffs compel Americans to buy $40k domestic built MPGuzzlers…I don’t think that is a long term win for the US either. It isn’t like Import Substitution policies/tariffs made 1970’s Latin America any more internationally competitive – pretty sure Argentina made/makes cars…but they are essentially non-existent in intl trade.

Because they suck and are overpriced, yet sheltered by the implicit subsidy of tariffs.

America, if it is smart (please sweet Jesus, just once more, even though we don’t deserve it) could use tariffs to get a bit of breathing room/re-organization time…without becoming addicted to *tariffs'” illusions.

“If China sells the world $10k cars and tariffs compel Americans to buy $40k domestic built MPGuzzlers”

This is a BS comparison. China doesn’t build $10,000 vehicles that are equal to a $40,000 US vehicle. You cannot even legally drive that $10,000 econobox in the US because it lacks the required safety features.

You can compare a Tesla Model 3 made in China and sold in China to a Model 3 made in the US and sold in the US. The entry-level Model 3 made in China costs RMB 235,500 ($32,330). In the US, without any incentives, the US entry level model costs $42,490.

But, but, but… the China entry level model is a lot less powerful than the US-made model, from 0-100 km/h (62 mph) in 6.1 seconds, while the US model 0-60 mph in 4.9 seconds. Power has a price. So the price difference apples-to-apples would be even less. In addition, the RMB has dropped against the USD over the past two years, and that exchange rate differences explains another big part of the price difference. At the exchange rate two years ago, that RMB 235,500 Model 3 would be $37,100. Then add the value of the power difference to that $37,100, and you’re close to parity.

” the China entry level model is a lot less powerful than the US-made model, from 0-100 km/h (62 mph) in 6.1 seconds, while the US model 0-60 mph in 4.9 seconds.”

Is this just due to costs, or are there other reasons the Chinese want less powerful motors?

0-60 in <5sec is a lot of power – can be dangerous for a driver not experienced with performance cars. I wonder if Chinese EVs are derated for safety reasons? Curious here.

In this long thread, this comment of yours is the first mention of exchange rates that I’ve seen (unless I missed it in your essay).

If the goal is to bring manufacturing back to the U.S., it would make sense to either levy a universal tariff or let the dollar fall.

Ironically, tariffs have the effect of strengthening the dollar further.

Currency markets are Milton Friedman’s solution to any trade balance. He’d say let the dollar fall. How to do that? We could do something like the Plaza Accords of the late ’80’s, which avoided a currency war. Or perhaps we’d have to raise taxes and/or cut spending to reduce the domestic budget deficit? It’s our deficit that requires Treasury to sell bonds, which leads to higher interest rates and a stronger dollar…?

But, per Triffin’s dilemma, this outflow of dollars to the global economy is exactly what gives the global economy the liquidity it needs to grow. This can be seen as a good thing for everyone except domestic manufacturers and workers. There is no free lunch.

Trump is right. He’s being honest with us: some pain is involved. But what kind of pain?

Raising tariffs to then cut taxes further (Trump’s plan) accomplishes nothing to improve terms of trade. This is pain with no gain for workers but lots of gain for the top 1%.

It’s all connected. So, what’s the answer, Wolf?? Maybe you can link to a previous essay on this subject, if you’ve addressed this before?

Karl,

The answer is the combination of:

1. a strong dollar because the US has a $1.2 trillion goods trade deficit, and a strong dollar keeps import inflation down. Last thing we need is more inflation through a weak dollar.

2. Universal tariffs on all goods from everywhere — and encourage other countries to do the same, so a mutually friendly way (instead of a “trade war”) of raising taxes and encouraging local production. But tariffs can vary, such as more on China, less on Canada. The US, with its $1.2 trillion goods trade deficit will mathematically come out ahead.

3. Some of this has been happening for a few years. Here is the factory construction boom. That’s what it takes, but a lot more of it:

Hey Wolf, I have a question regarding tariffs. Since we are on the topic of

You seen more pro tariffs than anyone else and I sort of see you as the shepherd leading the herd (in a sense).

Back in 2018 and 19 Trump enacted a bunch of tariffs on countries like China. You just had an article showcasing that the rise in tariffs did not increase cost to consumers, corps ate the cost and the gov made more money.

But those tariffs also caused countries like China to play defense- they stopped buying soybeans from US. Articles estimate loss of about 25 billion to our agriculture sector. Congress ended up having to spend a bunch to prop up big soybean

Now what the articles never state is if we ended up making money from this, and by that I mean did the increased tax on Chinese goods bring in more money than the soybean farmers + subsidies cost us?

I don’t know where to even begin to gather that data.

LOL, the farmers!!! They’re totally on the government’s payroll. The get paid to not plant, they get paid to plant, they get this that and the other…

So, soybeans are a global commodity. If China shifts its purchases from the US to Brazil, that part of Brazil’s production goes to China, instead of to somewhere else, and that somewhere else still needs soybeans, and so they buy from wherever they can get it, which is the US. Same with oil, LNG, and other global commodities. If China doesn’t buy, someone else will, and the US will sell to them. And that’s precisely how it worked out. That’s the whole thing about global commodities.

The whole thing was an anti-tariff shitshow that farmers and their lobbyists used to rake in even more billions of dollars from the taxpayer.

I’m in manufacturing.. I wish someone would pay us NOT to produce stuff hahaha

Thanks for the input wolf, I’ll try to be more cognizant of the anti tariff rhetoric.

Interesting that all Chinese EV companies figured out how to make EV’s quickly after allowing Tesla a sweet deal to come in and set up shop without a JV. But maybe the silent JV with every single local auto company will hurt in the long run.

Canada was already threatening to cancel starlink contracts because of Musk’s political involvement, I wonder how long until something similar happens in China, now that they’ve learned the trade secrets

The secret sauce…..EV’s are much simpler to construct than traditional ICE vehicles; only 20 moving parts, vs. 2000. China also dominates the global production of batteries, so integration is simple. The rest is marketing, and China car manufacturers are expanding everywhere in the world where the middle class is still growing (Africa/Middle East/Asia). I suspect….if Trump really pushes EU with new tariffs, China will roll out the red carpet; there are already direct freight train routes from China to Germany after all.

Spot on Wolf.

I don’t know where this heads politically for reasons you outline, but it has been a major detachment of representation from those represented.

Commenter cookdoggie said it nicely above:

“[Voters] willing to tolerate absolutely distasteful people just to change the status quo”

Nope. Voters will tolerate personally distasteful politicians in the hopes that they will give them better lives. A good politician has to be something of an a-hole. Political fighting is a dog fight. For example, the Democrats tried to thoroughly destroy Trump, but struck out. Trump is now batting and will be batting for four more years.

Somehow, I don’t think Trump lasts near that long.

What do not understand, how it is we have a trade deficit with Europe. Can someone explain this?

Is that news to you? 🤣

The EU has forever had an industrial policy in the footsteps of German industrial policy, heavily promoting its own production, subsidizing it in some places, and protecting its overall market in various ways.

The hubris associated with dollar hegemony in the world is what has led America to where it is today. That is the root cause.

As long as a nation can create money and not feel the effects of such inflation, it will go in that direction.

America was becoming grossly uncompetitive (in heavy manufacturing) already in the 1970’s. Lot of reasons including environmental regulations and unions, but the real cause was we realized we could strong arm the rest of the world into doing this for us.

Remember “deficits don’t matter” Cheney? Well he was correct, of course, for his time and place in US history. Unfortunately, nothing in life stays the same.

Back in the ’70s when I took ECON 101, we learned an economic maxim. The country that can produce the good the cheapest will dominate the market. This practice went into effect in the 70s, 80s and 90s. Most manufacturing was shipped overseas to China and Asia. This maintained profits for American firms and Americans got hooked on cheap crap in their local Wally World. American companies, in pursiut of profits and marketshare, made these decisons including technology companies. Dell, the laptop I am typing on, has 95% of it’s parts made in China and Asia. Wall Street is responsible for globalization. This trend is beginning to partially reverse as ths standard of living increases in these Asian nations and China. Advanced technology and automation are making American companies more competitive. However, don’t expect everything to return to the way it was 50 years ago. Cheers.

wolf, you said in the other thread that the 10 year dropping was because investors believing that the fed is taking inflation more seriously.

but this belief causes yields to drop, financial conditions to loosen, and then risk assets get bid, and it provides more kindling for inflation.

how does this cycle get broken?

At the macro level, inflation is nearly always with us. Deflation is rare. The trick is to try to manage inflation.

Nobody wants 9% inflation, and everyone really hates deflation. The Fed says it is happy with 2% inflation per annum as a kind of optimal number all things considered, and is trying to nudge (manage) the economy to get to that point using its only tool, short term interest rates. A tough job.

BTW, the 2% goal seems to be carved in stone according to Powell. I and others sometimes wonder why 2% and not 1% or 3%. Perhaps it is based on historical studies, or some New Zealand central banker’s belief system.

i wouldn’t say “everyone ” really hates deflation. the elite and “brilliant” academics sure do, but i think the average person would be thrilled to see deflation in goods, services, but not in their salaries. and of course, anyone wanting to buy a house would be thrilled to see some deflation there.

Notice my first four words “At the macro level”. Of course at the individual level, most everyone would like deflation of goods and services, but maybe not so much their wage.

I think you mis represent the homeowners of this country. Because they sure as heck do NOT want their home prices to drop

troy, please re-read my comment.

that’s the problem. those who have a lot of assets want their prices as high as possible, the rest of the population be damned.

Troy,

I think *you* misrepresent us homeowners.

I just applied for an abatement with my city arguing that my house is worth $50k-80k less than they’re trying to say it is.

Some of us WANT our assessments to go down.

that’s why stuff comes in waves.

The Philadelphia Eagles are sitting on 666 wins and 665 loses in their franchise history, all games including pay offs…you have millions of Americans who think sports are competitive contests and not another racket…politics are now entertainment and our president was in Holly wood first…it’s a good article, glad I read it.

Hilton and Marriott stocks jumped today as they are beating estimates on strong profits from business travel. Now we have both consumers traveling and businesses spending money on traveling.

Thus, U.S. companies must be doing well. Travel is one of the 1st things cut if business is slow.

Looks like we have some politics creeping into the discussion, huh boys. Keep drinking the Kool-Aid!

At the moment, it is impossible to separate economics from politics. Once we achieve some stability, different day.

Hard not to with everything going on right now, and most deals with our economy.

I always find it interesting that people try to separate out the American political and economic systems as if they are distinct and don’t highly influence each other and are connected.

Wolf, thank you for bringing so much clarity to the situation. The financial media never presents the whole picture. You help us to see the forest from the trees.

MW: Trump’s focus on 10-year US Treasury yield to cut borrowing costs raises curiosity — and problems

IMO what has happened is that the corporations that import their goods did, and will, relocate portions of their production strategically to avoid taxes or tariffs. They’ve done it, and will get better at evasion. Our manufacturing base is growing again and billions have been pledged to support that by our government. Robotics, skilled and unskilled labor will benefit as well as all the add on support industries.

Importantly, tax receipts are broadly stimulated as local economies grow. Trickle down from foreign profits to corporations does not work very well because it only trickles down, but grass roots up does work because of the repeated local spending is repeatedly taxed as money moves up the feeding chain. Profits can be broadly based, and broadly taxed instead of concentrated.

MW: Here’s what pushed Ford’s stock to its worst showing in 4 years

F -7.49%

I have said since Adam and Eve that these people at the top, that come and go, cannot manage their way out of a paper bag. They keep kowtowing to Wall Street and keep getting their main strategies wrong. They’ve been trying to succeed by raising prices and fattening up margins while watching vehicle sales volume go to heck because their prices are too high.

https://wolfstreet.com/2025/01/03/ugly-charts-of-us-auto-sales-2024-stellantis-spirals-into-catastrophe-gm-toyota-ford-honda-rise-but-far-below-their-peaks-hyundai-kia-sets-record-ev-sales-10-despite-teslas-dip/

Ford deserves it for killing the Focus and Fiesta.

And the Fusion, especially the Fusion hybrid, which would be popular now. They handed this business to the foreign brands, especially Toyota with the Camry.

MW: Oil ends at lowest price of the year on rising U.S. supplies, tariff disputes

Here’s hoping for a new record trade deficit in 2025! Who doesn’t like records being broken?!

Is it correct to say that the Ireland “trade deficit” is only virtual and not real. After all, it is just imported corporate profits?

The US trade deficit with Ireland is real, but it’s not with Ireland; Ireland covers up the other countries where the good originated from. SO the trade deficit with Ireland should be spread over those other countries.

A letter is circulating among economists to warn Trump: remember Smoot-Hawley in 1930! Globalization is good! This ignores the political concerns about our hollowed-out manufacturing sector, which Wolf well articulates.

Economists sent a similar letter to Hoover, but Hoover signed the Smoot Hawley tariffs into law anyway. Still, the economists have a point: a currency war isn’t good for anyone. Unilateral tariffs only work if no one retaliates, right? So, unless Trump is bluffing couldn’t this trigger a global downturn, a Smoot-Hawley II?

That’s where we’re headed, it seems. It’s a game of Prisoner’s dilemma. An alternative is something like the Plaza Accords in the late ’80’s. Then we were worried about the Japanese taking over the world. As a result, our trading partners let the dollar fall without a currency war. That apparently worked, although some say that’s what triggered the subsequent real estate collapse in Japan. Still, Trump’s unilateralism seems to preclude a Plaza Accords II. Biden could have attempted this. Instead, he let the dollar index climb to nearly an all-time high.

Any comparison with Smoot-Hawley is braindead fearmongering anti-tariff bullshit, and there is no more discussion possible after that.

1. Back then, the US was the largest exporter in the world; and now it is the largest importer. 180-degree different, the opposite. If countries want to retaliate, fine, let them, and they should. Everyone should use tariffs to raise some taxes, and nearly all countries already do, particularly China.

2. Tariffs are already widely in use by all countries, and have been in use forever. Tariffs are very high in China against protected products. Lots of tariffs in the EU against US products, including cars.

3. The Great Depression wasn’t caused by tariffs. People who say that propagate anti-tariff BS. It was caused by a mix of factors, including the collapse of massive speculation on everything, entailing the total collapse of the stock market, and the collapse of the banking system where money in bank accounts just vanished when the bank collapsed, and companies couldn’t make payroll anymore because their money was gone, triggering huge unemployment, but without unemployment insurance, and so people stopped spending because they ran out of money even if their bank hadn’t collapsed, and it turned into a vicious self-propagating cycle. That’s why we have backstops today, such as backstops for banks (deposit insurance, the Fed’s liquidity tools, strict regulations, etc.), unemployment insurance, a retirement system, etc. Most of these things came out of lessons learned from the Great Depression.