Job openings and voluntary quits jumped by the most in over a year, layoffs and discharges plunged.

By Wolf Richter for WOLF STREET.

The underlying dynamics of the labor market bounced back in October, according to the Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics today. The data continues to be muddled by the Boeing strike that lasted through October and ended in early November, and by three hurricanes – Francine in early September, Helene in late September through early October, and Milton in mid-October – whose heavy rains and flooding temporarily shut down work sites in a substantial part of the country.

As we saw a month ago, the Boeing strike and the hurricanes had substantially reduced payroll gains in October, as reported on November 1. The jobs report for November, to be released on Friday, will likely show a solid bounce-back from those weak gains.

But today’s JOLTS data is for October still, which is why the bounce during what was a rough October is particularly interesting, and speaks of a retightening labor market.

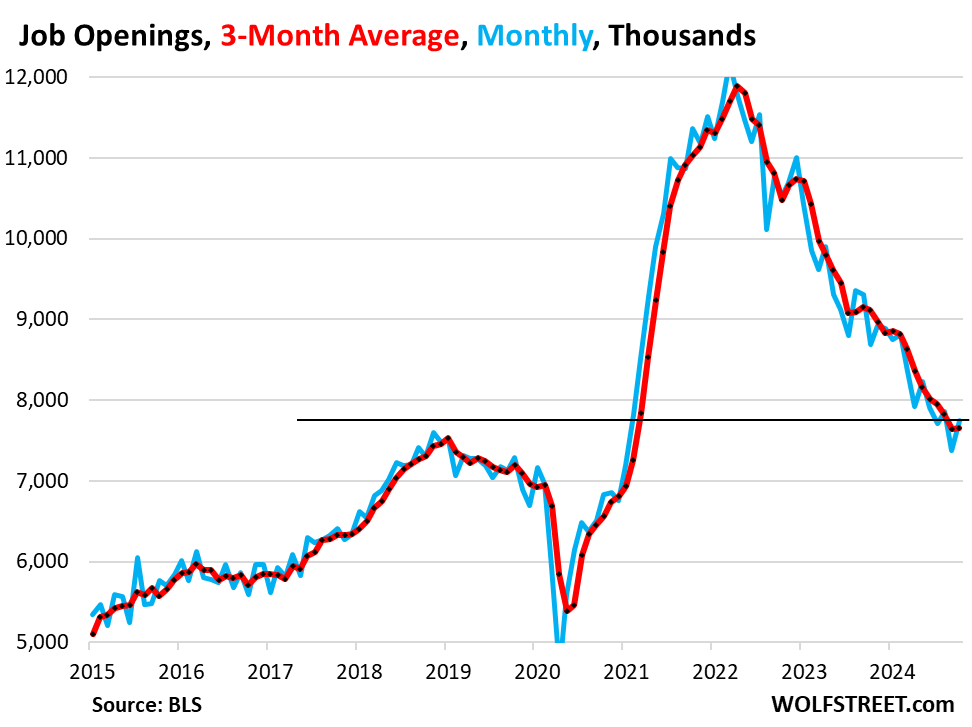

- Job openings spiked in October by the most since August 2023, after the drop in September, and are above where they’d been in July, and above the prepandemic record.

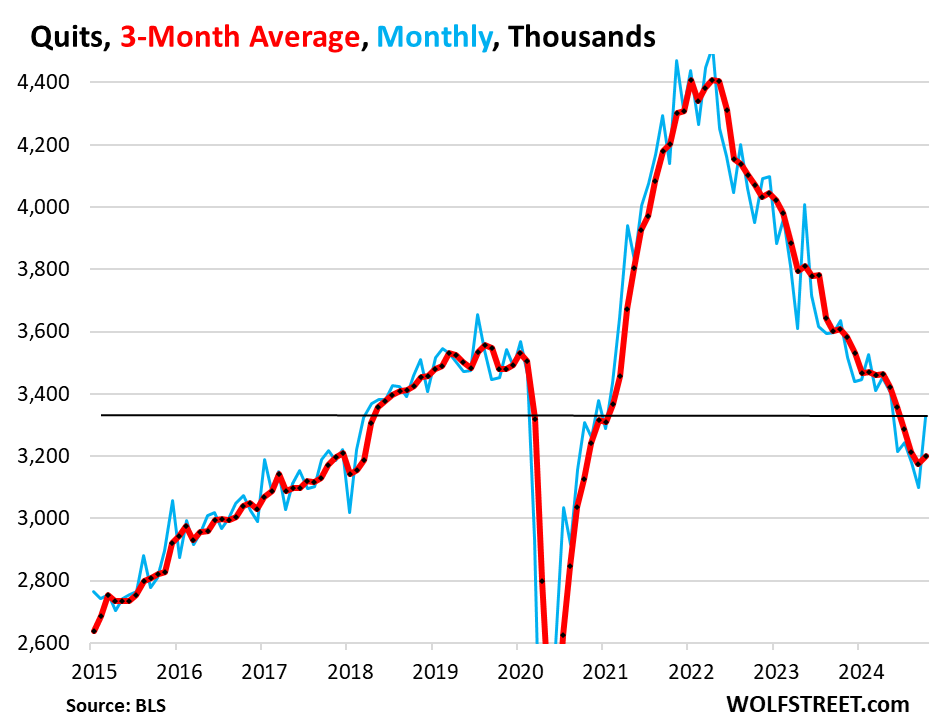

- Quits spiked by the most since May 2023, to the highest level since May 2024.

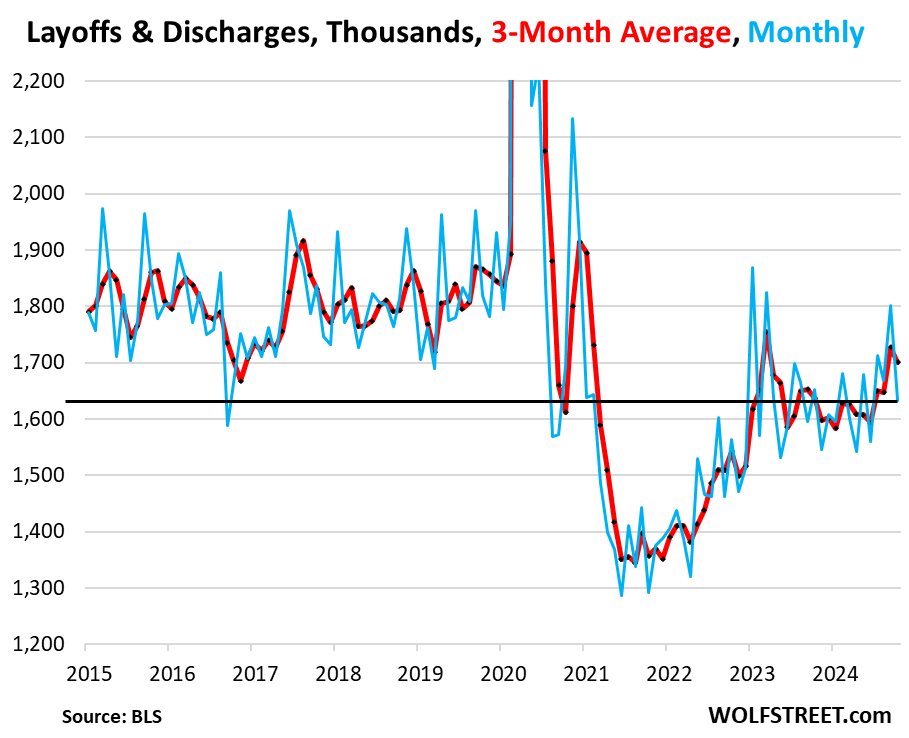

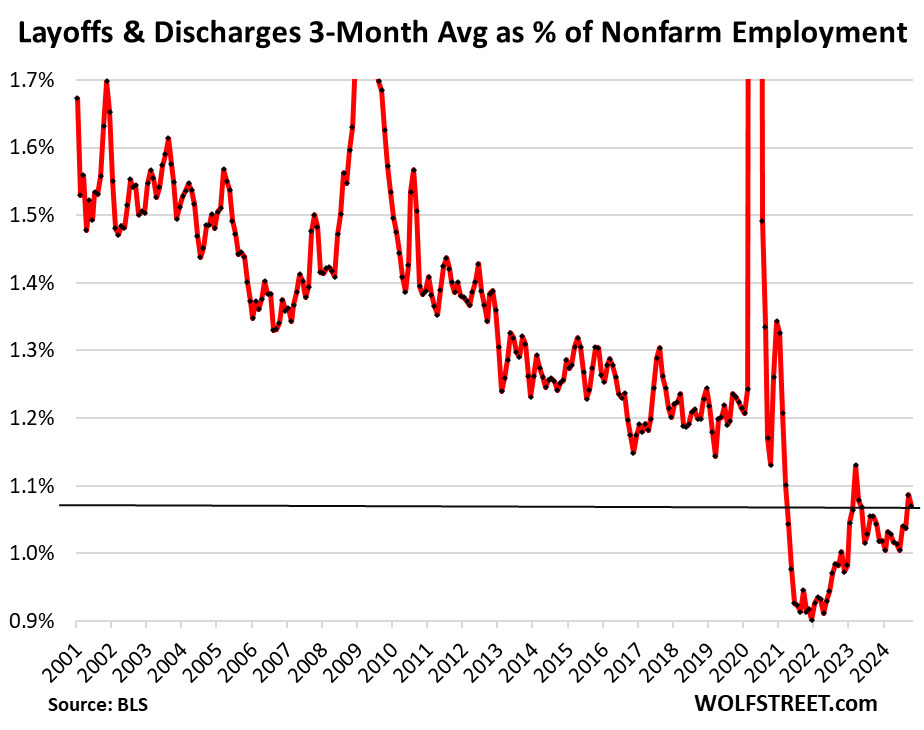

- Layoffs and discharges plunged by the most since April 2023, to the lowest since June.

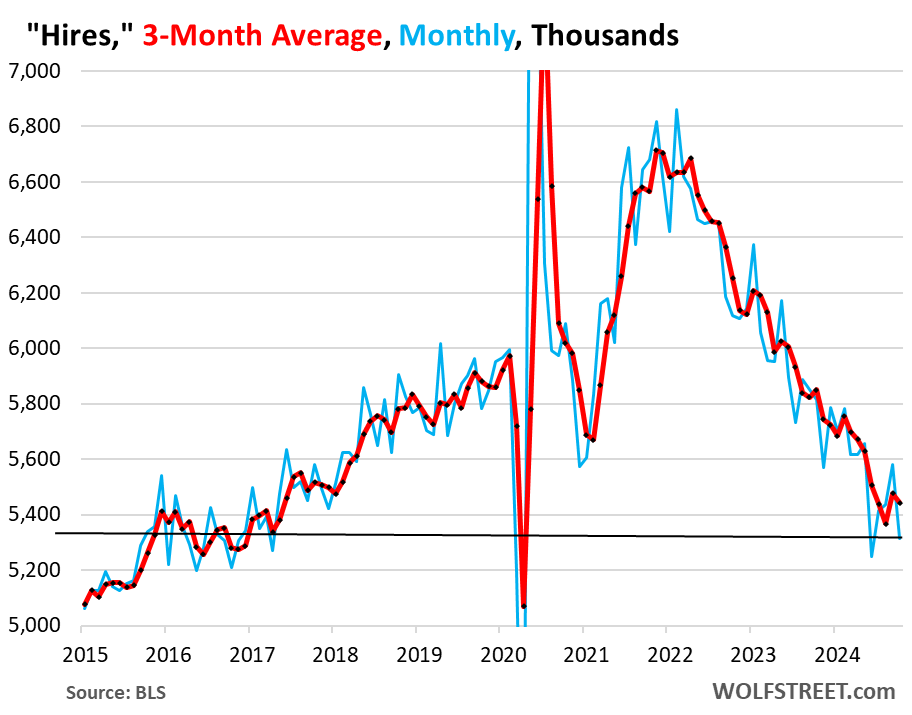

- Hiring fell in October after the increases in the prior three months.

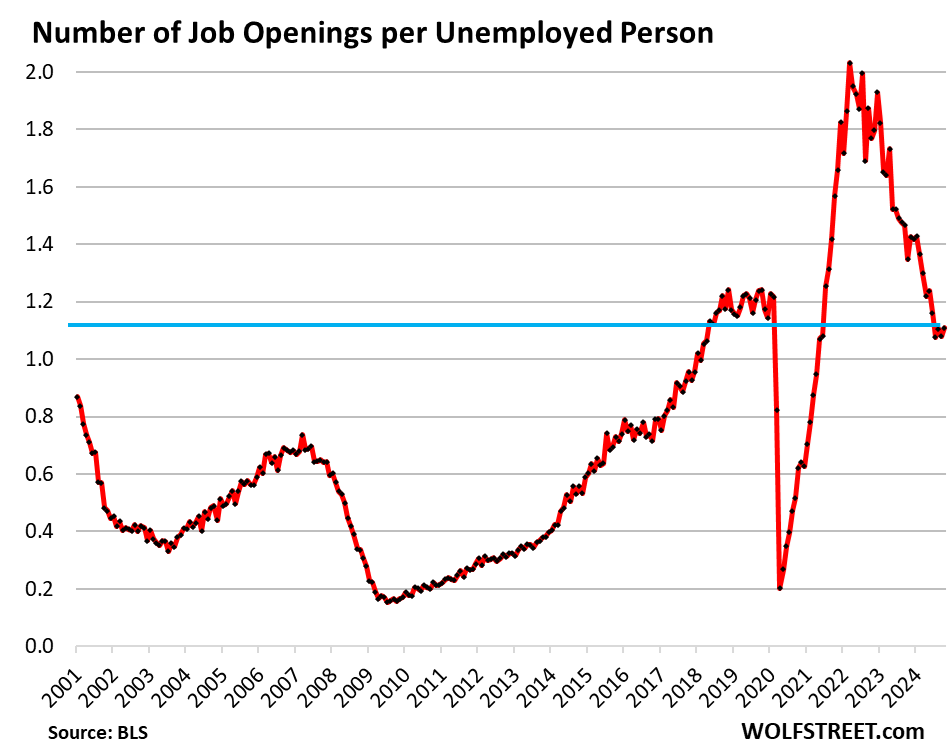

- The number of job openings per unemployed persons rose to the highest since June.

The Fed has already started backpedaling from the pace and depth of the rate cuts envisioned after its monster rate cut in September, which was triggered by what we now know was a false alarm about the labor market. And this data here will provide more reasons to continue backpedaling, and Powell will cite a few of the moves here at the FOMC’s post-meeting press conference on December 18.

Job openings spiked by 372,000 in October from September, seasonally adjusted, the biggest jump since August 2023, to 7.74 million, above where they’d been in July, above the prepandemic record (blue in the chart). This data is based on surveys of about 21,000 work sites, and not on job listings.

Not seasonally adjusted, job openings spiked by 928,000 to 8.17 million openings.

The massive churn of the labor force in 2021 and 2022 clearly has ended as fewer people are quitting, therefore leaving behind fewer job openings to re-fill, and fewer people to hire to re-fill those openings. But October was a sudden and big U-turn that points at increased demand for labor.

The three-month average, which irons out the month-to-month squiggles and includes revisions, ticked up to 7.66 million job openings, above the prepandemic highs in late 2018 and early 2019 (red):

The number of job openings per unemployed person – a metric of labor-market heat that Powell cites a lot – ticked up to 1.1 openings per unemployed person, the highest since June. This means that there are still slightly more job openings (7.74 million) than unemployed people looking for work (6.98 million).

The ratio has been roughly stable for five months, at a lower level than it had been during the hot labor market in late 2018 through February 2020. The sharp decline of this ratio until June was one of the reasons Powell cited specifically for the 50 basis-point cut; the metric was a sign that enough heat had come out of the labor market and that the Fed didn’t want it to cool further.

Voluntary quits spiked by 228,000 in October from September, the biggest jump since May 2023, to 3.33 million, the highest level of quits since May. The three-month average ticked up to 3.20 million.

The massive churn in the workforce during the pandemic, when workers jumped jobs and industries to improve their pay and working conditions, and to better match their skills and aspirations, had triggered the biggest pay increases in decades.

Fewer voluntary quits mean fewer newly open roles that have to be filled, so fewer job openings, and fewer hires to fill those openings. For employers, lower quits is good. It reduces the churn. Productivity rises when workers stay longer and learn the ropes. In addition, pay increases have moderated because employers no longer have to entice workers with aggressive pay packages to stay, or to come work for them.

But October’s surge in quits, if it is sustained, would be the first sign that workers are regaining confidence in the labor market, that more of them are getting hired away from their current job by more aggressive employers, and that the grass looks greener on the other side of the fence once again. These would be hallmarks of a re-heating labor market.

Layoffs and discharges dropped by 169,000 in October from September, the biggest drop since April 2023, to 1.63 million, the lowest level since June. The three-month average fell to 1.70 million.

Layoffs and involuntary discharges include people getting fired for cause. Getting fired is a standard feature in America, and it occurs a lot even during the best times. And currently, they’re still historically low.

Layoffs and discharges as percentage of nonfarm payrolls – which accounts for growing employment over the years – declined to 1.03%. The three-month average declined to 1.07%, both far below any time during the pre-pandemic years in the JOLTS data going back to 2001. It documents that employers are hanging on to their workers.

Hires dropped by 269,000 in October from September, seasonally adjusted, after three months in a row of increases, to 5.31 million.

Not seasonally adjusted, hires rose by 104,000 to 5.73 million.

The three-month average dipped to 5.44 million hires (red).

These workers were hired to fill roles left behind by workers who had quit or were discharged, and to fill newly created roles.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Seems like we’re in for another wage-price spiral next year…

I hope you are wrong, but I wouldn’t bet on it.

well consider all those HIGH PRICED retirees going away at 10,000 per day or more

I’m working and looking at making bank in next couple years

to help pad and increase retirement income

my workers won’t have clue to what they had

Along with that, if it happens, will cause inflation to rise, I would imagine.

Exactly. What I see around is the people who got laid off quickly find other jobs with even better conditions. Labor market is definitely tight. I think most companies are hiring at a similar speed of (or even faster than) firing.

Not what I’m hearing anecdotally from friends/family. tech and marketing, as well as safety and site management. pay is coming down or flat, work remote flexibility is going down in tech, and getting interviews is difficult even with extensive and proven work history.

100k-300k roles middle to upper management.

Long live telework!

Still think they cut in Dec.

Let the ropes be cut on this tied down economy!

Hehe

I think they will, with a good chance of that being the last one, or maybe one more in January and then a pause.

That said, I would be pleasantly surprised with a hawkish hold.

May have to settle for a hawkish cut… If that even exists lol.

In the last few days, the CMR Fed watch has jumped from ~66% to almost 73% today. It will be interesting to see how it reacts as we finish up this week. I expect the Fed to cut once more and then go into a least a 2-month holding pattern, meaning they may not move until March. By then, we may be looking at them signaling we’re month-to-month with a potentially hawkish outlook that a 25-BP rate increase is necessary by spring.

I’d say “muddled” is starting to put it lightly.

The reason it’s tied down and it needs to be tied down more is because all the enormous historic money printing which has driven inflation to the Moon and look at houses they’ve more than doubled in the last few years. Once this inflation starts picking up it could get worse.

Yes, but the truly wealthy, i.e. the real owners of all the productive assets, the banking class, and their bought-and-paid-for politicians CANNOT have any deflation in those assets. Moreover, many TBTF operations and zombie banks/companies have leveraged the “value” of those assets 100-1000x.

Cantillon Effect in full force now and inflation is a mathematical certainty at this point. Inflation, will be much higher than the Fed’s new 3% target…

Interesting times.

The Fed is nothing if not stubborn and hidebound. There is no institutional sin worse than admitting they were wrong. And September’s rate cut kickoff to please the pivot mongers is looking more and more like a policy error.

unless of course, it wasn’t an error at all. if the goal was to inflate assets such that the people they answer to get more and more of the world’s wealth, then it was very successful.

Exactly, because the FED is purely an asset pimping and pumping regime for the billionaires and hundred millionaires. That is their entire goal.

The US has morphed into a rich person’s playground where the well healed and well connected destroy the very fabric of society in the name of insatiable greed.

How big an impact does Return to Office have? Or is it spread out across too long a time frame to have a significant effect? Some fraction of WFH workers will quit rather than move/commute, and some (smaller) fraction have been holding multiple WFH jobs, which might not be sustainable.

A lot of the WFH people with multiple full-time jobs already got fired from their multiple full-time jobs. It didn’t take companies years to figure this out. They went all out to eradicate those people. Many of them worked for Twitter, and when Musk fired 80% of Twitter’s workforce and shut down the offices, no one even noticed, LOL. A lot of the tech layoffs accomplished exactly that, get rid of deadwood. That has been going on for two years. Now the mantra is that if you work from home, you better perform measurably and adequately, or you’re on top of the next layoff list. So I don’t know how many of these WFH people with multiple full-time jobs are still left, or if that number is even big enough to matter amid the 160 million workers who actually work.

Mr. Wolf: “Even the mightiest Oak Tree is held up by its’ deadwood.” Author unknown.

While that may be true for some oaks Gary, it is just the opposite here in the saintly part of the TPA bay area where Milty just showed clearly that any oak with heart rot wood went down, and many of them BIGLY with stems 18-36 inches diameter of mostly dead wood…

While most of the oaks and most of the other trees were NOT natives of this area, it is truly amazing to see the native Sabal palms still standing, with some of them 60 feet and more high and stems 6 inches diameter in places…

“No one noticed”. Actually lots of people noticed:

– huge % of cuts were content moderation / customer service. They do not keep the site running, but they do keep it from deteriorating. Plenty of research shows the rise in extreme content etc. (Whether you think that’s a good or bad result is a matter of taste) but it was still noticed.

– Several outages and streaming problems. High odds the lost platform management staff would have solved these issues in advance

– External API project disbanded. This was a cost sink project to expand the ecosystem. also a matter of opinion whether this is good or bad business decision, but it was still noticed.

– massive shrink in ad revenue is caused in some part by the loss of experienced ad reps. It’s not 100% a “go woke” movement- some businesses do not like their skilled reps getting replaced with form letters.

The other thing to realize: large software companies inevitable put lots of resources into true R&D: so while “no one notices” when R&D is no longer performed, that means “no one notices” when they lose relevance via stagnation as the years progress.

Not to detract from the truth that many people were surely dead weight, but that’s true of people in every software company, for a couple of universal reasons.

So what? X is still there. It’s still working. Some people hate it, but what else is new. Content moderation on Twitter never worked properly anyway. I have tons of impersonators on Twitter that have been stealing my content, including my charts and the image of me, and then contacted people in order to sell them fraudulent stuff in my name, and Twitter never did anything about it. Twitter was staffed by thousands of overpaid lazy nincompoops doing all kinds of stupid projects, if they did anything at all. Musk should have fired 99% of them.

anyone remembers the botched launch of desantis campaign on twitter, lol.

Twitter was the place to get news from the ground, now bluesky has been an a lot earlier to get good info live from the Korea situation.

@ Grant –

“Life’s but a walking shadow, a poor player, that struts and frets his hour upon the stage, and then is heard no more: it is a tale told by an idiot, full of sound and fury, signifying nothing.”

the problem with content moderation and “keeping it from deteriorating” is in the eye of the beholder, and was practiced in a very politically charged manner.

i’d rather have no moderation than biased moderation.

In the year after Musk took over revenue dropped from 4.4 billion to 3.4 billion. If the fired employees were making less than a billion, the co was better off with them.

Unrelated I guess but a question: why change the name to X? He had rights to the name Twitter, and the comments were tweets…?

Twitter has always been a silly name with a silly logo (a blue bird!).

Did revenue drop due to the lost employees or to (part of) the market’s dislike for Musk? I’d argue it was mostly due to the latter.

Twitter and bird as in the old saying, “a little bird told me …” And I think of information, a little message, flying from person to person. So not all inapt, and kind of lighthearted, unlike the Musk school of ponderously taking oneself as monumental powerful in the sense of a boy’s power fantasy, the current cultural watchwords. So, a different “silly.”

“you better perform measurably and adequately”

This WFH mantre about measuring performance remotely doesn;t work for some jobs which have recently been outsourced to WFH. Take insurance claim adjusters. When you talk to one of these dudes, which I have been doing for the past three years, with 3 large claims, all you get is information read from a computer screen. Poor service and no personal connection or empathy with the claimant. You might as well outsource the job to India which is what is happening as we speak. A worker at my grocery store was in a bad accident, called his State Farm claims department and they routed his call to Bangledesh, where the dude told him to get a letter from his Doctor and e-mail it to him. How’s that for service? How do measure that dude’s productivity?

A claims adjuster’s job is to save the insurance company money. Your lawyer’s job is to cost the insurance company money. Don’t confuse the two. The claims adjuster doesn’t work for you. So it’s in that light that a claims adjuster will be evaluated.

That said, when our car was totaled, we had a good experience with our insurance company. We got paid quickly and a fair amount.

My 2014 Toyota Sienna minivan (paid $25K Miami) was hit in the right rear quarter. USAA insured the negligent driver. They offered a “courtesy” inspection at their body shop. Initially within the $10K policy limits, additional inspection rendered the vehicle a economic total loss, over $9K damage. I told them I wanted to settle and retain my vehicle because I just completely prepared it to make it to 200K miles. They offered me $8300. OK. Except I must sign over my title to CoParts who would return my vehicle and salvage title, which would preclude operating it on a public highway. USAA said take it or leave it, we are “closing the file”. Small claims court accepted my complaint for the maximum of $8000 here in Florida summonsing the driver and USAA Insurance rep.

“You don’t go to court to win. Always wear the white hat. You go to court to completely overwhelm and destroy your opponent.” Chistopher J. Lombardo (my 20th and last divorce attorney).

Wolf,

I’m in the middle of a personal injury lawsuit as we speak. Our Toyota was totalled last Novemder 2023 by a hit & run driver who was caught later on. I’ve got the best personal injury lawyer in the State of Maryland. Unfortunately, I’ve discovered that in this state the victim is not able to get anything out of this but get their medical bills paid and the lawyers paid. Nothing for loss of work, loss of quality of life, loss of mobilty etc. You’re lucky to break even and get your life back. The insurance company that covered the hit & run driver in this case are nothing but corporate maggots. My Lawyer told me the hard truth. When you are injured in car accident, even if it wasn’t your fault, the Lawyers make money, the doctors make money and you are lucky if you see a dime.

In terms of multiple WFT jobs, it comes down to management. I’ve worked at companies where everyone was in the office and most of the staff was producing nothing while management was completely out to lunch. I’ve worked in fully remote situations where everyone was generating large volumes of output. If they could also hold down a second job, good for them. I’ve also seen people hold side gigs while in the office. If management is clueless, a physical structure won’t make them any more effective. People have come to confuse the term “work” with physical building – as in “I’m going to work now.” But, they really just mean they are commuting to a building. Doing work is something different entirely. Offices are simply an expense line item, not a management technique.

I worked as a field engineer for two decades. Besides managing big oil & gas equipment installation projects, the office was a place to go to to “finish” my work. I had to put together technical and management reports, reports to client management, government reports, etc. While it was somewhat possible to do some of this at home, the office made it MORE EFFICIENT.

At the office, there were word processing and report production capabilities like big printers to make field installation maps (plats) and other needed visuals. There was a team of highly skilled admin folks to input my work (never learned to type) , correct it, add to it, polish it, and assemble all the parts.

There was a technical library and a “jobs” file that contained a wealth of current and historical resources, and there was also other technical folks who were there to converse with on issues that came up. We had a good sized conference room for client visits and to do online presentations via a video system.

And, working from the office got me out of the house every day!

Now that I am retired and an old fart, I have time to play golf during the week. I am surprised at how many WFH folks I meet at the course. I guess these workers are lawyers or some other skill set that enables WFGC (work from golf course) without too much trouble.

Twitter is writing off billions in value since 2022 though…

It should have never been valued that high, ever. 10x GAAP net income is all it’s worth. And if it doesn’t have net income as a mature company, it should be a penny stock.

I don’t do Twitter or Facebook.

Somehow, my life is getting along pretty well without doing either of those too.

As a content producer you certainly had a different experience than those of us who were just consumers, but going from a usable site to unusable is a pretty big dropoff.

I was one of those folks–had three at once.

Microsoft made it the easiest as there were weeks that would go by without my “manager” ever sending me a message. In the year I worked there, would estimate I did a grand total of 4-weeks work.

Rather than “pre-hiring”, I got the sense most firms were taking on extra help as a means of trying to lower the burden on valuable staff by giving them an “assistant “, but most were too busy to ever take the time to train and leverage us–typical intern paradox stuff.

RTO/RTP (return to the past) is mostly marketing fluff. Only Fortune 500 companies resort to it, and not all of them do. Allstate recently reduced their CRE footprint: (from linkedIn)

Allstate reduced its Corporate RE portfolio from 12 Million SF to 4 Million SF (-67%) and RE cost from $382M to $138M (-64%). An annual savings of $244,000,000

A few loudmouth CEOs like Andy Jassy and Jamie Dimon make it seem like it’s a trend, but they’re both likely talking their books to save their underwater CRE.

Long live telework!

The firm I work for (small food manufacturing) uses remote work as a recruitment tool, and I would definitely say the quality of the average employee is higher than it would be otherwise if only selecting from local pools and makes us more effective as a firm.

Amazon has always had a weird model of actively trying to burn through young talent under the belief that ambitious youth (many who need the job to keep their work visa and pay back student debt) trumps experience.

The Fed’s chicken-out moves in 2023–working with the Treasury to bail out uninsured tech zillionaire depositors, and halting rate hikes–which sparked the market rallies that continue to this day, were triggered by a couple of shitty small banks failing.

The Fed’s unnecessary rate cuts–75 basis points in two meetings–were triggered by a false blip in labor data, later revised away.

Can you imagine how hard they’ll panic and juice the markets if something actually bad happens to trigger them?

fully agree. on one hand, rates are at 4.5% and the fed balance sheet is back down to where it was in like may of 2020 or something. but stocks are priced for zirp and continued printing.

the only thing that makes sense is that the markets believe that zirp and qe is just around the corner, so they’re “forward looking” to that.

Or inflation, inflation makes asset prices and earnings go up. They’re betting on rate cuts into a strong economy – which means it should take off. I think it goes up as long as the fed doesn’t scare anyone by raising rates, which it’s unlikely they’ll do.

right but not to the degree that the market has gone up. inflation does increase profits, but p/e ratios are at nosebleed levels.

for the market to be pricing in as much inflation as the stock market it, yields would have to be much higher in the bond market.

so one of those markets is wrong.

There’s a common conception that equities do well during inflationary periods — because earnings “keep up” with inflation.

Empirically, that’s not necessarily true.

Yes, revenues and operating costs tend to increase with inflation. But: (a) quantities sold tend to fall; and (b) interest expenses increase. On net, real earnings may fall.

For example, the S&P 500’s real ($ 2024) EPS was around: (a) $51 in 1965; (b) $45 in 1975; and (c) $42 in 1985.

The S&P 500’s real index ($ 2024) was around: (a) 925 in 1965; (b) 550 in 1975; and (c) 600 in 1985.

If you had simply rolled TBills from 1968 to 1980 — even before Volcker’s massive rate increase — you would have had a higher REAL return (+15%) compared to investing in the S&P 500, including dividends (-12%).

The bail out (take over) of SV Bank prevented most of the domestic startup landscape from going bust. It would have decimated payroll and those companies would have quickly dissolved under employee flight or had a slower death of huge loan burdens. Yes there are private startups that are actually profitable or close to it in high growth, but the investment landscape at that time was not friendly (and still isn’t great).

So there’s something nationally strategic to what the Fed did there; not just making big baby depositors happy again.

THIS is it the fucking problem. Businesses that cannot be profitable should be allowed to fuck off and die. In addition, if management makes a BAD decision (like banking with crooks) let them SUFFER REAL CONSEQUENCES for their CHOICES.

Go after the bad people/corporations and put put these ivy league criminals in prison with the general population. Behaviors will NOT change until there are real consequences.

In the SVB case, yes, we should protect depositors, to a degree, but make damn sure everyone knows the rules and APPLY THE SAME RULES TO EVERYONE. The rules were known. FDIC insurance covers up to 250K, THAT’S IT. If you put more eggs in that basket, fuck you, you make a BAD CHOICE.

Or monetary stance is much closer to the former soviet union than any sort of “representative republic”.

Interesting times.

So now that the FED and Treasury has made whole those private deposits over $250,000, I guess we are all safe (above $250 K) in that regard with our FDIC insured assets?

Anthony A.: I hear that!

Nowadays we find we find ourselves, ex post, suddenly the designated payers into a new cobbled-together “insurance” system which didn’t exist yesterday, which we’d never imagined (nor had anyone else involved), to bail out people whose losses we (or anyone else) had not foreseen. What a way to run a risk management system! What could be next, subsidizing risks of rich folks’ palaces on wooded crumbling cliff edges?

One thing is for sure, JPow and the Bailout Boys are not coming to save us. They will save the banks and their billionaire buddies, that’s for sure, and they will let inflation rip red hot all over again without a care in the world.

i don’t even think it ever really slowed down, regardless of what the cpi figures show.

But we will get the dinner check, spread out enough over time and loss to deflect the responsibility. That happened with the bills for the ’08 fiasco, and the Wars on Terror.

Panic mega cut on first signs of trouble, but raise rates after you’re 12 months past obviously not transitory.

Inflation while rates are already high is a rock and a hard place, but seemingly that’s where the FRB is navigating the economy.

I just can’t figure out what to expect next.

I expect the play is just keep hammering short term gov debt.

Perhaps the Fed has learned from their past sins, and won’t be so quick to cut rates or do QE when the next crisis emerges.

Their actions in early 2023 (depositor bailout and rate hike pause triggered by the banking nanocrisis) and just recently (75 bps cuts triggered by a brief and, as it turned out, completely phantasmic labor loosening) certainly don’t give confidence that they’ve learned any lessons at all.

They didn’t stop hiking in 2023 when the SVB thing happened. They hiked in March, April, and July, the latter being the final hike.

No disagreement that the depositor bailout and recent rate cuts were unnecessary.

😂🤣😂🤣😂

The simplest answer is a negative shock that will cause layoffs and panic selling to send inflation back to 2% and the ZIRP trend of the last couple decades.

My two big buckets of risk are:

1) International–China is really bad (there now) and I get bad vibes for something beyond a GDP target miss. EU crackup from a variety of sources. Russia complete collapse.

2) Student Debt/intergenerational transfers–student debt pauses are finally ending, which will constrain consumption of younger cogorts and put a strain on the consumption of their boomer parents who will step in to further support them.

Employers want an employee who hits the ground running, knows what to do without being told, and asks for peanuts in financial compensation, because he’s “reasonable.”

Employees want a stable job, a life-work balance, a good pay and a social arrangement at work where they get to be friends with the people they’re sharing the workplace with. They also want a non-asshole boss.

Both parties are being unrealistic, but because the boss controls the pay strings, his version of unreality tends to come closer to prevailing…

Are retirements considered voluntary quits?

No, they’re reported under “other separations.”

Ilan will hollow up DC. Gov workers are quitting, moving elsewhere.

Once you’ve worked for the Government for three years, you become unemployable. Where else would Government workers go?

And, the Government still has a pension plan, which traps people into unfulfilling jobs for an upside at retirement.

We actually need a lot of these people. The jobs aren’t easy, but they are very different. You can’t just hire a guy with a non-Government position to do high level Government work, either; he would be lost.

Hopefully Ilan is the next Dillerson, and T gets pissed at him and lets him go before the term even starts. Maybe he’ll lose some wealth alienating his liberal (previous) customers in exchange for angry old white men who foam at the mouth in anger at the idea that anyone might want to drive an EV…

All a low response rate does is increase the random volatility of the data. That’s all it does. It doesn’t change trends.

And despite the low response rates, these are still huge samples of work sites.

Musk plans to fire workers via e-mails. WFH deadwood will be told to stay home and enjoy a permanent vacation.

I once took a course on how to fire and employee. One of the takeaways from that training is you have to make the employee feel good when he is getting fired. You have to tell him he needs to look at this as an opportunity to enhance his career in the marketplace. I wonder what Musk will put in his e-mail.

“You are FIRED”!

You are not getting fired. Your position is being eliminated.

If they go with the language used in the more senior ranks of corporate America, they’ll be given the opportunity to “resign to spend more time with their families.”

My Mom used to work for a famous musician Peter Deushen (Pianist), in NYC in the late 1960s. My dad got sick and was in the hospital for a few weeks, and recovered OK. She got fired while staying home for a few days to visit him in the hospital and when he came home. Her boss fired her during her time off. His statement upon her departure was

” We are giving you more time to take care of your ill husband”

Rex Tillison, The Exxon CEO, and former Sec of State, was the first cabinet official in history to be fired while sitting on the toilet. He was doing his business, watching TV in his bathroom when T announced that he was fired and replaced by Mike Pompao the former CIA director.

I’m interested to see if governments (CA state/ federal) will dramatically reduce job openings post-election and what impact that will be on the overall JOLTS data in the coming months, knowing there will need to be leaner and meaner governance coming soon!

Federal Government job openings accounted for only 1.4% of total job openings in October. So if half of those openings disappear, it will get lost in the regular monthly ups and downs and you won’t be able to tell the difference.

I suspect that agencies are preemptively beefing up their ranks by 200% to prepare for 50% cuts.

Musk will come in and learn the hard way that:

The Government is inefficient by design. Any attempt to make it less so will result in the loss of billions, perhaps trillions, of dollars.

Musk flops. Agencies have to find work for all their new employees that cannot be fired. Government becomes less efficient.

Mark my words.

The flat US Treasury yield curve will revert to the normal upward slope someday, won’t it?

Some questions about this normalization are:

– Will it be the result of short duration yield decline, or long duration spike?

– When will it transpire?

– Will the normalization be technocratically orchestrated, or market driven?

(Aside: in your third paragraph after “Job openings spiked…” :

“Higher” should be “hire,” I think.)

In my metaphorical crystal ball I’m seeing…

4.25%-4.5% FFR

4.75% 2-year

5.5% 10-year

6.5% 30-year

8-9% 30YFM

That would be wonderful for this saver. Can you elaborate on your reasoning? Tariffs are inflationary and the swell of treasury issuance continues, etc? Or something else?

how are you seeing that? these fools at the fed keep saying they think the “neutral” rate is 2.5-3%.

i don’t see them holding the ffr at anything above what they believe neutral to be, whether their belief is right or wrong.

In my small corner of the world there is a big difference is hiring velocity. 2 years ago we might have had one job opening, filled it in 3 weeks then posted another job opening a month later for the same position. Rinse and repeat. Saw many “hiring classes” at peer companies as well where people were brought on and trained at once.

Now, that job sits open for a while. Maybe we don’t even formally post it until we connect with some people from our network. And timelines to fill are months. And there are no hiring classes anymore anywhere.

Wages have gotten to a point where expectations are 50%+ higher than they were in 5 years ago. And the general feel is that we should slow down and be careful at these prices. The individual contributor searches of today feel more than like the c-suite searches of yesterday.

It’s a headwind that didn’t exist a few years ago. It also has pushed the business toward consultant types over full time employees where possible as a way to derisk.

I am more interested in where the jobs are. I suspect that manufacturing jobs are actually decreasing due to automation and AI. Will this help tamp down any wage price inflation going forward? That’s the question we need to ask, otherwise I think (as others apparently do) wage price inflation will also continue.

HOA fee. $275 to $360 per month next year. Now THATS inflation.

Would love to read one of Wolf’s (or anyone who can write without BS) on how HOAs are handled, who is raking in money by creating them or whatever. I know someone must be making out on this nonsense…

Also, I suspect condo fees are going nuts because so much maintenance has been deferred for years, and now buildings are being checked closer. Sellers getting out to avoid the fee hikes.

ShortTLT-

Direction seems plausible.

I have no statistical evidence, but I always thought of a 2.5% spread as “normal.”

Assuming your 8-9% estimate on long end is reached (and that this lofty level is due to then inflation realities), one would assume an anti-inflation response from the fed would be warranted and that policy rates might be higher than now. (Sort of a Michael Engle “gravitation” argument.)

All a guess, of course…

1) Between June 1962 and Feb 1966 the Dow took off from 545.55 to

1001.11. GDP was up. In construction of new housing 5+ units were

up, income was up and unemployment was low. Within a decade an

oil embargo caused mayhem, assets destruction and riots.

2) SPY made a new all time high. Debt is up. Unemployment is low, Disposable income is up and China imposed an embargo on us.

3) We might import essential minerals while extracting them from old cell phones, computers and other consumers devices. Rotation from frivolous consumption to industrial production of essential sectors to our national security, protected by tariffs. Trump might negotiate lower tariffs on China and our friends, but he can’t cave in.

4) If tax rates on the rich will be lower they can invest in industries to make profit. Everybody will benefit. Gov debt might be cut by a 1/3 if Trump will shrink DC, cut regulation and allow the private sectors to takeover. The Chinese embargo might be a blessing. It force us to rush

it, do whatever it takes, to produce what we need and not to cave in to blackmails. If we cave in today it will invite more threats tomorrow.

“Twitter has always been a silly name with a silly logo (a blue bird!).”-W

….the current name is even more moronic,

WITH the bonus of masonic/satanic symbolisim

Noooo! Not Muskarino too…

Companies like Staples and Home Depot must be having trouble hiring workers. I was in there twice in the last few weeks and noticed no employees except cashiers working in there. I had to load 200 ILbs of topsoil myself from Home Depot into my SUV w/o any help from the ‘hunks’ that are usually there to help out. Same with Staples. I had to cut the 100lb box of paper and load the reams one at a time because there was no one in there to even help get the box to the checkout counter or to my car. Here it is, in the peak holiday selling season, and the stores have no help. No one wants to take these low paying service jobs. The stores won’t pay a decent wage either. Customers are SOL (S$it out of luck)

You saw the record profits right? That’s from these kinds of stores cutting costs to the bone and price gouging boomers who buy things like topsoil and paper still. I’m trying to break my parents of these old habits to stop them getting guaged too, but it is what it is.

“…and the winner of the race to the bottom is:…”

may we all find a better day.

Judging by the increase in imbeciles delivering my groceries and Amazon stuff, I’d say employment is tight and getting tighter. If Trump really does deport millions, it will get even tighter. Wage inflation will jump. Tariffs will also increase prices, but it is unclear by how much. With all this in mind, the Fed will of course lower rates at the next meeting. Because the Fed, well, Powell, has been wrong more often than correct about the future of the economy, the smart move might be to position yourself opposite to the Fed’s views. It used to be don’t fight the Fed. Now it is do the opposite of the Fed.

Thurd2

“If Trump really does deport millions, it will get even tighter. Wage inflation will jump. ”

So we need more illegal alien in here so you don;t have to go buy groceries at the supermarket like everyone else?

Some people are old or disabled and can’t leave the house easily. Have some class, dude.

Swamp, ever hear the term “non-sequiter”? It is a kind of response used by ignorant people.

Muss, yes, delivery services can be very important to the aged and disabled, as you say. Many people are too ignorant to realize this. I think it is not so much lack of class, although it could be, but more likely a lack of intelligence.

Thurd2

Most of the people in my neighborhood that I see getting groceries delivered are young yupees, who are too lazy to get off their sorry a$ses and go to the grocery store themselves.

You’re absolutely right. I worked for one of these firms in analytics.

The yuppies justifying it by “they had a hard day” is quite a large chunk of the customer base, alongside the “freeing up time for my side gig” logicians who spend more on delivery than their twitch channel brings in.

Another big chunk is 20-30 somethings too high or addicted to their video games to drive to the store.