Single-family home sales edged up in 2025, condo sales dropped further.

By Wolf Richter for WOLF STREET.

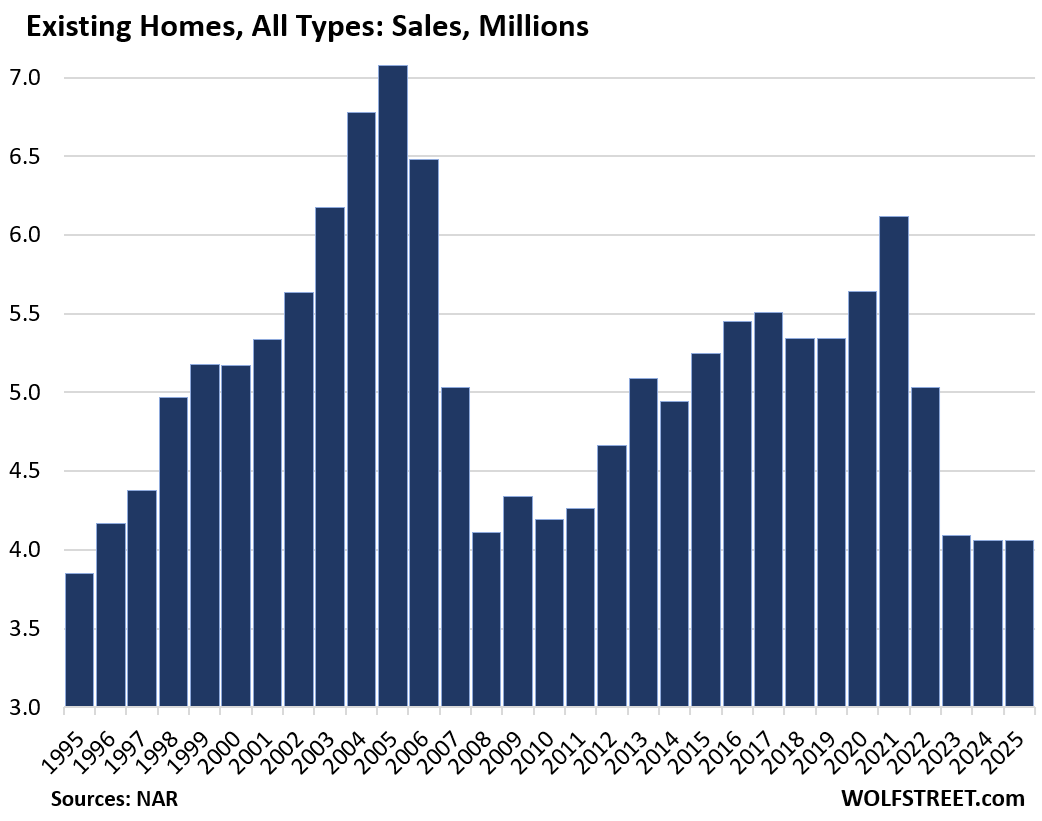

Annual sales of all types of existing homes declined by 0.2% in 2025, from the prior year, the fourth year in a row of declines, to 4.06 million homes, the lowest since 1995, with single-family home sales ticking up a hair, and condo and co-op sales dropping further.

Monthly sales that closed in December rose by 1.4% year-over-year, to a seasonally adjusted annual rate of 4.35 million homes, the best December since 2021, but still down by 29% from December 2021, according to the National Association of Realtors today.

For the past three years, home sales have run essentially at the same collapsed pace, down by 34% from the pandemic high of 2021 and down by 43% from the all-time high in 2005 (historic data via YCharts).

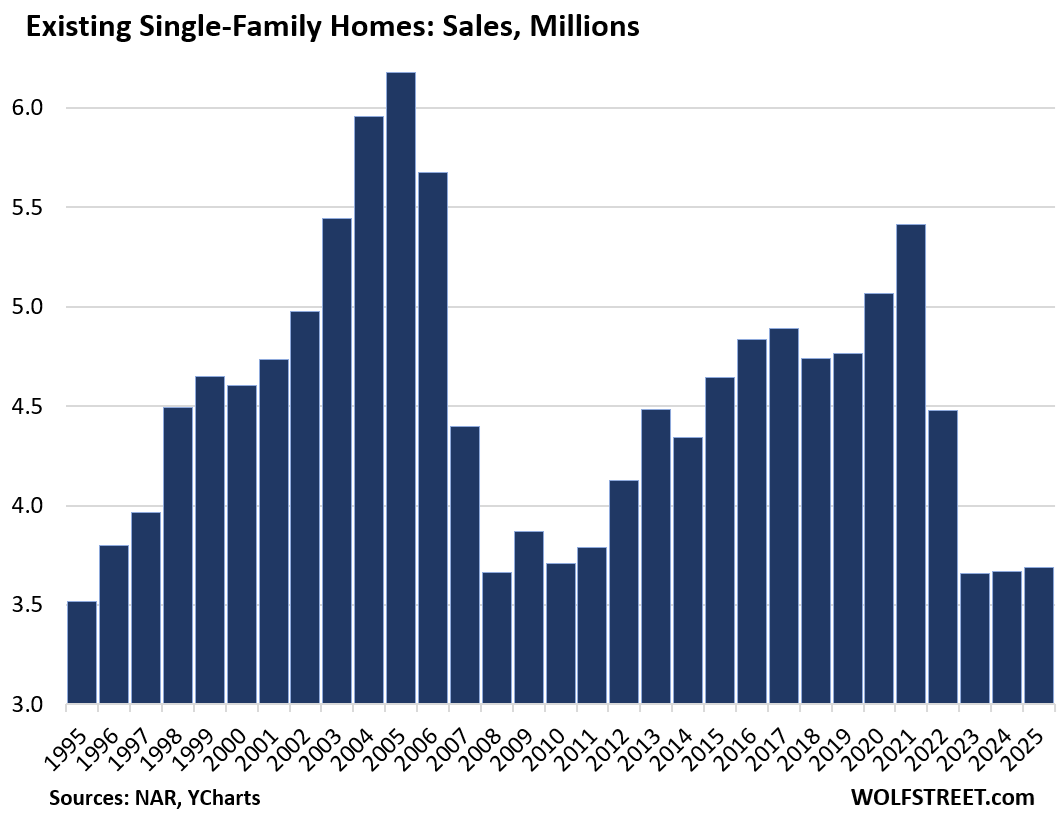

Single-family home sales in 2025 ticked up by 0.5% to 3.69 million homes. But that was still down by 32% from the pandemic high in 2021, and down by 40% from the all-time high in 2005.

Monthly sales that closed in December rose by 1.8% year-over-year to a seasonally adjusted annual rate of 3.95 million homes, the best December since 2021, but down by 27% from December 2021.

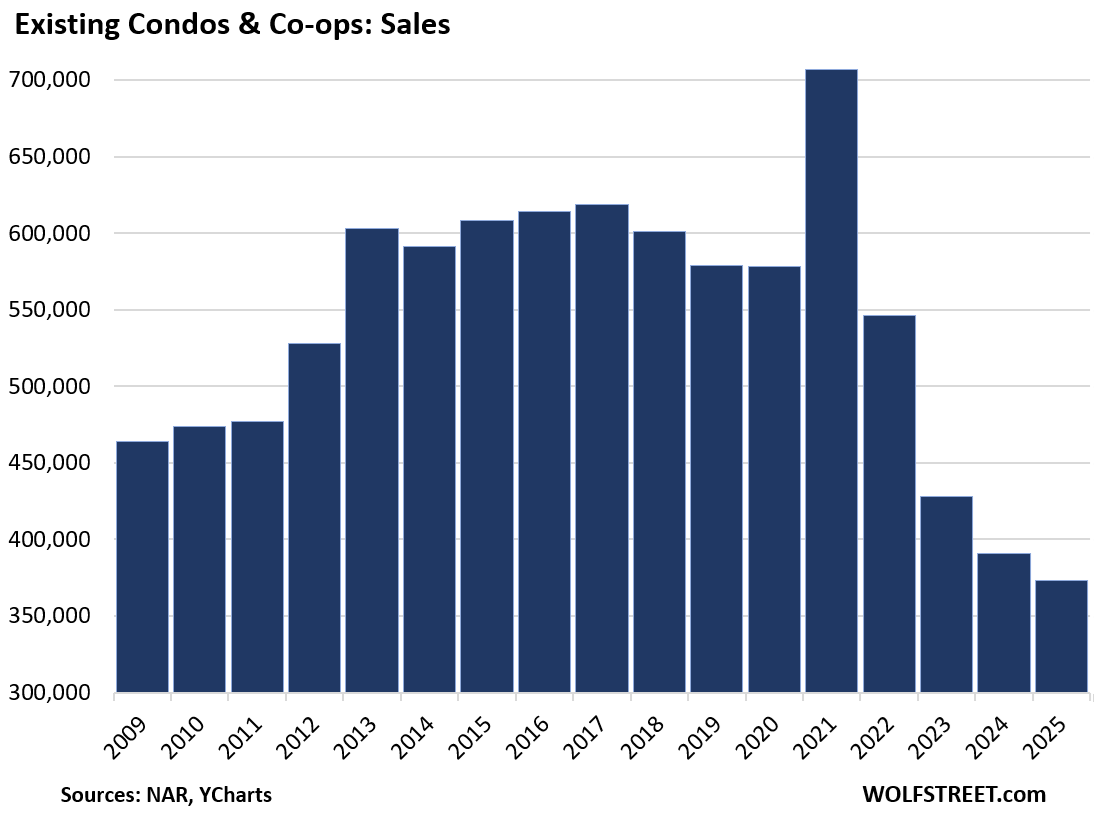

Condo and Co-op sales in 2025 fell by 4.6% to 373,000, the lowest in the data by NAR going back to 2009, down by 32% from the pandemic high in 2021, and down by 40% from the all-time high in 2021.

But the condo bubble of 2021, when sales exploded to 707,000 and prices exploded in many markets, is now sticking out like a sore thumb. Since then, condo prices have been careening down in many markets, and in some markets are down by 30% and more from their peaks in prior years.

Monthly condo sales that closed in December fell by 2.4% year-over-year to a seasonally adjusted annual rate of 400,000 condos, along with December 2023 the worst December on record, and down by 41% from December 2021.

Yanking their listings off the market over the holidays.

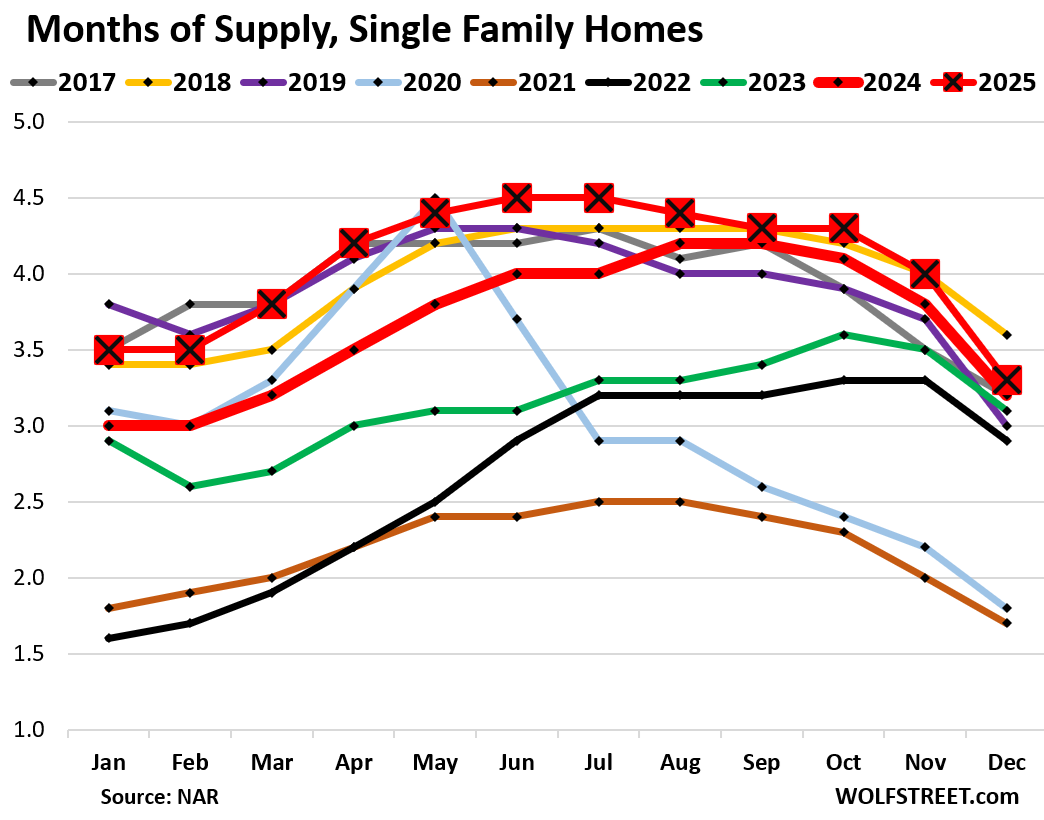

Supply of homes for sale always plunges in December as sellers yank their listings off the market over the holidays, only to relist them in the spring.

In November, supply of all homes combined had been the highest for any November in many years. But in December, sellers ran out of patience, and the yanking-fest was bigger than in some prior Decembers, especially with condos.

Supply of single-family homes fell to 3.3 months in December (red line with big squares in the chart below), a steep drop from November (4.0 months), which had been the highest for any November since 2018.

But even the sharply lower supply in December was still the highest for any December since 2018.

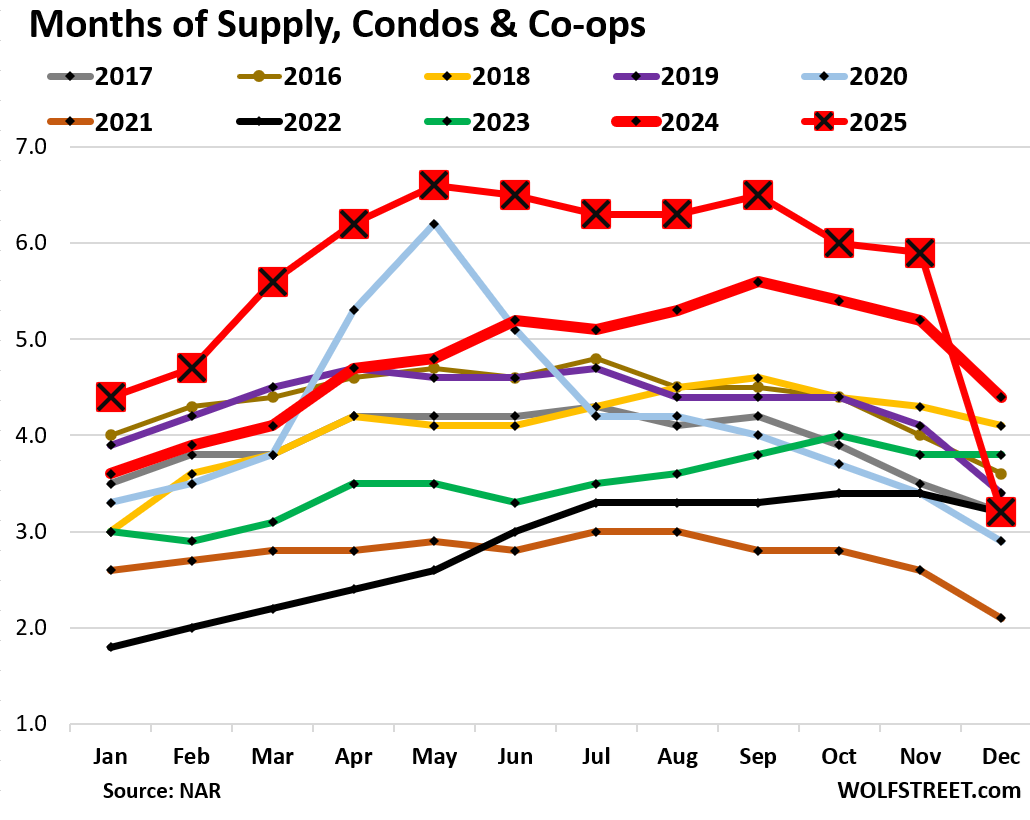

In terms of condos, sellers yanked their condos off the market at a stunning pace over the holidays, amid little demand and big haircuts on prices in many markets – to relist them in the spring.

Only 32,000 condos were sold in December, but inventory plunged by 79,000 condos, or by 42.5%, from the prior month. That’s the force of delisting over the holidays.

Supply — which is inventory divided by the sales rate — plunged to 3.2 months, from 5.6 months in November, which had been the highest for any November since 2011 during the Housing Bust.

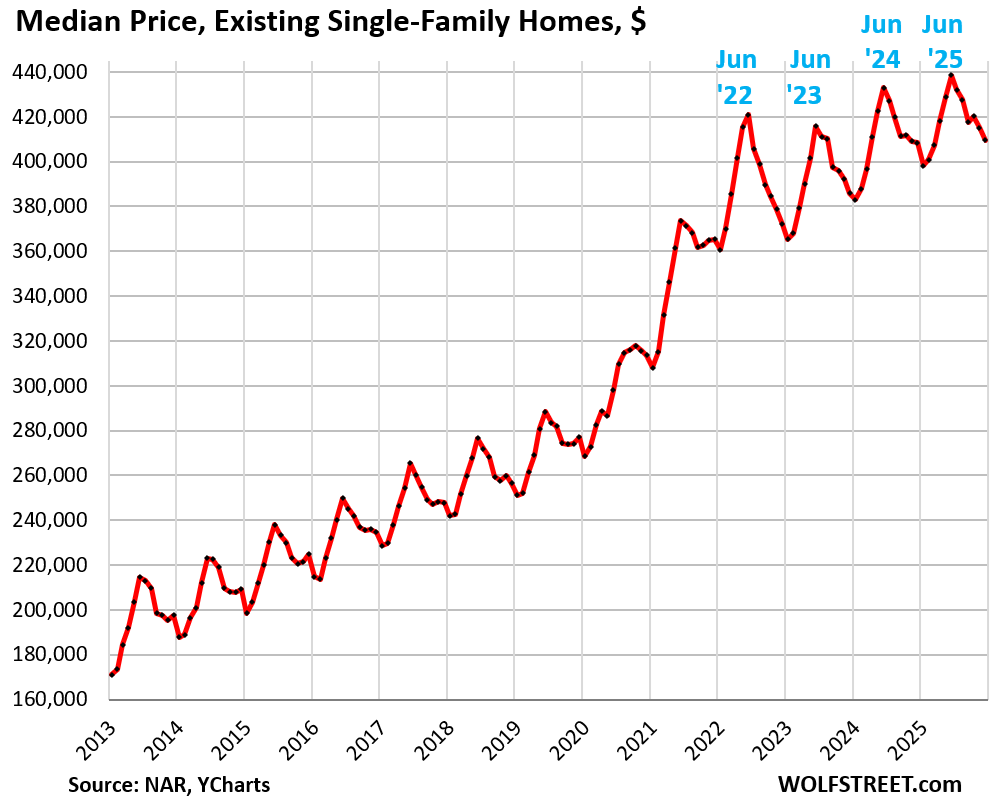

The national median price of single-family homes fell by 1.3% in December from November along seasonal patterns, to $409,500, just 0.2% above December 2024 ($408,500).

This national median price of single-family homes had exploded by 47% from June 2020 through June 2025, most of it during the two years of mid-2020 to mid-2022.

January or February usually marks the seasonal low each year, June the seasonal high. The index is not seasonally adjusted. The seasonal zigzag is a result of shifts in the mix of what is on the market and sells, which shifts the median price up or down.

But price dynamics differ dramatically from market to market, and the national median price is meaningless for specific markets. In some markets, home prices have fallen substantially, including by 24% in the Austin-Round Rock-San Marcos metro, the biggest drop in our lineup of 33 large and expensive housing markets. Conversely, the Milwaukee-Waukesha metro is the market with the biggest year-over-year gain (+4.1%) and record prices.

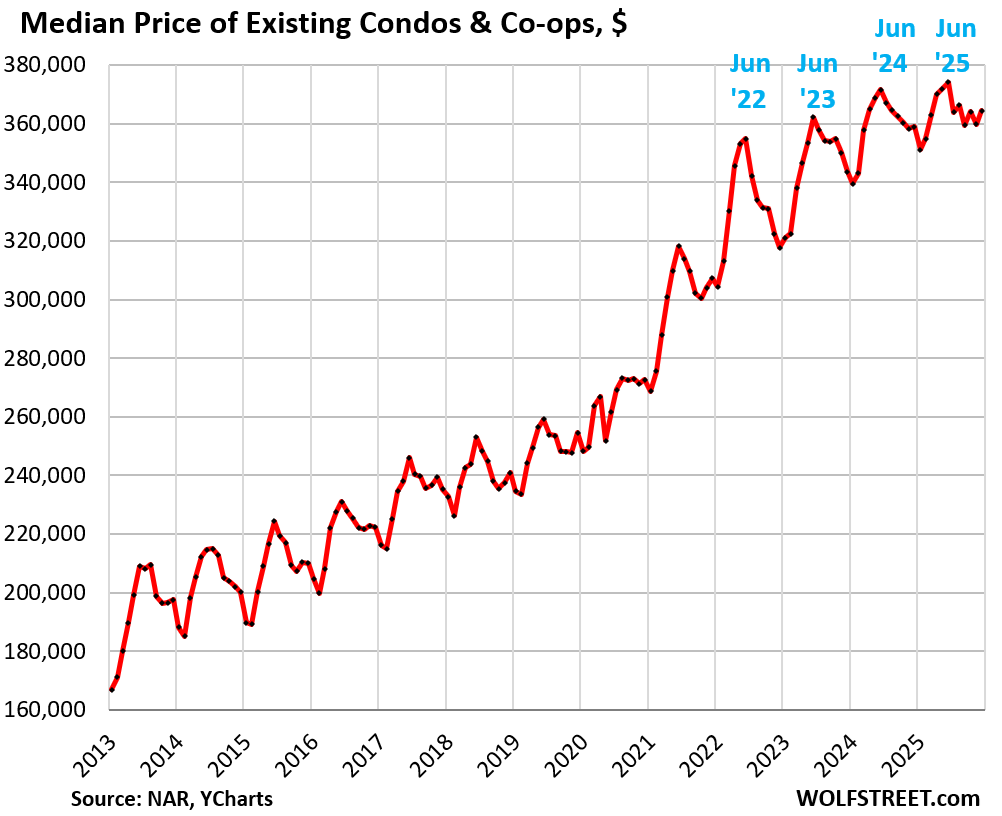

The national median price of condos and co-ops rose by 1.3% in December from November, on dismal sales volume that shifted the mix of what sold. Year-over-year, the median price was up by 1.5%.

This national median price of condos and co-ops had exploded by 43% from mid-2020 through mid-2025, most of it during the two years of mid-2020 to mid-2022.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Good info Wolf.

Also – I like your graphic free headers that show up on social media when like is sent. Most websites include a graphic that just takes up too much space and crowds out other things. Thanks for presuming that we and our friend are literate and don’t need pictures to understand, in this semi-literate world !

Thanks WR for this report.

Prices are still too high and needs to come down a lot for homes to become.

This spring selling season would be interesting.

So, are Realtors aggressively advising suddenly to delist? Why such a sudden exodus right now? Is this mass consensual delusion by sellers, with a lot of deniability about what their homes units are actually worth?

Most sellers still want 2021 prices. They won’t budge on price unless they are forced to.

Even if the rates go down little bit, it won’t make any dent on affordability.

Mass delusion, coupled with aspersions from this administration that lower mortgage interest rates are just a few personnel changes away and happy high prices days will be here again.

I’m not counting on interest rates holding or being raised. I think the independence of the Fed is likely about to be shown the door.

If SCOTUS rules Trump can fire Lisa Cook, we’re done for. There are two doomsday scenario’s in my mind right now. An invasion of Greenland or firing Fed voting members. Either of those happen and I doubt many of us will have the slightest care in the world about the housing market 2 years from now.

What is the consequence of FED losing independence ?

World losing trust in USD ? I don’t think so. People are still buying US treasuries despite US Gov having USD 35+ trill in debt.

FED balance sheet going up for funding Gov and suppressing rates? It already happened in last few years.

Definitely not realtors. Mass delusion AND the belief that the POTUS will absolutely NOT do anything to harm Property owners and sellers no matter what he might say.

The sunk cost fallacy is alive and kicking in the housing market. Owners have yet to realize the price they think the homes and condos are worth are disconnected from fundamentals. Unless rates drop below 4%, the sales will not increase without significantly lower prices (>25% drop). And in some places that may not be enough to offset insurance and HOA fees.

Spring is going to be a MAJOR DISAPPOINTMENT. Hoping prices will come up some? – THEY WON’T. The party is over! The fantasy valuation circus has ended. Any soft-landing scenario is off the table.

Many of you are making the assumption that sellers are somehow trying to trade the market, and by waiting they’ll get more. As if they’re trying to time when to sell their meme/bubble stock in a volatile market.

No. They’re trying to time their sale when there are more buyers, more liquidity, so they don’t have to sell in a very low liquidity market. There’s a subtle but important difference.

Makes sense. All that is needed is for a few months of labor statistics to be interpreted as soft and 50 basis cuts could show up by April/June meetings. At some point this perpetual “meh” will need a change.

Mass delusion or not, sellers are in no hurry to sell. Apparently very few are in a forced sale position, hence the bubble remains and we still have aa shortage of homes (at least in popular to live in areas).