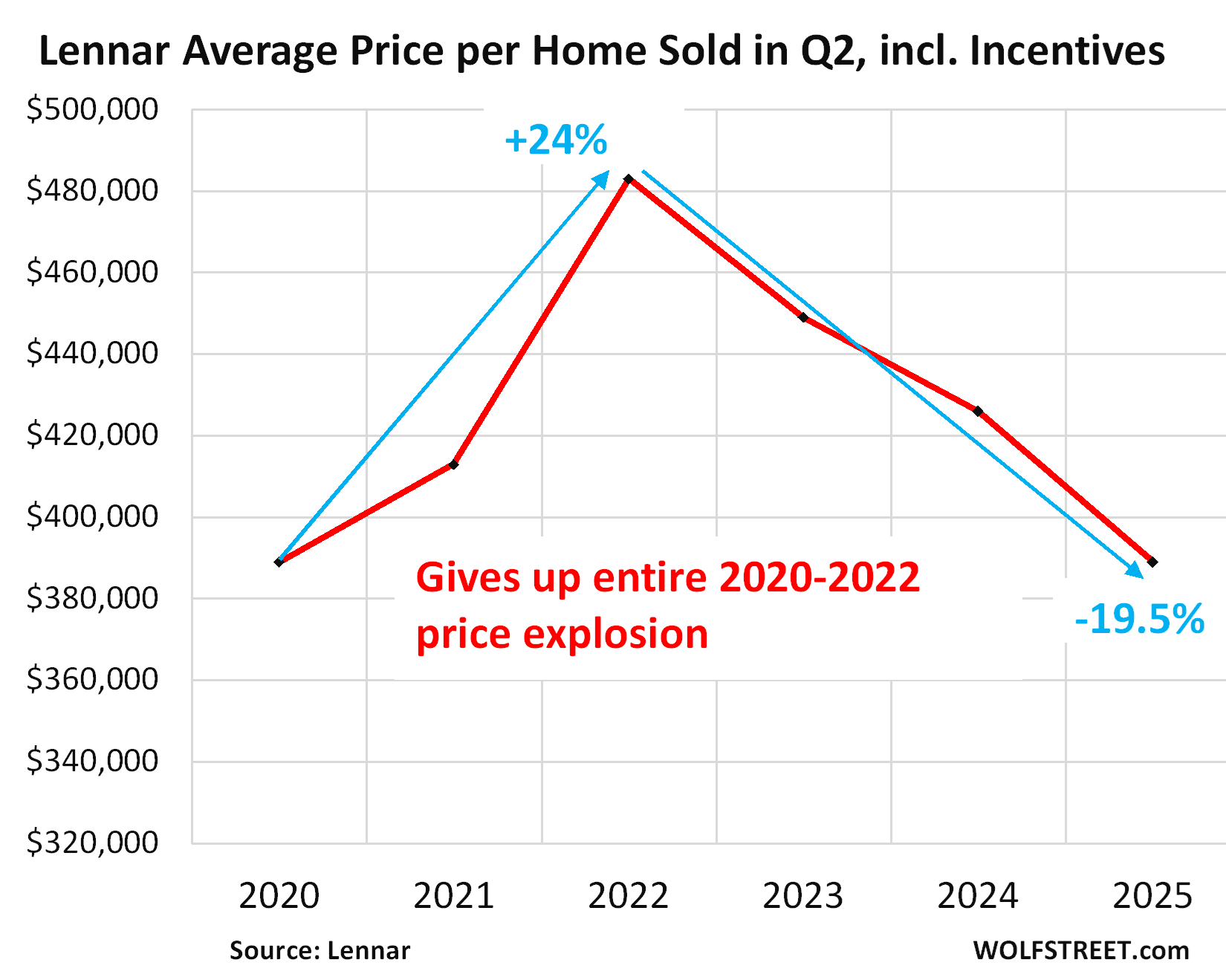

Homebuilder Lennar’s average selling price has dropped by 19.5% from the peak three years ago.

By Wolf Richter for WOLF STREET.

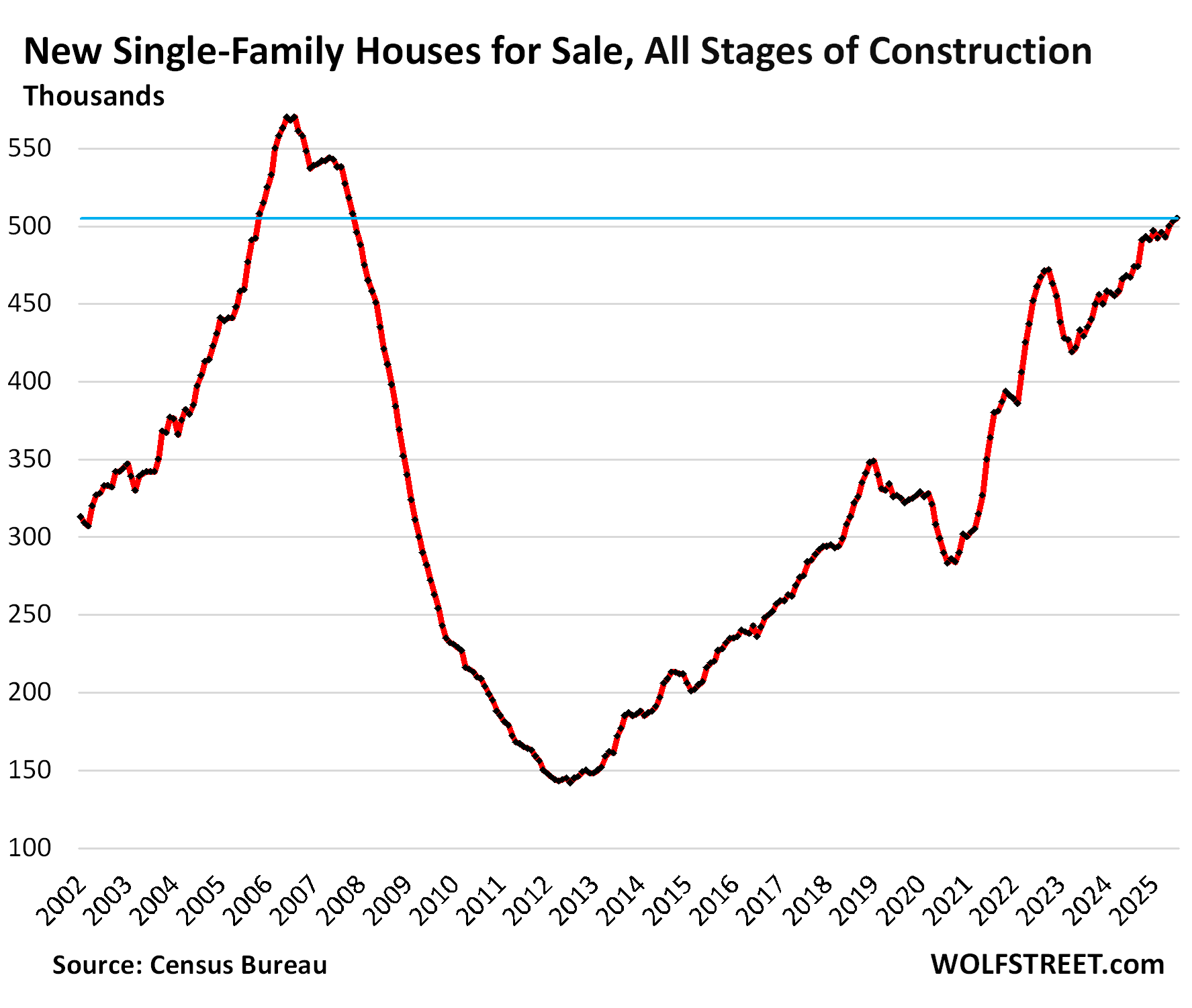

New single-family homes for sale at all stages of construction rose to 505,000 homes in July, the highest since October 2007. But back then during the Housing Bust, inventories were on the way down, as homebuilders were trying to stay alive by cutting back construction.

Compared to a year ago, inventories were up by 8.1%, compared to July 2019, inventories were up by 54%.

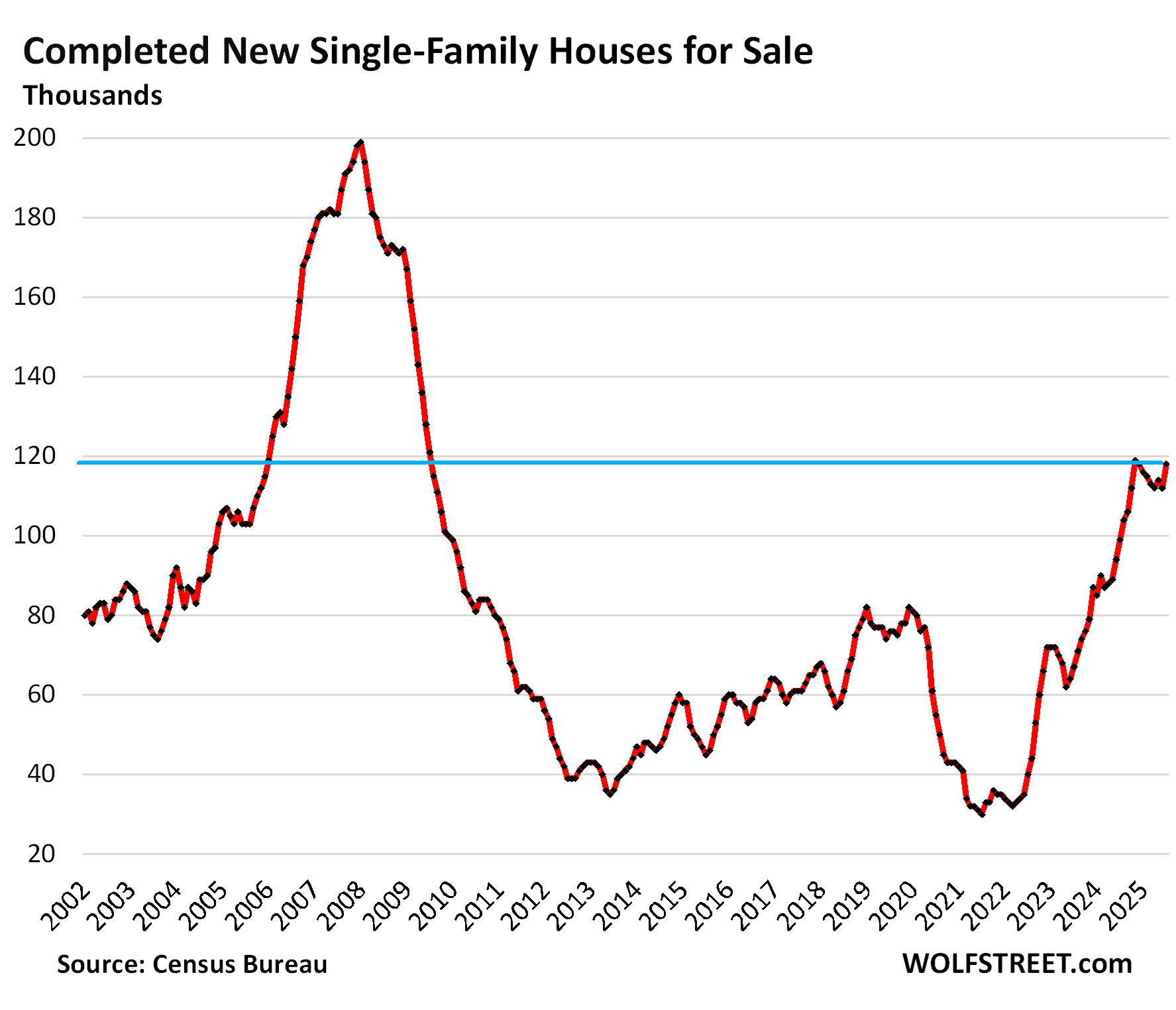

New completed single-family homes for sale jumped to 118,000 homes in July, up by 55% from July 2019, just behind November 2024.

Inventory for sale of these “spec homes” has been in this range since October 2024.

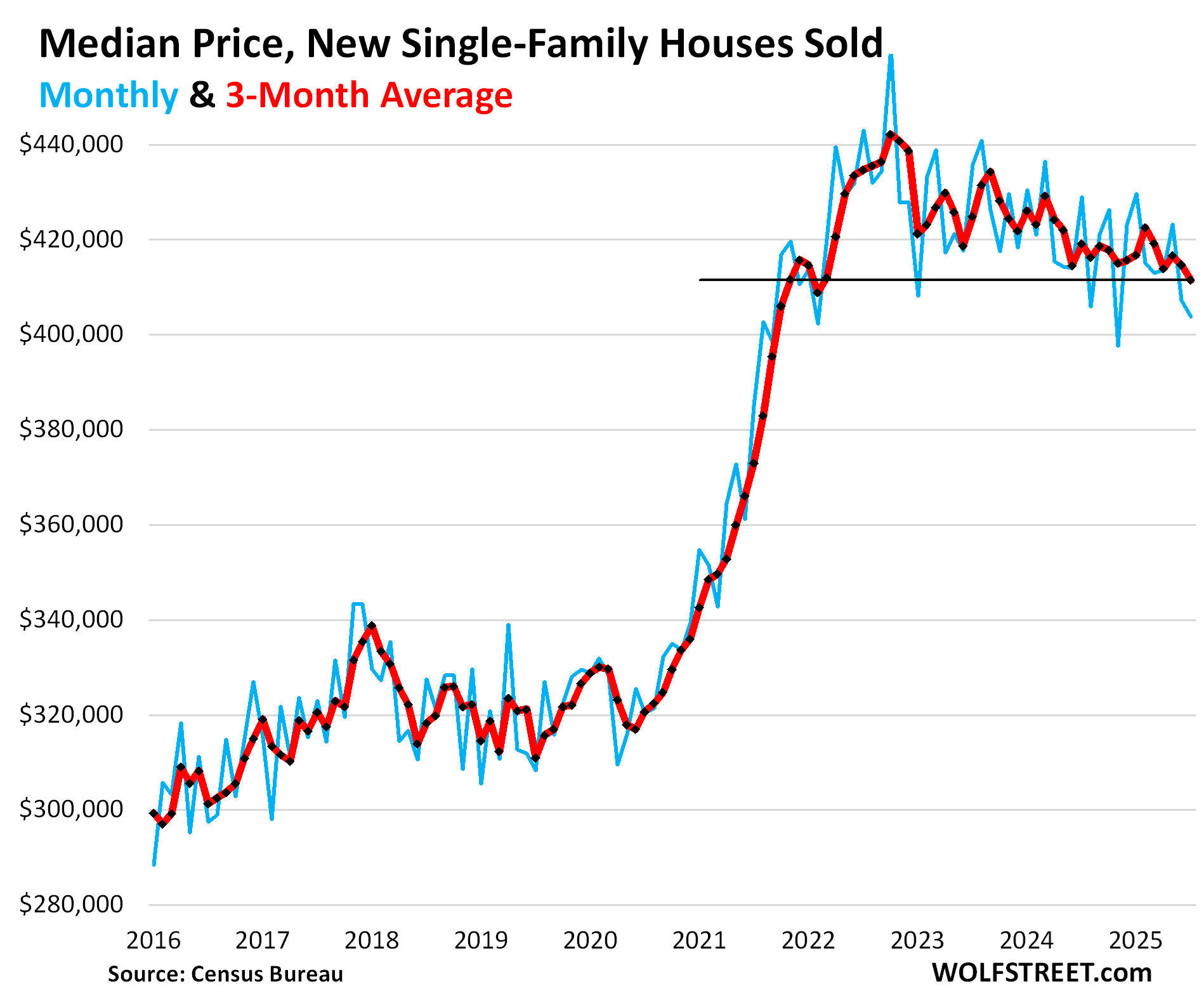

Prices fell, even without including incentives.

The median contract price dropped by 5.9% year-over-year to $403,800 in July (blue in the chart below).

The three-month average, which irons out some of the month-to-month squiggles, dropped to $411,400 (red), down by 1.8% year-over-year and by 5.9% from the peak in late 2022. This price level was first seen in November 2021.

But the Census Bureau tracks sales prices of new houses by the prices written into purchase contracts that buyers signed. These contract prices do not include the costs of mortgage-rate buydowns and some other incentives. With the costs of the buydowns and incentives included, home prices fell far further – we know that from builders quarterly financial reports (for Lennar and D.R. Horton, see below).

So these contract prices overstate the effective sales prices and understate the effective price drops. And still, they’ve been coming down, even with massive incentive costs not included.

The price explosion during the pandemic, when people were willing to pay whatever, had led to a explosion of profit margins at homebuilders. Those profit margins are now getting trimmed back, and net profits have fallen.

And including incentives…

Homebuilders have been trying to stimulate demand with big incentives and costly mortgage-rate buydowns.

Lennar disclosed that its incentive spending jumped to 13.3% of revenues in Q2, “primarily” due to mortgage-rate buydowns, the highest incentive spending rate since 2009.

Lennar’s average sales price dropped to $389,000, down by 19.5% from the peak in Q2 2022 and is back where it had been in Q2 2020, having given up the entire 2020-2022 price explosion. Average selling price includes the incentives.

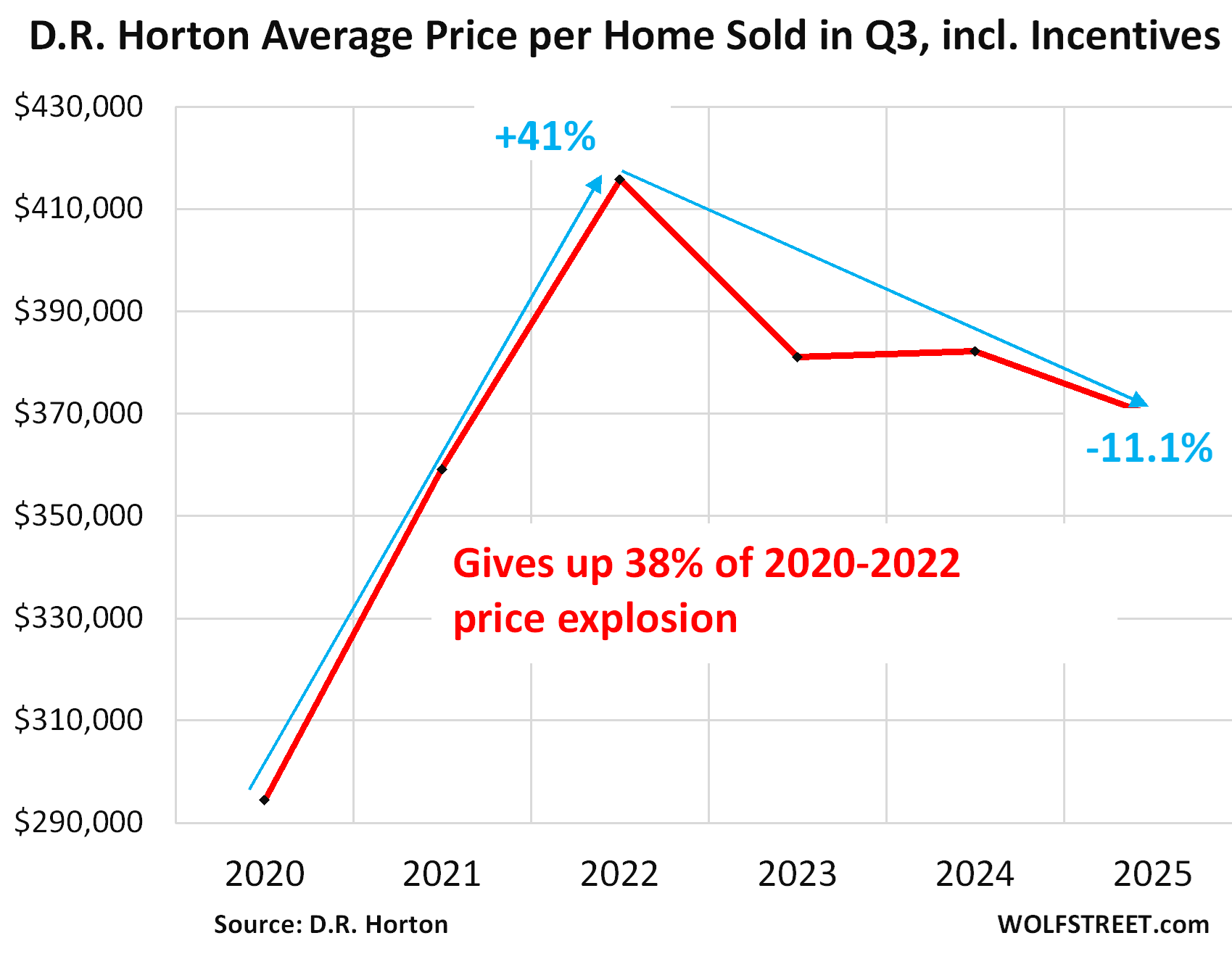

D.R. Horton reported that the average selling price per home sold declined by 3.3% year-over-year, and by 11.1% from the peak in its fiscal Q3 2022, to $369,600 in the quarter ended June 30. Average selling price includes the incentives:

Sales have hung in there, thanks to the deals.

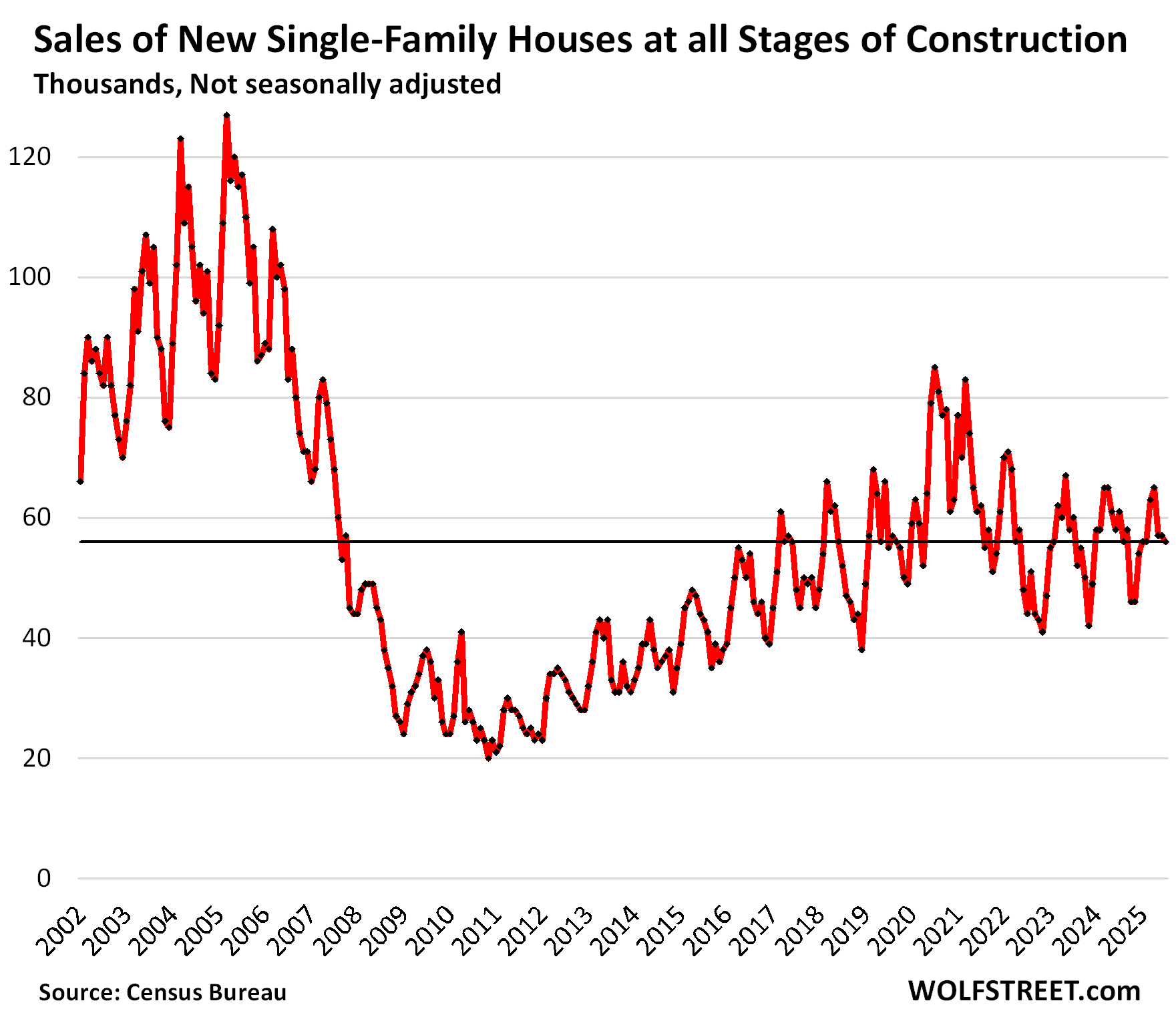

Sales of new homes fell by 8.2% year-over-year to 56,000 contracts signed in July, not seasonally adjusted, and were down by 1.8% from July 2019 – still in a mediocre to decent range, rather than in the deep-plunge to rock-bottom range of existing homes.

So efforts by homebuilders to stimulate demand via lower prices, mortgage-rate buydowns, and incentives have worked to some extent to prevent the kind of plunge in demand for existing homes. See: Sales of Existing Single-Family Homes Crushed, Supply Highest since 2016. Condo Sales Near Low in the Data, Supply Highest since Housing Bust. Prices Begin to Bend

Homebuilders have to maintain their businesses, and they have to find the mix of price points and incentives at which they can sell, and they sacrifice some of their fat profits to get there. They cannot decide to just outwait this market.

Inventory for sale by region.

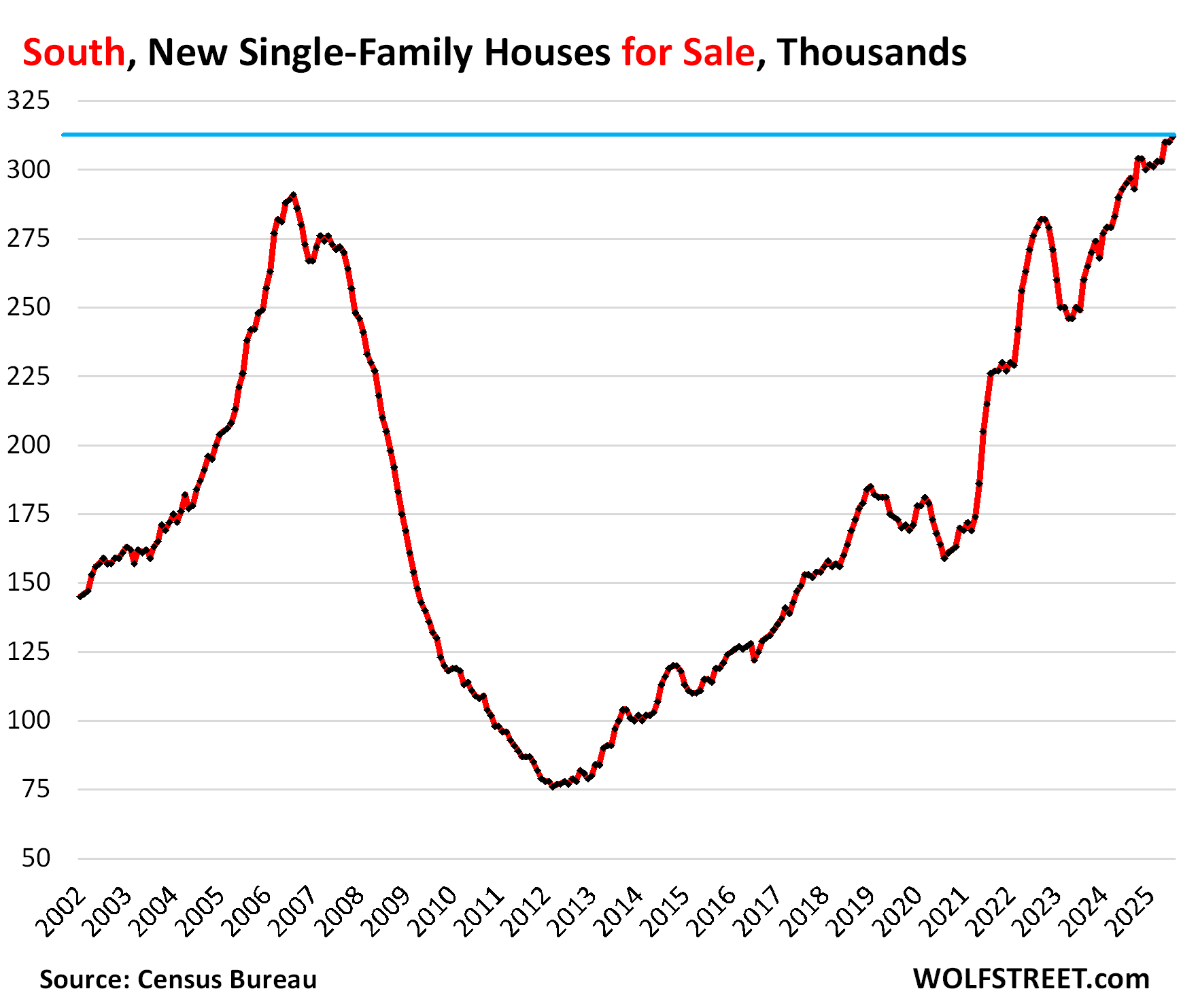

In the South, inventories of new houses for sale spiked to a record of 312,000 in July, up by 79% from July 2019. Inventory has been above the Housing Bust peak for over a year.

The Census region, which is dominated by the mega-housing markets of Texas and Florida, accounted for 62% of total US new-home inventory, and for 57% of total US new-home sales (a map of the four Census regions is below the article at the top of the comments).

Sales dropped by 6% year-over-year to 32,000 new homes, and also by 6% from July 2019. The incentives that homebuilders are piling onto this market are keeping sales at decent levels.

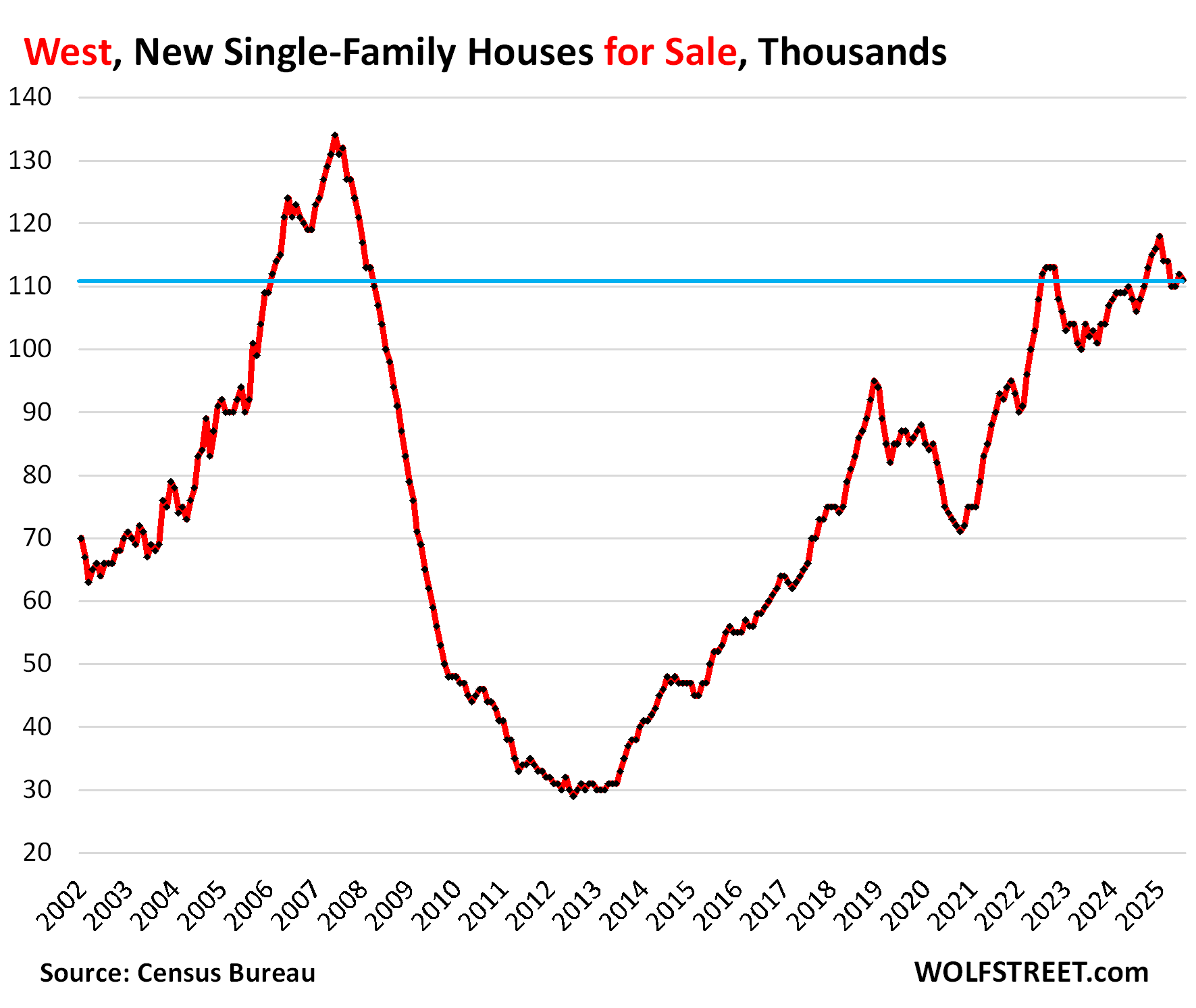

In the West, inventories of new homes for sale have declined somewhat since the end of 2024, to 111,000, but were still up 4.7% year-over-year, up by 28% from July 2019.

Sales in the West dropped by 19% year-over-year to 13,000 new homes but were level with July 2019. Here too, lower price points and incentives have helped keeping sales at mediocre to decent levels.

The West, dominated by California, accounted for 22% of the total US inventory and for 23% of total US sales.

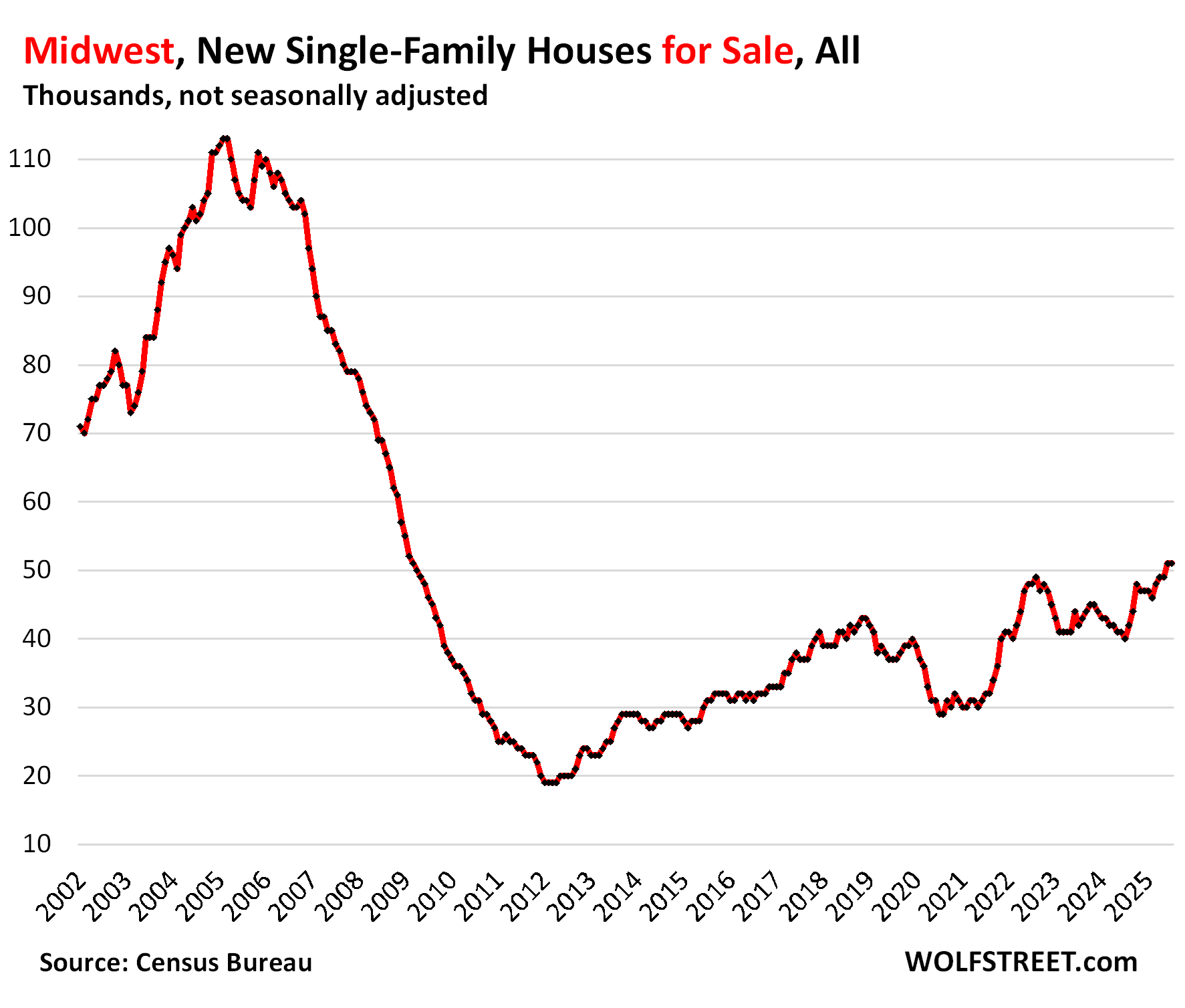

In the Midwest, inventories of new homes for sale in July jumped by 27.5% year-over-year and by 38% from July 2019 to 51,000 new homes, the highest since February 2009:

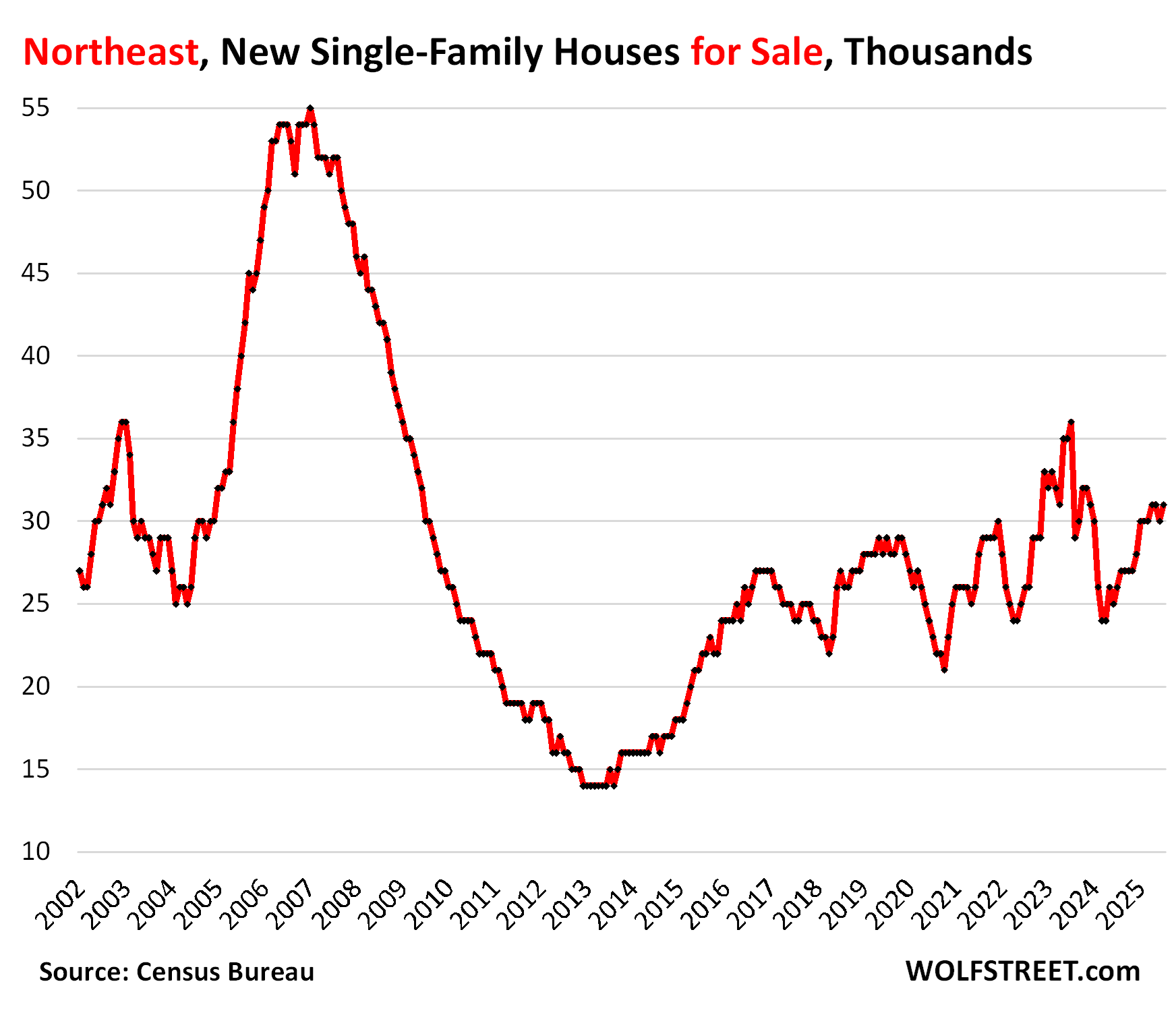

In the Northeast, inventory jumped by 19% year-over-year and by 7% from July 2019, to 31,000 new homes.

The Northeast is a relatively small area with big densely populated cities where multifamily housing (condos and apartments) is a far bigger part of new construction than single-family housing.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The promised map of the four Census regions of the US:

In time, people will realize that this is the housing bubble of all housing bubbles. The mother of all bubbles. The Great Financial Abomination. Thr bubble to end all bubbles. TEOTWAWKI in housing.

Nah this time is different and people in many areas will also day their area will be different and immune to correction or crash as well.. Time will tell

If inflation really takes off then many of us holding low interest loans might just ride it out on the sidelines. If money moves out of stocks, I suspect a good portion might just head into real estate. Never underestimate the power of property to bubble higher.

I dont think so.

Extreme un affordability with job insecurity would paly a major role in prices going down and down.

Lot of tech companies are paying off in thousands despite their earnings being very good and stocks at ath.

Inflation fixes many purchase mistakes.

Also, every month that passes is another month with slightly fewer 3% mortgages and slightly more 7% mortgages.

Eventually the “I can’t sell because my cheap mortgage is too valuable” group will only be a trivial factor in the real estate market.

Waiono, money doesn’t “move out” of stocks and “into” bonds, or real estate. Every seller has a buyer. So all the money “stays in” on any transaction. It might not be your money but it’ll be someone’s!

What most people also overlook is that the value of all shares rises and falls with the price of just the most recent shares traded. If 100 shares trade down 10% as a result of adverse news, EVERY share is down 10%. That shareholder “wealth” doesn’t “go” anywhere, it is vaporized.

Also, human nature is such that people are much more reluctant to buy things whose prices are clearly declining.

Now that housing prices have started falling, buyers will hold back waiting for better value, and sellers will get more aggressive to avoid losing their gains.

Prices will continue to fall until they better reflect fundamental values rather than anticipated speculative growth.

None of that paper wealth will be “going into” anything else, it will be obliterated.

The headwinds on real estate are going to accelerate. Costs of building materials will make it less appealing to just update vs move, same with labor costs for construction.

The job destruction from AI still hasn’t really hit yet, but it’s coming and everyone knows it’s coming for the generation of people who sit behind a computer all day. Young people have already gotten the memo and are rediscovering the trades, but it will take quite a few years to rebuild the losses from decades of pushing kids into college vs HVAC school.

Factor in the deportations and drastic reduction in number of people legally moving to the US, lower birth rates, enthusiasm for Airbnb dropping off, etc..

Housing has always been a relatively safe bet, but no one really knows how the AI bubble and housing bubble are going to play out, so it’s all speculation at the end of the day.

If monetary inflation really takes off in earnest the value of assets will still go down relative to simple things like labor and food because no private entity will be issuing credit denominated in dollars, especially not on 30 year terms. Assets’ nominal prices are tied to predictable returns on investment and inflation makes it anything but predictable. Unless you can turn a profit in a predictable time frame the investment isn’t made and there are better inflation hedges than real estate.

Somewhat off topic …

Cook was canned this evening for falsifying loan docs. Trump is gaining control of the Fed Board.

The long end of the Bond market is sniffing inflation and nudging higher. Trump has time for two cuts this year which could easily send the TNX yield to 5ish by EOY. That could put home rates well up in the 7’s….That should shake up the real estate market.

Should be an interesting week.

There are 7 members on the Federal Reserve Board of Governors including Chairman Jerome Powell. All interest rate policy decisions are made by the FOMC (Federal Open Market Committee) which is comprised of all 7 members of the Federal Reserve Board of Governors plus 5 of the 12 Federal Reserve Regional Banks Presidents in the US. Replacing a single BOG member will not change the vote on the FOMC in September.

(Bloomberg) — President Donald Trump’s campaign to oust Federal Reserve Governor Lisa Cook, if successful, would give him the opportunity to exert more influence over the US central bank by securing a majority on its seven-member board of governors.

Yes, he will need another 3 votes. But so far Trump is finding ways to get what he wants. He ousted Cook. I wonder how the other 5 voting members are feeling tonight? I did not vote Trump, but I can honestly say he’s not the floundering newbie he was 8 years ago. He has nothing to lose and he is going all in to get his way. Today, South Korea joined the ever longer list of countries that rolled over to Trump, no matter what bluster they came up with prior to meeting face to fave at 1600. 100 Boeing airplanes is a big win for Washington State. Boeing’s been on the ropes.

56 minutes ago · SEOUL, South Korea (AP) — Korean Air has announced a $50 billion deal to buy more than 100 Boeing aircraft and several spare engines and obtain engine maintenance for 20…

The 10-year yield has made up the entire Powell-speech drop this evening. It’s back to 4.31%, from 4.24% after Powell’s speech.

“Somewhat off topic”

Not really… because mortgage rates are going in the same direction.

Yippee… Keep it up, 10 yrs yield going up unlike the housing market is where I hope will continue and this is just the beginning.

After all, gotta have an alternative soon when T Bill will eventually inch closer to lower and lower… Either that or I might just buy a share of BRK-A and call it a day if neither shirt or long term moving closer to TINA

I’d look for a technical buy point in bonds.

We just got assigned our first foreclosure appraisal here in the swamp in over 4 years. These are hard to do. You have trouble getting into the property and they are usually in terrible condition. I believe this is just the beginning of a repeat of the 2008/2009 RE meltdown.

Wouldn’t a meltdown on that level take some black swan event like the subprime mortgage banking crisis? 2008/2009 wasn’t solely due to overpriced housing.

There are foreclosures happening here in Bend, OR as well.

“everyone wants to live here, prices will never go down”.

~every homeowner in Bend, and every other nice place in America

He cannot fire her. Not within his remit.

He did. The letter is out there.

I’m sure there is something in her work contract that alludes to fraud!

There will be a huge court case…more uncertainty.

There was no ‘mortgage fraud’ whatsoever in Lisa’s matter.

awww..how cute…are we still pretending to live in a world where there’s a remit to his power and executive orders? like a kid saying “Hey you can’t do that!”

We have seen all the not-within-his-remit action so far; how many got absolutely shut down and reversed without further pursue? Best we can hope for is going to the Supreme Court; even then, it’s 50/50, and if it’s not favorable to his decree, can also ignore the court’s order…

The only thing that will actually change course is unintended consequences, if his action end up blowing up the long term yield opposite to what he wants, that’s the only hope you’ll see any pivot. Time will tell..

Maybe we are there already then…

Ah yes, the “lying on a mortgage application by a Fed chair is okay when they do it but not for anyone else” argument. By contrast several Fed chairs resigned with just a hint of stock trading impropriety.

Sorry to burst your bubble Fed chair lying on her mortgage application and not resigning out of duty, then ignoring the elected president doesn’t play well with the common person on the street. If she really valued the reputation of the Fed she would step aside – the paperwork showing lying (best case) on an application is already out there.

Donnie is NOT ‘gaining control of the Federal Reserve Board’ at all, and Lisa Cook’s term is valid into 2038 and she will not be leaving before then.

These Fed positions have way to long terms.

Everyone who claims two primary residences on any property tax or mortgage document, and everyone who claims tax exemptions on their second homes and rentals listed as primary residence should absolutely go to jail. Every real estate fraud from the presidency on down should be fired and prosecuted. That’ll drive down home prices everywhere.

Quick, build more nursing home prisons for the millions! I’m sure everyone on this site is safe.

Preach brother. Send all the mortgage fraudsters to alligator Alcatraz

Now, mortgage interest rates and 10-year and 30-year mortgage rates are set to soar as any and all respect for the Federal Reserve’s independence has been shaken to the core and thrown into utter turmoil.

“any and all respect for the Federal Reserve’s independence has been shaken to the core and thrown into utter turmoil”

Compared to Bernanke?

Yes, that is sarcasm

They need to fire the 200 PHds (stands for Piled High & Deep) that work on the staff of the Fed across the country. They have led the country into ruin. Bring back Musk for a special assignment or better yet let “Big Balls” do it.

Naw, Big Balls got beat badly by 15 yo girl. He is not up to the task…

Some clown has a home for sale in Aspen Colorado for $300 million. Are you frigging kidding me? Not long ago, you could buy a nice corporation for that amount of money. It seems that the dollar is a dead man walking.

Any seller can ask whatever he or she wants from a real estate property and that has nothing whatsoever to do with the value of the US Dollar.

“I got a little place in Aspen.” ~Smug white people

Yes? That’s Aspen and it is a micro market that has nothing to do with the rest of the country.

The fact that Aspen and other ultrarich towns with outside money are stratospheric affects real estate prices within a two-hour radius, driving up dumps in not-so-great towns (if I name names, the Boebert fans will come out). That housing run-up in turn helps drive politics in the whole half of the state, and immigrant workers and legal, immigrant, licensed contractors for the rich are scapegoated.

And the Aspenites are smug, yes.

Going to be hilarious when existing-home sellers realize their homes aren’t even worth half of what they think they are worth, and they’re forced to sell (recession, divorce, death etc.)

Until that happens (and that may take a while), the home builders are going to get to eat their lunch in terms of market demand, and make a ton of money off the stupidity of existing-home sellers. Why, exactly, should anyone wanting a home go with an existing home when they could buy a new home for less?

Location, build quality, schools, etc…lots of reasons

PCE ex housing is up 20+% in the past 5 years. Housing therefore has lost at least 20% relative, if nominal prices are generally flat.

Location, location, location. Obviously.

Still licking my wounds from 2012 – Misery loves company – Schadenfreude!

I really shouldn’t feel like this: it’s not nice but I just can’t help it.

How much will prices have to fall to regress to the long term trend line in each region?

Not sure about per region but about 45% nationally.

What it shows was homebuilding never recovered from the Great Crash, and slow building has allowed them to pull back on pricing and still move product while slowing their pipelines. In short, they still are running off those lessons from 15 years ago, when stupid high leverage killed a lot of competition. Vultures made a lot of money off that leverage when they bought entitled and prepped acreage that had no immediate demand. And the survivors kept those lessons as the next boom began. And now that it has ended, they will be standing around waiting for the next boom.

Meanwhile, Trump thinks the Fed can ultimately control interest rates, not really understanding how the bond market is really in control. But just another day in paradise. And interest rates for mortgages could still fall, if the compression between the long T bonds and mortgage rates falls.

All I know is that the foundations of the financial and monetary systems are under stress, and something will break in a bad way as a result of all this.

Someday this war’s gonna end…

Here’s what Lennar is offering in south Texas (hundreds of new homes available):

🎉 SPECIAL BUYER INCENTIVES — $12,000 OFF the price of a home OR toward additional closing costs! 🎉

✨ 3.99% FHA (fixed) + Up to $6,000 in Closing Costs

✨ Fridge, Washer, & Dryer INCLUDED!

📍 Magnolia & Montgomery — North Houston

We have brand-new Lennar homes in the Magnolia and Montgomery areas, priced from the low $220s up to the $500s — with FHA payments starting in the $1,620s per month!

🔹 From the Low $200s

• Magnolia Ridge — from the $220s | FHA from the $1,670s/mo

• Magnolia Springs — from the $230s to $240s | FHA from the $1,690s/mo

• Moore Landing — from the $230s to $330s | FHA from the $1,620s/mo

• Chapel Run (Montgomery) — from the $230s to $260s | FHA from the $1,690s/mo

✨ For Higher-End Buyers

• Colton (Todd Mission) — from the $370s to $400s

• Kresson (Montgomery) — from the $470s to $500s

Harrris county median household income is $72k/year.Seems quite affordable.

Very much aware that (a) this article is about New SFH prices, not Existing SFH prices and (b) Case-Shiller isn’t the preferred index here, but I found one element of today’s release quite interesting: Going back to 2015, this is the *first and only* June in which the 10-City and 20-City Composite Indices experienced pre-seasonally adjusted MoM declines. I thought that pre-seasonally adjusted MoM declines were supposed to be an AUG/SEP through JAN thing…and that home prices only go up…

“June’s results mark the continuation of a decisive shift in the housing market, with national home prices rising just 1.9% year-over-year—the slowest pace since the summer of 2023,” according to Nicholas Godec, S&P Dow Jones Indices.

“Looking ahead, this housing cycle’s maturation appears to be settling around inflation-parity growth rather than the wealth-building engine of recent years”

Out of curiosity, does this data only count new homes built on previously undeveloped lots, or does a complete demo and rebuild of a new house get counted in these numbers?

If it requires a building permit, it’s in the survey. In a few places (2% of total residential construction), no building permits are required to build a house. And estimates are included for those.

Here is the more detailed methodology:

http://www.census.gov/construction/soc/methodology.html

“The Survey of Construction includes two parts: the Survey of Use of Permits (SUP), which estimates the amount of new construction in areas that require a building permit, and the Non-Permit Survey (NP), which estimates the amount of new construction in areas that do not require a building permit. Less than 2 percent of all new construction takes place in non-permit areas. Data from both parts of SOC are collected by Census field representatives. For SUP, they visit a sample of permit offices and select a sample of permits issued for new housing. These permits are then followed through to see when they are started and completed, and when they are sold for single-family units that are built to be sold. Each project is also surveyed to collect information on characteristics of the structure. For NP, roads in sampled non-permit land areas are driven at least once every 3 months to see if there is any new construction. Once new residential construction is found, it is followed up the same as in SUP.

The Census field representatives use interviewing software on laptop computers to collect the data. Facsimiles of the computer-based questionnaires are provided to respondents to familiarize them with the survey. These facsimiles show the questions that are asked for housing units in single-family buildings on Form SOC-QI/SF.1 and in multifamily buildings on Form SOC-QI/MF.1. In addition the Census field representatives provide an introductory letter explaining the survey. Field representatives also use Form SOC-QBPO.1 to collect information regarding procedures for handling building permits in building permit offices (BPOs) sampled for the SUP.“

In my market of Northwest Indiana, Lennar and DH Horton started building in 2020. Together, they are now building around 1,000 homes per year.

What is driving their growth is the never ending stream of homebuyers leaving Illinois and moving to Northwest Indiana to escape high property taxes, incompetent government, poor schools, etc. Even with relatively high mortgage rates, the in-migration continues. These new homeowners tend to keep their higher paying jobs in Illinois and daily commute to and from home to work in Illinois or Chicago. The traffic in the area is terrible, with subdivisions being built along former two-lane county roads with very little public roadway improvements occurring.

The growth of Lennar has come at the expense of smaller builders in the area. Lennar can offer the incentives that smaller builders can’t or won’t and are undercutting them by as much as $50,000-$100,000 per house. These small builders who rely on local bank financing, are slowly being strangled out of the market.

This is all about maintaining national market share.

While Lennar is struggling in FL, GA, TX and AZ, in 5 years they have become the dominant homebuilder in NW Indiana.

I don’t see this ending anytime soon. I read where Lennar has a $2.3 billion national line of credit. They are buying any and all available farmland in the area and aggressively going through the planning process to make the sites buildable as fast as possible.

In St. John, IN, just across the border from Illinois, they are developing a subdivision called Astoria. Purchased the farm in October of 2024, built all the infrastructure over the winter and paved the streets in Spring of 2025. (Building permits can’t be granted until primary asphalt is installed.)

So far, all they are building are spec houses. Last count last week was 9 under construction and several foundations being prepared.

Existing homeowners in the area trying to sell also can’t compete with them for the same reason that small homebuilders can’t compete.

Within a two mile radius of this subdivision, there are over 1,050 lots going through the planning stage in adjacent communities by several developers. My take is that most will end up selling to Lennar although at a bulk price discount.

Wolf, keep up the good work.