Despite the rumors during bond turmoil, foreigners kept buying Treasuries and the “basis trade” didn’t blow, but the “swap spread trade” made a mess.

By Wolf Richter for WOLF STREET.

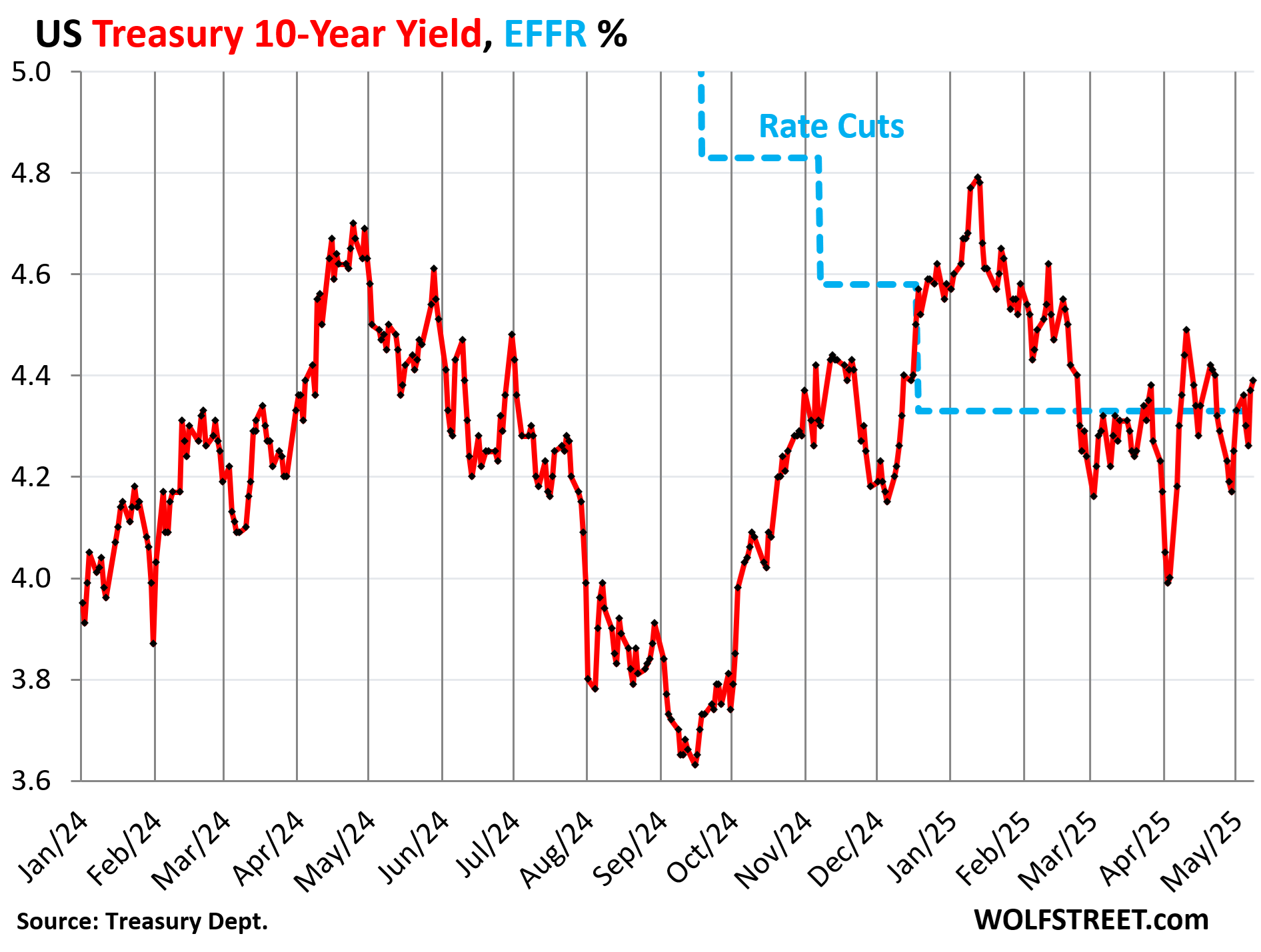

The 10-year Treasury yield rose to 4.39% today and is now back in the middle of the range of the past two-plus years, despite the gyrations in between, having brought behind it the deep plunge to 3.99% (bond prices soared) in late March and early April, followed by the brutal re-spike to 4.49% (bond prices dropped) after the announcement of the new tariffs on April 2.

But now the yield has calmed down at 6 basis points above the Effective Federal Funds Rate (EFFR), a short-term money-market rate that the Fed tries to keep locked in place with its policy rates.

Spikes followed by plunges, and vice versa, in an always edgy bond market are part of the deal and don’t indicate long-term trends.

Everyone from Bessent on down loved the big plunge to 3.99% because everyone loves low long-term interest rates because they matter for the economy, and the real estate industry was salivating about mortgage rates falling below 6% or whatever because the 10-year Treasury yield is hugely important for mortgage rates.

But when the 10-year yield re-spiked in early April, it unleased all kinds of rumors in the media about foreigners refusing to buy Treasuries to punish the US government, and about the “basis trade” blowing up, and both turned out to be wrong. But there was a highly leveraged Treasury trade that soured when yields re-spiked, and unwinding that souring trade exacerbated the yield-spike further, and we’ll get to all those in a moment.

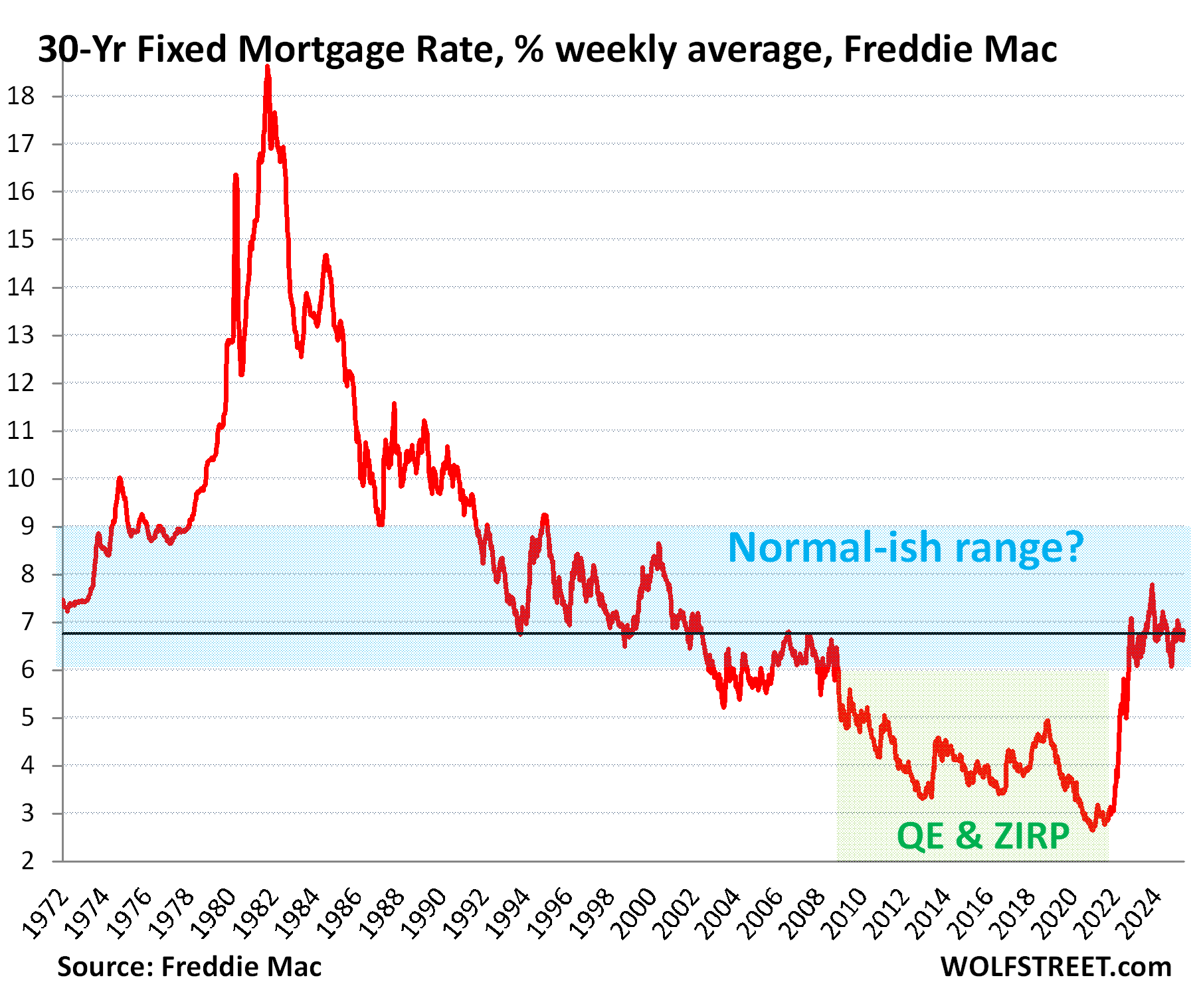

Mortgage rates remain near 7%.

The average 30-year fixed mortgage rate was unchanged at 6.76% for the second week, according to Freddie Mac on Thursday. They’ve been north of 6% since September 2022.

Historically, the average 30-year fixed mortgage rate didn’t drop to 5% until the Fed started QE in 2009, which included the purchases of ultimately trillions of dollars of mortgage-backed securities, which helped push down mortgage rates and was part of the Fed’s scheme of interest-rate repression and asset-price inflation.

But when raging consumer-price inflation broke out in 2021, the Fed eventually put an end to buying MBS, and since mid-2022 has been shedding them. And mortgage rates have been in what we might call the historically normal-ish range since September 2022 of above 6%.

The 3% mortgage rates were a brief aberration that created massive distortions in the US housing market and were the final act of the 40-year bond bull market.

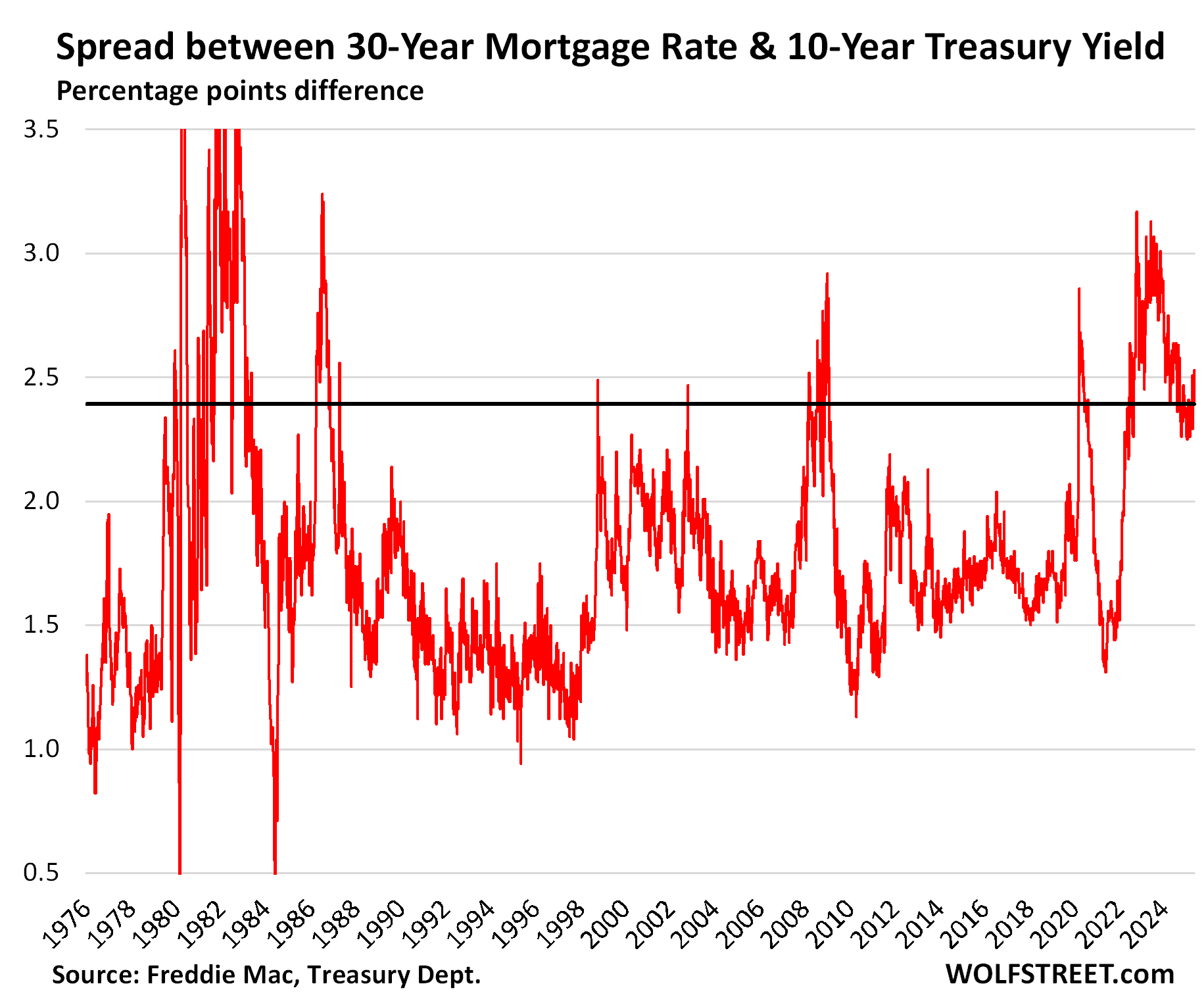

The spread matters. Mortgage rates track the 10-year Treasury yield, but are higher, and this spread varies but is currently relatively wide at about 2.4 percentage points, keeping mortgage rates relatively high with respect to the 10-year Treasury yield.

Over the past 50 years, there were not many years when that spread was wider. My thoughts about this phenomenon here.

The Fed’s new mantra: “Wait and see.”

At the Wednesday press conference after the FOMC meeting, Powell kept getting bombarded with the same questions about rate cuts.

But Powell, with super-human patience, kept giving the same answer: The Fed will “wait and see,” he said 11 times. “Uncertainty is extremely elevated,” he said, and the Fed is well-positioned to “wait and see.” 11 times. It has become a mantra.

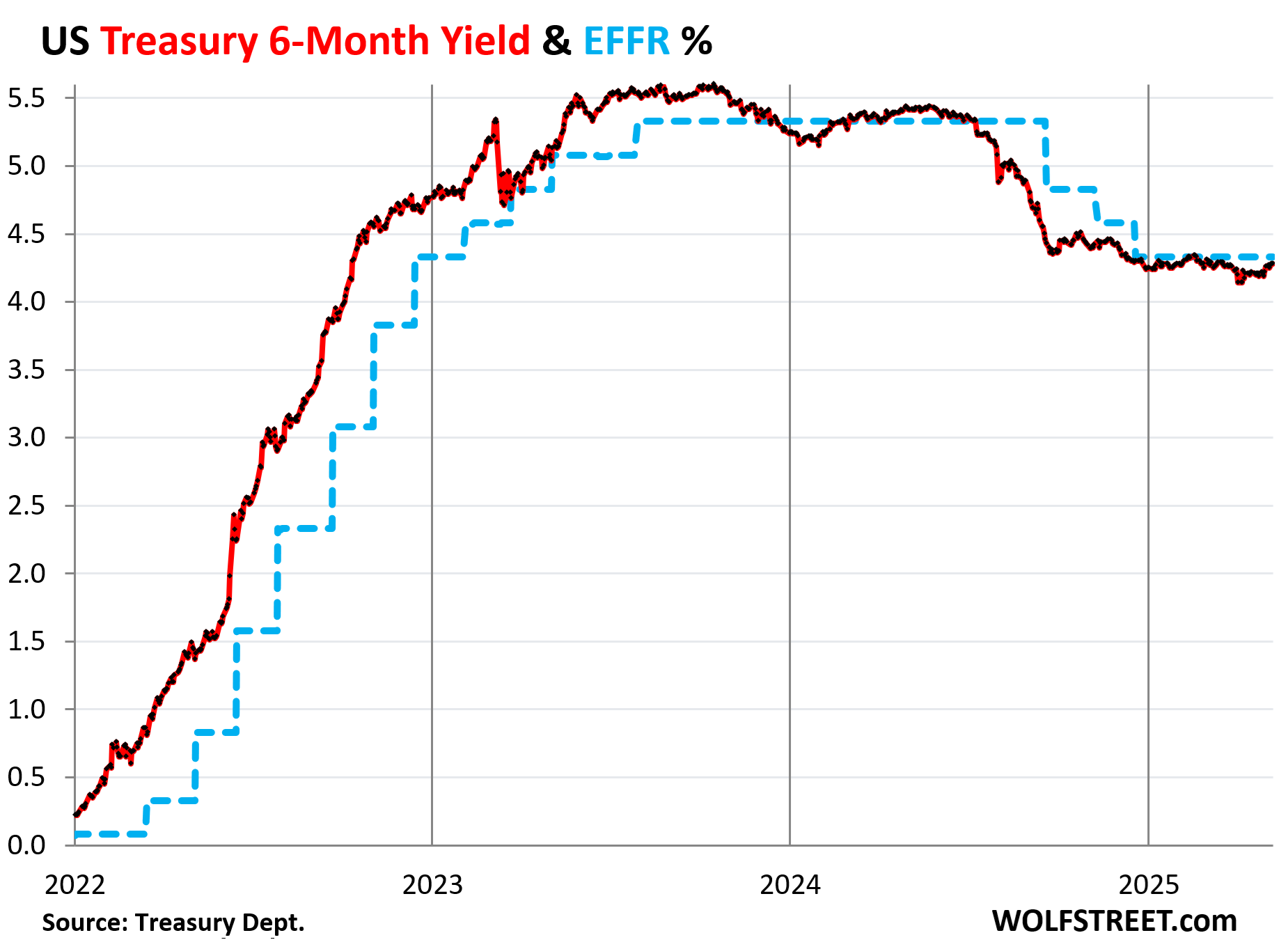

The six-month Treasury yield has taken rate cuts off the table within its window. It has edged higher since March, approaching the EFFR from underneath:

The yield curve steepened at the long end.

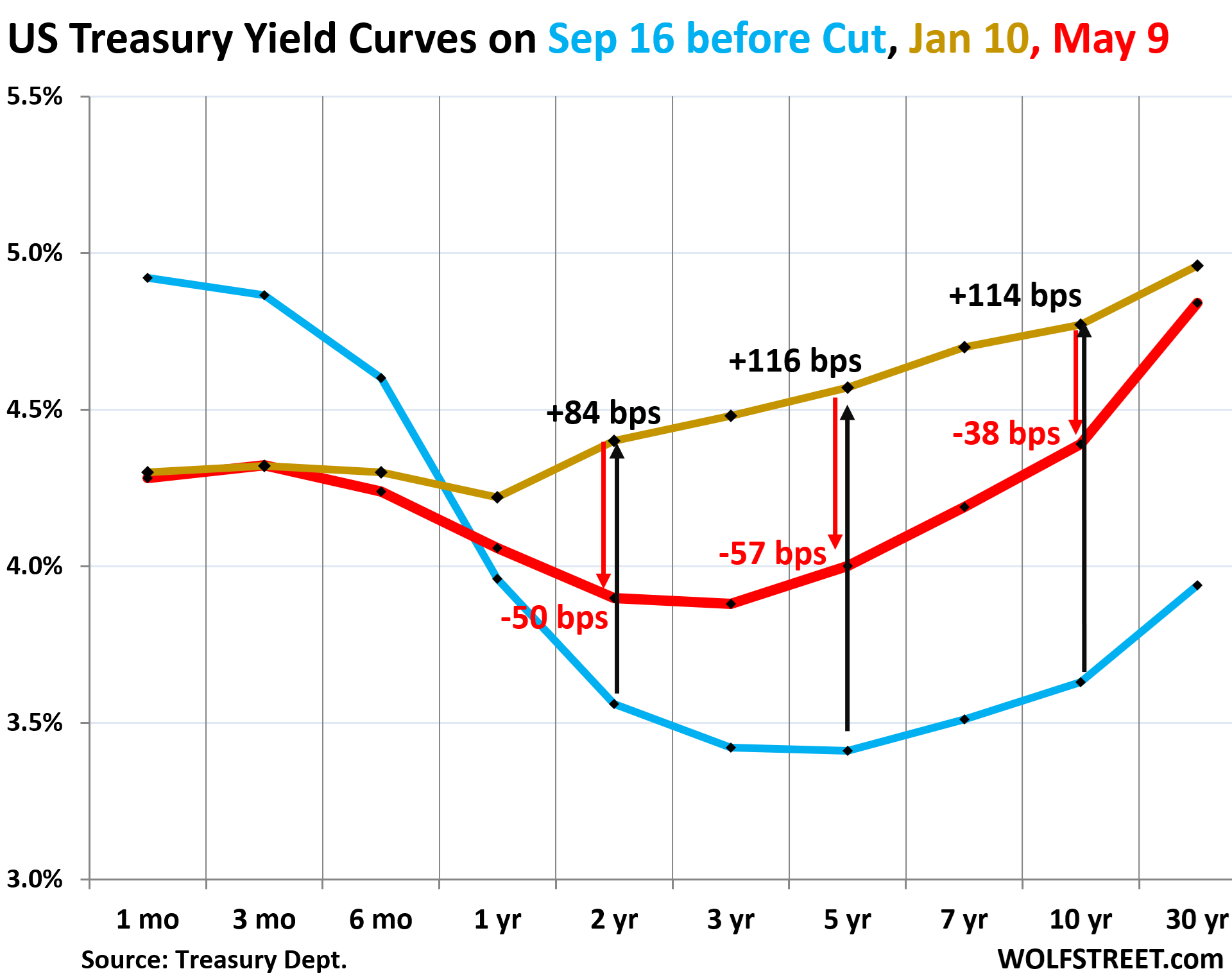

The chart below shows the yield curve of Treasury yields across the maturity spectrum, from 1 month to 30 years, on three key dates:

- Gold: January 10, 2025, before the Fed pivoted to wait-and-see.

- Red: Today, May 9, 2025.

- Blue: September 16, 2024, before the Fed’s monster rate cut.

Amid the mantra of wait-and-see, short-term yields from 1-6 months haven’t moved much and remain near the EFFR. The sag in the middle got a little shallower, as those yields rose.

Long-term yields have snapped back from the early-April lows, with the 10-year and longer-dated yields higher than 1-to-6-month yields. That part of the yield curve has un-inverted, if only by a hair.

Foreigners kept buying at Treasury auctions, no problem.

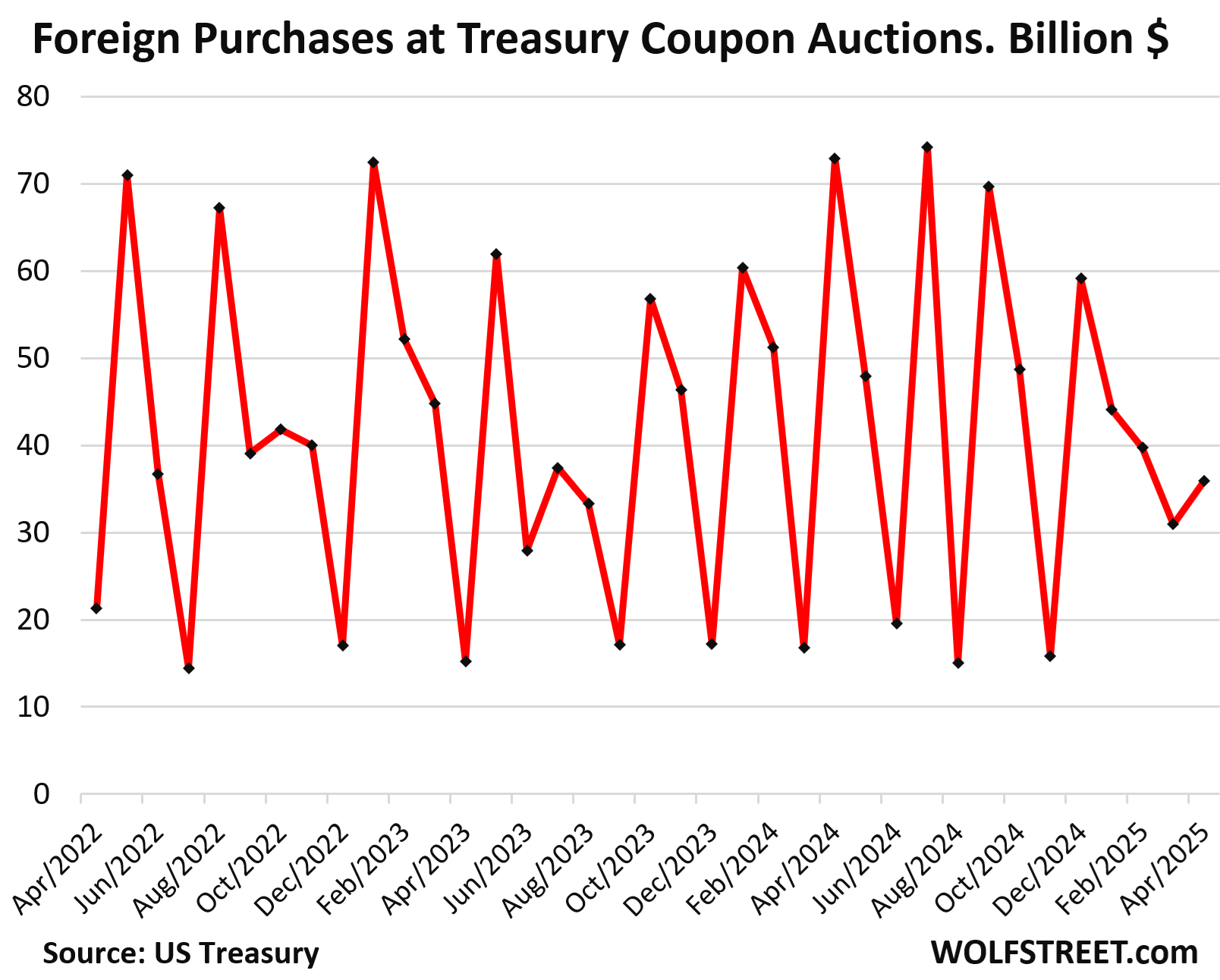

When yields spiked in early April, rumors raged that foreigners were punishing the US government for the tariffs by not buying at the Treasury auctions.

That turned out to be just another rumor that was fun to spread, as we now know from the Treasury Department’s Treasury Auction Allotment Reports, released twice a month, with detail as to who bought what.

In April, foreign investors bought $36.0 billion in 2-year to 30-year Treasury securities, up from March ($31 billion) and within the range. The large month-to-month variations are in part a result of the large variations in the amounts of securities sold in various months.

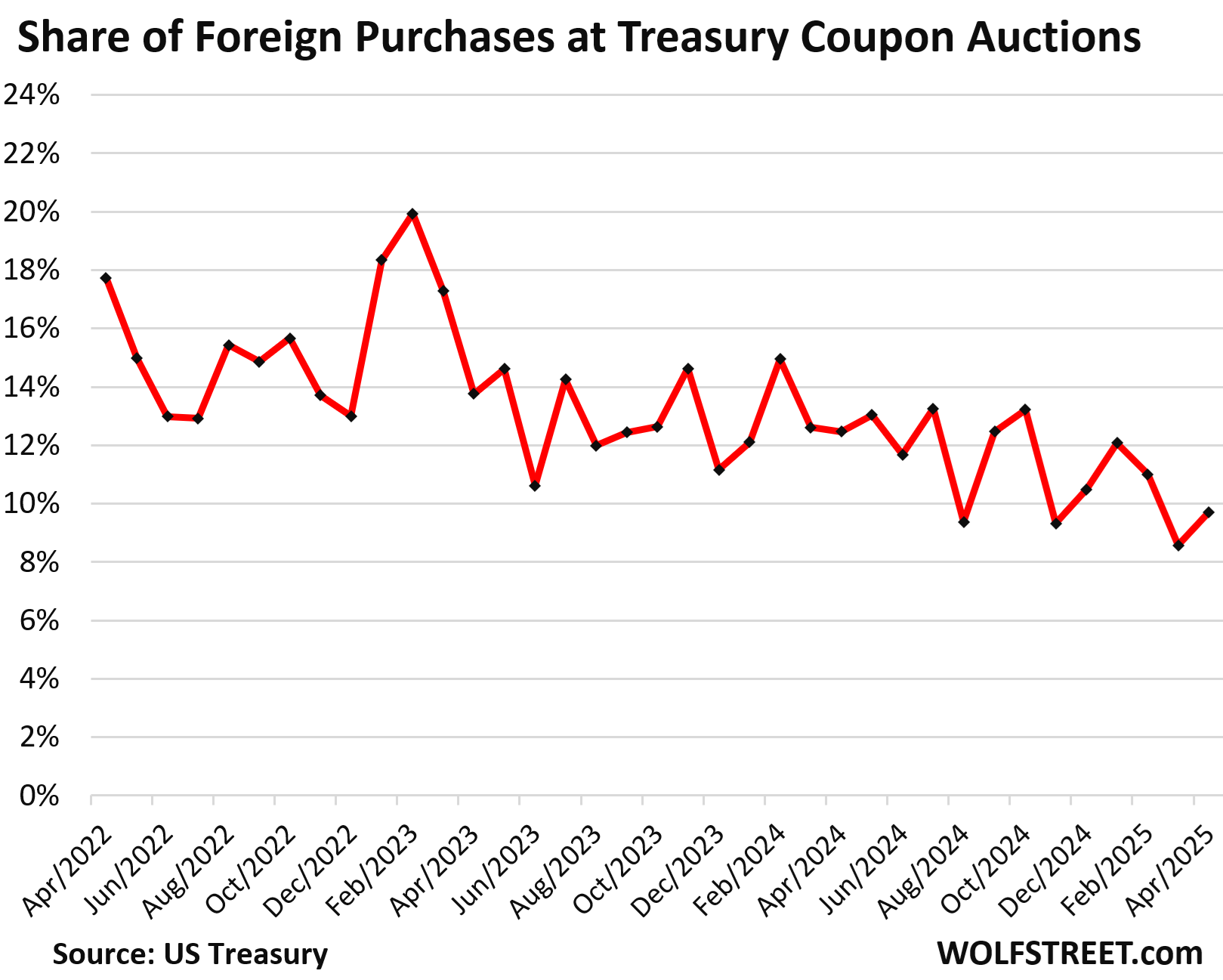

Over the years, foreign purchases have increased in dollar amounts, but the US debt has grown so fast that foreign buyers have lost share, and domestic buyers have picked up those securities. This also shows up at the auction, where foreign purchases have not kept up with the increasing auction sizes. But the process has been slow.

In April, the share of foreign purchases of total securities sold (Fed purchases excluded) rose to 9.7%, which was a higher share than in March (8.6%). But we can see the longer-term trend that their buying is not keeping up with the increasing auction sizes due to the ballooning debt and deficits:

“No Evidence” the basis trade blew, but the “swap spread trade” made a mess.

There is “no evidence” of an unwind of the Basis Trade, said Roberto Perli, Manager of the System Open Market Account (SOMA) at the New York Fed, in a long speech today on the Treasury market events in late March through mid-April that had caused such consternation.

He estimated the notional value of the basis trade to be about $1 trillion. He said:

“One factor that could lead to a rapid unwind of the basis trade is substantial repo rate volatility or a persistent increase in repo rates, which could in turn increase the cost of financing the position and therefore make it unprofitable.

“But this by and large did not happen in April since repo rates were fairly stable and dealers remained willing and able to intermediate. As a result, according to Desk staff’s estimates, the basis remained relatively stable.

“This stands in sharp contrast to March 2020, when the basis jumped by about 100 basis points and the unwinding of basis trades was likely an important contributor to the sharp dislocation in the Treasury market we observed at that time.”

But the “so-called swap spread trade” made a mess, as the 10-year yield was snapping back in early April, exacerbating the spike in the yield. Perli said:

“Reportedly, many leveraged investors were positioned to benefit from a decrease in Treasury yields of longer maturity relative to equivalent-maturity interest rate swaps, partially due to the expectation for an easing of banking regulation that would bolster bank demand for Treasuries.

Since swap spreads are defined as the swap rate minus the Treasury yield, leveraged investors were making a directional bet that swap spreads would increase.

“However, on the heels of the tariff announcement, swap spreads started to decline and made the swap spread trade increasingly unprofitable.

“Because this trade is usually highly leveraged, prudent risk management dictated that the trade should be quickly unwound, which is what appears to have happened. The unwinding involved selling longer-term Treasury securities, which likely exacerbated the increase in longer-term Treasury yields.”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

As the USS Dollar continues to go boldly where no one has gone before.

Dollar Index [DXY] at 100.4:

Uh, according to Wolf’s chart, we’ve been here before. The sky is not falling.

Acknowledged, but the return to 4.39% suggests everyone knows where we are going ultimately. It’s like we’ve seen this show before and we know the dollar is drifting further and further away from 1971.

Lol, 10/10, no notes.

Yes, I acknowledge that you completely disproved my statement with a single graph, but I still feel I’m right.

The hardest part for dollar obsessives is the that any correlation between dollar strength and anything meaningful is moderate at best. When are the economic glory days we’re supposed to be shooting for? The late 90s, when we had some of the highest employment rates in history? Well, the dollar index was almost exactly at 100 then. The Trump years that everyone seems to be pining for? Same.

We’re not seriously suggesting the basis trade didn’t try to unwind? Does no one care about being gaslit anymore?

Sorry to disappoint you. It would have been so much fun if the basis trade had blown up. It did blow up in March 2020 though. But do read the stuff about the basis trade in the article, not just the subtitle.

Where, pray tell, is that which everyone knows is where we are going ultimately ?

Good article, Wolf. Definitely described the known parameters of the 10 year. The interpretation of the facts is an individual prerogative. For instance I think your statement :

“Everyone from Bessent on down loved the big plunge to 3.99% because everyone loves low long-term interest rates ”

Which I think is accurate. The market reacted in a mindless fashion indicating confusion which was subsequently verified to the retracement that we are currently experiencing.

The reasons for a market driven decline in the rate complex are, outside of QE which artificially suppresses the complex, not a sign of robust demand.

Gee, ~5% for 30 year UST risk. Nah. Pass.

I’m a fairly smart guy, I have a finance degree, I’m a decent investor, I make nearly a million bucks a year. However…

Yield curves and rate spreads over time coupled with basis trades, reverse repo implosions and the other myriad 3rd derivative terms make my brain hurt. I buy undervalued equity, and I sell over valued equity. That’s all I do, it’s all I can really understand.

As Warren Buffett (the soon-to-be-retired Warren Buffett) would say, stick to your circle of competence. If you don’t understand obscure transactions, eschew them. There’s no shame in that whatsoever.

Another great article Wolf. You are covering issues that aren’t addressed in the regular media and I thank you for that. I doubt most reporters have the bandwidth or expertise to cover these complex issues. Your explanation of the spread between MBS and Treasuries makes perfect sense. (Yes, I read the GDFA) Do you think this also impacts ICE credit vhttps://fred.stlouisfed.org/series/BAMLH0A0HYM2 spreads?

Perhaps your readers would find your take on credit spreads (similar to MBS/Treas spreads) very compelling. I certainly would. TY

I talk about junk bond credit spreads quite a bit, most recently on April 21:

https://wolfstreet.com/2025/04/21/despite-turmoil-in-stocks-financial-conditions-financial-stress-and-junk-bond-spreads-still-in-la-la-land-or-barely-exiting/

Wait and See…Isn’t that what they did 4 years ago and let inflation run wild? Oh, it’s transitory they said, we don’t need to raise rates.

Opposite. Fed rates are now well above CPI, not far below CPI, and the wait-and-see is before CUTTING rates (though it could be before hiking rates further if inflation serves up a really bad deal).

I’ve been saying that Volker type FFR is in the cards. We are still in an inflationary expansion. It will take more than “wait and see” to fix this.

April 7 and 8th, something broke, maybe basis trade melt down, but something broke on those trading days. Huge risks off in equities and we had yield exploding higher on the 10 UST, not too common. But the rare and scary thing on the 7th and 8th, when trillions of dollars worth of stocks and bonds are being sold the $USD dollar always gets a bid from the functional outcome; the trade is settled in $USD, the fact that the $USD sold off on big $ asset liquidation days was something non of us have seen in our lifetime, It definitely scared Bessent enough to talk some sense into his boss. Will it happen again? That’s the 100 trillion dollar question. Definitely a warning shot over the bow. Danger ‼️