Active Listings compared to April 2019: Jacksonville +23%, North Port-Sarasota +29%, Tampa +31%, Orlando +40%, Cape Coral-Fort Myers +42%, Lakeland-Winter Haven +71%.

By Wolf Richter for WOLF STREET.

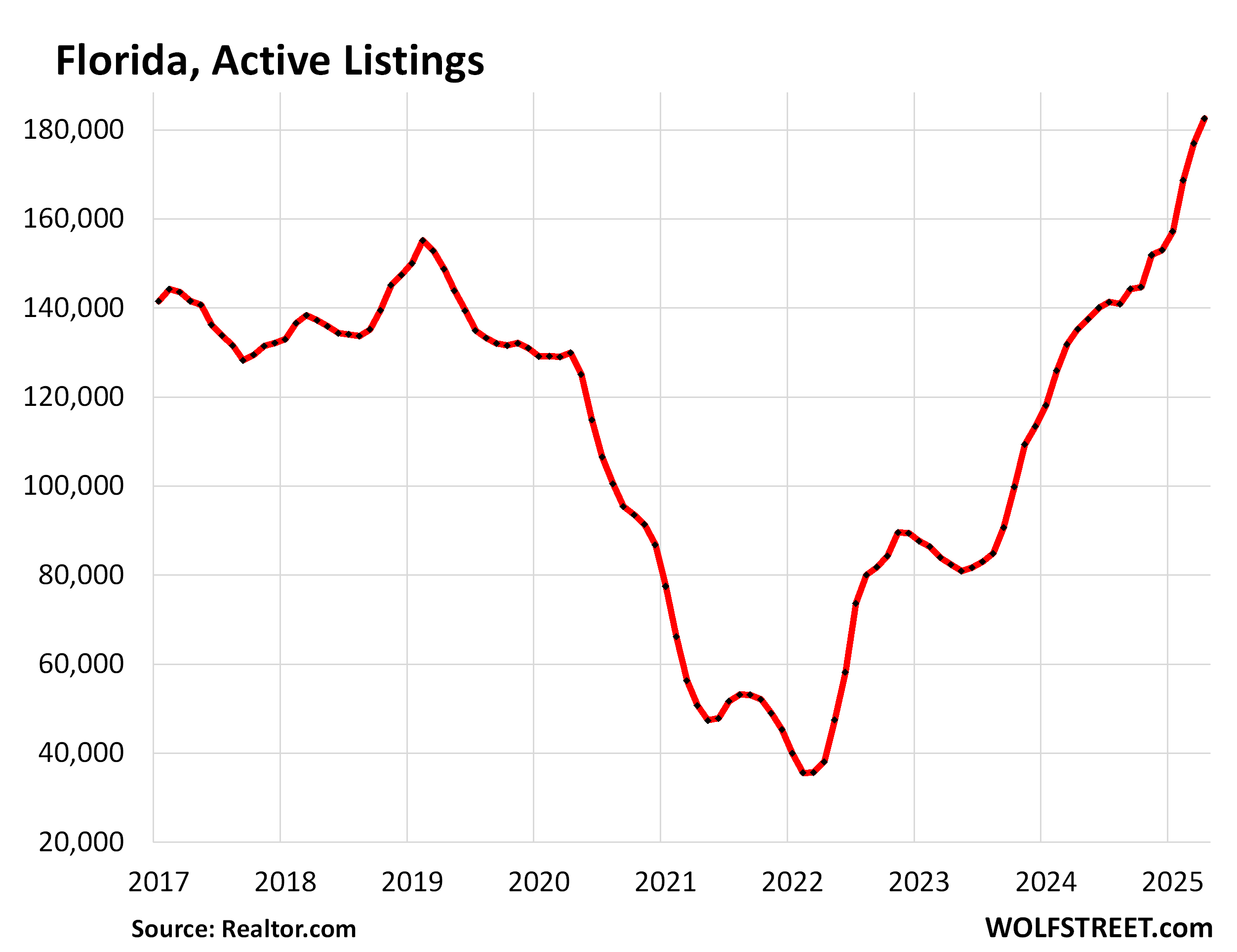

Unsold inventory of existing homes for sale is piling up in Florida at a stunning rate. Active listings jumped by 35% year-over-year in April, to 182,589 homes, by far the highest in the data from realtor.com going back to 2016, and was 23% higher than in April 2019. There’s a housing shortage until there suddenly isn’t.

The month-to-month surges in February, March, and April were particularly spectacular. It seems sellers have lost patience with “this too shall pass,” in terms of the 6%-plus mortgage rates, and have started to put their homes on the market in larger numbers, and leave them on the market when they don’t sell, instead of pulling them off the market within a short time. But buyers are on strike.

So inventory has been piling up because sales plunged. Lots of supply, little demand. Why? Because prices are far too high after the price explosion since 2020, and those too-high prices have triggered demand destruction, one of the most fundamental economic dynamics.

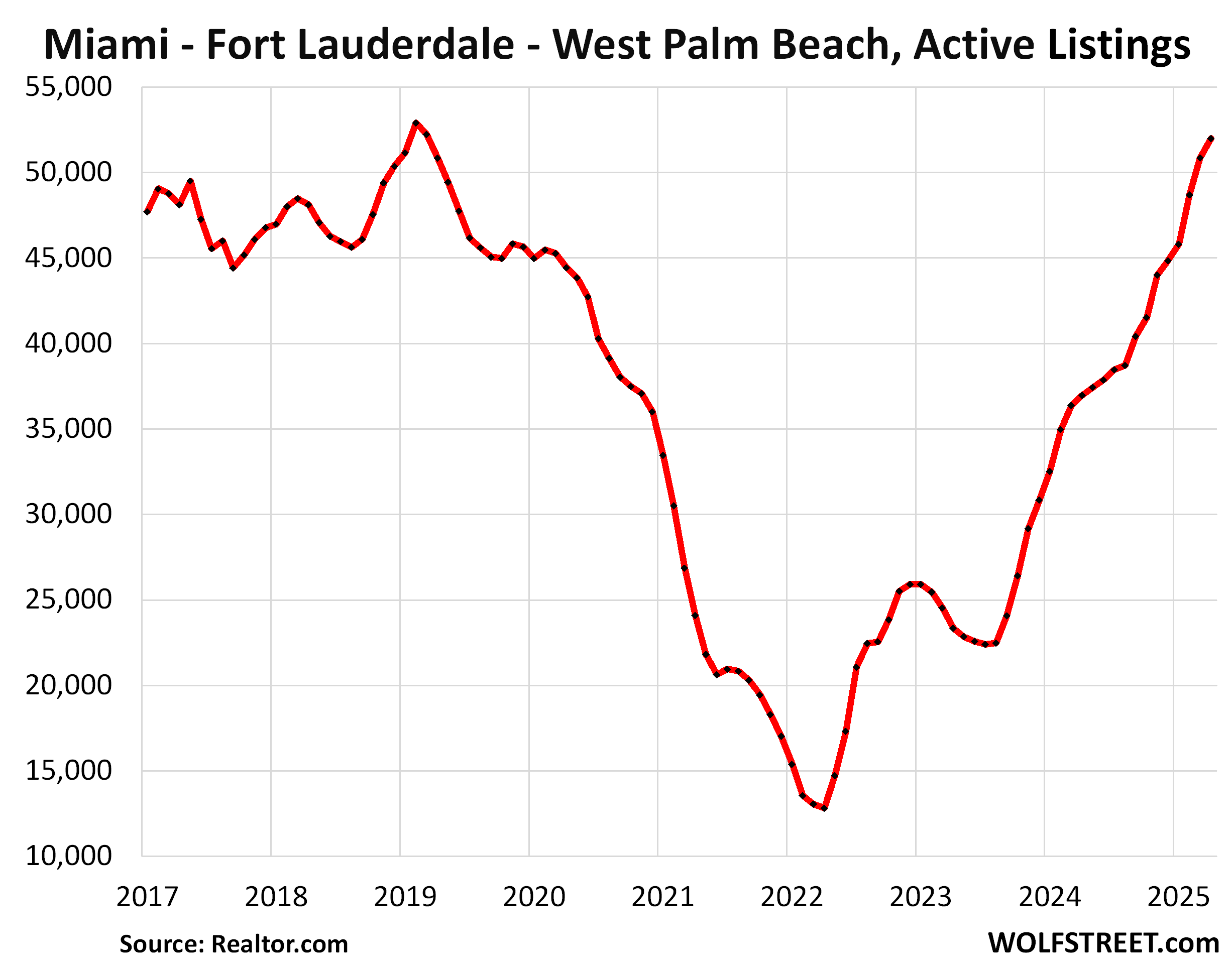

Miami-Fort Lauderdale-West Palm Beach metro: Active listings jumped by 41% year-over-year in April, to 51,987 homes, the third-highest in the data, behind only February and March 2019. Compared to April 2019, inventory was 2% higher.

The Miami metro is still a little behind the other big Florida metros, in terms of the inventory pile-up, but it’s coming right along now:

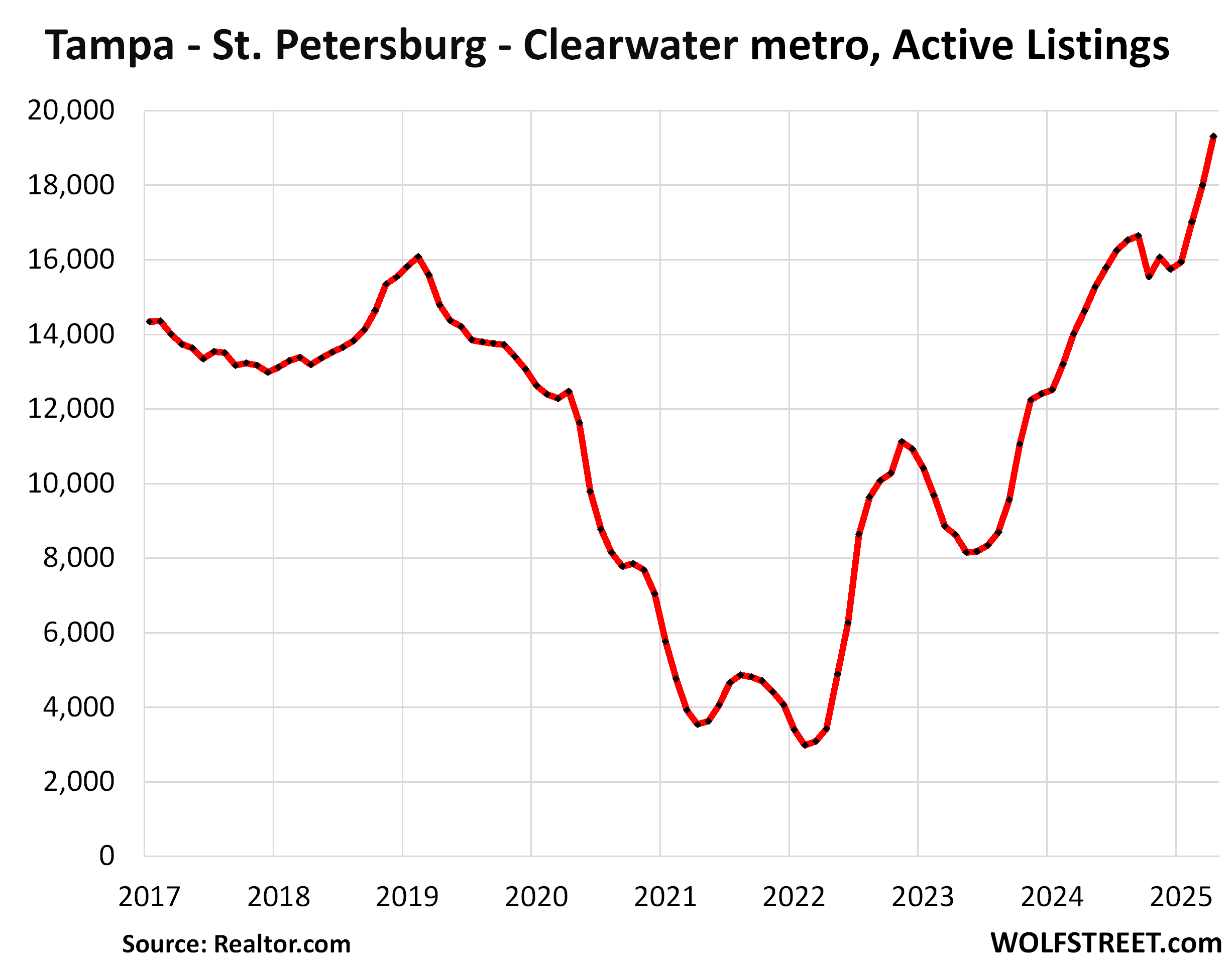

Tampa-St. Petersburg-Clearwater metro: Unsold inventory jumped by 32% year-over-year in April, after three majestic month-to-month jumps in a row totaling 21%, to 19,310 homes, the highest in the data from realtor.com going back to 2016. Unsold inventory was 31% higher than in April 2019.

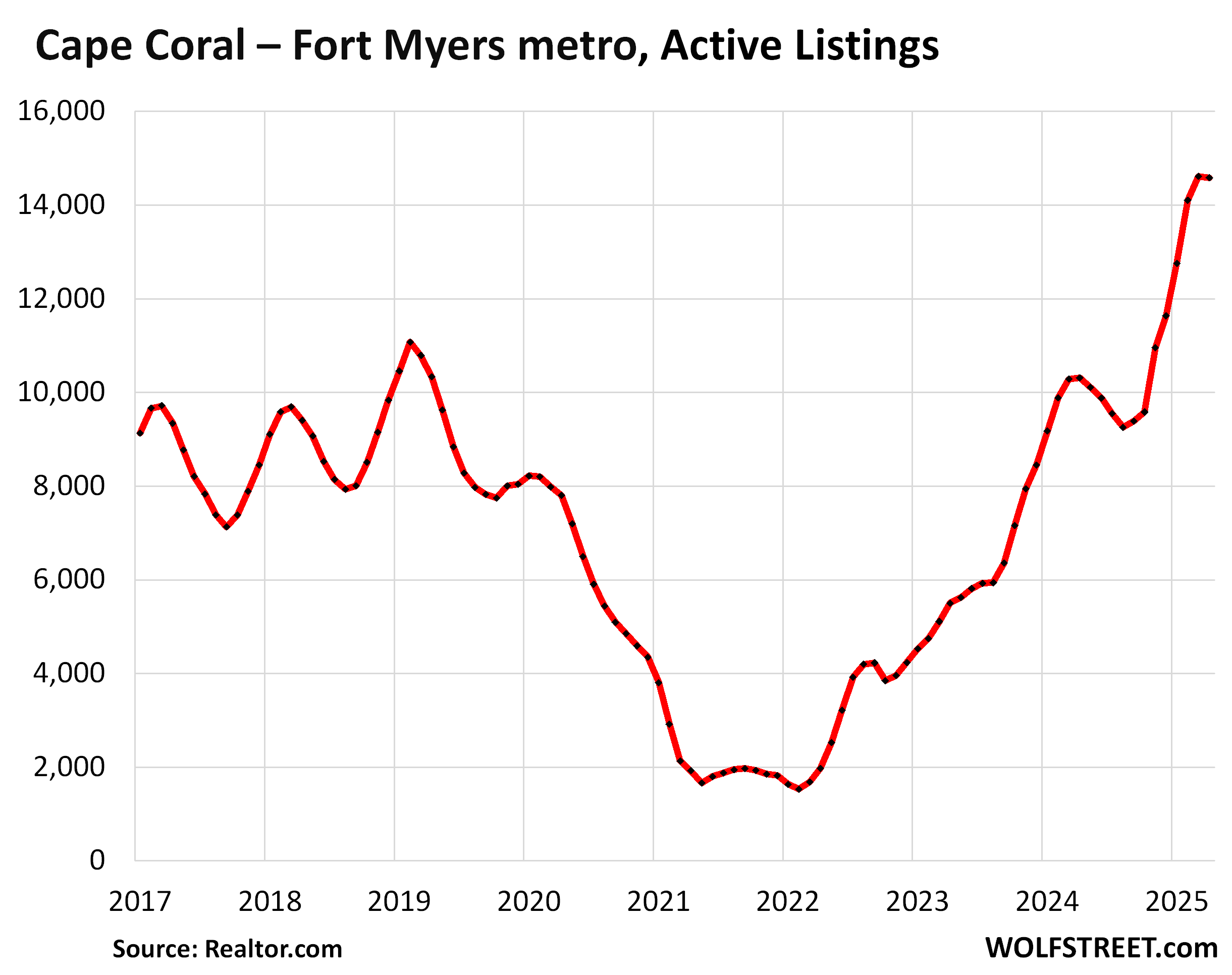

Cape Coral-Fort Myers metro: Active listings spiked by 41% year-over-year in April, to 14,580 homes, along with March the highest in the data from realtor.com going back to 2016, and 42% higher than in April 2019.

There is some pre-covid seasonality in the metro where March marked the high point, and then inventory fell in April and continued falling till about September. But this year, instead of falling in April, inventory was essentially unchanged. The same occurred during the inventory surge a year ago.

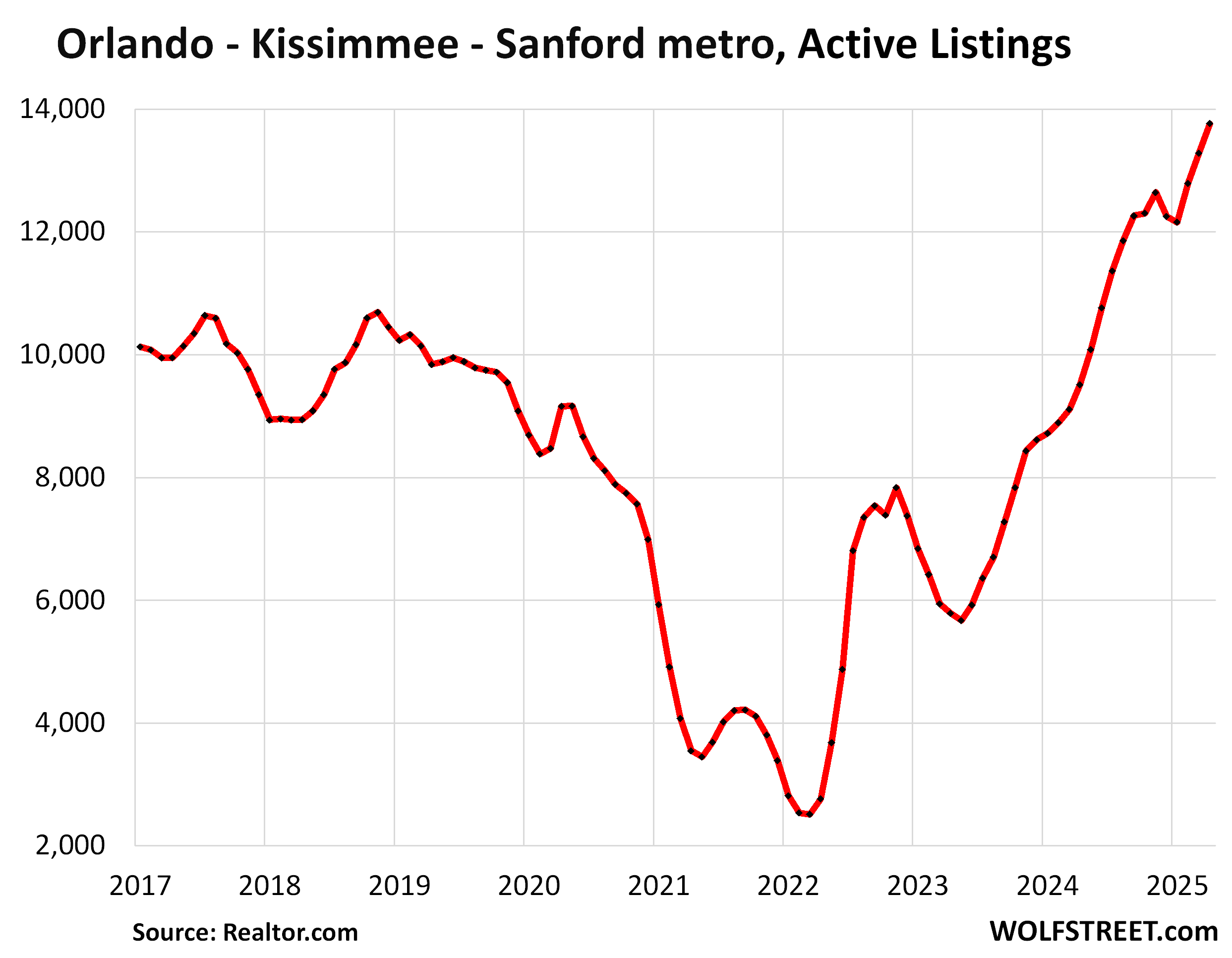

Orlando-Kissimmee-Sanford metro: Active listings spiked by 45% year-over-year in April, to 13,765 homes, by far the highest in the data from realtor.com going back to 2016, and up 40% from April 2019:

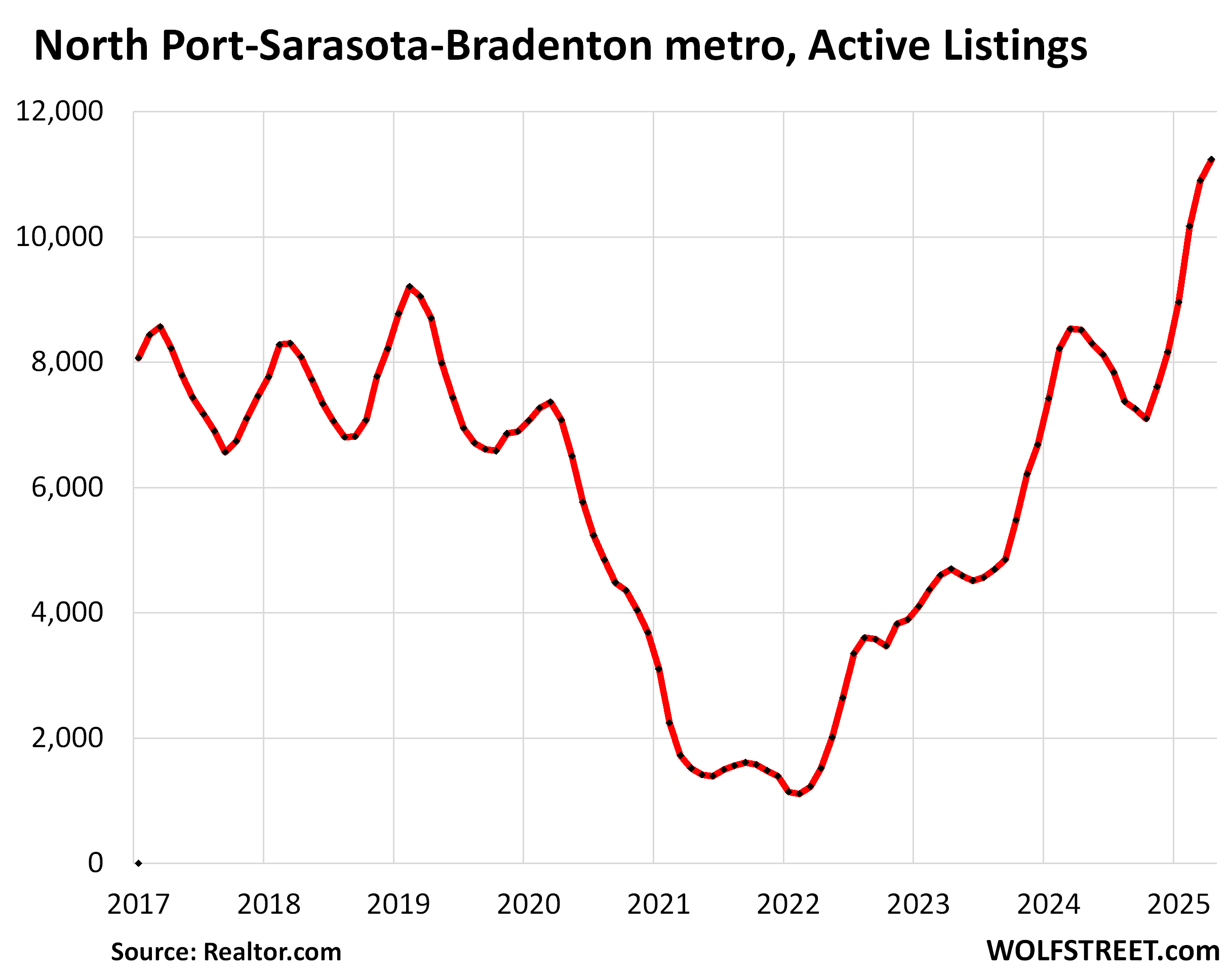

North Port-Sarasota-Bradenton metro: Active listings spiked by 32% year-over-year in April, after six majestic month-to-month jumps in a row totaling 58%, to 11,234 homes, the highest in the data from realtor.com going back to 2016, and up 29% from April 2019.

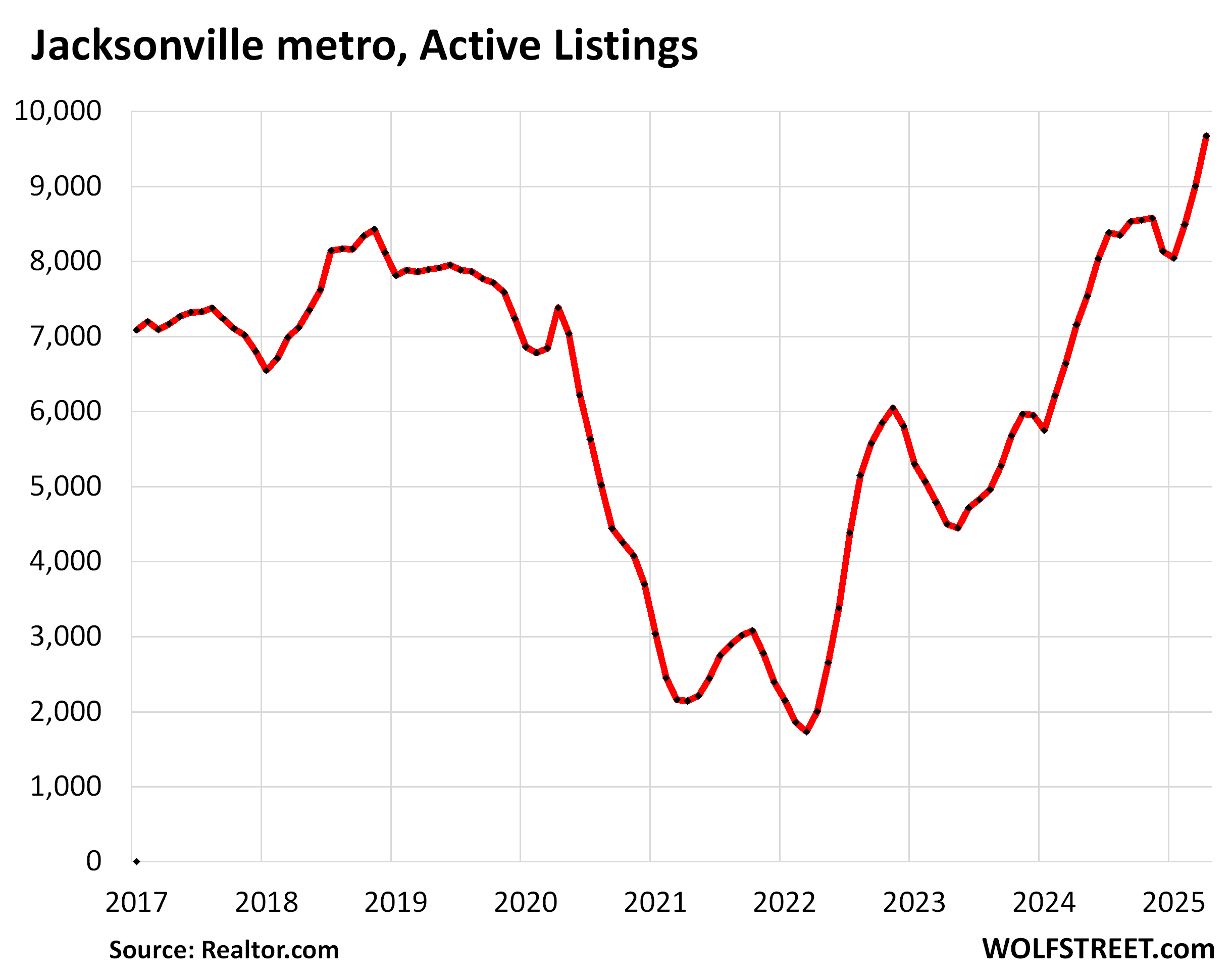

Jacksonville metro: Active listings spiked by 35% year-over-year in April, after three majestic month-to-month jumps in a row, similar what we’ve seen in the other metros, totaling 20%, to 9,676 homes, the highest in the data from realtor.com going back to 2016, and up 23% from April 2019.

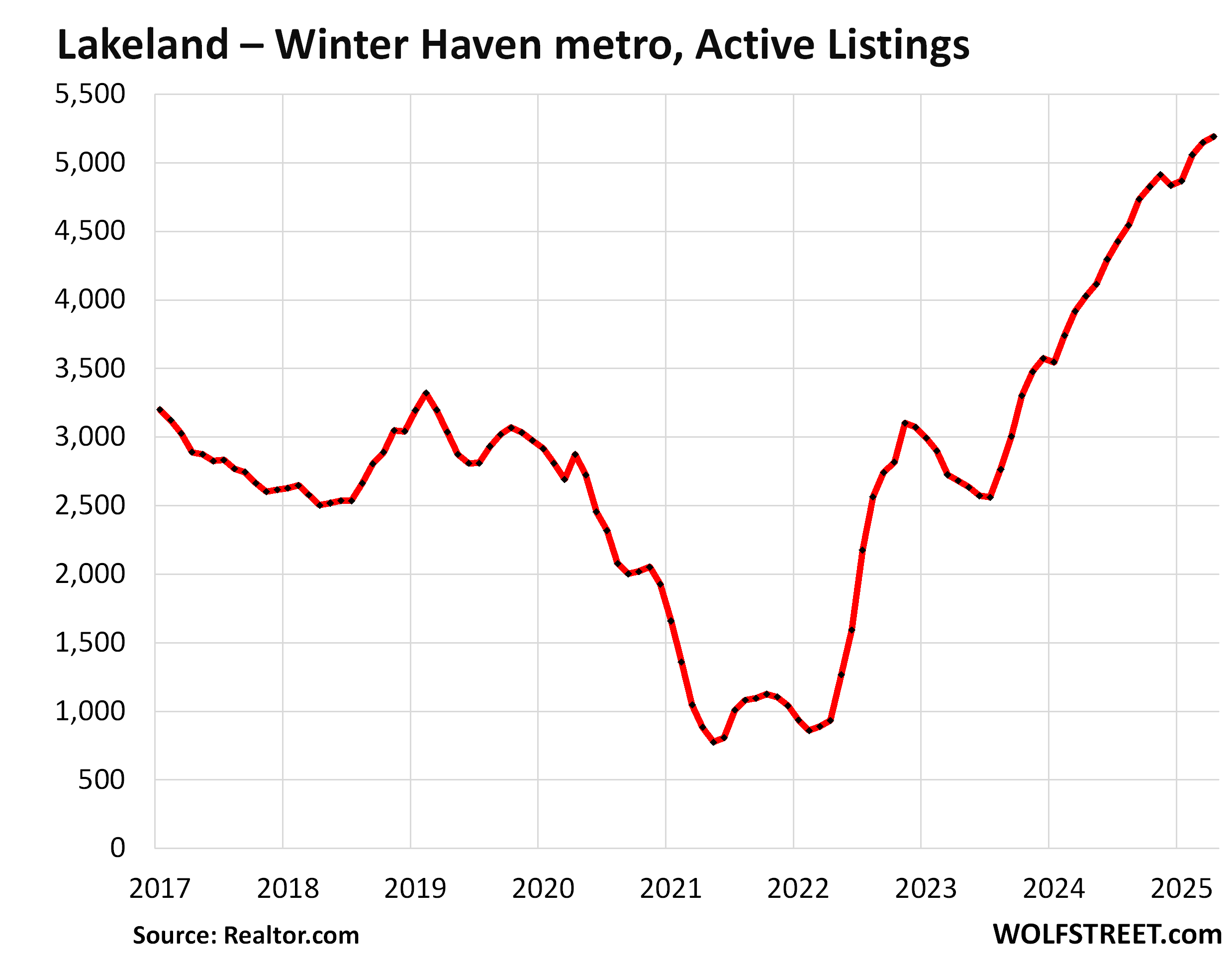

Lakeland-Winter Haven metro: Unsold inventory jumped by 29% year-over-year in April, to 5,191 homes, by very far the highest in the data from realtor.com going back to 2016. It was 71% higher than in April 2019, and 107% higher than in April 2018. Showing signs of a glut:

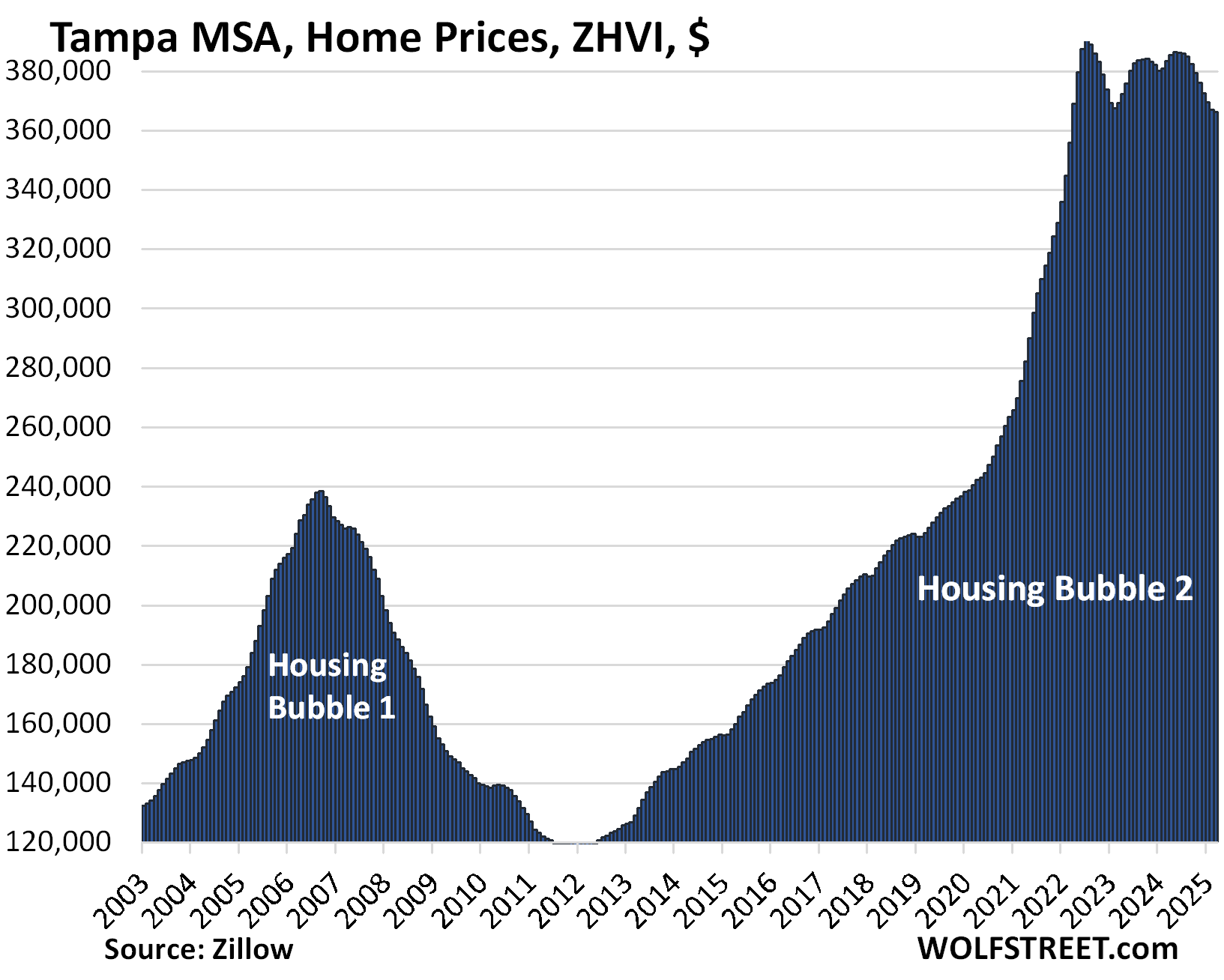

Prices have shot up way too far: For example, the prices of mid-tier homes in the Tampa metro spiked by 60% from 2020 to the peak in mid-2022. That’s what triggered demand destruction, one of the most fundamental economic dynamics:

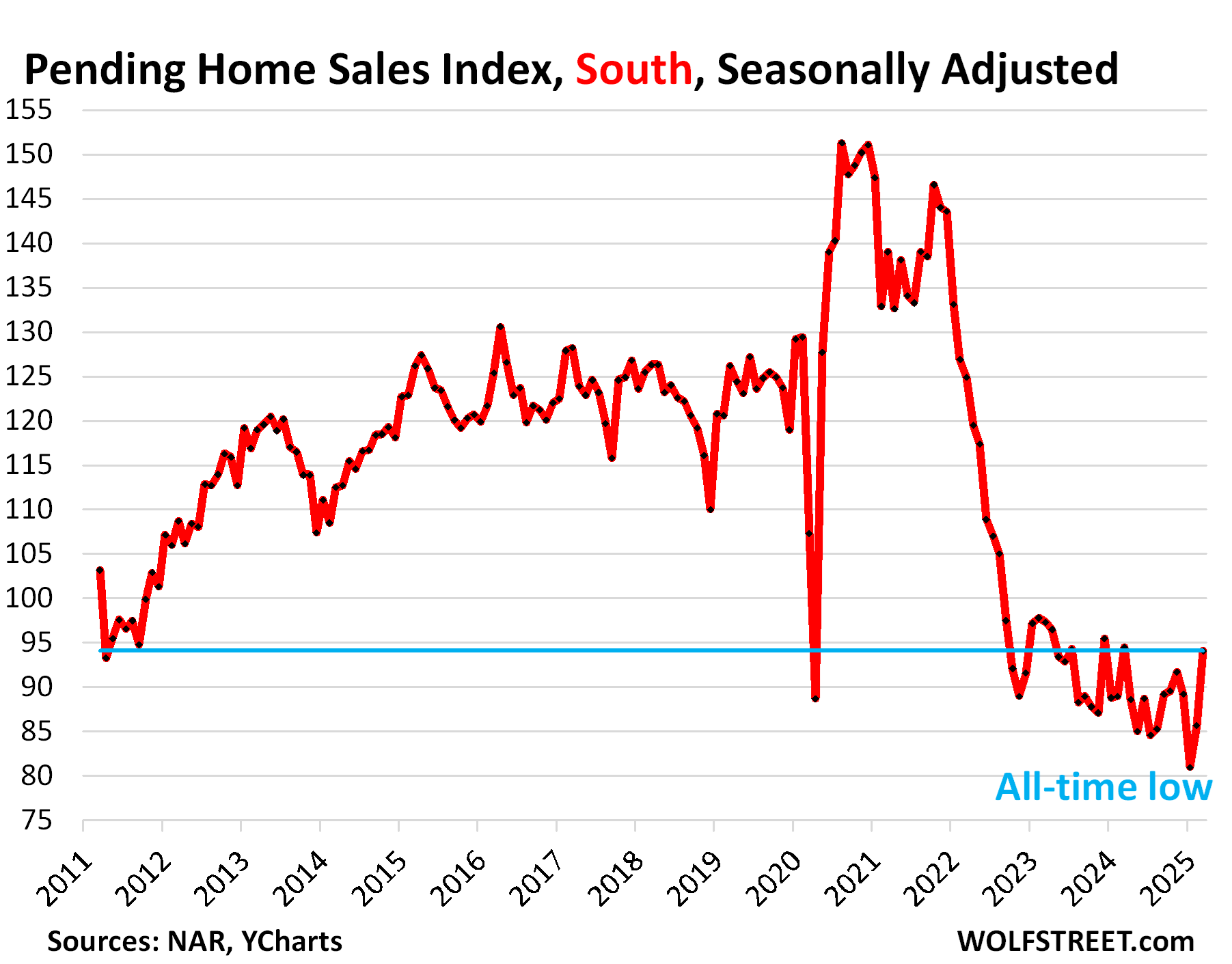

Demand destruction: In the South, pending sales of existing homes were again down year-over-year in March, and marked the worst March in the data from the National Association of Realtors going back to 2011, though they rose from February, seasonally adjusted. Compared to March 2019, pending sales were down 25%.

And that’s the problem: At these way-too-high prices, result of the massive price-spike since 2020, demand destruction has set in, which is why inventory is piling up. But there is a classic cure for any demand destruction – there always is: substantially lower prices.

Home prices have started to move lower in many metros, including in Florida: The Most Splendid Housing Bubbles in America, March 2025: The Price Drops & Gains in 33 of the Largest Housing Markets

Condos are making particularly sharp moves: In 15 Bigger Cities, Condo Prices Already -10% to -22%, 5 Are in Florida with Accelerating Drops. Absurdity Comes Unglued

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Interestingly, today’s bubble peak, inflation adjusted, is about the same as the 2007-8 bubble peak. If history follows, we may be looking at some bargains in the near future.

Let’s hope so. At a minimum, let’s hope high mortgage rates stay around for at least 2-3 more years. That may be just enough time to get a very broad 20% or so decline existing home prices.

On Old Highway 98 in Miramar Beach there is a stretch of beautiful three story beach homes built in the early 2000’s for a couple of million $ each. In 2008-2009 almost every one was for sale…for 600-700k. Recently they were back up to $3+ million. Since the first Florida real estate boom of the 1920’s it has proven to be an extremely volatile market.

If price discovery in housing, an illiquid asset, were ever allowed to happen, it would crash below the 2012 bottom, nominally. But instead, it’s rigged by the government.

For context, how does inventory of 182K listings compare to the depths of the financial crisis?

Miami is still a good long-term bet for housing. The booming Sun Belt won’t die down in population for decades to come, and everyone needs a place to live.

Doesn’t Miami have a serious problem with sea level rise? I’m thinking here mostly of the consequences for its water table and public works (water and sewer) rather than outright inundation on its perimeter).

Wonder if most of the RE agents are having any honest conversation with their sellers like lower your price to move those supply and stop hanging onto 2022-23 prices or they are still selling BS narrative like oh rate is going to get cut soon and floods of demand will pile up again or telling them one of area is still having bidding wars..etc.

Anecdotally, been seeing way more email blasts on houses for sale from Redfin in SoCal compare to last 6 months, now daily I get about 4-5 a day on areas I searched before, probably doesn’t mean anything. It’s still funny to see some gem from these ads though, hopium is still around and once in a while you’ll still see sold with price increase and the original price wasn’t cheap to begin with..like the gem below.

$690,000

2 Beds · 2 Baths · 862 Sq. Ft.

Laguna Niguel, CA

Phoenix Ikki, that’s not a bad price for a property in Laguna Niguel. I wonder if it is a tear-down, right next to the freeway, or maybe the seller is low-balling the price.

Hmm, did you see the sq footage? The place is a shoebox size condo with a large HOA monthly. Location matters but not at these kind of pricing and without an ocean view

Excellent piece, Wolf. The national implications are definitely something to watch. Your work, as always, delivers just the facts – a true Dragnet for our times.

Wolfman, there is no mention of the Florida panhandle :-(

I’m not surprised Florida will be the first to drop in price due to the housing bubble, as its always been more of a speculative state for real estate and a lot more pro-real estate developer than California and other states.

The Panama City Beach area is still growing because of tourism (within a 14 hour drive of Chicago and 5 hours of Atlanta) and other industries like Eastern Shipyard, Kraton Chemical Plant, SeaPort of Panama City, Berg Pipe, Miller Marine custom boats construction, Trane HVAC manufacturing, the new teaching hospital and medical research facility run by Florida State University, as well as the Coast Guard base, the Naval Station Panama City and Tyndall Air Force Base.

Also Panama City Beach is becoming popular for off season or non beach weather (December 1-February 28) tourism with different types of major events and conventions.

1. “there is no mention of the Florida panhandle”

The metros here are the largest metros in Florida. They’re just not in the Panhandle.

2. The Panama City Beach area is still growing because of tourism …

what’s growing is inventory, LOL. In the Panama City-Panama Beach metro, inventory is double of where it was in April 2019. It’s among the worst in Florida:

As you say Wolf, prices have to be come down to clear inventories, but the part I don’t understand is, with such high inventories in Florida, what is keeping prices so high, as if they defy economic gravity.

Prices ARE coming down, they’re just very sticky, nothing moves fast in RE. I included the Tampa price chart in the article. Have a look.

Good of you to add reference to what some of us old and older folx born and raise in the flower state usually label as LA, which is this case means “Lower Alabama” rather than SoCal.

Other name, of many, some not family friendly, for the area is ”Red Neck Riviera”…

In any case or name, it really is a beautiful area with the best season far into warmer months than ”Florida” and IF I had my wish, we would absolutely have a home about 50+ miles from the coast up there for our summer home,,,

Unlikely due to my better half being born and raised in the Saintly Part of the TPA bay area, with tons of family local.

A D, do you work for the Panama City Chamber of Commerce?

Typo. It’s AI not AD.

It’s “just a 14-hour drive from Chicago” said no family with three kids ever.

Ya really have to learn how to drive with kids HD:

leave in the afternoon, with some thing, games or whatever to amuse the kids,,, then drive through the night.

Next day, if driving across USA, go to motel at earliest check in time!

Sleep while kids are in pool, etc., then have a really great meal and drive all night, then repeat…

My kids loved it, and slept all night in the ”camper shell” while I drove, alone most of the time, but sometimes with a partner who drove while I napped,,,

(BTW, have driven all the way across USA many dozens of times,,, sometimes just because of the really incredible beauty of our country, which is still there.)

If the Fed cuts mortgage rates increase.

Jay’s favorite past time is painting himself into corners.

Powell is doing the best he can (not a compliment). But he is probably doing a “good enough” job since almost everybody hates him now. Of course almost everybody will love him when he caves to Wall Street and Wall Street’s political puppets and lowers rates, like last year when he cut 50 basis points based on employment data that turned out to be wrong.

Who is placing these properties on the market? What percentage are those middle income earners that where convinced by ads to have a holiday home in the sun, just like the mega-rich? Then finding out about all the hassle of maintaining at far away place and now even more expensive to do so. Or is it old men not being able to find a member of an all girl swing band?

Howdy Youngins. JFYI. A 6 – 7 % percent Mortgage rate is really kinda normal. A Bubba Believe it or not.

Right Bubba! In the 7 houses I have owned since 1980 I have never had a mortgage rate that low. Lowest was 8%.

With you, like totally dude!!

That was also for me the lowest! Hi est was 18%, for my first owned House, as opposed to land…

Price of that house was $40K, and after serious upgrades, we sold it for $105, with $16K invested including labor and materials,,, that house sold recently for $800K.

Cannot blame young folx wondering how to proceed.

Cannot suggest anyone buy any RE, seems clear enough that the continuing degradation of USD will continue to make ALL assets equally degraded.

But, in reality, ”who knows” is most likely, as always…

What is a ‘normal’ interest rate? The most common? If so 2.5-5% is clearly the most common of the last 30 years. If you want to go back further it’s still probably the most common. Interest rates have been dropping for the last 50 years. There is no ‘normal’ interest rate. Given the global increase in lending liqudity and general decrease in risk now compared to decades past, there really is no reason to expect those rates would make sense today. Is it your belief there is just a platonic, normal rate and all others are ‘wrong’? In 1000 years we’d still be at the same rate regardless of economic conditions? I’m gonna go with believe it not.

Note that despite the massive increase in inventory, seasonally-adjusted prices have barely budged. Many, many homes in Florida are siting unsold for 90-180 days. If you look at the stats you’ll see that new listings in most metros in the state are being priced at a higher median sales price than ever before (both sales price and per square foot). Basically, sellers continue to be completely delusional with respect to price and this is the primary cause of the massive buildup in inventory… as one can see that more aggressively-priced properties seem to sell briskly.

While you do see a lot of sellers reducing prices, it’s by small amounts which aren’t making much of a difference. You also see quite a few sellers re-listing their properties with a different agent, as if that’s somehow going to sell the house without substantially changing the sales price also. What that does do is though is reset the property ID in the MLS which then resets the property’s unsold days on market so the actual days on market is actually quite a bit worse than the stats imply.

Annually, sales peak around June 1. I pity the fools who do not sell by then. They could easily tag on another 180 days on market since after that date demands naturally falls substantially due to seasonal factors.

I predicted this inventory situation was going to happen in another comment on this site early this year and so far things are working out about as I expected. It is definitely going to be a very interesting time this summer in the real estate market in the South and Florida in particular!

I knew a number of Canadians that went to Florida to buy a winter home back in the 2010-12 time frame, and bought two because they were so cheap. They can definitely afford to sell 30% down from the peak, those post covid buyers will definitely feel the pain

Florida needs to be experienced in July – September for the full effect.

😂😬😂😬😂😬