Big changes in life, corporate switcheroos from working-remotely-forever to return-to-the-office, job changes, natural disasters, etc., force their hand.

By Wolf Richter for WOLF STREET.

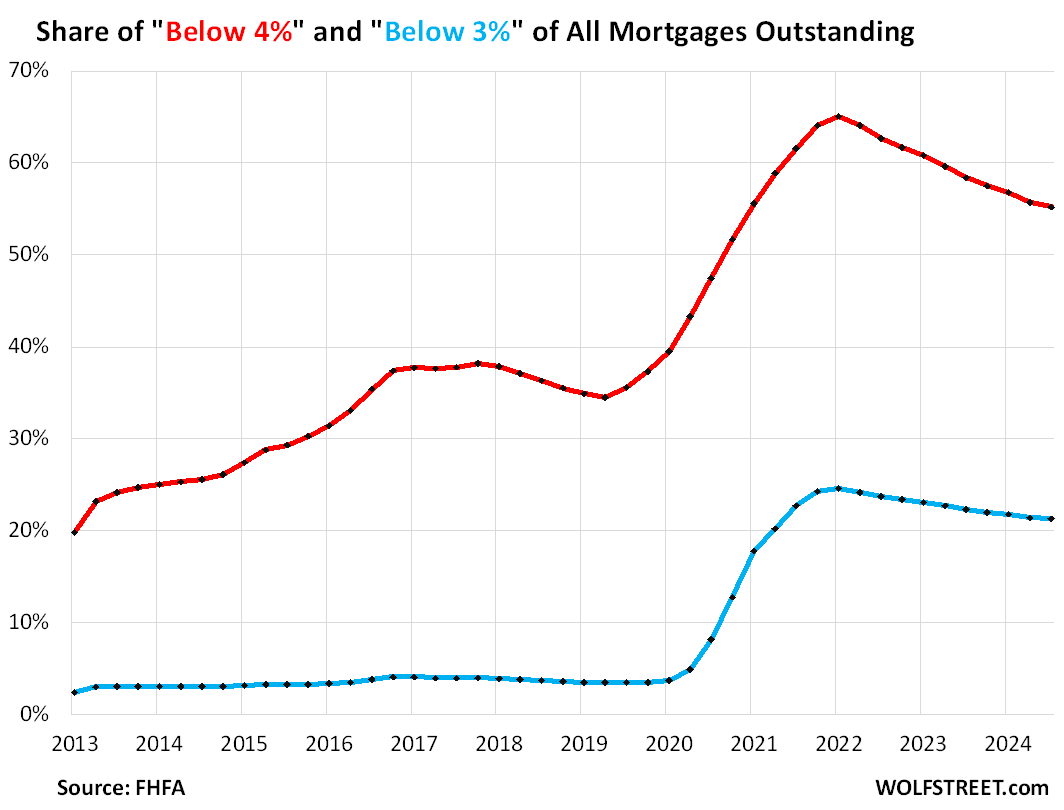

The share of mortgages outstanding with rates below 3% – as close to free money as regular folks could get – has been declining slowly but steadily to 21.3% of all mortgages outstanding at the end of Q3 2024, from the peak in Q1 2022 (24.6%), according to the Federal Housing Finance Authority’s National Mortgage Data Base of all mortgages (blue in the chart below).

The share of mortgages with rates below 4% has dropped to 55.2% of all mortgages outstanding at the end of Q3 2024, from the high of 65.1% in Q1 2022 (red). This is the share of the total number of mortgages outstanding, not of mortgage balances.

The share of adjustable-rate mortgages dropped to just 2.3% of all mortgages outstanding in Q3, after the spike in interest rates pushed the adjustable rates higher (from a share of over 10% a decade ago). Some ARMs had rates below 3% before 2020, which is why the blue line is above zero before 2020; those were ARMs. And those folks experienced a payment shock when rates began to rise in 2022.

The “locked-in effect” has bedeviled the US housing market ever since mortgage rates went back to the old-normal levels in the era before QE, before 2009. This effect describes a feeling of homeowners with mortgage rates that are well below the current rates, such as 30-year fixed-rate mortgages with rates below 4% and even below 3%. These homeowners obviously rejoice in the deal they got, and many swear up and down that they will never ever give it up.

But they’re also somewhat handicapped if they want to sell their house to buy a different house that they then have to finance at a much higher mortgage rate. Doing the math leads to payment shock.

The real estate industry laments this locked-in effect because it removes those locked-in homeowners both as buyers and as sellers from the market. This explains part of the plunge in demand to where in 2024, sales of existing homes plunged to the lowest volume since 1995, despite sharply rising inventories. This is terrible for the real estate industry and for mortgage lenders and brokers because they earn commissions and fees from each transaction.

But some locked-in homeowners nevertheless sell their homes and pay off their low-interest-rate mortgages for a variety of reasons – big changes in life (divorce, death, etc.); corporate switcheroos from working-remotely-forever to return-to-the-office; new jobs in different cities; natural disasters that destroy the existing homes, etc.

And suddenly, a home with a low mortgage rate has to be sold, or has to be refinanced, and the old mortgage is paid off, and a new mortgage at a much higher rate is taken out.

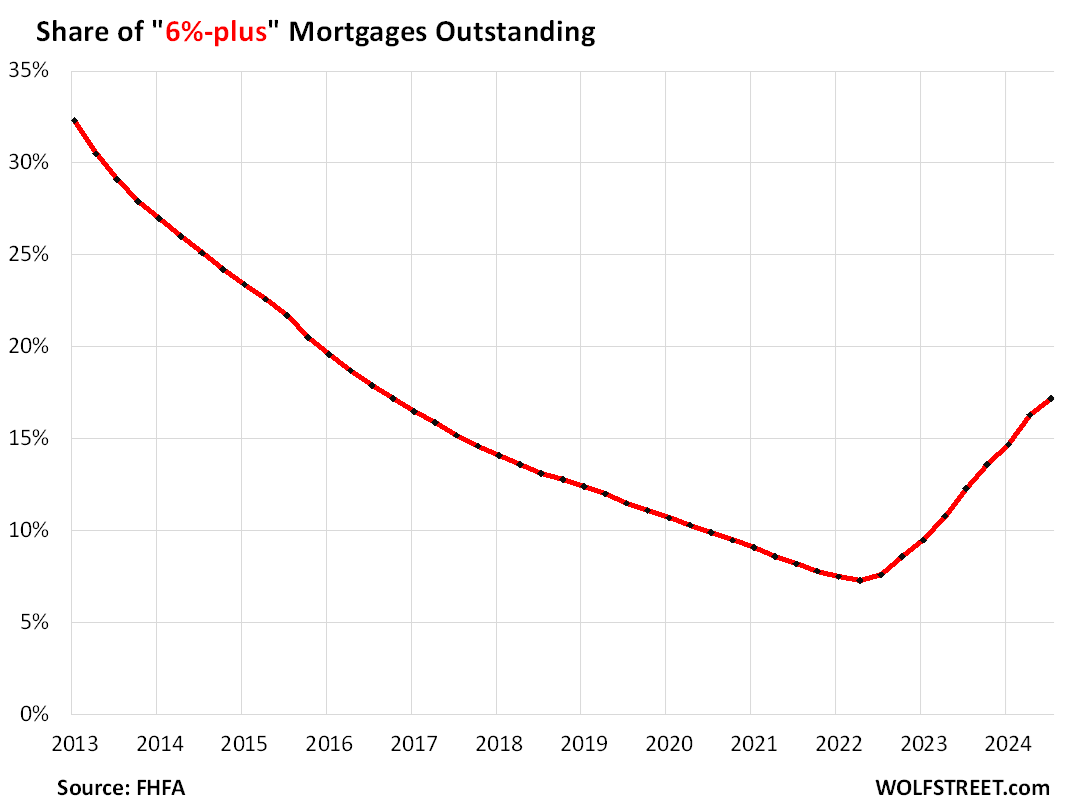

6%-plus mortgages. Conversely, the share of mortgages outstanding that have rates of 6% and higher has more than doubled to 17.2% at the end of Q3 2024, the highest since Q3 2016, from a share of 7.3% at the low point in Q2 2022.

Obviously, this share of 17.2% is still very low. But the share more than doubling in two years is a rapid increase. It reflects purchase mortgages and refinance mortgages with rates of 6% or higher.

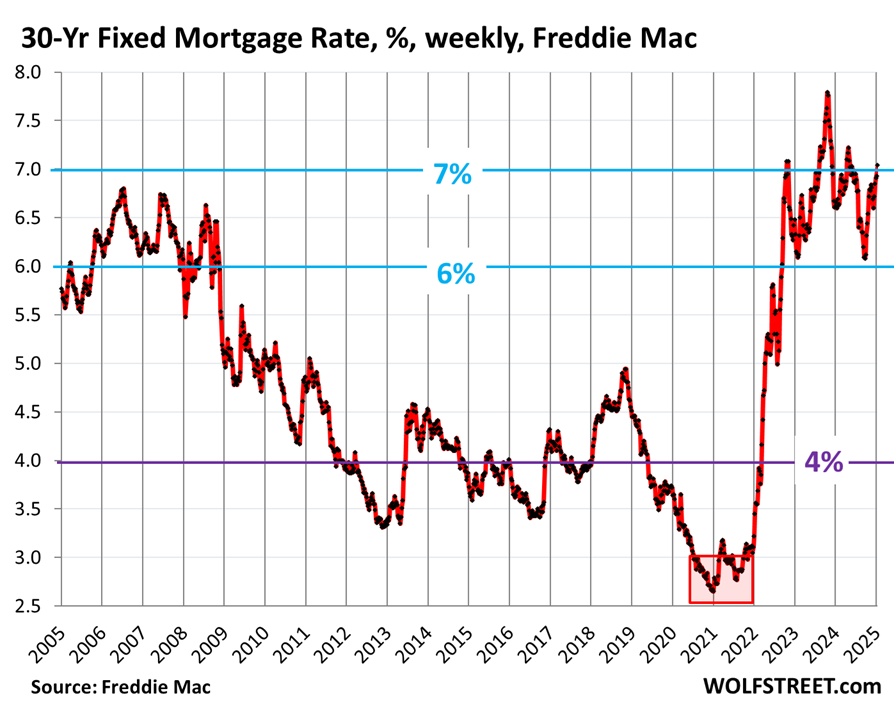

The average 30-year fixed mortgage rate is currently just over 7% and has been above 6% since September 2022, according to Freddie Mac data.

The below-3% 30-year fixed-rate mortgages occurred only during a short period from mid-2020 to late 2021 (red box), triggering an enormous refinancing boom that by Q1 2022 caused nearly a quarter of all outstanding mortgages to have rates of less than 3%.

The 30-year fixed-rate mortgages with rates below 4% occurred periodically starting in 2012 during the era of QE when the Fed bought bonds, including large volumes of Mortgage-Backed Securities to repress mortgage rates.

So these below-4% mortgages are not forever. At some point, “locked-in” homeowners find themselves in a position where they want to, or have to, pay off the old mortgage and take out a new mortgage at a much higher rate. And eventually the locked-in effect begins to fade.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

My mortgage is paid off, but I won’t be selling or buying until prices come down, way down.

RTGDFA. life happens.

I did read the article. I was speaking for myself. You sound jealous because my mortgage is paid off and yours obviously isn’t.

That’s so dumb. Check the index (s&p 500 for example) and imagine you put the money there instead.

I’m bidding on property now

don’t think bank will have low enough reserve

hope to be last bidder so they come to me to make offer

my counter will be – I’ll put down 50% if you give me 30 year 3.5% mortgage for balance

gonna take $50k fixup

looking for couple more rentals

Jim – Stupid to own your home outright? Both real estate and the market will tank, but at least he’ll be able to live in the house. You can’t live in a deflated index fund. Yes, someday, the everything bubble will burst. This time isn’t different.

“Both real estate and the market will tank, but at least he’ll be able to live in the house. You can’t live in a deflated index fund.”

Underrated comment here.

Gotta weigh in here: presumably it was paid off before sub 3% rates came along and you snoozed through that or believed inflation was transitory. I built a Zeroes ladder (Strips) to fully fund the rest of my 3% mortgage rather than pay out off because it put me +$110k to do it that way. 10-year Zeroes are 4.8%; 20-years are 5.1%. Buy the nominal amount of your annual mortgage payments then hold to maturity.

Also, if you own free and clear and are moving to similar housing, your the person who should’ve care what current prices are. If you’re concerned the market is, say, 50% overvalued, you sell into that bubble, then spend the bubble proceeds on your next place. If your downsizing, you win.

Excellent! We paid ours off 8 years ago and haven’t had a mortgage since. It is fun to be the one screwing the banks, as opposed to be on the receiving end, isn’t it?

Jim (commenter below): You assume all my wealth is tied up into my home. That is what’s dumb. I did put money into the S&P 500 index funds, amongst others, for many years and I’m doing quite well. I don’t need you to count my money and give unsolicited advice. I have a financial advisor for advice and guidance.

I meant Jim, the commenter above

Life only happens to people who don’t plan. Having an emergency fund means you aren’t blindsided by sudden expenses or life changes.

See LA

Fair point.

Still waiting for you to learn to say, “Yeah, that was not a well thought out comment”.

Probably will happen when Joe diddy finally starts being honest.

……..ie, not holding my breath.

I’m just a jealous economic loser, so comment is unimportant.

Of the 5 ‘D’s that are cited as the reason for a forced sale, disaster is the only one that could get me. I do have insurance but I digress…

Death, divorce, displacement, and dissatisfaction are not applicable to my circumstances. Well death is, but I don’t think I’ll need to buy another house if that happens…

In my opinion, you should be selling Before prices come down, and buying After they come down.

WClass

If we only had that crystal ball, we could all do that. Wait a minute…..if we all did that no one would ever sell or buy, would they?

And as the article says, life sometimes happens and people have to sell or move regardless of the market.

That is why my always and everyday advice is to pay off the mortgage, any mortgage, as quickly as possible. Having no debts is the first step towards freedom, and having rent to pay or a mortgage nut is a millstone until it is gone.

Good advice and that’s exactly what my spouse and I did. We paid our mortgage off and were able to retire early. But even still, we don’t believe in overpaying for a home, especially for one that is now 300k more than it was four years ago. We don’t care about mortgage rates, since we won’t be needing a mortgage.

I am absolutely happy with my 3% mortgage while earning ~4.6% on a 10 y treasury. Why give up free money? As Wolf says, there are reasons if you have to move and need the money or don’t want to deal with becoming a landlord, but as long as you stay put, it makes zero sense to pay down your mortgage early.

Paul S wisely wrote:

“Having no debts is the first step towards freedom”

My wife and I support that statement 100%!

Having no debts in retirement is a huge stress reliever.

Yes, we understand that every time we buy something using the credit card we are accumulating ‘debt’. We pay the bill in total each month so it doesn’t seem to be oppressive.

When they say..

“I am absolutely happy with my 3% mortgage..”

What they mean is..

“I wish my mortgage was paid off..”

When they say..

“You still have to pay taxes, hoa, insurance and maintenance..”

What they mean is..

“I wish I was a homeowner..”

When the mortgage is paid, you may exit the casino and not gaf.

I will say that depends on several factors. Cap gains being a major one if the home is located in a pricey coastal area. Returning to the rental market another…

with inflation being what it has been and still is, a married couple could burn through 500k faster than their former home drops 500k.

Capital gains being everything in the coastal market. Even if I wanted to sell, give up my 2.5 mortgage and downsize with no mortgage, I would have to pay so much in capital gains that the option is off the table. I will live her until I die most likely so this is one home that will never be available to the market.

AmericaisforAmericans

“one home that will never be available to the market.”

This also means that you will never be a buyer, so one buyer less, and so you contribute to the plunge in demand that we have been seeing. Realtors hate you because they would have made money off you coming and going (selling your current house and buying the next house), and now they don’t make any money off you. And if the house gets sold after you die eons from now, they will only make half of the money they would have made.

Wolf,

You assume that a homeowner will not rent their existing home and move and buy another home, but you then again, you always do.

QQQBall,

I didn’t assume anything. I replied to what “AmericaisforAmericans” said. So read his comment first before you think I assumed anything. AmericaisforAmericans didn’t say anything about rent. He said verbatim, including typo: “I will live her until I die most likely so this is one home that will never be available to the market.”

Ironically, it’s people like you who are keeping the prices inflated. Thanks.

Imagine blaming people who have paid off their mortgage or have a low interest rate for the price of houses!

The idea that home prices are going to come “way down” is a pipe dream. That was a one off, a black swan event, won’t happen again. Maybe they will level off but we simply don’t have enough single family homes in this country to match demand and won’t for many years.

That all markets in the US went to heck together, roughly over the same 5-6 years, was a one-time event over the past few decades. But NO ONE buys the “national median home” — people buy in local markets, at local prices, and local markets go down all the time for a variety of reasons, and stay down. I always like to cite Tulsa as one of the examples because I used to live there when prices where high, and I bought in 1989 after the initial collapse, and I sold in 2000 at a big gain, but well below the high from the early 1980s, and then the buyers lost 30% when the sold 14 years later. The housing bust started in the 1980s, and prices went to hell and stayed in hell until the covid free money arrived. That’s about 40 years. Good luck trying to outwait that. There are lots of local markets like that.

Here are the biggest cities with the biggest declines so far from their respective peaks in 2022:

https://wolfstreet.com/2025/01/19/the-big-cities-with-the-biggest-price-declines-of-single-family-houses-or-condos-from-their-peaks-from-9-to-21/

Tulsa may have gotten hit with a crime wave which affected Real Estate prices. I watch a show on A & E called homicide, 24 hour. They have had non stop series filmed in Tulsa. The Cops and detectives have been very busy in Tulsa.

WR–would love to see the big city grouping with median price relative to median household income. Affordability is always reflected at the national level for price/income, always interesting to look at these things from a closer perspective.

My house is paid off too did it in 2012 and have held since saying the same thing and boy do I regret it sure my house has quadrupled in value but so have the rates and prices of everything else. If I could do it over again I’d have sold during COVID and bought a new house with a low rate. Oh well mine is plenty big and I can afford nice cars and stuff

Really? You regret paying off a home because you don’t own a crystal ball? If that is the standard, I regret not selling everything I own in 2012 and putting it into bitcoin. I should have sold the house and put it on the Commanders beating the Lions too!

Good luck winning every bet.

My mortgage is paid off, but I won’t be selling until the capital gains tax on home sales comes down, way down. The capital gains tax exemption on owner occupied home sales has not been adjusted upwards since the taxation of gains on home sales was last changed in 1997. Some seniors I know hold on to their homes until they die and then their heirs can benefit from a tax free inheritance when the tax basis of the home is adjusted to then current market value.

That is a good plan.

How far would prices have to come down to encourage you to sell?

The tax treatment of capital gains on owner occupied housing would have to change.

…did someone say, “hey stupid” why are you paying over 7% on your mortgage. 17% of people are paying over 7% for their mortgage and 55% of people pay below 4%.

That’s like me paying 4 dollars for a burger while stupid is paying 7 dollars for the same burger.

I know it’s rude to point out the stupid people but…

Young folks are in a hurry to be grown ups. 7 gets them what they think is a home, but just turns out to be an expensive lesson.

7% mortgages are nothing as that is probably the long term average.

When I moved to Los Angeles in 1981 (job transfer), I had to sign on for an 18% one. What’s wrong here are housing prices related to income.

You beat me to it. Back in the early 80’s I too had an 18% mortgage. Here they are whining about 7%!

Lol people are whining about the affordability. Price and rates together. Rightfully so as prices need to come down to be even remotely comparable. Looking at just rates or just prices alone is a waste of time.

Your comment on 18% mortgages has a worse scar misses the fact that 10-year treasuries were paying more than 15% at that time. At that time, some people would have said “why would you pay off a 10% mortgage when 10-year treasuries are yielding 15%?!”

Mine will be forever, or to term I should say. 26 years left at 2.5%. I took the max money I could get and fortunately was very lucky with timing, buying my first during the GFC at age 27 and upgrading twice along the way.

CH,

My Silent Generation parents said that with 6% mortgage and a 12% savings account. They paid off the house in the 90’s when sanity returned.

They were luckier than mortgage holders today. Back then, they also got 8% COLA wage increases on top of raises. That probably caused more inflation but they benefited.

” 7 gets them what they think is a home, but just turns out to be an expensive lesson.”

Along these lines, I always roll my eyes when the phrase “new homeowners” gets tossed around by flacks trying to hype the RRE mkt.

The vast majority of the time those “homeowners” have tiny equity and huge mortgages…talk about self-forged handcuffs.

It really is amazing how it only took 30-40 years to BS a *huge* number of Americans into believing that debt is really “liberation”.

See also…auto market.

Family formation can’t wait forever. Fertility rates are already plunging globally and housing prices are a big factor. The expensive lesson will be when we have an inverted demographic pyramid and there is a tipping point where the young can no longer support the old and infirm. The olds will be shuffled off to the death pods for the greater good. Keep it up and you’ll find out soon enough

Pfft. We will find a way to tax corporations and wealthy people to take care of the olds. That’s a massive voting block.

Besides, housing is only part of the financial equation. Child care, pre-school, college, and even then you still can’t pay some people to have kids.

Absurd, we can import millions of immigrants from 3rd world countries who will gladly work for nothing, live 20 people to a 3br/2ba hovel, and pop out plenty of kids.

Unless the US becomes like Japan and comes to despise the dirty gaijin outsiders.

#Trucker Guy, in Europe those entering from 3rd world countries may pop out plenty of kids. But only first generation, the next generation quickly adapts.

Another point, less the African continent, fertility rates are dropping world wide.

Home toad,

I see your point but it ignores time.

If I joined a burger club 5 years ago that guaranteed $4 burgers for 30 years, then the people who didn’t join are stuck with paying $7 for a burger today. Are they stupid to buy a burger? Some say yes but if you really want a burger and have the savings, you have no choice. :-). The Burger Club may become insolvent with too many active members.

30 year fixed mortgages are the same and distort the market.

Whoever holds below market mortgages, may also become insolvent.

Forgettabout it froggy!

My first mortgage was 18%,,, and the deal IN and OUT was very good for us…

$8K, 20% down on $40K purchase; SOLD with a lot upgraded and fully rehabbed for $105K with total, other than the mortgage considered ”rent.”, invested $16K…

SO, I want all y’all to keep in mind the balance between the higher/normal interest rates and the prices, and NOT get bogged down on high BOTH,,,

OTOH, as WR explains over and over, ya gotta do what ya gotta do when the poop hits the paddle…

“I’m a good frog I am I am”

I guess they’ll have to paid off in 30 years, right? So I guess we’ve got that going for us.

This is a good point. I wonder how many of them are simply being paid off due to having run the full course.

I have known Boomers who did it to minimize costs in retirement or one fellow who was expensively retrofitting his house to give to his children so they would have better lives without a mortgage.

One thing that hit was my Uncle in the early ’80s was being begged weekly by his bank to pay off his 6% mortgage…since he was making way more than that in savings interest! He always laughed and said no, but eventually that was all paid off, too. Mind you 6% on $5000 is different than 6% on $500,000 dollars and wages were proportionately higher in those days, but still.

Wolf is correct that people have to sell and pay off their mortgage for a lot of reasons. Boomer death clock shows almost 6000 a day dying (and 1/3 rd already gone…)…

It’s in the article these rates were only available for a short period after the pandemic.

Watched the new Presidents comments today.

Interesting but it’s not the cost of apples people are upset about.

It’s auto insurance ($thousands)

Homeowners insurance (up $thousands)

Property taxes (up $thousands)

etc.

And the RTO order for fed employess will be interesting. Interesing times

It’s good to keep this in mind. The three immediate costs with homeowner ship is your partners, the tax man, the insurance man and the banker. getting rid of the banker just changes the number, not the burden. “free and clear” is a misnomer; everyone should understand this.

That RTO order is huge. I heard my daughter-in-law screaming and crying (and she lives 200 miles away.) She’s actually going to have to get dressed again instead of living in her jammies.!

I actually am upset about the price of apples and other produce. My grocery bill for myself is the 2nd largest bill, coming in close to $500/mo. (I’m in Richmond, VA). I don’t buy meat or dairy. I’m underweight. I try to buy in season produce.

Property tax on condo is 2k a year.

Calculating my insurance is tricky bc HOA ($260/mo) covers part and then most of the interior is bundled with my car.

For full coverage on auto I switched and am less than $100/mo again (Allstate slowly, then somewhat quickly, upped from $100 to $200 over the course of a year or 2. Like it switched to $104. Then $111. Then $118. I turn my back for a second and it’s almost $200).

Meanwhile if I wanted an apple per day (I do but I don’t bother anymore) – the last one I tried to buy was $2.24, which I left at the register – it would cost me $67/mo or $817 for the year.

I’d also like 1/3 box of blueberries ($5-8/box), kiwi (almost $1 each – I eat the skin so I want the golden ones), and enjoy tomatoes on almost everything, esp since don’t buy cheese so I need some juiciness. Last time I went to buy one that looked perfect for tomato sandwich, in peak tomato season… It was almost $4.50. Not even organic. Onions are over $1 each. This is ridiculous. This is all Kroger btw.

I hear you; my only thought on the cost of apples is that consumers have a lot of choice on what they might want to eat. But of course we all have to eat and so maybe it’s not a great comparison.

$4.50 for a tomato? Unreal. Time for Purina Human Chow.

Soylent Green Grimp……,Soylent Green!

And those are regular grocery store prices?

Even at more expensive stores like Trader Joes I’ve never seen apples >$1 ea up by me (Boston).

Marie Callender meals, $2.50 per

Because cost of building is triple the cost

Banks love the return to office since its “propping up” the dying CMBS market. Its also a positive feedback loop in shedding low interest rate assets for higher ones. A win win for the banks and a total loss for the common man.

1. Just q quibble: CMBS are held by investors, not banks. Banks hold the CRE loans outright. But return to the office is not affecting the empty office space on the market for lease, it’s filling office space that companies retained and that was largely unused.

2. Most of the residential mortgages are guaranteed/held by the government, which packaged them into MBS and sold them to investors. Banks don’t hold a lot of residential mortgages anymore.

I’ve seen comments from federal workers that a whole lot of office space was jettisoned after Covid to save money, so in many cases there isn’t an office to return to. I know my company at the time was engaged in ruthless pruning of office holdings and moved almost all staff to remote.

I don’t know that companies like that are in the mood to take on a bunch of new leases, so the whole thing may be performance theater, especially as the new administration is focused on cost cutting. Smells mostly like a way to get a bunch of people to quit without having to offer them severance packages.

This RTO order is just a form of soft lay-off.

Horrible that Americans would be required to get dressed and go to work… the humanity. It’s not to hard to get dressed, look presentable and brave the world, driving to work you get to see all the homeless beggars wandering aimlessly. At work you can use the microwave for a tasty lunchtime feast.

There are fully remote workers who were hired or moved during the pandemic, and live outside their duty station’s commuting area, comprising 14% of federal workers. They will have to move or quit, unless “provided that the department and agency heads shall make exemptions they deem necessary” becomes big enough to drive a truck through.

But for the local workers, I don’t see many walking away from a civil service job just because they have to show up. Most are already working in person part of the time due to RTO mandates implemented over the past couple of years. Overwhelming majority will show up 5 days a week if required.

Re: Banks don’t hold a lot of residential mortgages anymore.

Is the article in the below correct that TD holds these mortgages?

Is TD the exception, or is $9 billion of residential mortgage loans not a large amount?

$9 billion is minuscule. There are $12.5 trillion with a T in mortgages outstanding. $9 billion is 0.07% of $12.5 trillion. If this is mortgages in the Bay Area, it may only be 6,000 mortgages.

Banks have $23 trillion with a T in assets. Mortgages make up only a minuscule portion of that $23 trillion. Most mortgages are held by investors that bought MBS, both government-backed MBS and private-label MBS.

Thank you for the excellent article, Wolf!

It looks like life is happening (death, divorce, disaster, dissatisfaction, and displacement) is happening right on schedule. 7-10 years for divorce, house dissatisfaction, and job displacement (The 7 year itch). That’s why 30 year mortgage rates are based on the 10 year Treasury. It has been almost 5 years since rates were at their lowest. Time flies…

Regarding Return To Office, the pandemic caused an unnatural sudden transition that happened in less than a year. Office space became empty, restaurants and shops went out of business nearby, and transportation dried up due to lack of customers.

Bringing office workers back should help with bringing back the empty restaurants and shops nearby. The transportation back into these areas should also recover.

Who benefits? The banks with their dismal CRE loans, the cities with their sales taxes, and the transportation revenue for parking,

trains, buses, Ubers, etc.

The office workers will have more expenses for eating at restaurants, visiting shops, taking any transportation.

Well, back to my PB&J in my home office(for now)

RTO will clear up the golf courses during the week for us retirees too!

Good point!

I wonder if golf courses will suffer?

It is one big wackamole.

Right in the middle of the Pandemic, Spring 2020 we did a case on E Street in Downtown DC. right across the street from the FBI building. I sat in the car right where I could see the entrance to the FBI. I was there 2 hours and didn’t see a single person enter or exit the building. The same could be said for the rest of the government buildings in downtown DC. Ending WFH in the government is long overdue, and should have been ended long ago.

They’re not working from anywhere.

Piecing together some quickly found data:

34% of households rent.

Of the 66% that are “homeowners”, ~40% of that 66% actually own the home (paid off) and the other 60% of that 66%, or about 40% of ALL households are people living in houses that they are paying off for themselves. Call them “Homepayers”. 55% have mortgages under 4%, so roughly 22% of all US households are owner- occupied by mortgage locked homepayers. 1/5 of all households but dropping every day as noted in this article.

Landlords have mortgages too, but those properties are much less affected by the job and divorce/death issues – they just find another tenant. A rental house financed at under 4% is a cash generating machine that should never be paid off early.

you’re assuming the rental house financed at under 4% was not purchased at peak 2022 pricing in places like austin or miami and thus can’t command enough rent to cover those costs, even at sub-4%.

Most rental property is bought with cash .most banks wouldn’t finance unless at least 50%down on a rental. That’s why most are either bought with REITs or purchased as a starter home and then rented out for upgrades.

I think the biggest shock for the “under 4%” mortgage holders is when they put the house on the market and discover that with today’s 6%+ mortgage rates, they have to take a lower price for the house than the evaluation they’ve been taxed and paid taxes on for some years. And some may struggle to get what they still owe on the house.

If they buy a new house, it will be lower as well so it offsets. Unless they brought recently then they may need to bring cash to the table if they didn’t put a big down payment.

Old Engineer,

If they are emotional optimists, they may already have an offer on another home.

The pressure is on to close both houses. Somebody will have to cough up the cash difference and it is usually whoever is more emotional with the move.

Or I just pay off my 2.875% mortgage per the terms of it, and continue to live in my house afterward.

My 1.99 is feeling really great right now. I think I’m staying in my rambler

4%? Hell, it’s 1.9% on two of my rentals…

Life is all about timing and choices…

Same as it ever was.

I agree these homeowners probably had no choice. Each lost mortgage below 4% represent the failure of someone’s dream.

The scale of loss calls into question the assumptions behind the ideals of the “American dream” – that you’ll buy a house and slowly pay it off and retire.

If life is this volatile- that a large percentage of homeowners cannot even hold onto a great-deal mortgage for even a couple of years – then we should all be in apartments rather than buying these suburban albatrosses.

And don’t get me started on how much cheaper it is to rent than to buy. The dream is now a nightmare.

Well, it’s very clear to me that the corporate property owners would like nothing more than to see all of us crammed into large apartment buildings.

Careful what you wish for.

Well, it is a far more productive use of land when you can house 40 households instead of 1 or 2. When you look at most of Europe you don’t see these swaths of builder grade mass production tract homes that became popular in the US after WWII.

Maximizing the space is just more sensible, even if American have been groomed since birth that Single Family on a chunk of dirt is the middle class indicator.

LOL!

Yes, things are very different in Europe (in some locations), but I wasn’t commenting on land productivity, even though I grew up on a farm and know something about that. Economics is a social science Sandy, and human behavior is a funny thing. Again, be careful what you wish for. Livable cities are definitely good, but that requires rule of law and altruistic leaders. Look at the major cities of the U.S. They are being run but corrupt dirtbags. See the problem yet?

“roomed since birth that Single Family on a chunk of dirt is the middle class indicator”

I have a really, really loud stereo system. Trust me, you don’t want to share a wall with me.

I laughed at that comment about corruption in those bad cities. I lived in a small rural Texas county for 20 years. The entire county government was an exercise in looting. Members of the sheriff’s department were dealing drugs.

Sandy, you must have grown up in a modern gulag and USSR project that is what American cities are becoming. You might like Asian cities, with populations, like, 10 million plus. The horror. Enjoy your theories and proclamations about what life is/is for, and please stay very far away from me.

Not really. Maybe the 3% mortgage house just doesn’t work for them anymore.

If I buy a basic car for $20k and finance at 0% for 60 months when I’m 20 and in college, does that mean trading it in for a $35k car when I’m 24 and making much more at a real job is a bad idea? But what about that sweet 0% loan?

As always, it’s not the interest rate that ultimately matters. It’s the price, the principal. A lot of people with 3% mortgages from late 2021 paid absolute top dollar for their houses and can only sell at a loss now. Wolf’s frequent housing price articles show the graphs. It will take a long time for all of this to work itself out.

I think I would argue that it’s really about the monthly payment. Interest rate just impacts the nut by increasing how much the seller can overcharge you.

Huh? Many simply paid off their mortgages in full and have no loans on their house at all which is the real ‘American Dream’ that everyone should fully embrace and fulfill.

Exactly, and when my daughter inherits this paid off house someday (not so soon, I hope), she will get the increased appraised value as her cost basis. That’s a benefit no one talks much about.

Anthony,

I’m confused – how is a higher assessment beneficial? Won’t it just cost her more $$ in higher insurance & tax payments?

ShortTlt is correct. The benefit of inheriting a house (if you’re going to live in it) is that it is NOT appraised at the higher, current value at the time of your death. Property taxes are thus not increased.

ShortTLT,

A person inheriting property gets a “step-up” in the tax basis of a property to its FMV on the date of the owner’s death. If the property has increased in value (and/or the tax basis has decreased due to depreciation) the step-up is a significant tax benefit to the new owner.

Bongo,

It’s not that ShortTLT is correct or incorrect. It’s that Anthony A. is talking about the impact of the estate tax’s step-up in basis on future income taxes for the estate beneficiary. ShortTLT on the other hand is focused on carrying costs of the property such as insurance and property taxes. Those are separate considerations.

Rojogrande,

I can see how the step up is beneficial if Anthony’s daughter plans to sell the house shortly after inherenting it. I’m not sure how else it’s beneficial, but I’m not really familar with estate planning. Feel free to enlighten me.

ShortTLT – The cost of insurance and tax payments are set by the state and go up based on the appraised value. What Anthony is saying is that when his daughter goes to sell the house, her cost basis the IRS will use will be the day she inherits the house.

So if Anthony bought the house for 100k and it is worth 300k now, and lets say the daughter inherits the house tomorrow, the cost basis for taxes is 300k when she tries to sell it. That is a savings of 200k in cap gains.

If Anthony was to give the house as a gift , her cost basis for capital gains tax would be 100k as what Anthony paid for it.

ru82,

That makes sense – I was assuming Anthony’s daughter would move in rather than sell it. But I see how the increased cost basis helps in the latter case.

“The cost of insurance and tax payments are set by the state”

Minor quibble with that: in my state, the towns do assessing and decide the tax payment.

Thanks for reminding me that I need to submit my town’s tax abatement form.

I’m not going to pay off a 2.7% mtg when T-bills still yield >4% and I can profit off the spread.

T Bills pay 4%. okay. Is the 4% taxable?

SGOV still yielding 4.5%.

Sorry to say that even my paid off home still incurs an operating cost yearly.

Heck I’m glad I sold off almost all my properties between 2022 – 2024. Only 1 more condo to go in vegas and that’s going up on the market in the next month or so.

My old mountain neighbor just told me insurance to insure is now up to almost 12k and asking me for me help on who can provide a better rate.

In 2019 I was able to insure my home next door for under 3k and in 2021 it was 4.6k.

Even my modest overpriced home insurance is up around 100% since 2019.

That might have been the American Dream 50 years ago. Todays American Dream is to keep using your equity to buy bigger and bigger houses/boats/toys/RVs until you live the lavish life you deserve. Followed by complaining about how your kids never move out because the rents are too high.

I had mortgages on my first and second homes in the 70’s. Since then it has always been cash.

If your old, like over forty, perhaps you need better spending and saving habits!

Over 40 is old? Oh lord almighty..

It would be interesting to see the dollar weighted percentage of mortgages below 4%, but there is no doubt that this will continue to decline, though maybe not a whole lot from here unless relocations begin to pick up.

It’s interesting that the below-4% mortgages has dropped faster than the below-3% mortgages.

Is that because more (relative to the below-3%) of the 3-4% mortgages were ARMs or shorter-term (3-5 year) fixed loans?

I also recall that a mortgage for purchasing an investment property (ie AirBNB) required a higher rate loan ~4% since it was not a primary home. I wonder if more of these investors are cashing in while prices are still high? Primary homeowners are more likely to ride it out and enjoy their home with their affordable 3% payments.

I’ve read that there’s a TON of fraud there, nobody checks whether or not you are actually occupying the home or renting it out. It’s the NINJA loan for the 2000s.

Its all fun and games until the place burns down and the insurance company verifies if that info (owner occupied or rental, AirBNB, college student flophouse) was disclosed by the insured.

Shiloh1….

What makes you think they lied to the insurance company? The mortgage broker maybe, but why the insurance company?

I never felt the whole “locked-in” thing. Bought a house about 10 years ago, not at the bottom in my area but close enough. That rate wasn’t terrible, but then refinanced at just under 2.5%. My only regrets are getting a 15 year instead of 30. Those rates will probably never come again and I feel lucked-in, not locked in. I plan to never sell because about the time this house is paid off I can start buying a condo at a beach somewhere for my wife and I in retirement, and just rent out my house to someone who didn’t or couldn’t buy. At the rate local rents have increased, rent on my (now) family home will mostly pay for a condo. Even now, I could rent this house out for probably 25% to 30% more than my payment on a 15 year mortgage. Definitely NOT locked in, definitely lucked-in. My kids can sell it when they inherit it from us, or live in it or rwnt it out or whatever they want.

With the standard deduction being as high as it is now, the benefits of Mortgage interest deductability is neglegable for 90% of the population. So paying of a 4% mortgage when the CD rate is 4 1/2% and going lower, is pretty much of a wash. I did this calculation back a decade and 1/2 ago when interest rates were much higher, and decided to pay off the mortgage. It turned out to be a good move. Saved a lot of interest and wound up with a lower tax rate after going on standard deduction.

Not only is the mortgage interest deduction not very useful for most, but with a combined cap on state income and property tax, the property tax deduction becomes useless to many. These changes tipped the scales slightly with TCJA in 2017 to hurt the homeowner. The off-set to that was the increase to the standard deduction, which helped the renter more disproportionately. Winners and losers.

I wonder what happened to commenter Debtfreebubba. I no longer see his comments anymore.

Off bragging elsewhere? Hee Hee?

Howdy Lucca Debt Free Bubba never left and always reads articles by the Wolfman. Bubba just quit commenting. It seemed the prisoners did not like being called what they are so I stopped typing. I had to comment below today since the Wolfman proved me correct. HEE HEE

I was worried you might have taken out a loan!

Bubba I always liked your comments. I was never a prisoner. I never buy anything unless I have cash. Debts are obligations and I hate owing anything to anyone.

People will always need to move to get a bigger place, smaller place or they’ll refi to pay for various life expenses (college, remodel, ADU to live with their kids, etc…).

The Fed was 100% in the wrong to suppress mortgage rates so far. It will take years to fix the issue and a lot of young people feel like they had their futures and American dream were stolen from them. And I can’t say I disagree even though I have a 2.5% mortgage rate.

I have 2 homes and I would say without hesitation that what FED did was crime.

But who can hold them accountable ? No one.

I can only say this to people: Rich people have taken control of all things, and they’d make sure assets don’t fall in price.

Great piece, Wolf. That drop from the share of mortgage that are sub-4% from about 65% to about 55% is a larger decline than I’d have guessed. What also strikes me about this is that—despite that significant drop in the percentage of homeowners who are “locked in” to where it now represents just over half of those with mortgages—home sales have still not picked up in that span, and remain at dismal levels.

This is further evidence that, while “lock in” is certainly part of the story with this dysfunctional market, it is hardly all of it: prices are also too damn high!!!

It doesn’t make a lot of financial sense to pay any amount of interest to hold an asset that is trending lower in price. Perhaps that’s why some people are selling now, particularly when renting is the better financial option in many locations.

Once upward price momentum stalls at an overvalued level, the RE market becomes very dangerous for all buyers, including those who buy with cash.

The decision appears to be – sell now or wait 5-10 years to get another chance at today’s price levels. If interest rates keep climbing because of Trump’s growth initiatives, it could get a lot uglier, particularly when Trump announces his plans to increase housing supply, which they say is coming. It could accelerate matters.

even if interest rates don’t continue climbing, prices will drop even more. the numbers simply don’t work.

1:04 PM 1/21/2025

Dow 44,025.81 537.98 1.24%

S&P 500 6,049.24 52.58 0.88%

Nasdaq 19,756.78 126.58 0.64%

VIX 15.06 -0.91 -5.70%

Gold 2,759.30 10.60 0.39%

Oil 76.09 -1.79 -2.30%

Howdy Folks. Even with the current decline, that still means there are lots and lots of prisoners still handcuffed in there own homes… The continuing and rising inflation should keep them as prisoners for decades to come…. You could become a land lord and free yourself…..Good Luck.

Everyone is talking about “normal” interest rates of 6 or 7 % as the single reason for real estate not moving lower ever again. That is also comingled with housing prices being double or even triple house prices. I bought first home for $18K and at least 4 other homes for $250K or less. So the second part of the problem is inflated housing prices combined with higher interest= nobody has high enough salaries or savings for down & monthly payments. So in my mind, lenders need to figure a new way to finance. 30 years should not give lenders such huge profits. Go back to simple interest and be happy with less profit while earning some profit. OR do nothing and earn nothing!

Correct. Prices are the issue. It’s not rates. You can make anything expensive or cheap based on the price, not the rate.

Want to make a late comment to: “Ugly Charts of US Auto Sales, 2024”.

Quite obvious that car makers , despite no bottlenecks in supply chains, decided to reduce supply while hiking prices (via add-ones, etc). A simple example: 2.5M cars/trucks/SUVs @ $40k = $100M in revenues. 2.0 M vehicles @$50k = $100M in revenues. Known strategy with Kia/Hyundai, Toyota, Ford, Stellantis, GM, etc. Add-ons are primarily electronics or leather upholstery but not body sheets, or different body styles (sedan vs. coupe, etc) – so these are “easy” add-ons . Looks almost like oligopoly conspiracy to lower supply # of vehicles on the market, so the price competition will not occur based on oversupply. Obviously the goal of this strategy has been to maximize profits , while reducing COGS (total expenses). The “ugly charts in vehicle supplies” is a strategic move of the auto manufacturers, imo. Lower supply of used vehicles helps.

The dynamics were different: automakers were forced to reduce supply because they ran out of semiconductors for even mundane parts (rearview mirrors, etc.) and couldn’t manufacture enough vehicles. This was a global issue, impacting all automakers, not just in the US. So what they then did was — given that they could only get a limited number of semiconductors to produce a limited number of vehicles — they prioritized expensive, loaded models that they could charge lots of dollars for, and they raised prices on those expensive models, and they deprioritized their lower-profit units, including for US rental fleets that normally buy 2.5-3.5 million new vehicles a year, but suddenly couldn’t get their units, and ended up buying used vehicles at the auction, which drove up used vehicle auction prices. We discussed these here endlessly in real time.

That is not to say that there isn’t oligopolistic pricing behavior in this industry. It has existed for many years with full-size pickup trucks, where there were only four high-volume makers (Nissan doesn’t count because it never made enough Titans and now discontinued making them). Have a look at the pricing of the Ford F-150 XLT going back to 1990, compared to the sedan Camry:

https://wolfstreet.com/2024/11/11/our-f-150-xlt-camry-le-price-index-going-back-to-1990-is-updated-with-2025-model-year-prices-there-were-some-twists/

I read these excellent Wolf Street articles and the resulting comments with a bit of pity for some folks.

Not many seem to understand the sense of well being, satisfaction, or maybe its freedom from concerns about rates, buyer or seller markets or even the current “valuation” of my home. How? Debt free, none, and carry no CC debt. All I pay is my taxes and daily living expenses.

Plan for being debt free early enough and you can enjoy a fairly stress free life. I wish I had a better vocabulary to describe it, suffice to say having control unimpacted by anyone’s rates or market conditions is simply liberating.

Some like myself…only learn the hard way.

GFC was no fun. Never again on the debt bandwagon.

No need to feel bad for others “Imposter”, life is a grind and meant to be.

But on a happy note,

Soon I’ll be able to walk down the street with my robot by my side, I’ll call her “lima”. I’ll paint her green and teach her how to nibble on my ear.

“Us old folks” were raised by parents whose primary financial goal was to pay off their house. Some of that determination to “ have a roof over our heads” was passed on. Clearly Imposter you were bit by that bug and now, like me, enjoy that feeling that is indeed hard to put into words. It hurts my head to do all of the Houdini Math to determine if your home is a safe investment. Of course it is safe. It is your home. I have been a residential remodeler working for homeowners for 40 years and have worked through all the cycles. I can safely state now a great majority of folks aren’t going anywhere and are increasingly spending the money that they need to make their home perfect for them. Not worrying about out-pricing the neighborhood. They understand that there is real value in improving their 30 year old house and appraised comparison values do not have to come from the house next door but can come from five neighborhoods over. Not worrying about selling it. Understand that the kids will benefit from stepped up basis. Investing extra money. We get many calls every day. It is my belief that this is a trend that is going to keep growing and growing and pride in home ownership will continue to grow.

I actually see the trend going the other way. The percentage of listings from folks who bought their houses 0-4 years ago is much higher than one should expect.

I think a lot folks bought based on FOMO and overstretched their finances to buy. They are rightly worried about the momentum shift. New potential buyers should be worried as well.

It’s a completely different story for those who bought 5 years ago, or 20 years ago, or 50 years ago. Affordability is now at an all-time low. That is saying something very loudly.

DM: America’s top banker Jamie Dimon issues perilous warning over US stock market just hours after Trump took office

JPMorgan Chase CEO Jamie Dimon has issued a warning about the US stock market.

I think Dimon is just upset that he’s being iced out by Trump. Now Trump is bashing Moynihan too. Republicans used to complain about government picking winners and losers well you ain’t seen nothin yet

Hi Wolf. What does this mean for people with no mortgage on their house – are they somehow screwed if some government bailout should occur?

No, it doesn’t mean that. Last time the housing market was bailed out by the Fed and the government, it was the banks that got bailed out, and the homeowners that hung on to their houses got bailed out (prices shot up), whether these homeowners had a mortgage or not didn’t make any difference. But remember, it took 3 years of QE and 0% for home prices to stop declining (in 2011).

Locked in has it plus and minuses.

Minus – it is hard to move up or move to a different city.

Plus – A low rate and we all know house prices will be higher in 5 years from now. One of the benefits from inflation even at 3 %. A 400k house with 3% inflation of 5 years will become a $464k house.

All i am saying, it is hard to fight inflation.

“we all know house prices will be higher in 5 years from now”

Do we though? How do we know that?

“we all know house prices will be higher in 5 years from now”

How is that a plus? You’ll just have to pay more $$$ to the taxman and insurance man…

Good point. We do not know.

-I am just basing this on continued YOY inflation.

70% of all countries are cutting interest rates to push liquidity.

-Economy is still doing well and it is very possible that –Trump lower corporation taxes going forward and thus boosting EPS for US companies. Stock buybacks. Pay raises.

– Low unemployment as companies on shore.

As of today…there does not appear to be a black swan. (Debt that cannot be paid back)

But I am many times wrong.

Real Estate agents are singing the blues over these locked in homeowners. Nobody is buying and nobody is selling unless they actually HAVE to. Real Estate prices are no longer going up like they used to. The case for buying now has never been worse. The risks are high and the promises of quick appreciation is over. Houses are unaffordable and becoming more so with each passing day as mortgage rates move up to 8% and higher. Only the rich will own homes. The rest of the middle class will be lucky to get into a small 2 bedroom Condo near their place of employment.

That is a true fact, the justification for buying at these insane prices because “you’ll make it up in equity in no time flat” is out the door. I know sales are still happening, but I’m having trouble figuring out what kind of fool buys right now – unless it’s a location where prices never had a major run up (likely no place where STR is viable).

Sandy,I would “buy”right now with a reasonable price,still not even close.

I personally want a lot of land(20 acres +) and a modest home(will put up workshop).

When done,not worried about pricing as this is the home I will die in short of zombie invasion ect.,may die in zombie invasion!

Quick question. I’m almost sure I saw a new post/article provided yesterday but it seems to have disappeared. Am I missing something from my end? Did something change with the website? Thanks,

There is no record of you posting a comment yesterday (assuming you used the same login email). The last comment I have is from Nov 19. None of your comments were deleted. Maybe something didn’t work when you tried to post it.

Sorry Wolf for the confusion as I thought you had published an article with yesterday’s date of 1/21/25. When I access your site, it jumps from the article dated 1/20/25 to 1/22/25 so I was wondering if you offered an article dated 1/21/25. If not, no worries and disregard my post. Just wanted to make sure I didn’t miss something along the way.

Oh I see what you mean. Yes, we were cross-country skiing for the past few days and just came back. Given that this is my annual big vacation or whatever, I didn’t post a full load of articles. But we had a blast. Perfect conditions for skate-skiing, sunny, and cold. One day was crazy-windy, and that was a battle that we’ll never forget and part of the fun too.

I sold an investment property and made a bundle of money. I debated on paying off two loans, a combined total of 215k, that would save me $1350 monthly but have held off. For peace of mind I WANT to do it, but with rates at 2.75 and 3.5 on the other it’s hard to do….SGOV for the short term until I decide I guess.

Dave, Can you elaborate on what you see as an up side of not paying off loans costing you 2.75% and 3.5% interest? Paying off would free up about $16.2k to use as you please. I’m not a finance guy by any stretch, but it seems like the interest is benefitting only the creditor not you.

I’m not Dave, but I also have money in SGOV which currently yields 4.5%.

With a 2.7% mtg myself I’d rather profit off the spread than pay down add’l principal.

“the interest is benefitting only the creditor not you.”

I’d argue any creditor holding a long-duration 2.75% loan (when the risk-free rate is >4%) is on the losing side of the trade.

I did a “thought exercise” for the fun of it. I used one of the numerous web based mortgage loan calculators with the following assumptions: 30 year loan, 0% down, 350K initial loan. For a 7% interest, I get monthly payments of $2328.56 for just the principal and interest. For a 3% interest rate, I get a monthly payment of $1475.61. I wondered how much the “selling price” of the $350K home would have to be reduced to match the 3% monthly payment. At a 7% interest rate, the home “sale price” would have to be approximately $225K to get close to the 3% monthly payment (actual loan payment would be $1496.93). No wonder all the people with 3% loans are staying put if possible, unless the guy with the $350K house is willing to reduce his price 35%.

A lot of the mortgage sites are now saying “6-7 % is the new normal, and it is a great time to buy a home”. Big change in viewpoint from several months ago, except for the “great time to buy a home”. LOL

yes, because they want to convince buyers to buy at stupid high prices.

Some real data:

– my house was locked in a 15 year about 2.5% although small compared to equity. We could have paid it off but why.

– but I didn’t like the house and time to downsize. We decided to rent smaller in a more beachy area close to SD and sell our big home in Orange County, CA. T bond interest on old equity will cover 100% of new rent. Will take a year or two to think about if we keep renting, buy in CA again, move out of state, etc as we enter retirement.

– OC house sold in one day $100k over asking, and we were aggressive on list price. Buyers on the higher end OC are snapping up due to pressure from the LA fire refugees, who are mostly well-to-do, and this area is only 45 mins from LAX. We also have a back-up offer at same $100k over asking, and realtor said she is still getting requests for viewings.

– New buyers are putting only 30% down, so our small low interest mortgage is being replaced by large high percentage mortgage

– old neighbor is moving out of state, but cap gains on her home after 35 years in CA will kill her, so she will be turning it into a long term rental and hold/rent until death. The same fire refugee dynamic on our sale will help her for rent.

Sometime it is all about the timing. Thanks for the boots on the ground.

There is also the steady amortization of fixed rate mortgages. My 2.25% mortgage pays down by about 3% per year.

The amortization of a 30-year mortgage is all but “steady.” In the first year, it pays down very little principal, and most of the amounts paid go to interest. But in year 30, nearly all of the amounts paid go to principal and very little to interest. You can build an amortization schedule on a spreadsheet that shows you how much in each mortgage payment goes to interest (declining every month) and how much to principal (rising every month). If you make extra principal payments early on, it changes this dramatically, with dramatically lower overall interest payments. Everyone with a mortgage should have an amortization schedule on a spreadsheet. It’s very instructive.

Wolf – this is a great recap – but it might also be nice to add how many homes are owned without mortgages and how those trend lines are intersecting with everything else . Large increases in purchasing power for mortgage holders occurred from 2013 to 2022 and are now reversing – but if people are paying off mortgages at a faster rate, it might offset the purchasing power declines. Just a thought.

We refinanced a few years ago when I was an MLO through the company I worked for. We went from 5% to 2.375%, which dropped our monthly payments to just over $1,100 (from $1500). We have continued to pay what we used to pay – $1,600/month – in an effort to rapidly pay down our mortgage and unencumber ourselves of an almost $200k debt burden as soon as possible. We do not like carrying debt.

My parents have argued we should invest that extra money instead, to which I pointed out that investing 10 grand at 10% possible return (thus “earning” another $1,000) isn’t as effective as reducing the 2.375% debt of $200k, for which I pay OVER 1k in interest costs per year. They didn’t get it.

And this is why so few people understand, even remotely, what’s happening in the economy.