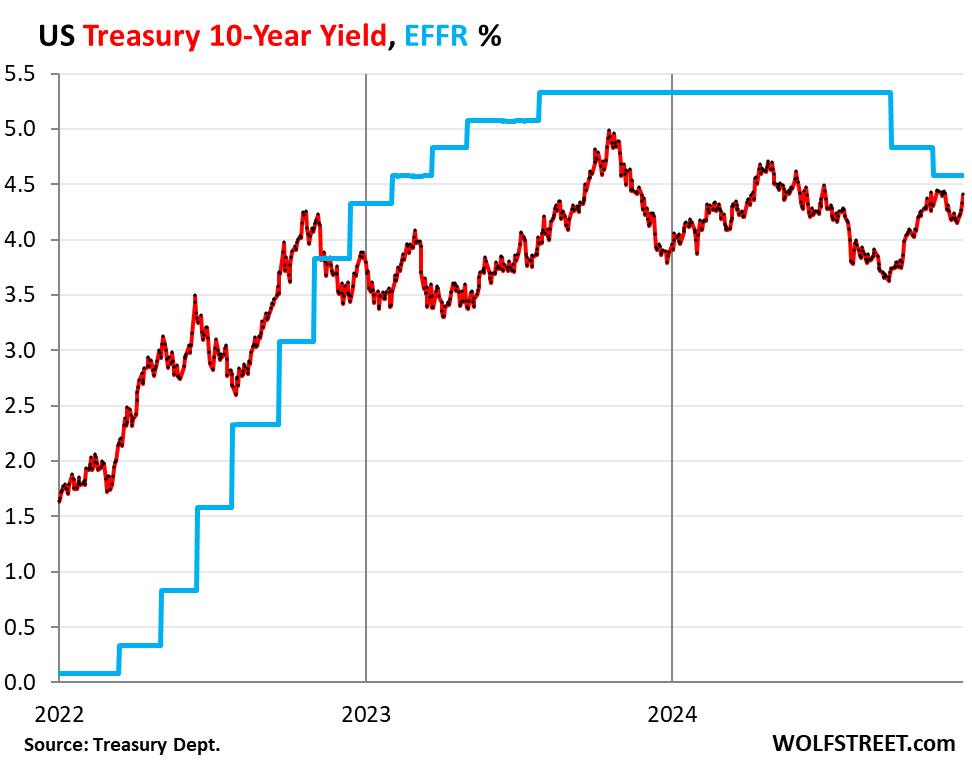

Fed cut by 75 basis points since September while 10-year Treasury yield rose by 75 basis points to 4.40%, as Bond Market frets about Inflation & Supply.

By Wolf Richter for WOLF STREET.

The 10-year Treasury yield jumped by 7 basis points on Friday, to 4.40%, having risen five trading days in a row. It’s now just 4 basis points below the post-rate-cut closing high on November 13 (4.44%). These yields are the highest since June.

Since the eve of the Fed’s September 18 rate cut, the 10-year yield has risen by 75 basis points, while the Fed has cut by 75 basis points. The difference is 150 basis points! The 10-year yield is now higher than all shorter-term yields.

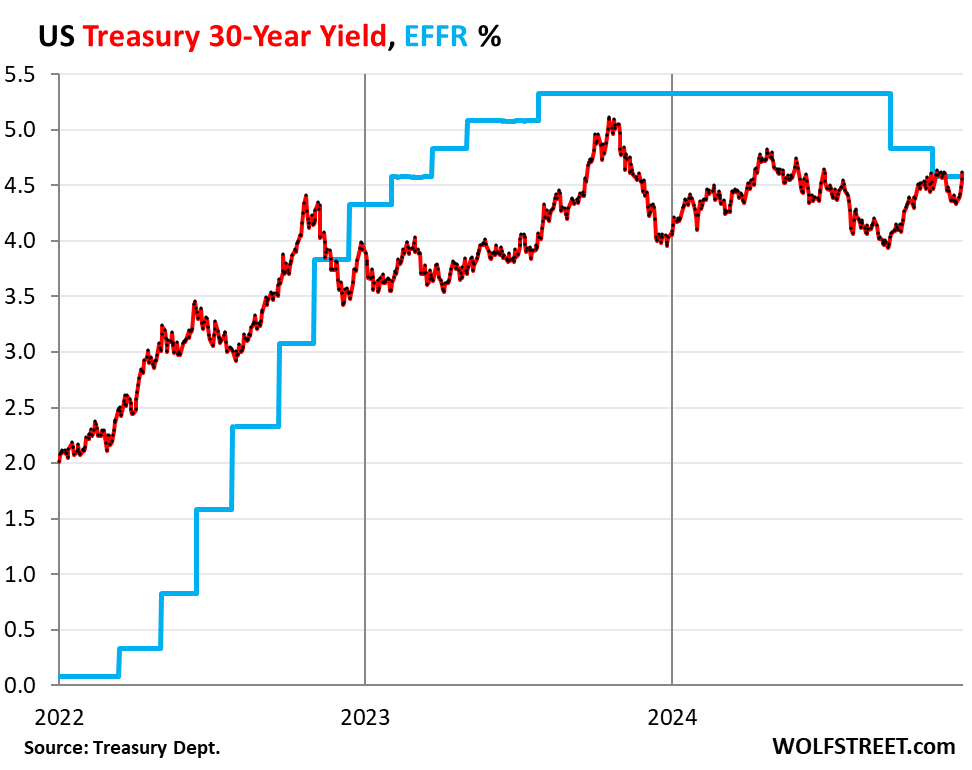

The 30-year Treasury yield jumped by 6 basis points on Friday to 4.61%, now once again above the federal funds rate (4.58%), which the Fed actively brackets with its policy rates. It rose for six trading days in a row and is now just a hair from the November 13 rate-cut high (4.63%). Both of them are the highest since May 2024.

Since the eve of the rate cut on September 18, the 30-year yield has risen by 65 basis points, while the Fed has cut by 75 basis points. Rising bond yields means dropping bond prices.

Among the drivers of higher long-term yields are renewed inflation fears and prospects of a continued tsunami of supply of new debt to finance the massive flow of deficits that the market envisions, even as the Fed is unloading securities through QT and has already shed $2.1 trillion.

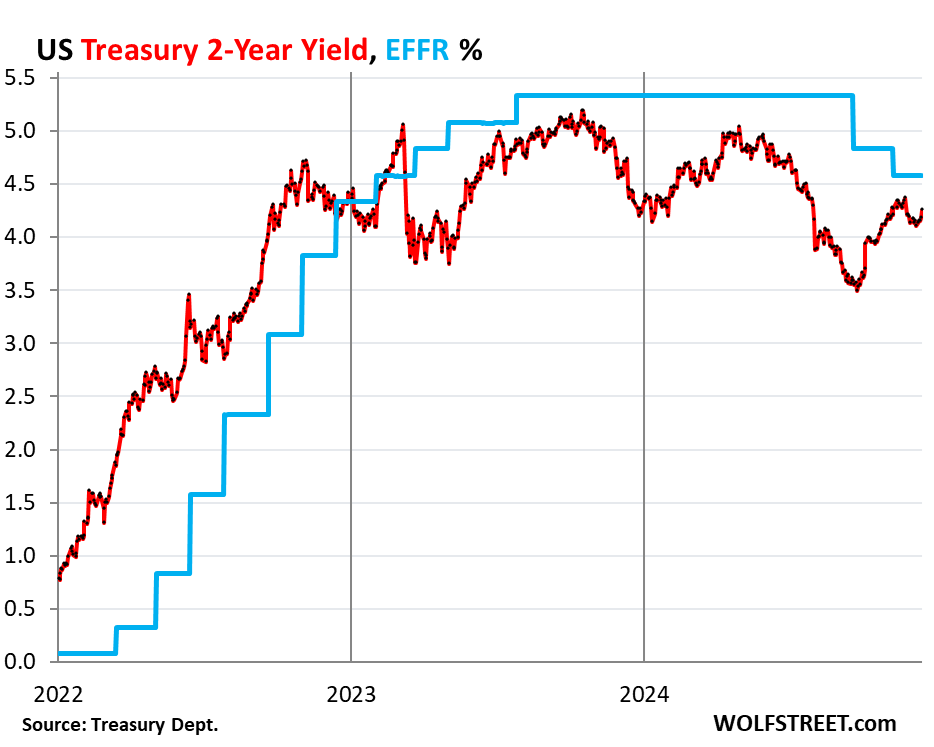

The 2-year Treasury yield jumped by 7 basis points on Friday to 4.25%. Since the eve of the rate cut, it has jumped by 66 basis points.

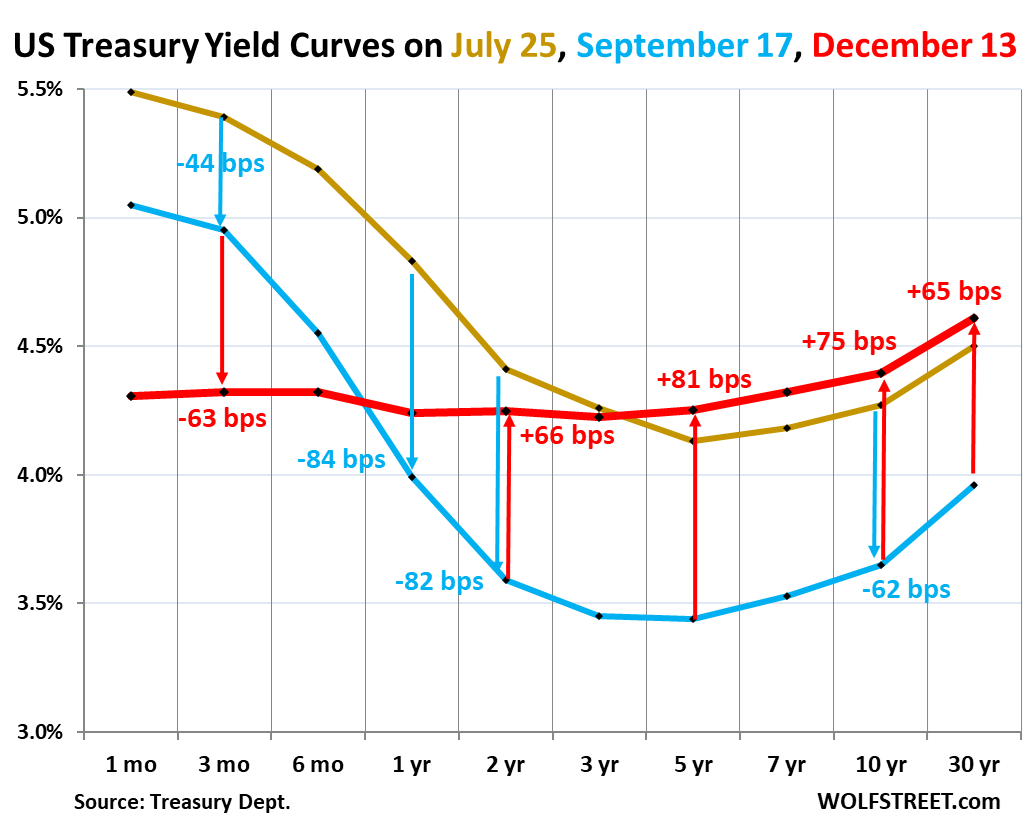

The “yield curve” in the process of un-inverting.

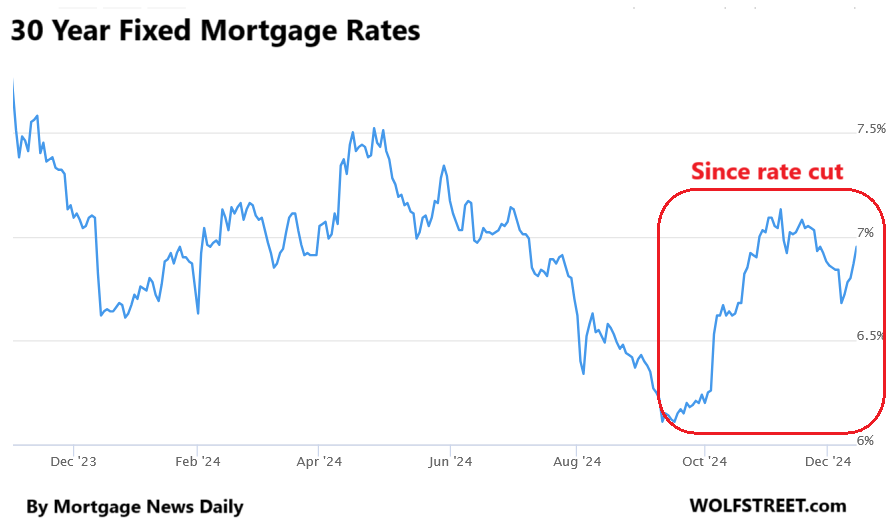

Since the rate cuts started, short-term yields have fallen sharply, and – shock to the real-estate industry – longer-term yields have risen, which pushed mortgage rates higher.

In a normal yield curve, longer-term Treasury yields are higher than short-term yields, with the 1-month and 3-month yields the lowest and with bond yields the highest.

Since July 2022, the yield curve has been “inverted” – with longer-term yields below short-term yields – as the Fed hiked its policy rates, thereby pushing up short-term Treasury yields, while longer-term yields also rose but more slowly, and thereby fell behind.

The yield curve is now in the process of normalizing, but it still hasn’t normalized. In a normal yield curve, the longer-term yields are substantially higher than short-term yields, and they’re now just a little higher. The yield curve will steepen and become more normal with more rate cuts and higher longer-term yields.

The chart below shows the “yield curve” with Treasury yields across the maturity spectrum, from 1 month to 30 years, on three key dates:

- Gold: July 25, 2024, before the labor market data spiraled down (turns out, it was a false alarm).

- Blue: September 17, 2024, the day before the Fed’s rate cuts started.

- Red: Friday, December 13, 2024.

The 10-year and 30-year yields are now higher than the shorter-term yields, and that portion of the yield curve has un-inverted completely.

The 7-year yield (4.32%) is now equal to the 3-month and 6-months yields. And that portion of the yield curve from the 7-year on forward is essentially flat.

Note by how far the longer-term yields have risen since the eve of the rate cuts (blue line), while yields of less than one year have fallen below the blue line.

Mortgage rates have re-risen.

The 30-year fixed mortgage rate roughly parallels the 10-year yield, but is higher, and that spread between them is fairly wide these days due to some factors that we discussed here. A wider spread means relatively higher mortgage rates.

On Friday, the average 30-year fixed mortgage rate rose by 8 basis points to 6.95%, according to the daily measure from Mortgage News Daily.

This U-turn in mortgage rates, after the rate cuts began, was an unpleasant surprise for the housing industry, mortgage bankers, and potential home sellers that are sitting on their vacant homes that they’d moved out of a while ago, but didn’t put on the market because they’d wanted to ride the price spike up all the way.

But with these mortgage rates, and the ridiculously high prices after the 50% surge during the pandemic, demand for existing homes has plunged to the lowest level since 1995, amid surging supply, while homebuilders are now sitting on the largest number of unsold completed homes since 2009 that they need to move pronto — and they’re making deals to do so.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

-Just under 10% of all homes bought the last 3 years were flips nationally. That percentage number continues to go down year over year as more supply enters the market month by month and year over year and with rising interest rates cratering demand.

-The last 2 years in the housing market in terms of actual sales of new and existing homes was on par with 2008 as its been at a dismal level in terms of home buying transactions. Like the paragraph above this one, back during the GFC spec buying and flipping was at an all time high right before the crash. And then the market cratered in the GFC and housing prices got crushed.

-The total delinquency rate continues to march upwards as was recently reported by Black Knight in the housing market. Defaults are rising and it will get worse with taxes, insurances, and debt levels rising along with it. For example, North Carolina has a bill on the table to increase Home Owners Insurance 42% year over year. Homes in Hurricane territory, forest fire, flood, and ocean front territory will see premiums explode in the coming years if people can even get coverage in certain areas. 20% of all Florida home owners doesnt have or cant afford HOI. That’s a bad sign for what’s coming there as Florida’s housing market is in serious, serious trouble among others.

-Inflation is getting worse, and the worse it gets the higher the 10 year US treasury goes up while the FED continues to lower short rates.

-Defaults on DSCR loans are rising and DSCR may be out the door and done with soon enough. People old enough in the mortgage business know full well about the NINA, SISA, IO, and pay option arms that helped crater the housing bust in the GFC with fraud stated income and assets with no doc loans along with subprime. Plenty of that fraud is out there with 2nd home buying and for rentals with made up income to qualify. Like the first paragraph states, 10% of the demand will be stripped away just from flips when prices start to nosedive and people start losing equity. We are already seeing that in certain markets right now as flipping dries up.

-Tariffs and a potential $15 trillion dollar spending plan by the new president will exacerbate the inflation problem.

-Supply in the housing market has increased 3 years in a row. I expect supply to potentially explode in 2025. 500K more homes added to the market that dont sell for example puts us back to 2016 inventory levels. At that point fear will start to take over to get out or lose serious equity. Not all housing markets are equal, some states and cities will be hit much harder than others.

-Fed better be really careful with making another policy error blunder like they have done time after time decade after decade. If inflation gets seriously unanchored a 2nd time, everyone should buckle their seat belt. The job losses alone from a crushed mortgage industry can and will be massive just like the GFC which many people seem to fail to remember very well. That crises almost took down to big to fail Bank of America that almost fully imploded because of Countrywide.

Thankyou for your post

Meanwhile Wallstreet is forecasting sp500 at 7000 next year!

Might get there next week. There’s too much f**king liquidity in the system.

Liquidity is one problem, but the biggest problem is the Fed’s message to the market. They can shut down this orgy of speculation very quickly by not cutting next week. But we know it won’t happen, especially with a guy like Powell.

Would you shut down an orgy?

it’s not liquidity. liquidity has been removed very rapidly. i know wolf doesn’t like when people mention the fed restarting qe again, but that’s the reason the markets are as they are.

do i believe that qe will begin again? no. but it doesn’t matter what i believe. what matters is what the market believes.

and the market believes that the fed will never do anything to interfere with asset bubbles, as long as cpi inflation is under control, but that if the asset bubbles pop and deflation becomes a risk, that they’ll ride to the rescue to do whatever it takes, zirp, qe, whatever.

the market absolutely believes this. the svb debacle last year is an example of them working through the weekend to calm any possible problem that could lead to the bubble popping.

if the fed wanted to control asset bubbles, which it doesn’t, it could do so very easily.

My favourite out of many great quotes by JM Keynes ‘Markets can stay irrational longer than you can stay solvent’.

I wouldn’t bet against markets hitting 7,000 because if we assume the dot.com era was peak irrationality then there’s still fuel in that tank.

Robert Shiller came up with CAPE for a good reason, analysts earnings projections (to which you can add strategists market predictions) are no better than a coin toss.

Very interesting post.

And what happens to multifamily if Trump is successful in deporting millions of illegals? That segment is definitely overbuilt. I agree that 2025 looks to be inflationary. The only question is does it move us meaningfully towards the breaking point, aka recession?

The problem is that inflation means an expanding economy. My guess is that all of Trump’s talk about cutting spending, even in terms of waste-fraud-abuse, may end of being more hot air than real cuts. Just cutting $100-$200B may have dire consequences for the economy.

As for your last part, my most important question has been for 203 years, will Congress trot out rent & mortgage relief again? I certainly think they’ll try.

We shall see, but certainly a great post on your part.

In terms of “what happens to multifamily…”: Lower rents! And that would be very good for the economy, so people have more money to spend on other goods and services. Landlords, investors, and lenders would just give up some of the gains they’d made over the past 15 years, no biggie. They took a risk, and they got paid to take this risk, and now the risk would come home to roost, that’s how cycles work.

When Trump deports 12 million people along with probably another 8 million legal family members who follow them, it won’t matter how low rents go. There will be no one to occupy them!

Combine that with no one left to pick produce or work in meat packing and you have a perfect storm for exploding grocery prices. If the deportations/exodus occurs, I am predicting at least 10% inflation – maybe higher.

The year 2025 is going to be a disaster of Biblical proportions. Which seems appropriate actually.

Escierto

“…deports 12 million people…”

🤣 12 million in four years cannot happen for legal reasons and won’t happen for all kinds of reasons. They’ll raid some meatpacker and round up 50 illegals, with the media transmitting it live, and then they’ll spend weeks trying to jump through the hoops to actually deport those 50 people.

Check out Trump #1 in the chart below: Blue is what counts (interior removals). Orange (border removals) means sending people back that just came in, and while important, it’s not what you and I are talking about. Turns out, deporting people that are already in the country and established in some way is complicated, and Obama deported more of them than any other president. Biden was the worst. Trump deported more than Biden but fewer than Bush. So we’ll get more deportations than under Biden, likely fewer than under Obama, and not nearly enough to get to 12 million in four years. Click on the chart to enlarge.

https://econofact.org/immigrant-deportations-trends-and-impacts

Escierto just got punked SO BAD by Wolf’s data. That’s what happens when you try to bring raw, blinding emotions to a data fight.

Even assuming that there is a population waiting to move into apartment complexes primarily occupied by illegal immigrants, any spending power gained from reduced rent would be immediately offset by the higher prices they would pay on fast food.

Even with deportations do you really believe the total population will actually decline? No chance, and illegals will keep pouring in, Democrats sold the materials to build the wall, which was probably not much of a deterrent anyway since any wall can be climbed or dug under, it’s called a ladder 😂

I think a bigger question and a better question to ask yourself is, what happens with the great “unknown”.

And here is what I mean by this.

As of today, we still cant get inflation down to 2% and Core services inflation is no where near 2%. The FED has been fighting, supposedly fighting, inflation for 3 years and counting. 3 years, and not only is the inflation fire not out, its now reaccelerating.

Back to what I said in the first paragraph, “the great unknown” that

lurks silently.

Back in the 70s and 80s, there were 2 big nasty surprises that happened that ripped inflation to the upside. Those are the Arab Oil Embargo, and the Iraq Iran war which helped explode inflation.

Ill put this in Laymans terms. Not being able to control what you want to control, oil for example, led to a huge inflation spike. Every small $10 oil increase you can add on about .2 or so to the CPI. Oil is just one example.

There are a lot of unknowns right now around the world that are far and beyond Trump’s control. Between war, inflation, major economies cratering, The Japan carry trade etc… And some of what is in control, tariffs, spending, etc..

The housing market is just a big tip of the ice berg when it comes to future unknowns. The fed and the stock market are acting like inflation has been slayed and there is zero worldwide risk anywhere. That in itself is laughable, but to each their own. The bond market sees things differently.

As Buffet has said over and over, be greedy when others are fearful and fearful when others are greedy. I dont think I need to explain to anyone where we are right now in terms of greed and in terms of where the fear level currently is in the US economy. The US housing market behaves like an air craft carrier, It is big and slow moving when it comes to change. But when it does change, things can happen faster. Other things can change much faster. i.e, inflation reaccelerating and getting out of control, especially when a great unknown kicks into high gear.

Bravo, Vader. Very well put — times two.

And bravo, Wolf. Thank you for shining a light where few others are looking.

There are several potential “Black Swans” flying in the night sky… the big question is when one will land.

“As of today, we still cant get inflation down to 2% and Core services inflation is no where near 2%. The FED has been fighting, supposedly fighting, inflation for 3 years and counting. 3 years, and not only is the inflation fire not out, its now reaccelerating.”

Of course they could, they just refuse to. This current scenario is Jerome Powell’s wet dream. He wakes up bathed in his own fluids, happier than a pig in slop. He is intentionally torturing the working class and the poor, stealing their wealth and giving it to his billionaire buddies.

Are these 12 million illegal immigrants in the room with us now?

Sí amigo, estoy alquilando tu habitación trasera.

One of my acquaintance is selling his home as he is not able to find affordability home insurance in San Diego

He bought his home 20 years back but simply can’t afford expenses on his lower middle class income

Another friend pays 3 k per year just for tax insurance and hoa for a middle class home in San Diego. This is before paying for mortgage.

It’s sad ..

3k per year is cheap. I pay 6.5k/year in prop taxes alone for 960 sqft on a fifth of an acre.

I’m wondering if it was a typo? I pay $2400/year in taxes on 3 acres and a modest ranch. I’m in the second lowest tax county in my flyover state.

Typo, sorry,

It s $3k/month before Mortgage payment.

Per concluding paragraph I agree I cannot see how the FED can expect inflation to get to 2% especially with every asset class (except perhaps housing) and BTC going UP. FWIH about 70-80% of spending is from the top 50% … which are doing very very well if they are long US market and/or BTC.

Well this is where the p/e ratio will kick in at some point and the revenues from the top 50%s spending won’t translate into profits (earnings), at least not to the degree forecast, and stock holders will sell and then there will be layoffs to move the stock price back up and then they won’t be buying so much and we’ll quickly get back into balance.

Still blows my mind that the 30yr yield only barely touched 5%. Tons of money views the r/r of that hold very differently than my money does.

I think part of the reason for this is lower than usual amounts of long-term bond sales. With such high short-term yields, buyers have focused on that segment as well has the treasury. Nobody wants to pay a high price for a treasury with okay long-term yield with the prospect that the price is going to fall in the future as the yield rises. Remember, bonds are an investment & lose value, if you think you may not hold onto them until maturity. With $36T in debt, I think the bond market is very un-easy about what happens in the next 5 years or so.

You say “bonds are an investment & lose value.”

NO, bonds don’t lose value–unless something special happens, like a rising interest rate.

In which case they lose value.

Is a rising interest rate really unusual? I expect we hit double digits sometime over the next decade. Long term bonds won’t do well.

10 year US Treasuries will soon be over 5% and headed to 10%.

WE can at least HOPE SO, eh SCBD!

That would be WE the PEED ons for SO many years as a result of the various and sundry and extensive QE.

“””FIRE THE FED””’ would be my opinion as one way to ABSOLUTELY BENEFIT” ALL , repeat ALL of WE PEED ONs who are hard working and prudent regarding ”saving””

THAT was SO clear prior to the FRB establishment designed ONLY to save the banksters bad choices at the clear expense of WE the Peons who knew how to earn and save…

frb

qe

If the 10 year were to rise to 10%, the dollar index would likely follow along for the ride. And this would likely cause considerable stress for the EM bond market, which would likely implode. The domestic ramifications would likely be similarly devastating. Small caps for example, would probably become a smoldering crater. Large caps might fair a little better, but probably not much better.

Portents abound.

Are bond vigilantes going to convince the Fed to hold off another cut soon, lest the diverging rates further damage Fed credibility?

Bill Fleckenstein has long talked about the Fed losing control of the bond market, all the way back to the Greenspan era…

The Fed doesn’t “control” the bond market. It only controls more or less a corner of the short-term money markets via its policy rates. Longer-term yields (bond market) do whatever they want. QE was a way to push down longer-term yields, and enough QE will do that. But now the Fed is doing QT, and very purposefully.

Wolf,

You’re right that ‘control’ is a bad word for this, though I’m lifting the exact term from Fleckenstein’s commentary from decades ago. Now it’s more along the lines of ‘bond market taking away Fed’s printing press’.

An interesting question arising from the ancient usage of the word ‘control’: Did Fed policymakers have more influence on long-term rates back in the 1980’s-2000’s than what is happening today? As in, the Fed having more credibility as a revered institution keeping bond traders more in tow to the Fed’s current rates at the time?

No problem if no one can answer this; I was just curious as to these potentially research-heavy questions.

Deregulation and disinflation determined the difference.

Perhaps emergency rate cuts or other rate changes on short notice is another way of peering into the question of whether the Fed’s authority held more reverence during Greenspan/Bernanke.

As Wolf has said many times, Powell’s Fed never surprises anymore, always telegraphing moves far in advance. I would think a surprise rate move or holding steady would reassert a lot more authority, at least psychologically.

An emergency rate hike would likely work in tightening the loosey-goosey financial conditions, and that might help on the inflation front. But the Powell Fed doesn’t even know the term “emergency hike.” Any rate hikes are telegraphed months in advance. But the Fed did dig out emergency cuts during the lockdown in March 2020. But that lockdown was a huge shock to the economy, and we don’t get those very often, I mean, once in my lifetime so far. A normal slowdown doesn’t trigger emergency cuts, but cuts that are telegraphed well in advance.

QE was effectively a manipulation, if not control, of the bond market by the Fed. Past overuse of QE may cause bond vigilantes to think twice about trying to force the Fed’s hand on rates. I, for one, would opt for buying gold as a hedge against the Fed losing its remaining bond market credibility.

Gold is an infinite duration, zero coupon bond if you think about it.

@ShortTLT

Yes, and the oldest form of currency, a commodity, plus many other things. Unlike a bond it’s not subject to default and it’s supply is not easily manipulated.

I am not a gold bug but as gold wears so many different hats, it is necessary to consider it a completely separate asset class. No zero coupon bond would have appreciated over 25% this year.

Wolf, that would only be true if the Fed didn’t buy and sell the bonds themselves, in addition to setting the short term policy rate. We might argue about how successful they have been, but Operation Twist was certainly at least an attempt to control the bond market.

People confuse “control” and “manipulate” which are NOT AT ALL the same thing.

Is there any way to explain the high yields on the long end of the US treasury market while credit spreads between treasuries and high-yield corporate bonds are remarkably low?

Is it a timing thing, or am I missing something obvious?

The thing to explain is why credit spreads are so narrow. The answer is, drumroll: market mania. Risk premiums have become minuscule. Investors are now taking lots of risks for little extra compensation.

Generally Wolf is correct. Mr. Market is quite complacent these days.

There is another possible explanation. As a former Bond market participant, from way back when, I do recall when the formerly pristine credit, IBM, bonds traded through ( richer) than US Treasuries in the early 1980s.

The explanation at the time was that IBM was potentially a better credit than Treasuries and the supply wasn’t as frequent.

Now , with our enormous Budget Deficit, supply of US Treasuries is a multiple of 40 years ago. There are no more AAA rated corporations like IBM was in those days, but then again the U.S. credit isn’t what it used to be either ( regardless of official “ratings “)

There is another possible explanation for tightening credit spreads, worsening credit risk on Treasuries. Holders of Tresuries face not only increasing deficits but also heightened political risk. The downgrades from S&P in 2011 and Fitch last year were both triggered, at least in part, by increased political risk.

There is zero, zip, nada credit risk with Treasuries.

I hope the Fed can steer us away from a Japan scenario, but I fear we will get a more compact 10x faster version , we are 1985, why Japan will finally return to normal in 2035

Are credit spreads narrowing in part because they are moving towards being priced to relative to swap spreads rather than treasury rates?

https://www.bis.org/publ/qtrpdf/r_qt2412y.htm

Treasury rates seem to be the one asset class where pricing is moving out of kilter with all other asset classes.

In terms of your last statement, it’s the other way around.

“Market Mania”

More like market is sure that the Fed will save the market should the need arise (like in Mar 2023) and do whatever it takes. Hence the disappearing risk premiums.

Could it be argued that the average corporate is just as risky as the US government?

Granted the US government cannot technically default but ignoring technical default why should corporates be considered less creditworthy than the highly indebted US government? Some corporates are way more creditworthy than the government right now. Of course not all corporates are the same

I personally think household balance sheets are better than the US government so higher mortgage rates compared to 10 year Ts is also baffling. This seems like a long term arbitrage….short Ts long MBS.

Wondering how sound this strategy may be longer term.

This is just nonsense. There is credit risk in corporate debt, some of it fairly low, some of it very high. But there is zero credit risk in US government debt. Period. You’re engaging in fantasies.

Here maybe why:

“Pimco said it’s reducing exposure to long-term U.S. bonds amid concerns about soaring federal deficits and debt. Instead, it favors shorter-term bonds, some overseas issuers, and corporate debt.

Bond giant Pimco significantly ramped up a market backlash against soaring U.S. debt by announcing plans to reduce exposure to long-term Treasuries.

In a note on Monday, the world’s biggest active bond fund manager referenced “bond vigilantes,” a term coined by Wall Street veteran Ed Yardeni in the 1980s, describing traders who protest massive deficits by selling off bonds to push yields higher”.

I’ve heard mention that the rates uninverting being a good thing can depend on whether the short term rates are falling or the long term rates are rising. It looks like when comparing to July the main driver seems to be short term rates falling. In a healthy economy I’ve heard that generally you want the long term rates to be rising faster than the short term rates are falling. I could be wrong but it seems like a lot of the short term is a result of the feds actions while the long term is an expectation of inflation coming up due to the inflationary nature of tariffs which both seem like they wouldn’t necessarily be healthy. I’ve seen people talk about rates uninverting into a recession. Do you have any opinion on whether this uninversion could be recessionary(if that’s a word)? I would think not based on other articles you’ve put out that I read but was curious your thoughts on this. Thank you!

I’m not Wolf but I am 100% in the group that believes that when the yield curve un-inverts while the Federal Reserve is cutting rates, unemployment is rising, and total employment is down year-over year … a recession has most likely either just started or is about to.

Good thing unemployment isn’t rising.

it might not be in percentage terms, but anecdotally talking to headhunters, it’s much harder to get good jobs now.

Inflation spikes caused by rising auto and home insurance rate hikes is almost over. This is typically one of the last sectors to peak since rates need to be filed and often approved by state regulators. In other words, the end of the tail whip is upon us. All this talk of a resurgence in inflation is absurd and will be short lived. The bottom line is most people can’t afford large purchases via loans anymore. If you think the economy can handle that for extended periods of time, you’re sadly mistaken. Businesses will fear price gauging when the Don takes over. Down long rates come on a gradual basis in 2025.

We’ll see if home and auto insurance increases will moderate. I’m not convinced. And I think you mean price gouging. Price gauging is something all companies should do.

Perhaps the biggest factor in the sharp rise in insurance premiums was insurers clawing back bond portfolio losses in 2022 resulting from the normalisation in interest rates. I expect insurers to have spread the loss clawback over several years premium increases. When losses have been clawed back, insurers should be in a position to reduce premiums. Whether they do or not is down to adequate competition between them.

More and more homes everywhere threatened/affected by natural disasters. The complexity and high price of repairing uni-body autos full of high end and costly electronics does not indicate a reduction of auto insurer costs. I don’t see insurance rates ever moderating nor do I see long term housing prices moderating unless buyers and builders reduce size and the cost of furnishing. Don’t see deflation happening either unless the bankruptcy king crashes the world economy with tariffs and overspending. I think this is a ‘hold on tight’ and be very concerned environment.

If builders can’t cover their costs they will just stop building and supply will tighten.

But WR articles have already shown that home prices are going down and down albeit at the slower pace .

This my friend is deflating

Don’t believe me just read up WR article he posted few days back

Electronics OK. Uni-body? That’s since forever. Well, a long time. Unless you are a vintage fancier, you have never driven any other.

“All this talk of a resurgence in inflation is absurd and will be short lived.”

That’s absurd, LOL. Inflation is cycling back to other items, as you might have seen if you ever read any of the inflation articles here, including motor vehicles. Inflation whack-a-mole. Read this so you know what’s cooking in the inflation kitchen:

https://wolfstreet.com/2024/12/11/beneath-the-skin-of-cpi-inflation-cpi-core-cpi-accelerate-further-month-to-month-the-3-month-averages-heat-up-for-4th-month-in-a-row/

“most people can’t afford large purchases via loans anymore.”

That’s another absurd line (where do you pick up this BS? YouTube?). Households are richer than ever. And they’re sitting on trillions of dollars in just CDs and money market funds. They’re also earning record amounts of money and they’re spending record amounts of money, and they’re saving the rest to continue building their wealth. I just explained this to you:

https://wolfstreet.com/2024/12/13/money-market-funds-large-cds-small-cds-and-total-deposits-americans-huge-piles-of-interest-earning-cash-as-rates-drop/

Here are the household money market fund balances:

Wealth gap is probably at record levels, which does tend to distort the health of the economy if you base an assumption on limited or inaccurate stats.

Which income brackets are sitting on this trillions of dollars?

The wealthy didn’t get that way by putting their money in CDs and household money market funds. The wealthy are wealthy because of their ownership of companies (the $50 trillion in stocks is where part of that is). Why does this dumb BS keep getting posted here every time there is some economic data???

I normally now delete this BS because I have uselessly wasted too many hours shooting it down. So I will waste my time one more time, after having deleted about three of those kinds of BS comments on this article already:

1. Yes, there is a big wealth disparity in the US.

2. No, the “bottom 90%” are not poor, that’s the most ignorant malicious shit circulating out there.

3. Some data for you to cleanse your brain with:

Households by INVESTIBLE ASSETS, meaning financial assets that wealth management firms can invest, which does NOT include real estate, such as a home and vacation homes, and does NOT include other assets, such as cars, boats, etc. and does not include funds needed for household operations, such as checking accounts.

10% of households = “ultra-rich” with over $10 million in investible assets, and “high-net worth” with $1 million to $10 million in investible assets.

35% of households = “mass affluent” with between $100,000 and $1 million in investible assets (not including homes, cars, household operating cash, etc.)

Remaining 55% of households = “mass/retail” market with less than $100,000 in investible assets (not including homes, cars, household operating cash, etc.).

Data from credit-reporting agency Equifax.

^^^ Perfect thank you. So no wonder so many people think the economy is crap.

You’re behind. That changed with the election. Now Republican-leaning consumers think the economy is great, while two months earlier, they thought it was in the shitter. All consumer sentiment surveys flipped with the election. Nothing to do with the economy, but with political preference. It’s weird, but that’s what it is.

Where do you think this 2.2+ trillion come from that was added to the US MMFs of Households?

Bank accounts, among other places.

Total wishcasting. Insurance companies are still bleeding money and need to raise rates to reflect increased risk. And you didn’t mention health insurance which is insane.

Past 2 weeks a lot of grocery prices have dramatically increased where I shop.

It will take some time for Trump to enact policies that might address all the economic problems we have, assuming we don’t have a nuke go off in a major city or more attempts on his life.

Good luck with that, Buddy. One of those people that believes he’s looking out for you, a Basement Dweller?

Home insurance will be up Feb 1 next year 38% at this house. Insured by one of the largest, well advertised companies. I guess up “only” 30% in 2026 will tell the peak is in. sarc/

“Down long rates come on a gradual basis in 2025.”

Tell me you own TLT without saying you own TLT

🕺🤫

Everyone has soooooooo much money, Dude. Houses getting tripled in size everywhere I look. Inflationary outlook in all parts of life. Where do you hide out the days?

I still have not got any response as to who is buying these long term Corporate BB and junk bonds, when you can get returns approaching 5% on 10 year Treasuries and even higher on insured CDs. This market is so overpriced that it could be the first shoe to fall, and it will.

On another topic, the Real Estate market here in the Swamp has just frozen up completely, No sales, no listings. I don’t know what is causing this.

“On another topic, the Real Estate market here in the Swamp has just frozen up completely, No sales, no listings. I don’t know what is causing this.”

My guesses are 7% mortgages and coming into the holiday and tax paying season. Same is going on in my hood in Texas.

Find me a new issue CD with a 5% apy. I’ll wait.

Still waiting for Swamp Creature to provide an example of a new-issue 5% CD.

I don’t know folks?? Seems to me like we are steadily moving towards an International Government debt crises and France is currently leading the charge! The Fed and the Bond market looks to be finally jockeying for a full blown “ Face Off”.

The Fed has, for over a decade destroyed the savings and returns for both retirees (savers) and a huge swath of the Financial sector, mostly, that of the Insurance Companies, pension funds and Municipalities through their low to zero rate policy. We are headed into a Vicennium of this diabolical policy! Nobody talks about the wealth destruction that has occurred throughout this period as a result of there being little to no return on fixed income products. I would suspect that the losses (opportunity costs) are in the many of trillions! Money has never been intended to be used at “no cost”! It just seems like the Fed has finally lost all credibility. It doesn’t even “feel” right that the Fed is embarking on lowering rates. Markets are driven on greed and emotion with both being capable of huge gains as well as huge losses. It just “feels” like the markets are calling BS on the Feds current path???

Rates and inflation will surprise on the upside thought 2025.

VERY good and helpful comment for those of us willing and able to invest accordingly RS,,,

Thank you for this, and please keep on keeping on with your helpful comments on ”WOLF’s WONDER”

Don’t know you and yours, but suspect you might be one of those reading Wolf’s Wonder and at least trying to become clear about the delta between

While I am NOT a fan of ”facts” by any faction,,, I am a total fan of all efforts to at least try to present facts on net…

LSAPs on sovereigns was Bernanke’s deliberate policy. Interest rate suppression reduced the real rate of interest for saver-holders. It, as intended, stoked housing and stock prices.

I think so as well. Rates and inflation heading up next year.

For me the surprise being that, after all these years, its not Japan!

“Rates and inflation will surprise on the upside thought 2025.”

Bond bulls will get wrecked in 2025.

Yellen says she is sorry about the deficits. Wtf!? To me cash is still king. I can wait some more. When they sell their gains they will get their money back. If they sell first that is.

Interest rates are both a cause, and an effect of changes in money velocity. Powell eliminated Regulation D transfer and withdrawal restrictions as well as reserve requirements thereby accelerating the transaction’s velocity of funds. This has raised the level of interest rates.

People are so dumb buying treasuries — even though we’re headed very soon into 24x mkts —lol:

“Every day, between 40,000 and 50,000 new meme coins are created, according to BDC, an Estonia-based blockchain consultancy. Nearly 13 million have already been created in 2024. Combined market value? Some $100 billion. MarketVector’s Meme Coin Index, which tracks the performance of the six largest meme coins, has soared 215% year to date, more than double Bitcoin’s 100% gain.”

So many tulips,,,which one to buy?

Yeah, everybody can issue their own money, and all be rich!

I met an Uber driver a few weeks back who started his own crypto coin pegged to the US dollar. He wanted me to check it out. Internally I just sighed.

Whenever the common folk (I use this term endearingly, as I am a common folk) jump into a market like this, it means the market is saturated. Thankfully I’ve never gotten into crypto due to my spidey senses.

Everyone expects tariffs next year. Trumps goal is to reindustrialize the US. That means (presumably) producing more stuff in the US. Can that work without a weaker USD ?

The tariff idea seems to lead to a stronger USD as fewer USD end up offshore ?

Fewer USD in foreign hands to spend on buying US debt. USD interest rates must then go up to attract buyers for our debt leading to a stronger USD and less competitive US produced products.

With tariffs we no longer get to import deflation so a stronger USD does not translate into lower US prices ?

Trump is a real estate guy. RE used to be about using debt as leverage. But today, at least at my own personal micro level most RE deals I look at don’t work if there is any significant burden of debt. Rents are high, but land and construction costs are even higher.

Im thinking that what we end up with from Trump will be different from what is talked about now. I think we can count on: less regulation leading to more production. Lower taxes on the margin, lower energy prices. With luck less war and fewer sanctions leading to greater global production and demand. But powerful forces in the US are opposed to less war…

In 1936 when Germany could have easily been checked by Anglo-French determination, powerful forces were opposed to war.

Don’t forget: more incels and other creeps.

The fed has been complicit in so many bubbles, driving risk taking to enormous heights each time, I wonder how much they are honestly taking into account the crypto bubble? I ultimately think this will end in tears, but my god, they have to be nervous about the extent to which an unwinding could cause a severe cascade effect on other markets.

Their dual mandate apparently doesn’t factor into account financial stability??

Moderator???

I think the Fed wanted to sidestep that (shades of the dance of Greenspan around subprime). Gensler at SEC and Yellen at Treasury were trying to limit the Ponzification of the financial system. Apparently the will to do that at the federal level has just evaporated. And I can only hope the press I’ve seen on voices to abolish the FDIC is merely a scare story. If it is true, many new poker-playing propeller-heads entering the Trump admin have zero comprehension of the banking and payments systems (so long and hard in their development), and the threat to the dollar itself and our economy this level of manic casino frivolity poses. And it is global: stablecoins are already the most effective tool of global crime. Several Trumpists are already up to their elbows in it. No worries, Barron has daddy’s ear!

I enjoy reading the comments and seeing how almost everyone wants higher return on treasuries. I am certainly in that group but just interesting to see how many people see the government as this entity that really isn’t the collective of the peoples will. Most of that tremendous debt was created over the decades by people elected to spend that money as they see fit, and given the amount of politicians that get reelected it would suggest most are happy with the decisions.

If I relate government to a household analogy, which I get doesn’t have the same parameters, I would want to manage my long term debt to be in line with income. The point is I view my family as just that but the government as a cabal, when in fact it isn’t at all.

“The global economy was facing the worst collapse since the second world war as coronavirus began to strike in March, well before the height of the crisis, according to the latest Brookings-FT tracking index.

“The index comes as the IMF prepares to hold virtual spring meetings this week, when it will release forecasts showing the deepest contraction for the global economy since the 1930s great depression.

We have known that for three years. Where they totally asleep at the IMF?

In China the 10Y is 1.72%. The PBOC raided people’s bank accounts for an IOU in order to control the long duration. The PBOC is trying to ease states debt, mfg debt, to reduced mortgage rates and encourage consumption. The SSEC bounced to 3,600. Bond speculators, if they can, might park in US 10Y @4.71%. The spread is too large. [1M] DX flipped in Nov. [1W] flipped in Sept 30. Gravity with Germany, Japan and China will pull the US 10Y down. China escaped the debt sinkhole.

US yield curve : all rates are tangled together, like a rope, with little

spread between them – what a mess – from 4.2% to 4.6%, after rising from the lows, possible to descend again and test the previous lows, while building a new rates cluster that will end somewhere in 2026/2028. ++++++++++++………

The treasury bond market (20 and 30 year) are telling us that inflation will continue to be a problem, and that the Fed’s lowering rates will

likely make it worse.

Will the increase in health care coverage be reported in January? 10% increase on the exchange yoy!!

Based on the continued rise in longer-term rates, it seems the market is expecting inflation to increase over the next 5-10 years from where it is now even as the Fed is signaling lower rates.

For perspective and wider global macro:

@10-year Chinese government bonds ended last week (12/13/24) yielding a measly 1.78%: a 40bp drop in barely three weeks”

Yuan falling too, hmm

It’s definitely time for me to swap my maturing US Treasuries for Chinese equivalent. /s