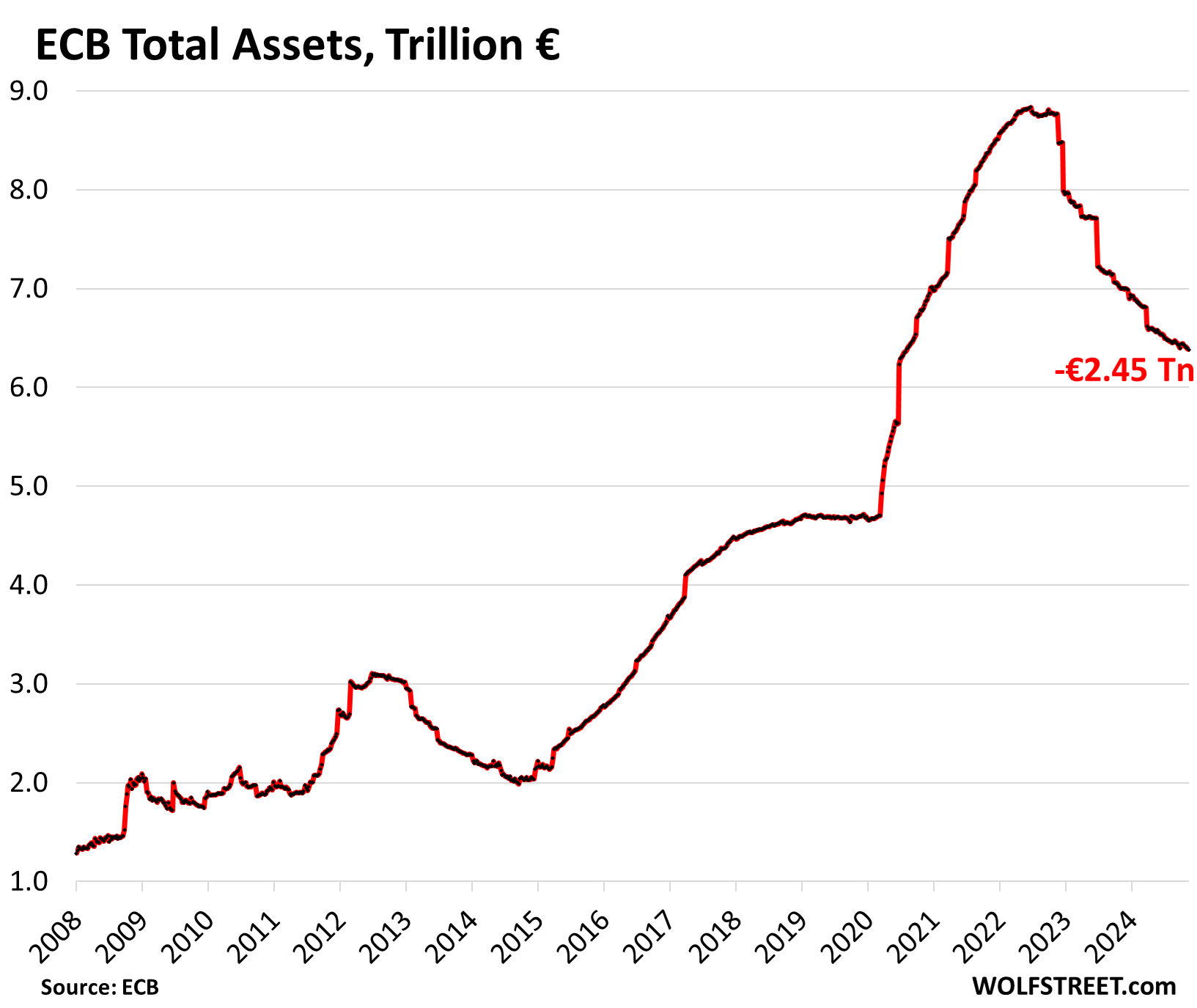

Meanwhile, the ECB’s QT marches on, balance sheet has shed €2.45 trillion since the peak, or 59% of its pandemic QE.

By Wolf Richter for WOLF STREET.

The ECB’s own measure of wage increases, its index of “Negotiated Wages,” is based on collective bargaining agreements after they were negotiated between employers and organizations that represent workers. It’s a forward-looking measure, reflecting wage increases that are going to be implemented soon. “Negotiated wages” cover about two-thirds of the Euro Area economy. These “negotiated wages” exclude bonuses, overtime, and other individual compensation that is not linked to collective bargaining.

And it blew a fuse today. In Q3, “negotiated wages” spiked by 5.4% year-over-year, according to the ECB today, after the false-hope deceleration in Q2.

In its June economic bulletin, the ECB explained: “Monitoring wages is a key element in the ECB’s approach to analysing the inflation outlook. This reflects the prominent role of wages in the dynamics of underlying inflation, in particular in the services component, which has remained persistent.”

It also said that the “outlook for further disinflation” was predicated “on the expectation of moderating wage growth.” Q2 brought the moderating wage growth, triggering the ECB’s initial rate cuts. Q3 blew all of this out of the water.

Big wage increases are obviously great for households, and a great way to stimulate demand, as households have more spending money, and they feel better, and so they spend more, creating more demand and more jobs, and more economic growth, and that’s great.

The ECB’s concern is that big wage increases also add to the fuel that keeps inflation going, particularly in services where wages are a big cost input that companies try to pass on via price increases that translate into higher inflation rates.

And services inflation has remained stubbornly hot in the Euro Area, despite the massive plunge in energy prices, and declines in prices of many goods. The services CPI accelerated to 4.0% year-over-year in October, after a deceleration in September, according to Eurostat earlier this month. It has been stubbornly rising at about 4.0% year-over-year since November 2023 (red in the chart below).

Services inflation of 4.0% is far too high to get to the ECB’s 2% inflation target, once the drop in energy prices ends, and goods prices return to normal patterns.

The services CPI started surging in 2022 to reach 5.6% in mid-2023. It then decelerated through November 2023 to 4.0%, and has gotten stuck there – more than double the year-over-year increases in the 10 years before then.

Core CPI, which excludes food, energy, tobacco, and alcohol, has been rising by roughly 2.7% year-over-year since April (blue).

This jump in negotiated wages will translate into hefty actual wage increases when they’re implemented over the coming months and next year, which will then feed further into the stubborn services inflation. The ECB governors are going to have their hands full trying to agree on how little and how slow to cut to not make inflation worse. But rate cuts are not permanent. If inflation re-heats further, the ECB can always nudge its policy rates back up.

Meanwhile, the ECB has been making progress with QT. Total assets dropped to €6.38 trillion, down by €2.45 trillion from the peak, according to its balance sheet released yesterday. It has unwound 59% of its pandemic-era QE so far:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

As has been expected. Wolf just has the unbiased data to show it to be the case. Moving forward, I expect all inflationary metrics to increase. To quote an insurance agent friend of mine in regard to the stubbornly high services inflation. I believe his exact words were “insurance has become like the protection rackets of the 60’s and 70’s”. When I asked him what that meant he simply said “fuck you, pay me.”

Your description is not how insurance works at all.

Insurance is more polite and not in person?

Try not paying your insurance on mortgaged property and let us know how that turns out for you. Insurance is, in may ways, a protection racket that you simply must pay.

The sneaky snake get by just fine, eating a few rodents along the way.

Speaking about rising wages for the Europeans, the cunning sneaky snake lives a life unburdened.

Not just rodents. Toads too…

There are around 22 individual classes of insurance coverage. In the case of dwelling/homeowner insurance you are paying for the risk of loss from certain specified perils such as fire and others for which there is a very real cost to the insurance based on the law of large numbers in order to insurance against the risk of loss to yourself or the owner of the property if their is a mortgage.

It’s more like collusion protection racket. 😁

What’s plan B? Have no insurance and look for government handouts if shit hits the fan? I have no problem with insurance. However, its the whole raising everyone’s insurance premiums so some people can keep living in risky areas that bothers me. Not to mention carrying the burden of additional insurance in case of a collision with an uninsured motorist. An uninsured motorist need to have their vehicle confiscated. Someone who chooses to live in flood prone, fire prone, hurricane prone areas needs to pay 3x the insurance on similar house elsewhere, and not get any handouts if the choose to not to pay. Safety nets work only if everyone acts responsibly, which is sorely lacking these days.

A lot of the increases are a result of increased lawlessness. Those in power let crime run rampant and we all pay more “protection” money as a result.

I’d be curious if any readers abroad are seeing big increases. I suspect insurance costs are pretty low in japan, as an example of my thesis.

Insurance is about spreading risk and the insurance companies and reinsurers have to make an underwriting profit for the whole system to survive. A lot of people say insurance companies are greedy and of course they want to make (a lot of) money, but the last few years have really been a race to get insurance rates to keep up with losses from the latest and greatest insurance scams, increased materials and labor costs to restore property, and to an extent lawlessness and stupidity (a lot of claims result from stupidity). What else can you do though, gotta pay for it and then pray you don’t need to use it. It’s one of those gambles in life, a lot of people choose to drive uninsured and a lot of homeowners without a mortgage choose to “go bare” – one of those is illegal and not enforced enough, the other is a choice that has pros and cons.

The California DMV requires all automobile/vehicle insurers to provide proof of coverage electronically and will not issue renewal registrations to any vehicle owner who does not have insurance so they may not use public roads.

“greatest insurance scams, increased materials and labor costs to restore property, and to an extent lawlessness and stupidity”

Of these 3, the only one that makes sense is #2, property restoration.

The problem, as I see it, is that Allstate, et al are spreading the risk of hurricane destruction across all of these states the 43 or so states that have no hurricane risk. Sure tornados do a lot of damage but it’s very localized compared to hurricane.

I have no doubt that a major part of my 40% increase in home insurance rates over the last three years is directly attributable to my insurance company spreading the risk of the FLA hurricanes into my premiums.

At some point, Congress will have to get involved to change our insurance is divided up. IMHO, my risk / premium should be equal to the risk of all the types of losses an insurance company can expect from my county.

This way, those people in Tampa will have to pay the full cost of insurance increases rather than it being spread around the country to counties that have nothing to do with hurricane risk.

Their in the very profitable business of insuring it all, their administrative costs are 800% more than Medicare as they put up great walls of bureaucracy in the way of paying claims, property insurance costs be nothing but if you live in a high likelihood area of weather intensification but have never paid the true cost of your insurance then it’s hard to have sympathy at such an early juncture of the true costs being realized

crazytown,

Not sure, but fairly certain I heard Wolf talking recently about how the insurance coffers were way full and they were doing all kinds of “investing”.

SoCal…do you really trust any bureaucracy in CA to not totally F everything up? That’s just naive.

I have a rental property with “too many claims” as justification for insurance company to drop coverage. But also turns out that my insurance claim records are stored in a “5 year look back” shared database and no other insurance company will provide coverage now until I’ve got a clean past 5 years. So now I have state provided insurance as last resort. Also, turns out that contacting a claims adjuster for an estimate even if not going through with filing the insurance claim also counts towards “too many claims”.

So…quit trying to scam the insurance company?

Well in the 70’s inflation really hit hard at first. Then it came back again and again and really did not do too much damage after those initial terrible times.

You can lookup stock, bond and treasury returns for those years.

The first step after eliminating debt is eliminating insurance on the path to financial success. If you would like to elevate the multi-generational wealth of your family and estate, self insure.

Amen, brother.

And if you’re poor, buy every BS “insurance product” on every appliance you buy…and stay poor. Don’t forget your utility service entrance points.

So wrong that some of these schemes are even allowed. I get so angry – and insulted – to get all this garbage in the mail, as if they could believe that I am so pathetically stupid. Same people that are desperate to cut down on postage costs by asking me to go paperless.

MW: US Treasury yields rise by most in a week amid focus on prospects for US economy

Thinking ECB and Fed are both going to have to quit QE and May be, just maybe have to start QT again. Their wage projections look like we just went through, +5%.

You got something mixed up. The Fed “quit QE” in early 2022 and has done $2 trillion in QT since then — and STILL going strong. The ECB “quit QE” in mid-2022 and has done €2.4 trillion in QT since then, see last chart in the article above.

Yes I had it backwards. Good stuff WR, makes you think!

QE = Quantitative Easing

QT = Quantitative Tightening

It’s like playing whac-a-mole. First durable goods spikes in inflation, and the central banks hit it, then services pops up and the central banks attempt to hit THAT.

Capitalism suffers a few defects, two of which are: (1) a follower’s mentality where companies pile into a few sectors, the same few sectors, to make money; (2) a desire to price-gouge, to grab extra coin from the hapless consumer whenever possible.

Persistent services inflation demonstrates both tendencies.

“First durable goods spikes in inflation, and the central banks hit it, then services pops up and the central banks attempt to hit THAT.”

You may be grossly overestimating the sharpness of the Fed’s tool(s).

Sharpness? The FED doesn’t do anything “abruptly”.

those “defects” are basic human traits, not restricted to capitalism in any way, shape or form.

Clapping hands emoji ^^^^

Well said Viktor – you might not know it, but you’re loosely paraphrasing Herbert Hoover who said – “The only trouble with capitalism is capitalists…” – or more directly, us.

“The only trouble with capitalism is capitalists…”

All the more reason to further increase business regulation rather than the ‘coming soon’ near elimination of it. ‘Sigh’

all i know is that the central banks, including the fed, have completely blown their credibility. nobody trusts them to care about inflation. if they did, investors wouldn’t be piling into the mag 7 at zirp/qe valuations. if they did, people wouldn’t be buying bitcoin for $97,000 each.

nobody trusts that the central banks will try to protect their currencies. at best, they think they’ll do a coordinated debasement. that’s why the everything bubble continues to inflate.

Please, let’s not compare crypto the free basing of meth equivalent of a market to the stock market.

The stock market (while volatile) is efficient. (While risky), is a great way to build wealth, slowly.

Anyway, back to your usually scheduled internet feed of BS…

Can we PLEASE replace referenced to ”capitalism” with the reality of OLIGARCHY that has been the ruling ”ism” since FOR EVER?

Other than the VAST and continuing propaganda on all sides, all including west and east and everywhere between, SO far,,,

Oligarchy has been and continues to be THE MAIN MODE

Of economies and governments, etc., etc., since at least when WE, in this case the species of hmns WE were ”clans.”

To think otherwise is to bow down and bend over to the massive propaganda…

Based on the fact that the ECB “has unwound 59% of its pandemic-era QE so far,” it seems like the USA has some catching up to do. Wolf’s Nov 7th piece states “Quantitative Tightening has shed 41% of the assets that the Fed had added during pandemic QE.”

I don’t know what question to ask about this discrepancy, other than point it out for others to comment on. If I asked a question, it would be a leading question and honestly just ill-informed.

The ECB did QE in two big ways: huge loans to banks and bond purchases. When it decided to start QT, it made the terms of the loans less attractive by raising the interest rates, and then banks paid off those loans on their own, and all those loans plus earlier ones have been paid back. That was the easy part of QT, and it amounted to €2.1 trillion. And that was a lot of bank liquidity to suck out of the system.

The slower part is rolling off the bonds it had purchased. And in that department, the Fed is far ahead.

Fed needs to quickly sell 3 trillion more back into market.

Just what difference do you think that would make?

Looks like the wage increases are lagging inflation. We’re they not supposed to recoup their lost purchasing power? When I read things like “it was hoped wage growth would slow” all I hear is people with money were hoping to keep more money flowing to them at the expense of the working class.

Wage increases have been outrunning inflation since 2023. So wages are in the process of catching up. But in the early stages of the inflation shock, wage increases were outpaced by inflation by a wide margin.

When families have adapted to the higher prices and finally get that matching wage increase, it then feels like they have extra money. Many will spend it wildly rather than returning to the budget they had before.

But blaming the usual suspects: central banks, insurance companies, and capitalists, with loud whining, will be maintained all through. So rarely do I see wage earners looking in the mirror and saying anything at all about their added costs to this circle. Not that the others are blameless, but ….

maybe you run in different circles than i do, but outside of people with a ton of stock and bitcoin, no one i know feels like they have extra money.

and that includes people who got higher wages.

When you’re rich, you assume everyone else is too? At some point, you can no longer understand what it means to have to “budget”?

Thank your Government for all the free money handouts.

Nobody you know has every gotten a raise, or an unexpected bonus, or a tax refund and then gone and spent it on something “fun”? You’re right; we do run in different circles.

Inflation is a slow-motion debt jubilee.

The only question is, how does it affect politicians, the majority of voters, asset holders and the donor class. That will guide the policy decisions.

Nonono. The question is, how do politicians, majority voters, asset holders, and the donor class perceive it to affect them. Their respective perceptions will guide the policy decisions. It’s not about the objective effects at all, except insofar as they are felt and influence perceptions!

Nations that used slavery also had low unemployment rates.

Europe is a sclerotic disaster zone and best avoided for investment.

Get the popcorn out for French debt.

Appears that EU is entering a very difficult regulatory environment for the technocratic money management folk: stagflation.

If they stimulate the economy they throw inflation into overdrive; if they address inflationary pressures, unemployment takes off.

Throw in the effects of energy shortages (self-imposed), and it sounds like a real witches brew.

This stock market is toast.

Because of passive investing, we only need to look at NVDA, which everyone owns.

The top is in.

It is time to make money on the way down.

If you know a good way to short Bitcoin leveraged, please let me know.

Harry Houndstooth,

You’re now putting the same typo into every one of your email addresses that you log in with (“.comj” with the extra j at the end), which sends it to moderation. Your browser it likely auto-filling the email box with this screwed-up email address. If yes, you need to clear the browsing history in your browser, which you should do regularly anyway for privacy purpose. It’s easy to do and part of the normal features of every browser.

MW: Mortgage rates inch up toward 7% ahead of the holiday season. Don’t expect a big drop anytime soon.

Barron’s: Home Sales Climb to Highest Level Since Summer. Why the Worst of the Downturn Could Be Over.

If QT continues, where is the money to pay these people coming from? They must have really printed a lot of money during QE if excessive liquidity is still in the system. Putting this money into wages instead of investments might increase velocity a bit, but in the end it is not sustainable…..unless they go back to QE.

The yield was up 20 basis points at today’s 4-week T-bill auction…

Just an update.

Better balance that budget Mr. Trump, LOL.

Seems like we (US) have been pretty much paralleling ECB – albeit a few weeks behind – for a while now. So I guess this is just another indicator of future inflation, which should make ShortTLT happy…