Americans far from “tapped out.” Credit card delinquency rate dips to 3.2% (Fed), “prime” delinquency rate 0.99% (Fitch), “subprime” gets over free-money hangover.

By Wolf Richter for WOLF STREET:

The Federal Reserve today released the delinquency rates for credit cards issued by banks in Q3, and so we now have a trio of credit card delinquency rates through September that all measure different aspects of credit card delinquencies:

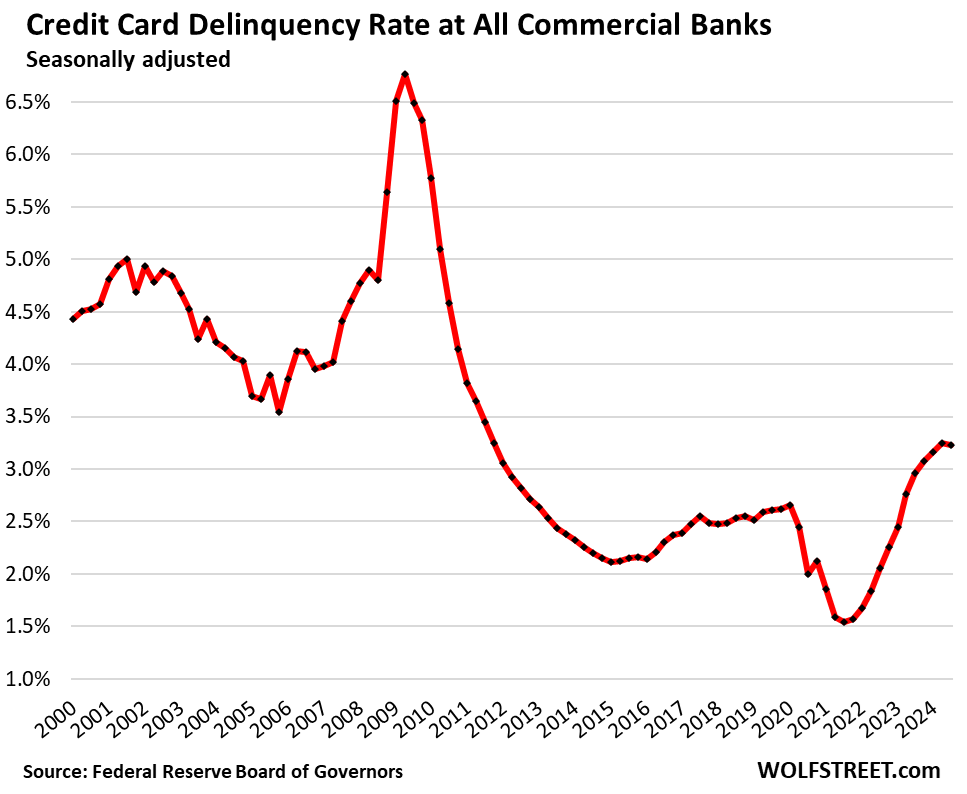

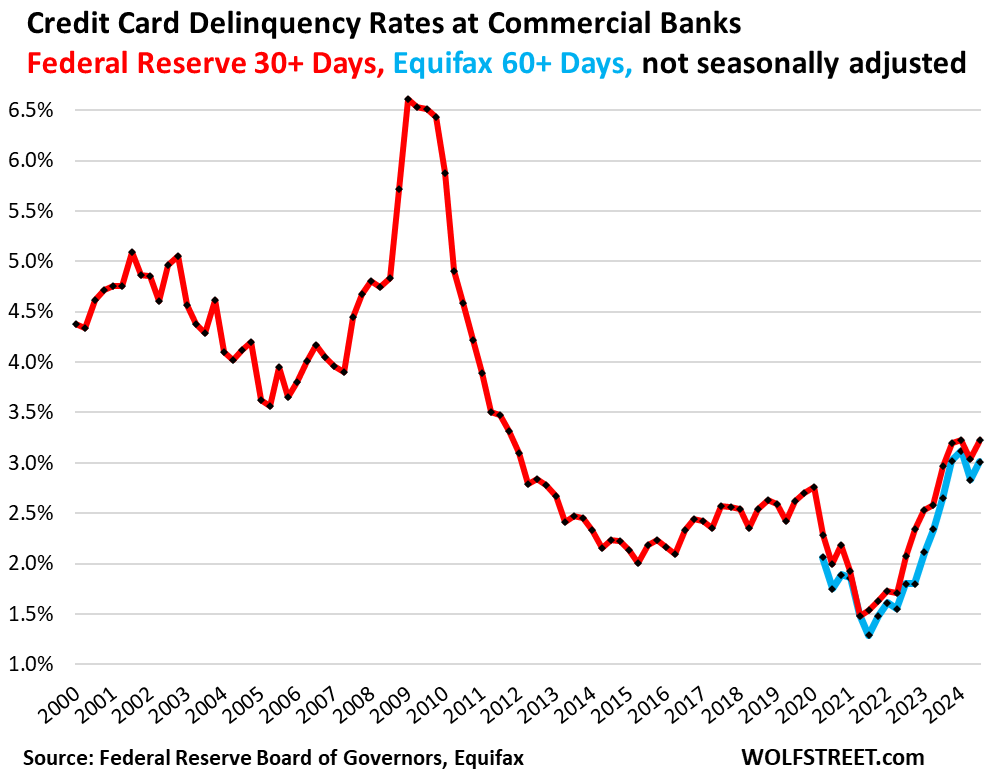

- Federal Reserve: 30-day delinquency rates on credit cards issued by commercial banks (3.23%)

- Equifax: 60-day delinquency rate on credit cards issued by commercial banks (3.01%)

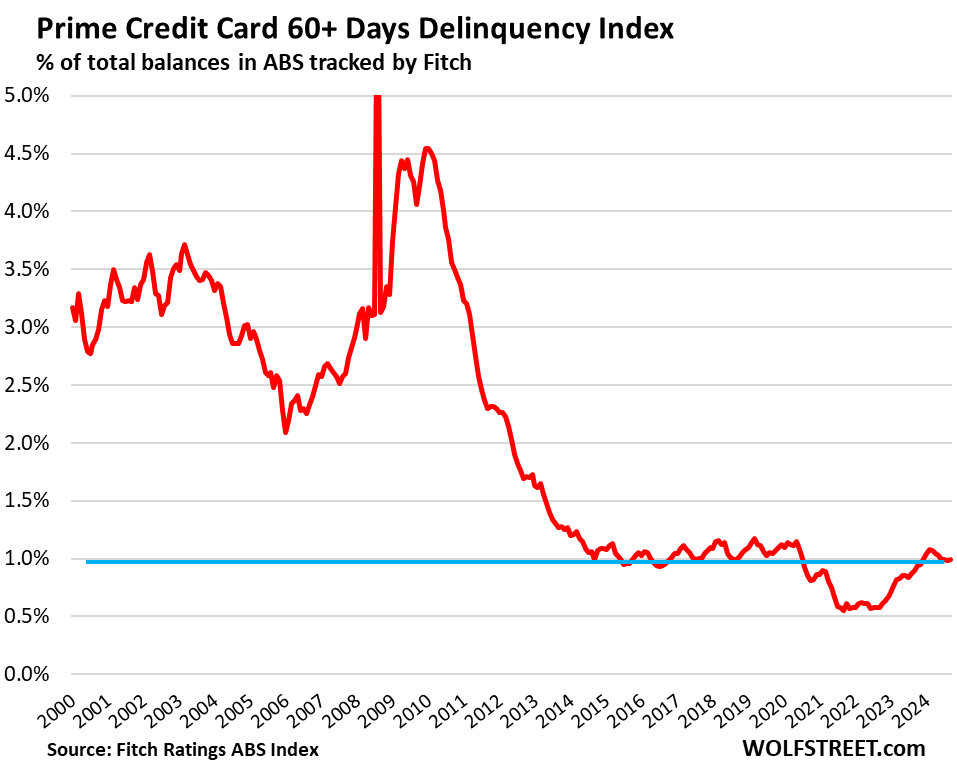

- Fitch: 60-day delinquency rate on “prime” rated credit cards (excludes subprime) packaged into Asset Backed Securities (0.99%).

The Federal Reserve’s 30-plus day delinquency rate on credit cards issued by all commercial banks dipped a hair to 3.23%, seasonally adjusted, according to the data released today. The increase out of the pandemic was driven by the subprime hangover, while prime credit cards are in pristine shape, as we’ll see in a moment.

Not seasonally adjusted, the Federal Reserve’s 30-plus day delinquency rate ticked up to 3.23% at the end of Q3. The increase was in line with the pre-covid seasonal increases for third quarters, which is why on a seasonally adjusted basis, the delinquency rate dipped a hair. The increase undid part of the decline in Q2 (red in the chart below).

Equifax’s 60-plus day (“severe”) delinquency rate rose to 3.01% in September, below the highs this year of 3.11% to 3.12% in January, February, and March, not seasonally adjusted (blue).

Subprime doesn’t mean low income, it means bad credit.

Delinquency rates on credit card balances plunged during the free-money era when people got piles of cash from stimulus payments, extra unemployment payments, PPP loans that were then forgiven, and in addition, they saved cash by not having to pay mortgage payments and rent payments during the era of mortgage forbearance, foreclosure moratorium, eviction moratorium, student loan moratorium, and whatever moratoriums. And people used that cash to catch up with their debts, and they used it to spend on stuff instead of loading up their credit cards. And so delinquency rates dropped to a historic low in Q2 2021. Then they began to rise again. And hangover-like, they overshot some.

The issue is always in subprime because subprime is always in trouble, which is why it’s subprime. Subprime means bad credit, not low income. That young dentist getting in over his head is a good example of high-income subprime. People get out of subprime credit ratings by catching up and reducing their debts, while other people get into it over their head and end up in subprime for a while.

And the rise in credit-card delinquencies is due to subprime cards.

Fitch Ratings splits “prime” from “subprime” and reports monthly the 60-day-plus delinquency rate for prime-rated credit cards whose balances have been packaged into Asset Backed Securities (ABS) and sold to investors. The prime delinquency rate in September remained at just below 1% (0.99%) for the fourth month in a row.

The New York Fed’s 12-month “Transition into Delinquency” always throws the financial media for a loop. Last week, some members of the financial press dished up what they wrongly called “delinquency rate,” when in fact it wasn’t an end-of-quarter delinquency rate (amount of delinquent credit card balances divided by the total credit card balances), but the New York Fed’s unique measure of a 12-month inflow into delinquency, without netting out the outflow, a measure that the New York Fed calls “transition into delinquency” and “delinquency transition rates,” which was 8.8% (and it declined). That’s not a delinquency rate. The New York Fed doesn’t release credit-card delinquency rates at all. But the reporters that put out that stupid clickbait were too lazy to look up the documentation on the New York Fed’s website.

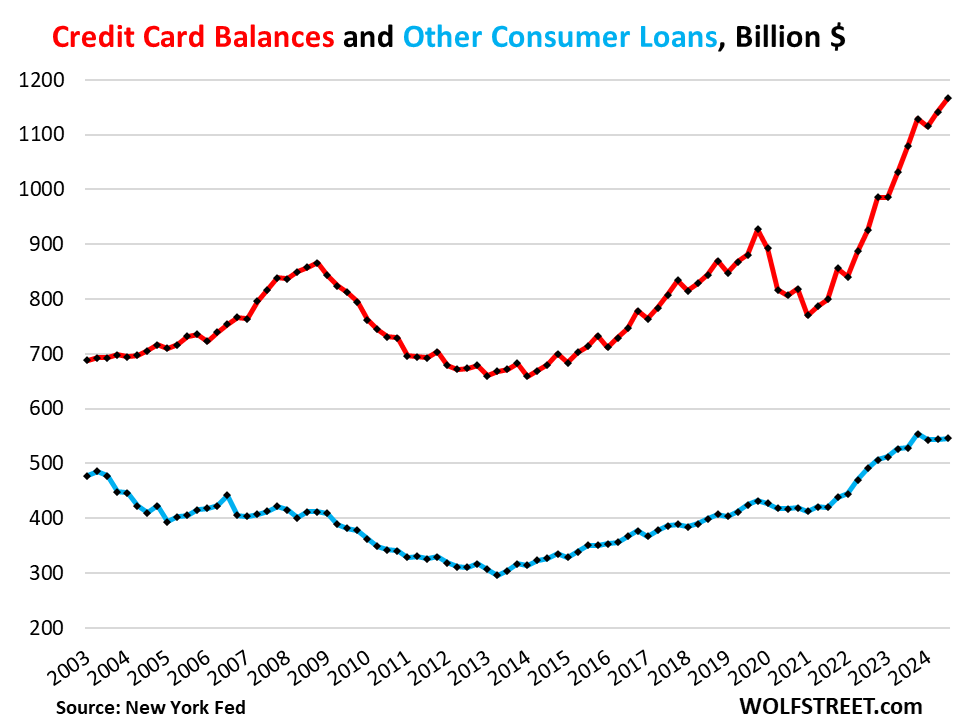

Credit Card Balances are a partial measure spending, not of debt.

Credit card balances are a measure of consumer spending – including for expensive business trips that are reimbursed. They’re not a measure of borrowing because most balances are paid off by due date and never accrue interest, but allow cardholders to get their 1% or 2% cashback, airmiles, and other loyalty benefits. Credit cards are the dominant payment method used by consumers in the US, ahead of debit cards, and far ahead of other payment methods, such as checks or cash.

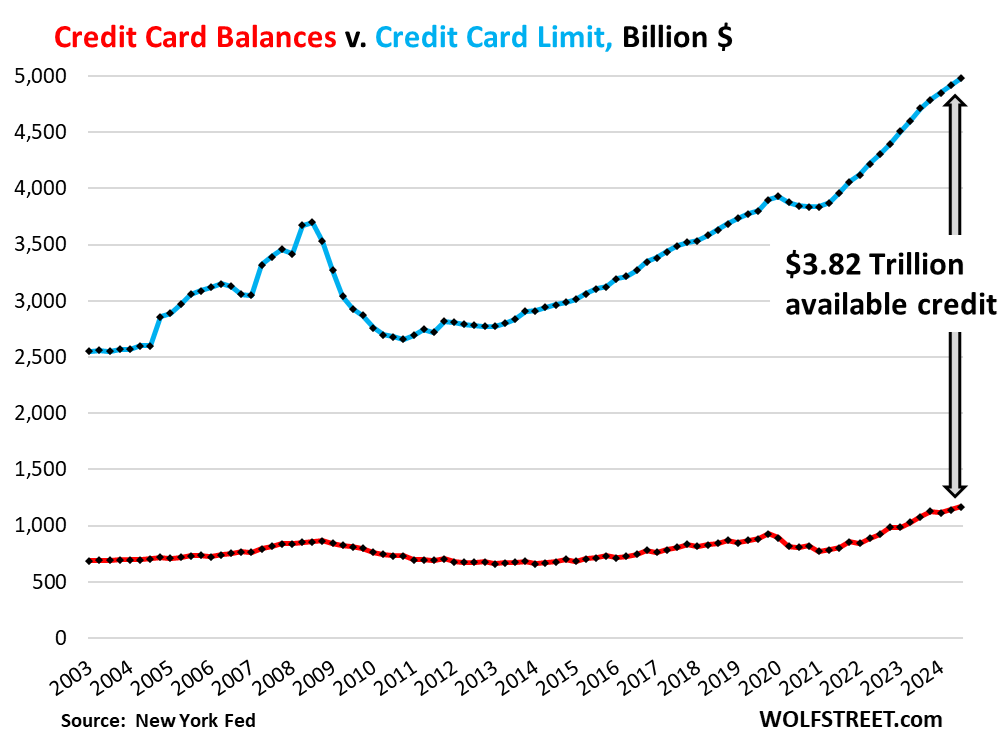

Credit card statement balances rose by $24 billion, or 2.1%, in Q3 from Q2, to $1.17 trillion, according to the New York Fed’s Household Debt and Credit report. Year-over-year, credit card balances rose by $87 billion, or by 8.1% (red line in the chart below).

These growth rates were in line with solid growth in consumer spending, including spending on travels, including reimbursed business travels, and with inflation.

“Other” consumer loans, such as personal loans, payday loans, and Buy-Now-Pay-Later (BNPL) loans remained essentially unchanged in Q3 for the third consecutive quarter, at $546 billion. Year-over-year, they rose 3.2% (blue line).

BNPL loans are short-term and interest-free loans that are subsidized by the merchant. They’re a modernized version of installment buying, a concept that has been around forever.

Income rose 142%, credit balances only 53% in 20 years.

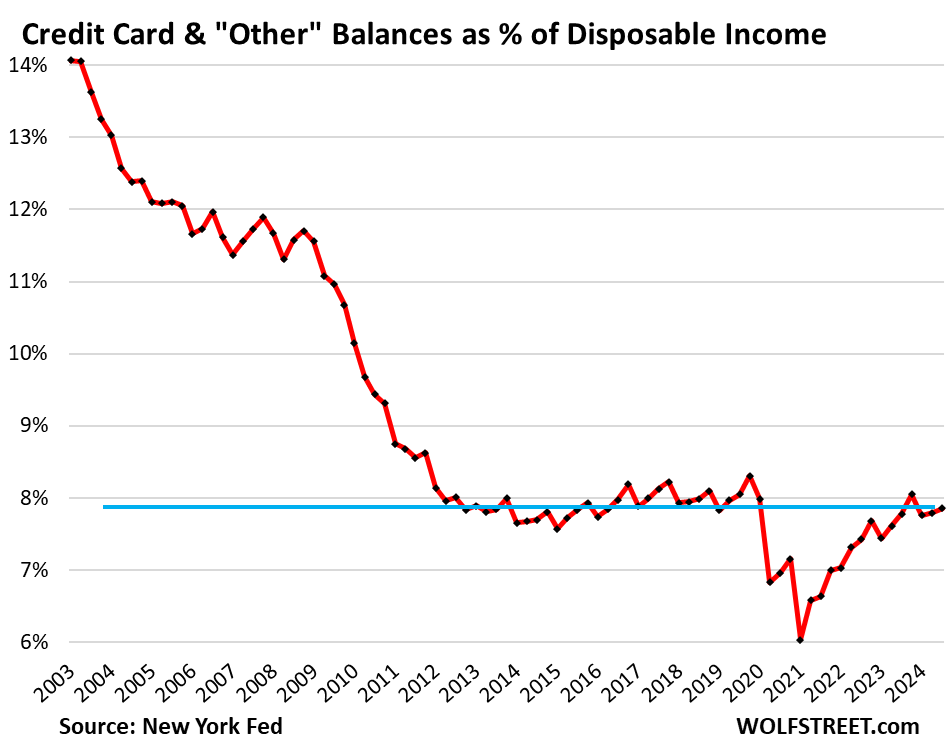

Over the past 20 years, disposable income surged by 142%. But balances of credit cards and “other” consumer loans combined rose only 53% over the same period (to $1.71 trillion in Q3).

As a result, the burden of the combined credit card balances and “other” balances, in terms of the debt-to-disposable-income ratio, has declined over those 20 years, from 14% in 2003 to 7.9%. The ratio has been in roughly the same range for 12 years, with the exception of the pandemic when government handouts grotesquely inflated disposable income.

Disposable income, released by the Bureau of Economic Analysis, is income from all sources except capital gains; so income from after-tax wages, plus from interest, dividends, rentals, farm income, small business income, transfer payments from the government, etc. This is essentially the cash that consumers have available to spend on housing, food, cars, debt payments, etc. And what they don’t spend, they save.

Banks are eager to expand credit.

The aggregate credit limit rose by $269 billion year-over-year, to $4.98 trillion, as more card accounts were opened with banks trying as aggressively as ever to get people to set up new accounts, and as credit limits were raised on existing cards.

Over the same period, credit card statement balances rose by $87 billion, to $1.17 trillion (red line)

So the available unused credit surged by $182 billion year-over-year, to a record $3.82 trillion:

In case you missed the rest of our series on consumer credit over the past two days:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Most of those charts don’t show positive trend lines for the past two years. Some of that is just things getting back to normal after all the free cash spigots were turned off following COVID (60-day-plus delinquency rate for prime-rated credit cards, credit card and “other” balances-to-disposable-income ratio, etc.) but the rest seem well above the averages for the 2013-2020 post-Great Recession era.

Probably not a danger YET… but people will have to make spending adjustments to keep out of danger. Wage increases are getting stagnant and refinancing to lower terms isn’t possible right now. All that is left for most people is cutting disposable spending.

So read the text. This “danger” stuff you’re citing is nonsense.

So I’ll repeat:

Credit card balances are at a historically low 7.9% of income down from 14% in 2003.

Delinquencies of prime credit cards are in pristine condition (0.99%), which is the VAST MAJORITY of credit card balances.

Subprime (a small portion of credit card balances) is coming out of its free-money hangover. We saw that with auto loans too. Subprime is always in trouble which is why it’s “subprime.” Subprime means bad credit, not low income.

Just curious — why are you excluding bank charge-offs in your Commercial Bank credit card delinquency charts? Credit card charge-offs were 4.7% in Q3 2024. That’s about 50% higher than delinquencies.

Combined, Commercial Bank credit card charge offs and delinquencies were 7.9% in Q3 2024. That’s higher than 2006 and 2012-2023. And roughly on par with 2007.

And yes, I RTGDFA… twice! :-D

1. Why did I “exclude” charge-offs from this article? Because it’s a different topic. That’s why. So here is why they’re different topics:

Charge-offs are a decision that the bank makes after loans have been delinquent for quite a while, and the bank estimates that it will not be able to collect that portion of it and writes it off. Delinquencies tell you what is going on with consumers. A spike in charge-offs tell you that the banks are finally cleaning house and charge off stuff that they think they will never be able to collect.

2. You CANNOT add delinquencies and charge-offs. You’re double-counting the same thing. Charge-offs are the same delinquencies but on a later date when they haven’t been collected yet, and the bank feels like it’s time to clean house, given that there are some guidelines as to when a delinquency should be charged off.

3. Charge-off rates (blue) are nearly always higher than 30-day delinquency rates (red), and they obviously lag delinquency rates. During the Great Recession, delinquencies peaked at 6.8% in Q1 2009 then dropped off sharply, while charge-offs peaked at 10.5% in Q4 2009 and stayed there for 3 quarters. In Q2 2010, delinquencies were back down to 5.1%, while charge offs were STILL at 10.5% (each vertical gridline = 1 year):

Keep borrowing on those credit cards to buy crypto, and paying it back with the unlimited crypto profits. BitCON $10,000,000. DogeCON $1,000. You better FOMO now, because he who FOMOs first, FOMOs best.

Amazing how the Fed can print $5 Trillion, then unprint $2 trillion, and a magical $50 Trillion of “wealth” across housing, stonks, and Ponzicoin appears out of thin air.

This definitely could go on forever. It definitely couldn’t be the biggest asset bubble of all time, inflated to ever higher heights thanks to constant market interference. It is the beginning of a permanently high plateau. Assets are all priced at fair market value, and could only go up from here, right?!

Just keep printing more – inflation and magic fiat creation benefits everyone! (except young people trying to start a family, but who cares about them)

/s

most of that $50 trillion is an illusion. if any large number tried to sell to realize those “profits,” the prices would plummet.

it’s a weird game the fed is playing.

The top money earners are the ones buying and selling to each other….

Those near the bottom do not have a hope in H.

I’m happy I am secure solid in the middle after I cashed out.

This is certainly true, but if an individual owns an overpriced stock, or an overpriced house, he can definitely sell right now and get a lot of money, that can be spent.

The Bureau of economic analysis wouldn’t even recognize it as income, but it’s money available for spending.

vinyl1, yes, an individual can for sure. but the entire idea of overinflated assets driving the economy is premised on the vast majority thinking prices will only go up and decline to sell.

LOL!

The problem for eCONomic activity is how much of that “wealth” is actually liquid. Do we really want all that crypto liquidity spilling into the real economy? Seems to me that bitcoin is an asset of largely the 1%, at least based on the huge amounts parked in very few hands. In that regard, it as been an inflationary pressure release valve. If the market share is 2 trillion (and it may be more) do we really want another 2 trillion in FRNs chasing the same goods and services?

Does anyone know if this is really true about crypto being a “rich man’s asset”, because I’ve heard that said here a few times?

I’m skeptical, because in the early days, I knew some dumbass laymen touting crypto, which is just another reason why I’ve never considered buying any.

I also read some BS rag article once how people like Jay-Z touting this trash had the black community thinking they had a way into “the white-man’s investing world”, and were later crushed when crypto (must have) took a dump. I wasn’t really paying attention, because it all sounds like BS, but is it really that all the nerds and dumb people got crushed, and now just people that are already rich anyway have bitcoin?

It should be noted that investing is free to anyone now, no matter how poor. But that doesn’t mean that lots of people don’t still lose money.

As Franz said, that 50 trillion is an illusion, HOWEVER, the crypto market is not and those positions can be sold for the local currency or used to directly buy things. The take home message is that the crypto space is sucking up a lot of liquidity. Now imagine all of that liquidity being pumped into the real economy chasing the same goods and services. I can think of several things that might lead to a liquidation in the crypto space.

YES!!!!!!

Oh wait, does that last thing mean you were being sarcastic?

I don’t think you can use credit cards to buy crypto. Back when I used Coinbase and Binance, both required ACH to transfer dollars in. There was no way to pay by Visa/MC/Amex etc.

I suppose if you’re really stupid, you could do a cash-advance to fund a crypto purchase…

> There was no way to pay by Visa/MC/Amex etc.

No waiting — “innovation” Coming soon to the commanding heights of a financial regulatory system near you. Casino mentality will now encroach on the banking and payments system. A fun first: a US President affiliated with people selling sh!tcoins. What universe are we in? Who swapped our universe?

phleep, you need to get out of that box you are in and get with the program. You may need Dogecoin to buy a ticket on the shuttle to Mars one day.

There are now many vendors who will sell you bitcoin with a credit card. Of course they upcharge quite a bit, but it’s definitely possible.

You don’t need to borrow. You can get a credit card with BTC rewards and start stacking Satoshis as you buy your everyday items. I can send you referral if you’d like?

“…start stacking Satoshis…”

:vomit:

I just knew you would come through, Depth Charge.

All this aggregate economic data on Wolf Street would be much more informative if it were split out into more detailed deciles/quartiles, etc. The growing disparities between the top decile/quartile/third/half, etc. of earners/household wealth massively distorts the aggregate picture so much so that they’re increasingly useless.

Sounds like a project for you to take on, Jerome! Please post your results here! :-)

Jerome,

Your comments would be so much more informative if you RTGDFA, rather than copy and paste BS.

I broke it out for you in the article: “prime” credit card delinquency rates = 0.99%. That’s the vast majority of credit card balances. Subprime delinquency rates are much higher and pushed the overall delinquency rate to 3.2%.

And don’t worry about poor people and delinquencies. Poor people cannot get a lot of credit, if any. If they’re delinquent, it’s on small amounts.

With auto loans I gave you prime (blue) and subprime (red) delinquency rates:

Prime: 0.3%

Subprime: 6.1%

Only about 16% of auto loan balances are subprime at origination.

All this stuff is in the articles about our Drunken Sailors. All you have to do is read them.

https://wolfstreet.com/2024/11/16/auto-loan-balances-burden-subprime-prime-delinquency-rates-and-subprime-dealer-americas-car-mart-in-q3-2024/

maybe he’s not talking about credit cards specifically, but wealth disparity in general and its effects on the psyche?

Franz G

He was just copying and pasting BS without having read the article. I have seen this BS verbatim many times. He doesn’t come here to read, he comes here to drop BS on the comments without reading. Sometimes it’s funny, sometimes it’s stupid.

There was zero about wealth disparity in this article. Poor people cannot get a lot of credit. It takes a high income to borrow a lot of money.

To bottom 25% of income earners have to make do with debit cards. Most of them have no credit card debts because they have no credit cards, and if they do, the credit limits are low, and debt is minuscule and doesn’t move the needle.

What I’ve learned here on Wolf Street is it’s the bottom quarter making all the doom-porn headlines. 70% of American households are homeowners, many with a 3% mortgage, 40% of households have a paid off house. So grateful to Wolf Street for getting me out of the doom crapper so I can enjoy a much better outlook on the American way of life.

Speaking of doom-porn headlines… I am so sick of all the articles citing high cred card balances as evidence of consumer distress. Talk about a broken record…

People that carrry a balance on credit cards and pay crazy high interest (My first Google hit was “The average credit card interest rate is 28.65%”) are making a bad financial decision and they have a lot in common with people that make other bad decisions like drinking too much or eating too much junk food in that there is no one reaason that they do it and they come from many different backrounds and have different incomes.

ApartmentInvestor,

Don’t be so harsh on people. A young couple needs to buy some living room furniture for the new house. But after the down payment and other costs, they don’t have enough cash in the bank. So they make a deal with themselves: spend $5,000 on furniture on credit, and then make a concerted effort to pay it off in a few months. Forget eating out, forget vacations, until it’s paid off. So they pay lots of interest. And after a few months they got it paid off. Meanwhile, they can enjoy their house with a nice living room. Young people do this all the time. I did too. They’re not going to default. They have a plan, and they’re following through. And that may be the last time that they will pay interest on a credit card. And once they paid that off, their FICO score goes to 840.

Agreed. I don’t even think of credit cards as credit – they’re just a payment method that give me better points & cashback. Both my credit cards autopay the full balance due each month.

@Wolf I paid credit card interest once (as a young undergrad just over 40 years ago) when I bought a Sears Craftsman tool box (that I still have) that was on sale for $100 off on my Sears card (that my Dad told me to get at 18 to build credit) after I did the math (using visicalc on my AppleII+) to show I was saving more with the sale price than I would pay in interest over the next two months. With that said, just like as you point out that “most” of the bottom 25% don’t have much credit I’m pretty sure that “most” people paying 28% + interest don’t have a concrete plan to pay it off. I have been in the apartment business since I got a part time job as an assistant property manager more than 40 years ago so I have been not only looking at credit reports, but talking to people about the reports all these years (I have also been fixing stuff in apartments that long and I got the tool box to organize my tools since I was making more doing apartment maintenance work on nights and weekends than I was making working in the office renting apartments and paying bills).

I did exactly what Wolf said when I was a kid and had a hard time making ends meet. My wife and I made the decision to go into debt, modestly, to get some creature comforts.

The tradeoff was: no vacations and rarely did we eat out. But, we had some nice furniture, reliable cars, and never really “went without”.

Everyone likes to parrot the Dave Ramsey “no debt” mantra – and in many ways, he’s right in the advice he’s giving to people who are not responsible with debt. That said, there are many millions of Americans who are responsible with their use of credit and debt and for them, it’s a great tool.

I believe it is about 40% of homeowners who have their homes paid off. It’s not 40% of households, which by definition also includes renters.

Yes, thank you. 40% of the 70% that are homeowners I believe is correct. This paints an entirely different picture than the endless doomster click-bait out there. I have to admit, for a while there they were getting in my head. Especially with all the money printing and after the 2008 crisis, which seems like yesterday.

There’s “doom-porn,” and then there’s “cheerleading,” both at the opposite ends of the spectrum. Heya, cheerleader, gimme a C!

Its’ getting harder and harder to pay cash in stores around here. There’s so much theft and crime, many retailers are refusing to accept cash. I just ripped up my Wells Fargo Visa card and cancelled my account. Moved all my periodic billing to another card. I had so many criminals getting in there I got fed up.

A “no cash” policy does keep out the riff-raff. It is, by definition, exclusionary.

I’m a cash guy when buying in person, Equifax doesn’t need to know all my business. In fact, few things make me happier than being told “we don’t take cash”, before walking out on a big dollar purchase. I didn’t need that crap anyway…

When stores refuse cash, I refuse to ever shop there again. I laughed at a resort a few years ago when they wouldn’t sell me a hat and a meal for cash. I didn’t buy anything and left.

Fenway Park in Boston is now 100% cashless. It’s gross. Your benjamins might as well be toilet paper.

Going cashless cuts down on employee theft (and the cost of an armored car service). A cousin that used to be a flight attendent said that everyone was sad when the airlines went “cashless” since they could no longer sell the mini booze bottles they brought with them in their carryons for a 500% profit.

30+ years out here in flyover. Our business does not accept credit cards. My dentist, doctor, or places I dine at all offer cash discount.

I’m finding the opposite: more stores/gas stations/restaurants are offering discounts for cash vs. credit.

small businesses are the ones doing that, and they’re not doing it to save the 2% on the interchange fees, but to save the 35% on income taxes, as you can be assured that they’re not reporting all of their income.

GOOD thread ”wolfsters”’

Just going to weigh in with my experience in the SF Bay area about 40 or more years ago:

Back then, when I could run really well, usually enough to discourage the hippie types on Telegraph Avenue after I told them to ”get a job”, etc., I was usually carrying at least a couple thousand cash in my pocket and got really great discounts from the owners of the vendors needed for my construction, repairs, and restorations biz work…

HELL YES WE did that to avoid taxes,,,,

And SO did almost every other type of ”venue” including my breakfast favorite, Spengers, where I would go to enjoy tons of fresh and totally sour dough bread along with a couple dozen oysters from their family owned beds up north owned for eva by that family,,,

Then go to work and only drink water all day because of the vast nutrition provided by that break fast,,,

AH, the good old days,,, eh

And I am sure you weren’t missed at all.

Not sure I follow… retail theft usually involves stealing the product, not emptying the cash register… there’s still product on the shelf to steal in a cashless store.

Oh, and the theives can just buy a bunch of stuff on their credit card, and then file a fraudulent chargeback claim saying they never made the purchase. They’ll likely get their money back.

In the latter scenario, cash is /more/ secure…

not employee theft. skimming is nearly impossible with a no-cash policy.

That problem is solved with proper cash register management. When I had a store, I personally counted every register at open and close. The kiddie was $100 in each register. Any large cash payments had to be double-counted.

Employees sometimes made stupid mistakes, e.g. putting a $1 in the $5 slot in the drawer, and not always counting back change correctly – but they never stole from me.

Employees absolutely can steal cash.

I used to work with a guy that previously worked at a fast food place. He would bring from home the change you would give if someone ordered a value meal and paid with a $20. When someone ordered, he would not log the transaction, give the customer burger and fries, and give them change from the employee’s own pocket – thus stealing the price of the meal.

Employees can’t do that at cashless businesses.

Now I understand the signs that say “your order is free if we don’t give you a receipt”

@SC

Had the same problem with a hotel loyalty program. People were stealing the points by using to stay. Called the fraud out in time once, to send local law enforcement an email about the theft. Don’t know or care what the LEO did. The points were returned and worked with the program to make changes about how they were used. I now get a text with a security number before the reservation is accepted. Works fine.

i prefer stores that don’t accept cash. the people paying with cash slow down a queue noticeably, and the stores don’t have to worry about employee theft or the cost of armored car contracts.

Yep.

The check out at the stores I shop are slowed down because

we talk to our neighbors in line, and the employees behind the

counter. I know its an odd concept.

If I am forced to eat at takeout and sub joints, etc. (like, if I am traveling in the States), I like to pay cash so I don’t get hit with the tip screen asking for 25% tip on takeout *after tax*, and on credit, so the employee wouldn’t even get it all. Not that I mind saying no, but this happens before they bother to make my food. This is a pain, though, because now I have to find a place for those change coins until I get home to put them in my wife’s purse.

I always tip well at real restaurants, even though I don’t like or appreciate that culture. I am not willing to spread it further, though.

“Subprime means bad credit, not low income.”

Perfect example of the difference between being income affluent and balance sheet affluent.

Just a quick question/inquiry. Is there a source that anyone can direct me to that analyzes disposal income by population class? What I’m most interested in is trends with disposal income between poor, lower middle class, middle class, upper middle class, and the wealthy (old school classes I know but I need to start somewhere). Further, if this source can split out disposal income by source (e.g., earned wages, rents, interest/dividends, etc.) that would be great. While the analysis provided in the article that compares total credit card and other debt to disposal income is insightful, having this broken down by population class would shed more light on the relative strength and financial risks with each population class. Again, just wondering if this level of granularity is available from a public source as if anyone would know, it would be Wolf.

Or maybe I should just pay more attention to the Walmart indicator. That is, when consumers feel financial pressure/stress, they tend to shift spending to the low cost retailers such as Walmart (and away from larger purchases from specialty companies/retailers, B&M or e-commerce).

BTW, I agree with Wolf as CCs (and equivalents) and to a lesser extent, DCs are now the primary consumer payment methods used by consumers. Checks are all but dead while cash still has some uses (but continues to lose market share).

THE LOWER 25% OF INCOME SCALE DON’T HAVE CREDIT CARDS, they have to make do with debit cards, and those few that have credit cards have LOW CREDIT LIMITS, and if they’re delinquent, they’re delinquent on minuscule amounts.

High debt (leverage) is a privilege reserved for higher income people. The wealthiest have the most debt. They borrow billions of dollars against the shares of their companies so that they don’t ever have to sell and pay taxes.

Borrowing is a privilege that poor people don’t have.

Wolf, I’m amazed that you still have hair on your head. Would’ve expected you to have pulled it out already. Whenever I see your block box in the comment section and the first line is all caps I start chuckling. Poor chap didn’t RTGDFA or spouted some silliness.

Thanks for the smiles, laughs, fantastic analyses, and commentary.

The only thing I requested was a simple referral to an additional detailed analysis. That’s it and a simple yes or no would have sufficed. I did read the article and simply was looking for additional information, especially with the classes that are not consider poor and do have access to credit (i.e., middle class, upper middle class, etc.). As usual, the replies provided read too much into my request and jumped to the conclusion that I didn’t read the article. As everyone should know, the devil’s in the detail so anytime there’s an opportunity to drill down into the detail to learn more, it should be taken.

BTW and to make sure WR is clear on this subject, stating that there is no interest rate associated with a BNPL program is not accurate. WF referred to it as a discount which is just a fancy way of getting around referring to it as an interest charge. It doesn’t matter if the retailer sells the product, they’re absorbing an interest charge so that the middle party (e.g., Affirm) can finance the purchase to the end consumer. If any of you are familiar with this game and actually calculated the implied or implicit interest rate on these BNPL deals, you would be amazed at equivalent interest rates that run well north of 50% per annum. You can call it any name you want, including a discount, but the truth is, a middle party is present and financing this purchase.

So go ahead, and shred me again and call me an ignorant fool, but before you do, please take the time and do your research to understand how BNPL programs work and the role of the middle financing group plays. Its a shady form of financing that is extremely lucrative to the parties operating in the middle (as they’ve found a way to avoid disclosing the true cost of financing the purchases).

Tage Tracy,

“…to make sure WR is clear on this subject, stating that there is no interest rate associated with a BNPL program is not accurate.”

What I actually said in the article is this:

“BNPL loans are short-term and interest-free loans that are subsidized by the merchant. “

But it’s a little more involved: Instead of paying the credit card swipe fees of 1% to over 3%, the merchant pays the BNPL provider a fee. It seems to be a good deal for merchants because they (Amazon et al) are pushing it when they could just use my credit card that they have on file. But the BNPL providers are losing lots of money: Affirm, one of the largest BNPL providers, lost $2.2 billion over the past 4 years. They lost money every single year of their existence.

So the BNPL loans are costly to investors, they’re a good deal for the merchant because they save the swipe fees, and they’re interest-free for the customer. That’s how that works.

” It doesn’t matter if the retailer sells the product, they’re absorbing an interest charge so that the middle party (e.g., Affirm) can finance the purchase to the end consumer.”

Tage Tracy,

I manage the Affirm API for the retailer website I run for my day job. This is incorrect. The retailer pays a higher fee for Affirm payments (similar to Paypal), but the retailer is not directly subsidizing the interest cost.

It sounds like you’re confusing this with some other store financing promos, which are often sponsored by the mfgr. E.g. my company offers promotional rates on financing thru Synchrony, but those promo rates are funded by the manufacturers whose product we sell.

But Affirm doesn’t work that way – I suspect they’re funded by retailer transaction fees, again similar to Paypal.

“Affirm, one of the largest BNPL providers, lost $2.2 billion over the past 4 years. They lost money every single year of their existence.”

Well that explains it LOL. Should have finished reading Wolf’s comment before replying.

It’s almost like /investors/ are subsidizing BNPL financing.

I “make do”just fine with a debit card,have not had a loan in over 30 years,me credit is probably trash as I am a cash purchase sort of person/perhaps bank check for large vehicle or home.

As for stores who will not accept cash,well…..,have fun restocking the shelves.

Cash is an expensive and anachronistic annoyance for retailers.

I don’t use debit cards period. They are very dangerous. I had one stolen out of my trunk while playing golf. Within 2 days I had $3,000 stolen out of the card in NYC where the card was laundered. The dudes used it to get laid and get multiple blowjobs with hookers in NYC, all at my expense. It took months to get my money back from SunTrust Bank, who are nothing but a bunch of crooks themselves.

I only use $500 gift cards, purchased at my local supermarket, from now on and keep them locked up at home.

I don’t use debit cards either for the same reason. I don’t even have them in my wallet unless I’m on the way to the ATM.

I had an ATM card from Well Fargo to use to get cash without going in the bank. It worked great during the pandemic when I stayed out of banks period. Then I found out Wells Fargo lied and didn’t tell me the ATM card could also be used to buy things from certain vendors. I destroyed the card. Later I closed all my accounts with them except my business account. I also cancelled my Visa cards with them in protest.

I use my credit card at the pump for gas and for auto repairs, and when I want a record for business tax purposes purposes. I use a gift card for on line purchases. Everything else I pay cash. If a retail establishment doesn’t take cash I walk out and tell them to go f$ck off. .

Take a look at a $20 bill in the lower lefthand corner above the Treasurer’s signature. It reads “This note is legal tender for all debts, public and private”. They have to take it for payment, if not sue their ass and add a little extra for your trouble. All circulating denominations of US currency have this statement somewhere on the face of the bill.

My balances run high for a year and then disappear all at once. No lack of credit cards for those with decent credit that provide not only 2% or higher rewards, several hundred cash bonus and 0% APR for 12 months or more. Nice to get a little back from the bank. Put most of the paycheck into treasuries and most of the rest goes on the new card.

Glen,

Not looking down on anybody but your story sounds like the old days of kiting a check to use interest free money. The delay between the time the check was written and when it cleared the clearing house was then about ten days. Slowly this time shortened to where it was more work than profit. Now when a check is deposited in a bank the check is cleared almost immediately.

This was illegal but worked fine as long as you kept ahead of the check.

To me it is a solid $800_$1000 a year or so with little to no effort. I already charge anything I can and simply put a calendar reminder when 0 APR is expiring. I get it isn’t worth it for those where $1000 a year is small change and of course this gets less as yields go down.

In other words, it’s a fairly good time to be an american with a job, access to credit and other opportunities, and relative safety…

Is there not inherently a flaw in the data?

I mean if you had an 800 FICO and then you’re 60 days late on a credit card payment I’m fairly sure that 800 fico is gone. And now you’re counted in sub prime therefore protecting the pristine credit category.

I guess the fed transition rate would really be the best indicator on how many people are beginning to struggle

That’s not at all how it works.

Subprime loans are subprime at origination based on the credit score of the borrower at the time they took out the loan. It will remain a subprime loan for the duration of the loan, no matter what the borrower’s credit does in the interim.

Same with prime loans, they’re prime at origination. And if they fall behind, they’re still a prime loan, but a delinquent prime loan. That’s why the delinquency rate of prime loans is 0.99% because there are some delinquencies (people go on vacation and forget to make the payment before they leave, or a payment doesn’t go through and the borrower doesn’t notice it, etc.)

The loans are securitized with the credit score at origination.

But the borrowers credit score will change with delinquencies and eventually become subprime (below 620 FICO score), and any new loans that the borrower takes out are then subprime loans at origination.

That is the case will all loans, including auto loans and mortgages: whether a loan is subprime or prime is determined by the credit score of the borrower at origination, the loans are then sold and securitized with that credit score, and will stay in the loan pool for that credit rating for the duration of the loan.

The subprime mortgages that caused such a heartache during the mortgage crisis in 2006-2012 were subprime at origination, made to borrowers with a FICO score below 620 at origination.

For those who do miss a payment and get a penalty or ding on their payment record, call the bank/credit service and ask for a waiver. I’ve had to do it a few times and have never been turned down.

Yup. Capital One did this for me once before I had autopay setup.

Okay for installment loans but I thought we were talking about credit cards here.

How is a credit card delinquency categorized in the scenario where they had a prime score when applying and approved but after missing payments and going delinquent now have a subprime score.

I don’t think many subprime borrowers can even get credit cards tho

What I said in the article was that the “prime” delinquency chart (data from Fitch) reflects credit cards whose balances were put into pools and securitized and were prime-rated at the time of securitization, and were sold to investors as bonds (ABS) with “prime” credit card debts. That doesn’t change.

Investors bought these ABS of prime-rated credit card debts. Investors get paid as credit card holders make interest and principal payments on these debts. There are two types of pools, “liquidating pools” that vanish as card holders pay off their debts, and “revolving pools,” where the paid-off debts by cardholders are replenished with new card debts from other borrowers. In either pool, any losses due to defaults and any gains due to late fees etc. become part of the pool. What Fitch tracks are the delinquency rates of the cards those pools.

In the most simplified version, a bank will sell the receivables from its credit card holders to a trust that then securitizes that debt in that trust and sells it as bonds to investors. A trust can be fairly large, such as $1 billion. The bank doesn’t sell the cards or the borrowers, just the specific amount they borrowed at that time, just like an auto loan. When these customers take out new loans on the SAME credit cards, the bank then sells these new loans to a NEW trust that securitizes them into different ABS. When a customer has a prime FICO score at the time the debt is sold to the trust, that amount is prime. And that doesn’t change. If the same borrower’s FICO score later becomes subprime, it doesn’t change the old debts that were sold to a trust some time ago. If that now subprime-rated borrower borrows more against his credit card, these new balances even on THE SAME CARD are then sold to a DIFFERENT pool and are tracked as subprime balances.

Retired, on a fixed income adequate for my life style. Zero debt. Use my CCs for payment of nearly all day do day expenses, running about 6 grand a month combined, and pay them off before statement dates. Have been for 5 years now. I find it interesting that lately, Equifax sends solicitation emails suggesting I use a bit less credit card to improve my credit score while alternately sending emails for additional credit card offers. Small but odd contradiction in their automated email messages. Must be a lot of others in same situation, wonder if get same solicitations.

We do, same situation, with 800+ credit and very little use beyond CC(s) paid off every month, etc…

Best feeling, far damn shore, to have NO DEBT beyond monthly CC pay offs.

The same thing happens to me. I don’t think it’s a contradiction. They’re saying use less card to boost your score (meaning the utilization of available credit is in their view, tipping too high) and… Hey! Here’s a new card offer to boost your amount of “available” credit!