“Survive till 2025” is the motto in CRE now, but that might not work either.

By Wolf Richter for WOLF STREET.

The office sector of commercial real estate has been in a depression for about two years, with prices of older office towers plunging by 50%, 60%, or 70% from their last transaction, and sometimes even more, with some office towers selling for land value, with the building by itself being worth next to nothing even in Manhattan.

Landlords of office buildings are having trouble collecting enough in rent to even pay the interest on their loans, and they’re having trouble or are finding it impossible to refinance a maturing loan, and so many of them have stopped making interest payments on their mortgages, and delinquencies continue to spike.

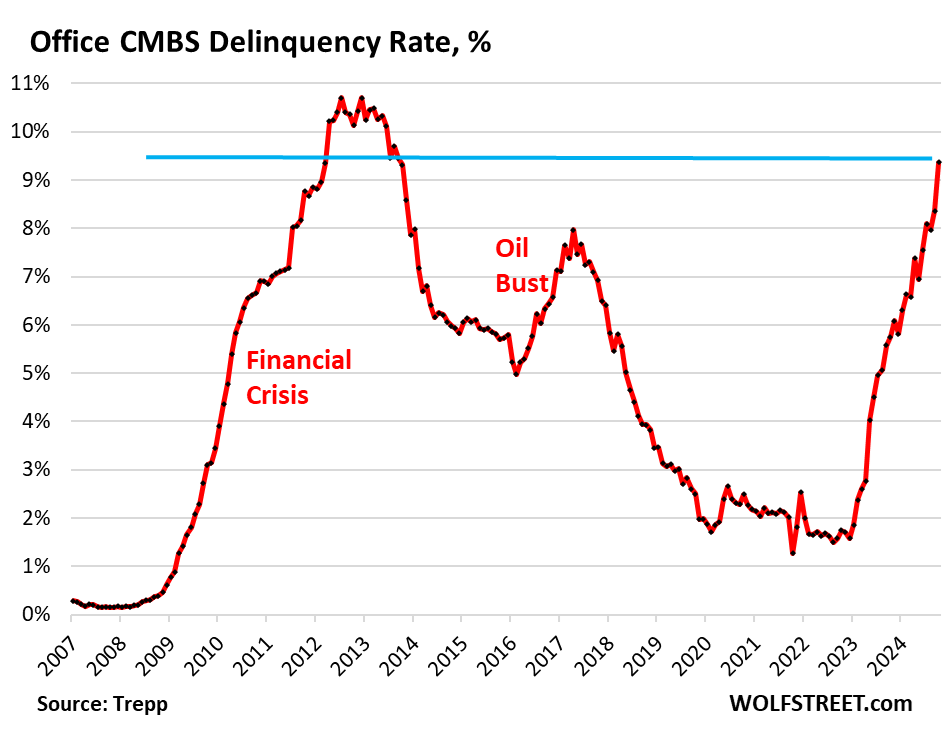

The delinquency rate of office mortgages backing commercial mortgage-backed securities (CMBS) spiked to 9.4% in October, up a full percentage point from September, and the highest since the worst months of the meltdown that followed the Financial Crisis. The delinquency rate has doubled since June 2023 (4.5%), according to data by Trepp, which tracks and analyzes CMBS.

Office CRE fund managers have spread the rumor that office CRE has bottomed out, but the CMBS delinquency rate doesn’t agree with this bottomed-out scenario; it’s aggressively spiking.

Three months ago, the delinquency rate surpassed the surge in delinquencies that followed the American Oil Bust from 2014 through 2016, when hundreds of companies in the US oil-and-gas sector filed for bankruptcy as the price of oil had collapsed due to overproduction, which devastated the Houston office market in 2016.

But now there’s a structural problem that won’t easily go away with the price of oil: A huge office glut has emerged after years of overbuilding and industry hype about the “office shortage” that led big companies to hog office space as soon as it came on the market with the hope they’d grow into it. However, during the pandemic, companies realized that they don’t need all this office space, and vast portions of it sits there vacant and for lease, with vacancy rates in the 25% to 36% range in the biggest markets.

Mortgages are considered delinquent by Trepp when the borrower fails to make the interest payment after the 30-day grace period. A mortgage is not considered delinquent here if the borrower continues to make the interest payment but fails to pay off the mortgage when it matures. This kind of repayment default, while the borrower is current on interest, would be on top of the delinquency rate here.

Loans are pulled off the delinquency list if the interest gets paid, or if the loan is resolved through a foreclosure sale, generally involving big losses for the CMBS holders, or if a deal gets worked out between landlord and the special servicer that represents the CMBS holders, such as the mortgage being restructured or modified and extended.

Survive till 2025 has been the motto. But that might not work either. The Fed has cut its policy rate by 50 basis points in September and is likely to cut more but in smaller increments. Many CRE loans are floating-rate loans that adjust to a short-term rate (SOFR), and short-term rates move largely with the Fed’s policy rates. And floating-rate loans will have lower interest rates as the Fed cuts.

Long-term rates, including fixed-rate mortgage rates have risen sharply since the Fed started cutting rates, so that option isn’t appealing.

So the hope in the CRE industry is that rate cuts will be steep and many, thereby reducing floating-rate interest payments, making it easier for landlords to meet them. And so the prescription was: Survive till 2025, when interest rates would be, they hope, far lower than they were.

But rate cuts will do nothing to address the structural issues that office CRE faces. The landlord of a nearly empty older office tower isn’t going to be able to make the interest payment even at a lower rate when the tower is largely vacant.

And these older office towers face the brunt of the vacancy rates, amid a flight to quality now feasible because of vacancies even at the latest and greatest properties. And there are a lot of these older office towers around that have been refinanced at very high valuations in the years before the pandemic, but whose valuations have now plunged by 50%, 60%, or 70%, and they have become a nightmare for lenders and CMBS holders.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Maybe the motto should be survive until majority of big corp will follow Amazon’s footsteps and forcing everyone back 5 days a week in the day.. that’ll increase those vacancy rates alright..

Ironic that Amazon likely benefits if more people work from home. I’m much more likely to have something delivered to my house if I know I will be there to receive it

Not sure how much that matters with Amazon Logistics doing deliveries basically around the clock.

I can get something delivered from Amazon at 4am on a weekday – compare that with UPS red label A.M. service, which is only as early as 7:30am.

Doesn’t matter if you work 9-5 or 3rd shift. Amazon can deliver when you’re home.

Well, if overbuilding and oversupply is the cause of vacancies, return to the office do not really fix the problem. There still may be vacant offices.

Amazon’s exposure to CRE is higher than other Companies like Meta or Google is what I hear..I’m looking for data but would be good to see if there’s anything to it,…perhaps from better connected folk like Wolf.

Every time I read an article like this my first thought is “I wonder how big of a budget hit the big cities with a large portion of their tax base dependent upon downtown office towers [which have now dropped 50% or more in valuation] are going to be taking?” My guess is a rough average of 10-15% drop in real estate tax collections, which is a huge hit to a city with fixed expenses like pension costs and bond payments. Sure, you can cut the current workforce [police, fire, parks, libraries etc] and defer maintenance but that reduces the quality of life for the existing residents. Taxpayers who can leave do pick up and leave [think of those with higher wealth levels and those with more education who can WFH or just change employers completely] which further erodes the tax base.

It is not clear to me where this mess ends. The Feds can bail out the [blue] cities but that will just bump up the deficit, now approaching $36 trillion dollars, even higher. Plus it will piss off the red cities and states that get stuck paying for it. Bankruptcy to reduce pension bond payments? Yes, but that involves a whole new hit to the economy. Sure looks like a real hard landing ahead to me. I hope I am wrong for my grandkids sake. Anyone out there a way out? Wolf?

So much money was produced out of thin air via QE. The consequent assets bubbles are trying to be managed to be deflated slowly, so far successfully. This is managed by slowly destroying money by QT, however, events may happen that causes that other money destroyer, bankruptcies. The fear is an uncontrolled cascade of bankruptcies as per 1929.

Well FRB bought MBS.

Next will be FRB buying CMBS “because contagion”

This is the issue with debasement. If your punters don’t get at least near the subsequent uplift in spending power necessary, then the deflated debt model can’t work because the debt is still too expensive.

There has been no “contagion” from these office CMBS, and there will not be contagion because they’re held by non-bank asset managers spread around the globe, where each asset manager holds only a relatively small dollar-amount of them, and losses of the higher-rated tranches are not huge, while the equity portion and lower-rated tranches, held by risk seekers going for the higher yields, get wiped out.

These global asset managers are pension funds, insurance companies, bond funds, etc. They’re not subject to runs and collapse, such as banks are.

For “contagion,” you need to have banks in the middle of it. But banks sold those mortgages to investors by securitizing them into CMBS. Maybe this way, they sold their worst riskiest stuff and pocketed the fees?

Your pension fund most likely already owns this toxic shit.

It’s sort of happening in Boston right now, with Mayor Wu landing a proposal to soften the blow of increased property taxes to make up

Boston might be better off because of biotech, much of which can’t go remote. But our legal, financial, and other office space is certainly suffering. And the COVID boom started a lab space building boom that may not be needed in the current environment of cost cuts. We will see.

Boston will just write more parking tickets to make up for it.

Biotech has been laying off like crazy. Don’t know of any companies hiring in the past few years, at least in this country. Maybe in japan.

In my county I voted against a bond issue, for road repairs and maintenance, for ~$500M. In my area this number is simply ridiculous. It would be millions per mile not including interest over the unspecified term for the loan. The payoff would amount to billions at current rates.

Voters keep approving these amounts because the roads really do need to be improved, with no thought given to where this money will really go or how it will be paid back. The really scary part is that in neighboring areas the referendums for bond are for refunding past deals that were never paid off.

Where did the original bond money go and where did the additional tax money to pay them off go? Answer: It was misspent and largely unaccounted for. This is why property taxes are off the charts.

Oy! Do you by chance live in Illinois? I only ask for curiosity’s sake as I believe the solution to the issues that plague our whole country is to vote out the entrenched politicians and demand term limits from the new.

I live in Northeastern Illinois (Western Suburbs of Chicago) and the roads are in terrible condition.

The other day while driving out even further west I saw a number of huge warehouse looking buildings. Some did seem occupied by “logistics” firms.

Others seemed empty.

They aren’t office buildings so where in the stats are they?

Petunia,

It is not just your city, and it is not because funds are unaccounted for. It is because the building pattern of every city in the US and Canada does not produce enough economic productivity to support the cost of maintaining the infrastructure.

The result is that nearly every city in North America is heading for insolvency.

Not only that but downtown businesses. In Sacramento, the mayor pushed the governor to have employees bring back employees 2 days a week. It has helped the businesses some but resisted by employees a lot. Most of our downtown is going through a huge transformation.

Boston’s mayor has the answer! Increase spending, giveaways, and INCREASE the commercial real estate tax!! Yep, must save the voters from increased property tax, so push it to commercial property owners. ( non voters). This increase will be paid, no matter if building in foreclosure. A lien paid when building is sold.

MBTA = Money Being Thrown Away

Where did you get this notion from?

What you’re saying is you’re not going to order something to your house if you’re not home all day that day?

How many people in this country do you think live completely by themselves? You don’t have anybody that could grab this package for you?

How many packages do you think get ordered that get stolen? It would surprise you it’s actually a very small amount despite what people may think. 95% of packages are just nail clippers or a coloring book, stuff nobody would ever want to steal.

I really just don’t see the logic in this statement, seems more of something a boomer would say,

“I prefer to be home so I can make sure those darn kids can’t mess with my delivery”

Oh man tons get stolen.

There is a video going around of the FedEx guy literally having to juke and dodge people who were going to take the package he was delivering.

It’s best to get things delivered to a secure location.

What downtown city real estate tax?

I mean you apply for a city business license but that’s all I can think of you are taxed on.

The state actually gives larger companies tax credits, deductions etc to even be in the state.

The city def doesn’t tax the employees just for being there.

If Big city mayor was shaking down the commercial real estate guys for 15%, we might hear about it.

Property taxes on commercial properties based on assessed value of the commercial property (office tower, multifamily building, etc.)

So if you have an office tower that was assessed at $600 million, and the property tax rate is 1.2%, you paid $7.2 million in property taxes a year. When the assessment gets cut to $300 million, your property taxes fall to $3.6 million, and the City’s income from your tower gets slashed in half.

Oh, the building owner is taxed.

I was thinking about the business leasing there.

I’m not following you when you say the red states and cities will pay for over building in the blue states and cities. Just look at federal spending for everything from highways to Grants and you will see the red states don’t pay their fair share for nearly anything… not only that many of them don’t have state income tax or pay very little which makes most of them them beggars at the Federal Pig trough?

They will pay for bailing out the pension funds. Fed money is collected on income tax. Individuals and businesses pay that. States do not. Wealthy individuals fund the US government, without regard to where they live. That is the huge flaw in takers states vs donors states logic.

Oops, Wolf, sorry about the double post

I think it was worth repeating again. We need more people to be thinking a few moves down the road, especially our elected leaders. Enjoyed your post.

Thanks very much.

This is very good news Mr. Wolf; anytime the Capitalists lose money on real estate there is that much less to compete with us serfs. If the banks take a big hit then they won’t have the money to loan for Wall Street to buy up residential real estate as well. Crack the Champaign.

Surviving beyond 2025: after 3 late payments interest rates will be cut

to zero, the loans will be overextended – with a discount – to ease payment until CRE will rise from the ashes. Borrower rating will be

high with a history of 8/12 late payments and no defaults.

Excess commercial properties need to be converted to residential and quickly. Some plans envisage a dormitory type setup with communal showers and smaller living spaces. Red fish blue fish, puts a new slant on muni bonds if the cities belly-up.

NYC Mayor Adams may propose using the empty towers for temporary living space for migrants, instead of putting them up in 4 star hotels.

I’m not so sure of communal showers, but I think you are on the right track.

First, there needs to be property tax reassessments.

Second, cities should consider mixed use zoning. Maybe there could be shops and restaurants on the first few floors, then office spaces that even small businesses can afford, then residences.

And third, allow these towers to be sold as condominiums.

Now we almost have a work from home scenario where work is only a few floors away. Also, this would help abate rush hour traffic in congested downtown areas.

Like Wolf said, utilities and infrastructure might be an expense issue, but I think there are enough innovative engineers around to where this can be overcome.

I dunno. I’m just kicking some ideas around.

Pretty sure Wolf has stated before that the cost is prohibitive to the point it’s tear-down or an expensive gut to get the resi space you’d need to meet regs etc.

In the end this is where big money buys cheap, then sells high once stability returns (at everyone’s cost)… win win for those who know when the knives have stopped falling.

I read that article that Slick is referring too. My profession before retirement was in design and construction, including EXACTLY the type of housing he was describing. Of all the alternatives I have read this is the…most?…feasible. I built, owned and managed 55 units of this type, which I designed and built for college students, and that is about all they are good for. They are not great housing for most people. No way are they for kids or couples. Besides, why would anyone want to live in a small cheap single room with no bathroom in a deteriorating downtown core if you can afford live somewhere [anywhere] else.

Sorry, but I don’t see the downtown office-to-residential transformation working unless you have a huge demand to live downtown.

But I could be wrong, if the cities clean up downtown crime etc, cut taxes [to make projects like this affordable] and the population goes through the roof [think Hong Kong or Cairo] with no other alternatives.

I sure don’t want to live like that.

If there aren’t jobs that require you to be in the area or jobs at all, who is going to move into

a converted tower ?

Let”s do MATH. left side of equation equals right side. So, you want to review tax assessment s. Boston is…proposing higher tax! This may or may not balance revenue s due to lower valuations. Boston has been very reluctant to lower valuations. Now let’ review otherside of equation. SPENDING . if the revenues are lower, CUT spending. There is the problem. What would you like to reduce?

Also, converting to residence from office, even if it were feasible, and in most cases not…the residential property tax is much lower the commercial.

Alot of talk, little thinking.

Probably the only way wide scale conversion works is through significant government subsidies, either directly to developers (for places a paying customer would actually choose to live) or indirectly (for very poor, homeless, migrants), with the hit in property taxes paid for by everyone else.

Commercial towers aren’t very great as condominium towers.

If they were, there would already be zillions of conversions going on.

Slick,

In Sacramento, smaller old ones are being torn down and redeveloped with smaller units and they are everywhere now. This is much more costly with large building and Sacramento large building aren’t New York large buildings.

Rebuilding to be like Europe and other places in the world?

Where housing, shops and offices are mixed in the same area. But others have propper flats with at least one bedroom, kitchen, bathroom and livingroom.

Large towers and sprawling malls may be better to demolish and rebuild the area with buildings of mixed use three to five stores high.

It’s often very difficult to repurpose office space into residential space and the cost is enormous. Maybe going forward, architects will start designing office space with this sort of conversion in mind, but most of these buildings were built to purpose and it’s not clear if it would not be cheaper to just tear them down and start over. Either that or the discounts on the buildings need to be even higher.

Office towers were not built with the level of utilities – especially plumbing – that are required for residential property. If this solution was easy it’d already be happening.

Another option would be office to factory conversions, for certain types of manufacturing.

There has to be a better way to use these devalued empty buildings to meet societal needs. Vertical farming, data storage, energy storage, etc. An innovator’s dream.

I think this is rooted in horrible tax policy called 1033 exchange. The constant trade up of assest to avoid gain taxes ultimately leads to over build, it’s an inevitable outcome and particularly unstable when population ages and growth slows. I think it will get far worse before it gets better, build cash.

As someone with 1033 exchanges I think they are necessary for long term real estate investment. Otherwise being taxed on the inflated value of the property when you sell sucks so much of the profit out of the project they are not a good investment.

If governments would index property sales to inflation that would help. A lot.

Hey now. The government has far more ways to spend our money than we do!

Yes, investors get a double whammy from inflation. Your costs go up due to the inflated high prices (much like everyone else), but then also you have to pay capital gains tax on gains due to inflation rather and actual increase in value.

“Otherwise being taxed on the inflated value of the property when you sell ”

Hold on…doesn’t everybody else at least pay capital gains on the increased value of assets when sold?

Why should RE get a special break of tax-free roll-over?

I won’t argue that the G likely p*sses away 30%+ of the money it exacts (when it isn’t printing it…) but leaving that scam aside for the moment, at least all asset classes should be treated roughly the same.

Otherwise it is a recipe for economic distortions and inevitable booms and busts.

Ahem.

I knew once inflation started to rise the FED was going to be in a pickle as the entire economy was and is addicted to low rates and helicopter money. They would need to raise rates to try to stomp out the inflation but that would cripple the economy and increase government borrowing costs, so they wouldn’t be able to keep them very high for very long and in the end would be forced to accept an inflation rate higher than 2% to avoid a meltdown.

Do many, or any, of the CRE mortgages contain provisions for minimum value to loan balance ratios? I recall years ago, in one of the several construction recessions since 1978, many of my customers were claiming to be broke due to their bank calling their WC loan for a breach of terms because their business valuation had fallen below a minimum valuation to loan balance provision in the loan documents. Just curious if you know if the same exists in many CRE mortgages.

When those properties were cash-out refinanced in the years before the pandemic, and even in 2020 and 2021, as we have seen, the valuations based on appraisals were just ridiculous. So that loan that had an 80% LTV may now be 50% upside down. That’s the problem.

For example: appraised value at refi: $100. Loan amount $80 at refi. LTV = 80% at refi. Building now sells for 60% off appraisal = $40. Loss for lender = $40, or 50% of loan amount, despite 80% LTV at refi.

If an owner, such as a bank owning its own tower, depreciated that building to zero over 39 years and carried the land at acquisition cost, when it sells the Tower at 70% off 2019 appraisal, it might still book a profit. It’s the landlord that did a cash-out refi at a ridiculous valuation that is getting the lender in trouble.

What kind of BS is this? That’s irrelevant here for two reasons:

1. the comment was made to show that cash-out refis produced the losses for the lenders; it wasn’t a comment about taxes or inflation.

2. someone selling an old vacant office tower these days is doing so to get rid of it, and not to re-invest the proceeds in another office tower, LOL

Wolf

As we all know, those that have the gold make the rules. In commercial(actually, in most sophisticated real estate investing), the wealthy are able to own property of all types in LLC’s with no recourse of debt collection from the lenders to the actual people involved. Funny how Delaware(anyone we know from there that is a President?) is the kingpin State of hidden assets via LLC’s that have hidden ownership.

Shocking…but the average Joe gets slammed, the average cen-tillionaire or billionaire looks at BK as a savvy business decision(hmmm…like another former and perhaps again President?).

It’s no wonder most Congress critters are attorneys, crafting convoluted laws written by other lawyers doing the bidding of those that command them without conscience.

Inflated appraisal valuations to juice refi amount? Who would do such a thing?

Wolf,

Here you put your finger on the central role that delusional appraisals/valuations (driven by artificially strangled interest rates blindly fed into DCF/NPV formulas) play in the whole perpetual boom-bust model the US appears to have degenerated into.

The topic is worth a post of its own, with multiple, slowly-stepped-through examples.

The concepts aren’t that difficult to grasp – but the “leadership” class of the US has less-than-zero interest in having the general population understand/appreciate what has been going on.

Sausage factory owners seldom do.

An ugly 40 year old building with a very inefficient envelope is hardly worth salvaging. As soon as you start renovations, energy code requirements kick in and force costly upgrades. It’s better to tear down and start new. Even a 100 year old building is better if it has good architecture. It’s usually an envelope of good thermal mass like stone, and most cities have historic preservation incentives to salvage good buildings.

Changing use (office to residential) is very difficult. Again, the infrastructure isn’t set up for it. It would need to be gutted for individual tenant metering, heating/cooling, etc. It’s always doable, but seldom worth it.

Yes, and many older towers have asbestos, aging core infrastructure (elevator, pipes, hvac), and truly horrible outdated layouts. I certainly would not want to live in some brutalist architecture high rise.

don’t forget sprinklers, which were required in office buildings long after residential in many cities.

Sounds like a just the opportunity for that WeWork guy!!!!

Than line by itself is ignorant manipulative clickbait BS.

What they’re talking about: Millennials are richer than their prior generations at that age, and they on average waited a little longer to buy, so they’re richer and older than prior generations when they buy, and they’re the #1 buyer. Gen Z are the #2 buyer.

Does the Fed own any of these in its MBS balance sheet?

No. But the Fed hold about $8 billion in government-guaranteed multifamily agency CMBS (issued by Fannie Mae, etc.).

55% of all multifamily mortgages are guaranteed by the government, which then securitizes them into agency CMBS. The taxpayer is on the hook for those:

https://wolfstreet.com/2024/03/18/whos-on-the-hook-for-multifamily-cre-mortgages-1-taxpayers-far-ahead-of-2-banks/

The blue line represents multifamily mortgages issued and guaranteed by federal government entities, including those that were securitized into agency multifamily CMBS (chart via MBA):

Let the fuckers holding this toxic shit, choke and die on it. Leave the taxpayers out of it. Hold a damn auction at the end of the day and let the damn markets actually set the prices for a change.

New business models will never see the light of day if they continue to be priced out by corrupt status-quo bullshit games.

WB

Now, don’t hold back, let us hear how you really feel.

Just saying what everyone thinking.

“Let the fuckers holding this toxic shit, choke and die on it. Leave the taxpayers out of it. Hold a damn auction at the end of the day and let the damn markets actually set the prices for a change.”

Didn’t you learn from TARP and O’B anker that something like that will NEVER happen?

Don’t forget about TALF! …and all the other “emergency” bullshit excuses to steal!

The country is in the situation it is in because we have been rewarding bad behavior for 50+ years. The fix is simple, allow people/corporations who make bad decisions and behave badly to suffer some fucking real consequences for a change.

WB

I like that response, We finally have clarity. I agree 1000%

Overdue, painful, turn of the business cycle that will bring down office rental rates and make way for new businesses. If not business, much needed dense housing. Just more painful than it had to be due to fed monetary manipulation. Now is when future millionaires will be made by those can figure out how to make the best out of this mess, Wolf will write about them in 10yrs or so….

Meanwhile, In Miami a recent business article pointed out how a just completed office building here is getting $200/SF for space vs, $60/SF when construction started several years ago.

It all depends on the market, the demographics and population shifts.

No it doesn’t depend on the market. Miami’s older office towers are in just as much trouble, though there are differences in degrees.

But there is a flight to quality, from older office towers, to the latest and greatest, as I pointed out in the article, and it’s not the latest and greatest office towers that are in trouble, but the older office towers.

Class A availability rate rose to 21% in Q3 in South Florida, according to Savills.

I am asking for Wolf’s comment for a couple of naive questions:

I see vacancy rates quoted at 36%. This means offices are occupied at least 60%. However, when I bike around Redwood city and Palo Alto, I see lots of empty offices. Empty since pandemic. For example, the Pacific Shores Center towers are empty. Realtor poster advertises these as 1000,000 sq. ft of offices. Embarcadero road has a set of just renovated buildings. Poster at one says 100,000 Sq. ft. These were empty before renovations and are still empty. So, there are millions of square feet of empty buildings just along one bike trail. So, if 60% of offices are occupied, where are these? How does this realtor business make money while maintaining empty buildings? Don’t they have to pay for renovations and property tax?

There is a difference between vacancy rates (or more correctly “availability rates”) and unused office space.

Availability rates = office space on the market for lease divided by total office space. In San Francisco, that’s 36%, and in Palo Alto it may be similar.

Unused office space = space that companies have leased or that they own but don’t use. Some of it is on the market for lease or sublease, and the rest just sits there waiting to be used. This could be two floors of a 10-floor segment a company leased and hopes to grow into it, while it uses the other 8 floors. Or it could be the entire building that is unused. Or it could be a floor that is used so sparsely and sporadically it’s like a ghost town most of the time. Unused office space is somewhere in the high gazillions of square feet. That’s the true office glut, and it’s much worse than the availability rates because a lot of that unused office space is not on the market for lease; companies are paying for it, and are hoping to use it someday, but are not using it this year and next year, and maybe not ever.

The slogan reminds me of the oil industry in Texas in the 1980s.

“Stay alive in ’85” was the mantra.

Then in January 1986, the Saudis flooded the market, the price of oil dropped from $30 to $9, and the whole Texas economy that had over-levered itself on the back of the oil boom imploded.

It wasn’t just Texas either. Louisiana and Oklahoma had significant energy industries, and were decimated as well.

Denver slogan. “Last one out of town turn out the lights.” Twas brutal.

I was visiting my mom in Oklahoma in 1988. A real estate agent took me to a neighborhood where there were 10 houses for sale. You could get all 10 properties for $75k total. Rents were still reasonable at that point. I was stupid and said no.

Tell me about it, LOL!

My book Testosterone Pit — the Oil Bust, the Salesmen, a dealership — takes place during that time in an unnamed city where “even when you go to hell, you have to go through Dallas.”

Well, if one is from the Deep South and dies, he may go to Heaven but has to stop over in Atlanta first.

I was in Denver Colo in 1987 on Government business. I went jogging in downtown Denver and noticed the area looked like a ghost town. There were high rise buildings that appeared to be empty. I passed a homeless dude on the street and asked him who worked in the high rise building. His answer “NO ONE”. Need I say more. That’s what the oil bust did to Denver in 1987. Same thing happening again.

I met a bunch of Texas wheeler dealers in those days. All they talked about was “see throughs”….40 and 50 story towers with just the concrete built.

A property that is meant to be an office will retain its office-like characteristics after any conversion. It’s like plastic surgery: even with the best skinjobs, you can still see the lumpiness of the older face underneath.

I stayed at a hotel in Tulsa that used to be the old City Hall, a 1960s concrete office tower. Office-to-hotel conversions are easier. Yes, you’re correct, it had the visual touches of an old office tower, including the brass mail chute on each floor that was no longer functional but looked cute. They left it there for decoration. Younger people probably have no idea what that was for.

But you couldn’t open the windows, which is a no-no for residential buildings; and the afterthought-bathroom was functional but not ideal.

Between Nov 1985 and Apr 1986 oil plunge from $31 to $9. It caused a Dutch Disease in the USSR. It collapsed in 1990/91. Denver and Tulsa were collateral damage. Reagan won.

Bad time to be invested in commercial REITs?

Remember buy low (now), sell high (next year?)

Buy low, sell lower?

These are sophisticated investors that own CRE. They know the risks, and are not victims in any sense if they fail. The one thing this country must not do is perpetuate the policy and moral hazard of privatizing profits and socializing risk. If the value of these properties falls, those investors will correctly take the financial hit, and many will undoubtedly be there to take over at lower valuations.

We are presently in the (apparent?) backlash phase called Return To Office, but that is not our future. Smart planners should be planning for less need of these buildings. Everyone knows what kind of buildings we’ll need more of… Residential. Preferably affordable.

Define “investors”

The big dogs almost never take a hit

The chumps off the street, retirees, widows, they get fleeced

Office CRE is Mallpocalypse 2.0

Office is toast. Two highly reliable, independent, in-person office presence metrics reflect this in their national averages. Placer.ai mobile phone analytics data indicates an in-office presence rate of 61% compared to the prepandemic rate. This rate has increased just a little in almost two years. Kastle Systems’ badge ID swipe data at thousands of physical office locations indicates an average in-office presence rate of about 51% prepandemic presence rate. This rate has hardly changed in more than two years. Average out these two and you get about a 55% actual office presence compared to prepandemic.

There are many shoes still left to fall in the office market. The thing is that office leases are a very long term affair as they often last a decade. So the shoes drop very slowly which makes it difficult for folks to comprehend just how messed up things are going to get (you know the old saying about a boiled frog…).

>Average out these two and you get about a 55% actual office presence compared to prepandemic.

I’m surprised it is that high – three places I worked for in three different industries went full WFH during the pandemic.

Wolf,

Harvard Business Review published an article about the looming crisis coming in CRE. In it, they said that if the banks have to take even just a 20% loss on their CRE lending portfolio, that it could result in over 900 small and regional banks being undercapitalized. They said the scale of the problem would be so large, that even the Fed and FDIC would have a very difficult time in finding a solution that could save these banks, and by extension, the banking system.

Nah, here’s who actually is exposed to most of the CRE loans, and it’s not the banks, it’s investors and taxpayers:

1. The banks that are proportionately most exposed to CRE are small banks (there are over 4,000 mostly small banks with no national significance):

https://wolfstreet.com/2024/04/13/banks-exposure-to-cre-loans-by-bank-size/

2. Multifamily CRE has put taxpayers on the hook, 55% of multifam CRE is guaranteed by the government. The rest is spread among banks (29%) and investors (16%):

https://wolfstreet.com/2024/03/18/whos-on-the-hook-for-multifamily-cre-mortgages-1-taxpayers-far-ahead-of-2-banks/

3. This gives you can overall view of exposure to CRE debt: banks hold only 38%, spread over 4,000 banks, including FOREIGN banks:

https://wolfstreet.com/2023/04/10/banks-and-commercial-real-estate-debt-a-deep-dive-investors-and-the-government-on-the-hook-the-majority-of-cre-debt/

4. And foreign banks exposure to US CRE debt:

https://wolfstreet.com/2024/02/12/even-banks-in-asia-pacific-apac-on-the-hook-for-us-office-cre-fitch/

Wolf,

Here is another recent article published by the New York Federal Reserve Bank which examines the fragility of certain sectors of the banking industry as a result of the combination of bad CRE loans and losses on their long-term Treasury bond holdings.

My impression is that there is a real risk of contagion spreading in credit markets as a result of the collapse in commercial real estate.

The problem is not just in office CRE. According to Cred IQ, a data firm that tracks credit conditions in CRE, while they rate 13% of all office loans as being in distress, multifamily residential is not far behind, at 11% while retail is at 10.6%.

You need to read some CRE articles on this site instead of posting link after link (that I then have to remove) of articles that you seem to not even have read because you misrepresent them partially in your statement, to suit your narrative.