How the yield curve is un-inverting shocks real-estate folks who’d promised rate cuts would push down mortgage rates even further.

By Wolf Richter for WOLF STREET.

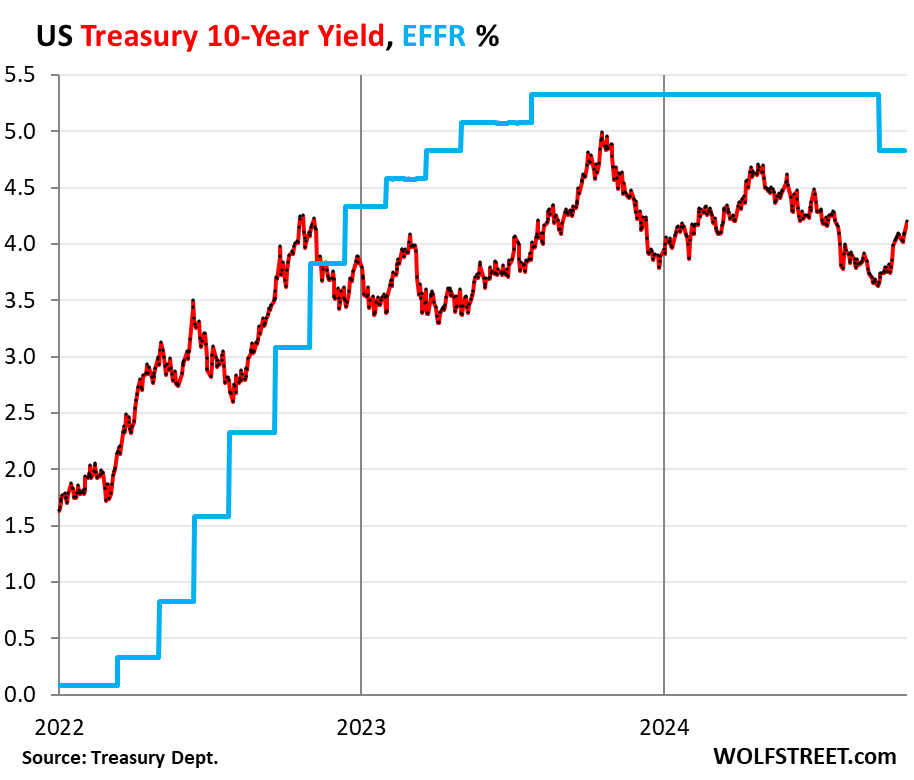

The 10-year Treasury yield jumped today by about 12 basis points, to 4.20% at the moment, the highest since July 26, up by 55 basis points from September 17, on the eve of the big-fat rate cut, when the 10-year yield had bottomed out at 3.65%.

Today’s action may have been driven by hawkish commentary by Dallas Fed president Lorie Logan on the future of the Fed’s QT, by renewed fretting about inflation, and by concerns about the recklessly ballooning government debt that would pile up new supply, or by whatever.

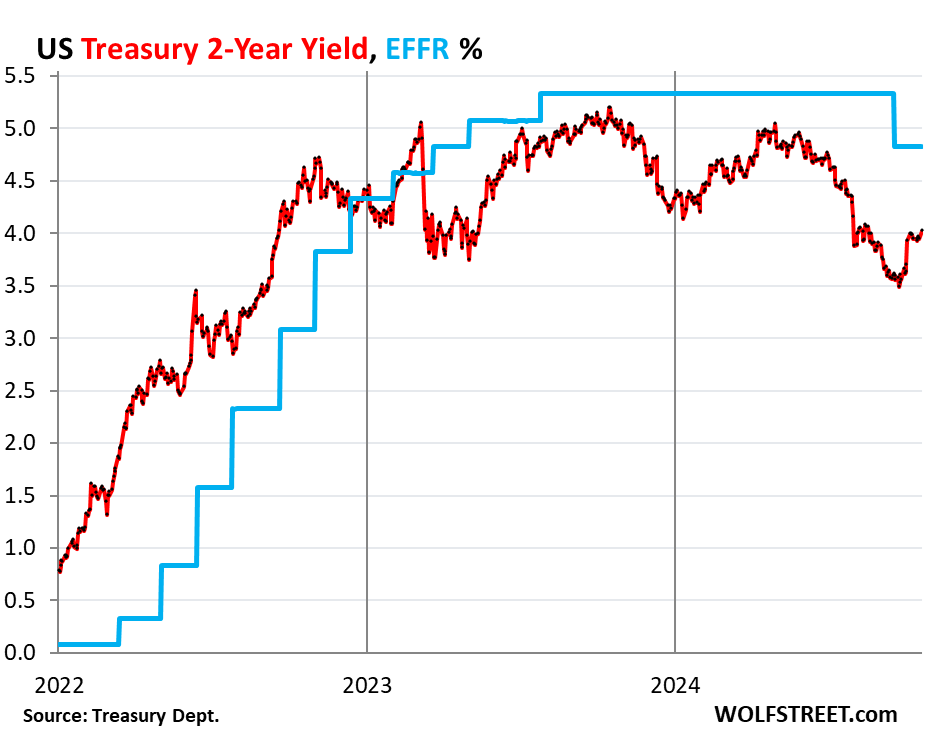

Markets move in a mysterious way, and the “why” may remain elusive, but we do see the outcome, and we know that QT, inflation, and supply are the triple enemies of bondholders (blue = effective federal funds rate which the Fed targets with its headline policy rate):

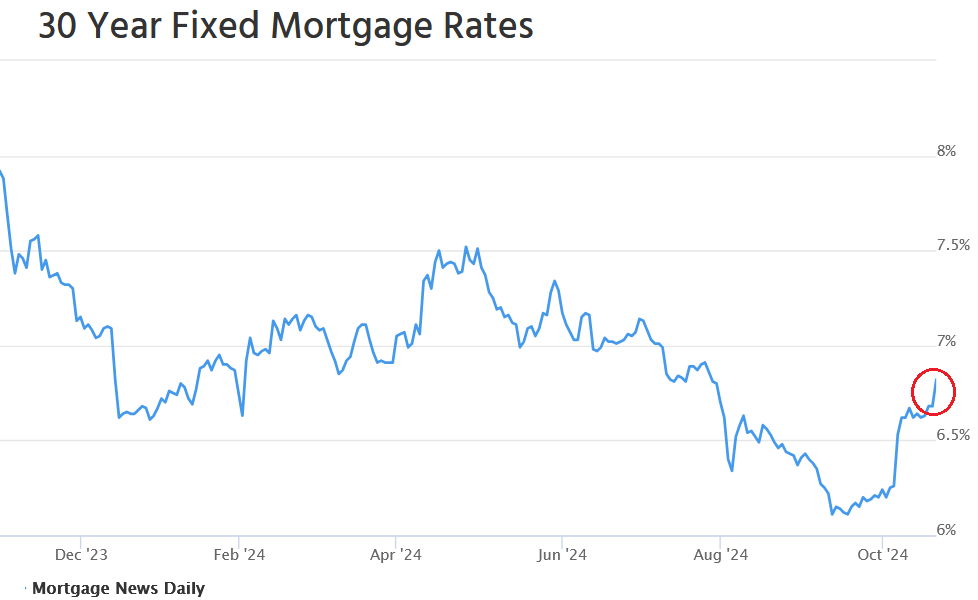

Mortgage rates, oh my. There goes the housing market, what’s left of it. The daily measure of the average 30-year fixed mortgage rate jumped by 14 basis points today, to 6.82%, the highest since July 26, and up by 71 basis points from the eve of the Fed’s mega rate cut.

At the time of the rate cut, this daily measure of mortgage rates by Mortgage News Daily had dropped by 187 basis points from the peak in October a year ago, to 6.11%, on just a wing and a prayer, having priced in 2% inflation forevermore and many rate cuts.

So now, with a 50-basis point cut under the belt, and with smaller fewer cuts being outlined for the future, and with CPI inflation having risen on a month-to-month basis for the third month in a row, it’s time to unwind some of the exuberant craziness?

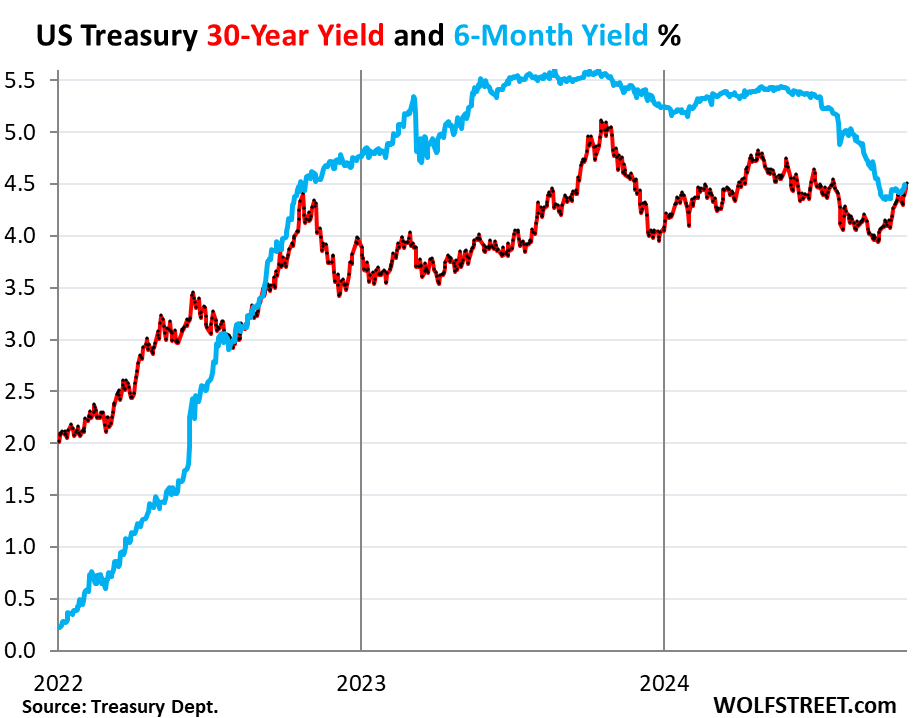

The 6-month yield and 30-year yield un-invert. The 30-year Treasury yield today jumped about 11 basis points to 4.50% (red), now matching the 6-month yield (blue). So this is another piece of the yield curve that has now un-inverted.

Normally, the 30-year yield is far higher than the 6-month yield. But in July 2022, with the rate hikes pushing up the 6-month yield, and the 30-year yield following more slowly, the pair inverted when the 6-month yield became higher than the 30-year yield. Now the pair has un-inverted.

This came as a shock to real-estate folks who’d promised lower mortgage rates once the rate cuts start, as the rate cuts would drive down mortgage rates even further. They’d hoped that the yield curve would un-invert with short-term yields plunging on densely-spaced monster rate cuts, and long-term yields falling more slowly but still falling a lot.

Instead, the yield curve is un-inverting with short-term yields falling with the Fed’s rate cuts and dialed-back expectations of rate cuts, while long-term yields are rising on inflation fears, Qt, and the dreaded onslaught of supply of new debt to fund the huge and reckless deficits.

Only the Treasury yields in the 3-year to 5-year range were still below 4%, by just a hair.

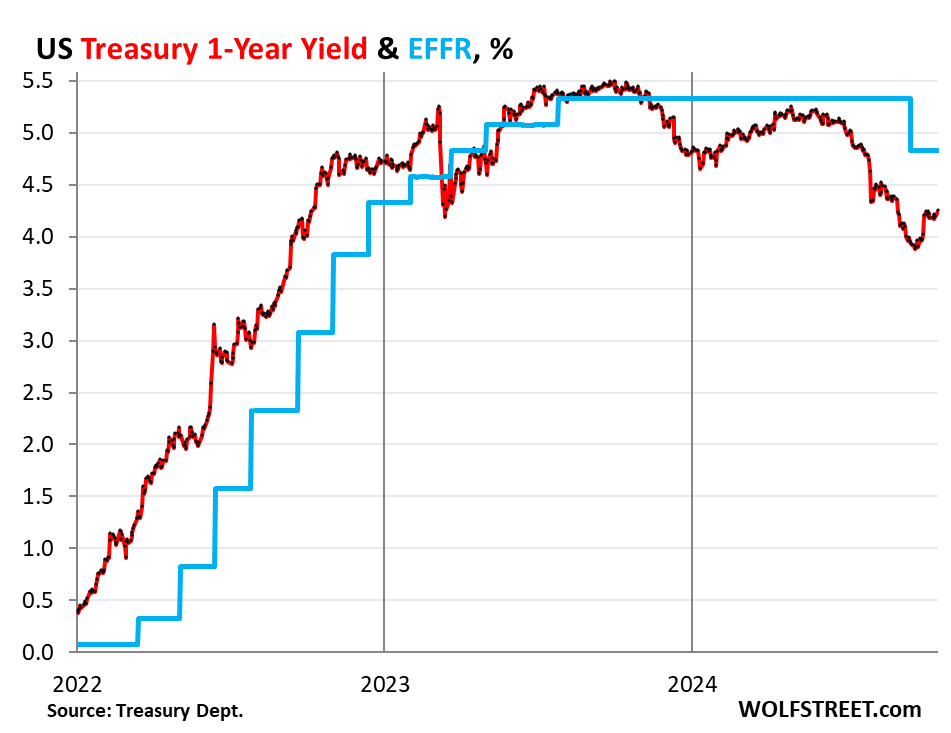

The 1-year yield rose to 4.25%, as the Treasury market has been backpedaling on rate-cut expectations. Since September 24, it has risen by 37 basis points.

The 2-year yield jumped 7 basis points to 4.04%, the highest since August 19. But it has roughly been in this range since October 9.

The pair of the 2-year yield and the 10-year yield had un-inverted on September 6, at the time because the 2-year yield had plunged amid rate-cut-mania and continued to plunge until the eve of the actual rate cut. Since then, it has risen by 48 basis points.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Still don’t feel bad for real estate agents. It always was a lucrative business with little in needed skills except smiling and talking about bonus rooms and granite counters and such. The good ones hopefully banked a lot and have all the same skills to sell used cars so opportunities abound.

They get paid because of having to deal with people like you.

They sure are entitled.

Entitled to favorable government policy, favorable fed policy, favorable tax policy, etc.

Don’t forget me, I am a pain to deal with too!

new realtors are going to be lawyers when know it all’s screw up the purchase and miss big red flags

well at least us slumlords are busy keeping 1st time home buyers out of market

Agree. Same for the car salesman. Mostly, good human beings, just working to make a buck. Like most jobs it was essentially a

Dispassionate promotion of an inanimate object for money. The current American business model.

Actually no one knows why they were paid so much.

It’s not like the new salesman at Toyota earns 6% on a new Sequioa he sells for $89,000 to the recently graduated art major (snicker 😆).

I say if they want to make 100k a year, then sell 20 homes at 5k a piece commission. And that would not be a bad year by any stretch.

Real estate agents are actually pretty sad people to know up close. It’s like when the old lady who uses way too much makeup comes to the pool cookout. You’re just cringing alot.

Or sell a single two million dollar home. It really depends on the particular market the realtor is working. There are plenty of 2-10 million dollar homes in numerous markets around the US. You just have to be in the right “club”. The real estate game is full of conflicts of interest. Essentially everyone (including the local government), except the buyer has a vested interest in the price being high.

Anyone not using a real estate attorney and giving some low level realtors 6% on transactions kinda deserves to lose their money.

We sold all of our homes using a real estate attorney and one home using a fixed price firm and zero offerings for the buyers side. All homes sold instantly between 2021 – 2023.

One realtor that came by wanted 7% from our multimillion dollar home I just laughed and told him we are using our attorney on this and the fee is going to be around 10k vs 250K+

Home sold in 2 days with a ton of crazy offers during that price peak.

Imagine giving away that kind of money to someone doing next to nothing in terms of value.

Overpaid nonetheless.

The great ones cashed out and sold their brokerage last year and retired. Now I just T-Bill and Chill (trademark pending by Wolf).

I don’t know about you but my AI model, after several retraining sessions came up with a solution I agreed with that predicts that maybe yes and maybe no’

I would go with Yes, the 50/50 chance is the only odds that Life gives Us. It will or it will not. Think about the permutations and you will see I am right.

Disclaimer: I have seen, on the roulette wheel, Red win 32 times straight. I lost a lot and learnt a lesson by 10

Well, NBAY, I don’t know where to begin to dissect the issues that you have.

As a first stab, I sense that you hate yourself, for whatever reason. It happens.

Just to remind everybody that statistically, love is the human emotion that wins 78 or 74 pct of the time.

You’re seeing love in this election season?

All I’m seeing is sad people who have lost touch with right and wrong.

We lost John Lennon too soon!

I’m totally crushed…..may even cry a while.

And it’s all your fault…….you meanie.

Now your dogging on car salesmen as well? Forgot who’s writing this article have you.?

Try selling a house in this climate, or even getting a client to sell a house to. Your own gas, months without a pay check, dog turd clients to deal with. Hard to live without a pay check..

Home toad,

Not dogging the people just the dog and pony shows and especially the commission system of real estate. Agents often but less work into a 2 million dollar house that sells itself than a 300K fixer upper. It is what it is but food has to make it to the table. I write software for state government modernization projects that are almost sure to fail at great expense so it is the systems and processes I look at. Most of the people are great and well intentioned but systemic issues prevent success. I tend to look at much of the real estate and car challenges the products of lobbying rather than what is the best business model for both sides.

If you lower the asking price the house or the car will sell.

That’s the answer to the 64 thousand dollar question!

Longtime – …of course a review of the non-documentary film ‘Game Show’ and its depiction of the Charles VanDoren scandal-an interesting take on the American psyche and the power and inclination of mass (especially TV) media post-WWII, might be in order, here…

may we all find a better day.

Yes, a brutal occupation. Non worse except cold calling

Actually met the broker putting up the for sale sign on the house behind us Sunday morning at 0800; she didn’t have time to let me see inside as she had another appointment 50 miles away in less than an hour, and two more after that, but:

Said she had a couple dozen calls since listing the home Friday afternoon, and expected it to see in one or two days as it was priced right at approximately $400/SF.

Likely be a ”tearer downer” as have been all but one in our hood last year or so.

We often have to do the work the RE agents should be doing. If they want these big commisions, they should get off their a$ses and do their jobs.

Nobody is forcing anyone to be a RE agent. Lots of people work hard. It’s life.

That’s why I commented, working hard is good and deserves at least a bit of respect.

Smaller and fewer cuts are outlined for the future I’m reading. I can see Powell standing tall with his barn door open, explaining himself.

Working hard also keeps the Devil away…..probably the most important part of that particular human behavior?

Builder’s will build less homes and use their $$ for other investments. Result is less inventory, higher home prices and less work for contractors. Not good.

I’m married to a 25yr Realtor Glen & you couldn’t be more wrong! Not only do they have to have excellent negotiation skills, but they are advisors & family counselors as well. Huge financial & emotional purchase, and real estate agents keep homebuyers calm & guide them through what can be a very stressful time. On top of that, she has a network of home purchase/repair/improvement contractors ready to assist her clients, and typically coordinates those services as well. Guessing you’ve never worked a 100% commission job? Not only takes great skills, but also a lot of courage.

Tim G.

You’ll find in the comment section here a vitriol reserved for realtors that borders on obsessive. I come here for Wolf’s knowledge, I have learned a ton since first discovering the page (I’m a residential mortgage lender), but some of the arrogance you find in the comment section along with the lack of empathy makes me wonder why I even read the comments.

The bifurcation of society (intentional or otherwise) has consequences. I’d argue that having more statesmen in D.C., and NOT simply people trying to simply enrich themselves (as the net worth numbers clearly show) would be a significant place to start fixing all this.

2007/2008 demonstrated pretty clearly exactly who OWNS your “representation”. The fish rots from the head down as it were. Plenty of people behaving badly, but what did you expect? American society has been rewarding bad behavior for quite some time. If you don’t believe me, perhaps I can interest you in a mortgage-backed security?

Yup. Kracow’s comment above is a great example. Yet another one who has to brag about his “knowledge” and wealth.

this is very common on any public board; fb, reddit, ig, linkedin, and yes wolf street. agree its not fair, but you do have to wonder what its all about..

I’ve nothing but bad experiences with Realtors. Used them 6 times over my lifetime, and every one of them was a disaster. The last one was so incompetent that we almost wound up in a major lawsuit because they sold us a house with a leaky roof and didn’t disclose this at settlement.

Sometimes it is better to just RTDA, and skip the comment section.

30+ yrs Mrs & I with our mom & pop. I live in flyover & we are a rarity.

I only know of 2 other families that do not rely on a spouse working

for a private or public sector company for the benefits.

That said…..I know I could not handle pressure of commission only job. And 25yrs! You are a lucky man.

No offense, but if you think that all it takes to be a real estate agent is “smiling and talking about bonus rooms and granite counters and such,” you should probably just admit that you don’t know what good agents do. I don’t know what you do for a living but I am sure I could describe it in derogatory terms. That kind of comment is just embarrassing.

This must be the most bizarre trilogy of comments I have ever read on Wolf Street.

I’ve seen weirder threads.

No different than this world we all live in.

Bizarre things can break out anywhere, anytime, and often are NOT harmless.

NBay – 5×5 re: the world. As Dr. Thompson succinctly noted: “…when the going gets weird, the weird turn pro…”. Best.

may we all find a better day.

We could see rates at 8% next year. I surmise, after discussing with the Great Mephisto, that will rip a new one in real estate home pricing nationwide.

Fingers crossed.

The romance of autumn makes me hopeful.

A hard crash in real estate prices, fingers crossed ;)

Oh how wonderful it would be.

Have to wonder… Did they do the rate cut to try to get EFFR to be a smaller hurdle for long bond rates to get over?

We’ve all been scratching our heads thinking, ‘Why the hell did they cut???”

Maybe that’s why?… Wolf, any thoughts on that?

They cut because of suddenly spooky labor market data that came at a time when inflation was far below policy rates, so they could cut to protect the labor market.

But two weeks after the rate cut, the spooky labor market data was revised upward and away, consumer income and the savings rate going back years were revised up, GDP was revised up, spending was revised up, retail sales were revised up…. Two weeks after the rate cut, the revisions and new data showed that the economy is in solid shape and inflation might be on the upswing.

I summarized this situation here: it will answer your question why they cut and how things changed since then. So do read it:

https://wolfstreet.com/2024/10/13/what-if-theres-no-landing-at-all-but-flight-at-higher-speed-and-altitude-than-normal-with-higher-and-rising-inflation/

@Wolf – I heard that the rise in unemployment might have been due to a rise in the number of illegal immigrants, who obviously will be unemployed at first. Later, some of them will get jobs that pay under the table. So, does this group of people gives us the false impression that unemployment has gone up ?

Your question was interesting enough for me to dig for an answer. It can be found if you search for “US Census: Design and Methodology – current population survey”. In a nutshell, I’m not sure illegal immigrants are counted – or at least not counted at their true level within the economy. First, because the survey never asks whether or not a worker has legal status. Second, because the questionnaire is very “official-looking”, is completely optional, and is conducted in English. I would assume many illegal immigrants would not participate, either because they are scared, or because they can’t understand the questions (in which case the surveyor terminates the survey).

Greg P,

Correct, illegal immigrants in the labor force and working are largely undercounted by the BLS household survey, which is why the labor force number has been stuck for a few years, as has the overall employment number based on the household survey.

If illegal immigrants work for an employer, either as employee or as contractor (construction company, meatpacker, etc.), they’re counted in the nonfarm jobs in the establishment survey.

The unemployment insurance data from companies’ quarterly UI filings don’t capture workers who are not eligible for UI, including new immigrants without work permits. But the UI data is used to adjust the nonfarm data, and these adjustments without illegal immigrants then distort the nonfarm jobs data, leading to the big downward revision we had in the summer.

So the whole thing spreads a lot of uncertainty about the labor market data.

In terms of the language of the surveys: Over the years, I got a few surveys as household and for my business. It starts with a postcard in the mail that told me to do the survey, and gave me a website address and a login. The survey is done online, and if you can’t do it online, you have to call a phone number. If I remember right, at the login, I could choose an alternate language to English. But still, not many illegal immigrants are going to do that, even if they can choose Spanish or Mandarin.

Illegal immigrants are not eligible for unemployment benefits unless they have been paid ‘on-the-books’ where the employer has paid their portion of Unemployment Insurance Tax to the Division of Employment Security, which is not likely the case.

MrFooFoo

Illegal immigrants are NEVER legally eligible for UI. If they get UI, someone committed a crime, such as identity theft.

Does this mean that they’ll put the rate back up to where it was? I think we all know the answer to this.

From my perspective, there is no need to raise rates again unless inflation really takes off. They shouldn’t lower either. Just stay steady and see if inflation continues to move in the right direction over time.

Good, now we just need to see this uptrend momentum continue to last beyond the next Spring season. The longer this can last, the more chance that it will break this Mexican standoff from the sellers. Certain markets already cracking so this is a step in the right direction. For more hubris markets like the one I am in, demand still needs to come down quite a bit more and more sellers get more desperate. I think quite a few out here think they can pull the same trick of pulling the listing and hoping for a better time to relist, since this rate-cut narrative so far is falling apart, I think their next magical bullet will be seasonality and pinning it all on Spring…

Btw, glad Wolf keeps us informed on this stuff compared to some MSM, was listening to NPR the other day and they were talking about how the housing market is frozen…etc…not once did they mention rate cut doesn’t directly affect mortgage rates. Instead, they were busy asking and coming up with some excuses as to why we haven’t seen mortgage rates drop. If normies are listening to that kind of information, I can see why people continue to pin mortgage rates drop to FED cutting rates..

Sellers giving in, one hearse at a time. I watch for the old made in USA craftsman tools at the estate sales.

20% mortality rate for 70 year old home owners, too!

I represent exactly that… My mortality is tested daily, putting my underwear and socks on

The sellers who are smart and get out now are leaving in limousines. The hearses will be reserved for those who chase the market all the way down, stubbornly refusing to give in to the reality that their asking prices are too high.

I actually watch This Old House from 15 years ago to learn the right way to fix something.

You’d be amazed the corruption seeping into fixing things nowadays.

We’re devolving

Tool are cheap at estate sales. I went

to a sale where the deceased had

been a mechanic for the railroad.

Tools of all kinds and sizes selling

for nothing.

Phoenix_Ikki,

Will be interesting to see how this hits California versus the nation. While home ownership has stayed relatively constant in the US as a whole it has slipped over the decades significantly in California, especially among younger people. No doubt it will move just because some people have to sell or people decide to sell vacant houses but doesn’t feel like it is going to suddenly make things affordable, except of course where housing in relatively reasonable in the state already. My friends live in SD in a nice neighborhood about the size of my house but next to a freeway and it is worth 3X the cost of my house. That said, San Diego is not Sacramento so I can see the premium!

No one ever said San Diego or SOCAL in general will be affordable. But home prices doubled in certain parts of SD from 2020 to 2022. The issue is can those prices sustain when rates are now 2x to 3x higher than 2021 QE era.

For example, my neighbor bought his house for $1M at 2.75% in 2021. The house next to us is listed for $1.6M and rates are ~6.5%. The payment would be more than double what my neighbor pays. No takers yet. But lots of the RE invested people in SD were/are convinced the next boom is just around the corner and it will be $2M for a house in the suburbs that’s east of the I-15.

@Glen In the 70’s homes in Sacramento County were just slightly more expensive than homes in San Mateo County. The gap just keeps growing and like your friends home in SD County the “average” home in San Mateo County is about 3x more expensive per sf than the average home in Sacramento County (and homes in Hillsborough are almost 3x more expensive than nice East Sac Homes on the “Fabulous 40’s”). Since I am in my 60’s a lot of friends have been having “estate sales” before selling their parents homes and it amazes me how many “knick knacks” the average Bay Area couple in their 90’s has in their home (that almost nobody wants). P.S. To @Shiloh1 like you I always buy up the American made Craftsman tools when I find them at estate sales.

I have a full set of Craftsman made in the US tools that I bought years ago. I have a set of SK Wayne tools that I bought as a teenager. I also have a Milwaukee Sawzall that was actually made in Wisconsin and came in a metal rather than plastic box.

The other day I was at Home Depot where the Milwaukee tool people had a large table they were using to advertise their tools. I stopped by and told them, “If I want to buy made in China tools, I’ll go to Harbor Freight.”

DK – 🤣🤣🤣!!! (…after picking myself up off of the floor and a handkerchief session , though, I must say the PRC CAN produce high-quality, thinking back to my looming macro-trepidation about our place in the world upon encountering the first well-made/insanely-low cost PRC-made tool (vernier caliper) I acquired in the early ’90’s, and early production-run riding gear orders for the moto-shop in the aughts (subsequent runs being steadily adulterated with cheaper materials, the manufacturer’s apparent strategy to take higher/sustainable margins as long as the shipments continued to be accepted and sold…). Sadly came to the conclusion that, among many of us, the ability to discern, and willingness to pay, for genuine quality in goods (services, as well) is in long-term question. “…you get what you pay for…” seems to often generate a blank look behind an agreeing nod…”. (…must add a cautionary: “Made in USA”, or anywhere else, is no ‘exceptional’ guaranty of quality (late 20th-century US auto production comes to mind…).

may we all find a better day.

Re: USA tools

I’m sure you are aware of Black and Decker going totally to hell and then (I think) rebuilding all it’s reputation. Haven’t been to construction site/mech shop lately.

Also when the Snap-On guy came to auto shop in ’11 or so, for his traditional, “your kids will inherit these tools” spiel, he was laughed out of there by comments concerning Chinese stuff from Harbor freight.

I still have a great Fluke 21 from the 80s, and I don’t think Tectronics took a break from quality, either…also have good set of Craftsman batt power stuff (trying to regularly keep 19.2v batts charged and alive….for the 2 lights if nothing else)

Yes, I am always prepared to discover anything is partially or completely made in China, now.

Wouldn’t worry about cutting edge defense stuff, though, regardless of what the China fear mongers say……and I have good sources.

The people on NPR aren’t really riddled with logic or reason.

Which is the least plausible scenario. That there is still upside potential in the stock market, which has never in history been over priced too this extent.

The CAPE index supports my view that all of the asset classes are grossly overpriced and the interest rate is grossly under priced for the risk.

Phoenix_ikki – there is a recent npr web article which explains why fed rates dont really impact 30 year mortgage rates. Your show or podcast might not have given the right info, but the web article does.

But, npr & msm suck. I too got my info elsewhere more than a month ago. So called real estate investors at my workplace were frothing after the 50 bps rate cut, thinking that they can continue “investing”. Bozos probably still dont know why 30y mortgage rates went up.

Btw, are you from phoenix az or some other place ?

Yeah it’s funny to watch people bet one of their life’s most important decision on some MSM narrative without doing any homework on what really affects mortgage rates.

Nope, not from Phoenix, in grossly overpriced SoCal

My guess is he is a fire-breathing bird, if that’s a thing.

Does the bond market know more than the Federal Reserve and the National Association of Realtors…. Sure looks like it!

Mortgage rates are based on the yield of 10-year US Treasuries plus around 2% to 3%. At 3% that would put mortgage rates at 7.20% and they are now 6.85%. Those numbers have nothing whatsoever to do with demand for housing.

They are still licking their 2022 wounds.

Most funds haven’t even recovered yet.

Especially the target date funds which like 80% of institutions throw everyone’s retirement into by default. Or maybe they choose them.

They are kind of lazy and crude if you ask me.

Wolf, today I heard on CNBC that in the next 3.5 years, there will be $15 trillion of debt that will need to be refinanced. If we keep adding $2 trillion in new debt on top of that, what do you think that would mean for the yields?

Also, Goldman came out with a forecast today that in the next decade, there will be a sluggish return of around 3%. I feel like there is probably a correlation between those two.

Lastly, aren’t we at the beginning of an AI revolution that is expected to transform our economy, accelerate growth, and make everything much more efficient? Isn’t that contradicting somehow?

Up, up, and away!!!

Milo,

I always find the societal and economics of AI, or in general, productivity increases. They often model the 60s where lot of convenient applicances would bring back poetry, arts and music will all the free time and it never did. I see AI as something that will slowly take jobs and our society and economy is not built to handle it. I always think of the South Park special where the handymen are the millionaires and the accountants and programmers are outside Home Depot looking for work. Theoretically in aging societies will declining populations this should be a good thing.

Extremely astute. The robots taking over the jobs of the people who most need them. A conundrum for humanity.

> They often model the 60s where lot of convenient applicances would bring back poetry, arts and music will all the free time and it never did.

To be fair appliances did free up a lot of time. We spend it all on tv and looking at our phones.

Goldman is stupid wrong.

How can anyone make that prediction after the S&P is up like 66% from 2022??

That’s just noise, for whatever reason.

Stocks will do what they always do Revert to the Mean. 7 to 11% I say.

I recall the 30-year average annual return for the S&P is around 8%.

If stocks rallied 66% in 2 years like you say, how much lower will they have to yield over the coming years to get back to that 8% annual average?

The question is, just like most of WS, are they wrong or are they actively pushing for an agenda to suck more people in? I incline to think the latter…

I’d say AI is a bump in the road but I suppose it’s more accurate to call it a massive pit in the road where money goes to burn. Over valued and over hyped much like VR was with Oculus.

I think Goldman put that out to try to get investors to purchase more of our Debt! I read that the Treasury Dept needs to issue about 8T+ more of our Debt within the next 14 months. IMO as long as ALL the Equity Markets, (Dow, Nasdaq, S&P 500) are up over 30% YOY, and the huge supply of L-T bonds already purchased within the last year. It’s going to be impossible to get investors to purchased 30, 20,10 year bonds etc.. for anything less than 4%..so unless the Feds put the petal to the metal on QE again, or the Stockmarket crashes/losses over 20% in the near future, I don’t see the 10 year falling far below 4% anytime soon myself. But hey I could be wrong!

In Canada I just made a quick search. Mortgages: 5y fixed at 4.34%, 10y fixed at 6.19%. A bit odd that the 10y is quite bigger (or 5y quite smaller)?

Seems correct, the lender is committing to a term 2x longer at a fixed rate, the borrower is securing a rate for 2x as long, you don’t think there should be a premium on that? If it was reversed nobody would be getting a 5yr mortgage

Sure, 10y should be bigger. But by 2%? That would imply that between year 5 and 10, the inflation/interest rates expected to go up a lot. The 10y-5y Canadian bonds do not have much difference, I guess like 0.5%. The debt seller would love the 10y rate, but the buyer could instead do 5y twice. Just looks like there is a hight risk premium for what comes after 5y.

In Canada, the size of the 10-year mortgage market is tiny. Only about 5% of mortgages are 10-year. Lack of competition explains a portion of the premium.

It is not the rate of interest that is the problem. It is the asking price,

Thanks for the great update. LT rates are going higher. By design IMO. Forcing financing costs higher on housing, credit cards, auto loans will slow (or in the case of housing) end inflationary pressures. Powell needs inflation to cool. Yellen needs cheaper borrowing ST. And she needs higher yields on LT so her bonds are bought. Look at the 30 year chart.

Is that a bull flag forming? I think it well could be. If so, well that will change things up.

One Builder (there are several in the area) of new starter homes in my immediate area has just dropped the price of NEW homes under construction 10% across the board and is offering a 3.99% interest rate buydown for two years, then going to 6%.

I got the “Blowout Sale” flyer in the mail over the weekend. These are homes that run from 1,200 – 2,900 sq. ft. @ around $175/sq. ft.

$175 sq is pretty affordable and is on the low end of what a new house per square foot should cost. You must live in the Midwest to see $175 sq ft?

As always, looking for perspective, after, RTGDFA — in this case, looking through the inflation telescope and totally agreeing with Wolf and the bond mkt.

I recently discovered The Pring Index, which I just used at stock charts.

The Pring deflation index there is — !PRDI

The Pring inflation index there is — !PRII

Using a ratio of !PRDI:!PRII — a rising ratio is inflationary and a declining ratio deflationary.

You can use moving averages and go back to 1995 — but the main supportive outcome of this ratio shows we’re still very much in an inflationary cycle, but a lot of micro whipsawing in direction during the last six months.

There’s definitely not a downward trend in this index, which is an index of companies sensitive to swings in cycles.

In terms of moving averages, inflation seems alive and well and is at at all time high in this index series, and above the 45 day MA.

A rate cut in a few weeks will surely help this index head even higher — and the thesis that mortgages will be falling is highly unlikely.

I’m open to discussion and being ridiculed, as we sit around the glowing embers

TLT to $85.

I’m literally betting on it…

I rather have $ under my mattress than TLT.

Looks like the Fed whiffed it on this rate cut and is going to go back and increase rates again to give the market confidence that inflation really will go down and stay down. Right now obviously nobody believes that it will.

I assume you’re being sarcastic. The fed only makes drastic moves like that when it’s bailing out the markets. When it comes to inflation it’s more of a wait and see and maybe half ass it later kind of thing. Which is exactly why nobody believes them, nor should they.

Anon,

The Fed raised interest rates far higher and faster (including three 75-basis point hikes) than anyone thought it would (Goldman said in the spring of 2022 that rates would max out at 2.5% in 2023), and kept them there far longer than anyone thought they would (15 months of wait and see), and it has reduced its balance sheet far more (so far by $2 trillion) than anyone thought it could, and it’s still reducing the balance sheet despite the rate cut and despite some banks that blew up. Is that eager ignorance I hear dripping from your comment?

It’s easy to criticize in retrospect. But the FOMC is supposed to know what they’re doing. They have a huge responsibility to the public and Congress. Apparently, they were not good students:

“At the Dec. 27–29, 1971, American Economic Association meetings, Milton Friedman (1972) presented a revision of his prior work on the lag in effect of monetary policy (e.g. Friedman 1961). His new conclusion was that ‘monetary changes take much longer to affect prices than to affect output’ ”

“Looks like the Fed whiffed it on this rate cut”

Yes.

“and is going to go back and increase rates again”

No.

But wouldn’t it be so sweet to see the Fed increase rates, thus jolting the markets awake so that the FED is taken seriously?

A lot of things would be sweet to see, but we never see them. The Fed doing the right thing at the right time is one of them.

They’re always either going in the wrong direction, or going in the right direction but too late / not enough / not long enough. And of course between 2020 and now, we got the former followed by the latter.

Long long ago I dabbled in a little timed road racing. Early 1980s. Sometimes you’d hit the brakes then hit the gas too early then say “oh shoot!” and have to slam on the brakes again. And your lap was totally shot.

Maybe the Fed won’t make any changes and they’ll just let rates and inflation drift upwards as people question their effectiveness. Probably now the best thing they can do for credibility and stability is nothing. No more rate changes, no changes to QT. Let it all ride as is for a long time.

Last Yankees-Dodgers World Series was 1978, the 10 year yield was 8.5% and headed higher. A foreboding message? Heck, that’s as good an indication as anything else. I do know that something has to happen sooner or later to take the air out of all the egregiously reflated bubbles.

The last Wankees/Doggers World Series was in 1981, is that I think you meant.

Yes, this year the big payroll teams made it but the Yankees are always a comparatively high payroll team but haven’t even BEEN to the World Series since 2009.

OR

Maybe it’s that 2 of the top 5 highest paid teams in baseball have bought all the talent. Or they sell the most tickets and so make the most money.

Money, there’s your answer. Story old as time.

Yes, money far damn shore veggie;

how ever, it’s the size and profitability of the TV ad market, not tickets even though they are absurdly expensive too these days.

The crowd wildly shouts in the Colosseum: “Volcker, Volcker,” as the gladiator is unshackled to challenge the Dragon of Inflation.

Bah ha ha! I like this

It seems that the Fed is finally losing control of the bond market. The amount of new QE needed to suppress the bond market would be just too great given the 1 trillion the government borrows every 100 days. This is on top of maturing bonds than need to be rolled over.

Powell is absolutely complicit in this. He lit the fire and now he pretends to be a firefighter.

P.S. Perhaps the bond market is smelling a Trump victory, who is already promising all kinds of tax cuts.

What would federal tax cuts do except to make the federal deficit and debt that much greater leading to even higher interest rates and yields on US Treasuries of all durations?

There’s a part of me that loves to see it. The hubris of these people is just unreal.

For those who live in Spatula City, Hubris: Pridefulness to the point of Cluelessness.

Excessive pride or self-confidence.

There is an old Lamb of God song called “Terror and Hubris…”

Not sure what spatulas have to do with anything.

The bond market is smelling the three headed bond slayer: inflation, QT, and increased supply – just as Wolf mentioned.

Both candidates are inflationary and will increase the deficit.

TGA liquidity drain coming soon to a bank near you…

Not just tax cuts but tariffs, which are also inflationary.

I remember the good ole days when they were going to tax millionaires.

Couple years of printer go burr….and all the adds are how now they are going to tax billionaires.

Soon it will be the trillionaires.

A new generation of Bond Vigilantes is rising, to slay insane government policies and inflation…

Put another way, if bonds smell like a bad deal, rates must rise.

The federal debt will eventually have to be faced squarely in the face. A day of reckoning is at hand.

The bankers want rates that’ll support Wells Fargo and Citi; the stock market boys want rates that’ll buoy a bull run forever; the average citizen wants not to pay taxes that’ll diminish the size of the yearly deficits … and yet, they can’t all have what they want.

It may be that Japan defaults first. They already have the highest debt-to-GDP ratio of any First World nation. That could trigger a domino effect of collapsing houses of cards as government after government throws up its hands and says it just can’t afford to pay any more, ending with the cities of North America defaulting on *their* debts …

It all looks grim. I have more to say. For more thoughts on business, go to: dark.sport.blog …

LOL. Again! No country can ever default on debt issued in its own currency. Even Argentina didn’t default on its peso debt. But it defaulted multiple times on its foreign currency debt issued in USD and EUR. Japan will never ever default on its yen debt, the US will never ever default on its USD debt. What can happen though is higher inflation. People keep fretting about the impossible (because stupid is more fun?) and ignore the thing that is already happening.

This is one of the few places on the internet where this reality ever gets expressed — it’s a very poorly understood fact of post Bretton Woods sovereign currencies.

Russia in 1998 defaulted on its domestic currency debt (“GKOs”) – its ruble denominated treasury bills; and at the same time it did not default (and subsequently never defaulted) on its foreign currency denominated – USD denominated eurobonds.

While an actual default can’t occur on ones currency, a nation can constructively default if it devalues it’s currency to the point where a note or bond holder gets paid nothing of value upon redemption.

Imagine your holding a $100 US Treasury note that matures and the US government pays you the $100 but a loaf of bread costs $100 or $1,000…

That’s constructive default.

It’s very unlikely, but not impossible.

That’s inflation. And that does happen, and is happening already, as pointed out.

Always agree with Wolf. Inflation is the usual way out of the debt mountain. It’s all a matter of time when this happens. Often in combination with tax rises and spending cuts.

Correct! Of course, also like the peso, the purchasing power of the currency can decline severely. And just like Argentina, that will be a fucking problem.

CONgress better balance the budget.

Interesting times.

Like Germany after WWI. Germany could easily pay back war reparations in German marks… once marks had been devalued through hyperinflation so that they were worth next to nothing – relative to other currencies, or for that matter – relative to German commodities like foodstuffs.

Sadly I don’t think your average person even understands inflation, even smart “average” people that just don’t pay attention to economics and have devoted no time to understanding it.

Defaulting is relatable. Everyone can run out of money to pay their debts and in that way they can relate to the fear mongering of government default (for what they think is the same reason)

So Musk is an idiot saying the US is headed for bankruptcy? Lol

Yes among many other idiotic things, he’s been saying…we can blame it on Special K he is taking but then again probably not…

Please don’t take anything he say about the financial world seriously..

Musk is an idiot for that and many other reasons.

Milo,

Yes, obviously. Ask Musk in what bankruptcy court the US is going to file for bankruptcy, LOL. But the richest guy in the world can say whatever, no problem, and he says whatever, no problem. That’s been going on for years. A lot of it is just a bad joke that people take seriously.

He is also a genius, obviously, but the idiot part of him keeps getting in the way.

Being incredibly intelligent in one area does not make one automatically knowledgeable in others.

Anyway, I don’t know what Musk actually said but he either is wrong or maybe he is using “bankrupt” as a colloquial term describing our inability to pay for future services compared to current levels. That is different from the legal term bankruptcy

Talked to a commercial real estate lender today, during the convo they casually mentioned that a lot of their clients were doing shorter terms because obviously rates would go down and they could just refinance in a year or two. Not the first time I’ve heard this from industry people lately, but it’s becoming funnier and funnier to me every time I hear it especially over these past few weeks.

I remember hearing that commercial strip mall lease terms were like 10-20 years. I was amazed.

Think how Cush that commercial agent’s job is.

He gets like 2 calls a year, Max!

Haha

Everyone and their brother is long bonds right now. Feels a bit bubbly just like the stock market.

Short TLT has been a great trade in the last couple sessions.

I wouldn’t buy it but I wouldn’t short it now. If it went back to the low $80’s that would probably bring in buyers. It can’t go to zero. I’s not the kind of asset that could go down a lot, although it’s not out of the realm of possibility. In 2020 oil futures went below zero, so anything is possible. There are many stocks out there that could get absolutely annihilated.

My puts are in the money once it falls below $92. My breakeven price is something like $87 and change.

That’s why Warren Buffett is dumping Bank America stock. You can’t support the FED’s 3rd mandate, “moderate long-term interest rates”, unless they do QE.

“You can’t support the FED’s 3rd mandate, “moderate long-term interest rates”, unless they do QE.”

LOL, not sure if you’re kidding. But just in case you’re not kidding: long-term interest rates ARE moderate RIGHT NOW — and some would say LOW (10-year yield at 4.2% is on the low side of moderate). And they’re doing QT.

“Everyone and their brother is long bonds right now.”

I don’t know if that’s true, but that would be the most irrational financial position I can think of.

How is locking in high-yields at the start of a rate-cut cycle “irrational”?

Some people prefer to earn more money instead of less…

“How is locking in high-yields at the start of a rate-cut cycle “irrational”?”

You bond bulls are funny.

You really think the 10-year can go lower in yield when it’s barely above shorter rates i.e. 2-year?

Term premium exists for a reason. Future money should be worth more than current money.

If you are buying the actual bond and are comfortable holding to maturity then fine. However, if you are buying bond funds, the return does not justify the risks.

The yield curve will not stay inverted or flat forever, one way or the other. I can’t see a scenario where the potential return of TLT justifies the interest rate risks.

Yeah it’s not bubbly at all.

The fundamentals look amazing.

Give it a year and then start to worry, a little.

TLT is one of the finest examples of broken clocks being right twice a day — it’s a great speculative bet that continually goes in a cycle of going nowhere.

If you have the time and patience for stagnation that’s a great place to hang out, but doubtful you’ll break even.

Right now, the clock is reliving 2011 with bonds being highly confused.

It won’t last long before the interest rates decline again. As you said

Markets move in a mysterious way,

How do you think these latest deficits were financed?

Baring a significant market crash, and with all the issuance to come, interest rates must go up. The question is, do rates stabilize on the short end and does the rest of the curve rise above the current 4-week T-bill rate? How’s that going to work, with the current debt and deficits? Looks to me like the Fed has given up the inflation fight.

Hedge accordingly.

I feel bad for young people trying to buy their first home or upsize a bit… they aren’t catching any breaks at all.

I feel bad for any non-rich person trying to buy their first house. Age has nothing to do with it. Prices are way, way, way, way, way too high.

It’s obvious to me, as the husband of a former “high producer” agent/partner in Morris County NJ, that some of you have no idea of what it takes to be a successful RE agent in a market like this one. If you don’t work your ass off, you won’t get the referrals that are the main source of future business. Nor will you get to represent the high end builders and bring their high priced product to the RE market, at a reduced commission BTW. Or maybe, just maybe, many of you are jealous off all high producers/earners. I think I see that here on Wolf a lot!

It’s obvious that all of that is just bling, flash, and utter nonsense.

“Nor will you get to represent the high end builders and bring their high priced product to the RE market”

All the while telling the buyer what a great deal they were getting on this overpriced bomb you were peddling.

I see few problems at least paying so much for realtors.

In my neighborhood, home prices are 1.5 mil USD.

Paying 6% of 1.5mill is ~60K.

Now, from buyers perspective, paying a realtor 30K for few hours of work does not make sense.

Almost all the relevant information is available online/open database and with help from attorney, one can buy without using an agent. I have done this myself.

I know lot of people who were not qualified for anything, with just a high school diploma, is a realtor.

A realtor selling a 300K home Vs 1.5 mill home, efforts are more or less same. Then why pay 5 times more for 1.5 mill home.

People should absolutely not pay this much to realtors as they don’t bring much value. Just explore discounted reator.

You are making the classic mistake of equating hard work to value provided to a customer.

People here are mostly coming from the perspective of sellers and buyers of SFH’s. Very few really come back with a great experience and really believe the commission was justified. Majority of customers use RE’s because by any large, NAR has monopolized selling/buying.

Furthermore, that commission was a collusion as recently shown in courts, which cements the belief the “customer” is being swindled.

Nobody is saying your spouse is unethical or is not a hard worker, but again hard work does not equate to pay. And my experience with sales…let me put it this way: Gavin Newsom would probably be a very successful RE agent.

My son’s sister in law is building a house. They sold their small home and were exuberant to have made $150k! Woo-hoo! Currently living in a small travel trailer. They have 6 children. He makes 80k/year.

Bought 15 acres for 150k. Had to put down 25%. Building a 2500sq ft home. Paid cash for used trailer.

“We can sell it after we’re done (after 8 people trash it for a year??)”

Except they didn’t make 150k. Prior to close had to redo septic for 15k. Already under contract for land…

Their construction loan is interest only until complete, then they have to roll the land payment into the new mortgage payment at these rates. They bought the land at peak, project is taking way longer than planned, and they did it all predicated on rates coming way down by the time they closed.

I repeatedly advised them not to do it. They were excited about the rate cut and my son told me they said “See, your dad was wrong” and just like that, they’re locked into 7%.

They CANNOT afford the payment. Not even close.

“Well, we can sell it and make xxxx”

No one else can afford it either.

I will purchase it on cash bailout prior to foreclosure after all equity has been squandered.

6 kids and a wife in a travel trailer sounds like a recipe for divorce, or worse.

Dorian Paskowitz did alright.

Here’s what I don’t get. Why lenders for the most part don’t compete on rates. There’s like 2.5% between mortgage rates and bond yields in the 30 year. Is the risk appetite for a rate that is 1% above bond yields not worth it to lenders? A 5.5% rate would probably go a long way to unfreezing the housing market and bring mortgage demand back up.

Mortgage rates fell from nearly 8% in late October 2023 to 6.1% in early September 2024, and all it accomplished is that SELLERS came out to sell, and inventory and supply shot up, but buyers remained on buyers’ strike, and sales remained at the slowest pace since 1995. And that’s how it should be. This is a price issue and not a rate issue — prices shot up by 50%-plus in many markets in a three-year span! These high prices have caused demand destruction worse than during the housing bust. The solution is lower prices. Demand will re-emerge at substantially lower prices. This is a fundamental economy dynamic that applies to just about everything, from commodities to cars.

“prices shot up by 50%-plus in many markets in a three-year span” This still feels surreal to me and smacks everyone that’s been saying real estate moves slow right in the mouth and kick them in the jewels…I guess Covid broke a lot of things and also helped set a lot of undesirable (or desirable) records depending on which side of the camp you’re on… crazy time we live in for sure and seems like we’re more and more reliant on bagholders of future generations to keep this machine going..

I agree to a point that lower prices will drive more demand. But I think people were expecting mortgage rates to drop further and didn’t even have a chance to realize that they should that advantage of 6% rates. We would have seen a huge amount of refinance applications from those in the 7 to 8 plus percent range, and I don’t believe that really happened. That because up my point about people waiting for the rates to drop further if I’m correct.

“people were expecting mortgage rates to drop further and didn’t even have a chance to realize that they should that advantage of 6% rates.”

This is precisely the kind of irrational thinking that just kills me. If rates drop, you can refinance. But you CANNOT CHANGE THE PRICE OF THE HOUSE after you buy. You’re stuck with it. It’s the PRICES that are too high, not the rates.

This is interesting. The risk appetite isn’t there, at least it’s there enough so that the spread is what it is. What would be scarier is if the spread between the two widens. Because that indicates that the perceived risk of the mortgages is greater. When can folks not make payments on their mortgages? We’ve seen this before…

Perhaps the rates could drop as home prices drop? More loans issued to a larger population, so risk is distributed more compared to fewer borrowers with greater paper debt.

“Perhaps the rates could drop as home prices drop?” I think this is what happened in 08-12 but I am sure this time is different as many others are saying…

MW: 10-year Treasury yield ends at roughly 3-month high as U.S. deficit concerns linger

Excellent analysis. Thank you.

Your posts are very concise, Wolf. It’s a nice feature!

No fluff needed or provided.

WOLF – you are 100% correct comp prices are way too high. The rate matters, but the price is the key. However, that does not mean they will come down meaningfully at all. In most markets outside of TX & FL, comps are still going UP in 2024. In 2025, there will likely be more socialistic govt $ thrown at housing to “help”. This will only lead to less homes for sale, 40&50 year FHA mortgages, forbearance, on and on. The government is all-in on preventing any meaningful deflation to home prices and their precious high level of property taxes which are based off the high comps.

Existing home sales dropped another 18% to a 14 year low. Realtors may as well start looking for jobs at their local car wash.

Wall Street and NAR suggesting home sales down because of election hesitation — versus interest rates and home prices being beyond the reach of a tsunami of Americans.

I’m sure home sales will rocket after the election chaos is over…..

Home prices are about 50% higher than the same period five years ago.

Pandemic wages up by how much?