Too-high prices destroy demand. Everyone knows that. Lower prices would bring out demand.

By Wolf Richter for WOLF STREET.

The extent to which demand for existing homes has collapsed and remains collapsed is astounding, but ultimately not surprising: Demand plunged in 2022 when mortgage rates soared, and plunged a lot further in 2023 as mortgage rates continued to rise to almost 8% by October 2023. But then as mortgage rates dropped starting in November, and kept dropping in 2024, demand stayed at these collapsed levels through September, despite mortgage rates having dropped to near 6%. And now that mortgage rates have bounced off the September lows since the rate cut, demand has collapsed further, even as inventories have been rising all year (look below the article at the top of the comments for inventory and supply charts of existing homes and new houses).

And everyone knows why: Prices are too high. That prices are too high, after the crazy spike, can be seen in the charts of our Most Splendid Housing Bubbles in America. And people have gone on Buyers’ Strike. We’ve been saying that for a long time, and Fannie Mae found in a survey just before the rate cut that lower prices are exactly what buyers are waiting for – lower prices, lower mortgage rates, and higher wages. In other words, people are still on Buyers’ Strike, and they’re staying on strike.

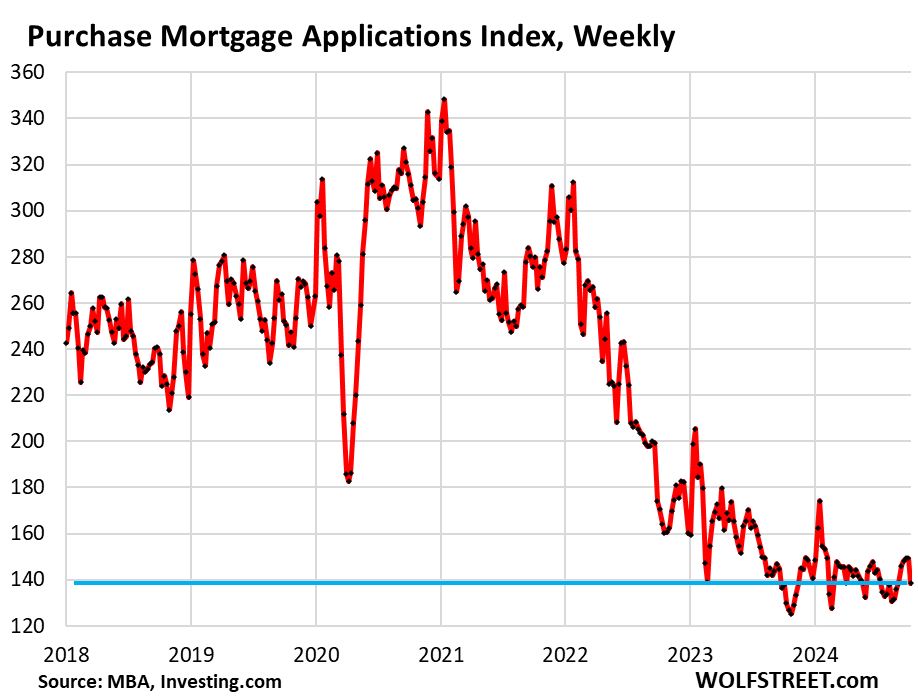

And it was confirmed today by the plunge in weekly applications for mortgages to purchase a home – a plunge from already historically low levels – according to data from the Mortgage Bankers Association. The Purchase Mortgage Applications Index has stayed in the same historically low range since the beginning of 2023:

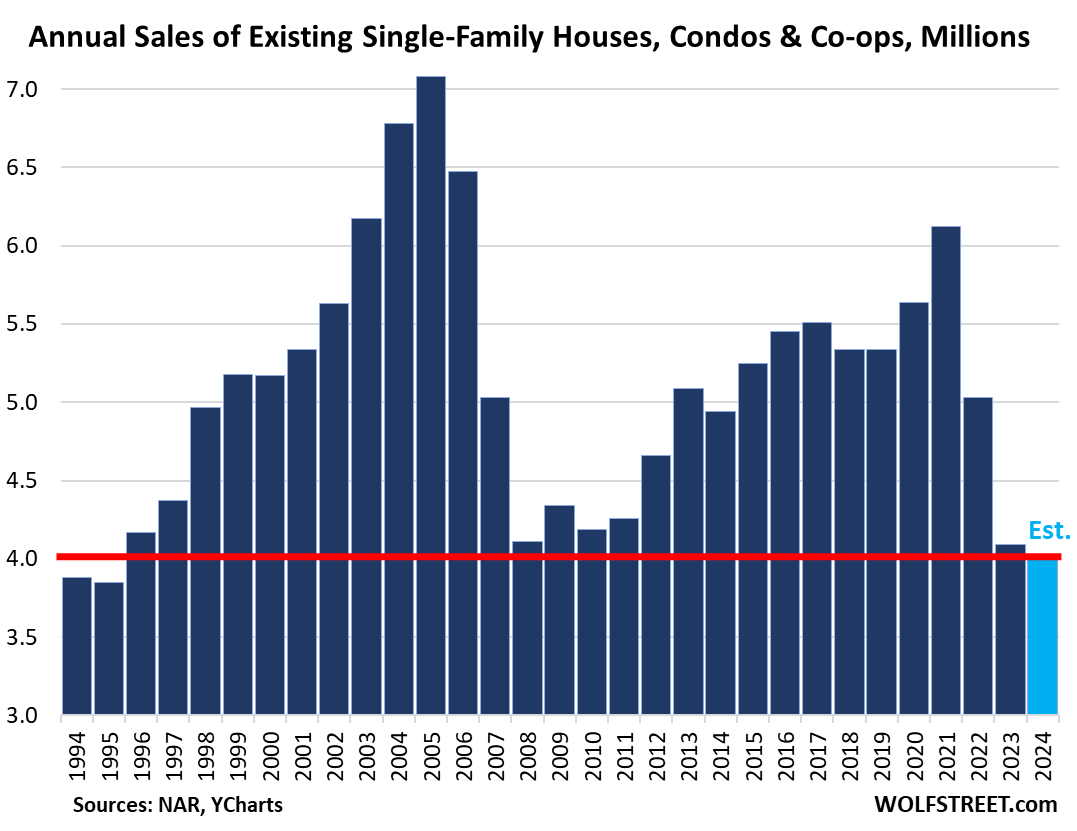

Fannie Mae economists, in their forecast for the remainder of 2024 said, “we expect affordability to remain the primary constraint on housing activity for the foreseeable future, and we now think full-year 2024 will produce the fewest existing home sales since 1995.” So we’re not alone.

Sales of existing single-family houses, townhouses, condos, and co-ops have plunged by about 26% from 2018 and 2019, and by about 34% from 2021, according to data from the National Association of Realtors. In 2023, they fell to 4.09 million homes, the lowest since 1995. In 2024 so far through August, sales are tracking 2.5% below 2023. And if that decline continues, sales will drop to about 4.0 million homes.

This demand destruction is worse than it was during the depth of the Financial Crisis as millions of people lost their jobs and mortgages blew up, and 2024 is the second year in a row, all because prices are too high. High prices destroy demand. Everyone knows that (light-blue column = our estimate for 2024, historical data from YCharts).

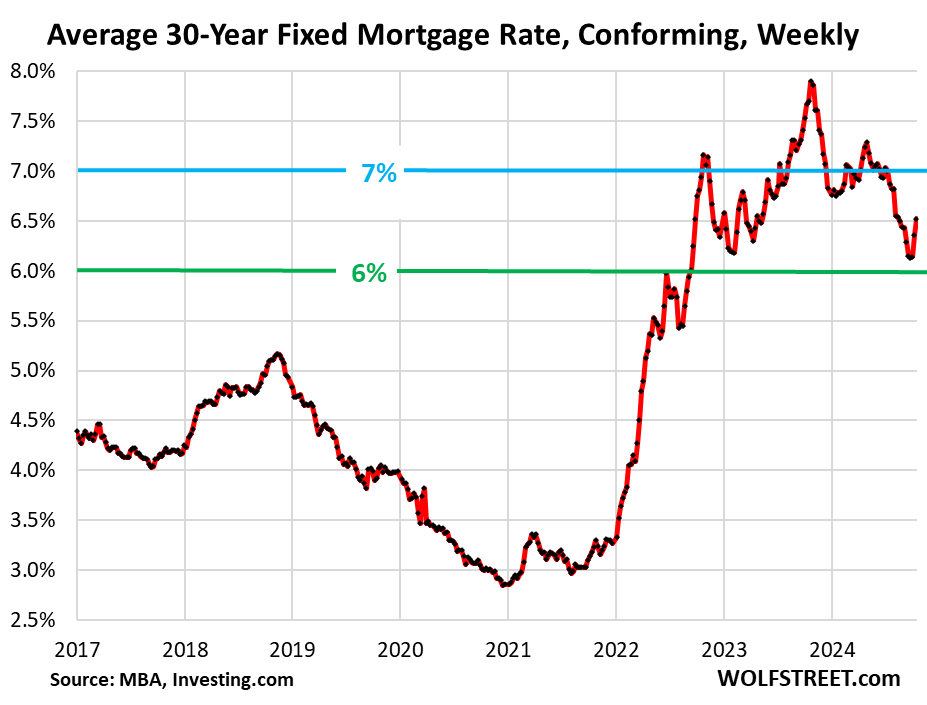

Mortgage rates had dropped to 6.13% just before the rate cut on September 18, a two-year low, according to Mortgage Bankers Association data. But 11 days after the Fed cut its policy rates by 50 basis points, all data-heck broke loose. Large upward revisions of job growth, personal income, the savings rate, economic growth, and PPI inflation, topped off by CPI inflation rising for the third month in a row, changed the entire scenario, rekindling inflation fears. The bond market reacted to it and longer-term yields surged, as did mortgage rates.

The average 30-year fixed mortgage rate jumped to 6.52% in the latest week, according to the Mortgage Bankers Association today. It’s quite a U-turn:

As mortgage rates dropped from November 2023 through mid-September 2024, home sales have continued to wobble along historic lows. Now that mortgage rates have jumped, home sales will likely fizzle further for the rest of the year.

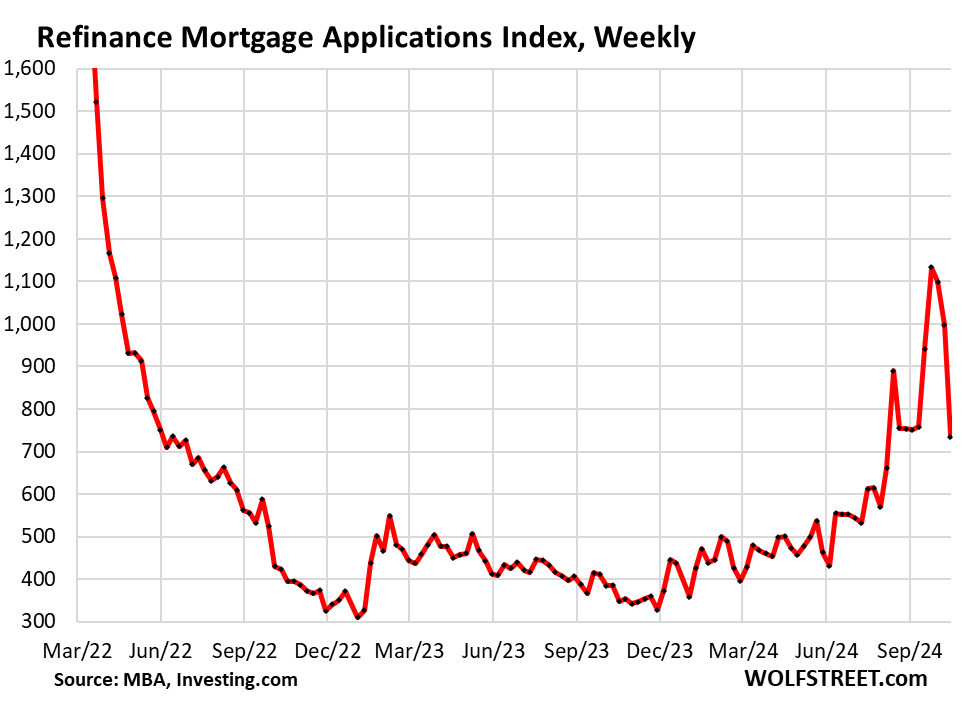

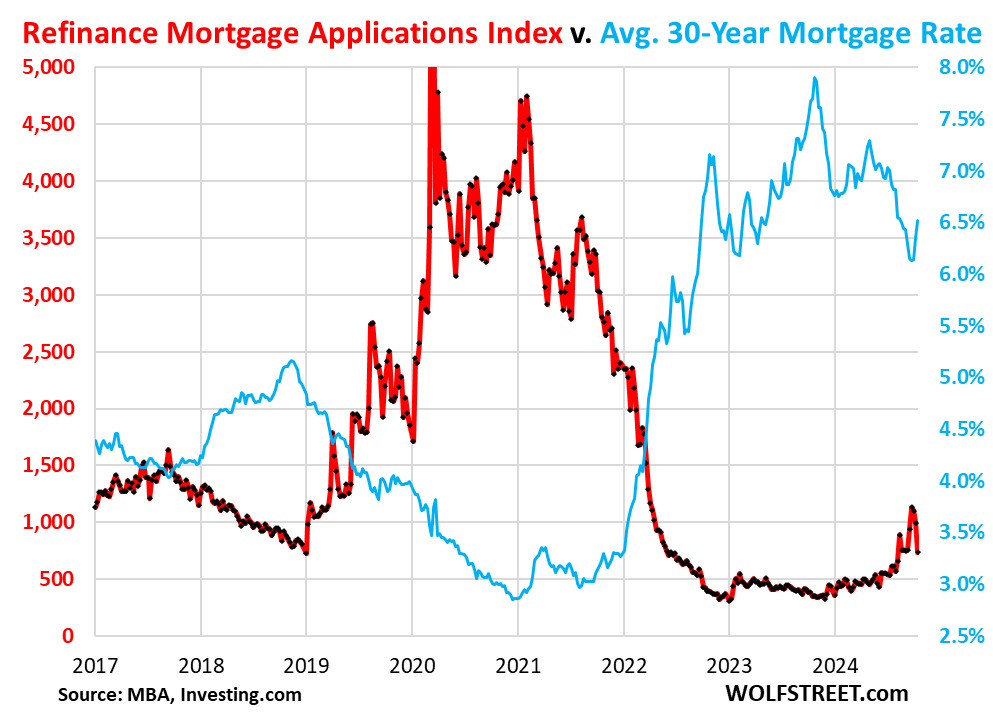

During the time that mortgage rates dropped, while home sales wobbled along historic lows, applications to refinance existing mortgages rose from the ashes and more than tripled by mid-September, from near-nothing levels late last year, to the highest activity level since April 2022, which was when the rate hikes started.

But over the past two weeks, as mortgage rates spiked, the Refinance Mortgage Applications index re-plunged, according to the MBA today. Here is the detailed view:

On this longer-view chart, which includes the historic spike in refi applications during the 3%-mortgage era, we can see how refi applications (red) move inversely with mortgage rates (blue).

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Just as a reminder about inventories of existing and new homes, gleaned from prior articles here:

Active listings of existing homes surged 34% year-over-year, to 940,980 listings, the highest since April 2020, and the highest for any September since 2019.

Of the biggest 50 metros, active listings exploded in the San Diego MSA (+77% year-over-year), followed by Tampa (+74%), Orlando (+69%), Seattle (+68%), and Miami (+68%).

The red line = 2024, purple line with black dots = 2019. The four lines below the 2024 line are the years 2020, 2021, 2022, and 2023 (data via Realtor.com).

Supply of existing homes rose to 4.2 months at the current rate of sales, up 27% from a year ago, and the highest for any August since 2018.

Inventory of new completed houses jumped by 46% year-over-year, and by over 200% since mid-2021, to 104,000 houses in August, the highest since November 2009, according to Census Bureau data today.

About half of all new houses sold are in various stages of construction currently, many of them in the early stages of construction or even before construction begins, and buyers have to wait for (sometimes many) months before they can move in. Finished houses are essentially move-in ready. But builders have tied up a lot of capital in them, and they have to be sold quickly. Inventory of completed houses encourages builders to make deals.

Inventories of new houses at all stages of construction – from not yet started to completed – rose to 470,000 houses, right up there with August-October 2022, and they’re all the highest since 2008. Supply rose to 8.2 months.

You truly provide the best analysis avaliable!

+1

Until we have the much-needed, preferably nasty recession to bring back affordable housing, states may need to push for zoning to sell apartments as opposed to renting them.

As a simple example, a single individual may be willing to pay $125K for a one-bedroom home (formerly an apartment). Otherwise, I just don’t see how younger people will ever be able to afford to buy vs rent.

Why wouldn’t they just rent?

And I think that is called a condo.

So they don’t face coordinated annual rent increases by the corporate landlords using Realpage?

BP, instead of rent increases, they will face paying property tax and associated increases.

Actually for AA in TX:

NOT SO in CA and, surprise for many, FL!!

Both states, certainly one of the most reactionary ”liberal,” and certainly one of the most reactionary ”conservative” at this time have what should be in every state, a system that allows old and elder and elderly folx such as me own self to be able to live in our long term homes without being either ”on the streets” or on some sort of huge GUV MINT subsidy…

That some folx consider this unfair is, IMO, only because they are not in their 8th or later decades, after, usually, having paid their share of ALL the tax burdens when working and earning…

One old mentor told me many decades ago when I was complaining about the tax burden,,, “” BEE happy to pay taxes,,, it means you are successful.”’

And so they can take part in ownership. The rise in value of homes / condos are a big part of the wealth disparity in the US and around the world.

@GuessWhat…guess what happens when houses don’t appreciate?

This is actually common in places where those of less means can actually afford a house.

I’m not against home ownership but it’s not the universal wealth generator people make it out to be.

Many big metros are starting to allow Accessory Dwelling Unit (ADU). Think of them as tiny homes in people’s back yards.

They should be very affordable.

ru82 – a way to frontrun an inevitable ‘favelization’ (or abandonment) of big urban’s?

may we all find a better day.

I agree something needs to be done for a variety of reasons… I think office Bldgs need to be repurposed for condos or apartment buildings too. We need to give tax incentives to developers who are doing this and not just those developers who are bldg more rental properties at very high rents and not providing the affordable housing component in these developments either… I’m sick of this nonsense and I’m pro development but this has gotten out of control.

I’ve been looking for another rental

seen couple get to point I’m almost interested

then scooped up

lots CASH out there

Need to outlaw ownership of SFH for rental purposes, and force landlords out of the game. Make it tax disadvantageous to collect houses or hoard real estate to avoid having to work a productive job. It’s the only way. Too much cash in a few hands can just buy everything, and everyone is landlord crazy with the idea they will buy enough houses to monopolize the resource so they don’t have to work a productive job anymore.

Home ownership could increase desirable birthrates as well.

On the flip side, renters should all lock arms together and refuse to pay rent since the system is against them.

Ethan in NoVA,

“Need to outlaw ownership of SFH for rental purposes”

🤣 So throw people who WANT to rent a house into jail?

Why stop there. While at it, throw people who want to rent an apartment into jail, and allow only condos, and forbid rentals of condos. Throw all renters into jail, that’s where they belong, especially that heinous group of “renters of choice,” jail is free room and board.

I mean the absurdities we get to read in the comments here are just funny sometimes.

Landlords invest and take risks to provide a service that is in demand, and they hope to make money. And if their calculus doesn’t work out, they blow up.

I think there’s an argument to be made that if housing is a commodity then high prices are a drain on the economy just as high oil/gasoline prices are. Ironically, places with the most inflated home prices, eg California & NYC, are the loudest about the need to tackle this crisis, except, of course, when it means enacting policy that would cause the price of their own home to decline. NIMBY

Why do this now when the market seems to be solving the problem on its own…

Spread compression b/t the 10 yr & mortgage rates would help a lot. Thoughts?

Spread compression occurred during QE when the Fed bought MBS.

Now under QT, as the Fed is unloading MBS, the spread has widened.

The Fed has indicated numerous times that MBS roll-off will continue even after QT ends until all MBS are off the balance sheet. MBS are a mess to deal with, and the Fed wants to get rid of them. After QT ends, it will replace those that roll off with Treasuries.

So maybe the narrow spread during QE is gone for good. Back to the old normal?

My local realtor says things couldn’t be better! Of course it happy talk. I’ve never once met a realtor who has said, “wait awhile until things begin to crack”. Not once!

Of course he is happy. He’s probably got a lot of listings. Of course, he probably feels the offers are just a shot time away.

The good old days when we the housing bears thought even 2018 and 2019 prices in certain markets like SoCal and NorCal were quite bubbly…boy do we look stupid now…if that was bubbly, this current tug of war and insane out of this universe prices is whole other thing…hopefully 10 years from now, we don’t look back at now and go, boy were we wrong when we thought home prices then were high..

In a way it will be a major victory if prices goes back down to 2019 level and will probably take some kind of Armageddon event to get us there but then you realize it’s kind of a small concession since price were high back..

Yeah, just need another $5T stimulus like we got in early 2020 right after some felt 2019 prices were bubbly.

Prices can’t come down to 2019 levels since the Fed still holds more MBS than it did in back then and their balance sheet is still $2T away from where it was, too.

Wrong… prices can come down if enough people need to sell there homes. Fed has nothing to do with it.

Really looking forward to this happening so I can think about buying something. Hopefully next five years🤞

Supply and Demand.

It’s taught day one of economics class.

More demand = higher prices

More supply = lower prices

The fundamentals will come back into play eventually. Not this year but next year home owners looking to sell will be more motivated.

I work in finance in the tech sector, we’re doing budgets for ‘25 and caution is the name of the game.

I.e. HC reductions.

”Right ON” Ad:

Prices WILL come down, they always do…

Only real question is WHEN,,, not IF,,, and for how long???

Repeating on here my experience looking at a couple of ranch type houses on a canal with ”sailboat water” to the GOM in 2006 for sale for $800K,,, I did not buy and told my friends to stay away because on the way there, I heard a clerk at 7-11 tell how he had flipped a condo the day before for a good profit…one sure indication of getting close to the end of the bubble IMO.

Same ranchers sold at auction couple years later for $225K…

“Prices WILL come down, they always do…”

But the fundamental problem is that while the Fed/DC have no problem abusing savers for 20 years (ZIRP) in the name of asset inflation/Wealth Effects, the Fed/DC treat the inescapable return to natural, unmanipulated interest rates – and the inescapable asset deflation/Poverty Effects that go with it, as a national emergency requiring another few trillion in printed fiat, another few trillion in Fed debt.

Rinse, cycle, repeat.

So asset price declines/normalizations aren’t allowed to go very far (until DC suicides the national currency/economy and has its scale-weighting thumb chopped off).

The Fed has so badly distorted the asset markets and created a fictional economy based upon empty fiat, any return to “normality” looks like a disaster, one that won’t be politically tolerated (until the pols have debauched the last dollar they can).

Call it Weimar America.

Over 65% of people already have a house, the others are renting…what’s the problem.

Houses are still selling, 2023 over 4 million homes sold, in 2019 homes sold were 5.34 million.

This is America, we don’t sell cheap houses here. That house is a gold mine and people know it.

After reading the article and seeing the housing ” pile up” I still conclude that times are different today than in other housing affordability crisis, where jobs are plentiful and money is sloshing.

This is odd creature that our leaders have created, the franken beast from hell.

Agree prices can come down. Disagree the Fed has nothing to do with it. They hold two thousand billion in mortgage backed securities, which it is great to hear that should go to zero. Think, if those mbs had to be absorbed by the free market instead of printed money, they would probably have had to be sold at a lower price/higher yield, so, higher mortgage rates, which probably would have reduced the cheap debt fueled speculation and hoarding which drove prices sky high. I think draining the mbs to zero, putting the free market check on speculation again will take away what seems to me is a pall hanging over the country in housing, so let’s stay the course for good.

What does the fed holding MBS and their balance sheet have to do with prices coming down? Serious question.

fed holding assets on balance sheet = artificial demand for bonds = lower rates. lower rates drive real estate demand and hence, real estate prices.

I think you’re confusing a ‘stock’ variable with a ‘flow’ variable.

The MBS currently on the Fed’s balance sheet doesn’t represent current demand for MBS, it represents old demand for MBS that drove interest rates down back in 2020-2021. Today, the Fed has completely stopped purchasing MBS and is no longer providing additional demand to that market. If the supply of MBS to the market should increase in the future as home sales pick up, the Fed won’t be there as a buyer, so mortgage rates will have to increase to entice demand from other potential buyers to meet this additional supply.

@Central Bankster

That doesn’t influence current rates. The Fed is out of the buying MBS game for now and hopefully forever. The stuff on their balance sheet has no influence on current rates.

I read recently that the NAR came out and said the 6% range is the new normal. There were A LOT of people still buying real estate assuming that rate cuts were coming and they’d get back to QE era rates. That’s not happening.

The best thing that could happen is buyers and sellers accept that QE is dead and rates will never go back down to where they were. Everyone adjusts accordingly.

Really hoping housing price to crash. The insanely high property tax is unbearable

There’s a good reason for tax reform like CA’s Prop 13 to limit the amount of increase in annual property taxes and (hopefully) force the State to live within a more specific budget. I’m surprised the boomers in other States haven’t tried to force this type of tax reform.

Yeah I sold a bunch of stuff in 2019.

“NOTABLE HEADLINES

Goldman Sachs expects the Fed to deliver consecutive 25bps cuts from November 2024 through June 2025 to a terminal rate range of 3.25%-3.50%, while it expects the ECB to deliver a 25bps cut at the upcoming meeting and then sequential 25bps of cuts until the policy rate reaches 2% in June 2025.”

-Alfred E Neuman, Fed Chair

per WolfSt:

Economy is booming, personal debt levels are down, wages are rising through the roof, 35T is just a number, stocks make SpaceX look like a gopher…

Just buy, buy, buy!

They *were* bubbly in 2018 and 2019. You weren’t wrong. The world-historic monetary and fiscal policy errors of the pandemic era created a megabubble on top of another bubble.

Thanks WR for these reports.

I hope home prices becomes sane again for working family to afford one.

I guess it’d be a long haul grinding process taking many years to bottom out.

Home sales, rising inventory, stagnant at peak employment. What would happen when the recessing hits….

Yes. Thanks, again, Wolf, for raising people’s (and my) consciousness about these facts. We have a tendency to believe things based on a few anecdotes that we hear or see. Stories.

You are doing a great service for everyone who reads these articles. Even for those who only read part of the GDFAs.

Mr. Wolf: CNBC has a article: “How a rare type of mortgage is landing homebuyers a 3% rate,” Oct. 15, 2024. The CNBC article discusses “assumable mortgages.” Shades of 1979 and very early 1980s treasure hunts, but at only a 6-7% mortgage environment, not the 13-14% of the old days. If this inflation gets out of hand, that it certainly will, it would be a spectacle not seen since ancient Rome was burned.

1. The key in the headline is “a rare type of mortgage.” You can forget the rest. There are not enough numbers out there to make any difference.

2. The buyer would have to come up with a large amount of cash up front because they don’t just assume the payments; they have to pay in cash the difference between the remaining mortgage debt and the purchase price of the house. So the buyers that would really need a 3% assumable mortgage to be able to buy the home cannot afford it because they don’t have enough cash to pay for the seller’s home equity up front. This is a nice benefit for the already wealthy though who could easily afford a 6% mortgage.

couldn’t they theoretically get a second mortgage for the difference, at the higher rate?

Yeah, they can try, but the second-lien mortgage is going to be at 8% or 9%, and the advantage of the assumable 3% mortgage diminishes.

Wolf is correct, and so are you: Sold a house and held the ”purchase mortgage 2nd” way back in the day, then sold that 2nd for a good profit when the interest rates dropped well below the rate.

Not a bit of challenge from any one connected, especially the guy who bought the house we had rehabbed top to bottom, and was very glad to be able to get into it at the price…

It was hard to sell apartments in the early 80 when interest rates spiked, and we would do some (but not many) sales “subject to” the original loan (that more often than not had a “due on sale” clause). These deals were rare and as Wolf says hard for a buyer so come up with enough cash so we had some sellers take a “secret unrecorded second” mortgage where the new buyer would send him a check every month to cover both the first and the second mortgage and the seller would keep paying the bank and sending in rent rolls once a year so they didn’t know about the sale.

“The buyer would have to come up with a large amount of cash up front because they don’t just assume the payments; they have to pay in cash the difference between the remaining mortgage debt and the purchase price of the house.”

…which is almost certainly priced higher *because* of the below-market rate being assumed.

There’s no free lunch.

Thank you for the insight.

I put in an offer on a house with an assumable mortgage (VA) last year. I had cash to put about 45% down to make the math work. The seller countered, effectively wanting me to pay $180K to assume the mortgage because he would lose his ability to do zero down as I’m not military. So that is another hurdle.

One tiny point of anec-data: Property in Sonoma County (1949 “modern farmhouse” on just under an acre)

-Sold in 2019 for $735k

-Listed 3/2021 for $899k, sold quickly for $1.05M. (Maybe Bay Area people who could WFH?)

-Listed in 8/2024 for $1.05M, just closed for $915k.

Somebody lost a bunch of money. Maybe it’s in a fire area needing FAIR insurance ($$$$)?

If enough of these pandemic impulse purchases come on the market, there’s hope for those of us who actually want to live in semi-rural areas.

You might have something there about the “fire area”. Natural events have affected most of the areas Wolf had listed as:

“Of the biggest 50 metros, active listings exploded in the San Diego MSA (+77% year-over-year), followed by Tampa (+74%), Orlando (+69%), Seattle (+68%), and Miami (+68%).” are in nasty weather zones.

@MaddieB I was just talking to my brother today who was alone at a friend’s “weekend home” in Healdsburg (he called to ask me how to fix the ice machine and texted back a couple hours later with a photo of some ice teling me that the “blow dryer trick” worked) . The friend that owns the home and his wife are SF attys (both partners at a big firm). Since I am in RE I asked the address of the house (a renovated 1920’s 3×2 bungalow a short walk from the square) and Zillow said that it sold for $1.2mm in 2006, $1.8mm in 2017 and my brothers friends bought it for $1.9mm in early 2019 (the same month my sister bought her place in Aspen thinking she was buying at the “bubble top”). The current “Zestimate” is $2.7mm (Zillow says the value of my sister’s Aspen place has almost doubled). P.S. What general are of Sonoma County is the recent $915K sale (for those outside CA Sonoma County is bigger than the state of Rhode Island).

300 Bloomfield 95472

Yet Mcgumphrey and his wife Sue Mcgumphrey say “phawww T’all thet” “Mih Haass es Wurt a fertune”

Offer them less than asking and they may sic the dog on you.

Or they may accept, because they’re bleeding money, especially if the house is vacant and they’re headed into the slowest selling period for about 5 months.

Wolf’s Annual Sales chart of existing homes is starting to look a lot like the chart back in 2006. Days on the market chart is following the same pattern. Could be that we are looking at a repeat on the 2006/2007/2008 Real Estate meltdown, followed by a CMBS crash at the same time?

Maybe but that would be too easy of prediction, plus as they say.. this time is different..

The 2007 crash was triggered by variable rate mortgages. Prices were so high the Fed and Treasury let the grifters sell 1 and 2 year trigger adjustables. Nothing down? I saw 110% mortgages! the 10% covered the closing costs. Not unusual to see a mortgage broker add 8,9 10, even 13 points on top which they would refer some back to the real estate agent that brought in the “investor”. Buy a million dollar home with literally no money down at 2% teaser rate interest only. LMAO! One year later it adjusts to 12% fully amortized. Talk about musical chairs! Of course Wall St , the Fed and Obanker knew about it….Now everyone is “safe” in the stock market.

TheCon.TV

re: “The 2007 crash was triggered by variable rate mortgages.”

People expected that housing prices would always rise and since Bernanke drained legal reserves for 29 contiguous months, housing prices fell.

C-19 is different than the GFC. The nonbanking sector, the non-inflationary sector, is rapidly expanding.

https://fred.stlouisfed.org/series/DDDI03USA156NWDB

Thinking SO also SC,,,

MAY BEE different this time due to the VAST increase in communications available for WE the PEONs now thanks to the WWW/internet…

NO DOUBT in what’s left of this old guy’s mind of what a huge delta from net…

HOPE all the young folx and everyone willing and able to work will harvest the benefits of web, etc., to be able to have a home they love, etc., etc.

I don’t think so.

Very little home equity during HB1. Now there is a lot of home equity. Nobody knew who owned the mortgages for the foreclosed homes in HB1. This caused a banking crisis as banks did not trust banks.

This time the GSEs now back most MBS so there will be no fire sales or banking crisis. We were tested with the region banks when interest rates started going up and the FED took care of the liquidity issues quickly.

Sure, we can see house prices drop but no financial crisis and stock market crash. During HB1, housing went down which took the big banks and big Investment Banks down which caused commercial paper market to freeze which about took everyone else down too. When your local utility company which has a solid cash flow but had all its lines of bank credit cut (banks were freaking out) and the commercial paper market froze, then they suddenly could not make payroll. They always used the commercial paper market for monthly payroll and it froze could not pay their employees during the GFC until the FED supplied liquidity.

I think there is too many good things going good economically right now to cause a GFC again. Oil and AI.

But just my two cents. LOL

@Swamp – I am getting the same vibe and made similar comment on the prior thread.

When prices start to go down, potential sellers start to get much more motivated.

All the historical examples show that real estate bubble deflation starts slowly, but once it gets going, it cannot easily be reversed.

Once we see price weakness on more and more charts, the process will be too late to stop.

This time around, the sales surge which pops the bubble will have less to do with crappy exploding and/or fraudulent mortgages, and more to do with vanishing equity on “investment” properties, leading to speculators simply throwing in the towel.

To the average homeowner back in 2006/2007 there was no indication that anything was going wrong. I was there and noticed nothing unusual in the print media. Bernanke was out there piping his usual bull s$it about the economy being strong, and the NAR was saying that this was “Never a better time to buy a home”. I get the NAR’s publication so I was reading the same bull s$it like everyone else in the RE industry. Then everything fell apart, out of nowhere. Same thing can happen again and we’ve got the CMBS meltdown already happening to add to the woes. I like Wolf’s charts above (a picture is worth a thousand words) and believe them more than crap from the Washington Post, Lawrence Yun, or that jackass Fed Chair JP.

On problem appears to be that new homes, in general, are not in the high demand areas, so they don’t put downward pressure on prices in high demand areas. Hard, but they need to increase density, and redevelop vs. adding to the far out suburbs. Office to housing conversions would be a perfect solution, but too difficult even when there is a fire sale on office buildings.

I’ll agree new builds often aren’t in high-demnd areas – e.g. my city, Boston. But we certainly do not need more density; the city infrastructure can barely handle the quantity of people currently living & working here.

Folks just need to pick a less-crowded city to live in, lol.

I know it has been mentioned on here, but office building converted to residential is a no go. It is cost prohibitive. Think about redoing all the plumbing for bathrooms that were one per floor to one for each apartment unit. At least one. There were several other considerations that make that type of conversation not feasible.

The paper that did the analysis said it would be better to turn them into data centers or laboratories or some other commercial use. But residential units would be too expensive. They calculated that it would be cheaper to simply raze the building and start over.

I could be done easily, but regulations, codes and government policies make it difficult. If Bruno the head thumper were allowed to run things, it would be handled well. Hundreds of people would have a dry safe building to call home. Just follow Bruno’s fair but simple rules and all is well. Someone flying, head first out the window would be a lesson to the trouble makers.

Bathrooms, kitchen facilities would be taken care of in Bruno’s special way….

Not disagreeing but I think it all depends on the type of building and its location. I think I read something similar but I am actually seeing a lot of offices turned into apartments or condos if the location is good.

Maybe the future is renting out a room in a tower with shared bathrooms. Like a giant version of a mansion in a run-down area when anyone with money to maintain the mansion moves away, so they rent it out to single guys with mullets who work on their cars in the front yard.

In this dystopian future, smart tenants may decide to buy a bucket, so they only need to visit those wretched restrooms once a day.

And at some point, tenants may not be allowed to leave unless they are actually looking for work, to decrease vagrancy and problems outside that bother the rest of us.

Just being silly…

Office space to home increases the density in many cities beyond the capacity of the infrastructure creating dislocations. Converting office space high-rise to hydroponic farming is another solution. For example a recent 50 story office building in NYC sold for $8.5m after the land was separated from the building which sold for $250mm … the math works for farming and the funding can be sourced from NASA and other government entities interested in improving quality of life in major cities.

In CA those who move to a nearby town or to certain counties don’t lose their prop #13 benefits protected by prop #60 and #90. A few lucky

elderly cashed in and move to a cheaper place but the rest are locked in.

C/S loves them.

@Michael Engel CA Prop 19 that passed in 2020 now allows anyone 55 or older to move to any city in any county in the state and keep their low property tax basis (unlike in the past when only a small number of cities and counties allowed a person to take a low tax basis to a new home). Prop 19 was funded by the Realtors since it also no longer allows kids to inherit the $10mm beach house in Seadrift or the $10mm lakeshore Tahoe cabin and keep the places paying $3K a year (It is hard to make a cabin with a $100K/year tax bill pay for itself and there is a “tiny” percentage of kids that keep a family cabin when it costs less to stay at the Four Seasons once a month).

Vacation properties are the most vulnerable residential RE during a downturn.

HowNow-

Seems right…

What percentage of homes are owned as “vacation properties,” and how has that trended over last couple of decades, I wonder?

(Anecdotally, in my area — 45th parallel — lakeshore property has been built up and bid up dramatically over the last 30 years. Much bigger footprints, rising taxes/expenses, tons of toys, and lots of work. Plus, the kids growing up and moving away….)

In the Pgh area corp are snapping houses for biotech, AI and robotic.

Pgh existing and new listings are the smallest in the country.

Mortgage rates were high in the 1980s due to an inflationary spiral caused by rising oil prices, government overspending, and rising wages. In October 1981, interest rates reached their highest point in modern history at 18.63%.

My MIL you need to buy a house LOL.

We invested in my wife going to Georgetown medical school.

All OT and second job money fully funded 401k, IRAs and ESOP = rich.

We enjoyed rentals during moving around stage and year 2000 bought current house.

I fear interest rates will rise due to inflation, further hurting the housing market’s affordability.

But those higher rates will also push down prices, which is what we need.

The medicine doesn’t taste good, but we’re taking it because it will get us better.

Well one has too ask themselves using the tools of logic:

The bubble in housing prices is a product of grossly under priced interest rates. Which brings us to address your fear that a rise in interest rates that accurately reflects the inherent risk of overpaying for a property.

Now, for instance, if someone paid XX $ for a property and the interest rate went up their property is automatically worth less than they paid for it. Worse, their loan obligation is greater than the price they can sell it for.

Yeah. Housing prices operate a bit like bonds. Higher interest rates correlate with a strengthening currency. As monetary policy tightens – higher interest rate yields – it draws down asset investing; currency becomes more attractive, risk is reduced . Why buy the cow when you get the milk for free.

IF you are not some sort of ”bot” you absolutely need to start editing your posts on here for basic English dang..

many of your posts contain helpful concepts, but those ideas are not getting across to many because of the lack of editing…

thank you

he might be esl. Even if he’s not, a lot of people just don’t distinguish between too/to or their/there/they’re. They’re just not oriented towards that sort of thing. Combine that with “auto-finishing” words – it can be challenging trying to figure out what someone actually means.

Home Ownership in America is now an Upper middle class only club, just as new car ownership. There is now a complete line in the sand of wealth in America. The Haves and Have Nots. It’s better to be a Want Not today. Lease a vehicle, rent a space with family or friends and ride out the storm. Enjoy more your disposable income, rather than paying ridiculous sums for insurance, maintenance, and services. Your over all health and mental stability is the only thing worth worrying about. Ozempic may be better investment than California or Florida real estate.

There are so many declarations to unpack I think I will propose an alternative, optimistic view of this crazy world. The savage efficiency of Autumn, hidden by an intoxicating, gorgeous display.

High school graduation, I was faced with being drafted into Uncle Sam’s southeast Asian policy or play football for a proud small college. Having 200 dollars on my account, I chose collegiate football and an education over combat in Vietnam

Counting Calories with a tracker App and moderate exercise. Ozempic is a nasty and expensive medication. One thing to remember about these “high stock valuations and high real estate prices” is that in actuality, they are in part just a reflection of the value of a dollar. Gold was ~$900 in 2009, today it is $2700. But the horror lies in the fact that for most, wages are at best 80% higher than 2009. The bottom 50% wage worker has become outright poorer in the last 2 decades regardless of recent wage gains. Particularly when it comes to housing, food and gold.

BS,,, WE, in this case the family WE, own our house, and are not in any definition of any ”UPPER” class…

IMHO, ”home ownership” in USA is and always has been for those who are willing, and to be sure able, to work and SAVE and then pay down the mortgage…

Mostly, in my direct experience, it comes down to paying off the mortgage ASAP,,, as opposed to buying the latest truck or other similar ”stuff.”

Yeah, I bought a foreclosure in 2012. It’s doubled in price. But those opportunities are now gone.

We’d have to resort to a “command economy” for any quick fix.

Enjoy some of your wages, sure but a person can be thrifty and save to get a good deal when the bubbles finally deflate instead of having little when opportunity arises and having to keep on renting. Mental and physical health definitely top priority but you get that from humility and being appreciative and nutritious food and physical activity, not from a big pharma product with sketchy side effects.

I wonder how easy it is for builders to switch from single-family homes to apartment dwellings. With the destruction in demand for home purchases, the rental market shows a long-term uptick. It would make sense, if retooling were possible, to go into construction of rentals.

Some of the biggest builders, such as Lennar, are already heavily into multifamily. Lennar is developing thousands of multifamily housing units in San Francisco right now, including the old naval shipyards redevelopment (condos and rentals).

But builders are also bigly into single-family “build for rent,” entire communities of them with a common leasing office and common amenities. They fill those up with tenants and sell the package to pension funds or to the big single-family landlords.

Re: “This demand destruction is worse than it was during the depth of the Financial Crisis”

There’s an increasing amount of barometer warning flags waving — and there’s so much noise with election madness, that news like this is almost ignored or glossed over.

The housing overvaluation story has been a companion to the boy who cries wolf recession saga that had become a joke — yet, the reality of housing correcting is in plain sight!

I think the housing story obviously connects to stock valuations which are stretched beyond a breaking point — the same mindset we saw not long ago in housing mania.

I enjoy seeing tweets by Sven Heinrich and two stand out — trading volume is extremely low and asset class correlations are breaking down.

In terms of market weirdness, I’ve been watching the S&P Dividend Aristocrats and the correlation to gold — they are as tight as maple syrup on dog fur. That shouldn’t be the case, typically gold has an inverse relationship to equities — but in this highly shallow mkt, everyone is chasing the same exact game plan — and everyone is crowded into the same nividia life raft, carry bags of gold.

Definitely The Perfect Storm, in the final chapter of post-pandemic greed — too many sellers listing at absurd prices, while buyers are laying low, protecting cash. Winter Is Coming, as the inventory dike is crashing down and it seems likely the epic biblical flood is on the way — and as for the equity levee, it’s just as strong as the housing levee (used to be).

A brief synopsis of your excellent article which presents the facts in a manner that is unimpeachable. Captured in your almost casual suggestion that:

“And everyone knows why: Prices are too high.”

The monetary return for those trying to describe the financial bonanza of the past ten or more years as reckless, have been trampled and pissed on.

The Fed keggar continues. Damn the tarpedos.

Eventually the rooster comes home to roost is an American saying that comes too mind when I’m thinking about what happens when the financial balloon bubbles in asset prices collapse.

Or are we in a ” permanently high plateau of stock valuation”, as Ivy League professor Irving Fischer justified a short while before the October 1929 asset value collapse that was a principal factor, among others, of the great depression.

So so very happy I sold my condo when I did. Buying in 2012 and holding to late 2020. Maybe I missed the very top of the market but it’s better to be a little early than too late.

“This demand destruction is worse than it was during the depth of the Financial Crisis”

All I can say is, holy guacomole!

How quickly the paradigm changes…

With all due respect I don’t think the paradigm has changed at all. Record highs in stocks and housing and a 50 bpts cut in the overly restrictive FFR.

It is not the dollar that is the problem. It is the weight of the currencies that are still deflating their currencies. Who in their right mind would lend Italy, kisses and hugs, long term money at 200 bpts or so below a similar duration US treasury bond.

Like a yen, paper eventually being covered by the USG to maintain the established parity as agreed too by the Bretton Woods agreement that established the relative valuation parameters among the western nations.

Dang,

Plenty of other solid reasons not to lend Italy money as well! History repeating itself there?

re: “It is not the dollar that is the problem.”

Gold is telling you something different. Our fiscal deficits are unsustainable.

Gold is telling me that it’s in a bubble like every other asset.

I think it’s quite interesting seeing the title of this article, and yes, reading the article, and contrasting it to a comment in the previous article – “If I had a quarter for every guy who comes on here with prognostications about upcoming recessions, layoffs, and how we shouldn’t trust the data…”

Something has to give in. Either there will be a prolonged seizure in the housing market with sales near a standstill (is this possible?), or all those house-rich people will have to come back to reality priced housing.

The first scenario would do major damage to the economy. The second would hurt homeowners, but would allow true price discovery in the housing market, something that is so desperately needed.

“true price discovery”. LOL! Something that hasn’t existed for quite some time now.

The most important price of all, it the price of currency, and central banks around the world have openly admitted that they are manipulating that price (interest rates). The “club members” have been front-running these central banks and sucking more real wealth into their coffers, and further speculating and leveraging bets. The moral hazard and capital mis-allocation is simply astonishing, but eventually the laws of Nature and physics will reassert themselves and people will learn what real wealth is again. Is a mathematical certainty.

Interesting times.

Sedona Mike-

“Something has to give in.”

I put forth a post to this effect a month ago, and was labeled “grandpa” by one commenter who apparently believes we have graduated to a new age of controllable cyclicality — mainly thanks to technological advancement. (But, hey, I AM a grandpa, so there you are!)

The systolic and diastolic repetition of risk-on and risk-off investment beats on from generation to generation.

Good comment.

The 2008 GFC had a lot of imbedded leverage from MBS . Maybe this housing bubble is the result of the Fed plus global money printing machines so well documented by Mr Wolff however I personally don’t want a return of the GFC scenario . Demographics may be playing a role of the increase in home listings or maybe the increase in listings is a function of lower rates plus slower sales as buyers go on strike . Here in East Texas just had a home listed for 6 months plus finally under contract. Listings on the market definitely more than 6 months. Prices are lower than new builds .

I have a question. It seems in some of the highest priced areas: Cali, Boston, etc… asking prices for houses are far higher than you could ever rent the property for. That doesn’t make any financial sense to me, but I might not be very bright. Why are people paying those prices? Are they just hoping the price goes up even higher? Isn’t that awful risky?

I’ve asked myself the same question for over a decade in Salt Lake City. Why would anyone buy a home that has a 3% cap rate or less? The answer is: they’re BRRRR’ing, flipping, or just willing to wait it out until rents improve. When a metro area is growing and RE values are increasing, it is still worth it to own as long as you can carry it.

In hot metro areas, rents are trailing indicators. In cool ones, you get cash flow but usually less appreciation. That’s unfortunately how the game works.

But when values start to flatline that logic no longer holds.

IN my hood, carrying cost of home is ~$9K but one can rent the same home at $5.5K

Prop 19 forces children to make their inherited parents house their

prime resident within a year in order to benefit from their parents prop 13 lower tax base. Otherwise the house tax rate will be reassessed at market value. The selling will increase when houses will be reassessed. Inflation will slowly chew RE real value, in small changes, in frog cooking. Add to that a systemic change from houses to apt rentals. People’s total assets will deflate. The regional banks will shift their landing from RE to THEIR REGIONAL industries. The US will produce more in the US. just in time. Demand for highly skilled and semi skilled workers – like carpenters, electricians, nurses – is high. Unions will thrive. The gov will collect more from taxes and tariffs . They will fill their coffer…..

I just write to tell you Wolf that you provide the best analysis out there. You are my number one source, by far. We need more like you, especially these days, when it is so difficult to trust the media.

Thanks Wolf! The law of averages in play. What is the average income relative to the average home price (and the associated costs of ownership)?

Eventually reality sets in.

Interesting times.

Supply and demand drives sales, however the supply’s cost has to be in line with the demand’s ability/willingness to pay. Looks like we are in the midst of supply adjusting its cost to meet demand’s ability/willingness to pay. Maybe a little adjustment of demand’s ability/willingness to pay. Might be a while before they meet and agree in substantial numbers. Interesting to watch this play out though. Always appreciate Wolf’s straight forward approach to it.

I recently sold an old family home and financed it myself, to a young local tradesman.

Nice to have a monthly check rather than bills on an appreciating asset.

I wonder if more asset heavy oldsters are thinking along these lines.

Sold by owner, non assumeable note, and a buyer with skills to make the place better.

Not possible in urban sh’s, but in flyover there are options.

Thinking of paying cash for another and doing it again.

Question? Do private cash deals or private sales get caught up in all the numbers?

Private direct deals have always been around. I sold my condo in 2000 directly to the buyer without listing it and without a broker (older couple downsizing, cash deal). There is nothing new about it. Their share is kind of a constant with minor fluctuations. Private direct deals are included in the Zillow data I use for the “Most Splendid Housing Bubbles” series but are not included in the sales count.

In terms of your deal, you’re the bank, and the risk is that the buyer defaults on your note. I obviously don’t know what kinds of documents the two of you signed, but assuming that it’s a standard mortgage, you can’t just evict them, like you could with a rental contract. If you have to start foreclosure proceedings, while they live there without making mortgage payments, you will find out how much of a hassle it is, how long it takes, and how expensive it is to recuperate your property, and in what condition it is in when you’re finally going to get it back.

So that’s the risk. Maybe the risk is slim. But it’s there. That risk is why mortgage rates are higher than Treasury yields: lenders want to be paid for taking this risk. So if you get enough interest and if the buyer pays the note as agreed until it’s paid off, you got yourself a pretty sweet deal.

Wolf,

In my area, I see a number of sold listings on Zillow with no pictures other than the google street view. Does this indicate a private deal as you’ve described here?

Not necessarily. It just means that the seller/broker didn’t upload any pictures or took off the pictures after the sale (if Zillow lets them, not sure about that). It could have been a private sale, but not necessarily.

If it’s a private sale, while it’s on sale, it would show as “off market” on Zillow like all homes that are not for sale.

The data I use is homes that sold, and whose sales closed. And private sales show up in the Zillow data because no one can keep a sale secret; it’s going to show up in the county tax records, which Zillow also has in its Data Base of All Homes.

Here in SoCal, listings with no pictures uploaded are usually rentals with tenants/squatters. Or sometimes teardowns.

Two ways prices can be lowered: first is the price is dropped today. Say $500k to $475k. 5% drop. The other is to wait a year and relist at $500k. If inflation is 3-5% then that’s really a $15-25k drop too. Maybe you rent out the house for $2k a month and after expenses you net $15k. Then your “wait and relist loss” is $0 to $10k. The waiting buyer is out $24k and then pays what they would have a year ago anyway. It’s a tricky situation for everyone. It scales to 3, 5 years too, and I personally expect flat house prices until 2030. Flat is down with inflation but rent income helps. Only if you’re expecting a 15, 20, 25% drop in the next year or two does it make sense to rent and wait, in my opinion.

The way the FED drops housing prices is demonstrated by the GFC:

M1 NSA money stock, “means-of-payment money”, peaked on 12/27/2004 @ 1467.7. It didn’t exceed that # until 10/27/2008 @ 1514.2. Legal reserves were drained for 29 contiguous months.

The money stock didn’t change for 4 years. In contrast to today, Powell has let the money stock grow by 10% over the last 32 months. And in contrast to the GFC, the nonbanks have not experienced disintermediation (an outflow of cash, or negative cash flow), so velocity has not fallen.

You’re assuming you can find a respectful and willing tenant for $2k/mo.

That might be a reasonable rent in some markets, but hopefully the tenant doesn’t wreck the place.

Hearing all the ‘war stories’ from one of my former landlords was the reason I chose not to buy a 2-family despite my realtor suggesting it at the time.

Probably better for sellers to just drop their prices sooner rather than later.

Re: “ we now think full-year 2024 will produce the fewest existing home sales since 1995.”

Imagine what full-year 2025 will produce!

The momentum trend has just started.

The buyers strike is partly because prices are still too high, but in even larger part because homebuyers expect interest rates to come down further. They are playing a waiting game.

It is not the same situation as 2009 or 2013, when there were foreclosures flooding the market, mass job losses and no one could qualify for a mortgage.

A lot of people can’t qualify for a mortgage in the HCOL areas.

My HH makes over $300K a year, no debt, and I couldn’t qualify for most homes in my neighborhood where I rent for $4500 per month. If sellers want to sell then they need a buyer willing and able to pay.

>rent $4500/mo

Hopefully you are getting luxury for that price, but man that’s a lot to be paying in rent.

Last apartment I rented was a literal penthouse for $2600/mo. I had a roommate so we paid $1300 each.

All in, my house costs about $1800/mo including mortgage, taxes, insurance, water/sewer/gas/etc.

Seems like your income would go a lot farther in a lower cost-of-living area.

If he is in SoCal, then $4500 a month ain’t anything fancy, maybe a 3 or 2 bedrooms condo. That’s how much my greedy previous landlord wanted and then some for some 80s decor 3 bedrooms condo near Cal state Long beach.

Over $300k and can’t qualify? I know it’s insane in this part of the country but what’s your credit score like? That might have something to do with not qualifying. Otherwise if you can’t qualify…I am wondering who the hell are buying these mediocre houses in SoCal and not talking at the $1m to $1.5m price tag…

” homebuyers expect interest rates to come down further. They are playing a waiting game.”

Ever since FED cut rates, rates are going up and up.

Buyer are waiting for affordable monthly payments. They don’t really care about the price. It’s all about monthly outlet. Add on these, higher cost of everything e.g taxes, insurance, CoL.

Zooming out this is somewhat amusing:

Existing Home Sales in the United States averaged 4064.74 Thousand from 1968 until 2024, reaching an all time high of 7250.00 Thousand in September of 2005 and a record low of 1370.00 Thousand in March of 1970.

Moral hazard will save us!

The future: smaller homes, smaller cars. And yes, Canada is not going to send its water to USA. Cry, cry.

Lol if you seriously think Canada has any ability to implement such a restriction, with the GDP of just Ohio and Pennsylvania. Canada is just a 51st state, left alone to pretend it’s a western version of north korea. What a joke.

J…hm, but that idea was being floated over twenty years ago and went nowhere with the Canucks. It would probably be easier to just buy Greenland instead…oh, wait…

may we all find a better day.

MW: ‘A disappointment to home buyers’ as Mortgage rates surge to a two-month high

TLT is having a nice decline today.

So good time to buy then? Rates are coming down. It makes that $1.3m 1000 sqft house so much more afforable..haha

I would not *personally* own TLT as my username suggests… although I’ve been thinking of adding some actual 20-bonds to my 401(K) for hedging purposes.

Just re-read your comment… TERRIBLE time to buy a house, especially in your market! Wait for sellers to come back down to earth.

Maybe I am cynical; and too much informed, but I just don’t believe the cause of the last crash was over levered buyers. Sure, that’s a factor. The United States is not going to risk it’s entire financial system on a few middle income buyers. There is more to what happened that they are willing to disclose. In any case, Bernanke told everyone there was absolutely nothing to see here in the months before all hell broke loose.

This time, values are higher, so much so, that population demographics in lottery winning towns of this mess have changed themselves.

Im not smart enough to know how this all ends, but I suspect very few Americans feel any sense of safety in anything. That was not the case in 2008.

The bit about demographic change rings true. The fun people who lived in Austin 20 years ago have been priced out and replaced by snooty California transplants who think they are fun and cool but are not….

kra – as an old Californio used to being called ‘weird’ in my old TX days at Ft.Hood (as well as other venues) sorry to hear, per your report, Austin hasn’t been able to (per the bumper sticker) to stay that way, as well…

(…wherever you live, if a true slice of heaven, heed Master Berra’s words: “…nobody goes there anymore, it’s too crowded!…”).

may we all find a better day.

“Bernanke told everyone there was absolutely nothing to see here in the months before all hell broke loose. ”

He’s just another grifter pimping for Wall St. That’s what the Fed does.

Crashes are just vehicles for Wall St. to scoop more assets.

Your interpretation of the cause of the financial crisis is naive conspiracy theory. Everyone knows that the seeds of the financial crisis were sown in 1998 when Citibank was allowed to buy Travelers, which came with the investment banks and brokerage firms that Travelers had acquired in prior years. This acquisition violated the Glass-Stegall Act, but the Fed, as top bank regulator, allowed it to happen. A year later, Glass-Stegall was repealed. Glass-Stegall had prevented deposit-taking banks from speculating in non-bank activities. And that went out the window. Suddenly the banks were free to take huge risks, and they did, and those risks came home to roost, not just mortgages, but all kinds of other bets, credits, and derivatives, which caused banks to topple, and contagion spread, and so the financial crisis. It was so obvious that even I saw it coming in 2005, and got ready for it two years too early, LOL

Yes, people did see it coming.

But it’d not a conspiracy “theory”.

It’s proven fact the Fed was complicit in it.

From banks foreclosing on people that didn’t even have a mortgage, to slicing and dicing mortgages into “safe” MBS, to regulators turning a blind eye, to eventually TARPing the entire steaming pile of fraud.

TheCon.TV lays it all out in a great fact based documentary, although it doesn’t even come close to fully exposing the massive corruption that took place. My Wharton buddies college roomie was a VP at Countrywide. He was laughing about how Fannie came to them and asked them to help sort out the delinquent shambles of the mortgage market. The ended up making far more cleaning up the mess they made than they did in running the original liar loan scam…and all paid by the US taxpayer.

The sad part is that nothing has changed. Just rearranging the chairs on the deck as the Titanic goes down.

Yep, I had my accounts with Citi back in 1996 and noticed that they set up what looked like stock broker’s offices in the bank. Then the teller started steering me into talking to these jackasses when all I wanted to do was execute some simple personal transactions. That turned out to be the beginning of the Citi’s demise. A lot of other bad things happened with them and I closed all my accounts shortly thereafter. I wished they had been allowed to go under instead of being bailed out.

Ha..another thing we can thank the FED for…they are like herpes…a gift that keeps on giving to average Americans

In Bernanke’s defense, I don’t think there was any other way to address it. You think our leaders should say “we f’ed!”….because if they don’t give positivity, they will ensure a negative response and even start the issue they are concerned about

Bernanke has no defense for being a sell out crook.

Bankrupt-u-Bernanke turned safe assets into impaired assets. He did so by dropping American Yale Professor Irving’s “price level”.

Read his book, “The Courage to Act”. He is good at math but bad at economics. Zoltan Pozsar bailed him out of trouble with the funding, credit, lending, and loan facilities.

I don’t know that it’s a conspiracy. I do know that what the American people get told is the result of politics. And “things” are very often not what they appear on the surface. China played some role, and since then, since that time, China has been an “enemy”. Correlation is not, well you know. But what walks like a duck – well ya’ll know that one too.

Well so far I was wrong. After seeing new price records in at least 5 U.S. cities in Q1 and Q2 during the “rate cut mania”, I thought for sure this would repeat after the July mtg and new highs would be set in Q3 and Q4. I’ve heard a handful of realtors and mortgage brokers say recently, more or less, “I can’t wait for the election to be over so people will start buying again.” Interesting times…

They can always wish for another pandemic and lock down…that’s the only way they will get another 30% beyond up in two years…plus it’s more realistic of a scenario than hoping for after the election everything will rocket back up IMHO

I wonder how time changes things.

Chinese People love and adore real estate religiously and I have lot of Chinese friends.

One of them, from Shanghai, would always brag about Shanghai real Estate and Shanghai in general. Shanghai is the financial capital of China and is really really opulent city. People used to believe that come what may, property prices in Shanghai would never ever go down.

My friend bought a flat in Shanghai 20 years back and he wanted to liquidate this property due to his old age and maintenance.

When he dipped his toes in the market and put his property out for sale, he was shocked. It was last year. After many months, he was able to sell his property at 50% price of his original price.

Yes, we are different and this time is different.

And honestly, I have the world’s smallest violin for them….supposedly a lot of people also suffered from the market correction over there recently…seems like their herd mentality is just as prevalent as ours. I am just hoping these same people won’t do a capital flight and start buying spree again in the US because they view US housing as a no loss bet forever…

Another big difference, looks like at least on the surface, CCP has more backbone to let the market fall, although the recent easing eroded that narrative a bit, unlike us though, it seems like there’s quite less of a will to let the market fall that much by comparison. FED and the government can talk about housing affordability being a problem yet they continue to exhibit the fireman is the arsonist approach.

Oh Pow Pow can go out there and say young people need a break in the housing market…blah blah, yet they are the ones that bought MBS, if he can cut mortgage rates (which he cannot directly) you can bet your A$$ he will do it in a heartbeat..

ZIRP effectively removed a huge supply of houses from the market which would normally be there. Few will want to move when they will lose their 3% mortgage. Thanks Chairman Powell. When supply goes down, prices go up. People who have to (as in must) buy a house are setting the outrageous prices (historically speaking) we see today. People who want to buy a house, but are in no rush, are sitting it out, collecting a nice 5% on what might have been their purchase price or down payment.

Builders will have to make up for the lack of normal supply, and prices will stay high until enough new houses are built for sale as homes (not rentals). Laws banning or restricting Airbnb type houses or treating them and taxing them as mini-hotels (which is what they are) will force second homes onto the market, which will help with supply. Lots of boomers are in their dying stage and this will also help with supply.

Then the prices will start to drop, as they are doing now (but prices are still outrageously high). It will be a long process, because so much supply has been eliminated, but it is happening. A recession would help (by lowering demand), but a recession does not seem to be in the cards now or in the near future.

So what happened to home prices following 1995? I.e. how much did prices drop?

Go to Zillow for Palatine, IL and sort on price high-to-low. You’ll see a set of new-construction homes listed for $0.995-1.15 million that have been on the market now for nearly two years even by Zillow’s admission (I’m not sure, but I think I saw some of these on Zillow _more_ than two years ago).

Originally listed in the mid $800k range.

Prices raised twice. To finance mortgage rate buydowns?

We are looking for our retirement home but I refuse to buy until home prices drop. I’m only 56 so I have time to wait. And wait I will….

Wolf,

It looks like the mainstream media is finally starting to come around to your thoughts and analysis:

https://fortune.com/2024/10/18/housing-market-jerome-powell-fed-mortgage-rates/

It is amazing the number of articles by financial sites that are trying to explain why mortgages are going up instead of down after the Fed rate cuts. Some of them seemed genuinely surprised by it.

I’d like to know exactly would cause housing prices to come down! Its not like there is bloated profit in homes, its the compounding of HIGH COST of materials and labor. You simply cannot build a home for the same price as 5 or 10 years ago. Then you have the crazy regulation that adds more to the cost and then 15 million illegals adding to the demand so GOOD LUCK.

Anyone who’s done renovations over the years understands that a piece of sheetrock that was 7$ 10 years ago and its 14$ now, will understand the argument that prices will fall is total folly. I went to purchase a 4″ pvc 10′ long pipe the other day and nearly fainted when I saw it was 48$ each!!!!

Costs don’t matter to the price. The price is set by willing and able buyers, and buyers don’t care about costs. Builders can go bankrupt, no problem, if they can’t get their costs down far enough to where they make some gross profits with the prices buyers are willing to pay.

Look at the inventory charts above of new houses, spec houses and total. There is a shitload of inventory, and builders will be motivated to sell it, and that means cutting prices.

new house prices have already come down some, not even counting the costs of mortgage-rate buydowns and other incentives.

https://wolfstreet.com/2024/09/25/here-comes-the-inventory-of-new-spec-houses-highest-since-2009-sales-jump-builders-take-share-from-homeowners/

“can bee seen” 🐝