As the Fed is unloading them, others are loading up.

By Wolf Richter for WOLF STREET.

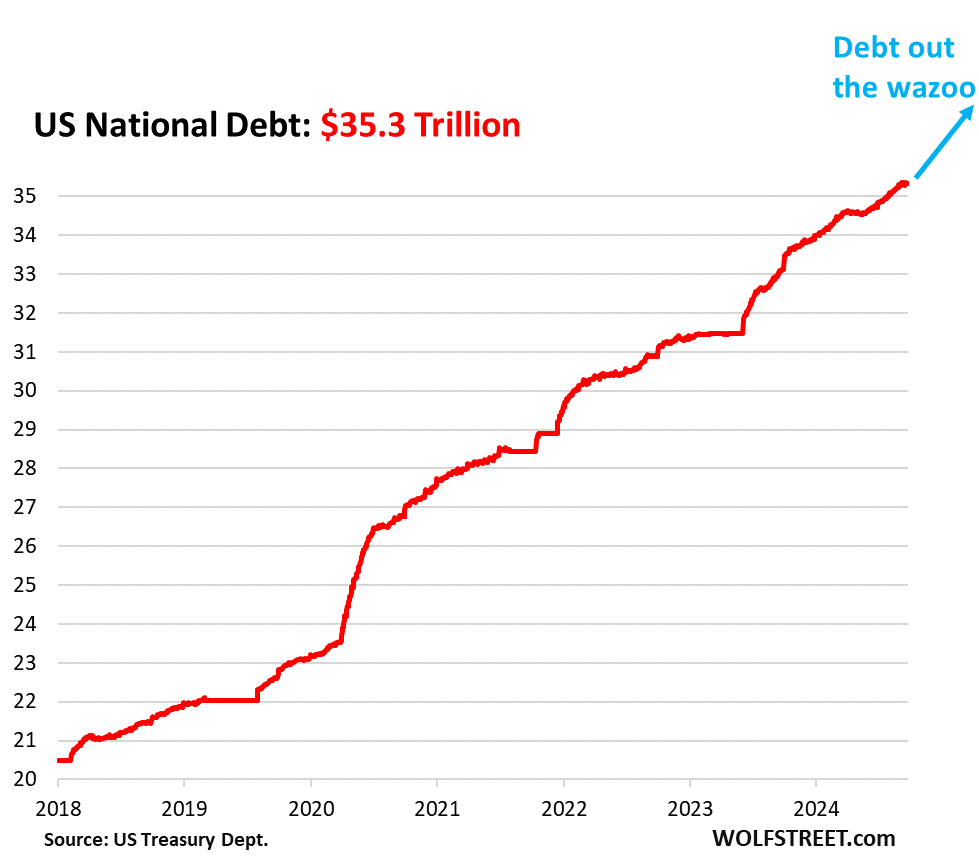

The US national debt has ballooned so fast to $35.3 trillion – by $12.0 trillion since January 2020 – that it’s mindboggling, especially in a growing economy. And every single one of the Treasury securities that form this colossal debt was bought and is held by some investor, and we’re going to look at those entities that hold this Treasury debt.

Who holds this $35.3 trillion in Treasury debt?

US Government funds: $7.11 trillion. This “debt held internally” are Treasury securities held by various US government pension funds and by the Social Security Trust Fund (here’s the SS Trust Fund holdings, income, and outgo). These Treasury securities are not traded in the market, but the government funds purchase them directly from the Treasury Department, and at maturity are redeemed at face value. They don’t involve Wall Street fees and profits, and they’re not subject to the whims of the markets.

The remaining $28.2 trillion in Treasury securities are “held by the public.” At the end of Q2, the time frame we’re going to look at now, $27.6 trillion were held by the public. A small portion of these Treasuries “held by the public” cannot be traded, such as the popular inflation-protected I bonds, and some other bond issues.

The rest – $27.05 trillion – were Treasury bills, notes, and bonds, TIPS (Treasury Inflation Protected Securities), and FRNs (Floating Rate Notes) that were traded and were therefore “marketable.” They’re by far the largest class of US fixed income securities, far ahead of corporate bonds ($11 trillion).

Who holds the $27.05 trillion in “marketable” Treasury securities?

The Securities Industry and Financial Markets Association (SIFMA) just released its Quarterly Fixed Income Report for Q2, which spells out, among other things, who held these $27.05 trillion of marketable Treasury securities at the end of Q2:

Foreign holders: 33.5% of marketable securities. This includes private sector holdings and official holdings, such as by central banks.

Overall foreign holdings have continued to rise from record to record. The big financial centers, European countries, Canada, India, and other countries have increased their holdings to new records. China, Brazil, and some other countries have reduced their holdings for years (we discussed the details of those foreign holders here).

The US entities that hold the remaining 66.5%.

US mutual funds: 17.7% of marketable Treasury securities (about $4.8 trillion), such as bond mutual funds and money market mutual funds. They decreased their share from Q1 (18.0%).

Federal Reserve: 16.1% of marketable Treasury securities. Under its QT program, the Fed has already shed $1.38 trillion of Treasury securities since the peak in June 2022 and as of early September has brought its holdings down to $4.4 trillion (our latest update on the Fed’s balance sheet).

US Individuals: 11.1% of marketable Treasury securities (about $3.0 trillion). These are investors who hold them in their accounts in the US. They increased their holdings since Q1 (from a share of 9.8% or about $2.7 trillion).

Banks: 8.1% of marketable Treasury securities outstanding (about $2.2 trillion), roughly unchanged since Q1.

State and local governments: 6.2% of marketable Treasury securities (about $1.7 trillion), a slight decrease in share since Q1 (6.3%).

Pension funds: 3.7% of marketable Treasury securities (about $1.0 trillion), a decrease of their holdings since Q1 (4.3% and $1.7 trillion).

Insurance companies: 2.2% of marketable Treasury securities (about $600 billion), an increase of their holdings since Q1 (1.9%), reflecting Warren Buffett’s conglomerate, Berkshire Hathaway, which includes GEICO, which has loaded up on T-bills over the past two years through Q2.

Other: 1.4% of marketable Treasury securities (about $400 billion).

The burden of the US debt: These interest-bearing assets held by investors are costly liabilities for the government. Here’s our discussion on the burden of the national debt and what portion of the tax receipts are eaten up by interest payments and how that evolved over the decades: Spiking Interest Payments on the Ballooning US Government Debt v. Tax Receipts, GDP, and Inflation

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Something Intelligent

;)

Like this: We are all doomed!

Bueller? Bueller? Depth Charge?

Here it is in full view, the largest economic empire in the world. Image the calamity if long term paper runs into a bear market. Where will the growth come from?

That would be fun to see. Seems like it never arrives though.

Heard that the high cost of housing is due to the fact that real estate is the absolute best way to launder dirty money, move legal/stolen money out of other countries, and hide taxable money, etc, etc, etc. Laws on allowing infinite complexity of shell corps and countless financial “instruments” private equity and private “swap” agreements help the game easily continue untouched by “law’ (which is just a commodity now)….and lucrative business.

Source said since we are likely to reman biggest military dogs on planet, we are best choice for hiding above money. Same thinking applies to national debt….like owning a piece of the biggest dog on ball in space.

Numbers don’t really have much to do with military power….mostly for show….actual medium of exchange is “favors”.

Military gets all hardware it REALLY wants.

I have a cival war bond wrote by aberham Lincoln in french 12 numbers 4 months before he was shot

A better analysis would reveal who owns the long dated maturities. Those are the potential bombs that can take down an institution.

The US, largest economy in the world, plus we are also the drug capital of the world, not even close. We produce the finest crack heads and derelicts anywhere.

Back to Tom S comment,

The paper and the bear… reminds me of the toilet paper commercial. Charmin….strong enough to clean a bears ass.

So were 35 trillion In debt, minor inconvenience, an illusion, look at our new charts.

“Drug capital” Toad? CVS? Walgreens?

Or did you mean Big Pharma?

How can anyone look at that graph and not be sick to their stomach?

Keep in mind the x-axis is not at zero.

X-axis is “year”. Do you mean the y-axis?

U.S is reaping the benefits of having the global reserve currency to the maximum extent. If the dollar was not a reserve currency, with this infinite debt frenzy, the inflation would be 3 digits like Argentina.

I would think it would be the opposite. The US wouldn’t have foreign buyers (as much) and would have to offer higher interest rates for domestic buyers. That would put greater pressure on the government to reduce the deficit buy cutting spending and increasing taxes. Which would be deflationary.

Kent,

You are playing 3 dimensional chess relative to the people who have operational control of the G.

The people who control the G basically play sub-checkers (“The future? In the future, we’re all dead and we are all we care about.”)

The history of the last 50+ years is that,

1) G spending/spending priorities, takes priority over *everything else*,

2) 90% of the time, the G won’t risk political blowback by raising actual taxes to pay for #1,

3) In one form or another, money printing will occur to pay for #1.

4) Pre-internet, the private sector was framed for the entirety of the inflationary consequences of #3.

5) Post-internet, the frame job works much, much less well.

6) The future? What future?

7) Actually, things may get so bad (likely irretrievably bad) that both spending cuts and tax increases will become inescapable.

But US public finances might already be too far gone.

US leadership 1945 thru today, was handed God’s credit card and still managed to f- things up.

Deflation vs inflation….need a helicopter dropping food not money..no handgrenades

Inflation you piss off the poor. Deflation you piss off the rich. Please keep your hands and feet inside the ride at all times.

In the big deflation AKA the Depression, the rich were pissed off, the poor were starving.

What’s there to be sick about? Clearly there is plenty of demand for USG debt given how low yields on duration are.

Foreign bondholders are the single largest category – they have no problem investing in this debt.

Well they don’t have a problem for now. The problem is the old tag line about going bankrupt…slowly at first and then all at once. During times of elevated geopolitical tensions there is a demand for flight to safety assets. It is already manifesting in a rush to 2 and 3 years. If that were to get compounded with a rotation from 10s and 30s to 2s and 3s or just outright selling of the back end because the implicit inflation target is now 3 or even 4 then we have a Rut Ro moment that lots of Scooby snacks can’t fix

“The US national debt has ballooned so fast to $35.3 trillion . . .”

How many minutes ago was this article written? Went to US Debt Clock to verify and the US national debt is already over $35.4 trillion!

The US Debt Clock is a bullshit algo for entertainment only. Securities don’t work that way. They’re issued via auction on specific dates on a schedule that is published (those are the dates when new debt is added), and they’re redeemed on the maturity date (those are the dates when the old debt comes off). The actual impact happens on the settlement dates. The bullshit US Debt Clock algo presumes that new debt is issued every second of every day 24/7. If you take the US Debt Clock seriously, you’re an ignorant idiot. If you look at it just for fun, knowing it’s bullshit, fine.

Wolf,

My college student son (on his own initiative!) went online and ordered some Treasuries online. I don’t think he had to bid. Are these types of purchases too small to worry about with regard to your statement above about debt being added/subtracted?

I’m not sure what you’re saying here. Your son could have bought existing Treasuries that someone else was selling through his broker; or he could have ordered to buy at a Treasury auction either through his broker or through TreasuryDirect.

Assuming that he bought at auction: He, the little guy, can’t bid directly at the Treasury auction. These are not public eBay-type auctions where anyone with a credit card can bid. But Primary Dealers, big brokers, etc. bid. Your son had to buy through his broker or at TreasuryDirect.

For example, here are the auction results from yesterday’s 28-day T-bill auction:

https://www.treasurydirect.gov/instit/annceresult/press/preanre/2024/R_20240919_1.pdf

$80 billion were sold, there were bids for $233 billion from “competitive” bidders, $6 billion from “noncompetitive” bidders, plus small amounts from FIMA and SOMA. Everyone got the same yield (the “High Rate” of 4.7%) that was established at the auction by the competitive bidders. The noncompetitive bidders also got the yield that was established at the auction. Note that noncompetitive bids ($6 billion) were filled 100% while of the $223 billion in competitive bids, only $73.9 billion were filled.

If your son put in an order at his broker for this auction, his order would have been filled at the “high rate” of 4.70%, and it would have been part of the $80 billion that was sold.

Wolf, if that’s true, you’re guilty of the same thing. See those lines on your graphs? In reality, they’re not lines, they’re a bunch of dots.

You use linear interpolation to connect them together, and the US Debt Clock does the same thing…

Nonsense.

1. I use actual debt levels at the end of each day after settlement and connect those days with a line.

2. The Debt Clock uses an algo that increases at a fixed rate every second 24/7 not matter what happens with the debt.

3. During the debt ceiling, when the actual debt level doesn’t rise at all often for months, the Debt Clock just keeps going up unperturbed and goes off the rails totally, whereas my charts show a flat line because the actual debt doesn’t increase.

4. Periodically, they reset the debt clock to bring it back on track because it’s off so far.

Look, people, the debt clock is just for fun, like slot machines, or Pachinko machines. Kind of looks like it too.

The good old greenback….the currency every loves to hate.

Er…not so much as in the old days – and even then, it was only for want of alternatives.

Altcoins and every other global hunt for a less crappy store-of-value indicate that.

Regardless of your opinion of the operationalization of Altcoins, the *impetus* for their creation and popularization is entirely the result of fiscal/monetary abuse of the US dollar.

Without that abuse (ZIRP, etc.) there would be no frenzy for AltMoney.

Nobody was looking for dollar alternatives in 1950.

cas – ‘impetus’, perhaps. Or, given our not uncommon percentage of human-flavored thieving-monkey psychology, a forward-thinking desire to possess an equivalent power to exercise fiscal/monetary abuse (…figures won’t lie, but liars will figure…).

may we all find a better day.

As long as there are suckers out there who will lend to UST at low rates, US Govt will continue to do ok.

Look at 10 year yields. Even after years of high inflation and seeing how banks suffering paper losses, long term auctions are doing fine. 3.6% rate for 10 year is a joke. Good luck to those folks. They sure going lose their purchasing power to inflation over 10 year.

I can understand countries like India buying it. It helps them with earning good income in USD while maintaining the Forex reserves. Helps maintain currency stability.

I wish FED had continued the same QT pace till 2024 end. Or at least until the ON RRP levels come to zero level.

As rates drop I will be slowing moving my savings from MMF into other assets.

Now with the FED, EU, and China all cutting where will you find yield. Almost all Euro counties are below 3.5% I guess Mexico Treasuries? Their 10 year is at 9.21%. Brazil is at 12%.

US companies are already starting to binge on the lower rates. TMobile just announced it will sell 2.5 Billion of bnds. T-Mobile USA intends to use the net proceeds from the offering for general corporate purposes. These may include among other things, share repurchases, any dividends declared by T-Mobile’s Board of Directors and refinancing of existing indebtedness on an ongoing basis.

Wayfair also just announced a 700 million sale of bonds

Not only is the government taking on more debt….so are corporations. More and more debt. LOL

What assets? Real estate, stocks, Bitcoin? All of these things are near all time highs (well not commercial RE) but what exactly are you going to chase for investment return since your cash makes 4% instead of 5.3%? I’m genuinely curious.

There’s nothing stopping these things from making all new all time highs every day for the next 10 years.

Interesting to note that Warren Buffet has loaded up on high interest short term T bills which can be treated as cash. No 10 year low interest paper.

exponential growth is possible!

“the Fed has already shed $1.38 trillion of Treasury securities since the peak in June 2022 and as of early September has brought its holdings down to $4.4 trillion”. I thought the balance sheet is roughly at $7.1T?

Well, there is also $2.3T MBS holdings.

“TREASURY SECURITIES”

The overall balance sheet has a lot more stuff on it than just Treasury securities, and has shed more than just Treasury securities. Click on the link I provided in the article.

But this is about Treasury securities.

Thank you Wolf. I was fluxed when I read the $4.4T and looking at the current total balance sheet. Yes you are correct.

Foreign central banks hold treasuries often because of mercantile policies, i.e. they want to keep exporting to the US without balancing trade and whose populations seek to save excessively but can’t do so domestically. Its very hard to feel sympathy if this strategy blows up in their face as the natural consequence is to hollow out US manufacturing and put the US on whats tantamount to an eternal credit card monthly bill without ever being able to pay off the balance.

In reality the US administration should never borrow internationally as its essentially the administration borrowing goods from abroad to distribute, against principally lower skilled Americans who can work and want jobs. Makes the administration look good of course. The UK does so as well. Don’t vote for a government that seeks to borrow but of course everybody does.

“Foreign central banks hold treasuries often because of mercantile policies”

Or, because those Treasuries can be used as collateral for a dollar loan from the Fed.

Very Keysian of you Wolf!

The size of the U. S. Treasury market is one of the limits to world trade. Ships aren’t loaded without a guarantee of payment. Treasuries used as collateral are a large part of that process. Might be one of the reasons yield curves invert before recessions.

One of my favourite quotes of all time: in 1971, US Treasury Secretary John Connally famously remarked how the US dollar was “our currency, but your problem.”

We are already there.

“How did you go bankrupt?”

Two ways. Gradually, then suddenly.”

― Ernest Hemingway, The Sun Also Rises

If suddenly, as in a human life, perhaps hope catastrophically, decisively. That might be the merciful, optimal trajectory. (As in a long “health span” and a quick demise.)

But that is one toy model trajectory among so many possible. Ours has defied that for quite an interval. There is a lot of statistical claim embedded in that Hemingway quote, at least in the way it is most used by quoters. Entropy (and Tyler Durden) say, “On a long enough timeline the survival rate for everybody drops to zero.” But finance and life are about how one reckons, and navigates, the trajectory, meanwhile. Our world has held together long past any of my prognostications. It has many variables I cannot see.

Finally! Thanks Wolf. Many of us have been enjoying the 5-5.5 % interest on T-bills and looking for our next move, pending this information. I know many retirement funds must hold a certain percentage of government bonds and now wondering if these minimums will change. We are in a situation where inflation is much higher than the “official” numbers, but so is risk.

Interesting times….

I would quibble a little bit over how “internal debt” is characterized here and in the national media. The interest rate paid to the SS trust fund does rise and fall based on “market rates”, so there is still a correlation between the “whims of the market” and how much is booked as interest gained to the SS Trust funds. Secondly, this amount of total interest is routinely dismissed as just shuffling the money around internally and most focus is on “net interest”, which goes out to taxpayers and foreign governments. I challenge those that dismiss “internal debt” to take a look at the predictions for solvency of the SS/MC trust funds, those fund statements do depend on these “internal” shuffling of funds to prolong the solvency dates for those funds, imagine if all this accrued internal interest was just dismissed and the solvency of SS jumped from 2035 to 2032 or earlier! Our interest paid on the national debt is well over $1T now and will continue going higher as inflation remains higher for longer, that’s my doom & gloom report for the month, lol.

Wolf, can we get a social security update soon? I’ve been hearing the ‘SS will be bkrupt by the time you’ll use it’ meme more and more lately.

I have heard this stupid-ass ignorant bullshit ever since the dad of my high-school sweetheart told me this in 1974. He ended up drawing SS for decades, and when he passed away, his wife got the SS survivor benefits. And it’s still around, LOL. Idiots are just idiots, and there’s nothing you can do about it. But those ignorant idiots will of course not read my articles about SS because they want to remain ignorant idiots.

But I will post an update in October, as I do every year, when the fiscal year income and outgo are released. Looking forward to it.

People need to understand that SS can never ever go “bankrupt.” The absolutely worst thing that can happen is that that future benefits might get cut.

I’m wondering if Wolf has any opinion on the chance of the US “means testing” Social Security (and stop giving it to the guys that saved and invested and have solid investment income). Things are going pretty well for me and I’m worried that my Social Security may get cut off in the next 30 years so I started taking it at 62.

Lots of things change all the time. That’s why the point when benefits might have to be cut if the system isn’t tweaked keeps getting moved out further every year.

Now we got 10 million mostly young-ish immigrants in 2022-2024, most of whom already work or will work, many of whom pay into the system; the legal immigrants will have to work for decades before qualifying for benefits, and the illegal immigrants that pay into the system may never qualify for benefits. In addition, wages have risen far more over the past two years than in prior 20 years. All this will boost income to the system without boosting outgo. None of this data has been incorporated into the forecast yet. So this will move the date for benefit cuts – if nothings is tweaked – out further.

They could do a number of small things that combined would solve the problem because the gap just started a few years ago, and has been small, while the prior surplus has been large. Means-testing at a high income level, raising the retirement age a little, raising the wage limits subject to SS taxes a little faster, etc. all could be used. But Congress is in a wait-and-see mode right now.

“future benefits might get cut”

Or that benefits don’t keep up with inflation – my actual concern.

I wouldn’t rely only on SS for retirement income tho.

No one should rely solely on SS. It’s designed to keep you out of abject poverty. SS benefits are inflation adjusted via COLAs. But the COLAs may not match the inflation of where you live and your purchasing patterns.

People who worry (or in most cases are tricked into worrying) about the “solvency” of SS are worrying about the wrong thing — they ought to be worrying whether or not the society that they retire in retains the productive capacity to supply what they are going to need during their retirement. The real resources, including labor, are what actually matter.

eg – this (…a crucial flywheel weight that seems to have fallen from the historic wheels of formerly-‘successful’ societies…).

may we all find a better day.

Need balance and blueprint.

Even if the fund dries up or lacks, US Govt can borrow money to replenish the fund.

There may be changes coming in the future, but SS would never ever go bankrupt.

Although, inflation may eat into the value of SS

Medicare premiums and SS is taxable income effectively means-test. Also if every retired person moved out of the US immigrants would be recruited to take their place to keep trillion dollar industries from crashing.

Where do ETFs fit in? Are they part of Mutual Funds, or under the other section?

ETFs are like stocks. Their liquidity comes from the stock market. They’re completely different creatures than mutual funds.

Overall foreign holdings have continued to rise from record to record.

is there a way to untangle the foreign official from foreign private sector? like, is it the foreign governments? or is it the foreign financial institutions that are increasing their holdings? or both?

The Treasury department releases the foreign holders in detail, including “official” v. the rest. You can look at it here:

https://ticdata.treasury.gov/resource-center/data-chart-center/tic/Documents/slt_table5.html

thanks. it looks like both are buying.

If I read it right, over the past year:

foreign govmnts + 84.5 B

foreign private + 655.4 B

Yes, correct.

If the Fed cont to cut rates unrealized and realized gains will rise.

Taking profit will send the 10Y (rate) up. The front end will drop. The long duration will rise. In order to tame the 10Y rise the Fed will have to buy

the long duration, increasing its assets.

If the economy will swing from the service sector to producing real stuff, real goods, investors will park their money in the stock markets instead of bonds and notes. Demand for skilled and highly skilled workers will rise. Taxe collections will rise. With that surplus debt might drop by $5T/$8T, or more, in nominal terms. Much more in real terms.

Bring back the World War II propaganda slogans.

“We can do it”

Nada. “Can’t find someone to do it for you? Call 1-800-Mexi-CAN!”. Let your fingers do the talking.

Inflation is the growth of the currency and or debt. How can we have inflation if the fed is not buying treasuries or mortgages and is actually shedding them? Reading the post it looks like each new treasury created and sold is pulling out currency from many areas thus reducing the overall currency in circulation and converting it into debt. I am a Dullard, Dolt, and Cretin as my late father affectionately called me so I rely on others to enlighten me.

“We’re going to need a bigger chart!”

Wolf, since we hear so much about bank troubles with their mark to market US Treasury losses (e.g., Silicon Valley et al) and they hold only 8.1% where approx 40% are owned by funds, individuals, municipalities, etc — are there any horror stories in that cohort? How are they doing?

I have one bond fund that seems to be doing OK ~5%, but I’m not an expert and don’t pay much attention to it.

There are no problems with long-term Treasury securities if you hold to maturity, you’ll get all your money back and collect coupon interest along they way, which is what long-term investors buy them for.

But if the inflations runs high during that intervening duration, you get full deposited dollar money worth really cents :)

If the timing is wrong, you pay the piper one way or the other. Now that we have access to historical prices of individual houses, I have observed many in Tucson. The one who went at the wrong time, hasn’t made a dime in 20 years but the dollar has depreciated (in terms of it’s buying power).

Many old folks, especially in developing countries do that, buying long term CDs and what not thinking it gives them current income, but the principle diminishes. Perhaps, if one is going for long term, it is good to go for the Perpetual bonds or CD’s (the duration = infinity) and try to live off the income!

why is it that in your fantasy world, inflation applies only to Treasury securities??? Inflation eats the purchasing power of your salary along with the purchasing power of ALL your assets in equal measure — gold, housing, stocks, cryptos — not just Treasury securities. This BS is getting old. Stick it on X!

“But if the inflations runs high during that intervening duration, you get full deposited dollar money worth really cents”

In that scenario, rates would presumably have gone up, and you can invest your coupon payments into higher-yielding debt.

Those higher rates would presumably cause assets to reprice down. And unlike stocks, you know you’ll get paid back for your treasuries.

So why did the banks fail? Because their depositors pulled out money and the bank has to sell Treasuries early at a loss? Don’t other investors have emergencies and need cash too and have to sell? When I need a new $40-60K SUV I will have to sell something.

Then you sell the T-bills or the money market funds that you have for that purpose. It’s nuts to buy a 30-year bond to temporarily place the only cash you have. No one does that.

Even if you did buy 30-year bonds with the only cash you have, then you borrow money to buy the car, and you pay off the loan when you have the liquidity.

A bank is a very unique creature: it borrows short (promising depositors instant liquidity) at very low rates to lend long at higher rates. That’s inherently a risky deal, subject to runs and collapse, which is why banks are so heavily regulated.

I think lower rates are insane….but…..I love them as yellow rocks streaks into 2700 an ounce…..up only 50% in a year, with mine companies just exploding up 300% and going to a lot higher as DC continues believing the fed will support their prolific ways. It will all end when reality hits the fools that buy a treasury at 4%, pay taxes of a third of the yield leaving 2.7 and lets the inflation running at 3 provide them a negative real yield. It’s been working for the feds so far so who is to say it will not for another decade or so…..until that day when the negative yield is so much that even an idiot will not touch them without a risk premium….when that day comes…..hope I’am gone…..unfortunately……it is coming. Both parties spend like sailors…..it’s just who they spend it on that is the debate.

17.7% owned by mutual funds, and what percentage of the Treasuries in those mutual funds are in turn owned by individual investors? Mutual funds are just proxies for the actual owners.

Yes. Same applies to pension funds, etc., whose Treasuries are in essence for the beneficiaries. But there’s a difference between direct holdings in your account and having a bond fund in your account or being a pension fund beneficiary.

So that would be .gov directly owning ~25% of the market and .fed (.gov by proxi) owning 16%.

Free market or turning Japanese? I really don’t know so.

The Treasuries in the gov pension funds are due beneficiaries of these gov pension funds (it’s “other people’s money”). Same as with private-sector pension funds (also OPM) — the difference being that the government manages these gov pension funds instead of highly paid private sector people. And even the private-sector pension funds are backstopped by the government because you cannot leave it up to highly paid private sector managers to appropriately manage OPM, as many pension fund implosions have already shown.

Why does the following link show current foreign Treasury security holdings at 22.4% and above it is 33%?

https://wolfstreet.com/2023/12/20/are-foreign-holders-finally-bailing-out-of-the-incredibly-ballooning-us-national-debt/

You need to re-read the article more carefully. The 33% is the amount as a percentage of only “marketable” Treasury securities. The 22.4% is the same amount but as a percentage of TOTAL Treasury securities, including those “held internally.”

When you live long enough you see the same things developing over and over.

If Harris wins this election I think the Senate will go Republican either way which stymies her agenda, and the 2026 midterm elections start on January 4th next year. This setup reminds me a bit of 1994 when Gingrich and the Republican Revolution took over and the budget was balanced by the late 90s by a compliant Democrat. At the pace we’re going it’s $40T debt by 2026 so that election could heavily focus on spending and stability. A balanced budget would be extremely painful and disruptive now after nearly 20 years of reckless abandon.

Now if Trump wins then it could be the opposite – the Congress swings left in ’26 and spending just keeps going and going and the Fed is going to have to buy those bonds again as the debt approaches $50T by decade’s end. We can have a little contest here guessing the lowest point on the Balance sheet before it heads to infinity.

I am less concerned with the debt than how the significant debt will impact foreign policy. This will play out over decades however but the US needs to maintain its preeminent currency reserve role. How far will the government go to legal it? Our history to maintain economic dominance is successful but inevitable clashes are not too far off. Probably nothing of concern in my lifetime but I can certainly see it for my teenager. Politics and economics are never separate except in textbooks.

Your final sentence contains much wisdom (especially for macroeconomics).

It will be interesting to see what the future holds. We’re likely to head for austerity or hyperinflation. After the restructuring that will result from either, we’ll likely see wealth centers within the USA be located in very different places than they historically have been. Large population centers are likely to have a more difficult time during the recovery.

Curiosity question vis proposed unrealized gains taxes (25%) for anyone with a net worth $100 million or larger:

– is this gross or net P&L?

– how is total debts and obligations defined and incorporated into the calculations?

– does it to apply to all asset classes?

– does this apply to IRA holdings?

– will this impact bond markets?

– how is this projected to influence where the wealthy invest?

– will this have a huge wealth effect?

Interesting comment today:

“ Timiraos states that the key issue actually lies in the difference between the marginal cost of debt (currently falling) and the average debt rate (which may still rise), especially for borrowers who locked in low rates before the Fed began raising rates. As the Fed rapidly raises rates after more than a decade of low borrowing costs, many industries’ average debt rates still remain lower than the marginal cost of new credit, even with the Fed currently cutting rates.

Timiraos cites BCA Research’s Chief Global Strategist Peter Berezin’s view that the easing effect of Fed rate cuts on the economy is not clear, because even if the Fed starts cutting rates, the average rates faced by households and businesses will still rise.”

Who is buying the bonds?

Simple answer – entities that need continuing cashflow more than they need profits. Entities that therefore *must* be betting on a return to cheap money via more QE