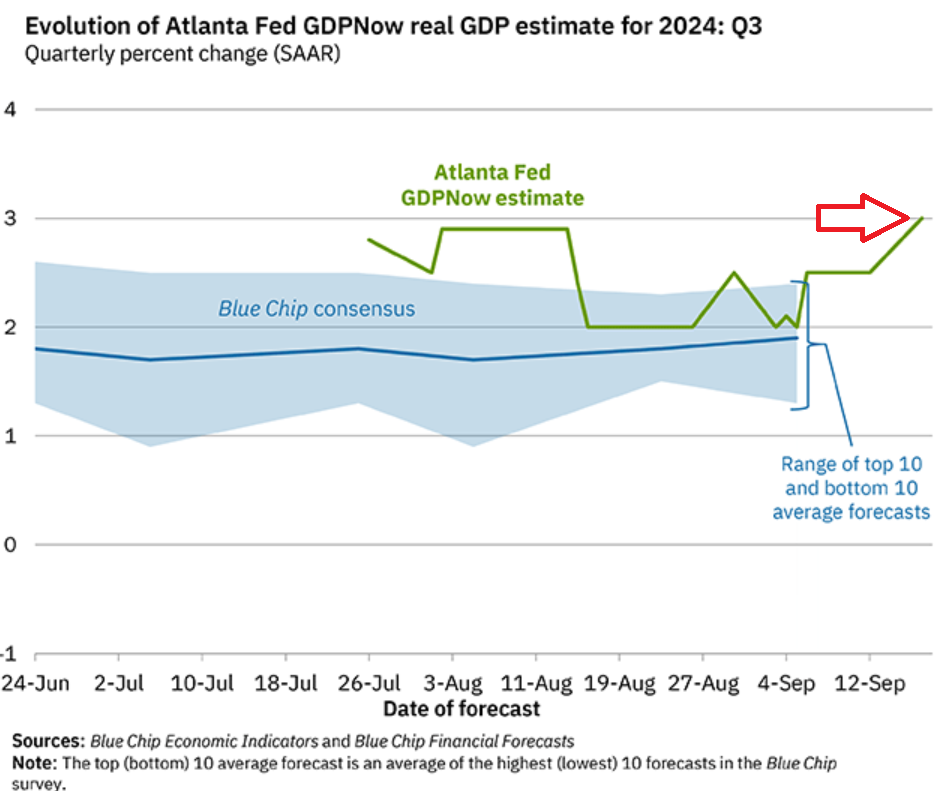

As retail sales rose despite dropping prices of goods, inflation-adjusted retail sales – adjusted for this deflation in goods – rose even faster: hence the jump in GDPNow.

By Wolf Richter for WOLF STREET.

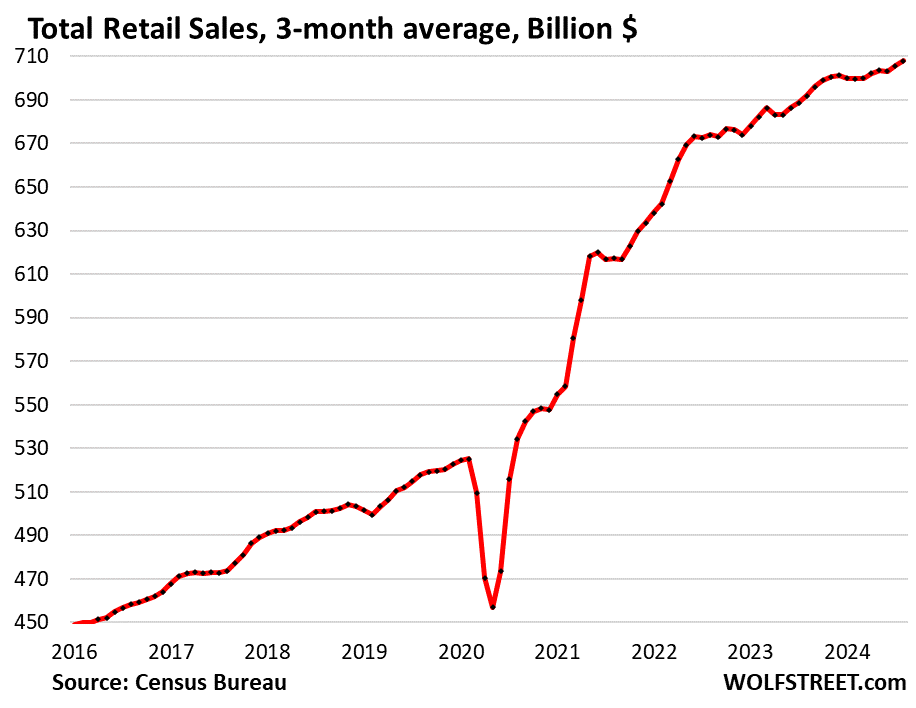

Retail sales rose 0.1% in August from July, seasonally adjusted, on top of the upwardly revised 1.1% jump in July, and the 0.3% dip in June. Not seasonally adjusted, retail sales jumped by 1.5% in August from July to $737 billion.

To iron out the month-to-month squiggles and revisions, we like to look at the three-month average (chart below), which rose 0.3% month-to-month and 2.3% year-over-year. The biggest gainer was ecommerce, the second-largest retailer category behind auto dealers: +1.4% month-to-month, +7.8% year-over-year.

What is remarkable is that retail sales continue to rise even as prices of many goods that retailers sell, have been dropping all year, particularly durable goods and gasoline. When prices drop and consumers buy the same amount of stuff, retail sales in dollars would decline with prices (and we see that with gasoline where dollar-sales track gasoline prices lower).

But retail sales have risen despite price declines in goods that retailers sell, which shows that consumers are buying a lot more stuff, particularly durable goods.

We saw this yesterday: Used-vehicle retail sales in units jumped by 8% in August from July, and by 14% year-over-year, to 1.68 million vehicles; and new vehicle unit sales jumped 11% in August from July and by 7.6% year-over-year, to 1.42 million vehicles: people are buying more vehicles! And they’re doing it because the pandemic price spike is getting unwound, and as prices come down, they’re spending less per vehicle, but more people are buying vehicles.

Note the slowdown in retail sales late last year and earlier this year. But that’s like so behind us. Our Drunken Sailors, as we lovingly and facetiously have been calling them for over a year, are back at it, splurging at retailers.

Price drops in goods make retail sales even stronger.

Back in 2021 and 2022, massive price increases in the goods that retailers sell – motor vehicles, food, gasoline, electronics, clothes, sporting goods, furniture, etc., online and at brick-and-mortar stores – caused retail sales to jump as consumers scrambled to keep up with the price increases.

Since 2022, much of this stuff (except foods) has been seeing price declines, and retail sales of those items measured in dollars, not units, should fall based merely on the price declines. And some did, like gasoline, because consumers aren’t buying more gasoline when it gets cheaper.

The CPI for durable goods has dropped by 6.1% from the peak two years ago. Prices for used vehicles have plunged by 20%. New vehicle prices have dropped 2%. Consumer electronics, appliances, furniture, sporting goods, etc. have all seen price drops.

So, on an inflation-adjusted basis – adjusted for this deflation in goods – retail sales look even better. Lower prices and higher sales translate into much higher “real” sales. And this will show in the inflation-adjusted consumer spending and GDP data.

And it did show in July’s “real” consumer spending, adjusted for inflation, which jumped by 0.4% from June, the biggest month-to-month growth rate since February 2023.

And it did show in today’s Atlanta Fed’s GDPNow, which, upon the data for retail sales and industrial production, jumped to +3.0% “real” GDP growth for Q3, which is relatively high for the US whose 10-year average GDP growth is 2.0%. The recession is going to have to take a back seat to our Drunken Sailors.

Sales at the largest categories of retailers.

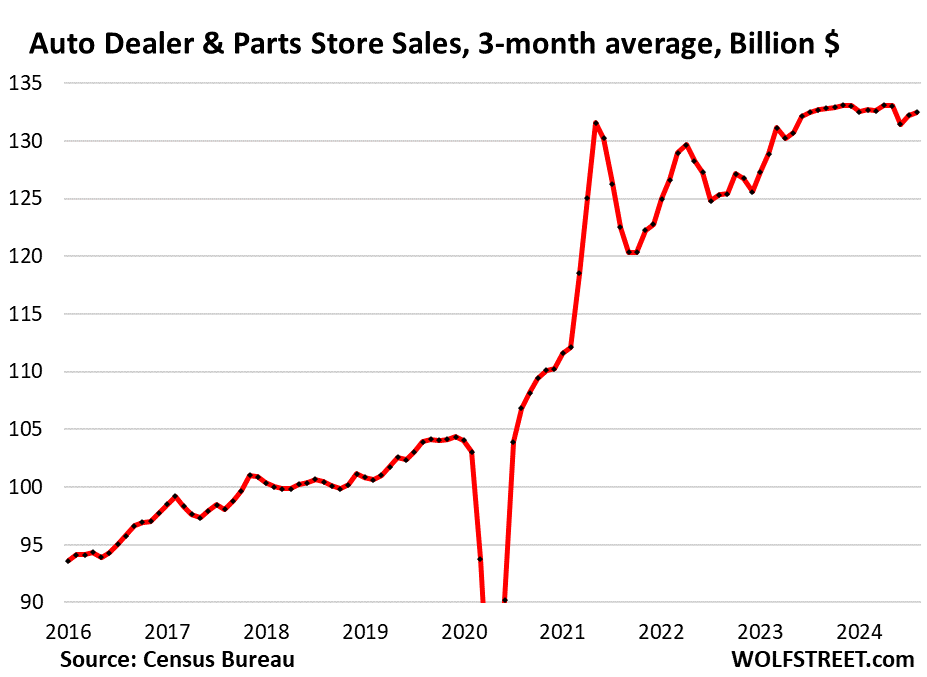

Sales at new and used vehicle dealers and parts stores, the #1 category with 19% of total retail sales, bounced back plus some, with big increases in unit sales in July and August, from the mayhem in June due to the CDK hack that had put thousands of dealers on ice for a few weeks.

And the rise in sales volume overcame the effect of lower prices and of the shift away from overpriced high-end trucks – the erstwhile pandemic darlings – that are now clogging up dealer lots.

The three-month average in August rose 0.2% from July on top of the 0.4% increase in the prior month, to $132 billion.

The spike in dollar-sales in 2021 and 2022 was based on price gouging by dealers and automakers, even as unit sales volume plunged due to vehicle shortages. The relatively flat dollar-sales for the past 18 months, despite rising retail unit sales, are a result of these gouge-prices getting unwound.

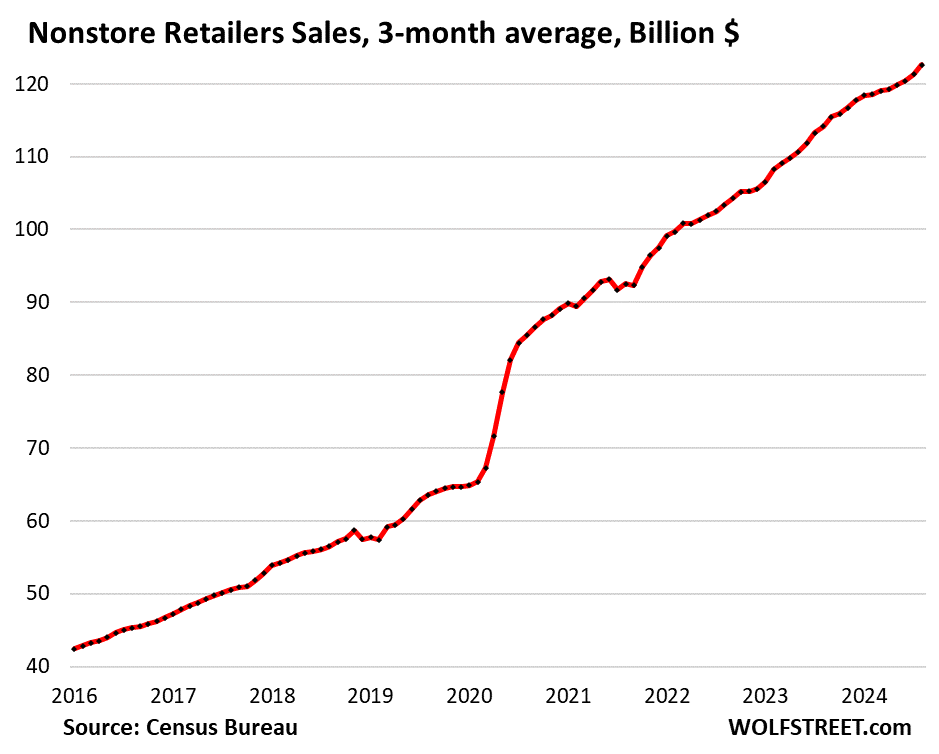

Ecommerce and other “nonstore retailers” (#2 category, 17% of retail), includes ecommerce retailers, ecommerce operations of brick-and-mortar retailers, and stalls and markets, three-month averages:

- Sales: $123 billion

- From prior month: +1.1%

- Year-over-year: +7.4%

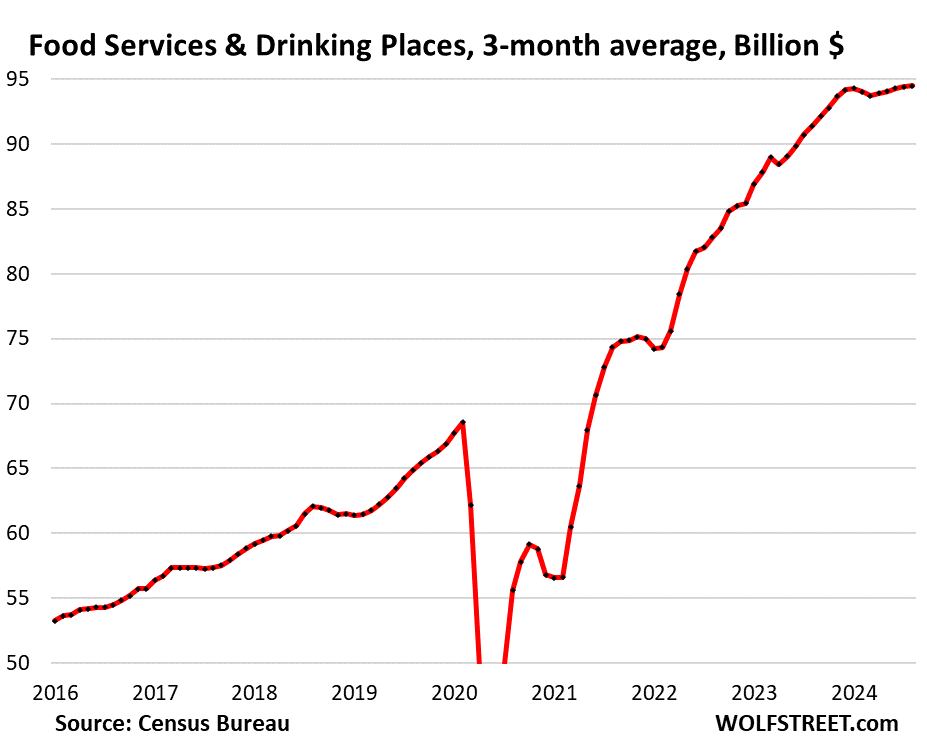

Restaurants and bars, officially “Food services and drinking places,” #3 category with 13% of total retail, includes everything from cafeterias to restaurants and bars.

After a slowdown earlier this year, growth resumed over the past five months (three-month averages):

- Sales: $95 billion

- From prior month: +0.1%

- Year-over-year: +3.4%

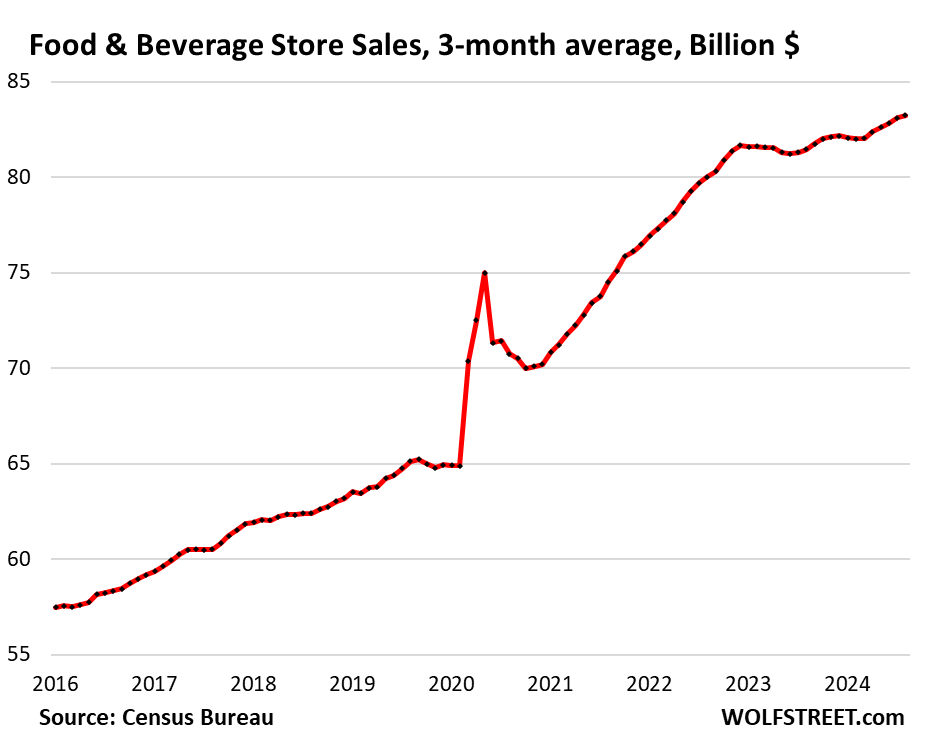

Food and Beverage Stores (12% of total retail). Generally, only price increases and population growth increase sales.

Prices have about flattened out at very high levels after spiking from 2020 to early 2023. In August, the CPI for food at home was unchanged from July and roughly flat with January, and up just 0.9% from a year ago.

But the population has surged in 2022 and 2023 by 6 million people due to immigration, and in 2024 has continued to rise, according to the Congressional Budget Office, using ICE and Census data. These people work, or are looking for work, and they’re buying stuff, including at food and beverage stores, thereby pushing up their retail sales, which is what we can see here even has prices have remained roughly stable (three-month averages):

- Sales: $83 billion

- From prior month: +0.1%

- Year-over-year: +2.2%

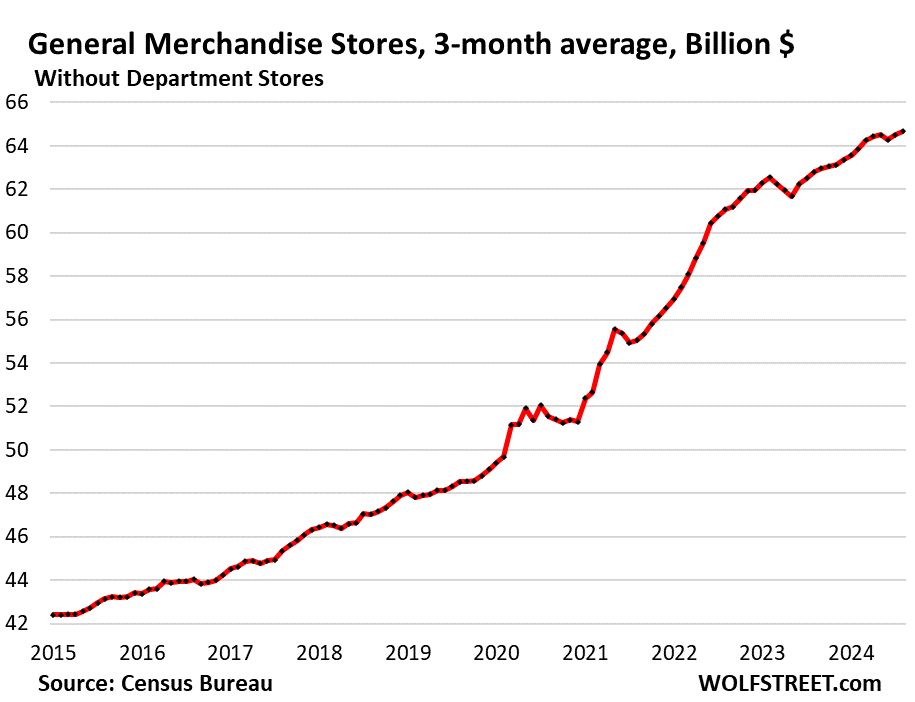

General merchandise stores, without department stores (9% of total retail), are also where the 6 million additional people buy their essentials, such as groceries at Walmart.

- Sales: $65 billion

- From prior month: +0.3%

- Year-over-year: +3.0%

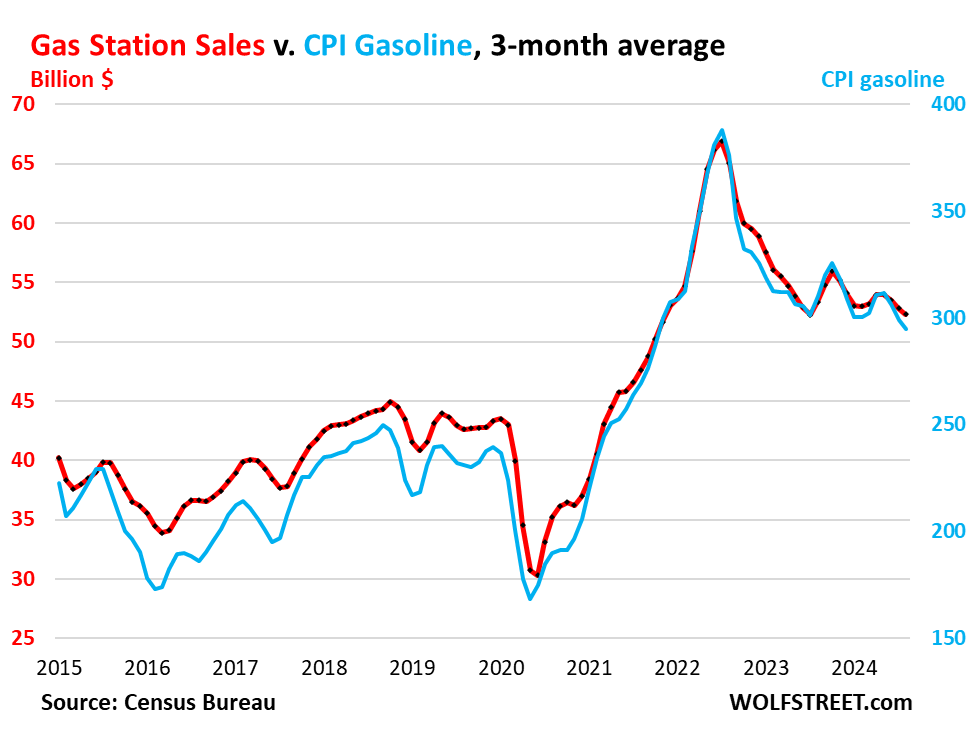

Gas stations (8% of total retail sales). Dollar-sales at gas stations move in near-lockstep with the price of gasoline. The price of gasoline plunged from mid-2022 through mid-2023, and has since then meandered lower, including in August. These price declines push down sales in dollars (three-month averages):

- Sales: $52 billion

- From prior month: -0.9%

- Year-over-year: -1.9%

Sales in billions of dollars at gas stations, including other merchandise that gas stations sell (red, left axis); and the CPI for gasoline (blue, right axis):

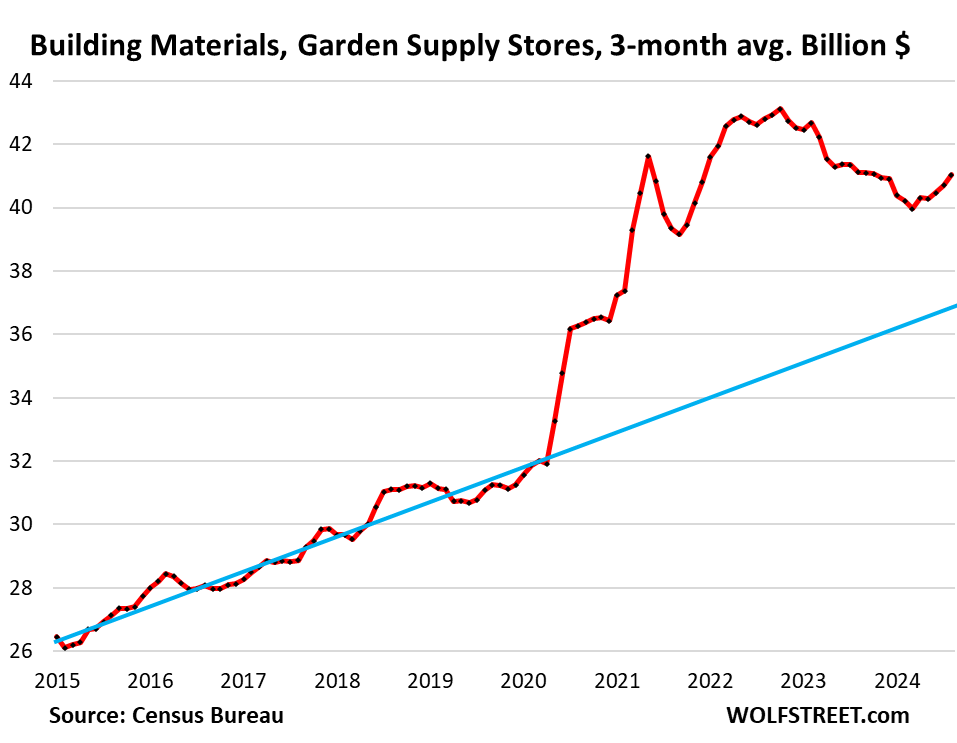

Building materials, garden supply and equipment stores (6% of total retail). The prepandemic trendline in blue. The remodeling boom fizzled in late 2022, and expectations were that spending at these retailers would revert to trend, amid lower demand and lower prices, and that happened for a while. But earlier this year, growth started picking up again, and strongly so over the past few months:

- Sales: $41 billion

- From prior month: +0.8%

- Year-over-year: -0.2%

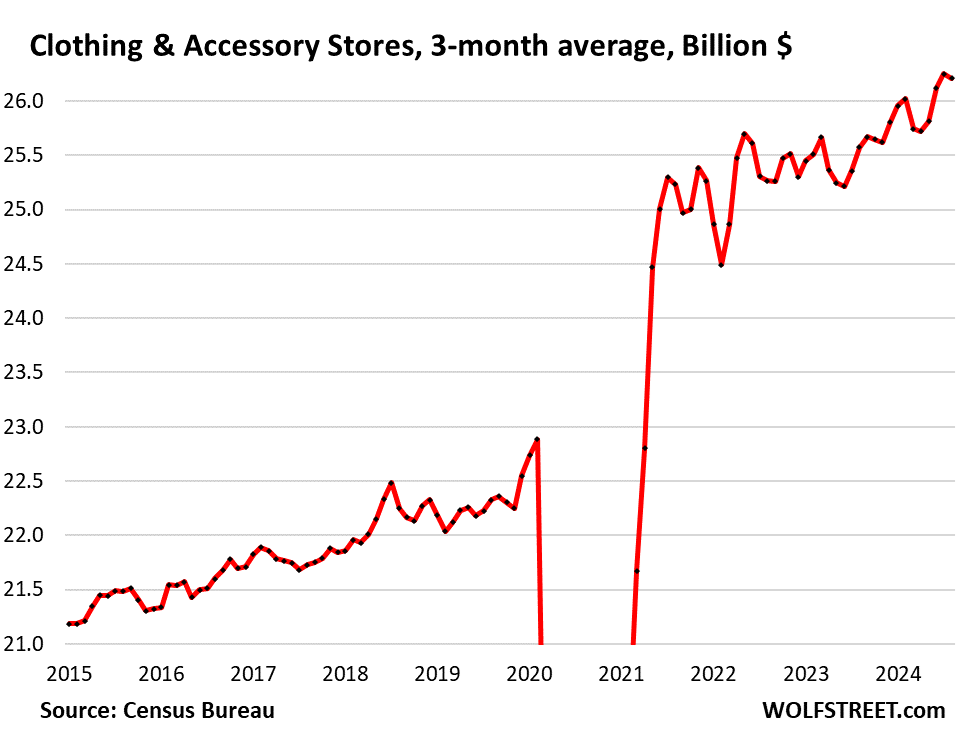

Clothing and accessory stores (3.7% of retail), all three-month averages:

- Sales: $26 billion

- From prior month: -0.2%

- Year-over-year: +2.5%

Miscellaneous store retailers (2.2% of total retail): Specialty stores, including cannabis stores (three-month averages).

- Sales: $15 billion

- Month over month: +0.8%

- Year-over-year: +6.2%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

They printed way too f**king much, and it’s still sloshing around. Now they’re going to cut rates at the apex of the biggest everything bubble in the history of mankind, to juice an already overheated economy even more. Prepare for more MASSIVE INFLATION.

I just knew that Depth Charge would come through with an appropriate response 🤣❤️

I’ll have to watch for the depth charge responses thanks for the heads up Wolf.

Meantime CPI for Canada dropped from 2.5 (Jul) to 2.0 Aug.

Canada is a resource based economy. America is a technology based economy. No comparison

Technology is, at least normally over decades, deflationary.

Technology is getting cheaper and it increases productivity almost everywhere.

So far Canada has been a leading indicator for USA inflation dynamics.

Ok who manufactured the surplus in Maple Syrup?

There’s your problem

😆 jk

My carnival squash plants in the garden are yielding a nice crop. So, I picked up some west-central Wisconsin-sourced maple syrup at the farmers market this morning.

Bake the squash halves covered at first. Use a little salt, pepper, butter, maple syrup and a good sprinkle of chopped pecans to fill them up. Uncover the squash for a few minutes at the end of cooking to reduce the moisture and get a slight crisping at the top.

Nope, never a surplus of Maple Syrup!

Canada isn’t running the kind of deficit that the US Federal government is.

Massive inflation has already happened – in terms of assets. Assets are about 50% (DJI, RE) to 500% (crypto) more expensive compared to 5 years ago. It just has not translated fully into the consumer inflation yet. It will translate slowly into the consumer prices for the next decade. Below 2% inflation is a distant pleasant memory of past that you can tell to children.

I am probably a broken record. But right now most agriculture and and energy commodities prices (minus the 2008 and 2022 blip), have been flat for 10 to 15 years.

We are lucky there has not been any inflation in this area. I am guessing it is because of productivity gains in energy via fracking and agriculture via GMO/herbicides/pesticides and better land management that have increase bushel yields up YOY. Soybeans, corn, and wheat are at 2007 prices. U.S. Dollar per Bushel per acre corn yield in 1960 was 50 and now it is over 180. In the year 2000 was still only 140. That is a 22% increase.

LOL. Just a couple of years ago weren’t we suppose to have people starving?

The vast majority of the inflation comes from the services, which is mainly based on shelter.

Technology driven productivity gains can help to keep energy and food prices relatively low. But they can’t slow down shelter inflation that is tied to assets, as there is fixed amount of land in the country and very small portion of it is accessible for new construction.

Ponzi,

Mostly agree – but housing inflation could end (and reverse) in a year if bullsh*t zoning games were changed.

But local governments want to maximize their property tax base (easiest done by maximizing *existing* home values via restrictive zoning) and the Feds want to use human habitation as a lever to implement their macro policies (ZIRP and the Housing Casino).

From yesterday’s ‘Red River Farm Network’, Grand Forks newsletter:

“Corn yields nationally are expected to average 183.6 bushels per acre. Soybean yields are forecast to be a record high of 53.2 bushels.”

Northern Missouri, southern Iowa and southern Illinois are driving up the numbers.

But that ain’t all. North Dakota is having a nice barley crop with good quality for malting — you know, to make beer!

-Cheers

Huge drought in the Midwest this year and yields are expected to be way down. (Corn and soybeans)

Anyone who talks about “inflation of assets” doesn’t understand inflation, or investing for that matter. Currently they are not wrong, but for the wrong reasons. They are clueless while getting the right answer.

Haha you referred to crypto as an asset.

🤣

Hold on let me check my bookshelf on investments about the last century… hmmm

Those guys must have mistakenly left crypto out???

Crypto, the only asset that requires electricity!

Today, I went to the local car wash I have been patronizing for years. The usual wash with an inside vacuum that was $18.99 (up from $14.99 last year) was now $25.99! Can you believe this crap? This is the least expensive wash option, and it’s NOT California (it’s Texas).

I said to the attendant that there will be customer blowback on these price increases. He said it’s already happening as their throughput is dropping since the new prices went into effect.

Looks like I will be washing my car in the driveway from now on.

Car washing should be done at home if possible anyway. Your paint and body panels will thank you. I understand though if physiological obstacles pose an issue.

At 81 years old, and a new pacemaker installed last week, I’ll do it myself going forward like I used to years ago.

My wife used to help me but she died 18 months ago.

@Anthony A. sorry to hear about your wife and the pacemaker, but doing stuff like washing the car yourself (take it easy and do it early before it gets hot) is a great way to get some exercise. P.S. If you park in the garage every night you will have to wash your car less. A friend just helped his 95 year old Dad clean out his garage that was so full of stuff (including his Mom’s clothes that were put in there about a decade a go when she died) so he can now park in the garage (he is still sharp, and driving by himself but physically is really slowing down.)

As far as I can tell there’s little difference in prices for real estate or any daily goods and services between my relatively affluent Los Angeles suburb and most of the country.

Roger Miller says he used to push a broom for 2 hours to get him a room for 4 bits…do-wacka-do.

That’s 50 cents for you out of towners.

They have to start cutting the FFR. Through 11 months of FY ’24 the interest on the debt is $1.05T, and something like $7T in dept is rolling over between now & the end of CY ’25. We’re literally spending about 40% more than we take in.

First, they were concerned about transitory inflation. Then, they briefly started worrying about jobs. Now, they’re concerned about runaway debt payments.

At this point, I’d say they’re a 50/50 chance and growing that we get a late ’70’s inflation rebound by next spring.

I love your dedication to your nuttiness regardless of the facts. No one sticks to their beliefs better than you.

I literally love watching a good car wreck.

I love watching you get triggered by anything I post. Your purple face and skyrocketing blood pressure come through clearly in your ramblings.

because… news flash the Fed wants inflation. How else do we dispose of the debt?

Inflation only disposes of debt if you stop accumulating new debt at a shocking pace. That’s not what is happening.

Can’t they write it off?

50 bps cut, as expected. Sigh.

S&P500 hit all time high record today. Just in time for the Fed to start cutting rates. Senior citizens had their chance to open 3-year 4% CD.

Didn’t stick. Close but no cigar.

The S&P 500 closed in the green today. 5,634.58. Yesterday’s close was 5,633.09.

The S&P 500 is up 7 business days in a row.

It has only had one negative monthly return (April 2024) since October 2023.

I wish wolf would do a post about how much financial advisors and their ilk take from Americans every year.

Prob not enough interest though

I’d be curious to know how much money this type of services pull in per year, as in the whole industry.

Looks like it’s going to be a fat bonus for WS this year. Christmas in Sept especially if they get their 50 basis point this week. Dow and NASDAQ powering up with no signs of slowing, economy is still doing well based on these numbers, your perfect goldilocks no landing scenarios…who would have thought… no better time for a rate cut than now…

Funny how with no recession in sight, companies feel more empowered now to turn the tables on their workers…Amazon bringing back 5 days a week in the office policy, and many companies will follow soon. This is during time when everything is rosy…scary to think when the recession does hit how much more these companies will throw employees under the bus…but no worries, recession has been eradicated now, one less thing for worker bees to worry about.

You have to admit that GDP is better now in all this chaos than it was in years past when we were shipping all our jobs over to China.

Now to only realize that was a stupid move.

We’re just going to be in crisis after crisis after crisis from now on until we use up all of it’s ability to frack out GDP and beat the rest of the world.

I don’t think anyone in the C suite thinks that shipping jobs overseas is a stupid move.

Manufacturing yes, jobs no.

I wasn’t aware a significant amount of jobs had returned from China. Seems regardless that a combination of protectionist trade policies and local manufacturing in many areas will feed inflation. I’m not against it by any means as I am against it for not the same reasons most are, but it won’t go unnoticed. Admittedly not an area I have any expertise in but seems intuitive.

It’s not that “jobs are coming back,” that’s a BS phrase. It’s that new production facilities are built in the US, and new production takes place in the US, instead of in China, and labor for this new production is in the the US instead of in China.

Wall Street compensation is probably going to hit new records this year. It hit an average (skewed highly towards the top end) of $240,400 per employee in 2022, for work done in 2021.

The stock market has gone parabolic for 2 straight years, and many Wall St bank stocks (JPM, GS, Amex, etc) hit fresh records recently. They’re going to be handing out money like candy.

Everything else be damned, if we have to cut rates and inflate things and run everything hot just to keep the power to end Telework out of the hands of my employer, then that is (quite seriously) all I care about.

Ha Wolf, I like how you italicized “despite dropping prices of goods” right under the headline. That’s a great way to get ahead of the inevitable “what were retail sales adjusted for inflation” comments.

It’s still not going to work because these people don’t even read the subtitle.

But I get extra credit for trying?

Definitely an “A” for effort.

Sounds like the USA economy in general is recovering nicely from the Trump years. Still a few sore spots, especially food. And prices are not going to deflate back to the pre-pandemic years (around here we call them “BC years”, as in “Before Covid”.

I assume you are talking about the three years 2017, 2018, and 2019? You are going to dream of those days as inflation eats another 25% of your dollar purchasing power over the next four years. The fiscal spending and taxing is setting itself up to accelerate, not to stop. The subsidies that are about to get rolled out in combination with the supply chain disruptions will send prices to the moon.

Neither candidate has talked about the deficit and how to reduce it. The deficit is not a concern as of now but it will devalue the currency.

So your probably right…we will see continued currency devaluation. Luckily, it will not be as bad as most other countries as they have the same problems. The US is still one of the cleanest houses on skid row when it comes to debt.

the u.s. is actually worse when it comes to debt in terms of percentage of gdp and other measures. it’s just that it can finance it more easily.

FranzG – Your correct but….. The US government has over 200 Trillion in assets via buildings, land (Forest, Parks), Mineral rights, and at least 1/3 of Alaska? They could sell Alaska land and pay off all that debt. Many other countries cannot say the same thing?

I bought a nice house and my spouse stayed at home with our two older kids during the Trump years.

Had to move for my job and can no longer afford or a house and my grocery bill doubled since 2020.

I’d gladly take the pre 2020 years of the economy than our current situation of ripping inflation and hyper speculation.

Check what happened when Powell did his first baby steps to raise rates in Year Two of that era. Trump called Powell ‘worse than Xi’. Trump wanted zero rates. and praised the EU for having negative rates.

The economy can be a result of Congress’ decisions from the prior administration(s)..so Trump years may be more a reflection of Obama/Congress. Biden’s term more related to Trump/Congress/covid decisions. Whomever the next President is, Congress has avoided so many decisions this administration that the future economy/country may be a dumpster fire for a few years because of it.

This is what happens when the Fed says they will cut rates.

Covid and the resulting mismanagement by Powell and his friends created all of this. Why would anyone pull back and be responsible when they think rate cuts and QE is right around the corner?

I’m not exagerrating. I talk to people who live next to me and they told me that bidding wars are coming back to housing as soon as rates go down. I fear that we will never return to a normal economy where wall street isn’t driving the narrative.

There is literally no reason to cut rates right now and we all know they are going to.

What’s better yet for the government & FOMC is the upcoming Housing Bubble #4 will not show up in CPI & PCE thanks to the separation of rent & owner’s equivalent rent from actual home PRICES, which are classified as investments instead of consumable goods. Housing Bubbles #1 & 2 didn’t show up in inflation indices either.

It showed up in N-gDp growth rates.

yes the idea that the fed has to follow what wall street wants is ridiculous on its face.

So why are we cutting??? Economy is clearly doing fine at 5.5% fed funds rate

Lower inflation has given central bankers political cover to start bootlicking Wall Street CEOs again.

You see, savers were actually getting positive real yield, which is bad for some reason.

Yeah we can’t have that…we’re a consumption economy, saving is the enemy of our core tenet. Borrow beyond your means and YOLO spending, now that’s encouraged.

Things will slow in the 1st qtr. of 2025 if the money stock fails to grow.

The Atlanta fed chart looks like a boat on the sea upon which the drunken sailors party…

The baseball player…….I hit a double and am standing on second base…….so it’s time to have a beer.

Manager…….did you score……no……well then what is the beer about.

Unemployment claims lowest in a long time, unemployment low, managers afraid to call folks back to work for fear they will quit, inflation still above norm and in some sectors heating up, Cushing storage as low as its been in decades and the cause of lower inflation tied to lower oil, federal oil reserve drained, housing prices high, retail sales rolling, the dollar threatening to drop, gold exploding, two hot wars for weapon production, DC spending out of control and our fed wants to lower rates. After artificially lowering long rates. Because some dude might have to look for a job for longer than a week.

Insanity.

I quite enjoyed the keg on second base college days. Seemed like a solid reward for getting that far although just having a lawn chair saved the effort but came with other risks.

You forgot to mention Wolf’s article from Sept 13. A wall of well over $10 trillion, 100% liquid money, is resting peacefully in various consumer accounts (including T-bills), just waiting to get spent.

I wonder if folks feel less compelled to roll over T-bills with those rates dipping below 5%?

My T-bill ladder is quite a bit shorter than it was even a couple months ago.

I took several 5-figure t-bills out of my ladder this week. Rates are not attractive right now. Back to the HYSA.

Agreed.

Yes, likewise. moving to some more well-managed dividend-paying commodity/energy companies. The size of the move is somewhat dependent on what Jerome says today…

Fred Flinstone is a great avatar name for Neanderthal thinking…

Unemployment has come up from 3.5% to 4.2% in the past 12 months (note: we were last at 4.25 in 2017 exempting the Covid cuts) while job postings are down by more than 50% per JOLTS.

It is not uncommon for job seekers to need 3+ months and multiple interviews to land a new role in this current labor market. More than 1million people report being unemployed from 15-26 weeks according to DOL data. So, it’s very much likely that “some dude” might burn through their UI benefits (if eligible) and some savings cushion before getting re-employed in this slowing market.

This is a good time for a reminder (largely ignored) that the FED has a dual mandate of stable prices (not defined by statute, but seen as an AVERAGE of 2% inflation) AND maximum employment.

I’ll be a contrarian Wolf Packer and be an Employment Hawk rather than the typical flock of Inflation Hawks and note that there’s good data that cutting 25-50 bps MIGHT avoid a recession. The FED has plenty of room to reverse the cut if inflation reverses.

I’m kind of with you on this one. I’ve now lived through periods of high inflation and high unemployment, and I must say given the choice between the two (but not both at the same time) I have an inexplicable preference for the latter. Obviously the choice isn’t necessarily binary, there are periods where both are low.

It seems that inflation is more broadly experienced, although with varying levels of pain. OTOH unemployment is typically experienced by a narrower subset of society, it’s often very painful. And I think that a lot people assume they won’t be the ones affected by rising unemployment “well it wouldn’t be ME I work hard”, and statistically I suppose any given person is usually right. Until they’re not of course.

You have just described why unemployment is a political issue (because it sets groups against one another) AND why the supposed “trade off” between unemployment and inflation is even more so. It’s political economy all the way down …

“It’s political economy all the way down…”

DM = EM

Dual mandate?

I love how people cite this and ignore that the fed failed miserably from 2020 – 2022. Or does the dual mandate only matter when it feels like the party of exploding asset prices ended?

Wolf already explained that we have excess supply of labor, via immigration, and we do NOT have job losses.

Setting all of that aside, unemployment below 5% is still incredibly good.

“they’re spending less per vehicle, but more people are buying vehicles.” Is this is part because ~ 15 million people have come into the country? I for sure think so. This is competition for goods & services. Calling like I see it.

Information from ACS/CPS data published by the Economic Policy Institute:

“The most recent estimates from the American Community Survey (ACS) indicate that the number of immigrants residing in the United States grew by 3.6% between 2022 and 2023 (see Figure A). This is below the historical peaks of 5.5% annual growth in the immigrant population that the United States experienced between 1994 and 2000, according to Current Population Survey (CPS) data”

So, it appears that immigration has slowed compared to historical levels.

Calling it like the data says it is.

LOL, you don’t even know what you’re talking about and what you’re citing.

1. you’re citing percentage increase of the total immigrant population (such as me) that has been established enough to answer surveys. But newly arrived immigrants, especially illegal immigrants, do not answer surveys.

2. So how many million new people is that? Duh.

3. The Census Bureau has failed to update its population data with the illegal arrivals but will do so likely early next year.

4. Meanwhile, the Congressional Budget Office, using data from ICE, immigration courts, and Census Data figured earlier this year that the US population grew by 6 million people in 2022 and 2023, and is on track to grow by another 3.3 million in 2024, for a total of 9.3 million people in a three-year period. The CBO released this data publicly. All you you have to do is download it so you don’t drown in your own BS.

From the Congressional Budget Office data:

Population growth in millions of people:

Population growth in percent:

Mr. Richter calling like it IS…..Thank you!!!!

Immigration is exactly why the Fed should ignore “rising” unemployment – it’s not actually rising, the labor market is just re-balancing.

I think the recessions are relics of past. G7 countries central banks discovered the silver bullet to dodge any potential recession: money printer. By printing trillions instantly and continuously, you can avert any possible recession before starting. It worked every time since 2009. Since everybody else is doing the same, your currency will stay at the same levels relatively to the other currencies. So, we will not have any recessions in US ever.

Asset prices will go crazy, but it will make the party funders and vast majority of the people who do go to ballot and vote happy, as they all sit on assets, which appreciate rapidly everyday. Many will continue to complain about the increasing hospital bills, but they will be more happy to see the appreciation of their assets in stock markets and zillow. And the transition of the asset inflation to consumer inflation is relatively slow process. It is like boiling frog.

So, no problem at all. Only the those ones who don’t hold assets will be dissatisfied with the increasing wealth disparity. But those guys have no influence, as they don’t fund the candidates and most don’t vote at all.

Conclusion: have assets

what if you’re 22 and just graduated university?

The button got stuck on during the pandemic and we couldn’t stop printing. Sorry, all your future wealth has been transferred to the boomer generation. Consider it as a bulky gift to your grans.

You can do great, you are only 22 and you have interests in the financial area. Everything is in front of you!

As Bill Gates was saying: save as pessimist and invest as optimist.

Reduce wasting of money, waste is very common in America.

mrmoneymustache is a great place to set you on the right path (did to me).

Exactly. That’s what everybody is doing. That’s why almost all asset types (re, stocks, bitcoin) doubled, tripled, quadrupled and continue to rise.

Sharp price spikes are allowed in assets, but sharp declines are not. Hence, there is zero risk for buying assets, as long as you have balanced portfolio (i.e don’t put all your money in one stock or one cryptocurrency).

That’s why I believe inflation will not go down any more and stay at current levels or increase.

Right. But there will be corrections in the assets. Perhaps steep and likely not for very long time. Zoom out S&P500 or Nasdaq say 50 years, and the say 5y average should look very good.

For me balanced stock for long term provides low risk overall.

Someone proved that after 15y, stock is less risky than bonds. Talking about the end results.

What utterly false and inane nonsense. Get a clue.

“Hence, there is zero risk for buying assets, as long as you have balanced portfolio.,..”

It’s actually scary to think that there are people naive enough to believe this. This shows the depth of brainwashing that has been accomplished. “Zero risk” LOL

Dear Ponzi,

the idea that craziness will go on forever is promoted in every bull cycle. But risks continue to build up at places where no one has any focused attention. And eventually they blow up. This central bank policy will too. It is just difficult to determine it in real time. But in the end it will be obvious to all.

If money printing was a sure cure then we would be citizens of the Roman empire today. This is paper wealth and cannot be spent or enjoyed. You are right that this is causing social disparity and perhaps we would have successfully solved a financial problem by creating a social problem.

I have faith that sense will prevail :)….perhaps misguided faith.

Hi Aman,

I really liked your perspective. It is very intelligently put in the historical perspective. May be you are right.

Anyway, the Roman Empire lived almost 15 centuries. So, we have way to go! :D

Good perspective Aman. But I think we are looking at slow demise of purchasing power of USD. Not so slow, if you look at what happened in last 4 years .

USD devaluation in purchasing power is the only game to deal with this much debt.

No.

Aman – True. But after the GFC, Central Banks have not been given the leeway to take any action to stop something from blowing up.

Until I start see concerns from the Central Bank elite….then money printing is working.

About two years ago the Central Bank of France wrote a memo saying debt does not matter and Central Banks should take whatever means necessary to stabilize an economy.

At some point debt does matter, but I don’t think we are close to the inflection point yet. It is as if the FED now has to ability to come up with a new type of financial engineering program (money printing/bailout ) that quickly puts out a simmering fire.

Asset prices will rise. The true value does not. My house I bought 20 years ago has not doubled in enjoyment/comfort for me but the price has doubled. ;) You just need to make sure you are participating in the assets that rise at the same rate of faster than the rate of inflation.

For people who do not own assets that rise with inflation like real estate property long term or the stock market will suffer and generally become poorer.

@Aman in the “roaring 20’s” the price of modest homes in San Francisco doubled in price (going from about $1K to $2K). Bears said to sell and cash in on the windfall, but bulls said to hold and that prices would keep going up (those “modest” $1,000 homes are all worth over $1,000,000 today). P.S. The grandkids of the guy that bought the $1,000 home in San Francisco 100 years ago can spend and enjoy the $5,000/month ($60K/year) in rent they get from the home.

Did you ever see the brick wall of a historic building that used to be a hotel. At the top, it still says in fading paint and huge font something like: “76 cents per night.”

Motel 6 was called that because it charged $6 per room per night, even when I was in college, a room there still cost something like $8.

$2000 invested in the DOW 100 years ago would be worth about $25,000,000 and throwing off about $150,000 a month.

100%….there can never be any loser any more everyone gets a trophy and it is going to bring this country to it’s knees….

it all works out great until no one is willing to hold currency at any price.

This is an interesting argument:

“Lower prices and higher sales translate into much higher ‘real’ sales.”

I wonder then if in 2021-2022 the inverse would have been true:

Higher prices and lower sales translate into much lower “real” sales.

For most manufacturers, sales of 50 units at $60 is more desirable than sales of 60 units at $50. Less labor, less warehousing, shipping, etc. More units at lower sales prices is going to hurt them.

What’s that old joke “we lose money on every sale but we make it up in volume”

“we lose money on every sale but we make it up in volume”

That’s the Amazon biz model.

That was us (Anaconda) with water tubing production in the 1970’s where I was working. We ended up selling so much water tubing that we eventually went out of business and closed 5 manufacturing plants.

Except Amazon is very profitable.

Because Amazon doesn’t produce anything (except for on the Web Services side) — it’s an intermediary that collects network rents.

Amazon’s retail division is a retailer, like the retailers we discussed here in the article and the comment above that you replied to. This whole thing is about retailers. And retailers never “produce’ anything. They buy in large quantities from some big vendors and sell in small quantities to lots of little consumers. Not sure why you think Amazon is different.

Yeah because they constantly screw over their FBA retailers by stealing and damaging their inventory.

“I wonder then if in 2021-2022 the inverse would have been true: Higher prices and lower sales translate into much lower “real” sales.”

The answer is YES. It’s not an “argument,” it’s just math. The market does what it does, and this math describes it. We discussed this endlessly back then.

And what’s happening now in the market is that lower goods prices (deflation) at higher unit sales and therefore higher dollar sales produces MUCH higher inflation-adjusted dollar sales.

Back then, not adjusted for surging inflation, retail sales and consumer spending surged in dollars, auto sales in dollars exploded, as you can see in the charts, and as I explained in the article. But the number of vehicles sold plunged and then had trouble creeping back up. And so in 2022, with stimulus money gone, and adjusted for inflation, consumer spending on a month-to-month basis edged up a little and then dipped a little. Year-over-year growth rates of consumer spending were low and dipped below 1% in November 2022. That’s where all the recession talk came from back then – consumers were struggling with the inflation shock.

Now it’s just the opposite scenario in terms of goods than it was in 2022. But this is just goods that we’re talking about here. Services prices are still rising in though at a good clip.

The outgrowth is that the gazillion high-end trucks parked on dealer lots now need really big price cuts (incentives and rebates) to sell. But automakers already booked their gross profits on those units when they invoiced them to the dealer, $25k or $30k or more per unit, they already reported that profit to Wall Street and announced share buybacks based on it. So they don’t want to cut prices much. They’re doing some. Stellantis needs to do a lot, it’s drowning in trucks, and the price cuts it’s offering are not enough to move them. Instead of offering bigger incentives, it’s cutting production. Stellantis dealers are furious; they want massive rebates and incentives to move those trucks that are clogging up their lots.

But that is a business strategy that may or may not work. What this report here describes is what is actually happening in the market, and how when adjusted for inflation, those sales at deflated prices will boost inflation-adjusted consumer spending.

And what’s happening in the market is that lower goods prices at higher unit sales leads to higher dollar sales, and MUCH higher inflation-adjusted dollar sales.

Death of one or two of the American auto manufacturer is probably not a bad thing at this point. Feels like they are zombies being kept alive… by something.

The bailout back in 09 probably didn’t do anyone any favors in the long run.

GM and Chrysler didn’t get bailed out. They filed for bankruptcy and wiped out their shareholders and bondholders got a big haircut. To emerge from bankruptcy, they got DIP (debtor in possession) funding from the government, which the government got paid back plus interest, and the government bought shares of the new company to provide funding, which the government later sold for a profit.

The pension funds got bailed out in the process. But the government was on the hook for them anyway through its pension fund guarantee program — the Pension Benefit Guaranty Corporation (PBGC).

This all looks incredibly healthy to me. Certainly nothing worthy of a rate cut panic.

Wow these charts just scream 50bp cut to me.

The imbeciles at the FOMC have conveniently said they don’t have a growth mandate, only employment & inflation – a literal reading of the Federal Reserve Act – therefore, strong GDP growth independent of its two mandates won’t lead to more rate hikes or prevent rate cuts.

Just watch if we get a “bad” quarter of <1% GDP growth, Wall St will quickly price in 5%+ of rate cuts plus another $10 trillion+ in QE. Fortunately it hasn’t yet happened in this cycle, but it did a few times during the long 2009-20 expansion, sometimes due to technical factors (inventories, trade) instead of genuine economic weakness.

Government spending is included in GDP. According to the CBO government spending is up 6% this year, while the deficit continues to grow by billions of dollars per day. GDP only up 3% ?

Pay no attention to the man behind the curtain, the Great Oz says everything is wonderful. Make that cut 100 basis points!

Somewhere over the rainbow.

You’re wrong. You’re downing in BS. So I will help you get out.

1. Only part of government spending is included (“Government consumption and investment”), such as building schools, roads or spending on national defense. Government salaries and many other government outlays are NOT included in GDP. They go into GDP when the recipients spends it, same as with corporate employees, or independent workers. No salaries go into GDP.

2. Spending by federal, state, and local government combined accounts for only 17% of total GDP.

3. In Q2: Government consumption and investment (federal, state, and local): +3.1%, after the 1.8% increase in Q1. Federal government +3.9%; state and local +2.6%.

https://wolfstreet.com/2024/07/25/economy-re-accelerates-in-q2-our-drunken-sailors-splurge-on-durable-goods-private-investment-jumps-federal-gov-undoes-blip/

The deficit was 6% of GDP. So the government took in less than it gave out. Government spending increased 5% (roughly) year over year per FRED database.

Government gives out as salaries, transfers etc. but these aren’t added to GDP. Assuming all of that money is spent by recipients in the same period it would add to the GDP. But it is still not growth because the government may have paid out the same in previous period too.

It can be tricky :)

Either way there is no denying that the massive debt build up of the government is supporting income and spending. And given the non discretionary nature of government deficits this is going to be hard to control.

Happy solutions could be

1. Sustained and increased productivity (solid GDP growth)

2. Inflation (slow enough but long enough)

3. Immigration (more labor more GDP)

Unhappy solutions could be

1. Higher taxes

2. Higher inflation and more episodes like 2022-2024

3. Default (let everyone else bear the cost of our recklessness)

Default is out since they can always print with obvious negative side effects. However another unpopular option would be to reign in spending. Hardly looks like any side will gain enough traction to pass any of their unpopular choices. My guess is status quo for quite some time with some possible options of ensuring full social security benefits as no side benefits from 20% or so cuts with a population that tends to vote.

“Assuming all of that money is spent by recipients in the same period it would add to the GDP.”

No it wouldn’t. It’s not that straightforward. If the government pays for these salaries and transfers from tax receipts, it’s just a redistribution. It takes income from some that then cannot spend it and redistributes it to others that might spend it. So it might be about GDP neutral.

People like simple one-liners, but almost nothing works based on a simple one-liner.

What do you guys think tomorrow’s FOMC’s decision will be?

Most to least hawkish:

1) -0.25% start followed by conservative forecast (-0.25% Nov, -0.25% Dec, then wait & see depending on economy)

2) -0.50% start followed by conservative forecast (-0.25% cuts, we don’t want to undershoot neutral given possibility of neutral being closer to 4% than 2.5%)

3) -0.25% start followed by aggressive forecast (-0.50% decrements not off the table in upcoming meetings even if economy largely holds up)

4) -0.50% start followed by more aggressive cutting, matching market expectations of 2.50-2.75% terminal rate by Dec 2025

Everyone thinks rate cuts are a given.

Are they?

It is 100% guaranteed that rates are going down tomorrow.

The modern Federal Reserve doesn’t announce upcoming policy actions like Powell did at Jackson Hole, and then not follow through.

Plus, focusing strictly on disinflation, there hasn’t been any alarming data since the previous meeting. It wasn’t like the late-2023 false start when Powell started talking about cuts and suddenly we got a bunch of 0.4%-0.5% monthly prints in early 2024.

Every treasury note or bond is trading about 1.5% lower than just few months ago. So yes, given and then some.

In my view, the rate cut decision is about as important as the song selection on the deck of the Titanic.

Past monetary and fiscal mistakes tore a hole through the hull. Only an extended period of monetary and fiscal discipline will right the ship.

I suspect the stern will be pointing to the moon before anything resembling fiscal discipline appears in our .gov

“Only an extended period of monetary and fiscal discipline will right the ship.”

And we know that is never going to happen. Prepare accordingly.

Bet you $100 it will be a cut for sure tomorrow. There’s no scenario I can see unfortunately that will result in not a cut

I’ll agree it seems very, very likely.

At the same time, I’ve heard this same rate cut song & dance before.

No idea…..what I do know is when you don’t allow someone to clean the stalls once every couple days……the smell is horrible but the disease will the animals.

After nearly 20 years…..can you imagine the junk that is in some of these loan portfolios…….companies running on air……..but even the threat of a slowdown has these people running for cover. The reason for the fear…..if the government, being now an adjusted 46% of GDP had to jump start the economy the dollar would collapse. So much for 3% inflation.

It’ll be number 1

Too slow to raise too slow to cut rinse repeat

Plus some jawboning on protecting the labor market

Yields and the dollar should be temp bottoming

Answering for WS and all the talking heads bulls….it will be #4 or nothing, if it’s not #4 then it will be a temper tantrum, biatching and crying…

4) -0.50% start followed by more aggressive cutting, matching market expectations of 2.50-2.75% terminal rate by Dec 202

Yes, we are spending more. The new house needed curtains, shower heads, some furniture, etc. We try to buy discount as much as possible but even that is priced higher. We buy multiples when good brands are discounted especially toiletries, soap, makeup, etc. What we are not spending on is eating out and entertainment, which we barely did anyway.

1:04 PM 9/17/2024

Dow 41,606.18 -15.90 -0.04%

S&P 500 5,634.58 1.49 0.03%

Nasdaq 17,628.06 35.93 0.20%

VIX 17.61 0.47 2.74%

Gold 2,596.20 -12.70 -0.49%

Oil 71.17 1.08 1.54%

A 50 cut means the Fed sees something out there that ain’t good and could sink or pause this bull market.

25 now with a slant to pause and 50 after the election.

Nope. They are “afraid” of the spread between the effective federal funds rate and two year treasury yield becoming “too wide”. The people controlling the world’s money are lacking in principled backbone. They practice witchcraft more than goalseeked long term planning.

It’s funny that a year ago nearly everyone said no way Fed would do anything this close to the election, so as to appear nonpartisan. Guess that ship has sailed. I will say JPow has stuck to what he says all year while Wall Street just pees their pants and wails. So my guess is .25 cut now and data dependent going forward. That’s what he outlined at JHole and nothing has alarmed anyone since then to change that.

What the Fed sees is that its policy rates are about twice has high as its inflation metric (core PCE), which is very unusual and considered very restrictive. What the Fed sees is that inflation has come down a whole lot, but its policy rates have not budged at all.

I’m just very glad I locked in a bunch of long-term treasury bonds at 5%. I have a feeling the Fed is starting a long-term rate repression regime again.

Before the pandemic, the Fed needed ZIRP and QE to prevent the economy from sputtering out. Why would it be any different now, with much higher debt levels and asset prices that are even more overpriced?

Absent inflationary stimulus, this economy swims like a rock.

the fact that warren is demanding 75 bps shows that she is loyal only to the extremes, her rich buddies that finance her party, and the poor that get things for free.

the middle class that does work is not a concern to her.

All is forgiven. Its not like its an election year, or she is being a mean tweeter.

I am. Not a fan of Elizabeth Warren, but to say she is a fan of “her rich buddies” is laughable.

This is the funniest thing I have seen posted on the ice ternet today. Congrats.

She must be as clueless as she sounds then.

get that 5%, that you to redo every 3 months, while i just took out 10 % in three months with $TLT

I made about that much shorting TLT earlier this year, but you’re right it hasn’t been a winning position in the last 3 months.

I bought a 10 year CD @ 5% for my 401k about 18 months ago. At the end of last year, I was kicking myself for buying that kind of duration at such a “low” rate.

Now that’s looking like a not-so‐bad decision.

Why do that when you could simply keep rolling T-bills for 5-5.5% interest?

And then still have access to buy the commodities/energy companies when the eventually lowering of rates comes?

Partly because it’s in my 401k – I can’t access those funds for another 30 years anyways.

When I finally convinced my company to give me a self-direct 401k, we were still in the aftermath of the 2022 correction, and I had laddered CDs and treasuries of various maturities to escape the crappy target date fund I was locked into previously.

I also have a T-bill ladder in my non-retirement account – but nowadays that 5% CD is yielding more than my T-bills. I just rolled one over yesterday and the best yield I got was 4.963%.

New immigrants have to pay the Mexican gangs and send some money back home to their families. They are buying used cars under 15K, paying high insurance rates and high loan rates, bc they have no history. They

work and spend, but BLS knows nothing about them. Wolf does !

Howdy and fear not you young Wolf Packins….. FED will start to lower and the 70s 80s style inflation cycle will continue. Greenspan shall live forever and ZIRP is dead??? We shall see…… Up, down, Up, down and lets see what happens.

Bring back the disco

Leisure suits too!

10% in a year? You are killing it.

While searching frantically for pessimistic doomer ideas, I came across this:

“While real GDP growth looks to be on firmer ground, the economy still appears to be in a near textbook soft landing”

That nailed it for me — the drums pounding for 50+ bps cut — connected to the textbook soft landing.

So, I plug in, examples of soft landing:

“Arguably once, in 1994-1995. Under Chair Alan Greenspan, the central bank doubled interest rates to 6% and succeeded in slowing economic growth without killing it off. The tighter credit did have adverse consequences, though”

So, here we are, in the path of a textbook rate cut sequence— and awaiting a multitude of revisions on GDP, employment, incomes and all that other messy data that may take a year to unravel — but of course, in this post pandemic era where literally no data has been solid — we have everything priced to perfection with very slim odds of everything going well.

I almost forgot, the consumer is strong and retail booming as rate cuts explode and yields collapse …

It amazes me the number of posters who do not realize that the FED isn’t concerned about asset prices. They are concerned about inflation and employment.

Conspiracy nutters need a foil.

It’s a distinction that has no impact in practice.

Significant asset price drops almost always involve a drop in consumer confidence, recession, and unemployment, so you can bet the Fed is concerned about asset price drops. It’s common sense.

Can you cite any instances the past 30 years in which the stock market dropped more than 20% and the Fed didn’t respond quickly with massive monetary stimulus or rate reductions?

“Can you cite any instances the past 30 years in which the stock market dropped more than 20% and the Fed didn’t respond quickly with massive monetary stimulus or rate reductions?”

2000-2002: S&P -50%, Nasdaq -78%.

1. There was no QE at all.

2. The labor market (tech!) started to tank in 2000 with the first negative nonfarm payrolls in June 2000, and they kept losing jobs into 2003. During that time, nonfarm payroll jobs dropped by 2.6 million, which was a big drop.

3. The official recession started in March 2001.

4. That’s what those rate cuts were all about.

5. Rate cuts started in late 2000 from 6% to 1% because the labor market had started to LOSE jobs in a serious way and because the economy entered a recession.

Stocks continued to tank and didn’t bottom out until Oct 2002.

The Nasdaq didn’t reach its 2000 high until 15 years later (mid 2015). The S&P 500 briefly kissed its 2000 high in 2007 before re-tanking, and didn’t effectively surpass its 2000 high until early 2013, so 13 years later.

And it took trillions of QE in response to the Financial Crisis in 2008, which was about to sink the entire financial system, and which had imploded the labor market, to get stocks back to where they’d been 13 to 15 years earlier.

Bobber, you’ve been trolling my site with manipulative BS over and over again. Do that on X, that’s what X is for

My gut reaction opinion here in this campfire retort, isn’t to take a side or argue, but —,the majority of times the Fed didn’t bail out markets and react to stock market losses, was in a different era, when moral hazard was actually part of a discussion in terms of policy reaction.

Greenspan seemed concerned about the prospect of bailing out zombies. In many ways, that was also part of the Bush era, when the concept of Plunge Protection came about.

As time has progressed with the Fed and presidents, there’s been a lot more concern about the stock market being a critical driver of the Wealth Effect— primarily because of the expanding size of trillion dollar indexes — linked to economic dynamics. Allowing markets to fall 20% is a huge matter that can set back GDP and overall sentiment.

Obviously there’s always been a relationship between markets and the economy, but the more modern outlook influenced by moral hazard is setting up a reliance on government bailing out losers.

I’ll have another bratwurst please …

My larger observation is that asset prices have been so high for so long, the high prices are now a leg of the stool. Any significant asset price drop risks destabilizing the financial system and the overall economy. I believe this is why the Fed refuses to accept recession today, unlike in the past when the threat of QE did not exist and asset prices could periodically revert to the mean without severe economic fallout.

Wolf, if you look at the chart, S&P 500 rises from 700 (2009) to over 5200 (today). It’s long due for a big correction.

Do you have a chart for the Nasdaq from 2000 to present? Thanks!

Based on that timeline, the rate cuts began within a year after assets started dropping and employment concerns developed. SHTF from many directions. That falls in line with my point, which is that asset prices are linked to economic growth, and asset price drops go hand in hand with recession.

Whether the Fed says it responds to asset price drops, recession, or unemployment is largely a non-issue in substance.

The thought that asset prices could drop more than 20% from todays lofty levels without causing a recession and threat to employment is fanciful in my opinion.

100% agree. when wealth is so concentrated that such a huge percentage of spending is by asset holders, there’s no way the wealth effect reversing doesn’t cause a drop in spending and a recession.

also, the fact that the fomc decision was near unanimous shows that there’s an element of groupthink there, or that there are no real hawks.

LOL!!!

Great sarcasm Jim!

Inflation is still significantly above the Fed’s target, while unemployment is historically low.

Mr. Wolf: Prepping isn’t cheap. My retail purchases are loading up the front end of the economy, because there may not be a back end. Besides there are all kinds of interesting goods on the market now, check out geiger counters and dosimeters, so many colors and designs you could make a fashion statement.

Yes, the eCONomy is fine, no reason for the The Fed to cut rates.

Wolf, did you get hacked? I received spam email from a Gmail account claiming to be on behalf of wolfstreet.com

No. These impersonators and fraudsters are sending emails to gazillions of people, most of whom have never heard of me or this site and who then look me up and contact me. That’s how I know.

If you ever get anything from anyone that is proclaiming to be Wolf Richter and is trying to sell you something, it’s a fraud.

Over the past two decades, in huge hacks of big organizations and governments, the Social Security numbers, phone numbers, and emails of just about all Americans have been stolen. Some of the big hacks we have covered here, including the Equifax hack some years ago. These data are then sold in huge bundles to spammers and fraudsters.

I always recommend to use either a throw-away email or a fake email to sign into comments. Fake emails don’t work in most social media sites, but they work here.

I get hundreds of spam-fraudster emails every day. The craziest stuff. It’s a scourge.

Losing the marking. should be like: John Doe bracket John at example dot com bracket.

Also, they cannot use my actual email address since they cannot log into my email. They will use a similar-looking email address with one letter different. So check how it’s spelled.

Could you check the sender email? e.g. John Doe .

The display name and the actual address. Likely only the display name in the address is Wolf.

For the address, what is the domain? The portion example.com.

CME Fedwatch: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

probabilities for today: 65% 50 basis cut, 35% 25basis cut, 0% no change, 0% raise rates. (as of 9/8 8:20am)

———————————–

Thanks for the post Wolf. Its interesting that the retail sales numbers are coming in so hot, as the bond market is still leaning towards recession risk. We have had a “bull steepening” in the rate curve for months now. This is what is likely driving the Fed’s decision to cut ultra-short term rates. The bond market is signalling the Fed, and the Fed is simply responding to market conditions. Keep an eye on the rate curve for predictive power.

Wolf- Historically, when does retail spending begin falling in a recession? its a lagging indicator, correct?

A decline in consumer spending, of which retail is part, can CAUSE a recession because it’s so big in GDP. When “real” consumer spending growth goes negative, it triggers a recession. This can happen when the labor market falls apart, and people lose their jobs, and cut back on their spending.

That’s why the NBER looks are personal consumption expenditures, personal income without transfer payments, and the labor market to gauge when a recession started.

No recession, in fact, eCONomy is doing quite well. Inflation has been tamed? Gold is calling bullshit, new floor at $2,550…

Your move Jerome.

Interesting times.

50 basis points from Jerome.

why even bother having a fed? just let wall street make the decisions.

Woohoo…WS got what they want but just like feeding pigeons, they will want more by year end….what a freaking joke…guess we will see how inflation play out.

…and that floor just became a concrete basement. Thanks Jerome! That was the easiest $$$ I made this week.

Seems they are extending the elevated inflation by being overly cautious. It doesn’t matter to me whether they get inflation through intent or continued caution, it’s inflation just the same.

After the 20% inflationary spike and many years of ZIRP, wouldn’t a balanced monetary authority start erring on the side of savers? What happened to consideration of long term health and moral hazards.

The Fed acts as though a recession would be intolerable. Why?

Gold could get a pop. With today’s half point cut, some people will exit T Bills. They may not like the risky stock prices, so alternative assets could catch a bid.

It’s very difficult for the US to tip into recession while the Federal government is running record “peacetime” (because Congress hasn’t declared war) deficits. This is obvious from a sectoral balances analysis (Wynn Godley).

I doubt if USA would tip into recession ever since FED/Gov has found the impact of money printing and playing with interest rate.

As someone who is allocated a lot into assets, I am thankful to FED for the last few decades and big thank today for cutting 50 bps.

Personally, I am happy but I also understand there was absolutely no need to cut rates this much.

“ which shows that consumers are buying a lot more stuff, particularly durable goods.”

I knew from the start of the hiking cycle:

The indomitable (animal?) spirit of the American consumer will be difficult to break.

The goal, of course, is NOT to break the consumer. I’m impressed by the levitation of the US economy but not really surprised.

Energy, food and geographic independence sure DO make a nation great! Add the control of the world’s money supply and voila!

50bps down, and another 50bps before year end they say.

DOW 50k anyone? Is TINA coming back to town?

OR

DOW 25k? Can’t be: Assets are risk FREE!

I read an updated guidelines article of yours(by Wolf Richter • Aug 27, 2022 • 125 Comments) & YES I only READ the comments.

Usually I only read your comments & try to figure out what your responding to. Entertaining & informative!