Our Drunken Sailors are back at it, but in moderation, so to speak, their feathers largely unruffled by interest rates.

By Wolf Richter for WOLF STREET.

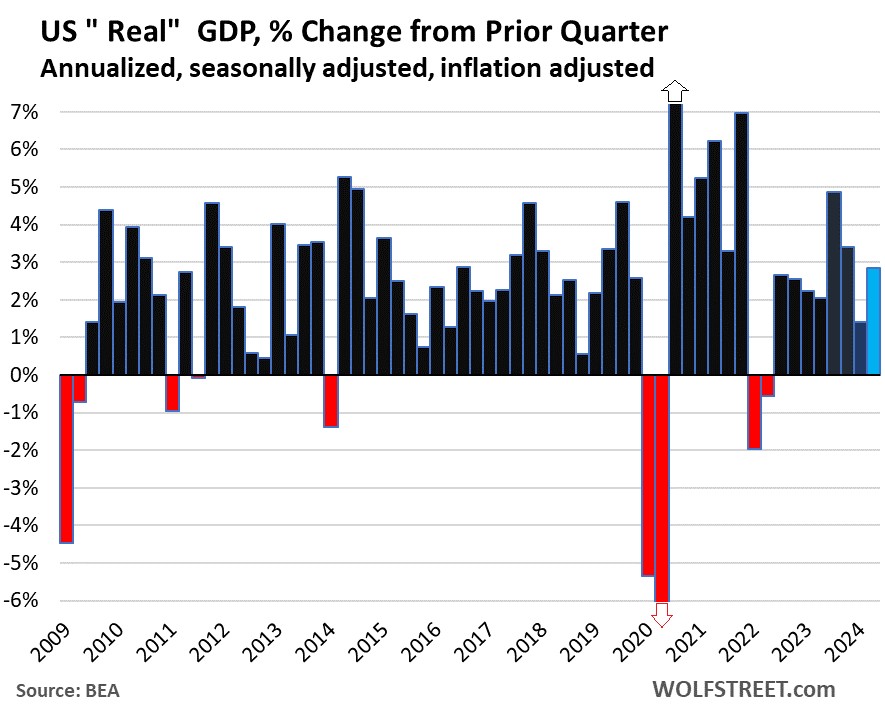

GDP, adjusted for inflation (“real GDP”), rose by an annualized rate of 2.8% in Q2 from Q1, doubling the growth rate in Q1 (+1.4%), according to the Bureau of Economic Analysis today.

By comparison, the 14-year average annual growth rate is 2.2%. So the 2.8% growth rate is well above average, and pretty good for the US economy.

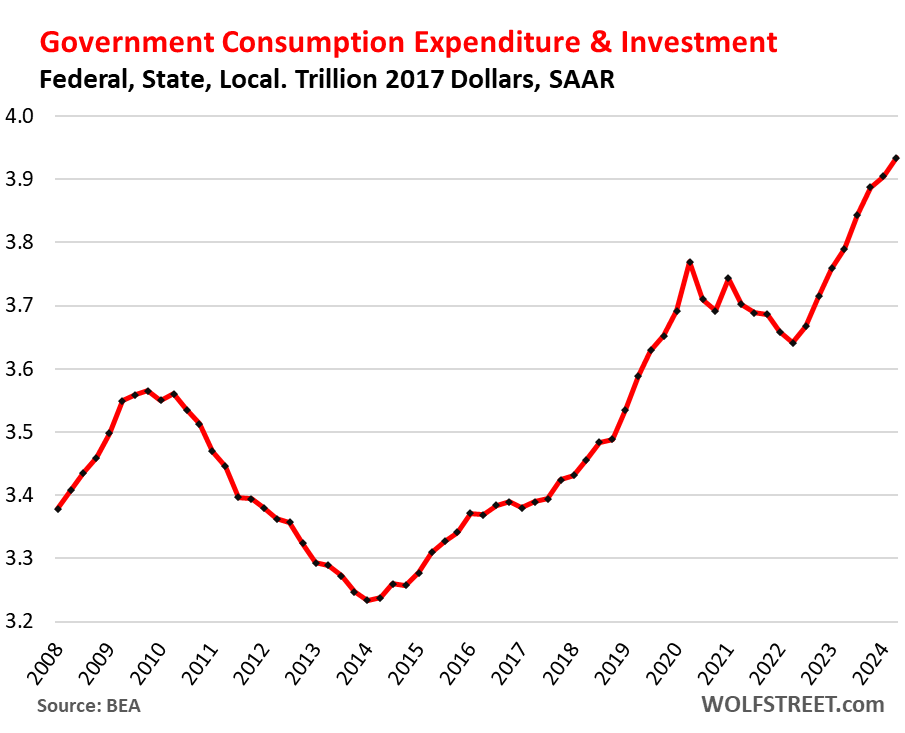

We said at the time of the feeble Q1 release (+1.8%, now revised down to +1.4%) that it was driven by a “blip”: a decline in federal government consumption and investment, which turned out to be correct, it was a blip, it bounced back in Q2 (+3.9%), as we all knew it would because the drunken sailors in Congress are not suddenly slowing down.

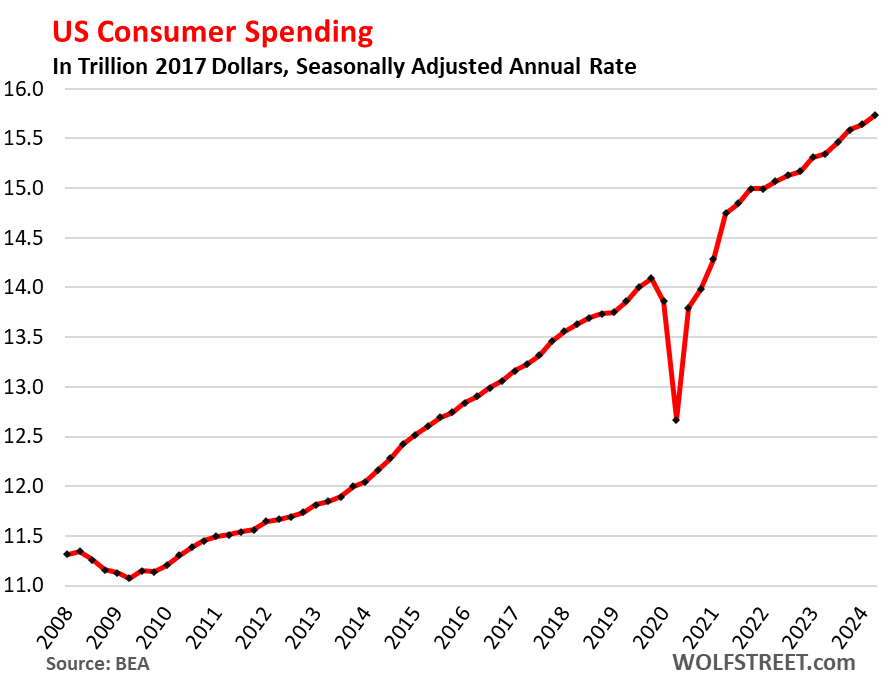

- Consumer spending (69% of GDP): +2.3%, on a 4.7% surge in spending on durable goods (motor vehicles, recreational vehicles, household durable goods, etc.). Services +2.2%; nondurable goods +1.4%.

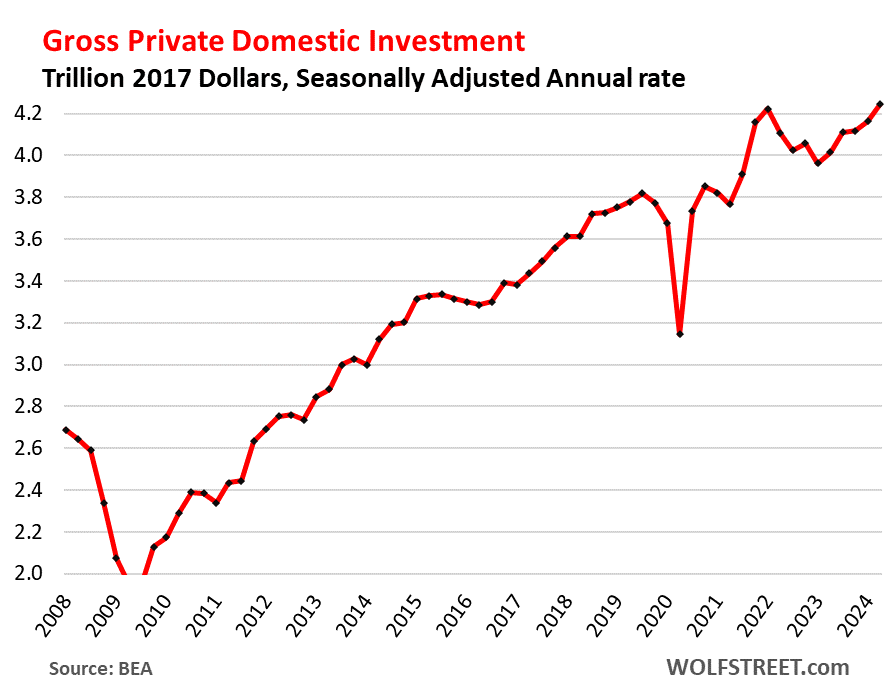

- Gross private investment (18% of GDP): +8.4%, amid an 11.6% surge of investment in equipment and a 1.4% decline in residential fixed investment.

- Government consumption and investment (federal, state, and local, 17% of GDP): +3.1%, after the 1.8% increase in Q1. Federal government +3.9%; state and local +2.6%.

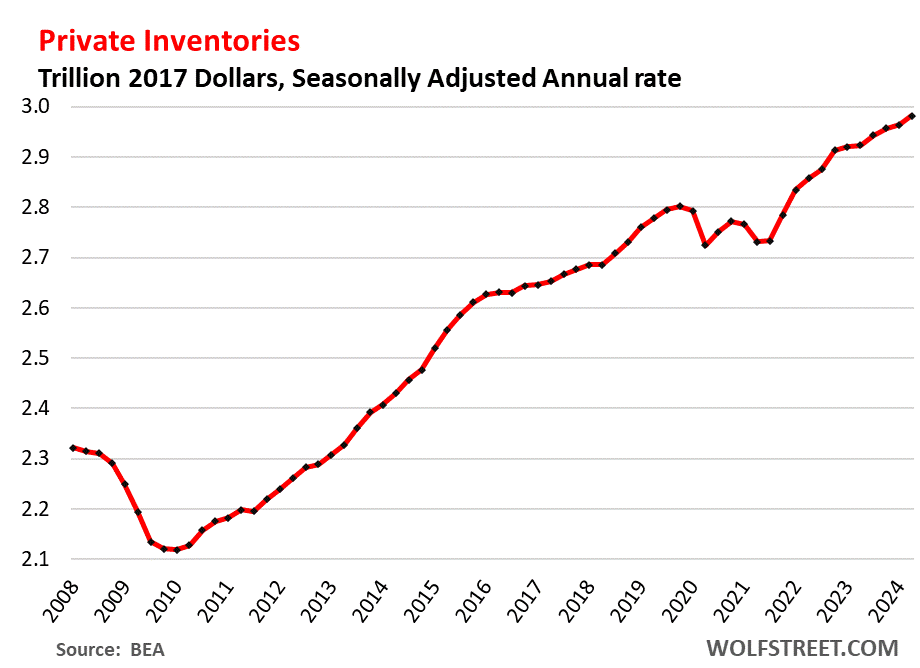

- Change in private inventories investment added to GDP growth in Q2 after dragging on GDP growth in Q1.

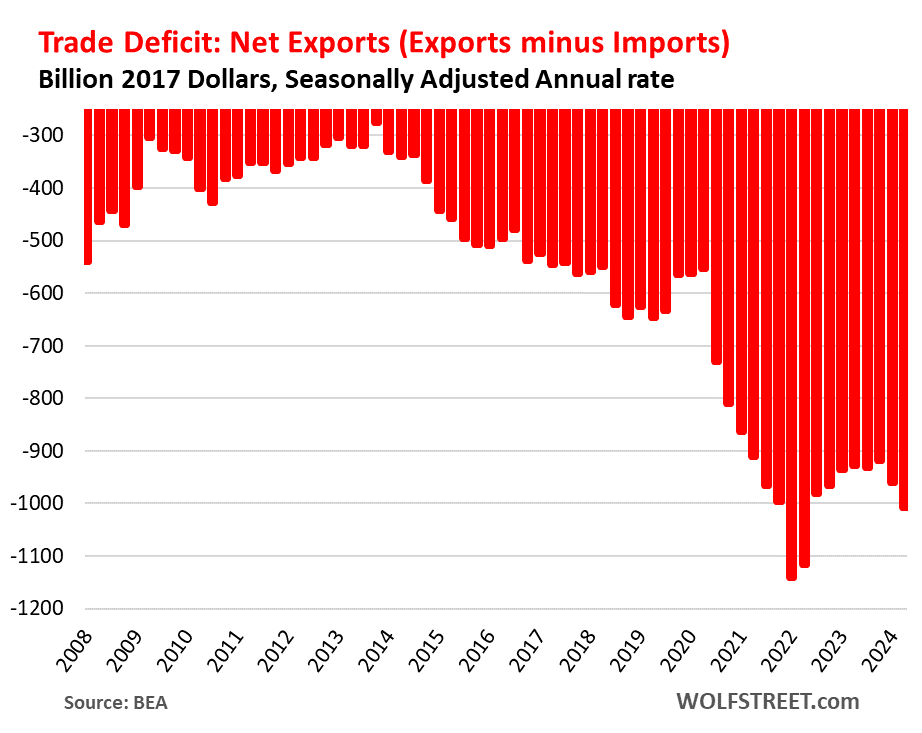

- Trade deficit worsened by a big chunk for the second consecutive quarter, on surging imports to meet strong US demand for durable goods. Imports drag on GDP.

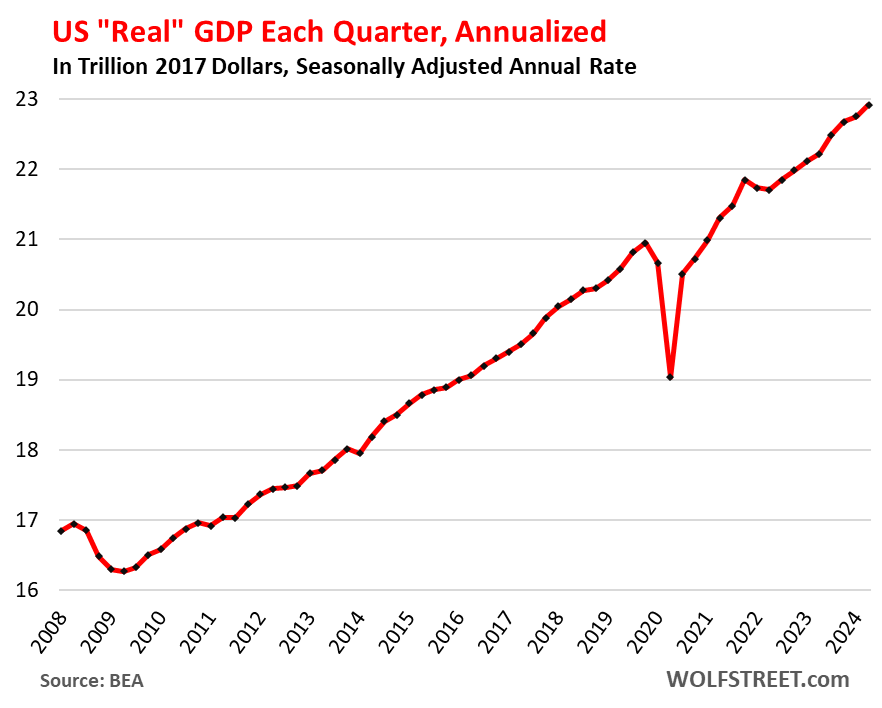

The actual size of the US economy: “Current-dollar” GDP (not adjusted for inflation and expressed in current dollars) rose by 5.2%, to $28.6 trillion annualized.

This $28.6 trillion of current-dollar GDP represents the actual size of the US economy, measured in today’s dollars, and is used for the GDP ratios, such as the US debt-to-GDP ratio.

“Real” GDP in dollar terms, adjusted for inflation and expressed in 2017 dollars, rose to $22.9 trillion annualized in Q2:

Consumer spending on goods and services rose by 2.3% in Q2 from Q1 to $15.7 trillion annualized and adjusted for inflation, an acceleration from the Q1 growth rate of 1.5%. In Q2, consumers re-stepped on the accelerator.

- Services: +2.2%.

- Durable goods: +4.7% (after the 4.5% drop in Q1), driven by motor vehicles, household durable goods, and recreational vehicles and goods.

- Nondurable goods: +1.4% (after the 1.1% drop in Q1), with increases in food, beverages, and gasoline, and a decline in clothing and footwear.

Our Drunken Sailors are back at it, but in moderation, so to speak, their feathers largely unruffled by higher interest rates:

Gross private domestic investment jumped by 8.4%, to $4.25 trillion annualized and adjusted for inflation, a sharp acceleration from Q1 (+4.4%) and Q4 (+0.7%). Of which:

Fixed investment: +3.6%, of which:

- Residential fixed investment: -1.4% after the +16.0% spike in Q1

- Nonresidential fixed investments: +5.2%, the fastest growth in a year:

- Structures: -3.3%.

- Equipment: +11.6%

- Intellectual property products (software, movies, etc.): +4.5%.

Finally back to the peak in Q1 2022 of the free-money pandemic spike:

Government consumption expenditures and gross investment rose by 3.1%, to $3.9 trillion annualized and adjusted for inflation, up from the 1.8% growth rate in Q1.

Federal, state, and local government consumption and investment accounts for 17% of GDP (state and local governments account for 61% of government spending, the federal government for 39%).

This does not include transfer payments and other direct payments to consumers (stimulus payments, unemployment payments, Social Security payments, etc.), which are counted in GDP when consumers and businesses spend or invest these funds.

- State and local governments: +2.0%, to $2.42 trillion.

- Federal government: +3.9%, to $1.51 trillion, up from -0.2% in Q1.

- Defense +5.2% (to $846 billion)

- Nondefense +2.2% (to $668 billion).

The Trade Deficit (“net exports”) in goods & services got more horrible:

- Exports: +2.0%, to $2.55 trillion

- Imports: +6.9%, to $3.56 trillion, of which goods +7.7% and services +3.6% (services imports includes spending by Americans traveling overseas).

- Net exports (exports minus imports): -4.7%, to -$1.01 trillion.

Exports add to GDP. Imports subtract from GDP. Exports are much smaller in dollars than imports, hence the trade deficit, or negative “net exports.”

The worsening imports dragged GDP growth (+2.8%) down by 0.93 percentage points. If imports had remained at the same horrible level as in Q1, rather than worsening further, GDP growth would have been 3.7%, instead of 2.8%.

Change in private inventories: Inventories rose by 2.4% annualized in Q1 to $2.98 trillion. An increase in inventories counts in GDP as a business investment. In Q2, the faster rate of increase added 0.82 percentage points to GDP growth, after the slower rate of increase in Q1 had subtracted 0.42 percentage points from GDP growth.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So what’s the excuse for rate cuts by Sept now? It better not be one with nunbers still this strong, unless they also think strong spending is “transitory” too.

Hopefully Pow Pow is not listening to Dudley or looking at Canada or Swiss for his next move.

There are 12 members on the FOMC which decides unanimously on all interest rate policy decisions at the Federal Reserve – none of which are made solely by the Federal Reserve Chairperson.

“…which decides unanimously on all interest rate policy decisions”

The 12 (of the 19) members in voting slots get to vote, and the majority wins. The votes have been unanimous in 2023 and 2024, but they weren’t always, including in 2022, when there were a couple of meetings with dissenting votes.

How are the 12 and the other 7 who can’t vote selected?

Gabriel,

Of the 19 FOMC members, 7 are members of the Board of Governors of the Federal Reserve System, including Powell; they are nominated by the President and confirmed by the Senate. The Board of Governors is a federal agency, and the seven governors are employees of the federal government.

The other 12 of the 19 are the presidents of the 12 regional Federal Reserve Banks, such as the New York Fed, the Dallas Fed, the San Francisco Fed, etc. These regional FRBs are private banks owned by the financial institutions in their districts. The board of each of the FRBs appoints its president, and those presidents of the regional FRBs then automatically become a member of the FOMC.

The NY Fed president is in a permanent voting slot. The other 11 FRB presidents rotate through the remaining four voting slots on a set schedule.

This system of rotating FRB votes assures that the 7 members of the Board of Governors, all federal employees, have the majority (7 votes). The FRB presidents have 5 votes. All of them combined make up the 12 votes.

The Chair has an outsized role in cajoling, browbeating, and persuading other committee members before the meeting. So while it’s true there’s a vote, it’s also true that the Fed Chair “leads” the committee.

The fed funds futs market is chasing it’s own tail again. Rate cut hopium. Don’t believe the hype.

Would be hard for the Fed to justify aggressive rate cuts when economy is growing above trend. Maybe the idea would be to encourage private debt creation and let the government reduce its spending.

Hard to see short term rates going below 3-4% anytime soon. Unless of course a credit event occurs….which of course is a possibility the longer interest rates stay high. I guess best case is rate cuts before the ugliness of last decade starts to roll over. Best to pretend that the borrow knows best how to mark their assets to fair value

It all depends on inflation. There are several inflation readings before the September FOMC meeting. Those inflation readings will be key.

To borrow an analogy from chemistry, I’d characterize the Fed as having very high activation energy. In other words, it will take a lot to move them in either direction on rates.

Outside of a BIG jump in inflation or unemployment, I think 5.25-5.5 is the new normal until further notice.

Really? The vibe I’ve been getting is they’ve been hoping for an excuse to cut for awhile now, they seem nervous leaving rates where they’re at

“Outside of a BIG jump in inflation or unemployment, I think 5.25-5.5 is the new normal until further notice.”

I hope so. It’s an outrage they would consider lowering rates after the extreme loss of purchasing power over the last four years. I can understand lowering rates during a slowdown when inflation has been normal in prior years. But lowering rates after the giant clusterf of the last four years is criminal. And inflation is still not back to 2%.

MM1 – that’s the vibe I get from idiot finance reporters, which is why I watch the FOMC pressers and listen to Powell directly these days.

Desert Rat – I agree lowering rates would be outrageous. Exactly why the Fed won’t do it.

So, let me get this straight. In Q1, GDP was only 1.6% but there was an uptick in inflation that shutdown rate cut talks. Now, in Q2, GDP jumps to 2.8% and all of a sudden in the latter two months of the quarter, we’re just now seeing positive signs of cooling inflation.

Something doesn’t seem right here. Do GDP and inflation typically move out of phase like this over a 3-month period?

1.6 to 2.8 is a 75% jump in GDP but inflation is gently moving towards the core PCE target of 2%.

These GDP figures are adjusted for inflation (“real GDP). This means that a bout of high inflation reduces real GDP, which was the case in Q1.

Absent a 9/11-type event I cannot imagine any adjustment on rates by the FOMC at the mid-September meeting. Their next meeting comes the day after the November 5th election (convenient!) so delaying any changes until then shields them from accusations of “playing politics in an election year.”

It feels like they will stay steady. Lots of things seem to have leveled out even if a little on the high side (3%ish). Housing seems to be flatlining. Auto seems to be flat or dropping.

I am guessing rent will increase some still to play catch up with all the increases landlords were levied in insurance and property tax increases this past year.

Rates are still on the high side of when compared to the 3.5% inflation, but it is not repressive. IMHO

The economy looks to be in good shape still so I agree… why would they cut?

Agree that they’ll stay steady. Short rates are higher than 3.5 inflation yes, but 3.5 inflation is still well above target.

An equilibrium of sorts.

So it appears that the Fed rate hikes, even with the lag effect, have not damaged or slowed the economy with these rates in place. When we had ZIRP, it was emergency mode. Now, it’s relatively normal. No catalyst (yet) for reductions. That is, as Wolf points out, if inflation doesn’t increase.

Should they cut? They should NOT. whom they are fooling?

They waited more than decade to see inflation go above 2% before ending ZIRP.

Will they cut? I think that’s most likely outcome staring in Sept.

Deep down Powell is a Dove and all those hikes were out of character for him. Otherwise he would not have been so relaxed on Q1 data. If bad Q1 data didn’t make big dent in confidence, average Q2 data should not increase the confidence too. So why is giving mixed signals.

Talking a lot of softening labor market, we are very close etc in Congressional testimony.

4% is still 125-150bps of cuts. I doubt they’ll even cut *that* much – if at all.

I think a credit event would be mostly self inflicted due to the artificial rate suppression that occurred combined with risk on behavior of investors, business leaders and consumers. I think trying rate cuts to stem a roll over would be repeating the mistakes that caused the problem. The natural roll over seems inevitable and I’d recommend people saving for a rainy day, which isn’t pessimistic, just sensible and responsible.

N-gDp is decelerating. R-gDp just topped out.

No rate cuts this year,maybe a .25% increase early next year…

This will be one of those long odd horse you bet on with 30 to 1 return. I wish you’ll be right but it’s tough to see any increase in the future

There absolutely will not be any more rate hikes. They barely have the guts to keep holding, and it looks like even that won’t last much longer unless inflation really takes off again.

Wrong, and what there won’t be are any rate cuts this year.

Then I expect a surge in weird fads and zombie companies of the future, while inflation bodes to roar back on the heels of that. Yuck. This comes just in time for major court contests against the SEC and other traffic cops, inviting systemic risk. Perhaps also; there will be an executive branch very friendly to that trend. My hand will be firmly on my wallet.

I think the premise is wrong. The spending splurge is partially driven by the interest rate increases that have impacted money markets and other income producing securities. There is about $6 trillion in MMs. At 5% interest, that’s a $300 billion/year run rate of spending boost that wasn’t there 2 years ago (all paid for by borrowed money). BDCs are kicking out 10% income. Preferred stocks 7% or more. People with cash, mainly old people, are suddenly making spare change they didn’t have for 10 years. Couple that with the fact the vast majority of homeowners are not affected by rising rates due to refinancing at 3% or so and you have a spenders dream.

Everything is now reversed. When rates go down, I believe we’ll see home prices fall as more homeowners get unlocked from their low mortgage handcuffs and can justify selling. We’ll see services decline as savers see their income fall and don’t have as much to spend. The Federal Government can’t handle 5% on $34 trillion for much longer. Something’s got to give and I believe the Fed will be forced to lower rates and re-start QE, inflation be damned.

Thanks for the input. I know a retired couple that are very very happing with the interest rates on their bonds but also just as happy with the stock market gains this year in the SPY. They are mostly in SPY and Berkshire.

They are traveling and taking vacations like there is no tomorrow.

This sort of fits in with the Airlines and hotels having a record summer of customers.

Airlines are reporting dismal earnings.

Right. Retired with all sorts of assets – the recipients of the FED’s grotesque “wealth effect.” Time to cut them off at the knees.

Last 15 years of ZIRP and massive expansion made a great divide I feel.

First group made use of opportunity to borrowing at low cost and bought lot of assets. Others are ones who felt and thought liked responsible during that time (not look like fools) who saved or didn’t borrow much and didn’t buy lot of assets.

First group surely enjoying now. Whether for long term only time will tell. But tired to waiting for that correction when Assets prices will get corrected. CRE correction has happened. But Stocks and Residential RE ATH.

Sure. Now Savings is giving 5.4% yield. Thats nice. But remember all the Purchasing Power lost in last 13 years.

I am sure those Boomers are NOT ONLY reason for Inflation. Drunken sailors don’t care whether they have money or not. they just live like no tomorrow.

DC,

But, but, but…the last guy just said more QE is coming.

Sandeep,

Not everyone who was on the Fed’s “nice” list was irresponsible. It is possible to save and invest without leverage.

Those of us who know the monetary system is corrupt, smoke and mirrors, also know you can’t win if you don’t play.

More than spare change some people are buying yachts thanks to those 5.4 percent 90 day T-bills.

Yha, sure. You’d need $20m in bills for 5 years to cover even a modest yacht after taxes. Sheesh.

Yeah. I think Real Tony went overboard on that one.

I think Tony is just being modest, doesn’t want to brag about his new yacht.

When “modest” becomes “totally ashamed”, then maybe there is some hope for this stupid species. See bulfinch.

Pity, we came a long way against immense odds…….just made a lot of REALLY wrong turns when this “civilization” shit started.

Oh, Esther — will the shopping never cease?

Not even surprising at this point. The vast, unsounded punch bowl has once again emboldened the e-shopaholics to find another few inches in their closets and garages in which to accommodate…more…

Interest rates are not high by historical measures. Why not just leave them where they are?

I was curious if government was spending more (as a percentage) of GDP than in the past (1929-2023).

Wolf wrote: “Federal, state, and local government consumption and investment accounts for 17% of GDP (state and local governments account for 61% of government spending, the federal government for 39%).”

Looking at the St. Louis Fred: “Net Outlays as Percent of Gross Domestic Product.” That 17% number for Federal Gov’t is low compared to past decades. There could be plenty of room there for infrastructure, like roads and housing. The stuff that the private sector does not want to do because they can’t turn a profit on it.

Lower the rates, and see a surge in credit-fueled scams. I can’t believe it is being discussed. But in a system where people will not approve tax hikes, all this borrowing and spending must be handled. Sad to say, what alternative is there, other than inflation?

Tax hikes?!?! You don’t think I’m getting $&@‘d enough?!?!

…’free’ money is where one finds it (be it insanely-low interest or shortfall in tax revenue…).

May we all find a better day.

1:04 PM 7/25/2024

Dow 39,935.07 81.20 0.20%

S&P 500 5,399.22 -27.91 -0.51%

Nasdaq 17,181.72 -160.69 -0.93%

VIX 17.84 -0.20 -1.11%

Gold 2,362.80 -52.90 -2.19%

Oil 78.20 0.61 0.79%

Howdy Folks Will history repeat? I sure think so. Check out the CPI history

Duck Duck Go or Google

Us inflation Calculator Historical ( Hysterical ) inflation rates to see our

Future

The economy is apparently “Roaring” in the 2020s.. so why does the Federal government need to deficit spend like it’s the great depression of the 1930s? What would GDP growth look like with a balanced federal budget and even slightly shrinking National Debt?

Or maybe it is like the Great Depression and government deficit spending is the only thing keeping it roaring?

Gee that Trade Imbalance has really blown out since 2020 compared to earlier years, that’s a lot of importing (I assume exports have grown modestly).

The government doesn’t have to deficit spend. But drunken sailors love their tax cuts.

it’s not tax cuts. it’s too much spending. there’s no way america or any other western country could tax everyone enough to pay for everything the people want.

Here in Canada over the last 26 or so years I saw a trend with interest rates and government stated inflation numbers and gold. This is not just a Canada thing, it is mostly western world thing. I knew, I had a gut feeling central banks and government policies would be towards cutting interest rates and knew gold which reflects real inflation expectations and real inflation numbers would shine so to speak reflecting true value not the fake, manipulated government interest rates, inflation policy started to be used after the mid 90’s.

This is why to protect myself and my family I made sure for myself and my wife, kids invested our money with a 50%/50% split between GICs and gold. This is what I did, the GICs averaged 4.37% over the 26 years and gold averaged 7.85% over the 26 years( bought all in $450 an ounce Canadian versus $3,200 Canadian today. So 6.11% average rate of return per year 50%/50% split. They will again cut interest rates too soon, too fast and gold will reflect that again. In Canada they already cut 2 times 50 basis points total or 0.50% percentage point in just 12 weeks from 5.00% to 4.50%.

Wolf don’t waste too much time in analysis, you know that next month these figures will be revised down and you’ll be having to tell your readers the same thing: “what we told you last month was rubbish”.

But in fact I said in the third paragraph: “We said at the time of the feeble Q1 release (+1.8%, now revised down to +1.4%) that it was driven by a “blip”: a decline in federal government consumption and investment, which turned out to be correct, it was a blip, it bounced back in Q2 (+3.9%), as we all knew it would because the drunken sailors in Congress are not suddenly slowing down.” Nailed it, LOL

The trade deficit is looking very good, but it seems the strong dollar might account for a lot of that. Anyway, just like Jerome Powell said we have to have supply in balance with demand; less US exports means more for domestic consumption and more imported foreign goods gives even more supply. However, a measly trillion dollars or so won’t make the kind of dent we need on approximately 20 trillion of consumer spending; the tariffs need to be dropped to quench inflation.

What are talking about? Trade deficits are at highest in a decade? USA is still depending on outside supply, the domestic supply does not yet exist. So we are still supply constrained. Add additional Trump tariffs and more inflation is to follow.

Correct! There are only two choices left to deal with the debt. 1) inflate it away or 2) default and world war.

Sorry but I don’t see our CONgress actually sitting down and balancing the budget. In fact, that may in fact be mathematically impossible at this point.

NOTHING is “mathematically” impossible……we invented it ALL in our “magnificent” heads…..and we are still at it.

Shelter and food, (plus water and clean air) however, are becoming a REAL SERIOUS problem for many, mostly for the “lazy”.

Vagrancy laws were quite popular especially on the local levels during the Great Depression for dealing with these “lazy” people.

Try to sleep under a bridge in Sedona or Hilton Head……..what’s this “freedom” shit?

NBay – the ability of some classes to essentially ‘wish the unpleasant away’ has never failed to amaze me (that narrow ‘mathematical’ bill will always come due, especially in unrenewed-resources, in some form, nonetheless)…Best.

may we all find a better day.

Dustoff, a variation on “wishing unpleasantness away” from a voice well over 100 years ago…..

Per Nietzsche;

“The age of the most despicable man is coming……the one who can no longer despise himself”.

Last prez was a symptom showing his prediction was 100% RIGHT.

Great data, and somewhat expected. I’ll say it again, another wave of inflation is about come ashore. Higher for much longer, and just an FYI, 5% is not historically high.

Buckle up buttercup.

This will help lift gold even more higher than it rather would. Shawn’s points on gold and government understating inflation and cutting interest rates too fast too soon will make gold even more attractive in 2 to 3 years. Gold will probably be $3,000 US an ounce by 2026 to 2027.

Gold is headed towards $20 per pound and may get there much sooner rather than later.

that’s not the way the financial media is presenting it. they’re saying “inflation drops to 2.5%, easing path to rate cut.”

these people don’t stop.

Yes, more doublespeak. It’s double plus good comrade.

Humans have been devolving for quite some time, so this is unsurprising.

The people who have and control productive capacity will eventually stop producing for others, who cannot offer something of real value in return. My father and grandfather called it the “fuck you, pay me” part of an imploding system.

Every time the tea leaves get stirred, the paint a slightly different landscape.

Standing back, looking at this GDP canvas, we apparently have a resilient and growing economy — with the equity markets fully engaged in pricing in an unbelievably upbeat upside for future growth gains.

The exuberant forward outlook is connected to a decreased earnings yield for the S&P and decreasing yield on various treasury yields — which is where the tea leaves make absolutely no sense.

Looking at the teeter totter imbalance of S&P P/e — the relationship of extreme higher bubble prices are rising far faster than earnings growth — which in the pandemic vacuum might seem irrelevant — but, we’ve been engaged in this endless dance of higher for longer Fed rates, for two years, as equities have literally jumped to the moon.

What currently seems curious, is this excess exuberance in equities occurring before a Fed rate cut — I think we’re awfully close to the entire betting population collectively thinking a cut is certain.

A rate cut obviously will goose an already ebullient market into parabolic frothy territory — pushing valuations beyond the moon towards Jupiter — and, pushing S&P earnings yields lower — as treasury yields fall.

In that scenario, where valuations don’t matter, isn’t this just going to supercharge moral hazard and lay the groundwork for future instability? As I recall the Fed is mandated to manage stability?

S&P 500 Earnings Yield is at 3.64%, compared to 4.03% last quarter and 4.26% last year

If you look at it, you might find that rate cuts often are followed by a tanking stock market, not a rising stock market.