The huge spike in profits during the high-inflation years backtracked in some industries but got even hotter in others.

By Wolf Richter for WOLF STREET.

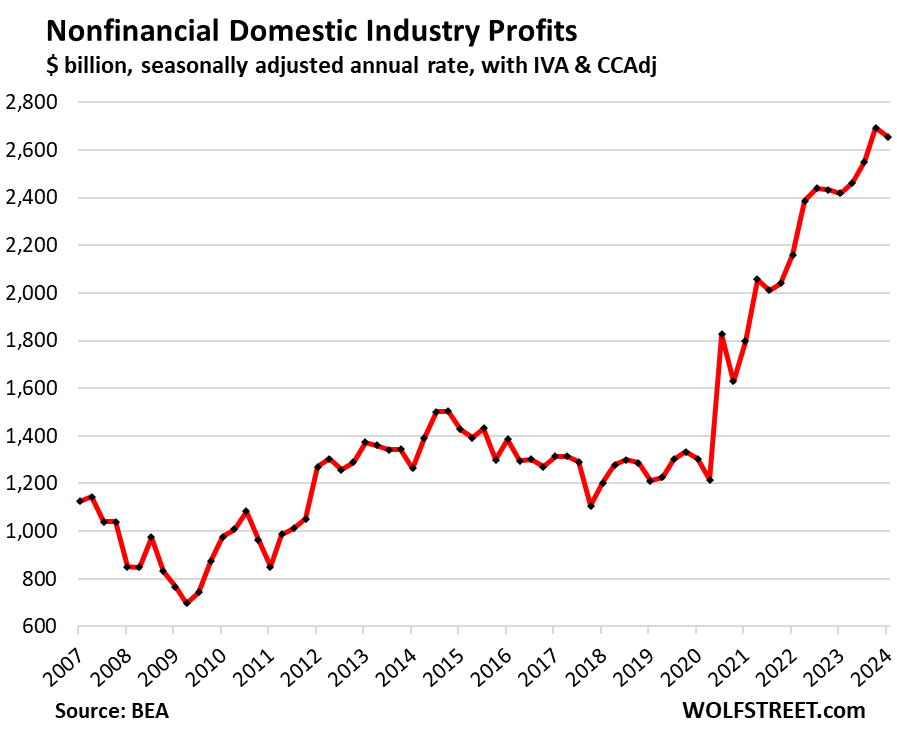

Corporate pre-tax profits in non-financial domestic industries fell by 1.4% in Q1 from Q4, to seasonally adjusted annual rate of $2.66 trillion, according to the by-industry data on corporate profits released today by the Bureau of Economic Analysis.

Year-over-year, profits were still up by nearly 10%, despite the drop in Q1, as profits had surged in the prior three quarters. Since Q2 2020, profits have doubled! This is why some have termed this episode of inflation “greedflation.” But that’s what big inflation is all about: Companies raising prices far faster than their costs went up, and their customers being willing to pay whatever. It’s the Fed’s job to knock some sense back into these economic players by making the cost of capital painfully high.

The drop in profits may be another sign that consumers and businesses have discovered that they hate, hate, hate price increases (inflation), and that they’re no longer willing to pay whatever, and that some resistance has built up, well, selectively as we’ll see in a moment.

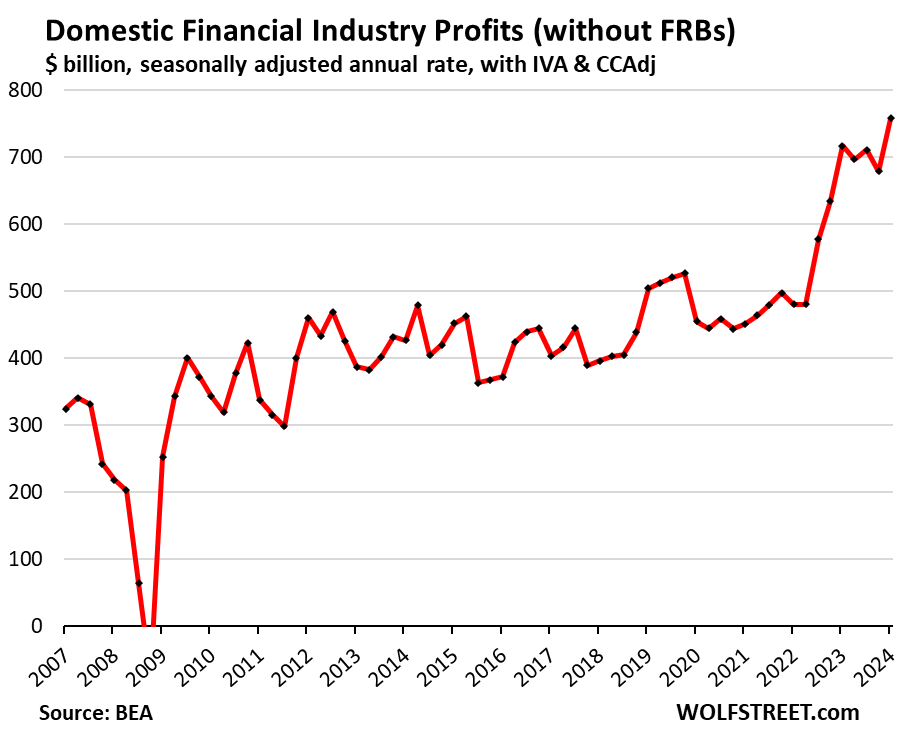

Corporate profits in financial domestic Industries: Above we saw the profits of nonfinancial businesses. Here are the profits in the financial sector.

Profits in the financial sector spiked by 11.7% in Q1 from Q4, to a seasonally adjusted annual rate of $758 billion, more than undoing the profit declines in the prior three quarters.

Year-over-year, profits rose by 5.7%. Over the two years since Q1 2022, profits spiked by 58%!

The financial industry includes banks and bank holding companies, plus firms engaged in other credit intermediation and related activities; firms engaged in securities, commodity contracts, and other financial investments and related activities; insurance carriers; funds, trusts, and other financial vehicles.

We have removed the 12 Federal Reserve Banks (FRBs) from this tally. The Fed has booked $114 billion in operating losses in 2023, spread across the 12 FRBs. But those losses are irrelevant for corporate profits since they’re the direct result of the Fed’s paying interest on reserves and ON RRPs.

How are these corporate profits figured?

The BEA obtains this information from IRS income tax data and from financial statements filed with the SEC. These are pre-tax profits “from current production” by all businesses that have to file corporate tax returns, including LLCs and S corporations, plus some organizations that do not file corporate tax returns. Here are some definitions:

- IVA (“inventory valuation adjustment”): Removes profits derived from inventory cost changes, which are more like capital gains rather than profits “from current production.”

- CCAdj (“capital consumption adjustment”): Converts the tax-return measures of depreciation to measures of consumption of fixed capital, based on current cost with consistent service lives and with empirically based depreciation schedules.

- Capital gains & dividends: Excluded to show profits “from current production,” rather than financial gains.

Profits by major nonfinancial industry category.

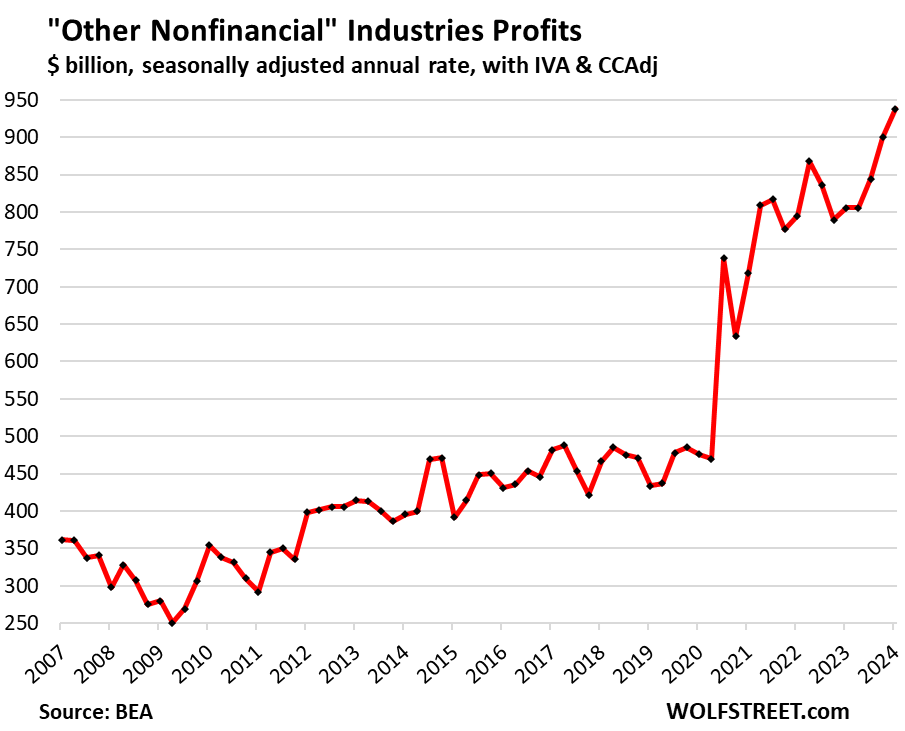

“Other nonfinancial” industries: The biggest category in the BEA data because it includes so many huge industries, such as construction; professional, scientific, and technical services (where some of the tech and social media companies are); health care and social assistance; real estate and rental and leasing; accommodation and food services; mining and oil-and-gas drilling; administrative and waste management services; educational services; arts, entertainment, and recreation; agriculture, forestry, fishing, and hunting.

Profits spiked by 4.2% in Q1 from Q4 and by 16.5% year-over-year, to a record seasonally adjusted annual rate of $938 billion. Since Q1 2020, profits have doubled, as companies raised prices far faster than their costs had gone up, and their customers, befuddled by the inflationary mindset that had kicked in, went along with it.

It’s this kind of thing – already big profits doubling in the span of four years as companies raised prices far faster than their costs rose – that has caused people to call this bout of inflation, “greedflation.”

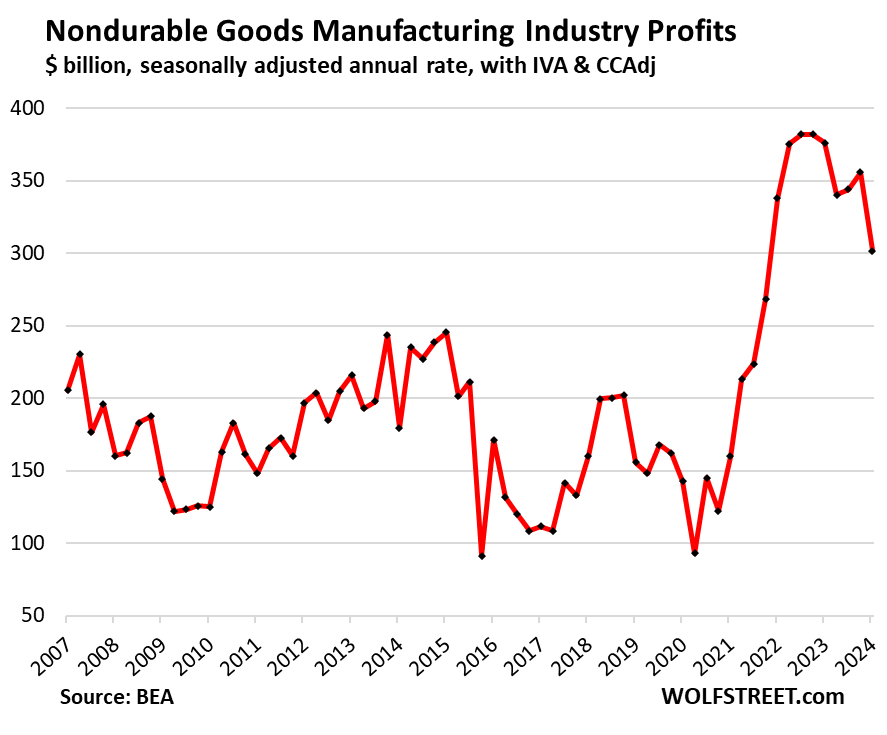

Nondurable-goods manufacturing: Profits plunged by 15.3% in Q1 from Q3, and by nearly 20% year-over-year, to a seasonally adjusted annual rate of $301 billion.

These industries produce food, beverages, household supplies, petroleum products (including gasoline and diesel), coal products; chemical products; and other nondurable goods.

Sign of the unwinding of greedflation?

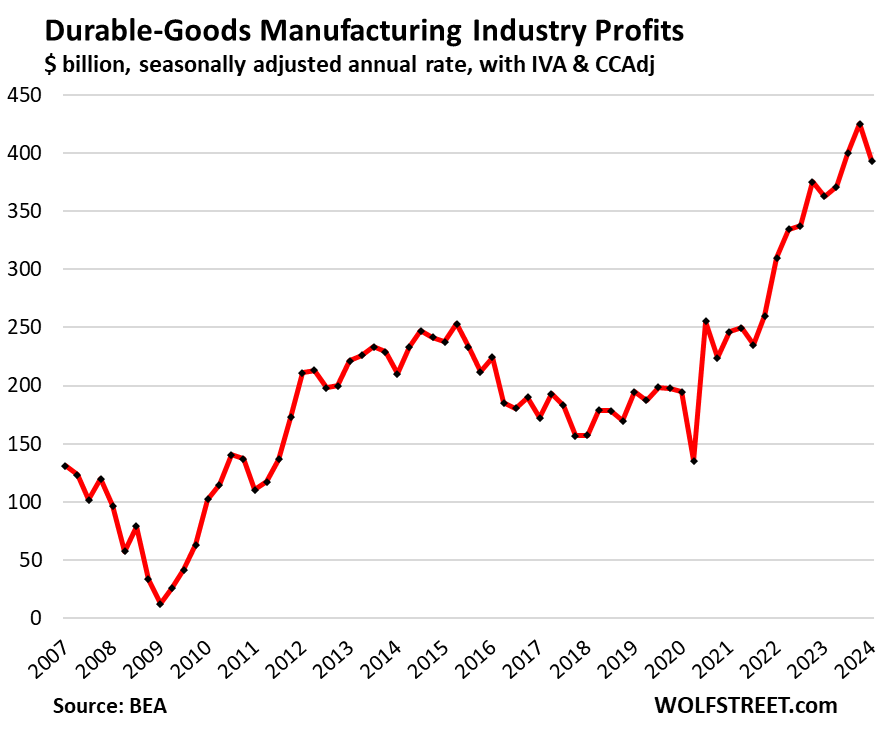

Durable-goods manufacturing: Profits fell by 7.4% in Q1 from Q4, to a seasonally adjusted annual rate of $393 billion, which was still up by 8.4% from a year ago. Over the three years since Q1 2021, profits have spiked by 57%.

These companies produce computer equipment and electronics products, electrical equipment, appliances, motor vehicles and trailers, machinery, fabricated metals, components, and other durable goods.

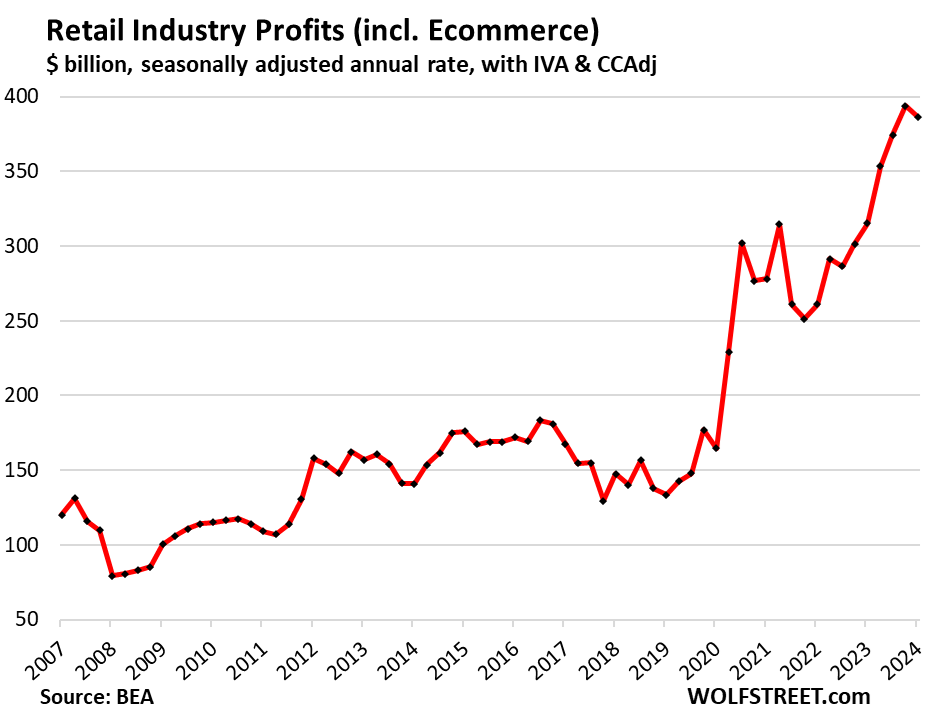

Retail trade, including Ecommerce: Profits dipped by 1.9% in Q1 from Q4, to a seasonally adjusted annual rate of $386 billion, but were still up 22.6% year-over-year. They more than doubled since Q1 2020:

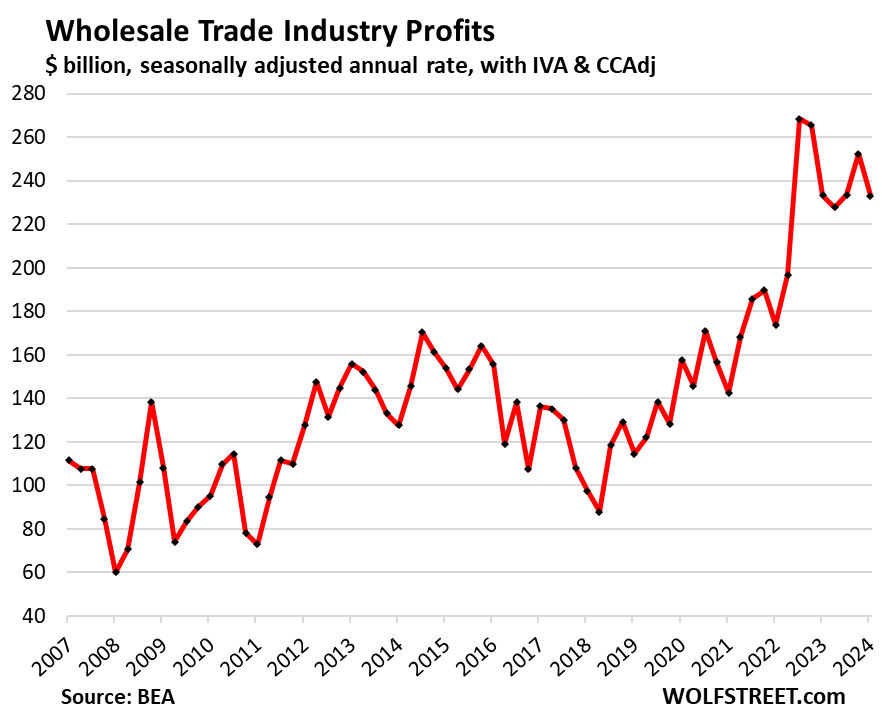

Wholesale trade: Profits fell by 7.6% in Q1 from Q4, to a seasonally adjusted annual rate of $232 billion. Year-over-year, profits were flat.

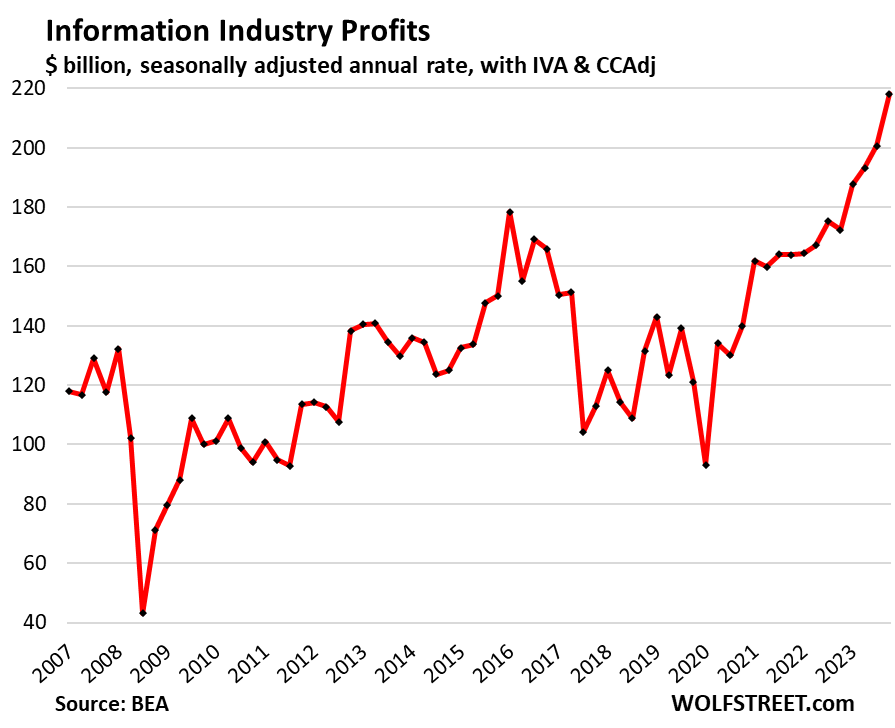

Information: Profits spiked by 8.8% in Q1 from Q4, and by 26.6% year-over-year, to a seasonally adjusted annual rate of $218 billion. All those layoffs in the sector must have helped.

The sector includes web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications.

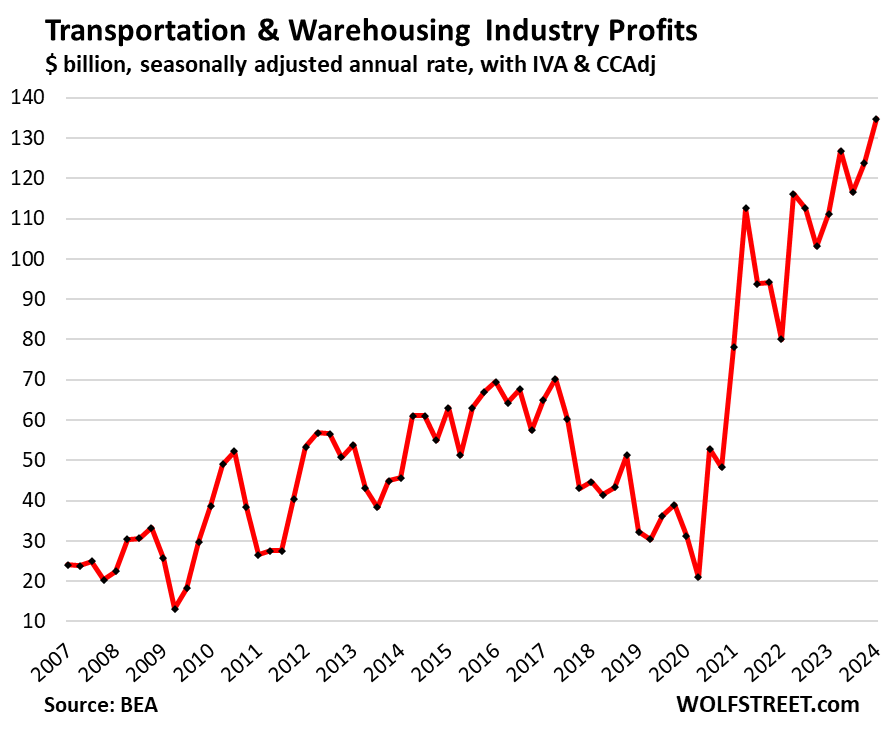

Transportation & warehousing: Profits rebounded for the second quarter in a row to a new record, spiking by 8.8% in Q1 from Q4, and by 21.2% year-over-year, to a seasonally adjusted annual rate of $134.8 billion.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The banks and other financial players along with insurance companies sure know how to screw you.

I have a bunch of 6 month t-bills that I buy thru Fidelity. Every time I have a t-bill that will be maturing in a couple of weeks, like clockwork I start getting phone calls and emails from Fidelity. They are informing me that as a Fidelity customer I have access to their financial planners. I also get more adds about investing in ETF funds through Fidelity.

With interest rates being what they are, I just buy more t-bills. Then the calls and emails and adds calm down until the next t-bills are up for maturity.

Lol!

I do the same thru Schwab. I probably buy a three to twelve month T bill at auction every other week and don’t renew automatically. I pick and choose the auction I wish to participate with the matured funds. I never get any calls or emails from Schwab. II have been with Schwab over 40 years.

Wow. This makes it pretty clear that intentional price gouging is real, and not in our imaginations as so many corporations have tried to convince us. “Rising costs” they all said. Yes, apparently at twice the rate to customers as to the corporations.

Another gift from corporatist politicians’ gutting of antitrust regulation since the 80s.

Is it not governments job to make sure there is competition in these industries? Seems there is none? Under Biden inflation only hurts “little” people, never corporate profits…

No the consumer needs to shop around. Bargains can be had.

XXX – ‘TR RINOS’ (reread the history of U.S. antitrust policies) have long been expunged from the R party. Expecting any revitalization of the SEC from that side of the aisle, (let alone the other) requires an utterly-amazing leap of faith at this point in time (you HAVE contacted your Rep. and Senators with your concerns over this matter, nay?).

may we all find a better day.

Wow, just mind blowing data. Thanks for sharing.

So, the government printed money and gave it to the citizens. In turn they happily handed over everything to the corporations. I guess they also bought few shares in those glamorous companies like Apple and felt they have to give it to them since they are now owners too. ypical American mindset :(

Second that…Wow!

Thanks Wolf.

Eye opening indeed. So what is Congress going to do about Greedflation? That’s funny, isn’t it?

Line their pockets.

We live in a Corporatocracy; an economic, political and judicial system controlled by business corporations or corporate interests. these folks own our congress and own our judicial branch. They write the rules and congress stamps them and the judicial system gives these rules their blessing.

There are good books on the subject out there. A recent: Barons, money, power, and corruption of America’s food industry.

When the government declares “corporations are people too,” it becomes inevitable!

A locale near me has floated the idea of allowing LLCs to VOTE!

Struggler – THIS! As an ‘AUS’-vet, my longstanding argument against corporate ‘personhood’ is that there is no mechanism that they also be subject to that draft ‘tax’ of possible loss of their ‘LIFE, fortune, and sacred honor’ on the spearpoint, as is the common citizenry.

may we all find a better day.

Remember when one party declared Citizens United the worst Supreme Court decision ever? And then that party started receiving more corporate money than the other party and we rarely hear about the decision now? Weird, right?

Publius – mebbe not. Consider the old business saw: ‘…nothing happens until somebody sells something…’. The ethical billfold very-often seems to be the one found at the top of the pocket, and sooo easily accessible…

may we all find a better day.

Wolf: It would be much appreciated and informative if you had also put a graph of GDP Q by Q to match with the profits graph so it would be easy to eyeball when and by how much profits were growing excessively in regards to economic growth.

BINGO

I was thinking the same. Are these just nominal profits of devalued dollars?

No. Only a small portion of it. CPI Inflation was about 21% over this period, in part because companies raised their prices a lot faster than their costs went up. But profits jumped by 50% to over 100% over this period.

Yeah Wolfman, I was looking at an inflation adjusted chart for the S&P 500.

As of tonight, the S&P 500’s average annual real (or inflation adjusted) return since February 2021 is only around 4.85%, or a total real gain of around 18% from February 2021 to present day.

With a 10% correction of the S&P 500 over the next few months, and the S&P 500’s real return for the last approximately 4 years will be marginal.

I ran an AI query to discover that the historic real return for the S&P 500 is about 6.5% annually.

Long-term interest rate fluctuations are something that financial institutions need to manage well, or they disappear. The terrible ZIRP years proved this, unless they had their well – hidden deep reserves well bolstered they had big trouble. Those reserves can only be rebuilt during periods of rising rates, which is what is happening now. Details of their deep-fund manipulations are not easy to find on their financial statements. Greedflation? Not necessarily.

Profits are good. (When you lose money you eventually go out of business.)

And, so long as you have free competition, large profits are better, and huge, obscene profits are even better. (Think Apple, Google, Nividia)

Large profits do a number of good things for the economy.

They tell everyone these products are wanted by consumers.

They show the business is being run efficiently.

They encourage more capital to flow into these industries, eventually increasing supply and dropping prices. (Think computers. )

They provide a return to the original investors, which encourages entrepreneurs. And rarely do successful entrepreneurs spend this money extravagantly. (Think Musk.)

As an aside, it is interesting that when governments get into a business the first thing they do is establish a monopoly. (Think “health care” in Canada.)

I will only add that profits add to your “seed corn”. How you deploy them matters. Buying back your fucking stock is NOT a good deployment.

The strong hands will cut prices and give deep discounts to cannibalized the weak hands which imitated them for years. There are too many of them. Consumption will be down. Tariffs will rise. The banks will thrive. The best stress test is a strong real growth. Low end workers will compete with 10 million illegal immigrants, but highly skilled workers will benefit.

Classic symptom of demand pull inflation. Money printing and massive government stimulus leaves us peasants outbidding each other for scarce goods…

As an electrical construction company, we’ve been passing through ridiculous cost increase for switchgear, lighting, etc. Switchgear is the worst. For the last couple years, suppliers could double their prices as long as they mixed a strong BS cocktail that contained the key words “supply chain issues”. As long as you said that, clients just shrugged their shoulders and paid up.

ALL of the increases in the cost to do business are passed on to my customers. At the end of the day if the margins get any thinner, I will simply produce for myself and trade with others for the thing I need. THIS is what will ultimately shut the system down. For all the things people need, shelter, food, energy. They will pay up, only so long as they can. many people I know have already let things like insurance lapse.

The most interesting chart for me in this article is the last one: Transportation and warehousing.

At one point I had learned that the DJT (Dow Jones Transportation index… not the other ticket) was a sort of indicator of the “real” economic activity in the world.

Sure enough, it bottomed out with everything else in 2020, hit a spikey ATH in 2021 (with… everything else) and participated in the 2022 market crash (repricing).

Since then, the index has not participated in the recent rally to new ATHs and has rather been consolidating below the 2021 price.

Assuming the profits in the chart are reflecting some of the businesses included in that index, I wonder what the market is telling us?

(Since higher profits USED to indicate a higher stock price, even in industrial companies, post-tech era)

I remember as a child watching “Fleecing of America” news articles on MSM. Thankfully Wolf remembers those too. Thanks for keeping organizations honest! Other than freezing our pockets, voting with our dollar, and sharing your article – what else can we do? Are there laws that politicians should be enforcing to hold others countable for gouging?

Related to Greedflation, is the amount of retail store closures associated with unproductive and unprofitable businesses not being supported by customers.

Consumers, at least those not wealthy, are making choices about where to spend pennies.

“ Coresight Research, which tracks store openings and closings, said that as of May 31, major U.S. retailers have announced 3,279 planned store closures for 2024. That represents an 18.5% increase over the 2,767 closures announced in the comparable period of 2023. “We estimate that the closures announced year to date will account for 46.7 million square feet of closed retail space in 2024,” Coresight noted in its report.”

That kinda connects to the thesis we will see lots of employment revisions by year end.

“That kinda connects to the thesis we will see lots of employment revisions by year end.”

Nonsense. It connects with what I have called the Brick and Mortar Meltdown since 2017.

High inflation is the cure for high inflation, assuming the Fed doesn’t won’t print money out of thin air, like it did many times before in the face of low growth. We’re already seeing reduced demand from customers on the low end of the economic spectrum (Nike, Walgreens, Target, dollar stores, etc.).

The drop in bond prices and spike in 10 year treasury yields is likely a major driver in the rise in insurance profits, especially among life insurers. They are rolling off bonds they hold to maturity from 2014 that were probably paying 0.75% or similar to replace them with bonds paying 4.5%. They got used to operating lean during the zirp years so now they get a windfall. I worked at a life insurance company in the mid 2010’s and they would talk about the big tailwind from yields getting up to 1.5%

Thanks, Wolf, for this incredibly insightful analysis. I don’t see a lot of comments here today, but I think your analysis above is one of the most important articles you have published in recent years. Here’s why…

I thrived as a dollar-cost-average index investor from the 1980s through June 2020. However, in June 2020 I flinched. With the Covid pandemic a few months old, I saw the potential for unprecedented economic disruption. I sought a safe haven, and I took my decades of stock market winnings off the table and shifted heavily into the U.S. Dollar (i.e., Treasury bills and cash). In retrospect, I made about the worst move I could have. Here are the three things I didn’t see coming: 1) the willingness of the U.S. government and the Federal Reserve to debase the U.S. Dollar via massive spending increases and massive money creation; 2) the ability of U.S. businesses to raise prices and profits so dramatically (your topic today); and 3) the willingness of U.S. consumers (newly swimming in cash, thanks to the government) to pay through the nose in the face of significant price increases. Shame on the U.S. government and the Fed for driving massive inflation. Shame on me if I ever seek refuge in the U.S. Dollar again.

Doubting Thomas, you have been taught a harsh lesson, as have many others. First, Be There or Beware is always true, I only converted 50% of my equity into +5% cash, so I am only 50% bitter. Second, Perfection of the Market. Many share buyers somehow knew that money was going to push equities up, no matter what and momentum took hold. Third, the USA dollar is the only place to be long term.

Historian – Thanks for your response. I agree with your first two points. But with due respect, I don’t agree that the U.S. Dollar is the only not place to be in the long term. I know the Dollar is the “least dirty shirt” of the major currencies, but its long-term purchasing power is entirely subject to the actions of the U.S. government and the Federal Reserve. In contrast, businesses can raise prices in response to inflation and maintain and even grow real value in the face of Dollar debasement. I am still heavily invested in U.S. Treasury bills and enjoying returns over 5%, but I am slowly but surely dollar cost averaging my way back into stock market indexes (despite good evidence that stock markets are currently overvalued). After the last four years, I don’t trust the long-term value of the Dollar. But I do trust businesses to navigate the choppy waters of inflation. If you think I am missing something, please point it out. I want to earn money as an investor, not be the smartest boy in the classroom. Cheers, and thanks again.

Edit: Should say, “I don’t agree that the U.S. Dollar is the only place to be in the long term.”

Strike “not” from “only not place”

There, then, should be much larger tax receipts in all government categories, from large to small. Why is the debt always accelerating?

They’re not committed to pay it off or spend within tax receipts. Having the largest military costs a lot.

The Jobs Act has made it so they pay no taxes, are you kidding?

Great article!

By chance does anyone know if disposable AA batteries fall under durable goods or non-durable goods? Wheras a car battery may be a durable good, an alkaline AA battery might not last as long as be considered a non-durable.

When I used to work at Target batteries were considered part of the electronics department, but always seemed to me they should have been considered a home good.

Anyways, thanks in advance!

Generally, durable goods have an average life of at least 3 years when used.