Our Favorite Recession Indicator shows next recession keeps moving further out.

By Wolf Richter for WOLF STREET.

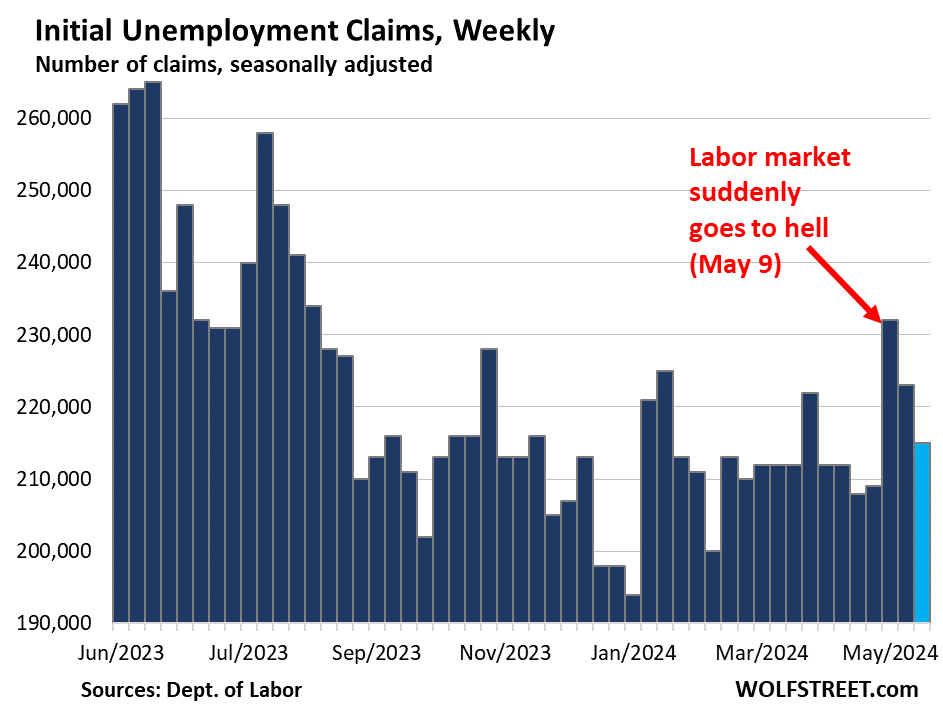

This is kind of funny. Initial claims for unemployment insurance fell by 8,000 to 215,000 in the current reporting week, after having fallen by 9,000 in the prior week, according to data the Labor Department this morning.

What’s funny is the headline treatment that the jump two weeks ago (May 9) to 232,000 had received: It was hyped as a sign that the labor market is suddenly weakening, and that the Fed would start cutting rates soon (which we obviously pooh-poohed at the time).

So today, initial unemployment claims were back to the historically low levels that had prevailed for much of the past two years, another sign that the labor market is relatively tight. We take this seriously because the data are an ingredient in our Favorite Recession Indicator (more in a moment):

One of the big reasons why these initial unemployment claims data fluctuate from week to week so much is that this is raw data of unemployment insurance claims that newly laid off people filed with state agencies, and that the state agencies then process and submit by the weekly deadline to the Labor Department.

When they miss the deadline, those claims then go into the next week, which lowers the number of claims in the current week and increases the number of claims in the next week. When Rhode Island does it, no one notices the difference. But when one of the big states does it, it leads to big shifts from one week to the next.

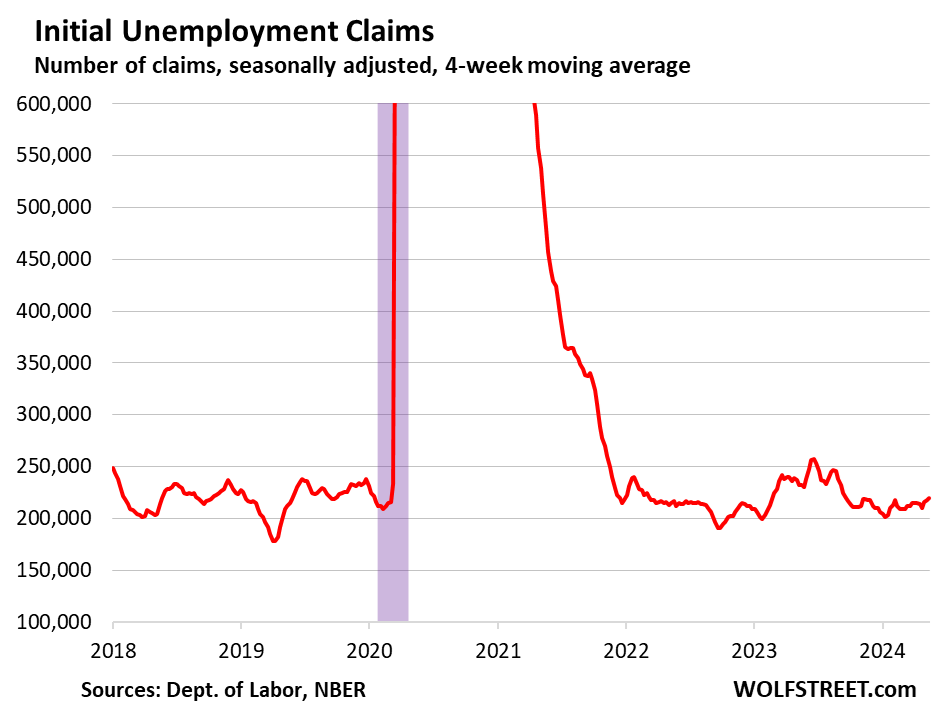

Which is precisely why the Labor Department also releases the four-week moving average, which irons out those shifts between weeks.

On May 9, the four-week moving average of initial claims inched up to 215,000, having been essentially flat at historically low levels, as we pointed out at the time.

Today, the four-week moving average ticked up to 219,750, still at historically low levels. The now vanished little hump between February 2023 and September 2023 was the result of the layoffs in tech and social media:

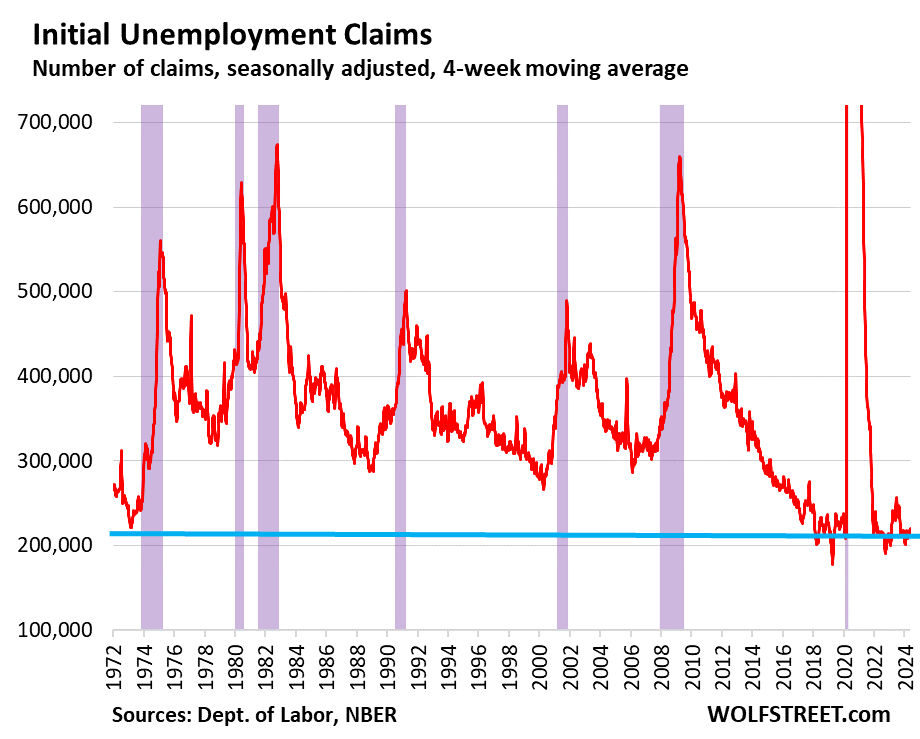

The long-term view (recessions marked in purple) shows just how historically low these initial claims for unemployment insurance are, especially when considering that employment and the labor force have increased over those decades, along with the population:

Our favorite recession indicator.

We’ve been on recession-watch here since shortly after the Fed kicked off its rate hikes in March 2022. The National Bureau of Economic Research (NBER), which calls out the US recessions, has always defined them as broad economic downturns that include downturns in the labor market.

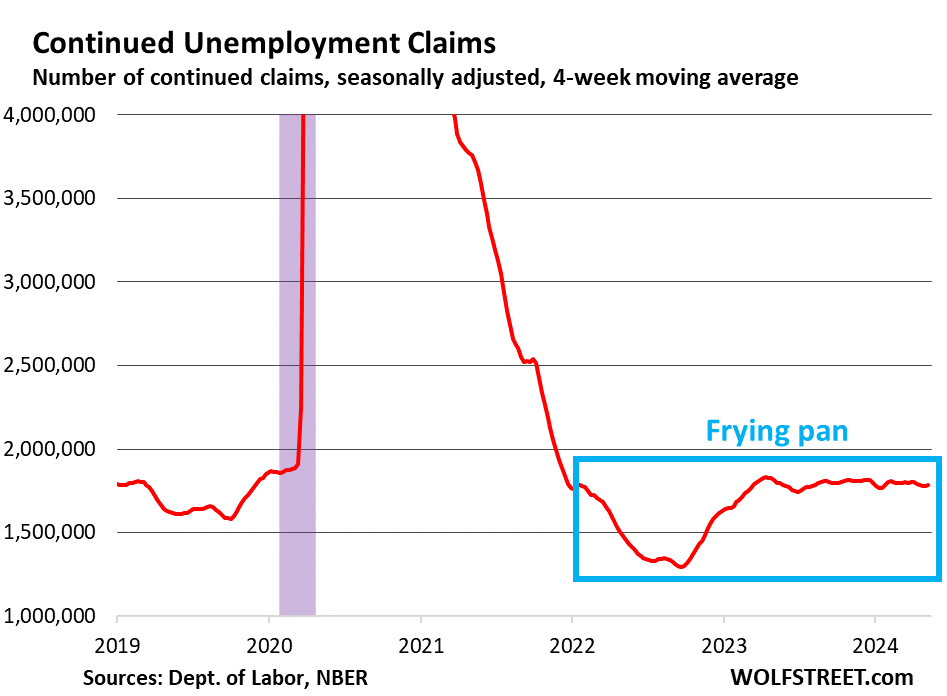

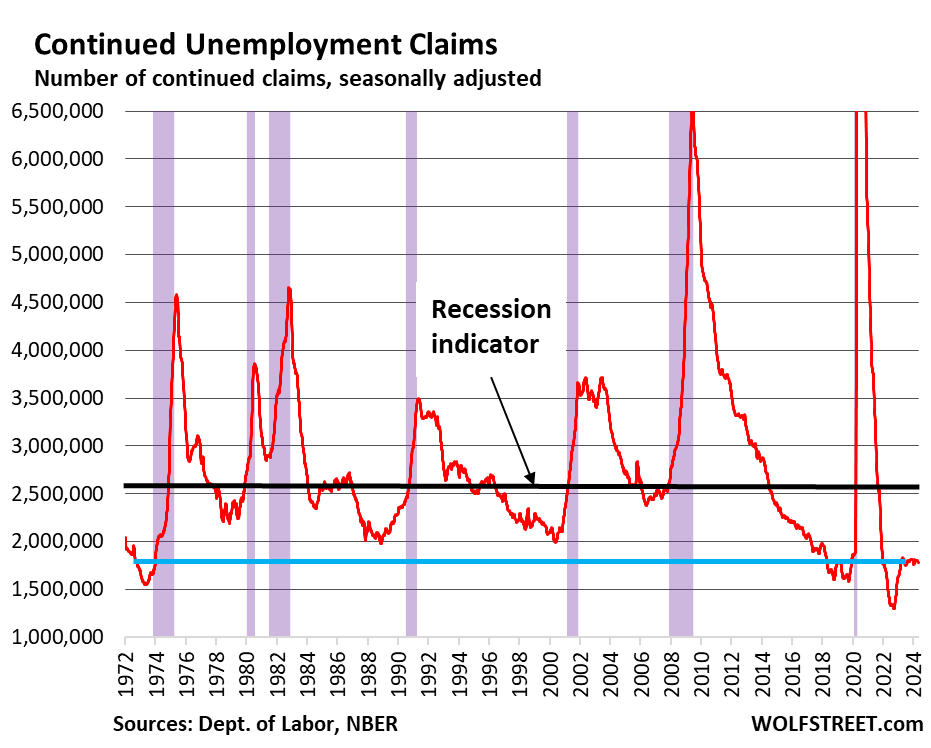

So we’re looking for sharp increases in weekly claims for unemployment insurance benefits (charts above), and for sharp increases in continued claims for unemployment insurance (charts below).

The number of people who are still claiming unemployment insurance benefits at least one week after the initial application – people who haven’t found a job yet – has been in the same relatively low level since mid-2023.

In the current reporting week, 1.79 million people were still claiming unemployment insurance. The four-week moving average has been roughly steady at around 1.78, and down a tad from the levels in December of 1.81 million.

A higher level of continued claims suggests it takes people who lost their jobs a little longer on average to find a new job.

This “frying pan” pattern, as we’ve come to call it, has been cropping up in a lot of economic data, formed by an undershoot coming out of the pandemic, and then a return to normalization:

Our indicator (below) points at an oncoming recession when the blue line gets close to the black line.

Recessions from the Great Recession back through the early 1980s began when continued claims for unemployment insurance spiked through the 2.6-million mark (black line in the chart below).

Today’s level of 1.79 million (blue line) is far below recessionary levels (black line). It points at a labor market that is among the tightest of the past 50 years and tells us that there is still no recession in sight yet.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

MW: Economy speeds up, S&P finds, but inflation is still a sore spot

Jobless claims fall again to 215,000. Strong labor market fuels U.S. economy.

Inflation, EVs and rising fuel efficiency put unexpected dent in gasoline demand

Why bond returns could hit double digits in 2025

There’s got to be alot more labor bad news in the coming months to portend a looming recession. I don’t see it this year at all. With $1.5-1.7T in looming deficit spending this year, all bets are off. Government spending at all levels is literally sustaining the economy from a very big recession. None of this is rocket science. It’s all about shouting loud enough to get the Fed to lower rates, as if a DOW @ 40K isn’t enough of an asset bubble.

Wolf, thanks for this continued article series. Question for you on recent trends. Do you think there are new factors that are keeping continued claims down when compared to the past to a significant degree? I’ve heard things like part time work (uber, etc.) have contributed to people not taking unemployment benefits. Wondering if there are major trends skewing this specific data series.

Yeah, this BS keeps being circulated by websites where the labor market is always collapsing. But the proportion of part-time workers is historically low.

https://wolfstreet.com/2024/05/03/jobs-wages-mass-immigration-full-and-part-time-workers-unemployment-prime-age-participation-rate-and-multiple-jobholders-who-are-they-anyway/

For the record, my favorite wolf street series is the roll off of Treasuries & MBS for QT

Yes, it’s called $1.7T in deficit spending. That’s the new trend, so this makes normal indicators like the inverted yield curve, etc near meaningless.

A honest question:

Suppose, if someone is laid off and is on un employment benefits. The unemployment benefits go away after few months. Would this person show up somewhere in data as unemployed ?

I have a friend on this boat. Out of job for a year, out of benefits, tyring his best but no luck so far.

When standard benefits expire after 26 weeks, and the person is still not employed, that person remains in the “unemployed” data in the monthly jobs report. The monthly jobs report is released every first Friday of the month, and we cover it here.

This article is about unemployment insurance claims, and when people no longer file a claim for UI, they come off the data. This has always been the way and is a CONSTANT, not a variable. It does not change anything because it’s always the case.

It is an ambiguous chart that is more difficult to understand than is necessary. The blue line is “today’s level of 1.79 million” per the article. Why today’s level is shown as a horizontal line (ie on the axis that represents time) is something that took me more time than it should have to figure out. Representing an instantaneous value by a line spanning 50 years seems like very poor charting.

Despite what Wolf says, you are correct. Imho, that blue line does not belong on the chart as it just adds confusion. Or maybe I still don’t understand the information the chart is supposed to convey.

Tater, the blue line is interpreted with reference to the black one (last figure in the target article). The black one is a ballpark new unemployment claims threshold above which all hell breaks loose. The blue line, the current level, is well below it. But I share some of your concern about time, especially with that early 70s threshold (left side of the same figure) being closer to our current levels. Coincidence or generational signal suggesting a multi-decadal cyclical change in threshold? Who knows? Speculation. Maybe the data set goes farther back in time and could provide some clues. Maybe not. But notwithstanding that, it seems to me a fair point to make: current levels are far below the 45+ year all-hell-breaks loose threshold.

Seems like it should read: “Our indicator (below) points at an oncoming recession when the red line gets close to the black line.”

Nope. The BLUE LINE. This horizontal BLUE LINE

But the blue line is _parallel_ to the black line—they’re never going to intersect!

Tally me among the initially-confused-but-figured-it-out.

WHO THE F**K SAID “INTERSECT?

Can’t you people read??? This is what it says in bold print in the subheading:

“Our indicator (below) points at an oncoming recession when the blue line gets close to the black line.”

DDTM: the blue line is just the level of the most recent datapoint. Its to make comparing it to past peaks & valleys visually easier.

The blue line moves up and down along the Y axis. The black line is the level on the Y axis (# of continuing claims) that needs to be reached for the recession indicator to be positive.

Wolf is trying (I think) to emphasize that continuing unemp claims are at historic lows, ergo we’re still a ways off from recession-risk territory. The blue line helps make the point visually.

The blue line allows the reader to immediately understand today’s continuing claims data in the context of the 50+ year history of the chart relative to the historically recessionary level. I don’t think it adds confusion to understanding the chart, but rather helps the reader understand the information the chart is conveying more quickly.

Would not that blackline move with increased population?

You’d think it should (slant upward), but it didn’t over the past 4 decades.

I was wondering the same. How is that recession indicator calculated?

It’s NOT calculated, it’s a historical observation, it’s how it happened over the past four decades: when it got closer to about 2.6 million, the recessions began, going back 40 years. So when the blue line started rising toward it and got closer, the recessions got closer. That’s how it has been over the past four decades.

Reading comprehension is a big problem in the Country.

So to answer your question No people can’t read.

Blue black red lines got me flat lining lol

…seems a pretty fluid attitude, that of coloring/driving inside/outside of the lines (akin to ‘rules for thee, but not for me’?)…

may we all find a better day.

Why have tax collections (income tax and FICA) over at the treasury not increased significantly since 2019 with such a “wonderful” job market (I think total income tax collections are up like 6%) and a roaring labor economy? Seems those should be correlated to a degree?

You’re abusing my site spread lies and bullshit. Do that on X. That’s what X is for.

Red line in the first chart below is tax receipts. Green line in the second chart below is Social Security payroll deductions (receipts to the Trust Fund). Both are VASTLY HIGHER than in 2019.

That is significantly different picture of the data than the chart I was referring to regarding tax collections – see link below:

https://fiscaldata.treasury.gov/americas-finance-guide/government-revenue/

Abusing website and spreading lies and bullshit by referring to treasury.gov website — WTF???

The chart you’re referring to in what you linked is inflation-adjusted tax revenues. Can’t you read anything, you idiot?? And even adjusted for inflation, those tax revenues are up from 2019.

Wolf:

You keep pointing that the increase in labor force has to be taken into for other indicators. How come it is not applied here (not just you but everyone like the historical data on continued employment and the magic 2.5M threshold)? Perhaps a percentage might give a better indication. Thanks.

I’ll just repeat what I said above: You’d think the black line should slant upward, but it didn’t over the past 4 decades.

So if in the future, the blue line hits the black line, and there is no recession, then, well we watch the data where the recession kicks in, and then the black line will have a kink upward, because it was horizontal for the past four decades, and nothing is going to change the past.

Wolf I think you are just missing the subtleties of this slope. It looks to me like ~0.1% increase per year.

This is still 1/10th the working age population growth. The back drop is lots of funny changes to who in a household works and makes claims over this same period.

BS. I’m look at the actual numbers. Continued claims in millions at the time the recession started:

Jan 1980: 2.71

Jun 1990: 2.43

Mar 2001: 2.56

Dec 2007: 2.62

The tea leaves aren’t cooperating. Or more likely, I am realizing my profound ignorance.

I don’t think it is ignorance phleep. If it is, you have plenty of company. I was certain at the beginning of 2023 that a recession would begin in that year. So much for that.

The results of this latest cycle of interest rate hikes are not the norm.

Hikes are USUALLY accompanied by layoffs. This one has not – though that may still happen.

Hikes are USUALLY accompanied by stock market decreases. Not this time. At least not yet.

Hikes are USUALLY accompanied by people curtailing their consumption. Again, not yet. As Wolf has documented, drunken sailors a-plenty out there.

All these typical hike effects may yet happen. It may be the unusually high degree of Fed stimulus that has caused this delay in economic consequences. Listening to Powell, I’ve repeatedly gotten the impression this has taken him by surprise as well.

Dropped 600 pts today on the news of no rate cuts.

Artificially low + late + massive, massive over stimulus + drunken sailor congress = massive lags, if at all. The Fed should have went immediately to neutral, then started their 75 bips campaign from there.

On the positive front, M2 is slowly creeping back to pre-pandemic trend, but I’m not posting any maths on that cuz Wolf is on the warpath today :)

Jeremy – I’ve put a lot of energy into understanding M2 over the past year and have come to concur with Wolf on its flaws as a meaningful economic measure. My thesis isn’t fully baked yet, but I’ll risk his wrath with a high-level teaser:

At the simplest level money is created in two ways; naturally – through economic activity funded by commercial bank loans, and artificially – printed by central banks and loaned to said commercial banks (QE). Everybody here probably already knows this, but I had to learn it myself…

When the natural process is predominate, money supply follows GDP as increasing (or decreasing) economic activity organically creates (or destroys) money as needed. In this environment a competent central bank can maintain an inflation target without much effort.

But when the artificial process exceeds some undefined level (the data points to a balance sheet range of $5T-$7T, but most likely a % of GDP is more appropriate) this excess liquidity will result in inflation of all types as it flows through the financial system and is subsequently multiplied via the natural processes alluded to above. That’s what we’re living through now, complicated by the well documented supply chain disruptions and subsequent deglobalization.

I’ve never asked him directly, nor have I seen him state it explicitly, but I suspect that thinking of this type is why Wolf focuses so much (and so well) on the Fed balance sheet and only alludes to money supply scornfully. And if any of this is even directionally correct we should all just follow his lead and keep an eye on the Fed balance sheet for an indication as to when the excess liquidity has passed.

And before you flame me Wolf, please be gentle, I’m planning to update my subscription in July…

From someone who entered the adult working world in 1960, my observation is it doesn’t get any better than now. And now, is going to last a while longer.

I recall losing my job in 1970 on the very day my neighbor got a big promotion. The lesson is it all depends on where you’re standing when the music stops.

If inflation was in check you might be right. But it’s not.

Not to mention it looks like goods deflation has reversed course to join the party. Next two cpi and pce prints have shit comps rolling off. Summer is going to be fun. Coming soon: Fed hawks on full display.

“And I think to myself, what a wonderful world”. That was a different Louie but he would agree “it doesn’t get better than this”.

As far as the jobs market is concerned, jobs galore, just got to learn how to stretch your dollars a bit further….easy peasy.

The music stopped for louie armstrong 53 years ago.

Not necessarily. While some claim most AI projects are new “pump and dump” scams, there are lots of jobs that will be automated even with the narrow AI available, particularly because our gentler, demographic “cliff” means once baby boomers retire there will be job automation opportunities, as with clothing creation during covid, reportedly.

Some AI job automation will face hiccups: I anticipate lots of food poisoning lawsuits due ill maintained/operated AI robot-cooks. However, the cost savings from using AI-controlled robots for some, repetitive jobs will be too large and tempting.

10:52 AM 5/23/2024

Dow 39,155.16 -515.88 -1.30%

S&P 500 5,283.45 -23.56 -0.44%

Nasdaq 16,797.60 -3.94 -0.02%

VIX 12.35 0.06 0.49%

Gold 2,336.50 -56.40 -2.36%

Oil 76.72 -0.85 -1.10%

Noise!

I really enjoy the analysis here. I do have to wonder about the reason behind all of the misleading headlines, though… Are they simply publishing what people want to hear? Are the sources controlled by people with a very specific agenda? It’s hard to shake the impression that much of what is out there is midleading, even when you can’t put your finger on it but what is the endgame, or is it all that shortsighted??

Predicting the collapse of the labor market gets a lot more clicks than saying the labor market is doing just fine. Clicks = money.

Clicks which are endorsed by advertisers = money.

Other clicks, not so much.

The agenda-to-mislead is subtle but real, driven by those who control the advertising money.

We need a return to subscription-based media, where the incentive is to avoid lying to the subscribers and thus pissing them off to the point where they cancel.

In the meantime, it pays off well to donate to Wolfstreet and keep the unbiased analyses flowing!

All good points, but the subscription model only works when the product is journalism. Generally on the internet the product is eyeballs, ours (credit Serra/Schoolman).

An educated person could get all of the relevant economic information they need from this site and the Fred data. The rest of that BS is just content generated by the “news” vertical of a vast entertainment (eyeballs) empire. Treat it like the entertainment it is.

What if the subscribers want to hear specific things regardless whether they’re being lied to? I’m not being facetious, I think it’s a real problem today.

“Clicks = money.”

Chicks = honey

[Tin foil hat territory] Hey all, media like the town cryer, newspapers, radio, television, YouTube, socials, dark web, brain implants, etc. Have always been weaponized by a small elite groups to placate the masses while they engineer total control. Reason for all the fear mongering news and fake news is to keep the masses fearful, divided, and controllable . When people are afraid, they look to that savior to taken them back to normal. This entire process of elections are now a clown show of electing the new money God for X number of years. Just some people are rigging this process for their own benefit; any means necessary.

What’s fascinating is not just how low unemployment is, but that it seems to have stabilized at this level.

On the retail side of my company’s e-comm operation, they’re constantly struggling to find good salespeople. Lots of churn, with some employees not lasting more than a month. Slackers who would have been fired if hiring wasn’t so tough, etc.

Feels like labor shortages are the new normal.

Yes, of course, it is with all of the demand. The top 40% are killing it in terms of spending. They can afford to. Everyone else becomes a very mixed bag to S-show as you work your way down the ladder.

With some luck from continued sticky CPI, a consumer credit crunch will meet a CRE with the same fate sometime in the next 12 months or so. At some point, something(s) will combine to start kicking up job losses.

What’s a “retail side of [an] e-comm operation”? This may ordinarily be self-evident, but I’m struggling with it today.

Heh, I say it like that because I think my department (e-comm) is more important. But its just a traditional brick & mortar retailer that added an internet sales dept when selling on the internet became cool.

Why wouldn’t it? Boomers and older retiring with buckets of money to spend. Plenty jobs serving that cash stream.

I dunno, I think there’s something else going on.

I also see lazy salespeople – not just lazy with the non-selling tasks, but literally leaving money on the table. Not wanting to write up orders for easy sales that would earn a hefty commission. The other day I said to one of them “what the hell’s wrong with you, don’t you wanna make money?” And she just shrugged.

I was also trying to take a step back from one of my regular 1099 gigs, and my boss had a hard time finding my replacement. I stayed on working that gig for longer than I wanted to avoid leaving the company in a tough spot. But I was puzzled by the fact that no one I asked wanted the job. Its a cool gig that pays well (but also hard work).

I guess it just feels like no one wants to work.

16-24 cohort aren’t working anywhere near in 2000. That’s a structural change aside from the pandemic – kids are focusing on school. But 25-54 are working at peak clip. Over 55 aren’t working as much – aging population and they have a ton of wealth. There’s your structural demand for labor for all their dollars. Take health care as the easiest example for where it shows up in both jobs and inflation. The Fed can’t do anything about that as long as Dove Powell stays Dove Powell. The wealth effect is entrenched here and we need to induce a recession to change it.

Not sure if we are allowed to link articles here, but “Blackrock’s bond guru Rick Reiner…” hit the nail on the head today. The article did leave out one key term – financial repression has ended. Looking back with 20/20, no wonder the Fed couldn’t spur inflation for a decade plus.

Yet despite near record low unemployment, high stock market, high residential real estate prices and moderate inflation, the Fed is walking on eggshells not to spook the markets.

Perfect example is Powell’s answer in his May FOMC speech when he was asked, “Did the FOMC discuss rate hikes?” and he stumbled out a non-answer, which the recent Minutes show was a LIE. Various FOMC members did raise the concept of rate hikes in the Meeting. Yet Powell bent over backwards not to admit it.

That is very telling.

Me thinks there is something afoul in Denmark. Can’t yet put my finger on it… But it either has to do with the election or some risk that they are aware of which we are not.

It’s obvious what’s going on. The administration is pulling his strings. They don’t really want the inflation to stop. They like hurting the poor.

Wolf, I’m wondering is there anything that can give an indicator of how much excess employment there currently is? The theme I’ve heard recently from friends in consulting (Deloitte, Kpmg, and Bain) is that they’re sitting around doing nothing. They’re worried and looking for new jobs. When they’ve interviewed they’ve heard oh yeah we’re getting longs of applicants from ‘fill in long list of big name consulting firms here’. A number of friends in sales have been laid off and haven’t been able to find new positions. People who always hit their numbers and were making $300K+ a year. Friends in recruiting are nervous, again they’re sitting around doing nothing all day. One in external recruiting had their commission structure halved and hasn’t been able to find new work. Most people seem to be employed at the moment, but there seems to be a lot of excess capacity at most companies that they’re holding onto in case business takes off, but I have to wonder if at some point they’re going to realize rates aren’t going back to zero.

The big four consulting firms have been cutting staff, that’s been happening for a while and is already included in the numbers, and it should have happened a long time ago. Some announced layoffs late last year and earlier this year, others are doing it quietly, it seems as part of their restructuring. Companies have finally figured out that these consultants are useless and a waste of money. Covid taught lots of managers lots of things about what it is really useful (employees who are productive on their own), and really useless (office space, consultants, etc.).

Consultants need to go back to school, pass the CPA exam, and work in the big four’s auditing divisions. There is a shortages of accountants.

At what point will the Federal Gov’t have to rein in spending and actually pass a balanced budget? I would think that alone would slow growth and weaken the labor market.

This almost never happens, and there is ample historical evidence to demonstrate that it almost never happens.

According to a new Harris poll published by The Guardian today, most people think the US is already in a recession, somehow:

56% think we’re in a recession now.

49% think the s&p 500 is down for the year.

49% think that unemployment is at a 50-year high.

Quite the divorce from reality.

These people are being fed “facts” from sources who have a vested interest in making sure their viewers are angry and upset. These people have not been in touch with reality for some time.

…not hard to understand when ‘doom-scrolling’ has become entrenched as a component of our insatiable national thirst for ‘entertainment’ and always-there confirmation-bias (I.F. Stone and Walt Kelly, you departed us much too-soon…).

may we all find a better day.

Without sounding like Hans Moleman aren’t a lot of people in the Baby Boomer generation retiring a lot this decade, opening up more available jobs?

It’s like Canada caught up to it, and decided to give away millions of student visas with technically unlimited work hours, until recently capping it to 20 and promising to increase it 30 hours a week.

Not to bust your bubble, but many of the Boomers I know that *retired* or took the juicy buyouts from where I previously worked, are now employed by a competitor at a higher salary, better benefits, and more responsible positions – some of which are well past 70 years of age.

Apparently, certain companies value the experience of those that were instrumental in the success of their prior employer and reward them handsomely for that knowledge. The company that ejected them replaced them with a bunch of MBA’s that know little of the car business and spend their time squeezing nickels until the Buffalo sh!ts so they can meet their bonus target. When they finish destroying that company, they’ll move on to the next – hopefully in another industry.

Age retirement is different in this day…. the bulk of the population are no longer digging ditches, farming, ranching, nor mining coal. They push buttons on keyboards and burn neurons, which is not particularly physically taxing.

Does anyone have any idea when the AI related job losses will start to hit?

Every major technology innovation time period starts with increased employment, then moves to massive job cuts because of skill mismatches, then steadily increases employment as laid off workers or students learn new skills.

Seems like this is coming down the pike– perhaps someone has ideas on when/how the AI job cuts will start and when/how the new skills needed will emerge on the horizon.

Anyone have insights?

Crickets….because no one really knows how to use AI to replace jobs at this point in time at scale.

They’re trying to replace customer support people, but not only is that going to backfire by causing harm to their own brand, it’s only a tiny economic dent. So what, instead of talking to Indians right away, customers now have to talk to an AI before they can talk to an Indian?

So until problems start emerging that AI can actually fix, the solution will keep searching for a problem and AI will be a multi-trillion dollar toy.

AI needs well curated big data sets in PRIVATE spaces to be exposed and maximized. That’s happening now, but in relatively few data clouds, and with relatively few results. We are NOT EVEN CLOSE to seeing results from this trend. Picks and shovels now, results later.

When this capability finally shows results, THEN the exponential upper middle class white collar job losses will be measurable.

AI could theoretically replace any job that doesn’t involve manual labor. The technology is not there yet though imo. Chatgpt is machine learning, not ai, the word generative I find interesting because it doesn’t seem to create but more be a more efficient Google. If I ask it a coding question, I’ve it usually just regurgitates what’s in the highest ranked stack overflow post. If I ask it to do mine and my friends resume, they will be almost identical swapping skills on but the language used would make it obvious to any person it was a template (it does give a good starting point for a resume though). I’ve always wondered what does a Walgreens pharmacist do that a pill dispensing machine that scanned my driver’s license and insurance couldn’t do? IBM Watson in trails was out performing doctors significantly with treating cancer and certain other diseases. I listened to a talk given by one of the big 4 accounting firms back in 2017 (required CPE when I used to be a CPA) – they basically said the thing that will hold ai back is the rate of adoption. People have to learn to use it, old people have to be okay getting in cars with no steering wheels, people need to trust a machine vs an actual person for medical diagnosis etc. Adoption rates for people over 30 are slow and slower the older they are. Businesses who transition to fast lose customers. On the flip side jobs like accounting I’ve thought could be replaced by AI for years. I actually automated my old job as a CPA at a large publicly traded company before leaving to be a software engineer but then realized I had to sit there and pretend to work because I’d basically eliminated my job. I could have done that to the whole teams pretty easily.

Leisure and Hospitality, Medical and Social services are great place for the 6.5 million unemployed to look for entry into the rat race. Brick and mortar retail establishments and restaurants are just revolving doors. We are losing down or closing early seems to be the moniker for a lot of small businesses. The old saying is that everyone who wants a job has job might be true in todays society.

It was almost funny yesterday during the Gundlach/Rosenberg broadcast that Rosie & Gundlach agreed that the top tail risk of 56% inflation resurgence and 23% recession should be reversed. That recession is more likely. I’m shocked by that. I guess we will see who is right.

Employment is a lagging indicator. By the time the employment numbers start to sag, the recession is well underway.

BS. Look at the charts. I mean, just glance at them. And you will see.

///

Could this be the result of the general push away from a finance based economy towards a product/manufacturing based one? The big funds and Wall Street are still king of the game, but a 200 billion investment from 2023 is a significant sum. Hmmm…Investing into manufacturing instead of stock buybacks?

///