This surge in sales of high-end homes changed the mix and thereby skewed the median price.

By Wolf Richter for WOLF STREET.

Sales of existing homes of all types were still dogged by the 7% mortgage rates, but a shift has been taking place that took amplitude in April: Many more higher-end homes came on the market and sold, while fewer mid-range homes sold. This shift impacted all kinds of metrics, from inventory for sale to the median price.

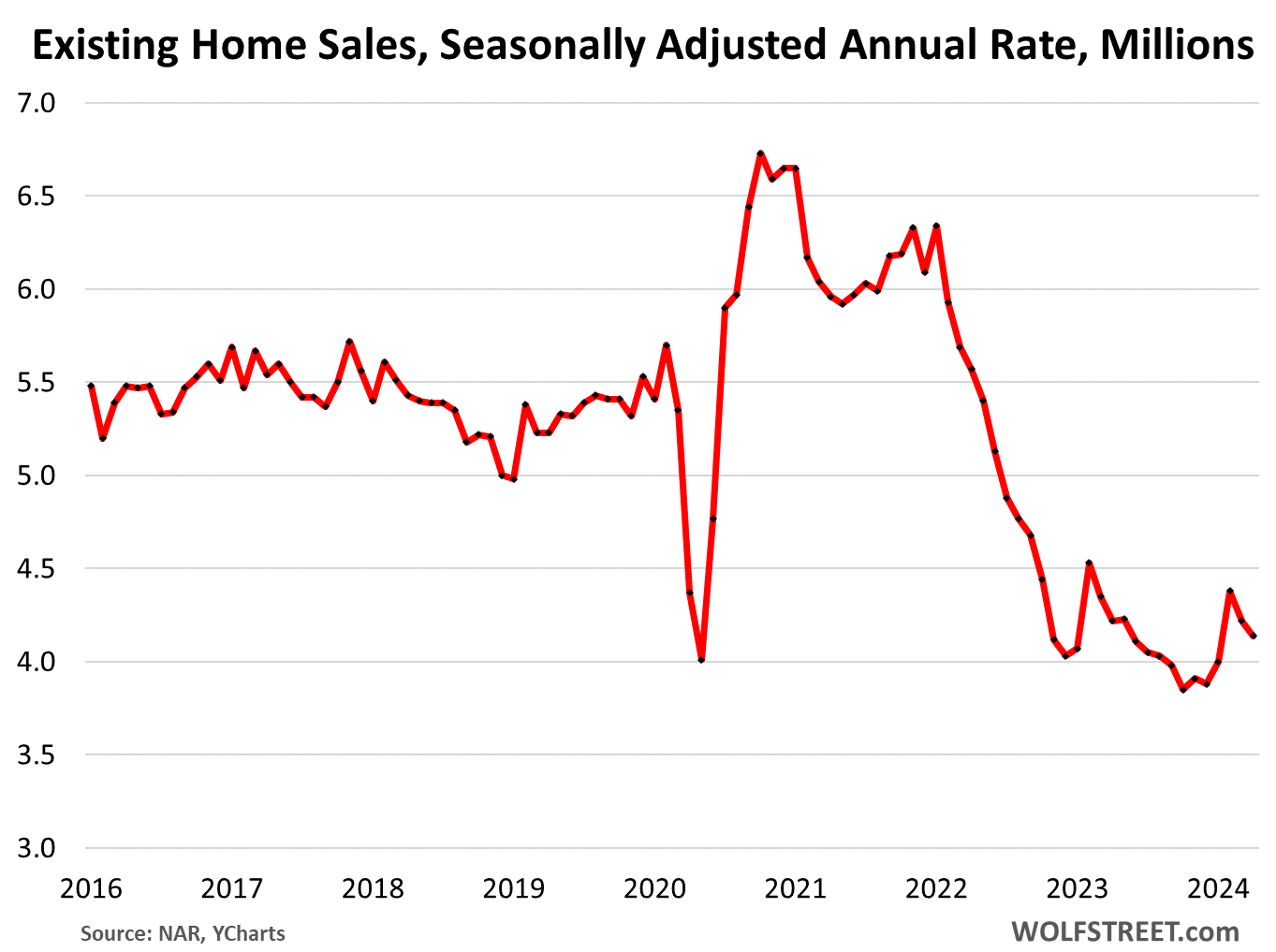

So the seasonally adjusted annual rate of sales of single-family houses, townhouses, condos, and co-ops fell by 1.9% in April from March, to an annual rate of 4.14 million homes. Compared to the Aprils in prior years:

- April 2023: -1.9%

- April 2022: -25.7%

- April 2021: -30.5%

- April 2019: -20.8%

- April 2018: -23.8%.

The seasonally adjusted annual rate of sales late last year had been the lowest since the depth of the Housing Bust in 2010: (historic data via YCharts):

The entire housing market has shrunk by about 20% because a large portion of homeowners with 3% mortgages are neither buying nor selling, they’re just sitting tight and have vanished as demand, and have vanished in equal number as supply, and so sales and supply are down in equal measure, and the churn is down. Realtors make money off the churn, coming and going, and for Realtors, this situation adds another layer of problems to their livelihood.

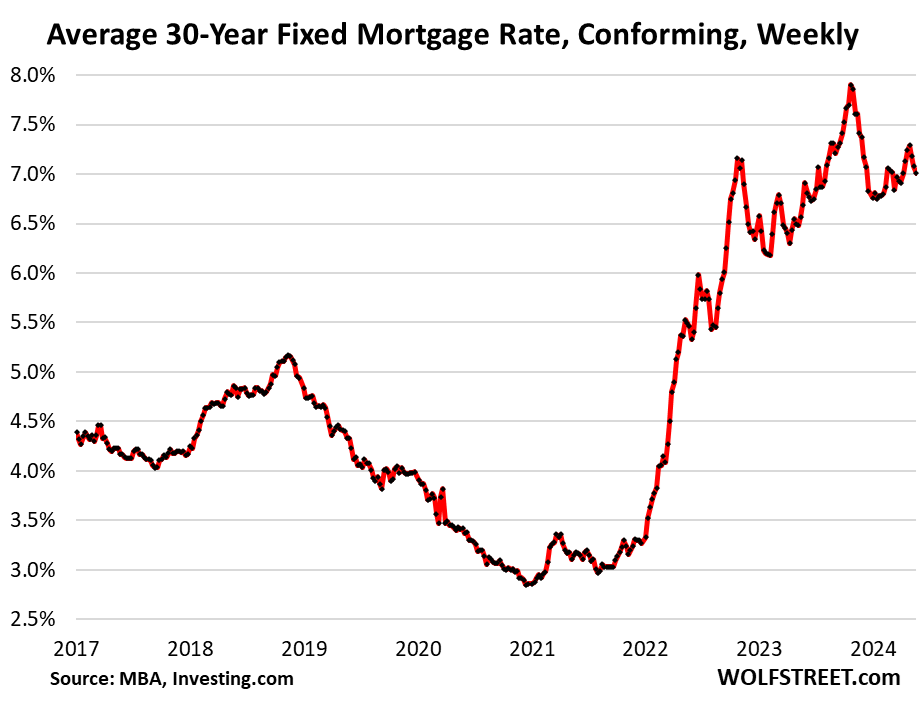

The average 30-year fixed mortgage rate was above 7% in the latest reporting week, according to the Mortgage Bankers Association today:

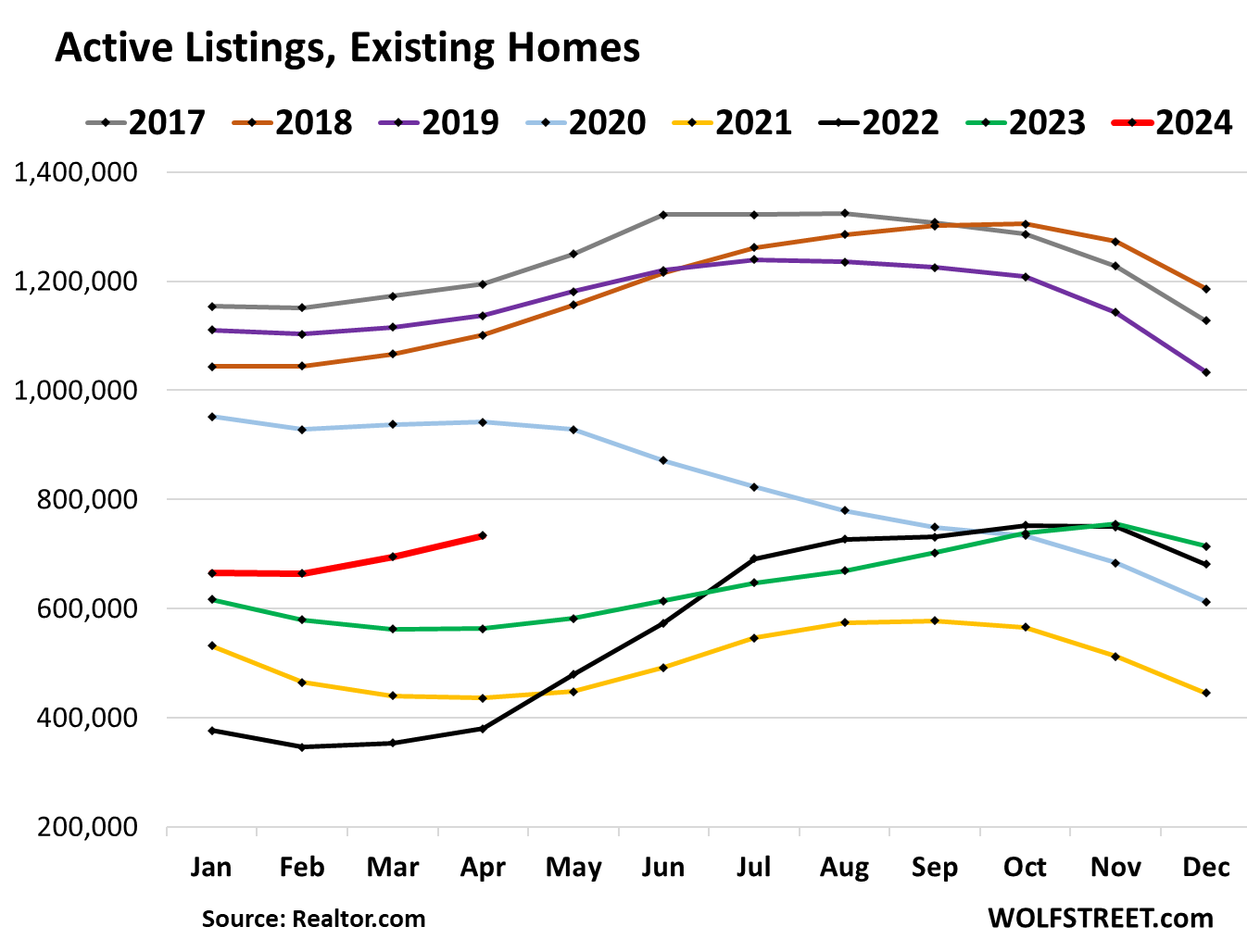

Active listings have been surging, as new listings are coming on the market amid slow sales. In April, active listings rose to 734,000, the highest level since before the pandemic, and up by over 30% from a year ago, according to data from Realtor.com. Compared to April in prior years:

- April 2023: +30.4% (green)

- April 2022: +93.3% (black)

- April 2021: +68.6% (yellow)

- April 2019: -35.4% (purple)

- April 2018: -33.3% (brown)

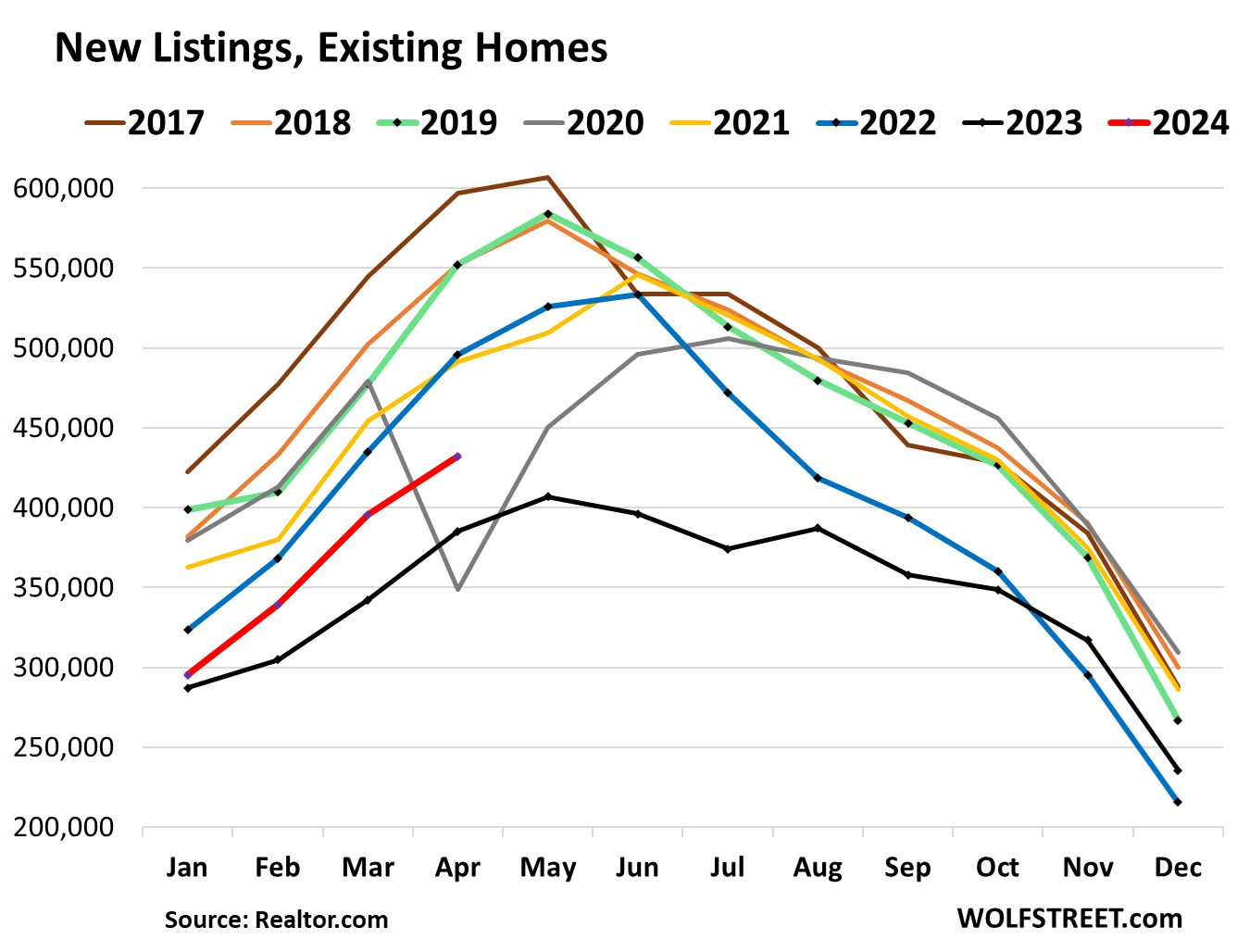

New listings rose by 9.2% from the prior month and by 12.2% from a year ago, to 432,000. This recovery of new listings and the sharp drop in demand has been fueling the continued rise of active listings, in a market where demand and supply both have shrunk by about 20% as many of the 3% mortgage holders have vanished from the market as buyers and as sellers (data via Realtor.com):

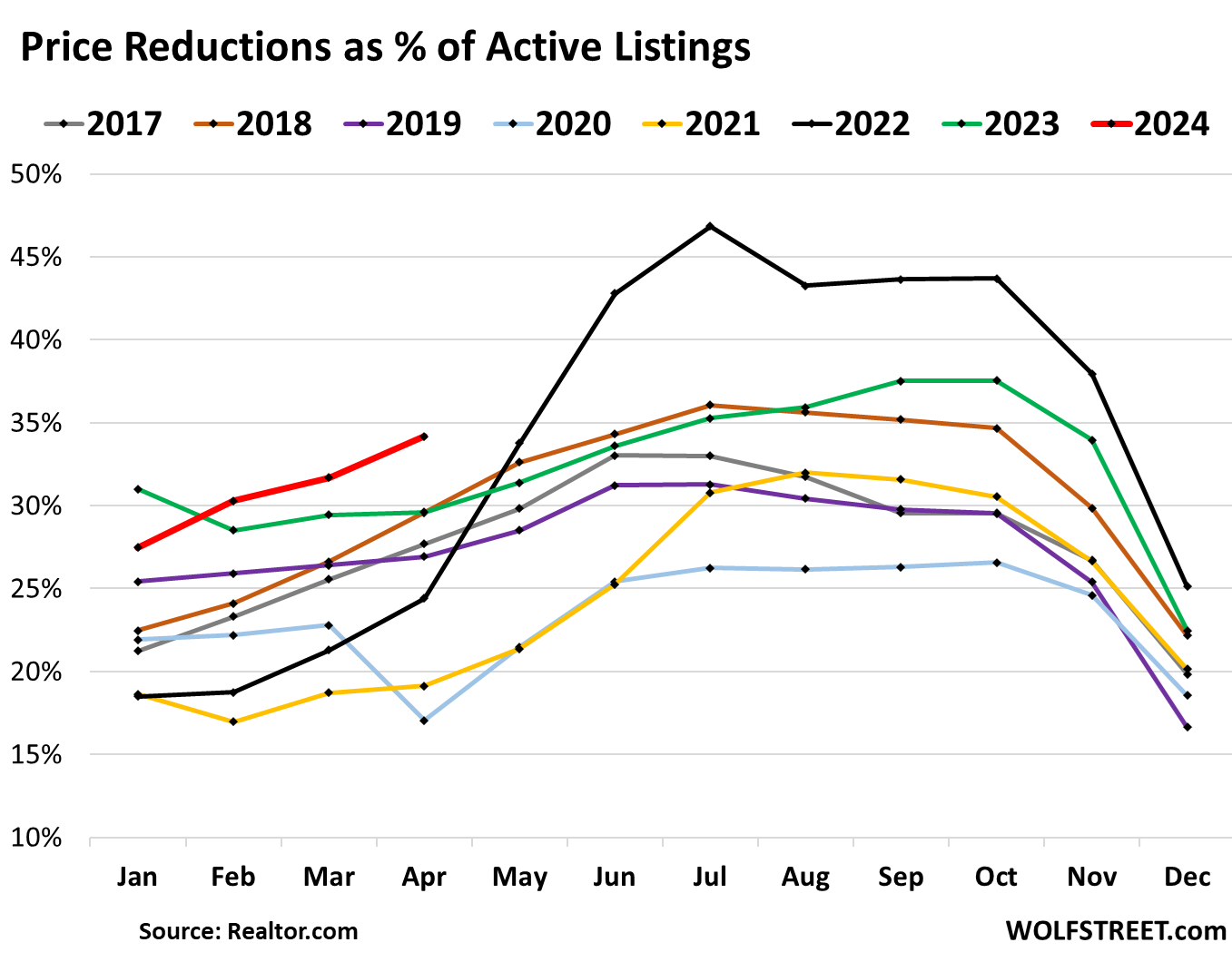

Price reductions jumped to 34% of active listings, the highest for any April in the data released by Realtor.com going back through 2017, as sellers are grappling with their aspirational prices and reality:

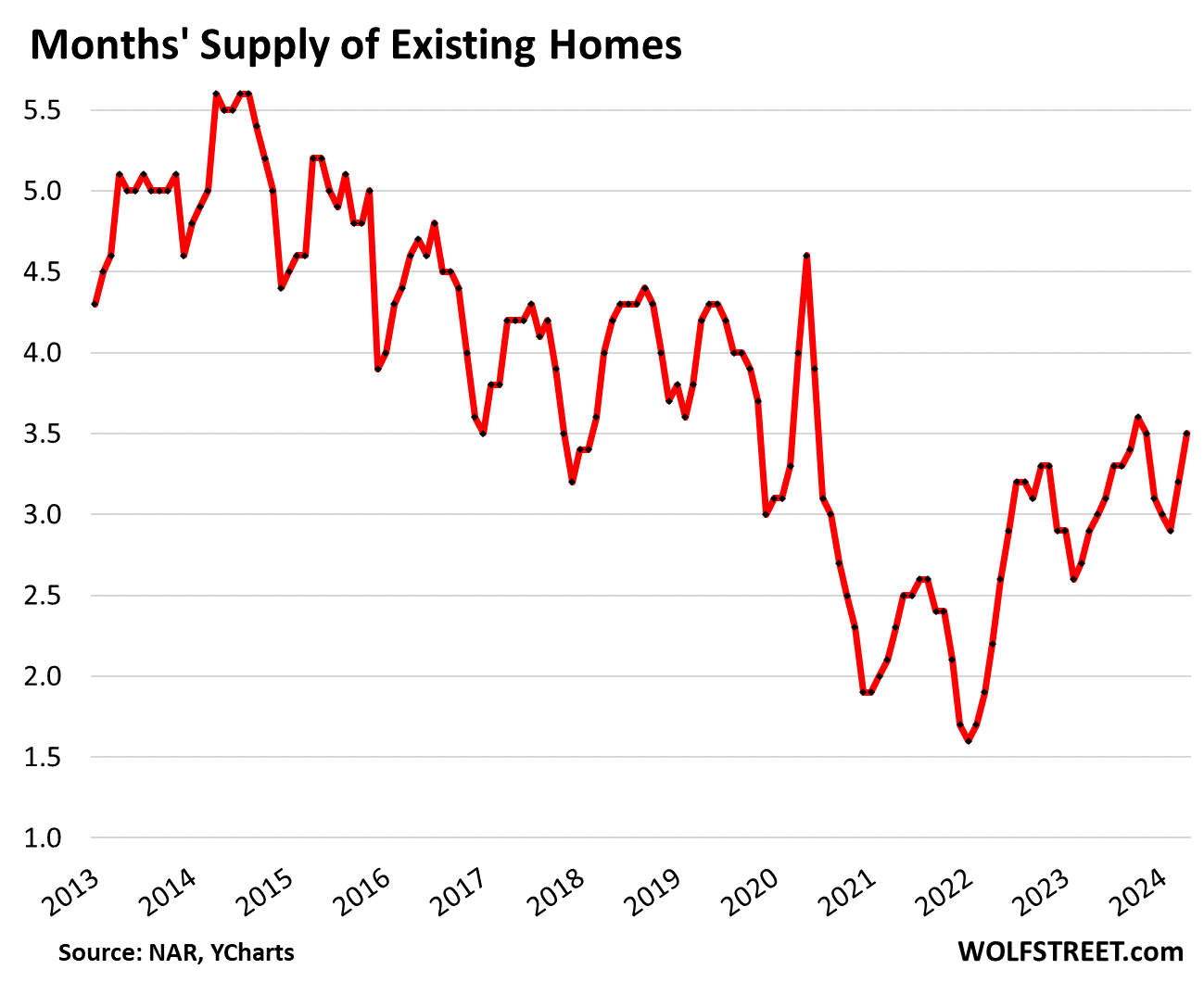

Supply jumped to 3.5 months, the highest for any April since 2020, as inventory for sale rose 16% year-over-year, to 1.21 million homes, while sales were down by 1.9% from April 2023, and by 20% to 30% from Aprils in earlier years, according to NAR data.

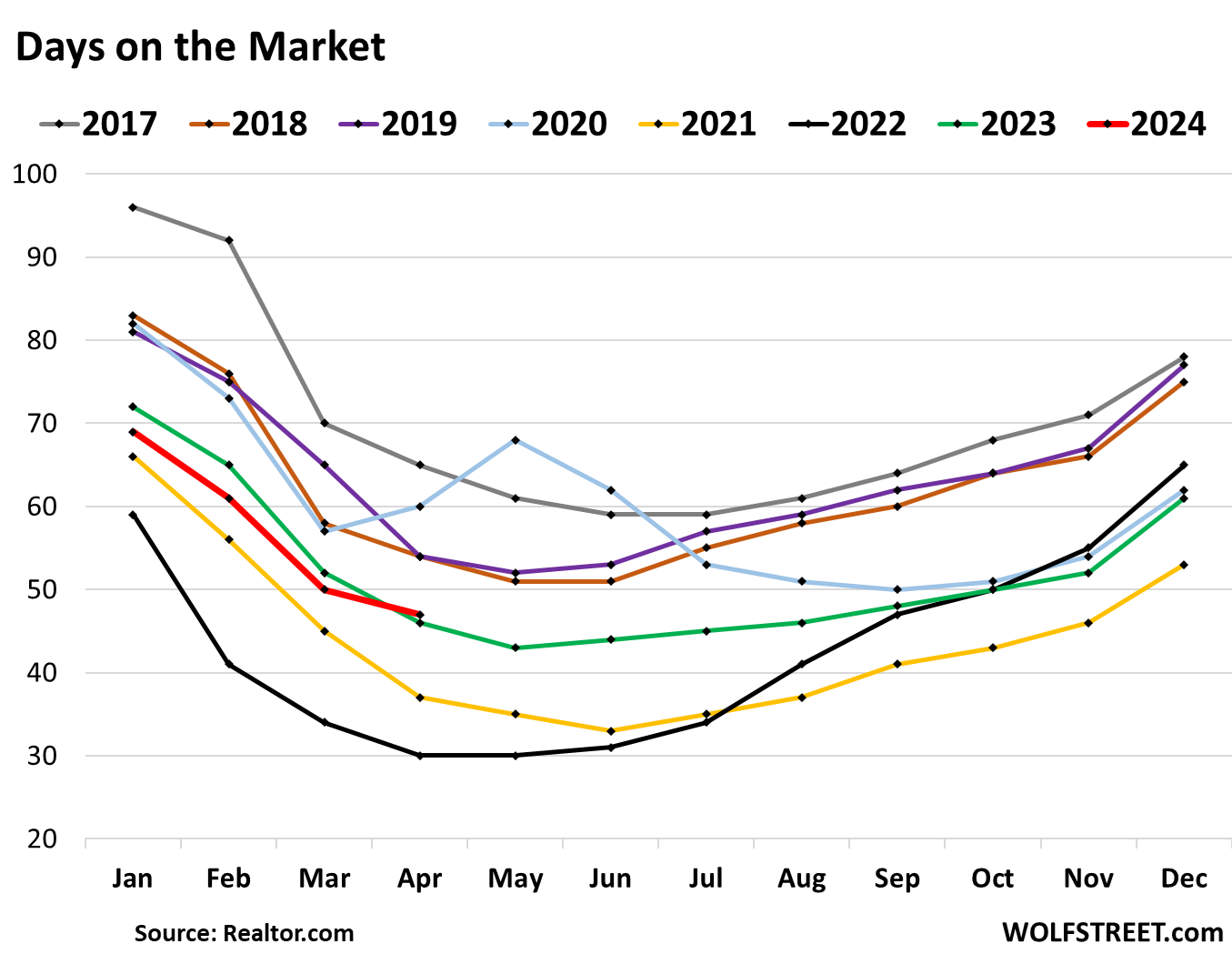

Days on the market – until the home is either sold or pulled off the market – followed seasonal patterns and declined to 47 days in April, but that was the longest for any April since 2020.

This metric is a function of both, how quickly a home sells, and how quickly it gets pulled off the market without selling (data via Realtor.com):

Change in the mix of homes that sold skewed the median price higher.

“Home sales changed little overall, but the upper-end market is experiencing a sizable gain due to more supply coming onto the market,” the NAR pointed out in its report. It said that inventory of homes of over $1,000,000 surged by 34% year-over-year.

Even as total sales “changed little overall”:

- Sales of homes of over $1,000,000: +40% YoY

- Sales of homes of $750,000 to $1,000,000: +24% YoY

- Correspondingly fewer homes sold in the mid- and lower-range.

So the mix of homes that sold changed, with relatively fewer lower- to mid-range homes selling, and a lot more homes at the higher end: $750,000 and up, and particularly $1,000,000 and up.

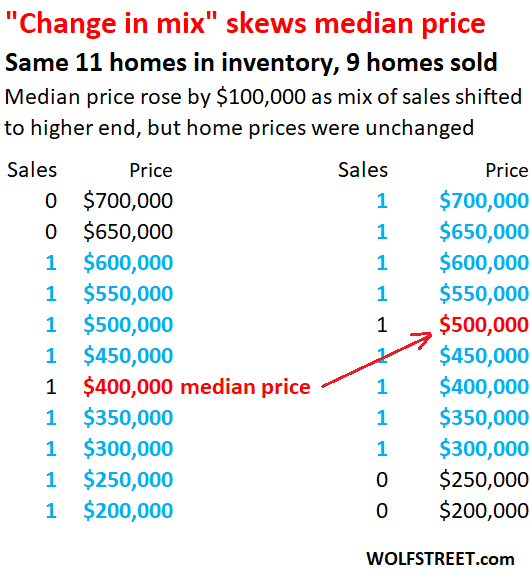

Since NAR brought it up, we have to talk about how a change in the mix skews the median price. To illustrate this principle, we once again have to look at our favorite market where 11 homes were in inventory at the beginning of the month, and 9 of those homes then sold.

The median price is the price in the middle of those 9 homes that sold. To get the median price, we make a list of the 9 homes that sold in order of price: The price of the fifth home from the top (or fifth home from the bottom) is the price in the middle = median price.

In the left column, the bottom nine homes sold, and the top two (black) didn’t sell. The median price is the price in the middle of the 9 homes that sold: $400,000.

In the right column, same homes, the top two higher-end homes sold, but the bottom two didn’t sell. So this shift in mix shifted the price in the middle up to $500,000, but the actual home prices didn’t change:

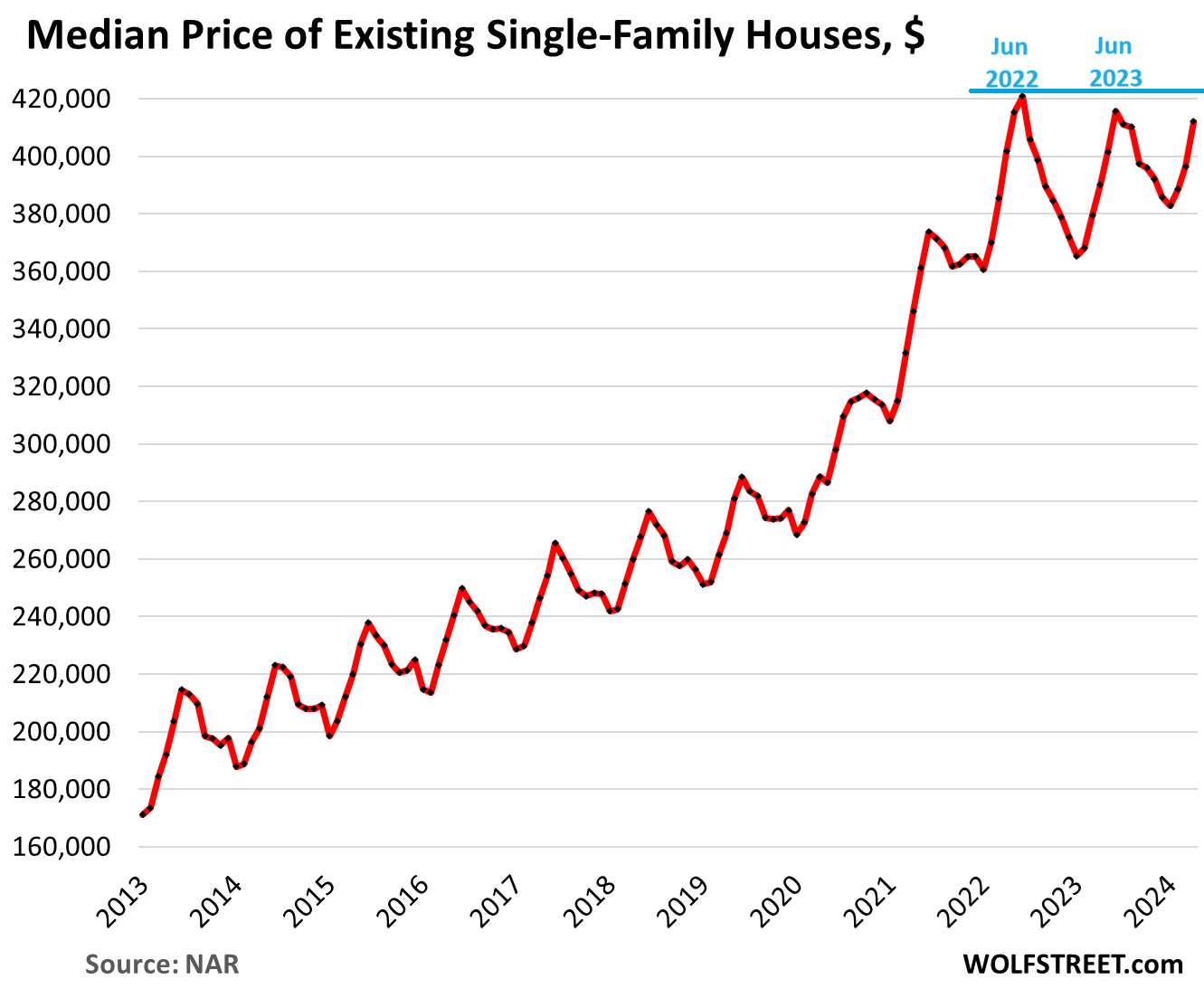

The median price of single-family houses whose sales closed in April rose to $412,100, up by 5.6% year-over-year, amid this large-scale shift in sales to homes above $750,000, and particularly to homes above $1,000,000 that the NAR pointed out. The April median price was 2.1% below peak in June 2022 ($420,900):

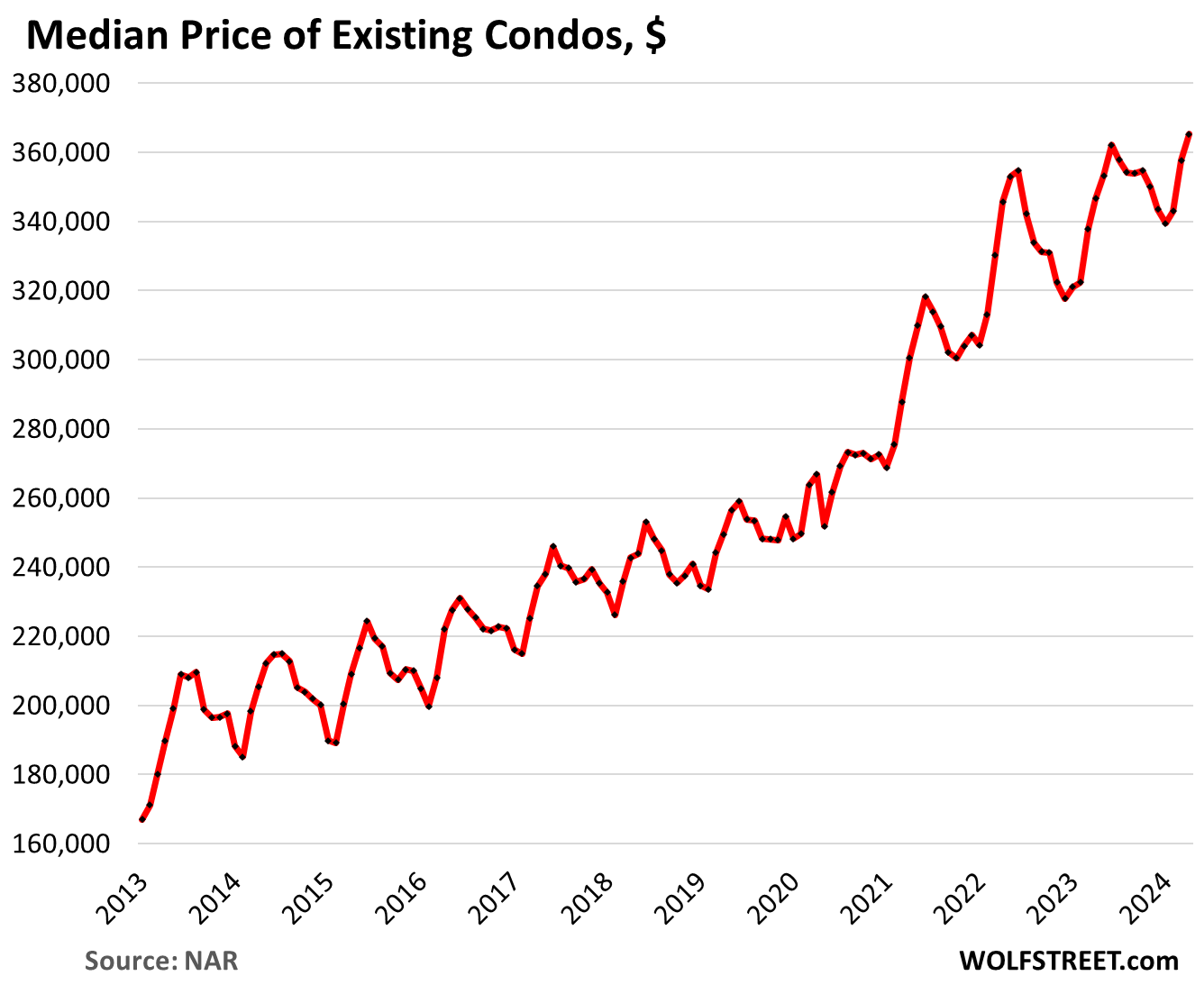

The median price of condos whose sales closed in April rose to $365,300, a new record, amid similar shifts in sales to the higher end.

In comparing house prices (chart above) and condo prices (chart below), we note that in 2013 and 2014, the median prices of single-family houses and condos were roughly the same. For example, in June 2013, the median condo price was $209,000 and the median house price $213,000. But then condo prices increased more slowly from there into the pandemic. In April, the median condo price was nearly $50,000 below the median house price:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“This surge in sales of high-end homes changed the mix and thereby skewed the median price”

I am sure the part about median price going up again will be what MSM and housing bulls talk including the context.

Crazy how higher end market is going up, wonder if market at all time high and Crypto back to $70k have a lot to do with that? As for inventory, hoping the housing market will draw some parallel from the auto market when it comes to inventory down the road, wishful thinking perhaps..

The wealth gap has never been larger, and it is rapidly expanding. Those who oppose rate hikes are in favor of the wealth gap. They love it, and they want more of it. They want to financially destroy everybody but the wealthy.

Those who oppose rate hikes also kill puppies and drown babies.

Since we’re just randomly attributing bad things to people without understanding their arguments or reasoning.

It’s the ZH conspiracy mind set: ‘there are evil forces at work’.

Hundreds of years ago: ‘why has my cow stopped milking?’ Because that old lady gave it the evil eye.

The fundamental problem is the electorate, the people. aka ‘us’ , who prefer short term largess, goodies, to balanced budgets.

JimGaslight reporting.

Nick Kelly, to your point: Watched a recreation of a Salem witch trial in Williamsburg this past year.

The startling thing about the witch trials is that for verification, the court used the following:

“The courts also used three types of evidence during the trials: Confession, Testimony of two eyewitnesses, and Spectral evidence.

Spectral evidence was a witness’s testimony that they saw the accused person’s spirit or spectral shape in a dream while the accused person’s physical body was elsewhere. The Puritans believed that physical realities had spiritual causes, so they accepted spectral evidence as proof of guilt.

The Malleus Maleficarum, or Hammer of Witches, was a 15th-century book written by two Dominican friars that provided instructions for identifying witches, how to get them to confess, and how to punish them. It was popular from the 15th to 17th centuries and helped convict thousands of people, almost all women, who were executed.”

When Depth Charge describes things: “They want to financially destroy everybody but the wealthy.”, you can’t help but think witch trial. Unfortunately for the rest of us, there are a lot of witch hunters among us.

The Fed is propping up powerful financial entities who depend on low rates, AKA hedge funds and PE firms that will be bankrupt with market rates. This isn’t a conspiracy theory, it’s empirically what is happening, and it doesn’t matter what reasoning they give for what they doing.

What he says is true, the rich will gain and the poor will lose as we continue down this road, even a blind mouse, 3 of them can see this is true.

The babies and pups are dead as well as price stability, Powell and the gang can do something about it but are afraid that something else might break. I say chop the tail off of the mice then lop off their heads.

The (commoner) Aussies have a good bumper sticker;

“Better Criminals than Puritans and Euro-Trash”

Better than 60% of us still believe they have a Daddy in the sky…I can see it’s comforting, but then so is a teddy bear.

I’m not convinced that the wealth gap is affected all that much by monetary policy. Who do you think gets most of the increased flow of money from the interest income channel when rates rise? It’s certainly not the poor.

No, monetary policy is a “heads I win; tails you lose” proposition for the rich. They get the asset price rises in low rate environments and the income streams in high rate environments. And the more they get you to fixate on monetary policy, Depth Charge, the less you’ll notice that the real action, and what they dread most, is on fiscal policy — which is to say raising their taxes.

This is nuts. We have had 14 years of interest rate suppression, which massively inflated stocks and propped up hedge fund and PE assets that are disproportionately owned by the wealthy, and even now interest rates are obviously below that needed to control inflation. Monetary policy has been vastly more important to wealth inequality than fiscal policy since 2008.

From my experience, the more free gov money the community gets, the more inequality increases. I’m part of the service/goods providers in my community. When more free money drops the money naturally flows to us, because that is where the people spend their money. And then we just stick in our accounts making interest. Compound this over years and you get extreme inequality. One class lives on government money and another gets that money by offering goods and services. I’ve seen it from both sides as I grew up with a single mom on welfare, and now I am a business owner where a lot of my customers are on welfare/disability/SS.

Yep eg, a decade of Terror and Death Taxes ought to balance the old economy out to a reasonable wealth range…….with lifestyles dropping left and right, of course. The suffering will be minimal, the crying ear splitting.

But as REAL human TIME on the our spaceship is running out, nobody with ANY power will allow taking a chance on Green New Deals and last ditch stuff like that..(might end up with bad neighbors)…They having believe MORE huge amounts of money will save them, and a scramble IS on to get it.

It can, but only if a lot of deaths “happen”.

I’ll bet the Heritage Foundation has some scenarios written up, since it seems to be the favorite rock to hide under.

Didn’t notice the whiney voices out from under other rocks, especially the Happy one.

Oh well, makes a comment section…….

What a croc.

Hanlon’s razor is the adage that you should “never attribute to malice that which is adequately explained by stupidity”

Number two…a first.

When is high or lack of insurance going to become a factor?

And who will pay it?

But I lost to another professional complainer.

It already is a factor….#3. Mr wilson can’t get a home loan because of these higher ins rates, the wilsons are dressed up with nowhere to go.

I don’t have insurance on my house, I weigh the odds and hope I’m not burned alive in my abode, a good many don’t have this option as I know.

I’m sure the ins companies are doing good,… all porked out.

Astronomical insurance inflation affects the wealthy far less. They can afford to self insure.

What does astronomical insurance inflation mean, in real terms? An extra $20/month? $40? Compare that to renters who pay an extra $100 or $200/month when their rents go up.

Just read a guy in Florida has seen his insurance go from 800 in 2013 to 4200 now and he’s 40mi inland.

Seems to me the whole insurance concept may be imploding as auto, property and health are completely unaffordable.

But I’m sure the govt apologists will come along shortly with a set of charts they’ve been crafting to show us why everything is fine and this is not the inflation you seek.

Your prediction was exactly correct about MSM completely ignoring the skew in median price data. Every other sentence was about lack of supply and begging for lower rates. What a joke.

Not going to get lower prices until we see a recession. People with 3% mortgages and huge pay increases from inflation are sitting real pretty. For all this talk of price stability, how many years of above 2% have we seen now? So pissed off I didn’t just buy 2 years ago, oh yeah, thought the Fed would actually do it’s job and create a recession to bring economy in balance. At what point in our history was it the job of the govt. to prevent recessions?

This is silly and lies it is do to the ponzi scheme set forth by the Jesuits which is processed by their real estate agent which they traine to over charge the American people. They traine the agents to word contract that are misleading snd vague that breaks down the laws of this great nations Supreme law of the land. Inputting a tax by converting the private real properties (homes)

into resident : which is a place that you live and do business out of.

[content deleted by Wolf for reasons see below]

Hey Kunal,

You can promote anything legal on this site, including real estate, cryptos, etc., as long as you do it properly:

By buying an ad.

But you cannot promote real estate, cryptos, and whatever in the comments for free. That’s just cheapskate stuff.

The place for your future promos:

Look on the homepage, the gray box below the third headline…

https://wolfstreet.com/

…that is an ad space that I sell direct to advertisers. It’s a “sponsored post.” You write the article, “by Kunal,” or whatever, and you can promote and link anything legal, including your own business, housing going to the moon, your collection of classic motorcycles you’re trying to sell, or whatever. Check out the sponsored post that is there now to get a feel for what you could do. Think about the possibilities!!!

You can rent this space for $500 per 7-day period, prepaid at the time the unit goes live. I haven’t raised my price since I started offering this service two years ago = 0% services inflation, just trying to do my part, LOL. This is really cheap – almost free – to promote whatever for a whole week. You can contact me via the email address under the “Contact” tab, and we can work out the details. Cheers!!

If supply is up but demand is still lagging, where is the supply coming from?

Death always brings out change, grandma died and now we clean up her place, sell her stuff in an estate sale, including her death bed…then split the doe.

That’s all I could think of… I’m sure you could name a few.

We sell her house as well Cole, and then Grandma’s house is added to the supply.

vacant homes = shadow inventory. That’s what’s finally coming on the market.

People moved but didn’t sell their old home because they wanted to ride the spike all the way up, and then volume collapsed under them, and they decided to hang on to it, and now some of them are starting to put them on the market. This will build into a crescendo.

Home Toad

You killed grandma’s pet deer ?

“then split the doe.”

That’s cruel hahahha (the word is spelled “dough” )

“…believe it or not, you won’t find it so hot, if you ain’t got the ‘do-re-mi’…” – Woody Guthrie

may we all find a better day.

Wolf, is that hedonically adjusted $500?

LOL

Seasonally adjusted

Uh,what kind of classic motorcycles are we talking about,Vincent Black Shadow in the herd,asking for a friend!

It won’t be long before there’s a glut of homes on the market. More price reductions are coming!

Per Wolf’s article: “sales and supply are down in equal measure”

Until this dynamic changes, I don’t see a meaningful reduction of prices in the overall market.

That’s not how I interpreted the article. It states “listings and price reductions are the highest in years” and that inventory is increasing.

ChS

You left out the most important part and took it out of context: That’s only related to the 3% mortgage holders living in their own homes who don’t want to move. It means they have no impact on the market.

But the rest of the market is now filling nicely with active listings surging to multi-year highs, even as sales are way down, and price reductions as percent of active listings jumped to a record in the data. So you see the dynamics.

Thanks for clarifying!

I took your statement in the article to mean the 3% mortgages were driving the sales and supply dynamic down equally across the entire market not just specifically in that subgroup.

I did note your statement that active listings were beginning to surge, so I would assume that we will see the buyer/ supply ratio to shift if favor of the buyers moving forward IF the number of buyers doesn’t increase proportionally to the supply.

If median sales price stays the same, but the sales mix includes a greater share of expensive homes, I think that means home prices for expensive homes are DECLINING. If so, we should see it in the Case Shiller home data over the next few months.

Mr. B:

You may be right on upper end homes declining in price, or it may be that the upper end, the upper 10% or 1% are just cashing out equity to buy an even bigger mansion at higher prices.

I’m curious, and wondering if Wolf can find this out, what percent of high-end homes are bought for cash. Because only interest on the first $750,000 of a mortgage is deductible on your federal tax return ($375,000 if single).

Unlikely. High end home sales are mostly churn, someone selling one home to buy another. So high-end home sales generally should prop up median home price. People with lower priced homes at 3% mortgages aren’t selling because their cost would go way up. For high-end homes, this is less a factor as many are cash purchases.

HowNow’s “cash buyer” question is a major, major one.

The Fed relies upon interest rate manipulation to influence/control the macro economy – and the housing market is a key – if not *the* key way of doing so.

It is by far the most leveraged investment that the greatest number of individuals will ever engage in. And Fed rate policy directly and immediately affects (and effects) the cost of that leverage.

But…the Fed can’t influence cash buyers…because they don’t use leverage…or much, much lower amounts.

Historically, the thinking was that cash buyers would still be influenced by Fed rates…because higher rates would tank the value of existing homes, lowering the cash available to cash buyers (who raised it by selling previous homes).

But what if cash buyers are sourcing their cash from other sources (not home sales)? Or sourcing financing/cash from non-USD rate markets (who still have much lower rates than US)?

At a paranoid extreme (not borne out by the limited buyer data available) – the Chinese have trillions in USD (from 20 years of kicking our ass in trade deficits) – *theoretically* those trillions can be placed anywhere on Earth, in any asset class.

Requiring no leverage for deployment – they already have trillions.

And to the extent the CCP influences/controls the deployment of those assets…they can/might do so with an eye beyond economics.

(Governments print their own money – along with weapons, it is an instrument of societal control (just check with US Fed…) so Governments are broadly free to act in defiance of short-term economics in their asset deployment…since the money printer can offset/hide the consequences for a while.).

I’m not saying this is going on…I am simply saying that *huge* asset holders/potential buyers can be empowered to act in defiance of hiked USD financing costs and are also empowered to act in apparently non-economic ways in the intermediate term.

Governments have both powers (huge asset hoards and money printers) but even huge sovereign wealth funds/hedge funds have huge cash hoards and really don’t require financing.

Again, I’m not saying this is happening…but in theory it *could*.

RE records don’t seem to reflect this…but I would be curious to learn the percentage of current buyers using LLCs or other opaque intermediaries.

It would explain how we still see 80% of historical sales volume even though mtg rates have gone from 3% to 7% (after the reverse interest rate movement – ZIRP – caused the doubling of home *prices* over last 20 years).

“High end home sales are mostly churn, someone selling one home to buy another.”

How can you know this for sure (true source of cash buyers’ cash)?

Cas127

To find out where those really rich people in the world are moving to and buying a house all you have to do is look at those international rich people migration reports that are put out every year.

And FYI there is one country that is gaining more millionaires than any other country in the world from immigration and it isn’t the USA.

Care to make a guess?

It doesn’t have an inheritance tax and zero capital gains tax on the sale of your principal place of residence.

Amen. The same pattern will continue. An NBC poll reported by Axios and other statistics report: unhappiness reached heights in younger generations who have taken it in the teeth economically, meaning ordinary, below-60 yo, better- informed Americans realize they are under financial pressure/oppression. As “Britain’s Second Empire: The Spider’s Web” reported (as to just the fewer, tax shelters in the UK Commonwealth), vast hidden wealth of older US/UK/EU generations has accumulated tax-free due to tax evasion/ avoidance to younger generations’ prejudice and controls the US Congress, etc. It is a zero sum game and they hid and accumulated most wealth while younger generations bear the burdens.

Is there any wonder why the GOP wants to defund the IRS?

You think the IRS is focusing it’s resources on billionaires?

“younger generations who have taken it in the teeth economically”

They have it better than any other time in human history.

MM:

This is the sales pitch to unload a declining quality of life to the future.

Many (most of us?) have it about as good as it gets!

The (previously) “preferred” measure of societal progress is that the kids have it better than the parents did.

In some ways I do. In others, not so sure.

Unrelated to the article but; the educational system peaked decades ago, higher education is unaffordable for more, healthcare is bankrupting the older generation (defeating the generational wealth transfer), insurance increases threaten housing and auto affordability, US infrastructure is degraded and needs major overhaul (IRA?)…

The snowball has its own momentum and certainly threatens to take out many. Just be sure you are not caught off sides.

What’s “better”?

Seems to be presently defined as just MORE MONEY so they can BUY more EXPENSIVE SHIT!

Put more people between themselves and ghettos, slums, homelessness/jail?

Are they more athletic, agile, flexible, healthy, more aware of all aspects their world, eating a more healthy diet? (NO, not FN steak and sniffing wine corks)

Sales are up here in my little rural Red County. Per the public MLS site:

April 24 Sales

$14.4 M – 29 units – $430K Median

April 23 Sales

$5.7M – 16 units – $275K Median

March 2024 Sales

$9.9M – 24 units – $363K Median

I never trust median price, highly misleading.

Did you factor in the seasonal adjustment?

MW: Dow closes down 200 points after Fed officials show willingness to hike rates if needed

“Dow closes down 200 points after Fed officials show willingness to hike rates if needed”

Good

“Fed officials show willingness to hike rates if needed”

“If needed” – HAH! It was needed months ago. Instead, they have concocted a speculative mania hyperbubble in all assets which is going parabolic. F**kin’ liars.

Tomorrow Dow (the most meaningless junk index) will be up 500.

Dont forget the biggest bubble of them all: (CNBC headline) “Nvidia shares pass $1,000 for first time on AI-driven sales surge”.

Two years ago they were around $125/share. Now they are the third biggest company by value at a mere $2.46 TRILLION market cap.

Now that is one big bubble! And they are so generous with their dividends at 1 penny per share (on a $100 share) after the 10 to 1 split. But don’t worry, they spent billions on buying back their VERY expensive stock to get their CEO his bonus.

No CEO in history has ever been more deserving of bonus. Look at the growth of this company!

The CEO is paid $34M for 2024….way more than enough. Give all the workers a bonus.

Replying to Jak:

The workers are flush with all their stock options and many are considering early retirement.

Growth for growths sake is the ideology of a cancer cell.

Nothing to be “Happy” about there.

Can you

Please remind me (because I’m old and shit don’t work like it used to) what is your ‘favorite’ market. Thank you.

The one with 11 homes for sale every month at the beginning of the month where then 9 homes sell every month during the month. The only thing that changes is the mix. This market is called “Illustration”

It’s my favorite, because I have shown it many times over the years to illustrate how mix skews median prices (though today I rehabbed it a little).

Nice use of rehab.

I see what you did, HGTV would be proud.

One thing that will do in the housing market is a failure in the auctions of 10 year bonds due to supply and demand imbalances. Mortgage rates will rise to 8% or higher. Add in a recession and it will be game over for the housing market.

Lot of buyers of 10 yr bond at 4.8%. There is enough demand.

If demand wanes, then yield may go up little bit..

10year at ~0% few years back,, now 10Y at 4.7% didn’t break anything.

I am assured that 10Y at 5 plus percent won’t break anything.

Due to the mechanics of tsy auctions, a full-on auction failure is a near-impossiblity.

Lack of demand at an auction will simply cause it to tail, which pushes up the yield at that duration. Higher yields will bring in more demand.

While the mix affects the median price, the Case Shiller index should not. This seems to be going up too. What is the correlation between case shiller price index and the median reported price?

The mix might also be going up because the houses have on an average gone up in price. A 650k house in LA / SD might be 1M now.

Your comments Wolf?

I’m not sure that “correlation” is the right relationship to be asking about because these are two fundamentally different measurements.

CS measures how much the same house has gone up in price, aka a direct measure of home inflation.

Mediun sale price is just that – the median point in the dataset that is sale prices of whatever is currently selling.

It tells you about the types of homes that are selling, not how much those homes have gone up in price.

This seems like a good point to me also. Case Shiller should measure the same home price difference. The definition of high-end is no longer 1M.

If you purchased a home for 400K 10 years ago and it is now worth over 1M, do you now have a high-end home?

When I was younger, I always wished and wondered what it would be like to be a millionaire. Now that I am one sitting in my same worn out comfy recliner it my same living room, I am not impressed.

Wolf,

Do you feel that this indicates that lower income Americans are being (increasingly) priced out of the market, while upper income ones are doing fine?

Or is it too early to say?

What it shows, among other things, is that inventory of higher-priced vacant homes is now coming out of the woodwork — the shadow inventory we’ve long been talking about. And with more inventory in that ballpark, and more price cuts to stimulate sales, there are more sales in that ballpark. That’s how the frozen housing market begins to thaw.

Interesting.

Seems like homebuilders are building smaller (and cheaper homes) to hit the lower end market, higher priced vacant homes are getting price cuts to move, and a bunch of lower to mid range resales are not moving because the sellers refuse to face reality.

I just looked at the San Francisco Bay Area “Luxury” and “Ultra Luxury” sales in April. Luxury means over $3 million in five counties and over $5 million in the four expensive counties. Ultra-luxury means $5 million in five counties and $10 million in the four expensive counties. Lots of this inventory is now coming out of the woodwork, very high-priced stuff, and a big number of sales are happening, and this change in the mix did skew the median prices upward. This is going on in lots of places.

Also a new phenomenon hit, appraisers are using new methods to come up with sq. Footage. So buyers are paying for imaginary sq. Footage.

250 sq. Ft magically materialized in a home down the street from me.

So the new buyers paid about 10-15% more, for a math error.

Sufferin’ – given the highly-variable presentation of the size of a ‘cord’ of firewood in our rural area over the decades, I’m not too surprised…

may we all find a better day.

The higher end market is probably also doing better because there are more cash purchases and stock market and other assets are near all-time highs. People in that category are not as concerned about the increase in mortgage rates that is affecting the middle and lower market.

Another 5500 sf. Condo on my property under contract…

$12.3 MM? I think?

Yes: Many of our owners are willing to sell at these prices.

We had an owner refuse I think $3.5MM for his 1200sf. 2-bed. He “can’t sell for less than $4.25MM” because… greed.

3.5 months of supply looks almost normal vs. pre-COVID levels, but today the % with price reductions is much higher, suggesting the market is actually cooling off fast?

Given the post-COVID changes in how houses and condos are sold (much faster…), perhaps 3.5 months’ supply is actually high enough to start bringing down prices?

I suppose one needs to look market-by-market…

Case-Shiller will tell, but not for a few more months due to the lag in the data they use.

I’ve been telling my kids this is likely one of the worst times in history to buy a house, due to the triple-whammy of high prices, high rates, and deficit-spending governments about to get extra-hungry for additional tax revenues.

Wolf,

Can you find any numbers on all cash sales?

My gut feeling is that those buyers on the high end don’t need to worry about mortgage rates … so they can pay whatever.

Today’s number was 28% all-cash sales, unchanged YoY and MoM. With 3% mortgages, even wealthy people financed because that was the cheapest 30-year money maybe ever, so you had lots of people finance homes that they could have paid cash for, and now they know that they made a hugely profitable decision, with T-bill yields over 5%. But with 7% mortgage rates, the math no longer works, and they’re now paying cash, which is excellent usage of cash.

We discussed this the other day here. So I’ll just repost the chart. The 32% was in February:

Great news to see higher homes selling at reduced prices, Ive watched the reduction closely the last 6 months in Colorado. I suppose folks with huge piles of cash and investments are finally getting the luxury homes they want in great non congestive areas. Outside the beltway seems there are more 55 and over communities being built with nice amenities. The 3% are holding steady and many won’t move with a life event taking place, which puts us at what I think is a very safe and secure housing market. I see so many complaints frequently from those who jumped into the $FOMO, but did not buy what they loved, and now regretting the outside environments of growth, crime, traffic, vagrancy and congestion.

Hey Wolf. From 1970 to 2000 the 30 year mortgage rate was consistently at or above our current rate. Can you explain why a 7% mortgage isn’t a reversion to the mean. I mean, there were some bumps from ’70 to ’00 (Reagan), but I think generally folks would view that as relatively prosperous for the US.

Thanks for your insight.

When you get used to winter temperatures for 3-4 months in a row, that first 45 degree sunny day feels like summer.

Because while your interest rates have become proportional again, the asset prices are now exponential.

I sold a house last week in AZ for what I paid 18 months ago plus closing costs, so I’m happy about that, it listed pending sold for cash. I bought it to live in while building my winter home and figured I could sell it again without much loss. Two weeks to close on both ends, easier than renting a place and a hell of a lot nicer place to live.

Dicing with interest rate movements and inherently unpredictable supply and demand factors doesn’t seem “easier than renting”.

Hello wolf, no article about treasury lately. Why treasury debt is not going up for past few months.

Does that bother you that Treasury debt isn’t going up?

Just kidding.

The serious answer is Tax Receipts. April 15 was Tax Day. Huge amounts of tax receipts this year on capital gains taxes and strong economy. Look at the TGA. In April, it spiked to nearly $1 trillion as tax receipts kept flooding in.

Somewhat related to housing…

“To understand the great downfall of the American mall, look no further than the recently revealed sale price of downtown Seattle’s Pacific Place.

The mall and its underground parking garage sold for a total of $88.25 million this month, according to county records filed Wednesday, a quarter of the price the properties garnered when they last traded hands.

The mall sold for $66.75 million, well below its 2014 sale price of $271 million. Its nearly 1,200-stall garage sold for $21.5 million, down from $87 million in 2016.”

And…Seattle wants to convert Class subpar A/B/C office into residential in the downtown core with the homeless, drug, crime, and more newly migrants coming in for the free eats and rooms.

Shave and a hair cut…two bits!

The great Mallpocalypse grinds onwards …

If the rich are getting richer then…..duh

Wolf, you honestly do have one of the best economic blogs on the internet. I was trying to put together some of what I saw happening with the markets and economy and your last 3 articles were all very helpful.

Seems like this trend will continue with the likelihood of most housing prices down from the highs but still rather high. Many expect several rate cuts at least by the end of 2025 and while that may not further increase asset prices it certainly might get the market moving. I am sure every generation has said this but it does feel like especially in the last 20 years or so a new normal has arrived. It was in movement since long before that but seems evident the US needs the face the new reality, which is hardly our strength. It is a fascinating time period to observe but very apparent in other areas of the world which are seeing this ahead of us here.

Idk. That kind of sounds like”we have reached a permanently high plateau”…

I mention from time to time that I watch Kalispell MT as a canary in the coal mine so to speak (this cycle’s Port St. Lucie?). I get a daily feed of new homes listed for it and the surrounding area – I typically get 10+ homes daily.

Courtesy of Redfin, April stats are: Median Price $550k (up 15%), Number sold 29 (down 3.3%); DOM 84 (up 24 days). Current Inventory is around 320 homes – so a 10+ month supply. Eyeballing the inventory prices, skew is to the high side: less than 20% priced below the April median.

Lots of listings priced at 20% to 50% over the 2021/22 peak (and when interest rates were 3%). Will be interesting to see the inventory build and see when prices break (although in MT it’s tougher to see as selling prices aren’t published).

That’s what I’m seeing in higher priced desirable areas. Lots of irrational listings. The successful sellers have a completely different mindset. Sold listings always reflect price drops or reasonable pricing to begin with.

Appreciation potential is poor in Kalispell. Inventory is up 300% from the 2021 lows and homes now cost 8x local income. Risk of loss is larger than normal.

I lived in Montana pre Covid in Bozeman. I remember coming home from work and there would be a traffic jam of Uhauls coming into town mid 2020.

It takes a long time for people to settle in and realize they may or may not have been had. 2-5 winters at least. The Blackfoot Tribe called the Gallatin valley “The valley of thorns” for a reason.

Plus the obscene prices paid during that time… People know about western Montana now…

It would take a pretty strong recession to shake Montana fever. They have had insane dips before like in the mid eighties. The local economies are not powerhouses without continual outside investment and interest.

If it was me I’d put money on the ___*omitted*____ valley vs Kalispell. Wait out the development and pony up to some good access to wilderness with proximity to a charming town outside one of the major hubs.

People sitting on a vacant home since 2022 have lost anywhere from 15 percent when compared to selling and buying treasuries to around 35 percent by selling and buying VOO. Residential real estate is often a dog of an investment compared to the markets and especially the last couple years.

I bought a rental home in early 2022 and started renovating it. Due to several issues it is still vacant but done.

The same house across the street but not all new like mine just closed escrow about two weeks ago for just a hair over twice what I paid. You read that right, twice what I paid. Not even counting depreciation, or tax benifits, I’d say you are not only wrong, but strenuously wrong.

Things in the SF Bay Area are rather crazy.

People must be in debt up to their eyeballs buying homes at current prices and interest rates. Same goes for the cars and trucks people are driving. It boggles my mind.

When the business cycle finally turns down and job losses mount, the ensuing losses on all the loan defaults is likely to be quite dramatic.