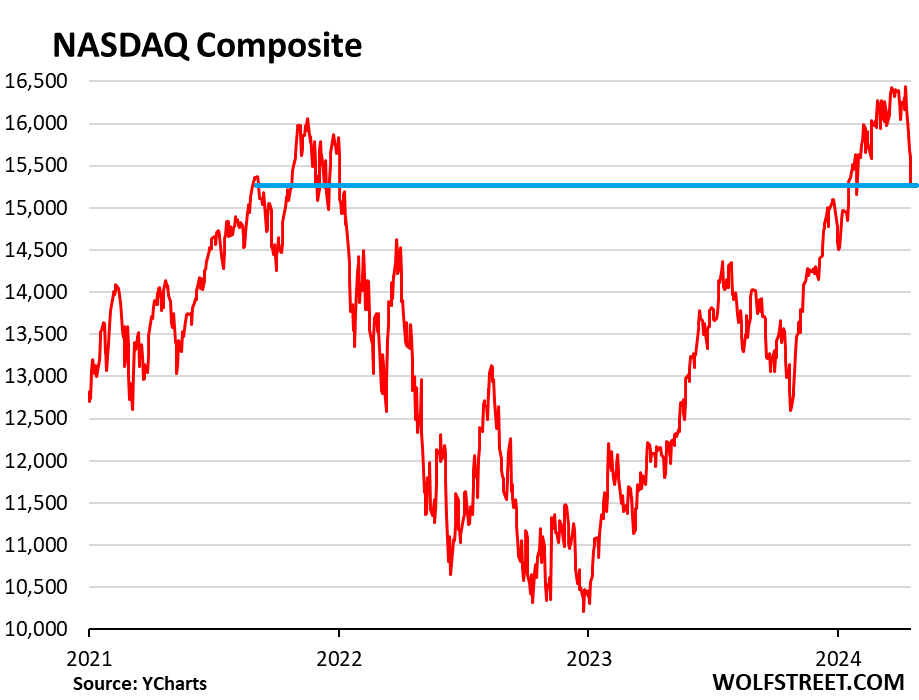

Nasdaq fell 2.05%, back to where it had been in September 2021. We have some new WTF Charts of the Year.

By Wolf Richter for WOLF STREET.

The Nasdaq Composite fell 2.05% today to 15,282, back to where it had first been in September 2021. Since the all-time high on March 21 of 16,538, it has dropped by 7.6%.

Seems, the AI and semiconductor hype-and-hoopla show got interrupted somehow, or maybe it got too silly and people just started walking out of it. Some of the biggest names in that show plunged today – and we’ll get to a few in a moment.

Seems, this hasn’t been a great investment since September 2021, at which time it became clear that the Fed would end money printing, then begin unprinting some of that money it had printed, and hike rates on top of it. Nevertheless, it has been one hell of roller-coaster ride (all stock data for the charts below by YCharts):

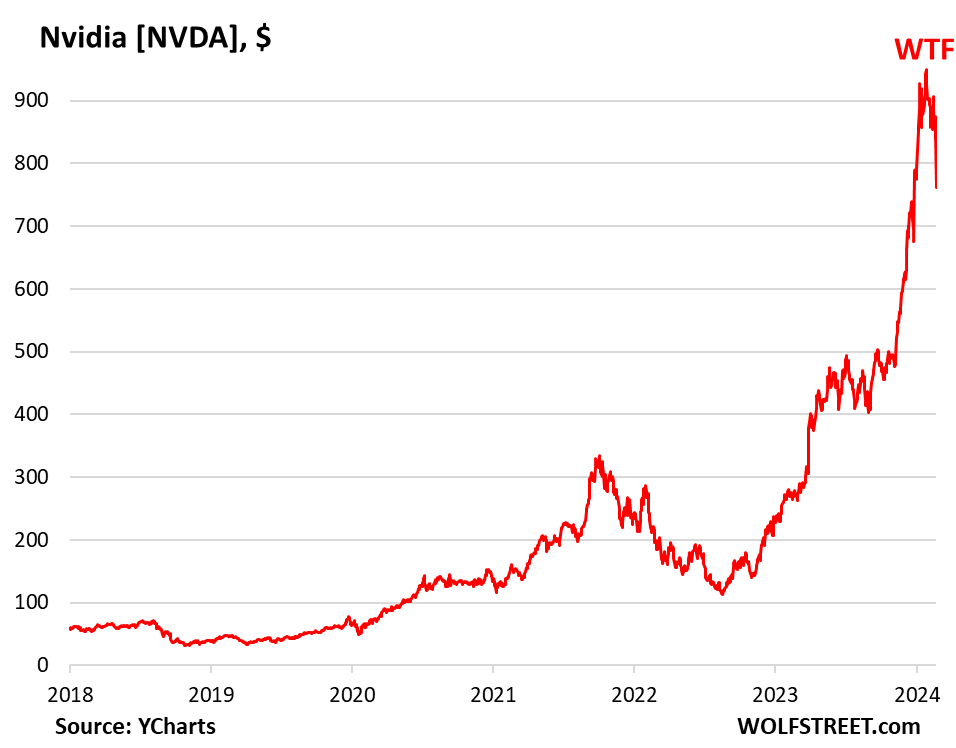

Nvidia [NVDA] plunged 10% today, to $762.00, the worst one-day plunge since March 2020. It’s down 21.8% from its all-time high of $974 on March 25. It became infamous here in this joint on February 24, when we honored it with a WTF Chart of the Year. At that time, Nvidia’s market cap had spiked to nearly $2 trillion, and shares to $788.

We compared it to our WTF-Charts-of-the-Year of Tesla, which a couple of years later made it into our pantheon of Imploded Stocks, though its business continued to boom, and its Model Y became the bestselling model in the world. It just meant that the mania had begun to seep out of the stock.

The minimum qualification for making it into the pantheon: the stock has to drop at least 70% from the all-time high. For NVDA to be inducted into the pantheon, the stock would have to drop to $292, and that’s not hard, that’s where it had been only 10 months ago. It was already a very high-priced stock back then. So today, we’ll honor it with a new and improved WTF chart of the year.

But it gets funnier. I mean, look, you can’t take this stuff seriously.

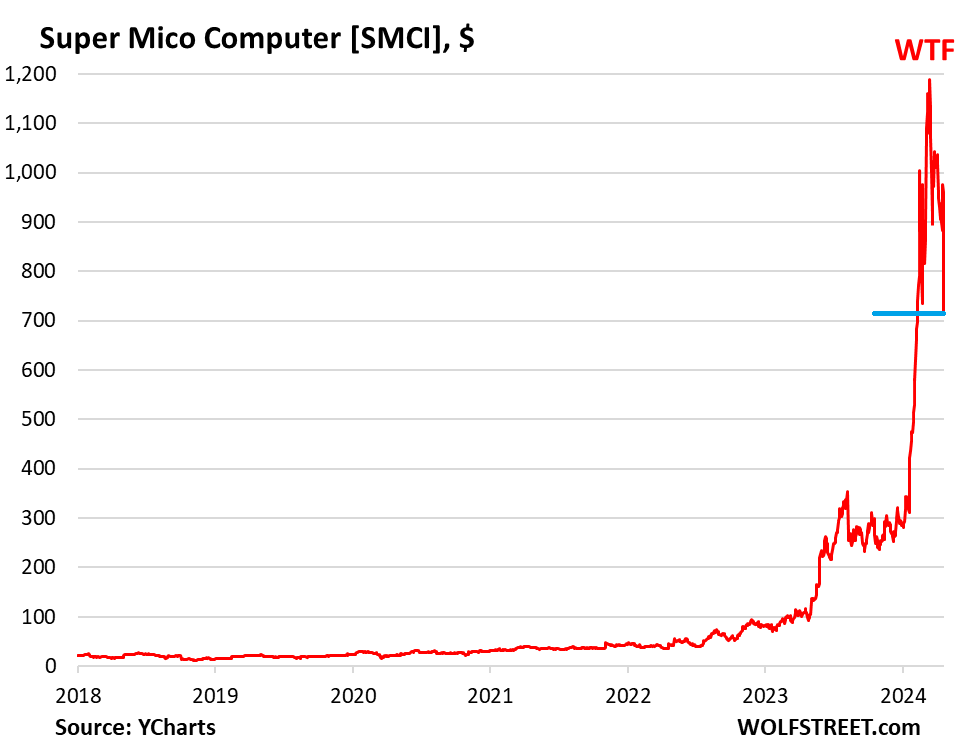

Super Micro Computer [SMCI] has been deeply tangled up in the AI mania by being one of the many vendors that build servers based on Nvidia’s GPUs. The stock collapsed by 23% today to $713.65 after the company skipped announcing the preliminary results that had been expected ahead of its official earnings results. At these stock prices, anything can trigger a get-the-hell-out moment. It is down by 42% from its all-time high on March 8 ($1,229).

Over the 12 months from up to the all-time high, the stock had gained over 1,100%. This stuff is just hilarious. Kids having a bunch of fun or whatever. It has now given up 40% of that gain. This stuff shows just how silly the markets had gotten.

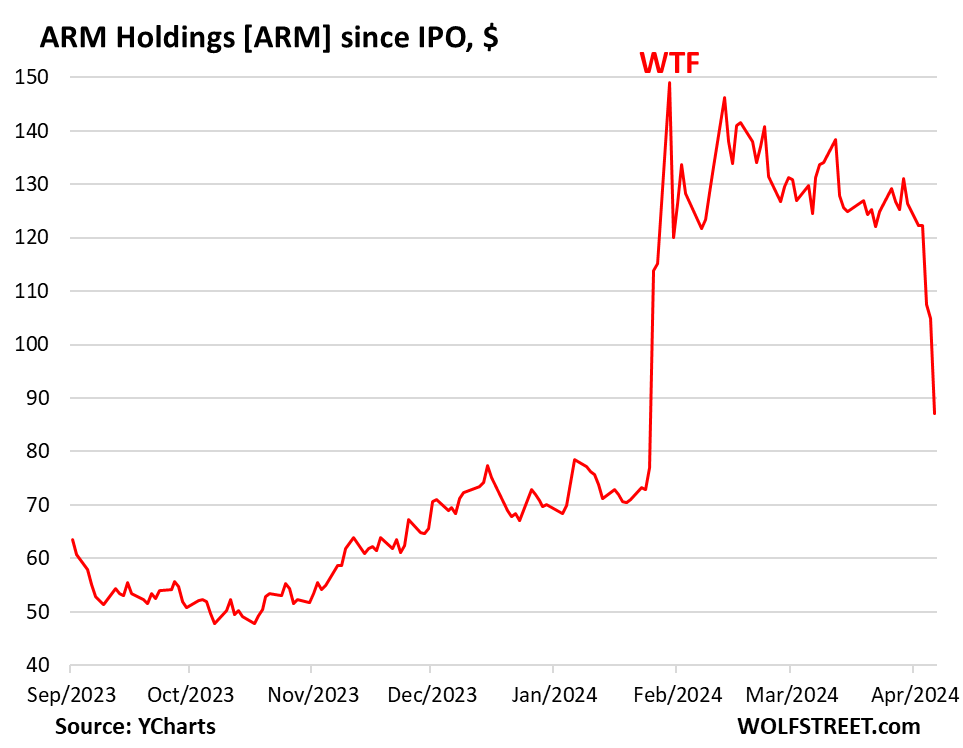

Arm Holdings [ARM] plunged 16.9% today to $87.19. Over the past three trading days, it has plunged by 28.7%. The chip designer IPOed in September 2023. At the time, SoftBank had owned 90% of it, and it still holds a huge portion of it. In February, ARM had doubled in a matter of days:

The SOX Semiconductor Index dropped 4.1% today and is down 16.6% from its all-time high on March 8:

![]()

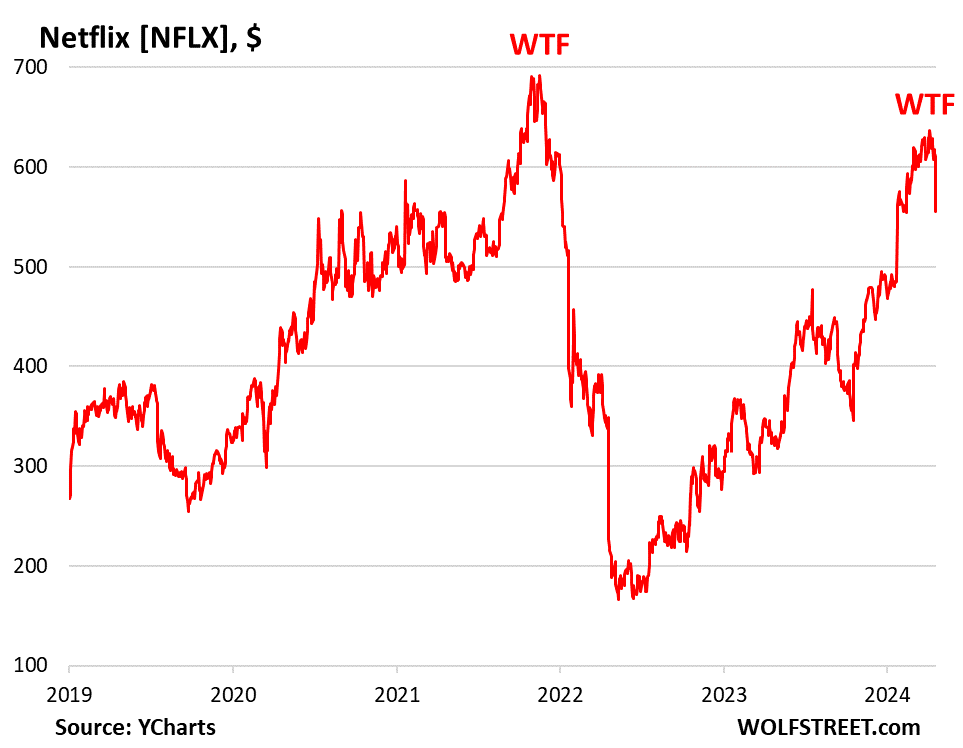

Not related to AI: Netflix plunged 9.0% today after it announced earnings, which were solid, but included a revenue forecast that disappointed. And it announced that next year it would stop reporting subscriber numbers that everyone had come to rely on. That’s another very funny looking double-WTF chart:

The other giants saw more modest declines today:

- Apple [AAPL]: -1.2% today, to $165, down 17% from its all-time high

- Meta [META]: -4.1% today, to $481.07

- Amazon [AMZN]: -2.6% today to $174.63

- Alphabet [GOOG]: -1.74% today to $155.72

- Microsoft [MSFT]: -1.3% to $399.12

- Tesla [TSLA]: -1.9% to $147.05, down by 64% from its all-time high in November 2021.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Confession: This makes me happy. I feel guilty for it. but bubbles gonna bubble, and “get rich quick” types are gonna pay.

Agreed, while most Americans saw there 401k balances go down slightly today a bunch of rich a holes lost a lot more.

Time for a bounce tho probably choppy and weak then the real party coming soon 🥳

Not AI, but Trump Mesia’sgotten bashed too.

Not usually one of those spelling critics, but since we may be on the eve of the second Crusades, probably should get your saviors straight.

I’m in my 40s, and just checked out of curiosity. My 401k is down 9.1% since its peak a few weeks ago. I’m mainly invested in unexciting index funds. Bottom line is too much of the market has been living on hopium surrounding “the magnificent 7” and that’s not a sign of a well rounded market.

If there is too much hopium, why are you still in index funds?

His 401k might not give him any other choice.

I had to pressure my company to let me do a self-directed 401k after my crappy vanguard funds lost a ton of money in 2022. But now I can invest in basically any listed single stock/ETF/MF/bond/etc.

Your probably still up 15%. since last october?

“a bunch of rich a holes lost a lot more”

So much class/wealth bracket hate here. Sad.

It is sad that greed has overwhelmed our society I agree

Yeah (fat?) Gatto, far too much coveting going on amongst the bottom 0-50%.

Sad AND sinful. They are all damned……lake of fire for sure.

American Dream,

Greed is human nature and always existed. I doubt there is more greed among the wealthy than in the past. If you think otherwise, it’s because you’ve been propagandized to believe it.

Where I do see more greed, or really envy (and then hate) is among the less-wealthy, who have been feasting on a social media diet that makes everyone think they should be rich….and for doing less than what it typically takes to build wealth.

It’s easy to be greedy when you don’t have to see or hear the cries of the suffering children.

Thought I would drag the children out…make their appearance here on wolf street.

Gatto, You should read Sarte, and really start bitching.

PS; You are one of my favorite people to be ignored by here, but don’t let it go to your head….it’s my MO.

What is the point of waiting to retire with money when you are old, and decrepit and cannot enjoy your savings the same at 65-75 when you were 25-45 full of energy and youth?

The golden years are not when one has grey hair; they are when you have hair lol. It is so damn preposterous ppl get sold this lie by corporations of waiting until retirement. The corporation wants your azz to work all your productive years while you waste away and grow old. To delay your enjoy of life. Then you wake up at 75 feeling life has passed you by, indeed it has.

This body I live in needs to be

cared for, so I care for it.

Trying to learn how to be healthy at 50, overweight, regular slob is not a good place to start,

La-di-da.

Nobody has s clue what’s going to happen. My main question is the dollar . How in the world has it been so strong?

“My main question is the dollar . How in the world has it been so strong?”

Strong economy, higher interest rates than other developed economies, and lots of QT. Those are very supportive of the dollar because investors in other countries want to buy and own dollar-denominated bonds under those conditions because their own countries have lower interest rates and weak economies, and in Japan’s case 0% rates, QE, and plenty of inflation (that’s a lethal combo for a currency).

It’s funny to me how a strong dollar always surprises the dollar-collapse folks. They just cannot understand, or they don’t want to understand why the dollar hasn’t collapsed yet, after decades of predictions that it would.

The U.S. greenback, one of the most legendary currencies of world history, continues its impressive historical run of strong holding pattern … The long-term prognosis for the currency is good, as the BRIC countries cannot easily replicate the greenback’s convertibility and PPP (purchasing power) strength.

…the cleanest dirty shirt is still the cleanest in the hamper…

may we all find a better day.

$USD currently has unique properties and benefits strongly from “least dirty shirt” dynamics. The “collapse” mongers are fantasists at best.

There are an increasing number of foreign countries who have an interest in arranging mutual settlement alternatives, but these will take years to implement and are unlikely to affect the investment environment during our lifetimes. Expect $USD to remain strong in FX terms, especially in times of crisis.

Unfortunately for segments of the US economy a high value dollar presents challenges. Whether or not your elected representatives have the wisdom to implement the appropriate fiscal arrangements to compensate the “losers” remains an open question — one with implications both for strategic planning and political stability.

Wolf, i guess a logical question is ” strong dollar” compared to what. Sure, USD looks good against other fiat vmbut what about against gold or BTC? Not so strong. In ’71 when Nixon ” closed the gold window you could buy 1 Oz of gold fir approximately $35 USD. That same 1 oz of gold in 2024 will cost you $2400USD. The oz of gold hasn’t changed, it’s the USD has collapsed and is a great WTF chart vs AU.

BTC is a gambling token and not a currency. It’s just a gambling token. It spikes, it crashes, etc. It’s down 10% against the USD in a month. If enough people want to bet on it, it goes up, if not it goes down. Like a said a gambling token.

Gold pays no interest and no dividends. Dollar-cash assets do. So if you compare gold to dollar-cash, you have to include interest and dividends. Otherwise I’m just going to ridicule you as a gold bug.

Pure wisdom dispensed daily.

A day without Wolfstreet is like a day without light.

Like Wolf said the US has actually had a lot more aggressive monetary policy recently than most countries esp with QT and interest rates, in saying that though the dollar lost a lot of it’s value recently, not just in exchange rates or Forex, the harsh inflation itself is a sign of dollar’s loss of value. It’s the dollar losing value against the goods and services it’s intended to buy, and lately against things like commodities and precious metals. Even this nonsense going on with crypto and NFt’s, much as I hate it is an indication of some wavering on the US dollar, if the dollar really was that strong and a source of confidence, then dumb wastes of the electric grid like Bitcoin would be worth very little (except money launderers). As it is, there’s some anxiety about the USD as storehouse of value.

So some currencies have done better but other’s have done even worse. It depends on a lot of things. The yen’s fall is partially because BoJ has actually wanted it to fall and wanted more inflation, for its own strange (to us) reasons. In other cases, it really depends. The US has very high debt now both public national debt and private debt for households, and a large trade deficit. (Japan as much debt as it has, has much lower private debt and closer to trade surplus) That does introduce some vulnerability to the dollar and of course some connection as to why yields keep going up, and both Americans and foreign holders won’t tolerate unchecked devaluation of the dollar and inflation, then it would no longer be a storehouse of value. But the Fed has not taken such a policy. I know we give JPow a lot of flak here and I know I’m constantly mentioning Volcker, and the Fed prob. should be more aggressive on rates and esp QT, but Powell has done a lot more than he often gets credit for, he’s not about any dollar free-fall and that helps to make sure the dollar doesn’t fall too much.

As Wolf has noted you have to consider the entire globe when looking at US currency, RE, stocks etc.. your markets are open to the rest of us and when we compare investment opportunities the US economy is still the strongest. Inflation may be high but also tbills and bonds are paying decently, if my country’s central bank drops interest before the US does or FED hikes and we do not I will likely have to trade in for US tbills because not only will the % be higher but our currency relative to USD will drop as well, that would more than offset the cap gains I can avoid paying by holding my own country’s tbills. For people from some other countries it isn’t much of a choice in terms of risk and returns, they will want US investments.

What strong dollar? My dollar buys less continuously.

“strong dollar” refers to exchange rates with other currencies (so “strong relative to other currencies”), not to inflation.

Exactly the sentiment that gets schmucks elected.

The human cloud is relentless.

My NFT investment will make a comeback!!!

Haven’t seen you at HBB in ages. You’re missed. How much you want for your NFTs? I got cash. They’ll be coming back strong!

This is a synthetic economy, engineered to attain a dominant position in the pecking order of people destined to be forgotten.

The exhorbetant prices are a direct result of the Fed policy. The cost of ownership is passed on to the product price

The only people that are suffering are those with no income.

” this stuff is just hilarious, kids having a bunch of fun”

Says something about the author.

Some of those kids, full of vinegar and piss are at home biting their nails.

“At these stock prices anything can trigger a get the hell out moment”.

Then they could be productive members of society instead of gambling on the markets. If they have enough money to throw at this nonsense then they can afford to lose it all. Not gonna feel sorry for tech kids that make way too much money for the value they bring to society, push inflation up with mindless consumerism and then let it all ride on this nonsense. Lessons need to be learned somehow. If they can’t figure out that bankruptcy is the last option then they should have been raised better.

Productive as in working corporate retail or gig delivery jobs for menial wages? If lucky, they can get a productive government job shuffling paperwork

And a lot of them arw rich af if they were/are involved in the development of all this technology. I see them in Miami plunking down $10’s of millions to buy homes like it was play money

More than kids this is big buck losses and gains volume is small but losses big

So, if you look up FOMO in the dictionary, you’ll find, as an antonym, “AGTHOM”.

If you bought NVDA in the last few months, you were gambling, not investing.

Do you also feel bad for people who piss away their money playing the lottery?

I highly recommend the first episode of the ESPN documentary about OJ.

Dare we believe that sanity is breaking out on Wall Street?

Oh, how I want it to be true, but I dare not believe it.

I guess I should have gone into the selling-euphoria business!

The answer is no. Never will empathy or sanity be used to describe the asset price economy.

I guess my sister liquidated our deceased sister’s stock portfolio at just the right time last week….🙄

That’s the spirit.

Money for nothing. Chicks for free.

I saw this coming right before the drop. The RSI was running the hottest it had been on many years and was starting to decline, a stochastic cross down had occurred, and the Fed started backing off rate cuts. I started selling anything that paid no dividend to only a slight dividend. Sold off home builder stocks. Sold off my one Nvidia share while I still had some profit. Moved into various short length CDs until I see signals that this correction is over.

Cole,

This was pretty clear that it was coming. As soon as NVDA got out of overbought territory, it was going down hard.

Most of the “gains” were due to call buying, not stock buying, which would evaporate at any time once the calls expire.

Same as Gamestop.

Also looked like a sloppy head and shoulders, with a downward slope.

According to technicals, likely to get a bounce at around 700.

Big question– do you think the next level down will be to “support” at 660, or down to 500?

I’m buying NVDA puts on Monday. Lots of puts. YMMV.

“this stuff is just hilarious, kids having a bunch of fun”

Wish I had a horse in the race?

The thrill of victory, the agony of defeat.

It’s been the thrill….now for the agony.

“Anything can trigger a…get the hell out…moment”.

I got into Nvidia puts when CEO delivered way over the top AI presentation in the conference mid-March, but the stock went down a bit.

Did same with Tesla when Musk presented their stupid humanoid robots. I think I got 7-fold with Tesla puts. Nvda should be 20x.

Keep an eye on LLY too. And Meta.

I’m not quite looking at where I think the price will go. I’m looking for when the technicals are saying things are oversold. I’m looking for when extreme fear has set in. Looks like we still have some room to go down followed by a period where prices don’t do much.

Technicals doesn’t take into account rising inflation & yields, geopolitical tension, etc.

Hedge accordingly.

Send your suspicitions to the Fed who I’m sure will get right on it.

Since they are the likely cause they may be refractory to being questioned.

We all knew March 2020 was coming, but I failed to get out beforehand, was kicking myself for quite a while.

Thank God I failed to get out.

I mean, you probably did the right thing and all (I like how you tossed stocks with no dividend), but you just don’t know what’s going to happen. Unprecedented times. And even before unprecedented times, it seems that no one knew what was going to propel the markets.

It’ll be interesting to see.

I think the closest parallel we’re going to see here is going to be the 80s, but with a bit of caution. I don’t think this is quite as bad as that.

Complete with Heritage Foundation cracking it’s political whip? Wow!

It’s Guilded Age or bust with those guys.

And they only had newspapers to shape the people’s minds. What is it now, down to just 4 media/advertising/sponsored content conglomerates……plus the internet games…..and Wolf’s empire.

According to Hussman there was only twice in history that the stock market was priced so dearly, 1929 and 2005. Both signifying the beginning of the end.

My brother sold Nvidia right before it tanked because of the talk of capital gains taking a hit in the Canadian budget. Turned a million into 185 million before tax. He’ll only pay the 50 percent capital gains tax not the 66 percent capital gains tax post June 25th.

And rich people here in the States complain that their taxes are too high lol. 50% was already crazy high!

That Canadian capital gains tax rate quoted is for anything over 250K. Don’t shed too many tears for those “suffering” under those circumstances.

That’s not the tax rate, it’s the portion of the capital gains that gets taxed at all. Even the change up here leaves a quarter million exemption in place. So it’s a nice ‘tax the rich’ solution. Who could dislike that?

Any reason why you believe the government has a right to more than half of your income?

how is capital gains your income Bob? What exactly blood, sweat and tears you put into it?

No, the govt, is not taking your money. The society that build you this playground you are frolicking in is asking for their share back.

themsicles,

If all Bob’s gains were dividends & interest, would a 50% tax still be fair?

If not – why are cap gains more worthy of high taxes than investment income?

Why not tax hourly wages at 50% too?

50% is not the tax rate, it’s the portion of the cap gains that taxes are applied to here in Canadaland. The rate on that 50% is dependent on your income

Still say everyone should look up the progressive tax rates of 1960. Plenty brackets makes for fairer slope. Of course cap gains are incomplete, unless you still believe that “supply” side crap. Besides, the planet can’t take any more of it.

Need IRS full part of military (incl special ops) and as well informed as NSA, CIA, etc. What’s more important than enough money to run the country…and pay for Comprehensive Green New Deal…….ya’ll can still play well regulated capitalism…..just have some boundaries and rules to “The Game”.

What “rule of law” and democracy USED to be all about.

Incomplete = included….spell check is almost sentient AI, if ya want to create digital pests.

Is it the season of the return of WTF charts?

Yesterday it was ON RRPs. Today, it is AI-linked bubbles.

The last time I recall this on Wolf Street, it was based on exuberance due to Fed printing and low interest rates — stimmies and oversupply of cash and credit. There were wild used car sales vending machine towers, silly NFTs, etc.

In today’s edition, the bubbles blew in the face of rising interest rates, but the new giddy narrative was the supposed future cash flows of AI eating the world (or cynically scalping those who drank that kool-aid too exuberantly). I could see that rapidly getting out over its ski-tips. Thankfully I missed this round. My MSFT stock is “only” up 59% and trading at 36 times earnings. We’ll see where this retrenchment takes it. Now we’ll see who is really monetizing for the near-to-mid term. NVDA is still trading at a “modest” PE ratio of 63.7, too heady for me.

I’m glad to have stayed mostly in debt-free cash with a low-risk 5% return. Buy the dip? Not me, not yet.

I wonder what other WTF charts might emerge.

What is ON RRP?

They’re the big topic here – including in my Friday morning article — and they have been explained here in every article about the Fed’s liabilities:

https://wolfstreet.com/2024/04/19/feds-liabilities-and-qt-as-on-rrps-plunge-toward-zero-operating-losses-begin-to-decline/

Dear phleep

The only reason for the existence of the WTF charts is humanity.

I still have equity positions but am enjoying the Tesla pain lately. In our world it seems all news, good or bad, is free marketing, but the fast and loose will catch up with them, especially with the RoboTaxi and Cybertruck woes. Unfortunately not a lot of companies are poised or allowed to compete with them. Hmmm. Address climate change and get Chinese electric cars here without massive tariffs or keep playing the xenophobic card? Not a hard guess on that one!

IMHO, Elon just dropped the ball. “Sources” have it that the Model 2 is dead and they’re going all in on the RoboTaxi. There is a giant world-wide market for the Model 2 if Tesla can find a way to compete with BYD. There is an order of magnitude smaller market for the RoboTaxi. The vast majority of auto use is driving to and from work. Billions of people do it every day. Who is going to trade a personally owned automobile for a vastly more expensive ride in a vastly more expensive RoboTaxi that you have to wait on? Sure its great for many city dwellers, the elderly and infirm. But that market isn’t going to hold up Tesla’s share price.

Musk said that Reuters was “lying” with its story on the Model 2 getting canceled. So be careful. Could have been some hedge funds planting a story. Happens all the time, that’s what they do for a living. Eventually (at the next earnings call), Tesla is going to officially say something about its plans.

Well said.

You need to be very careful with a stock like Tesla. Elon can move the stock 10% in either direction with one of the stunts he pulls regularly.

Since this is a “real” company, fundamentals matter (even if inflated).

A lot of these complaints about battery life, inability to charge dead batteries, cold weather problems, etc. can be overcome.

Also, Tesla is getting oversold, and earnings are coming up.

Hard to know which Elon will show up to the conference– so you might consider booking any short position gains before this.

A lot of very smart people have gotten demolished shorting Tesla, even though on fundamentals it makes sense (Bill Gates was short $500M at one point).

Wolf, given his auto experience, can probably comment on fundamentals, and I would love to know if he thinks this may look like a Cisco circa 2000 situation…

BVW,

Chart of NVDA today sure looks like CSCO from late 99/2000.

And the winner is?

Gold! Up 15% YTD. If anyone thinks the Fed isn’t worried about this, they are not in contact with reality. Hate to mention Zoo Hedge but a good bit over there re: gold being revalued by central banks. The author has a dialogue with the German central bank, Bundesbank or BUBA to its friends.

BUBA has over 3000 tons of gold which if revalued to today’s value would help out BUBA’s position.

Just a shiny rock, only valued cuz, like, it’s valued? What ever.

Maybe everything is meaningless. But in the meantime, here and now, the shiny rock is always acceptable in state- to- state deals. Unlike for example the ruble, which is not money outside Russia.

Books have been written about the role of gold in WWII.

Germany had almost bankrupted itself with its arms buildup, but for the first 2 years was able to pay for things like Swedish iron ore with captured gold. Couldn’t it have paid in Reichsmarks? No.

But isn’t that ancient history, made obsolete by Bitcoin?

No.

With you Nick, and bitcoin is just a gambling token Trojan horse keeping gold interest in check.

Got gold?

Bought Au in 1999 $250/TO. Coat pocket of Au now $100k.

Gareth Soloway called that one.

Isn’t it obvious why gold is valued?

It just so happens gold exibits all properties of sound money. Fungible, recognizable, portable, scarce, non-destructible, and on, and on. Nature’s money so to speak. Few things are like that. E.g. silver is not very portable. Diamonds are not easily recognizable.

Good news. Bitcoin fixes that. Lol

“Diamonds are not easily recognizable.”

Also they figured out how to make diamonds in the lab, and they’re purer than natural diamonds. But they still haven’t figured out how to make atoms, including gold, in the lab.

It’s quite easy to transmute atoms in the lab (for instance, using particle beams, or the neutrons from a nuclear reactor), but the process is extremely inefficient so it’s very expensive.

This is how all the “new elements” beyond uranium & plutonium were discovered.

Neuron bombardment of uranium creates the transuranic elements like plutonium. I have never heard of gold or oxygen being created in a lab this way. If possible it would have been done as an experiment virtually regardless of cost.

@Nick: Yes, but not just with neutrons. In addition to nuclear fission or fusion reactors, particle accelerators can make both lighter and heavier elements via fusion or fission. The extremely heavy elements (e.g. element 116 Lv) were synthesized by fusion of two lighter elements.

There’s an entire industry devoted to making specific isotopes of specific elements for medical purposes, such as radioactive iodine for thyroid treatments. Those are produced cost-effectively enough to be economical (at least within our grossly overpriced healthcare system).

“Radiochemistry” and rare isotopes have other (research) applications as well.

Just be careful if someone from Russia offers to sell you a few grams of an extremely rare isotope for $100K, that’s like the Nigerian Prince scam.

In My Humble Opinion, the diamond industry’s attempt to elevate the value of mined diamonds over the perfect lab diamonds is hopeless.

Even the stars can’t do that. Have to start with hydrogen ( or a Big Bang) to make gold, etc….or so the latest quarky theories go.

Anyone interested: enter ‘gold in aerospace technology’

Lots of uses, and why does anyone chose a solution this expensive? No alternative.

“Nature’s Money” (at least the first new one we will all NEED to try to acquire enough of…..and by whatever means one has) will be water and a survivable brain and core temperature.

Can’t see how gold figures in at all.

Playing around with stuff from mom’s old CPAP machine. Got dirt at varying depths (ground floor apt) and tap water to work with. Not sure if cool lungs will work with body’s existing thermoregulation sensors/mechanisms…..worth a try.

Likely too late for Comprehensive Green New Deal, everyone’s too obsessed with money and free markets.

Maybe something like those portable oxygen generators?

“…will be water and a survivable brain and core temperature.”

Trouble is you can’t pass those along to your grandchildren. Unless you own some land with a creek I suppose.

Oh, good article….testament to stupidity-wise.

General consensus seems to be F all the grandchildren….one’s own and anyone else’s. Bean counting/spending game is more important….

Just saw traffic cops in India are wearing air conditioned helmets.

Think it’s too humid there for it to be a swamp cooler.

Anyway, guess they were passing out from standing in the sun directing traffic all day. Had good sized fanny-battery pack.

Stock tip of the day, get busy!!! Few can cool whole houses or even rooms……not in the world most people here live in, anyway.

I have an AC, but man does it suck juice, even when I block off 1/2 of 500 2q ft apt with old sleeping bag or plastic tarp. I Tucson we ran 86, but I’m older now and get weird(er) over 82-85 all day.

The Federal Reserve owns little to no gold and could not care less about the moronic manic speculation in this little trivial yellow junk.

The Federal Reserves holds about 8,000 tonnes of gold. But on its balance sheet it’s valued at cost from a gazillion years ago. And the valuation never changes.

Is it valued at the cost in 1971 when I believe the US went off the gold standard? Learning another new thing here- thank you!

I believe the Gold Reserve Act of 1934 transferred all ownership of gold from the Fed Reserve to the Treasury.

Here is who holds what:

https://www.fiscal.treasury.gov/reports-statements/gold-report/21-02.html

They value gold at $42 per troy ounce.

Does it? When is thelast time anyone verified this?

The Federal Reserve STORES gold on a contract basis for other parties, but the Federal Reserve actually owns practically none of it. The US Treasury OWNS about 8,000 metric tonnes of the stuff which is stored across a variety of US Treasury depositories including the ones near Fort Knox and in New York.

When I did thin film coating with 99.9% + gold ca1970, guy in central supply said it cost the company $64/oz. Was maybe 5″ of appx a thick 1/32″ wire folded in small brown bottle.

Was an Anti-Reflection coating for a roughly 2′ x 3′ x 1 1/4″ solid Ge window for FLIR devices in B-52s if I recall right.

Was still chintzy with it, acted like everything in there was his.

Still swiped a bit, later sold by a guy I played VB with who ran a dental lab. Another thing that helped me through Reagan’s 1980s double recession.

Many people never came out of that…I was very lucky.

This could have an impact on the high end of the property market if this implosion continues.

Trust me, these ‘gamblers’ would already be reacting to theses falls and they have purchased many an asset through a shelf company.

I could put it this way, they have had for a long time, since the tightening cycle began a ‘Bug out” bag of assets which will never see them mow a lawn or wash their cars.

Quite the opposite of what youre thinking. When stocks tank, money tends to go INTO real estate, not out.

It’s another asset class and the thinking in the past has been… “at least I can enjoy using my beach house, unlike stocks. Himes dont tend to drop 50% in a month either.

Not true..

Just wait and watch

High end market is already seeing steep correction.

All asset market enrt up and all would do down even gold.

When the market corrects big time .. margin call forces people to sell gold and other assets..

yes that is correct

I don’t think that was the experience in 2008. Money fled stocks and real estate: real estate for a longer time. In a big drop-off in equities, in net worth, people seek cash, and to lower leverage, because they are still carrying debts. Piling on more debt for illiquid assets? I respectfully think not.

Of course, the recent experience with helicopter cash-drops might change that.

I think one reason gold is sparkling right now is because anyone with an eye to the future can see that the outlooks for stocks, real estate, bonds and cash are all dismal (to varying degrees) for the next few years. This also happened in 2008, at least until the credit collapse forced fire-sales of everything.

“When stocks tank, money tends to go INTO real estate, not out.”

This was true when rates were lower. But rising rates & inflation are a different ballgame.

With the riskfree rate now 5+%, new RE investments will need to earn at least that much.

NB: blackstone corp bonds issued >6 months ago tend to trade at a discount to par.

Lets wait and watch.

When the fear strikes.. even the gold goes down

I know gold bugs think differently.

If you think objectively.. gold has no intrinsic value and pays no dividend and can’t be even used as currency.

Does it sound like bitcoin?

Crypto mania, VR mania, EV mania, AI mania. AI mania will end when another new tech mania starts. Keep your eyes peeled.

I haven’t checked, but I’d think that a crypto collapse or similar other-worldly investment, would presage a drop in overvalued tech stocks. Is there a “unicorn EFT”? Watching that might be a way to bet on declines in some of the SAAS stocks, almost all of which still have negative earnings. And, even though they’re small in size, there are tons of tech microcaps that have yet to turn a profit.

Maybe it’s high time to invest in shoelace nibs.

“I’d think that a crypto collapse or similar other-worldly investment, would presage a drop in overvalued tech stocks.”

Why is that? I was thinking it’d be the other way around, as people lose in the real(ish) world of stonks they then pull their money from the bookies to pay their bills.

There have been so many manias during the last 5 years. Boom and then Bust.

What is the next one being planned by Wall Street?

Smarter Furbies? Beanie Baby action heroes?

Smarter pet rocks?

My guess is the next hyped mania will be Quantum Computing.

Good guess.

I had my own WTF moment last week. A question on Jeopardy: name the current Federal Reserve chairman. All 3 contestants just stared at the monitor.

That sounds funny to us here, but that’s the bitter reality.

Actually, I long for the days when central bankers were anonymous and legislators took seriously their responsibility for economic outcomes via fiscal policy, which is by far the more flexible and powerful economic lever. But I know they’re not coming back anytime soon.

I had a bit of a funny moment recently talking to my wife about the Fed chairman. We were going through the list of past chairmen on Wikipedia and I was explaining “so there’s J-Pow, and before him was Old Yeller, and before that was Helicopter Ben … we don’t have a name for Greenspan, I guess, but we should because he was the worst of all!”

It was one of those moments when I realized that I was living in a bubble, and a pretty weird one at that.

My favorite cosmology is that we are all living in something like an ant-farm that is a toy for a really rotten kid from a superior alien species.

Always hope his old man will take it away from him for being abusive, instead of learning.

“Who is Johannes Gutenberg?, Alex.

Who is James Clerk Maxwell, Shiloh?

I broke my arm right at the same time ARM stock collapsed a week ago. The first x-ray showed a bone about double the normal size with a 2/3 inch break. I’m now on sarms Rad 150.

Was this Kids Jeopardy, or something? The people on Jeopardy tend to be pretty well rounded in their knowledge. I’m shocked they didn’t recognize someone that the news covers at least once a week. Or maybe the contestants have significantly dumbed down in the last 10 years?

…dumbed down, or a case of age-sensistive selective focus (would wager all would have shined if the question concerned a leading light of contemporary pop culture…)?

may we all find a better day.

I’ll bet 3/4 of adult US population would not know this.

Bought back the calls I sold last week and made some money on them. Bought long dated deep ITM calls three months ago and had I listened to my inner voice a few weeks ago, I would have been drug smuggler rich upon selling them. Instead I’m just large down payment on new house kinda’ rich but at least I walked away with a healthy profit when I sold them today and closed the trade. I’d also been writing synthetic covered calls against those options every week so that helped juice the returns.

I’ll be waiting the next time NVDA bottoms out and I will wash, rinse and repeat. I enjoy providing degenerate gamblers with short dated calls and pocketing the premiums. NVDA sells real products at a profit so there’s always money to be made in the stock as long as you don’t jump in too early.

What is synthetic covered calls against options ? I’m so dumb

I ordered 3, my favorite, the shiny brown glazed donuts.

Then I noticed the chocolate eclairs 3 rows down, I became confused.

Our of desperation I told the donut dude to just put 3 donuts in the bag..whatever…and I would be happy.

Glad I could help.

Instead of buying the stock you buy long dated (over 365 days) deep in the money (ITM) calls for the stock. You can use them as collateral for your covered call trades but since you own the long dated options and not the stock it’s called a “synthetic covered call”. The long dated option becomes a proxy for the stock.

There are videos all over youtube for this trade and Investopedia has great explanations for it.

What margin rates are you paying on those trades, and do they cut you a break on fees if the covered call gets exercised early?

Me too on the dumb part. I just count how many monitors at their trading station.

As good an acumen index as any.

“NVDA sells real products at a profit so there’s always money to be made in the stock as long as you don’t jump in too early.”

If you really believe in NVDA that much, why not just go long on the equity itself? The whole point of a covered call strategy is to trade off share price upside in exchange for income from writing the calls.

Personally I like the covered call strategy right now becuse I feel there’s limited upside to equity prices at this point.

This week was a very nice one. Falling AI stocks gave a signal that bounces can be shorted. All AI related stocks have to fall a lot imo.

The reason for all this nonsense is the (social) media and 24 hours a day gambling on the mobile.

Hear what you’re saying but we’ve had bubbles longer than mobiles, so would we have this many WTF charts without decades of low interest rates? Not to mention human nature ie FOMO/greed.

Wolf’s AI keeps puting me into moderation bin. That’s the only use of AI I know of.

The investing companies found out that it is all about the programming.. and since what they want is not about the truth, but developing illusions, the programming is incredibly expensive and flaws get incredibly amplified to the point that they are blatantly obvious.. flaws that I have observed on YT (integration of material from two different time periods in the 20th century). An astute investor would be divesting now with what profit achieved and wait for this to bottom out while development matures.

I screwed this up. I left my house down payment invested in the market and it is worth the same as it was in late 2021. But, the houses I am looking at to purchase are 20% higher from 21, and 10% higher from 22. I am not sure what to do now. My wife is not happy because we are looking at smaller homes now. This sucks. I keep telling my wife that we should wait but she is putting pressure on me. North Chicago suburbs.

Stop trying to time real estate and stock markets. It’s impossible for vurtually anyone except Mugsy, above

You should do what you want to do.

No one knows the future……keep that in mind.

As far as purchasing a home…..for the middle class it’s not about timing or making or losing money…..it’s about quality of life and having a place to call home.

Get your ego out of the process and think about what is best for you and your family.

A good piece of advice I received 65 years ago……if you buy at x and x ends up being 100x 40 years from now will you really care if you could have bought at x minus 20% in a year.

Real life…..if you bought the DOW at 1000 in January 1973 and it dropped to 576 by October you would have felt bad…..but if you held until now……you would have 38 times your money and dividends and compounding would put you 100 times ahead.

Will home prices drop in the next few years…….maybe…….but maybe not. Inflation continues to roll without a serious brake……so…….if the economy rolls for another three years you can count on another ten percent or more of inflation that will erode whatever price drop you are hoping for. If the fed ever drops rates because of economic weakness the dollar will probably drop substantially which will drive the cost of living higher and make a home more expensive.

Tension usually breaks like a fever……just don’t let it force you to make a decision……make the decision based on what is best for you.

The US middle class is being squeezed. It’s not a transitory issue. Homes being priced higher is just a part of everything being priced higher. Get used to it. We’ve spent daddies savings and are spending the future right now while the band in DC continues to play music and ignoring the water rising.

Of course if you are the type that moves every three years everything I’ve stated is hogwash…….but if your wife has family in the area…..you probably ain’t going anywhere even if you think you might.

Just trying to help……good luck young man!

Great advice from Fred, I just want to add “only buy if you can afford it”. If you make enough to afford the home you want you won’t care if the price drops. If you are spending more than half your after tax money on it when renting is cheaper it will get old fast.

>A good piece of advice I received 65 years ago……if you buy at x and x ends up being 100x 40 years from now will you really care if you could have bought at x minus 20% in a year.

Well, that 20% drop would have been the difference between 100x and 125x. So it actually matters more, financially speaking, after 40 years have passed.

I think the real reason that you won’t care about the 20% difference 40 years later is that life will have continued on and you’ll have (hopefully) learned not to waste time and energy regretting the impossibility of timing the market.

She’ll probably leave you anyway. I say go for broke and double up. Find younger wife in Florida later.

Good advice.

But no wonder Wolf’s AI keeps you in moderation.

🤣❤️

(BTW, the most astounding benefit of the comments is all the free marital advice people are getting)

@Wolf,

The objective function being constantly optimized is the right day to “cut bait”. Lol!

Tilliman,

Do whatever it takes to make the wife happy is the furthest thing from marital or financial advice ever, but it does come to mind.

Suffering together is better than suffering alone is also the furthest thing from marital or financial advice ever, but it does come to mind.

Reminds me what an old supervisor said to me about 15 years ago. “I have a pension plan, a good one. It’s called staying married”.

She was pretty good in all ways, so he was safe enough going forward, but still.

My version is “divorce is for rich people.”

If your means are merely average to comfortable, divorce is the wealth and health killer.

eg

If you find yourself down on your luck, plenty of single rich grannys to choose from, find a lively, adventurous one for health purposes.

Or start a granny gigolo service to help build income, three Granny’s a day will also keep the flab away.

“My version is divorce is for rich people.”

Not really, it’s also quite fine when you’re flat broke because there’s nothing to take, ask me how I know. Actually don’t ask please.

Please please don’t buy Now

What happened to stock market would happen to home prices as well

It is insanity to buy homes ar these levels wirh so absurd prices along with high mortgage rates

Canadians still think American homes are next to free and are still buying cash to hedge against the fall of the Canadian dollar.

You know the AI peak is in when there are adverts on TV for corporate AI products and they talk about nebulous stuff like empowering your data and analytics.

Yes. At the very very top end. Maybe it pays dividends.

But those users won’t watch adverts and buy it like they will for ice creams or sofas.

I can’t remember back to the 98-01 period (student, drinking, women) but assume similar happed through the dot com period?

Back then, all you needed was a dot com site, a business name, some fluffy/flashy TV ads, and you got rich…..until there was nothing to deliver at any profit.

Any innovation arrives, of any merit, and it is a matter of time before the rats pile in. Marketing takes over, as substance fails to fulfill the wild hype. It happened to dot-coms, and to crypto; why not to AI?

phleep – recalling the old observation: “…just when one thinks they’ve mastered the the rat race, faster rats are introduced…”.

may we all find a better day.

Hi Dustoff. Hope all’s better.

I don’t think they are faster rats, I think they ambush you along the course…..guess that’s faster thinking, though

Greetings NBay! A pleasure to see your handle, as ever (and hope yer back is giving you less-hell than usual. Just saw my neuro for the PD yesterday, upped the carbo-levo intake and told me to double-down on the PT-got him to agree that ranch work, now that the rains are subsiding (84.5″ so far) can count towards that). Agree that if the rats were truly faster, they wouldn’t find the ambuscades necessary (…or as in the joking reference to the late, great Carroll Smith’s racing ‘…to Win’, series: ‘Cheat to Win’…). Best!

may we all find a better day.

Never thought I would EVER say this, but I wish I could do/yell, “PT and more PT Drill Sargent !!”, again.

Later.

Recent times, massive investment drivers:

Bitcoin

Block Chain

A.I.

I’ve given up. Anyone have a guess at what will be the next “thing” to shovel investor money into cash furnaces?

Good question. I think it will be brain chips. Feeling blue? Brain chip. And all of a sudden your girlfriend looks hot and exotic.

As soon as it can be said, we can expect the joys of the darned thing appearing in fact. And nowadays, the most refined arts embroidering it are distraction and addictiveness. Then we can await the zillionaires crowing about their achievements for selling it. Just remaining a “regular guy” is my contrarian art form now, as the environment goes post-human.

You’re forgetting the meta-omni-vr-verse…

I still don’t see anyone rocking decent VR kit except one friend who’s a gamer-head.

Again it’s out there, and it’s useful, but the idea it’s the next iPhone (isn’t everything since the iPhone?) is a dream.

The Search For The Next Tech Pet Rock

Does not need to be high tech. Reincarnation of pet rock is called a grounding bag. Only $139. Look it up. I got the first ad for it last week.

Was the AI mania the last leg of the everything bubble?

So much of the environment is now geared to blowing bubbles everywhere, everything, forever. I wonder what mega-pop can correct that.

“… The chip designer IPOed in September …”

“IPOed” sounds like “opioid”. If this was intentional pan, it is spon on in describing the “consensual hallucination” (another great term coined by Wolf”

We are in the best of times and it feels good to see fools lose money!

Can’t wait until Bitshit hits the dust! Love to hear all the facts that nobody can verify like how many there are, etc., or it’s a system that can’t be hacked!

Exactly the same with all the cash burning startups.

Simple questions will protect you.

When and how will this company be profitable?

Who will pay for all the computing power when bit mining is no longer profitable?

AI has a wonderful future, but it is not what all the hype tells us.

It is about fewer talking monkeys on the payroll and saving money. Who needs 10 highly paid engineers when one can do the work of 10 or a hundred with AI to do the shitwork!

We already have a great example in it’s infancy. Look at the stock markets. Most of the traded are already machine.

Interesting thought. What was the number of employed human traders before machine traders existed and what is it now?

I would guess it’s similar but don’t even have a clue where to begin to look for some hard statistics.

Are you saying AI existed all along?

It has been evolving in small ways for years and will continue to evolve at an ever faster pace.

Some want you to think it is one big event and will only evolve with the big names. They are the same ones wanting your money.

An often unmentioned problem with “AI” is it assumes we humans already have the “I” part.

Obviously highly dubious, no?

I will agree we are “exceptional”, though……..not necessarily in a good way, though.

…I keep tripping over contemporary tech that tries to ‘fix’ something in my personal OS that isn’t broken while opening my wallet in conjunction…

may we all find a better day.

91B20 1stCav (AUS):

Nassim Taleb spent a lot of ink on unneeded fixes, that don’t improve things. There is even a fancy word for it: “iatrogenic.” I see it everywhere now.

Iatrogenic makes me think of metabolic syndrome, tardive dyskinesia, anything that ends in -mab etc, etc, etc.

And long waiting lines/times at Walgreens.

Wolf was sure right about them WAY overbuilding.

New Pharmacists, new techs, almost every month……THEY are paying the price for the C suiters’ error.

Bitcoin has been hacked several times and the code updated but dont tell the devotees, it was immaculately conceived according to them. It has truly become a religion for some.

another good example is robotics in manufacturing. We had a 6 person line making 500 auto batteries a shift with robots a 3 person line could make 2000 a shift. It happened all over the manufactuing world and that was 15 years ago I imagine it is a much more now.

Sorry bear hunter, verify the bitcoin stuff to your hearts content here – https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html

I’m sure you magically won’t have time to read or understand the spoonfed info, anyway.

What you must understand about bitcoin is that it is verifiable, and that’s the big appeal.

Again, when max keiser says that everyone ends up paying the price they deserve to pay on their first btc purchase, people like you with all the info at their fingertips continue to prove it.

Additionally, you can go read about “large language models” @ https://github.com/trending – this is the text based chat gpt code and it is new(er) but there is nuance to this.

All technological progress has “early phases” so again I’m not really seeing what you are saying here that is supposed to upend everything.

What you are saying is akin to “Nuclear bombs aren’t new, we’ve had TNT bombs for decades !” – or – “Electric cars are not new, we’ve had gasoline cars for 100 years!”.

Streaming reality tv content

I really haven’t been paying attention to the stock market. Isn’t 30-50% annual moves in a major index end of days type volatility? Seems kind of extraordinary for this to be happening *after* the pandemic.

There is still a lot of loose money sloshing around out there, looking for someplace to go. That would explain a lot of gambling dynamics in markets, departing from classic discounted cash-flow valuations. The Internet also juices up things like the DJT stock, which is completely unhinged from fundamentals.

I’m probably going to sell out of my remaining ARM position on Monday. My gain on the overall trade will be 100%. As Chuck Prince, ex Citibank CEO, said in July 2007 “[When the music stops, in terms of liquidity, things get complicated, but] when the music is playing, you’ve got to get up and dance”

The main driver for Netflix’s subscriber growth was the recent crackdown on shared passwords which they have been phasing in around the world. However, the effect of this move is mostly a one-time thing which is another reason why the Street downplayed the company’s results (in addition to Netflix’s announcement that they will stop reporting subscriber numbers next year).

I do not understand why the hell anyone pays for netflix,mostly junk and available for free streaming all over the net with your “I don’t care “laptop

Mostly convenience, especially if your household includes a less sophisticated user base, as is my case with wife and children.

There’s a lot of free content out there, Pluto, Plex, Tubi, and other services all accessible via streaming devices. $0.

Repeating the lesson for youngsters on this site. I will probably keep my remaining NVDA position until their upcoming earnings release scheduled for 5/22/2024 expected by analysts to be $5.54 per share in real earnings, $22.16 annualized for a PE ratio of 34 for a company that grew earnings 500% during 2023 from $1.09 in the first quarter to $5.16 in the fourth . If NVDA has a strong beat the stock should run further. I’m up over 140% on my trade so far. Refer to the quote from Chuck Prince posted above.

As these market darlings drop in price the available margin drops with it. After 2:00 pm when the margin desk clerks are making their calls you will see what a rush for the exits looks like. Index tracking ETFs have no option but to sell as the index leaders prices collapse. The proportion of stocks held by ETFs has never been higher and they are going to be responsible for much of the carnage which follows.

I am entertained by these rollercoasters, but don’t have material exposure to them outside of some index tracking inside some whole life policies (mine and my children’s) and some ongoing index purchases on behalf of my children.

For money I may actually need I stick to short term fixed income and a handful of oligopolistic Canadian bank and Telco stocks. I sleep well.

Seems like there was 14.77M shares of NVDA sold short on Friday. I doubt any sophisticated rich people lost money. The opposite likely occurred.

Wolf,

Any chance of getting to see the historical PE ratio graphs of some of these imploders?

PE ratio ain’t perfect (mgt can pretty easily manipulate reported earnings for a while) but the PE ratio is still a pretty good early warning signal against valuation craziness/stupidity.

The ratio can be used to state implied growth assumptions at any price level and compared to long term PE ratios for both indices and individual stocks.

Knowing that the long term SP 500 PE ratio is about 15 (including decades of healthier growth American economy) provides useful context when HypeStock is trading at a 30, 60, 90, 120, 600 (or zero) PE.

It tells you just how far out on the thin ice people are tap dancing.

It’s almost all negative numbers for earnings. We would learn that they never should have been bought in the first place, and “now is the time to sell”, paraphrasing realtors about when to make a move. Nobody has a brain in their head anymore because of all the free money. Every decision is feelings based now, at every level, and in every corner of society.

https://www.multpl.com/s-p-500-earnings-yield treasuries are at 5% or better

https://www.multpl.com/s-p-500-pe-ratio stocks have not made sense for a while but I sat out and missed out actually shorted the market for awhile but I ran out of money I was willing to lose before the market comes to its senses

I agree stocks are overpriced, however data going back to 1880 is probably not relevant. Looking at the 2008 recession it looks like the bottom was closer to p/e of 15. My guess is new normal in a healthy economy might be around 20. Also compared to 2001 and 2008 previous bubbles, 27 p/e doesn’t look bad. Although that could change quickly if earnings shrink….which looking at the graph for 2001 and 2008 it looks like the last leg of those bubbles was it quickly spiking.

This is an artifact of ZIRP. There will be mean reversion.

Crap-stain AI needs to be taken down a notch or two. That NVDA chart looks like a rocket launch trajectory – having now hit terminal velocity, gravity will do its thing.

How do we differentiate the setup today from the setup before Black Monday?

It feels a bit like a Black Monday setup – a quick panic that follows a ridiculous price runnup. A few big players can trigger it.

What day is tomorrow?

Just another manic monday…

Yes, but risk is elevated after Friday’s confidence shake out. The Big Tech trade appears to be reversing out. There is a long way to fall, potentially.

Wolf – the $GOOG price is incorrect

Thanks. Looks like I got the MSFT number in there twice somehow, in the GOOG lines, and then again underneath it in the MSFT line.

This is what too much liquidity looks like. Massive bubbles.

Oh how the mighty have fallen.

Ps Wolf, looks like you’re missing the minus sign in front of goog’s 1.74% decline.

Maybe just maybe the AI death declared too hastily? 🧐

Perhaps same like me declaring and wishing DJT going to hell. Both are just emotions and desires.

Most films I ever saw would have been made better without a musical score, no sound track, no “Applaud” light up. Use of the sounds of the environment. When I was young, I admired David Lynch, but I often thought with his thoughts on transcendental meditation, and in interviews stating that he cannot come up with his ideas while listening to music that he would have shed that aspect of his film making at some point. He never did. David Lynch films without music. Never happened. Imagine perhaps if it did. Imagine if it happened a lot more often, with a lot of other things.

Wulf

What about the memeist stock of them all? Truth Social, still valued at $4bn on $4mn of revenue? 1000x earnings. Valued so much higher than Reddit with 200x more active users.

Yes, that thing is interesting. I’m not sure what people see in it. A campaign contribution? A donation?

There are simple formulas to estimate the fair price of a stock, based on earnings, growth, and current interest rates. I often use this simplified version:

Value = EPS x (7 + Growth rate) x 4.4 / AA 10-year Corporate bond rate

OK, let’s assume the corporate bond rate is 6.6. If NVDA’s growth rate is 20%, then fair price is about $450. What growth rate would be needed to justify a price of $900? The answer is about 45%.

But you can see that the price of NVDA is not a bubble. They do have real earnings and real growth. They’re selling every chip they can make, and at the top price. If they can stay ahead of competitors, they could grow into their current price.

“….they could grow into their current price.”

That’s always the hope in the background. It was with Tesla too in 2021. Since then, Tesla’s sales and profits have surged, but the stock is down 65%. And it’s still overvalued.