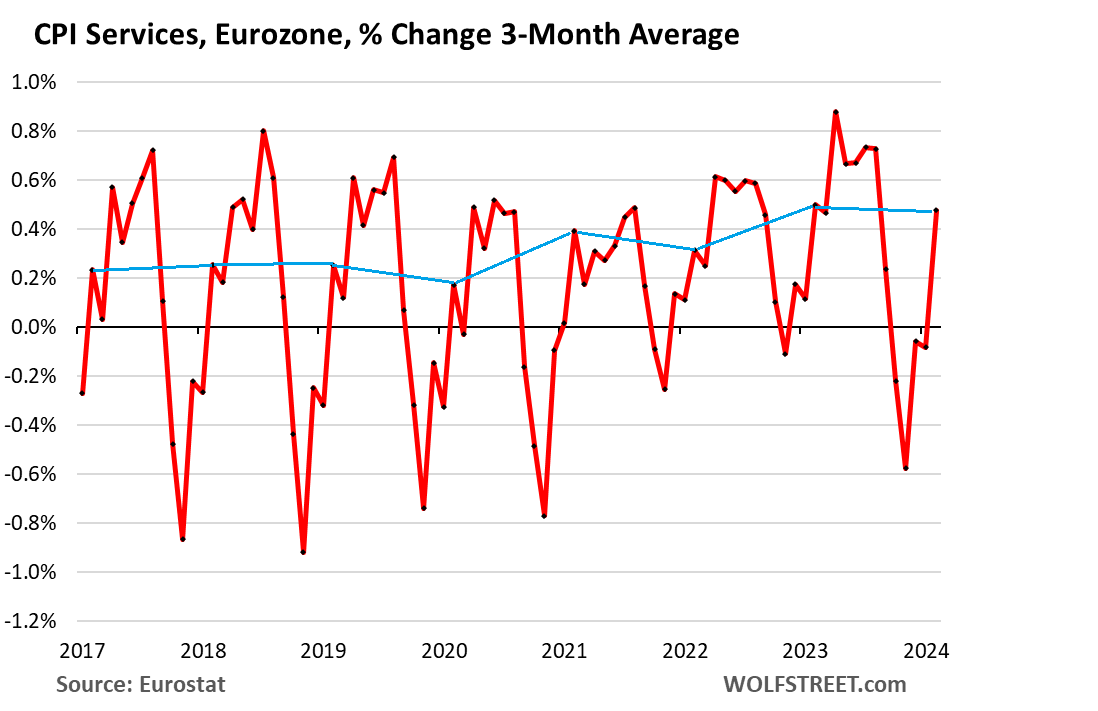

Over the three months through February, services inflation has been running at roughly the same hot rate as during the peak a year ago.

By Wolf Richter for WOLF STREET.

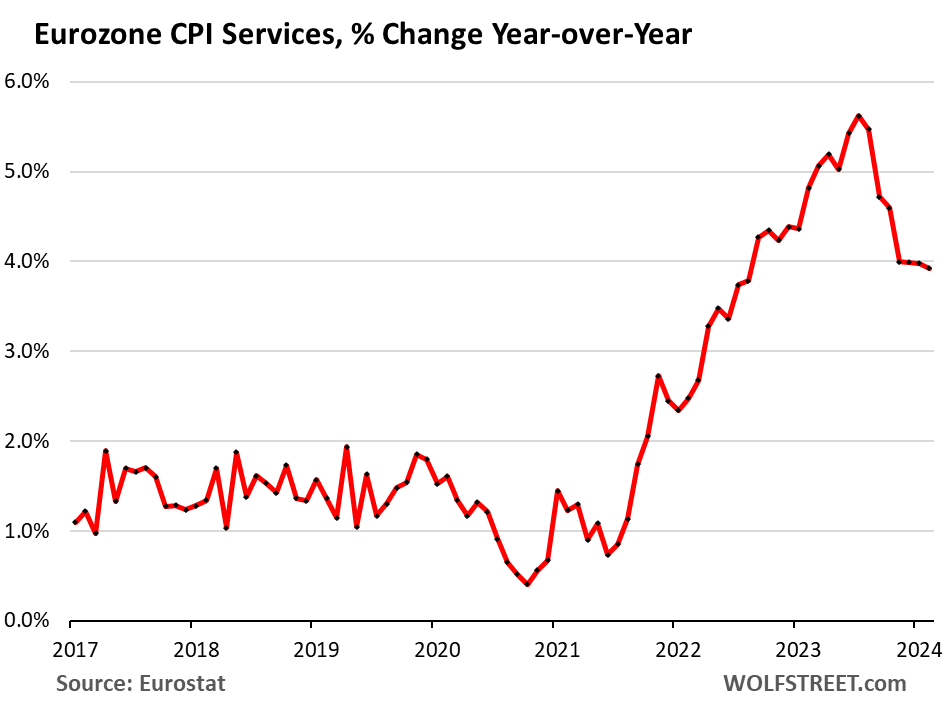

In the 20 countries that use the euro, inflation in services in February has gotten stuck at around 4% year-over-year for the fourth month in a row, and on a month-to-month basis appears to be accelerating with a 0.8% jump in February from January, the second highest for any February in the data going back to the beginning of the Eurozone, after the 0.9% jump during peak inflation a year ago, according to data from Eurostat today. And ECB Council Member Robert Holzmann came out to say, despite the quiet period before the meeting, wait a minute, we’re in no hurry to cut rates.

Hot services inflation is also dogging the Federal Reserve; in services is where inflation has gotten entrenched and is thriving: The US “core services” PCE price index spiked the worst in 22 years month-to-month, as we saw yesterday. So this is a broader problem.

On a year-over-year basis, the CPI for services in the 20 countries that use the euro has been essentially unchanged near 4% for four months, after cooling from the surge through mid-2023. Services is where consumers spend the majority of their money.

Services are huge. It’s where consumers spend the majority of their money. Many services are essential to modern life, such as housing and related services, healthcare, insurance, broadband and telecommunications, auto repairs, transportation, etc. Inflation is notoriously hard to eradicate from services.

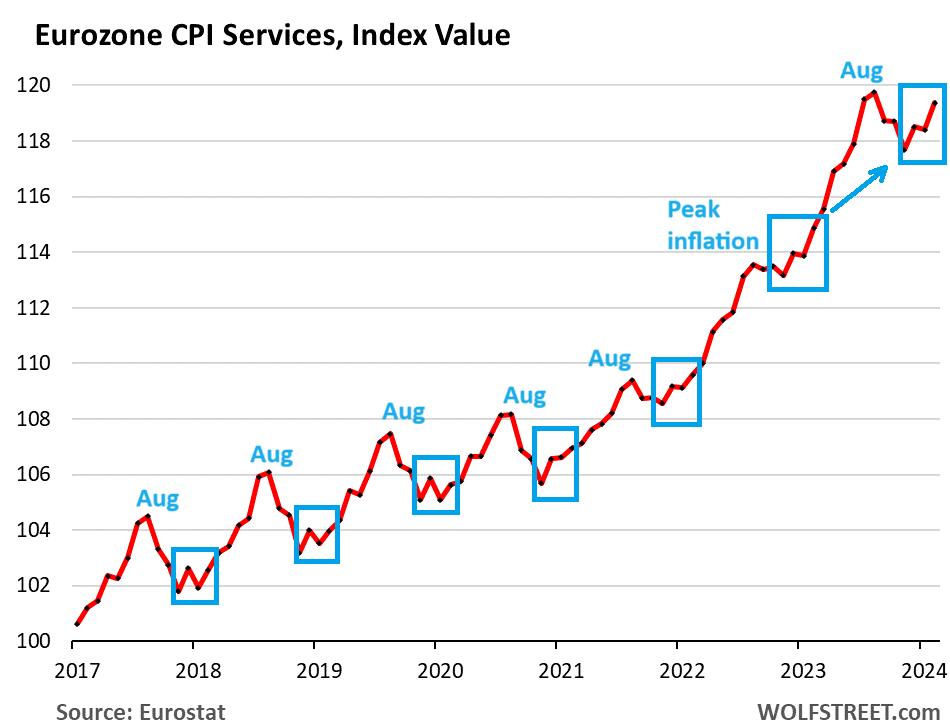

The services CPI as index values shows what is going on here. More on the blue boxes in a moment.

As we can see, before the pandemic, August marked the end of the seasonal surge in services inflation. The index would then decline sharply, but not all the way, to hit a higher low in November (the beginning of the blue boxes), tick up in December, fall back in January to where it would be about the same or just a tad higher than November, with near clockwork seasonality.

The rise in February would bring the index value back to the December level, before the surge through August. That was the seasonal pattern before the pandemic. Seasonality was thrown overboard in late 2020, when November was the low point, and the index then surged every month through August 2021, dipped a little, and surged again for two cycles.

Top blue box in the chart: the re-acceleration. November 2023 was again the low point of the cycle, but unlike before the pandemic, January was substantially higher than November; December barely dipped; and then the index spiked in February. During these most recent three months, services inflation ran at nearly the same red-hot pace as during peak-inflation a year earlier. This is very disconcerting (circled in the chart above).

On a month-to-month basis, the services CPI in the Eurozone spiked by 0.82% from January. The index is very volatile with the biggest positive readings in July, and biggest negative readings in September and November. But that was the second highest reading for any February in the history of the index, just a hair below February 2023 (+0.87%), which was around peak services inflation.

The three-month moving average shows a similar picture: in February it jumped by 0.48%, just a hair behind the record February 2023 (0.50%), and both were the highest in the data, and running over double the rate before the pandemic. The blue line connects the Februarys.

What is disconcerting: The month-to-month and three-month moving average in February 2024 is now running at roughly the same rate as during the peak services inflation a year ago. This is an early indication that services inflation, after bottoming out at a year-over-year rate of around 4%, may be headed higher from here. This already occurred in the US, where year-over-year core services inflation hit bottom at 4% and in January already bounced off and headed higher.

ECB governor Holzman reacts to further slow down this rate-cut mania. “We watched inflation data coming in from the European and country level, and what we see is that they confirm my view that we have to wait, have to be attentive and can’t rush to a decision” about rate cuts, said ECB Council member and Austrian National Bank Governor Robert Holzmann on Friday, March 1, thereby sticking his comment edgewise into the seven-day quiet period ahead of the March 7 policy meeting in order to nudge markets further out of their rate-cut mania.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I lived thru 1970 s gas at 25 cents then 75 cents.glass of beer 25 cents then a1.00$ watch out the storm is no longer just off the shore . It’s here PREPARE

Howdy Flea. Disco years were important for me. Started my own business and needed a signature loan. 20% interest. I did make through those years but am afraid with all the spending again??? Rinse Repeat by our Govern ment.

How is EuroZone inflation impacted by the US government?

Howdy Logic The world pretty much ZIRPed, Spent, Printed, and almost forgot, lock down their economies.

Absolutely, we’ve been living in an ultra low environment for at least a decade. Now the beast is released! I paid my BOFA HELOC of in the anticipation of higher for longer ,labor shortages, cost of goods raising and lowered debt to below my means. I saw this coming for once,2008 got me good.

Yes, when interest rates fell towards zero in 2009, I spent the next decade trying to get my loans down. When interest rates rose two years ago, I had paid off 80%, so it’s a lot easier. This isn’t great foresight, it’s just that 300 year low interest rates aren’t going to last forever.

All those years of my family diligently paying down our mortgages are finally paying off. I’m sitting on a low-cost inflation hedge. I like real assets! And even in a recession, it’s debt-free!

I remember the day a can of pop went from 10 cents to a quarter in the vending machines in Canada.

”Twice as much for a nickel too.” the official Pepsi slogan when it came out in the 10 ounce bottles was great news for kids selling the afternoon papers for a nickel in 1952 RT. We made $0.02 of that nickel, and if we sold all 25, felt rather well off compared with other kids in the area. ( And didn’t need parental approval to drink as many as we wanted, eh? )

Last time I actually purchased the SF Chronicle, visiting CA a few years back, the daily was a buck, and the paper half the size it had been and not worth a fxxx…

Yes, in 1973 a pint of beer cost about 11p in sunny England,( I was 17) by 1975 it was 25p+. Saying that, College and University was free and the government gave us all a big enough grant to almost live off the stuff. Oh and the legal drinking age, is the same as that of going to war, which is 18.

the msm narrative on services cpi is that “oh it’s always high” – as if they can’t see that upward bend in that trendline

I now close my eyes at checkout in homeless depot and others places

especially PAINT – $145 5 gallons

passing along higher prices with HIGHER WAGES

don’t like it

we pass on YOUR BUSINESS and wish you well

In California a $145 5 gallon can of paint will cost almost $160 out the door after adding sales tax and the new “paint tax” (aka “paint recycling fee”),

There is also “srinkflation” in paint and I just noticed the “5 gallon” cans of Glidden paint sold at Home Depot are now marked “4.84 gallon”…

So is there a lot of theft? The taggers seem to have an endless supply. Last time through LA I could barely read the freeway signs they were so messed up and just about every wall in a poorer neighborhood or industrial area by a road or highway was covered with graffiti.

Bet they don’t pay a recycling fee!

Fed HAS to talk like it’s all good, because any OTHER kind of talk—like the truth—feeds the monster.

Not exactly clear who you are defining as the ‘monster’?

I’m assuming the Eurozone doesn’t/didn’t use the odious healthcare adjustment that understated services inflation in the US up until November either, right?

A big portion of health insurance in European countries are government programs. Germany has a dual system, private insurance for higher incomes, government insurance for lower incomes. France has one health-insurance system run by the government. Etc. So, much of the health insurance inflation is decided by the government, and it’s — I would assume but I don’t know — a lot easier to track than the state-by-state mess we have here in the US.

Hello Sir,

Firstly, thank you for your articles, they are truly amazing and informative. Keep up your great work.

Secondly, I’m french, I hope you don’t mind if I correct you about our system.

We actually have a dual system, 70% public (la securité sociale) which includes healthcare, public retirement, family social aids, disabilities and 30% private (les complémentaires santé).

Since October 15th 2023, it’s 70/30 for everything but dental 60/40.*

Since January 1st 2016, companies have to pay at least 50% of their employees’ private insurance. Usually companies have their own agreements with private insurances and we use them because it’s cheaper than having your own contract outside the company.

Also, since January 1st 2024, when we see the doctor, do a medical examination or get a box of medicine we get reimbursed everything from the public part but 1€, supposedly to preserve the system, it was 0,50€ before that.

For the private insurance, the reimbursement depends on the package one’s has.

I guess as long as consumers don’t seem to give a shi*t and continue to spend on services …. there is zero reason it will ever go down.

Consumers to give a sh*t, I mean just read the comments on this site about increases in insurance premiums, etc., people are livid about this stuff, but lots of services are essentials, and it’s hard for consumers to walk away, and so companies get away with raising their prices, and so they raise their prices.

Well said Wolf. I work hard to keep my services costs as in line as possible. Definitely switching several providers soon and likely canceling cable. Everything has gone up and it does feel like getting nickeled and dimed by every recurring bill I have.

I cancelled Comcast at $200/month (internet and TV) only to sign up with a fiber service (internet) at $79/month (no TV channels).

To watch anything but bullcrap “free” TV, I signed up with UTube at $79/month to get good content and *some* sports.

My savings? = about $20/month…..and I expect increases with the new services. Beating a dead horse is what this feels like.

Anthony A.

How do you spend $79 on youtube? Premium subscription is around $20/mth.

Anthony A,

I think so few people evaluate their needs. I had Comcast for only Internet but was problematic because upload speeds were trash. I got a 2 year deal for 250 mbps symmetrical fiber for $30. Saved money as well as equipment is much cheaper to buy from Amazon or Best buy than rent. 1gb was $10 more but 250mbps would likely be solid for me and 2 neighbors at least. I see Internet as essential now, but in many cases many could be fine with much less but how much you buy into streaming is more a first world problem. I do periodic streaming but often easy to get free for periods of time.

The issue is not first world problems but the essentials, which you can shop around but going with something like minimal coverage is insanity if you have any assets of value.

We don’t have cable TV at home, but we pay $329/month at the cabin for both cable and internet (with Optimum) since renters want to watch TV. The price has doubled in the past five years. I just logged on to look at the Liberty Utilities site to see of the power at the cabin was out since my Next cameras were not working and noticed that we are paying $0.39/kWh for power up there. Google says “The average residential electricity rate in California is 32 ¢/kWh, which is 72% higher than the national average rate of 19 ¢/kWh”…

ApartmentInvestor,

I am sure most Americans can relate to your pain of owning multiple properties and struggling to pay cable for people renting it out. I will take a moment of silence to feel your pain and send good vibes your way.

Jack, he means YouTube TV. It’s basically a streaming cable service. It seems expensive, but where I live, the $79 with no box rentals (you can just use a SmartTV or get a $30 Amazon Firestick or Roku) is much better than $110 plus box rentals.

You also get effectively unlimited DVRing, although you can only keep the recordings for 9 months.

I saved on services by cutting out ALL cable and home internet bit over 1yr ago, I pay a bit more for my cell phone when I got a 150GB data deal, I never need more so far which is good and it’s a lot less money than what I paid before. I replaced almost all the watching with reading, I spend some saved money on books but at least those are physical “assets” and I can get 10%-20% back at the used book store 😆, rest of the money pays for my gym membership, I’m no longer out of breath climbing a flight of stairs or dragging my luggage through snow lol. Inflation has had some positive impacts in my life

Just had a 1st hand experience with insurance companies paying through the nose for medical bills. In our case they could have paid the reduced rate which we were entitled since we went to participating providers. Instead, they paid the full list price (3x) for the medical bills. Then when we sent them the reduced co-payment bills from another provider, they denied payment. These insurance claims adjuster are the dumbest f%ckin morons on the planet, and we all are paying for it through our insurance premiums.

Medical billing is a black hole in the U.S. Even with us on Medicare.

Just wait until you get “served” by a medical specialist that’s not in your insurance network. That can happen without you even knowing it’s going on.

Your insurance company will get an end of discount with the approved health care provider. This will more than offset paying the full price payment you saw.

Back in the days of $8000 yearly deductibles I would lie and say I had none and ask for cash price. Costs for MRI, blood tests and more were always 1/3 the cost. Given I would never hit the $8000 I went cash. If something hit the fan then at least I was covered.

Crazy how much money is burned on administration of everything versus simply providing healthcare but of course that is what for profit does. Equivalent outcomes as other developed countries at 10X the cost.

Glen, we’re not really a developed country in that respect. We are a country that’s 70% developed with 30% of the population effectively third world, in terms of education, income, culture, etc.

@Anthony A,

In California, Law AB 72 has protected plan participants from surprise out-of-network medical bills since July 1, 2017. I thought something similar had been passed at the national level sine then, but I may be wrong.

The “No Surprises Act” became Federal Law on Jan 1, 2022 as part of the Consolidated Appropriations Act 2021. You can sign this right away if a doctor puts a form in front of you, so don’t sign anything without reading. There is a national hotline for reporting out-of-network charges you did not agree to with a signature.

I’d like the Out of Network hotline complaint phone number to make a complaint about the medical provider charging us an outrageous fee for services when they were preferred provider.

Notice how the Swamp has elevated the dialog on this site.

Yes.

Unfortunately I need car/health insurance and have to rent a house to live in (at 50% more than what it was 3 years ago). I refuse to buy a house in this market.

I have to buy food to feed my family. I’ve pretty much cut my household budget down to just essentials and we are still getting burned by the high prices that continue to climb.

My latest dental copay was $400 bucks for my son’s teeth extractions since he needs space. No choice but to pay up. On top of my dental premiums going up 40% from a few years ago.

Do people know why it’s going up so much? I just don’t understand.

I moved back in with my family in 2019 cause I was priced out of my previously cheap city (you could get a 3 bedroom for $900 and a studio for 400 not that long ago). There is something strange about how nice everything looks and all the thriving business and homelessness exploding at the same time (mostly with disabled and seniors too….)

I miss being able to just afford here at market rate and now I can’t even afford low income apartments… realizing how long ago that was rn. It’s been 10 years since I could ACTUALLY afford an apartment without family helping me. 2019 prices were making my family drown trying to keep me independent.

Case in point: Spectrum (cable provider) just increased its rates by 13%. Included in that is a 40% increase in required equipment. Same equipment, just we’re charging you more.

Called and have in the past been able to “negotiate” a small reduction. No joy this time – basically just pay. Unfortunately no real options: no fiber, wireless is poor, so I could go with Starlink, but that’s even more expensive.

Death by a thousand cuts.

Buy your own equipment.

You don’t have cell phone service where you live? Verizon and TMobile both offer cheap internet using 5G.

“people are livid”.

People need to get over it rather than just yell at the moon or Pi$$ into the wind. Life is a total exercise in navigating around these kinds of things. If the costs of items is too high, simply do not buy those things. Most things are wants, not needs. Food shelter and clothing are the essentials. It is easy to trade down on food and still get high quality nutrition. It is also to trade down to affordable shelter. Good clothing can always be found at resale shops or the salvation army. We are considered rich by most anyone’s standards and we still buy our clothes at re-sale shops. You would be surprised at the amount of items that are there with the original tags still on them.

There are ways to navigate around the things that seem to make life difficult.

If times were really rough, starbucks would not exist. Likely neither would “whole pay-check foods”.

Having survived as an adult for over 60 years, I believe I can safely say, we are actually living in pretty good times.

Easy to trade down to affordable shelter?

Let me know when you get your head out of your rear.

“We are considered rich by most anyone’s standards and we still buy our clothes at re-sale shops.”

I was shocked to find I am in the (bottom of the) top quintile in net worth in the USA, yet I squeeze every penny. I don’t take vacations, and my car is quite old.

@Louie for used clothes check out eBay. Better selection “and” better prices than most used clothing stores.

@phleep, that behavior pattern is WHY you’re in the top 20%

Too many people have “squanderlust”

The problem with switching services providers to save money is that you may make the mistake of going with a s$ithole company just to save a few bucks or get better service. I made that mistake last year and am now paying a heavy price. I switched from USAA homeowners ins to Geico because of the poor service of USAA handling multiple claims over the years. I moved my auto policy over as well to get the discount. Geico was also much cheaper. Now after the recent hit & run accident involving personal injury I am now having to deal with an insurance company run by clowns and sh$theads the likes of which I have never experienced in my entire life. This is a criminal organization masquerading as an insurance company. I went back to USAA and cancelled all my insurance with Geico. USAA is much more expensive but at least they support Veterans and eventually pay their claims, even if you have to spend 60 hours documenting your losses.

Swamp – have found an observation of USAA’s membership restrictions over the years interesting. When I wore the uniform 50+ years ago as an EM (ok, drafted), they were ‘officers only’. They have since included NCO’s, then EM’s, then lower-ranking vets, and now, apparently, non-serving next-gen ‘family members’ (in what appears as some sort of ‘legacy’-linked marketing from their tv ads) from all of the aforementioned groups (suspect their customer base was experiencing a long-term enrollment decline congruent with active armed services numbers post-VietNam and a need for more corporate ‘growth’). Hope they treat you better second time around, but their marketing makes me reach for the antacids..best.

may we all find a better day.

Operation Reverse Twist imminent.

Disgraceful.

Stupid bullshit spread by illiterates who can’t read a speech, right out of ZH.

I will discuss this over the weekend.

What is “disgraceful” is this manipulative lying about what was actually in the speech — and about QT in general. People that spread these lies hate QT and hope that lies will turn QT into QE. The same crap over and over again for nearly two years.

Howdy Lone Wolf Glad I only read that headline elsewhere. Will watch all weekend for your article. Thanks

Sorry, what is ZH?

Zerohedge

Thank you Massbytes

I warned during ZIRP that higher rates could lead to more inflation. The theory of low interest rates is that consumers will take our loans to stimulate demand. But ZIRP was so experimental and uncharted that it resulted in businesses taking out loans and subsidizing consumers with low cost products/services that lowered inflation.

Now that people are paying fair price for Uber rides and movie streaming, that money is showing up in their Consumer Price Index.

The answer is not more ZIRP but to recognize the long disasterous distortions that ZIRP wrecked to our economy that we still suffer today.

Howdy Alpha. ZIRPing made me crazy . I knew bad things were coming. Did Govern ment intentionally imprison those folks???

How high will interest rates rise in 2024?

Nah, voter Williams of NY Fed was doing the Bulltard yesterday, giving the hungry reporters more kissy kissy about lowering rates. There’s no way these clowns are goosing the market “unintentionally.”

Long end rates are going to rise.

There is no appetite in DC to bring deficit spending into the realm of sanity. Biden wants to spend, Trump wants to cut taxes on himself.

Either way, UST is going to have to monetize insane amounts of new debt for the foreseeable future.

“Higher for longer.” I think I read that somewhere.

Interest rates are heading up in 2024. Just look at the oil prices. Near $80/barrel and heading to $100/barrel. I’m getting 5% on my CDs. Next year I will be getting 6%. Keep up the good work JP.

I hope so. I want a catastrophic crash of the economy in the next few months for political reasons.

Lol. Same/same but different as the saying goes. Fundamental issue is economic liberalism and especially how it manifests in US. Revolution could change things but most Americans have it to good to challenge the status quo and have bought into the concept of American Exceptionalism. Long slow decline is all this country has in store but Americans will argue parties all the way there!

Yep, that’s what I mean. I don’t mean D versus R, but in terms of discrediting the status quoa. And getting the average person to realize how bad immigration has been for America in the past 40 years.

Einhal,

Well much of the immigration issues stem from foreign policy that has played some role in destabilization. I think native Americans might disagree with the 40 years and might more accurately label it genocide. Hard to point to a country we haven’t messed up. Honduras, Guatemala, Chile, El Salvador,… Perhaps easier to list the ones we haven’t exploited or outright destabilized. I would also disagree that immigration is a problem but moreso the inability of our elected representatives to simply solve it,but perhaps that is what you were implying.

Geezus, give it a rest, bub. Does your little anti-immigration hobby horse even have a license to shit in the street? Go peddle that trash on some other comments forum.

America made its own bed with this mess at the border, particularly with NAFTA. It brought about rapid and ruinous decline to real incomes in Mexico of ~ 34%. Think 1930’s Great Depression to get a sense of the scale. By design, we gutted the livelihoods of small/medium scale Mexican farmers by way of exporting our own highly-subsidized versions of their crops south of the border.

America engineered the misery we’re seeing unfold. Lay off the victim blaming.

Immigrants and their children are almost 90 million people or 28% of the US population. Maybe you should go to some public place and loudly announce how much you hate immigrants and their offspring and see how that goes. Personally I wouldn’t give a plugged nickel for the average nativist citizen – most immigrants have a lot more initiative and enterprise.

Escierto, yes, since 1965, we’ve become the dumping ground for the rest of the world’s downtrodden, and America is much worse now than it was then. You can choose to deny the correlation (and in my opinion causation), but I won’t.

Have you seen the statistics for third world immigrants and their children? They’re not pretty. They’re overrepresented in all of the social ills.

Even today, America is too crowded, our infrastructure is taxed, traffic is a nightmare, and we don’t have nearly enough good jobs for low skill people. There’s no reason to be importing more poverty.

Oil won’t go to 100 per barrel.

In that case usa can franck out more oil and bring price in control.

Picking up nickels in front of an out of control steamroller works for sum.

They peaked already this year.

DM: NY Community Bank stock sinks 20% in one day (and troubled lender has now lost two-thirds of its value in a month): So, is Shark Tank star Kevin O’Leary’s prediction the bank is about to fail coming true?

Shares in New York Community Bank fell more than 20 percent when markets opened on Friday after the ailing lender announced new leadership.

SoCalBeachDude..Do you (& others) realize that NYCBANK is actually New York Community BANCORP? Do you know how many BANCORPS there are the US of A?

Don’t know why the real name is NOT being mentioned by MSM (sarc)

Bancorp is just part of a name. Lots of big banks don’t use it in their name. All the larger banks are bank holding companies, whatever their name says.

Below are the 10 largest banks in the US. Only one of them (U S BK NA/U S BC) uses Bancorp (BC) in its name, same as NY Community Bank BC.

NY Community Bank is the 28th largest surviving bank in the US.

Btw (before you come up with conspiracy theories about it), “NA” means “National Association” which a bunch of banks use in their name, such as Wells Fargo and Citibank.

JPMORGAN CHASE BK NA/JPMORGAN CHASE & CO

BANK OF AMER NA/BANK OF AMER CORP

WELLS FARGO BK NA/WELLS FARGO & CO

CITIBANK NA/CITIGROUP

U S BK NA/U S BC

PNC BK NA/PNC FNCL SVC GROUP

TRUIST BK/TRUIST FC

GOLDMAN SACHS BK USA/GOLDMAN SACHS GROUP

CAPITAL ONE NA/CAPITAL ONE FC

T D BK NA/TD GRP US HOLDS LLC

BANK OF NY MELLON/BANK OF NY MELLON CORP

In 1996 Chemical Bank acquired Chase Manhattan.

Every bank I’ve ever dealt with has gone bankrupt.

Franklyn National bank – bankrupt

Perpetual Fed Savings & Loan – bankrupt

National Bank of Washington – bankrupt

Wychovia National Bank – bankrupt

Need I say more

so wolf tells it like it is.. as we all know

but then, the ‘spin’ on ABCnews (website), for example.. is:

“european inflation eases”

what a total joke. this goes back to the comment i made on the prior article about the gigantic delusion so many seem to be living in, which in turn, engulfs ALL the rest of us.

it cant be both ways.

id provide the link, but i know wolf doesnt like that..

Most outlets are looking at a 12 month period and ignoring base effect which can distort the picture tremendously. Late 2022 and early 2023 had some high prints, and those are now coming off the books, which gives the impression that things are still cooking when in fact they are heating up again on a 1, 3 or even 6 month basis.

As an investor, this is something very interesting and useful as I suspect the market will react in the coming 1-3 months, especially if the March 12-13 CPI print is again hot. The Fed won’t be able to ignore that.

1. Inflation HAS cooled a lot.

2. What we’re talking about is the reversal of the cooling trend.

3. Those articles are either written by AI or by clueless recent journalism graduates. There are lots of people out there with experience, including central bankers, including Holzmann whom I cited, who see this the way I do: the reversal of the cooling trend, and that reversal is disconcerting.

If WR and R Holzmann are aware of “the reversal of the cooling (inflation) trend, and that reversal is disconcerting.”, then the Fed must surely be aware, too. So, should/will J Powell convince the voting members to raise rates by the next meeting? 25 bps would suffice, I would think. Or is it still too early to think about thinking about raising rates … i.e., we need more data to better see a trend? Sure, inflation has cooled a lot … but we’re staring to see head-fakes with the trend.

Raising rates gradually is not going to break the financial system … everyone already knows the rates will stay higher for longer, so why not raise rates at the next meeting? Oh, must it be telegraphed first?

I should clarify that I viewed WR’s comment, “ … the reversal of the cooling (inflation) trend, and that reversal is disconcerting.” applies to the US and Eurozone.

Inflation just lags the cycle… It’ll decline the most in the later stages of the incipient global recession.

The same reason why Inflation was able to surge from q3 2007 to q3 2008 before collapsing. Even though recession started in a December 07.

The problem is having a 2% inflation rate as a minimum and then running inflation hot at 4/5% per year but with “not our fault” rates of 9% and of course you run out of people willing to hold currency i.e. the velocity increases, something that is suspiciously silent.

I remember being roundly mocked by Wolf on this site for pointing out that there would be a deliberate dollar debasement as there was under Volcker.

Now there has been.

I don’t remember him mocking you for that. The deliberate dollar debasement has happened for nearly four years. When did anyone say otherwise?

I do agree with your larger point though. The only way current long-term yields make sense is if you don’t think there’ll ever be an “emergency” (as defined in the sole discretion of the Fed) that warrants printing. If you set 2% as a minimum because on my God deflation is SO BAD, then the goal is really the blended average of the 2% minimum in the “good years” and the 4-9% in the “bad years,” meaning probably more like 5-6%. If that’s the case, as I believe it is, long-term rates will blow out in the next decade or so.

I like how the feds average inflation targeting only works one way.

The fed doesn’t target an average, they target a rate. I believe WR has dealt in the past with this fallacy that any overshoot of the target percentage rate must somehow be compensated for by an equivalent “undershoot”.

MustBeADuck, it’s not a fallacy. If you’re only targeting a rate on a year by year basis, you must be very careful not to overshoot. But they’re not. They even admitted they wanted to let inflation run hot to compensate for the years of “undershoot.”

Therefore, they use it as a one way ratchet.

It would be like trying to lose weigh and targeting 1,600 calories a day, but then eating 4,000 calories a day on “special occasions,” and having tons of them, without having lighter days in between to compensate.

It’s complete nonsense.

The Fed did go from making policy to hold inflation between 0-2% to a “symmetric 2% target”.

That’s not working out well.

After decades of easy money, and associated corruption, there’s not enough will to make the hard choices.

Google CNN “Americans’ cost of living remains a massive headache, even as recession fears fade” for a good article as to why Americans are so sour on the economy, despite the Wall Street shills screaming about a soft landing, disinflation, and how great everything is.

Even this article however contains some NAR BS. There’s no lack of supply. There’s a lack of willing sellers are reasonable prices, because wealth has become so stratified that people are willing to leave houses empty or stay in houses they don’t need.

Again, this is the problem with printing money. It’s not “magic.” You can’t control where the printed money goes, and in the case of the past 15 years, nearly all of it went to the very top, where it sits in the hands of a few people who use it to bid up the prices of all assets, including housing.

The fact that so many young people can’t or won’t have kids is not good for society, not if that low birth rate will be used as a justification to import more unskilled third world immigrants.

Also, the fact that empty nesters own twice as may large homes as Millennials with families shows that things are out of whack, and THIS is why we’re hearing generational warfare.

It also demonstrates why the average American doesn’t care about the stock market. Nearly all stocks are held by the top 10%. Even if younger people have some exposure in 401Ks, the average balance is under $150,000, and it’s not touchable without tax consequences till age 59. No one feels “rich” because of a 401K balance.

It is true that a healthy stock market has helped incumbent politicians in the past, but that’s because the stock market used to be a barometer of the health of the economy.

Now it’s a barometer of whether “investors” and other parasites think the Fed will start printing again.

I don’t agree. What I think people consider that is middle class, that 11-25% bracket on income and wealth absolutely care about how their 401k is doing, along with those below them that are younger and looking to end up in that bracket as they get older and their career matures.

Plus RE prices mooning has made people feel good enough for them to buy brodozers, Rvs, boats, vacation condos, etc. Why would 401k wealth be any different? Yes it’s not easily accessible but it’s contributes to their psychological state where they’re more likely to spend money on something vs. cut back on spending.

I read on other discussion boards people who are definitely not in the top 10% and they very much care about the stock market. And crypto, lol. Stocks take a big hit and they don’t even want to look at their statement, stocks go up and it’s dinner out for the family.

I think you’re overestimating the amount of income needed to be in the top 10%. I suspect the people with whom you converse on discussion boards are not even close to representative of the American population as a whole.

A Google search revealed that in 2022 the average 401K balance was around $120k, with the median being around $25k. I’m sure it’s higher now, but the point stands.

No one is getting that excited about their 401K going from $100k to $125k while the costs of insurance, child care, rent/property taxes, groceries and other costs of living are skyrocketing.

The people who bought boats, RVs, and vacation condos because of the “wealth effect” from stocks and housing are probably closer to the top 5%, if not the top 2%.

Damn, should have been “amount of wealth,” not “amount of income.”

You must not get out much. Any RV park or lake with boating will be packed by fire and police, many who have retired at 55 with a sweet 7 figure pension. I stay at a lot of RV parks and everyone is pretty friendly so you get to know each other. Quarter million dollar Rvs with a jeep in tow is common. Thin blue/red line = $$$$.

I believe I remember some articles on here about this. I think that there are a lot of people in the top 10% of income and assets who are spending because of the wealth effect. I also think I remember the curve not being at all linear and once you get to the top 5% and go up from there the amount of wealth goes up significantly for the handful that meet those thresholds and those few are extremely wealthy.

The same article also says that inflation is cooling big time 😀

Neighbor next to me in SD is an old couple in their 70s. It’s a rental. They paid $150K in 1992. The house has sat empty for the last 6 months as they remodel the inside using a two man crew they paid daily in cash.

The own another more expensive house up the street that they paid peanuts for that is now “valued” at over $2M.

Meanwhile all of the under 30 people who work for me can barely afford a 1 bedroom apartment and have given up on owning a house.

The system is rigged.

@Rigged:

Instead of expecting your elderly neighbors to subsidize someone else (Did it ever occur to you that they are providing both a rental unit for someone, employment for the two laborers as well as providing for their expenses so they can be self-sufficient… and those homes may not have sold for “peanuts” back in the day – compared to today, yes, but then? Maybe not so much.), you have the ultimate solution to the dilemma you cite (barely can afford a one bedroom apartment).

Why don’t YOU give your employees a substantial raise? One big enough that they could more than afford a one bedroom apartment – maybe even a two bedroom! Or take your own money, buy an apartment complex, and rent out units at below market rates?

Oh. Snap! That would impact your financial situation and we can’t have that. People always want someone else to solve the problem. However, they consider themselves exempt because they’re special.

I also note that you claim to live in a neighborhood of $2M houses. Why not sell your house to a 30-something for $150K like you expect them to? I guess some kinds of greed are bad and others are good. /s

@El Katz,

Or, hear me out, we could have a gov’t and fed that is responsible and doesn’t let inflation run out of control.

I know you ended your post with /s but what rigged is trying to say is that the asset holders reaped the benefits of feds policies for last few decades.

I agree with rigged on this.

All this is happening by design

@Rigged are you “sure” they paid $150K for 100% of the home in 1992? My friend bought a (nothing fancy) condo in San Diego’s Mission Valley for $150K in 1991 and Zillow says it is worth ~$500K today (up 3.3x). The CA minimum wage is up 3.8x since 1992. Google says the median home price in SD is up 4.3x since 1990 so unless your neighbors got the “deal of the century” (or spent $1mm+ on a massive renovation) their home has not gone up in value over 13x since 1992.

Rigged didn’t say what the home purchased for $150,000 is valued at today, only that it is less expensive than the $2 million home up the street. Accordingly, Rigged didn’t say the home went up in value 13x since 1992.

Housing is mostly a local politics issue.

Pay attention to your local government.

The last decade people under built and people in houses prevented stuff being built.

I am disabled and definitely feel this pain. It’s mostly disabled and seniors who are without housing where I am.

> The fact that so many young people can’t or won’t have kids is not good for society, not if that low birth rate will be used as a justification to import more unskilled third world immigrants.

This is just social darwinism and is of course on purpose. Americans who were unable to get rich are discouraged from having their own children with the threat that they will experience sharply downward mobility (which would foment discontent and is a major political risk for elites). It is much preferred to give opportunities to immigrants who will at least be grateful, even if the deal they are being offered is dramatically less generous in absolute terms than in years past.

Phimble – and nature abhors a vacuum, including those of population…

may we all find a better day.

One thing that can never be inflated away is the cost of your own labor if you are the one doing your own servicing. I’m thinking about home repairs here, but there are other ways if you get creative and there is a wealth of information on the internet. With a little ambition there are many jobs that most able bodied people can accomplish with some patience. Most of the time when I hear people complaining about the cost of a remodeling project and offer to lend them the tools and explain how to do it, however, they blow it off like using a tape measure is rocket science. Most people prefer the wailing and gnashing of teeth to putting on a respirator and sanding drywall.

I used to ‘sand’ small drywall projects with a wet sponge.

My Nissan clown car’s headlight assemblies fogged over due to a design flaw. Even though they were recalled Nissan tested them and said they passed. So the choice was spend $1000 in labor or do it myself for $150 in parts. To swap out headlights requires taking off the entire front end bumper – talk about a design flaw. It was scary as hell but I got the directions at the library and went very methodically. What a feeling of accomplishment and hope I never have to do it again. Nissan is scum.

Cookdoggie

My Nissan Sentra cost me $2,000 in repairs/year. The car was made in Mexico using parts made in China. It was a piece of junk. I gave it away. I didn;t even take a tax deduction.

Slick – …one could beleive ‘cursing the darkness’ has become a popular ‘Murican pastime…

may we all find a better day.

“Many services are essential to modern life, such as housing and related services, healthcare, insurance, broadband and telecommunications, auto repairs, transportation, etc.”

Holy smokes, even without a mortgage or other debt, every time I get a statement from any of the above ‘services’ , it is up, most way up.

My Transportation cost increase figures from just last week:

I lease a pickup truck (because I actually use it as intended on my rural property). The last lease on a 2021 Ram 1500 was a 39 monther for $447 per month zero down as I have always done. Last week, the same model for 2024 with exactly the same equipment selection now leases for $603 with zero down, with the same finance company and dealer. That’s a 35% increase.

That’s the end of leasing for me. I’ll use the truck I have and see if the industry returns to its senses, otherwise will drive this one into the ground.

A vehicle lease has a money factor – which can be converted to an interest rate. Look at the difference in interest rates between 2021 and now and see how that would impact the lease. Also: 39 month leases are an inventory balancing strategy – sometimes used by manufacturers to straddle vehicle model years. The lease companies don’t want a flood of vehicles coming back simultaneously as it impacts auction values. The 39 month will often be subsidized in those situations (Example: Use a 36 month residual for a 39 month term). Might not be subsidized in the present market.

In addition, the cost of the vehicle likely went up. The residual may have dropped because the resale value at lease termination may have also been negatively impacted due to changing market conditions from the high used values in 2021 to the more down to earth market of today. In addition, the depreciation dollar amount per month will also have increased due to the higher MSRP (which is the base for the residual – not what you pay) on the new vehicle, even if the residual remains static.

IMHO, this entire modern era of innovative finance and excessive greed is crystalized in the simple turnip idiom.

Everybody feels compelled to milk the system for every possible micro possibility of getting just a little more reward.

The entire spectrum of greedy addiction that is squeezing inflation a bit higher will eventually have consequences — and Humpty Dumpty will be shocked that turnips can only provide a finite amount of blood.

FYI: When people say that you can’t squeeze blood out of a turnip, it means that you cannot get something from a person, especially money, that they don’t have.

That phrase was invented before 100% credit availability for *anyone* if the interest rate is right. Those turnip can *always* yield more blood now.

JeffD – …explains all those things I’m seeing that look like fang marks…

may we all find a better day.

I know Wolf has many times pointed to disposable income as a driver, but I can’t help but think its a symptom of demographic shifts and related rebalancing of economies. Covid just happened to speed up the rebalancing schedule and these are it’s echos.

What happens when a significant and growing portion of a society, laden with unproductive debt, drops out of the labor force and has more time to consume services with wealth and income no longer bound to the labor markets? Inflation surges as wealth is rebalanced.

Rebalancing is always painful… but it works itself out eventually… The cure of higher prices is higher prices. We need a consumer capitulation… One not papered over with bail-outs. Economic pain great enough to have generational impacts on sentiment, behavior, and resource distributions. The proper reset that was avoided in 2008 rather than the decade plus limp through LIRP/ZIRP and QE.

In shake-out after shake-out, extraordinary measures were taken, fortunes were preserved that shouldn’t have been and the detritus was never scoured back to the foundation before rebuilding began. FDIC extended unlimited deposit insurance to shadow bankers at Silicon Valley and Signature Bank was born again so NYCB could teeter while everyone else arbitraged the BTFP.

Drunken sailors savings rates hover near lows as they YOLO through higher service inflation like their are no financial risks and consequences, because they have been conditioned to do so. They won’t change their behavior before they’ve been wiped out and we can’t allow that to happen since the results would be dire, so we’ll play a few more rounds of chicken and see what happens. Deny, delay, deflect, but watch out for that last step, it’s a doozie.

What happens when a significant and growing portion of a society, laden with unproductive debt, drops out of the labor force and has more time to consume services with wealth and income no longer bound to the labor markets?

Firstly, that scenario is not likely to ever happen. Even with the dead weight of the wealthy promoting such rubbish about the very people who made them who they are;

which makes them feel that they actually matter, which they don’t.

Substitute in your mind the German war reparations of WW1 which were never gonna get paid down, with our burgeoning national debt which will never get paid down.

The difference being that Germany owed in other peoples money, whereas the $34 trillion debt of ours is our doing and denominated in dollars.

It behooves us to go all out with inflation in order to make those debt reparations no big deal.

Well, I suppose one could convince oneself of any preposterous idea if they pray hard enough.

The Treaty of Versailles which was inflicted on Germany after WW1 , not only imposed a debt that they could never pay, but made the industrial means to survive, illegal.

Hardly the same as the current American dilemma.

The big question is why would anyone on earth loan the us gov money at 4-5% when you can get half a percent daily in the s&p500? Are all these gov shenanigans really that obvious?

“… when you can get half a percent daily in the s&p500?”

That’s funny. It’s actually just bad math? Or just delusional? And ignorant of “risk.”

1. 0.5% per trading day equates to a gain of about 15,000% a year, LOL. Good luck.

2. The S&P 500 is up 7.1% since Jan 3, 2022 – so that’s 7.1% in about 570 trading days = 0.01% per trading day, not 0.5%. Huge difference. Including dividends, you would have made about 10% on the S&P 500 since Jan 3, 2022.

3. Over the same period, you would have made 10% in interest income on your T-bills, and the interest income is exempt from state income taxes, whereas capital gains and dividends are not.

4. The S&P 500 can dive just fine, and it can dive a lot, and it can stay down for many years, and it has in the past, and it wiped lots of people out… that’s called “risk.” Where as there is zero risk that T-bills will dive.

5. I assume that you were serious. But if it was sarcrasm, it was kind of funny, I hafta admit.

Isn’t that his sarcastic point though? That “investors” are melting up every asset as though there is no risk. They’re acting as though the Fed put is still there.

Given the last 25 years’ history, the continued existence of the Put is the smart assumption to make.

Well, I think that sums it up nicely. The risk is always the attribute that is ignored until the crisis occurs.

The seasonality of prices in the EU is fascinating- something I also experienced when I lived there. Winter is so much cheaper than summer, but to see it show up in the inflation numbers here is a cool touch.

Wait, what. The European business cycle is of a Nordic orientation whereby it is less expensive to be cold than the discomfort that the six weeks of summer inflict.

Love your 1:46pm comments on risk. Spot on!!

Not sure how anyone could have missed the imploded stocks articles. Those are textbook lessons for those who blinded by just the chance of appreciation, simply do not recognize risk, driving on at high speed despite the flashing lights, barricades, warning signs, waving flagmen, and sirens.

Its amazing to see them whizzing past and flying off the cliff of doom, silently descending in an ever increasing arc to the rocks below. Reminds me of the Henry Gibson scene from “Blues Brothers” as they float to their doom. Oh, how bad am I!

Or they bet the farm and win, against all odds. Having made 3 and lost 2, I don’t recommend that they make that bet, against the asset market in the naive belief that American markets are pristine, whereby that they are anything but.

Well, the Euro market potential consumers is 450 million or so as opposed to the American consumers that number at a significantly less than 350 million.

Yeah, they should pay their dues for their share of the common defense.

The absurdity of the current Euro monetary policy can be visualized by comparing the 10 year Treasury yield with the Italian bond yield of the same duration, that is paying 1.5 pct less.

Inflation is an acquired taste. Like cocaine. Seemed like a good idea at the time.

The everyday person is the last one that benefits and the first person that pays the price.

Who cares is the attitude that the Euro data exude. The Euro is a crypto currency with teeth, a pretend currency with a printing press.