Reheating services inflation isn’t a surprise. But the PPI for finished core goods saps hopes for goods “deflation” to continue to hold down overall inflation.

By Wolf Richter for WOLF STREET.

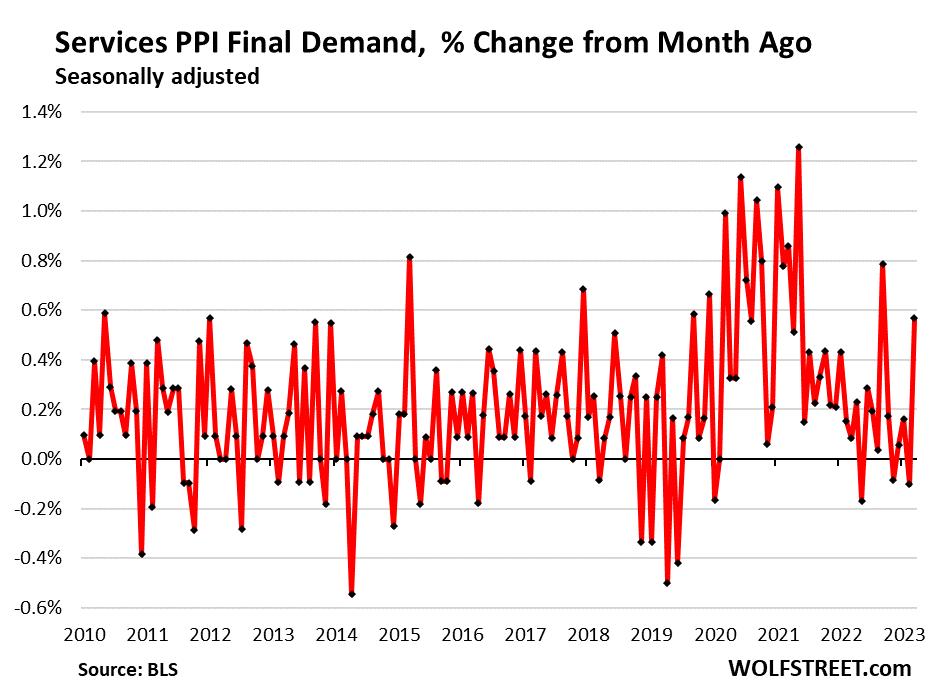

The Producer Price Index for final demand services jumped by 0.57% in January from December, seasonally adjusted (+7.1% annualized), and by 0.65% not seasonally adjusted (8.1% annualized), according to the Bureau of Labor Statistics.

So now there’s the sudden surge of inflation in services that producers use, after months of benign readings. Since the red-hot days of early 2022, there has only been one higher reading, in July 2023.

Final demand services weigh 62.3% in the overall PPI. The surge in the services PPI was driven by a big jump in its biggest component: “Finished consumer services less trade, transportation, and warehousing,” accounting for 32.9% of PPI. It spiked by +1.0% month-to-month or 12.7% annualized.

All of this month-to-month inflation data is very volatile and noisy with big ups and downs, and trend changes take some time to be confirmed, and one month isn’t enough. So we need to exercise some caution. But this was the first big jump in the services PPI in months and it parallels developments over the past few months in the CPI for services, and so the warning lights are blinking.

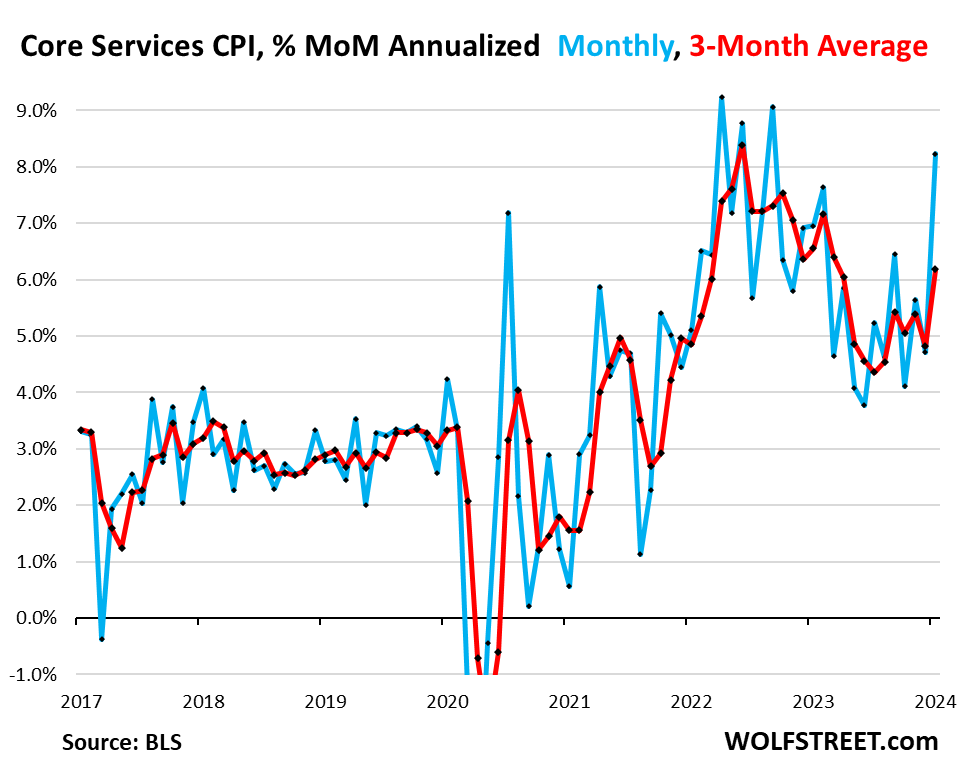

On the consumer-side of the economy – the prices that consumers pay directly – the surge of services inflation in the CPI has been reheating for months and in January spiked from there.

So now services inflation hit producers, not just consumers. And producers are going to try to pass it on.

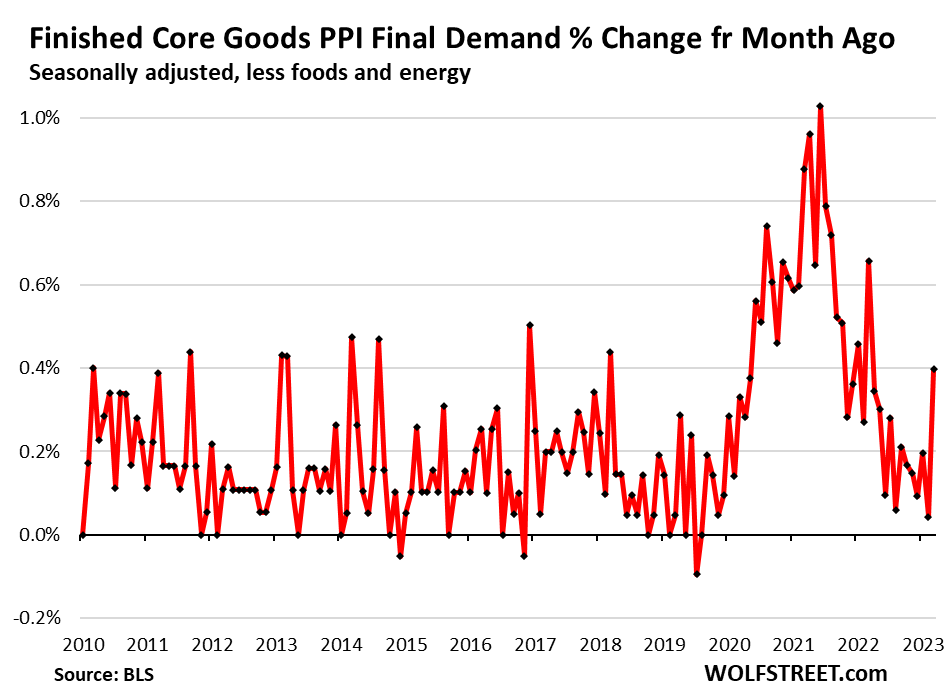

Finished core goods inflation suddenly reheats as well: The final demand PPI for finished goods less food and energy – which weighs 19.0% in the PPI – after months of benign increases, suddenly spiked in January by 0.40% or by 4.9% annualized.

The spike is a breakout from the prior 7 months when the core goods PPI remained in the same benign range, after the long plunge from the 2021 spike.

This is disconcerting because the whole disinflation momentum in consumer prices (CPI) last year was driven by drops in prices of durable goods (negative inflation or deflation) and the plunge in energy prices. This PPI data on finished goods is now throwing some cold water on the hopes that goods-deflation will continue, and will continue to hold down overall inflation measures:

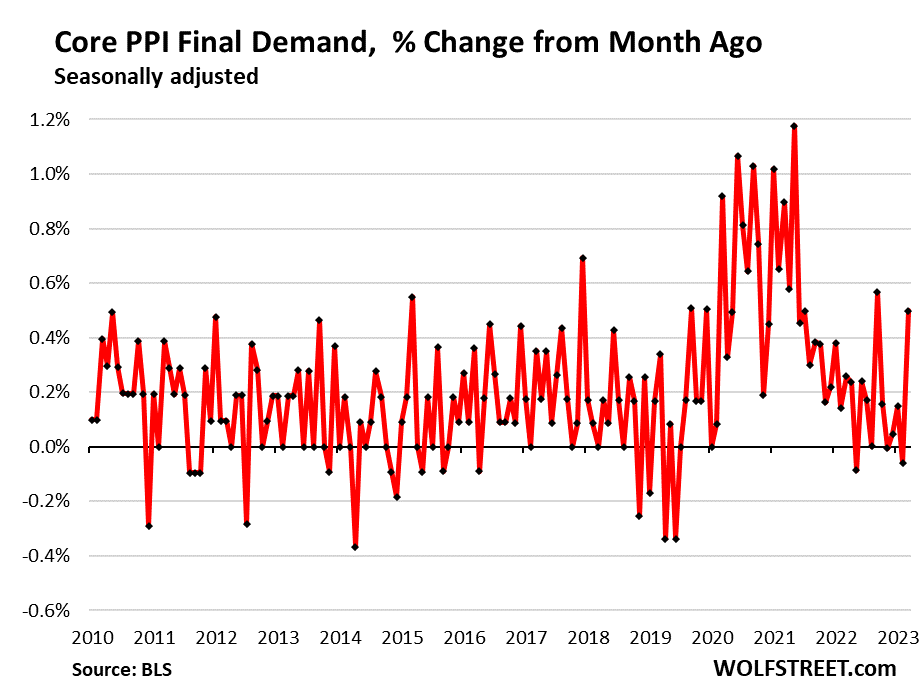

This surge in services PPI and finished goods PPI fueled the jump in the core PPI, which covers goods and services excluding foods and energy.

Core PPI final demand jumped by 0.50% seasonally adjusted (6.2% annualized) and by 0.62% not seasonally adjusted (7.7% annualized). Since March 2022, there was only one month with higher readings (July 2023) and only barely higher:

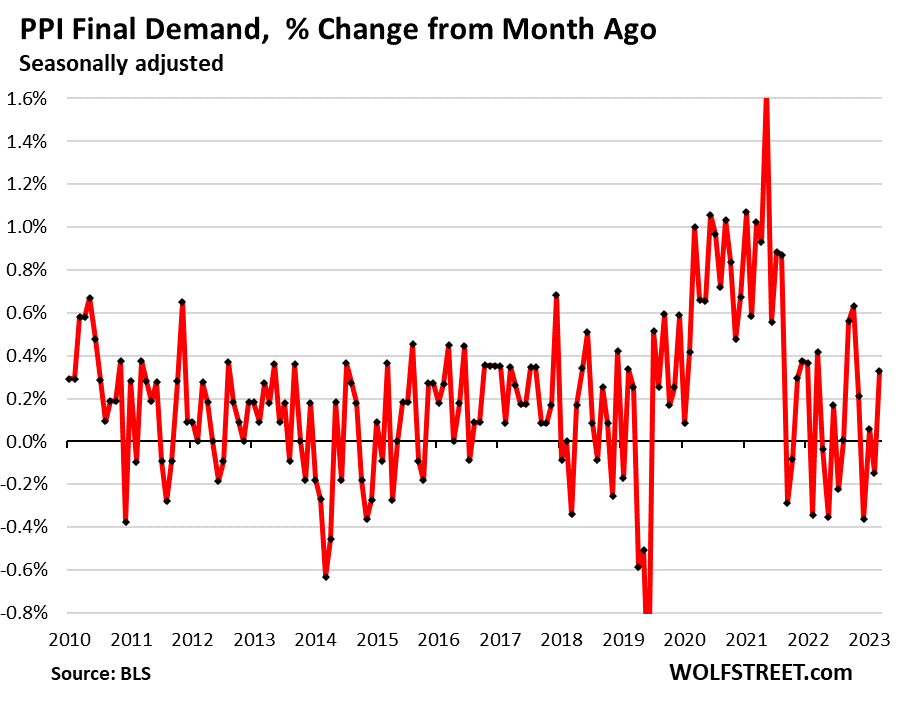

The surge in services PPI and the finished goods PPI also fueled the rise in the overall PPI final demand: it rose by 0.33% in January from December (4.0% annualized), despite continued negative readings in the energy PPI:

The surge of services inflation, and the possible reheating of core goods inflation is a very disconcerting development.

The issue with services inflation is particularly grave because of services’ weight of over 60% in the producer and consumer inflation baskets.

And this parallels what we have already seen in the CPI: “Core services” CPI jumped by 8.2% annualized in January from December. And the three-month moving average jumped by 6.2% annualized, the worst since March 2023, according to the CPI data released earlier this week:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“And producers are going to try to pass it on.”

Never understood this. If they could charge more and make more margin, wouldn’t they do that regardless of underlying cost to make their product?

Sure, if they have no competition and their customers have unlimited budgets.

What competition? You mean the cartel of three to five companies for every industry? The only thing saving the car industry from cartel pricing at the moment is Tesla. RealPage’s YieldStar software sets cartel pricing for rents through an “independent” entity. All insurers in California just raised insurance premiums by a rubberstamped 20%. Do I need to go on further? As far as household budgets go, people are living on credit, so actual income is not setting any limitations on spending for anyone, cf “pay whatever” Drunken Sailors.

“People are living on credit”.

Do you have some data to back up this statement? The data that Wolf has shared shows that income gains have been more impactful than growing credit usage.

Inflation is remaining persistent and frustrating but wage growth has been strong across the board. People aren’t primarily relying on credit to survive, you can look at the other articles here about consumer debt to see that. There’s a small portion of very very leveraged people that hold most of that debt.

However inflation being very hot on rent still means that even with wages increasing people still feel worse off because even though their budget overall might be better they’re paying more on rent and food as a percentage of budget. This is why everyone is so mad about it.

It’s becoming obvious that the fed made big mistakes with hiking last year, or more accurately by not hiking enough. Nobody seriously believes that the fed will allow an asset crash, so inflation is remaining persistent because nobody wants to be left out. Eventually the music will stop and someone is gonna be left holding a really really big bag. My gut says it’s gonna be all the people who bought into American CRE backed securities for the high yield. The average American consumer right now is genuinely doing fine.

@JS,

Consumer credit has increased from $4.2 Trillion in mid-2021 to a little over $5 Trillion today. That’s about $27 billion a month, on average. This is a subset of all debt taken on.

https://fred.stlouisfed.org/graph/?id=TOTALNS,

JeffD,

This is the kind of contextless nonsense that drives me nuts.

Over this period, CPI inflation rose by 14.4%. And consumer credit (which includes student loans that no one is paying down) rose by 14.2%. Consumers out-earned inflation in 2023, and the burden of that debt was already low and declined further.

In addition, credit card balances are statement balances, most of which get paid off in full by due date, and never become interest-bearing debt.

It would be helpful if you actually read the articles here so you don’t have to post this BS.

https://wolfstreet.com/2024/02/09/our-drunken-sailors-credit-cards-balances-burden-delinquencies-and-available-credit/

https://wolfstreet.com/2024/02/06/auto-loan-balances-subprime-delinquencies-and-income-who-are-those-drunken-sailors/

@Wolf,

OK. But 5.0/4.2 equals 1.19, which is a 19% increase in consumer credit over that timeframe. Also, that FRED data I linked shows securitized debt, not monthly credit card statements.

1. There are three components in consumer credit: credit card and other revolving debt; auto loans; and student loans. But student loans are not debt anymore. People are not making payments on them, and they’re being forgiven in large numbers, and when they default, nothing happens. The only consumer credit that is actual credit are credit cards and other revolving debt, and auto loans. And I gave you the burden as percent of disposable income for both of them.

2. No, the FRED data = “Total Consumer Credit Owned and Securitized,” (read the title of the chart you linked), and the data is statement balances because that’s the only data there is because that’s how lenders quantify the credit they have loaned out.

I think you’d have to assume a monopoly for that to be the case, but producers and manufacturers compete with eachother. They still try to increase margins when they feel they can, good example is automotive sector where US manufacturers focus on large decked out trucks and SUVs for the margin, but that comes at the risk of giving up market share to lower priced vehicles.

That is an optimistic way to look at it. Companies are informally keep prices high in they control enough of the market. Look at the diapers where plenty of choices on the store but almost all made by Kimberly Clarke and P&C and prices are high. Not dissimilar to Arco and 7/11 that are across the street from each other always having exact same prices. I’m not suggesting price competition doesn’t exist simply it is more complex than having a monopoly.

Wasn’t the expectation 1.0%? If so, results not bad.

Yes you are right, I just wanted to keep my answer short and simple to a seemingly simple question, I feel nobody wants to read an essay on here aside from Wolf’s articles. Obviously the subject is more complex and collusion, fixing and gouging schemes exist and we know them all too well here in Canada, just look at our telecom sector, we pay quite a premium compared to just about any developed nation. That is a bit of collusion between a few giant companies, then our comms commission gets involved sometimes and smaller operators emerge and prices get better, then in time those operators get shut out of markets and bought out, competition dwindles and prices get bad again, cycle begins anew.

So yeah I mean sellers of products or services want to maximize margins, but there are some limitations, if they raise too high their margins can grow but if too many customers are priced out or just won’t pay then total profits will suffer, if competition exists and chooses to undercut then profit suffers again, and government can also get involved. When inputs costs go up it cuts into both margin and total profit so they try to pass on to consumers, try is an important word IMO because raising prices can preserve margins but kill total profits.. but if our bosses gave us raises due to inflation and competitive labour market, then we pay the higher price and inflation indicators keep going up 😆

No, it’s more like having a retail monopoly.

Feb. 12, 2024-Seeking Alpha:

“Walmart and Energizer face class action lawsuits over battery prices.

Walmart (NYSE:WMT) and Energizer Holdings (NYSE:ENR) are facing class action lawsuits over an agreement that kept disposable battery prices high.

A U.S. district judge in California ruled against the two companies pertaining to the validity of three proposed class action lawsuits. The plaintiffs claim that in violation of Section 1 of the Sherman Act, Walmart (WMT) pressured Energizer (ENR) to inflate wholesale battery prices for preferential treatment at stores and coerced Energizer (ENR) to cut off other retailers who sold the batteries for less than Walmart (WMT). The agreement between the two began back in 2018.

Because of the agreement between Walmart (WMT) and Energizer (ENR), the plaintiffs said disposable battery prices were kept artificially high…

So yeah, welcome to the real world of monopoly retail. Hint, it’s not just batteries.

Don’t you mean “collude” with eachother?

This is what most don’t want to face. Our system is not a capitalist system.

We have socialism which is a merge between business and the government

In a capitalist system the businesses that lose money and are unproductive they go under (bankruptcy) and the low cost producers buy their assets at firesale prices.

WE HAVE A PLANNED, MANIPULATED, SOCIALIST ECONOMY….this is not capitalism. We have distorted what made the USA great.

And unless we go back to that system we are going 2 end up like the USSR, Germany and so many other countries BROKE AND IN TATTERS. It is just simple history…. It’s just a matter of time not if, unless we change course.

Matt,

“Germany and so many other countries BROKE AND IN TATTERS.”

LOL. The US is a lot more “broke” than Germany… check the debt to GDP ratio for both countries:

Germany = 60%

USA = 121%.

USA is better off than Greece tho. Maybe you meant to say “Greece” instead of “Germany,” no?

And “in tatters,” well that’s hard to quantify, but as you can see in the comments here, lots of Americans think that the USA is quite “in tatters.”

https://wolfstreet.com/2024/01/27/us-debt-to-gdp-ratio-worsens-further-despite-solid-economic-growth-as-government-debt-balloons-at-a-scary-pace/

The fact that every automotive manufacture has switched productions to trucks and purposely ramped down sedan production reinforces the idea of cartel/monopoly practices. Tesla has had the near fastest growing market share for five years now, and all they produce is sedans, proving there is plenty of demand for sedans out there if the auto manufacturers would produce them.

plenty of demand for **electric sedans**

I am not sure this equates to high demand for ICE sedans which is the only product legacy manufacturers seem to have a hope of producing well. But with smaller margins, and stiff competition from Toyota, VW, etc….they decided it wasnt worth it and they were going to focus on what they do best….trucks. Whether or not that was a poor decision overall will surface in time.

Tesla fills a niche and fills it well. Given their headstart and leg up in the EV world due to their boldness, legacy OEMs have not had a competitive product here.

They would all love to; right now people on the consumption end of the equation, however, are willing to accept the inflated prices with minimal push-back. Until people stop buying things, the prices will continue to go up, increasing price/margins more rapidly than even the cost.

In the period of a few short years, consumers have completely forgotten that saying “no” is an option, for a variety of reasons. Prices will climb until consumption stops.

There is no pressure to say no when disposable income keeps rising.

So, how long can you live with out food?? This is a stupid argument.

Let’s just starve to death instead of buying food?? Maybe if people are splurging on consumer goods this makes sense, but many are just trying 2 survive.

Prices are rising because the DOLLAR IS LOSING VALUE. Just look at the chart of the purchasing power of the consumer dollar…

By the FEDs own numbers the dollar has lost around 98% of its purchasing power since the FED was created in 1913.

If that is price stability I would hate to see what they say is not stable. We have been getting robbed by inflation since we were born…by design ..since 1913, wake up!!

I wasn’t around in 1913. So I don’t care about what happened in 1913 or since 1913. Not one iota. I don’t care about 1950 or since 1950 either, for the very same reason. In terms of the dollar, I care about the recent past, now, and going forward. The rest is irrelevant.

It’s worth it to take a serious look at what a real mess it was prior to 1913.

For the most part, it works pretty well. 1929 was a learning experience on deflation and deflation is the scariest event of all financial events because it cannot be controlled.

It didn’t help when the dual mandate was introduced. What really doesn’t help is the irresponsible actions of our legislature and the administrations who pander to the whims of the citizenry and the special interests of which there are many.

Matt, you mean “get woke”? (I kinda doubt that, but verbally it all DOES make sense…eg, “wake up!” = “get woke”, right?

Or just buy into your simple “cause and effect” and say something creative and bad about the Fed? (it IS popular here).

My favorite guess at a “main” cause and effect for the inflation you speak of, is the “missing value”, caused by the fractional bankers and Wall Street taking their cuts. Plus lots of Fiscal stupidity on gov’ts part…pork, wars, low taxes, and such. The Fed did other weird things….I think, that probably didn’t help….still trying to learn.

But I can always claim senility which you (using 2 for to) obviously can’t.

M*Vt = AD. If AD remains the same and wages increase, then there will be deflation, not inflation. But that’s not what usually happens. The FED normally accommodates the labor market. The FED validates the increase in prices. The monopolistic price practices of OPEC during 73-74 is a perfect example.

If all producers of this product/service face the same industry-wide cost increase, they’re all motivated to pass it on at the same time. And one of them will go first, and make announcements of price increases, such as in their earnings calls, and the others take their cue and fall in line with similar price increases. That’s why these announcements of price increases are made – to communicate with other companies.

So consumers can refuse to buy this product or service altogether, and sometimes they do enough of it, and price increases don’t stick, and instead margins get squeezed. But consumers cannot switch from one maker to another to avoid the price increases because they’re all raising prices at about the same rate. So maybe they’ll cut back a little for a short period of time, and then they go pay the higher prices and keep on consuming. We have seen this play out time and again over the past three years.

I intend to “stick it to the man” by not eating food at inflated prices.

So there!!

Unless they are unusually profitable, they must pass on their expense increases or they will go under. Economics 101.

This seems right, as a realistic description. I’ll add though, I think even in a monopoly, rising costs can cause businesses to raise prices. Only assumption needed is that the demand curve slopes down.

e.g. I sell 100 widgets for $100 each, they cost me $99 each to make, so I make $100 profit total. If I raise the price to $101 and only sell 10 widgets, my profit is $20 (lower).

Now my cost goes to $100. I have no profit at $100, so now it makes sense to raise to $101 because $10 profit is more than $0.

The optimal selling price is the price at which marginal cost = marginal revenue.

If marginal cost rises, then optimal selling price rises.

“If they could charge more and make more margin, wouldn’t they do that regardless of underlying cost to make their product?”

Yes, in other words, if they’re ‘greedy’ now why weren’t they greedy before all the money got printed?

So I understood the pause in raising rates but when The Fed started talking about cutting I felt like that was premature. Chicago Fed President Austan Goolsby is still saying they should be prepared to cut anyway because they dont want to be too late. These guys just always seem to want to downplay inflation going up and seem to eager to declare we might be heading to a recession and better be prepared to cut. Why dont they just play it cool and let the data speak for them? The whole “what is The Fed going to do” act just seems so played out and immature. Maybe all the media attention these people get has inflated their ego so much that they feel like they have to say something every single chance they get. A simple “no comment” or “we honestly arent sure what is going to happen” would be so refreshing.

A headline that says it all doesn’t get clicks!

Its just like in sports. Sometimes a team gets up early and celebrates and then they lose the game. Sometimes a football player celebrates a TD before they score and then they dont score. Why cant people just shut up and do their job. If they get inflation down without wrecking the economy then they can celebrate quietly and be ready to do it again if they need to. Why do or say anything that might be counter productive to your goals?

Goolsbee is the Fed’s super-dove. And he last spoke before the PPI data.

Bostic, another dove, has already come out with lots of we-need-to-wait-and-see… backpedaling on his 2-3 rate cuts scenario in the second half.

Setting expectations and providing forward guidance is appropriate for the FED.

It would be odd to have an organization whose mission is to direct monetary policy to then withhold comment about their actions.

https://www.federalreserve.gov/aboutthefed/the-fed-explained.htm

Getting (somewhat) back on the topic of the post, I think Wolf nailed it with his early call of Higher (inflation) for longer.

There will be no rate cuts this year. No way the Fed will do anything with this data coming out. In fact, the possibility of a rate increase just went from zero to about 20%. The housing market here is completely insane. Just went back to work after 3 months off. Properties in s#ithole neighborhoods are selling. Did one yesterday. There was so much trash and broken glass in front of the property I could barely park my car anywhere without getting a flat. Out of control crime , NO PROBLEM. The FOMO psychology has taken hold and buyers are out there buying any piece of crap that comes on the market.

“Setting expectations and providing forward guidance is appropriate for the FED.”

The idea that the Fed is obligated to telegraph its moves well ahead of time, avoiding surprising markets at all costs, has contributed to some of the worst Fed moves in modern history–including the almost incomprehensible damage caused by waiting far, far too long to pivot away from ultra-accomodative pandemic policy after it had become clear that the economy was much too hot and housing had gone supernova.

“Why cant people just shut up and do their job”

This.

“Why cant people just shut up and do their job. ”

What a wonderful place it would be for everyone!!

But then too much to expect when you have pompous asses all over the place (just imagine the drop in income if Cramer keeps his mouth shut one day) always wanting to open their mouths or play their books with a media which needs them to quote them and sell their tripe.

Blake, KPL,

Just like Santa’s elves?

All “wonderful”….or so I hear……

Wonder what his management secret is?

It is surprising how much we still believe the Fed after they have been dead wrong about everything they have said or predicted.

My guess is that the Fed is clueless as everyone else. Perhaps someday they will have the wisdom to admit and accept that they cannot manage the economy. People are not blocks of wood that you can rearrange whatever way you like.

Correct Aman. Accurate economic predictions are impossible for anyone to make, regardless of their position. Listening to Powell, I get the impression he has been surprised at some of the results of this latest cycle of funds rate increases. Particularly the resiliency of the labor market.

On a related note, therein lies the conundrum of the entire financial media – not just the federal reserve. Much of the media commentary is about predictions – for the economy overall, for the stock market, for individual company stocks, etc. Financial managers (including hedge fund managers and mutual fund managers) MUST make predictions to justify their (too high) cost.

Of course, they are dead wrong most of the time. But that won’t stop them from making more predictions tomorrow. This is part of the reason I manage my own investments. Most financial managers are full of what makes the grass grow green.

Aman: “We still believe in the Fed”

Because it is a real (powerful) entity. The same one responsible for the problems they seek to solve.

Many don’t seem to have much faith in the Fed, others mostly faith that they will be responsible for the next crisis (causing/ NOT solving).

For the most part the “masses” know very little about the Fed or economy. The Fed will still affect them in general.

No. The Federal Reserve FOMC has been very correct as to all of its stances over the past 10 years.

🤣😂

So the Fed was engineering 9% inflation as a policy goal? That’s the logical conclusion if all the Fed’s stances over the past ten years were “very correct.” Look, even if the Fed is trying to do the right thing, no one or any institution is “very correct” all of the time in a 10 year period. There are too many variables and mistakes are inevitable. Mistakes are OK if you admit them and try to correct the course. Denying them invites ridicule.

I apologize if you failed to add the sarcasm tag.

In all other respects, I agree with DawnsEarlyLight.

“My guess is that the Fed is clueless as everyone else.”

You give them too much credit. Everyone else could see that the global economy was massively overstimulated in 2021, and that housing was white hot, while Jerome Powell took an extended nap with his forehead on the “BUY” button.

Yes, exactly.

Amen.

Yes. He was taking a “smoke break” while the economy burned. It was infuriating.

Economic forecasts are given that in such a time, 6 months, a year, for example inflation is predicted to be x%. What should also be stated is the confidence in this prediction, a +/-. Of course the further in time the forecast uncertainty increases the larger the +/-. All the central banks appear give forecasts which are too optimistic, some inbuilt bias is in their models. In my opinion it is best to take the lower bound of the banks forecasts.

Experts often tend to be arrogant, and think they have it all figured out, even when they do not. I think you get that many ‘experts’ together and they’re going to believe they’ve got it all figured out, because they’d like to believe that. It sucks to admit that you don’t know what you’re doing, even when you dont.

True experts tend to be humble. They know how much they don’t know.

In other words, there are no “experts”. Not one. Just the “best” model makers at a given time in history.

Who decides who is “best” is yet another model making exercise, and so on and so on.

But there are always decisions to be made while part of Namarupa.

Obviously everyone here has picked one of their favorite model makers…..or comment collectors.

Does it matter? Goolsbee isn’t a voting member in 2024. He’s an alternate.

You’re obviously not part of the government or a politician. I could be wrong, but I’ll take my chances.

On 16-Feb-24, on CNBC interview Bostic clearly stated in Dec SEP, he had given only 2 cuts. Not even 3. This is confirmed by himself. That too he is expecting in second half of 2024.

If Dove like Bostic is careful, I hope other FOMC members will be cautious about inflation coming back or stalling at current levels.

Looking forward for March SEP and see what they have to say.

Almost as if the long-term rates that people actually pay have more to do with controlling inflation than the Fed funds rate, so when those dropped, disinflation stopped.

I understand sir I just wish none of them were doves or hawks. How about we just have some level headed logical professionals that monitor the economy and make minor adjustments when needed and keep their personal feelings to themselves.

Many on this sight support the philosophical position that “monitoring,” then controlling the economy and employment, can occur without eventual inflation. The Fed, as currently mandated, grew out of that position.

“In reaction to the fearful slump of the 1930s, Americans closed ranks against deflation. The 1935 Social Security Act and the 1946 Employment Act are among the innumerable legislative expressions of this national effort. The Medicare and Medicaid Act of 1965, technically an amendment to the 1935 law, and the 1978 Humphrey-Hawkins Act, technically an amendment to the 1946 law, affirmed and reinforced the central place of government in the economic affairs of a new generation of Americans.”

— James Grant, Grant’s Interest Rate Observer, Feb. 2024, The Inflation We Choose

The societal demand for economic management by a central authority is based on this Keynesian sentiment, which reveals the bias toward inflation:

“Thus inflation is unjust and deflation is expedient. Of the two perhaps deflation is, if we rule out the inflations such as that of Germany, the worse; because it is worse, in an impoverished world, to provoke unemployment, than to disappoint the rentier.”

— J.M. Keynes

It’s the concept that we should “rule out the inflations such as that of Germany” that illustrates the inflationary bias. A central bank charged with managing employment will always lead to inflation.

IMHO. Would love to hear other opinions.

I think Wolf’s take that we still need to wait and see is worth emphasizing.

The inflation resurgence makes complete sense to me because goods/ material costs were not going to deflate forever and rising wages will eventually show up in prices of everything (until we replace people with robots in all aspects of production). HOWEVER, I have been surprised with how quickly inflation moderated. Time will tell if the upswing is the head-fake.

Thanks Wolf,

I read somewhere the ten year is above the 50 and 200 day moving average implying a trend higher for interest rates. The Fed has paused and paused and paused, trying to keep rates low. All the QE and monetary easing has a price to pay no matter what Yellen tries to do on the short end with the debt.

The 10 yr yield looked bullish until Friday 2/16 close. It now looks like it’s near a peak. Friday’s action was bearish in the 10 yr yield.

We are one energy price spike away from a massive reacceleration in inflation.

May have already happened in the red sea and its impact on shipping rates.

Also telling that Buffett is selling some of his tech holdings and buying energy. Dude knows value far better than most

Shipping rates are already headed back down. This is the one case where “transitory” was a correct descriptor.

We’ll be told by Jerome Powell and Co. that “it’s transitory.” They have plenty of hubris to do it, and would turn up their noses at the same time.

Looks like that “shock and awe” 5+% isn’t going to do anything to inflation, even with sprinkling the “fairy dust” of Quantitative Tightening. What a surprise that Jerome Powell is going for the Arthur Burns school of ineffective monetary policy instead of a more masculine Volcker approach. Thank God for satellite car radio and the 70s channel; all that is missing is some more “trickle down” middle class economic policy, probably to be renamed “dribble down” to account for the policy’s age.

Gary- re

“ineffective monetary policy instead of a more masculine Volcker approach. ”

Gee whiz – ya think? 5.25% vs Volcker’s 20% Fed Funds rate ?

Fed balance sheet now going sideways. Are they detecting stress? CRE fallout?

Stop it troll. This Thursday’s release covered the week ending 2/14. Treasuries mature on the 15th and EOM.

Next week’s release will cover 2/15, which will show the drop in Treasuries.

Dean,

So I’ll just repeat this here today for the third time because this BS never seems to stop:

Only ignorant idiots say that QT has “paused” or “stagnated” or “is going sideways.” How many times do I have to repeat that the Treasury roll-off occurs mid-month and end of month. Mid-month was Feb 15, which was Thursday. The balance sheet that was released on Thursday was through close of business Wednesday, so the February 15th roll-off will be on the balance sheet on Feb 22, and it will be big. And then the second roll-off in February occurs at the end of the month, which will be on the balance sheet released on Thursday March 7.

This is what you people get for not reading my Fed articles, which explain all this. And instead you pollute these comments here with this ignorant manipulative crap concocted by braindead morons on sites for idiots.

This is the balance sheet through Feb 1, and read the article so you learn something:

https://wolfstreet.com/2024/02/01/fed-balance-sheet-qt-1-34-trillion-from-peak-to-7-63-trillion-lowest-since-march-2021/

QT will stop at some point and for sure, it won’t drain the reserve to 4.5T.

The 3 Trillion extra reserve between 4.5T and 7.5T might become permanent. That explains the 20% price hike the past 3 years.

The Fed has its fingers in a lot more pies than in the last decade.

Consider the standing repo facility and FIMA repo pools which are relatively new tools in the Fed’s toolbox.

And how many institutions (primary dealers etc) have Fed master accounts, not to mention the TGA …?

The Fed is a central bank but it is still… well… a bank.

7.5 Trillion is NOT Reserves. That is FED’s balance sheet amount.

FED has been rolling off around 60B in Treasury Securities every month.

In Reserves also there are various, Bank and ON RRPs.

ON RRPs are coming down much faster. Already down from 2T to 500B levels.

So far FED has not talked about stopped stopping QT anywhere.

Typo above. FED is NOT renewing 60B Treasury Securities every month. so its balance sheet will go down by 60B minimum. + MBS whatever amount that is.

Wolf, I went to the federal reserve site and zoomed into the last year: https://fred.stlouisfed.org/series/WALCL

You should ask about the source before assuming. Yes, my interpretation may be incorrect but I did not regurgitate data from a random blog. The last month went sideway on the Fed’s site. Is this not the same data? If not, then I apologize for convoluting the comment section with other Fed data.

“The last month went sideway on the Fed’s site.”

Use a calculator, you idiot. In the chart that YOU linked:

Balance sheet Jan 3, $7.681 trillion

Balance sheet Jan 31, $7.630 trillion

difference: -$51 billion

exactly what I told you here on Feb 1. READ THIS:

https://wolfstreet.com/2024/02/01/fed-balance-sheet-qt-1-34-trillion-from-peak-to-7-63-trillion-lowest-since-march-2021/

“ And instead you pollute these comments here with this ignorant manipulative crap concocted by braindead morons on sites for idiots.”

I’ve got the solution to your problem, Sir! Add a CAPTCHA picture grid. When someone comes to your site they have to answer the CAPTCHA to enter. Except the question isn’t “find all the stoplight fragments” it’s “find all the prime numbers”, “find all the current leaders of world countries”, “find the misspelled words”, OR my personal favorite: “find the benefits of education in a society”

Before you all say it, I know I haven’t added anything to society’s promise with this post. You try adding value while you’re high…

That was unnecessarily aggressive. You are right in your economic conclusions, but wrong in your communication methods.

No, it was way too restrained, as you can see. I don’t want commenters that are abusing my site to spread lies and BS. They can do this on X or ZH, not here.

People have spread these QT denier lies here for 18 months, and I now have zero tolerance for it. The internet is a toxic place full of lies, and fine with me, but I’m trying to keep my little corner somewhat clean.

Soft landing vs hard landing that’s the key in my opinion for rate forecasts. So far we have not seen unemployment rise or earnings drop for spx so no rate drops. I think there is a better than 50 percent chance for unemployment to increase triggering rate cuts .

Just in time for a correction (10%+, my guess for the next few months).

Up/down doesn’t matter much to the machines and big traders as long as volatility is large.

I guess markets will broaden on this. I put in a sell this morning and probably some more tomorrow. Collect some cash for a correction bottom (if I am right).

The guy with the youtube channel BULL BOOM – BEAR BUST sold everything about a week ago before the CPI and inflation data came out.

4 years ago, around the same February week, S&P dropped 50% the following month.

It wasn’t a 50% crash. More like in the 33% range, and it took some time. It was a month.

Howdy Folks. Rate cut coming in May…… HEE HEE Never should have ZIRPed. Interest rates should have moderated like the olden days. OH well

Seems like a solid time to diversify into NFTs and get out of Bitcoin.

🤣😂😶🌫️

Crude oil just touched a hair below $80. Look for this to affect gas prices very soon and the CPI going forward. ENJOY

Howdy Swamp. YEP, The Lone Wolf always mentions the low price of oil must go up…….. Inflation for years Youngins……Unless Congress cuts spending….. HEE HEE

Within this inflation context, I don’t think I said that the price of oil “must go up.” What I did say many times is that “oil cannot drop forever” or “gasoline cannot drop forever.”

What I mean is that energy’s plunge will end at some point, and its contribution to “disinflation (= slower increases of CPI) will end. The plunge in energy prices (negative energy CPI) has been a strong counterweight to hot services inflation, which is one of the reasons overall CPI has come down so much. So just stable energy prices at these levels will raise overall CPI.

Long-term, crude oil is at a sustainable level right now. US frackers are making money at this price, and it’s not so high that it’s killing demand. If oil spikes to $130, it will reduce demand for oil and then overproduction by US frackers will set in and push the price back down. And if oil collapses back to $30 or below, frackers are going to run out of cash and file for bankruptcy protection, and we’ve already had big waves of that between 2015 and 2020 when a couple of hundred frackers keeled over, including some big ones such as Chesapeake, in what I called the Great American Oil Bust. But I don’t see that happening again for a while.

Howdy Lone Lone. In layman terms Oil must go up ? HEE HEE

Currently the market expects at most a rise of 10% in the price of a barrel of oil before OPEC(+) starts pumping again with an estimated excess capacity of 5 million barrels per day to keep the price at/below that point.

OPEC itself expects that the price won’t drastically lower due to demand growth for the next two years exceeding non-OPEC supply growth.

Unless something major happens the market has by now priced in the disruption of supply through the Suez canal.

For this site a funny one is that every one and their dog dreaming about rate cuts by the US Fed, then realizing that those probably won’t happen has, as they say, put downward pressure on the price of a barrel of oil (which means in this case a slower increase not a reduction).

About the only thing left that can increase or lower prices is refilling of reserves. A certain amount is of refilling is already priced in, going above/below that expected refilling will increase/lower prices.

So the TL;DR:

Prices are expected to be reasonably stable despite worldwide tension. There is enough production capacity not in active use to limit price increases and expected demand growth makes a decrease unlikely.

Seems like a good time to be Amish. No expensive cars, insurance, electricity, computers, internet and you grown your own food and raise your own horses.

Howdy HC. Get out of debt as quickly as possible. Always save some of what you earn…….

But the Amish dont have financial markets where tons of folks can make a killing off the backs of the working class, while actually contributing zero value to society as a whole.

So it would never work overall in America. Need more financialization lol. Good thought though.

Perhaps the working class need to unite and put their needs and those of society first. I think a book or two has been written on the topic.

Then came a small field-test, also known as the 20th century. Modest limited versions of it worked, IMO (as in the USA). Strong versions of it were historical catastrophes of the first order. I always keep a Stalin book going as a reminder of the appeal of big collective dreams.

Yeah, but then you have to pay your driver more than before, and you have the high cost of propane for your generators (couldn’t use natural gas even if you were in a town).

And the Amish dudes I know have access to Email…not sure if their driver checks it for them or they use their cell phones and just never respond as if they are looking at it themselves, but there must be some associated cost.

The Amish sell furniture, too , and have a shop on the Texas/Oklahoma border. Nice stuff!

Being Amish seems like a lot of work…

I expected that this episode, which began with the reflation of at least three asset price bubbles:

Stocks, Housing, and Bonds.

Would result in a 1.9 + standard deviation increase in the rate of inflation.

Volker also failed to actually reduce the rate of inflation initially, trying to cajole the unleashed animal spirits into the corral.

He learned what Taylor was trying too say. The FFR interest rate has too be significantly greater than the rate of inflation in order to reduce the rate of inflation.

Otherwise, increases in interest rates, tend to subsidize the current rate of inflation.

Because they are below the market clearing price for the risk, they provide a mathematical arbitrage opportunity which only a small cadre of the American aristocracy are able too take advantage.

How are current rates blow the clearing price for risk?

I’m thinking of short rates aka risk-free rates. S&P div yield is well below 3/6 month T-bill currently.

Which is a heads up for each and every American

That only one of the human emotions that ever did any good, was love.

Fear is the most useful emotion. Without fear, we would all have died as children. Or at least have broken a lot of bones…

I dunno, I’m a pretty big fan of hunger, myself.

I wonder what you are eating to make you think hunger is an emotion…

Will the fed pivot back to “higher for longer” at some point over the next couple of months? Mr and Mrs. Shocka love 5.4% t-bills. Have a nice weekend everyone!

They will let you know after they have decided whether they will resume their role as the subservient or aggressive prostitute.

If this month’s core CPI and PPI are any indication of future months, rates will have to go higher. I am “all in” on T-bills (6 month or less) laddered, so that would be fine with me. But these monthly series are volatile, so we will have to wait a couple of months to see if any trend develops. I emphasize that the monthly data are volatile, but they are not noise. If they were noise, we would not be writing about them.

This mom data is very volitile indeed… Wolf, why no 3mma graphs overlaid on thes charts?

Because it’s the first month of a violent turn. If you do a 3-month or 6-month average, you end up ignoring it or blowing it off. And that could be a big mistake.

Wolf,

Sorely missing from the article was our dear Powell pulling his hair out.

May be a recession is the only way to cure inflation and “soft landing” will go the way “transitory” did!

For most of the population, recession is a life changing event. Loss of job, etc.

Recession is not the only choice we have. If we were all patriots like the reckless innovators that ritualized Americana we would be cognizant of the simplicity of the structure upon which they based their elegant edicts and that is obvious as a kiss.

“For most of the population, recession is a life changing event.”

No, far from it. If 2 million people lose their jobs in a recession, it’s a life changing event for 2 million households — 2 million out of 131 million households. 2 out of 131 is NOT “most.” It’s a small percentage (1.5%). “Most” people never even know that it is a recession because for them nothing changes.

“If we were all patriots like the reckless innovators that ritualized Americana we would be cognizant of the simplicity of the structure upon which they based their elegant edicts and that is obvious as a kiss.”

Can I have that word salad with Ranch dressing? What were the elegant edicts of the reckless innovators? I can speculate about what you mean, but if I have to the clarity of your comment is lacking.

Definitely written by AI or a bot.

In one post, doesn’t know the difference between “too” and “to” and then writes Shakespearean prose in another.

Ok Dang, fight back! Something really profound now, ready…

…i’m not the bot, you’re the bot…

“I don’t expect the level of prices to go down.” Janet Yellen

Of course I think a risk taking swashbuckler might buy out of the money puts on the S and P index. But I’m no longer young enough with the recovery time from substantial loss.

Therefore, I continue too hide out in short term treasury bonds. Awaiting the resolution between price and value.

Every chart shown shows lower lows and lower highs, so in my investing experience, inflation is likely going lower. Unless we have a breakout of the channel? No?

No. Get new glasses? Some that are not rose colored?

Matt: “Unless we have a breakout of the channel?”

The above article highlights the “unless.” This has happened, it could revert to bobbling down the trendline further, OR as above commenters have suggested the Taylor rule may be a thing.

“This time is different” because of magnitude. More people, more money, more financialization.

More lag time, more headfakes and more crises?

More debt and more interest on them (federally) means more and more difficult choices to be pushed past a term of office.

I foresee some sort of shenanigans from our great monetary authorities before the close of the decade in order to accommodate this great repricing.

Never say “default.” Rather: aggressive renegotiation of terms.

US Federal Government is still running a huge (>5% of GDP) deficit, and I can’t see that dropping much in an election year. Not making it easy for the central bank to control inflation, that is for sure.

This is anecdotal, so take it for what it is worth, but recently I keep seeing people online comparing the cost of going on vacation in the US vs going in some foreign country (most recently, skiing in Colorado vs Switzerland, but there have been plenty of others) and inevitably the US seems way overpriced, as compared to Japan, or Australia, or Canada, or Europe, or wherever.

It seems like the cost structure in the US and/or level of the US dollar is getting a bit out of whack compared to the rest of the developed world. Good if you are an American wanting to travel abroad, but it suggests to me that inflationary pressure remains strong in the US, stronger than in many other developed countries.

I’ve done a lot of domestic and international travel the last 12 months and the US is definitely overpriced and low quality by comparison (Japan and France x2 for international). I try to buy my more durable goods from overseas as well and avoid stuff here including cars and importing them myself. This year I’m only doing domestic vacations, but they are national parks only. Not really worth to travel in the US otherwise and I rather go overseas again, which I’m planning for two times in 2025.

Final Demand services up point SIX percent. Largest increase since July 2023. Next FOMC meeting, I need another interest rate increase. J Pow and Company are not doing a very good Job. We Need to find another Volcker.

Volcker spent years battling the markets on inflation – and he got very frustrated – before he won after the big nasty double-dip recession. It’s not like he flipped a switch and neatly turned off inflation. It took years and was very rough. I came out of grad school in July 1981 at the beginning of the second dip, the big one, of the Double Dip recession with its unemployment crisis, AND 10% inflation, and armed with my Masters in English, I worked at a Taco Bueno to make ends meet. Not fun! I eventually went back to grad school to get an MBA (1985), after which I was able to make a decent living, but inflation was STILL high.

And CPI inflation mostly stayed between 3% and 6% for two more decades.

The Case-Shiller Home Price Index is not falling. The consequences of past inflation will be with us for a long time.

Let’s check back on this comment in 9 months.

Coming from abroad, what I really noticed is the much lower elasticity to the price of the average American consumer. This behavior, with an higher inclination to over-spend, makes the war against inflation much more difficult.

Only when traveling abroad (but not in an American resort) Americans realize how hyper inflated are their prices.

The differential is really staggering!

I’m seeing lower highs and lower lows on all these CPI/ PPI charts off the 2020- 2022 highs. We will have to see a few more months before we know if this is a trend change or just another lower high. I think odds favor continuation to the downside.

The lower low and lower high theory doesn’t apply here because…

These charts show month-to-month % change of a level and not index values or dollar values (such as a stock chart or stock-index chart). These charts do NOT show price levels or index levels or levels of any kind. They show month-to-month change of that level.

The whole theory of lower lows and lower highs is based on price levels: when prices fall far enough, they bounce off and rise, and when prices rise enough, the bounce off and come back down, but a littler further than they had been at the prior low. But these charts show percentage-change month to month of that index level.

You can try to apply your lower-low-lower-high theory to the PPI index value chart, see chart below, which would be comparable to a stock price chart or stock index chart.

(Even if you apply the theory of lower lows and lower highs to these percent-change charts, you see that in the services PPI and core PPI the lowest low was in March last year, and now there are HIGHER LOWS).

With deficits running 2 trillion/yr as far as the eye can see there will be no letup in inflation and hence no rate cuts. The only thing that will change this is a hard landing, with massive unemployment and bankruptcies.

Did we really expect this stubborn inflation to go away easily? Its like a cancer and if not treated aggressively, it will have a more damaging effect long term on our economy. Are we not tired of living with this now for 3 years? Vote of no confidence to the worthless fed talk about 2%, soft landings, and holding interest rates. They aren’t serious in getting this solved. They never were.