China’s renminbi keeps losing ground, after initial progress. But the tiny “other” reserve currencies combined are taking share from the USD.

By Wolf Richter for WOLF STREET.

The US dollar has been the dominant global reserve currency for decades, amid many global reserve currencies. And there are lots of people, institutions, and governments that want to see an end to this “dollar hegemony.”

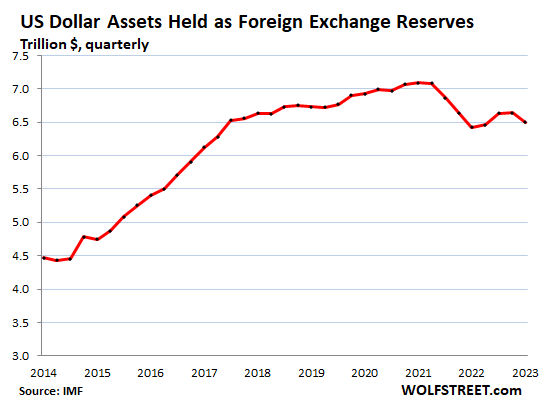

But central banks other than the Federal Reserve are still holding large amounts of US-dollar denominated assets – $6.5 trillion in total – such as US Treasury securities, US government-backed MBS, US corporate bonds, US agency securities, even US stocks (the Swiss National Bank), all of which combined make up the USD-denominated foreign exchange reserves that central banks other than the Federal Reserve hold.

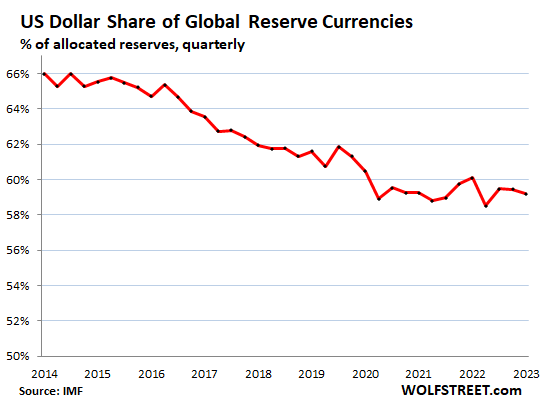

The share of USD-denominated foreign exchange reserves dipped to 59.2%, according to the IMF’s COFER data released on December 31 for Q3 2023. For the past 20 years, the USD’s share has been on a slow downward trend, with other currencies nibbling at it from all sides. The euro was #2, the yen #3, the British pound #4. The Chinese renminbi dropped to #6, behind the Canadian dollar (more on all those in a moment):

In dollar terms, the holdings of USD-denominated assets at foreign central banks dipped to $6.5 trillion. Note that the Fed’s holdings of Treasury securities and MBS are not included in foreign exchange reserves. No central bank’s holdings in its own currency are included.

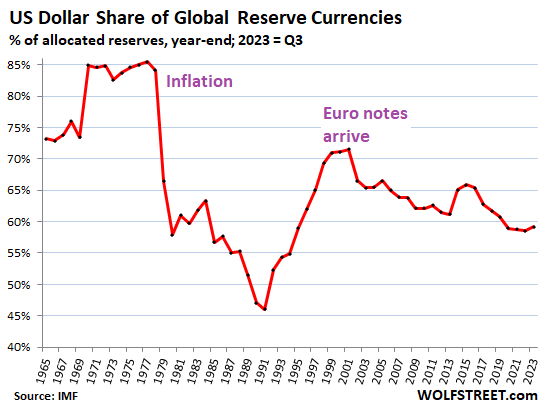

Since 1965, the USD’s share of global reserve currencies has gone through a tumultuous history, including the collapse of its share starting in 1978 through 1991 from 85% to 46%. This came after inflation exploded in the US in the late 1970s, and the world lost confidence in the Fed’s ability to manage inflation. And the decline of the USD’s share continued even as inflation began to fade in the 1980s.

But by the 1990s, confidence returned gradually and the dollar’s share rebounded until the euro came along and put a stop to the gains by the USD (2023 through Q3)

The other major reserve currencies.

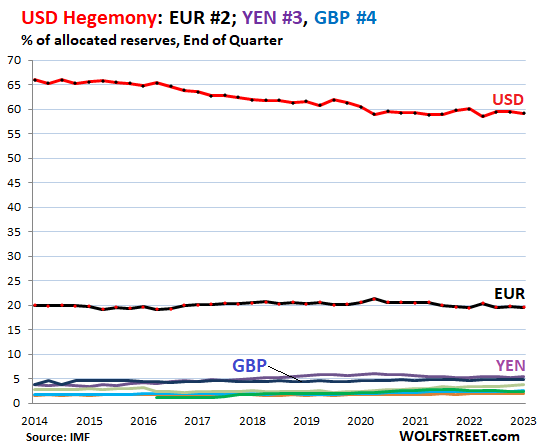

The euro’s share (#2) has been roughly stable at around 20% for years. In Q3, it dipped to 19.6% (black line, red dots in the chart below). The other currencies are the colorful tangle at the bottom of the chart:

The USD is losing ground against the tiny “other currencies” combined.

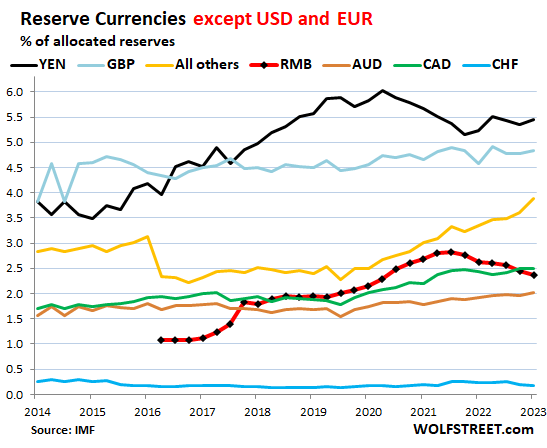

The chart below shows the colorful tangle magnified. China is the second largest economy in the world, yet its currency plays only a minuscule and declining role as a reserve currency, and is no threat to the US.

But note the surge of the yellow line, “all other currencies” combined, each of which has a smaller share than even the swiss franc, but combined, they’re making headway.

- #3, Japanese yen, 5.5% (purple).

- #4, British pound, 4.8% (blue).

- #5, Canadian dollar, 2.5% (green), bypassing the Chinese renminbi.

- #6, Chinese renminbi, 2.4%, sixth quarter in a row of declines, lowest since Q4 2020 (red), amid the reality of capital controls, convertibility issues, and other issues. Central banks appear to be leery of holding RMB-denominated assets.

- #7, Australian dollar, 2.0% (brown).

- #8, Swiss franc, 0.18% (blue).

- “All other currencies” combined (yellow) have a total share of 3.9%. The largest one of them has a share even smaller than the Swiss franc’s share of 0.18%. But their combined share has risen from 2.5% in 2019 to 3.9% currently. These tiny reserve currencies combined are taking share from the USD:

Dollar-exchange rates and foreign exchange reserves.

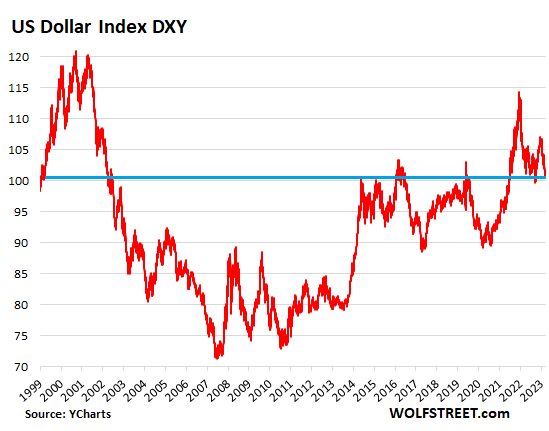

The USD exchange rate matters. Foreign exchange reserves are measured in USD. For reporting and comparison purposes, the holdings in EUR, YEN, GBP, CAD, RMB, etc. are translated into USD figures at the exchange rate at the time. So the exchange rates between the USD and other reserve currencies change the magnitude of the non-USD assets – but not of the USD-assets.

For example, Japan’s holdings of USD-denominated assets are expressed in USD. But its holdings of EUR-denominated assets are translated into USD at the EUR-to-USD exchange rate at the time. So the magnitude of Japan’s holdings of EUR-assets, expressed in USD, fluctuates with the EUR-to-USD exchange rate, even if Japan’s holdings don’t change.

The exchange rates between the USD and other currencies can fluctuate wildly. The yen dropped a lot in 2022 and then again in 2023 against the USD. So the value of yen-denominated assets held by central banks (other than the Bank of Japan) would have declined when expressed in USD, and it would have pushed down the share of the yen-denominated foreign exchange reserves expressed in USD.

But over the long run, the currency pairs are amazingly stable, despite massive fluctuations in between. The Dollar Index [DXY], which is dominated by the euro and yen, is back at 101, where it had been in 1999 (data via YCharts):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

1971 happens to be an important reversal — “On August 15, 1971, President Richard Nixon ended the international convertibility of the U.S. dollar to gold. This event is known as the “Nixon Shock”.”

1991 reversal – IMHO, USA and USSR was involved in an arms race and spending spree which I liken to the kids game of “Who will blink first”. USSR did; we ended up with lot of oligarchs in those broken states that would park their ill gotten wealth in western nations (and many find they are frozen now). The breakup gave us big boost from other countries as the only world power with Russia having all nukes but no use. But our own arms industry is swallowing us and the technology change is contributing a lot in that direction. Next 20 years would be very interesting.

1. the Nixon shock. Nope, you got the dates wrong. The share of the USD as global reserve currency spiked in 1971 to 85% and stayed there till 1978. So Nixon’s gold decisions in 1972 did not trigger any kind of reversal for the USD as a reserve currency. Opposite maybe: other central banks saw it coming and loaded up on dollar reserves since gold would no longer be it.

2. What did have an impact was the raging inflation — the “inflation shock” — in the late 1970s and into the 1980s that scared the bejesus out of everyone.

By the end of 1991, raging inflation was vanquished. It was below 3%. Central banks regained confidence. Nothing to do with the Soviet Union.

Inflation was “vanquished”…?

Really? Where? Inflation in Russia exploded in the 90’s, I was there. You are being extremely disingenuous Wolf.

My comment was about inflation in the US not in Russia. Did you accidentally microwave your brain this morning?

US keeps printing dollars like a drunk sailors. The only reason we are fine because every other big economy is doing same (Europe, China, Japan, UK etc).

Its all Fiat that only runs on trust and the trust in all Fiat is running low across the world. So these charts can change really fast. If China moves on Taiwan, USD share collapses by another 20%.

It would be good to have a chart of gold held by central banks as well.

Gold is not a foreign exchange reserves (financial assets denominated in a foreign currency). It’s a precious metal that central banks hold it as an asset. It has nothing to do with this discussion here.

LOL… why on Earth would the USD shares collapse if China moves on Taiwan??? In fact the Chinese economy would absolutely implode as Western corporations ran for the exit doors they way they did when Russia invaded Ukraine.

To some extent the weight that has already been dragging down the Chinese economy for the past few years is the THREAT that China keeps posing to Taiwan. No CEO wants to get caught short with most of their company’s greatest assets stranded in a nation that is at war with the United States… or one that threatens to go to war with a US ally.

I understand that gold reserves are not considered FX reserves but a portion of FX reserves can be diverted to gold reserves by central banks. Recently there have been a few countries that have added aggressively to their gold reserves (Russia, China, Turkey, etc). This has driven the amount of total global gold reserves back up to the amount held in 1974- about 37K tonnes. Total global gold reserves bottomed out at about 30K tonnes at the end of the 2000s. Many say this trend is driven by central banks’ desire to diversify away from holding USD assets. Gold gets a lot of flak but this trend is impossible to ignore.

Gold still doesn’t matter.

If you are using Russia, China, and Turkey as examples, you might want to rethink your logic.

Gold as a store of value has been collapsing faster than most fiat currencies. On it’s present course, in a few decades gold won’t be valued at anything more than a shiny metal that looks nice and has some industrial value.

Over at Zoo H they are obsessed with the ‘collapse of the US $’ and some supposed BRICS thingy. China is the only economic power of consequence in that club. Much is made of the trade between Russia and China with each taking the other’s paper. Not as well broadcast: yuan much more desired than rubles. What would you buy with rubles? I’ll bet Russia doesn’t want rubles for its oil.

“…I’ll bet Russia doesn’t want rubles for its oil…”

You lost your bet. Russia not only accepts- but even demands payment for its oil and gas in rubles. See the Wikipedia article on “dedollarization” or articles all over the web.

Russia wants foreign countries to buy Rubles, that’s why they demand payment for oil in that currency; it props up the Ruble. The actual currency of Russia is oil and any other assets it can sell to anyone, sanctions or not.

De-dollarization was a BRICS goal long before the Ukraine/sanctions debacle.

The trick is the verb “want”. Russia likely want stronger currency for their exports, but they have been forced to negotiate in Rubles due to international sanctions.

Jos-

Denial Not a river in Egypt , dude

Mark,

Exactly what am I supposed to be denying, dude?

Jos Oskam,

LOL, you fell for a PR stunt. “unfriendly countries” were told to pay in rubles, but they’re not buying much oil from Russia anyway. So that was kind of a joke. The rest of the countries — those that are actually buying oil and natural gas from Russia — can pay in whatever currency they work out, including the RMB to pay for China’s massive energy imports from Russia, euros, dollars, etc.

The ruble has plunged about 37% against the USD since the end of 2019 and by about 74% since 2008. It can plunge overnight.

Actually there is a Reuters article showing that India’s oil imports from Russia have gone from nothing to over a million barrels from FY22 to FY23. It includes the heavy grade Urals but also the lighter stuff from the Far East and Artic. Russia’s Rosneft and India’s Oil Corp are deversifying the oil grades exported to India.

India has been turning this oil around into oil products and exporting them back to Europe. Diesel exports to mostly France, Belgium and Netherlands rose to 150K-167K bpd in FY23, which was 30% of India’s total gasoil exports. 50% of India’s jet fuel exports goes to Europe as well for 70-75K bpd. So the point is, sure “unfriendly countries” are not directly buying much oil from Russia, but they are buying it indirectly from middlemen such as India.

Hi Wolf,

Being an old cynic I am not easily taken in by PR stories. I was never impressed with the “unfriendly countries” narrative. And of course, your remarks about the instability of the ruble are entirely true.

The thing is that Russia’s nose was bloodied when 300B of their dollar reserves were “frozen”. After that experience they simply no longer want to trade in currencies that can at any moment be weaponized against them: primarily, the currencies of those “unfriendly countries”.

For Russia, the ruble is simply the safest bet. Not because it is such a wonderful currency but because of geopolitical arguments.

That’s why India is rejecting to pay for Rusia oil in Rubles.

For all its faults, and there are many.

Russia has the lowest debt/GDP ratio of the developed world.

Has interest rates above the inflation rate.

Russia has been borrowing overseas in dollars and euros through its state-controlled companies, which are a big part of its economy, including its entire energy sector and its defense contractors. Those companies are heavily indebted and provide lots of subsidized services in Russia. So you need to look at the overall debts, including those of the state-controlled companies.

The reason Russia has little ruble debts is because foreign investors don’t want to buy it for a bunch of reasons including that Russia already defaulted on its ruble debt in 1998, and because the ruble has plunged by 75% against the USD since 2008.

Sort of the same in China, isn’t it?

Government debt at 56% of GDP. But there is a ton of debt present at the Local Government Finance Vehicle level. (And who can guess what’s hidden behind the silk curtain!)

Dictated or not, it’s truly scary stuff.

Russia is in a bit of a pickle with state-controlled companies. Its central bank had to increase the bank rate to 15% to address a weak ruble and rising inflation. The central bank target is 4% to reduce inflation. Take their largest car maker, Avtovaz, which inherited debt from its former majority shareholder Renault who sold its stake for 1 ruble due to the conflict in Ukraine. They get 20 billion rubles in government support but half is spent just in servicing that debt. This bill is set to rise to 17 billion rubles next year. A number of other state controlled companies are in the same boat.

GBP global forex share (of 5% in 2023) is at its highest level this century. A continuous upward trend since Brexit in 2016. Worldwide markets are signaling confidence in the UK and Brexit. The complete opposite of what the popular media narrative would have you believe!

The markets may have confidence but the UK population does not. Every poll shows widespread discontent with Brexit. Only 22% now believe that it was a good idea.

I wouldn’t trust the “polls”, if I were you. The “polls” were confident of a Remainer win in 2016 — and we know how that turned out!

The financial markets in 2023 are quite clearly showing confidence in Brexit and signaling that everything is turning out (much) better than expected. Good news for the UK as it moves into 2024.

Yeah we know how it turned out and everyone regrets their poor decision. Let’s see how it turns out, C-3PO.

so your typical Brit wants the EU to control their immigration policy?

I think you are reaching about confidence. A lot.

There are lots of reasons countries hold foreign currencies. No doubt one reason is confidence. However there are other reasons as well. Another reason is that other countries are doing more business with that country. Or that countries currency has changed and those foreign country’s central banks needed to hold enough British currency to stabilize the trade between those countries.

For example, take most major European Central banks. 10 years ago they could hold Euros as a proxy for their British holdings and the trade their home country made with England. It was close enough. Now, Euros are not a proxy for GB anymore so they had to buy Pounds.

Maybe I am not right, but I think you are taking a few fractions of a percent rise in Pound holdings and making a grand proclamation about Brexit. Just as speculative.

Thanks for this very timely article Wolf. Timely, because of the discussions taking place at this very moment whether or not to actually confiscate the currently “frozen” RU dollar assets to give them to the Ukies.

If this confiscation really happens, parties all over the world are bound to take notice and ask themselves if they, as dollar holders, could be next. Their dollar assets could someday all of a sudden no longer be theirs if they do something that displeases Uncle Sam. Not a reassuring thought.

Here in Europe more and more people are getting sick and tired of the weaponization of the dollar. They don’t like their dollar assets being used as a club to beat them into submission. This dislike is really a phenomenon that was rare a few years ago but now becoming clear and increasing by the day.

It will be interesting to see how these developments will affect the above-presented graphs in the coming years. Something about things not going to heck in a straight line comes to mind…

This is a major piece of what is unfolding IMO.

Sidebar…Europe, of course, has a long history of colonialism (up to the present; e.g., France and uranium) that, ummm, weaponized economy/foreign trade/finance. EU populations are also figuring out they are getting screwed by the EU central bank, ideologically driven climate change policies, etc., etc. The evidence is there in recent elections. Sorry to say, but Europe has been set up by the US and other nations to be the first to fail in all of this.

BRICS+ is a very real threat to the dollar. What folks are missing is all the other “stuff” going on besides what currency (or commodity bundle) underlie trade, finance/contracts, etc.

The good news, I guess, is that the US still remains, by far, the largest capital market in the world. The transition in global finance (and domestic control efforts such as CBDC coupled to robust identity management systems and very tight cryptosystem controls/oversight) takes time. In my own mind, once one strips all the rhetoric, I think developing countries, Southern Hemisphere countries, etc., are ultimately trading one weaponized financial system for another.

What part of the world, since we walked out of Africa 150,000 years ago, does not have a healthy history of colonialism? People need to stop using that word, thinking it’s some kind of clever cudgel. good grief.

Something more appropriate like human enslavement perhaps….

The S is on the verge of collapse, with the grid so unreliable most businesses have a generator. The B is in turmoil.

Did you read the article?

BRICS is not a threat to the dollar. The share of BRICs is going nowhere. Their economies suck (or are dangerously controlled by oppressive regimes that only idiots trust).

The gain has been in non- BRICs currencies.

If you are going to argue that your use of the “+” means you are including those non-BRICs currencies in your argument then you are being disingenuous.

Corey Seager, Marcus Simeon and myself all won the World Series last year.

What is the currency of the BRICS that is a threat to the US$?

There isn’t one. So when and if these very second string actors, except China, agree on one, we can actually benchmark it.

BTW: thanks to guy who pointed out India’s sales of fuels refined from Russian oil. Didn’t know that. However India’s manufactures overall are very low for a billion plus people. This BRICS club reminds me of that line from I think Groucho M: ‘I wouldn’t join a club that would have me as a member’

.

I’m not overly surprised. I suspect it’s less the weaponization of the dollar that pisses people off, but more that the U.S. feels entitled to live beyond its means by taking advantage of having the reserve currency and inflating away debt when it feels like it.

Who might be next? Who exactly is worried? ‘people are saying….’. They use that in newspapers these days.

Your next door neighbor? The folks on the bus?

Remember, Russia’s “dollar assets” are actually Treasuries, not literal dollars in a bank account.

“If this confiscation really happens…” that is effectively a DEFAULT of the UST on its debt obligations.

If you buy treasuries with your USD. You give the government money… in exchange for the treasuries.

So yes, it is in fact dollars they would not be getting back.

Not sure why you got confused there

Right – and how is that any different than defaulting on those bonds?

If you’re a bond holder, and the issuer refuses to make interest payments or return the principal at maturity – that’s defaulting on the bond.

Hi Wolf. Would you have any thoughts on international trade transitioning from USD to other currencies? Is there a meaningful shift?

A lot of experts are pointing towards increased use of RMB for trade.

Thanks.

This is a planned/unexpected (take your pick) outcome of sanctions! Driven by factors other than the foreign trade component of GDP. IMO.

Sandy,

Currencies have to be stable and freely convertible to be an efficient trade currency.

The euro is the second largest trade currency. A lot of trade gets handled in euros and that works just fine. If a Chinese customer of a German company agrees to pay in euros, great, and that happens a lot. If they rather pay in dollars, well, then that’s to be negotiated. And the big German and Chinese banks are well set up to deal with this type of trade, and it doesn’t really matter whether the company gets paid in euros or dollars, as long as it gets paid.

The problem arises with garbage currencies, such as the ruble or the Argentine peso. No one wants to get paid in those currencies, and there are over 100 of those currencies.

So yes, the RMB should become a larger trading currency, given the size of the Chinese economy and its trade ties to the rest of the world. The RMB has been fairly stable over the years (managed!). But the RMB still faces issues: there is an onshore rate and an offshore rate, convertibility is limited, etc. These are issues that the euro and the dollar don’t have.

Also, note the difference: a company can price something in dollars (such as commodities) and then pay in another currency, such as the euro or the RMB. That works well and is done a lot between the two companies.

China has been very “activist” at times with capital controls.

That’s a significant variable in all of this.

What is the Mark-to-Market value of those Foreign-held U.S. reserves?

What’s the mark-to-market value of ANY of the foreign exchange reserves (including those denominated in EUR, YEN, GBP, etc.)? It doesn’t really matter because central banks generally don’t sell. If they want to shed assets, they’ll let them mature and don’t buy more. And they will get face value when they mature.

Oh, I am so conflicted. I am sometimes ashamed of how US hegemony behaves, but not enough turn away from her warm embrace.

Then, be our friend and follow the Rules Based International Order.

I Hate Myself for Loving You!

-Joan Jett and The Blackhearts

I don’t understand the causal relationships implied in this statement from the article:

“This [drop in US Dollar Share of Global Reserve Currencies] came after inflation exploded in the US in the late 1970s, and the world lost confidence in the Fed’s ability to manage inflation. And the decline of the USD’s share continued even as inflation began to fade in the 1980s.”

1. Was inflation not occurring in other countries?

2. Did some event or policy change occur in 1991 that caused the decisive reversal in the US Dollar Share of Reserve Currencies?

3. In 1991, did the value US Dollar also bottom our and rebound compared to other currencies?

Thanks

One dynamic in play over the period you address:

The currency has been inflated – to manage debt/social stability. We were able to export inflation overseas by exporting productive industries overseas and importing at cheaper prices (Hello service sector! Hello increased gov’t employment/empire building!). Not the only gambit in play…but a major piece just the same.

“1. Was inflation not occurring in other countries?”

Germany, whose Mark was a major reserve currency at the time, had an inflation rate of 3-5% in the late 1970s. Even during the worst of the oil shock in 1973, inflation maxed out at about 7% very briefly and the quickly came back down to 3%. Over the same period, US CPI went double-digits, topping out at 14% in 1980.

“3. In 1991, did the value US Dollar also bottom our and rebound compared to other currencies?”

The dollar as per DXY plunged in the late 1980s and early 1990s. The DXY fell to 82 in early 1990s and then stabilized in the 80-90 range range for a few years for rising again.

The event that happened in 1991 was actually TWO events… the Gulf War at the beginning of that year stabilized the oilfields of the Middle East for almost a decade AND the fall of the Soviet Union on Christmas Day 1991 meant that there was a “Peace Dividend” that could be spent on balancing the American budget.

Frankly there was a third event as well that had the largest impact… the Budget Reduction Act of 1990 not only violated President G H W Bush’s “no new taxes” pledge from the 1988 campaign… it also imposed spending limits on Congress for the following decade.

The result of ALL OF THIS was that U. S deficits plunged starting in 1991 and 1992. Thus the direction the graph goes for that decade. Not until the newest “bright and shiny object” (the Euro) came along in 2002 did the Dollar stop rising as the chief global reserve currency.

Look at it from the rest of the world’s point-of-view for that decade… the nation with the world’s largest economy suddenly has no military enemies, secure energy supplies, inflation under control, “full” employment, declining national deficits, and a technology-driven productivity explosion. Plus the two biggest competitors to the Dollar had BOTH imploded in1992 (the Yen and the British Pound Sterling).

Given all of that… which currency would YOU want to hold more of?

Great points, Phillip Jeffrey’s, Wolf , and Spenser G. That helps.

Thanks!

The only thing holding up the U.S. $ is the contraction in the E-$ market since 2007. All prudential reserve commercial banking systems have heretofore “come a cropper”.

“Traditional macroeconomics predicts that persistent double deficits will lead to currency devaluation/depreciation that can be severe and sudden.” – Wikipedia Twin Deficit Hypothesis

Federal deficit statistics, which prove no positive correlation with interest rates; that is high deficits (relative to N-gDp) are associated with high interest rates.

Historically this is true, but it is dangerous to assume past facts predict the future, or even provide a valid interpretation of the present (during WWII the U.S. operated under a “command” war economy).

When the balance of payments is balanced by foreigners acquiring net holdings of our equities, bonds, and real estate, and capital outflows (interest, dividends, rentals, etc.) exceed inflows, we are either decreasing our net creditor position in the world, or increasing our net debtor position. Since 1985 it’s been the latter.

There will come a time when the world is sated with dollars.

Howdy Lone Wolf. I believe you should continue educating the youngins about the 70s 80s inflation. Boogie Down Folks. Disco fever is coming back. 34 trillion and then to the moon.

For the dollar, having the next currency, the Euro at 20% is not the same as if the RMB were in that position. As we saw here a few days ago, even with 6% growth for so many years, nobody wants China’s stock market either.

Yeah, each year we have predictions of the great bust about to happen, but we all seem to go on rather comfortably in the U.S. year after year. We can still make money. If anything, the Fed knows how to prop things up. So enjoy while you can.

This time is different, I guarantee. That ugly American arrogance will come back to bite us this time. We’ve kicked that can about as far as it can go.

I think time is an important piece of context. Something as dominant as the US dollar can keep it position for at least several more decades or perhaps more but there is a shift occurring. This won’t be a collapse of the dollar but simply more parity and perhaps wiser spending within our own country. We don’t need to be spending 10X Russia on the military or more than the next 10 highest countries combined. Spending 8 trillion in debt since 9/11 isnt a great investment in our societies future. Education, health care, shelter, food and many other priorities exist. That isn’t even factoring in that we have barely scratched the surface with the local and global turmoil that climate change has and will continue to cause.

At current pace, the decline of the US dollar as reserve currency will happen within a decade.

I absolutely don’t see any threat to USD as a reserve currency.

The big question is: what is the alternative ?

USD is still the cleanest shirt among dirty laundry.

You need to learn how to read charts, Pal. In the past twenty years (with all of the problems in the U.S. economy and nation) the U.S. share of the global reserve currency has dropped basically 12%… from just over 70% to just under 60%. Same rate of decline for the past ten years… six percent.

BUT NO OTHER CURRENCY has been catching up. The Euro is stuck in the 20% range give or take 2 points. The RNB is literally in a ghetto of its own making.

The Yen has had a nice move upwards by a couple percent recent in years… but let’s be honest… there is a limit to Japan’s possible economic growth (and thus to its share of global reserve currencies). Japan has to QUADRUPILE its share just to catch the Euro… never mind the Dollar. Same for the British Pound.

While none of us should ever underestimate the ability of American politicians to screw up a beautiful thing… it is going to a long time before the Dollar is actually displaced as the global reserve currency. Just the fracking revolution alone helps America’s economic house stay in order in ways that energy importers will never be able to achieve.

Depending upon what you mean by “At current pace, the decline of the US dollar as reserve currency will happen within a decade.” I will gladly take that bet.

If you mean the dollar will drop on percentage as a global reserve currency, then I will agree. That isn’t a prediction because it is already happening. Not because of USA actions as much as more and more foreign economies are maturing so their currencies are becoming more reliable, so more people will be willing to hold those currencies. The USA is still one of the biggest most dynamic economies in the world so their currency will be attractive for decades to come.

If you mean the era of the dollar being the most dominant currency in thr world than you are a fool.

“We don’t need to be spending….”

I don’t necessarily disagree with your assertion, but the argument you’re holding forth holds no water unless supported by a discussion of the national security and national military strategies, threat analysis and corresponding force structure assessments. Based on these the need/requirements statement exists as is. Your argument is a value judgement about the allocation of resources among competing requirements demands. One could just as easily argue, on a values basis, that percentage increases into education, welfare, etc., allocations has historically proven to be wasted money with demonstrably deleterious consequences – let alone marginal social return to dollars invested.

I thought gov’t Climate Change investments violated the separation of church and state dictum. But what the heck, free people are able to hold competing values!

I think both need cuts. We spend way too much on the military policing the world. I prefer a non-interventionist strategy.

We also spend way too much on social spending that has been proven not to work. You can’t teach kids with 80 IQs to do calculus. We should be teaching trades.

“We also spend way too much on social spending that has been proven not to work. You can’t teach kids with 80 IQs to do calculus. We should be teaching trades.”

How much do you think the USA spends on teaching kids with 80 IQs to do calculus?

That you even think that is even a minor factor in our nations spending/taxation problem shows you really need to use better sources of information.

Please. Democracy requires a well informed populace. Your failure at remaining well informed is hurting the country.

Sorry, dummies do not make it in ‘trades’. Maybe hanging drywall when told to lift here etc, but instrumentation is highly complex as are some facets of electrical, carpentry, and fabrication. I have gone to uni with people so effing stupid I would not hire them to cut the lawn. I also know a drywall installer who can hold 40 measurements in his head and not make a mistake. His Dad was a millionaire drywall contractor in the 80s.

Do you want a ‘dummy’ working on your expensive car? Didn’t think so.

Nothing you said has any connection to reality. Whether it relates to the welfare state or climate change.

Your devotion to your religious cult doesn’t change the facts (science) behind either.

Unless our foreign friends are buying more USA debt, then the absolute value of their holdings is declining from inflation.

1. Print more money get more inflation. 2. Inflation is good for the debtor as the debt is paid back with less value. A debtor that can print their own money is historic. A system (Federal Reserve) that prints money for oligarchs assets is a Greek Tragedy immortalized in the history of the fall of Democracies.

“Unless our foreign friends are buying more USA debt, then the absolute value of their holdings is declining from inflation.”

That ignores the relative level of inflation between the two countries.

The lessor of two evils is still lessor.

Wolf, et al,

Any thoughts about what our political establishment(s) could be doing to defend or nurture the U$D to maintain its dominant position among world currencies?

I know you addressed this to Wolf, and not me, but my vote would be to start acting with a semblance of fiscal restraint.

That means no $2 trillion deficits during a “booming” economy.

That may happen automatically. The end of the Trump tax cuts is right around the corner… and it is hard to see any agreement in Washington on what to spend extra money on going forward.

“Divided Government” at its best… Literally!!!

In addition to what Einhal said:

It’s the Fed’s job to manage the dollar, and it’s doing QT at a record pace — thereby un-diluting the dollar.

I’d argue the Fed’s addition of the FIMA repo facility is a big thing they’ve already done towards this end.

What makes you think the dollar is losing its dominant position among world currencies?

It is not. Sure the dollar is slowly losing percentage as a reserve currency, but it is and will be for a long time dominant.

The loses so far have had little to do with the USA and more to with the rest of the world getting their $hit together.

After WWII the US had it easy. They were the only major economy that did not suffer major destruction. It was easy for the dollar to be used as a reserve currency. The only other choices were European counties that had most of their economic base destroyed, or Soviet counties that were terrible command economies with lots of endemic corruption.

There literally was no other realistic choice.

Since then, some of those foreign economies have either combined (Euro block) or got their $hit together (Japan, South Korea, China, etc), or both. Those counties have gained share of global reserves. Even among those countries who have gotten their $hit together, some took short-cuts (Japan and China) that resulted in spectacular short term gains, but long term problems.

What is more important than looking at pure percentage of currency reserves would be to look at a country’s percentage of global GDP compared to its percentage of currency reserves.

In an ideal, perfect world, a country’s share of the global economy would match it’s share of reserve currency. This generalization falls apart at the extremes (a crappy little country with a terrible economy isn’t going have a comeserate percentage of reserve share because no one will want their currency. Similarly, there is some network effect, an attractive currency will be more widely desires.

Until we reach the point where some other currency is more widely attractive than their global share of the economy, I wouldn’t worry about it.

Don’t get me wrong, the governing bodies of the U.S dollar are doing some silly things and I thin better things can be done, but these criticisms are mostly mild compared to other countries.

These are literally 1st world problems. Every single country in the world world would trade places with the U.S in a heartbeat. They would gladly take the $34 trillion (plus) in debt in order to have the advantages of our economy.

Thank you all

Is bitcoin considered a reserve currency? Would this be in the ‘all others’ category?

🤣 BS question by self-identified bitcoin troll. Bitcoin is considered a gambling token, and nothing more. It’s neither a currency nor held in reserves.

You know how you know bitcoin isn’t a currency at all? Nobody prices anything in it.

Nobody says “I’m willing to sell my house for 15 bitcoin, irrespective of its currently value in dollars.” Anyone who accepts bitcoin as payment requires a floating amount of bitcoin based on its current value in USD. That means that no one is actually treating it as a currency.

Good point. I will simply point out that there may be places in the world where Bitcoin is exactly what locals quote prices in.

But currencies are more than just a medium of exchange… they are also a place to store wealth. Bitcoin, despite all of its problems may make more sense to some people in some parts of the world than their own local currency or gold to store some of their wealth in… particularly if dollars are hard to come by in their nation.

US dollar hit nadir in 2008. It became more expensive. Many currencies

are circling the dollar like moons, but they are deflating. The cost of

everything in dollar terms is high. In the next recession the want of

dollars will grow.

“The USD is losing ground against the tiny “other currencies” combined.”

Would this include other countries conducting bi-lateral trading using own currencies?

Some months back, UAE announced all traded with India would be conducted in Rupees, some $84B. Thats insignificant in global trades. However, as more countries and businesses look for potential trades outside of USD, perhaps one question maybe, what happens when the share of USD in global trade drops below 55% or even 50%?? what financial metrics maybe impacted?

The US economy is far (far,far…..) less than 50$ of the global GDP. Not even close. If everyone is acting rationally, why should their currency be more than 50% of global reserves?

Serious question.

Someone asked couple of weeks ago what is the correlation of “dot plot” with actual subsequent Fed rate.

From Hussman today:

“The problem is that the SEP forecasts (read “dot plot”) of FOMC members are projections, and in many cases seem to be nothing but noise – extrapolation of recent trends, or slight departures from recent interest rates. Indeed, over the past decade, the Fed’s median year-ahead SEP projection for the Fed Funds rate has had a correlation of 0.6 with the subsequent rate. That may sound promising, until one realizes that the prevailing Fed Funds rate itself has had a correlation of 0.6 with the Fed Funds rate one year later.”

An r of .6 is nothing to get excited about. The r-squared of .6, which measures goodness of fit, is only .36, or 36%, where a perfect correlation is 100%. I might get excited about an r-squared of 81%, which is an r of .9. This is rarely seen in economics for all sorts of reasons, noise and/or poor model being the two most likely.

I also read that the dot-plot includes forecasts even of NON-VOTING members!

I wish there was a way to recommend posts on this site because yours deserves it (and more).

Far to many people are putting far too much stock into the “dot plot” of the FED. The dot plot is nothing more than random ass predictions from people whose jobs are not geared to make predictions but instead act on current information.

It is literally like asking the cashier at the grocery store to make a prediction of the price of the next person’s in line groceries based off of the price of the previous 3 customers.

That isn’t their job.

The dollar is backed up by the full faith and credit of America’s nuclear arsenal and America’s system of laws. Russia and China have a lot of nukes, but corruption is so rampant, only a fool would have any faith in their currencies. We also have corruption, but we are wearing the least dirty shirt.

Our system of laws meaning weaponizing the DOJ and IRS against organizations that disagree with the administration in power at the time?

As a 30-year finance professional, I have to say I’ve never seen evidence the IRS was or is weaponized. They operate autonomously as far as I can tell. I’d have to see several specific examples of bias to change my mind on that. A lot of the criticisms I see stem from political narratives and parties sympathetic to tax cheaters.

I’m not as familiar with the DOJ, so I won’t comment on that.

The problem, Bobber, is that what has happened in the past may not be a useful predictor of what is happening now or in the future. This is a big problem in economics, and in other fields also. The IRS could be now or is beginning to be weaponized, no matter if I absolutely know it has not happened in the past. The DOJ does seem to be going after a lot more Republicans than Democrats, so the DOJ seems to be now weaponized more than in the past.

Einhal, I am suggesting that all this nasty stuff happens in all countries, only perhaps less in the US. It is very difficult to quantify, but when the SHTF, as it does occasionally, global investors still tend to move to the dollar, and certainly not to the ruble or renminbi. Perhaps this will change, but I am not betting on it happening any time soon.

I’m also a finance professional (but not with 30 years of experience), and while I can’t definitively say I’ve seen the IRS weaponization with my own eyes, I’ve read the charging documents in the NY fraud case, and it’s complete BS.

The fact that James is allowed by the courts to get away with this is a bad sign.

The problem for you William Leake is that you have absolutely no evidence whatsoever of that happening. Literally nothing that would stand up to even a mediocre cross examination of the facts. You just choose to believe it because you belong to a culture that brainwashed you.

Before replying, take a second to actually think. I’d you think actions are being taken for political reasons, ask yourself how these actions are getting past 100s of law enforcement officers, dozens of career prosecutors, multiple judges, and such.

If you truly believe as I do that one of the things that makes this country great is that it is based an a system of laws that require things to be proven in a court of law and not simply by an orange cheeto saying stupid stuff in a tweet.

Maybe you prefer a system where a single person can make assertions that they cannot prove in a court of law, but as long as you agree with them it is ok. Just know that is not a system of laws. It is dictorial fascism.

Dictorial Facism is great if you share the same side as the dictator, but just know that there is a long history of dictators turning on those closest to them when it suited them.

I prefer a nation of laws, even one that is unevenly applied like in the US.

You need better of sources of information because the ones you are currently using are doing a terrible job of informing you.

Our system of laws is not based upon what some orange fool says at a rally. He can get his ignorant followers to chant “Lock her up!” as much as he wants. That is not how our system of laws works.

Instead it is based off of hundreds (if not thousands) of law enforcement individuals investigating activity and determining if they have enough actual evidence to convince lawyers, jurors, and judges based in a separate branch of government to convict the person of a crime, then actually presenting that evidence in a court of law and have it subjected to opposing arguments (with numerous appeals to higher courts of law).

After all of that, if the evidence passes numerous tests, it will be used to convict someone of criminal activity.

Or you can just turn off your brain and listen to an orange clown who constantly takes advantage of your ignorance and make you think they are equivalent.

Are you a thoughtful person or a ignorant fool? Your choice.

The “least dirty shirts” might be gold, Bitcoin, real estate, commodities, and other alternative assets. All we know for sure is the USD will lose at least 2% purchasing power per year, maybe 9% in bad years, as recent years have clearly shown.

In my opinion, it’s prudent to allocate a percentage to alternative assets given the Fed’s past eagerness to artificially stimulate markets. In the near term, the Fed might reduce interest rates, reduce pace of QT, extend bank emergency lending lines, or initiate other maneuvers as part of its misguided attempt to achieve a no-recession landing. Such dovish posturing on its own could reignite inflation expectations.

Bobber-

I like your hedge idea for a relatively minor allocation to non-traditional investment assets placed as a hedge against a return of higher inflation.

Carrying your thought process forward though, if the initial “dovish” Fed attitude you describe is assumed, and a resurgent bout of inflation ensues, mightn’t disgruntled voters then finally demand that the “government” (fiscal AND monetary policymakers) amend their profligate ways to “Whip Inflation Now?”

Then, perhaps, we wind up with a DEFLATION of -2% per year for 10 years, as in the 1930’s.

How much and what do I allocate for that!? (Only half-kidding)

Respectfully.

If you are worried about the dollar losing 2+% of purchasing power per year, you should be far more worried about the other things you call assets (they are not really assets, the are objects of greater fool theory).

SCMP article today (actually tomorrow there) indicated 45 high level folks in PRC have been indicted last year, and now the chief anti corruption guy is being investigated for not going fast enough.

Seen anything similar in USA recently, please forward link.

Thanks,

“Then, perhaps, we wind up with a DEFLATION of -2% per year..”

Deflation will come out of no-where and shock & alarm most – even the very smart ones as per this board. -2% …. you wish!

See, that’s how they do it, transfer the wealth from us to them, every generation or two. The thing is to catch the 90% unawares & unprepared and you have to give it to them, it does take a lot of work, a lot of deception; their reputation for being smart & shrewd is well deserved.

My dad was a boy in the depression and recalled how his family and most of their friends & associates lost it all in the banking collapse. His favourite comment: ‘Never trust the banks. Never trust the bankers’ . Of course, it’s different now…

So I’ve been in cash or near cash for quite a while now (too slow & old to trade anyway) plus pm’s and acreage ‘far from the maddening crowds’ – just in case.

Have I missed out on some good deals, some excellent profits? Yep. But then I’ve found wealth not all it’s cracked up to be – though hate to be poor, of course..

Time will tell but I’d guess mid 2024 we’ll start to get a few financial earthquakes (plus physical earth changes as there’s a lot going on subtly, of which we are unaware)

A reserve currency must be trusted. If other countries think there is a chance their funds will be confiscated because of political reasons, they are not going to take that risk. The rest of the world is getting sick and tired of a rules based order in which a bunch of Neo Cons make the rules and the rest of the world have no say.

That literally makes no sense at all. First off, a reserve currency is a “reserve currency” because OTHER NATIONS hold onto it. There is no danger of it being “confiscated” by Neocons since it isn’t actually sitting in the U.S.

Secondly, to the extent that ANY nation can “confiscate” funds… America is about the safest bet going. Not even the Chinese trust their government enough to want to keep their wealth inside of China. Same for Russians. And the EU is far more likely to impose sanctions and seize funds based on a variety of issues) than American Neocons are.

Huh? I know it won’t make a difference to you because people of your opinion are generally not open to differing views, but do you really believe that if a person is someone who is follows the laws of the U.S. they are more likely to have their finds confiscated than someone whose funds are held in China under dictorial rule?

Remember, to have your funds confiscated in the U.S. you need dozens of career law enforcement people, prosecutors, jurors, and judges to agree with you. In China it just requires one official to do so.