All eyes are now on underlying inflation. Forget the collapsing energy prices that pushed down overall CPI.

By Wolf Richter for WOLF STREET.

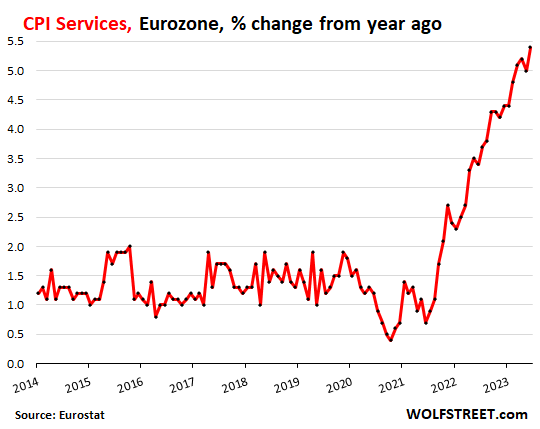

The inflation rate in services in the 20 countries that use the euro spiked to 5.4% in June, compared to a year ago, up from 5.0% in May, a new record in the data going back to 1997, according to Eurostat today, confirming preliminary estimates earlier this month.

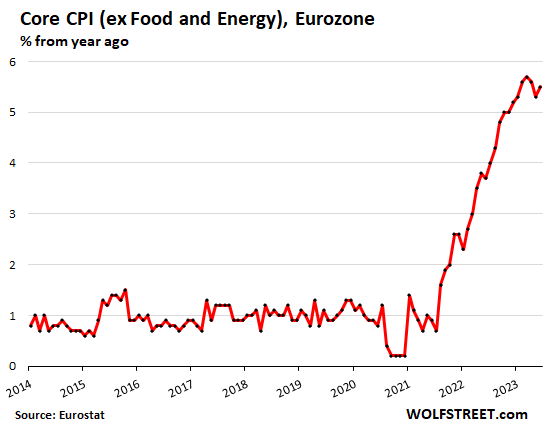

“Core” CPI – without food and energy rose to 5.5%, up from the preliminary estimate for June of 5.4%, and up from 5.3% in May, according to Eurostat. Energy prices have plunged, and food prices, which had spiked horribly, are backing off. But underlying inflation – as measured by core CPI and services CPI – has turned into a stubborn headache.

Services CPI is huge. When inflation gets entrenched in services, it’s hard to dislodge. The majority of consumer spending goes into services: Healthcare, education, housing, insurance, streaming, subscriptions, air fares, lodging, restaurant meals, repairs, cleaning, financial services, haircuts, etc.

There are many services that consumers are having a hard time to comparison-shop, and there are services that are essential to modern life, such as housing and related services, healthcare, etc., which makes it hard for consumers to resist price increases.

“Core” CPI (without food and energy) worsened to 5.5% in June, from the preliminary 5.4% and from 5.3% in May. This was another bad inflation surprise after core CPI had eased off a bit in April and May, and pundits out there had already proclaimed the “peak” of core CPI.

The ECB’s inflation target is 2% pegged on core CPI. So this is not going in the right direction.

Back on June 5, when the May inflation data came out, with core CPI down for the second months in a row, and pundits widely declaring that core CPI had peaked, ECB president Cristine Lagarde came out leaning against this notion of core CPI having peaked.

She told the European Parliament’s Committee on Economic and Monetary Affairs: “Indicators of underlying inflationary pressures remain high and, although some are showing signs of moderation, there is no clear evidence that underlying inflation has peaked.”

And she repeated the ECB’s line that rates would need to be hiked “to levels sufficiently restrictive” to bring inflation down to the ECB’s 2% target, and that the ECB would maintain those rates “for as long as necessary,” she said.

So now there’s a first setback to that “core CPI has peaked” theory, which came with the subtitle that rate hikes wouldn’t be needed anymore.

Overall CPI has been plunging for months because energy prices plunged; the CPI plunged by nearly half, to 5.5% in June, from the energy-price-spike driven peak in October last year of 10.6%. So now overall inflation and core CPI are the same, at 5.5%, with core CPI going up and overall CPI having plunged.

And all eyes are now on core CPI and services CPI to get a sense of underlying inflation, and underlying inflation is now above 5% and heading in the wrong direction.

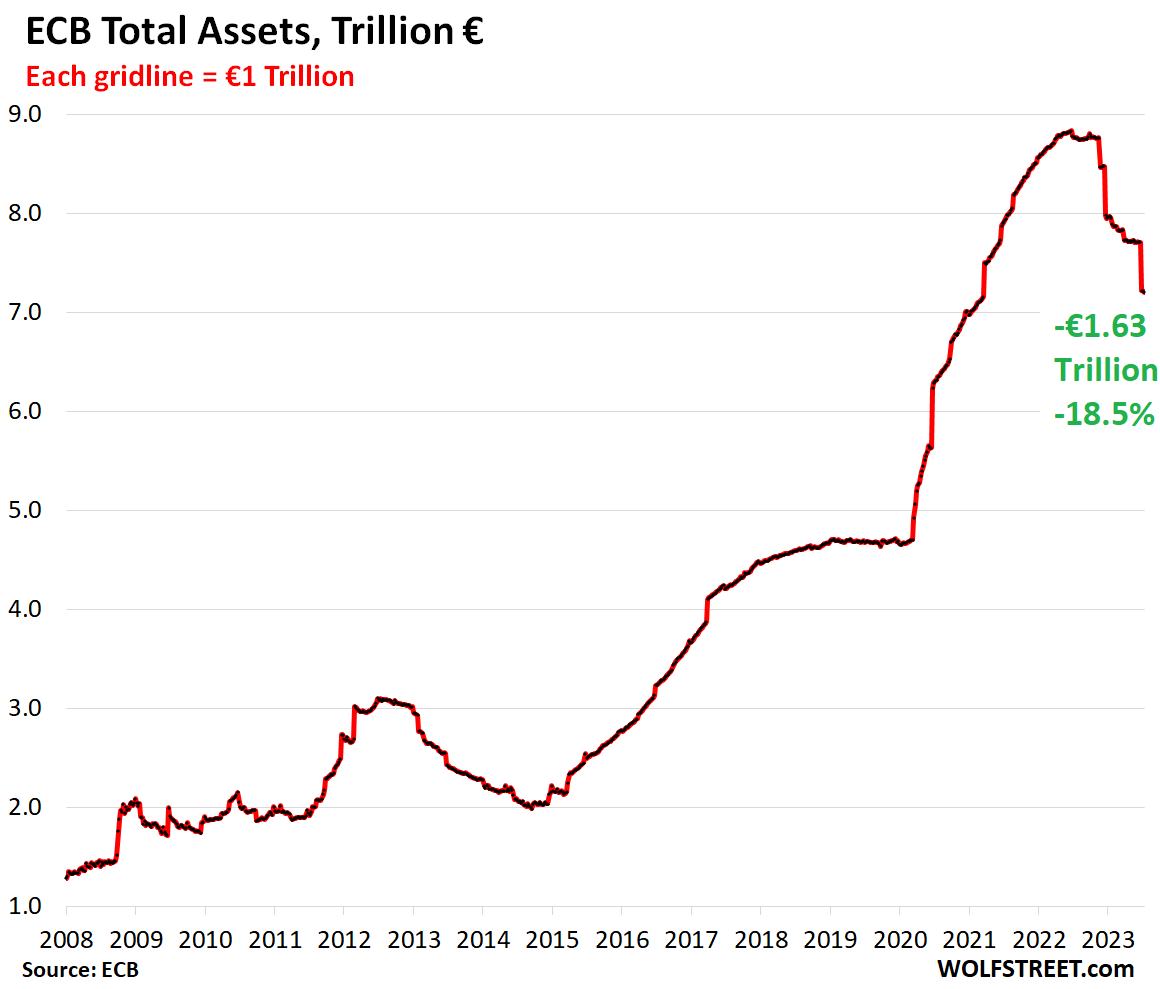

No central banker will publicly admit that crazy money-printing and interest-rate repression over the years added fuel to this inflation fire. They may admit it after they retire from the central bank, but they won’t admit it while still a central banker.

Nevertheless, without admitting anything, the ECB has been unwinding those factors. It hiked its policy rates by 4 percentage points over the past 12 months, from -0.5% to +3.5%, with more rate hikes to come.

And since last November, it has slashed the assets on its balance sheet by €1.63 trillion, or by 18.5%, from €8.84 trillion in June to €7.21 trillion as of the balance sheet released on Tuesday. Of the €4.15 trillion the ECB had piled on during the pandemic, it has now unwound 39%. So that’s a good start:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Someone removed the punch bowl and the drunks haven’t quite noticed yet.

You can feed them straight punch and they’re so wasted they thing it’s booze.

They’ll “notice” when they see the present the “kitchen crew” left at the bottom of the punch bowl ….. gross.

Obviously, the stock and bond markets couldn’t care less about any of the merely transitory so-called inflation. Or perhaps those markets are thrilled that we’re now seeing a significant stead rise in price again!

Wonder if this is what is to come for the US…because once again about 9 out of 10 MSM is busy telling you inflation is done, mission accomplished. Headline CPI is down, Core CPI is on the way down and peaked, some even say deflation is next…

Howdy Phoenix, Yep and Yes Sir and why not. The entire world did what we US did. Heck, the entire world even pretty much locked down and then reopened for business…..

Agreed, all the market news is “nearing end of rate hikes” risk on. It’s an aspirational rather than realistic narrative or is it just pre emptive push back against the fed.

It’s all “pause” and “skip” games until inflation kicks you in the cheetos, again, and that can hurt.

Gotta keep the hopium alive…

Funny thing is that headline CPI is virtually guaranteed to rise going forward because it was recently dragged down by large negative rates in isolated categories that cannot continue. Those categories will, at a minimum, stabilize, or they might even rise. I don’t know if core CPI will rise or fall, but I’ll bet that the headline number goes up.

The institutional bias is always to understate inflation and interpret economic data consistent with that bias. The Fed also believes that the quantity of money doesn’t affect inflation, and so creating trillions of dollars from thin air and giving them away during Covid was seen as riskless. The rest of the West followed the Fed’s lead. We could be in real trouble if suddenly the markets start to believe that we’re in real trouble on inflation and the bond market tanks. A run on the bond market might be an avalanche that the Fed and its Western cohorts can’t stop without badly damaging confidence in their currencies-which will itself be inflationary. The next couple of Fed meetings will be interesting.

> The Fed also believes that the quantity of money doesn’t affect inflation, and so creating trillions of dollars from thin air and giving them away during Covid was seen as riskless.

I respectfully disagree.

1) The Fed’s beliefs have changed, so getting the past and present tense so muddled is unhelpful.

2) Putting those words in the Fed’s mouths and minds is, I submit, incorrect. They know (knew) that quantity of money correlates to inflation. They were not casually acting on your claimed belief, as in some lark straight out of ignorance and indifference. Instead, they were, I think the statements and behaviors strongly suggest, responding to a COVID emergency and its fog of war as the markets were in fact crashing. I would concede they later underestimated and procrastinated about inflation consequences, as that fog was dissipating. I submit, they are not as clueless or irresponsible as you suggest, as evidenced by their policies for a couple years now. We can argue their response is insufficient or not, but that is different.

Jerome Powell has said specifically that the growth of the money supply has no effect on the economy; he said it in Congressional testimony. How do you think the Fed was caught flat footed by inflation? He blamed inflation on supply chain disruptions.

It goes that way for awhile and then some “feral” reserve bankster comes out and throws cold water on the rhetoric (which is a good thing) or some other event does, and then the pendulum swings the other direction, bonds sell off and the cycle repeats. Been doing that, cycle after cycle of bullshit for the past year at least. So sick of it.

No it hasn’t… Not for things that matter.

I remember this same thing happening in the 1970s here in the US. Inflation would creep down for a month or two (probably “headline inflation”) and someone would declare “inflation was over.” Then it would rebound a few months later. I vaguely remember rates being lowered and then raised until the late 70s, early 80s.

As before, the show will go on.

Don’t doubt it

The US looks much better: 2 points higher fed funds rate, CPI started down much earlier and is lower. ‘course, I don’t think the US is out-of-the-woods yet—I hope they keep pushing rates up slowly and continue to let assets roll-off. Good to see that Euro central bank folks are taking action. They’ll get it down, but this does look a bit scary!

Wolf,

How do you feel about the labor strikes in Europe/UK, and how does this tie into getting services inflation down?

My experience has been that the labor unions and their political allies fight tooth and nail against anything that will bring wages down, which is necessary to get inflation under control.

Then we get a protracted mess with huge political overtones.

Given the rise of populism, I am thinking the genie will be even harder to put back in the bottle.

How do you see this playing out?

“… anything that will bring wages down, which is necessary to get inflation under control.”

That works great if it’s not your wages. If it’s your wages, you’re being impoverished by this method, and so you would likely try to stop that process, no?

Oil field in the 1980s had real wages down but by the end of the oil downturn (20 years) 90 percent of oilfield employees had retired or left the industry when rig count finally bottomed in 2000 at 400 vs 1980 peak of 4000. My point of the story is excess spending and world events can take decades to develop and I would say very difficult to predict timing

“…90 percent of oilfield employees had retired or left the industry when rig count finally bottomed in 2000…”

Yes. This type of thing made it into my book.

From my novel, “Testosterone Pit” — subtitle: “The Oil Bust, the Salesmen, a Dealership.”

http://www.amazon.com/gp/product/B009NOFGXA/

Takes place in ca. 1993-1995, in an unnamed but easy-to-identify oil-bust town, and one of the characters that everyone calls “Oiler” used to be a roughneck. He’s introduced this way:

“Possibly only Karen in payroll knew his real name. He’d been a roughneck and had made tons of money, but during the oil bust, he’d lost his job, and for a couple of years, he’d tried to find something else in the oil business, but the oil business had moved to Houston, and no one needed roughnecks like him in Houston, so he stayed put and climbed down the ladder. Still, he couldn’t find anything, as all the other jobs had disappeared at the same time.

“So he lost his house and his boat and went bankrupt and got divorced, and all he had left were child support obligations, a garnishment on his paycheck, coarse hands, a red leathery neck, and fond memories of drilling rigs. But he’d become an adequate salesman, and he loved Logo because he’d introduced him to Ferronickel, and he loved Ferronickel because he’d given him a chance.”

Wolf,

Question: How in the hell have I been reading your site for two plus months and not know you wrote a book? You need to promote it more. I have ordered it and I look forward to reading it

Promote more.

Seriously.

Absolutely. Therein lies the fundamental problem of people who benefit from and get hurt from inflation.

Have you read Richard Cantillon (18th century economist)? He wrote about the basics of inflation and actually participated in the South Sea Bubble on the long and short side (successfully).

What he said about inflation and asset markets (and the political consequences) is as true today as in the 1700s.

His ideas also formed the core of the Austrian School of Economics.

Do you see this dynamic playing out here in a big way, and what would you be looking at to confirm/disconfirm this thesis?

I see you’ve bought into the notion that the fault for inflation rests on the wages of the workers who, for the most part, have been screwed over and gone nowhere wage-wise since the 1980s, while CEOs have had massive pay increases and many big corporations have had record profits during the same time period. Now that workers FINALLY have the upper hand again, everyone wants to pin responsibility on them – oh, sorry, the elites want us to pin responsibility on ourselves, not them – and ignore the fact that it was a decade of easy money printing, which benefited the upper classes, and ultra-low interest rates, which benefited those taking on debt while crushing fixed income earners, not to mention destroyed price discovery and risk assessment.

Another day, another tail wagging the dog.

Elites are just angry some of the money went to the middle class.

Yes. The ‘wage/price spiral’ is more likely the ‘corporate profits/ price spiral.’

Of course. So what happens next?

The question here is not good vs. bad, but what the reaction function of organized labor is vs. the reaction function of governments vs. the reaction function of the companies that pay wages.

What is your prediction and when will it happen?

We’re already seeing it. Companies offshoring more and more jobs, embracing AI when and where they can, and the elite – through MSM – painting wages as the cause, which of course means everyone will smile nicely when those in power target incomes and try to create unemployment so as to scare us back into passivity.

It doesn’t much matter either way, as I’m a firm believer that the die has already been cast; the elite in the modern industrialized world will *not* give up their economic nor political power, yet continuing as is means we little people will be subject to more and more decimation of the middle classes, crippling inflation, decline in living standards, etc.

So, my prediction? Continued economic dislocation, ever-increasing political dislocation, eventual political and social upheaval and violence. Let’s throw in some environmental mayhem just for good measure.

Timeline? Next five years. Ten tops.

Half the amount of money in existence and inflation will drop. Without wages going down. Some measures must be taken to keep money circulate. And quite some «wealth» may evaporate.

Wolf you write; “No central banker will publicly admit that crazy money-printing and interest-rate repression over the years added fuel to this inflation fire.”

Strange that they wont. Were they to admit to the fact and explain why it is now necessary to institute painful belt tightening measures to stop runaway inflation they might find a majority of the population on-side.

Not being open and honest will come back to bite them. Real interest rates are still close to zero.

How exactly will this come back to bite them? Like a Nobel prize in economics?

I think you vastly overestimate the majority of the populace. Everyone has their hand in the cookie jar (like it or not). One may be okay taking away the sugar cookies (childish, who needs that), but come for the macadamia nut and you’ll start to hear the pushback.

Hopefully I’m wrong, but I think the majority just wants the other person’s “waste” cut and don’t view theirs in the same manner. Humans are incredible at justifying things

Yes, humans are a rationalizing animal, not a rational animal, as assumed by economic professors.

People wanting to survive is rational. People wanting to deflect blame or find scapegoats, is also rational. It’s not reasonable or fair. But there’s some rationality in that kind of deceit.

Come back to Bite them like Bernanke got Nobel Prize . haha.

You touched on inflation causing a drop in DXY the other day. And that higher interest rates make it more attractive to be holding debt. At what point does inflation fighting high interest rates become insufficient to attract money to a high inflation currency? And when does money flow to lower rate, lower inflation currencies?

Asking for a friend in Canada…

Don’t cry for me Argentina, the truth is hyperinflation never left you.

…dammit, XC!…

may we all find a better day.

So what about central banks raising rates? Money printing and runaway deficits continue. Service sector is in on the action for all it’s worth, who wouldn’t milk it? You know you would. The prime mover is always about wealth to be had even while the planet begins burning.

You’re watching the Inflation Half-Time show.

Get your drink and popcorn and wait for 1/2 half.

The 1 place everybody notices inflation is at the supermarket, and worldwide harvests are all down and cross Odesa off the list too as a food conduit, while 8 billion of us want 3 squares a day, that’s where the heavy inflation lifting comes in over the next year/s.

Food prices have been going DOWN substantially for many months but if that isn’t enough for you, Joey has announced a war on greedflation today targeted at grocery stores and other food establishments today.

Easy way to fix services inflation that is 70% housing. Simply return to the long established “mark to market” accounting principle that ended in 2019 with a switch to “held until maturity” (that doesn’t account for any economic realities over the years). No REIT is going to hold properties trying to pump up their rents and prices if the underlying security doesn’t reflect market price. How can these securities be sold internationally with a fundamental different accounting principle that what their country uses?

You are spreading misinformation about accounting standards. There are 3 accounting methods for fair value securities: AFS, trading, HTM. Standards were updated so fair value changes of both AFS and Trading go directly to the income statement (no longer does AFS go to other comprehensive income). No changes to held to maturity accounting which has been around for a long time.

DM: Is THIS America’s most expensive Big Mac? Latest McDonald’s price rise sparks fury over ‘greedflation’

A McDonald’s outlet has come under fire for charging nearly $18 for a Big Mac meal – after the firm was accused of ‘greedflation.’

Soon only the rich can afford to eat at Mickey D’s.

And, I am ok with that.

Used to mention the $20 Big Mac meal (when it was $7). Take a look at the share price. Clearly they are raising prices as high as the market will bear. Is there any co.petitor who can undercut them?

Funny how the general market consensus right now is inflation is going away and everything is fine… It’s kinda like ignoring the 152 degree day in the Persian gulf or 20 straight days of 110+in Phoenix.

You can ignore it until you get burned and that’s what’s about to happen in my opinion… 🤞 anyways… Equities are topping bonds are bottoming but the real question is what happens in the next few months. Does inflation actually go away or does it stay. If it stays then the fun begins…. Based on this I’d say inflation isn’t going anywhere. Either way it’s just a matter of time (2-3 years max until all this paper wealth gets wiped out)

Pedantic, but 152 degree is a heat index, not the actual temp.

Worse yet, I think you cited a heat index for one and not the other. The heat index in Phoenix tends to be lower than actual temps usually due to low humidity (about a 1/3 of that in Iran)

Hot regardless

It’s funny how a consensus on the severity of a problem can be so overblown. It wasn’t 152 degrees in the middle east. That was a heat index figure cherry picked to support a narrative and make a headline. Phoenix just slid by the previous record heat wave of 19 days above 110F set in, drumroll… 1974 – half a century ago (source: New York Times). Climate-scare snippets do not provide a good analogy for today’s market conditions at all. Climate change is a slow, creeping problem (at worst) that won’t end in some singular global catastrophe in the next 2-3 years. Currency collapses and economic disasters, on the other hard, can happen quite quickly.

Climate change and extreme weather are clearly accelerating. Will Phoenix have just slid by the record of 19 days after another two weeks of 110 plus??? Idiot! and not even the point of the comment.

We don’t have evidence of billions of years of earth changes and humans have adapted to climate adjustments for thousands of years. Cheap energy !

The problem with perception of weather trends is the very limited experience horizon of the vast majority of people. BY FAR the hottest years in the US (and much of the world) in the 20th and 21st century were in the 1930s, especially 1936.

Winston,

1934 was the hottest year until 2012 . Next time when you Google something, look at the publication date. So here are more modern Google search findings:

In the contiguous US, the six hottest years have all happened since 2012. 2022 was the fourth-hottest, behind 2012, 2016 and 2017.

Globally, including 2022, the eight warmest years on record have now occurred since 2014,

Globally, 2021 was one of the seven warmest years on record. The warmest seven years have all been since 2015. The hottest three were 2016, 2019, and 2020, according to six leading international datasets consolidated by the World Meteorological Organization.

If you want to hear about real climate change, read up on “The Great Dying”. And man had no part in it.

Climate change has become a religion to a lot of people.

Please please please don’t confuse “weather” with “climate”. A hot streak in Phoenix, or a cool streak in Denver (both have happened this summer) don’t say anything about climate, and people who pin local transient weather phenomena on “climate change” are not spreading science they are spreading ideology.

“Climate change is a slow, creeping problem (at worst)”.

Thats just an ignorant statement. Miss a few meals and we’ll all be rioting come monday.

The point is, we dont know, but most likely there is a breaking point. Lets hope we don’t find out where.

Slowly, then all at once, as EH wrote, or things don’t go to heck in a straight line, as WR puts it.

Stegelburg, my point was that climate change is a poor analogy that was clearly injected into a financial conversation not because it makes sense, but because some folks just have to force that narrative into everything.

Financial collapses can hit the news over weeks or months, and are often a year or two peak to trough. The well regarded IPCC says that we’ve had about 1C of warming since pre-industrial times, and maybe we’ll get to 1.5C by 2100. And almost nobody is missing meals as humankind is far better fed under warmer conditions than it’s ever been in the past. There’s no magic breaking point in the IPCC’s predictions. Markets absolutely have breaking points that can snap in weeks while global warming (even the anthropogenic kind) happens over multi-decadal timescales.

Stegelberg….The earth was much hotter before, and supported a lot of flora and fauna. Will the transition be great? Not sure. But it’s not going to the end of life.

The statement of “The point is, we don’t know, but most likely there is a breaking point”

You can’t say we don’t know, but then throw down a “most likely….breaking point” which implies a catastrophic scenario.

The earth is warming regardless. It’s coming out of an ice age. Humans will adapt. Some areas will be more or less hospitable than they are. Do our best to conserve, but his is an article on inflation, and some of our tax incentive/policies/hand-outs with regards to environmental “issues” are very much contributory to said money supply.

Or if you actually believe the earth will end for humanity…spend away. Literally gave yourself a blank check justification.

@Gaston

The earth is not coming out of an ice age.

To the point that it was cooling enough that the first signs of a new ice age being around the corner were already showing.

Up to a point the amount of Co2 (and equivalents) the industrial era started pumping into the atmosphere were delaying that. However the point where the temperature stabilized was somewhere in the 1970s to 1980s. Anything after that point has resulted in warming.

Now warming isn’t that bad in itself. The planet has been hotter in the past. The problem is the speed at which it is changing. Thanks to our accidental geoengineering we are doing in decades what at the fastest natural speed would have taken thousands of years. And that is catastrophic for human civilization since it does not allow for a slow shifting of bread basket areas or a slow migration out of zones that are becoming uninhabitable by humans (It’ll be interesting to see how long the Dutch can keep out the water for example).

The point is we, that is humanity, can do something about it and limit the changes to something that is manageable. The problem is that quite a few people do exactly as you describe and that is going “Why bother, we can’t do anything about it, lets party since the end of times is coming”, worse is that enough of them have power to prevent any action from being taken since it would mean slightly less profit for them in the short run.

@Who Cares,

At no point did I say “why bother”. In fact I said do our best to conserve.

But humanity doesn’t want to conserve. They want their cake and to eat it to. That won’t happen barring a technological breakthrough in how we source energy.

I could be mistaken, but all I see is people consuming more and more, driving, flying, etc. I don’t see people commuting by walking or bike, refraining form buying products from countries with atrocious environmental standards, building houses that don’t need as much A/C or heating, reducing petrochemicals. All I see is a mentality that someone else with fix it and I can continue as I always have.

“Phoenix just slid by the previous record heat wave of 19 days above 110F set in, drumroll… 1974 – half a century ago”

Exactly, which more than suggests that weather patterns are cyclical. The propaganda on everything is so in your face.

Ocean acidification is something that is new with our carbon emissions. How much before shellfish can’t grow? We’ll find out at this pace. It amazes me that people think reducing carbon emissions would be more costly or difficult than retreating from all of our coastal cities as they flood.

You are confusing weather and climate. Those heatwaves are extreme weather events.

Climate is the determination if this is an extreme weather event or normal weather event.

And that is the problem. What was a 1 in a 100/1000 year event is being normalized to several times a decade.

This winter , spring , and first month of summer were abnormally cold and wet in phoenix. This is how az weather works. Lots of extremes.

To newguy and others: From an economic perspective, warming actually carries some big positives. It’s not like coastal cities will have to pick up and move next week because the ocean suddenly rises several feet. Maybe a house falls into the ocean every now and again in CA as they always have, but major shifts will happen over decades & centuries. Climate change won’t just wipe the whole state into the Pacific all at once, unfortunately. And the severity of weather disasters creeps along so slowly, that it’s still impossible to say statistically that this or that hurricane was “caused” by climate change. Maybe one day we’ll learn that it’s a bad idea to subsidize horrible decisions like building cities in flood plains, with or without climate change.

The positives are that the world is greening rapidly (per NASA). Leaf area has expanded 5% in 20 years, an entire amazon rainforest worth of total plant life. More greenery slows climate change and more CO2 accelerates growth of natural plants and crops. Food is more abundant than ever in human history by a large margin. Cold kills people (consumers) far more than heat does, so heat is not all bad. Warmer times have pulled a huge portion of the world out of crushing poverty and famine, amazingly despite the best efforts of Central Banks to keep the peasants in the mud!

So many scarey predictions were wrong. Overpopulation was supposed to end in catastrophe,but it didn’t. We were all going to die in famines, but we didn’t. We were supposed to fear a new ice age, but the opposite is happening. We were all supposed to replaced by robots, but businesses and markets adapted to technology. And since robots call-in sick all the time (they often call-in dead), people like me have a job building them, operating them and keeping them running.

So what’s next? Global warming will kill us all? AI’s magic bullet will eliminate all jobs? Spare me. Predictions rarely come true in the ways they were expected to come true. More often the opposite of the prediction is what actually happens.

…got freshwater? From where? (…one might try examining photos of famous glaciated areas of the world circa 1900 and present day for a simple start to increasing one’s hydrologic knowledge…)…

may we all find a better day.

“When inflation gets entrenched in services, it’s hard to dislodge.”

What makes services inflation so much more stubborn?

How many times have you willingly accepted a pay cut?

I was thinking along similar lines.

If the input cost to a product you sell goes down, you can pass the savings onto your customers while keeping the same margin.

But if your input cost is your time, it can’t go down without your margin also going down.

Curious to hear other opinions on this.

Speaking of weird moves by central banks, check out this about Turkey’s: by Brad Setser from Council on Foreign Affairs

‘But Turkey’s central bank has borrowed a ton of foreign exchange from Turkey’s own banks and from other governments. It then spent its borrowed foreign exchange defending the lira. The result in some ways could be worse than a standard fiscal crisis. Turkey’s banks have lent so much to Turkey’s central bank (and on a smaller scale, directly to the government) that they cannot honor their domestic dollar deposits, should Turks ever ask for the funds back.’

Back to me. My sister loves Turkey and can remember the lira equaling one US$, or maybe one C$ but either way it has fallen about 80-90 %? So many Turks have used US$ bank accounts to safeguard savings. But according to above, the US$ aren’t there.

There has been a lot of wondering about Turkey’s recent policy shift towards US. Maybe this is because by September Turkey will be completely out of forex, aka ‘broke’, will need to approach IMF, and will want lead donor USA to soften conditions.

Frederick, where are you?

may we all find a better day.

And, not to mention “Shrinkflation”:

Sara Lee blueberry bagels reduced from 1 lb., 4.0 oz. per bag to 1 lb., 0.7 oz.

Bounty “double rolls” reduced from 98 sheets to 90 (how is it still a “double roll”?)

Gain laundry detergent containers reduced from 92 fl. oz. to 88 fl. oz. without any obvious difference in the size of the container

Dawn dish soap bottles reduced from 19.4 fl. oz. to 18.0 fl. oz.

Green Giant frozen broccoli and cheese sauce packages reduced from 10.0 oz. to 8.0 oz. with no change in the advertised number of servings per package

In some instances of skimpflation, the volume or weight of a product remains the same, but the proportions change. For example, Hungry-Man Double Chicken Bowls (a frozen dinner of fried chicken and macaroni and cheese) maintained a net weight of 15.0 oz., but the protein content dropped from 39 grams to 33 grams.

For CPI purposes, prices are measured by quantity (per gram, per ml, etc.) not per package. So shrinkflation has no impact on CPI. Shrinkflation is designed to deceive consumers.

“Quality adjustments” are used to reduce the impact of price increases and the rate of inflation. Why aren’t “quantity” or “descending quality” adjustments made? That wouldn’t only apply to goods. Services, like medical care relative to its cost, is on a descent, too.

Rhetorical question: the answer is that governments know that they need to tamp down “inflation expectations”.

Quality adjustments are NOT used on food. They’re used on new and used vehicles and consumer electronics, where the make total sense (though the degree to which they’re applied is up for discussion).

Thanks.

This article thinks that service inflation is quite high

But the policy makers don’t think so

If they are really serious they would have acted more aggressive

Lets wait next week if Powell hikes 25 or 50 bps.

50? Hahahahahaha, literally 0.0000000% chance of that. Get serious.

jon,

Well, in this case, it’s Lagarde’s turn, not Powell’s.

Easy does it. You people just want the Fed to throw everything into chaos so that it will have to cut rates. But if it proceeds slowly from here, rates will inch higher, and stay higher for years, and there won’t be any rate cuts and no QE, and you’ll be bitterly disappointed for years.

I think not.

I’d be very happy if I am proven wrong.

Based on your last few articles here, US Inflation esp core inflation is still quite high and service inflation is also quite high.

Financial conditions as are loose as it was when FED started QT.

Home Prices all time high. Stocks marching towards all time high.

If FED take cognizance of these then they would hike by 50bps and put out a hawkish statement next week.

FED along with Govt is already declaring victory over so called slowing inflation.

But Here is what would happen I guess: FED hikes by 25bps and puts out dovish statement.

Let’s revisit this after 5 years. I can assure you, FED’s balance sheet would be higher than what they have today.

Seems like you do not grasp relationship among interest rates, QT, economy and inflation.

Let me put it SIMPLE, high interest rates SLOW DOWN economy, but they have MINISCULE EFECT on inflation. The ONLY effect of slowed down economy is to keep taps on inflation (not adding any further inflation into the pile). Only once economy blows out into recession and central bank cuts rates down, only then inflation is affected in significant way and goes down.

Inflation is primarily affected by SIZE and SPEED of QT. I will not digress into details of mechanics though.

Once economy falls into recession, FED will gently cut rates to soften the blow, but WILL NOT STOP QT, due to inflation. FED will use REPO market to remedy any credit issues. Anyone who is hoping/expecting rate cuts combined with new QE is living in la-la-land.

In the EU the banana-republics have taken over the asylum

Failure to hold the original countries in the EU to the agreed upon metrics (Inflation, Budgets, etc.) encouraged countries that had no possible way of meeting their goals to join under the expectation that they too would not be required to maintain their economies and could be excused and still receive bailouts. If the EU (or the Eurozone) fails it will entirely be due to the inability to regulate themselves honestly.

I just finished two books on Europe in the 20th century, The Vanquished (about WW1’s late stages and aftermath) and 1946 (same for WW2). Not to say the place isn’t troubled in some very real ways, but believe me, on just about any variable you care to measure, the place is astronomically tame, safe and steady compared to then. It isn’t the image of the swingin’ and affluent years (neither is the USA), but still ….

Ha Ha…100% agree with Wolf’s comment completely. Everyone wants total chaos now instead of letting rate hikes work their way through the system to tame inflation. If S&P hits 5000 by Xmas and Fed raises rates to 7.0% folks will still be complaining. The Risk & Reward now playing out on both sides of the coin. Greed has the bigger appetite, 2007/2008 MBS scandal and banks being bailed out tells us that Wall Street will always be rewarded….Greed Is Good when it always the taxpayers money. The Sky will not be falling anytime soon.

I have yet to see any coherent argument that a measly 25 basis point rate hike last meeting would have led to “total chaos.” Hyperbole much? The “pause” was reckless.

Reckless?

The FED had raised rates at a historically fast pace. Pausing for one month was fine. Maybe even prudent.

I know some people want extreme pain and chaos, but that is more a reflection of them than anything else.

Everything the FED has put out indicates rates are still going higher. Doing so at a measured pace is not reckless

I disagree – the market has been handling 5+% rates just fine. A few poorly-managed banks collapsed, and the FDIC came in and cleaned up the mess.

The market can handle higher rates. 7% FFR won’t cause the entire economy to implode, but price stability is still broken as Wolf says and needs to be fixed. The current rate of inflation is still unacceptably high, imo.

What market would that be ? Oh the US financial markets, At first I thought you were referring to a fictitious ” free market “.

Personally, I don’t think the markets could handle positive interest rates like 7 pct FFR. They would fold like cheap lawn chairs.

For inflation to go down, asset market needs to go down to tamp down the ‘wealth effect’.

Exactly. Why wouldn’t everyone keep buying Real Estate and sToNk$ when all they do is go up?

Did you check today?

House prices need to come down as well, otherwise they will keep pulling up rents.

Great point about the central bankers not admitting anything now, but very likely to admit that money printing was crazy after they retire.

Principle applies equally to many contentious public policy issues where hubris, self-defence, and groupthink are in action. If you want to know the truth, ask a RETIRED expert.

Two typos in para under middle graph: “months” should be “month” and “Christine” has an “h”.

Typos we type with fat fingers poor vision with lots of digital distractions.

“No central banker will publicly admit that crazy money-printing and interest-rate repression over the years added fuel to this inflation fire. They may admit it after they retire from the central bank, but they won’t admit it while still a central banker.”

Perhaps some Europeans have ways of making them admit it.

“…No central banker will publicly admit that crazy money-printing and interest-rate repression over the years added fuel to this inflation fire…”

Jens Weidmann, ex-president of the German central bank, has continuously been ringing the alarm bell about this. Finally he stepped down in disgust in 2021, long before his term was over. His was a lone voice of sanity in the wilderness of economical idiocy.

Now that all the chickens are coming home to roost, his name has effectively been memory-holed. None of the EU or ECB “economists” wants to be reminded that this monumental fcuk-up was entirely predictable.

The EU (and euro) is a monumental fcuk-up.

It may prove a failure, but for now the euro is the dollar’s main competitor

Well, thankfully, Mexico has it’s peso and not the overpriced American dollar. The same problem plagues the Euro whereby most of the ” states” that make up the EU do not have the standard of living sufficient to support higher prices.

Which advertising has convinced the people that their children will be bullied if they’re not equipped with the latest gear.

The kind of thing that , historically, Europe is known too fight over.

I have to take your word about Weidmann’s push back to Draghi’s let er rip policy.

I do remember the controversial sanctions imposed on Greece, Ireland, and other members of the EU in which the government adopted a dire budget that paid back the speculator banks, emboldened by the rule of law, who had lost money on their infrastructure, public and private, investments. I think Weidmann was a central player.

War, climate and social factors obviously have no impact on prices. Neither money printing or continued negative or near zero real rates have any real impact.

Just saw the headline that the Fed is quite possibly DONE fighting inflation as of this month’s FOMC.

I agree that JPow will stick to the plan. At least 2X .25% hikes…

Then they will announce the next few 25bps hikes, as the base effect shows clearly the next wave (me, arguing for a huge pay increase as I have had nothing but real cuts for 3 years).

He will have to crank the AC at the presser, so he doesn’t pit out his suit, thereby causing a tsunami across the globe, possibly wiping out a large portion of rice crops in Asia…. Thereby fueling wave 3.

War is the fundamental way this empire is following the script that led to the demise of the Roman empire. If it really went away completely.

So many of the traditions that the populist, Roman citizens invented, haunt us today. However, their empire lasted from before the birth of Jesus Christ until today. There are still kings and queens in this society.

Who, let us not forget, their inbred entitlement was responsible for two world wars in the last 100 years.

Very good news in the Eurozone.

Central bank policy will have to evolve. They were able to juice economies by pulling forward demand using debt. I think they feel like total debt to gdp can be around 4X. Not sure what they will do when the debt leverage game hits the limit. Maybe yield curve control or inflationary default.

If yield curve control (interest rate control) is required, then, that is what will introduce a Ponzi aspect to monetary policy.

Yield curve control is accomplished by QE, which entails creating new money to buy and remove debt from debt markets. Once new money is required forever, it’ll be like a Ponzi, which also requires new money, forever.

Currently, Japan appears in this situation. Their yield curve control requires 0.50% on sovereign debt in a 3% inflation environment. According to Deloitte, that results in the central bank buying all of new sovereign debt.

I don’t see an exit strategy absent them ending fiscal deficits. I’m beginning to think more and more that “quantitative easing” is an intelligent design like approach to explain Weirmar Republic economics.

Actually, there is no alternative to printing money.

US Govt cant and wont reduce deficit.

US Govt can’t afford very high rates as interest payment becomes onerous.

it means FED would need to come in and do QE/YCC.

It basically means currency devaluation and inflation.

Inflation can be easily controlled by fake govt metrics.

The real inflation on ground is quite high but govt metrics says otherwise.

“Actually, there is no alternative to printing money.”

LOL. There is the CLASSIC alternative that has been around forever: inflation.

Inflation solves that debt problem by devaluing the debt and increasing government revenues. That’s the “alternative” that has been around forever. It means higher inflation and higher rates for quite a while. It’s already here.

You need to cut back on this repeated QE-nonsense you’ve been posting for months. My AI-powered troll filter is flashing red.

The BOJ apparently owns over half of all Japanese Bonds.

Re: ‘climate change’ which some people equate with ‘weather change’ and reply ‘the weather is always changing’

It would be a good idea to name it by the cause which is ‘atmosphere change’. It is incontrovertible established fact that CO2 levels are rising fast. Unlike some very difficult research, this one is within reach of serious amateurs, as were all the early scientists.

Right here in this small city there is an exhibit of a large tree slice about 4 feet diameter. The tree rings go back more than 3 centuries, with small labels pointing to key years. The same thing is true of ice cores, with the differences being that no one drills ice to get ice like we cut trees for lumber, and worse, you have go to where there is thick permanent ice. An ice core going back 300 years is only a few feet long. It has trapped air bubbles and testing the CO2 level is easy. It has increased by 50% since 1750, which is yesterday in atmosphere science.

It sure isn’t yesterday in terms of the development of earth science. In 1750 when earth science barely existed, it was the establishment view that the earth was created as it is now, with the Grand Canyon already dug, in 4004 BC. An early version of ‘it’s always been like this’.

Reasons for the CO2 change other than human activity have been eliminated. A large volcano can influence the weather for a crop season with dust and smoke, obscuring the sun. This settles and returns to the levels pre-eruption.

Volcanoes have been erupting for millions of years.

Burning of fossil fuels only begins in 1750. and doesn’t take off until most of a century later. The first use of the Watt steam engine is merely to enable coal mining by pumping out the mine. Fifty years later, improved steam engines have their own voracious appetite and in Europe do everything muscle power did before. But the average guy didn’t have his own combustion vehicle like us, and he didn’t press a button every time the room temp wasn’t to his liking, the power supplied by combustion. And China wasn’t starting a new coal- fired plant every month.

How does CO2 change climate? Most of the sun reaching earth is reflected back into space, but at a different wave length than it arrives. Higher CO2 makes the reflection less efficient and heat is trapped. The atmosphere of Venus is over ninety percent CO2. The surface temp is higher than Mercury at about eight hundred C. It was once an earth- like planet with oceans.

Should we care, or care enough to alter our behavior? Well I don’t, but I am 70 and have no children. This question is best left to those with young children or grandchildren. At the present rate we may get another 50% of CO2 increase in their lifetime.

Correction: surface Venus is about 900 F not C

‘Climate Change’ – The right wing has been losing on this for more than a decade. I don’t see their luck changing because the young believe in climate change and the old die.

I have adopted climate change as an investment thesis, ‘dont fight government spending’. Mind that is U.S., EU, Japan, Korea, India,…and many small countries.

Since I try to play Whitey Ball investing (Whitey Herzog, 1980s Saint Louis Cardinals Manager: hit line drives for singles, run the bases, and play defense. 1982 World Series Champs

For singles: I use metal miners with dividends. Gonna require a lot of metal over the next 30 years if my thesis is correct.

Run the bases: I trade around a core position in major metal miners, and carbon energy to a lesser degree because we need it and isn’t going away soon.

Defense: I buy financially strong mining companies

If you want a political fight, I am not interested. If you want to make money I am interested in well reasoned investment thesi for the future. Real world economics.

I don’t think the argument is about the needs but about the price.

The article about the status of the Keynesian measurements of inflation in the EU was really good. Reading through it I realized that the EU is nothing like the US and should not be looked at through the same lens.

Europe is in the throws of an inflationary spiral that was enabled by their monetary en flagrante delicto of the past 15 years. The data indicate that, like our Fed, their policy is inflationary.

The Euro as a currency has never reflected the entire requirements of a commercial currency.

Wolf, your statement that service inflation, once entrenched is the hardest to remove is undoubtedly true. No argument.

That said, (and this may come off as strange), service inflation is also the least politically damaging inflation. At least in an economy like the U.S. where the service economy makes up a large portion of the overall economy and almost all part of service inflation is wages.

Basically, in an economy where a vast majority of workers are service workers, wage inflation is the least evil type of inflation.

Don’t get me wrong, it is still a problem and still needs to be dealt with, but it is a far better problem for our economy than if inflation was in raw materials and goods.