Debt has a nasty habit of ruling the financial world of any entity, whether it’s a household, business or nation.

By Craig Francis.

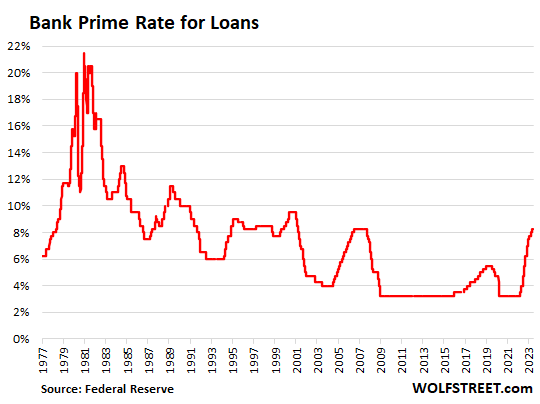

My opinions may not be shared by others, but since I’ve been through four major financial crises, including the wretched stagflationary period of 1976 to 1982 during which bank “prime rate” for loans hit 21%, these events helped me form a few opinions along the way.

In May 2023, Jerome Powell, president of the Federal Reserve, increased the Fed Funds rate for the 10th time, adding another 25 basis points to Fed fund rates. This brought the prime rate to 8.25 %, the highest in almost 20 years. This round of rate increases is the most rapid in 40 years, reflective of the Fed’s slow realization that inflation was real and tangible and not transitory as first thought.

From this point in the second quarter 2023 and going forward, I’m fairly certain we’ll see another 25-basis-point increase within a month or two, barring some unexpected event that causes Powell to pause in his plans for higher rates.

A dramatic decline in the present inflation rate or wide recognition of a strong recession could provide reasons for Powell to stop. Either event might even incline Powell to reverse course and drop rates quickly. The 2024 presidential election cycle is another event that generally produces lower rates, pump priming, and heightened monetary stimulus, as Federal Reserve Presidents often succumb to political pressure. Powell’s been pretty much flinch-proof lately, but that could change quickly if historical Fed actions are any guide looking forward.

With a recent CPI print at 5% Powell may still be compelled to increase rates another tick or two to put the final kibosh on inflation. Other factors might have him pause as he reflects on the damage that has been done by 10 rate hikes in the last 17 months. Damage is evident pretty much everywhere we look, not least of which are the financial conditions of most small and mid-sized banks and unsteady commercial real estate values.

A couple of small rate hikes over the rest of the year might help staunch inflation, yet consequences could easily turn out to be grave, including a serious recession, a big stock market air pocket, further damage to the lending sector or deleterious effects on real estate values. D, all of the above is also possible.

That means Powell is still in a tough spot as to whether he should hike again, pause for a period of time, or turn rates back down. If he continues pressing rates upwards through 2023 before a nominal pivot sometime in late 2023 or at least by early 2024, this will further exacerbate American economic conditions with effects felt worldwide. It’s a well-accepted fact that things are breaking now as a direct result of the fastest rate hike in US history.

What’ll break first? The economy, or Powell’s will to beat inflation? Looking back to the 1980-1982 period, Paul Volker, the former President of the Fed, did pause and pivot, only to see inflation spike again coupled with two back-to-back recessions. He quickly reversed course by going back to rate hikes which finally did the job of breaking the back of inflation in 1982-84 period.

As Powell reads his monetary history, he is caught in a heck of a squeeze; bump the prime rate to 8.5% within the calendar year of 2023, maybe giving one or two final rate shots to quell inflation as he floors the rate pedal to assure himself that he doesn’t make the same mistake as Volker who let off on rates before inflation was well and truly dead.

This pathway might tamp down inflation in the long term but it’ll add to the cost of living and doing business going forward. Interest is, by its nature, an inflationary cost. It’s passed down through cost chains and affects all expense factors whether loans are present or not. Even if rates stabilize at these higher levels, it leaves us with a substantial increase in the US debt. As all government costs galloped higher, the interest paid on $32 trillion in Federal debt also rose rapidly.

A $2 trillion here, a $2 trillion there, and pretty soon we’re talking about real money. In federal debt terms, as we move to the end of 2023, we’ll see another $2 trillion in debt. Moving through the federal fiscal period of 2024 and into 2025 we’ll see a minimum of another $2 trillion in US debt, notwithstanding monetary pump priming in the Presidential election cycle.

The debt ceiling resolution didn’t provide for any type of substantive spending cap. We could easily see even more deficit spending which, in and of itself, is grossly inflationary. Federal debt is one of the largest heads of the inflation Hydra, and thus it’s very hard to kill. It’ll make its presence known in all debt markets as Federal spending pushes out other investments that require loans to function.

This rapid ramp up of US debt is a big negative to the US credit rating, even while it weighs heavily on access to all capital. But it’s made worse when interest costs are added to these gargantuan totals. Half the Federal deficit is now interest on the debt. The annual borrowing cost is $1 trillion. In reality, the US treasury is financing the interest charges by tacking it on to the federal debt instead of being paid as we go.

The need to fund excess government spending, including the interest on this debt, puts strong pressure on interest rates. The US Treasury needs someone to buy this debt. While Uncle Sam is on the hook for this debt, he’s still paying the interest. But creditors will demand good rates, or they’ll seek investments elsewhere.

As the interest on the federal debt exceeds $1 trillion a year, total national debt will hit $36 trillion in two years. It’s well on its path to $50 trillion by 2030. There comes a point in time, as Powell contemplates rate policies, that most of his decisions are rendered moot. He’ll simply have lost control

As debt-based inflation takes root and we see only more red ink as the US debt moves upwards at an exponential rate, higher rates can take a life of their own. Almost all countries in which debt to GDP exceeds 100%, debt and rates tend to run past all forms of policies and human control.

For what it’s worth, rates will most likely come back down to earth for a while but not before much more damage is done. Debt has a nasty habit of ruling the financial world of any entity whether it’s a household, business or nation. Long gone is the day when US debt was manageable. With a US debt to GDP ratio of 1.30 to 1, that Roman river was crossed around 20 years ago. By Craig Francis.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“…yet consequences could easily turn out to be grave, including a serious recession, a big stock market air pocket, further damage to the lending sector or deleterious effects on real estate values.”

Wolf – wouldn’t “deleterious effects on real estate values” be something Powell should want after the pandemic price boom? If the average home isn’t affordable for the average family, how else would that be corrected?

Apologies if I’m missing something here.

Depends on where you sit.

Everyone PLEASE NOTE that this article was WRITTEN BY CRAIG FRANCIS, not me.

We want to make sure that it gets attributed property.

Duly noted Wolf; ah, those soft landings of the ’70s and default by inflation, with the concurrent rise in dumpster diving renters and the homeless.

i missed the credits to this post, but could tell it wasn’t yours. I thought this was an AI trick for which I was going to say… busted.

I asked young bankster today about mortgages(washington fed)

he shook head – doing NONE

what about commercial – nope

don’t even have mortgage person there anymore

For all too many, where you stand depends on where you sit.

Powell is making me incredibly wealthy. The haves are loving it, like a McDonald’s commercial, and the have nots realize that barring a crash that allows them to buy stocks and real estate on the cheap, they will never have the opportunity to make up for lost time. Non asset holders are essentially lost to a lifetime of getting further behind by the day.

Get help.

Yes! Jpow gave many market opportunities over the last year but if you read the comments here it’s bear central.

Seems to be all Powell really cares about. Appeasing the masses while increasing disparity.

I’m guessing Powell wants an “orderly” or soft landing.

Probably best case is to inflate Real Estate away… It stays the same price or loses a small single digit percentage… all while inflation eats away at it’s real value over a few years.

Throughout world history, no economy has ever escaped the business cycle.

Policymakers are obsessed with trying to engineer a soft landing. In previous decades, when the economy overheated, they would just force a recession & inflation would quickly dissipate.

Is a recession to flush out the last decade+ of financial excesses really such a bad thing? As someone who’s been laid off before, being jobless sucks … but you recover. And the broader economy is also very resilient. And we’re starting from a record-low 3.5% unemployment rate.

We’re now over 2 years into this inflation problem. With a soft landing as the goal, it might take until year-end 2024 or later for inflation to return to target, if economists are correct. That’s 20%+ of purchasing power loss since 2020 that we’ll never get back.

Why would anybody think the Fed was more skilled in interest rate/macro-economic manipulation in 2010-2020 than 2000-2010?

DC reputations are entirely rooted in immediate collective amnesia (otherwise known as MSM brainwashing).

Like a festering wound, you either get it fixed early or you let it get worse until you have gangrene.

How can a Central Bank tighten when Politicians are on crack?

20 plus years too late. Juicing the economy with free money, no interest cost, is like putting nitro into an IC engine. You get the boost but the engine needs to have major repairs sooner, rather than later.

All I’ve ever seen is the business cycle destroyed since 2008 and every book on economics from the distant past made worthy of being thrown into the fireplace.

So you are saying if we aim for the soft landing at a 2024 window and inflation does return to target. We as americans will not get that 20% purchasing power loss back ever? Everything will forever stay inflated?

I think it’s possible that if we had socialized medicine and effective caps/rent-out requirements on residential RE ownership then we might not need that cycle and might not need to use recession as a damper for inflation every so many years. We already have subsidized farming- although that’s not working to keep down food inflation as much as might be necessary, it certainly does help. Food, shelter, medicine. Just the basic necessities.

That plus ongoing random drug tests for all politicians might go a long way..

This is probably the first article I can remember from Wolf that really paints a dire picture of the US financial system.

So if I were the Fed chair I would know one thing. High interest rates for a long time will be a killer. The size of the debt does not matter as much as the interest payments, which are a combination of debt and interest rates. So if they can kill inflation and return to lower interest rates, they can start to refinance debt at lower rates and that might open up a window for the US government to finally get a hold of this debt problem (although it is questionable whether the politicians will do anything).

If they dont get interest expense under control, the future of the US dollar and economy is bleak. There will be relentless upward pressure on interest rates as the supply-demand balance shifts upward. As bond funds continue to take losses, investors will actually sell off bond funds, which will require even higher long term interest rates to attract sufficient investment. As interest rates move even higher it is possible that interest expense could hit 1.5 trillion per year. This would be close to double the military budget.

The way to do this is to crush the economy. Yes, crush it. Kill it. Destroy the bubble economy. That is the best way to kill inflation quickly and quickly bring back down interest rates, so they can reduce the interest payments. The best way to crush the economy is to increase the pace at which they reduce the balance sheet, thereby crushing the wealth effect that props up spending. Combined with the return of student loan repayment and job losses that crush wage inflation, this will cause the economy to contract and force companies to stop raising prices as demand slackens.

PLEASE NOTE that this article was WRITTEN BY CRAIG FRANCIS, not me.

We want to make sure that it gets attributed property.

Craig’s opinion about the future doesn’t line up 100% with my opinion about the future — though it’s close in many aspects. But no one knows where this is going, and we’re all having our opinions about it. So it helps to see an insightful article that isn’t 100% lined up with my thinking.

Wolf

Well appreciated, to have different angle of view.

Wouldn’t the solution to this problem be to cut spending to below its tax revenue. Cut money to states to bare minimum. Trim old tax incentives for the rich like electric cars, solar panels. Lower spending that increase inflation in core goods and services. Let the banking market provide liquid instead of uncle sam. Last time I checked I don’t have a money printer and sorry but I want a house I have to save and wait, not be given free uncle sam money.

I do assume that you (Wolf) largely concur with the viewpoints expressed in the article.

@Captive. Spot on comment. I’m so tired of all the absolute BS about the harm high rates will do. BS. Where you stand depends ABSOLUTELY on where you sit. Cry me a river all you folks who got in while the getting was good. Aw boo-hoo, your home value is no longer a clean double; sniff-sniff, a millennial will no longer have to sell his first born child for a mortgage, oh wait, they can’t have kids cause of the price increases. —go pound sand!!!

Powell will increase rates until Wall Street capitulates. Stocks are far overvalued and employment is too strong to get the kind of inflation reduction needed to get anywhere close to 2%.

I so hope you are right.

I agree completely. The market will prop up inflation, and the fed knows this. Until the market corrects, the fed will keep raising and holding.

I have a dumb question Wolf…

In cases like these, why doesn’t the FED do 10 bps or 15 bps hikes rather than a pause?

Is 25 the lowest they’ll go?

Why?

Is it one of those:

“We’ve never done a 20 bps hike!!!” things?

Moves that small are too small to have an effect (see below) and would be immediately trumpeted by MSM morons as a pivot.

Despite the quasi-mystical influence attributed to Fed interest rate movements, there is at least a loosely-coupled, somewhat-linked relationship between Fed interest rates and actual investment calculations (nobody is claiming the relationship is exact or granite-hard).

The Fed’s rates have a pretty close relationship with broadly available real world lending rates and those lending rates get plugged into discounted cash flow/net present value calculations that are at least nodded to when making major real-world investments.

Nobody kids themselves that the towers of estimated cash flows are exact or that interest rates won’t bounce around…or that any of a million other factors don’t intrude…but in broad strokes, the higher the Fed rates, the worse essentially all alternative investments/expenditures look.

There’s actual formulas for it.

So the higher the interest rate hikes, the more potentially inflation spawning speculative investments get kiboshed.

Inflation looks pretty out of control still, so more beany-baby VC delusions, skyscraper stupidities, and consumer paint-huffing expeditions have to be taken out and shot to bring inflation down.

10 bps hikes ain’t going to move the Fed’s long-lagging needle.

The US has to burn off 20 years of a malinvestment orgy where 80% of the Fed’s ZIRP free money got wasted on speculative crapola.

Not to mention the Covid “1 million dead is somehow a real-asset boom” boom.

When you think of DC macroeconomic control, think of deck chairs and Titantic

Yes, if anything the Fed really needs a 50 bp hike now for the June 2023 meeting and even more important, go much more aggressive with QT and selling MBS’s, even the most formerly dovish consultants we’ve been talking to have been turning into turbo-hawks with the latest US asset bubbles and as the gaping damage from this ongoing inflation becomes clear. Record US homelessness as rental inflation continues to surge and housing remains priced way beyond incomes, more Americans off the grid or living out of cars or vans, rampant shoplifting and looting causing small shops to shut down and bigger chains to change their policies.

And that’s just the start of the nation-killing effects of this inflation–record low US birth rate and heading lower fast (over half of American adults crammed into dingy overpriced apts with roommates and living at home tends to crash fertility rates fast), accelerating de-dollarization abroad and rejection of the US dollar for payments (a “reserve currency” isn’t much of a reserve when it’s shedding value every day for 2 years), price discovery impossible in the bloated equities markets and crypto, rampant quiet quitting and de-motivation at work ruining productivity (inflation means almost all Americans are basically getting pay cuts), restaurants and hotels unable to find staff who can’t afford cost of living increases, then the writer’s strike and more strikes brewing. This latter effect is looming a lot larger than first realized, it’s a direct result of inflation–can’t survive in entertainment hubs like LA and NYC with cost of living surging like this–and with competition going up in so many other cities, even the mainstream entertainment press (Variety and EW) are reporting that the Fed’s failure to crush this inflation may well be the nail in the coffin of Hollywood and New York as the most important entertainment centers. That’s the ultimate real, concrete price of unchecked asset bubbles like this and the extreme pandemic over-stimulus when covid hit with ZIRP, QE on top of $10-12 trillion in fiscal stimulus–the US currency itself has been devalued and the excess liquidity is crippling the value of the real economy.

There’s a reason Paul Volcker is rightly viewed as an American hero today in retrospect–he understood that sound money is the basis for practically every other goal a country has, without that all it’s aspirations are just empty rhetoric. Jerome Powell has apparently been studying up on Volcker a lot lately as have Waller and Jefferson, but they need to convert those studies into the kind of hard, decisive action that Volcker would take in a crisis like this.

Without sound money, nothing else in society can function properly. Just Read “When Money Dies”. It was dog eat dog until the new currency was issued at the end of 1923. We’re in the beginning stages of a repeat of the Weimer Republic.

Yes, sell all mbs

We have no alternative now but to

“Destroy the economy in order to save it”.

“We’re in the beginning stages of a repeat of the Weimer Republic.”

I’ve read that one a thousand times over the last 40 years, and here it is again.

Cas127

I feel you… but 10 bps is bigger than a Pause.

Right?

I’d rather have a small hike while they “wait and see” than a 0 bps.

I agree, but there is an entire media industry dedicated to calling any Fed waffling a pivot, in order to offload more of NYC/DC’s garbage investments to the unwary.

It isn’t like the Fed has been draconian so far…they have engaged in a slow gradual ramp up for over a year…after more or less 20 years of destroying the interest earning power of the USD (really just another name for de facto devaluation).

Eventually the only tool the fed and the government will have to deal with the giant debt is to inflate it away ( to the detriment of savers). I am not sure I see any other way because it sure does not look like it will be payed off the old fashioned way with taxes and austerity. Seems like an unfair outcome but the piper has to be paid.

Raising corporate & personal taxes back to the rates they were in 2000 hen we last ran a surplus would also do the trick.

This dishonest nonsense again?

why so angry? the rich should pay their fair share. they are the ones benefited the most from all this money printing.

Was that a joke?

I think you are right. Inflation and nebulous soft landing at sometime in the future is what I am betting on.

i keep hearing this idea of inflating away the debt, but that doesnt work.

what level of inflation are we talking about here…5%..7%…10%. the trouble with inflating away the deficit is that once inflation starts to kick in, you start to get run-away inflation and that is a killer. the Fed is forced to raise interest rates and therefore increase the interest payments that are paid each year, adding to the future debt. it becomes a vicious cycle.

the other side of the coin are the entitlement programs. in a country with massive entitlement balances in the future, all you do is create the need for entitlement spending to increase dramatically. this is a horrible deal because if inflation is outstripping the interest rates, then the assets in the entitlement programs are actually losing value and the date at which they go insolvent is even earlier.

i have not done the exact calculations, but it is my guess that we would actually do better with just a tad of deflation. and adjust the cola downward with deflation.

the sooner we bite the bullet and get a balanced budget in place and kill off the speculative bubbles, the better we will all be. continuing the funny money circus is destroying the real economy.

There is another way. Stopped spending money blowing up countries, stop being the #1 weapons dealer in the world, cut back the military industrial complex and use all that $$ to right our ship.

It is a completely viable plan that stands NO chance of being enacted.

I was talking to my friends who do remodeling work on houses. They are still swamped. He said so many of their customers realize that the cost of trying to move to a nicer/bigger house would cost too much because of the higher interest rates so they are remodeling or adding rooms or outside living areas.

LOL The demographics of this group are people who have received raises or promotions. They have the extra income to take on a bigger mortgage payment but they realize the bigger mortgage payment only buys them the same sized house they currently live in. Thus many are taking out a HELOC and remodeling. That is where the extra money goes that would have been for a bigger mortgage payment.

YEP. Made a great living rehabbing/contracting, residential real estate repairs, additions, foreclosures…… NEVER had trouble finding work for over 40 years.

But it requires skill and hard work. Not for everyone…

Yeah everyone’s a bum these days.

Back in my day we had to work 19hr days for one whole Nickle in the coal mine which we were paid by the cart load. If you stole food from the mess hall you’d get bigger faster and therefore fill more carts. My best day I still 37 rolls from the mess hall and filled 5 carts making me .15 whole cents. Had to quit at 23 due to lung cancer.

Required skill and hard work to be successful then, something hard to come by these days.

And the recoupment coefficient of probably 95% of rehab work is…75% of money invested.

Ok if you are doing it for your own use/benefit…money down the drain if you are doing it for “resale value”.

Real estate is a highly levered, highly risky investment where you hand over a huge hostage to the local tax/spending politicos – and there is a reason why homes are notorious as money pits.

People only think RE is a wonderful investment because they don’t pencil it out.

So absolutely true. I bid very low on a fixer this week and was actually relieved when the bid was rejected. I was going to live in it, so not expecting any return, but OMG.. When I checked material prices again just to be sure.. (and yes, they are still high) there is no way it was worth even that bid. I don’t know who on earth is going to buy these places, but they better be prepared to throw a lot of money down a hole and not get it back.

Exactly the situation that I am in. Won’t be moving anytime soon so I am making repairs (80%) and upgrades (20%) to my current home to preserve its value.

In fact, just last night I was wondering if Wolf has any data on how widespread that is. We talk about how the consumers are still spending as the Fed raises interest rates… but it is not necessarily BAD spending if it is step one in their plan to hunker down and ride the current situation out.

LOL? Sounds like a buncha frustrated would-be interior decorators with HGTV addictions feeding their addiction. No laughing matter.

It’s well on its path to $50 trillion by 2030.

———————————

Every American is looking forward to new found wealth in a few more years.

Spend like there is no tomorrow. What a legacy for our kids!

The problem with pausing is markets are interpreting it as a definitive end to tightening, followed soon by rate cuts. Historically, pauses aren’t common.

The well-telegraphed pause has unleashed a massive wave of financial speculation, loosening financial conditions & making the inflation fight harder.

June is a strange time to pause, too. Before Powell & Jefferson started blabbering, rate futures had priced in a 0.25% increase. When the market gives you the green light, you take it.

Going forward, there will be more potential excuses not to tighten. In August, student loan payments resume. In September, there’s a risk of a government shutdown. And the closer to 2024, the more Federal Reserve officials will want to stand pat to avoid any appearance of election interference.

After the first chart, should the prime rate be changed from 8.25% to 5.25%?

“This brought the prime rate to 8.25 %, the highest in almost 20 years.”

Ha! It’s still won’t make Depth Charge happy …

Prime Rate vs Fed Funds rate. No need to change the chart (re-label).

Publius,

The “prime rate” is the basic lending rate by banks for business loans. It usually parallels the Fed’s policy rate, but is higher. In the old days, the Chase Manhattan prime rate was the most-quoted rate (before Libor), and variable-rate business loans by other banks were quoted as “Chase Manhattan prime + 2%” or whatever. This was still the case in the late-1980s when I cut my teeth with business loans. Eventually, most big loans and floating-rate bonds were switched to “Libor plus x%”. Now they’re getting switched to “SOFR plus x%.”

But banks still quote business loans in terms of “prime plus.” I just got another unsolicited promo from my big bank for a massive variable-rate working-capital line of credit (credit crunch my a**, LOL), with a rate “as low as prime plus 0.5%.”

So that would be nearly 9%! And that was a promo rate, from the bank’s normal prime + 1.75% for this size of loan.

This look at the prime rate here gives you a more realistic view of where business loan rates actually are right now. They’re not at 5.25%. They’re much higher!

Okay, thanks for the correction/explanation!

Wolf

Is 5.25% is Federal Fund (?Discount) rate for the Banks to borrow?

Where does the other 300 basis come from, before it becomes Prime plus fpr the consumer? just getting more clarification.

Thank you.

A bank wouldn’t be in business very long to borrow at 5.25% and then lend that money at 5.25%

YEA HAW Fellers. You betcha Mr Wolf. This sure is fun this time around. No tellin what these folks will do. Pull a Greenspan, Mr Powell? This Redneck is ready this time. More QE when others ar a thinkin QT? Do it. This retired fella is ready. Thanks Mr Wolf, I can t wait for that Dot Plot Thingy you taught me about.

“The US Treasury needs someone to buy this debt. . ”

With the alleged commitment to QT, and the huge supply coming down the pike, who will buy our debt and at what price? With the increased supply and the potential absence of the Fed to support the auctions, could there be an instance of actual “free price discovery” coming?

Powell could turn to a Congress that complains of higher rates and say…”you guys created this supply, not me.” Hopefully.

If honesty/integrity has been absent in DC for 50/60/70 years, why would you assume it would appear now, when the whole show is imploding?

If the stock market comes crashing down, perhaps a lot of $$ will jump ship to the dry land of treasuries, thus putting a ceiling on yields.

MM

This is what I’m thinking as well.

Then lower yields will lead to continued inflation and higher for longer will lead to the real bond crash IMO

Stocks showing lots of signs of topping soon… Looking at you Barron’s cover

I’ve been trying to decide between gold or bitcoin to stay even with inflation, it may actually be some form of crypto currency tied to gold…

Cmoore,

I recommend you buy Beanie Babies. Or maybe a crypto that is linked to Beanie Babies.

It’s a sure winner.

/s

What about Franklin Mint commemorative Norman Rockwell plates?

At least you can eat off them.

But, then again, you can wipe your…nose with the Fed USD too.

NFTs of DJT. Go all in, then retire sumptuously.

Both craptos and gold are just trash speculative commodities.

Speaking of acronyms. Whatever happened to SBF? Is it just me, or is MSM, DNC etc, deliberately putting it with Hunter’s laptop/

He gave 70 Million to the Dems, he surely gets witness protection program

Are there any cryptos tied to gold? I thought most crypto investors hate gold and see it as competition to their favored asset. BTW, the USD is still the bully of the beach kicking sand in the faces of the precious metals. I don’t think you they are a viable alternative for maintaining wealth. Maybe agricultural land in New Zealand?

“viable alternative for maintaining wealth”

Useful, practical knowledge.

Can be obtained for free on the internet or any public library.

Utterly portable and direct applicability to real world assets.

I think there are very serious risks with a token tied to gold, especially agency problems: where is the gold, and in whose custody? Who certifies and handles and secures it? What keeps it from being stolen? It has basically similar problems to stablecoins and exchanges that collapsed so spectacularly. At least gold ETFs have some legal wrappers.

Maybe check out silver

1.30? You guys are sailing.

1.60 here in Canada.

According to the “Nobel Prize” winning Paul Krugman, “Debt is just money we owe ourselves.” So why worry about debt?

Those interest payments that Krugman is talking about go to the top 10% who own 90% of the stocks and bonds in this country. So, apparently Krugman is just fine with that.

As he often is Krug is only half-right, or both right and wrong, if you prefer.

Our national debt as constituted is a form of upward wealth transfer; the national debt doesn’t have to be constituted that way; we just lack the political knowledge, will, and power to change it. As long as the interest payments are reasonable (what qualifies as “reasonable” is debatable) and as long as real resources (labor, raw materials, energy) aren’t tightly constrained, national debt in a sovereign currency regime isn’t something to be terrified about. I know, I know, this is heresy in these parts..

What needs to be kiboshed is the trope of “we’re robbing future generations with our debt!” If the debt is to be paid by, and therefore, to future generations, how is that robbing them?

What is true is that, as currently constituted, that future debt will be paid to the same 10%, 1%, .1%, or .01% classes. This is where sociology and politics intersect with economics and finance, and it is why Smith, Ricardo, and Marx talked about “political economy.” It took a concerted effort to rebrand political economy as neo-classical, marginalist “economics” in order to divert workers’ attention from the seemingly invisible class war that rules our lives.

So we should deputize and trust the noble ragged masses to have all the wealth and governance? What a fantasy. Likewise they (demonstrably) can’t manage resources, the environment, etc. They certainly can make more copies of themselves, complain and demand more. They are no less crazy or selfish or greedy than the rich: simply more incompetent. Their poverty has served to keep them out of any real test of this,, out of any trouble. This widespread and almost never-challenged fantasy deserves a call-out.

Agreed. I’m tired of this Puritan era belief that the poor are somehow noble and pure of heart. This fantasy that if the wealth were redistributed to them, that everything would be better, has to stop.

This visceral hatred of workers and poor people is instructive.

“So we should deputize and trust the noble ragged masses to have all the wealth and governance?”

Where did I say that? But thank you for the reductio ad absurdum in place of a substantial retort.

“Their poverty has served to keep them out of any real test of this”

Because all members of the plutocracy are self-made, with no large inheritance, in-place upper-class social network, political influence, or educational advantages, right?

“I’m tired of this Puritan era belief that the poor are somehow noble and pure of heart”

Again, where did I say that?

The poors are all wicked, lazy sinners deserving of their lot and of our contempt, amiright?

you have missed so much of the picture here.

massive deficit spending is simply a way of not paying the bill today. this pumps up the economy today and creates asset bubbles. when you have asset bubbles the value of the asset will either drop or not rise for many years into the future and the future generation of investors will not make an adequate return. there are some stocks from the dotcom era that reached peaks that were not breeched for another 20 years, despite growth in the company for all those years.

what needs to be kiboshed are the greedy people who could care less about the future and our kids and only care about themselves and their wealth today.

Two beers, there’s a vocal contingent of Marie Antoinettes around here that carry water for the 1% and their god given right to hoard all the wealth. Let them eat cake!

Well…it would seem future generations enjoy the virtue of paying themselves….but they do not receive the goods and services past debt covered.

Henry George. Biggest selling book in the 1890s in the USA after the Bible. Progress and Poverty.

It’s rentiers vs wealth creators.

I think you are way off in a basic way. Think about it.

Every household today has an average $200k debt burden on their shoulders. The benefits of that debt build-up were reaped by prior generations.

The generational wealth transfer is huge. It’s a transfer from one generation of taxpayers to the next.

Phleep—you tip your hand here as a bitter, disdainful technocrat with a pungent antipathy for anyone you consider lessers.

Noble ragged masses?? You mean the great unwashed? The proles? Or maybe just “the help”

How do you treat waitstaff? I bet I know.

Bobber, you’re conflating household debt with national debt in a sovereign currency regime. They are completely different issues.

They are not different. You seem to think governments can print money without consequence.

Because quite simply it just doesn’t work that way.

Foreigners may prefer not to lend if they’re going to get back currency debased in value from negative real interest rates.

Their problem is, where else do they lend large amounts?

“where else do they lend large amounts”

At home.

China is aware that China has 1.4 billion potential real asset producers/goods consumers.

Stop it, go ahead and invest in China. For emporer Xi will steal it as a socialist dictator. There is no honor in China.

hatefedbs,

We are talking about China’s/Foreigners’ money…where do you think *they* find simplest/safest to invest?

Particularly if the the Chinese government (which holds well over $1 trillion in US Fed debt – thanks to 20 years of huge unaddressed US trade deficits) gets to basically decide.

The US has run relentless worldwide trade deficits for over 50 years (all the while DC telling us…”Don’t worry about it”).

There is a huge consequence – gigantic foreign holdings of US gvt debt (that is how the 50+ years of trade deficits got financed – it wasn’t a magic bunny granting wishes).

As I see it, that’s not quite the problem foreigners face. Foreigners already have USD from their massive trade surpluses, and that USD is already subject to devaluation whether they lend it back to the US or not. Their issue is figuring out what to do with the USD if they don’t lend it back to the US. They can reduce trade with the US in order to stem the flow of dollars, but where else in the world can they run comparable trade surpluses? This is a difficult issue for every country.

Interest payment divert money away from investments and large interest incomes discurage doing “real work”.

A rentier society will slowly consume all producers of future income.

Interest payments encourage saving for the future.

When future money isn’t more valuable than current money, you get the “why save it, just spend it now” attitude, which 15 years of zirp have implanted in a whole generation.

Not with money created as debt by banks. Monetary inflation will then eat any gain interest gives. Only “hard” money like gold may keep their value over time, but with a monetary system with the amount of money fixed there can be no interest on money.

In short, money of any monetary system is good for payment transfer and short time storage of wealth, but not long time storage of wealth.

My guess is that Powell will kick the can.

He isn’t trying to stop inflation. He is trying

to keep the banking system from imploding.

Add in a contentious election cycle and he will

cave. He isn’t in it for the long term.

3 months is far enough removed from the implosion of SVB (a single mismanaged bank out of hundreds) that it can be assumed the crisis is over? The markets are clearly not concerned.

Agreed. The markets melting up (Nasdaq is now up 30% this year) say it all. No one has any confidence that Powell cares about inflation.

One more interesting point. I saw an article that said that retail investors were adding 1.6b a day in money to equities. So on a weekly basis that is equivalent to 8b. Compare that to the amount of money the Treasury needs to attract in capital to finance the deficit spending and load up the balances again. I can see at least 100 billion per week being drained for the coming 2-3 months.

Initially, it wont cause problems, but once the demand for Treasuries is sated, it will reach a point where only higher interest rates will attract investment dollars. And long term rates will be off to the races.

SP500 dividend yield = 1.5%. Long lerm median is 4.2%.

short end treasuries or m/m probably the best risk adjusted returns until the Fed lands the plane.

The author’s emphasis on the prime rate is odd; it’s a relic of a bygone age. The rate on the ten year treasury, and the Fed funds rate, are the two rates that count. Fiscal policy is highly stimulative and the Fed is barely at neutral; pause now and kiss the two per cent target goodbye.

“The author’s emphasis on the prime rate is odd; it’s a relic of a bygone age.”

No it’s not. See my comment above about the “prime rate”: My business is constantly getting new promo offers for working-capital lines of credit at “prime plus x%.”

The focus on the prime rate is good because it gives people a more realistic view of what rates businesses are actually looking at when they borrow from a bank — not 5.25% but closer to 9% or over 9% for some!

– If I were to make a bet then I would put my money on 1)) no rate increase 2)) rates cuts are coming. The only question is; WHEN. Why ? think: yield curve.

Obviously not.

Maybe it is time to start thinking radical thoughts, like, I dunno, maybe raising TAXES on the people who are holding all of that so called “excess” paper money?

Maybe repeal the Trump Tax cuts for the .000001% ?

Nixon tried wage & price controls. But as someone who lived thru that period of time, it requires a functioning central government. I also recall a lot of complaining that it was wages that were frozen, not prices.

Or some combination of the above with rate hikes ?

There is always more than one way to skin a cat. Are you still expecting the banking cartel, err, Federal Reserve, to fix the problem? ? The Cartel may fix the problem for the wealthy & well connected. But it will be on the backs of everyone else.

The tax cuts expire 2025. And yet, CBO forecasts show increased annual deficits beyond that.

Regarding Trump tax cuts, the modest tax cuts for the middle class expire in 2025. The huge corporate tax cuts for the wealthy class are permanent.

Trump clearly favored the wealthy when designing his tax cuts. You could call it a bait and switch.

Corporations pass high corporate tax on to consumers they have to. Corporations fold if their incomes disappear. Higher corporate tax would probably lower inflation as spending by consumer would drop quickly .

The top tax bracket might get restored to the previous 39.6% rate if the 2024 election results in divided government.

But the bulk of the cost still comes from lowering middle-class taxes (as there are way more middle-class taxpayers than millionaires) with no clear way to pay for it.

Given that both parties want to preserve the TCJA tax provisions for middle-class earners & below, the deficit & national debt are set to explode in 2025 no matter who’s in power.

Costs are incurred when money is spent. Failing to collect taxes is not a “cost” nor does it have to be “paid for”.

Yes, you can look at it as “excess government spending” or you can look at it as “insufficient government income”.

MarMar,

Or, you can look at fiscal revenue, look at fiscal spending and look at how they relate to the overall GDP to get a wider picture.

And what Mr. Francis points out so well, is that we should also look at the size of the debt that “Uncle Sam is on the hook for;” the annual cost to carry that debt; and where the trajectory of that debt is going. “$50 trillion by 2030.” Looks to be bloody, eh?

From Track 8 of The Rolling Stones’ “Let It Bleed”:

“Well, I hope we’re not too messianic

Or a trifle too satanic

We love to play the blues

Well I am just a monkey man”

Uncle Sam’s monkey on his back just gets heavier and heavier. Mr. Francis sums it up, “Debt has a nasty habit of ruling the financial world …”

Nasty habits? Sing it to me Mick: “I’m a fleabit peanut monkey, all my friends are junkies.”

You metnioned the catch, it requires a ” it requires a functioning central government”. Or rather one that not act only on short sight gain for themself and their sponsors.

The 2017 tax cuts were a little more more complicated than this. They benefit almost tax payers, but the elimination of deductibility of SALT over 10K actually raised taxes on some high income taxpayers in states with income taxes, particularly the 0.1% in NY, NJ, and CA. It’s been very interesting to watch the so called “party of the people” fight to eliminate the SALT limitation, when an estimated 90% of that benefit would actually to top 1% of taxpayers in few high tax blue states. Funny to watch that same party not want the wealthy to pay their “fair share”…

I see inflation trotting higher, driven by services. No one is paying attention to what is staring them in the face.

The cost of housing is putting pressure on wages. (1) It is young people who work, and a lot of them rent. (2) Home inventory is low, which will push up both prices ant rents until corrected. Until more housing inventory appears, inflation will continue to spiral higher because of a checkers match between (1) and (2). The *rate* of inflation will be controlled by *tightness* of housing inventory.

Even ignoring the previous paragraph, the Fed is looking at two possible scenarios to get out of its self inflicted wounds: (1) Remain serious about its 2% rate target or (2) Allow the target to float substantially higher. In the short to medium term, both will result in a move higher in interest rates.

It will be (2) because the Federal Reserve works for Wall Street.

In a pre-QE world, if they tried to raise the inflation target, bond yields would also adjust higher. But now they want to keep moving the goalposts & suppress yields to nothing, and that’s unacceptable.

2000: switched benchmark from CPI to PCE (PCE always runs lower than CPI)

2012: adopted 2% PCE as official inflation target, no makeup for previous shortfalls

2020: changed 2% PCE target to long-run average, allowing makeup for previous shortfalls.

20??: segment of FOMC wants to raise target above 2%

Meanwhile, real bond yields have gone lower & lower, failing to keep up with inflation.

Yields are not going that high on the 10 year because Wall Street thinks QE will resume and they can make a profit on the capital appreciation.

Perhaps the trillions in tax cuts for the rich and trillions spent on wars over the past 30 years have something to do with our gargantuan debt. Somehow reversing these policies is never discussed.

The members of one party are clamoring for more tax cuts. The 1% are not rich enough!

Considering how the .1% always makes bank and workers always struggle, no matter which party is in power, maybe the two legacy parties aren’t as adversarial as their showboating for public benefit would have us believe?

nah, more crazy talk…

Yet the other party wants to eliminate the SALT deduction, 90% of which goes to the 1% in a few high tax states.

Now thats just crazy talk!

“Perhaps the trillions in tax cuts for the rich and trillions spent on wars over the past 30 years have something to do with our gargantuan debt. Somehow reversing these policies is never discussed.”

Exactly.

Mention this, though, and one is accused of “class war.” The real class war, though, is unilaterally top-down, rarely mentioned, and therefore essentially invisible. It is so woven into our lives that most people don’t even notice it.

But, yeah, the debt is all the fault of the lazy poors who greedily gobble up too much of that meager social security and medicare they already paid for..

Couldn’t possibly be all the non-discretionary commitments the gov’t has made.

/s

Defense spending must be pruned drastically, but entitlements are 2/3 of Federal spending, no serious person can suggest we can have sustainable finances without a drastic change in entitlements as well.

We are the boiling frogs.

Unless we get a big black swan crashing through the fed’s looking glass window, opening a deflationary moment, inflation rates will not see 2% for a long time due to the irreversible debt trap.

What happens after that is like predicting the weather.

Good Luck, and thanks for the article Craig

1) Paul Volcker raised the prime rate to 21%, but new oil fields in Alaska,

the Gulf of Mexico, the North Sea, the ME and Siberia beat inflation, did the job for Paul Volcker. In 1971 Paul Volcker advised his president to divorce gold.

2) A deal with Iran might deflate oil prices, but a supply shock caused by China might lift inflation. The value of the $1.8T to support US gov budget deficit might deflate. The Fed Prime rate might double or…, but Fed hikes are the symptoms not the cause.

3) The Dow is trying to close Mar 1/2 2023 open gap.

4) SPX entered July 7/8 2021 BB, 4,361.88/ 4,289.37.

Paul Volcker stopped inflation by imposing reserve requirements on NOW accounts in April 1981.

I don’t agree that interest cost are inflationary.

Interest is largely paid by spenders to savers, so increasing the interest rate will transfer money from spenders to savers, which is deflationary.

In any event, the effective means to attack inflation is reduction of the money supply, or quantitative tightening (QT). Unfortunately, the Fed is reducing the money supply at such a slow pace, you have to wonder if their real goal is to maintain inflation in the 4-8% range.

With today’s government, it’s more important to recognize what’s not said. If you listen to what’s said, you will often be misled. The actions often don’t reconcile to what’s stated, and its unclear whether this is by accident or design.

“Interest is largely paid by spenders to savers”

Banksters, used car shysters (not you, Wolf! 😊), payday loansters, and credit card sharks are “savers”! Hallelujah!

Wonders never cease.

Markets are widely expecting the Federal Reserve to unofficially abandon the 2% target, if it cannot be done without upsetting Wall Street.

“It’s a well-accepted fact that things are breaking now as a direct result of the fastest rate hike in US history.”

This is a well known consequence of keeping ZRP, too long for over the decade along with unneeded or over done QEs and stimuli. This should have been expected.

Not so “well-accepted”. Some banks are breaking, but the Fed will just merge them out of existence. Employment is strong, housing prices have not been much affected. Some bankruptcies have happened that would have happened anyway. Poor people may be having trouble with rising prices, but poor people always have trouble with something. The simple fact is that rates (fed funds and 30 year mortgage) are not particularly high, but are about average 1971-2022.

Most banks should break. They survive on the stupidity of their customers (overdraft fees, accepting .01% APY on savings, monthly fees for checking accounts, carrying balances on credit cards, and other fees).

Nothing of any consequence has broken, yet.

Government (and mortgage holders) are sitting on low interest rate debt in a rising rate bond market. Feels a bit like the 1960’s which was a lost decade for stocks and set up the inflation spike of the 1970s and the advent of deficit spending as policy in the 1980s. Reverse that, close deficits, which would cause disinflationary spikes, and a lost decade or two in stocks.

‘With a US debt to GDP ratio of 1.30 to 1, that Roman river was crossed around 20 years ago”

Matters little. They are aiming for Debt to GDP of 200% or more like Japan, as long the US green back is accepted in the rest of the world.

The total global debt to GDP is over 350%.

The Gross Domestic Product (GDP) in Japan was worth 4940.88 billion US dollars in 2021, according to official data from the World Bank. The GDP value of Japan represents 2.21 percent of the world economy

Oh no, anything but “deleterious real estate values”! We want land to be unaffordable to normal people forever, right, gang?

Unaffordable real estate isn’t just the job of the Federal Reserve and the international bankers. The local city “fathers” also play an important role in serfdom through zoning, all the developers show up at city hall. The state has lobbyists as well; most interesting sign seen years ago at the California State Capitol in the hallway was something like: only elected representatives and Lobbyists past this point.

Its the “new normal”. Just a teensy gully.

The conditions of the real estate market are much more important politically than the performance of the stock market. It’s probably why so many are still expecting rate cuts next year. Its an election year

Yes the righteous path is to pay off debt. The other path oft taken by politicians for expediency sadly is to inflate the dollar to pay the creditors. QED is QE

Interest payments by govt or FED does not really matter as they can print money out of thin air to infinity.

Only side effect is inflation and this is evident in the purchasing power of USD for last few decades ie losing purchasing power over time.

This should be all fine as long as world accept USD and I see no threat to USD as world currency for next few decades or so.

Tomorrow, CPI would print lower and market would go higher. After few weeks, CPI would be revised higher like last few times and market would keep going higher.

Powell would pause on Wednesday with a dovish statement and market would go higher.

This is what I think, Let’s see :-)

Pakistan just announced they had unloaded the first oil tanker with Russian oil paid for in Chinese Remimbri…

The US dolar may lose some of it’s purchasing power abroad, even if it is accepted.

Where did Pakistan get the RMB? It borrowed them from China, LOL. Pakistan owes China $23 billion and is trying to restructure its debts because it can longer pay for them and countries cannot file for bankruptcy. The IMF is already involved. So yes, hang your hat on that.

I’m not on board with the Chinese Remimbri, but I also don’t buy the “cleanest dirty shirt” argument.

Don’t lose the forest for trees.

USD still has decades ahead as a reserve currency unless something really breaks.

All CBs are printing.

Still it is interesting if a country like Pakistan turn away from US dollars because they can not borrow more US dollars and instead turn to a different lender.

That may have both economical and political consequenses. Having a different lender lined up may reduce the risk for Pakistan to default on their US dollar debt.

All out wars may be inflationary… a COMBINATION of scarcity and fiscal borrowing. WWII for instance. But you can pick any date in the last 40 years and find America either fighting a war or bankrolling one (e.g. Mujahedeen vs Soviet Union) and inflation was minimal for the entire time.

In fact, THIS bout of inflation got sparked IN BETWEEN the time that we pulled out of Afghanistan and the Russians invaded Ukraine. So far we have spent $75 billion supporting Ukraine for the past 17 months… less than 10% of America’s ANNUAL defense budget of $850 billion

It ain’t the military that caused this bout of inflation…

When you create money and pass it around, inflation follows. Huge amounts of money has been fabricated to support/bail-out the connected at the expense of the commoners.

The only reason interest rates were so low is because the FED suppressed interest rates.

Rates are currently at earthly levels. The huge money creation and suppressed interest rates were the manipulation that bubbled asset holders and contributed to the wealth gap.

To get inflation below 5%, even to 2% is still inflationary and gross negligence.

The reason inflation is so high is runaway government spending. Interest rates are still too low compared to inflation rates. Having said that, the only way out of this problem is for the government to reduce spending and adopt a balanced budget. A large percentage of government spending is extremely wasteful and counterproductive, and there is a huge amount of fraud as well. Lowering interest rates would only allow the government to spend more and prolong getting our arms around the spending problem. As Wolf pointed out in an earlier article, higher interest rates have actually increased consumer spending, and helped many on fixed incomes. Individual investors / savers should not be punished for saving money by receiving less than a fair return for their investment in government securities. The government needs to stop expanding spending. That likely won’t happen unless there is a Conference of States addresses the issue, or we get a much more financially conservative Congress / political leadership.

Our national security is at risk if debt continues to mount. And so is the wealth of the majority of the population, except for the very rich who benefit regardless up to a point, until the bottom falls out.

Hopefully he keeps pumping rates until the housing market completely crashes.

I know, I know, a bunch of people sitting on hundreds of trillions of unrealized gains on their houses would see this imaginary wealth evaporate and be really sad. But for the rest of the world struggling to afford sky rocketing rent, its desperately needed

It’s very hard for me to relate to today’s prices. In 73 I went from a $320 apartment to a new home with a payment of $368. My wife cried because she was worried we couldn’t afford it.

I literally bought our 1st Christmas tree with the change I had been saving from my Jean pocket.

Today, I was quoted a sum of $5,200 to have approximately 5,000 sq.ft. rototilled. Two different outfits, $300 apart. I know of several people who continuously pay over 40% penalties on a monthly obligation. The 40% is not a typo.

As long as people are continuing with this habit, it tells me that there is still an abundance of money running around.

I don’t think the Fed can afford to pause, unless inflation is the desired result. I am, and have been on a buyers strike. The tilling I will handle.

You can buy your own machine for that price and really Stick it to the Man!

Buying a home in 1973? Probably 75+ years of age . Someone needs a root /tree stump grinder in my yard to til 5000 sq Ft. Maybe a 5 day job and 10k . All depends on the task. I could not do the work physically.

Powell won’t hike. He’d pause and send out dovish signal.

The manipulated cpi tomorrow would print lower.

The elephant in the room is debt. We spend more than we earn/produce. The consequences hereof will become obvious to any household guilty of the same behaviour. Debt is now out of control. Earn or produce more or cut spending.

Earning more through outcompeting the Chinese in manufacture no longer seems possible. All that is left is cutting expenditure. The cost of sustaining the US empire is unsustainable and unnecessary. The lives of those living in countries which also ran expensive empires that succumbed as a result are not that awful. Simply ask the Romans, Turks, Dutch and British

Your comparison has a flaw. Households cannot print money. The Fed can print money.

True. But household consumers can increase the velocity of money.

5.25% is hardly high , except in relation to the absurdly low levels during the last decade .

As long as Wall St is stable or goes higher , Powell will be under no pressure to stop raising rates.

Rates of 3.76% and 3.90% on the 10 and 30 year respectively still reflect sharply negative real interest rates and need to approach short term rates.

Many analysts have mentioned that something always breaks before the FED is done . The demise of SIVB and First Republic were examples of banks with extremes of deposits over 250,000$ and losses on bond portfolios .

The “ breaking” in the financial markets will be much more significant .

How can the Fed conduct QT with a massive treasury auction calendar?

Supply might actually determine price!

The market may raise rates without the help of the Fed

Sorry Craig,

If Powell does NOT hike this time, it will be his 2nd major mistake in 2 years.

Have you noticed the melt-up in mega cap stocks. Have you noticed net liquidity is higher than when QT started. Have you noticed lowest UI in 60 years. Have you noticed core PCE inflation.

He better hike. Damn the financial assets.

Michael

Michael Bond said: “Have you noticed net liquidity is higher than when QT started.”

———————————————

No. How are measuring this?

One way = total Fed assets.

https://fred.stlouisfed.org/series/WALCL

QT started June/22 at $8.9 trillion, fell to $8.3t, was goosed back to $8.7 with the March/23 unpleasantness, down again to $8.3t, now rising slightly.

QT + QE = Q’d Up.

Why worry about the debt?

Next time we have a zero interest rate recession, we can monetize half the debt, without fear.

Call it “quantitative pleasing”.

Should not be inflationary because bond money is not slated for consumption.

I initially thought the fed would pivot but have changed my mind. They don’t care about inflation, inflation is their friend. What they care about is having abundant debt in the form of cash equivalents, treasury bonds. The higher the rate, the higher the demand abroad and at home.

Today, I watched a video in Spanish, on a new fha programs that allow for 0% down and up to 50% debt to income. No talk of interest rates anywhere in the discussion, just nominal payments. More debt to trade. The higher the rate, the higher the demand.

Inflation and higher rates are going to be around for awhile.

Thank you for the article Craig. I appreciate anyone willing to share his opinion and put it out there for other people to consider.

Savers have been sacrificed for 15 years at the alter of political spending and it is about time savers are paid a reasonable interest on their hard earned money. There needs to be a balance between interest paid and interest earned and let the markets determine what is the balanced interest rate. The future spending will determine what government agencies need to survive and which ones need to be eliminated. The market will cleanse itself if Kenysians will allow it to be done. Abolish the Fed would be a good start.

The annual borrowing cost is $1 trillion. In reality, the US treasury is financing the interest charges by tacking it on to the federal debt instead of being paid as we go.

Does that not indicate ‘zombie country’???

At some point rising stock prices will cause money to recycle back into the economy and stoke prices. It’s a game of chicken.

Keep the stock market frothy and the economy picks up while inflation is alive and kicking or let the edifice collapse with higher rates and have a hard landing and wash out the malinvestments and overpriced assets. Unfortunately it will come down to politics. Inflation continues dipping and everyone cheers victory over inflation assets take off and prices for real goods make new highs for the cycle. If Powell was really serious he would have taken the funds rate at least 150 basis points above the core inflation rate. My bet is they call victory to soon.

Guys. The higher interest doesn’t work in an economy that is built on NEGATIVE INTEREST RATES. The problem isn’t the high interest rates, the problem is the decades of taking heroine, but now that heroine is gone, and as any drug addict they will fall into withdrawal. High interest rates is good if you live in a sane economy, but we don’t. But does that mean that we should continune shooting up heroine?

I’m sorry, I get a little bit upset when people say that high interest rates is the problem because they are not looking at it the right way. The problem is not the high interest rates, the problem is the decades of money printing and negative interest rates.

Savers have been sacrificed, turn on student loans, raise taxes back nominal rates, a 50% property tax hike based on value appreciation in Douglas County Denver glorified suburbs just announced, and you would think somebody shot your dog for trespassing. It’s a weird world and time we live in today, from toilet paper bubbles to your favorite steak marinade costing $2.50 on Walmart shelf to $8.00 bottle on Amazon for 3 pack. It’s seems that no one is happy in America, but everyone is making money and spending more. I’m all wet with laughter, as the irony of never wasting a good crisis has set USA on a collision course with destiny…my home doubled in value but I have no one willing to buy it. Long are gone the days of $3500/share for AMZN.

As I said: The only tool, credit control device, at the disposal of the monetary authority in a free capitalistic system through which the volume of money can be properly controlled is legal reserves. The FED will obviously, sometime in the future, lose control of the money stock.

May 8, 2020. 10:38 AMLink

The solution:

https://files.stlouisfed.org/files/htdocs/publications/review/2023/06/02/fiscal-dominance-and-the-return-of-zero-interest-bank-reserve-requirements.pdf