Retail CRE debt has been crappy since 2017, and banks managed without collapsing. Now Office goes to heck. Multifamily, the biggie, is following.

By Wolf Richter for WOLF STREET.

First, the US Banking landscape.

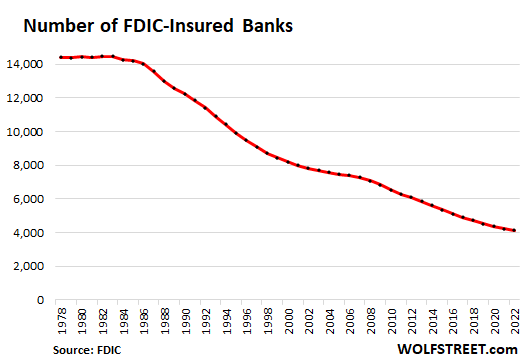

There are 9,697 domestically-chartered banks, savings associations, and federally insured credit unions in the US. Of them, 4,135 were FDIC-insured commercial banks as of December 2022, with 71,190 branches, according to the FDIC’s year-end tally. Now minus three banks, in order of collapse date: Silvergate Bank, Silicon Valley Bank, and Signature bank. So, today maybe 4,132 banks.

All these banks, savings associations, and credit unions had $29 trillion in assets. Of them, the FDIC-insured banks alone had $23 trillion in assets. Of them, four held 40% of those assets:

- JP Morgan ($3.2 trillion in assets)

- BofA ($2.4 trillion in assets)

- Citibank ($1.8 trillion in assets)

- Wells Fargo ($1.7 trillion in assets).

Then there’s nothing for a long distance before we get to the fifth largest bank, US Bank, a regional bank, with $585 billion in assets. Silicon Valley Bank was the 16th largest bank at the end of 2022 with $209 billion in assets.

The 32nd largest bank had less than $100 billion in assets. The 132nd largest bank had about $10 billion in assets. The 2,050th-largest bank – the bank in the middle, or the median bank – had just $315 million in assets.

That’s important to understand when we talk about bank failures: If a few of these smaller banks collapse, few people outside of their community would even notice, though it could be a big blow to their community, especially in rural areas where this may be the only bank within miles.

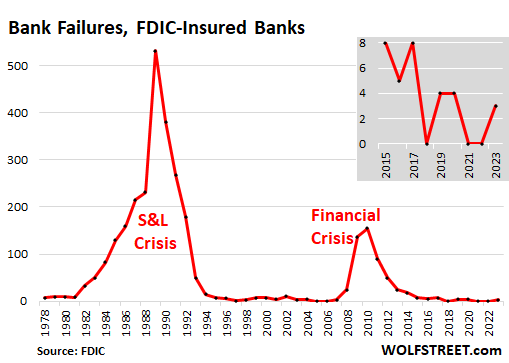

Bank failures are kind of routine, but can spike.

As long as banks have existed, banks have failed, just like other companies have failed, even the most splendid ones. In the US, banks can’t file for bankruptcy (though their holding companies can). Failed banks are taken over by regulators and are “resolved.” This is a much quicker process than dismembering it in bankruptcy court, and it allows for most of the deposits to be returned to the economy in short order.

So far in 2023, among the FDIC-insured banks, there have been three bank failures, if you include Silvergate, which was forced to shut down. There were no bank failures in 2021 and 2022, but four in 2020 and four in 2019.

The gray insert shows the bank failures from 2015 through 2023 so far. The massive spike in the 1980s was the Savings & Loan crisis, which led to the prosecution and quality time in the hoosegow for a bunch of bank executives. Yes, those were the good old times. By contrast, during the Financial Crisis, no one even attempted to send anyone to the hoosegow.

CRE Debt by category.

Multifamily (apartment buildings, student housing, etc.) is by far the largest category. CRE debt outstanding by CRE category as percent of total CRE debt:

- Multifamily: 44.2%

- Office: 16.7%

- Retail: 9.4%

- Industrial (warehouses, etc.): 8.0%

- Lodging: 6.7%

- Healthcare (life sciences): 2.1%

- Other: 12.9%

Some CRE debt still in good shape, others are in trouble.

The data below on special servicing rates are from Trepp, which tracks CMBS. Special servicing rates are a precursor for potential defaults for CRE mortgages that have been securitized into CMBS. We can use these special servicing rates as an indication of the trends among overall CRE mortgages.

Note that retail has been in trouble for five years, and banks have managed their way through it. Lodging has been in bad trouble since 2020, and banks have managed their way through it. Dealing with bad debts is what banks do as part of their routine.

Industrial is still in good shape, with a special servicing rate of 0.4% in March, down from 0.6% a year ago.

Retail has for years been the worst category due to the brick-and-mortar meltdown that I documented here since 2017 that took countless retailers – from the largest such as Sears and Toys-R-Us to the smallest – to bankruptcy courts. And it still is the worst category, with a special servicing rate of 11.6% in March, worse than a year ago (10.9%). Banks have been managing this issue for years without collapsing.

Lodging became a nightmare during the lockdowns and travel bans, but has been getting less worse, so to speak, with a special servicing rate of 6.3% in March, down from 10.9% a year ago.

Multifamily is now slithering into trouble, with a special servicing rate of 3.0% in March, up from 1.7% a year ago.

Office is going to heck. The special servicing rate has risen to 4.8%, up from 3.15% a year ago. Collateral values have collapsed. The issue is structural. Years of hogging office space by companies that they didn’t need and couldn’t use collided with a shift to working from home, and downsizing, and flight-to-quality that is leaving older office towers vacant. But given the size of these deals, everything is slow-moving. I discussed yesterday some of the recent deals, price cuts, and foreclosures sales, with haircuts ranging from 36% for the lucky ones to 100% for unlucky CMBS holders. Nearly all of the bag-holders were investors, not banks.

Banks’ exposure to CRE debt.

The data below is from a report by investment manager Cohen & Steers [CNS], citing data from the American Mortgage Bankers Association, the FDIC, and the Federal Reserve.

The size of CRE debt. CRE-related debts fall into different categories:

- $4.5 trillion: CRE mortgages on income-producing properties, meaning properties that are completed and have tenants – the CRE mortgages that everyone is talking about when landlords default.

- $467 billion: construction loans.

- $627 billion: owner-occupied property loans that the FDIC classifies at “commercial mortgages.”

- Plus: Revolving lines of credit, senior unsecured bonds, and warehouse facilities (extended by banks to nonbanks to temporarily fund their mortgage issuance until they can be securitized).

Banks held $1.73 trillion (38.4%) of the $4.5 trillion CRE mortgages of income producing properties. Investors and government entities held or guaranteed the remaining 61.6%, according to the Cohen & Steers analysis. In other words, $1.73 trillion in CRE debt is spread over 4,132 banks.

- Banks and thrifts: 38.4% ($1.73 trillion)

- Government-backed Agency, GSE, and MBS: 20.8%

- Life insurers: 14.7%

- CMBS, CDOs, and other ABS: 13.7%:

- Other: 12.5%

In the broader sense, including construction loans, banks hold 45% or $2.25 trillion of all CRE mortgages:

- Top 25 banks held $700 billion (14%) of CRE debt, about 4% of their total assets

- Next 110 banks (assets $10 billion to $160 billion) held $800 billion (16%) of CRE debt.

- The 4,000 smaller banks held $750 billion (15%) of total CRE debt.

Regional and smaller banks, the last two categories accounting for 4,110 banks, are relatively more exposed to CRE. On average, their CRE exposure amounts to 20% of their total assets.

But office mortgages account for 3% of their total assets, according to Cohen & Steers. So in general, it’s not going to be office CRE that will cause them trouble; office CRE is too small, though it could cause a few heavily exposed small banks to topple. Anything can.

For a bank with $1 billion in assets, CRE exposure of 20% means that the bank would sit on $200 million in CRE loans. This would be composed of all kinds of CRE loans. On average, this bank would also be exposed to office mortgages amounting to 3% of its assets, or about $30 million. This makes for a huge diversity of small local players that know their local markets.

A few small banks are hugely exposed. But a “handful” of the 4,000 small banks have exposure to CRE that exceed 50% of their assets, and if they run into CRE trouble, they may be added to the chart of failed banks above. This is called “concentration risk” in banking. It’s not good.

The top 25 banks have relatively little exposure to office loans, with office mortgages accounting for less than 1% of their total assets, according to estimates by Cohen & Steers. So with them, defaulting office CRE would cause some hits to earnings but not an existential crisis.

It’s investors that are taking the biggest hit on office mortgages – not banks.

There will be some bank failures.

We will see the number of bank failures rise. CRE debt will take down some of them. Other banks will be taken down by other factors. Credit risk, interest-rate risk, and concentration risk – it’s a bank’s job to manage them, and those that didn’t will get strung out. Banks will report crappy earnings for years. Investors have been taking big losses on CRE equity and debt already. And that will continue and get worse. Everyone will learn all over again that you can lose money in real estate.

But CRE is unlikely to lead to the next big banking crisis. It’s just not big enough for the banking sector.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So with tax revenue from falling CRE and residential values, are municipal bonds the next shoe to drop ?

What was that ladies name in 2008 who said municipal was going to blow, but the bailouts put it off? meredith whitney? This is why you don’t do bailouts, because it doesn’t fix S*%(. Its like compounding interest, the longer you don’t deal with it, the worse it gets.

Woonder why Hinderberg shorted India’s Adani group, but failed to short SVB and so many banks in its neighborhood.

I bet it’s because it knew that all US sh** will get bailed out by its stupid taxpayers.

Amani group shares took fall, Indian government didn’t interfere, knowing that it will just create opportunity for well run businesses.

Leo,

No, wait a minute. Think this through before you spin conspiracy theories. SVB’s shares didn’t get bailed out. People who shorted them made a once-in-a-lifetime killing, now that they can buy them back over the counter for 58 cents, down from $280 two months ago. That’s a 99.9% gain for the shorts (not including related expenses). Put options had much bigger gains if holders they made it through the messy period where the shares didn’t trade.

Well, we should allow the markets to be. We should assist in supporting both older models and newer ones.

NOVA is just a hide out for some of them

I remember the days when JCP was only flirting with bankruptcy, and message boards were full of people insisting the value of the company was under represented…because of all the hidden value in its real estate assets, you silly little investor. This was all going to be purchased by Amazon, Walmart, etc. who knew what was really going on.

Well….**insert sad trombone sound**

Can’t say I’m surprised to see that retail is still at the bottom of the already damaged commercial real estate pile, for all sorts of reasons. Seems like it attracts a certain variety of bag holder.

Yeah, Bruce Berkowitz lost about 89% with his Fairholme Fund because of his Sears holdings. He was counting also on the value of the commercial real estate owned by Sears as far as increasing Sears book value.

Now Berkowitz is making money finally as a controlling shareholder of St Joe, since it is mostly invested in the Florida panhandle (Bay County (aka: “Pay County”)).

In Pay County, whatever St Joe wants is what the Bubba$ and Good Ole Boy$ in local government will gladly give. Roll Tide

FAIRX didn’t work out well for me.

It had a great record (9 ?) when I bought it in late 2009. I didn’t realize it was as focused as it was, i.e., few holdings.

Well it was that way when I sold it in 2021.

As such it had larger swings than most of my other funds. Perhaps should have been labelled a financial sector fund.

I read Bruce’s annual reports but didn’t understand the legalese he got into. He was upset with some part of the government…how Freddie Mac or Fannie Mae were dealt with. I was patient but I finally gave up. It wasn’t a disaster but definitely subpar returns for me over the 12 years.

Now for a real disaster I bought FSELX (select electronics) at its peak in early 2000 and I swear someone messed with my mind (I’m serious, NOT a joke) and sold at almost exactly its bottom in 2002.

Dumb ? Maybe. I prefer to think ignorant, there’s a difference after all.

If a fund has a 10 year annualized return of 30% (as did FSELX early 2000) my thinking was if it did bad it would might be flat for a few years.

Hah !

Mean reversion…what was that ?

I found out.

Of course not everything does mean revert although plenty of authors write as if everything does.

Typo :

“it had a great record ( 9 years ?)” …

etc.

Randy,

Looks like you sold too soon. Yes, focused they were ad are. Not because of whhhhhhhy but stories shown. I am with Bruce, Legolas may be a deep, deep issue for many.

Too many loops and deep holes.. Agreed, you should have stayed and not sold them. Either way, Bruce may be correct and wise. They are not just focused, they appear to behave a wealth of insights and knowledge.

Not bad for old dogs who have a tough bite. As you know, we can buy, sell, trade but after 12 years, maybe Bruce is correct.

No Wnnnnnny, see the bees at their work with a lot of drones. Full picture, 12 years, they are still focused & wise. Should be amazing run.

Would that be

Wah

Wah ?

No, wah wah waaaaaaahh…

I had been buying Macy’s stock <$16/shr for that exact same reason – I felt the value of their owned RE assets would put a floor under the stock price, i.e. they were trading below their own liquidation value.

I ended up exiting that position late last year. Glad I did – now I'm also questioning how much CRE will hold up in value, and what that means for traditional value-investing strategies.

Nice write up! Hoosegow is so fun to say!

1) Blame the banks. Banks have to manage credit risk, interest rates

risk, a focused portfolio risk and contagious risk. If they don’t its their fault. Banks always fail, with no fault of the Fed or the FDIC, during the contagious period.

2) Andrew Mellon : don’t bail the rats. Dodd Frank : don’t bail the banks. In March 2023 Dodd Frank got a heart attack. SVB and CS were bailed at other depositors expenses : u & u the tax payers.

3) Chart 1 : FDIC insured banks vs banks total assets : total assets LT trend is up. It reached $23T in Mar 2023, a new all time high, with tiny dents during recessions. No harm was done. The latest dent might be a backbone. This cancer was removed promptly. Forget about the 3 banks bs. No recession.

4) Chart 2 : banks failures : after Paul Volcker acts 550 banks failed. Interest rates risk peaked in the 1980’s. The best time to buy a house was 1995 at the bottom of the bubble.

I was close — bought in ‘97, but that’s mostly courtesy of the accident of being born at the right time along with employment that never required me to move.

Mostly dumb luck, really.

Maybe everyone should buy them a real nice home, something new & furnished for a very long time.

Agree with Bruce, lega……….l. Too many oops…….

5) Chart 1 and 2 : 10,000 FDIC insured banks were extracted since 1983 down from 14K to 4K, no painful, no spikes, under FDIC anesthesia, in tranquility …and what about the rest.

Something is wrong.

Most of these banks were acquired by other banks in a huge wave of consolidation. Bank consolidation continues to this day.

It is also easy to blow yourself up with leverage…and banks are in the leverage business.

If a couple of large loans go bad and get sold off at 20% of initial presumed collateral value (per your recent posts) it doesn’t take long for banks’ mandatory regulatory capital to evaporate. Hello, FDIC and/or forced merger partner.

That is why OG bankers were such hardasses…they knew a couple of bad loans could put *them* out of business.

1 When they disappeared and shrank during the massive consolidation the chart should show a large plunge followed by

minor ones.

Only 550 FDIC banks failed. Is something wrong ?

That massive wave of consolidations started when the Glass Stegall act was being watered down and it continued when it was repealed, and it continues to this day but at a slow pace because there are fewer banks left to buy. That’s THREE DECADES of massive wave of consolidation.

Credit unions have now muscled into that space, buying banks and turning them into credit union branches. They’re a big force now — and they’re ruffling some feathers due to their tax advantages.

The biggest credit union, Navy Federal, has $156.8 billion in assets, so as a bank it would rank in the 20’s. But the next largest credit union is a lot smaller. Although Navy Federal has taken over other credit unions, I don’t believe they’re ever taken over a bank.

I also suspect the typical profile (assets, loans, savings, etc) is different from a bank (e.g. NFCU has $156.8 billion in assets, $133.6 billion in savings, $109.9 billion in loans, and $19.2 billion in equity).

Maybe FDIC vitamax…. So jealous. See the bank hasn’t fallen, the just distributed the funds and invested. Read the P&L or Balance sheet for each one before any decisions are made.

Some new banks are really getting out there but seem to be failing. Some of the older ones like the drones have made mistakes as well.

Maybe it is time to settle fairly with the older banks.

Hey Wolf,

New reader here. Thank you for the article first. In the title’s preface you mention multi family next in line to have trouble.

Can’t help to be skeptic of that statement since there is a big shortage of dwelling units and US pop keeps growing, albeit at a slower reported figure.

Thank you again Wolf

I’m going to publish an article today about multifamily defaults and foreclosures, big ones, so you’ll see what it’s like.

That shortage of dwelling units is a myth. There was and still is a HUGE construction boom of multifamily, putting the latest and greatest apartments on the market, and older buildings are losing residents.

Wolf if people are buying treasuries and ,they default on debt. Why wouldn’t they just bail in all the treasuries?

Hey Jorge,

US is strong & focused.

Just because CRE isn’t big enough to bring most banks down doesn’t mean they’re safe though. Rising rates hurt a lot of banks assets beyond CRE (like treasuries, MBS).

The government has (attempted to) “ring fenced” the banking system, by “macro-prudential” regulation of moral hazard. The banking system isn’t actually sound, it only appears to be sound because of an asset mania and false confidence. (Yes, I know the government can print money like toilet paper to make everyone “whole”.)

Looking at the stats above, the four TBTF fail banks matter more than most of the others combined. Due to inflated asset values from a bubble economy, none are likely to fail from loan losses as long as the financial levitation act persists.

I’d have to dig it up, but my recollection is that JPM only has a loan book of somewhere around $1T. If correct, the rest is mostly in marketable securities though these banks also have non-bank affiliates with “investments” in all kinds of things that most don’t know about. Regardless, JPM’s loan portfolio isn’t likely to be the attributable cause of any potential failure and the same is true of many other big banks.

No, as usual, any systemic problems are going to come from somewhere else entirely which most aren’t expecting, including any government regulators: the corporate bond market, or hedge funds like LTCM, or my first choice-from outside the US altogether. This is the kind of source that will create “contagion risk” for the banking system.

As in the past, the actual cause of the failure will be a loss of confidence. That’s what causes bank runs and credit conditions to tighten. Factually, any entity can remain a zombie in theory forever as long as someone will lend them money. The reason they don’t is entirely psychological.

AF,

The contagion risk really is correlation risk, because decades of ZIRP inflated almost all USD asset prices far beyond rationality (by screwing around with DCF/NPV calculations via interest rate manipulation…or viewed alternatively, by destroying rates on “riskless” Treasuries – encouraging/compelling investments into a lot of doomed/stupid speculative projects).

So as one asset class blows up, almost all will blow up in a cascade…because they all have ZIRP overvaluations in common (and…because overvalued assets serve as collateral for *other* overvalued assets’ financing…it is the unwinding of the ZIRP pyramid scheme)

So as unZIRP proceeds (to fight the predictable inflation proceeding from ZIRP’s money printing), all those stupid DCF/NPV calculations from the ZIRP era blow up (viewed alternatively, “I never wanted this overvalued office bldg CLO equity tranche, now that Treasuries yield 0+X%, get me the hell outta this dumbass investment”)

THEWILLMAN,

Banks are never “safe.” They’re in a very risky business: borrowing short and lending long. That’s why you try to keep your funds under the FDIC limit. And it’s why they’re highly regulated (even if regulators fall asleep).

So true, but looking at markets many prices are falling. We the drones fail a few top B, but the new seasoned Q, strong

Thank you for this analysis!

Why is it not a scandal that, as population has grown, the total number of banks has cratered? I saw this in my community as bank after bank, most over 100 years old, was snapped up by a larger bank. It seemed that everytime this happened the executives got very rich by selling something they didn’t create but somehow ended up owning a significant portion of – aren’t stock giveaways wonderful?

The graph is trending to a concentration of just a few banks. How few do there have to be before we get in serious trouble with lack of competition?

Seems like about 4 which are ‘Too Big to Fail’!

Because it would be admitting that we’re getting more poor, and who likes to admit that? Plus, what is easier to control, 14,000 banks or 4,000 and falling?

It seems like that in the early 1990’s it was popular for the financial degreed people to start their own banks.

I don’t see as many bank startups as I did back then. Are there more regulations?

Anecdotally, my second cousin-in-law did this with some university classmates and his bank failed. He didn’t go to jail for that. The money he made fueled a raging spending spree that included fast cars, booze, cocaine, and women. He went to jail related to that.

He now stocks shelves at the local hardware store and seems much happier.

my ”good old boy” neighbor did somewhat the same thing back in the days of the S&L Boom:

Then, after some correction, he told me he ”quit drinking, quit smoking, quit snorting, and quit sex.”

Said it was absolutely the worst 15 minutes of his entire life…

(Sorry Wolf, can’t help it sometimes.)

Good for him. But, we all know it is much more exciting to make deals, work with funding and watch others grow. The top 4- the older one was placed with behind cntrolls. Thus, enabling full growth. It was focused and not winnnnnnng. Thus, maybe we should pull back all controls and allow it to shine.

The other 3, still lacking many skills. Growing but just not as sharp. Not as focused as the older one. Agreed in earlier post with Bruce…..We should watch out for leeeeggggal. Looks like top Bee was stung.

Digger Dave,

There has been a HUGE wave of smaller banks acquiring even smaller banks, and it continues. Bank consolidation is a big theme, meaning a smaller bank grows by acquiring tiny banks and turning them into branches.

This contributed to the surge in the number of bank branches (convenient physical locations is what people really care about, not bank headquarters). And bigger banks have opened branches everywhere. This growth of branches continued through 2008. It then plateaued through 2012, and has since been declining as branches get closed left and right.

My bank closed three branches that I used to go to, one after the other over the years. Now I have to go to their new branch which is a mile further away (I’m walking, so it’s a little extra exercise). In other words, they closed three old branches and opened one new one. That’s the trend.

I’m recalling (not personally) the year of my mom’s birth, as FDR was arriving, and in her smallish southern California town, three small banks failed. Then I recall (personally) all kinds of regional/community S&Ls that were tied to non-diversified loan books that took them to bankruptcy. I don’t see “small and local” as a general positive in the modern economy, as trouble goes to the one-location shoe store, or the one-property small farmer that bank has a loan to. All it takes is a drought season and — poof.

Interesting. So internet banking is killing branches and the number of banks is still shrinking, which I think means that the only way to juice executive pay now is for little-big banks to eat even more little banks and shut down their unnecessary branches.

I hope I’m not around for the day when Brawndo owns everything.

Ha! It might not be so bad. A night out at the updated Fuddruckers sounds delightful!

It my impression that people looking to sell a big package often look to public pensions as potential buyers…like CLAPERS

And recall, just a few months ago….Biden somehow signed a cash infusion into these public pensions

$36 billion for the Central States Pension Fund,….12/8/2022

Is this the beginning of more of same? And isnt this so similar to bailing out banks, sans the big headlines?

The Rubicon was crossed in 2008, expecting anything different after that is just stupid. The level of obfuscation will increase to keep you from understanding what is going on.

Or, government has spread into the business of retroactive insurance for all sorts of risks and hazards not well-insured going in — including old age, crazy weather events, etc. This might be considered the history of the mid-20th and early-21st centuries. Like all insurance, it spreads a loss across many people/assets. The payees, and they are hundreds of millions, generally don’t complain, or they vent their theories in comments sections. They are the payors too.

But, one can always choose to take the trendy tone of today’s comments sections, and sound like a belligerent adolescent sporting a conspiracy theory. Life is full of choices.

“But, one can always choose to take the trendy tone of today’s comments sections, and sound like a belligerent adolescent sporting a conspiracy theory.”

Uhhhh sure, i’ve been saying the same thing since 2008. And every crisis since 2008 has been met with the same response. So i’m not sure where your snark is coming from. Heck we may not even be in the wonderful situation we’re in if you people actually cared about the country more then your personal bank account. But then i’m sure you’re of the generation who’s mantra was “Greed is good” so why should i expect any different?

What about California propping up residential real estate with low rate loans? I know it’s just a finite pool but still incredible how the state repeatedly intervenes.

California: zirp loans

Canada: increases already absurdly high immigration to boost demand

UK: reduces stamp duty and has regular “help to buy” schemes

There is a 1% total assesed value tax on unnoccupied dwellings now in parts of Canada unless you can prove that it is occupied or under renovation. Guilty until proven innocent. It’s also a line item in the federal tax return. Fun huh? That’s how they deal with the immigration lunacy.

And btw your insurance voids if the reno exceeds 3 months.

Yep, and here we are.

Fraud, manipulating markets, highly risky behavior and ignoring GAAP is just a business decision with a worst case of paying a fine.

“The gray insert shows the bank failures from 2015 through 2023 so far. The massive spike in the 1980s was the Savings & Loan crisis, which led to the prosecution and quality time in the hoosegow for a bunch of bank executives. Yes, those were the good old times. By contrast, during the Financial Crisis, no one even attempted to send anyone to the hoosegow.”

6) Bank DEI ==> DUI banking.

It’s investors that are taking the biggest hit on office mortgages – not banks.

And just when some of the REITS and preferreds are looking like bargains.

Wonders of securitization: once again (after ’08), there is a huge cadre of investors who chased yield (or pumped-up craze-era yield dreams) into securities that then are bleeding out. I guess that’s a feature, not a bug, of capitalism, depending on what one’s portfolio holds. Most of these investors can, hopefully, afford a loss.

The volatility in the last few years wasn’t just in revenues and assets: it was massively in psychology. The boasts here in Wolf Street comments about things like crypto assets and wacko business models seem like just yesterday.

The weakest of the weak links in this train wreck are probably the municipalities. With what is all the tax revenue that once came from these now defunct CRE properties going to be replaced?

Banana bucks. Stocks, gold and bitcoin seem to think so.

Thanks for taking the time to put this together Wolf. Really good job explaining the big picture (regarding the banks) as a follow-up to the office tower piece!

I think big picture is economy is now fiscal vs monetary. Read deficit for last 6 months is $1.1 T financed at an average of 1.9%. Government spending is stimulative and inflationary until lagging borrowing cost catch up. Projected finance cost for future is going to be around 5%. Still seems like there is going to be a hard landing once the lag is over.

I read a while back that anytime stock valuations get in the top quintile on a price to sales basis the cycle isn’t over til you go to the bottom quintile.

People are pulling their money from banks and buying federal debt. (Treasuries)

Thus the money is moving to government to sustain its growth (spending) which is out of control. COVID was the big excuse to enlarge the govt and reduce the private sector…..and it did.

What we need is what we used to have….in a land far away and long ago.

Short rates cover the inflation rate….positive yield curve.

Seems impossible now.

The talking heads still speak of what the inverted yield curve means, but NEVER mention the Fed’s meddling in the long end. And those talking heads speak of rate cuts and 2% ten year notes. Remarkable how no one expects or remembers the lender getting paid as he should. Its all about the borrower controlling the rates.

STILL rates dont cover inflation….really not much different for the holder of dollars than when inflation was 2% and rates were .05%

Thanks for pointing this out.

What is lost in the Government spending is that in the long run the debt devalues the currency. It takes more currency to buy the same stuff.

Yes, the FED is reducing liquidity but Government spending is still increasing.

It may be a wash in trying to reduce inflation?

Thanks you OS:

Value your inputs here, as one who HAD NO clue about bonds, now my fave mkt, but still learning with your comments, but IAH mostly the Wolf’s wonderful ”stuff.”

Which is exactly why I send him a century or so twice a year… entirely voluntary of course,,, just another reason I do that.

Of all these categories I would have guessed that multifamily would be the strongest if not growing due to strong demand. Albeit, long term, student housing is expected to be weak due to the falling student population.

I’ll just repeat this here:

I’m going to publish an article today about multifamily defaults and foreclosures, big ones, so you’ll see what it’s like.

That shortage of dwelling units is a myth. There was and still is a HUGE construction boom of multifamily, putting the latest and greatest apartments on the market, and older buildings are losing residents.

This is a good question…how does record high apt rent inflation (20%+ in many, many metros across country…unprecedented) co-exist with increasing default risk in multi-fam

Turns out it is our old 2008 friend floating rate loan resets.

(This time the “expert” institutional investors got nailed…not home “owner” newbies.)

So, one explanation for the counter-intuitive, nightmare rent inflation (post 1 million plus Covid killed)…all those multi-family borrower/speculators are throwing their tenants into an inflationary wood-chipper in a desperate, doomed attempt to avoid default.

(And that is how “beneficial” ZIRP asset inflation turns into toxic real world inflation).

There’s this. A change from the preceeding 5 years. It claims that renters, in general, that obtained a new lease in January 2023 paid 3.5% less than in August 2022.

They quote Redfin’s chief economist Daryl Fairweather. He sees “very tepid rent growth” so long as the Fed continues fighting inflation.

I guess this is consistent with the graph Wolf

provided (above) that showed multifamily construction as high as its been in decades.

It’s a lot more complicated. In San Francisco, for example, apartment asking-rents peaked in 2019 and have come down since then. This is repeated in other parts of the Bay Area.

Then there is the issue of single-family rentals, which is a HUGE market, and the biggest landlords in the US are reporting substantial increases in the rents they’re actually getting.

The chart above is about multifamily, not single-family rentals.

Wolf,

You removed the link. Not sure why, but okay…

But at least let me mention the source: The Week.

I’m not familiar with this publication, came across it per google search.

Reread the article… for clarification:

I believe they are talking exclusively about apartments, not apartments and housing rentals.

Hope you’re right, but the possibility of contagion can’t be ruled out. Funding markets could seize up quickly with a high profile CRE related collapse. The ghost of Bear Stearns’ rapid fall still haunts.

Thanks so much for this, Wolf. Some desperately hoped for clarity on an area of the macro environment for which my concerns have been steadily growing. Your insights to these relatively obscure areas of the banking system are just invaluable to my efforts at keeping some perspective on the whole mishegoss. Can’t thank you enough

I think multi-family is the canary in the next shoe to drop . There are many cities where population is no longer growing but they are still building multi-family units like mad. In the current tightening climate the number of people that can afford expensive apartments ( that is the only thing they build these days) is in decline but they build on. I think this is the big one we will be talking about a year from now.

Just a train wreck of mixed metaphors there. You should get a 30 day ban for that

Agree SC,,, and I for one just hope they actually FINISH those MFH projects before the poop actually hits the paddle majorly as was the case in the last bust.

Saw many projects just stop dead,,, and then, a couple years later start with finishing buildings, including many that ended up smaller, as in 3 storys rather than 7, etc., etc.

IS now and likely to continue to be ”VERY INTERESTING” Times,,, eh

In my immediate area, ’08 froze a few big multifamily projects. They came roaring back, just in time for the pandemic. These kept building through that time. For now there is sort of a “ghost city” here. I see scarcely any residents in these (mostly freeway-adjacent) buildings, which aesthetically I call “the Warsaw ghetto.”

Back in the ‘80’s. Denver. Builders pulled out with foundations, basements in the ground. Took years to come back and complete. Remember driving through condo projects with 90% fha, va for sale signs. Foreclosures. Looked at condo for $7k. HOA was too high& renters almost non existent. Didn’t buy.

Our current house had the foundation poured in 1988 before the builder went bankrupt. The lot was purchased in 1993 and finished by another builder.

I considered this a feature since the foundation had 5 years to settle before anything was built on it.

You mentioned Multi-family slithering into trouble.

Is it getting overbuilt? You would think it would it would get dicey when homes become more affordable (low interest rate), but I guess the general tightening after 2008 didn’t let that happen? And now homes are less affordable, so you would think they would be boosted.

MFR seems like it should be a slow moving counter cyclical play. But that doesn’t seem to be the way it has been working.

Many developers & construction companies are piling into affordable housing new construction because of lower-than-mark HUD rates & LIHTC tax credits.

God knows it’s being overbuilt where I live. They’re jamming multifamily units into every square inch of our once beautiful town.

Article on multifamily defaults and foreclosure will be up in a little while. Also see the chart of multifamily construction starts that I posted here. It’s been a huge boom.

In my neighborhood, I see boom of multifamily homes and rentals.

They all are high end rentals $3K plus or more for 2BR/2BA homes/condos/apartments.

Haha!

Wolf, I’ve been out of the loop lately and it seems like you’re handling the “broken record” questions with grace.

OR, perhaps you’ve acquired a second, “flip-only” desk to redirect any new found energy :).

Sincerely though, great information and I’m looking forward to your updates as I imagine you’re just getting started with this data.

Time, for me, to take a close look at CBRE, perhaps?

The sarcastic joke in my neighborhood is when we see a new parcels of land being cleared for housing ” just what we need, another luxury 200 unity apartment building”

Russell.. it’s interest rates and debt service. Invest at 4.5% cap rate and get adj rate mortgage under 4% and now rates may

be near 6%. If rents and occupancies slide which increases operating expenses it gets brutal. Projects with lower LTVs of course will fare better. Realize too that IR caps will be coming off and to buy more cap insurance will be brutal. They need rates to crater and refi to fixed rate mortgages and extending duration

And so the banks suffer from departing customer deposits which require higher rates on the remaining deposits, illiquid AFS and HTM securities with large losses, underwater Commercial Loans which Wolfe has described very well above (I bet the Fed reports are no better), and a looming recession. A recession, if it comes, will increase losses in Commercial Loans and securities, as well as in Consumer Loans like credit cards and autos. Most banks will probably survive, but It will not be pleasant and it will take a long time to play out. The only thing that could prevent this from happening is a decline in inflation and interest rates back below 2%.

Thank you, Wolf! Another great article!

I had thought about bank exposure to CREs but your article clarified that this is relatively small exposure for the major banks. The total exposure is spread out to all of the banks.

You had stated that there are 4,135 FDIC insured banks. 4110 are regional and smaller banks that might have 20%-50% exposure to CREs. You pointed out that this will cause some pain for these banks.

What do you think the CRE exposure is for the 4,760 NCUA insured credit unions. Are they more exposed than regional and smaller banks?

I have retirement assets (not yet tapped) in a credit union. I am concerned and curious about this.

No reason to worry.

Your deposits your equity will be made whole wtshtf.

I also have a credit union account,hope it’s safe .Scary times Warren said leverage would blow up the system,but always is quiet until damage is done . Then comes to the rescue,to save his assets .

Nice article Wolf. Did you write this to shut me up?

🤣 💖

Why does the government hold 20% of commerical real estate?

If you asked me in a pop quiz I would have said zero. Why should the taxpayer take the loss when a useless old office building goes bust?

The government doesn’t own the real estate. But Fannie Mae, Ginnie Mae et al. buy multifamily mortgages and securitize them into MBS. They then sell these MBS to investors.

Wtf is the Gov doing in the RE market? That’s why the prices shoot to the moon. Same with education. Soon will be whining for bailouts.

Can’t be said enough: “Goverment on the hook” means taxpayers on the hook. That would be you and me.