Released Friday afternoon, the annual revisions by the BLS went in the wrong direction.

By Wolf Richter for WOLF STREET.

On Friday, the Bureau of Labor Statistics released its annual revisions to the Consumer Price Index for December, with some revisions going back to 2018. These revisions came just ahead of the January CPI to be released on Tuesday.

What was actually revised were the seasonal adjustments, and thereby the seasonally adjusted month-to-month CPI readings that everyone is talking about as a measure of current inflation, whether it’s accelerating or slowing down.

The revisions for the December month-to-month readings were all to the upside, including:

- Overall CPI (CPI-U), old -0.1%; new +0.1%. So there goes that.

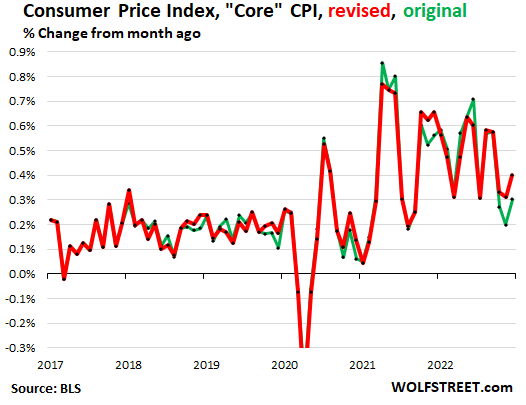

- “Core CPI” (without food and energy), old +0.3%; new +0.4%

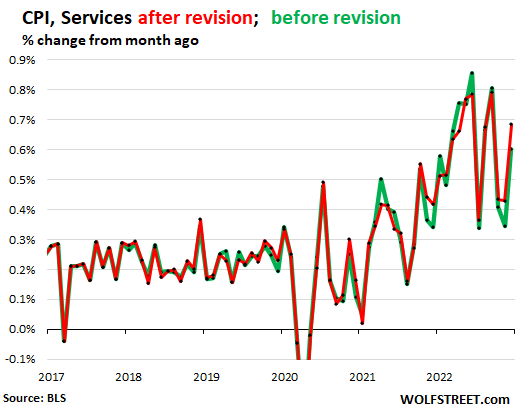

- Services CPI, old: +0.6%; new +0.7%. This is where nearly two-thirds of consumer spending goes. And it is red hot.

In addition, the readings for October and November were also revised up, taking a bite out of the “disinflation” scenario.

The indices were also revised for certain months going back to 2018, some months up, some months down. But for October, November, and December, they were all revised up.

In terms of magnitude, not necessarily direction, the December revisions were in line with revisions in prior years, the BLS said.

So we want to look at the two most important revisions, in terms of gauging how deep inflation has penetrated into the overall economy and what its direction might be.

The services CPI was revised to a red-hot +0.7% for December from November (originally 0.6%). And it was also revised up for November and October. This chart shows the revised services CPI (red) and the original (green).

The core CPI was also revised up for October, November, and December, showing much less “disinflation” in October and November, and accelerating inflation in December. The revisions also took out some of the spikes in 2022 and 2021. The red line shows the revised core CPI, green is the original version:

“Disinflation” hoopla gets deflated.

Disinflation means inflation, but easing rather than worsening inflation. These revisions for the past three months show that there was less disinflation in October and November than cited in all the hoopla about it, and that there has been worsening inflation in December.

They’re revisions of seasonal adjustments. The not-seasonally adjusted data was not revised. But it’s the seasonally adjusted inflation figures that everyone is tossing around, with the month-to-month figures – including the original negative CPI-U of -0.1% for December – being held up as of the disinflationary scenario. And the scenario just got a lot less disinflationary.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I felt like this didn’t move markets as much as it should have… Seems awfully ominous though for what’s coming next week😳

Seems to me technicals and fundamentals might align after CPI for the next leg down

Me too. Between inflation, QT and the 10yr yield heading up, I thought the market would respond. Delayed reaction perhaps.

Markets can remain unreasonable longer that your shorts can remain solvent.

DISINFLATION is word created by wallstreet, the infatuation with second derivatives held set fake narratives as the actual Derivatives like real Inflation and extinct Deflation point to doom.

“…Markets can remain unreasonable longer that your shorts can remain solvent…”

Why don’t they teach this stuff in school?

Yeah I’m wretching a bit seeing all the new words being coined because someone wants to be the author of the next buzzword we’re all going to pretend means something significant, like “quiet hiring.”

Ronal,

“…Markets can remain unreasonable longer that your shorts can remain solvent…” is a paraphrase of a statement attributed to J. M. Keynes from I believe the 1930s, “Markets can stay irrational longer than you can stay solvent.” It has been repeated in many schools.

Ronal wrote:

“…Markets can remain unreasonable longer that your shorts can remain solvent…”

Why don’t they teach this stuff in school?’

Careful there Ronal. You might get yourself targeted as “Woke”.

Woke = Anything that makes wealthy white people uncomfortable.

WOKE = Whitey Objecting Knowledge Emotionally

I just made that up but it’s a fun game.

I can tell you ALL you planetary pigs what “WOKE” is NOT.

Musk and Murdoch sitting together at the Super Bowl…….

That is some scary shit.

“All the wealth will be in a few hands and the Republic will be destroyed by this wealth preying on the prejudices of the people”

We let Abe down at Gettysburg…..COMPLETELY.

It’s NOT FUNNY!

Almost like the markets already re-priced in anticipation of all the stagflation talk 8-12 months ago.

That risk has “deflated” significantly.

Equities don’t price off one year’s discount rate, or one year’s earnings. Well, sometimes they do and history tells us we get hugely profitable buying opportunities (2009).

This isn’t 1999/2000/2001 except the crypto segment. That segment is down 75% and indeed will follow history. Overinflated, decade+ catch-up if ever.

The segment that should get further squashed today is the overstretched housing markets (Cali, parts of Texas, 90% of Canada). Not equities broadly.

What’s your basis for saying that the risk of stagflation or an earnings collapse has deflated? Sure, the idiot talking heads on CNBC have said that, but I haven’t seen any actual data showing that we’re heading toward a soft landing.

MBS had a really tough day yesterday. I was trying to understand why and perhaps these revisions are the reason.

Perhaps this will help explain the MBS “situation”:

The flawed premise for the financial instrument called an MBS is that a mortgage, as a debt instrument, is a “secure” asset (At the right price it is, but not when hundreds of thousands of homeowners are losing their homes because they cannot make their mortgage payments, never mind the MBS tranch multiplication piggybacking money for nothing SCAMS Wall Street was, and probably still is, running with them).

What the Fed appears to have decided to do way back around 2008 when they claimed, with a straight face, that there was “no housing crisis”, is a sort of backdoor “securing” of mortgage “values” via massive MBS purchases.

MBS financial instruments had next to zero demand when the Fed began buying them like there was no tomorrow. It doesn’t take a rocket scientist to figure out that this act prevented reality based MBS price discovery.

The price of homes should have dropped drastically starting around March of 2007, but the Fed’s “Wealth Effect” favoring actions prevented reality based price discovery. The Fed kept home “values” from completely tanking due to lack demand.

SOURCE: Median Sales Price for New Houses Sold in the United States

March 2007 $262,600

March 2009 $205,100

The Median Sales Price for New Houses Sold in the United States went consistently UP after March of 2009. The “value” of homes “recovered” to the 2007 level by 2012, and just kept going up after that.

August 2012 $253,200

Thus the “value” of a home was artificially, not only supported, but inflated (pun intended).

Looking at the Fed chart today, I noticed the steepest drop in Median Sales Price for New Houses Sold in the United States in the entire chart from 1965 to the present!

October 2022 $491,300

December 2022 $442,100

Some will say this correlation is “not Fed MBS dumping causation”.

Well, it sure looks that way to me. Dropping a median of $49,200 in ACTUAL sales prices in two months is jaw dropping when you start to consider what “median” actually means (i.e. HALF dropped MORE!).

That is how Reality Based Priced Discovery works. Let us hope it continues to prevail, not just in house prices, but in the stock market, which thanks to buybacks being “legal”, has not been reality based for about 23 years.

I have often wondered how housing prices have been so supported, for so long, seemingly defying gravity. I have also often wondered what the direct effect of all that MBS buying actually had on prices. I guess we are yet to see how far the curtain falls.

The median price decreased by $49,200. That doesn’t mean the median decrease was $49,200.

MBS? Mohammed Bin Sawbones?

;-)

BLS just changed the criteria for CPI calculation.I would venture to say that this was done to make inflation appear lower than it actually is.

Last time the BLS changed the weights a year ago, it made CPI worse in 2022. I’ve discussed this here many times. I track these weights. For example, it increased the weight of housing because people spend more of their budget on housing, and housing CPI (rent factors) then spiked, and with their higher weights made CPI worse. These theories are just nonsense. There are real issues with tracking inflation, but this nonsense isn’t one of them.

Thanks for the info.So with services sector so hot do you expect change in inflation calculations in this area?

They were ALREADY increased a year ago. That’s how it happens.

Wolf—what are your thoughts on the new January inflation reading coming out Tuesday being a new 1 year measure vs 2 years like previous readings?

There have NEVER been “two-year readings.” They have ALWAYS been month-to-month and year over year (1 YEAR).

So weighting changes move the comparisons disproportionatly to core CPI? Is there such a thing as an inflation spiral?

Wolf I’m referring to this from the BLS site: “Starting with January 2023 data, the BLS plans to update weights annually for the Consumer Price Index based on a single calendar year of data, using consumer expenditure data from 2021. This reflects a change from prior practice of updating weights biennially using two years of expenditure data.”

The weights, AGAIN, LOL. I explained that. I track them. There are like 430 product groups, each with their own weights, and the BLS tweaks them based on where people spend more money. That’s why the housing weighs rose because the rent factors took on a bigger part of the budget. Which made CPI worse in 2022. I get sick and tired of these BS theories that every time a method is adjusted to deal with changed situations in a complex economy it’s a government conspiracy to screw the people. That stuff is just silly. There are lots of other things to worry about that are real.

And I thought “The weights” were what you lifted in the gym.

As Hans and Frans used say, on Saturday nights, about weights and inflation,”We’re here to pump you up!”

Thanks Wolf!!

We can always trust you to keep us well informed about when inflation is really worse than we all thought.

Agreed.

It is amazing how this just flew under the radar.

Well, CPI next week should straighten that out.

Markets are a casino, that’s why. Markets will have to learn the hard way.

Oh..it’s just transitory I am sure…

LOL. There is now way that these numbers match the inflation that I have seen in CA, but maybe the decline in real estate is making the CPI go lower, despite increases in other things?

There is no way…is what I meant to write. Darn automatic fire tablet spell checker.

I hate autocorrect lol.

Good article. Thank you for the data.

Can we talk about EVs in this article.

Lol Lol Lol🤡

Just kidding

Have a good weekend.

Go Chiefs 👍

Did Wolf delete comments on the first EV article? I went back and perused and didn’t see anything too too outlandish. The EV comments I saw weren’t anywhere close to the moronic comments you’d find on FB, where people that don’t know sh&t about sh#t poo poo all over EVs. You can’t argue with these people, and even if you could, their grasp of the written English language is about as firm as a wet noodle, so why bother??

Digger Dave,

Wolf answers this in the final comment of the thread.

I’m starting to see a lot of Tesla’s around my neighborhood. The income levels of these people are way above the original owners that live here or used to live here. The only issue I have is if these people are so concerned about lowering their carbon footprint via EVs, why are they living in a $4,500 square foot home which replaced a 1,200 sq foot home that used to be there. All the subsequent utility usage, energy consumption, cutting all the trees down, and all the other factors contributed to a much larger carbon footprint.

How about deflation. We like that more.

They can’t tax deflation so you will never see it.

I wonder if Powell looks at these revisions or does he just look at the original figures?

Jim, it seems like the adjustments are minor as annual inflation in December 2022 is still much lower than previous months of June to November 2022.

Overall even with the adjustments, inflation continues to trend downward.

“…inflation continues to trend downward.”

No, it doesn’t. Look at the charts.

Don’t be misled by just looking at annual inflation. Annual inflation is in large part due to the “base effect.” Meaning it depends on the base rate a year ago. The Fed understands this, and Powell has instead cited 1-month, 3-month and 6-month inflation rates.

As Judy Shelton has said repeatedly, raising interest rates and creating unemployment to bring down inflation ain’t gonna work. These added interest rates incurred by businesses will just be passed on to the consumer in higher prices. What is needed is a cut in Federal spending and deficits. This is not happening, so look forward to higher interest rates, higher inflation, and Stagflation.

Swamp Creature-

Not true. What’s true is that aggregate spending needs to come down, yes. But whether those cuts are from government spending, business spending, or consumer spending is entirely a matter of policy.

The Fed govt is a sideshow. After defense, interest payments, medicaid, and entitlements (SS, medicare), the amount of Federal discretionary spending is small (relative to size of the American economy). While cutting $10bil from NASA or public parks or something sounds huge, it’s a drop in the bucket. Where do you propose the Fed cut spending by $1 trillion this year to effect a meaningful change in overall economic demand?

What has to happen is what the Fed is doing: increase the price of money with interest rate hikes and prick asset bubbles to reverse the wealth effect. Both will reduce spending in the private markets. Inevitably, if spending goes down enough, overall supply will at some point get cut as well, which will lead to job loss.

I don’t know who Judy Shelton is but she sounds like she doesn’t know what she’s talking about. Yes interest rates raise costs, but prices are set by buyers willingness to pay. If Shelton is right, why did inflation take off in the past few years when interest rates hit historic lows? If high interest rates must lead to high prices then isn’t the reverse true?

The Fed is trying to reduce private sector demand. Because that’s where discretionary purchases are made, not the government. That will give the remaining buyers power to negotiate lower prices. Those suppliers who can’t meet the lower prices will close shop, and at some lower price point, a new equilibrium between demand and supply will be found.

If Shelton doesn’t even understand a basic supply and demand curve I hope you don’t look to her for advice more important than what color will be in fashion this spring season.

This response is for Lune’s response to SwampCreature.

Sorry Lune, but if you don’t know who Judy Shelton is, this is your loss. Let me just say that she is probably polar opposite of Stephanie Kelton, whose horrible economic ideology has put us in our present pickle. You might wanna do a little online research. I am the last guy to make a PC remark, but your dig at the end about a fashion comment exudes some ignorance. Judy Shelton deserves better. I am fan of hers as I am of Danielle DiMartino Booth. Huge fan of Wolf Richter’s for his data analysis and acerbic wit. As for Ms. Kelton, “Time to take out the trash.”

–Geezer

Lune,

Yeh, Inflation is coming down right. I just noticed a 30% increase in many of the items that I buy regularly. These are necessities, so I’ll keep buying them because I need them to operate my household. That means I’ll have to cut my standard of living once again. Powell’s policy is not working because it is being done too little and too late, and is not the solution to the current economic problems. Judy Shelton is a breath of fresh air and is right on the money. She should have been appointed as fed Chair instead of that moron Powell.

“After defense, interest payments, medicaid”

I find it interessting that defense and medicaid is always excluded from any possible budget cuts. If the US will ever have to balance budgets because of problems of selling debt to foreigners these are exactly the sectors that will need to be cut.

So to answer your question: Defense can easily be cut by 50% to still be able to comfortably defend the country and allies. There is your first 400 billion. Medicare/Medicaid can be allowed to negotiate prices with providers and pharma companies. Bringing down the respective unit cost into line with the rest of the developed world will result in another 400 billion.

The collusion between the government and the MIC/healthcare sector’s lobbyists and the resulting bloat of these sectors is not something we should take as ‘god given’.

Would add that we seem to have forgotten that “raising taxes” is also an option for fiscal tightening, as opposed to simply “cutting spending”.

Powell looks at his bank account, then pours himself another single malt scotch while daydreaming about his tee time at the private country club in the morning.

Exactly! He’s nothing but a crook.

That’s good news. The Fed will have to be more hawkish and hold there. This, on the other hand, will also keep the ECB under pressure, which is also good news. I can see the balloons releasing more and more air.

Yep, when the environment outside the balloon reaches the correct pressure, it will start the process with the tiniest of leaks.

Judging by the real estate market in the US and other countries, and by the crypto circus, the bubble is already deflating quite a bit. I expect a big catch in the near future

There are a lot of baloons at this party. Some larger than others. RE and rents take longer to get to where their resting place will be, probably take at least a year to get there.

Services are interesting, they tell me the ppt and other free money programs are still a patch on the baloon holding back unemplyoment.

Unemplyment is the balloon patch that becomes unglued when the heat of dissipated liquidity unglues it all.

I already sold all stock in the EU and other countries: oil prices will go much higher soon.

Another day, more FED failure highlighted.

The Federal deficit came in at almost -500billion for the previous 3 months, double YOY! Going to need inflation over 15% to pump-up the tax receipts!

It’s amazing that the deficit is so high despite the unemployment rate being so low.Can you imagine what the deficits will be when things really turn south within 3- 6 mos.? Spending will have to be higher while tax receipts start to plummet.

Unemployment numbers are a skewed statistic that does not take into account labor participation rate. Try not to put too much weight into these things as ascertaining the true unemployment rate is difficult and would require far more work than the current “surveys” suggest.

Demographic and cultural changes suggest a very low labor participation rate with entire generations essentially giving up on the current economic model. “Quiet quitting” is a perfect example.

Yeah this, so much. Headline unemployment numbers esp the U3 can be misleading unless they get right context, especially the labor force participation rate and the fraction of employment to population. Unemployment can fall for a lot of reasons, including when millions of Americans just give up and stop working or forced out of the workforce, and then they’re just excluded from the calculations (U6 doesn’t capture this either). Our old prof had a bone to pick with this, pointed out the US has by far the biggest incarceration rate of any country even for the “crime” of holding a bag of pot (all while the Wall Street crooks from the GFC and all the fraud in medical billing goes unpunished), and all those jailed and a lot of ex-jailed Americans “don’t count” in the calculation. Back to get a master’s degree and huge student loans because the company decided to import cheap labor replacements from Bangladesh and India? (who soon fail and run the company into the ground anyway, but good for a couple quarters..) Now you’re out of the labor force. Had a kid and quit job because no family leave and childcare costs way more than you were even making in the job? Got covid and now your blood doesn’t clot right anymore? Now you’re out of the labor force.

Even the numerator can be misleading without context, ex. got laid off but working a few hours a week driving Uber to squeeze out another month’s rent? Congrats you’re employed, even though you’re broke and about to be homeless. For all the flak Europe gets, most countries now have around same or a higher labor force participation than the United States has, and that’s more meaningful than a U3 that can be changed by all kinds of arbitrary definitions. It’s often apples to oranges comparing the headline or equivalent to U3 because of that, over in a lot of Mediterranean countries for ex, they count students and people recovering from Covid in the unemployed stats while they’re excluded in stats in the USA, so our U3 numbers look lower even though our labor force participation is lower too. At least the Fed now takes the labor force participation into account more, without it the unemployment numbers really don’t tell us much.

Tax receipts go to record levels when the stock market does. Taxes on wages are just baseline income.

Diesel makes it all run.

It shows no signs of wanting to tank.

So maybe three rather than two 0.25% rate hikes and perhaps only if the disinflation narrative is further challenged on Tuesday. I doubt the Fed would have changed its “soft-landing” script based on these revisions.

The Fed has provided the market with a degree of policy certainty from which it is unlikely to deviate any time soon.

I didn’t have any expectations concerning that title, but the more I was astonished. The author did a great job. I spent a few minutes reading and checking the facts. Everything is very clear and understandable. I like posts that fill in your knowledge gaps. This one is of the sort.

Wolf – the comment I’m replying to was clearly a bot posting.

Yes, but I wanted to see what would happen if I allowed it. This is an experiment for my knowledge base.

It was unusual for a bot posting in that there was no link. Normally they promote something with a link (porn sites, etc.). I also blacklisted the login, because sometimes bots make a few innocuous comments, and when they’re approved commenters, you wake up in the morning with 200 spam comments with dozens of links each. This too happened to me here. So I’m waiting for the spam to arrive from that login.

And if it’s not that, I want to see what they’re up to.

The Dow to 36K, the Fed will be mad, the Dow plunge.

True…and the the DOW below 26000 then the FED would panic and print

36,666

I understand revisions but I also understand the skepticism of good folks towards the government.

The December 0.1% month to month inflation times 12 = 1.2% annualized inflation. The 0.1% month to month CPI increase is not likely to remain constant over the course of a year. This is not hyperinflation.

When the U.S. purchased the Louisiana Territory from France in 1803, they got land for about two cents an acre. Land appreciated in value over the long term. The Q1 2007 housing bubble median price of a home was $257,000. The Q4 2022 median price of a home was $442,000. Buy and hold outperformed trying to time the housing market.

David Hall

Interesting observations. The fear mongers screaming hyperinflation can finally drop their megaphones.

Seems “soft landing” means outrageously high 5-6% interest rates (sarc) for years to come. I suspect the $257K to $442K home will predictably be $700K in 2037, using your 15 year intervals.

Not an “interesting observation,” but a “willfully clueless observation.” Also shows he hasn’t read this article or any of the prior inflation articles here. Overall CPI was driven down by the collapse in gasoline prices, which already reversed, and by the drop in durable goods prices, which is starting to end. Everyone knows that by now.

A smart observation would have been to look at services CPI and at core CPI. That’s what the Fed is looking at.

In addition, no one here is talking about “hyperinflation.” That reference was just silly.

Wolf,

To further your argument, if month-to-month inflation numbers are positive at all (take your pick, PCE, core-PCE, CPI, whatever …) inflation is accelerating! This is a simple thumbs up/thumbs down metric. We all want the month-to-month numbers to go negative. The use of this metric is somewhat mis-leading. Month-to-month numbers of zero do NOT mean prices are stable, only that inflation is stable. Some commenters seem confused on this point.

Mr. Richter, very true the service side is hot on price increases. Anecdotal experience shows me this everyday. i.e. oil change, insurance, cable TV, etc.

Also, the government money pipeline is still wide open. Our state continues pushing out unspent COVID money like crazy!

//Overall CPI was driven down by the collapse in gasoline prices, which already reversed, and by the drop in durable goods prices, which is starting to end. Everyone knows that by now.//

Since you mentioned gasoline price and durable goods prices, I am getting my popcorn ready for the release of CPI on Valentine’s day, as well as the stock market.

You also mentioned that BLS changed the CPI calculation. We are now comparing apples to oranges (CPI calculation in the past isn’t the same as today). I trust what I paid for groceries, energy bills and landscaping services. The CPI index? I will take it with a grain of salt

“Not an “interesting observation,” but a “willfully clueless observation.””

Beardawg likes anything that allows him to cling to fantasies of house prices going up instead of crashing. He’s getting rinsed by the rate hikes.

I hope you’re aware that the outrageous 5% to 6% interest rates are the same rates that were being paid just prior to the 2008 financial crisis, so they’re historically not that high, though much higher than the 3% interest rates leading to this everything bubble. Interest rates were much, much worse in the late 1970’s and early 1980’s when they were in double digits and milk that used to sell for 59 cents a gallon went to $3.50 a gallon. Granted $3.50 a gallon may not seem that expensive in today’s dollars, but that’s equivalent to the price of a dozen eggs today going from 99 cents to $5.39 a dozen.

Eggs now $2.69 A dozen

728huey

Agreed. As I stated, 5-6% interest rates are normal (hence the “sarc” in referring to them as “outrageously high.” That was my point in supporting David Hall’s observation of median homes going from $257K to $442K in 15 years – likely $700K in 15 more years. It is BECAUSE 5-6% is perceived as high (by public and Fed Reserve) that the rate of growth of inflation will continue short term, as Wolf’s article shows. But since no one seems to want to get “outrageously high” with interest rates, it will be a slow slog for a long time. Everything will continue to inflate, including median priced homes.

@Flea – the only dozen eggs under $3 we can find are $2.99/dozen.

As of Feb. 7, 2023, the Cleveland Fed’s model predicts January core CPI at 0.46% month-on-month and February CPI at 0.45%

Inflation is about to tick back up. I’ve seen it locally with gas back to 2022 highs and price gouging on eggs. Will be interested how the market reacts to Tuesday’s report.

Barroz – your comment illustrates that there is always a very fine line between supply and demand if we want to believe we’re playing at ‘capitalism’ by charging ‘what the traffic will bear’, and not playing at ‘public utilitities’ at best, and ‘socialism’ otherwise (egg production volume is seasonal if not ‘goosed’ by factory-farm artificial lighting, or its workers ‘black-swanned’ by the millions falling to avian flu…(pardon the ‘fowl’ references…)).

may we all find a better day.

https://www.clevelandfed.org/indicators-and-data/inflation-nowcasting

Your comment is stupid because ~0% of economists or people believe inflation will be under 2% this year.

David Hall,

Think of the month-to-month numbers as mathematically a crude representation of the acceleration (2nd derivative) of prices. Inflation is the 1st derivative (rate of change in prices) and the month-to-month change in the rate.

The 1.2% you site is the INCREASE in inflation, not inflation itself. I encourage you to reread your comment with this in mind.

The problem with estimates of derivatives is they are extremely sensitive to noise.

Excellent. The concept of a second derivative (change of change) is lost on many people.

Now let me introduce the 3rd derivative called the “jerk”, i.e. the change of acceleration. Being “jerked” around might feel more real to many people. I know it does to me.

I think there was movie about that. Steve Martin, no?

Even negative month-to-month numbers imply that if maintained, eventually inflation would be reduced to zero. Even longer for prices to recover previous value. This month-to-month metric will eventually be cited as a way to mask the ratchet up of prices and why we should all smile when they stay there. As everyone keeps repeating, it is in services where prices will stick … until the next disruption orgy.

useful for camshaft lobe design or something like that

grimp,

Thanks, that was funny and on the mark as impractical. The practical implication is how to interpret the monthly inflation number. It is like being in a moving car, blindfolded. All you can feel is the acceleration or deceleration of the vehicle. Aside from that, you have no idea how far you’ve gone or how fast your traveling.

It is a projection based on an assumed constant velocity. There is no change of slope in a point on a curve.

This Russian oil supply cut was not foreseen. The risk of madness is an ever present threat to productivity. Fracking opened new oil horizons not seen by peak oil theorists. Extra carbon dioxide caused coastal flooding. Lithium batteries, electric cars, microprocessors and LED bulbs are game changers increasing productivity.

Black swans came and went, it is difficult to see them coming, easier to see them during the study of history.

Lithium mining is very bad for environment

Nothing is worse for the environment than fracking. Well, except, nuclear reactor meltdowns. Of which we had way too many.

When it comes to human existence on this planet, there are no free lunches.

Fukushima

Chernobyl

Santa Susana

Others?

Wolf – there used to be free lunches – as long as you kept drinking!

I understand what you’re getting at, but what you said isn’t really accurate, and David Hall is closer to correct.

The MoM number isn’t a 2nd derivative or a change in inflation, it’s a real inflation measurement, just over a shorter 1 month timescale. It’s how much prices have changed in the last month. And simply adding up the last 12 MoM numbers roughly gives you the YoY rate (subject to a small compounding adjustment).

The error you’re making is that the *change* in inflation rate (as measured by the annual YoY rate) doesn’t come from just the MoM number, but rather it comes from the difference between the new MoM number and the 13-month old MoM number which rolls off the 12-month calculation. The base effect.

So it’s accurate that if we get 11 more 0.1% MoM readings, the YoY number will be a little over 1.2% 1-year from now and, theoretically that is the annualized inflation rate we’ve experienced over the last month. The main problem doing this is the the MoM data is notoriously noisy and unpredictable so it’s unlikely to generate a reliable reading and using a full 12 months of data smooths this out a bit.

UrsaTaurus,

Thanks for replying. David’s comment:

“The December 0.1% month to month inflation times 12 = 1.2% annualized inflation. The 0.1% month to month CPI increase is not likely to remain constant over the course of a year. This is not hyperinflation.”

Upon more reflection, I think he is speaking to the adjustments that were made to the December numbers of 0.1%. In light of this realization, the whole comment is non-sense. The second derivative discussion was based on the assumption he was speaking about the monthly change in inflation as opposed to the monthly inflation number itself. Looks like he wasn’t discussing either.

This is similar to the Biden gaff of claiming inflation is coming under control because the monthly numbers showed no increase in inflation. Just because the rate isn’t going up doesn’t mean the current level isn’t doing a lot of damage.

It is a derivative if used to make a smoothed straight regession analysis line y=mx+c where m is the slope or the average inflation change.

Are you a landlord or a realtor or anyone associate with real estate industry?

Just asking..

Btw.. the comments you made are true.. median home prices are at 442k..

David,

I agree with Wolf.

Economics is just a hobby of mine, but even I knew the inflation we’re dealing with has been **Services Inflation**,

of course I read his articles and learn, and I’ve been letting my friends know, and I try to make them understand what **sticky service inflation*” means. They are intelligent and are starting to really imagine the “stickiness” of the “inflation cycle” for services. Just imagine if services keeps spiraling upwards, which is why Fed will put a stop to it, eventually. Meanwhile we follow the data:)

and we owe that cheap Louisiana purchase price to the Haitian revolution. It costs Frances LOTS of $$ to try and retain it, only to lose. That is what emptied Frances coffers and caused them to sell

Well, that and the fact the Louis was having one hell of a good time.

Is it me? but I can see interest rates going higher.

Leading economic indicators down 9 months in a row and treasury curve inverted.

With the long lag in Fed policy it might be good if Powell stopped here and let time be his friend as the current rates work through the system. The real economy can’t carry rates this high for too long without buckling.

But he is going higher and that will mean at some point the rates will be way too high as the recession hits.

Old school,

You mentioned some weeks ago your income went up due to interest rates going up. Which makes total sense of course.

I’m curious (if you don’t mind sharing) what were you doing for income in the decade or more of ZIRP? Thanks

I retired early at 48. I was living off of roughly 4% of my portfolio and mostly in stocks til 2016. Lived 5 years on about $1350 per month. More than enough for me if I am living a relaxed lifestyle. I have got some pain issues, so not much else matters but staying healthy.

I started drawing social security in 2016 which is more than I need and have left investment portfolio alone since then. So interest accrues, but I have some spending plans using life expectancy tables to get spending rate like a minimum distribution.

Powell can leave the rates where they are, but I think inflation will continue if he does. The economy can handle higher rates. People might think inflation is going down, but as the revision indicates, inflation is still going up. There will probably be more spikes with oil going up.

Rates are still far too low.

Yes, especially long term rates, if the Fed was serious, they would be selling MBS outright to allow real price discovery on longer term debt.

Wouldn’t selling MBS also prevent true price discovery in the market? Flooding the market with supply by selling would crash MBS prices. It is only by doing nothing and letting maturing MBS fall off that there is a true market.

LOL. I can see interest rates going to 20% (again)., for the 2nd time in my lifetime.

Maybe we should take a look at how FDR increased industrial productivity 96% and doubled corporate profits (after taxes) between 1939 and 1944.

Hint: rationining, wage & price controls, super taxing the super rich.

I think there was another reason.

I’m sure potuus joe b. will be happy to add this to my SS check/sn

In reviewing stock volumes traded on the Canadian TSX exchange for the most active 50 companies, it appears that trading volumes experienced a structural shift upward with the pandemic. Has the market become only a casino for new by day traders and is this where the denial of reality continues to originate? Any comments?

Yes it’s a casino. Worse it’s a new feudalism(or ponzy) where top 10 to 15 percent of society buy & sell with each other and bid up the prices of everything for the little guy.

This is probably the best description I’ve ever seen of this current economic model.

Yes. This will continue until ZIRP era traders learn they are no traders at all.

I predicted some months ago that Tesla’s daily volume will get to $50 Billion (just daily churn), which is a crazy number. So far I’ve seen $40 Billion days already.

Canadian haven’t a clue they think the markets are supposed to go up every year as things get worse each year.

An unscientific observation, but does the average spread between “original” and “revision” seem greater from 2020 on vs. past years? Does that benefit anyone – or just create noise to talk about?

1. this is an annual revision, meaning it happens every year, and every year it goes back 5 years. I only show the original data released in January, and the current revisions. I don’t show last year’s revisions. So you cannot see if these revisions were bigger than the revisions in the prior years. As I pointed out, the BLS said that they were roughly in line with the magnitude of the prior revisions.

2. There were the widely discussed issues of the pandemic, when normal seasonality went out the window in just about all sectors, from housing and jobs to retail sales. Seasonal adjustments have been modified to account for these distortions, and the BLS said that too, but there were still some revisions to be made.

As usual us retirees are getting whacked. The oil cartel brought gas down for the holidays but is now up 50 cents a gallon since Thanksgiving. Food shows no signs of retreating. It was also noticeable to me how much the deficit increased for January given that their were no remittances from the fed. Jay Powell should have gone for 50 basis point increase last week.

My daughter took a new job in December after relocating from the PNW. A 40% increase in salary for a mid millennial. Mortgage rates up 50 basis points in a week to 6.5%. There are lots of people sitting on under 3% mortgage rates nobody is moving unless they have to and Gen X.. They are swimming in money.

Feels like a 70’s repeat all over again.

I just bumped into someone I know. He and his wife are moving up the housing ladder. They bought about 3 years ago at a good price. Somewhere around $250K at about 2.5%. Bought new house at about $550K at 5.22% through USAA. Still have to sell current house hopefully for $430K. Hope it works out, but they are taking a substantial risk.

Old school

Sounds like they don’t know what the hell they are doing.

Mistake #1: Trading a 2.5% mortgage for a 5.22% mortgage just to move up the housing ladder.

Mistake #2: Using USAA for anything related to financing housing is mistake number 2.

Mistake #3: not selling you old house 1st before buying another one.

I did #3 in 1999 with a contingency for the sale of my old home. I turned out to be a complete disaster even with the contingency.

You used the word hope. A famous general once said “Hope is not a strategy”

sounds like a bridge loan opportunity for your friendly local lender.

We bought first and sold later back in 2011. Took about 3 months to sell, we had just one offer and jumped at it. Not really practical to sell first, as there is too much stuff to store. Much easier to buy first and do a controlled move. We used a bridge loan from our 401k so we paid ourselves back the interest.

Yes Swamp, hope is not even a tactic.

Retirees need higher interest rates to get wealthy. It would help if the rates were positive that is higher than the real inflation rate. My income more than doubled in 2022 due to higher intertest rates.

“Disinflation means inflation, but easing rather than worsening inflation.”.

What a bad joke. It is like Congress “cutting spending” but really only reducing the skyrocketing spending from wildly out of control, to simply out of control.

Don’t these people shop for food or other supplies? Inflation is cumulative. CPI may have its plateaus but it is a cumulative increase that kills the consumer. Incomes, especially fixed incomes can’t keep up.

Credit – ah, but whose oxen should the Congress gore???

may we all find a better day.

Judging by Oz’s embarrassing performance in PA regarding crudite, no, these people do not.

Went to Burger King 2 meals with tax $23 ,won’t go back

Burger King prices – with coupon – up over 50% in less than a year.

No, they don’t. They have people to do that. They run a tab and they pay it off automatically each month without looking at it.

Unless the butler requests an increase in the budget suggested by the cook.

How convenient.

Released on a Friday afternoon. After the SOTU address.

Will be buried by the MSM for sure.

Huh??? The MSM loves the inflation story. Loves it. It’s fkn everywhere.

This revision is super helpful in adding additional layers of confusion into a market environment where hesitation has collided with an explosive trend in super short options trading (0dte).

As an FYI, I sold my house at end of June last year and I feel increasingly impatient waiting for market reality to kick in, in terms of excess valuation through the entire economy.

I don’t think I’m wrong, but the latest uptrend in equity market activity is alluring. Nonetheless, the s&p500 is up by less than 5%, since I’ve sold, and the only reason for that, is the volatility spikes from insane options trading, based on 6 hour hit and run day trading.

The cash money markets are offering the same exact return as forward earnings, which are on the cusp of being revised download, as recession reality continues to phase in.

My impatient life is on hold, while my money market goes higher every month, while risk in other markets explodes higher.

In the background, CPI seems connected to wage growth and slowing growth, and apparently more people ready to risk everything on the exciting housing market and easy money options trading.

There’s rumbling from Twitter gurus that debt ceiling deficit battles, going nuclear in June, will actually boost market liquidity, because of complicated plumbing issues between Treasury toilets and Fed showers. That’s all about TGA and cash management flows and extraordinary measures. That’s partly behind the short term trading frenzy — but, before getting too excited about future cash flows, it’s a good time to be thinking cash burn.

I think we’re at that point where CPI going up is like tapping brakes on ice and making an effort to not read too much into the final destination, but focus on not spinning out of control going down our ice packed interstate.

The trucks that are flipping into ditches were in a hurry to get someplace, and these are the same drivers that were crashing down slopes all last year, not getting ahead. Those morons may be up 5% from last year, but I’d rather watch my safe income increase, without any risk

Amen

Riding on ice? Only with tungsten-carbide tips on studded snow tires, eh. And stay relaxed and balanced. No quick direction changes. See & plan ahead.

The mighty Miss is about to lose it’s ice cover where I ride. 37 days & 35 minutes ’til vernal equinox.

On topic: Two and one-half years ago, I bought a bicycle. That same bike today is about 30% more expensive.

As I rode across the river today on the north and south points of my ride, small waves glistened in the sunlight. Yeah, that made me smile.

@Dr Duration

I feel your impatience. Our target market isn’t really cracking at all. At least the return on cash is not Zero and rents in the area for apartments are reasonable, although whatever the level of negative real yield is not comforting.

“And the scenario just got a lot less disinflationary”

I’m SHOCKED!

Where is consumer discretionary spending going? Most mom and pops closed up shop because of the mandates. The big dogs, Amazon, Walmart, Kroger, and others take most of the dollars from consumers. Bed bath and beyond Best Buy and all these extra curricular. Retail chains are struggling. Services are, not specifically discretionary however, if you’re in a pickle between fixing your car and eating you’re going to eat and take up carpooling.

Is there a revision chart of headline CPI?

I could do it but it wasn’t worth my time. Headline CPI doesn’t matter in the interest rate debate — which is the point here.

I could also do one for durable goods, for used cars, for new cars, for gasoline, for food, I could do one for each of the categories. I chose the two that matter.

Hmm…

I gotta study the lingo. Abbreviations for everything.

BLS, CPI, MBS,PCE, MBS, TSX, CPI, and BLM—

I forgot, does BLM mean Black Lives Matter or Bureau of Land Management?

You forgot another critical one, FTGDFA.

BLM = Bank Loan Modification, LOL (another abbreviation you gotta look up)

Hike those interest rates up. 10%, 12%, 16%

Powell doesn’t have the guts to hike the rates like that.

Any rate hike is good if it sticks.

Back to the future!

Prior volatility will cause present volatility?

Just a reminder that

a) Real rates languish around negative 4.5%. The Taylor Rule says it will take a real interest rate of some 3% over inflation before it starts to reduce the level of inflation. Today that would means 10%-plus rates, unthinkable.

and b) The govt plans to continue to spend more than the tax take forever, and the Fed will eternally have to print up the difference.

Banana-republic here we come

harry hv,

Where do you get that garbage? Real rates are around 0%. You’re confusing annual and current rates of inflation.

If it gets sticky at ~4% tho…

I can easily believe we’ll get 6%+ rates.

Pretty sure FED still saying max rates will be 5.25%

7% sounds crazy to me rn, but I guess it could happen.

Sorry, I don’t believe any of these headline inflation numbers put out by the various government agencies. They are a pack of liars. Now they are changing the way they calculate CPI once again. When the government doesn’t like the optics of the numbers they have to recalibrate the way they calculate the numbers or all hell would break loose.

My bookie who takes my football bets just upped her commission to 20% from 10%. That’s a 100% increase. Put that in the recent bogus CPI report.

I’m personally watching the 50 day MA of the 2nd derivative of the de-re-un-inflationary deflation index, for the day it crosses the 200-day MA, and ends up in the double plus good category.

The Bank of Canada said that they paused rate hikes because they don’t want to negatively affect Canadian homeowners.

The thing is that the majority of young people don’t own homes. Inflation eats their grocery bills and rental costs.

So the social contract for young people in Canada is broken.

At least the Fed tries to appease everyone and they are not stopping rate hikes anytime soon with this data.

I guess Tiff forgot his job is to reign in inflation. I guess they had to do something about the homeowners in Brampton even though many of those homes were bought with mortgages based on falsified income. The new OSFI rule of debt not exceeding 4.5 income will spell the demise of the ones who cheated on their income to get a mortgage.

That would be outrageous for the Canadian central bank to appease a few real estate speculators and Brampton slumlords at the expense of everyone else who has to pay higher cost for food and rent.

The one thing i can can say with absolute certainty: is the price of balloons is going sky-high. Just look at how much fun you can have with a little latex and some helium–scrambling the war machine and gaining international attention. Nations under attack! Whoopee!

If i lived in asia i would be busy blowing up balloons and laughing my ass off. . .

If I lived in the USA, I’d be fitting 5kW lasers to something other than F-22s.

Why are so many bond markets inverted? Even the Near Term Forward Spread continues to be inverted…

As Powell himself said: “Near term forward spread has 100% explanatory power…” ~ Jay Powell

So what is going on? Probability of Bond markets eventually being right is certainly higher than the idiots & Bureaucrats that run the Fiat Banking Cartel & Federal Reserve…No???

“Probability of Bond markets eventually being right is …”

Near zero.

The bond market is idiotic. It figured in the summer of 2020 that the 10-year yield would go below 0%, and they were hyping it, and the 10-year dropped to 0.5%, and that was the stupidest thing ever. Amazing how stupid the bond market can be, and yet people keep forgetting how stupid it is. The bond market with its long-term yields saw none of the rate hikes coming, and is still in denial.

The bond market is a betting instrument just like the stock market or the crypto market. They don’t see anything coming. They’re taking short-term bets.

Just did a property in DC that got a 30 year Mortgage at 5.5% using VA financing. So does this go into the CPI? If so, it might explain why the CPI isn’t as bad as I thought. This rate is down from nearly 7% a few months ago. People are buying crap, which is the only thing most 1st time homeowners can afford. The property had a railroad train running right through their backyard.

Wolf Richter’s wisdom is priceless.

Were there ever real Bond Market Vigalantes?

Yes. They were institutional bond buyers that refused to buy bonds unless the yields were high enough for them. This caused the costs of borrowing to be very high. They’d learned a HUGE lesson in the 1970s and early 1980s, when they got shredded at every twist and turn by soaring inflation and soaring interest rates. Funny people forgot.

And yet the markets continue their drunken revels — the punch bowl hardly seems to have been taken away …

The punch bowl has theoretically been topped off with a mix of hallucinating drugs and alcohol and honey, and more snack trays will be delivered.

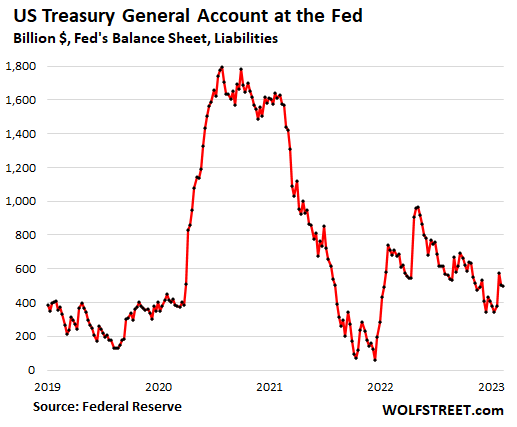

“Fed QT to date has been largely absorbed by lower TGA,” he and his team wrote in a recent note.”

Apparently, the day trading groupies believe the deficit battle is helping provide greater market liquidity. Treasury TGA offsets Fed QT and this opens up the magical door of speculation, where the sky is filled with rainbows and blizzards of easy cash.

I can’t reconcile the backdrop of spiking economic risk and more people jumping into tighter and tighter ranges of increasingly exponential risk. This game truly epitomizes flying monkeys jumping in front of steamrollers to pick up peanuts. Hopefully, the monkeys will become extinct within a few weeks.

My barometric device indicates Bitcoin is going to take a breather, and it’s hard to imagine we’ll see sustained upward trends, going into the hurricane.

“Fed QT to date has been largely absorbed by lower TGA,” he and his team wrote in a recent note.”

That’s BS on several levels. The government checking account (TGA) didn’t have the effect of QT when it was spiking in 2020, and it didn’t have the effect of QE when it was falling. And it recently has been rising again.

This stuff — falling TGA = QT — is just Wall Street propaganda BS designed for people who don’t know. They didn’t say in 2020 that the Fed’s “QE was absorbed by the TGA” because they knew it was BS, and because they wanted you to believe in QE. Now they want you to believe that QT isn’t happening. These people are filled up to their eyebrows with BS.

Look at it:

Just to add extra color to this subtopic, apparently, as bank reserves decrease, CPI goes up.

That’s what some random dude said a few years ago, as he expressed an opinion about TGA stuff.

“It is when the change rate of systemic liquidity BRs is falling, that CPI inflation starts to rise”

My assumption is, Treasury rates and mortgage rates go higher and equity speculation hits a liquidity wall as recession phases in.

It’s definitely a crazy time, but wait a few weeks…

FYI

This dude on Bloomberg seems to indicate inflation probably hangs around longer. My impression from this, is that TGA can influence CPI??

https://www.bloomberg.com/news/audio/2023-01-16/inventor-of-qe-on-bank-of-japan-s-policy-mistake-audio

Understandable if this is too off topic

TGA is unlikely to influence CPI — a dropping TGA just means that the government received less from taxes and borrowing than it spent.

But government spending and subsidies are influencing CPI if they persist long enough because they keep boosting demand.

Let me see if you are really saying that the TGA has no impact on either bond market pricing or QE/QT.

During 2020, the Federal Reserve went into the markets and bought up a huge amount of bonds and at the same time, the Treasury sold enough bonds that it could not only finance the deficit, but also build up a really big piggybank. After that initial spurt, they held the TGA balance steady until about 2021, while still increasing the Fed balances, and then early in 2021, the Treasury started to use all that excess cash to fund the deficit spending, therefore reducing the amount of bonds it issued. So the Fed buying not only pushed down the price of bonds, but also allowed the Treasury to build up a piggybank to use in the future.

This absolutely does have an impact on the pace of Treasury bond issuance at any given point in time. So this absolutely does impact the supply-demand relationship in the bond market and therefore the price of those assets. Are you really disagreeing that supply-demand does not have an impact on pricing?

You really do have to put together BOTH what the Fed was doing, with what the Treasury was doing at the same time to look at the impact it had on the economy. During the original spike to 1.8 trillion in the TGA, the Fed was buying bonds at an incredible pace, thereby allowing the TGA to sell all these bonds into the market without driving the yields of bonds much higher.

Let me put it this way, if the Fed bought 4 trillion of bonds out of the marketplace, but the Treasury issued 4 trillion of extra bonds at the same time, and just put the money into the TGA, the amount of QE would be zero. Those two things would offset each other completely, almost like an accounting adjustment that was not executed in the markets. But if instead the Fed bought 4 trillion of bonds and the TGA remained unchanged during the whole period, then that would have a huge impact on supply-demand relationship in the bond market. And a huge QE impact, versus no QE impact.

I am assuming I misinterpreted your post here Wolf.

This has gotten me interested in looking at the relationship between what the Fed did, what happened to the TGA and interest rates.

They’re saying falling TGA = QE blunting the effect of QT until June, when TGA gets resupplied. Then, QT on steroids

Lots of yak about Powell’s endgame: QE + QT (lower rates + bond purchases)…no schematics on how that would be engineered.

1) How many times the Fed will raise rates. The monthly Dow might

give us the answer.

2) Take a line from 1929 to Jan 2000 highs. Switch to quarters, to 3

months for fun and entertainment.

3) The Dow closed above this line in Jan 2021. For one year it stayed above, til Jan 2022.

4) In Apr 2022 the Dow lost it’s grip. Options :

5) Option #1 : the 100Y plunge started now.

6) Option #2 : the Dow will turn around and breach this line for the

second time, to 38K/39K. Top #2 : Adam and Eve. The second peak in Sep 2024.

7) Option #3 : top #2 anywhere between 2024 and 2028/29, four years, seven years cycle.

8) Option #4 : Top #3 in mid 40K. The Dow will fail to reach/ breach the 100Y line and plunge.

A repeat of 1966 to 1982 only worse.

Im certain the moderator will tend to this off topic post when he gets home from church.

1) The FANG were banged since Nov 22 2021 when a ceo was cashing in, for greed, for fun.

2) The Dow quarterly, channel : Oct 2011 to Jan 2016 lows/ parallel from

Oct 2014 high. Bubble down, bubble up and back to the trading range.

3) The first close under this channel was in Jan 2020.

4) Current the Dow is stuck in the middle. It might stay there for a while, resting, testing the Fed misbehavior. If the Fed nurse the impaired FANG, – SOB and our blue zone main assets, – the Dow might breach the 100Y line and rise towards the channel top, for top #2 and popped.

5) If the Fed is fed up with this gov and stock markets they might never stop. The Dow might drop below the channel for plunge #2, a signs of weakness #2. Thereafter bounce back up to the middle, observing the Fed response, like a dog observing it’s master…

I wonder if Insurance premiums are included in the CPI for services inflation. If so, I wonder if those homeowners in the areas just hit by hurricanes in the Sarasota area of Florida who are now either getting cancelled or experiencing 30% increases in their homeowners insurance premiums are in agreement with the recent published CPI figures?

Its called rearranging priorities

So they will just have to spend a little less on things like 75 inch TVs, Jet skis, and maybe spend a little less time at the most overpriced overrated place in the USA — DISNEY WORLD

“Insurance premiums are included in the CPI for services inflation”

Yes, it includes “tenants’ and household insurance,” health insurance, medical insurance, other types of insurance too.

My understanding is that along the Gulf Coast, homeowners have access to federal flood insurance programs. I’m not sure how that works. But if they do, it is included in CPI surveys of those homeowners — I just looked at the survey question.

This is the question: “Section 13, Part B – Homeowners’ Insurance – Detailed Questions”

https://www.bls.gov/cex/capi/2015/csxsection13bhom.htm

A lot of these homeowners don;t get the flood insurance because it is too expensive. And when the hurricane surge hits them they want the Federal Government to bail them out.

Flood insurance is expensive. The trick is you have to insure the entire residence if you have a mortgage. No matter that floors 2 and 3 will not ever flood, they have to be insured along with the bottom floor.

Those fortunate souls with no mortgage can insure just the bottom floor.

But yes, either buy it or don’t complain. And once bought out, if you don’t leave, don’t expect to be paid again. Unless you are a special protected class, then it has happened.

Details about flood insurance. Maybe provide clarity on effect on CPI. In 1980 flood insurance max on structure was 50k and today 250k. The cost I am sure is similar.

https://www.fema.gov/press-release/20210318/fact-sheet-myths-and-facts-about-flood-insurance

“Space Pense” will observe EMP above Ukraine.

Not ONE mention (or calculation) of the annual CPI number which is the most important.

Is the overall CPI (thru December) still 6.5% —- why isn’t the revised number mentioned???

Also, there have been scattered reports about rents dropping — not in NYC — they just hit a record high (outside Manhattan) the MEDIAN rent in Brooklyn is now over $4,000 a month.

The MEDIAN rent in Queens is over $3500

I wonder what percentage of the 8.8 million in NYC make over $100,000 (PER PERSON NOT HOUSEHOLD) because that is really the minimum you need now to survive. Some of us like myself have rent stabilized apartments where I still pay less than $900 a month for a two bedroom in queens which I live in alone and have money that I have inherited from relatives that died over the years

“Not ONE mention (or calculation) of the annual CPI number which is the most important.”

No, annual CPI is not the most important now. It’s now the LEAST IMPORTANT because it is driven down largely by gasoline, whose price collapsed from a year ago, and by some durable goods (such as used cars). If you look at annual CPI you have no clue where inflation is headed because of the “base effect.”

A year over year percentage change is composed of two factors: the base level last year and the current level. If the base was very high, the change to the current level is low. This is called the “base effect.” Google it.

This is why annual CPI is now useless in determining where inflation is headed, and Powell is by now focusing nearly exclusively on month-to-month or 3-month or 6-month inflation rates. You need to listen to him talk about inflation. Then you’ll get it.

I will just repeat what the article said, that will make it easier for you, so you don’t have to read the whole dang thing. The relevant sections that explain what you’re looking for:

1. “What was actually revised were the seasonal adjustments, and thereby the seasonally adjusted month-to-month CPI readings that everyone is talking about as a measure of current inflation, whether it’s accelerating or slowing down.

2. “They’re revisions of seasonal adjustments. The not-seasonally adjusted data was not revised.” ==> Annual CPI is based on not seasonally adjusted data, since they’re year-over-year, and seasons don’t apply. So there was no change in annual CPI. But the monthly data were all higher over the past three months.

The point I am trying to make here is that changes in the TGA have been enormous over the past couple of years and they absolutely have impacted the timing of when QE and QT have actually been released into the economy. Not the amount of QE or QT created by the Fed, but the timing.

You almost got it but missed what was released when the TGA dropped back down in 2021.

It wasn’t QE that was released, it was government spending. The TGA is the government checking account. It ballooned because the government sold $3 trillion in Treasury securities starting in March 2020 to have the cash for the pandemic payments, and when the cash for those payments went out, the TGA began to fall. Government spending of this type led to the huge spike in demand we saw, which triggered the inflation we now have.

QE had nothing to do with the TGA (government checking account), None of QE went in the TGA. Under QE, the Fed bought assets from the financial markets. This caused asset prices to rise on the spot (more demand for assets) because the cash went to the financial markets. Ultimately, QE also contributed to inflation, but indirectly, via the wealth effect, which we discussed a lot here.

There is no magic to the TGA. The government’s checking account used to be with JPMorgan primarily until the financial crisis, when the government moved its checking account to the Federal Reserve Bank of New York, where it still is. But if JPM still had that account, it would be the same dynamics. So think of it in terms of JPM still having the TGA. It makes the picture a little clearer.

OK, that I agree with. I think what is unclear is what you are calling QE. Generally, when your readers talk about QE, we think of that being the same thing as the Federal balance sheet increases or decreases, but it isnt. The actual amount of QE that hits the economy is the net of the Fed balance sheet and the changes in the TGA.

It just really helps to clarify the timing of the QE when people understand this is not identical to the changes in the Fed balance sheet. I’m pretty sure 95% of your readers dont factor that in. I understood the concepts, but when I looked at the Fed balance sheet I usually just forgot that there were changes in the TGA.

1) Turkey economy is in dire shape, before and after the earthquake. Turkey yield curve is almost flat, rising in a low slog up. The front end used to be 25%/30% with two humps below in the middle, but now they are all flat at about 10%.

2) The ECB raised rates rates by 3% from (-) 0.5% to 2.5%. For years gravity with US lifted the German long duration and pulled US middle down. The German 3Y was the worst, diving in deep water. The current German yield curve is almost flat, falling in a low slog down. The 3Y is above the 10Y. They are almost all the same.

3) Europe economy is in worse shape than ours, but the yield curve

would not show it.

4) The BOJ might join the ECB & the Fed, doing Ben Bernanke MIT PhD, inverse.

5) With little gravity between them Fed rates can fly. The Fed might hike in repetitions above 5.5% if Exogenous Causes lift inflation.

6) The Fed will lift the front end to fight the symptoms. The middle and the long duration will form a hump or two, before catching up and flattened.

7) The Fed, the ECB and the BOJ can cure the symptoms if they work in unison.

Corrupt governments always screw their citizens over with funny money like Turkey and Lebanon. They usually try some scheme to get people to turn in gold for paper. It’s up to citizens to try to get around the government’s corruption with barter or a black market.

The US isn’t that much better. Powell better do what it takes to get inflation to 2% to keep credibility in the fiat system.

If the Fed does indeed raise FFR to the 5.5-6.0% range, they need to act sooner than later as their options will be more limited closer to the 2024 elections.

2023 is the year to act tough on inflation, 2024 is the year to look neutral and support the economy if necessary to look politically impartial.

As much as the Fed wants to be 100% independent, that can not exist when the govt both can hire and fire and create and destroy the Fed rules and memberships???

Yes, the original sin here was the Fed waiting a full year on raising rates in the first place and waiting almost two years to very tentatively start QT. They are way behind.

Bonus TGA FYI

An Additional Tool for Treasury’s Cash Management Strategy

• Treasury’s cash balance policy is to hold sufficient funds to cover its one-week ahead cash needs (including the gross volume of

maturing marketable debt), subject to a minimum balance of roughly $150bn.

• Bills are used as an issuance “shock absorber”; Treasury’s cash above its policy minimum is effectively funded by bill supply.

• Viewed narrowly from a debt management perspective, the cost of carrying a TGA balance materially in excess of the policy

minimum could be viewed as being the full cost of bill issuance to fund the excess balance, as the TGA does not earn interest.

• That said, additional TGA balances displace Fed liabilities that otherwise would earn IORB. Since the Fed remits its net income

to the Treasury, on a consolidated basis the cost of excess TGA balances is limited to the difference between the rate Treasury

pays on marginal bill issuance and IORB.

• However, the interaction of changes in the size of the TGA with bank reserve balances could contribute to short-term funding

market strains, particularly if the level of reserves is low. This is an additional factor making a more stable level of the TGA desirable.

I was looking at some old docs about prior deficit battles and found it amazing how flexible the Treasury can be. Even as they near default levels, they have amazing ways to keep the ship afloat.

We are headed into a wild financial hurricane, so it’s important to learn as much as possible.

I think Wolf is providing an excellent resource here and being very helpful interacting with comments!

Does this also mean that the chance of a neutral or even better than expected CPI for Jan is higher now due to it being compared to a higher CPI number in Dec for MoM changes?

I don’t think that’s what this means. Any month-to-month increase would be on top of the revised increases.

US gov keep spending to keep the inflation alive, but less than in 2020, the Fed deflate the $31T gov debt in real terms.

The TGA account replaced JPM to deflate risk on Jamie Diamond.

As everyone gets to the bottom of the TGA Rabbit Hole and scratches their heads about why this matters, especially on a CPI thread, it’s worth pondering a few things:

Is a TGA anomaly going to be a good thing, headed into the deficit hurricane?

On that note, it’s sensible to remember a curious Haley Comet anomaly way back in September 2019 and this Fed accounting of that event:

“Following the conclusion of the balance sheet normalization program in August 2019, reserves continued to decline in line with the growth in the Fed’s non-reserve liabilities. In addition to this gradual and predictable decline, reserves exhibit daily variability most notably due to fluctuations in the TGA.”

That commentary is based on this:

“A measure of the interest rate on overnight repos in the United States, the Secured Overnight Financing Rate (SOFR), increased from 2.43 percent on September 16 to 5.25 percent on September 17. During the trading day, interest rates reached as high as 10 percent.”

The issue I’m pondering in this rabbit hole, is related to bank reserves and unusual adjustment to TGA. On the surface it seems irrelevant to get caught up in tinfoil hat fashions and engulf oneself in conspiratorial fantasy, but, it feels like a good fit.

Since a few of us are still in this smoke (steam) filled kiva, isn’t it a possibility that the Feds magic reserve accounts and Treasury wiring end up in some sort of rolling black periods, after another short circuit anomaly? I have absolute total faith in their utility monopoly and their almost godlike stature, their non fallibility and excellence to be the finest of accounting plumbers and architects — but — I think stars can align to spin normal occurrence out of orbit, into states of nonlinear chaos. The universal all encompassing law of nature, is that shi* happens.

As the deficit battle heats up and ad various fragile accounting is strategized and implemented, it’s possible that if inflation isn’t muted and if all the current colliding forces of recession — versus new bubbles, slam into each other, something, some spark, something economically unpredictable, appears.

Going back to 2019, the Fed came up with a software patch and fiddled around with a solution to duct tape their program. One assumes they are already anticipating emergency measures for our increasingly weird world, and as such, this entire posting session has been a complete waste of time, especially for poor Mr Wolf.

Nostradamus

From what I’ve read the TGA going down has something to do with the debt ceiling nonsense. I suppose money has to come from the TGA to fund essential services. It probably goes into the stock market as well.

As long the debt limit isn’t raised, this prevents the dollar from rising, no what the Fed says. Goody goody for stocks!

Heck, and I wanted to comment on the electric car article! Didn’t know anyone cared enough to spam a minor website on the topic.