This is how the internet works. Someone comes up with a meme, and it takes on a life of its own. I’m going to have some fun with it.

By Wolf Richter for WOLF STREET.

Back in mid-December, a hullaballoo erupted on the internet and the social media. The headlines and YouTube videos and Tweets were everywhere, and the pivot-mongers latched onto it and bandied it about with utmost energy. It was just what they’d been waiting for. Here are some of the headlines:

- NY Post: “Biden administration overstated Q2 job growth by 1 million: Philadelphia Fed”

- Zero Hedge: “Here Comes The Job Shock: Philadelphia Fed Admits US Jobs ‘Overstated’ By At Least 1.1 Million.”

- CNBC: “Philadelphia Fed suggests BLS overstated job growth in second-quarter by a million jobs”

- Reuters: “Missing jobs mystery puts Fed on back foot.”

- Mish Talk: “The Philadelphia Fed Just Revised Jobs Lower by 1.2 Million for Q2. Hello ‘Jobs are too strong for recession’ advocates. We have major revisions and more are likely coming.”

This “BLS” is of course the Bureau of Labor Statistics that releases the monthly employment report, of which we got the latest installment on February 3 – along with said revisions.

The whole thing arose on December 12 when the Philadelphia Fed’s new experimental fancy-schmancy algo predicted that the BLS had overreported jobs growth by 1.1 million and would therefore make a downward revision of 1.1 million jobs on February 3.

Oh boy! On February 3, the BLS made instead an upward revision of 813,000 jobs to nonfarm employment for the period through December 2022 – which blew the Philadelphia Fed’s experimental fancy-schmancy algo out of the water.

On top of this upward revision of 813,000 jobs of the past data through December, the BLS reported nonfarm payrolls jumped by 517,000 jobs in January (all data here is seasonally adjusted). These employment numbers make sense because the labor market has been historically tight, triggering all kinds of secondary effects, including the biggest wage gains in four decades and a spike in the employment of people with disabilities.

But the news sites and financial blogs and YouTubers all had made a lot of hay while they could back in December. I got links to their stuff in my inbox for days, and the WOLF STREET comments were bombarded with it, as it usually happens when something as titillating as this shows up in the headlines.

At first, I politely put some perspective to these comments, but it kept going for two weeks, and I finally took out my old double-barrel goose gun and shot these comments down, as you can see. Here are some samples in chronological order, from polite to double-barrel goose gun (as you can see, if you don’t read our comments, you’re missing out!):

Commenter, Dec 16: “Data will clearly show that the Fed has been hiking (way too late as always) right into the teeth of a recession, which began already in Q1 of 2022. The Philly feds jobs data already shows this. Versus the amply stupid establishment survey. Off by more than 1 million jobs for Q1. Q2 will be worse. Q3 will show we have been clueless. But we won’t see this for months in the revised data.”

To which I replied: “These benchmark revisions take place every year. The BLS adjusts its figures every year with these benchmark revisions, sometimes up sometimes down. The Philadelphia Fed attempts to estimate those revisions on a quarterly basis. They’re an estimate of future benchmark revisions. I posted the Philly Fed text in a comment under the prior article. Read it…”

Commenter, Dec 17: “Steven VanMetre just released on YouTube showing the BLS overstating employment figures in 2022 by at least 1,000,000? The Fed relies on the BLS and believes we have a strong economy when the opposite is true….”

To which I replied: “What you’re referring to in terms of the BLS: The BLS does an annual benchmark revision, and it does it once a year every year. The Philadelphia Fed, using the same data that the BLS uses for its benchmark revisions, tries to estimate on a quarterly basis what that annual revision from the BLS might look like. And that is now suddenly gospel? The internet is full of clickbait garbage about that.”

Commenter, Dec 29: “Any comment on the Philadelphia Fed pointing out that the BLS got the Q2 payroll count wrong by *1 million* – essentially erasing *all* jobs allegedly added during that period.”

To which I replied: “I’ve commented on it a gazillion times already. And I shot it down. You just didn’t read it. Go find my comments. I’m tired of wasting my time on it. This has already been debunked, including by the BLS itself. This was an experimental new algo that the Philadelphia Fed came up with to predict quarterly what the annual BLS adjustment will be. And it was BS. But the pivot crowd sure jumped on it and made a fool of itself once again.”

So here is what happened:

On December 12, the Philadelphia Fed released a report about its new experimental algo that uses the same data that the BLS uses for its benchmark revisions. The algo attempts to estimate what the annual benchmark revisions by the BLS will be, when the BLS reports them on February 3, 2023.

The Philadelphia Fed masterpiece said that only 10,500 jobs were created in the March through June period, instead of the 1.12 million jobs reported by the BLS, and that the BLS had therefore overstated the job creation by 1.11 million jobs during this period, and that the BLS’s annual benchmark revisions would therefore be a negative 1.11 million.

This algo has not been tested, and there was no way to say how accurate its prediction of the BLS benchmark revisions would be. But for anyone looking seriously at the labor market, the assertion by the algo that only 10,500 jobs were created in the March through June period was astounding. Someone must have smoked something very special when they designed the algo.

On Friday, February 3, the BLS released the actual benchmark revisions to nonfarm employment of the Establishment Survey in its monthly jobs report. And it went into the opposite direction

For the period through December 2022, the BLS revised nonfarm employment upward by 813,000 jobs. This is on top of the jobs created per the unrevised data. On a revised basis, the total number of jobs created in 2022 rose to 4.81 million.

For anyone watching this historically tight labor market – and all the side effects of it – the upward revision wasn’t much of a surprise.

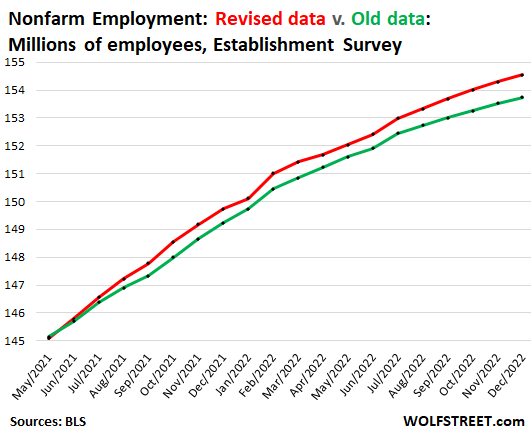

The revisions go back to 2021. This chart shows the revised data for nonfarm payroll jobs (red) released on Friday, and the unrevised old data (green), released a month ago. Both are through December:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Any comment on Krugman’s tweet about this inflation bring transitional! He was quiet all this time, now he comes out. Is it a sign that inflation is finally coming down and we will all start the money printing and interest rate slashing as normal.

Krugman said that? Oh dear! It’s like a divine warning we’re going to get a nasty surprise from inflation, maybe soon. Inflation is full of head fakes and nasty surprises. Just look at a chart from the 1970s CPI.

We just had big inflation surprise transitioned the nation from Alaska to Carolinas. Turns out it originated in China.

And still Wall Street didn’t recognise what a popped bubble and a crashing asset looks like.

Looking at what happens in stock and housing market in last week, it seems lot of people believe that inflation is doing to go always soon. Heck most of the houses (in couple of areas I keep track in) which were listed for last 6 months have gone contingent in last week (this could be also due to mortgage rates dropping in last week). Then statements from people like Krugman add fuel to fire.

Maybe the sellers finally dropped the price far enough and made a deal? You can always sell anything if the price is right.

I checked all ones that went contingent, some of them had price cuts but that was months ago so the only thing that makes sense is buyers FOMO+mortgage rate drop last week + people thinking inflation is going to go away.

Contingent does not mean sold, check back in couple of weeks, you’ll probably see back on market again. Been seeing quite a bit of that in RedFin and Zillow lately. Probably another game sellers try to play to drum up FOMO demand, similar to price increase I see from time to time too.

OK old boy,,, just want to advise you that a real goose gun will NEVER be double barrel.

WAAAYY too heavy for any shotgun, no matter if 12 gauge or 10 gauge or, in former times 8 guage…

THE main thing about a real goose gun, that I have had or shared several, is the long and longer barrel…

My last of that sort was inherited, and, in the absence of geese, I shot down a duck while floating down the river in Oregon in a canoe… Local bud in that canoe said he had never seen such, but, at that point, my goose gun was a 12 gauge with a 36 inch barrel, which I could not even begin to hoist now,,,

Thanks again for your very great clarity with the challenges WE, in this case almost all of the population WE, face each and every day going forward with the various and sundry manipulations…

We’re likely in the middle of a head fake. Housing & inflation will move through a 3-4 month trough between now and early June. It’s up from there, al beit not nearly at the pace we saw in the first half of 2022.

The Fed’s job at price stability just got a whole lot harder.

Listen to Krugman and then assume the opposite of what he sayd. The guy is clueless.

It is obvious that many people want printed money to continue as it was and cannot accept the idea that a coin has two sides and that it cannot always show only one side. Nothing in this world is unambiguous and one-way. The only sure thing is that sooner or later everyone dies

Good one J:

Fact IS,,, and has been for eva,,,

Only ”thing” can be known ALWAYS is death and taxes…

AT least one reason many of our avatars ( in the old meaning” ) said to respect ”Ceasar” etc., etc….

I’m not a big fan of Krugman, but he didn’t say inflation is necessarily heading down from what I could find… instead, he issued a warning that markets could be wrong and inflation might not go down as expected.

Inflation & housing are likely to form a bottom trough between now and June, then they turn upwards, unless the Fed pulls out a bazooka and does a 50-basis point increase in March & May. That would get the stock market & bond markets’ attention, possibly even pushing the 30YFRM back up towards 7% which would be SWEET! Housing across the US needs to broadly decline 25% or more with a small wave of foreclosures. That bring price stability back for a while.

You said I was crazy for this perspective somewhere around last Wed. Then the jobs report hit. There’s absolutely no recession or meaningful downturn anywhere to be found outside of a black swan event. 1st Qtr 2023 grow may even pop above 3%.

Jay, maybe there’s a misunderstanding. Maybe I misunderstood you earlier? Whatever. I see no recession in the near term. I see inflation either flattening near current levels or rising. I see interest rates rising, especially the 10 year. I see housing declining, even if there might be some noise this spring.

Krugman is a guy who won an econ prize, with a lot of predictions.

If any of the theories worked with a sufficient reliability, the equity markets would be far less volatile and we’d never have crashes or bubbles.

If you hearken back to the oil price spike of 2008, where it reached nearly $150 per barrel, you will find an article penned by Krugman which stated “oil prices are not in a bubble.” Shortly thereafter, the oil price bubble popped in spectacular fashion. Krugman is a crackpot.

I have found Zerohedge to be generally useful about what topics might be important, though know that their reporting on that topic is likely to be extreme (or just plain wrong).

It is a key on what to pay attention to, though I know I probably need to go elsewhere to get a balanced view of all the details of that topic. So it is good for that.

Actually I found Wolfstreet from Zerohedge too . :-)

This is my take as well, just a different spin from something like Apple News where I can read Vox, The Atlantic, and various other left leaning publications. The proprietor is clearly sympathetic to Russia but not slavishly so. The site is also handy for exposing right wing memes.

Shows once again the Fed PhDs don’t know what they’re doing. I bet they think they work in real science too.

It’s the last days of Empire. Imagine if the Romans had persuaded their foreign suppliers to accept pieces of paper promises in exchange for today’s valuable goods.

Gold got plastered on Friday and is now worth 50 less of those paper dollars. Expect more of the same.

That’s because NPR finally got into gold on Friday morning. They had some NPR youngling get all googly-eyed about gold, and she cited a 20-year-old college finance major who’d bought a little bit of gold, her first investment ever (with soon to be forgiven student loans?), and the whole story was like WOW GOLD, how cool!!!

And I go, oh no! Jesus, they jinxed it. It’s a sign gold peaked!

When this stuff shows up on NPR, presented promo-like by some youngling, it’s like the shoeshine boy in the olden days. Sure enough.

Wolf, is student loan repayment a dead letter now? Nobody will have to pay?

Totally agree with the ”real science” part A.

As one fairly well educated 50 or so years ago, including many deep dives into various ”social sciences” after getting up to speed with what were called ”hard sciences”,,, it seemed to me that the so called sciences other that physics, chemistry and math were only ”social constructs.”

SO sorry we, in this case the entire WE possible, have not found common ground to resolve the delta…

Sorry if that not sufficient basis for resolution of very clear difficulty of resolution of a fairly basic question…

I think the Fed is scared as hell that the FFR might have to stay above 4.5% for 2-3 more years to really bring down inflation. Along with structural $1T deficits, we’re looking at upwards of $1T in national debt expense once FY 2024 arrives.

Short news cycles, and competition for attention and catchy stories (and the corresponding behaviors of the viewers), seem to drive this front-loading of hasty opinions. Of course it would affect the style of commenting too.

Then, it becomes another chore to sort out what emerges over a reasonable time horizon as reliable information. Warren Buffett has long talked about keeping a certain discipline and distance from the constant surface noise. It hard to resist getting wired to the latest, latest news.

Zero Hedge? Loyal readers say that there are supposedly a few gems in there but the time it takes to find them is a total waist of time and a needless distraction. I’d rather be outside riding, swimming, or enriching my life with other people in some positive way.

You were kind to do this without using their names. They know who they are.

Good sunday morning laugh as well. Take a bow, Mr Richter. thank you.

Look, I love the commenters. It’s not their fault they were dished up these headlines, including by Reuters and CNBC. I don’t expect commenters to try to see through all this stuff out there.

*I* was one of the people expressing serious concern over the disparity between what the Philly Fed was saying and what the BLS had already said.

I don’t have a problem copping to it.

I’ll happily incorporate additional information as it becomes available…that was *what I was doing* when I raised the new data that the Philly was offering up (I think Wolf may have blocked some/all? of my comments on the matter – it happens…its his blog).

At the risk of being zapped again (I do spend time pecking these things out), I ‘m not 100% sure that having two major US institutions (BLS and Philly Fed) coming up with *dramatically* different results is the triumph for institutional faith that some might be thinking – regardless of which institution is right/wrong (more/less).

*Both* of these institutions have large budgets…to be *expert*.

A broader question is whether or not it is pretty late in the history of the internet for things like payroll counts to be based on an *inescapably* imprecise *sample* (margins of statistical error even if administratively executed without error, with a rock solid methodology) versus an internet *census* (true, per employee *count* – which the state unemployment offices must have for benefit purposes).

150 million+ employees is a very big number – but not so much for computers. Think about how many financial transactions are executed *every single day* at the level of standalone granularity nationwide (no ballpark estimates at your ATM, stock exchange, cash register, etc.).

Now contrast that accuracy/timing with BLS payroll counts (or *occupation* estimates!…which happen with an 18 *month* lag).

Asking such questions/questioning institutions does have real value.

“an internet *census* (true, per employee *count* – which the state unemployment offices must have for benefit purposes).”

= worst form of government spying ever. I would rail against forever.

America is a country where there isn’t even a national ID requirement, nor a registration requirement (you can live anywhere with out registering your address with the government), and you don’t even have to have an ID card in the US, etc., for all the same reasons.

I cannot believe that anyone so anti-government as you would even propose to give that kind of intense detailed spying power to the government, LOL

And what about all the self-employed, contractors, entrepreneurs, etc. Are you just going to ignore them?

Those commenters salaries depend upon NOT see through the stuff NOT in alignment with theirs. No surprise here.

Wall St, financial media and other vested interests sorely need reasons (real or not) to broad cast so Fed will pause or pivot soon. The addiction for free money is too strong.

Over the years I feel lucky to have found 3 sources of financial interpretation. None are on TV or youtube. Note: youtube is great for fixing plumbing problems – ha. CNBC is a lot of noise. Thanks, Wolf for doing what you do. I think people comment inaccurately sometimes but it helps them learn so comments are a good thing. I like when you remind them to read the verbiage.

TK,

Concur on all four point!

Thank you for keeping everyone honest.

We are still educated apes. There is no time to read in and outs and perform critical thinking. We go with the trend, (economic slowdown) and split in to two groups. Pivot or no pivot. Choose the one you like and come up with an elaborate defense on why we are right. Even if there is a rationale article, just dont read it, deny and accuse the person of witchcraft. Also add words like Keynesian, St. Louis Fed, Volcker, 1987 crash and operation barbarossa, in to the mix, the arguments become true.

1. 69% of people this this sentence has a secret meaning.

2. If you see a women in gym on Feb 14 evening 7pm, then she is single or married for 20+ years.

3. Most items on valentines day sale will be on discount aisle after Feb 14th. Buy them then. My idea is to buy a teddy and box of chocolates for me.

“7% of statistics are made up on the spot.” – Steven Wright

Am I the only person triggered by the ongoing shortcomings of this system of data handling?

This is a streaming world. Lumpy data is so last-century. At some level couldn’t this system use a kick-start of innovation? A clerk. A coder. An admin wonk. A politician??? (Heh)

Rescue an old white box from a government surplus sale. Create some read/write permissions and let the incoming data go live 24/7/365. Revisions can happen in real time, too. Stop the angst and bated-breath nonsense surrounding data releases when that data already exists in a holding cell somewhere. Real-time aggregation and delivery anyone?

Talk amongst yourselves.

(Infrequent reader; first time poster.)

Lots of people are trying to do that. There are all kinds of data like this out there. But that kind of data is ridiculously unreliable. It’s worse than nothing because it misleads you.

Payrolls are usually processed once a month or twice a month. Only a few employers run them weekly. No one runs payrolls daily. And so you’re back to monthly data, not daily data, because there is no daily payroll data at all because payrolls aren’t processed daily.

The US economy is immensely complex and huge and decentralized, with millions of companies and 160 million workers, each doing their own thing. Some workers receive regular wages, others work on a contract basis with quarterly tax payments.

Weekly unemployment claims, based on actual claims for unemployment insurance, are as close as we get to real time semi-reliable data about unemployment, and it remains steadfastly near historic lows, confirming BLS jobs and unemployment data.

There is private-sector data from payroll processor ADP, but it only has a small portion of all payrolls being processed. It’s a decent indicator for direction but is off in terms of magnitude because the select companies that use it. And it’s monthly.

FICA reports are the worst because the contractor payments are made quarterly.

Wolf…how about what the Household Survey has been telling us during 2022 and January ‘ 23 (83k jobs)?

Household survey includes the self-employed and gig workers, in addition to regular W-2 jobs. The establishment survey doesn’t include the self-employed.

To your specific question: Employment as measured by the household survey increased by 4.06 million in 2022 and January. See chart below.

https://wolfstreet.com/2023/02/03/in-information-sector-unemployment-rate-spikes-jobs-fall-for-2nd-month-rest-of-labor-market-is-rocking-rolling/

The household survey data was also revised upward. But, “in accordance with usual practice,” BLS did not revise the historical data, but it was included in the January data.

Civilian noninstitutional population: +954,000 (BLS gets that from Census Data)

Labor force: +871,000

Employment: +810,000

Unemployment: +60,000

Number of persons not in the labor force: +82,000

Unemployment rate: unaffected

Employment-population ratio: +0.1 percentage point

Labor force participation rate: +0.1 percentage point.

Since links aren’t allowed, this is on Forbes. From what I’ve read, the establishment survey counts jobs, the household survey counts employed individuals, so one person with multiple jobs would show up as a count of one in that survey and multiple jobs on the establishment. Why multiple jobs? To make ends meet?

Upon Further Review: That ‘Hot’ Labor Market Is Really ‘Ice Cold’

Dec 23, 2022

The Payroll Survey shows employment growth of nearly 2.7 million jobs between March and November. The Household Survey, over the same period, shows 12,000. Something is seriously wrong! The headline number that is broadcast in the media is the Payroll Survey, so if it is incorrect and the Household Survey is accurate, then the “hot” jobs market, which the Fed uses to justify its rate increases, is really a “cold” jobs market.

Looking at the recent past, the two surveys were in sync until March, when the Payroll Survey took off. Some of the issue could revolve around the small business birth/death assumptions. Since the Payroll Survey doesn’t sample small businesses, the Bureau of Labor Statistics (BLS) adds a number based on a time trend, and they even seasonally adjust this data. Over that March to November period, the Birth/Death model added 1.3 million jobs. This appears strange to any observer of economic trends, which tells us that business is contracting, not expanding. Even if the Birth/Death add-on is eliminated, the discrepancy is still 1.36 million jobs between the two surveys.

Winston,

Forbes publishes opinion pieces by independent authors. It publishes anything. If you cite stuff from Forbes, you’re grabbing at straws…

Every month, month after month, there are these morons out there who are describing how the labor market is “ice cold” or “collapsing,” etc. etc. and they’re wrong every month, and they’re waiting for the Fed pivot month after month because they think the labor market is “ice cold” or “collapsing,” the Fed will “have to pivot,” and month after month these morons are wrong.

But this trash gets shared, such as by YOU, and gets a lot of clicks for that reason – the biggest trash gets the most clicks. That’s how the internet operates. This kind of trash you cited is precisely why I don’t allow links.

BTW: “From what I’ve read, the establishment survey counts jobs, the household survey counts employed individuals, so one person with multiple jobs would show up as a count of one in that survey and multiple jobs on the establishment.”

The household survey counts everyone who is working, including the self-employed, contractors, etc. that are NOT counted in the payroll data of the establishment survey.”

People having multiple jobs has always existed – and yes it brings in more money. There are a lot of jobs that are considered full time but don’t require 40 hours a week of work.

There was a time in the 1980s when I had two jobs – full-time assistant professor (a nobody) at the University of Texas at Austin and an evening job doing data work at a beer distributor. Was easy to do. It’s amazing what you can do with a second income stream!

Other people have jobs at an office and are landlords with a bunch of houses or apartments. That’s “multiple jobs” as well.

“According to the latest ABC/WaPo polling, 41% of Americans say they are worse off financially under Joe Biden. That is the highest negative response to the question in the 37-year history of ABC polling.”

BTW, I’m apolitical. Presidents aren’t actually in charge anyway. Other bought and paid for politicians are.

Winston,

DUH! The free money is gone, the stimmies have ended, people are having to pay rent and mortgage payments again, the PPP loan money is gone, cryptos have collapsed, stocks are down… and so now they’re of course “worse off.”

You must be kidding if you say you don’t understand this!

I cannot believe the dumb stuff people come up with and spread manure-like around the internet. USE YOUR BRAIN, Winston!

VERY GOOD response IMHO bki: please do your best to continue to bring your ”breath of NEW air” on here, as, usually many on here have been commenting for a while,,,

While you say it’s your first comment…

Similarly to when I first started to comment to at least ”try” to bring some new thoughts…

Thank you.

Too nice, sir. I didn’t expect a welcome or even to be acknowledged by Wolf. Good stuff; tough subject for me to accept.

I like this place and especially the moderated format. Just an old fart tryin’ to Grok the Casbah.

Pakistan, a country of over 230 million, is down to their last $3 billion in foreign reserves; they are on the verge of financial collapse.

Reasons; never recovered from COVID, ie. 7 million garment workers lost their jobs; local currency collapse, countrywide devastation from historic flooding ruining crops.

A big canary.

Afghanistan terrorize Pakistan. Baluchistan protest against China’s

Gwadar naval base, commodities extraction and Chinese fishermen. Pakistan is in the top 10 armies, after India.

Pakistan producing low end stuff for the west, including US. Pakistan is a member of SCO.

GDP : $376B, per capita : $1,800/y.

I know employment is important and part of the dual mandate, but it is a lagging indicator. Bigger picture is an economy that needed zirp for 10 years, got too big of a drop of helicopter money and now the excessive money is being flushed out.

House prices need to get flushed by about 30% on average nationwide. Single family homes might go the way of dinosaurs if prices don’t reset lower.

Unlikely IMHO. The best we can hope for on housing is for the entry prices to plateau for several years and buy in then with devalued dollars. Sure Probate will always serve to set the bar, how far underwater one might be is a knowable number but no one is obligated to sell at a loss.

“I WFH” “Its a house not an investment” “I’ll leave it to my kids”. Ask anyone who owns Bitcoin at $40K. A 30% drop in housing would cripple our economy. Be careful what you wish for.

So we have to artificially prop-up because some people were too greedy?

BTW, do you work for HIC?

I am not really wishing for house prices to fall by 30%. Price to income is very high, in a few cities 10 times household income. It’s similar to PE ratio for stocks. Too high of a price is setting up society for a crash.

But prices are not plateuing. They are falling. Fast. Your best wish isn’t coming true.

So home prices can go up 50 percent or more in last 2 years and it ok

But if it falls 30 percent from peak we got a problem 😀

Home prices need to go down quite a lot for things to normalize

Let the real interest rate normalizes and we’d see how asset class of all kinds come back to normal

Btw.. home prices are already down 20 percent or so in my socal neighborhood

Need to go down a lot more

Home prices need to drop to intersect with the long-term inflation line. Just like what happened in 2012 at the bottom of the last bubble.

Please refer to Wolf’s excellent chart.

Home ownership should not be a speculative investment that has 40% yearly gains. It should be a place to live that tracks inflation.

With 10-20% inflation during the last couple of years, the floor on house prices has risen. Unfortunately, the speculative rise in house prices has been 30-40% during this time. Only 20-30% more to fall.

It’s been sad to see Mish Sherlock devolve from the sharp analyst who called the housing bust in 2007 into whatever he is now. It started going downhill when he kept insisting autopilot cars would rule the roads by 2020.

Two abstract things may be appropriate to ponder:

The internet is a perpetual motion machine that uses garbage to fuel itself, akin to cancer cell mutation. We live in an era of Babylon Tower (biblical) noise that’s overwhelmingly drowning us all in a witches brew of stupidity and confusion — thank God for ChatGpt! Marshall McLuhan, suggested long ago that “the medium is the message”.

The circus-like atmosphere of economic infotainment (directly connected to Fed speak and jawboning) flows into a polluted stream of obfuscation that intentionally amplifies noise, drowning out ambiguous messages, that like cholesterol, clog the arteries of cognition.

The current confusion related to data revision and attempts to reconcile data into simple concepts that provide everyone with logical continuity, are the zenith point of Babylon stupidity, where the most respected scholars, sit beside six year old students, in shared, profound ignorance.

It’s interesting how Powell recently alluded to his trust in financial innovation, as it relates to what he sees as about forty years of successful economic stability, which conveniently ignores forty years of economic instability, held together by economic glue that nobody understands. Curiously, the expansion of noise and confusion seem absolutely aligned with increasingly larger amounts of debt and asset expansion.

Circling back to McLuhan, he wrote about moving into a small world of tribal drums, where we will have total interdependence on a super-imposed existence. That was 1962, and with the advent of AI media driven messaging on our smartphones, our tribe will become more and more addicted to chasing confusion and being unable to communicate, unable to think.

Sunday Sermon #314, now available in stereo!

The on

good Dr. – ol’ Marshall was prescient, but wonder if even he could have seen the interweb turning so many into cub reporters pursuing the scoop…

may we all find a better day.

Mr. McLuhan & stereo?

48 hours ago, from my living room, I enjoyed a fantastic live concert on my TV and stereo from Orchestra Hall, Minneapolis. The center piece was a piano concerto composed and played by Gabriela Montero.

“It was her First Piano Concerto, nicknamed the “Latin,” a piece that packed a lot of power, yet was also rooted in the dance rhythms of South and Central America that calls to the mind’s eye swiveling hips and graceful spins. It also had much to say about systems of politics and economics that too often drain humanity from the equation. And all this without speaking a word.”

Yes, the medium is the message, but the medium also conveys the message, and with such advanced technology, that the Orchestra appears before me in my living room.

The audio engineer uses hardware and software from Germany, Klang Technologies & DiGiCo, to mix all the microphone inputs into a 3D “Immersive Audio” halo to recreate in stereo, what the conductor has arriving to him. This can be done moving sounds around everywhere, both above and below, in any amount of left-to-right separation and front-to-back. What plays in my stereo, live from the concert, is akin to having the conductor wearing headphones. In other words, what he hears, I hear. Jay Perlman is the wizard working the magic.

McLuhan adopted the term “message” to denote the effect each medium has on the human sensorium, and taking inventory of the “effects” of numerous media. Ol’ Marshall would’ve liked to have been enjoying the concert with me, I reckon. The man did indeed see the future very clearly.

DanRo – ah yes, remembering the follow-up: ‘The Medium is the Massage’…

may we all find a better day.

ZH has destroyed itself. With the “block” feature, there is no discussion, just incessant regurgitation. I would rather read someone’s idiotic comment than never read an alternative view.

Google and Goldman rule ZH. And the ads are annoying. You can’t keep eyeballs if you make it hard to be on your site.

Thank you for the reminder Wolf, great perspective… Also, I am SO CONFUSED. 500+ is a BIG number…

I very much expected labor signals to lag economic softness more than in past cycles… but for me that meant a prolonged dithering around in the mid 200’s. What gives? Wolf recently showed we are below trend, but the trend was built on easy-money and the fed started rapidly tightening around the same time we hit level breakeven.

Also, where are these people coming from? Can we read this as a last lurch forward from holdouts being driven off their couches after having FULLY exhausted the “COVID money”? I honestly expected that narrative had fully run its course for most households. I understand “excess savings” I just figured it was mostly trapped at the top by now.

“Where are these people coming from?”

Look at the labor force. It’s still way below trend. There are still lots of people who have not re-joined the labor force, or who have left it permanently for whatever reason, including retirements and excess deaths. But quite a few have rejoined it, as you can see:

https://wolfstreet.com/2023/02/03/in-information-sector-unemployment-rate-spikes-jobs-fall-for-2nd-month-rest-of-labor-market-is-rocking-rolling/

A rise in price often results in more supply.

But if you want to raise the supply to try to keep down the price, you need to reduce barriers.

So raise wages or increase immigration, if we have a “labor shortage”. Our corporate overlords are delusional in thinking they can bullshit a solution here.

They decided to make COVID rather dicey for old people and this is the consequence. Some are not with us and others got out and are not tempted to get back in.

There’s a long history of BLS jobs revisions.

It’s a not a simple data keeping exercise. It entails some predictive analytics among other things. Definitional changes have also been known to occur in components.

My take is not to be surprised by revisions. It’s to be careful in how much trust I invest in any gov’t controlled data source.

The whole political angle on pivot beliefs and market impacts? Not my bailiwick; mine is to take advantage.

Employers want it both ways. They want to raise profits. This can only be done by raising prices while repressing wages. This is because they want bigger margins. If they made 15% profits last year, they want 20% this year.

After years of mergers and market consolidation, a lot of companies today have a lot of pricing power. But even if they are a monopoly, they still must compete for labor.

Employers dream of returning to the post-GFC world where they could raise prices, buy back stocks and pay fat dividends while repressing wages.

But that world is gone for at least a generation. Our workforce is older and more disabled than ever. Employers are finding they have to actually pay for unskilled young labor for the first time in 40 years. And now they have to accommodate disabled people.

The story of the next 10 years — recession or not — is going to be one of bidding wars for the best labor (like housing for the past 20 years), and a steady but inexorable ratcheting upward of compensation packages across the entire spectrum.

Raising rates will only bring discipline to capital, meaning it will have to figure out how to create value-added systems again, rather than financial hocus pocus on balance sheets. That requires actual people doing actual things for other actual people (i.e.: labor). There’s no longer any way around it.

MF – …but will the patient recover before the life-support resources run out?

may we all find a better day.p

…have no idea where the ‘p’ after my signoff originated. Apologies.

may we all find a better day.l

40+ years of this non-senses has largely hollowed-out the capabilities of the US economy (most Western economies, actually) to produce “real” economic growth. Rana Foroohar’s book – “Makers and Takers” – provides an excellent account of it.

So if, indeed capital “will have to figure out how to create value-added systems again, rather than financial hocus pocus on balance sheets.” – then it is logical to ask the questions:

-With what?

-With who?

and be prepared for long, awkward silences.

Re: 517K NFP #… Did you see the BLS statement under the “Adjustments to Population Estimates for the Household Survey” heading in their press release?

Lulz

I just posted this in reply to another commenter. So I’ll just repeat it here in abbreviated form:

Household survey includes the self-employed and gig workers, in addition to regular W-2 jobs. The establishment survey doesn’t include the self-employed.

Employment as measured by the household survey increased by 4.06 million in 2022 and January. See chart below.

The household survey data was also revised upward for 2022. But, “in accordance with usual practice,” BLS did not revise the historical data, but it was included in the January data.

Civilian noninstitutional population: +954,000 (BLS gets that from Census Data)

Labor force: +871,000

Employment: +810,000

Unemployment: +60,000

Number of persons not in the labor force: +82,000

Unemployment rate: unaffected

Employment-population ratio: +0.1 percentage point

Labor force participation rate: +0.1 percentage point.

1) SPX, it took 10 weeks to rise from June 13 low to Aug 15 high. It took

17 weeks, – from Oct 10 low to last week high – to cover the same distance. SPX made it thanks to few high beta days, but the Dow didn’t care.

2) Look at your charts : the risk is high. The Dow might drop like a busted balloon, in the next few months, and sink.

3) RRP might support the impaired NDX & SPX, in a temp vaccine.

4) The hyperinflation might turn into a lightweight deflation, y/y, first.

5) Commodities…

For the SPY to drop, then your betting on the top 20 companies to drop. The top 20 are 30% of the index. The top 5 are 20% of the index.

These 5 make up 20% of the SPY.

Apple

Microsoft

Amazon

Google

Berkshire

Tesla and Meta already dropped far enough to fall off that list? Seems like it.

Is Apple going to drop far enough to fall off that list? Or will the whole list drop a bunch, and the whole list might still stick together, but just be a lot lower in value, but still be the most valuable companies in the US.

During the dotcom boom, Cisco was the highest valued company in the world. Then the shares collapsed and never went back to their dotcom boom high. People forget.

I find it stunning how zerohedge and assorted stupid memes have infected otherwise mostly sane people. Look at how long this stuff has been running as long as we have had fiat currency. What is it about a numerate bunch (usually engineers) that fails to understand that fiat currencies can run a very long time? Is it the same mental flaw that allows people to believe the world is going to end on a set date as predicted by yoyo number 4? I get that fiat currency is not convertible at a set price, and the comfort of the precious is not government guaranteed but really? Inflation is not an easy 1:1 monetary phenomena. Now, why is this hard to understand?

We print money, vast amounts of which are instantly exported for goods and some services- and that money is never to return as long as we have a functioning world trade based economy. Now, see the term exorbitant privilege. Now understand nobody has a great currency to rival our dollar. Russia could have tried, but empire was more fun than real economic domination- which would have required rebuilding from the last demographic collapse in Russia instead of causing the next.

Interest rates rising simply means taxes will have to increase, which was already baked in the cake. We do this dumb stuff on a regular basis.

We have nearly no social safety net, but we do make immense amounts of weapons. In short we have decided guns instead of butter in so many ways, but still people beat dead horses on Fox and here in the comments.

Amazing. Proven wrong for decades, but still selling snake oil deluxe. Zerohedge is the modern version of Elmer Gantry.

I used to read ZH for a contrarian point of view but it went off the deep end and I stopped reading it about six years ago.

Cool! Let’s keep borrowing ’til it’s 2099!

Agree with most of your comment but this makes me laugh “ We have nearly no social safety net”

Do these not count

Medicaid, Medicare, Obama care

SS

Food stamps

Student loans

And the list goes on. These programs cost way more then our defense budget and it’s not even close. But defense still way to high.

Seems like we constantly debating whose cesspool of statistics is less smelly than another. Perhaps forgetting that we may very well indeed, be standing in a cesspool.

“Someone must have smoked something very special when they designed the algo.” 🤣

Gotta love that Steven VanMetre…the guy suck at even being a fear mongerer. Someone needs to tell him when all your thumbnails on YT is doom and fire, nothing is doom and gloom, geez at least be selective about it. Then again the guy is good at citing Zerohedge so not much creativity out of the box…

Commenter, Dec 17: “Steven VanMetre just released on YouTube showing the BLS overstating employment figures in 2022 by at least 1,000,000? The Fed relies on the BLS and believes we have a strong economy when the opposite is true….”