Are we seeing the psychological effects of layoff-stories everywhere that replaced labor-shortage-stories, though the labor market overall hasn’t changed much?

By Wolf Richter for WOLF STREET.

The jobs report released today by the Bureau of Labor Statistics depicted a still growing labor market, constrained by the far-below-trend growth in the labor force, along the same lines as in prior months, and not particularly impacted by the Fed’s rate hikes, or its efforts to slow the economy.

But there is starting to be a new trend on wages – and this has been confirmed by private-sector payroll data, and when we get to it in a moment, we’re going to venture into some speculation as to why.

First some basics in the jobs report today.

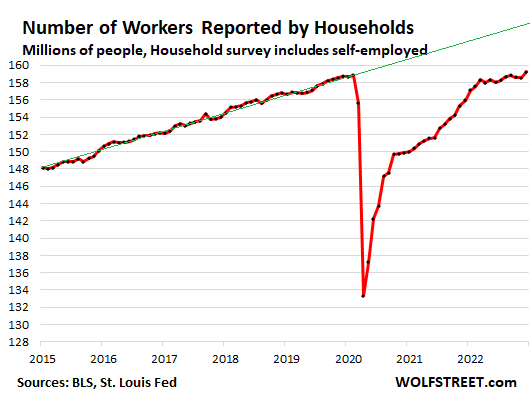

The total number of workers, including the self-employed, as reported by households, jumped massively in December (+717,000), reversing the declines of the prior two months. For the past three months combined, the total number of workers rose by 394,000 to a record 159.2 million, for the first time beating the pre-pandemic record. But it remains well below pre-pandemic trend (green line):

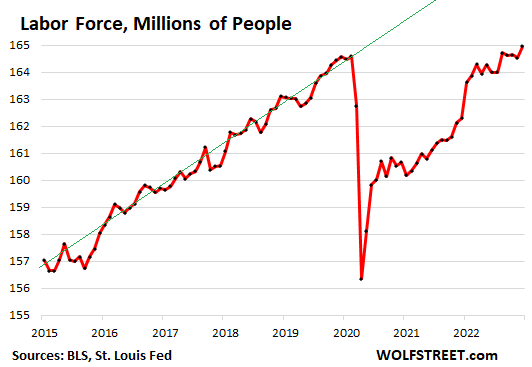

The labor force – people who either have jobs or are actively looking for jobs – jumped by 439,000, more than reversing the decline in the prior month, to a record 165.0 million. Over the past three months combined, the labor force increased by 347,000. But it remains woefully below pre-pandemic trend:

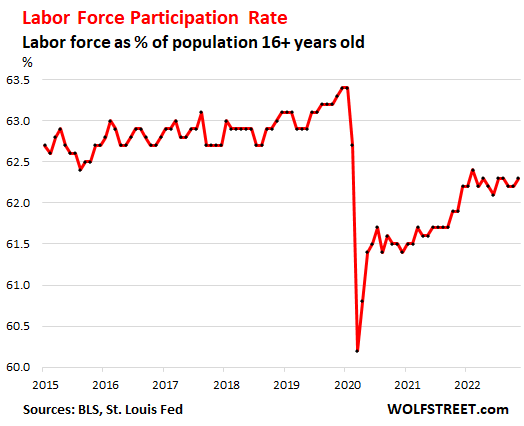

The labor force participation rate – the labor force as a percent of the working-age population 16 years and older – has barely improved this year. In December it ticked up to 62.3%, same as earlier this year, and up just a smidge from January (62.2%):

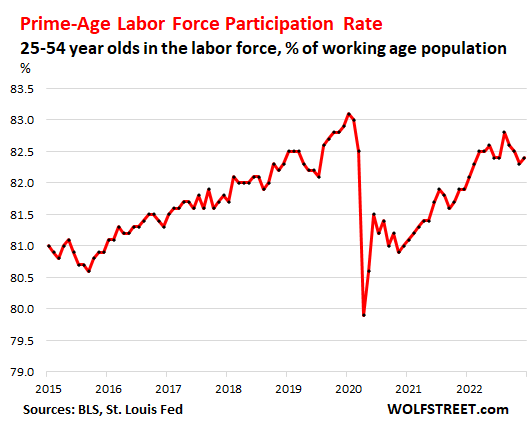

The prime-age labor force participation rate – people between 25 and 54 years old, which eliminates the effects of retiring boomers — ticked up to 82.4% in December, but that’s down from where it had been earlier in the year. And it doesn’t look great either:

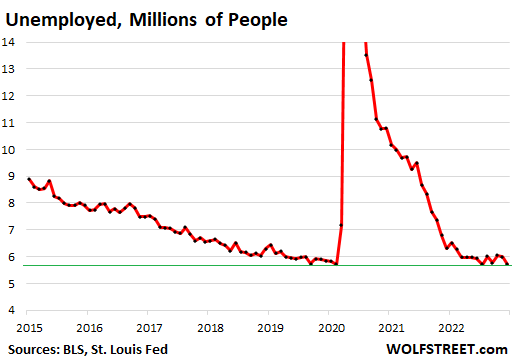

The number of unemployed and looking for a job fell to 5.72 million, about level with the pre-pandemic low. This is the portion of the labor force that is actively looking for a job but doesn’t have a job:

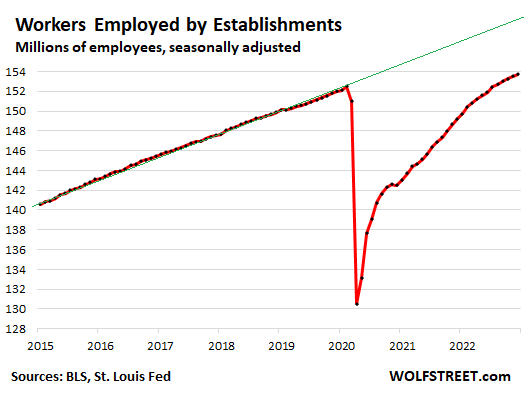

The number of employees on regular payrolls rose by 223,000 in December, and by 742,000 over the past three months, to 153.7 million employees, which is up by 1.24 million from February 2020, according to the survey of employers. Here too, below pre-pandemic trend and not catching up in recent months, but just growing in parallel:

This is the same labor market we’ve had all year: growing, constrained by the tight labor force, which has been putting massive upward pressures on wages, as employers have struggled to hire and retain workers.

Similar data has been provided by payroll processing company ADP throughout 2022, as have other data sets. They all confirm the same scenario: A growing labor market, constrained by the labor force, which is putting pressure on wages, amid large-scale churn in the labor market as workers quit jobs to take better-paying jobs somewhere else, thereby spreading wage pressures throughout the economy.

But wage pressures are now abating.

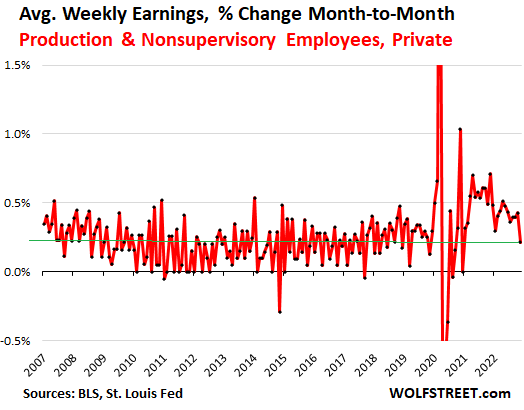

Average hourly earnings of production and nonsupervisory employees – engineers, teachers, bartenders, technicians, drivers, retail workers, etc. who do not manage other people – rose by just 0.2% in December from November, the smallest increase in two years, and now in the middle of the range of the years before the pandemic.

But note: This was a very large drop from the prior months, and such large drops in this volatile month-to-month data tend to get reversed at least partially in the following months. So my bet is that we will see at least a partial reversal over the next few months to a higher month-to-month growth rate:

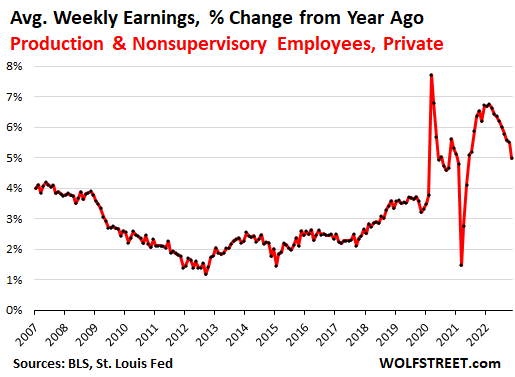

On a year-over-year basis, average hourly earnings of production and nonsupervisory employees rose by 5.0%, well above pre-pandemic growth rates, but the smallest increase in two years:

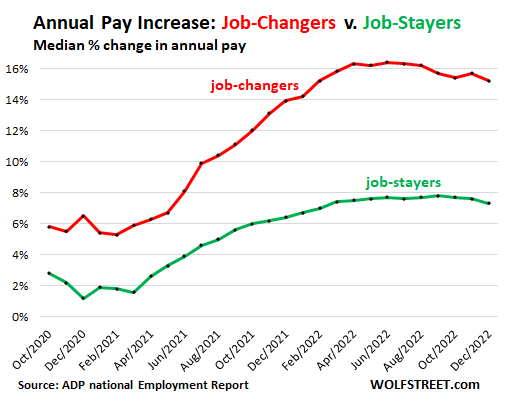

Annual pay increases per payroll processor ADP showed similar trends, based on payroll processing data from its client base. ADP splits the pay increases for workers who stay in their jobs, and for workers who change jobs.

Workers change jobs to make more money. The widening gap in wage increases for these “job changers” over “job stayers” has shown just how pressured employers are to hire people.

That gap widened as pressure increased in the labor market, from a gap of 3-4 percentage points in late 2020 and early 2021, to 8.8 percentage points at the peak in April 2022.

But it has since then backed off some: in December the difference was 7.9 percentage points, with job changers getting a median annual pay increase of 15.2%, while job stayers got a median annual pay increase of 7.3%.

These are still huge pay increases, but they’re also down some from the even bigger increases earlier this year (data via ADP National Employment Report):

On a month-to-month basis, for job changers, the median annual pay remained flat in December from November, and barely ticked up from October.

But for job stayers, on a month-to-month basis, the median annual pay rose 0.5%, the biggest increase since July, and both of them were the biggest increases since the mega-increases in December 2021, and in January and February 2022.

These month-to-month changes are volatile, and we don’t want to read too much into them. But they show:

- Convincingly that the huge pay increases of late 2021 and early 2022 are not happening anymore.

- Less convincingly that companies are still willing to give big raises to retain people but that the premium for changing jobs may be in the process of reverting to something more normal-ish.

Why?

The stories of layoffs at tech and social media companies, whose names everyone knows, are starting to have a psychological effect on both, employers and workers, it seems.

In the media, the theme of “layoffs” has replaced the theme of “labor shortages.” There isn’t a day when there isn’t some story about some layoffs somewhere; but the headlines about “labor shortages” have essentially vanished.

The irony is that both exist:

There are significant layoffs at tech and social media companies, after a massively huge hiring boom over the past two years – like Amazon, it hired 800,000 people globally in two years and now announced global layoffs of 18,000.

And there are still labor shortages in other fields, including healthcare, and there are still teacher shortages in various districts, etc. But they don’t show up in the media anymore. That too changes the psychology.

And there are lots of companies that are not in tech and social media but are aggressively trying to hire tech workers, and this includes the EV divisions of the legacy automakers and all kinds of industrial companies. But they may not pay what Meta used to pay, including the stock compensation packages. And they might not be all that flexible about working from anywhere. And so their job offers might have pay packages that former Meta employees might sneer at, at least for now. Maybe after a few months of not finding anything better, they might give it a second thought.

These kinds of psychological factors – currently the effects of layoff-stories everywhere and previously the effects of labor-shortages-news everywhere – are just as important to the labor market as psychological factors are to consumer price inflation, house price inflation, and stock market craziness.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So it seems inflationary psychology has been broken and the wage price spiral defeated. Good news for risk assets!

I like objective data. I don’t like media scare stories, because they are meant to help the large companies that advertise with them.

As wolf has now shown, there haven’t been any meaningful layoffs. Tech companies have layoffs every year, in good times and in bad. Only now they’re being hyped up to keep workers scared and not daring to demand more money. Consumer spending is still near record levels. No sign of recession. Those are the facts.

The only meaningful change the past 6 months is gas prices are back down. That affects psychology more than anything else. You can switch brands when product prices rise, but you can’t avoid paying for gas if you have to get to work every day. When that gets expensive it’s a gut punch every week or two for most people.

I’m seeing shortages of few things

latest is water heaters – the supply house for contractors was down to less than 10 water heaters

been waiting nearly 2 months for truck load(will have 100 on it)

can’t track truck though it is ON THE WAY

owner carryvans 3 trucks to Phoenix to big supplier there just so he has inventory

well at least price is only 100% higher than 2020 pre-covid

Yeah, please add to the list of defeated problems, that indicate that Fed is ready to Pivot, and markets are going to explode again!

1. Inflation has been defeated and prices are falling!

2. Housing is affordable again and setting up for another leg up!

3. Stock valuation are cheap again and indicate 50% growth this year.

4. Debt on Corporate and government balance sheets have evaporated and revenues have doubled, so lower risks should translate to lower rates.

5. US is now running a trade surplus of both goods and services.

6. US education institutions have managed to create millions of highly productive professionals that are ready to create AI to solve all the global issues.

/s

love it Leo

of course I to am holding line on wage increases /s

new year just went up $5 an hour for billing

I just got done with raising rents so they have few more $$

and I just need a taste

Yeah, my auto insurance went up 150%. Labor costs were cited as the main reason. Wallstreet pulls this crap every couple of months, trots out Nick the Pig to jawbone the markets higher on the hope of a Fed pivot that is not going to happen. It better not happen.

Good to hear some positivity in these negative tmes! I’v got three questions. What are you smoking and where can I buy some, and is it good for back pain and arthritis?

Mediatized – To annex (a lesser state) to a greater state as a means of permitting the ruler of the lesser state to retain title and partial authority.

This is above my verbiage level. But sounds like very sophisticated satire.

“The heavily mediatized layoffs at tech and social media companies, whose names everyone knows, are starting to have a psychological effect, it seems.”

It’s above my verbiage level too :-]

All the above data, while excellent as ever, is still lagging, looking in the Rearview Mirror.

1. You can find highway trucks to haul nearly any product with 1 phone call. This is a change from 30 days to 3 months lead time. This is also shown in the decline of imports and exports because of a shrinking economy.

2. The “Wealth Effect” also operates in reverse. “Amazon, it hired 800,000 people globally in two years and now announced global layoffs of 18,000.” Amazon, the world’s largest Sears Catalog, has lost $1Trillion in share value. And there are $Trillions more losses in Crypto, etc. The people and businesses that held these shares, as a group, will not be spending like drunken sailors.

3. New Housing has cratered. Lumber prices are below the cost of production. Thousands of jobs from the very small to the quite large are on the line.

4. The plug in the dam of massive layoffs is the “hoarding” of employees, many of which are unproductive Deadweight; for fear of not finding these warm bodies later. That dynamic will change like the Dutch Boy’s thumb in the dike.

My view of the lay of the land.

In terms of consumers cutting back, LOL, I just came back from Costco (San Francisco). It was total utter mayhem. I’ve never seen it this packed, Parking garage packed. Aisles packed and blocked to where you couldn’t get through. People were spending money like there’s no tomorrow. Despite layoffs, despite insultingly high prices, despite whatever. That’s my anecdote of the day.

Wolf, can confirm from a Costco in the Southeast last week – parking lot completely full. There is still a lot of money sloshing around the system. The Fed’s job is not done.

Wolf,

As I’ve asked you before. If Government can spend like drunken sailors (no offense to drunken sailors), and you can sell a 30 year Treasury to pay for your daily bread, then this will continue (for a while). But $30 plus Trillion alongside all the other Government and Private Debt still depends on “surpluses” somewhere to tax or borrow against.

Notwithstanding “private savings” that are in fact, Public Borrowing.

Thank you.

I went out grocery shopping earlier this week (not Costco) and loaded up on provisions. Living on the West Coast and seeing the parade of storms coming I thought it was prudent to have what we needed. These storms are also headed east. Storm provisions could be a factor in the huge crowds seen at Costco recently.

“The performance of the U.S. economy over the past year has been quite favorable. … Continued low levels of inflation and inflation expectations have been a key support for healthy economic performance. … Atypical restraint on compensation increases has been evident for a few years now, and appears to be mainly the consequence of greater worker insecurity. The willingness of workers in recent years to trade off smaller increases in wages for greater job security seems to be reasonably well documented. The unanswered question is why this insecurity persisted even as the labor market, by all objective measures, tightened considerably.” – Greenspan 1997

History doesn’t repeat but it rhymes, right?

Typo alert: ”rose by 394,000 to a record $159.2 million”

think you meant people or workers,???

the whole phrase is this: “the total number of workers rose by 394,000 to a record $159.2 million.” Seems ok to me.

He means remove the $ in front of the number.

OOPS ;-]

And the palovian pivot dogs drooled like mad from the opening bell

I was flying high on Boeing. Nothing to do with a pivot.

What made you want to go into Boeing?

In pnw cdn, anedotally, construction wages are up 30% to 50%. If one can find the workers.

Meanwhile, the BOC brings a sledge hammer, likely the size of a wrecking ball, to the party. Yhea rates need to normalize, but no one responsible is fixing the supply issues. And at this timing, these rate increases, don’t fix the supply issues easily, and they are adding significantly to ownership costs.

Meanwhile the cdn federal govt brings more liquor and people to the party: About 1m new people per year, last two years. Offers no jobs training initiatives. Runs huge deficit spending on unproductive programming. And welcomes in a national carbon taxes. Meanwhile, locally the building code and the cost to both permit and own are intransient and increasing; residential property taxes have increased 85% (where I live, same services to homeowners).

Also, it is not the rate of inflation, or if it is declining, that really matters, rather it is the final consumer price, as one of two factors, that impacts a family/personal budget.

So, in melding these trends, imo, SNAFU.

I hope there’s more job reports like that one in the future in Canada.

Canada is incredibly good at finding Government Jobs.

This always works until the camel’s back breaks.

and yet I’ve found several supply houses to industry tell me their sales are down $1 million per month for one store and 50% less in another flooring store

but construction still booming for now

but I have feeling that in 6 months there won’t be many houses left to finish

we just got final bill from contractor – $70k – simple numbers and all

Sounds like more hikes coming regardless. Money is no longer free. A huge balance sheet at the Fed, Quantitative tightening, 32 trillion in debt, absolutely no money velocity with debt. Bring it all on I say, Feb. 4 next hike, 20 business days or so. I feel empowered wolf, thanks again you have kept skeptical an cautious.

remember democrats are spending like it’s raining fiat $dollars

and fed will produce

cheap side

$285,000,000,000 for big chip company welfare

$1,200,000,000,000 for inflation PRODUCTION act

and another

$1,700,000,000,000 for omnibus bill

now DON’T FORGET – we don’t live within our means so some 50-70% of these ‘budgets’ will be financed with NEW DEBT at 5%

$3T at 5% annually = $150BILLION – of course more NEW DEBT

A slow tightening process, steady employment picture, and persistent pivot narrative allows QT and higher interest rates to play out far longer than they otherwise would. Asset prices will have LOTS of time to drop.

For stock market Bulls, this is the worst case scenario.

And yet the DOW, NASDAQ, and S&P 500 are all up today.

So what? How many times does Wolf have to post that you will have face ripping bear market rallies in EVERY bear market before people stop being so surprised by them?

With the recent higher lows of the Russell 2000 and Nasdaq 100, this face ripping rally might be a doozy. But what goes up must come down in this environment.

they got 369,000 new PART time jobs

of course they didn’t mention they LOST 1k FULL TIME jobs

got 4 months to do several smaller projects

then it’s vacation time – on road may 15 to sept 15

I’ll come back and work winter again as usual

maybe this year I’ll get lucky and find some more reasonably priced property

My limited observation:

I work in hi tech and considered high wage earner. I didn’t see any wage increase other than nominal ones keeping in mind the inflation.

But the people at lower wage spectrum saw big wage increases.

I am also in Tech and did not see any increase in my base salary in several years. The company has been handing out RSU stock in lieu of wage increases. So far this has worked out well for all. At least as long as the stock doesn’t tank. That could be a 30% pay cut if it tanks 90% like some on Wolf’s infamous list. I suppose that makes my co-workers and I highly motivated to prevent that.

Meanwhile, my 17 year old daughter had a fast food PT job paying $20/hour.

The year before, at 16, she was paid $10/hour.

100% increase in wages for her.

Fast Food work should be $30 an hour. Poof! Gone the stigma of “flipping burgers.”

Incidentally, my work once took me back of house at 3AM in one of the better-breed of burger joints locally — a place renowned for paying and treating their crews like fellow human beings. It was as clean and tight as a surgical theater and the staff actually seemed happy & collected. Not what I expected. You get what you pay for sometimes.

Fast food workers job title must go. Rapid Caloric Specialist should raise the pay level appropriately.

I’m trying out lazy 20 year old who is finally realizing mommie ain’t gonna give him cigarette money anymore

gave him 2 landscaping jobs that I’ll inspect monday

if good then $50 cash – not going to waste paperwork on someone until they prove themselves

I’m in tech in the Bay Area and salaries, RSUs and everything have been going to the moon the last few years. That’s in part why people kept jumping to new companies every few years. Many people are starting to regret the moves now that they are the last in and the first out in a layoff but stagnant salary has definitely not been the story here.

Fast food workers job title must go. Rapid Caloric Specialist should raise the pay level appropriately.

My contention is, the pandemic was nonlinear, like a massive tsunami, and as the water energy has reversed back to a more normal flow, we’re still reviewing the damage on the shoreline.

Most of the damage assessment during the last year is irrelevant noise, which is unrelated to prior trends. The new shoreline isn’t the old shoreline.

Furthermore, it’s not smart to be speculating on rebuilding, on land that no longer exists. It’s gonna take a long time to sort this puzzle out.

Very good points.

What happens to the companies that fled to expensive higher land from the beach before the tsunami?

Do they get reimbursed for wisely not taking damages by the government even though their new home is now beachfront to a floating trash pile of risk taker waste dropping their new home value? All of Wolf’s imploded stocks list…

Will the government cover those who did take damage from the tsunami rather than responsible companies, picking winners and losers, since these responsible non leveraged companies didn’t take direct damage from the Tsunami, thereby making risk takers cash rich asset poor and cautious companies asset AND cash poor at least relatively?

Will the government enforce against/encourage risk taking behavior? Might as well given in and spend massively into debt as there is no hope for absolution or at least there will be a “pivot” or “bailout” or new “covid” spending bill with trillions of dollars stimulus so there is no point in holding back.

If you were running a company and you believed cash would hold its value, would you employ people you didn’t need.

Wolf makes the point that some companies may be hiring but not at the salaries of Meta for example as the reason for salary stagnation and layoffs but stable payrolls. This is undoubtedly likely. I know many people who have been laid off and found other jobs that are maybe not as attractive, mainly in tech or tech like jobs. But its only part of the story.

Big tech is shedding its unneeded employees bought by stock price and debt. Those employees are settling into less favorable jobs where those companies either need them to adjust to a rapidly changing future or get left behind.

OR, the cash value isn’t going to be there so they might as well spend on trying to push some of the projects they were reluctant to do so before.

Fed Reserve will slowly inch up on rates until this second gets close to evening out while yapping about Volker. They hollowed out land from under these safer companies in order to build a new sand wall on the new shoreline to maybe save these employment or banks or stocks or whatever. If so, I do not expect that unemployment will rise. Its happening too slowly.

Wolf’s theory is probably correct. Rates will rise. Employment will be fine. Dollar purchasing power will crater…

Pretty great analog.

our state is now going after legitimate workers who got some unemployment during covid

now they’re clawing back thousands

of course the person I know has spent the $$ to live on because his business got crushed – went from $4k month to few hundred

and state says he didn’t ‘qualify’

ZH had an interesting take.

[link removed by Wolf]

In the spring 2022, after the first rate hike, ZH kept postulating that the labor market would implode by the summer 2022, and that the Fed would be forced to cut rates and start QE in August 2022. It’s been the same song and dance forever.

Wolf, you are being kind to ZH. Their “gold is going to double this year” stories are pure….gold!

A running joke there is that ZH is bad for your financial health. Sure, someday some events will play out the way the doom-porners post there, but so far, as in the last decade… nope.

Yeah and it seems like ZH is pushing BTC and crypto too along with the gold.

We will soon see BTC off its 2-3 month sideways movement and going down towards zero where it belongs.

Crazy those folks over at ZH.

not sure what ZH you’re all reading

I’ve said all along crypto is ponzi scheme

oops – crash, bang, boom

ZH is now Pillow Fight Club. Going the way of the Hula-Hoop.

ZH is a joke. I wouldn’t be surprised if it’s a CIA/FBI front to gather information on their crackpot commenters and throw them into a pool of suspected “domestic terrorists.”

ZH constantly runs articles from Epoch Times like they were credible journalism. It is the mouthpiece of the Falun Gong religious cult. I believe it is funded and weaponized by alphabet soup agencies because of its virulent anti-China policies.

Yeah… Participation Rates again! That means something to me!

So 160M in the workforce, 5M looking for a job, 10M Job openings… means we’re about 5M short.

Productivity in Q3 decreased 1.3 percent, reflecting a 2.1-percent increase in output and a 3.4 percent increase in hours worked (have to make up for the labor shortage).

The cost pressures are still there and haven’t backed off yet… this means the Fed will keep hiking.

But we knew that!

I am counting on it. My only individual stock keeps hitting my sell orders. I am down to almost nothing. I will then be 15% cash, 80% short term treasuries, 2.5% international stock fund, 2.5% physical metal.

I plan on staying this conservative til stocks get cheap compared to short end of Treasury curve. You are supposed to get paid for taking equity risk.

Excellent plan. I am so glad to see short term t bills pay higher interest than long term that I am having a good time buying them. Walls street wants you to keep buying and selling…. But the market feels like a whack a mole game. So just be cautious…

you do realize 1/2 ‘openings’ are fake – companies have to advertise for ‘special’ tech worker before they hire H1B

recently company magically cancelled all job postings

can’t hire when you expect/demand exact skills

my workers continually look at me for doing jobs they ‘don’t know how to’

usually I’ve had little experience, do some research and then JUST DO IT

right tool for right job always makes work easy

Job openings data is NOT based on job postings. How many times to I have to repeat it here. This is based on what 21,000 businesses tell the Census Bureau how many people they laid off and fired, how many people they hired, how many people quit, and how many job openings they have that they’re actively recruiting for.

My gosh, Wolf, city boy thinking. Moreover, most all y’all are city people.

What are you going to do when it gets tough?

Hey — it’s never not tough in the city. Plus, Wolf swims in bay water colder than my beer in nothing but a fig leaf. That’s tough enough.

Dear Wolf Richter,

first of all, thank you very much for your excellent work.

Here is something that puzzles me concerning the US labor market. In a piece for Bloomberg today, John Authers mentions the gap between the “establishment survey” and the “household survey” which he calls “startlingly wide”. He cites a chart from Chris Watling of Longview Economics Ltd. of London, according to which the establishment survey shows 11.05m new jobs created in the US since January 2021 while the household survey indicates only 8.59m new jobs in the same period. From this Watling concludes: “There’s growing evidence […] that the labour market is much weaker than the bulls suggest. In particular, the employment data published in the establishment survey is not confirmed by the household survey, which is well known to be more useful/accurate, especially at major turning points in the economy.”

What’s your take on this? Would you agree to Watling’s assessment? Thanks in advance.

I am in a large tech consulting firm and things are getting tight. We definitely over hired during the pandemic. We are doing our best not to layoff folks but if business stays slow another quarter I think it’s inevitable.

HOWEVER, based upon anecdotal experience, I see no slow down anywhere in the consumer economy.

I hate eating out but to go out to eat for social obligation.

I went to foodie area of my town and restaurant we wanted to go had 30 minutes wait.

All the nearby restaurant were packed.

My nephew and his wife are early forties and both are making very good money as professionals. They have three kids, car payments, a large house payment and take at least half dozen vacations a year.

But I am pretty sure they would be in big trouble if we went into a severe recession as it takes so much money to keep the lifestyle in place.

1. He is outdated, cited an old chart or whatever. That gap narrowed today by a whole bunch (by 500,000).

2. The “household survey” includes the gig workers and self-employed, in addition to regular employees. The “establishment survey” includes only regular employees on payrolls. Huge difference. I point this out in every article on this topic, including here.

3. As I pointed out in the past many times, very aggressive hiring by “establishments” brought many gig workers onto regular payrolls. So regular payrolls (measured by “establishment survey”) increased more than total number of workers (measured by the “household survey”) because some of that increase was by hiring people who had been gig workers/self-employed and now have employee-type jobs.

Canada hired a lot of people too, and a few temp agencies which rely on greater fools coming to Canada for a “better life” can’t find workers to work in the modern day wage serf camps even if the wage is higher than minimum wage.

Strange times indeed.

What recession. It looks more to me like the usual suspects are conspiring to create this recession. Tech and Finance are complicit. When everything is based on lies, the liars have no other game.

There is a massive fearmongering campaign going on by all of the butthurt speculators that Jerome Powell and Co. just took out back to the woodshed and beat the tar out of. They are gnashing their teeth and wailing like a baby who was just taken off of mommy’s teat about some imminent economic collapse which is nothing but a transparent manipulative tactic to try to steer Powell to pivot.

Here’s My take on ‘wages’. We are (for most..) coming out of a halluciatory ‘botched’ pandemic.. where various & wealthy socio-politico entities have been caught with their shields up .. the various ‘kahns’ (read; CON$..!) collectively uttering Nooooooooo!!!, as many ” wage-erners” find the official fog has dissipated somewhat – allowing said employees to question WHY they should bust ass … ei. an chance taking the “obsure” proverbial chest hit when the scales of establisment bullsh!tery slide from their own eye??

I think that the whole ‘SarsCoV’ embroglio has given many a new understanding re. those with think thems selves as God$

Wolf. Delete this if you wish. I do find it quite germain to the current trends re. the inference towards ‘work’ .. and for who’s gain..

*’shields’ ‘down’…

“we’re All doomed”, sayeth the Scotsman.

A couple of comments I have.

Most work is hard and rather stressful. You have to have an incentive to do it. Government policy is about incentives and they blew public policy during pandemic. The incentives to work was/are diminished and a few million are evidently out of the workforce.

As investors we should try to look past the current state of affairs. In my mind the key thing to understand is the very long term trend which is increasing system leverage and diminishing real economic growth. The other thing to remember is Fed policy lag of around a year and mass layoffs occur in the 9th inning of the economic cycle.

If you look back 100 years you have to be able to survive an SP500 of worse case about 500 and a return to trend case of sub 2000. People are talking on the boob tube that stocks are cheap at 3800. That assumes a Fed put happening quickly I guess.

“If you look back 100 years you have to be able to survive an SP500 of worse case about 500 and a return to trend case of sub 2000.”

While I get that logic, and am positioned for that better than the average chump, that’s a highly unlikely scenario. Even during the meltdown in 2009, we saw <700, and not for very long. I really (REALLY) hate being that guy who says it's different this time vs the 100 year history, but…it is.

There's just too much global money, too much domestic money, too much indexing, chasing SP500 for there to be a push to levels anywhere near that. I mean damn, even the panic from Covid only took us to 2300 (or whatever). Of course you can say the Fed put, or belief in the put, kept equities from pricing in the true fear. OK, possible. But until the Fed folds up its tent and starts printing diplomas instead of USD, the put will still be in minds.

I'm not saying it's impossible, just very unlikely.

Gattopardo. Yes. A lot of money chasing fewer and fewer assets. Example. The Wilshire 5000, started in 1974 which covered every stock that is listed on the New York Stock Exchange, NASDAQ and the NYSE AMEX. It was around 5000.

In the 1990s, it boomed to over 7000. Now it is down to less than 3500. A 50% drop.

So you have more money in circulation now than in the 1970s chasing about 30% fewer stocks. More money than in the 1990s chasing 50% fewer stocks. No wonder Wall Street is aggressively looking to buy other assets like housing, farmland, etc.

Plus 401ks only let you invest in the stock market.

There are more ETF and mutual funds than actual stocks. Crazy once you really think about it. Then there is Blackrock that manages 11 trillion in assets. More than the GDP of Germany.

The concentration of who holds the money gets smaller and smaller. I think Fidelity has 7 trillion under management. There is no way the Government will ever let Blackrock, Fidelity, Schwab or Vanguard fail. You have a few people running these financial beast that are making boatloads of money off of fees.

ru82: Your comment: “A lot of money chasing fewer and fewer assets” is troubling me. In addition, the float of many, solid companies has been diminished over the last 10+ years with share buybacks. And, we’ve had “nominal” inflation of stock prices. So…

I tried a few searches to see if someone had commented on these aspects, but found nothing except the obvious – that some companies have done well buying underpriced shares, while others bought at peak prices, etc.

Theoretically, the current prices of stocks reflect the float (outstanding shares) and the performance of the companies – so the valuations should reflect the reduced share count. But, when I consider the points you made, about fewer companies, more money in retirement accounts, and general price inflation… I’m at a loss. Are we a-comin’ or a-goin’? PE and VC firms may be diversifying into other asset classes, but the majority of us plebs are in equities/bonds, including REITs and commodities, so there is some diversification.

My guess, with no real analysis, is that stocks should continue to climb in price, provided a given company is profitable and productive.

But, thanks for raising that point.

Yes. SP500 going to 500 probably will not happen, but financial markets have a history of statistical outliers. I think we had $18 trillion of negative rates that caused stocks to hit all time highs on price to sales. Once you have the boom, the bust is nearly inevitable.

Last time Volker killed inflation Warren Buffett closed down his investing vehicle because there was no money to be made in stocks. There is no reason to own stocks if treasuries are yielding 15% until PE’s get to 6 or 7.

@RU82,

“There is no way the Government will ever let Blackrock, Fidelity, Schwab or Vanguard fail.”

Why would any of them fail? Blackrock, the largest, carries (almost) no risk. They do not own much of anything — they are a service provider. They could opt to make clients whole if they f*ck something up, but that’t why they have risk departments. All those firms are not SIFIs.

“In 2018, 29% of Boomers ages 65 to 72 were working or looking for work, outpacing the labor market engagement of the Silent Generation (21%) and the Greatest Generation (19%) when they were the same age, according to a new Pew Research Center analysis of official labor force data.Jul 24, 2019”

But lots quit or died during pandemic, creating good and important jobs at a rate we have never seen before. That’s my theory … I’m one of them … still alive!

I look at the labor market through the prism of my 4 grown and all very different children.

Oldest son (32) got his GED, and is engaged to marry a girl with a GED. She has a now successful small business. He helps her in her work, but prolly not nearly as much as he should be, knowing him. Household income about $90k.

Second son (30,) HS diploma. Working for 5 years in a warehouse for a vitamins company, now a shift manager. Spends literally everything he makes, has only $1k in a savings account. Income $75k.

First daughter (28), BA Degree in Economics. Insurance executive at insurance company, currently also living in an alcohol treatment facility. Income about $80k, though only part time for now because of her treatment. Company says, “take all the time you need, your job is still here whenever you want to go back to FT”

Second daughter (26), HS diploma only. Works 3 PT jobs waitressing (2-8), bartending (9-2AM, and weekends), and dog walking (mornings). Income (no kidding): $80k.

_____

Methinks some of the demographers are right: there is a severe shortage now of ANYONE who is willing to just show up and put in the hours, and if that’s what the Fed is going to go by, the rates will keep going higher and higher until—what exactly?

Here’s a generational/economic side comment to your post:

How many of your children will themselves have 4 children like you did? Easy answer.

Yeah. They definitely need to hurry. By age 28 I had 4. They’re at 0.

Thanks for the ground report — it presages a demographic crash of epic proportions.

Looked like markets wanted to rally today regardless of payrolls. Interesting to see what the tone is like from Powell next week with yields crashing this week.

I was a pensions manager in a former life. First week of the quarter, tens of billions of dollars roll out of employers’ vested accounts to fund retirement plan contributions for their employees. That’s when almost all the companies’ “matching contributions” hit the market, and it’s a tsunami of money that will go automatically into stock and bond accounts, all by formula.

You’re right. It’s going to be late next week that we’ll see what the market is supposed to be like. This week was going to be just noise, with the talking heads trying to fill air time and say something besides “it’s that time of the quarter again”.

“It’s going to be late next week that we’ll see what the market is supposed to be like”

Maybe, but then again we have CPI on Thurs, so the musical chairs game of trading around what is believed others will do will introduce plenty of noise.

That’s the “thing” about this market. IMO, there’s very little actual trading around belief in the fundamentals. No one bought today thinking “OK, whew, now the Fed can tighten less, and with a lower rate environment for shorter, equities are worth more to me, and even better, their EPS will improve.” HAHAHAHA. No, it’s more like “sweet, bro, everyone else is going to think the Fed will pivot, or everything will think everyone else will think the Fed will pivot, so I’mma buy me stocks NOW before they go up more.”

Thanks, Kevin. I’ve never heard of that before – that plan contributions are made 1st week of a quarter. Is that every quarter or, if a company is on a calendar year, the first week of the 1st quarter (January)?

This piece is exceptional in the way that it explores the psychological impacts of media headlines on the popular mindset. Thank you, Mr Richter

It’s ironic that much of inflation is due to “stories” that we repeat and reinforce. Same with almost all pricing – we anchor price points and get alarmed when they change. Then we bitch about it or exploit it.

That’s why I think gold bugs are in a “consensual hallucination” thinking that there’s some intrinsic value that gold will always have. Yes, it has global acceptance, but so does a pretty woman.

The labor issues narrative is really being pushed. I’d like to see the same analysis on the corporate and other sector price action.

Online I see claims that’s amounting to around half of the current inflation picture, yet nobody says much about it. Half of 7 is 3.5% which would be much closer to where we want to be.

I guess if they can’t make big money off low interest rate capital, they gotta hit the top line.

1) The Labor force of people between 25Y and 54Y participating rate was

trending up until 2019. In the last 3Y we should have a participating rate

of about 85% instead of 82.5%, if we stayed on the old trend, but the 2020 “event” changed everything.

2) More people in their prime age are in tech, vocational programs, especially minorities, kids from the crumbs areas and new immigrants.

Some are apprentice, others are in truck driving schools.

3) When they grad, they compete with each others, driving real wages

down.

4) These people like to work, for the sake of working, for self respect, even for less real wages, They are home makers who work to feed a family.

The woke colleges are not for them. They like real, productive jobs, benefiting from robotic and AI, paying twice as much as woke bs jobs.

Enlighten me: What is a ‘woke BS job?’ For that matter, what is the opposite?

1) The Labor force of people between 25Y and 54Y participating rate was trending up until 2019. In the last 3Y we should have a participating rate of about 85% instead of 82.5%, if we stayed on the old trend, but the 2020 “event” changed everything.

I saw that trend line too but how high can it go? In 30 years should it be at 113% participation?

After a 15 rounds bout McC was declared a winner.

China threat is growing, but the cancer inside our country metastasized.

We will have to Chemo the Mexican cartel.

I would have been one of the holdouts and would have nominated Wolf! I would have been on guard for the guy with the cheap toupee if he took a swing at me.

You have to be a rocket scientist to understand the demographics shifts.

What has changed is the media narrative.

The numbers aren’t changing.

Get people to worry about keeping their job or the ability to find a new job and they stop asking for raises. The don’t quite to find a better job.

Until there are real changes in the numbers it’s all phyco-babble.

Has anyone else noticed that the narrative we are told is happening and the narrative we live, keeps getting wider and wider apart?

Hello everyone.

The other day I did a calculation of inflation in the US from 2000 to 2022 and it gave me 73%

On the other hand, I did the calculation, in the same period, of the barrel of oil and it gave 220% with oil at 80 U$ a barrel.

Take 80 U$ as the average of the last months (variations are impressive but 80 U$ is fine)

Beyond unemployment, the increase in oil affects all activities.

How do the American people feel about this increase?

Please check the calculations I did!

You just picked the wrong moment, that’s all. In the summer of 2008, a barrel of oil (WTI) hit $150. And then six months later, it was at $30. And then…

Oil does that.

Hello Wolf

I did not choose the wrong moment, as the start I chose the year 2000 because before that it did not have such abrupt variations (not going into the 70s especially), the route implies the ceiling of 133 U$ and April 2020 of 17 U$ in recent times I chose an average of 80 U$ Despite the variations, today it is approximately US$75.

What I try to show is that energy, especially oil that moves all transportation, and agriculture, is the basis of the economy. There is no replacement in the short term and I dare say in the medium term. If the meat increases you can not buy it, you can change the car to a longer term, etc.

But without oil or oil at a very high price we will have serious problems. We still do not realize this and how difficult it will be to change to energies with less density

I want to add that such large variations are just as bad as the rise

A greeting for you

Oil consumption for transportation has been declining in developed economies for years! Vehicles have become more efficient and use less fuel, EVs are becoming popular, etc.

Where oil consumption has been rising is in the petrochemical industry to make plastics, etc.

Oil consumption has been increasing, look at the EIA graphs, except in the pandemic, you also have to add gas liquids, biofuels, or elements that were not there.

I clarified that the problem is value and it is no coincidence that just after oil reached 130 U$ the crisis of 2008/09 came

Electric cars still do not move the thermometer, let alone heavy vehicles.

Even though the vehicles are more efficient, the increase in vehicles per year brings us to 1400 million vehicles, plus ships and trains. It happens that the moments of crazy growth in Southeast Asia are long gone.

Can you comment on the composition of jobs as it relates to full versus part time jobs and what impact if at all part time jobs may be having on the numbers impacting the level of employment and hourly wages?

Thank you.

Announced layoffs are a psychological ploy to talk down the inflation that is harming valuations.

Would be unneeded if fiscal mechanism were sorted for stability and robustness

The 700,000 for new hires was for part-time positions.

In part this demonstrates yet again the dangers of aggregated data that hides a lot of variation within sectors. The pain is not evenly distributed.