The seller-buyer standoff.

By Wolf Richter for WOLF STREET.

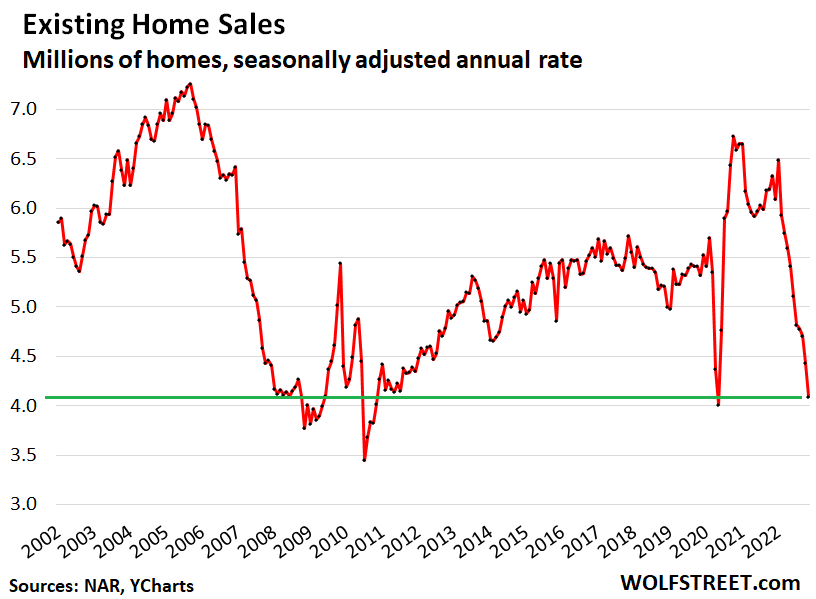

Sales of all types of previously owned houses, condos, and co-ops plunged by 7.7% in November from October, the 10th month in a row of declines, to a seasonally adjusted annual rate of sales of 4.09 million homes, nearly matching the lockdown-low in May 2020. And beyond May 2020, it was the lowest rate of sales since deep into Housing Bust 1, November 2010, according to data from the National Association of Realtors.

Year-over-year, sales fell by 35%, the 16th month in a row of year-over-year declines. Compared to the recent free-money peak in October 2020, sales were down 39% (historic data via YCharts):

The above sales figures are “seasonally adjusted annual rates” of sales, so what sales would be like for an entire year at the current rate of sales. Actual sales in November, not adjusted, came in at 326,000 homes, also down 35% from November 2021 (503,000 homes).

Cash buyers are massively pulling back. All-cash sales accounted for 26%, or for about 85,000 homes, of the total 326,000 homes sold in November, as measured by actual sales, not seasonally adjusted annual rate. This was up from a share of 24% in November 2021. But given the much higher number of homes sales in November 2021 (503,000 sales), the 24% share of all-cash sales amounted to 120,000 all-cash sales.

In other words, the actual number of all-cash sales plunged by 35,000 year-over-year, though the share of all-cash sales inched up by 2 percentage points amid plunging overall sales.

Individual investors or second home buyers are also massively pulling back. They purchased 14% of all homes sold, or about 45,640 homes (actual, not seasonally adjusted annual rate), down by nearly 30,000 homes from November 2021 when they bought 75,450 homes (for a 15% share).

Cash buyers and investors are like everyone else: They too see what’s going on in this housing market.

Sales of single-family houses plunged by 7.6% in November from October, and by 35% year-over-year, to a seasonally adjusted annual rate of 3.65 million houses.

Sales of condos and co-ops plunged by 8.3% in November from October, and by 37% year-over-year, to a seasonally adjusted annual rate of 440,000 units.

Sales plunged in all regions, but plunged by the most in the West and the South. Month-over-month and year-over-year:

- Northeast: -7.0% mom; -28.4% yoy.

- Midwest: -5.6% mom; -30.6% yoy.

- South: -7.1% mom; -35.0% yoy.

- West: -12.5% mom; -45.7% yoy.

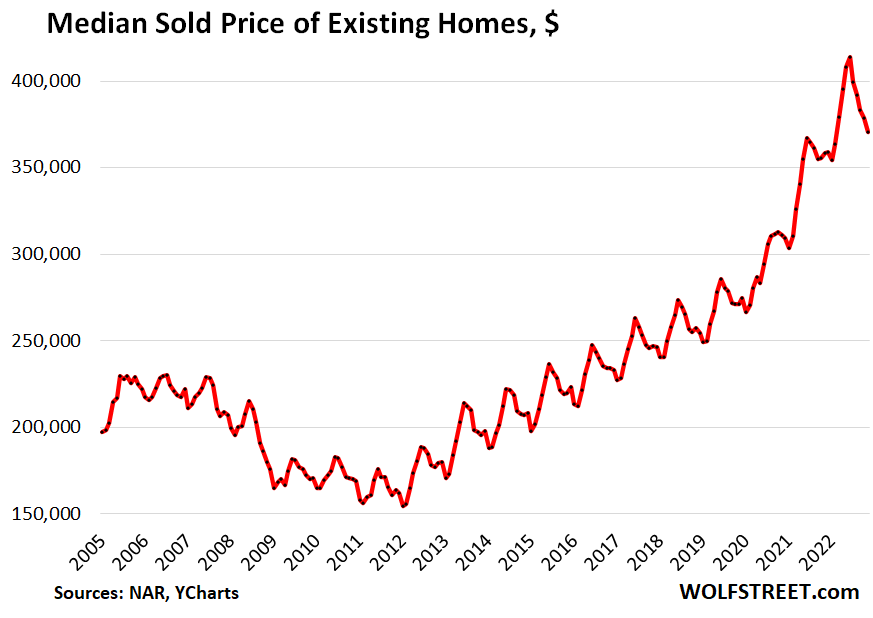

The median price of all types of homes whose sales closed in October fell for the fifth month in a row, to $370,700, down 10.4% from the peak in June. This drop slashed the year-over-year gain to just 3.5%, down from a year-over-year gain of 15% a year ago.

Only a portion of this June-November decline is seasonal. Over the five years before the pandemic, the average June-November decline was 5.8%, with the maximum decline in 2015 of 6.9%. This shows that the current 10.4% decline goes well beyond even the maximum seasonal decline. This is also confirmed by the rapidly shrinking year-over-year price gain, now down to just 3.5% (historic data via YCharts):

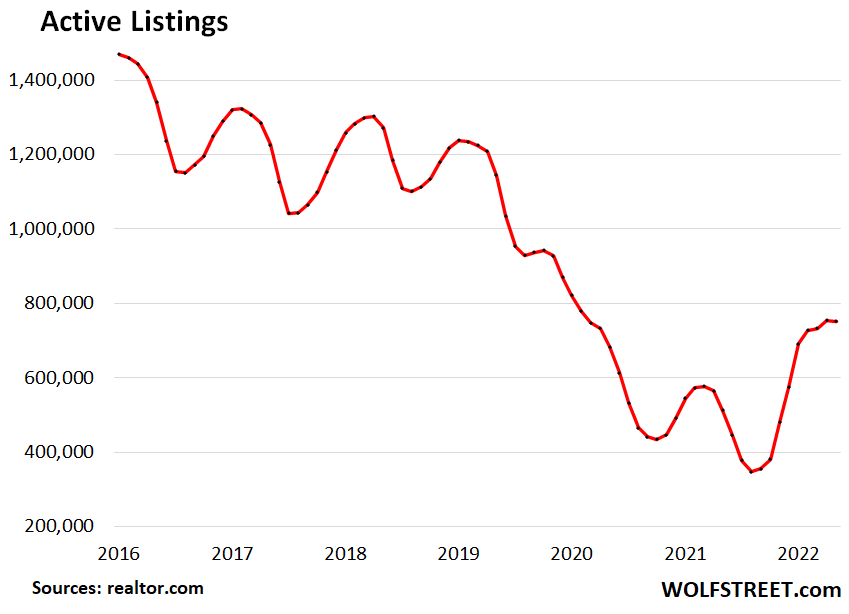

Active listings (total inventory for sale minus the properties with pending sales) were roughly stable with the prior month, at 751,500 homes in November, but up by 47% from a year ago and the highest since August 2020.

Active listings remain relatively low as many potential sellers are praying for a magnificent Fed pivot that will slash mortgage rates back to 3% in no time, and they haven’t put their vacant home on the market because they’re still thinking that this too shall pass; and if the home has been on the market for a while and got no nibbles, they’ll pull it off the market, particularly during the holiday period (data via realtor.com).

Months’ supply in November was unchanged from October, at 3.3 months, both months the highest since June 2020.

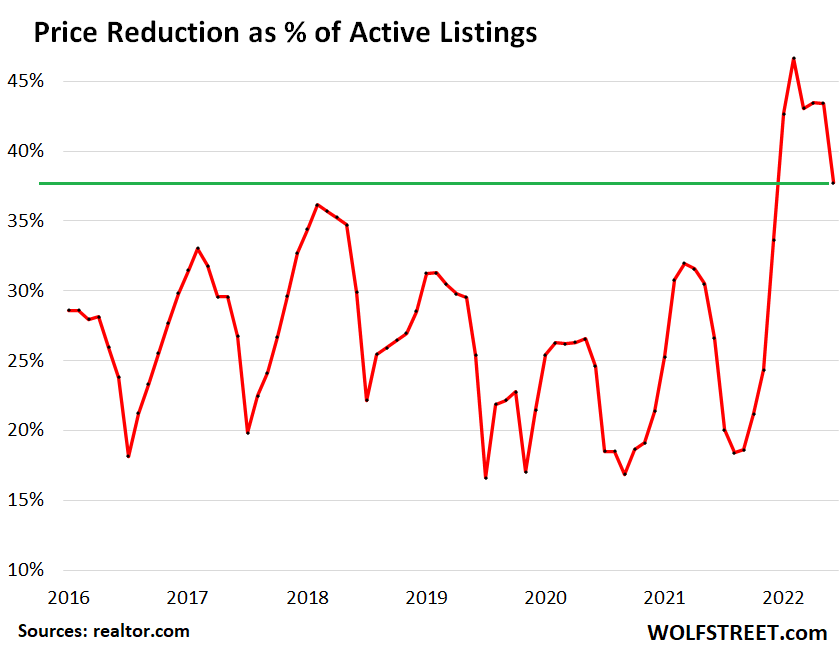

Price reductions: In November, 38% of the active listings had price reductions. While down from the prior months, all of the past six months had a higher proportion of price reductions than any of the prior months in the data from realtor.com going back to 2016 (data via realtor.com).

Seller-buyer standoff: This combination of plunging sales, dropping prices, rising but still tight supply, and a very high proportion of price reductions when homes finally do show up on the market indicates that there is a standoff between potential sellers, who think they’re going to outwait the Fed’s inflation fight; and the potential buyers who have zero appetite for overpaying, with even cash buyers pulling back massively, though they’re not dependent on mortgage rates.

As always, homes that are priced right are selling just fine, but “priced right” means priced down there where the potential buyers are, and there are plenty of them, but they are several floors further down. And as potential sellers figure this out, their homes are going to sell.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Cue the deniers, with their usual scarcity excuses, and how no one wants to give up their 3% mortgage. Re: the latter, CA has had the equivalent for property tax for decades, and we’ve seen that plenty of supply trades hands anyway.

You ain’t seen nothin’ yet! (Realtor(R) 44 years in Silicon Valley.) Where’s the bottom?

Nasdaq is down 35%. Housing is down only 10% to 20% on paper depending on region. So we have a long way to go.

Most homeowners still feel that Fed owes them a Pivot in lieu of all interest payments and property tax payments. There may be a few surprises.

On a side note, as quarterly closing numbers roll in, expect surprise mass layoffs in First week of January itself!

and I expect to raise rents 10%

Yep, there will be blood in the streets come January. Nobody wants to fire anyone before Xmas…. but after? Will be vicious.

Probably a few sectors that will remain intact, but a lot of the white-collar bullsh*t jobs will trimmed like the fat off a steak. Good riddance.

I think Kunal or Lawrence Yun will have a bone to pick with your comments. It’s just a gully!

A gully the size of the Grand Canyon, and we’re standing on the North Rim, heading south fast.

Wisdom – indeed, few vistas as that one, when seen stepping out of its bordering forest at sunset, are as impressive – or terrifying…

may we all find a better day.

OK, so heres your dose of deluded optimism then. I can’t help but wonder if higher mortgage rates and still-too-high prices will provide support for much less expensive markets (Albuquerque, Columbus, Birmingham, etc) as investor activity shifts away from wildly overpriced markets (Austin, Boise, Tampa etc). There are still going to be buyers who will have to accept that they will probably never be able to afford Oakland or Anaheim or even Sacramento or Riverside…but theres still plenty of deals to be found in Fresno. Maybe work-from-home is here to stay if only because no one can afford the Bay Area anymore.

I’m keeping my eye on the unemployment rate as my cue to sell…

Deals… in Fresno? As someone born and raised in Fresno who follows the housing market here on regular basis, there are no deals to be found currently in Fresno. Prices have a long, long, long way to fall for a deal to happen here.

JB – as I learned in the Spokane area in the ’80’s – early ’90’s, a ‘deal’ is a relative term depending on if you’re a local or an immigrant…

may we all find a better day.

I understand that. Yet prices in Fresno shot up easily 100k in a year on houses that were only going up 10k a year. It’s absolutely not the time to buy anything in Fresno. It’s very 2006 here right now. With tech layoffs and all of the Bay Area transplant wfh folks… perhaps you’ll find a deal here. But not today.

Just saw a .5 million dollar house in Spokane go pending — who’s shopping in the dead of winter in Spokane??

Funny world we live in…home sales is crashing, pricing is coming down fast…yet wealth effect still in full effect and consumer confidence is going back up despite stubborn inflation…

To these house sales # I say let it snow..let it snow..let it snow..I will view this as my own little Santa’s rally

Read somewhere recently that a huge amount of consumer confidence is tied in with the costs of gas in a given month, so the recent declines at the pump often have a wildly disproportional effect on the confidence numbers. At least until the bills for rent, home heating, and food kick in..

But but but Lawrence Yun at the NAR just said that houses are in bidding wars and going for above asking..

This is what Yun said in the press release:

“In essence, the residential real estate market was frozen in November, resembling the sales activity seen during the COVID-19 economic lockdowns in 2020,” said NAR Chief Economist Lawrence Yun. “The principal factor was the rapid increase in mortgage rates, which hurt housing affordability and reduced incentives for homeowners to list their homes. Plus, available housing inventory remains near historic lows.”

haha pigs will fly now since even Lawrence Yun is acknowledging the slow down…since I didn’t read the press release the question is what does he project for next year? I am guessing like Zillow or Redfin they are still forecasting growth next year at a smaller %

I don’t normally subscribe to TikTok but does this seem accurate? I always need my info spoon fed 😂

Regarding second home purchases, one of my community bankers here in booming rural America said they now require 30% down vs. 20% down on second homes, and the same goes for financing lots to build on.

That said, while our booming rural market peaked in price in the summer, the market is still a strong seller’s market. It’s not “on fire” anymore, per the big agents in town. The best I can tell, following homes in the $700-900K range, that market has taken a 7-10% haircut in the last 4-5 months. In the next two to three months, I’ll be listing my home, which should be in the $800K range, and I’ll report back. I paid $395K for it in July 2015.

Thanks for your post. Really needed a good chuckle from a realtor joke.

Here in Reno we are just hearing crickets and the #s you are listing are a bit better but this is getting ugly! The new property tax assessments are in and they are substantially higher! Come June home owners will be paying a big increase in the tax bill. Can you elaborate on what is happening in the foreclosure theater? I managed 5 privet investment trusts from 2016 until 2019 and had 5 flips going at a time when the foreclosure moratorium was created. That essentially put me out of business. I am waiting for the court house steps to start getting active again but the forward indicators I am seeing shows no sizable numbers of foreclosures coming soon? Any insight

I don’t think you’d see any significant foreclosures but the prices would still fall.

I’d guess lot of investor, short term rental folks would bail out this coming spring summer.

yeah have some old friends in Reno, most of them non-investors just living in single-family homes they’ve had for years, many raising their kids in them and they’re mad as heck about the property tax increases. It’s not like their income has gone up or they’re investing or making money from the property value increase, they’re just sitting there but all of the Bay Area money moving in has driven home prices sky-ward. Never made sense to me push up property taxes so much based on higher assessments, which after all are just a paper theoretical value that isn’t actually liquid in any way–a homeowner can’t just go withdraw extra cash from an appreciating home to pay for those extra property taxes, and many wind up with liens and lose their homes esp if they get sick or wind up in something like divorce that cleans them out financially.

There was a scary TV special (maybe on Nat geo) on how a lot of the homeless in many US cities are actually professionals and formerly homeowners–many even still working–with good incomes, but got wiped out with hospital bills or the court costs, alimony and child support bills from divorce. And then property taxes became unpayable, so they lose the home. It really can happen to anybody, would make more sense to reserve the property tax increases for someone actually making money from real estate investments or in the process of selling. That’s how a lot of Europe and South America do it at least for a primary home (and you won’t go broke from medical bills or divorce either), but it’s just too much of a cash cow for municipalities to stick it to small homeowners who just want shelter to raise their families in.

My guess is that the cash buyers are largely moving home equity from one home to another. So they sell one home and move the equity to a new home.

It is still easy for home owners to deny that home prices will fall much further. They look at year over year and say that it is only back to where home prices were in 2021, so no big problem. As prices continue to melt down, this denial will start to fade. And demand might plunge even further, since the new downward trend will be very obvious for all to see.

Prices really should not only fall to where they were in 2018, but probably much lower, given the much higher interest rates. 50% top to bottom is likely and at the bottom there will be carnage, with tons of foreclosures and short sales, probably in the middle of a really bad recession.

I always ask housing bulls “why should housing be higher than before covid?” Not one has given me a good answer.

Really a dumb question Gattopardo, Supply and demand both labor and materials. People renovating and additions mostly in the blue states but in the red states also and people moving from blue states to red states where covid restriction weren’t so crazy. Then you ave shut downs or restrictions from the covid scared policies effecting production increasing demand companies that are still at work. This is not to mention all the free money that we all got. If you don’t understand the consequence of that on an economy from the upside to the down side then you really do need to have a deeper conversation with someone who knows than I can give you hear.

How about inflation? Inflated wages. Inflated stock portfolios etc.

It depends on affordability such as the total home cost (mortgage, insurance, HOA fee, and property tax) is not more than about 35% of household income. I believe for FHA loans, it may be higher than 35%.

The 30 year rate now is around 6%. It peaked back in October around 7.2%.

For every 1% increase in the 30 year mortgage rate, generally there is a 10% drop in price.

If the rate steadies around 5.5% in 2023, and peak prices are based on about a 3% rate, then home prices could drop 25%.

From what I’ve read and listened to such as WBBR (Bloomberg Radio), the Federal Reserve wants asset prices to cool down to early 2020 levels.

They already accomplished that a few months ago for the S&P 500 when accounting for inflation.

AD-

I think you’re mistaken on a couple of points.

First, mortgage rates won’t go to 5.5%. The Federal funds rate will likely hit that, if not even higher, which means there’s no way 30 year fixed mortgages will be there. The drop from 7% to 6% in recent months is temporary. As the Fed continues to raise rates and QT starts to squeeze money out of the system, rates will continue to go higher. I expect a minimum of 8% and perhaps higher before we see any sort of sustained rate cuts (although there may be temporary fluctuations). If we use your calculation of a 10% cut in price for each 1% rise in rates, that implies a whopping 50% haircut. That might end up being more than the Fed can bear, but in California’s hottest markets (Bay Area, SoCal), we’ve already seen drops of >20% in just six months, with no end in sight.

Second, the Fed does not want assets to cool to early 2020. They aren’t targeting asset prices at all, anymore. Their focus is on inflation. Asset prices are just collateral damage. If inflation gets down to 2%, while assets stay at 2022 levels, that’s great. OTOH, if the Fed’s inflation fighting results in assets crashing to 1990 levels, oh well. At this point at least, the Fed does not care about asset levels, only inflation (although that can certainly change).

Lune, higher asset prices tend to lead to inflation.

I include housing as an asset and higher housing prices means investor landlords will try to pass higher rents onto the tenants; this is for them to realize a positive ROI on their recent purchase of investment real estate.

If stocks go up, a lot of times people will spend some of the earnings, thereby increasing the risk of inflation.

Lune, also the 30 year mortgage rate is generally synchronized with inflation.

The mortgage rate will decrease as inflation decreases.

I see inflation or CPI continuing to drop well in 2023 .

I’m with Lune and call BS that mortgage rates peaked. AD states they’re …”generally synchronized with inflation.” I think that’s denial talking. Who’s going to buy MBS at lower rates than a risk free yield in treasuries???

I’ve always hear to watch the 10 year.

“For example: Treasury yields impact conventional fixed-rate 15- and 30-year loans − and the higher that 10-year Treasury rates go, the higher that home mortgage rates will climb.”

As the old saying goes, those that sell first sell best. I understand the seller’s position of trying to out think the market and wait for a turn around in home prices but I believe they are missing a key concept the equity markets learned long ago. That is, at the end of bull markets, there tends to be a final blow off top that generates a late 10 to 20% rise in value based on nothing but hope and prayers.

Well, the housing market went through this from the 2nd half of 2021 through the first half of 2022 as the last 10 to 20% increase in home prices was based on nothing but greed and excessively easy money. And for some reason, sellers just don’t want to accept that the last year of home price increases was not real nor sustainable.

Hence, the smart home sellers either a.) got out roughly a year ago or b.) understand that out of the gate, if they want to sell their home now, start by dropping it 10 to 20%. If I’m a home seller in today’s market, I would be aggressive, adjust/drop the price and sell first as it is clear that not only is the Fed going to stay vigilant with higher rates for longer but more importantly, if broader based layoffs and a recession take hold, the value of homes have only one way to go. Down!

So those that sell first, yes, they will sell best and unload properties that can quickly become very expensive to hold.

Ny former roommate in PHX listed his house for $575K in June 2007, or somewhere around there.

He rode the market all the way down and finally sold it in 2009 for $350K.

A second realtor had advised him to list for $500K.

It’s funny, that when it comes to other assets, people can be totally rational, but are irrational when it comes to real estate.

For example, if someone said “I would never sell TSLA today for $140 when I could have gotten $380 a year ago!” you’d say “Yeah, well, that was then and this was now.”

But when it comes to houses, people think “I’ll never sell it for only $850k. It was worth $1 million a few months ago!”

They are unable to realize that the “peak value” is in the past, and likely not coming back. So playing “coulda woulda shoulda” isn’t all that helpful.

Talking to relatives, friends and co-workers you get a sense that housing, especially if you have skin in the game is like a whole other level of cultist mindset. The narrative of housing is the safest bet and it will always go up runs really deep. There’s so much emotion linkage to it, it’s not something you see with the stock market for most, and this is compounded 10 folds in asian countries like China or Hong Kong until maybe recently..

You can probably create a religion call the Church of RE and have plenty of people sign up to sing prosperity gospel all day long.

Maybe it has to do with the fact that RE is so highly levered – a very large percentage of buyers have their financial butt hanging over a cliff (if home prices fall below purchase price).

Nothing else is as expensive or levered as RE…and many owners have little understanding of pricing dynamics.

All that bottled up worry turns to fear, fear turns to terror, and terror turns to denial.

Agreed everyone talks about housing as an asset that will at the very worst slowly appreciate in value. Plus with the amount of money that goes down the drain when you own it’s hard to justify if you don’t think it’s going to go up in value constantly

True Phoenix. Hats off to the RE industry for effectively marketing the “always up in the long run” myth. Their claimed “returns” often do not account for all of the costs of owning real estate (like insurance, property taxes, maintenance, repairs, improvements etc.) They simply look at the selling prices and *POOF* we have a magical “always up in the long run” investment. Happy days are ALWAYS here again.

This has little bearing on the return for the average homeowner. Their individual rate of return depends on their purchase price, which may or may not have been favorable compared to the current market conditions. The FOMO people who invested in rental properties in the past three years are finding that out. Search #Airbnbust. As others have posted in this forum, I have zero pity for that group.

Real estate is a utility asset that has been overmarketed into an investment asset by an industry busily serving its own interests at the expense of the naïve. Fed interest rate policy poured gasoline onto that fire.

This has worked in most of the US in the last 50 years because we left the gold standard and are on a Fed standard of 2-5% annual inflation. Also many areas have drastically limited home building in a way that didn’t exist 50 years ago.

The object of owning a home is owning a home. A home is not an investment, it’s a place to live.

True. But over decades I’ve never met anyone who lost money simply because of the inflation compounding. We all need a place to stay. Maybe 2 or 3. And we you reach your 50s (and it gets worse with time), if you don’t own you need to pay rent which can be outrageous in big cities. I’d venture to say that a large number of retirees could not afford to rent the house they own.

Some things just don’t “recede” very often: like wages, taxes, insurance, the cost of construction of homes. Housing prices have receded, briefly, but have risen at about a 3% clip over time (excluding the recent home-price runup).

With continuous inflation, slow and fast at times, there’s little deflation in the historical record. Flat-out depressions temporarily reverse prices, but they are very rare and, with inflation ongoing, the effects disappear over time.

All major assets don’t move in the same manner as RE. Companies can go negative on earnings, their prices drop, they go broke or recover, but historically stock averages have risen. The composition of companies in those averages change, too. So, lumping all assets into the same heap isn’t wise.

RE has two main values: land and improvement. If land value rises, due to commerce, demographics and scarcity, the improvement (bldg) may or may not change value or may even depreciate. But, because inflation is a pretty permanent fixture in the economy, I don’t think that housing is going to act in accordance with assets such as stocks or bonds.

Well said HowNow. I might add, when the FED targets 2% YOY inflation (which we know is more likely 3% because they are always changing how CPI is calculated), real assets will go up over time via troughs and peaks. Overbought then oversold. Over the long term, real estate will go up. So will the stock market. So will land, gold, oil, food, etc.

sorry, but housing is based on supply and demand. the demand curve is substantially lower than where it was in the past. the supply curve is also pretty weak, but that will pick up speed as prices drop further.

RE is a non-productive asset. It really should be purchased based on the price that can be afforded as a cost. Unfortunately decades of interest rate repression put up on this crazy RE bubble path. Now we get to explore the other side of real estate – the leverage part, where price declines wipe out the financial assets of owners.

“And for some reason, sellers just don’t want to accept that the last year of home price increases was not real nor sustainable.”

You mean the last three years, at least.

companies like opendoor are buying the properties that cut their prices on the mistaken belief that they can flip them for higher prices. soon opendoor will be out of business for good. zillow was smart to get out of the flipping market.

“Individual investors or second home buyers are also massively pulling back. ”

This seems to be the key to put the final pin in the housing bubble. Many of these investors who purchased vacation and other rentals last year thought their investments would always pay off as home prices appreciated (and they would get rents on top of that). At the time there was really no risk in buying investment properties.

Many of them are now getting their assets handed back to them (ask the Airbnb folks). They must sell and sell soon to avoid further losses.

The key is for 30YFRM stay as high as possible, for as long as possible.

I have a friend who’s a realtor. He says anyone buying a home in the last few months with a mortgage is doing a 3 / 5 / 1 load. Fixed 3 years with buy down points, then the rate jumps up to a certain % and then goes to a market rate or there about after 5 years.

That is interesting info and just the sort of psychotic game playing (invisible to our God like betters in the Fed/DC) that leads to “surprise” collapses.

And lenders only take on such crap because in their wormy souls, they expect/demand DC to bail them out (see US Debt and/or inflation).

So instead of inventing more cost effective housing, the US invents new forms of hopeless, doomed loans.

The US has become such a sh*tty, sh*tty country.

Take a few Excedrin and call in the morning.

This country has problems, but it should not be confused with the genuinely and permanently “shitty” predicaments that some people in this world are subjected to. Glad to be here rather than Moscow or Dhaka.

And every real estate / mortgage guru says, but this time is different. We don’t have all those bad / subprime loans. Well. guess what? Subprime was only 12% of the market in 2008.

Prices are greatly inflated, and we’ve most likely moved past key metrics such as debt to income ration. Credit card debt is going up including interest costs just like back in 2007 leading up to the GR. Car debt is absolutely through the roof. The average Rav4 payment is $600 a month. Rent is through the roof & overall inflation is a good bit higher than 14 years ago.

If a real recession gets rolling, we’ll find out very quickly what 10M open jobs mean. The ONLY think holding up the economy is the labor market. Once that goes, we may find ourselves in a GR v2.0.

The 30 year rate has dropped from a recent peak of around 7.2% to currently 6%. I see the rate slowly dropping to and steadying around 5.5% by end of 2023.

I am in a hot Southeastern housing market and I am happy to report that over the past month or so there has finally been a drastic reduction in the amount of unsolicited “I want to make an offer on your property” calls. Over the past month I’d say it’s gone down from 4-5 calls per property per day to one call per property every other day. Meanwhile, median sales price per square foot has remained fairly stable, down only about 4-5% from the July peak. Rent prices OTOH have dropped 10 to 15% and are now also affecting the big, national management company-run apartment complexes as well. That said, there are still some laggard landlords who keep asking for ridiculous rents. Those properties can linger on the market for months.

I estimate that the cost of a typical home mortgage payment + prop taxes + maintenance is about 40% more expensive than renting an equivalent property in my area. It’s hard to tell how long such a wide disparity can last. The standoff between buyers and sellers that Wolf speaks of, especially in still-hot markets, is indeed alive and well.

For the sake of my younger cousin who just moved there, I wish Miami rents had dropped 10-15%. If anything, they’ve gone up more!

That’s why i love Miami RE, there’s nowhere to build but up!

Unfortunately, Miami is kind of an outlier compared with the rest of Florida and the Southeast.

In most of the Southeast housing inventory has risen significantly, except Miami where not only has it not increased but it’s actually decreased to below 2021 levels.

Annodatal from 33950 sw Florida. Inventory rising, sales slowing alot. Location has alot of snow birds who own for the cool 6 months. Ian did significant damage, but nothing like fort Myers and other surrounding areas.

At height of mkt spring 2022, 2000 sq ft, 15 years old, pool and dock were fetching 1.3m, compared to 950k 2018, 2019. Now there is a way over supply in those price ranges and anything priced over 1.050 doesn’t stand a chance. The stuff that could fetch 1.5 to 1.7 is now priced at 1.2 to 1.4, with little moving. The have been some comp buster sales of recent on nice properties in those higher ranges and those are starting to have an effect.

Many manuf home parks, which really took a hit in the storm. If over 10 years old no one will insure, so that whole segment is a mess. Roofs on all types of prop took lots of damage and now wind ins is getting very difficult to get.

So potential buyers are not only very picky, but if they cannot get a firm insurance quote prior to buying, then no sale. As a result there would be many many more listings, but can’t till repairs are complete, inspections finished, insurance claims done.

I suspect this market will get alot tougher after 1st of year and cash will really talk.

I wonder…

How many sellers have plenty of equity, plenty of money in the bank and plenty of time in which they don’t need the Dineros to feed the alligator.

In other words, how many sellers are not selling due to death, divorce, growing family, shrinking family, loss of job, new job, retirement, just want to move and can easily write the monthly check for months for:

Principal, interest, property taxes, insurance, utilities, maintenance, upgrades and cleaning?

“that there is a standoff between potential sellers, who think they’re going to outwait the Fed’s inflation fight”

But as the guys on the Altos Research podcast pointed out the other day, the market makers are the investors who are making rational and non-emotion-based decisions…and they are dropping prices and selling, even at a loss. Even if the individual sellers are holding back (given their 3% mortgages), the investor types are not and they’re the ones making a much more significant share of sales and establishing the comps.

Case in point here in AZ: Opendoor bought a home in February 2022 for $517K. They put it back on the market with some renovations in May for $685K. Over the next five months, with no buyers, Opendoor cut the price 12 times and finally sold it two weeks ago for $492K and $7K in seller’s credit according to the listings. Opendoor was willing to suffer a loss of at least $25K, not counting the seller’s credit and cost of renovations and carrying the property, in order to dump the house. And here is your latest sales comp.

Where did you see that opendoor bought it?

Also seeing some sold for low prices off market. Never made it to the MLS. Only one said it was part of a multi property sale, but I think several of them might have been.

A couple of neighbors recently bought a house that was listed by Opendoor. According to them, the house has all sorts of cosmetic fixups that were recently done — and they are having to redo them.

Suffice it to say that this couple is not part of the Opendoor fan club.

Looked at the deed recorded in public records at the Maricopa County Recorder’s web site (linked through Maricopa County Assessor). I glanced through some of the others currently being sold by Opendoor– you can search based on the entity name– and they’re doing the same thing all over the Phoenix metro area. Price cuts and accepting losses.

Thanks azbc!

OK.. Yeah, the county I’m looking in is not very accessable right now. Staff is WFH, never answers the phone and not much data online.

Arizona Slim, I’m not surprised..

The number of houses sold may give a hint. They are low, so still quite a few do not need to sell.

Even with prices falling, inflation and price hikes on other items may make it a better option to hold on to the real estate. If wages and income keep up with uppward prices of goods and services, the cost of holding on is falling.

Do you guys think this coming summer is a good time to buy a house for a FTHB?

Wolf/Any one any thoughts?

There’s a “right price” in any market. But, there’s also a lot of other factors to consider.

How much can you pay down? How secure is your job? How much other savings do you have? How clear are you as far as total costs of ownership?

If you have good answers to questions like these, I’d say be patient and make low-ball offers on houses your interested in.

Some say not to “insult” sellers with low offers, but personally, I wouldn’t worry about anyone’s feelings.

It ain’t a family reunion. It’s a business deal.

I agree, Halibut. Don’t fall in love with any house when home shopping. Create your own deflationary force in this world. Low ball. Nothing to be ashamed of. There’s no etiquette when it comes to buying or selling unless you’re persuaded by RE agents that there is such. Screw the “comps”.

JP Morgan was quoted as saying, ”buy on the way down, but only if you could be sure to hold through the bottom,” CG, because he knew full well that ya cannot know the bottom until after it is in the rear view mirror…

Most likely scenario IMHO,

—- IF and only IF GUV MINT mandated mortgage for or five bear ants is not used as political bait—-

Will be a declining market for a while, as always, followed by a lull, as usually, then prices start nudging up slowly once again, as always for the last 65 years or so that I’ve been involved in RE.

Do you guys think this coming summer is a good time to buy a house ? Humm

Anytime is a good time if you get the right price ..

A better question is ” In general will summer (23) be a good time to buy a house ” Short answer is that will be better time then now > I buy Foreclosures when I can get the right deal or A Short Sale ( look it up ) but you need to know what your doing and of course have Cash .

Much simpler dealing with the Foreclosure department as example at Wells Fargo > Its Fast and direct and best Price.

“Even if you have the best offer ” they well tell you they have several Offers and to please submit best offer and if you have friends like a Broker who knows how your offer looks ( your offer is looking very good ) then you can say ” that is my best offer ” repeating your offer amount again .

the Foreclosure market is complex if its a fixer 3.5 % over asking is a Great place to ask yourself if you would like that property at that price if 3.5% over asking works then you found the bottom and you can take the place of a Bailout .

NEVER PAY more then you think the place is worth , remembering that if you don’t get it you lost nothing but your time .

FTHB ? good question Perhaps 2025 / 27 if your looking to finance

its a craps Shoot no telling / if your talking protecting your investment then your talking buying after the bottom is found could be years away .

Mendocino Coast, for future reference, how do you deal with the foreclosure dept? ELI5? I only want one house when I can get it and wouldn’t want to tie up my money for months. I don’t know a local broker..

You have to do a gut check on how you’d feel if you bought too soon.

It’s not just about having a steady job and/or enough savings to ride out a long downturn. You also have to be psychologically prepared and temperamentally suited, to hang on without panicking.

If you’ve just paid $500,000 for a house that’s now worth $400,000, you’ve got no equity left, the market is still going down, the economy’s in a recession and your employer just announced a round of layoffs ahead… will you be able to ride that out? And will it be worth going through that experience, rather than waiting an extra year before buying into the next boom?

If its like last time just don’t pay the mortgage and the bank won’t foreclose for 5 years. They don’t want to admit the loss on paper.

and you aren’t kidding either. I knew a person that spend at least 3-4 years before he had no choice but to get out of the house. He didn’t pay tax, mortgage, rent. Only attorney fees to prolong the process for as long as possible.

Wisdom Seeker,

If we are like we were in 2008. It will be 4 years before we reach the bottom. House prices move slowly.

The smart homeowners held on if they could. They are now doing very well and might nearly have a paid-off mortgage if they refi’d for 15 years. The ones who foreclosed, rented for 7 years (2015) before they could qualify for a loan again and jump back in at nearly the same price. Well, the same price was in 2016.

I don’t think so. 2024 would be a better time to buy.

Very simple answer for one that’s bought 10 Homes in 30 years due to job transfers.

Rental is a great option. Inventory still low and the price discovery ongoing. Rent and wait until this ZIRP and Free Money period for 15 years works its way through the economy. The fed interest rate drops need 9 months to hit the economy and we are just seeing the signs from the March drop so we need another year plus QT on top.

Please wait to buy and let the price come to you .

Your comment triggered me..(apologies)…

I tried advising my daughter and her partner to do that, but youth, impatience and a disinclination to continue paying (increasing) rent pushed them to pull the trigger a few months ago (they actually close in January!) Probably right at the (UK) peak….fortunately or otherwise they have 50 % down from bank of mums and dads so their actual mortgage and tax is lower than current rent. That’s the only advantage I can see now. I gave up arguing with her and just said be prepared to stay there a looong time and don’t bother looking at comps….make investments elsewhere and enjoy having your own roof overhead. And try to pay it off ASAP. The last 40 years have truly been a historic aberration!

I’m not sure how quickly things will shake out. My guess: the era of ultra cheap mortgages is over, but it’s going to take years for people to accept this. Institutional investors are already deciding to pull money out of real estate and put it somewhere with better medium-term prospects, but the people who bought a house to live in are still planning to wait a few years in hopes that the market goes back to “normal”. Good luck with that. It’s the new normal now. 6% is the new 3%.

FWIW, I bought my first house in late April 2022. The fear was already setting in – the house would have easily sold for 10% more in February. It’s gone down at least another 10% since then. The reason I bought: I was pretty certain that I’d not be seeing another 4% interest rate, so it was buy or be priced out, likely for years. If I was still on the market, I’d not even think about buying until the monthly payment on a standard mortgage drops to roughly what it was in early 2022 – which was already considered unsustainable, but I’m not the only semi-sane person who paid up, so it might not be totally absurd.

Looks like things are moving quite rapidly. It’ll be interesting to see if it slows as we get closer to pre-bubble territory, or if the downward momentum will carry the market into some truly abyssal lows.

What would you define as pre-bubble? Pre-pandemic? Remember housing in 2019 peaks were already unaffordable in big cities, and that was with lower interest rates.

Given current interest rates, even if they don’t go higher than 7%, even the lows of 2010 would be too high for most buyers to afford. And if interest rates continue to rise with Fed tightening, watch out!

Median family income in 2010 was $58k. It is now $78k.

Based on affordability calculator on zillow. At $78k and a 20% down payment and a debt ratio of 36%, a family can afford a $310k home which would put us around 2020 prices. That is with a 6.1% mortgage.

If you go to 7% mortgage, the affordability drops to 290k.

I am guessing if housing keeps correcting and there is a mild recession, $300kish will be the bottom.

Again, I agree with ru82. We “anchor” prices in our minds and think they are somehow real. And we’re trapped by “money illusion” – similar to anchoring in that you think prices of things are somehow “stationary”.

“Nominal” prices today do not have the buying power of money from yesteryear. But there’s still good reason to low ball if you’re out shopping. Writing up a purchase offer is a massive pain in the rear. If you’re working with an RE agent, you can ask them to tell the seller that you’ll come in with an offer at “X”, but don’t want to bother submitting the paperwork if they won’t consider it. It’s worked for me a few times in the past. Once I got a slightly higher verbal counteroffer and accepted it. Also, if a house is vacant, it’s much easier to get a good deal.

Depends upon your time horizon.

Longer term, the peak in mortgage rates is going to be a lot higher than 7% and I’ll take the “under” that median wages and incomes will keep up.

ru82-

The affordability numbers you’re using are incorrect. They don’t include other housing costs, just the loan. Not property taxes, no maintenance, etc.

Regardless of the metrics, if you’re saying income increased by ~35%, then the total home price that’s affordable should also increase by 35% *at the same interest rate*. Rates in 2010 were around 4-5%. Assuming a 7% rate now, the average person can afford about the same house (maybe 10% higher) as they could in 2010, even with their higher income, due to the higher interest rates.

Furthermore, you’re looking at household income during the depths of the recession of the GFC compared to a historically tight labor market with rapid salary gains (albeit behind inflation). If/when a recession hits us again (which is exceedingly likely given how much the Fed will have to tighten to bring down inflation), average household income will definitely decline. While it won’t go all the way back down to 2010 levels, it doesn’t have to: a slight decrease in household income combined with a significant increase in interest rates will drive affordability below 2010 levels.

(That said, people have gotten used to spending much more of their money on housing. Before, 30% was considered the limit, but people now routinely spend 50% or more of their post-tax income on housing, and they’ve adjusted the rest of their life to accommodate that, so perhaps they’ll be willing to support much higher costs than families in 2010 were willing to do).

My reasoning has always been Powell is looking for a 20 percent drop in prices from the peak.

They were unaffordable in rural areas too. Even in coastal Ca. Prices were starting to stall and drop slightly in 2019.

It is my guess that sellers will get more aggressive once they start to feel the pain. With so much home equity to burn through, it will take layers and layers of selling for many months to get to a point of panic.

Only from 2009 to 2013 did median prices stay more or less affordable and level, as would be expected in a stable market. Every summer there is a mania-fueled spike, followed by a winter drop. Drops are not true long-term drops, because they’re punctuated by mania fueled increases. Of course the 2020 and 2021 drops barely registered, followed by silly money spikes. Now we’re seeing a long drop. The only question is will the trend reverse with small summer increases followed by another large drop? If long-term 2% inflation is a goal, home prices have a long way to fall.

Existing Home Sales Chart

QE was activated on the 3 previous occasions Existing Home Sales fell below the green line.

Even if I do not do this for a living, I consider myself an economist because of my masters degree. Basically I have studied this many years, and – it will go down the way it went up. It’s not going to be 5% 10%, it will crash like shit, and it will be fast. If I am wrong, there is different power involved, not only the normal market mechanisms..

It is not the invisible hand of the free market.

It is the insider-visible hand of the Fed.

At my local grocery store, I keep seeing small price increases that inch up every month.

I don’t think real inflation is going down in Canada.

Also, rents are very high in the Greater Toronto Area. Last year a one-bedroom in North York was C$1700. Now that same apartment is C$2300 or more.

The infamous Crescent Town Village in East York have apartments advertising one-bedrooms for no less than C$2000 a month.

Rents in Toronto are the same price level, except for downtown which is of course higher.

Most grocery items priced around a dollar are now $1.75 to 2 dollars. I don’t see interest rates getting high enough to break the stranglehold the Chinese have on the condo market. The Chinese their very first dollar and their very last dollar goes into real estate. They’ve been in for a long time so it looks like they can ride it out until prices move upwards again.

Why do I get the feeling that politicians are doing everything to protect their interests at the expense of Canadians?

It’s a common conclusion from even liberal economists that the 500,000 a year quota is to make life harder for Canadians but benefit the employers and landlords.

Great to to see the laws economics at work . Supply and Demand will continue to sort housing bubble out. What goes up must eventually come down. You have not lost or won until you sell, just as stock market so eloquently states. Where are all the buy the dip folks lining up for FOMO in real estate. Over inflated stocks have seen their best days. I’m hoping to upgrade from stairs to ranch style, also purchase 2 new vehicles when the bottom is near and no longer palatable. $Cash is King

Wait a minute, what’s going on here ? I thought real estate prices could only go up !!!

Seriously now, am I am hearing correctly that builders are now “building” inventory and will need to start offering serious incentives (indirect discounts) to sell said inventory? Won’t this eventually affect the secondary market. Also, once secondary market sellers like estates, job transfers, people who lose jobs and can’t find other suitable employment etc. etc. etc. start to sell, this thing could be lights out especially given what is going on in our economy and worldwide.

Wonder what So Cal Jimbo has to say about all this???

YOY price increases should level off by June 2023. That’s when market correction trend will finally be acknowledged by the RE industry pros. The bottom ? Anybody’s guess.

This has been moving much faster than your math. At the current rate of declines, YOY price increases will become “negative price increases” in January or February 2023 at the latest. Look at the numbers: the month-to-month declines have averaged 2.2% over the past 5 months. The YOY increases in November was already down to 3.5%. By June 2023, the yoy price increases may be “negative price increases” by the double digits.

This feels more like the early 1990’s, where real estate didn’t collapse, but rather had to work off the excess appreciation of the late 1980’s. In my area, prices took maybe only 10-15% hit from peak 1989 early 1990 prices. This happened over 1-2 years, but then prices stayed flat until 1998. So almost 10 years of nothing appreciation wise. If I had to place money on a scenario, this would be my largest odds bet.

I’m with you Dave. My gut feel (for what that’s worth, which is not much), tells me that we’re going to experience the tepid first half of the 90s all over again in the housing market. House prices could drop a bit and flatten until they meet back up with the long-term trendline. It took the us 2-1/2 centuries to grow our M2 money supply to $15.5 trillion (half of that printed in the last decade), and then we printed another $5 trillion in only 2 years! Half of all dollars in existence were created in the last 10 years. Stubbornly high inflation is going to remain inescapable for a long while… A 5% FFR and anemic QT isn’t going to change that. The real value of housing might not go anywhere or it might drop, but prices are a different animal largely governed by the value of the dollar in the long run. I just don’t see where an apocalyptic collapse in house PRICES (not real value) would come from with all of those dollars still sloshing around.

that isnt going to happen dave. the imbalance between demand and supply is going to be very acute within the next 12 months. home sellers are waiting for rates to go down and they are going to rise.

While a more moderate contraction is possible a more severe contraction is still in the cards. There’s no knowing when inflation will allay and the past few years have trailblazed new history. I’m pretty sure the scale of money printing and strict adherence to artificially low rates for such a long duration is charting new territory. In addition, the economy of today is far different from the economy of the 80s and 90s. With the way assets across the board appreciated so significantly for the past several years after contracting violently in 2008-2010ish time frame it’s hard to make a call. I get this feeling like the economy’s driving 80mph behind another vehicle and we’re just hoping there’s not a crash up ahead. There are a lot of controls that keep things intact, but we’ve done a good job of tampering with that.

I bought a “home” not particularly an investment. Much different drivers in each I think. Paid $400k for a 10 acre rural paradise on a small lake. Manageable, enjoyable ranch home, with low taxes, with fishing and hunting out back.

In San Mateo, CA, I saw a 1,000 sq ft “box” for sale this week, for $1.2m with close to $11.5k in annual taxes on the prior taxable value of $738k. It was jammed in, arms length from the neighbors on both sides. Apologies to the seller, but it is perhaps the most unappealing house in the area on Zillow. How does anyone desire or afford this?

In 2008 you had lots buyers rush in early when prices fell, only to watch prices continue to fall for the next 4 years. The old timers who have been to this rodeo before know not to catch the falling knife, and to be patient.

The rodeo is an interesting object, it’s existence is assumed to part of the firmament.

Be interesting if there was a non-monetary way to shut down the rodeo for good.

Is such a thing possible.

We “caught a falling knife” in 2010 but didn’t care because it wasn’t for sale. When we sold in 2016 we made a bucket load of money (like nearly doubled the purchase price and put minimal repairs/upgrades in it because it had about everything done by the prior owner). You can’t perfectly time a market. Pay what the house is worth TO YOU.

The house we bought in 2010 was a bank repo….. we offered cash, 15 day closing, with only inspection contingencies. The house was over-improved for the neighborhood but, as I told my daughter, we couldn’t duplicate it for what we paid. There were 25 offers.. we won because it was a bank owned property and they just wanted to get it off the books and our offer caused them the least brain damage.

The house looked shabby when we got it… unkempt landscaping, missing interior hardware… (some moron stole the TP dispensers, towel bars, cabinet pulls, etc.), and horrendous interior paint colors. Spent a few grand and it was a doll house. We cash out refi’d it (daughter took a mortgage and paid me back) and her payment… with taxes, insurance, etc., was $800 less per month than her 2 bedroom apartment rent a few miles away.

It’s the property…. not the price…. that matters most. If you get a cheap mis-located POS you still have a cheap mis-located POS as prices firm up. If you buy a quality piece for the right price, you don’t hate the house you’re living in and things, historically, have worked themselves out financially over time.

Patience doesn’t always pay as you can be *too* patient and miss the run up and get shut out again.

Jingle Mail!! Jingle Mail!!

Maybe not this time because with very low interest rates on the mortgage if you can still perform its probably cheaper to keep paying for your underwater house than rent. Have you seen the price of a 2 bedroom??

I believe both Reventure Consulting and Wolf as well have stated new apartment construction is quite high. You have to go back to 1970s or 80s for comparable number of units being built.

Perhaps increased supply will slow or even reverse rent increases.

Stirring tea leaves and planning on where house prices bottom is very premature and very much linked to pending earnings revisions and impairments in the next several quarters.

More than likely the Fed terminal rate will be part of a long and painful grinding down process that will end up lingering into a very slow pivot. During that grinding down period, capitulation will make sense, because most people will burn out on cost averaging, in investments that have negative returns. More than likely, inflation will morph into stagflation. Add-in increases in unemployment and sticky mortgage rates and in six months, cash burn becomes riskier, driving away investment (speculation).

Towards the end of next year, this topic will be far more appropriate, but I’m certain there will be far less enthusiastic exuberance about making easy money! There’s also going to be fewer people in the casinos.

Unlike 2008, the majority of home mortgages this time are backed by the US Government (Fannie, Freddie, FHA, VA). That is us. The taxpayer.

In 2008, the government bailed out the banks holding the mortgages. This time, the government owns the mortgages.

If we don’t have a 1980’s-1990’s soft landing, and 2008 repeats, what will the government do?

1) Bail out the homeowners and raise taxes on the 1-10% to do it? (See Wolf’s excellent article on Wealth Inequality). Colorado just passed a law to allocate a % of taxes to low income housing.

2) Send in “Dog” the Repo Man?

The banks couldn’t send in Dog in 2008 due to the poor reputation, so I doubt the US Government will.

With today’s society, I bet an HGTV show “Dog, the Home Repo Man” would be a hit and the ad revenue would partially pay government costs.

Dog’s SWAT team stealthily rappels down the chimney and repo’s the Christmas presents first before changing all of the locks on the door while escorting the deadbeat homeowners out into the cold.