We also keep an eye on Primary Credit and look at the Fed’s deal with the Swiss National Bank.

By Wolf Richter for WOLF STREET.

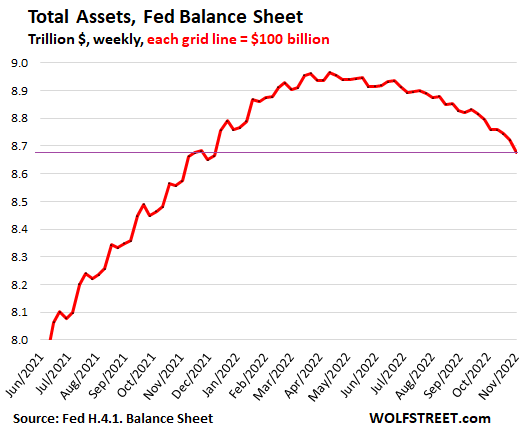

Total assets on the Federal Reserve’s weekly balance sheet, released today, with balances as of November 2, dropped by $82 billion from the October 5 balance sheet, to $8.68 trillion, the lowest since December 8, 2021.

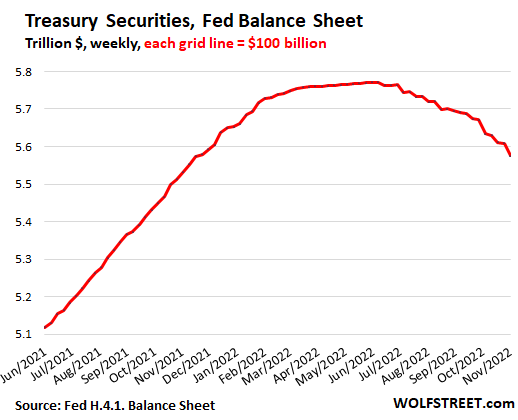

Treasury securities mature mid-month and at the end of the month, which is when they roll off the Fed’s balance sheet. Today’s weekly balance sheet included the Treasury roll-off on October 31.

Treasury securities: Down $196 billion from peak.

Since the peak in early June, $196 billion in Treasury securities have rolled off the Fed’s balance sheet, reducing the balance of Treasury securities to $5.57 trillion, the lowest since November 17.

Over the four weeks since the October 5 balance sheet, $59 billion have rolled off:

- Treasury notes and bonds (2-30 years): -$46.2 billion

- Treasury bills (1 year or less): -$12.6 billion

- Treasury Inflation Protected Securities (TIPS): unchanged

- TIPS related inflation compensation: -$0.07 billion

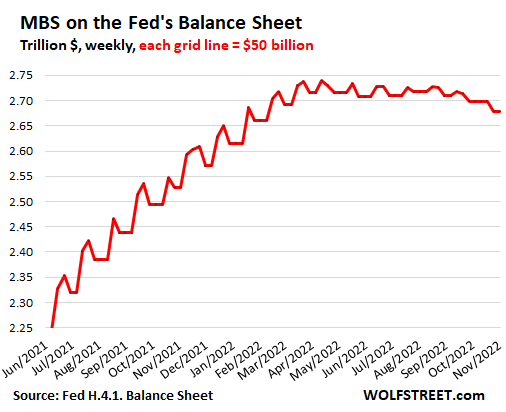

Mortgage-backed securities: Down $62 billion from peak.

Since the peak, the balance of MBS had dropped by $62 billion. Over the past four weeks, the balance declined by $20 billion, to $2.68 trillion.

MBS come off the balance sheet mostly via pass-through principal payments that occur when the underlying mortgage is paid off or when regular mortgage payments are made. Mortgages are paid off mostly when the home is sold or when the mortgage is refinanced. Since mortgage interest rates have spiked, refinance activity has collapsed (read: Mortgage Lender Woes), and mortgage payoffs when the home is sold have plunged as home sales have plunged by 30% from two years ago. So the pass-through principal payments turned from a torrent in 2021 to a creek now.

The inflow of new MBS onto the balance sheet petered out in October after the Fed stopped buying MBS in mid-September.

Back when the Fed was still buying large amounts of MBS, and when there was still a torrent of pass-through principal payments, the weekly mismatch in timing between the two created the jagged line in the chart. Since the large inflows have ended, there are no more upticks. The downticks represent the pass-through principal payments:

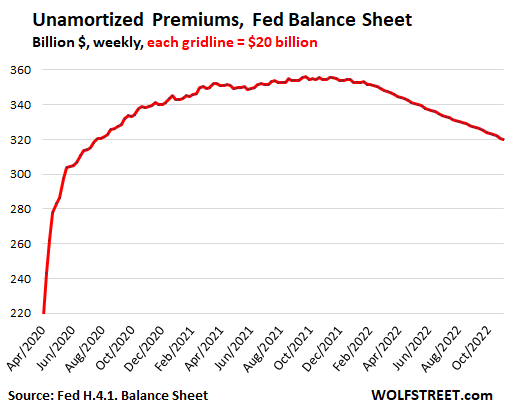

Unamortized Premiums: Down $36 billion from peak.

Like everyone who buys bonds in the secondary market, the Fed had to pay a “premium” over face value when it bought securities that had been issued years earlier when interest rates were higher, and that therefore came with a higher coupon interest rate than the market yield at the time of the purchase.

The Fed books the face value of securities in the regular accounts, and it books the “premiums” in an account called “unamortized premiums.” It amortizes the premium of each bond to zero over the remaining maturity of the bond. When the bond matures, the Fed receives face value for the bond, and it rolls off the balance sheet. By that time, the premium has already been fully amortized.

Unamortized premiums have dropped by $36 billion from the peak in November 2021, to $320 billion:

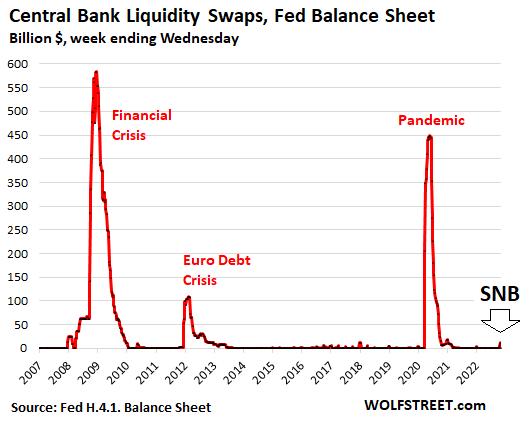

The to-do over the Swiss National Bank.

In October, there was some catastrophist chatter in some corners of the blogosphere about the Fed suddenly and “quietly” handing the Swiss National Bank a gazillion dollars.

In reality, the Fed and the Swiss National Bank engaged in dollar liquidity swaps on the Fed’s swap line with the SNB that has been operational for many years. These were 7-day swaps, and after 7 days, the Fed gets its dollars back.

In total, they undertook five 7-day swaps in a row, starting on September 14. The last swap, the largest one, amounting to $11.1 billion, matured on October 27. Since then, there have been no swaps with the SNB, and the balance with the SNB is now $0.

This chart shows the use of the swap lines during times of high financial frictions. That little dot at the end is the SNB:

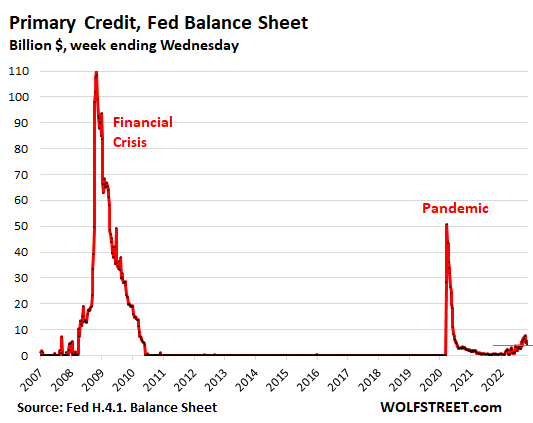

Keeping an eye on “Primary Credit.”

The Fed lends money to the banks and charges interest on these loans. Yesterday, as part of its rate hikes, the Fed hiked the Primary Credit rate by 75 basis points to 4.0%, which is what it now charges banks when they borrow at the “Discount Window.”

In March 2020, Primary Credit balances spiked to $50 billion. During the Financial Crisis, Primary Credit spiked to $110 billion. Both faded quickly and then remained at very low levels.

When the Fed started hiking rates in early 2022, Primary Credit began rising just a little. At the peak in early October, Primary Credit amounted to $7.5 billion. On today’s balance sheet, it fell to $4.4 billion. So this is something we’re going to keep an eye on.

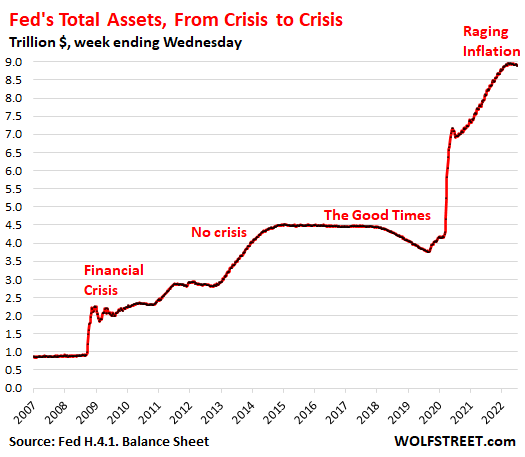

QT is the opposite of QE.

With QE, the Fed created money and with it purchased securities via its primary dealers from the financial markets, and this money then started chasing assets, which inflated asset prices and pushed down yields, mortgage rates, and other interest rates.

With QT, the Fed destroys the money that it had created with QE. QT works in the opposite direction and does the opposite of QE, and is part of the explicit tools the Fed is using to crack down on this raging inflation that was in part the result of years of QE.

But for years, QE didn’t trigger consumer price inflation – it just triggered asset price inflation, giving all central banks lots of opportunities to learn all the wrong lessons. Until it suddenly triggered massive consumer price inflation. And now we have this huge mess.

And how we got to Raging Inflation:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Central bankers are the best boom/bust machine there is. It’s like they’re doing opposite George.

These charts only mean one thing. Our asset bubbles are the world’s biggest ponzi scheme.

As it blows now, we should stop treating Stocks, bonds and real estate as investments!

+++ PLUS 1000 Leo,,,

never seen anything like this, but was not even a gleam in dad’s eye in 1929…

been trying to warn offspring about this bubble, including sending them many of Wolf’s Wonderfulls…

They, in this case our children, have SO much going in their forties, they appear not to care a bit,,,

almost as innocent and blasee’ as I was at that age, thou I soon learned enough about the BIG boys manipulations of the SM to get out, after many years of great results in that mkt…

Thanks again to the Wolfster,,,

WOLF for POTUS!!! or at least ”chief” of FRB!!!

If you are in your 30’s and 40’s it may not matter. You have plenty of time for the next bubble to explode and then you can cash out.

If you are in your late 50’s or early 60’s, you now have the opportunity to cash out and go into conservative iBonds (9.6%) or even 1 yr Treasuries at 4.78%. This is beating most dividend yields in the stock market and is 100% secure. Thank you Fed for returning to the old normal.

Invest now at a secure 1 year 9.6% or 4.78% and see if it is a good time in one year to to re-enter the stock (Like 2010) or housing (like 2012) market. If stock prices crater enough during that time, you will get higher dividends and a greater potential for stock growth during the next bubble. Just like last time. We’ve seen it all before.

Do not pay off your 3% mortgage! The Fed must suffer for their shenanigans. Maybe they won’t do this again. Wolf thinks they don’t really care. They aren’t like me.

Bob, the 9.61% I Bond rate is over as it ended 10/31. The new rate is 6+% (without looking it up) for the next 6 months ….still a good deal if you can get into the Treasury Direct website to place an order. And yes, T bills and CDs are are great rates now.

Playing in the stock casino is not such a great idea unless you have money to lose. Old guys need to be watchful of that if you are going to play the rigged game.

Nah, put him at Treasury, life appointment, where he also controls the IRS.

But I think he is overworked as it is, and like Mueller, wants no major part in DC games. Much worse headache than website, which is his own show.

Bob-

I’m not quite sure if we’ve seen it all before.

The Fed’s (and other central banks) decade+ of “emergency” QE LSAPs & ZIRP suppressed yields of government bonds and MBSs, leading to lower yields in corporate bonds and lower mortgage rates. Suppressing yields opens the door for governments and corporations to issue new debt, load up on credit, and encourages a worldwide housing bubble. Printers aimed at the wealthiest which didn’t necessarily translate to inflation. The bubble it created was one of assets and debt.

Global debt ballooned in 2020 and it’s even worse now. Global debt levels are currently sitting around $300 trillion with a debt-to-GDP ratio hovering around 350%. Issuers will be feeling the pain of servicing new debt issues and floating rate securities in a normalized rate environment. Private capital will be even more predatory for businesses with a not so stellar rating. Increased outflows and reduced inflows as we head into what seemingly seems like a certain worldwide recession.

Fixed rate bonds and securities issued in the zero interest rate environment have had their market values pummeled as yields shoot up. This is a problem for institutions using them as collateral, derivative contracts (think interest rate swaps – UK LDI pension crisis), etc. Take a look at bond ETFs to get an idea of the losses, anyone long on bonds is getting hit pretty hard.

The taper tantrum of 2013 was caused by the fed announcing a plan to reduce their balance sheet. QE was an emergency measure after all, and they felt the crisis of 2008 was behind them. The market threw a fit, shooting yields up and ended with the fed basically capitulating. They slowed the rate of purchases from $85b to $75b but as the chart above shows, they kept those printers going.

The $95b/month roll off is nice and all but needs some context. It will take nearly 4 years to return it to pre-pandemic levels at this pace. They definitely don’t want to sell into this market as that will cause yields to rise even further.

This looks like one huge mess of a can kick stemming from the 2008 GFC. We’re in unknown territory here. You hear so many calls for a pivot because, as some analysts have said, something big will break as a result of making a quick u-turn on ZIRP and QE. Markets have become addicted to nearly 14 years of Fed/CB stimulus and if their solution is QE-infinity then they could be in for a world of hurt.

> “head into what seemingly ̶s̶e̶e̶m̶s̶ [looks] like a certain worldwide recession”

Correction to that wall of text in, “I’m not quite sure if we’ve seen it all before”. Please excuse any other mistakes.

The Fed’s balance sheet is 28% of the size of the US national debt, 328% of Germany’s, 327% of France’s, and 338% of the UK national debt.

The Fed isn’t the only central bank to have been printing since 2008. Check the “Comovements in monetary policy” FRED blog, “Central Bank Assets for Euro Area (11-19 Countries)” (ECBASSETSW) chart, and the “Central Bank Assets to GDP for Japan” chart in FRED.

Some context for US national debt:

EOFY Billions %GDP Event

1941 $49 44% U.S. entered WWII

1942 $72 48% Defense tripled

1943 $137 70%

1944 $201 91% Bretton Woods

1945 $259 114% WWII ended

1946 $269 119% Truman’s 1st term

1947 $258 103% Cold War

1948 $252 92% Recession

1949 $253 93% Recession

WWII and the after effects contributed to a big increase in debt and the debt to GDP ratio. It decreased from 86% in 1950 to 54% in 1960. By the time of Volcker’s rate hikes to fight inflation, the debt to GDP was hovering around 32%. Tax rates, especially for the wealthiest, were much higher (before the Reagan cuts) and debt to GDP gave room for those crazy 20% rates from the Fed. 20% Fed funds rate in 1980 to combat 11.6% inflation..

We’ve had a steady increase since, from 34% in 1982 leading up to 61% in 2006.

EOFY Billions %GDP Event

2007 $9,008 62% Bank crisis

2008 $10,025 68% Bank bailout ZIRP QE

2009 $11,910 82% Bailouts

2010 $13,562 90% ARRA added $400B

2011 $14,790 95% “Debt crisis”

2012 $16,066 99%

2013 $16,738 99% Taper Tantrum

2014 $17,824 101%

2015 $18,151 100% slight rate increase

2016 $19,573 105% begins. Slowing QE

2017 $20,245 104%

2018 $21,516 105%

2019 $22,719 107% Secret $4.5t bank repo

2020 $27,748 129% C-19 response ZIRP QE+

2021 $29,617 124%

2022 $30,824 123%

ZIRP and QE opened the floodgates for governments and corporations to issue debt at artificially low rates with debt to GDP levels eventually surpassing WWII. These temporary emergency measures have been in place for 14 years.

Speaking at the 2019 IMF annual meeting, former BOE governor Mervyn King said, “Another economic and financial crisis would be devastating to the legitimacy of a democratic market system. By sticking to the new orthodoxy of monetary policy and pretending that we have made the banking system safe, we are sleepwalking towards that crisis.”.

He added, “There has been excess investment in some parts of the economy – the export sector in China and Germany and commercial property in other advanced economies, for example – and insufficient in others – infrastructure investment in many western countries. To bring about such a shift of resources – both capital and labour – will require a much broader set of policies than simply monetary stimulus.”.

We’re already seeing cracks form on the world stage. The Fed’s dual mandate is directed towards the United States, but its moves reverberate throughout our intertwined global financial system. The cure for the crisis we’re currently facing (inflation) is poison for the system spawned from the unconventional monetary policy that has been in place since 2008.

[This was supposed to be a simple edit which lead to another wall of text, lol. I hope the debt to GDP tables format correctly. I would add sources, but I don’t see anyone else posting links in their comments. First time commenting here.]

No mention of the average rate the notes and bonds carry. On a MTM basis, the current rates are prolly above the rates on the paper the Fed purchased?

Best I can calculate is inflation has averaged adding approximately $100 billion per month to the price of goods and services this year so there is a little catching up to do.

Central bankers aren’t the only big players in macro-econ. It’s my bet Corps will keep inflation as high as they can, and also induce as much recession as they can. The hope being the FED backs off when enough people scream.

What is a corporation? Ambrose Bierce’s Devil’s Dictionary defines it as ‘an ingenious device for obtaining profit without individual responsibility’. It is a legal construct, a charter granted by the state to a group of investors to gather private funds for a specific purpose. Originally, charters were granted in the service of a public purpose, and could be revoked if this were not fulfilled. The relationship between state and corporation is a complex one. Over the past 400 years corporations have conquered territory and brought in resources for the state, breaking laws put in place to constrain them and gaining in power and privilege. History shows a repetitive cycle of corporations over-reaching, causing such social turmoil that the state is forced to reign them back in through regulation.

Don’t know if that’s our AB or not, but still all true.

Re; the Swiss,

GENEVA (AP) — Switzerland’s central bank carried out the biggest hike ever to its key interest rate Thursday, following the U.S. Federal Reserve and other central banks around the world in aggressive moves to clamp down on inflation.

The Swiss National Bank could not rule out that further increases beyond the rise of three-quarters of a percentage point “will be necessary to ensure price stability over the medium term,” said Thomas Jordan, chairman of SNB governing board.

It aims to cool off inflation that came in at 3.5% in August, which is much lower than the record 9.1% in the 19 neighboring European Union countries that use the euro.

The Swiss rate increased from minus 0.25% to 0.5%, ending several years of negative interest rates — a testament to the stable growth, low-inflation environment, coupled with Switzerland’s appeal as a safe haven for assets.

In essence, that negative interest rate environment meant that people who parked assets in Switzerland paid for the privilege, a counterintuitive idea for many investors who might expect a return on their savings.

In 2015, so many people had bought Swiss francs (don’t recall what was going on then, currency fears, some kind of last chance to hide money for whatever reason?) that they set rates at neg 0.75%. I imagine a lot of the filthy rich people figured that was still much better than paying their taxes in their home countries.

Not sure how it figured into swaps mentioned in article, our own FED is enough of a mystery, much less what the “special people” all talk about at Davos.

The really sad part is Corps do best under dictatorships and Police States. This fight for democracy (even such as ours is now) thing is REAL!

And remember, Corps can usually crush States like bugs, the Federal govern meant is much harder, and the HUGE amount of lobbyist money proves it. Also Senate candidates like Herschel Walker.

Although it would be a hoot to see him address the entire congress on some issue of importance…..you think the GOP penis size debate was funny!

Stand up comics and South Park are the only real beneficiary’s of our unfortunately problematic democracy.

Just read the list of most dollars spent on lobbying. Top two groups are the US Chamber of Commerce and National Assn of Realtors. Several Pharma and medical groups round out the Top 10. Tells you everything you need to know about the current state of affairs. The remedies are right in front of us, we just don’t have the will.

Perhaps I’m not reading the damn charts as carefully I should, but I’d like to know whether the Fed is meeting its QT goal of $90 billion per month. I’d also like to see the Fed dump all of its MBS in Q1 of 2023, but don’t know whether that will upset Wall Street too much.

Read–1ST PARAGRAPH

with balances as of November 2, dropped by $82 billion from the October 5 balance sheet.

The scumbags are still not meeting MBS reduction limits. So inflation is just going to keep increasing as housing remains unaffordable.

The real economy has frozen. No new innovations, slowing business activity. Only rampant consumerism of paying more Dollars for lesser stuff.

E.g. The new year car models, that have much higher prices, actually have lesser features, and many have cut components, that will reduce safety and reliability. E.g. cams instead of radars and ultrasonic sensors, removing backup electronic control units from steering etc.

I don’t agree. The point of selling MBS separate from treasuries is to bring up the 30 year mortgage rate. That has already happened. 7% mortgages will be more than enough to crash the housing market. Just give it time.

Well, I am still working and my company is still innovating and selling products.

Admittedly, this is anecdotal. But it’s hard to argue against one’s eyes and ears. The real economy is not frozen, except in parts of China where the government is freezing it due to covid. Sure, a freeze may happen next year if and when the interest rates get much higher and squeeze enough money out of the system to cause things (other than inflation) to break.

But not today.

I’m with Einhal and Ed7 on this… 7% for a 30yr fixed is going to have an effect on housing (it’s already happening), but housing is a slow moving animal. The Fed doesn’t want to force a catastrophic collapse. They want to let some air out as the median price and long term trend start to line back up over the next few years. Just takes time.

As for a frozen economy… BS. My employer is still seeing very healthy business levels. I’ve been here a decade and I’ve never seen so many sales and cust service people in the office. Activity & headcount out on the factory floor are still humming along. R&D lab is busy as ever. Restaurants are still packed, and stores are still busy around here. Traffic here is the worst I’ve ever experienced. House sales are way down from a record-hot mania here in SoCal, but lots of them are still going pending within 2-3 weeks and I still see closings occurring regularly in my hood. Slower, especially for higher priced homes, but certainly not frozen.

Replying to Not Sure:

A lot of big companies are either started hiring freeze and lay offs citing current conditions and future macro eco picture.

Your company if has not seen slow down , would see it in next few quarters.

Nothing is frzen but things have slowed down drastically.

I am in San Diego where real estate is a religion and prices have come down 10% from peaks, price reductions galore and things are slow but not frozen.

If things become frozen then it wont be good for price reductions.

Jon check case shiller index for S&P 500. San Francisco houses fell 10% 4 months back. Based on extrapolation prices already corrected 20-25% today and this will be visible after 4 months.

As for rest, I similarly said “Inflation is rising” and got similar responses like “I don’t see any Inflation “. So let the time be the judge

They’re trying to meet the goal, but they’re not. MBSs are not being prepaid fast enough. Treasuries seem to be more or less meeting the goal (minus that they’re getting paid interest on some bonds that results in some offsets). But no way they can sell all their MBSs. I’m sure they’d like to sell some but it could help the market turns south (plus mortgage rates are already high). There’s no need to risk destabilization now.

I doubt that the housing market will ever return to normal until people quit thinking of houses as investment vehicles rather than as places to live. Crashing the housing market might accomplish that goal. Of course, we also need to end the securitization of houses and the tax benefits of house ownership.

“tax benefits of house ownership”…

What are those benefits? I just paid a wheelbarrow full of property tax and it didn’t feel like a benefit.

Halibut,

I was referring to the $500,000 exclusion of gain from taxable income (maximin exclusion for married couple filing joint return) as well as annual deductions for mortgage interest and property taxes. Tenants don’t get any of these tax benefits.

Halibut- same here! Our property tax bill this year was through the roof. Another reason we’ve never understood all these articles in the real estate media (paid for by Zillow or Blackrock maybe?) just assuming that homeowners are just giddy about their home prices going up and up–that just means more property tax, higher insurance, higher repairs and every other kind of bill. We had a discussion about our tax bills in a neighborhood cookout this past weekend and practically all of us were annoyed and unhappy about it. Rising home values are useful only if you’re at the point of selling your home, which the huge majority of homeowners are not. Otherwise rising home prices are much more of a burden than a benefit–they’re not like stocks or commodities where you can cash in your gains, all the costs of rising home values are liquid, but the values are not, and you gain nothing from that other than maybe better terms if you need a HELOC.

And it’s not like some parts of Europe or Asia where your property taxes are lower or just fixed at the point of purchase (at least for the primary home, investment homes are taxed more)–every time an American home’s assessment goes up, the property tax goes way up too. So you never really own a home in the US outright–even if you’ve “fully paid off your home”, you’re still just paying rent to the local government, lot’s and lot’s of it, and if one day you lose a job, get divorced or get sick and can’t pay that property tax, you get a lien and then lose your home. We totally get high property taxes on second homes, investment homes, Airbnb’s, land and properties, if anything there should be more of that to discourage speculation, but the high property taxes on a primary home just show how dumb is the idea of hoping someone’s own home values keep rising. And the way the media just assumes homeowners want that is just moronic.

May be end preferential tax treatment given to landlords

confused is correct,,, and in some places more than other, ”investors/speculators” are able to take advantage of the state and local discounts of property taxes, etc., that IMHO should ONLY be for owner occupied HOMES…

Certainly small potatoes compared with the very ridiculous tax advantages for the SO many ”TRILLIONS” of so called derivatives out there in the ”PAPER ONLY” financial situation WE, in this case WE the WORKERS have been supporting for the last couple decades with our labor.

The real scam in real estate is 1031 exchanges combined with qualified non-recourse financing and it affect on basis, the use of accelerated or large non-cash expenses (deprecation) to zero income while cash can be distributed (see Qualified non-recourse financing), and our estate tax laws. Oh with the 2017 tax cuts you can add income from pass-through taxed at a max 25% rate, which applies to “real estate” professionals.

It’s all government’s fault. They give tax incentives, buy MBS, blow the bubbles. People just react to the incentives. The leadership is rotten and corrupted to the core. Only option is to remove them all, that’s the only way to change the mindset. And the real ruling class behind them who’s really in charge.

Correction to my prior post –

*cash can be distributed tax free…

Add to post –

Combine that with triple Net leasing very few if any tax are paid anywhere along the chain. Distributions are tax free as return on capital, capital gains are first deferred with 1031 exchanges and eventual nullified by the estate tax basis adjustment to Fair Market Value. Property tax, insurance and CAMs are paid by the tenants.

Venkarel, I don’t agree. 1031 exchanges serve an important purpose. Otherwise, owners of investment real estate will never sell if buying a similar property elsewhere creates a tax liability. I actually think a similar thing should be in place for any assets, including stocks.

You don’t want to encourage people to make societally inefficient economic decisions based on taxes.

Lots of people are not itemizing anymore and so are not getting the “tax benefits” of home ownership on a yearly basis.

Yes, someone who owns a million or two million dollar house is probably itemizing. But that’s much, much less true if you’re talking about someone with a $300,000 or even $500,000 house.

Remember that the standard deduction was doubled in the 2017 tax law, something that evened the playing field for renters and home owners in areas with moderately priced homes (and so moderate interest payments and moderate property taxes).

I believe we will see confiscation of homes ,due to inability of owners to pay property tax here in Nebraska there totally out of control. Farmers selling going to other states no profits .Cities have schools bleeding taxpayer to death but schools look like Taj Mahal

Einhal, it is the combination of 1031 exchanges with basis step-up at death that creates my problem with 1031 exchanges. But the entire package of using a 1031 exchange to defer gain in the acquisition of a larger property with a larger mortgage (qualified non-recourse financing). Then using the basis increase to return “capital” tax free while reporting minimal to no income (if possible) aided by using ever larger deprecation and amortization deductions. After the death of the owner the property (or partnership/LLC percentage) is adjust to fair market value resulting in no capital gains tax. Furthermore, the ownership of the property in generally held in LLC’s which are then massively (20-40%) discounted in value due to lack of marketability and one other common discount I cannot recall right now. Which allows more real assets to fit under the estate tax exclusion resulting in a reduced estate tax capture. As well as third generation interior designers (this is a joke)

While this is legal tax avoidance it is pretty much only available to a certain “class” of person at the level of risk that this class assumes vis a vis the return.

I agree in theory that taxation of capital or equity should be minimized but the reality is our tax code does so in multiple places. As for inheritance tax, I do not know where I stand exactly. I see that it is a driving motivation for wealth accumulation, as well as perpetuating a cycle of wealth transfer to the oligarchs.

No disagreement from me on the basis step up (the government should not be tax advantaged or tax disadvantaged because someone dies, I don’t believe in basis step up or the inheritance tax).

And I also don’t agree with allowing real estate to depreciate as though the value of the improvements truly went to 0 (that’s not reality). But that’s a separate point from what we’re talking about.

Flea,

My ex-fiance grew up in the happy little farming community of Grant, Nebraska. Had a great childhood and HS experience.

Then the big Corporate farms came in and took over.

Look it up, it’s now on the state’s list of “blighted communities”. Doubt it’s a Taj M. high school there. And it’s not the only one, in NB or lot’s of other states. I’m sick of the whining about “poor family farmers”. That whining should have happened around 1980 when Corporate takeovers began.

And where did these unfortunate hard working once happy people get their explanation of what had happened to them from?

Talk Radio.

My problem with your comment is that it assumes this massive Fed balance sheet is not a problem. This is a horrible problem and the only way to really deal with it is to sell all that debt back to the market and let things get back to normal.

Can you imagine what home prices would be if…

– There was no Freddie and Fannie and the originating banks had to keep the credit risk?

– There was no mortgage deduction on taxes?

– Our government tried to stimulate homebuilding by making the building process easy?

– And we didnt have central banks driving interest rates down?

Please sir, can I have a bit more porridge?

All very good points.

But the scary (actually, terrifying beyond words) thing is that these DC cultivated distortions are so deeply embedded and entwined within their given “markets” that their withdrawal might be exactly like that of over-rapid heroin withdrawal.

Namely, death.

DC has been acting as a demented pusher for so long and so thoroughly that the “capitalist” adaptations to it have essentially rotted away the underlying economic health of the country.

History will look back upon the suicide of American “elite” leadershit with wonder and amazement.

And, at back of it all, the heroin dispensing, unlocked money printer.

But it is impossible to say they weren’t warned, by history and by students of history.

But DC was insulated by an army of MSM flying monkeys until it was too late.

As I said elsewhere, the internet came just 10 to 20 years too late – the brain and soul rotting MSM oligopolies had held unfettered, unquestioned, unexamined sway for too long – murdering American promise.

Cas sounds like the Talk Radio I mentioned above.

Won’t bother to even ask him for porridge, as I didn’t “Earn it” from him.

Confused,

ITS NOT A “GOAL” BUT A “CAP” (a MAXIMUM), for crying out loud. How many friggin times do I have to explains this?

READ THE ARTICLE, it will tell you the details – and it will tell you why “meeting” is the most ignorant word you could have used here.

No wonder you’re “Confused” – you never read anything.

I’m just so sick of this BS by people who never read the article, time after time. Go post this BS on Twitter. Not here.

Good morning, Wolf,

I had to take a screenshot of your comment.

When I was working, I wrote four articles about tax policy that were published in a journal read by policymakers in DC. I sweated over every word in the text and footnotes because I didn’t want to be wrong about the law or misunderstood by the reader. After a while, I realized that no one every reads an article as carefully as the author tries to write it and no one remembers everything the author wrote.

Like most of your readers, I am anxious for the Fed and Congress to kill inflation ASAP because inflation is so destructive. I lived through the wave of inflation that ran from the late 1960s through the early 1980s. Given all of the divisions in this country, I not certain that “our democracy” can survive two more years of serious inflation.

Thank you for providing the SWAP LINE chart. It makes complete sense and appreciate the clarification. During a crisis, the Prime and Swap lines are clearly tools used by Central Banks during a liquidity crisis. To your point, two tools to closely monitor.

As always, appreciate you putting the news into perspective.

Wolf,

I know you will delete this comment as it has nothing to do with the article…. but I just wanted to say how much I enjoy your web site and style…

And like others, when I read your articles, I read them in your voice…lol.

Keep up the great work. I do not know how you write like this, but keep up the great work.

I routinely post your articles to my channel on gab.

“ ITS NOT A “GOAL” BUT A “CAP” (a MAXIMUM), for crying out loud.”

The idea of setting a cap is to caution that they won’t go above it, that’s the sentiment that communicates their desire to not go too fast. But it also implies a floor to the market. Yes, it’s technically just a goal, but the longer they fall short the more discussion there is going to be about whether to sell MBS outright to reach that goal.

Where are my friends MarMar and NowHow?

Apple is down 11% in just 3 trading days. What happened? Don’t investors know Apple is a monopoly with huge balance sheet.

Should I start thinking about thinking of covering my shorts?

Again with the AAPL. You must be confusing this site with one of the Stonks forums on Redbook or whatever it’s called.

Did you mean Reebok or Robinhood? Or both?

Easy on the sauce. This is the financial forum I will have you know.

Traditionally there has been little discussion of individual stock trades on this site.

this actually for dougz:

THAT is exactly why I, and I suspect many others value Wolfstreet.com SO highly that WE send $ or $$ or $$$ to WR as regularly as WE are able…

I, for one, wish we could have a similar ”blog” or website, or whatever that was SO well ”””moderated””

GO WISH, eh

sorry, forgot to put in the

”’political” part of my wish to have a similarly ”adult” website…

Redbook is something else entirely …

I think you mean Reddit

Greenbook is a good movie.

Apple is just a massive SP500 pump and dump placeholder, Apple + Microsoft at their peak were greater than all the oil companies and all the banks combined. Apple > All banks. Apple > All oil companies. There are many such ridiculous statistics. Mainstream media started acknowledging another ridiculous comparison.Apple > Google + Facebook + Amazon. his just tells me how big of a fraud the valuations of the seven FATMAAN companies were.

In the span of 15 days from Oct 13 to Oct 28, apple went from $134 to $157. That is $23 x 17 billion shares = $390 billion increase in market capitalization. The increase is greater than more than 480 of the 500 companies in SPX. Just think about that for a moment.

Apple with book value $50 billion is not far from going to negative equity and then massive crash. Price to book ratio of 50, gimme a break. It seems to me that all the accounting statements have been fraudulently inflated. $397 billion revenue and $300 cost? Many of the costs are fixed or may be their revenue recognition method is highly inflated. One negative quarter will wipe all the equity as many of the costs are fixed costs I assume.

Be careful. Big Daddy special dividend could be coming. Short positions have to fund that.

Bobber, i do not short borrowed shares, only puts. Rolled all i had into September yesterday to increase time value in case things bounce here. Thank you for the advice still. Started looking at that SEC yield you mentioned the other day. Not all funds list it. I will dig more into it soon.

.25 dividend thats tiny daddy not big one!

My understanding is that banks are not required by the FED to have reserves. If so, what would be the effect on inflation if the reserve requirement was raised?

Banks hold an order of magnitude more reserves with the Fed now than when there was a reserve requirement. Unless the reserve requirement was raised massively, it would have no meaningful impact.

Big banks have no issue borrowing money from consumers at 0.01% and “lending” it to the Fed at 4% interest. Hence why they are keeping 3 trillion in cash with the Fed right now.

Gilbert,

ZERO EFFECT. Because the banks have $3.06 TRILLION in reserves already at the Fed — a lot more than a 10% reserve requirement would require — because the Fed PAYS the banks interest on those reserves, and they’re making money on those reserves.

Well a full reserve requirement and no interest may have some impact.😉

Wolf,

And just wait until the wider public really grasps this.

And then…just wait until the wider public learns that paying guaranteed arbitrage to the TBTF banks on idle reserves is the Fed genius “failsafe” that keeps (fingers crossed) wholly reckless re-lending from being even **more** insane.

The Fed has created a nuclear bomb safety held in place by a rusty paperclip tied to suicidal con men.

They are slowly (slowly) dismantling the bomb (it started leaking explicit inflation) but no country with a survival instinct runs things like this.

It is how they re-animated the corpse of a dead real economy.

“Over the past four weeks, the balance declined by $20 billion.”

So does this mean the Fed has missed it’s $37B monthly MBS runoff target by 46%?

Yes, but there’s not much they can do. Housing is almost frozenso no one is prepaying/closing their mortgage sand mortgage rates are probably higher than the Fed is comfortable with, so the Fed doesnt want to add any complexity.

They can outright sell MBS which they said they would do if pass through payments weren’t enough. Powell has made it clear he wants MBS off his balance sheet and would prefer to just hold treasuries. So I suspect he’s going to start selling soon.

Mortgage rates are not too high. They’re still below inflation. And house prices are still too high so I don’t Powell is worried about tanking the housing market. He had bigger fish to fry, namely inflation. And if cratering house values makes people feel poorer and therefore spend less ( opposite of the infamous wealth effect) then it helps him accomplish his goals.

“They can outright sell MBS which they said they would do if pass through payments weren’t enough”

Of course they can. The only question is will they and or when will they? I don’t see it happening this year, but next year is definitely a possibility. It makes sense that the runoff is, in part, pushing up the 30YFRM. Once the Fed gets to a possible terminal rate of 5% next year. They’ll need to rely on selling MBS to keep rates propped up. Mortgage rates need to remain high for the Fed to do its job.

Part of their job SHOULD BE to broadcast to the markets that they’re not going meddle in mortgage rate deflation just because a recession hits.

JayW said: “Part of their job SHOULD BE to broadcast to the markets that they’re not going meddle in mortgage rate deflation just because a recession hits.

——————————————

They have meddled in mortgage rate deflation for years.

That is what money and credit creation and interest rate suppression does.

I dont understand your comment that they cant do more. Of course they can sell more MBS to the market. As Wolf has said many times, the lack of demand is all about pricing. If the market demands a higher interest rate to absorb the MBS, then that is part of the price discovery process. Pure and simple.

The housing prices are a big part of why people are willing to spend so much money. It is called the middle class wealth effect, because the middle class owns homes, not stocks.

Once the Fed starts selling MBS at market rate, shouldn’t it be forced to do a massive write-down of its MBS holdings?

No one in open market will pay face value for those bonds – fair market value is far below.

By marking to market, Fed can reduce its balance sheet without any selling.

Wolf –

Have you seen any reason yet to reassess the layoff picture, or do you think it is still too early to raise an alarm?

In the “tech” sector, especially in the Bay Area, the number of layoffs, the size of the companies doing the layoffs, and the layoff headcount all seem to have been gradually but steadily increasing over the last couple months. If the rumors are true, tomorrow will be a twitter bloodbath.

Layoffs are irrelevant when job openings continue increasing, which Wolf just posted about.

Across the US, overall, going back about two decades, the low for layoffs (involuntary discharges) in one month was 1.26 million layoffs in December last year. Now we’re at about 1.3 million a month, which is still near record lows, and far lower than any pre-pandemic record low. So there are ALWAYS layoffs somewhere, but no one writes about them. It’s when Lyft lays off 700 people that it’s on the front page.

For right now, there have been historically few layoffs across the US. And many people that got laid off found jobs nearly instantly.

I don’t even know how many Twitter employees still live in the Bay Area since Twitter is WFH. Many of those WFH people have moved. Some of them may be (not) working two full-time WFH jobs already, and neither one of their employers knows.

This is the craziest labor market I’ve ever seen.

“Job market is strong” feels like the “subprime is contained” of current era.

Potential Nobel prize winning sentiment.

And “inflation is transitory”

All kinds of part time jobs no benefits at 12-17$ a hour all I see is old people doing them .As usual kick the retired when they created this country ,my aunt complained 35 years ago about same thing .So we do immigrants and old people both get screwed.

The ” (not) ” remark is just brilliant .

2008 is when all the QE insanity began.

It was actually defeated in Congress on the first vote.

Even with calls, letters and emails coming in at 400:1 against QE, congress listened to their constituents and voted a second time…passing this monster.

“It was actually defeated in Congress on the first vote.”

What was defeated was a big fast fiscal spend — a $700b war chest into the hands of Treasury Sec. Paulson. The moment that defeat happened, the S&P went into freefall. Congress then re-ran the vote and voted it through because there was, it appeared, a run starting on the entire planet’s banking and financial system. That could have brought us to Depression II and WW3. So there was a bona fide emergency.

IMO, “all the QE insanity” was a long series of Fed innovations that followed that, over a span of years, like the prolonged post-pandemic shenanigans that got us here, now. The initial extreme pandemic responses, shown in Wolf’s charts dramatically here, like the 2008 Congress vote, show a big spike in an emergency. The idea of applying “emergency” measures long past their due, is our problem now. This is reminiscent of the 70s misbehaviors over many years. Printing is so easy! Hopefully it is being wrung out now, and that absolutely means pain. “Pain” is a word Powell has now added to the Fed messaging. I can only hope he found a backbone.

Yes…”tanks in the streets” if wall street bankers didn’t get a bailout and their bonuses. Not matter how reckless their decisions are…

Too big to fail.

And you wonder how we got here.

“That could have brought us to Depression II and WW3.”

phleep said: ” because there was, it appeared, a run starting on the entire planet’s banking and financial system. That could have brought us to Depression II and WW3. So there was a bona fide emergency.”

—————————————————————

The only thing bona fide in your conclusions is that it an unsubstantiated opinion. conjecture. no support. no proof. just repeating the buffet/sachs/financial elite party line.

To the extent that the banks did need to be bailed out to protect the banking system, the government should have seized control of them and had them become government owned. Not given them free money to pay bonuses.

phleep, you ought to work for the FED as part of their propaganda department.

Much like a forest fire is necessary to clean out the forest, a horrible economic collapse is necessary right now. The financialization of our lives has been a disaster. Time for another approach.

There had been many financial collapses throughout the history of the world and the world always recovers. We just need to refrain from allowing the government to try to solve the problems in the wrong way, which is to destroy the free markets. We need to strengthen and build free market mechanisms that are durable and resilient and guard against anything that makes them weaker.

There needs to be some long-term thinking applied here.

You have to understand that the Fed is politically subordinated to Congress, by law. Fed policy was complicitly endorsed by Congress by not interfering, since they were already doing the Congress’ bidding, which is printing for government to spend. Congress can and will interfere with monetary policy if their spending to buy votes is inconvenienced. Congress *will* choose inflation over crash and default. It has happened before. The only acceptable inflation is zero or less, otherwise people are getting robbed.

Don’t it’s coming courtesy of IMF WORLD BANK

Yeah. I propose raking the leaves like Finland did.

NBay-dammit, sprayed my coffee…

May we all find a better day.

As the fed raises interest rates, the value of the bonds on its balance sheet become less and less.

It’s not that simple. As bonds approach their maturity date, their value rises to toward face value. On maturity date the value = face value because face value is what the holder gets paid by the government.

So a 10-year note that was issued 9 years ago and has 1 year left is now worth close to face value.

But a 10-year note that was issued in August 2020 at a 0.6% yield and has 8 years left is worth a lot less. But over the years, as it gets closer to maturity date, its value will rise toward face value.

If the Fed keeps the bonds until maturity when it gets paid face value, there are no losses involved. That’s what the Fed is doing.

This is exactly what the Fed should be doing with MBS. While its desirable to offload MBS and never allow them on the balance sheet again there is ZERO reason to become a forced seller at market to market prices.

If you want to sell 20 year treasury bond before maturity held in a Treasury Direct account the bond has to be transferred out to a bank/bond broker.How is the price you are paid by the bank/bond broker determined?.

Any time a broker sells a bond for you, they will try to find a buyer, and there may be few buyers for small volumes of older bonds, and they have to be motivated by a bigger discount than normal, and so the price you will be offered will not be good, and the broker is going to take a big cut out of it for all the work they did to arrange that small deal.

As small retail customer, I know I’m going to get screwed if I try to sell older bonds in the secondary market. I have done it a few times. And that’s why I’m not planning on doing it. I now buy at auction and hold to maturity. That’s a headache-free way of investing in bonds.

What Wolf says is exactly what I experienced when I started buying treasuries.

When interest rates finally climbed above zero, I bought T-bills a couple of times on the open market. Later, I did the math on what I was paying in commissions, fees, or whatever euphemism these thieves put on it. I was shocked, at both the actual number and how difficult it was to figure out.

Now, I will only buy treasuries at the auction and hold them to maturity. No commissions, no fees, no hidden costs. Each mainstream broker (Fidelity, Amertrade, Interactive Brokers, etc) does it a bit differently, but it’s a very straightforward process.

They have weekly auctions. Durations can vary but whatever you are looking for will come up soon – anything from 30 days to 30 years.

Another option is to open a Treasury Direct account and do it directly.

Hasnt the Fed been using alot of short term debt recently to finance the government? And is there a data on the maturities of the debt they purchased? Was it skewed to long or short term debt?

All the data on maturities of the stuff the Fed holds you can see (and download) if you click on the link I provided further down in reply to AB.

Prior to the Biden Administration, most of the QE was buying US treasuries from sellers (wealthy individuals, pension funds, mutual funds, etc.) who in turn bought other assets, hence we had Asset Price Inflation. But then at the beginning of the Biden administration an extra 2 + billion dollars was handed out to consumers facilitated by QE. Consumers with built up savings and reduced debt from the Covid lockdown period started spending their money creating excess demand in consumer markets (first goods, then services) giving us CPI inflation (obviously also made worse by the energy and food disruptions). My prediction is that this inflation will continue a lot longer than expected because a shortage of workers in many areas will keep unemployment from rising too much and hence will keep consumer spending growing.

Wolf, I’m calling political BS… over $4T was spent by the gov’t to battle the Pandemic and it spanned two administrations.

Laying ‘inflation’ on the Biden administration by name is BS! As the Billy Joel song goes; “we didn’t start the fire…”

WolfGoat,

Yes, correct, it is partisan political BS, plus a good does of other BS, and I should have deleted it. But you called it out as such, and so now I can let it stand.

Both parties are responsible for this inflation and unbridled spending thus needing QE.

But at this time the buck stops at Biden.

I am sure if Trump were president things would have been same.

No, Trump never takes accountability for anything and the base/GOP never holds him to it. Except for Cheney, Kinzinger and a handful of others. We know what happens to these apostates.

@ Wolf –

Owen said: “Prior to the Biden Administration, most of the QE was buying US treasuries from sellers (wealthy individuals, pension funds, mutual funds, etc.)”

——————————————–

Is this true or false?

Doesn’t the FED buy US treasuries only from Primary Dealers?

Wolf, very interesting info.!

Would you happen to know the difference between “Real M2” and M2? I was searching on the FRED database for M2 data and found the Real M2 data. When comparing monthly YoY %, the substantial decreases and increases of Real M2 seem to align well to Recessions, large Market declines and Market bubbles. I just don’t know the difference between Real M2 and M2. Thanks

From the FRED page for Real M2:

This series deflates M2 money stock (M2SL) with CPI (CPIAUCSL).

So Real M2 is adjusted for consumer price inflation. And if you want nominal M2, look for M2SL!

Thanks Widsom Seeker!

“Real” M2 is adjusted for inflation. It’s expressed in 1984 dollars.

Real m2 is a contrivance.

Asset price inflation has caused a generation of renting serfs fearful of being one above guideline rent increase away from living in a tent.

It’s criminal how that happened. An entire generation saw homes go from a few hundred thousand to over a million dollars in a few years.

I still don’t know w t f the FED was doing printing all that money and buying all of those MBS in the face of a hyperinflating housing market which was completely divorced from economic fundamentals and wages. And yet they are not accountable to anybody. They basically stole shelter from workers.

And (does this make sense?) in a sense the Fed has no skin in the game, because the Fed buys MBS and props up housing prices, but if there were massive defaults in those securities, it could just print money for itself to cover the hole, right? No sweat for it. So price discovery, real markets for real (non-rich) house buyers, is somewhat removed from the equation. So the gamed “market” drifts away from the reality of people who want to buy houses, biased toward those who already have them. Including, admittedly, me. But is is unfair, no?

There is no free lunch. The Fed doesn’t have its own lender. When it sells those bonds in market it’s receives less cash therefore it requires selling more bonds to extract cash to cool inflation. But this puts downward pressure on bond price raising market interest rate.

Of course it’s unfair. Complete corruption.

but what would be expected from liars and thieves?

Phleep, not quite, because the MBS that the Fed has printed for are ones that are guaranteed by the full faith and credit of the U.S. So the only way there would be defaults in those securities is if the Treasury (the U.S. government) defaults on its debts. You’re right that the Fed could effectively monetize government borrowing by printing the money to buy treasuries, but that’s not really what we’re talking about.

The FED, like the politicians in the US Congress and Canadian Parliament, serve their corporate donors and elite. They did it to help the rich get richer while gaslighting us that they saw inflation as transitory,or in Canada, we saw no inflation.

Wolf – I love the barrage of new articles you are putting out, so please take this criticism with the understanding that I appreciate what you do.

The graphs on this page show a very small period time, so the reduction in the balance sheet looks meaningful, but it you went back further in time, it would be more obvious that the Fed’s liquidation of MBS and Treasuries has been woefully lacking and that it could be argued that by not stepping up the pace much faster, this is actually still feeding inflation.

I remain amazed that the Fed has been able to get away with only selling off a tiny bit of the massive balance sheet and noone is calling them on it in the media. I feel like the Fed’s approach is all talk and very little action. The real action would be simply selling all of this trash to the market, the inverse of what they did to create this mess. That would stop inflation.

My guess is that Powell is waiting until after the election to start dumping assets at a faster pace.

Oh, I just noticed that last chart. That is the story I thought was missing.

You people are a handful. It took the Fed many many years to add just a portion of this stuff to the balance sheet and now you want the Fed sell it all in one day? This is just idiotic.

Long term chart at the bottom of the article, for crying out loud.

Wolf-totally offtrack & unnecessary (as I usually am, here), but would find your ‘daily Emily Latella-Moment Index’ chart highly-informative in the study of human nature (anecdotal quants where you can find them…).

(…and, as usual, thank you for your seemingly tireless and always-fearless work!).

May we all find a better day.

May we all find a a better day.

I think a reduction of 200 billion a month would be a good number. But I am confident that they would never do it. Powell doesn’t have the guts to upset Wall Street. They couldn’t even do a 1% interest rate hike.

Our financial system grew up with big public parts and big private ones. The private banks have self-interest, yes. But to have the public side suddenly start radically, unilaterally disrupting the whole setup introduces a whole new world of unseen problems and dilemmas. Careful what you wish for.

“Wall Street” is a big part of our financial plumbing. You can fire your plumber and start tearing pipes out of the walls and see what you get. Just like you can yank out all the life support systems from an unhealthy addicted patient and go full “free market” on it, and see that many such patients will expire immediately, and not in a pretty way.

What public side? The public side is only there to drink kool-aid, be debt and wage slaves, and pay for bail-outs.

Oh come on cb, you know what he meant. Especially when he he mentioned going full “flea market”. And 91B20 doesn’t have a full lock on offsmack comments, there’s me and ME to contend with.

@ NBay-

My response was to phleep’s comment, not that of B120.

Who is me and Me? Let us be direct. No need for “offsmack” comments.

91B20 started it with his SNL ref. Just silly SNL stuff. Not worth explaining.

No harm no foul here? we cool?

If not, we can both claim PTSD and get a thank you instead of a minor hand slap ;)

@ NBay –

completely cool

No one to buy it?

You really should put a zero reference on your charts. For a true perspective. Then, when was the last time any of this was at zero?

…and I am referencing the Fed’s debt.

The final chart tells the story better relative to time. Notice it was at 1 Trillion in 2007.

Even without QE, the balance would be rising for reasons I explained here. This simplistic nonsense is getting to me. You’ve been here long enough, you know this.

READ THIS:

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

Wolf,

The article you reference in the link claims a down to the bone maximum slack of $3.8 trillion available to runoff, yet the Fed is only running off $60 billion a month. Also, your chart at the bottom of the current article shows the Fed injecting $2.5 trillion essentially overnight. I believe that is the complaint.

The Fed is running off up to $90 billion a month. In October, it ran off $82 billion (1st paragraph).

Only morons would want to shut down the global economy by the Fed dumping $2.5 trillion in securities over a few weeks time. People don’t know what they’re talking about. If the financial system goes down — which is what this action would cause — your lights don’t come on and you cannot buy anything at the grocery store. Expecting or wishing for this is just totally nuts.

Your last chart is perfect.

I agree. The charts should show the zero for a fair picture. Asset reduction is slow and it probably should be slow in order to cause no panic. The fed should try to guide markets lower at a steady pace. I don’t think that that’s possible because rate increases are steep, but it has to be tried.

If I am positioned short in the stock market a slow decline is also the best scenario. That’s from past experience. The SP500 dropped about 2.2% per month from the highs, that’s fine imo. It is now still overvalued.

> The charts should show the zero for a fair picture.

Since when should an entity like the Fed have a zero balance sheet? So it might show something, but it is a fanciful, unreal point of reference. It simply won’t happen in a financial system of this scope, scale, modernity and sophistication, outside of the fantasies of some fringe wingnut.

It is easy to imagine more white space below the scale shown, down to zero.

A few of us are bracing for impact here in New Zealand. Most people seem oblivious. Interesting times.

You all talk of the doomed/falling/crashing housing market as a bad thing. I see it as an opportunity to buy more real estate at a great price!! And yes, I would be happy to pay 7% mortgage interest if the generated rents are greater than the payment

“We all” are not saying falling home prices are a bad thing. For many people, it’s the thing that they have long waited for. For others it is the long-needed unwinding of an era of total benighted craziness. How you make your investment decisions is up to you. I’m sure you understand that you’re not bottom-fishing if you buy now. Unlike the folks who bought in 2012, at the bottom, you’re buying near the peak of an insane bubble because prices haven’t come down nearly enough, and “we all” wish you good luck with that.

Everyone I’ve spoken to who has bought in the past few months, without exception, has basically said something like “Yeah, we’re overpaying, but we’ll refinance until a 4-5% mortgage when rates drop next year.

They’re that convinced that this is happening, and that there is no uncertainty.

I guess we’ll see whether they are right.

Maybe 5% ish could happen in a bad recession but I doubt we ever see anything below 5%. We know what happens when it goes below 4%.

I am thinking long term 6% or higher for the next few years. Inventory is still low. One reason the FED lowered mortgages to the 3% range was because of the excess inventory from HB1. No need to do artificially lower mortgage rates again.

Thus when people realize mortgages are not going to 4-5% again, they will start buying again. Hopefully at lower prices. That will depend upon the FED.

I was talking to my buddy about it this weekend. We both have had several mortgages with rates at 8% and 9%. I have had a rental house with an 8% mortgage rate. As long as the rent makes it work. Not a big deal.

Besides, there is another landlord here who is worth $20M, and he’s probably stealing rental property from you as I speak.

“But for years, QE didn’t trigger consumer price inflation – it just triggered asset price inflation, giving all central banks lots of opportunities to learn all the wrong lessons. Until it suddenly triggered massive consumer price inflation.”

Is there really any evidence for QE causing consumer price inflation?

If you don’t WANT to see the evidence, there is no evidence. Simple as that.

“If you don’t WANT to see the evidence, there is no evidence.”

This quote should be a banner at the top of the website.

Wolf

Is there a breakdown of the Treasury bonds and notes rolling off by maturity? If not, can reliable inferences can be drawn?

For example, if the breakdown of outstanding marketable treasury securities (Statista) can be applied proportionately to the Fed’s shrinking balance sheet, the overwhelming majority of roll-off would be in the 1-10 Yrs range, theoretically promoting inversion along the curve. If so, might that in part explain the guidance to moderate increases in Fed Funds rate?

I vaguely recall Powell earlier this year targeting a steepened curve. That’s not what’s he’s got. In the context of tightening, how would you describe the Fed’s direct control over longer dated Treasury securities? Does this end of the curve matter relative to the short-end and 10-Yr?

Also, lags noted I hope, given the shortfall in MBS roll-off, is the key headline thus far that the Fed has misjudged the extent of the downturn in the housing market?

All the maturity dates are listed on the page linked below — which is why I know that the next TIPS roll-off will be in January, and which is why I know that for example on Nov 15, $74 billion in Treasuries will mature, which is above the monthly cap of $60 billion (click on the buttons for Treasuries types to see each in detail):

https://www.newyorkfed.org/markets/soma-holdings

Thank you

1) Pending home sales slumped. At zero rates the banks dumped their

mortgages to Fanie Mae and serviced them.

2) At normal rates the banks will keep their mortgages.

3) After fourteen years, since 2008, there is a major shift in the economy.

The RE market is moving from the gov hands to the private sector, first slowly then faster.

4) The Fed will keep negative rates as long as it takes, fight runaway

inflation and dumped the RE burden back to the banks.

5) New home buyers will get used to 6%- 8% mortgages. The banks will

grow their assets, the Fed will gradually shrink them.

2) yep. The GSEs bought 98% of all loans and bundled them into MBS between 2010 and 2022. Banks just did not want to make a 30 year loan at 3%. To risky. Principle reduction and payoff was not good.

Now at these current rates, banks will start to keep the loans again. Banks may be a good investment at these rates. They can actually have a nice interest rate spread to make a profit instead of just putting the money into the FEDS RRP

ru82,

keep your eyes on the primary banks. A major shift is happening in 2022 : within few years mortgage loans will shift from the gov to the private sector, increasing their assets and profit. keep your eyes on the regional banks.

The 30yr is up 5 basis points this morning so perhaps QT is just starting to bite!

Hey Wolf, was there any Liquidity Swaps with the BoE similar to the SNB? Curious about that since they had that kabuffle with their Penison Funds.

There was a minuscule $5 million swap with the BOE on Sep 28. There are other minuscule swaps with other central banks. This may just be a way of testing the system. For example, there was a minuscule swap with the ECB of about $200 million or so. There was minuscule swap with the BOJ of $3 million on Sep 13. Etc.

I think the SNB swaps had to do with short-term dollar liquidity support for Credit Suisse. The SNB can sell its US stock holdings to get dollars, but it likely didn’t want to do that for a short-term need like that. The BOE problem was unrelated to dollars.

How many people in the Bay Area mortgaged their stock holdings to buy a house, or a new car.

Too many to count. Fun times ahead in bay area….

Buying a house by putting up your startup’s pre-IPO shares as collateral is a big business for some financial institutions here. I met a guy who worked for a bank that did that.

Kunal?

I kid I kid….

Interesting. How does a bank begin to value a startup’s pre-IPO shares for purposes of LTV? What kind of advance rates are they willing to pay?

Check the stock of SVB, the owner of Silicon Valley Bank [SIVB]. It’s on my imploded stocks list.

Pre-IPO shares are collateral for all kinds of stuff. The valuations are decided on behind closed doors at various rounds of funding. The scam is unraveling.

Jobs report sparking another pivot rally. I swear it’s Ground Hog’s Day.

The more they rally, the higher the rates.

Algo is defective.

Or they are trying to milk the ‘China’ news?

Personally, I’d be putting the quotes around the word ‘news’.

Arya Stark,

Why don’t you come around on days when the market has one of its many pivot selloffs? Why is it that you only come around with this type of comment when the market is up?

The Nasdaq has plunged 35% from a year ago. So “another-pivot-selloff” comment from you on one of the many sell-off days would be kinda fun, no?

Just pointing out that all it takes for a tweet about a pivot or pause or seemingly dovish comment by a fed governor to rocket all assets north in a ny minute. Today has been a perfect example of the manic moves.

Markets go up and down, and mostly down these days, with the Nasdaq down 5.6% for the week, and a bounce was needed, and a Tweet doesn’t do crap. But endless comments of this nature every time there is finally a bounce are getting old.

Yes I follow Ukraine twits and I love this meme statement….

“What pivot rally doing?”

The general direction is down and remember nothing goes down in a straight line.

I won’t be surprised if mkt goes up for few weeks.

Good for the Fed. Inflation is hurting little people and has to be dealt wth or it will get worse. The Fed are trying to walk the talk. Meanwhile Wall Street continues to push “the Pivot is Coming”. Less than 48 hours after Powell’s making clear that Fed is out to kill inflation, the Street is back to “the Pivot is just around the corner, asset inflation to return, China is back and will bring back deflation to the cost of living, free money from the Central banks on the horizon, they can see it now from Wall Street so Buy, Buy, Buy”. My thoughts are, which Wall Street always used to promote (when it was to their advantage) is “Don’t Fight the Fed”.

I don’t see any talk of a “pivot.” However, I do see a new headline from the FED saying it’s even too early to know how high rates must go. That is about as anti-pivot as it gets. The pivot narrative was just extinguished.

What does the Fed do with the cash the Treasury pays back for the matured bond? Does that cash go to cash heaven?

Yes, it goes to “cash heaven,” I love that! The Fed destroys the cash in the opposite way that it created it during QE.

QT is the opposite of QE.

Central banks don’t have a “cash” account. They routinely create and destroy cash instead.

There’s a big vault under the US Treasury… I heard it on the webs!

Where are you seeing the $8.68T number? I look at the Nov 3 report and see a balance of $8.726T.

You’re looking at Table 1 (Factors Affecting Reserve Balances of Depository Institutions)

You need to look at Table 5 (Consolidated Statement of Condition of All Federal Reserve Banks)

Thanks.

@ Wolf –

On your chart, you referred to period from 2014 through 2018 as the Good Times. Good Times for who?

It was a time of asset price inflation and interest rate suppression. It was a continuation of the bailout and was part of the base-staging for the problems we now face.

QT is actually pretty brilliant from a social engineering standpoint. QT can fight inflation much more quietly than raising interest rates.

QE is a brazen market intervention that should never ever happened. Government’s solutions are always worse than the problem, because all these institutions are self serving first. We need to take or money out of Government’s hands – it’s either metals or electronic, something that cannot be manipulated and inflated to oblivion.

JPow had one job (albeit with two components): stability.

He took rates too low, eased a bit too much. And now he’s probably over-correcting. ($4.1 trillion in fiscal stimulus didn’t help either.)

He was shaking as he read this week’s Fed announcement.

Buckle up. The car is swerving and we’re going off the road. And the inside players all know it.

I noticed this shaking also ,could be a medical condition or nerves or fear

Looked fine to me. He’s not the youngest dude. From the side, he looked a little hunched over, which reminded me to straighten up my posture :-]

Could be “essential tremors” which is a medical condition for some aged folks. I have two friends who suffer from it.

Also one of the heart drugs that helps control A-Fib can cause tremors.

Could also be Tardive Dyskinesia, (random uncontrolled movements) which comes from taking too many meds to help you cope with this society.

But don’t worry, there is now a med out for that, too, so you can stay on the other meds and still not be “needlessly embarrassed”, as the ad says…..

“And now he’s probably over-correcting.”

Uh-huh – a fed funds rate that’s almost 5% below CPI is “over-correcting.” It sounds like it’s time for you to review some history. Never before has the fed funds rate been so grossly behind CPI. “Over-correcting” would be continuing to raise the fed funds rate way beyond CPI.

The Pandemic Federal Reserve policy was MMT exactly. Now you know what happens if the government adopts this financial train wreck. Two years after the money printing inflation is out of control. All the malinvestment that resulted will have to be unwound, with much pain and suffering for everyone, including those who did not get any benefits from all this money printing. No one has learned any lesson from this. That’s the sad truth.

I prefer the headline “FED’s Balance Sheet Remains at Grotesque $8.68 TRILLION, Further Fueling Inflation.”

Wolf, the Fed creates money and buys securities from primary dealers but the dealers have to acquire those bonds and securities first. So the new money flows to the sellers of treasury bonds and MBS. Not sure how much of it chases assets from there. The government doles out the new money to all and sundry; I guess the sellers of MBS use it to buy more MBS.

Are the losses the FED is currently posting due to the fact they are paying higher interest to their member banks than their investments are producing? Their losses are also going to mean no income to the Federal Government from remittances.

How long can the FED sustain losses at the rate they are at, before it becomes a serious issue?

It will never become a serious issue for the Fed, the way the Fed is set up, since it can create its own money. Profit and loss are essentially irrelevant — and purposefully so — for a modern central bank.

It became a serious issue in 1933

The Fed doesn’t worry about profit/loss. Their edict is full employment (3-4% unemployment because you have to keep people moving around in jobs, but don’t want wage inflation to hit) and stable prices (inflation maintained at ~2%).

How much money is in the vault and floating around the world doesn’t concern them unless their edicts get out of whack. The fact they have to raise interest rates to pull things back down to a steady state level (creating a recession) doesn’t make them happy, but it was their own fault by not managing it properly (Most Reckless Fed Ever).

Now the impact on “We the People” (aka, our Gov’t) of higher interest on the National Debt and what that means for the operation of said Gov’t is a political issue, not an issue for the Fed to address.

There’s always raising Taxes to fix things when need be, but again, that’s a political decision!

If the Fed was really serious about QT, it would start selling bonds from the balance sheet into the open market versus just letting maturing bonds roll off. This a more aggressive form of QT that would quickly help drain the excess liquidity which is still fueling inflation.

Bob

Agree.

QE was fast and furious. Between Feb 2020 and April 2022, Fed dumped nearly 5 Trillion in 2 yrs.

Now the QT is relatively at a snail pace unlike that QE. Fed’s monetary policies were always towards promoting asset inflation, since 2000.

No wonder the same gang who brought us TWO boom-bust cycles in this century didn’t learn anything from their past mistakes. Now trying to unwind the 3rd largest, ‘everything’ bubble at their ‘own’ slow pace. Can’t shock the mkts, right?

For the 18 months between May 2020 and Dec 2021, the QE pace was somewhat under $120 billion a month. Now the QT pace is a little under $90 billion a month. Not a huge difference.

The March and April 2020 QE was gigantic and you cannot unwind that in two or three months without shutting down the global economy.

Keep your eyes on the facts, s’il vous plaît

Nobody is asking for two or three months. They believe it should be less than four years. A treasury roll off of $90 billion a month would be an improvement that actually brings down artificially created QE asset prices. The $60 billion a month is clearly not doing it.

“But for years, QE didn’t trigger consumer price inflation – it just triggered asset price inflation..”

?

This in turn increased ‘wealth’ effect which contributes to more spending and inflation

That was exactly what the FED wanted. They new asset prices would go up for the rich, who would spend and the money would trickle down. They just did not realize inflation was building up behind a big dam via the assets price inflation, then people start spending via the wealth effect all at one time. Then blastoff

Interest payment on the current 31 Trillions National debt

If the current ~4.5% average yield curve rate propagates to all $31 trillion worth of debt, we are looking at $1.4 trillion per year just in interest payments. This would be 29% of the 2022 FY total Federal tax receipt.

Is Fed trapped?

Thing to ponder over this weekend.

The total debt has jumped by 33% since Feb 2020. So what do you expect? That interest expense goes down? There comes a time to pay the piper. And the time is now.

I believe you did a great article a month or two ago showing that high interest rates were not a threat to the FED, Treasury or US Govt. If you can, please link that article here.

Thanks for remembering. Not sure if you meant this; it’s from June:

https://wolfstreet.com/2022/06/27/can-the-government-even-pay-the-rising-interest-expense-on-its-gigantic-debt-as-the-fed-pushes-up-rates-yes-heres-why/

@ Wolf –

That’s the article. It was exceptional and a great educational service. You do some of your best work when you methodically dispel oft repeated and accepted financial non-truths.

Thanks.

Wolfman is right. Time to pay the piper.

That means they have to at least hold spending constant or increase no more than one-half the inflation rate.

And they may have to increase taxes, preferably if they can be temporary tax increases.

Hopefully that would lower the debt to GDP ratio from currently around 122% to back to pre COVID pandemic levels of 102%.

@ Wolf – who said: ” Treasury securities mature mid-month and at the end of the month, which is when they roll off the Fed’s balance sheet.’

——————————————–

“roll off the balance sheet”? Did the Treasury actually pay off those treasuries with dollars? Where did the treasury get those dollars?