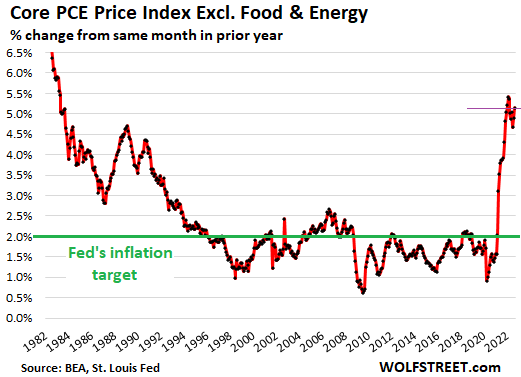

No signs of inflation slowing down, as measured by the yardstick for the Fed’s 2% inflation target.

By Wolf Richter for WOLF STREET.

The Fed, when it targets inflation and when it says that it wants to bring inflation back down to 2%, uses as its yardstick the inflation index that was released today by the Bureau of Economic Analysis: the Core PCE price index. This is generally the lowest lowball inflation index that the US government produces. It attempts to measure how inflation has spread across the economy, beyond volatile commodities, and so it excludes the food and energy components. Food prices jumped in September but gasoline prices plunged, and both are excluded from this index.

The PCE price index released today is the last inflation index before the Fed’s meeting next week. What the Fed got today is additional evidence that underlying inflation isn’t cooling off, and it got additional support for a 75-basis-point hike, which will take the upper limit of its federal funds target range to 4.0%.

The core PCE price index jumped 5.1% in September, compared to a year ago, the fourth-highest reading in this cycle, behind January, February, and March. All of them are the highest since 1983. You can see that little trough that formed in the index from April through July. But the August and September moved in the wrong direction again:

In terms of the Fed’s 2% inflation target as measured by core PCE, inflation is worsening and now measures over 2.5 times the Fed’s target.

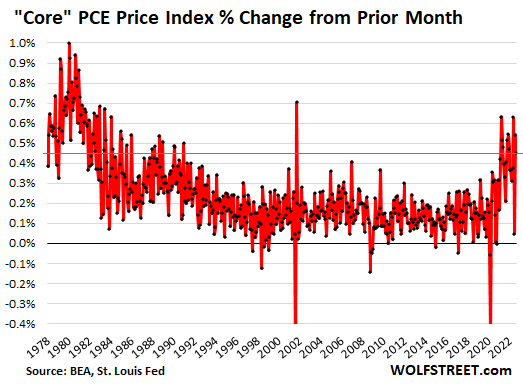

On a month-to-month basis, the “core PCE” price index jumped by 0.5% in September from August. This is in the range of the highest inflation readings in this cycle, and in the range of the red-hot inflation in the late 1970s and early 1980s, and another sign that underlying inflation is just not slowing down, though it varies from month to month:

Back in July, the core PCE had risen by just a hair over 0% from June, and it was once again ballyhooed as the end of inflation, and the meme was spread around that inflation had once again “peaked,” but turns out, this was just a one-time event, and raging inflation continues to dish up surprises.

Whether or not core PCE measures actual inflation as you or I experience it is totally irrelevant here. What matters here is that the Fed uses core PCE as a yardstick for its inflation target. It matters for future rate hikes. It matters for the bond market and stock market because it shows how far the Fed is off from its inflation target. And it gives some clues as to where the Fed might be going with its policy rates.

Based on today’s core PCE measure, and on other measures too, including core CPI and services CPI, the Fed has gotten all the ammo it needs to lift its policy rates by 75 basis points next week, and lift them further in December, and next year.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yep… Things are going to have to break, seriously, before the markets believe it. The Fed can’t be too happy about this rally. I foresee another Jacksonhole moment coming up. But… I could be wrong lol

When interest rates rise on our $32T of US Treasury Debt, I don’t believe our taxes will cover the higher interest expenses that will be paid our. My assumption is we will issue more US Treasuries and just monetize the interest expense on the US Treasury Debt. Government continues to spend; US Treasury Debt continues to rise. Consumers bear the burden of not being able to borrow debt (we aren’t the money printing machine) and since the consumer is ~70% of the inflation equation; the fed is inherently forcing the consumer to stop spending, not the government.

As our former veep said, ‘deficits don’t matter’.

The problem with this is Treasurys are having a rough go lately. Liquidity in the market is drying up. Few want government debt.

No, that’s not what the headlines that you read mean. Treasuries are in red-hot demand, as you can tell from yields still being so far below the rate of inflation.

The liquidity issues refer to Treasuries issued many years ago that are always hard to trade in large quantities. There are buyers but they buy at big discounts. For example, if you own $1 billion of 30-year bonds that were issued 10 years ago, and you want to sell that whole pile, you will have to lower your price (discount) far enough below the market price to find a buyer. That discount has always been there on older bonds, but it’s even bigger now because yields have risen sharply. That’s what they mean by “liquidity” in the Treasury market. So it could be difficult for example for a hedge fund to unwind a big leveraged Treasury bet that has gone awry (similar to what happened in the UK).

Is there any import in the story that with interest rates up the Fed has gone into the red paying the interest on the reverse repo’s?

The Fed loves this rally.

Total cover to keep raising rates.

Imagine trying to raise rates in a FED meeting just days after a 5,000 point drop?

You’re right, but the rally tells me the stock market doesn’t get it, or at least wants to ignore what’s coming (higher interest rates and more QT).

I am reading at Bloomy that trouble brewing at the Treasury mkt, which could become acute any time. Is this reason for front running and mkt melt up?

Any thing from Wolf on this situation?

Thanks

The market is really just trying to make up losses before everything possibly falls apart next year. And more than anything, it’s looking at the still buoyant labor market. If / once the labor market turns, then that’s the time to exit the market to whatever your portfolio / stomach allows.

Good point.

The Fed would be happy with this rally. Nothing is worse for them than having to hike by 75 bpts into a crash. Stocks are down a lot, housing is already coming down, volume has frozen, bonds are down a lot… The Fed doesn’t want chaos. It wants lower inflation rates, and the way to get there is to hike without chaos. And I think we’re on track for hikes and QT “without chaos.” Looking good :-]

or chaos can come like a furry and a suck punch to the back of the head…and to this hubris forever hopium market, I say well deserved.

That’s called a donkey punch.

Wealth, if that were the case and you may be right… Why did Paul rip up his prepared speech at Jackson hole that was supposed to be 30 minutes, to get a 10 minute no holds barred hawkish without a doubt we’re raising rates there will be no pivot speech instead. That happened just after in fact right at the end of the summer rally which caused it to drop. Just asking, I defer to your experience… It just seems to me that a 13% rally in the teeth of bad inflation reports is irrational exuberance.🤷🏽♂️

Obviously my voice activated comment should have said Wolf instead of Wealth…

The other comment is this market rally, to the extent and velocity it has risen, fosters the opposite of the tightening policy the Fed is trying to establish… I think…Please someone correct me if that’s wrong..

Anyway S&P closes JUST over 3900… next week will be REAL interesting.

I’ll end by repeating what I said in the comments of Wolf’s previous post…. IMAGINE what the markets would have done today if AMZN/AAPL’s earnings were good?

The summer rally was bigger and ended in a lower low.

Good!

“If ya don’t eat your KAOS, you can’t have any KONTROL. How can you have any KONTROL if you don’t eat your KAOS?”

“Hey, preacher, leave them bids alone. All in all, we won’t be bringing industry back home. All in all, it was all just fake bricks in the vault.”

It’s the top of the hour and the bottom of the seventh, and you’ve been listening to Mink Void with their new hit, “We don’t need no Feducation”.

LOL, you guys crack me up. Made my day.

If the FED does not want chaos, it should have not laid the groundwork for chaos in the first place.

The FED doesn’t want accountability for its past actions.

” The Fed doesn’t want chaos.”

Hard for me to believe, Wolf, seeing as how they ZIRP’d rates and purchased what, 1-2 trillion worth of MBSs, to help loan-owners blow the biggest leveraged housing bubble ever. They set the table for the coming chaos.

Granted it was idiot consumers that took the bait, but after over 100 years of practice you’d think the Fed would be a bit better at smoothing economic cycles.

Rob,

Smooth economic cycles wont make the Fed members and their friends rich.

They know exactly what they are doing.

Not comfortable with the Fed will hike until something breaks policy

If you’re not comfortable with it, then don’t think in those terms. That’s not what the Fed is doing. It’s a phrase that is being thrown around by hedge fund managers and bond fund managers that are losing their shirts with higher rates, and they want this to stop, and they’re constantly on CNBC and Bloomberg talking their book. But it’s really just BS, and you shouldn’t be comfortable with this nonsense. Deflating the Everything Bubble is going to take time, and it’s not going to be smooth, and some of the artificial wealth that was created from money printing and interest rate repression is going to vanish, and some of it has already vanished. People need to be adult about this, and not have this sense of entitlement.

People DO need to be “adult” about this. Stress is the major root cause of all disease, along with our “modern diets and lifestyles”. Science that is not driven by profit offers some interesting perspectives that might help you rise above the frenzy. It sure works for me. Realizing I am rather meaningless in the universe helps me focus more on only what I truly need.

Tales of what people have done to discover what they “really need” are abundant here. I hope inflation wises people up rather than panics them into blaming whoever or what ever for losses in already obscenely gluttonous life styles. You DO have the option to ignore advertising….the lives depicted there are simply not real…talk about “Hopium”…sheesh.

Multicellularity allows an organism to exceed the size limits normally imposed by diffusion: single cells with increased size have a decreased surface-to-volume ratio and have difficulty absorbing sufficient nutrients and transporting them throughout the cell. Multicellular organisms thus have the competitive advantages of an increase in size without its limitations. They can have longer lifespans as they can continue living when individual cells die. Multicellularity also permits increasing complexity by allowing differentiation of cell types within one organism.

Whether these can be seen as advantages however is debatable. The vast majority of living organisms are single cellular, and even in terms of biomass, single cellular organisms are far more successful than animals, though not plants.[51] Rather than seeing traits such as longer lifespans and greater size as an advantage, many biologists see these only as examples of diversity, with associated tradeoffs.

Don’t follow leaders, and watch the parking meters.

Like Mike Tyson says” everyone has a plan until they get hit in the mouth!”

Or just for fun, to go back a century before Tyson, there’s Field Marshal Helmuth von Moltke the Elder, who said:

“No plan of operations extends with any certainty beyond the first contact with the main hostile force.”

But yeah, Tyson’s quip is admittedly snappier….

I think they’re happy with it if only for the fact that they’re getting wealthier while the middle class and poor continue to get murdered by inflation. Not seeing any sort of reprieve for the people who can least afford the massive price increases everywhere. Just a revolting situation. But hey, they’ll sit there and argue over a measly 25 basis points while the world burns in a bonfire of their creation.

Yupe.

If you do not own some SRTY and SQQQ in this obvious blistering bear market rally, you may be missing out. Lower lows ahead.

You are right, but I temper that with minimal purchase of URTY and TQQQ to cut the bite from whiplash rally, guaranteed in a secular Bear mkt.

Nibble very slowly on div paying stocks like XOM and other various ETFs ( with div of at least 2.5% or better) across sectors and across the globe ( in my IRA) This is balancing out Bear trap rallies. Working fine.

Current party in power did everything possible to goose the economy and shape the future before the election. Put Powell in a tough spot and he tightened as fast as he dared, but with the lag the monetary policy will not bite til after the election.

Lame duck session probably going to dig a deeper hole before something breaks around end of the year.

There certainly doesn’t appear to be crash on the horizon, which I say is primarily due to a buoyant labor market. By the start of the new year, this could change with housing / building related goods & services being forced to ramp up layoffs.

Personally, I want to see if the Fed meets its MBS runoff targets in Nov – Jan. I’m hoping by January that they’re forced to start selling MBS. The rest of 2022 appears to be the calm before the storm. And of course, the Fed doesn’t want chaos. That means they’ll have to pivot sooner than they want to get the job done.

My definition of chaos is housing that goes beyond a 20% decline & unemployment that is at or above 5% for 6 – 9 months. I don’t think JPowell can navigate chaos beyond those levels without being forced to pivot / put.

“Personally, I want to see if the Fed meets its MBS runoff targets in…”

I have explained this a gazillion times. It’s NOT a “target” but a “cap” — a maximum. And it’s not “meets” because MBS come off via pass-through principal payments, and the Fed has nothing to do with that, they’re determined by mortgage payoffs, either through refis or sale of the home, and by regular mortgage payments, all of which are passed through to the MBS holder, which I explained a gazillion times. Refis have collapsed by 90%, and home sales have plunged by 30%+, so mortgage payoffs have turned from a torrent into a creek.

Having control of PPT allows them some control the optics….

I for one would like to see PPT go away…

Pretty soon, the PPT traders will be seen again at the bar around the corner, drinking during the day instead of buying stocks. This has been a big issue with the PPT, and Powell and Yellen got together to figure out how to keep these young traders at their trading desks. According to sources familiar with the matter, Powell and Yellen handed the bar owner a Trader Joe’s bag with Federal Reserve Notes fresh from the printer to pay the owner to shut the bar down through October so that these traders would stay at their desks. However, according to sources, no plans have been made for November, and the bar is likely to reopen this week. The sources said that they’re watching the bar and will let us know when the PPT traders show up during the day to get drunk instead of buying stocks.

Jackass hole = 🤣

I know it’s purely anecdotal evidence, but I just haven’t seen a change in the spending habits in my community. In fact, things seem to be chugging along pretty mightily, despite the ubiquitous sense of foreboding about the future.

All that could go out the window very quickly, but it definitely fits with the market rally, rising inflation, etc. Still a looooot of money out there.

100%! Been looking at my local Toyota dealership. Everything fuel efficient AND gas guzzler is sold out WITH $5K dealer adjustments(up) on everything. My contractor is booked solid through 2024 with projects. Looking to do a kitchen remodel- 13 WEEKS at least just to get the cabinets.

Waiting for a consumer spending slow down is like Waiting for Godot.

There are some good YouTube updates on housing activity and the cratering. You must be in a cheaper get to State.

Give it time brothers… give it time.

This is a multi year process folks. Patience.

We need to revisit this topic in about 2 years…..

Went to a nice steak house in a nice suburban area on a Wednesday night…

A step above an Outback but not by much.

Two hour wait for a table.

The place was packed.

Same, went to a Texas Roadhouse restaurant on Thursday. The line was out the door.

I was in Honolulu last week. The place was packed. A manager at the Hilton Hawaiian Village said this July was their busiest month ever.

Just went to Asian restaurant in Anaheim. Closed down. Not enough customers. Look at business where the bottom 50% live. There are twice as many poor/week to week than rich/people with decent money to blow. Twice as many. 1/3rd a country does not a good economy one make.

Asian eateries in Anaheim? I would only do Mexican there. In the city asian eateries shut down also.

I can tell ya, credit is still curning, it is the engine of most all growth

Our little piece of heaven here on the north side of Houston, Texas is just brimming with new BMW’s, Benz’s, BIG Trucks, and even a splattering of C8 Corvettes.

Restaurants are packed here, too, and an hour and a half wait is common, even on Sunday nights! No recession in sight here.

Gas is cheap though, as most stations are at $2.89 – $3.09 for RUG. Diesel is another matter.

I use the bike gauge. $6000 road bikes are out of stock indefinitely.

Anthony, maybe those C* purchases were downgrades from what would have been Porsche 992 buys? That’s their version of cutting back!

You know, the new 911 (992) GT3 RS has active aerodynamic downforce incorporated into its ‘performance bag of tricks.’ It is the new benchmark of moderately-priced supercars, is it not?

I saw my first Ford Lightening parked at my office building. Very nice looking truck. Not sure its worth $70k though.

Back of the napkin an EV costs about .05 a mile in electricty and a hybrid about double that. However you can own a hybrid at half the cost. That does not net to zero because the EV is about 25 cents to own for 200K miles, and the hybrid is maybe 12 1/2. And with an EV you won’t exactly be driving cross country marathons.

PLY: It is the same where I live in Australia – minus the foreboding. Australians were pretty untouched by the 2008 financial downturn and keep assuring me that we are the “lucky country.” House prices in my area have even gone up a little although we are not in the Melbourne or Sydney areas. Restaurants are full and shops are busy. You can’t get a “tradie” without waiting at least a month and when you do, the person is very expensive.

Saw an interview with a realtor in Las Vegas. Housing market there is dead, dead, dead. Leveraged assets was always going to be where it starts, especially housing.

Some of our cheaper lake properties are starting to go at discount fully furnished. Not sure if they were Airbnb rentals or vacation homes, but it does give me hope for the rest of our housing market. Houses $300K and above are starting to sit for longer periods. However, the decent houses in the $200ks are still selling quickly. I’m in the South.

No, there is a lot of credit out there….. big difference.

Amen 🙏

Diesel was up from $2.37 in Nov 2020 to $5.81 in June 2022. R/R strike,

during a never ending road works. will increase demand for diesel.

Reducing oil reserves for political reasons might exacerbate the situation.

R/R unions are more important than Long Beach and Savannah stevadores, because our economy is shifting internally.

If both unions strike Europe energy situation will get worse.

Natural gas was below $0 in Europe on Wednesday. Too much gas, no place to put it. Like what happened in May 2020.

Couldn’t they just ship it back to Russia and sunction them $100 surcharge?

They should ramp up QT by selling off assets rather than letting the bonds mature and roll off. Seems like the markets have quite a bit of liquidity still so the demand for them is there…might as well sell it while they can (even at a loss).

Treasuries are rolling off fast enough to hit the cap most months, and they have T-bills that they let roll off if Treasuries can’t meet the cap. The problem is MBS. The volume of payoffs has frozen, as refis collapsed and home purchases are way down. So pass-through principal payments are way down, and below the cap, and they should start selling MBS to get to the cap, and we might hear a little more about that in the minutes of the Nov meeting.

Thanks for this update, Wolf.

Unless they are forced to, who would pay off their 3% mortgage now?

That would explain the low volume of payoffs of MBS’s

Given all of the skimming that happens with a mortgage on its way to becoming an MBS, Ambrose Bierce pointed out that publicly available MBS funds are only paying a 1.4% dividend.

I hope the Fed is getting a better return on their MBSs. Otherwise, they may have earn 1.4% for the next 30 years waiting for the roll-off as people start dying in their 3% loan houses. Or the Fed could sell the MBS’s at a huge loss.

Does this make sense?

Our loan servicer just changed and we are going through the typical hassle of making sure our payments are now going to the new place. The web page for the new servicer is much worse than the old one. The mortgage holder may have gone with a service provider who charges less and has less interest in customer service

I will certainly not refi at 7% with a 3% loan. I have no need to sell and move at my age. With Treasuries paying 4+% I am not paying my loan down early.

If I was a crook and dishonest and I thought housing would crash 50%, it may be to my benefit to refi at 7% and take the all the 50% gains from the last 3 years out of the house now. I’m sure it is tempting to take the money and run if things fall apart. Living in a non-recourse state allows people to do this. The US government will bail out the banks like they did in 2008, and the mortgage holder can keep the yacht while going back to a discount rental.

They can pry my 3% loan out of my cold dead fingers. :-)

1. The Fed made $1.06 trillion in profit over the past 10 years and remitted that to the US Treasury Dept. So who cares if it loses some money?

2. Trillions of dollars have already been lost in the stock and bond markets, and not by the Fed. When rates go up, asset prices go down, that’s just how it is. MBS are no different.

3. The MBS pass-through principal payments are still flowing. They’re not zero. They have just turned from a torrent into a creek. So for the Fed, the MBS are still going away, but at a slower pace than the cap.

4. Once the housing market thaws a little, with sellers finally accepting reality and lowering prices to where they can actually sell their properties, the pass-through principal payments will speed up again. Same if we get a wave of foreclosures.

“I’m sure it is tempting to take the money and run if things fall apart. Living in a non-recourse state allows people to do this.”

I thought Wolf said that only the original loan is non-recourse, and that once you refinance, you lose that status.

Yes, make sure you read the loan documents very carefully.

JeffD,

In 2013 California changed its law to extend nonrecourse protections to refinanced loans where no cash is taken out, i.e., so the homeowner can refinance to get a lower rate. I don’t know if any other nonrecourse states have changed their law in this way. That said, borrowers in California can’t do what Seen it all before, Bob suggests because they’re pulling cash out.

And yet traders are buying stocks like crazy this morning with the Fed Pivot narrative once again out in full force. Powell has been crystal clear about his intentions, and yet the market keeps doubting him.

I do hope Powell will deliver another Jackson Hole type beating next week. Not even a complete collapse in the economy will get us to 2% inflation due to labor and material costs.

The fed fights 14 years to get inflation, me thinks they are not trying to kill it altogether

cd,

how is you financial acumen today? Above average? Can you tell me why SHY only yields 0.8%?

andy

obviously better than yours, try to not be a sheep so much Forrest

But…but…PIVOT!

OK…how about soft pivot?

Maybe a kinda warm fuzzy pivot?

“Based on today’s core PCE measure, and on other measures too, including core CPI and services CPI, the Fed has gotten all the ammo it needs to lift its policy rates by 75 basis points next week, and lift them further in December, and next year.”

The USA Fed has *SAID* they want unemployment. High prices combined with soaring borrowing costs plus a massive increase in joblessness *GURANTEES* recession *RIGHT NOW.*

There is anecdotal evidence of a price increase here or there but *CLEARLY* (and just looking at gold prices plus the US Dollar) the US economy has been massively *DEFLATING* and *NOT* deleveraging over the past 6 Months. Can’t fix a debt crisis with more debt!

Short $wfc Wells Fargo Bank strong sell

Short $bbt Birghingham Bank and Trust

Strong sell

Not sure about that. Banks net interest margins are going up as they still get bank deposits for basically free. I don’t invest in banks as you don’t ever really know about their loans and derivative risk imo.

As long as the 90 day t-bill leads with enough basis points room to spare, the Fed will have no problem continuing the rate increases.

Somebody need to tell this jackA$$ market to RDGTFA but then again even headlines should do if they bother…based on today’s action, you would think our Core PCE is at 2% now…freaking insane.

“No signs of inflation slowing down, as measured by the yardstick for the Fed’s 2% inflation target.”

Oh well, at least it’s nice to see some safe heaven med tech company like Edwards Lifesciences getting a beating…guess their executive leadership team might have to downgrade from Ferrari to McLaren soon if it continues, oh the horror…

Japan just committed to dumping another $200 Billion (yes, dollars) into the markets, so that probably contributed to today’s rally.

The financial media spreads all this with gusto, it’s a form of propaganda, and then when I look at the actual bond holdings of the BOJ, nothing happened. Most of this is just jawboning.

“Jawboning” when they don’t follow through is called LYING THROUGH THEIR TEETH. Any institution which engages in public deception is never to be trusted again. So why would anybody believe what they say? Zero credibility, all of these filthy, scvmbag bankers.

The BOJ is careful how it phrases this stuff. It says things like “up to” or “unlimited.” But the media are not careful — they just want to create clickbait, and that’s where the distortions are.

So if you pay attention to what the BOJ actually says, you get that the BOJ is just saying what it “might do maybe.” If you read the blickbait media about the same thing, you’re told that the BOJ “did.”

I’m buying at 64 if it gets there, even now not bad price

This is just pump and dump action. Comparing the markets to inflation is a reliable yard stick? Well, explain it to the participants.

My guess is the ‘pause’ button is 4.5%. The asset inflation came from all the tax cuts, and loopholes, mainly benefitting the rich, over the past 40 years. The pandemic just lit the fuse. The inflation will stop when the supply chains are repaired. If the asset inflation resumes, raise taxes on the rich. If the Fed applies what I call ‘Disaster Capitalism’ then we run the risk of lousy industrial returns and a debt deflation. Which would be at minimum a very severe recession if not a Depression.

There is no monetary or government policy which will enable the majority of the US population to escape the consequences of reckless fiscal and monetary policy during most of the entire 21st century.

Loose monetary policy contributing to the asset mania is a problem, but not primarily because of rising wealth inequality. It’s fake wealth anyway, so it’s not like anyone else would have or can have more if these people have less. That’s pure envy.

Taxes aren’t too low either. That’s utterly absurd, as no one has absolutely any obligation whatsoever to provide anyone else with an arbitrary minimum living standard.

I do blame the elites (not the 1%ers, few of whom are in the elite) for offshoring the jobs that didn’t disappear through automation and opening the immigration floodgates to weaken labor’s negotiating power, but that’s something else entirely.

From 1932 to 1987, the top marginal tax rate ranged between 50% and 90%, so your statement that taxes aren’t too low seems to be questionable.

Steve Hanke says it’s complicated but bottom line is money supply dominates when it comes to inflation. Too much money was dumped in. Going to take another year or two to get the pig through the python even though money supply growth is now negative. It all works with a delay.

Supply chains aren’t broken China is tired of being bullied ,as is rest of world

More anecdote: Yes, the people in my upper middle class neighborhood also seem unfazed — houses still selling at ask, or above ask even, restaurants full, lots of laughing couples pushing prams. All the hallmarks of a happy and secure populace. They must believe this is only a temporary lull and that their stock and home prices will reverse what losses they sustained. Or perhaps they don’t care because they cashed out and can withstand these price hikes. Who knows.

But it feels like, in six months or so, things won’t be so cheery — so much of the business generated in the past 10-15 years seems so socially useless. Ride-share apps, bakeries that sell nothing but dog treats, meal delivery services — who needs this garbage and how did it generate so much wealth? Such things could only come about via almost free money. And what happens to an economy that is so dependent on such useless ventures when that money suddenly becomes expensive? Will we ever have to return to making and doing real and important things?

I recall attending a lecture some five or six years ago where the prof posited that rising interest rates on debt would be the next black swan. I didn’t quite get what he was talking about then, but now I’m beginning to understand.

The problem is, making and doing real things would only employ a fraction of the workforce.

Now, if we should revert to only making and doing real things, what should the excess workforce do?

And how should they earn money for a living?

Yes, a really interesting conundrum! Most of the seemingly useless economic activity exists simply to employ people. I wonder, though, if it can continue to exist without extremely low interest rates.

It’s not low rates per se. It exists because we’re the reserve currency. It exists people the rest of the world is willing to provide their resources, finished goods, and labor for our dollars. If they cease being willing to do that, we’ll have to actually produce what we consume.

A huge segment of the American population no longer needs to work at all. I am retired so I am never working again but several of my kids don’t need to work either. Some of them only work a little because that’s all they need. Lot of millionaires out there who are not invested in stock market junk or crypto.

The only reason this is possible is because of a fake economy and an asset mania made possible by the loosest fiscal policy in history and the credit conditions and lowest credit standards in history.

I keep reading comments (and articles) mirroring yours where the inference is that what exists now and has in the entire 21st century is mostly sustainable.

It isn’t, regardless that it’s lasted for most of the last generation.

Debt isn’t wealth, the US stock market is an outlier globally with valuations in deep outer space, and real estate (the source of most middle class wealth) is in the biggest bubble in the country’s history.

There is also the fiction propagated here that demographics means there is going to a future labor shortage. Wrong again on that assumption.

Sorry, Augustus. We are all in cold hard cash and assets that resemble cold hard cash. The financial markets can do what they like – it doesn’t matter to us.

Augustus Frost

“future labor shortage. Wrong again on that assumption”

Right now unemployment is 3.5%.

Between 2010 and 2021, there were 1.2 Million workers below 55yrs age and 22 millions workers above 60yrs, the dominant group 65y-75y. The latter will retire slowly in coming 5-10 yrs. Who is going replace them? The rate of wage growth is NOT easing.

My neighbor is living off his house. He and the wife did a cash out refi and are living it up. I haven’t seen him work in over a year and a half. No, he’s not WFH, he’s a tradesman. The FED and .gov lost control. There is hell to pay.

“Now, if we should revert to only making and doing real things, what should the excess workforce do?

And how should they earn money for a living?”

You’ve just summarized why most Americans are going to be poorer or a lot poorer in the future.

It’s a not entirely all or nothing, but a substantial proportion of economic activity (measured by GDP) is going to ultimately disappear because it’s uneconomical, zero, or even negative value add which won’t be financed when central banks can no longer get away with distorting the cost of capital as they have most of the 21st century.

It’s starting now with the end of QE and ZIRP.

People don’t realize that capitalism like any other economic system is just a convention. Money is also a convention, subject to psychology and psychosis. Capitalism has produced excess population for its own good, as well as enormous inequality to ensure its demise. What comes next should apply the learnings of the most reckless and wasteful society ever.

From my anecdotal experience, this is exactly right. Even while upper middle class people have taken 20% hits on their stock portfolios, they’re still convinced this is temporary, that we’ll have a short recession, and that happy days will be here again. They don’t seem to think anything major has changed regarding interest rates or debt more generally.

I guess we’ll see.

I am still hearing the exact chorus from a pal who bought into stocks circa early 1982, and has glided on it ever since: markets over the long haul will always reward the patient buy and hold investor. Stock-picking is a sucker’s game. Etc. Are things different this time? Even that 40-year frame of reference is a small sample, like water supply in California: yes things can be different. And, who has the patience (or lifespan) to await the storied runup? That said, I have some dry powder and will consider at some point, buying back in, but as a recession baby I always keep big reserves. It lets me sleep well in “hard times.”

US stocks markets have been the exception. Look at the markets in China, Japan, Germany (used the DAX K Kursindex which is the equivalent to the S&P500, the DAX being a total return index), Spain, Italy, France, Hong Kong, UK, and many other countries with previously low inflation rates: their markets are all DOWN FROM their highs 15-20 YEARS AGO.

The entire world has come to invest in the S&P 500 because they got crushed in their own markets. But many things have changed, so the 15-year gravy train of the S&P 500 may turn into what the other markets turned into long ago.

Wolf; “The entire world has come to invest in the S&P 500 because they got crushed in their own markets. ”

Thank you. This seems like the primary reason for the stock market insanity.

All I hear is this is great buying opportunity for tech stocks and crypto. Lots of buying on the way down. No fear. So far they look smart based upon recent lows.

They looked smart into the summer bear market rally too, and you were trolling this site at the time with the same copy-and-paste stuff, and then they got crushed when stocks carved out a new low. Unless they dumped that stuff at the top into the lap of some hapless chap that believed the what you were telling them :-]

I feel like I can estimate the value of some stodgy dividend stocks. The ones I follow seem to be getting over valued. Who wants the risk of a 4% dividend payer when you can get 4% anywhere on the treasury curve.

This is Pavlovian conditioning. The markets have been behaving a certain way for nearly 100 years, so why would it ever be different?

This very belief is what will decimate many people over the next decade. And unfortunately the way sentiment works is most of these people will begin to freak out and sell their stocks to cut the pain when we are bottoming.

“Will we ever have to return to making and doing real and important things?”

Yes, unless the country wants to end up a lot poorer, which is my prediction regardless of the outcome. The rest of the world isn’t going to exchange real production for electronic digits forever and the US runs a merchandise trade deficit of over $1T per year.

“rising interest rates on debt would be the next black swan.”

I don’t think so because anyone who is paying attention can see it coming. It’s almost certainly going to be something unexpected or “unexpected”, like the illiquidity in the UK gilt market a few weeks ago.

Whatever the supposed “cause” (which is always psychological in the financial realm), there is also a good chance any future meltdown will be disproportionate to the supposed triggering event.

The fundamentals are actually already terrible, right now.

Are you really eager for your grandchildren to return to the coal mines?

It doesn’t matter whether he’s “eager” or not. The reality is that throughout most of history, people have to produce what they consume. This idea that we can basically get free production from the rest of the world simply because we’re “exceptional” is an accident of history that really only manifested itself beginning in 1948 or so.

It isn’t going to last forever.

Einhal,

Idea is we do not have to work as hard if we build on the knowledge and tools our ancestors left us. But in general we wanted or were encouraged to pull forward too high of a standard of living with debt. Most should have left the granite counter tops and luxury cars to the rich.

Japan is likely to implode within the next five years. Weekend at Bernie’s over there right now.

Japan is still mopping up the bubble from 30 years ago. Might take US that long to mop ours up from 2008.

Only if there is no more cheap energy people will have to return to making and doing real and important things. Like growing food.

With cheap energy available there is no need for a lot of the workforce. The cost of machinery is less than for labour.

“But it feels like, in six months or so, things won’t be so cheery — so much of the business generated in the past 10-15 years seems so socially useless. Ride-share apps, bakeries that sell nothing but dog treats, meal delivery services — who needs this garbage and how did it generate so much wealth?”

Today my wife and I visited a glass blowing studio where we purchased 7 glass hearts. Each will incorporate ashes from my wife’s deceased mom and they will be Christmas presents for the family. The cost? About $200 EACH. Happy wife, happy life, but yeah, socially useless and sorry again for kicking up the inflation dust.

Gotta keep in mind that the impact of these hikes won’t be seen or felt for another 2 quarters. That’s when equities start to rock and role.

Actually, according to the St Lous FED, deflation have started. Both M2 and M3 is down, showing that the amount of money is contracting. On the other hand, a quarter of todays money volume must be taken away to get back to 2020 level.

If the amount of money is deflated that much, it may have an impact on the prices of assets, goods and services. Still, I do not think the FED ever will do such a move

Not deflation, but less inflation?

Monetary deflation.

Inflation and deflation is a monetary thing.

Notice, in CPI it is I for Index, not Inflation, even if many use the CPI as a measure of inflation.

Controlling an inflation eruption coming after 40 yrs of deflation will be that easy. Once the inflation is about 5%, it takes 2 yrs to bring it down below 5%, let alone 2%, which is unrealistic. Inflation will be stickier than most assume

Looking at the St Louis FED charts on M2 and M3, where do you see 4 years of deflation?

The amount of money have been steadily inflated, less the last years wher inflation got a higher pace.

Different mechanisms and reasons have supressed the CPI, Consumer Price Index, but that it in the end started to catch up with inflation should not come as an suprise.

Sams

Fed has only to constrain the ‘demand’ side, by restricting the credit but has absolutely no control over the ‘supply’ side like Energy, Food, Medical/health care, Renters’ expense and Education. The later are so called ‘inelastic’ items in economics.

Energy has come down a bit but not for too long. Fed cannot create jobs or any of the other items, mentioned above. there is shortage of grains, seeds and fertilizers.

It took nearly 18 months for Mr. Volcker to contain from 15% to below 5%. I was here. Debt to GDP was around 35%, NOT like now over 130% now.

The coming annual deficit will be close 1 Trillion or more. The interest payment to our National debt holders will be close 1 Trillion annually, when the rates go above 4.5%.

The global (total) debt is over 200% It was at 100% in 1999.

Who is going to keep on buying our Treasuries, if the actual yield on 10yr bond is NEGATIVE -4%, against 8% inflation.

We are in uncharted waters

Sams

It is hard to fight inflation when the labor mkt is as tight as now with 3.5% unemployment! Rate of wage growth is hard to contain. Fed is trapped.

sunny, if you (like me) were around for Volcker, you likely also remember that the price of oil fell — a lot.

The rate hikes are much celebrated, whereas the long-term fall in the oil price has gone down the memory hole.

Don’t confuse money growth with the absolute amount of money. Yeah, M2 growth is down, but the M2 stock of money is still in the stratosphere.

Hugh Henry says Fed doesn’t understand modern money. Look at the last decade and you might agree. One example is central banks didn’t grasp British pension funds feedback on derivatives they were using because of low interest rates.

Heard another professor say that modern economic theory doesn’t really match reality of markets. For example modern economic theory of risk free securities and liquidity isn’t exactly how it plays out in markets all the time.

This coincides with all of my own anecdotal evidence. Some of the largest price increases are showing up recently. Inflation is nowhere near tamed, it’s accelerating.

And now the stock market is going parabolic for reasons unknown, other than insane levels of speculation and liquidity that just can’t be extinguished with the FED’s pea shooter. They brought a squirt gun to a nuclear war.

DC:

“And now the stock market is going parabolic for reasons unknown,”

My own conjecture is that some of this speculation is due to capital flows from the Euro area or less developed economies or maybe even Japan where the monetary situation is under even greater stress than here in the US. One of the big contributors to the banking crisis of the 1930s was the money flows attracted into the US from Europe by the Fed raising rates at the “wrong time.”

The big problem is laws and regulations. Many “investor friendly” policies are out there that never should have been put into practice. Stock buybacks are at the top of the list for what to abolish. Stock option taxation is a close second. Those are only the tip of the iceberg. If i were suddenly elected to office, I would begin working on phasing out many of these practices, or at least lowering the booty, over five and ten year time frames.

I think Wolf is right when he said “The entire world has come to invest in the S&P 500 because they got crushed in their own markets. “. Just as foreign investment in our housing had a big influence on our housing prices, world investment in our stocks may be happening and may be inflating our stock market.

Now that housing prices are stalling and slightly decreasing foreign investment seems to be going down. Or vice versa who knows.. IDK what would bring the stock market down, except unemployment.

I think regulating money flow in and out of US assets would have a far greater effect on price stabilities than what we have now. I don’t think any of our politicians have the balls for that though.

CNBC front page now showing two traders with wide smiles. You know what that means. Sold INTC and VZ calls from two weeks ago. Around 40% profit. Rebalanced some of it into Sept Apple puts. Looking at 2-year 4.8% CD for the rest.

A reminder that for every wide trader smile you see, there’s also a snarling trader frown you don’t see who was on the other side of the trade.

Yes, they don’t show those. A concerned look is as bad as you gets. Because on CNBC everybody wins.

It reminds me of my deceased father who was a college math professor and was a casino advantage player after he retired, prowling many casinos all across the country.

He would show me tons of casino promotional mailers he’d receive.

Not once in the hundreds, if not thousands, of marketing mailers did I see a frowning player’s face pictured at the slots or table games. Smiles everywhere.

It was a subject of smirking ridicule for my dad, who spent too many hours seeing the actual reality of unhappy, sometimes even angry, zombies playing everywhere.

One of the funnier quips my dad used to make about casino patrons: “The drive in fast and they drive out slow.” But I digress.

The Fed has definitely put itself between a rock and a hard place, we will leave out the counter-Fed spending by our Government in the blame game for the minute. The long-term historical (hysterical?) average for Fed Funds is 4.6%, so if, and I think it is a “when”, the Fed raises rates at the next two remaining meetings of some 1.5 percentage points to the cries of pain on Wall & Broad, it will have a top of the range number for Fed Funds of a mere 4.75%. Not earth shattering by any measure, and sure as heck way too low to put a fast enough dent in inflation still screaming at 8% or higher.

The “where did this number come from” 2% inflation target just ain’t in sight even if one wears rose-colored glasses to search the horizon. The supply side of the equation may just be about ready to get worse even with demand softening around the globe ( Net Exports graph looks like nothing but a dead cat bounce with the skyrocketed Dollar yet to make U.S. goods and services even more expensive and unappealing to our overseas trading partners). We have record low levels of diesel fuel to power our over-the-road tractors just before Holiday shopping, a nationwide rail strike is not off the table as we thought in late summer, and persistent droughts across the grain growing regions of America have almost guaranteed higher foods costs going into 2023.

The run-off of the Fed’s multi-Trillion dollar balance sheet is akin to watching paint dry (can they open-market sell MBS with a spike already in mortgage rates??), so in order to show the markets and the inflation-ravaged public that they are wielding the biggest Monetary Sword they can muster or lift off the dirt, the aggressive rate hikes are going to continue well into 2023. Probably, a step-down to 50 basis point hikes in 2023, but rate raising will be much longer than markets currently expect. I would not be surprised to see a Fed Funds rate, some time before summer of 2023, at 8% to 9%.

The U.S. bond market is front-running the Fed and not waiting for the monetary maestros to catch up because bond traders see the writing on the Wall, pun intended. The average Junk Bond yield today is 8.8% and destined to go much higher to start covering Default Risk on all of the garbage debt issued to primarily buy back stock and fund Zombies since 2009. Junk bonds at 12% to 14% are totally possible by 2nd Quarter, 2023 with such high-grade debt stalwarts as Amazon, Apple, and even WalMart starting to cough up giant financial hairballs in revenue declines, earnings shortfalls, and planned layoffs in the thousands of workers that we have not seen up until this point.

Good luck on maintaining monetary policy that will not spook the markets that are already on Valium, Mr. Powell. Even a hint a of a pivot when inflation is running at over 4x times your 2% target, and investor confidence in the Fed, what is left of it, goes out the window along with your dancing shoes. Loss of confidence is a classic way to spook markets, just ask UK bond investors. Happy Halloween.

Nice comment! Is that you Wolf?

Not Wolfmeister, me Davinsky who has been studying economic and financial data for some 48 years. Thanks for the back slap. Safe travels and remember not to breathe.

Truths you figure out in life 1) government benefits from inflation 2) government cheats you on Treasury interest 3) government doesn’t like to discuss gold

The Federal Reserve knows EXACTLY what they are doing. They’re like a fine mechanic tuning an engine to do what they want it to do; not what the customer wants it to do….

There are many specialized price indices which do not reflect any individual’s consumption basket.

GDP price deflator is falling. It will be a new trend.

Quarterly – Percent Change from Preceding Quarter

Q3 2022 (Adv) +4.1 %

Q2 2022 (3rd) +9.1 %

That trend bottomed in July and reversed, and rose in August and September, as I point out in the article. The bottom in July and the increases in August and September were in the same quarter. Because the July low (0%) the increases in August (0.5%) and September (0.5%) get averaged out in the quarterly data, you cannot see the reversal of the trend in the quarterly data.

Regardless of the reality on the ground (inflation & rates & earnings) a bear market rally is coming just like the one in the summer using any excuse to pump the stocks. Justification for the rally includes the election & last week fed speakers and even the fact that we are all still alive….

Bear market rally is coming or has already come? At this point, we’re up 6-7% in a week or two based on nothing. How much more do you see coming?

What bear market? The Dow at 32,862 is barely in correction territory, down only 10.7% from its 36,800 record.

The Dow is 30 stocks.

The S&P 500 accounts for the 500 most representative stocks, and it’s down 19%.

The Nasdaq Composite, which tracks thousands of stocks is down 31%

In addition to the Dow being only 30 companies as Wolf mentioned, it is also a price-weighted index and not market-cap weighted. The DJIA is pretty much useless to look at. Better to look at the S&P500 and other than that Wilshire 5000 if you want more companies.

Read a Jeremy Seigal book a few years back that showed the risk adjusted returns over a long period of time and the Dow 30 was better than SP500. Don’t know if that is still true. Sometimes those statistics change.

With all the bad news and market is up, at this point bulls don’t care about anything, not even facts. We may have another month or two and a 10% up before a major reversal. But this is just my opinion and I have been wrong more often than not.

Maybe the commenters here are wrong and a year from now the gaggle of pram pushing couples going to deluxe restaurants in their high-end automobiles will still be pointing their fingers at their phones, laughing merrily at Wolf Street commenters no matter how high rates go or how tight QT becomes?

With the amount of trillions they printed, I’d say it’s quite likely.

Ugh I hate that scenario

Possible, yeah. That’s why we spread bets.

But where in that picture are the masses whose lunch is being eaten by inflation? Placidly standing by and cheering the pram pushers?

Getting high, watching Netflix and self chillin’. But I can only speak for myself.

Could happen, hot money if cons get house is sure to happen, mid term trading years tend to move higher after election until new year. There are both yield and growth stories that are cheap if not a day trader. I remember more abs trouble in 90s and similar rates than mortgage.

Not an impossible scenario given the huge pile of savings still remaining for the consumer to churn through.

This is a bit un-relevant but, headline earlier today… “ Jim Cramer chokes up as he apologizes for pushing Meta stock: ‘I screwed up!’” in NY Post.

To all here who called it- nice.

Picked up a passenger at LAX. The nearby short term parking lot was full. So were the second and third closest lots. I entered the fourth closest lot and finally found a parking space on the top floor under the sun, a 30 minute walk to the airport. When I returned, I noticed this lot was also full and travelers were directed to a lot 3 miles from the airport.

Heroic, these folks. Patriotically spending. Recall when “W” told folks to go shopping, as a sort of patriotic duty? And how that turned out?

– Based on what I see in the charts (3 month T-bill rate) the FED’s fund rate will be at 4% next week after the meeting of the FED.

– For the 1st time in a while I see a serious break in the rising trend of interest rates. Even the 2 year yield has fallen in a meaningful way.

We’ve known about that 4% since the last Fed meeting in September. The Fed essentially announced it. There’s no surprise. The 3-month yield is now finally catching up, as short-term yields do, when you get closer to the date of the rate hike.

At the last Fed meeting in Sept., they projected at 75 hike in Nov, a 50 hike in Dec and a 25 hike in Jan. They could change their mind still, but that’s what they projected. Short-term yields are adjusting to it slowly as we get closer to those dates of the rate hikes. Simplest thing in the world.

Seems likely the rate hikes will ease off a little in the next few months now that the 3 month is higher than the 10 year rate – one of the few rock-solid recession indicators. So many companies are giving lousy guidance for 2023. It’s companies lowering future earnings estimates that will start to pull the market down more. So far we’ve simply eliminated the froth, we haven’t yet thrown out the baby with the bath water. My guess is capitulation is a year away at least.

All the signs are there except employment, which will be one of the last to turn. Admittedly, I thought it would already have started turning. Been waiting 10 years, I can wait some more.

– The weekly Dow closed on May 31 close, slightly below ma50. The monthly, on July close, slightly below May close, but well above June close. June 30 close split Oct bar in the middle.

– This week USD is the first close under Sept 26 low. It’s low was slightly above July 11 high @109.14. The next close might be below July 11 low.

The PCE is slight increasing. 0.75% rate hike next week but Mkt melt up with over 2% in each index.

What gives?

My best guess is that serious trouble brewing in the treasury mkt, which could become acute, once the next 2 rate hikes go through or even before that.

What’s the interest payment on our National debt, when rate becomes 4.0%-4.5%? Can Fed can handle it? It could be close to a Trillion if not more! Wait n See!?

The financial media is widely reporting that FOMC officials intend to take a “strategic pause” at 5% FFR regardless of the incoming data, in order to allow time for the tightening to work through the financial system. (Monetary policy operates with “long & variable lags.”)

That’s what sparked the insane stock market rally over the last 2 weeks. Wall Street hears “imminent pause/end to tightening” and starts backing up the truck.

It’s now rumors of a pause at 5% that is sparking a rally?? Hahahahaha. oh my how far we have come!

A few months ago, it was rumors of a pause at 1.0% that sparked a rally. Blew right through that one with a 75 bpt hike.

5% is high. That is higher than I expected them to go. But yes, there are now quite a few observers out there that say that’s where the Fed will pause. A little while ago, I elevated my range for a pause, that I’ve had for a year, from 4% to a range between 4% and 5%.

Federal funds futures are currently projecting a peak FFR between 4.75-5.25% in Q1 2023, holding for a bit, then cutting rates by second-half 2023.

I actually don’t have any issue with this policy path. 5.25% was the peak FFR before the 2007 financial crisis. It’s just unhealthy how the markets operate these days – it’s 100% dependent on the direction of Federal Reserve policy actions, rather than the underlying economy.

“5% is high.”

With CPI running at close to 9%?

Wolf will be proven wrong. The Fed stopping at around 4 to 5 will only be true if there’s a major crash, say starting in Europe. What’s up with the SNB propping up Credit Suisse with swaps? Are they just priming for UBS to take over CS?

You’re pointing at exactly the problem: it’s low compared to inflation; but it’s high compared to the debt that’s out there that was financed at very low rates and needs to be refinanced in the near future at much higher rates, and it’s high considering that these high prices are impossible with these higher rates. Markets are pretty good about sorting this kind of stuff out over time. But when it happens all at once, you have chaos. The idea is to hike without creating chaos. If there is chaos, the Fed is just going to start the insanity all over again.

Caution for those that walk away from Homes even in non recourse states.

IRS will still come for the loan forgiveness amount

According to the IRS, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you. You’ll receive a Form 1099-C, “Cancellation of Debt,” from the lender that forgave the debt.

Have filed many a tax return from folks that had no idea

How will this IRS 1099-C affect the stumbling Student Loan Forgiveness, Act III, proposed by the White House and being challenged by several State’s Attorneys General? When it is a private entity that owns the debt, government edicts without compensation have significant legal issues. Another fly in the ointment?

Still not a bad deal. Pay 30% tax and keep 70% of the free money and the house? Sign me up. The fact that it’s coming from some banker’s hide (or his stupid investors) is just the cherry on top.

Sorry, meant without the house. Who wants to hold on to a depreciating asset?

Refinance is usually 80% loan-to-value, which limits the “free money”. But you are right, some peoply might turn a hefty profit even after taxes. We won’t know though until prices fall at least 20%. I’m fine with that outcome.

That’s not true at all. The Mortgage Debt Relief Act stops that and will most likely always get extended. It’s extended until 2025 now.

All the posts here about nobody seeing consumption slow in their areas just speaks to how epic this bubble has been, and how conditioned our fellow idiot citizens are to the Fed continuing to spike the punchbowl.

Those of us fortunate to have found Wolf, and many others’ great info know better, and are hopefully scaling things back now. I’ll be selling 2 cars I no longer need due to core household shrinking (couldn’t quite time those sales perfectly due to household move to another state).

At first I thought that once the idiocracy awakened to just the threat (not even the actual arrival) of the coming layoffs, defaults, foreclosures, etc that will once again ensue, that we’d start to see the panic as the herd recognizes their predicament.

Now I think they’ll all need to be clubbed over the head to realize “it’s not different this time”, and by then it’ll be far too late to react accordingly.

My business…tied to construction is certainly experiencing the slow down.

My friends who own small retail to manufacturing are experiencing the slow down.

Not all bad. They all know who goes out the door 1st.

I have a nephew that sells vehicles for a living. He told me yesterday that sales have not slowed at his dealership (after I asked). He then told me he was thinking of ordering a $100K diesel pickup so he could drive it for a year and then “sell it for what I paid for it” due to the dealer discount and current demand. My jaw dropped. I asked if he was worried about the economy, interest rates, or inventory driven incentives changing and he responded no. I just shook my head. Major bubble thinking and he has only been selling for about 4 years. He obviously has no idea what a downturn in car sales looks like. The last time I preached financial sanity he got mad. I hope he comes to his senses.

I’ve been selling for twenty years. I got beautiful used Federal trucks 50% less than years before. The auction thinned out by 70% or more. Dealers went bust all over, just had no money and they had to sell dirt cheap to find even a buyer. I broke even for 5 years to survive. I expect worse this time from what I see in the fundamentals but you can choose to look at whatever stats you want. My one tidbit I leave with you, paper wealth is not real wealth until realized. It gets crossed off the books by pencil. Just like it got there. It goes to money heaven.

Take profit. Pay the tax and enjoy it.

Timing it the issue

Apple’s earnings have peaked yet the company posts a 7% increase. Got to say that I think Apple is headed for no growth in profits for a while. The services business is propped up by the money Apple steals from every company that launches an app through the App Store. I cant see Apple being able to keep charging these same amounts in the future. The 30% tax for launching in the App Store is simply extortion.

The big question is when does China make a move on Taiwan, or some other move that truly forces companies like Apple to choose. I see alot of focus on companies that are pandering to China’s politburo.

Apple’s margins are propped up by services and Amazon’s by AWS. Both of these will get hit by competition and regulation.

More downside coming.

As Republicans grow more confident about retaking at least the House, they’ve specified their top policy priority is making the Trump tax cut permanent. This will explode the deficit by hundreds of billions with no realistic way to pay for it. Both tax cuts & stimulus checks put more money in consumers’ pockets and increase aggregate demand & inflation. This is even after the UK turmoil. It’s insanity.

Some economists suggest we are in they middle of a massive collateral shortage. Repo fails have spiked recently. If we are experiencing collateral shortage, then the federal government borrowing more money would actually help grease the global monetary system.

The deficit explosion we’ve seen the last two years has nothing to do with tax cuts and everything to do with blowout spending by both parties and the current party in power wants to blow it even more on greenwashing new deal and crazy loan forgiveness, we have a spending problem not a tax problem.

FOMC Mester recently said on Bloomberg, point blank, that they will hike the Fed funds rate until it is higher than core PCE, which now means until 5.2%. They currently plan to hold at that level once they reach it.

JeffD

It is the treasury mkt I am concerned b/c of lack of liquidity (even Yellen is worried)

Bloomy reported that there is stress going on in the treasury mkt and may become acute, any time.

Will Fed follow like BOE? Is this the reason for front running and the mkt melt up?

Stay Tuned!?

There will always be buyers at the right yield. If people can’t sell their bonds now because they bought at a ridiculously low yield, there are consequences that they need to experience. Just because they may be forced sellers doesn’t warrant sympathy for bad decision making on their part.

JeffD

It is the Treasury mkt I am worried about. At 5%, how much will be interest payment on the current Debt of 31 Trillions!? they have to save the Treasury credit mkt, otherwise there will be Depression 2.0

The US debt jumped by 33%, or by $8 trillion, since Jan 2020. That’s where most of the additional interest expense is coming from. Now, it’s time to pay the piper, either with inflation out the wazoo or with higher interest rates. Take your pick.

Since inflation begets more inflation (can’t solve a debt problem with an acceleration of debt creation), I will take door 2, higher interest rates, higher taxes, and less government spending. The more painful road behind door 2 is more attractive than abrupt systemic collapse.

It will be interesting to see if they have to chase core PCE higher (I hope not).

Don’t know if it’s true, but David Rosenberg says the bottom is not in on the stock market til dividend yield is greater than the 10 year Treasury yield. That’s a huge gap to fill.

I think there are two possibilities for the stock rally from the past two weeks. Either a) the Fed is planning on pivoting next week or b) it’s your standard pump and dump. I’m betting on the latter. Even if rates top out at 5%, that will be enough to drastically knock demand down and send zombie companies packing. The 18% interest rates of 1981 are no longer needed. 4-6% will cause the Macy’s, Bed Bath and Beyond’s, and numerous others of the world to fold for good.

Einhal

Think about the interest payment at 5% on our debt of 31 Trillions and growing? 1.5 T or more!?

Some thing will definitely break. May be I am wrong. Any input on this issue will be appreciated

Saw a chart today consumers still have about 2/3s of the excess liquidity they soaked up during the pandemic. The consumer is resilient and supply chain issues reverberate all the way to the 19th Communist Congress in Bejing, and new jobs claims here are only off a little. The inflation meter is swinging back to corporate America. They weren’t buying tech today, that’s for sure.

Read the “Axios Macro” post of Oct 27

It explains in detail how bad the housing market is (and it will get WAY worse). Residential investment is down the most. Only the Q2 2020 Covid drop and Q4 2008 GFC drop were worse.

Mortgages are now 40% higher than last year. I see housing down 25%++ by the end of 2024. We’re just getting started. Not pretty.

Rents, which all inflation floats on imho, just went down mom in August nationally. The housing bust is gaining steam. Gas has gone down. Two biggies. Most food might never come down imho, but the recession has started and one by one most things come down as people run out of money/business and layoffs/bankruptcies pile up. Inflation in most things is hard when there is no money left behind it.

Inflation will take a second leg up once the midterms are over. Everything in America is based on politics. Double digit inflation by March 2023.

To all noting how little has changed: clubs full, can’t get trades, etc. etc. For an hour after Titanic hit the berg, it was a celebration. People gathered ice fragments and played hockey with them.

Of course the trades are all booked: the projects were committed before rates took off. Most principals can’t just stop, they paid too much for the land. They are committed.

No one has to wonder what the Fed intends: recession. Or in JP’s words: ‘house prices must fall to make them affordable.’

Check back in a year and see if everyone is booked up.

PS: for a bank, Canada’s RBC is surprisingly candid about the gloomy future. It projects that this RE downturn will exceed the previous five. Reading this, I quickly checked: the good news, RBC doesn’t think it will exceed the 80’s crash, when Volcker crashed the market.

I see home prices going back up starting around March 2024 and the Chinese all piling back in at the same time around August or September 2024. Home prices will move upwards in monthly double digit increasing figures when all the local Chinese pile into real estate at the same time. RBC is out to lunch or completely clueless on what will happen. It’ll be something to behold when Ontario see 10+ percent price increases in home prices in one month. I could publish books on this right now because the only variable is I might be off by a month or two but dead on on what will most certainty happen.

I miss SocalJim but thanks for filling in.

The only thing I can say is that the variety of comments across the spectrum is amazing,to say the least…

Only time would tell what is coming down the road..

Just a reminder,Old Souls Day is coming up too….

“On a month-to-month basis, the core PCE price index jumped by 0.5% in September from August.” Or, as I would put it, by 0.4509%. But hey, it’s way out of sight of the monthly 0.12% the Fed dreams of.

Clearly, the Fed has not done enough. I think a part of the problem is their six-week decision cycle. A steady 0.75% rate rise per meeting sounds a lot in one jump, but they are really only increasing rates by 0.5% per month.

Services inflation is ratcheting up and not doing it in six-week steps. If the Fed were to increase rates by 1.0% next Wednesday, they would be accused of being inconsistent, but uncertainty is exactly what’s needed to shock people into changing behaviour.

Are rents included in the pce? If so, are they at all influenced by housing prices and, if so, could this rent metric therefore be a lagging indicator artificially inflating pce atm due to the spike in home prices least year?

Rents are included. But the methodology of the PCE index is very different from CPI, and I don’t know how they get the rent data.

This makes the Fed’s story hard to tell because “equivalent rents” have a long lag and monetary policy has a long lag. If Fed thinks linearly and waits til core cpi is slain their policy is going to be mistimed by 2 – 3 years. Hopefully they are looking at leading indicators more than lagging ones.

Thanks for the responses.

I should have said core PCE, but I think you both understood the crux of my question. As you say, Old school, if equivalent rents are influenced by previous home sales, then last year’s ridiculous spikes in housing might be disproportionately influencing core pce.

https://apps.bea.gov/iTable/?reqid=19&step=3&isuri=1&nipa_table_list=64&categories=survey

Might have found the breakdown of PCE in the above link. We can see Line 15 “Housing and Utilities” there.

Line 25 looks like the Core PCE? And you can get a sense for the contribution of housing and utilities by comparing the previous year’s quarterly number to the current one, and then doing the same for the Core PCE; and it looks like there was a substantial increase in housing and utilities y.o.y, more so than the Core as an aggregate.

I don’t know if they weight the components differently, maybe that is specified somewhere.

https://www.bea.gov/resources/methodologies/nipa-handbook

Chapter 5 from this link…Table 5.B

“Rental of tenant-

occupied nonfarm housing”

–Method for calculation… “Tenant-occupied stationary and mobile homes: CPI for rent of primary residence.”

They also impute values…

“Imputed rental of

owner-occupied

nonfarm housing”

–Method of calculation…”CPI for owners’ equivalent rent of

primary residence.”

I’m guessing you guys know more about owners equivalent rent and how they calculate it. A cursory search shows it uses the value of the home to determine how much rent it would fetch.

So I think we can safely conclude that the core pce is going to be influenced by least year’s spike in housing prices.

For context, I live modestly, in the PNW in Canada.

Real inflation for me is way more than the published ~8%. Food. Energy. Services. Taxes. As a guess, feels more like 25% to 40%. Published inflation rates are total BS.

The dive to ZIRP was irresponsible. But even now, if a 4.5% rate is a Fed or the (world) Central Banks’ target, then that is still an insanely low rate, for a rational investor viewpoint. But given the debt levels, it will still be problematic for many.

I can appreciate higher interest rates will pull some peak off of residential real estate. And maybe, that is okay. But l suspect that it is more about making housing cheaper to attract new arrivals, than to support local people with low to medium wages. A price adjustment for a Canadian trade payment balance and an export business model in a globalized world?

Also, as others have said, interest rates will not solve supply shortages of things like: food, fuel, general labour & especially for skilled/professional workers; nor will higher rates lower taxes. So, in a predominately service economy, those prices with market power will remain elevated; uninfluenced by interest rate increases. More likely, higher interest rates, will add to the supply-shortage price impact. As higher interest rates are an input cost, and will add to the supply-side price & tax inflation. Consider the farmer who faces higher costs for the supply shortages of fertilizer and fuel, and will now face higher financing costs too. Same for doctors, dentist, electricians, governments, etc; all who have the market-power to pass along cost increases.

Only until people say no and stop buying their services, which has already started in certain sectors and locations. Soon it will be lower your price, or go out of business. Since many just won’t lower their price and step down in living standards, then we will see many go out of business imho. Here is where understanding the psychology of a spender in a recession will be a necessary skill to business survival. The greedy will not survive easily. You can’t run at historic peaks and overpricing permanently. Living standards are not constant for most in Fed made boom bust cycles. You roll with the punches, and know when to hold em, and when to fold em. Happiness and peace are rolling variables and need adjustments in perspective. You don’t want to go crazy all stressed out. There are the good times, and the hard times, for almost everybody. A good life usually has both.

This: ”Happiness and peace are rolling variables and need adjustments in perspective. You don’t want to go crazy all stressed out. There are the good times, and the hard times, for almost everybody. A good life usually has both.”

VERY well put Steve, and IMHO a very good perspective for a ton of folks going forward the next few years or even perhaps decades.

Remember well the era of 90% taxes on high incomes, and can testify it was NOT the panacea some seem to consider it in the distant rear view mirror.

Have known many ”old money” rich folks, clients, of ancestors in 1940s & 50s and my own since, and the one common characteristic then and now was and is how close they could be with their cash…

The entire ”trickle down” theory was and is total rubbish/propaganda spouted by the rat fink actor and subsequent pols and their toadies to enable to be able to continue to steal the wealth of trades folks and the middle classes as had been done strictly by force for thousands of years.

The catch is that some, maybe many, go out of business before they lower their prices.

And that this happen in the start of the supply chain. Fertilizer manufacturers cut production as farmers cut buying due to high cost. The result is less food grown.

This may happen in other industries too. Supply is then redused. Prices may eventually fall as only the least cost alternatives are made.

The trouble will then not be the pice of goods, but that they are not available. Bad if it comes food and shelter.

There is inflation, deflation and stagflation. What is the name for this one?

Shrinsession?

I believe the Bank of Canada is trying to bring down home prices or values so rents will eventually fall. Not a whole lot of immigrants will come to Canada if rent is more than they earn working a low paying job. The problem in Canada is once the housing market reverses and goes upwards the local Chinese will all pile in at the same time driving home prices to new highs in a very short period of time. The problem is they can’t bar the local Chinese from buying so Canadians will always be priced out of the housing market and rents will skyrocket once the housing market turns back upwards.

& why can’t they? Many countries have limits and financial dis-incentives for any foreign buyers.

These are the last twelve, monthly percentage changes in the Core PCE index (Oct 21 to Sep 22):

0.41 0.52 0.54 0.47 0.37 0.37 0.31 0.38 0.63 0.05 0.54 0.45

There had been a lull in mid-2021 and then high monthly inflation kicked off again in Oct 21. When the Oct 22 number is released at the end of Nov 22, if it comes in at less than 0.41% (the Oct 21 number), then the year-over-year rate will decline. That decline will be enough for the chattering classes to claim inflation has peaked, the Fed will pivot and the Santa Claus rally is here!

Pivot mongers are full of illusions — just like the tightening deniers were. For them, anything goes, no matter how farfetched. But fine with me.

I respect that you are still short. Cajones of steel :)

of brittle rust-perforated iron?

But starting in March/April 2021, when all the SPACs and IPOs began to implode, I saw that it would work out, with some patience. This year has been good.

The market only rallied on yearend profit taking by the shorts in stocks, the midterms right around the corner and profit taking on the U.S. dollar by the longs. All news has gotten a lot worse inflation is up and earnings are falling off a cliff. As we can plainly see the U.S. stock market is still 100 percent rigged and manipulated to prevent the collapse back to fair market value.

Wolf – just looked at two Treasury Auction Results on October 26. The 119-Day Bill and the Two-Year Note. Approximately 30% more Total Competitive for the shorter-term debt issue. Is that telling us something of concern? Thanks in advance!