Bank of Japan lets yen go to heck, trade deficit blows out, costs surge for manufacturers, prices surge for consumers.

By Wolf Richter for WOLF STREET:

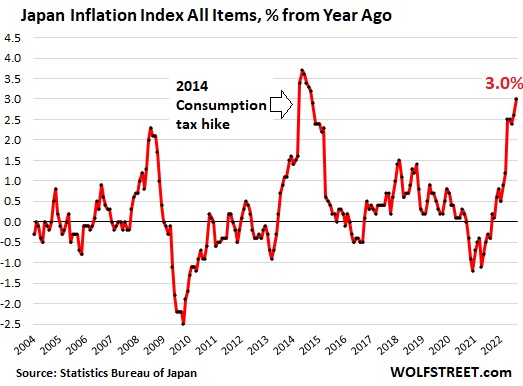

Japan has been lagging behind a little in the global surge of inflation that started early last year. But it’s now coming along nicely. The overall consumer price index for all items in Japan jumped by 0.4% in August from July, and by 3.0% from a year ago, according to Japan’s Statistics Bureau today. The measure that excludes rent jumped by 3.5%. The measure for food jumped by 4.7%. A year ago, inflation was still negative.

Some of the major categories.

- Food inflation: +4.7% year-over-year. This includes fresh food (+8.1%), fresh fish and seafood, a crucial item in Japan (+13.7%), and fresh fruit (+9.4%).

- Fuel, light, water charges: +15.6% year-over-year, including: Electricity (+21.5%), gas for the home (+20.1%), and “other fuel and light” (+18.0%).

- Household durable goods, such as furnishings and appliances: +6.3%.

- Clothing: +2.1%

On the positive side:

Communications, where there had been a price war between wireless carriers, prices fell year-over-year: -3.1%.

Government pushes down healthcare inflation: In Japan’s system of universal healthcare, funded by taxes and individual contributions, the government largely decides the prices consumers have to pay for co-pays, insurance, medicines, etc. For Japanese consumers, healthcare costs are small, by US standards. And the government is using the lever of healthcare costs to push down overall inflation.

Three of the four healthcare categories show price declines year-over-year:

- Medical care: -0.7%

- Medicines: +1.2%

- Medical supplies and appliances: -0.6%

- Medical services: -1.7%

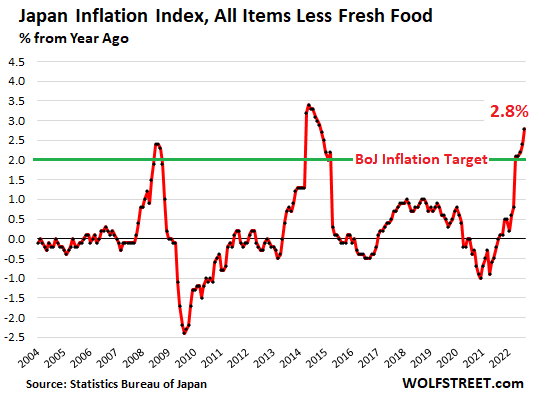

The core inflation index.

The index for “all items less fresh food” in Japan is what the Bank of Japan uses for its 2% “price stability target.” This index rose by 0.3% in August from July and by 2.8% year-over-year, have shot through the BoJ’s inflation target in April:

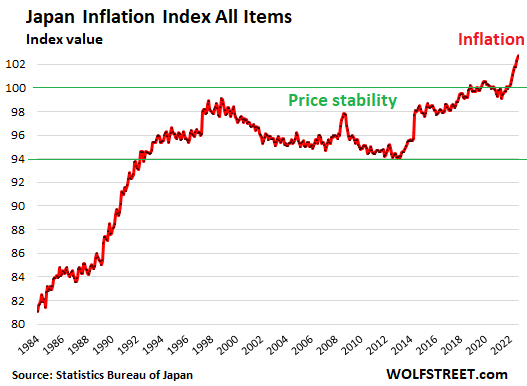

After 23 years of price stability, inflation takes off.

There was no “deflation spiral” in Japan; but there were roughly 23 years of relative price stability, with periods of mild deflation followed by periods of mild inflation, and the whole thing sort of evened out over the long term.

Japan’s all-items inflation index, when seen as an index rather than percent change of the index, shows this.

In 1997, the index was about 99. Over the next 13 years, the index then declined by a total of 5% all combined, unwinding in 13 years the amount of inflation of five years (1992 through 1997). Then the index rose again, hitting 100 in 2018, so up about 1% from 1997, and roughly remained there until late 2021.

Over those 23 years, the index increased by about 1%; in other words, actual price stability, where the yen maintained its purchasing power within Japan. I wish we could say the same thing of the USD, whose purchasing power within the US has plunged over the same period by 42%.

But now, price stability is over in Japan. And inflation has taken off:

Instead of hiking rates to battle inflation, the Bank of Japan watches yen go to heck.

The “All items less fresh food” index – the measure the Bank of Japan uses for its inflation target of 2.0% – is up by 2.8% year-over-year and surging, and the BoJ is still blowing it off. Governor Kuroda will be out next April, and until then, he, the architect of Japan’s money-printing orgy and negative-interest-rate policy, will likely dig in his heels, keeping the policy rate at -0.1%.

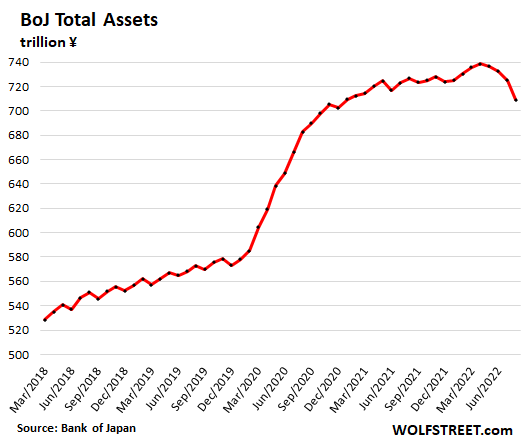

But Japan’s balance sheet has started to decline as some of the pandemic loan programs are being unwound.

Now the BoJ is up against the Fed, which has been hiking rates since March, and against the ECB, which has hiked its policy rate twice in a row, and more aggressively than expected, and it’s up against most other central banks that have been hiking their policy rates, some of them aggressively since mid-2021.

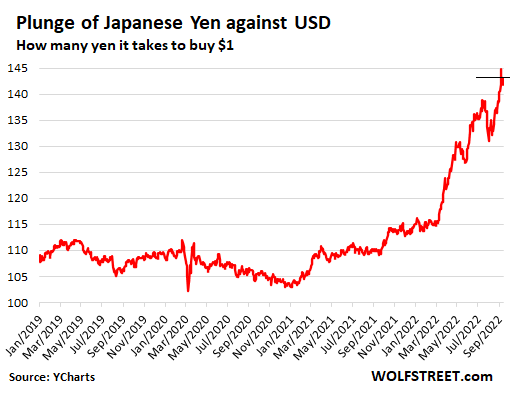

The yen started dropping against the dollar in January 2021. At the time it took about ¥104 to buy $1. In March 2022, when the Fed started hiking its policy rates, the yen began to plunge. Today, it takes ¥143.8 yen to buy $1.

The plunging exchange rate of the yen makes imported commodities and raw materials, including food and energy commodities, a lot more expensive in Japan.

But Japan also imports a lot of consumer goods. And Japanese manufacturers import a lot of manufactured components, and all that is getting more expensive. As a result, Japan’s producer price index jumped by 9.0% in August year-over-year. And since late last year, Japan’s trade surplus turned into a massive trade deficit.

But the weak yen doesn’t offer a lot of advantages to Japan’s global manufacturers because they have factories around the world. For example, all Japanese automakers have factories in the US and Mexico where they produce many of the vehicles they sell in the US. So a weaker yen doesn’t help these manufacturers at all.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Hey Wolf!

Very interesting article as always.

Line edit”

“Today, it takes ¥143.8 yet to buy $1.”

I always hear comparisons between Japanese monetary policy and US policy. How did the Japanese establish such currency stability whilst bank of Japan is the bond market? Seems bizzare.

Having a strong manufacturing sector and massive trade surpluses covers mucho sins.

But, that is over.

“And since late last year, Japan’s trade surplus turned into a massive trade deficit.”

Doesn’t matter at all until the overall Balance of Payments turns negative.

It has a huge positive balance as a result of investment income.

A weaker yen increases income from overseas investment as well as the value of those investments calculated in yen.

Until the overall Balance turns negative there is no crisis.

Japan used to be a great exporter with significant trade surplus. So all the shit was tolerable. Japanese Central Bank is again hoping for trade deficit to dive with fall in Yen if domestic Production can pick up. It knows that there is no real way to reduces balance sheet. The crap in their balance sheet would never be bought by any sane investor. See how the Fed asset chart trend looks like.

US is an importer with huge trade deficits. So inflation started within 20 years of pumping Central bank assets. It would have started sooner if not for our empire: The 10 AirCraft Carrier battle groups that ensure that Oil is only traded in dollars, thus preventing dollar from dilution as other currencies fall.

This world is rolling over as Russia ,USA and opec control energy . Everyone else is a slave to it sad story but true.And just like Cold War Russia continues to threaten nuclear war ,what a idiot . Seems to think he will survive,would be end of civilization

If only there was an alternative to oil.

@Harrold,

I’m a holder of an engineering/scientific degree, specializing in energy and mass conversion, let me say:

Nuclear and gas are good alternatives for power generation, till fusion is on-board (who knows when).

For mobility there is no alternative to oil products, but hybrids are great at reducing the burn. Hydrogen cells are also fine, keeping in mind that the only feasible hydrogen on Earth comes from oil, you know that, yes?

Everything else is anti-science and anti-human propaganda. Energy abundance is the only guarantee of freedom and prosperity for the people, without it – majority of the them become serfs who were born, lived, and died in their village.

Its a shame we can put a man on the moon but can not come up with any alternatives to oil.

Harrold,

The perfect does not have to be the enemy of the good – MPG doubling hybrid technology has been around for 20 friggin years.

Higher MPG, less oil required, time bought for more technological developments.

It isn’t brain surgery.

The only comfort is that more or less free mkts in oil provide the whip to incentivize heavy SUV fetishists (a lot of whom are women, alas) to rethink their auto choices.

The inmates are running the asylum. But don’t worry, supposedly later this month, Americans and people from some other countries will no longer need a visa for short term visits to Japan. The tourist cavalry will save the day right at the cusp of a major recession/depression!!!!

Wolf, with today’s expected 0.75% rate hike, the 10 year yields come dangerously close to Fed rate. Is this normal? What is the historical gap like?

Is the gap so low today because markets are fighting Fed and winning over it??

QT is going to push up the 10-year yield, and you’re seeing that now. That’s what QT is for. The Fed’s rate hikes hit short-term yields. Now it’s a question as to which will rise faster.

Thanks Wolf, so I checked historical data as well and this is what I found.

1. In last 30 years, anytime “10 year – Fed rate” goes little negative, Fed stops rate hikes and pivots some time later. This Pivot interval has been reducing over time to a few months last time. However this is when inflation was low.

2. In 1970s and 1980s, when inflation was high, we can see a deep negative “10 year – Fed rate” upto -10% that indicates that Fed kept raising despite 10 year yield freezing at lower value!

WA,

This Fed Pivot story is a fantasy. People who take this seriously are fooling themselves. We have 8%-plus inflation, and the FF rate is still for a few more minutes below 3%. Nothing that happened since the end of WW2 compares to this disconnect between CPI and the FF rate. Forget that “Fed pivot” fantasy.

WA, agree with your analysis, except the 10 year doesn’t “freeze at lower rate” during inflationary times (1970s, 2022).

In the low-inflation times since 1980s: when the Fed rate went up, the 10 year yield generally didn’t rise nearly as fast or as far. Then when the Fed rate went above the 10year, the 10-year did “freeze at lower rate”. Then there was a recession and then the Fed rate eased back down.

But in high-inflation times (1970s): when the Fed rate went up, the 10 year yield reluctantly followed. It didn’t freeze, and it didn’t turn back down until the Fed rate did. I think this is also happening now. For instance, both rates have risen by 2% since the start of the year.

Since most market participants are deeply conditioned to think things are still like the past 30 years, the steady upward march of the 10year yield is really confusing people. Those who haven’t undone their conditioning are facing deep cognitive dissonance, seeing the world act contrary to their ingrained belief structure, not understanding it, and spewing out propaganda arguing that they’re still “right”, rather than getting on with adapting to a new market regime.

P.S. For analysis, I went to fred.stlouisfed.org and graphed “DGS10” (10-year Treasury yield, daily) and “DFF” for the daily Fed Funds rate.

Thanks Wolf and WS for your replies.

I’m in Japan. Sapporo (actually I’m not using a VPN which I why I get flagged for moderation) although I am from the UK.

Sapporo is a bit of a bleak economic disaster zone compared to the rest of the place but some stuff I have noticed. First, my long life baguette shrank recently, subtly but noticeable.

I don’t think Japan can do as much shrinkflation as other countries because the quantity you get in cornflake packs or whichever has already been run down to nothing. If you are from the US you would be pretty surprised how little you get and how expensive food is.

Anecdotally, my wife’s coworkers are discussing leaving for more money and the employer is leaning into better conditions rather than having to change the money. This is very unusual grumbling in Japan.

Low income jobs here are really getting borderline to survival, the only element that keeps things possible is dirt cheap(micro) housing.

Plus yesterday on the expat email I saw a job offer, construction work, which must have been about 40% up on previous.

Having said all that, if there was an advertised job at a certain wage that nobody applied for, I know that the typical Japanese company would leave it empty. They have compulsory overtime after all. I think this is running out of rope and what will be the trigger will be when people eventually start switching jobs in the lower income bracket/non-lifer position. Nobody at Toshiba is going to demand a raise or leave. Imo, there are many blocks to inflation in Japan that don’t exist elsewhere and I wonder if when it does arrive it will be like some line of defense crumbling all across the line.

BUT (lengthy sorry) over the next 30 years, 33% of the oldest Japanese will have all their assets, foreign assets etc run through what is a fairly harsh inheritance tax system so I don’t consider Japan is risking a yen collapse. I personally consider the yen to be weak because 1) Japanese want it weak (e.g. Plaza accords) and 2) Fed effectively weakens all other currencies at the moment.

Mrs. Watanabe thinks to make money in two and 10 year yankie, why take NIRP when you can skin an American for 350+ basis points with more fruit ripening on the Vine.

Thank you Mr Jerome, Yen carry trade is back baby.

I’m living in Japan, having come from New Zealand in May. It’s still incredibly cheap here.

My monthly rent for a nice house in the countryside is US$245. Most prices about half what they are at home. A little inflation and I think it’ll still be cheap here.

May be tough for the locals though. Many elderly retired people around, probably with no way to increase their incomes. Also wages are low. I expect the government of Japan to come under a lot of pressure. Be interesting how it plays out.

Do you speak the language? Can one get by with just English?

I learning Japanese each day

No you cannot get by with English only.

Nowadays you can swing it as a tourist with English only, whereas 10 years ago it was almost impossible. JPN is trying harder and harder to be tourist friendly.

“My monthly rent for a nice house in the countryside is US$245.”

Is that a typo???

Japan has a shrinking population.

Plus there’s still movement by younger people from the countryside to the densely populated cities.

It’s not a typo buddy

Incredible!

Or in yen dollars 35,035 wow if my math is right

Correct. Yen 35,000 a month. Lovely house

What kind of insulation/heating/AC do you have?

My old house was 200 dollars/mo.

It was a sweatbox/icebox. Comfortable about 4 months a year.

The question is what can you get in the countryside? If you are retired and just looking for a quiet life then I guess it’s fine, but from what I’ve seen visiting Japan’s countryside, you can’t pay me to stay in those areas.

You can get what you need rather cheaply.

What you can’t get are crime, security issues, drugs, druggies, vandalism, guns. It’s a decent trade-off.

1) Today JP, the most powerful man in the world, will raise rates. The biggest victims of higher rates are the poor & the middle class, the housing market and buybacks.

2) Buybacks for executives perks and bonuses, reduced the number of shares and artificially increased EPS.

3) LT investors own a larger share of a co. MCD & BA cannibalized itself and have negative owners equities.

4) Next year mortgage rates might be 6% and the CPI might be

minus (-)6% y/y.

5) If by year end SPX reach 4,800, SPX real growth y/y might be minus (-)20%. We are get a lot of economic negative indicators to ignore !

6) With rising unemployment to 4%-4.3% and the injured housing market, the real GDP will cont to be negative. SPX options :

7) A bullish option : after rising to parity by Nov/ Dec, SPX will violently retrace the rise from June 2022 low to 4,800, in repetitions, before rising to a new all time high in late 2023 and 2024.

8) A bearish option : after reaching a lower high SPX will plunge below Feb 2022 high.

9) We don’t know what will happen in the blue zone casino. For fun and entertainment only.

The biggest victims of zero interst rates and cheap/easy money are the poor & the middle class.

The resulting inflation is absolutely destroying them.

+1

+2

“1) Today JP, the most powerful man in the world, will raise rates. The biggest victims of higher rates are the poor & the middle class, the housing market and buybacks.”

That’s funny. The biggest beneficiary of low rates are the wealthy whose asset values spiked. Now you’re saying the biggest victims of higher rates are the poor and middle class. It sounds like a lose/lose situation for the poor and middle class. Or perhaps you’re just parroting an assertion by the wealthy who are talking their book and ignoring the impact of inflation on the poor and middle class.

1) The Nikk 225 monthly : after plunging from 40K to 7.6K in Apr 2003, the NIKK popped up to 18.3K in Feb 2007, a weak 34% retracement, before plunging again to a lower low, to 7.021K in Mar 2009, a trigger, a test of the low.

Options for fun and entertainment :

2) Option #1 : after retracing 78% of the move from 40K to 7K, the NIKK will plunge to a higher low, before rising to 48K/50K, to a new all time high.

3) Option #2 : after parity, the NIKK will misbehave for years, before rising above 70K, thanks to the BOJ crazy printing, diluting labor and debt

[40K + (40K – 7K) = 73K].

Will this translate into wage demands though? I’m no expert on Japanese culture, but it seems there is a lot of business etiquette that is followed religiously there, and I don’t imagine going to your boss and bargaining for a pay rise each year is part of it.

Just wondering if they might have a lot more scope for inflation before a wage-price spiral gets embedded compared to countries with more dynamic labour markets.

I wish I knew more about Japan other than reading about their aging population and stagnant economy for decades. I don’t know about actual energy production and their sources for energy but after the tsunami a few years ago their Nuclear powered generation was to be reduced and replaced with maybe LNG imports?

So with the energy spike we have seen the last couple of years inflation would be expected. Maybe the actual inflation is underway and maybe difficult to contain especially with Japanese ZIRP. If the higher production costs is shifted to export pricing then the rest of the world can expect to pay higher prices for Japanese products. Another mole for Wolf to wack as they jump onto container ships headed for USA. Exports in 2021 to japan 100 billion imports 150 billion.

Are they installing offshore wind generators,seem like a common sense thing to do as there a island,or onshore

Nuclear is turning back on in Japan, and new build outs are coming.

There have been very large price rises in Japanese vehicles and more on the way. Toyota Yaris budget car in AUD$19,000 to $32,000. Toyota Landcruiser GXL was 80K now 145K .

Japan is very different compared to most developed nations. They are not afraid of imposing capital controls and other fiscal tools to re-balance the Yen’s standing vs other currencies. The only observation to be made now, is that there is a global inflation impulse. Next? Disruption and some global financial losses as deflation overcomes inflation. I’m morr worried about the U.S., which is functionally an Oligarchy right now.

Prices have been stable in Japan, but the prices have always been high for food, utilities etc.

Even as an ex=pat in Japan, food was very expensive in 1999 – stability just means they haven’ gotten much cheaper or more expensive since then.

DXY keep rising. It might reach the 115/126 trading zone. USD/JPY

reached 145. What will happen to the Yen.

Oil, nat gas, grains are really helping the DXY.

So, which is it going to be this afternoon- wild rally in the stock market when traders think they see a pivot, or deep decline when Powell disappoints them?

Flip a coin I vote it goes up got to keep the casinos open

Either outcome will be good a laugh.

I wonder what the price of beef is in Japan now? When I was there in the early 1970s it was $35/lb. I bet its approaching $100/lb now.

Wagyu?

It was the govt’s plan to have inflation. It has been been met. Per Bloomberg this morning, the govt intervened the FX market.

Another example as to why “free markets’ are a myth.