A red-hot question in our iffy times.

By Wolf Richter for WOLF STREET:

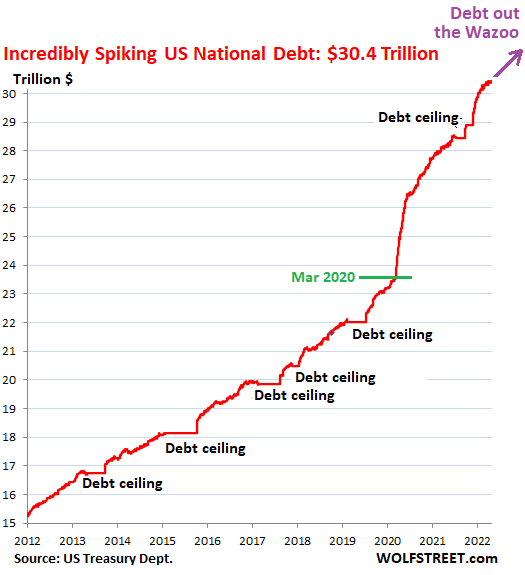

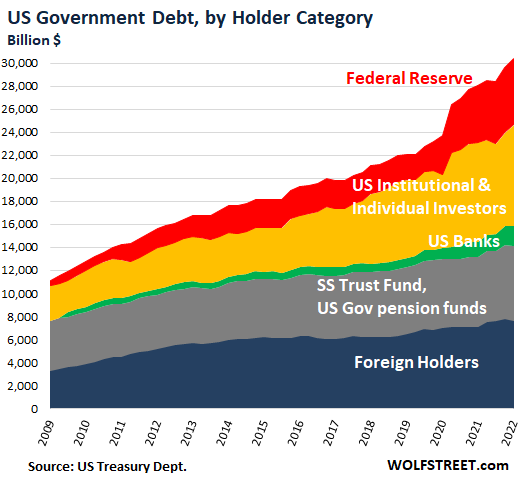

The US gross national debt has now reached $30.4 trillion, having spiked by a $7.0 trillion since March 2020. Every one of these Treasury securities had to be bought and is held by some institutional investor, bank, government entity, or individual in the US or globally.

The red-hot question is: Who the heck bought and is holding all these Treasury securities?

Treasury securities have become more attractive this year as yields have risen across the board, but remain woefully below the rate of CPI inflation. Yields have risen because investors demanded higher yields to buy them. If there isn’t enough demand for Treasury securities, then yields rise until there is enough demand. If yields rise enough, I’m a buyer. Yield solves all demand problems.

The Fed, the single largest buyer until early this year, is no longer adding to its holdings. And in June, it will start reducing its holdings, even as the government will issue more debt and someone has to buy it all.

So who is holding this Treasury debt in our increasingly iffy times?

Foreign Creditors of the US government.

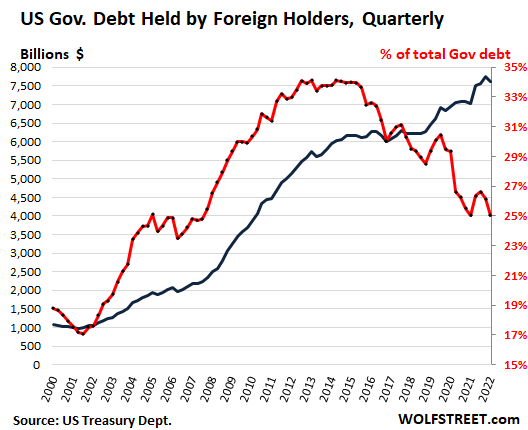

Foreign holders of Treasuries: $7.61 trillion at the end of Q1, according to the Treasury Department’s Treasury International Capital (TIC) data, down by $134 billion from the prior quarter, but up by $575 billion from a year ago.

About $4.07 trillion of it is held by foreign central banks and government entities; the rest by foreign institutional investors, corporate entities, banks, and individuals.

Over the years, the US gross national debt has out-spiked the growing holdings by foreign entities, and at the end of Q1 for 25.1%, squeaking past the prior multi-year low, and down from the 34% range in 2012 through 2015 (dollar = blue line, left scale; % of total US debt = red line, right scale):

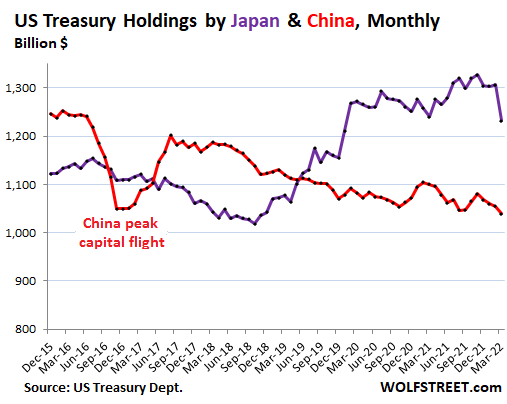

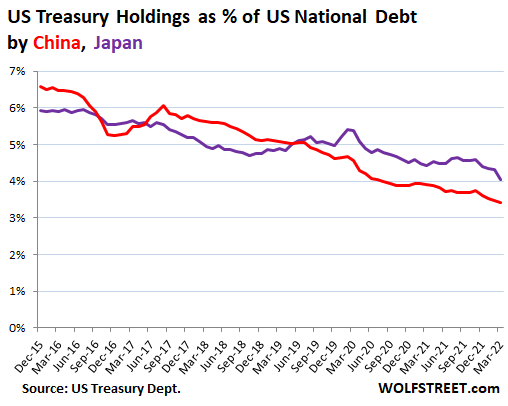

Japan: $1.23 trillion at the end of March, after a $74 billion plunge during the month. Japan remains the largest foreign creditor of the US, and with that plunge in March is now about back where it had been a year ago.

China: $1.04 trillion, whittling down its holdings:

Japan and China have been much less important as creditors to the US, as the gross national debt has continued to out-spike their relatively stable holdings. In March, Japan’s share (purple) dropped to 4.1% and China’s share (red) dropped to 3.4%:

Other large foreign holders.

Most of the 10 biggest foreign holders after Japan & China are tax havens and financial centers, some of them just small countries that cater to global corporations and the elite, including US corporations, that can shelter their capital there in offshore mailbox entities where some of their Treasury holdings are registered.

The third largest foreign holder, after Japan and China, is the UK with $635 billion in Treasury securities. This is the financial center of London, the “London Laundromat,” and anyone anywhere could be the beneficial holder of these securities. France and Canada have surged onto the scene recently with massive increases.

The top 10 foreign holders behind Japan and China:

- UK: $635 billion (+43% year-over-year)

- Ireland: $316 billion (+2% year-over-year)

- Luxembourg: $301 billion (+6%)

- Cayman Islands: $293 billion (+36%)

- Switzerland: $274 billion (+8%)

- Belgium (home of Euroclear): $265 billion (+12%)

- France: $247 billion (+117%)

- Taiwan: $251 billion (+3%).

- Brazil: $237 billion (-7%)

- Canada: $222 billion (+109%)

Domestic creditors of the US government.

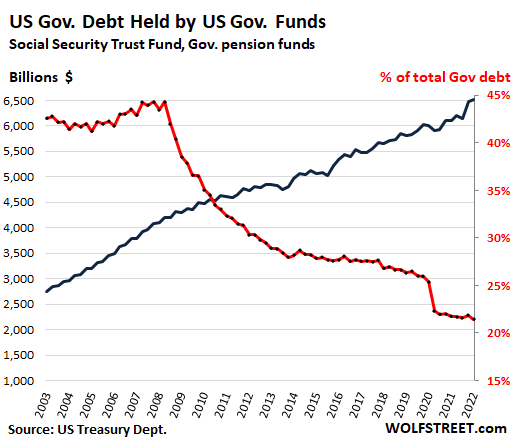

US government “internal” holdings: $6.52 trillion, a record, up by $48 billion from the prior quarter and by $411 billion year-over-year, according to Treasury Department data.

These funds are held by US government pension funds for military personnel and federal civilian employees, the US Social Security Trust Fund, and other federal government funds that invest their balances exclusively in Treasury securities. In other words, the government owes these funds to current and future beneficiaries of those funds – and not “to itself.”

Their share of the incredibly spiking US national debt has continued to drop and in March reached a new multi-decade low of 21.5%, down from a share of 45% in 2008 (dollars = blue line, left scale; % of total US debt = red line, right scale):

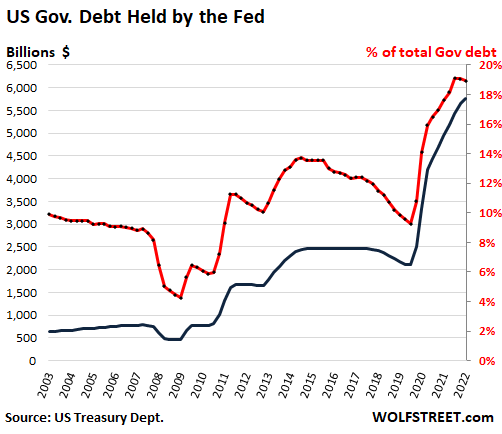

Federal Reserve: $5.76 trillion at the end of March, up by $818 billion year-over-year, and up by $2.42 trillion from March 2020 when it kicked off its most reckless money-printing binge ever.

The share of the Fed’s holdings of Treasury securities of the total debt has started to decline last year, and at the end of March dipped to 19.8% of the incredibly spiking US national debt.These are only Treasury securities on the Fed’s books and does not include the large amount of MBS and other securities the Fed holds:

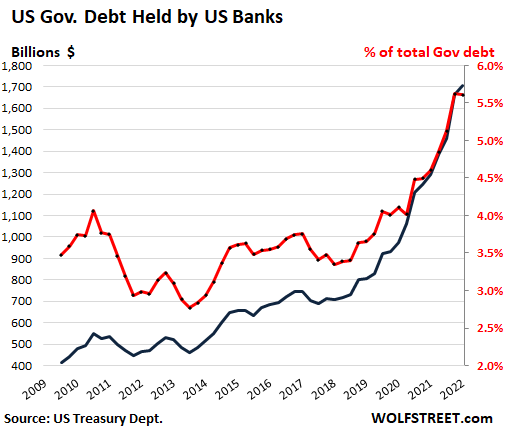

US Banks: $1.7 Trillion, according to the Federal Reserve Board of Governors’ data on bank balance sheets. This was up by $40 billion from the prior quarter and by $410 billion year-over-year. Banks, stuffed to the gills with cash, are gorging on Treasury securities, now that they’re paying a perceptible yield. They now hold 5.6% of the incredibly spiking US national debt:

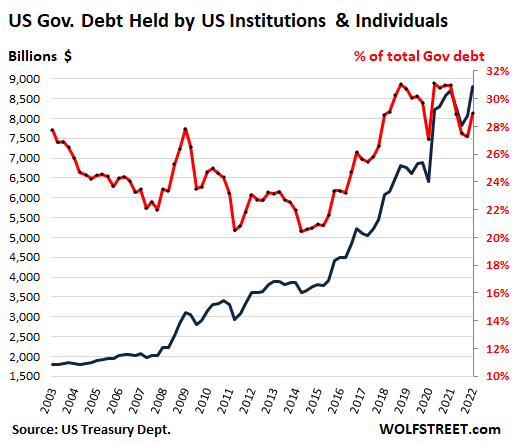

Other US institutional and individual investors: $8.8 Trillion, up by $722 billion from the prior quarter and up by $2.4 trillion from March 2020. These include bond mutual funds and money market funds, US pension funds, individual investors, such as me, US insurance companies, state and local governments, and other US entities.

And here they are, the major holders the incredibly spiking US National Debt, stacked on top of each other:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Bitcoin fixes that.

LoL.

I take it you mean in the same way that chocolate would make good fireguards…

Do you even bitcoin, bro?

Lol

Nope…

But I don’t idiot either…

so how does bitcoin fix it

sell us debt via bitcoin at $50,000 and then when it hits $20,000 sell it and reduce debt by $30,000

we’ll call it deflation of fiat debt

Fixes what?

Might as well add in the “how” aspect while you’re typing away.

All Fed and Media does is to tell our future generations:

1. There is more money in “Speculating” in Bitcoin / Real Estate / Unicorn Stocks than in hard work!

2. Its better to be come a youtube / tiktok star instead of becoming a Doctor or Engineer or Fireman or Farmer to do actual productive work!

Fed now relies on Jawboning with 0.75% rate hikes to try to tame the 8% “BLS” inflation! It knows that the America it created cannot survive a date with reality.

GOD BLESS AMERICA.

Want to end that farce?

Have you reduced your spending to only what is needed with “need” defined to be what can sustain and entertain you enough to stay out of the loony bin?

Have you stopped buying anything “Made in China” that you don’t actually need?

Have you paid off all debts?

I’m doing my part.

Point. Blank. Period. Right on each point!!

I thought he was being sarcastic, but his second comment disproved that. Electronic tulip bulbs are nothing more than serious electrical power consuming gambling tokens which inspire holders to pump them to encourage sales to greater fools.

Although they are illegal in China, guess what country is the largest miner of them? China, of course. That alone should tell you something.

Utility money laundering to hide peak demand of approximately 2015 combined with endless cpu demand including but not limited to web advertising, processing units, fans and cooling systems, tenant-less commercial real estate filled with hardware. In parallel with forced green policy, clown world.

Unregulated, duplicate system attempt with lots of middle men (there are make-believe jobs everywhere boys and girls, you don’t have to be a censor for big tech) and 20% transactions fees all baked in while the gov cheerleads it by default of their own destructive policies. Plenty of .gov enabled agencies are complicit in the fraud directly at this point. They will destroy the value of food and housing, for pensions going directly against the money was logically next. How’d it hit 60k plus? How is it allowed to be priced in dollars? Why is it the second topic to housing in wolfs comments? The desperation for any business without logic is apparent with no accountability to be found, just vapor-sh1t-splatter-CON-coin by the 1000s of flavors, with green man Elon-CON-musk as head spirit coach for all the CON apprentices

YacosModernLife, I agree completely. Financially and politically, it’s a corrupt farce everywhere, but electronic tulip bulbs are just another part of that, playing upon the same negative human characteristics that create and then allow the corruption – greed, stupidity, and ignorance, willful or otherwise.

The market has wiped out the youthful exuberance, next to go is the speculation, then all the gains from share buy backs. After that we will have to give up the gains from free money at the expense of savers and taxpayers. No more stimulus. At this point reality kicks in and the Trump effect goes away. At 18000 the market was over bought with. We haven’t fixed a damm thing from 2008 or 2002 but we’re 28 trillion deeper in debt on government spending. Even with our war mongering ways the economy is busted. If corporate America couldn’t survive with all this free money and fiscal support then it isn’t going to survive in a real world.

Guns, ammo and rice.

Pucker up you Buttercup’s.

That’s a good summary.

Also next to go in that list is when the buyers for that junk paper stop buying it. That is already starting to happen…

It seems that losing asset is much more of a liability now with the inflation rates skyrocketing.

Fixes what?

Andy, I would also like to know how crypto currency has any effect on the national debt.

Even if it was useful as a currency, how would it make a difference what the national debt was denominated in?

Yupp it does. Waiting for the traditional system to pull a luna haha will be funny when dollars are worthless.

Dan,

Just a reminder, to jog your selective memory, it’s bitcoin that lost 55% against the “worthless” dollars over the past 6 months, not vice versa.

Wolf

Any one keep mentioning BIT COIN are NOT reading the demise of ALL cryptos including so called STABLE coins in the last 2 weeks!

It is a CULT that is in denial! They belong to category called’ FLAT EARTH society!

USD is backed by “hard power” of the state. This as opposed to crypto which is literally nothing.

Fiat currency has demand to pay and service tens of trillions in debts, trillions in taxes, and trillions in other economic activity between private sector and government.

BTC or crypto?

No one has to accept it for anything. Anyone can create another crypto any time they want in theoretically unlimited supply, if they can find someone dumb enough to exchange anything of value for it.

I never fixed bitcoin. How do you make it water soluble? Crush and heat?

Sorry. This is a financial site…..How do you make it “liquid”?

Electronic Alchemy…OK….so a variation on an ancient theme….at least it doesn’t stink (unless you fry any potted semiconductor)….a really nasty smell.

I knew things were going to hell when kids were sold on and then “liked” cell phones and video games more than dirt clod wars or balls….at least there is still some shoplifting…that was good young hominid fun.

I suppose the bright side is they will be red hot drone and other UAV pilots….as long as you aren’t on the target side of the “policy”.

Sure, bitcoin-tulips will remove the need to worry about yields by removing your wealth. LOL

I love Stigljtz audaciously claiming interest rate hikes, which would reduce banksters’ profits, will not reduce inflation. He recommended supply side interventions!?! LOL The banksters and ultra rich are crying, please do not make us pay taxes like the hoi poloi, which we would have to pay if interest rates rise.

As social security continues to hold less debt instruments due to boomer retirement and the fed steps out and China continues to reduce their holdings to get ready for their attack on the dollar…….who is going to buy this junk.

Rates either sky high or……..inflation sky high…….take your pick.

Either that or DC learns what a budget is…….no way. DC is run by a spoiled pack of kids who were never told no.

So…….we are approaching the end…….

So sad. Something has to give and it will probably result in a country we don’t recognize.

The US Dollar is – by far – the most stable and most used currency in the entire world with no potential challengers whatsoever.

SoCalBeachDude

TRUE!

B/c of TNA!

But keep losing the purchasing power (since 1913) along with other Currencies, some more than the other!

Going against (of course with hedges against whiplash) by those who (nimble trders) know-how of optiontrading, with intestinal guts make money by going against bloated assets with exceptions of energy, commodities like oil, natural gas, grains, seeds and fertlizers!

Reversion to the mean will proceed slowly and some time suddenly!

Wonder how many retail investors HERE are using Option trading or inverse ETFs or Bear MFunds, to contain the damage by coming BEAR mkt of a life time for many Young (45y or under) investors?

And how many are sidelined with significant cash?

I’m 26 and have half in gold and half short apple and tesla.

Um, yes there are many, many alternatives. Not just in currencies–countries can opt to keep their holdings in valuable commodities than dollars (what China is doing). They can plow the dollars more and more into real infrastructure. They can simply diversify their currency baskets more–you fail to realize it’s not just “one reserve currency” that can replace the dollar, it’s the combined weight of a diversified basket. (And the renminbi is just one example, the Saudis and other oil producers are now taking several currencies out of necessity, they’re not going to keep holding useless dollars that lose much of their value.) Some currencies have central banks more aggressively protecting them, and then also metals–again it’s not just a single replacement, it’s a thousand cuts. Our firm works with private and public entities and they’re furious about Powell and the Fed being so late to defend the dollar, and if the Federal Reserve doesn’t go full Paul Volcker to preserve the dollar’s value, they will move out of the USD faster and faster. It’s delusional to think otherwise.

Yup, sadly its u to DC to reign in spending. Will not happen.

Yes, I was wondering about the 19.8% of government self held debt and how much was SS. I believe SS is selling now which would account for the starting downturn on the graph. When (if?) the Fed also starts selling/retiring, someone has to pick up the pace.

The graphs are very useful and Wolf does a great job, but past purchases do not necessarily imply future purchases. And I think we are all more worried about the future than the past.

It’s all well and good to say when interest rates increase everyone will buy them, but then the debt service doubles or triples over some period of time requiring more to be sold.

And a recession, that Powell does not seem to be afraid of causing by raising interest rates, would throw a real spanner in the works.

The amount of publicly held debt is actually, closer to $18T, as this is the amount that must be financed. This is the number that matters most.

FRB holdings are included in publicly held debt but since interest is remitted back, it doesn’t actually have to be financed.

So, the net debt to GDP is really about 75%, still “manageable”.

I want to add a couple of things here. Local banks and institutions, the FED and US Government were the categories that increased holdings.

1) Fed is winding down.

2) Where did banks get money from? Probably from all the money paid back by consumers, as well as stimulus money sitting in bank accounts, which with the reserve banking bonanza gets multiplied. This process is unlikely to continue.

3) No idea about Social security purchases and their trend, but I suspect insofar as some of the money is discretionary and dependent on voluntary inputs from citizens, might slow down.

if this is true, then interest rates are going to have to rise a LOT in order to allow for buyers to step in, and those buyers are going to have to sell other assets to purchase treasuries.

The reverse repo cushion is large though and banks could step in to purchase a big chunk.

I’d also like to know who buys debt as inflation eats up the purchasing power? (DEVALUES it)

If not the Fed, then who?

Everything was great when there was asset inflation but when first the pandemic destructed the supply lines, then Russia created a problem with energy supplies. Big policy error with the US government panicking and dumping trillion$ into the system.

I just get lost in the concentric spirals.

Who will buy any new debt if not at a much higher RIO?

How does this work with Stagflation?

What is a situation where you have deflating asset values and increasing prices for energy and food?

ROI

Defined benefit pension funds and insurance companies are natural buyers having offsetting long-term liabilities.

Foreign governments have accumulated current account surpluses which must be put somewhere. It doesn’t directly belong to anyone (most of the time anyway), so it’s not managed to maximize returns,

These three buyers account for a lot of (potential future) demand.

Nope, Fred,

Things are run by lobbyists, PR, and advertising folks for hire to the highest bidder; Whether individuals, families, corporations, PACS up the ass, etc, etc.

DC is just a place where their collective agendas unfold, and of course, watch, listen and talk about.

Grow up…it ain’t like your damned household……

“spoiled kids”….sheesh……

Wolf, have you any ideas why Reverse Repos at the Fed spiked to $1,981 billion?

Given the uptrend in interest rates I could imagine Repos might increase. But it surprises me to learn that Reverse Repos have spiked instead, to (I think) a new all-time high.

What do you think is going on? Why are broker-dealers currently swamped with so much cash that they need to lend it to the Fed in exchange for Treasuries?

With these RRPs, the Fed is paying 0.8% interest on risk-free overnight money (mostly from money market funds). That’s the best deal in town for money market funds specializing in Treasuries. Compare this to the 1-month Treasury yield of 0.65%. There is a huge amount of cash out there, including in these money market funds, and the Fed is giving it a place to go before it wreaks more havoc.

Enough QT will bring those RRPs to zero.

Wolf said: “There is a huge amount of cash out there, including in these money market funds, and the Fed is giving it a place to go before it wreaks more havoc.”

————————————————

I believe you once said that the FED does these reverse repo’s to keep either the FED Funds rate or the short term T bill rate from going negative. Is that the havoc you are referring to?

These money markets rates are strange. They continue to pay the retail guy next to nothing. I surmise those funds only exist because of the quagmire of 401K rules. Otherwise, the 401K money in money market funds would be in Capital One earning .6%.

“Is that the havoc you are referring to?”

Yes, part of it. If money market funds earn negative yields, they could end up “breaking the buck,” which would trigger a run on the funds, and some of those funds would collapse, which would trigger all kinds of mayhem. Money market funds are structurally unsound because they promise instant liquidity to their unit holders, but may not be able to sell securities fast enough to fulfill instant liquidity during a run on the fun; and because, like a bank, they promise that the value is fixed at $1 when it may not be because it’s based on securities. The Fed and the Treasury department have long said that they need to be regulated similar to banks because they pose the same kinds of risks.

By creating so much money and repressing short-term yields, the Fed has made the problem much worse, and those reverse repos are a way for the Fed to Band-Aid the problem it has caused until QT removes the excess liquidity properly.

Most people consider MMMF to be cash but it’s actually someone else’s debt and like all debt, subject to default.

The securities in the fund have to be sold first to another buyer to convert it to actual cash.

Doubt any of these holders will ever see their money back.

And I have no doubt all the offshore stuff is the man behind the curtain. I wonder when there will be a Toto moment.

I’ve always gotten my money back. And I have zero doubt that I will get it back in the future. The purchasing power of that money is the issue today — namely inflation. Sure, you get your money back after 10 years or 20 years, unlike stocks, but you cannot buy anything with it anymore, and the interest you earned wasn’t enough to compensate you for the loss of purchasing power.

Don’t you think that at some point this Ponzi finance collapses?

Aren’t we looking at the beginnings of a deflationary spiral down? Starting with demand destruction due to the last great burst of inflation?

Or am I just misunderstanding the game being played?

With all the systemic leverage, the risk a deflationary financial crash is a lot higher than the overwhelming percentage of market participants believe.

Central banks have been successful – so far – in maintaining systemic confidence but if it’s lost, there is nothing they can do to prevent a systemic financial collapse. It’s psychological, regardless of the supposed underlying “reason”.

They can only clean up the mess after the fact, as they cannot possibly act fast enough to prevent it.

This clean up could include multiple actions: “printing”, “bank holidays”, bank bail-ins, whatever.

To the extent it’s even considered (most have absolutely no clue), practically everyone believes it can never happen, mostly because of their belief in uninterrupted confidence in developed country government and central banks.

True, Wolfman

Its all intended based on inflating out of a debt crisis. Average working class wages go up 5% while inflation is 7.5%.

This leads to a steady drop of debt to GDP ratio.

Check out how this is playing out on the debt to GDP ratio within the St Louis Federal Reserve charts and graphs library.

It’s all by design as far as economic warfare on the working class :-/

The loss is actually somewhat greater if one assumes (may be anemic but still) positive expected real growth in the future.

The risk free return needs to compensate for expected real growth + expected inflation over this long horizon, say 10 years.

And for the most part, it does when bonds are allowed to be “priced”

https://mobile.twitter.com/AswathDamodaran/status/1486765414516346881/photo/1

Presently, inflation is dwarfing expected long term real growth so much that the compensation for latter doesn’t even register. However, even a small amount of real growth (that one misses out on) does compound over 10 years. Therefore, missing out on it while getting entirely compensated for inflation can still make material difference to one’s standard of living. However, this just shows that we are getting robbed more thoroughly than we imagine.

Amen.

Love those debt “ceiling” graphs.

The China pattern around 2016-17 is interesting. Looks like they were afraid Trump might accidentally keep his fake promises. He quickly showed that nothing would change, and they resumed their gradual disconnect.

After what happened to Russia’s holdings, China would be crazy to increase their Treasury holdings at this time. The day is coming when they will ask to be paid in Yuan. Why? Because the US is “agreement incapable”.

“But that will crash China’s exports!!” Well exports now only account for 20% of their GDP. And US consumers + companies will suffer as well.

I think china stands a chance of being one of the creditors that the US government does not push off the bridge first. They have missiles after all, and the pension management funds in the US do not.

The Russians don’t have missiles? Or are we talking about metaphorical ones?

The China relationship is a bit one sided. Not sure if they would like to end this deal.

China can buy U.S. Real Estate, Companies, Farm Land.

The US cannot buy or start a company in China unless you have a Chinese partner who owns 51% of the company. From what I read is Elon Musk has been an exception to the rule.

Property Buying in China

——————————————–

Foreigners who have worked or studied in China for at least a year are allowed to buy a home. Foreigners go through supervision procedures for about a week before they are allowed to buy properties in designated areas.

Foreigners cannot be landlords. Property ownership for investment by foreign companies and individuals are prohibited. Chinese living overseas and residents of Hong Kong and Macau are exempt from these restrictions.

“There is no private ownership of land in China. One can only obtain rights to use land. A land lease of up to 70 years is usually granted for residential purposes.

This is besides the point. The US seized funds belonging to the Russians. That’s money paid for products already delivered.

Exactly. Some people just don’t get it.

Why would any US competitor or “enemy” want to hold US based assets or for that matter, assets in any sympathetic country?

Eventually, China is going to stop trading real products for paper.

A lot of China’s treasury holdings are connected to their trade. They can’t divest what is needed for that.

That’s why I said “China would be crazy to INCREASE their Treasury holdings at this time”. They don’t have to buy more, in fact it would be unreasonable to buy more.

What may be interesting is the trend in the data. It looks like there is a shift from China and Japan as state actors holding a large part of the debt to entities internal in the US and in tax havens holding the debt. If the foreign holders could be identified as either state/government and “private” in the chart that would be interesting.

1) WTI weekly for fun and entertainment : Feb 28 2022 close is

the highest close. It was breached on Mar 7 high, in a red candle high, that failed to close above either Feb 28 close. Since then, there is no close above Mar 7 high after ten weeks. That’s a warning sign. Something is wrong with WTI.

2) The failure of Mar 7 led to a small correction.

3) Feb 28 low was breached, but there is no red candle close under

Feb 28 low. WTI in an eleven weeks trading range : no green candle close above Mar 7 high and no red candle close under Feb 28 low.

4) Turtle speed. Accumulation or distribution.

5) This week high @115.56 failed to breach Mar 26 high @116.64. It might trigger a correction.

6) The first test of this correction will be a weekly close under Feb 28 low, a setup bar.

7) The next test will be to breach the low of the setup bar, a lower low, a trigger.

8) Lower oil is a booster for the economy.

Who wouldn’t love a WTI correction? Like a shot of tequila at sunrise.

phleep,

Which one of those has a better chance of coming true…

Actually, in my case, the WTI correction. I’m celebrating 25 years without a shot, longer than the last WTI lapse. 25 more years and inflation/oil might do something really weird. Or several somethings.

Of course but the higher cost of fuel has more to do with refineries shuttered during Covid and not restarted and the lack of supply due to Russia

Accumulation. WTI going to $175-$200 within a year

I’m going to put some money on that.

WTI went to NEGATIVE $30 a few years ago, and could very easily do so yet again.

What has happened to the spread between WTI and Brent? Anyone have an answer?

Going back to pre-2010 normal. WTI used to trade a premium to Brent until fracking created so much production in the US that the price of WTI collapsed — by 2016 to $26 a barrel, and Brent collapsed less, so WTI started trading at a discount to Brent. Now it’s going back to normal, meaning to a premium over Brent.

Thank You.

Yes, look at rig count.

I have been tracking rig count for about 22 years. Rig count going up and we are entering a recession, which means less demand for oil.

Expect oil prices to crash at least 40%. They always over correct or panic drop.

Good post as Walmart even said high fuel prices were the main reason for lower earnings.

It is fair to say the trend is your friend, 40T debt in the next 4-5 years.

It’s like inflation. The cure to high debt is more debt. The Davos crowd was wrong …. by 2030, it’s not true that most people will not have anything and be happy, instead they will have debt up to their eyeballs and be ecstatic. #GotMilk will be replaced with #GotDebt?

Americans have replaced a tyrant 3000 miles away with 3000 tyrants who occasionally meet up at Davos. In other words, the American Dream has come true!!!

USA!! USA!!

All financial great powers are struggling with rising public debt per unit of productivity. Russia seemed to be trying a different tack, but that model, too, is being stress-tested.

It is some solace that many problems we see in the USA are global too. Better than being a worse house on a bad block. It gives the lie to the opportunistic partisan political braying, over every data point. Europe and China have been issuing debt out the yin-yang, in various forms. Maybe some kind of giant clearing-house could cancel some of this.

I have been buying miniscule amounts of 13 and 26 week bills via treasury direct. I find it easy to do, and get much better (still not even ‘good’)rates than savings account.

My purchases are not a millipixel of the graph..

Doug, I’m doing the same with 3 month bills in my IRA instead of 0.005% from Schwab. I, too, was hoping for a spot on the graph. Maybe next reporting period? LOL!

I just throw cash from dividends into SCHD in my IRAs.

Bobby1971,

The trend is your “friend” to $4 x 10^13 in half a decade? It certainly appears so.

OK, but with friends like that, who needs enemies?

“Put a monkey on his back

All of your so-called friends

Take you where the sidewalk ends

Lord, please save his soul

He was the King of Rock and Roll

American roulette

Stake your life upon it

American roulette

Say a prayer for the lost generation

Who spin the wheel out of desperation

American roulette

Same eyes, same eyes”

— Robbie Robertson

“To pump or not to pump”; that is the question.

Can the Fed stop buying and begin to sell and/or let the mortgages and bonds fall back (pun intended) into the system?

We’ll see, but my guess is that they cannot stand the heat that would be generated.

Cheers,

b

PS. The heat might look like the biblical “weeping, wailing and gnashing of teeth”.

The Debt-Held-by-Institutions-and-Individuals chart is remarkable. From 3.5% of total treasury debt, to 5.5% in 12 years. And obviously a very dramatic increase in absolute terms.

It would be interesting to see the chart expanded back to include the period of 1960 to 1980, the last bond super-cycle, when US Government bond rates rose from low single digits to peak around 20%.

The ultimate “bag-holder” (thanks Dang) over the next 20 years seem likely to be the bond-holding retirees who will suffer from both bond price losses and pension and insurance failures.

In an ascending channel interest rate cycle, timing is everything…

Wait- I self-checked my failing memory:

Government bonds peaked in 1981 at about 14%, per Homer and Sylla.

Sorry for the overstatement…

JH

I would also like to see this chart. Sometime in the 70s or early 80s I attempted to finance a house and found no money was available at any price. The current owner also had financial problems so we did the deal by CFD until money was available. About this time IRAs and 401Ks were made. I remember as I started IRAs for both my wife and I. We made out great with the high interest during this time. Every bit of this is from memory, which ain’t as good as it once was, will accept any jabs but would like to understand that period.

SR-

Yah. I remember my first IRA’s back in early ‘80’s, too. I think I bought $18,000 due in 20 years for $2000. Gov’t backed. Yielded about 11%.

A nine-bagger!! Should have held them to maturity, but couldn’t resist the big profit after market rates declined.

When you add up the total number bought by foreign governments, it doesn’t come close to the nearly 31 trillion flavors out there. Can we get 3rd world countries to fake buy our securities, such as the developed world is doing?

Musical chairs, or circle jerk?

Look at the private sector buyers, including me and bond fund holders, and banks, and pension funds. Plus the Fed. Foreign governments are only a minor buyer. That’s why I gave you a chart for each group.

using treasuries as collateral for credits for buying treasuries…?

$Gold weekly for entertainment only : there is no green candle close

above Aug 3 2020 high that indicate that the uptrend cont and there is no

red candle close under June 8 2020 low, that started the vertical rise.

Failing to breach the high is not a good sign.

June 8 2020 low was breached, but it’s not good enough. In order to

have a change of character we need a lower close under June 8 2020, a setup bar and a lower low, that breach the setup bar low, a trigger.

That sure is a lot of money.

Where did it all go?

It didn’t all go into GDP.

Debt is rising faster than GDP.

And it gets worse when you tally in household and corporate debt.

So where is it?

Or is that a bad question?

Or maybe one I shouldn’t be asking?

Boy, you’re going to carry that weight.

Carry that weight a long time.

You never give me your money.

You only give me your funny paper.

“That sure is a lot of money.

Where did it all go?”

That was not a rhetorical question.

Hint: water and money seek their own level.

Water flows downhill.

Money flows uphill.

1) One hundred years ago, In June 1919 inflation was very high, after

WWI, peaking @ 23.70%

2) In June 1921 deflation peaked, the worst, @(-)15.80, but there

were no gov bonds they were all gone.

3) US treasury recharged it’s better.

4) In the 1920’s inflation was moderate. The economy was boosted by

higher productivity, innovation, and confiscated German co “stimulating” our economy as part of reparation.

5) Merck was adopted 100 years ago. MRK weekly a shooting star.

Excellent post Michael Engel-

The 1921 depression was unique in the history of the fed…. It was deep, the Fed did almost nothing to end it, and it ran its course very quickly.

Could our policy makers learn from this? (Rhetorical)

There’s a good book on it, The Forgotten Depression by James Grant, who I’m sure has a few fans here. But nobody in DC listens to him.

AI keep killing me : in 1921 Liberty bonds became worthless.

In the 1920’s Japan switched Siberia and Sakhalin Is to China.

Few days ago Japan former defense minister complained…

US expedition force was out of Siberia.

” In June 1921 deflation peaked, the worst, @(-)15.80″

So up 23% then down 15% is “deflation”? This is the type of analysis that comes from government agencies. I suggest it is a net inflation gain or circa 8%.

retracing a sharp inflation, IMO, is different than deflation.

For example, if prices here and now retraced some of its recent 8% jump, and gas goes back to $350 / gal….is that really “deflation”?

Deflation, IMO, would mean more of a constant systemic price reduction from normal levels….not from aberration spikes.

Sigh…I guess it’s the continued result of bastardizing the term “inflation” with rising prices.

Observationally, the amount of money rose, and then it fell. We had inflation, then we had deflation. We also had price increases, then we had price decreases.

Yes, you could say it spiked then retrenched, but those are actually subjective (and hindsight) evaluations of what happened. It’s arguably more important, at least to historians and economists, to dwell on the causes and explanations for each phenomenon than to focus on the end result of a chain of occurrences.

Increased money supply (inflation 1) and increased prices (inflation 2) have been an upward climb for decades. It’s part of the plan to make the common person a debt slave. It’s more efficient than serfdom or traditional slavery.

Historicus

A little correction on your math (not an uncommon error): 23% inflation means prices go from 1 to 1.23. Deflation of 15% means prices then go down to 85 percent. Putting the two years together is 1.23 times 0.85 = 1.045 which is 4.5% inflation over two years.

I agree with the same for the stock market. Is the retracing of gains since before the pandemic started really a crash?

The NASDAQ QQQ has been hit hard recently but looking at the numbers:

207 – Dec 2019

404 – Nov 2021 – 95% Gain

282 – May 2021 – 30% loss since the peak. 36% gain since Dec 2019.

The overall gain in 2.5 years since before the pandemic is 36%.

This is a yearly ROR of 14.5%. It is well above the QQQ average ROR.

Is this a crash or a return to normal ROR?

No, it isn’t a crash.

How can a decline be called a “crash” when the price level is still in deep outer space?

The US stock market remains obscenely inflated.

Long Term US government debt may turn out to be a great investment if we go into a deep recession or depression. Especially with a strong dollar. I believe we are already in a recession heading for a depression.

That bet works in emerging markets. Dollar remains a safe haven.

Reminds me of my mostly hellish city where people are climbing over each other to move to in order to pay absurd prices for a mediocre experience. Boy, the rest of the country must be REALLY bad.

I told one of my youthful students, sleeping on a sidewalk and eating dog food is an “experience” too.

@ Tim R –

What is your city?

somehow I don’t think that even US of A can get away with doubling their debt every 2 years.. it makes no sense. something has to give

Bought my first cd in a long time last week.

Debt ceiling is a completely laughable concept. Yet another proof — as if we needed one — that congress is exactly that: a massive despicable con.

Kabuki theater. Dog and pony show.

China has seen 9-11% annualized growth in money supply (M2) recently as they try to deal with COVID and increase growth (Trading Economics Data).

There is no other country in the world that more egregious overprints money like the People’s Republic of China which has taken their money supply from around $3 trillion to more than $40 trillion over the past 15 years just like bogus monopoly money. Moreover, it is all on the back of the US Dollar as their renmimbi (yuan / RMB) is pegged to the value of the US Dollar with only about a 2% float.

An interesting question is then, how do they make the pegging work if inflation is that dissimilar?

(Inflation = expansion of money supply.)

The stupidity of buying grossly overvalued assets with debt increases the inevitability and severity of the eventual crash exponentially.

As people are beginning to see that inevitability growing ever closer, US government debt is becoming the least worst alternative to preserving capital to repurchase assets at rational valuations after the coming crash.

The combination of skyrocketing inflation in rents, taxes, mortgages, fuel, insurance, food, and utilities is hitting the working class, which is the vast majority, disproportionately hard and at a much higher percentage than the overall CPI. This combined with the shock of seeing their 401K/retirement accounts taking a massive hit is going to shake their confidence in their financial situation to the core. This reality check will impact their spending as their discretionary spending is diverted to necessities as retail spending is already indicating. This trend will be accelerated when the housing market corrects, and they watch their home equity evaporate before their eyes.

Deperrsing

De-pursing: like an 18th c. pick-pocket

Defenestrating. A popular sport nowadays.

It’s an explanation of how the vast majority of Americans are going to become poorer or a lot poorer.

It’s reality.

Amen!

AAPL weekly is down 25%, trading at 12PM under Oct 4 low.

Will it close < Oct low.

Looks like a little more buying today.

Crypto-pocalypse comes for MiamiCoin…

MAYOR BET MILLIONS OF TAX DOLLARS…

Maybe their nutjob Governor can bet all the State funds on that..I am all for it

Wolf, great job as always… you definitely capture what the Fed has been up to since the 2010 Mortgage debacle!

However, it would be interesting to capture the ‘stacked National Debt’ chart going back to the 80’s to see how the Fed Balance of government debt has grown since then. Maybe in the next iteration?

Well, I suppose once US treasury yields go up to a more meaningful level then maybe someone else other than the Fed will buy that debt.

If we break through to higher yield levels, we will attract capital from other countries and they will buy it up.

As Wolf has stated many times, yield solves all these problems related to what’s going on in this article.

So what’s working ,oil ,commodities,gold seems to have a floor around 1800$ seems manipulated

1) QQQ weekly for entertainment only, in the casino : There was a large white bar in Nov 2 2020, on moderate vol, that led to a bull run. Will QQQ close < Nov 2 low anytime soon,, cancelling the crazy 1.5 years uptrend : we don't know.

2) All we know is that this week close, at 2PM, 95% will close < Mar 8 2021 low, the next wave up. May 9 2022 low is not good enough, May 16 close

is a setup bar. Do we need a trigger, May be we will get one, in Oct 2002, or perhaps in Oct 2024, but not today !.

3) May 16 2022 low, a huge bar, the largest red bar since Nov 22 2021 plunge, on half vol. Something is wrong.

3) The spread between May 9 low and May 16 low is tiny.

4) What's the odds for hitting a temp bottom, a Selling Climax.

5) There might be a lower low, a test, but who cares about the rests now. Shall we bet that the next week will start a short term vertical wave up, or it's too risky, even with SL.

I read through the post and skimmed the Comments and did not see this issue addressed. Wolf, you did not distinguish between fixed rate and TIPS treasuries. They have very different return characteristics. For example, as mentioned before, I hold a TIPS ladder until maturity, so I do not value my securities at market, but I value the securities at the value of inflation added to the basis of the securities. As of today, my annual return for this portfolio is 8.4%. And I am confident I will have a similar gain a month from now after the next CPI numbers are released. Not chickenfeed.

I bought my first treasury. 2 year at 2.50.

Where well rates be when it matures?

If 2 year gets to 5 % in say, 3 years, I highly doubt it though. What would that do to riets aa an investment

Why are utilities going up with rising rates? Saftey maybe but doesn’t make sense to me.

Give it time. When the bear market gets deep enough, utilities will be sold hard.

Major utilities like Duke Energy and Souther Company have terrible balance sheets. Maybe good compared to other corporates (somewhat above average from my observations) but loaded to the gills with debt.

It will take awhile, but I do not consider these dividends safe.

I admit. I did it. They accepted my new cryptocurrency, Tulip.

As usual, your meticulous adherence to the official numbers, presents a picture of the current situation, without bias, which is provided, in abundance by your readers.

My two bits,

As I understand it, the Fed proposes to drain $5T over the course of three years. Essentially neutralizing the balance sheet expansion since covid QE. The Matterhorn like trace of the section of the graph labeled “government debt up the wazoo”.

I was reading and re-reading an interesting analysis by a former Fed trader, Joseph Wang, I believe who presents an analysis of the mechanics of the Federal Reserve’s likely operations during QT. His cite is Fed guy

My takeaway, after rereading it twice, is the Fed is going to have to fund the $1T of treasury issuance and sell $1T of QE bonds.

The long term interest rates are likely to go higher than currently anticipated. Good article.

Since I have savings in short term G bills, I am trying to figure a strategy to prepare for the coming economic tsunami during the normalization of monetary policy. The system is so brittle that the idea that the Fed wouldn’t be there, the Banker, that supplied liquidity when they, the wall street wise guys, had cold symptoms.

History paints the radical as an accidental visionary.

Eulogized as something he or she never was.

Make believe is the core, making a reality of what we believe, a dangerous idea.

Sorry, it seemed so poetic, which, in retrospect seems false. Especially the part about a dangerous idea, which I have spent my life minimizing, even when I was in the selective service lottery for service in Southeast Asia. I prepared myself to do it and then my number was 300+ so I never really had too make the choice.

Not too mention the heroic idealization of the radical by a comfortable conformist.

Maybe I could sell it as lyrics to a ballad.

Thanks, Wolf

Just like the most dangerous idea of all, love.

I would be curious to see the time frame holdings of US Govt. Debt.

If it is only the currently added 1.4 Trillion that needs to be serviced at 2.5% + and the previous 29 Trillion are locked in at lower rates, then the looming servicing of the US Govt. Debt is being exaggerated.

As quickly as treasury rates have increased, long term investors would need to sell at a great loss to lock in current rates.

The Fed’s 5.76 Trillion in holdings are not actually worth 5.76 Trillion at current rates. If the Fed is actually going to sell they are going to have to do so at a significant loss.

As the US economy may be slowing this fall buying 10Y or 30Y bonds right now in anticipation of

future price rises might be a good trade. (a bit risky right now) I see yields being capped as the Federal Reserve will obviously step in to start buying bonds again if the rates go too high.

The Fed has become captain obvious in terms of its actions and motivations. They created all this inflation and now they want us to believe they are going to put the US population ahead of Wall Street. I doubt it. That’s why they’re surrounding the Federal Reserve building in D.C with Barbed wire!

Does the FED or Treasury publish an aged schedule of all its issued debt by interest rates (I realize TIPS are repriced twice a year in May and November) and changes each month (new issues and retirements) showing the composite averate rate and period costs?!