The boom is over. And there are broader effects.

By Wolf Richter for WOLF STREET.

Spiking mortgage rates multiply the effects of exploding home prices on mortgage payments, and it has taken layer after layer of homebuyers out of the market for the past four months. And we can see that.

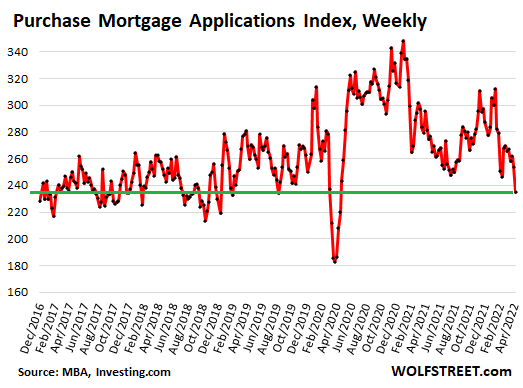

Mortgage applications to purchase a home fell further this week and were down 17% from a year ago, hitting the lowest level since May 2020, according to the Mortgage Bankers Association’s weekly Purchase Index today. The index is down over 30% from peak-demand in late 2020 and early 2021, which was then followed by the historic price spikes last year.

“The drop in purchase applications was evident across all loan types,” the MBA’s report said. “Prospective homebuyers have pulled back this spring, as they continue to face limited options of homes for sale along with higher costs from increasing mortgage rates and prices. The recent decrease in purchase applications is an indication of potential weakness in home sales in the coming months.”

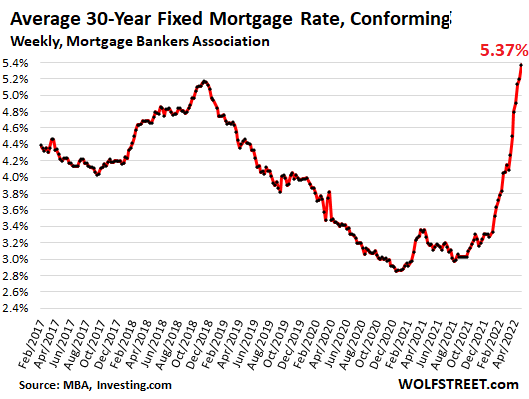

The culprit of the plunge in volume: The toxic mix of exploding home prices and spiking mortgage rates. The average interest rate for 30-year fixed rate mortgages with 20% down and conforming to Fannie Mae and Freddie Mac limits, jumped to 5.37%, the highest since August 2009, according to the Mortgage Bankers Association’s weekly measure today.

What this means for homebuyers, in dollars.

The mortgage on a home purchased a year ago at the median price (per National Association of Realtors) of $326,300, and financed with 20% down over 30 years, at the average rate at the time of 3.17%, came with a payment of 1,320 per month.

The mortgage on a home purchased today at the median price of $375,300, and financed with 20% down, at 5.37% comes with a payment of $1,990.

So today’s buyer, already strung out by rampant inflation in everything else, would have to come up with an extra $670 a month – that represents a 50% jump in mortgage payments – to buy the same house.

Now figure this with homes in the more expensive areas of the country where the median price, after the ridiculous spikes of the past two years, runs $500,000 or $1 million or more. Homebuyers are facing massively higher mortgage payments in those markets.

The combination of spiking home prices and spiking mortgage rates has the effect that layers and layers of buyers are leaving the market. And we’re starting to see that in the decline of mortgage applications.

The Fed has caused this ridiculous housing bubble with its interest rate repression, including the massive purchases of mortgage-backed securities and Treasury securities.

And the Fed is now trying to undo some of it by pushing up long-term interest rates. It’s the Fed’s way – too little, too late – of trying to tamp down on the housing bubble and on the risks that the housing bubble, which is leveraged to the hilt, poses for the financial system.

What it means for consumer spending.

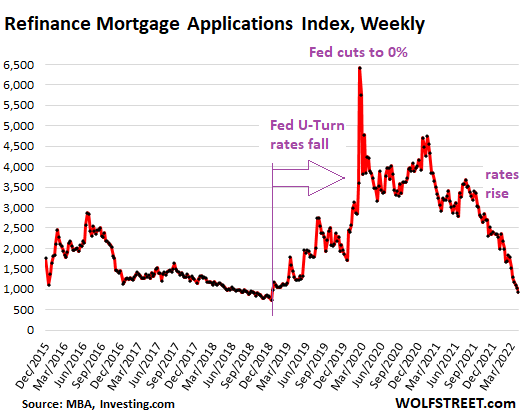

When mortgage rates fall, homeowners tend to refinance their higher-rate mortgages with lower-rate mortgages, either to lower their monthly payment, or draw cash out of the home, or both.

The wave of refis that started in early 2019, as the Fed did its infamous U-Turn and mortgage rates declined, became a tsunami starting in March 2020, as mortgage rates plunged to record lows over the next few months. Homeowners lowered their monthly payments, and spent the extra cash that the lower payments left them. Other homeowners extracted cash via cash-out refis and spent this money on cars and boats, and they paid down their credit cards to make room for future spending, and this money was recycled in various ways and boosted the economy. And some of it too was plowed into stocks and cryptos.

This effect ended months ago. By now, applications for refinance mortgages collapsed by 70% from a year ago, and by 85% from March 2020. Refis no longer support consumer spending, stocks, and cryptos.

What it means for the mortgage industry.

Mortgage bankers know that they’re in a highly cyclical business. Faced with rising mortgage rates, and collapsing demand for refis, and lower demand for purchase mortgages, the mortgage industry has started laying off people.

Add Wells Fargo, one of the largest mortgage lenders in the US, to the growing list of mortgage lenders that have reportedly started the layoffs late last year and so far this year, including most notoriously Softbank-backed mortgage “tech” startup Better.com, but also PennyMac Financial Services, Movement Mortgage, Winnpointe Corp., and others.

Wells Fargo confirmed the layoffs last Friday and a statement blamed the “cyclical changes in the broader home lending environment,” but didn’t disclose in which locations of its far-flung mortgage empire it would trim mortgage bankers, and how many.

So that boom is over. And the Fed has just now begun to push up interest rates, way too little and way too late, but it is finally plodding forward in order to deal with this rampant four-decade high inflation, after 13 years of rampant money-printing – an inflation of the magnitude the majority of Americans has never seen before.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Many realtors and mortgage folks hopefully learned to code during the pandemic.

Perhaps the ones that didn’t go through the same kind of bust in 2008. Probably not though.

Restaurants need way more kitchen help

For what? Robots can and are replacing most of the ‘help.’

No, they’re not.

I know from personal convo’s, fearing a weakening dollar. many “savy” investors did a refi on their current mortgage to purchase an Air BNB. Most purchased at a market high, citing inflation hedge.

And didn’t Wolf write “ppl were buying new homes, not bothering to sell their current homes, and using that house as a cash ATM?!”

Interesting times, to say the least.

“Restaurants need way more kitchen help”

Hard work for low pay. You’re not going to get it.

We’ll get it. The stimmies are cashed and spent.

Bye-Bye to more Mom and Pop businesses. Already have only one owner operated coffee shop left in my large 250K+ area, where we hung out pre-covid…guy cut hrs to 4-11.

Contractors/subs have to have a place to meet every am and swap info, make deals, BS competitors, and luckily picked him. My boss went every am, too, when I worked construction mostly PT early 80’s.

Small factories I worked in when younger are long gone.

Economy of scale, ya know?

Google Bork’s America article in American Conservative. (short and to the point). Wolf had a similar article here a while back, basically saying that all Americans want out of life is to consume a LOT and as cheaply as possible.

Chicago School of Econ stuff…uncle Milty, et al.

Wolf’s article addressed the “importance of consumer welfare, as measured by PRICE” and the consequences, IIRC. Anyway, here’s a link if he will allow it….it’s good history of part of how/why we got to where we are today. (I should have waited to send my donation till after he allowed it ;)….)

https://www.theamericanconservative.com/articles/robert-borks-america/

Restaurants will lose business:

The young are not so interested in restaurants, they are opting for home delivery so that will be a declining business.

Restaurant spend is a discretionery purchase and with inflation, people will have less money to be able to go to restaurants.

Restaurant popularity was high recently only because people did not have the opportunity to go to the restuarnt during the corona virus pandemic.

Bead, I laughed when I heard your restaurant joke.

No way in hell realtors are smart enough to learn how to code.

Most realtors are really just untrained tour guides.

Restaurants are going to one of the bigger failing businesses in the coming recession/depression. Back in the 1970’s (the last time we had a inflation rate over 10%) the average family ate out less than once a week.

Interest rates will have to climb to meet the inflation rate, and that’s going to take 3-4 years, and then another 4-5 years to come back down. It’s going to get ugly for anyone who’s never learned to live without credit. And credit is going to get much harder to obtain, even for those with good scores. That’s going to massively impact consumer spending.

20% of the salespeople make 80% of the money anyway, and they’re still standing when the part timers and newbies are gone until a fresh batch come along to pay ridiculous licensing and training fees when the next wave comes. It’s a real racket now.

I did it many decades ago and it was 150 bucks and 3 months’ evening courses, then straight into a brokerage where I worked part time. I ended up hating it, but my timing was great – the market took off right about the day I started working. Stuff was up 50% over a few months even though interest rates were ~15%. Later the market dumped, and I was gone like so many others when the easy times faded – I had lost interest anyway.

Today, for a license up here in Kanada it’s about 8 thousand dollars and a ‘learning path’ that takes a year, then an articling period for two years with a broker, a license fee of about 600 dollars, and several more education courses, 2,000 a year in fees, 1,300 dollars one-time fees.

All designed to slow the process of new entries into the market and milk them as much as they can. The middle class is the only class that will eat its own kind.

Ironically, my mortgage lender graduated with a CS degree but the money was better in mortgages.

Right. Just like the pipeline workers whose jobs were killed by Joe his first day in office.

LOL, more talking points.

Ed C,

What kind of drive-by one-liner nonsense is this?

I believe he refers to executive order 13992, which stops the pipeline on federal land. It is a loss of potential jobs not yet created. Not actually firing anyone, which he infers.

Wolf – You Beast!! I for one appreciate your input

Once the train gets rolling, lots of layoffs.

Don’t worry. Everyone’s going to get bailed out going forward. Here’s Janet Yellen backing permanent rent / mortgage relief as part of the Fed / Congress playbook to deal with recessions:

https://www.reuters.com/business/us-treasurys-yellen-calls-better-automatic-stabilizers-fight-recessions-2022-04-28/

The inmates are running the asylum and have bought into Modern Monetary Theory (MMT) hook, line, & kitchen sink.

This woman is pure evil.

They did learn to Code..

But they were coding for Mortgage Application and Processing Fintech startups…

Ro Rohhhhh….

It only means that volumes will keep declining and prices will keep rising slowly. America will soon become renters nation like much of the rest of the world. Homeowners will refuse to sell at any lower price knowing well that in the long run it will only appreciate. Those who will sell due to extreme reasons will be sold very quickly with many bidders.

In Bay Area, despite tech stock crash and despite mortgage rates rise, and despite work from home and little to no immigration, home prices continues to rise and in good areas 1-2M overbidding on 3-4M asking price is very common. And these are very old, tiny 2K sqft homes in poor condition.

Despite what experts have been telling , home prices in US will NEVER drop again because homeowners have tasted the blood and know that Fed will always save their bottom in the long run as long as they are patient.

🤣 You’re so funny.

I’ve noticed something else in the USA that may eventually smash new house prices. When people move houses, to get the latest big deal, they appear lose their homeowners rights to limited property tax rises and so have to pay whatever the new full property tax rate is. It’s odd for me, as we don’t have property taxes in the UK, just a thing called council tax (to pay for local utilities) and they don’t change and go up if you move into a new house. I imagine (and read?) that for new house movers this may be a substantial amount….

Just to let you know, the biggest council tax (on the biggest houses) is around the £4000 rate ($4900) even if you house is worth $50 million pounds/dollars or more. That’s why I sometimes struggle to understand USA property taxes…. I pay way less, just over £900 and my rise this year is up £4 a month, so not too bad…….. If I’m wrong about this ,then let me know but I’ve read of massive property tax rises when people move…..which may seem ok if your house is going up in value but if it doesn’t or drops in value then….ouch….

Youre talking about California because of a unique tax law that limits property tax rate increases for those living/staying in their home (prop 13). Thus some people who have stayed in their home for decades in CA have a very low tax rate on their primary residence.

I second that and add an ostrich meme.

Wake up or stop trying to be a comedian.

To-date, the Fed has only stopped buying MBS & treasuries and raised the funds rate a minuscule 25 basis points. There’s a LONG way to go before the “Fed Put” happens.

Do you actually believe this or are you practicing writing for “The Onion?” Because if you believe it I am at a loss for words.

LOL

Maybe he thinks that the fed will drop rates to negative and turn the free money spigot back on. In that case, home prices in nominal dollars could stay flat or even rise! (While the currency inflates to worthlessness.)

The Fed is odds on to drop rates into the negative when the next housing crash happens.

If the Fed sets the price of money at -5% you’d be mad not to be taking out loans all over the place.

They will go to -5% to stimulate the economy and get people spending.

I believe in data. Show me price declines in Bay Area and I’ll believe you.

Kunal,

“I believe in data. Show me price declines in Bay Area and I’ll believe you”

Sure. Absolutely. No problem. Happy to. Here we go: Prices fell 45% between June 2005 and March 2009. Lots of mayhem. I was living here at the time and saw it first-hand.

Is there you there Lawrence Yun or Chris Thornberg? What are you doing wasting your time trying to “sense” into us naysayers? Plenty of dumb lemmings out there for you to convince.

Tell them how great or how much it make sense to take a 40yr mortgage out or consider ARM all over again as I heard from one news story coming out of Houston yesterday.

We need to bring back option ARM’s to keep the housing bubble from popping. And if that doesn’t work interest only 50 year mortgages.

Lol

KUNAL

‘Fed will always save their bottom in the long run’

They are already behind the curve in containing the inflation which will keep increasing, until resolution of Uraine war, supply chain squeeze, cost food is increasing all over the world. so are the private and public debts in record territory in the human history!?

Will they really contain inflation or told to reverse, just before Nov elections! May be you believe in Fed’s miracles!?

Inflation staying the same is actually pretty terrible too. It needs to drop to 2%, and all the sordid gains it made never go away by the way. I hope everyone understands how that works.

Another post of yours totally detached from reality.

My reality in data driven. You guys live in a fantasy land but your wishful thinking will not crash the RE market.

Show me data that Bay Area prices are indeed declining and I’ll believe your reality.

Kunal,

As I showed you above, the Bay Area is INFAMOUS for its real estate price declines. Boom and Bust. That’s what the Bay Area is all about. If you don’t get that, you don’t get anything about the Bay Area. This has been the case since the Gold Rush days, Boom and Bust, always.

Real estate moves slowly, so you need to give me a few years to duplicate the chart that I posted above in reply to your other comment, about the 2001-2012 boom and bust. The next one will be even prettier, I promise, but I need a few years to let the magic work.

I visited friends in SoCal in 2004. I’ll bet their houses aren’t worth even half of what they were then now, and dropping.

Well, I moved out of SoCal in 2006. The apartment I owned went up as high as 360,000. It was finally sold around 300,000. Just checked the comparable surround units today, the price range from $440k to $543k.

It’s about 60% increase in price since 2006. So I am not sure which area in SoCal you are taking about where the prices is droping.

hmmmm? Over confidence much? “…home prices in US will NEVER drop again…” but in the mid 2000’s home prices were NEVER going to drop so one could get an adjustable rate mtg and refin. or sell at a later time because ‘the market ALWAYS goes up”…but then the credit crisis happened.

As Wolf just pointed out a day or so ago, new home sales continue to drop and inventory is at a 6 month high comparable to 2008.

Plus, there is another important detail overlooked: unlike the mid 2000s, the number of actual households are no longer growing. It doesn’t matter what the mortgage or pricing and inventory in the market is doing, if there is limited ACTUAL households (not investors) that NEED a home to live in, that’s going to negatively impact housing prices and demand.

History has also shown that the top of any market is usually found where there is/was a B-I-G glitzy “send off” party. It’s never marketed that way of course. In fact one usually gets the impression that things will be that way for ever. The ridiculous sized Mall of America marked the end of mall building in the U.S., Suvs and oversize trucks are marking the end of petroleum fueled vehicles in the U.S., and If this housing market hasn’t been big and glitzy, I don’t know what is.

That is the funniest post I’ve read anywhere in a long time! Thanks man!

Kunal. You do realize that a 2000 sf home in the bay area is gigantic right?

And you do realize that many, many people in those areas make enough money to EASILY support those valuations…. right?

Please support your statements with more data that makes sense. Otherwise your comments just read as complaining

yea, right. the blood has already begun to hit the stock market. the housing market is on a time delay. higher interest rates will begin to sap up all the demand, finally inventories will rise and people will move away from overpriced markets. And then there will be a 2-3 year decline in prices as all those investors sell their homes and people cant find a buyer.

the Fed is running very scared and wont be able to bail anyone out.

But prices still aren’t coming down. While this is bad for mortgage lenders, it’s no relief to prospective buyers and renters, who continue to pay higher & higher prices as inventory shrinks.

When and if prices do come down, they’ll still be far above 2020 levels.

They will come down when sellers are trying to sell to buyers that aren’t in the market anymore.

Last bust took five years to play out. During the first year, people didn’t even know it was a bust. So be patient.

The Bay Area and Silicon Valley not immune from price declines. Huge glut in commercial in the mid 90’s with housing price declines too.

More people realizing they are screwed on property tax. Those transplants to Austin, Texas are beginning to find out what they are in store for. No prop 13 in Texas.

Top to Bottom of last cycle using Residential Property Price Index (Nominal, Local Currency):

USA – down 30% over 5 years (2006 to 2011)

UK – down 12% over 4 years (2007 to 2011)

Ireland – down 51% over 5 years (2007 to 2012)

Spain – down 42% over 6 years (2007 to 2013)

Source: Helgi Library

Wolf, so last bust took five years at the velocity/pace of tightening that occurred then.

Assuming the Fed goes through with what they say they will do (big if) and assuming markets respond accordingly, if we have a tightening that continues to tighten as quickly as we are… then what is that bust timeline looking like this time?

I think we will bust faster than 5 years, especially with the recent proliferation of MLS data (Zillow, Redfin) that didn’t occur prior to GFC.

I do agree housing moves slowly but I think it will move a little quicker given technology and tools today?

This time, we have inflation out the wazoo and the Fed timidly and belatedly cracking down it. I have no idea how this will turn out. I envision a long-drawn-out situation.

These scumbag mortgage lenders owe us over 3K in fees that they never paid us. If they are ripping us off I hate to think what they are doing to the lemming masses that are lined up at their doorstep to go into debt on some overpriced shack for the rest of their life.

Rocket Mortgage per chance?

They gave me a pre-qualification that was basically a letter restating how much I told them I want to pay for a house. When the CSR, erm, ‘mortgage advisor’ couldn’t convince me ‘a pre-qual is basically the same thing as a pre-approval’ I got passed around to a few more CSRs, then a ‘manager’ who repeatedly tried to get my credit card # to pay $500 for a pre-approval letter, stating it was an administrative fee to cover running the credit report… that they had already pulled. Walked away pissed about the credit ding but glad that was all I lost aside from the wasted time.

I’ve heard Rocket referred to as ‘the Walmart of mortgage lenders’ but even Walmart has more credibility than those clowns.

Lily, that doesn’t sound right. Maybe I am missing some of the details here but even with a zero point / no origination fee mortgage application, you do pay for SOME stuff. It’s not uncommon for a lender to charge you for the credit pull.

They aren’t charging you money for the prequal letter – I’m sure they just so happen to be bringing up the fees at the time you are asking for the letters (while they have you on the phone).

I know it is annoying to have to pay for something you didn’t expect or didn’t know about, but it’s not uncommon to pay a few bucks for that. $500 seems sort of a lot though.

The good news is if you make several mortgage loan inquiries right around the same time, it will only count as one credit ding. So shop around! Don’t feel beholden to the lender that you currently have.

How could Rocket Mtg do that? They’ve got golf pro Ricky Fowler vouching for them on non-stop TV ads

I wonder how many of those buyers are organic people that ACTUALLY need a housing unit to live in VS. an investor. Investors will be the ones left holding the bag because they assume the organic market is still growing.

“So today’s buyer, already strung out by rampant inflation in everything else, would have to come up with an extra $670 a month – that represents a 50% jump in mortgage payments – to buy the same house.“

In one year, how does that not look like anything other than a massive bubble?

People keep asking what will prick the bubble.. it’s already been pricked. But as a wise man once said “nothing goes to heck in a straight line”

ARMs usage doubled from 3 months ago. Now 17% of the weighted loan amount. I bet that gets above 30% shortly.

Minutes,

Yes, this is interesting from an inflation point of view: People pile into housing as a hedge against inflation, where your monthly costs are locked in and don’t change. But that assumes that you get a fixed-rate mortgage.

With an ARM, your interest rate adjusts higher in a long-term inflationary environment, precisely the environment people are trying to dodge by buying a house in the first place. So when the mortgage rate resets, they’ll have a higher monthly payment, which defeats at least part of the purpose of having bought the home as an inflation hedge.

OK, there’s gotta be some room for ‘costing me an ARM and a leg’ joke around here somewhere…

LOL

My credit union just offered me an 18 month CD with an interest rate of 1.75%. I told them to sign me up for a 100K CD. Looks like the interest rates are finally getting off zero bound. The lemmings that followed Jim Cramers’ advice or Lawrence Yun are going to wish they had sat on the sidelines.

ARMs went horribly bad my last few years in banking, ’80 and ’81.

Swamp, what the hell? 18 months at 1.75K? Go tell them to pound sand???

Just sign up for a treasurydirect.gov account and get basically 2% for 1 year?

Why would you buy an 18 month CD at 1.75% when a 1 year Treasury bill is yielding 2%?

Peanut beat me to it

Swamp, wait a couple of weeks until the FED has their May meeting and announces a 0.5% increase in the FFR. You might see a one year T bill at 2.2%.

Well, 1.75% is a lot better that Wells Fargo who was paying 8 basis points for my 100K MM account. I told them to go pound sand.

If bad knock-on effects hit jobs generally, this postpones some price drops until the resets happen. My understanding is there is still a teaser rate (?) and then the interest in a series of resets, converges to reflect the rate rises over time.

I got an ARM in ’94 that worked out OK. Later refi’d to fixed.

Minutes

This is why home prices will continue to escalate or at least stay flat in a worst-case scenario. Lenders will offer introductory rates which look like 2020 / 21 borrowing costs. In that aspect, we are seeing 2003-2006 revisited.

This is just so comical. The entry of ARMs in the mortgage scene basically just proves that we are late in the 4th quarter.

But on the other hand, if you are signing up for a 5/1 ARM and don’t intend to live in the house for more than 2 years, I suppose it makes sense.

As long as the bottom doesn’t fall out and you are forced to hold and have to refinance having negative equity…

Lots of nasty scenarios possible especially with fixed rates rising…

Prop tax 20% higher, too…

Many people don’t know that if everybody’s home in the same taxing area goes up by 20%, your property tax stays the same. Your RE tax is based on the local government budget, not your individual home appreciation.

So, if your home went up 20%, and the neighbors saw a 25% increase, you may actually see a 5% reduction in your RE tax.

That said, inflation may be driving up local government budgets.

In California, all residential property taxes are set at a very low 1.25% (approximately) of the purchase price and then can only increase by 1% per year no matter how long a person owns the residential property that they live in.

Are you under the impression that everybody lives in your state?

@Bobber: “Your RE tax is based on the local government budget, not your individual home appreciation.”

In theory, yes. In practice, local governments find a way to spend every penny that comes in, and many pennies that don’t. We’re not expecting anything but a massive total tax increase with the reevaluation.

SoCalBeachDude,

The annual prop 13 property tax increase limit in California is 2%.

That’s not true in Chicago

Lisa, in Chicago the math is quite simple… Every home owner basically agrees to give all of their money to the state at all times ;)

Uh, no. Houses in WA State are taxed based on annual appraisals. If housing in your area goes up your taxes go up accordingly. My property taxes have almost tripled in 10 years, as has the appraised value of my property. This is an increasing burden on homeowners on a fixed income. Basically a unvoted increase in taxation.

KGC,

The appraisals are used only to allocate the tax burden across households. The appraisals do not impact the amount of tax that’s gets allocated to everybody.

If the government budget stays the same, the aggregate tax will not increase even if everybody’s property value went up 20% in a year.

This is the case for almost all RE taxing jurisdictions.

Most certainly not here in California.

Another plus to CA is that at 55 you take take your tax rate with you if you move.

Simple example: you bought your home 10 years ago for $500k and pay $5k a year in taxes, basically locked in.

House has appreciated to $1M due to price insanity, but you’re still paying the $5K. You want to move to a same price house elsewhere (same price since everything is up) but your prop taxes would double to $10k.

At 55 you can take your original price basis with you when you move. So you could sell for $1m, and buy for $1m, and keep the $5k tax. If you buy a more expensive house you pay the base, and only extra tax on the difference in the new price and the sold price.

The idea is that empty nesters can downsize and move to resorts and such, and open up family housing supply.

The same law also took a wack out passing the low tax rate on inherited housing if not occupied by the heir, which was also a good thing.

SoCalBD,

My point is that said buyer is paying 20% more for a house. So they’re paying 20% more in prop tax, not just a higher mortgage.

Anybody that’s asked me in recent years I told to plan for at least 8%, 10% if you’re conservative, and if you have to take anything over a 20 year mortgage you can’t afford it.

That’s not a bubble in prices of homes, that’s an increase in borrowing costs.

It’s both, read the two paragraphs wolf posted.

Cem

Wolf states (as you quoted):

“So today’s buyer, already strung out by rampant inflation in everything else, would have to come up with an extra $670 a month – that represents a 50% jump in mortgage payments – to buy the same house.“

That is a statement on the increase in borrowing costs. The price of homes may or may not continue to go up. You stated the “…bubble has already been pricked….”

One can speculate increases in borrowing costs are going to have a downward effect the pricing of homes – but to date – there has been no correlation.

That said, I would agree with your closing statement that pricing is likely to come down or at least flatten at some point – and also as you state, probably not in a straight line.

The thing about the RE market is the changes can be slow to see.

Wolf: ” … risks that the housing bubble, which is leveraged to the hilt, poses for the financial system ….”

I wonder if this can be a 2008 redux. The system-wide leverage is lower this time, right? But there may be hidden leverage adjustments to come. We don’t have NINJA loans out there, but we do have a lot of phantom assets (not just NFTs) bound to be exposed. So asset values reset down, and liabilities up. Loan exposure can get scarier than even these numbers.

Since 2008, the entire landscape has changed. Among the changes: the banks are no longer on the hook to the extent they were then. The residential mortgages they carry on their balance sheets are relatively small. They offloaded most of them via MBS to investors and taxpayers that are on the hook this time. The Fed can let housing go, if it chooses, and it might have to because of inflation.

> The Fed can let housing go

I’d love for you to expand on this more

He means the Fed doesn’t have to take extreme steps to protect the banking system to the extent it had to when the last housing bubble popped.

Or, the Fed doesn’t give a wazoo if the taxpayers have to pay for it!

Point made by maxpower is very important. The mosquito with two lobotomies earlier suggested that the Fed will rescue the pathetic dimwits who are buying into the insanity when reality intervenes. No chance this time around. And last time they weren’t rescuing the dimwit bubble buyers, they were rescuing the banks. No need for that this time. The market is in for a shock.

Banks are off the hook on residential but what about commercial? Not to be off topic but there is are a ton of for lease signs around here an I think you’ve already documented the office vacancy rates.

A lot of commercial real estate loans got securitized into CMBS — I’ve been covering this a lot — and those are with investors around the globe. Good luck, boys and girls!

However, some CRE loans are still on the banks’ books. That is not an issue with big banks. But some smaller regional banks that are heavily concentrated in CRE will take heavy losses, and some of them will collapse. The Fed has pointed at that issue for years, and it really doesn’t care because a regional bank collapsing isn’t a big deal. Stockholders, preferred, stockholders and holders of contingent convertible bonds will get bailed in, the assets will be sold to other banks that in return have to take the deposits. The FDIC does this over a weekend, even though it can take months or years for all the loose ends to get squared away.

The government-backed housing debt ponzi scheme is now in full display. Millions are starting to understand.

Agency backed mortgages? Tax deductible mortgage interest? First $500k of gains tax free?! Why so generous?!!

Because housing is the primary collateral for our debt-backed USD. Same for most other major currencies. And the supply of these currencies must constantly grow to avoid a deflationary implosion… so the collateral must also continue to grow in value.

Debt-backed currencies and underlying collateral are all on a one way trip (with some localized volatility along the way).

The Fed will “let housing go” just far enough to kill inflation (lower housing demand, fewer mortgages, lower money creation, lower inflation)… but they’ll turn around and “stabilize” their manipulated housing collateral eventually.

You have to admire the sheer audacity of it!! Convince the world it’s all a “free market” but they keep pulling all the strings. Wild!

This is why that crackpot (crackpipe) Yellen is talking about making the pandemic assistance to the unemployed a permanent feature in the economy as it pertains to housing. It’s not to help them out, it’s more crony capitalism and socialism for the wealthy which guarantees the lenders get paid by the taxpayers no matter what. We need to send these financial thugs packing. Go eff yourself, Granny!

Leverage that seems reasonable when you’re gainfully employed (let alone getting big raises by job hoping) can crush you if you get laid off. Some of these mortgage payments are a big nut to cover every month. At least no one has to worry about student loans! :)

Just curious, John…

Do you have to declare the student loan on a mortgage application even if it’s in forbearance…

Or is it a wink,wink, nod,nod…

Does it affect your DTI..

Thanks…

COWG, I was told by my bank that for the Federal loans in the current pandemic deferment, they don’t count toward the monthly DTI ratio. (I still budgeted them in cuz you’d have to be daft not to.)

The balance owed is still debt on your credit report regardless of repayment status for their consideration, but they didn’t count it in the monthly payment budget / DTI.

Lily, the fact that those federal loans don’t count against your DTI is absolutely bizarre.

And I think you just discovered a hidden “gem” of a piece of data that may help me better understand some of the not so obvious fragility of housing debt going on right now.

Think about how many millenials just bought houses over the past couple of years??

I just recently talked to a mortgage lender about the student loan thing at JPM. They told me that they calculate it by taking your total loan amount due for student loans and multiply it by 1 percent in order calculate the monthly payment that should be coming out for DTI calculations. For what it’s worth.

John, that student loan comment really hurt…….. ;)

I wasn’t trying to be a dick about it :) And I’m not complaining that I had to pay mine off.

John, I was just messing with you. Of course I don’t have any student debt!!!! :)

I apologize for the long post, Wolf, but it’s extremely pertinent to set the record straight once and for all. I am sick and tired of stupid mouthbreathers and intellectually lazy people parroting BS, eyes closed, oblivious to reality, so I will post this again:

May 24, 2018

“In his corner of American finance, where hard selling meets hard luck, Angelo Christian is a star, and he looks the part…

Each time Christian sells a home loan, the company he works for, American Financial Network Inc., takes as much as 5 percent—$12,500 on a $250,000 loan, to be distributed among his staff, corporate headquarters, and, of course, himself. As he and his team chase more than 250 leads a week, they’re on pace to close 50 a month. Christian says he has a Lamborghini on order to go with his Mercedes.

He calls back a customer who’s spent hours watching his sales videos: “Bad Credit, I Can Help,” “Fresh Start: Credit Boost,” and “Go For Your Dreams.” This would-be homeowner has a 596 credit score, putting him in the subprime range. His car has been repossessed, something that would likely disqualify him at the Bank of America branch next door.

“Usually a repo that’s like three years old, we’re not really going to sweat that,” he assures the caller. “We’re pretty lenient here.” He steers his prospect to several $400,000 homes with swimming pools. “Have your wife check that out,” he says, referring to a remodeled kitchen with granite countertops. “She’s going to love it.”

Many of Christian’s customers have no savings, poor credit, or low income—sometimes all three. Some are like Joseph Taylor, a corrections officer who saw Christian’s roadside billboard touting zero-down mortgages. Taylor had recently filed for bankruptcy because of his $25,000 in credit card debt. But he just bought his first home for $120,000 with a zero-down loan from Christian’s company. Monthly debt payments now eat up half his take-home pay. “If he can help me, he can help anyone,” Taylor says. “My credit history was just horrible.”

Christian can do this kind of deal because he is, in effect, making the loan on behalf of the federal government through its most important affordable housing program. It’s a sweet deal: He gets his nearly risk-free commission. Taylor puts no money down. If things go south, the government ultimately bears the risk.

This kind of lending echoes the subprime mortgage boom that preceded the credit crisis of 2008.”

That’s just a snippet. The “there’s no subprime” liars need to go RTGDFA. And this article was from 2018. Subprime has been going strong this entire bubble. The whole thing is based upon fraud. THE ENTIRE BUBBLE. You can’t get prices like this without it. They did the same thing again because they didn’t learn last time and they got bailed out instead of going to the slammer.

Haha I remember this article from reading it back then. The guy looks totally douchebag to the max. I felt like punching the picture of his face from the article.

Much like cult leaders and MLM upline, I hope these people will suffer the worst of it when and if that time comes

Yeah, he’s got that major fraudster/sleazeball vibe. I don’t know who started the whole “but there’s no subprime this time, lending standards are strong” nonsense, but that’s all it is. The standards are “fog a mirror” just like last time.

All thanks to the federal government. Is it the duty of the federal government to ensure that everyone have a house with a swimming pool?

The housing boondoggle is openly sponsored by government. Today, you can get a mortgage with 3.5% down and have it government insured up to a limit of near $1M in the Seattle area.

Speculators can put $35k down, buy a $1M house, then watch the home appreciate by $100k to $300k each year at current home inflation rates. If, by chance, the home value drops, they can walk away from the mortgage and only lose $35k.

You can invest $35k now to receive $100k to 300k in annual gains. Why does the government need to offer such a sweet deal? Does the government not have any respect for taxpayers who will have to bail out the speculators again?

System wide leverage isn’t lower, it’s higher than ever. It’s just not higher in US residential real estate.

History doesn’t ever repeat exactly and mortgages mostly government backed.

The crisis of confidence will originate somewhere else, from a source most do not expect. There are so many too choose from now. Most don’t have a clue there is even a mania, thinking that post 2000 financial behavior is “normal”.

How many first time buyer folks actually put 20% down?

Everyone I talk to buying a house is forced to get Mortgage Insurance…

Everyone is required to put 20% down on low-amount conforming loans which are purchased by Fannie Mae / Freddie Mac / Ginnie Mae. On Jumbo loans over that amount at least 20% if not much more is paid as a downpayment, and many buyers simply pay cash on high value home in the $1 million to $100+ million range.

FHA loans have down-payment requirements as low as 3%. VA mortgages can be had with ZERO down-payment.

Many people do not pay 20% down. Yes, it is required to be purchased by Fannie and Freddie. But those that don’t pay 20% down, those mortgages can get portfolioed or whatever. Not all mortgages are sold.

20% is not required to sell a loan to the GSE’s. They have low down payment programs that have certain criteria that are quite easy to meet.

Orange County has a conforming loan limit of $971k right now.

This mean you can purchase a $1,020,000 home with 5% down. It’s real. I have a mortgage broker friend who is/was making these loans.

A tiny dip in home prices and the mortgage is fairly well underwater.

Don’t you feel sorry for these folks who will might lose money on their home purchase, through no fault of their own? HDTV makes them do it.

Everyone? Come on now….not sure where you get this from, it makes no sense. We sold two houses last year, got over 10 offers on each house, and only 1 person was putting down 20%. Everything from VA Loans wit 0-3%, to FHA with 3.5-5%, and conventional with 5-10%.

People from money or extreme savers, or about 10-15% at most.

Plus many are getting help from parents. Their parents are sitting on a lot of equity and are loaning / giving the down payment to their kids.

As mentioned above, many young adults do not have 40k to 60k for a 20% down payment partly because they are young and it takes awhile to save up that much money.

I know several friends who took this path.

That’s exactly what I did in 1995. Since Dan the TicketMan did not qualify for any bank to lend me money to buy a home, there was really only one way to buy a house, and it was time, as I was 32 years-old.

My parents simply put $75,000 in a trust at our fledgling seed company’s bank (It helped that they could do so easily, of course). When the house that I now live in hit the market, I made an offer of $74,100 on an asking price by the seller of $72,500.

In two days, five offers were made, and one was higher than mine, but mine was “Straight Cash, Homey.” The deed was in my parents name. A legal and binding mortgage was made in Hennepin County & the deal my parents and I made was simple: a 15 year loan at the current 10 year Treasury rate plus 0.5%.

I got the interest paid income tax breaks as income from the family seed company started to come in for me and everything was transparent and equitable to both me and my folks. They declared the interest earned from issuing the mortgage on their taxes as well.

Perfect timing too, as the 15 years coincided with Dad and I selling Trigen Seed LLC for a very nice number to a seed company out of France. Karma & Family!

A great path to follow.

Dan Romig,

Given the way things are going and how poor millenials are compared to their parents, I would imagine that many will follow what you just described. I appreciate how honest and by the book your family did everything. Very admirable.

By the way… you paid over list!!! The horror…. :)

I have learned to live in the gray area of the housing market renting by word of mouth. My latest adventure is the 100 year old shack I am renting is going to get a total renovation with a new foundation, roof and everything in between. I have to be out for at least 6 months.

I have purged everything except what fits in my car, plus a couple of tubs I will store in my neighbor’s shed.

I am going to be renting out a friend’s place in a new town while she travels. We are all different, but having a lot of stuff and a large home always made me feel trapped until a lifestyle that I didn’t like, but I did it til my kids were out of the house.

Not sure I will move back into the old rental. I will see what makes sense at the time.

Old School,

Isn’t it a great feeling to not be shackled by tons of junk? I am early on in the journey and my kids are little so we have lots of junk shackle…

But I still make everyone get rid of all their junk and we still move ;)

Good reminder…..

At my old age of 78, I really need to clean out all my “stuff” (tools, a few sets of old golf clubs, boxes full of who knows what). No sense leaving all this junk for my daughter to throw out once I leave this place.

I fly under the radar as well. I rent from Craigslist ads single bedroom. Have very few possessions. Save almost 3/4 of my take home pay.

I always find some old guy, house is quiet, neighborhood is usually quiet. I stay gone on the road half the week. Works out well for me. I hate renting and living with another person but until the housing market collapses, I’m stuck. 3-4 months ago I could get into something in my area that fit my qualifications, now with interest rates up and prices up yet still, it’s only crummy trailers on 1/10 acre lots. And I’m not writing my name on a loan for that garbage at 250-450k.

I think it will bust. I certainly hope it does. I got sick of living in a truck for months at a time and had to get out to a local/regional job for my sanity. I’m getting sick of the boredom of living in what is little more than a cell. I don’t understand how “city folk” do it. Contempt to live in an apartment for decades, or even worse, an HOA dictated subdivision.

US inflation rate : from 5.6% in July 31 2008 down to minus (-)2.10 in July

31 2009. Up to 3.9% in Sept 30 2011, a 0.774 retracemet of the move down to 2009 low. After a correction to minus (-)0.20 in Apr 30 2015 up vertically to 8.5% in Mar 31 2022.

This inflation have probably reached it’s peak : Covid liquidity was wasted

on RE, used cars, tp…

Yep. Covid Liquidity has ended. Now lets see what the economy can do on its own.

The economy and the bull run was looking a little weak as Trump entered office but his tax breaks gave the economy another little boost. Then along came the covid stimulus and that gave the economy an adrenalin rush.

The FED is trying to give the economy a sedative but it also want to prevent a hangover.

CPI : from 5.6% in 7/31/2008 to(-)2.10%in 7/312009. Up to 3.9% in

9/30/2011, a 0.774 retracement. After correction to (-)0.20% in

4/30/2015 up vrtivally to 8.5% last month.

US CPI have probably reached it’s peak. JP liquidity was wated on RE, used cars, tp…

“US CPI have probably reached it’s peak”–let’s not forget that this inflation is only “temporary”.

In a hundred years they have never admitted that inflation is permanent.

That makes inflation permanently temporary.

Given that housing went up 30-40% in just two years in many areas, I suspect housing prices could drop 30-40% without hampering the economy a great deal. I assume the Fed now realizes this too, given the rate hiking plan. Let’s see if they stick with it. I have my doubts.

It would have been a lot easier if the Fed didn’t leave rates pressed to the floor for so long and didn’t unnecessarily buy so many mortgage backed bonds. Pandemic or no pandemic, it was a rookie error that strongly suggests a high degree of leadership incompetence.

Housing is by far the largest financial outlay and/or investment for nearly all Americans. The Fed stood by and watched housing costs rise 10-20% per year for a decade. For some unexplained reason, they thought it wouldn’t be a problem. Very foolish.

Unfortunately, it appears we have financially unsophisticated people running the nation’s monetary policy.

Some areas in San Diego have doubled in the last 2-3 years. It’s been an insane ride to watch.

By September of 2020, it was clear housing was not only going to be fine, but was seeing excess demand due to the pandemic. By December 2020, the fed should have stopped buying MBS. Instead, they kept buying all the way to 2022. Huge overshoot.

Hey sc7,

Did theBoston suburbs fall in line or do you still have the aberration in your area for the outside city center…

@Bobber – Good post.

Not only did they lower rates the Government handed out Trillions of dollars. Only 12% (unemployed) of the people needed the money, the others could not travel or go anywhere so a lot went into housing, stocks, cryptos. Plus all the people who did not have to make student loan payments suddenly could afford a house payment.

I think I had read studies prior to covid that student debt was a big obstacle in buying a home.

The FED hates deflation and over corrected and now they got a big inflation problem.

Time will tell if they will reduce the balance sheet by much as honestly….who thinks that they can lower it by even 50%?

I think they will do QT until it hurts the economy, then they will stop. Lets see how low they can go.

“The Fed stood by and watched housing costs rise 10-20% per year for a decade. For some unexplained reason, they thought it wouldn’t be a problem.”

This is why I have no confidence in them resolving the current problem. So they going to fix it now after letting it happen?

They’ve been intentionally driving up housing for a decade to: 1) get all homes back above water after 2008, 2) raise home prices as collateral for more USD creation via mortgages, to inflate away the national debt. They must to these things to “maintain order” (take on debt, pay it off, retire on asset value, generation after generation)

It’s not incompetence, it’s central management via monetary policy, hidden by deceitful marketing, and a solid poker face.

True, population growth is a deflationary wrinkle they haven’t figured out yet.. but they can fight demographic gravity for a few more years still until ponzi pyramid inverts.

In the meantime… The Fed says congrats to the levered winners! Better luck next time to the responsible losers.

But hey, the best things in life are free right?! Enjoy that sunset walk with your loved ones! But don’t walk too far, night shift for your second job starts soon.

PNWGUY got it right. Fed intended to bring RE asset prices above GFC levels. But they sort of overshot, probably for a variety of reasons.

I don’t think the Fed is asleep at the wheel. They know what they are doing.

Remember, if housing goes up 40%, it only takes a 30% drop to get back to where you started.

In some places with price jumps of 150% over the last few years, those new prices only need to fall 60% to get back to break even (a 60% drop is big, but after a 150% run it doesn’t seem quite so unrealistic).

This is a quality many people don’t realize (the higher market doesn’t have to drop as far as it rose to wipe out the gains).

Thanks for posting this math! I didn’t know that, although it makes sense! :)

I’m not sure what we have gained by artificially supporting housing for the past 2 years on a scale never witnessed before.

Wealth “illusion” effect

Home as an inflation hedge? So repairs, insurance, and taxes don’t inflate? That is news to me.

“The Fed has caused this ridiculous housing bubble with its interest rate repression, including the massive purchases of mortgage-backed securities and Treasury securities.”

It’s an absolute disgrace. And then to sit back and boldly announce that they are going to “let inflation run hot for a while” when it was never more evident that prices were soaring and had become completely unhinged from fundamentals – which is in complete violation of their mandate – is unforgivable. Yet they reappointed Jerome Powell. “Heckuva job, Brownie,” is what I’m reminded of. There is almost no accountability in government anymore.

I know one thing – I would hate to be a house seller now. Your buyer pool just evaporated.

“I know one thing – I would hate to be a house seller now.”

How about those people who bought a home during the pandemic to go work remotely in the country but kept their first home because of rising values? It might be time to start squirming a bit.

How about those buyers who will soon see their loans ‘underwater’?

They might be one in the same.

Depends how quickly they sell. If you can get to the exit door fast enough you might be able to make a good amount…

Is the Fed stupid, insane or plain evil?

I’d say, none of the above. But it should have never lowered rates this far, and it should have never ever done QE. And if it hadn’t done those things, we wouldn’t have those problems today — the spike in asset prices and the surge in consumer prices. Now there is no good way out. It’s too late for that.

What are the odds that the FED never does QE again? I’m starting to see articles questioning not only the FED but the entire financial response to the pandemic by .gov. It’s obvious that it did more harm than good, but to have the msm start putting these articles out there means maybe some blame game is forthcoming since “there is no good way out” and they are waking up to “something wicked this way comes.”

I agree that there are signs that it is dawning on some policy makers (and some folks in the MSM) that QE has terrible consequences, after having denied it for over a decade.

And it looks like the Fed will stay away from QE as long as there is substantial inflation, even if markets crash.

I think the period of relatively low inflation is over for a while. I think we’re looking at many years of substantial inflation, higher rates, and QT. And no QE.

I agree with all of this. It does seem like a major shift is coming. Will be very hard for the young people whose entire adult lives have coincided with QE. But I sure hope QE dies. It has been a horrendous failure.

That’s the psychological mindset changing which drives behavior which was previously believed to be “impossible:

Wolf, I agree that substantial inflation and higher rates will be with us for at least a couple/few years.

But how tempted will the Fed be (for whatever the reason) to touch the interest rate lever again at some point in the future? Don’t you think that if inflation moderates back down to 4.5 or 5% that the Fed would be tempted to lower rates again?

Futures markets seem to think so?

One thing we know about the future market: they’re always wrong about where they think rates are going to be a year or two from now. There are some beautifully funny charts out there on this with all these thin lines going out from every month, and compared to where rates actually went (Bloomberg does a chart like this, and others do too). They’re hilarious.

Thank you for staying vocal about it, Wolf.

I hope for priced out buyers and renters that the ever growing financialization of the private real estate sector will fail. Lately many have been paying big bucks for investment properties, directly or through REIT’s, and now there are apps like Addy in Canada (“game-changing, barrier-busting, super fun“), to attract retail into the final phase of the bubble. High inflation, deglobalization, war and the climate urgency may be doing the dirty job government and Feds cannot manage to do – their most important job. No crisis is “super fun”, but perhaps we will emerge out of it with more frugal habits, conscious consumption of goods and services with an emphasis on quality over quantity, and hopefully, a decently priced roof above one’s head.

Coccidioidomycosis,

I couldn’t resist…..was straight from very old memory and what us kids were told we would get if we didn’t quit digging forts and trenches and having endless WW1 style dirt clod wars in a big vacant lot off 99, when I lived in Bakersfield….any entrepreneur that monetized that pastime would have become rich. Was great (in hindsight) growing up pretty much unmonetized, unlike poor kids today……except for movies, cereal, candy, etc. Finally browbeat the old man into our first TV there, which he hated and called “the Mahogany Shrine”, when the must see Mickey Mouse Club came on TV and we walked home from friends after dark, (teen age drivers being the primary danger)

Anyway, I share your hopes regarding EVERYTHING you said, especially “climate urgency”.

Good Post!

I’d assess that as plain evil.

The Fed boxed itself in, and it’s clear they had no exit plan from the start. That’s leadership incompetence. Let’s not sugar coat it.

100% agreed.

Hubris. I mean look at their leader, someone who obtained his wealth and home from a better time. How could he and his ilk relate to what normal people are dealing with?

Jpow is worth well north of $50 MILLION DOLLARS. How can someone with net worth like that, have any idea how to set monetary policy for the 40% of Americans who “have zero savings at all” ???

Reverse Repo Program : down from last week to $1.803T.

Let me grab my popcorn and hope for this epic movie to start soon. Besides my popcorn, I have my bottle of crocodile tears next to me ready to deploy for all the FOMO buyers that rushed in at the top.

Too bad we can’t see mortgage application by region, as I always said, SoCal hasn’t gotten the memo yet. Would be interesting to see if mortgage application drop at all in more nice to do neighborhood in SoCal. RedFin and Zillow sold and cross over over asking price (with higher price) that I am seeing doesn’t seem to support that from an anecdote perspective

I am seeing lot of price drops in San Diego. Not sure what the future entails but high home prices in san diego has definitely made quality of life pretty bad for everyone.

Over a quarter of SDG&E customers are behind on their electric bills according to the Union Tribune. Meanwhile, I’m still seeing houses sell for 300k over in San Diego…

America’s finest housing bubble

A nice little 4,923 sq ft shack, assembled in 1926, on St Paul side of the river that I bike past quite often, 208 Mississippi River Blvd S, has been dropped from $2.2 m in March 2019 to $1.7 m now. Seems to be pulled and relisted a few times. Last record of it being sold was in November 2003 for $1.2 m.

Only a two car garage, so, won’t work for me. s/.

Good location though & .53 acres on the river ….

In La Jolla, if it were on the ocean, it would be a few bucks more I would guess.

I’d say the interest rate has some impact on this of course, but the bigger impact has been the inflation damage done to budgets.

When your budget gets a 25% or more hit, in a year, a lot of things get excluded in favor of basics. A 3% raise is long gone.

Moving to a new house, or renters buying a house is a huge undertaking in most budgets, and the first to get set aside when the squeeze is on.

If you doubt that costs of life are up at least 25% or more in the past 24 months, you aren’t living in the USA.

“If you doubt that costs of life are up at least 25% or more in the past 24 months, you aren’t living in the USA.”

Prices are up and corporate profits are at record highs.

There’s only two dots to connect here.

Prosecutions of corporations are at record lows.

I’d support an inflation of prosecutions of corporations…

How about prosecution of the actual counterfeiters ?

The Fed.

Why Fed Gov should bail out unfunded >$100K pensions of state gov retirees in profligate states like CA,NY,CT or IL ?

But Fed Gov can’t leave in the lurch their minor brethren either.

Uncle Jerome and Auntie Janet to the resque.

Article:

“CHICAGO PENSION DEBT DROVE CITY PROPERTY TAXES UP 164% BEFORE COVID-19”

Now effective property tax rate in IL is 2.47%.Meaning that 4 homeowners whose shacks appreciated to $1M will pay $100K pension of one Retired State Government Sacred Cow.

It looks good in theory but the effect of this skyrocketing RE BS on Chicago is absolutely devastating.

Soon Chicago’s ultra-rich will build a Wall alongside Lake Shore Drive and seal off the Gold Coast.

And the rest of the City will look not much different from South Side (aka Gangbangers Paradise) where houses are surprisingly affordable:

$6,800

3 bd 2 ba

13612 S Wallace Ave, Riverdale, IL 60827

What is funny – in the first American bestseller “The Jungle” (published in 1906) Lituanian immigrant Jurgis Rudkus purchased his first house in the very same place for $7,000.

So,in the past 115 years the price of similar house went down $200 even in NOMINAL dollars.Everything is copacetic 😀

The Illinois Tier 1 pensions are the golden ones. As those roll off, Tier 2 could alleviate the blood letting. But, it won’t. There’s always corruption to fund in Illinois and property taxes will never decrease.

I sold my house in Springfield one year ago at a loss. But, I’m out from under the taxes (and property taxes are just part of the Illinois tax hell)

Friends sold a condo on Michigan avenue at a huge loss. At least they won’t get murdered and/or carjacked. You can, theoretically, replace money. Death is permanent.

I suggest you leave Illinois. And, do it with urgency.

😀

In the Heat of a Summer Night

In the Land of the Dollar Bill

When the Town of Chicago died

And they talk about it still…

(The Night Chicago Died, Paperlace, 1974)

This tune was quite popular in the 70’s-80’s but somehow faded into obscurity.Well, Chicago survived Al Capone and Bugs Moran.Did fine under Mr Daley.But it will not survive Jerome Powell & Lori Lightfoot.

=I suggest you leave Illinois.=

Yeah, thats the easiest thing to do.But being not very bright yet very stubborn person I’m gonna put up the last fight, following Lori Lightfoot advice:

“As Chicago police say 57% of carjacking suspects are juveniles, Lightfoot says youth feel ‘unloved'”

Love conquers everything.The only thing is: I have no idea how to implement this wonderful plan.

Ya think it is easy to befriend a gangbanger-carjacker, hug him gently, give him a big sloppy kiss and explain to him the error of his ways ?

You have but one life, my friend…

Use it well…

Your responsibility is to yourself…

No other…

Alive in southern Mississippi beats dead in Chicago any day of the week…

Wish you well…

@COWG

A cat has nine lives. For three he plays, for three he strays, and for the last three he stays.

Judging by your previous comments you are that kind of cat too 😀

I will die in due time from natural causes and not after being shot from $120 Hi-Point.

In case of attempted carjacking involving the Precious Me – Chicago Sun Times will report “3 14 carjackers were shot and killed at 2 a.m. in Markham, IL.CPD investigation is ongoing … and ongoing … and ongoing … and ongoing”

Lori Lightfoot needs to get on the right foot. We need to go back to public stoning

All you need to know about Lori Lightfoot is that she has stated on record that she has I quote “the biggest dick in Chicago”

Halibut,

A large car-jacking operation in the Twin Cities has been shut down by the police departments recently, and life is less stressful, somewhat, as a result.

A lot of people in Minneapolis carry. I did for a while, but prefer not to.

Disadvantaged and unintelligent fifteen year old kids walking the streets with a 9 mm is not a good situation. There still is way too much of it out there, and in general, social media & no life experiences with the consequences to be paid is a dangerous combination. This is not confined to just low-income neighborhoods either.

Lightfoot’s personal security detail has more Police personnel than do most Chicago Neighborhoods.

“A lot of people in Minneapolis carry. I did for a while, but prefer not to.”

Better to be judged by 12 than carried by 6.

It’s better to live in a place where you feel safe without carrying and don’t have to worry about it.

Is crime way up in Springfield? I think Peoria had a record number of homicides last year. Champaign might’ve reached the same milestone.

Jackson Mississippi is the murder capital of the US. Jackson is the largest city in Mississippi.

Jackson reported 153 murders and had a murder rate of 99.5 per 100,000 people

might want to check out heyjackass.com for stats on Chicago shootings.

I was in Peoria and along I-74 last summer and it didn’t seem that bad.

But the area does feel very economically depressed with certain groups of people obviously not working and shuffling their feet around town. I suppose that is pretty much everywhere in the US now.

I have a retired teacher friend who retired a few years ago at 55 in a Chicago suburb. She has a $90k pension / year. I think in 10 to 12 years of retirement she will have accumulated more retirement pay than what she made in her prior 30 years. Her friends will just be getting ready to retire and she will have already been paid $1 million in retirement when you add in COLA.

I am thinking, since we do not get to collect SS until 67, why do government employees get to collect their pension early?

When I look at local city budgets, 20 years ago, retirement benefits were about 30% of the budget. Now it is over 40% of the budget and in some cases 45% of the budget. They are sneeky about it because they will say we have to raise taxes or we will have to let go the fireman or policemen. They do not tell you the reason why they have to let the fireman go is because they have to divert more of the general funds to the generous pension plans. Because as I see it, property taxes keep going up and the local government has more inflows, then why are they having problems with current salaries.

$90K ? Meh…

There was a website “Outrageous California Pensions” which listed all CA Gov retirees with >$100K pensions.The list was endless.Top guy – the former correctional system psychologist – was drawing $1.5M

Recently it was taken down.Not because there was something illegal but probably it violated the old “startling the livestock” law. “Livestock” nowadays means “property owners”

“ why do government employees get to collect their pension early?”

Because they run the state and local governments. They make the rules. They vote. It’s a total racket and most people are CLUELESS as to what is going on.

The Plunge Protection Team (PPT) abandoned their trading desks in early afternoon and headed to the bar around the corner, instead of buying stocks and propping up the markets, as they were supposed to do under strict instructions from Powell and Yellen, according to people close to the matter. This time, they didn’t all leave at once to avoid getting in trouble, as they had done yesterday, but they abandoned their trading desks and headed out in twos and threes, and by 3:30 pm, the last ones were gone, according to a source inside the building. At the bar, they skipped the beer and started drinking bourbon right away, with CNBC on the screen above the bar, where stocks were spiraling down and giving up their gains. And soon they were singing raucously and pounding the bar with their fists, “The whole shit show’s coming apart, let it go, let it go, let it go,” according to people familiar with the matter.

I know you are messing around. But seriously what is BTFD? I have read it some comments.

Buy The F**king Dip. One of the oldest and most used strategies for speculation. However, in a down-market, BTFD has a tendency to keelhaul traders.

The PPT (Pint Procurement Team) were seen buying the dip after they had finished all of the free peanuts at the bar. One young trader after indulging in one too many irish carbombs, promptly regurgitated his endowment of soggy beer-soaked cheese nachos onto the lap of a most dapper Fed Chair Powell.

Powell, who was not prepared for the turn of events fell off his bar stool and shattered his priceless Wolf Street beer mug. This constituting a ‘party foul’ led to ceaseless cajoling by his fellow conspirators much to his chagrin. He was forced to sit in the empty beer tub in ignominy with a dunce cap until inflation abated.

What about buy low and sell high? And the ol’ when the market crashes, wear brown pants.

I made the latter up 💩

for ZM:

You did NOT make the brown pants comment up:

From many sources allegedly on the ground, The KING of France made it up when a ”British” officer was brought before the king and asked why the British officers wore RED coats, and replied, “so IF we are wounded, the blood will NOT show to our troops.

French officers and troops were instructed by their KING to wear brown trousers/pants.

LMK if you have any questions about WHY the French King would order such a thing,,, but

those few remaining WW2 veterans will not need to ask, but will still honor all the ”Free French” fighters of that war appropriately.

Buy the F#*%^# dip

Love your snark.

Those lazy PPT good for nothing sack of S$$$…..after counting on them for last decade and more, they dare to get ready to walk of the job now?

I really hope they didn’t also join the great resignation and decide to be a full time Youtuber now…

1) The Fed cannot raise rates > 8.5% to 10% to subdue inflation, because US gov debt is to high, gravity with Germany will not allow it, and a prolong

period of buybacks, increased corp debt, higher than 80% of total

assets for many corp.

2) The Fed will keep rates moderately elevated,

until higher dx and a lower cpi, – still above normal – will hurt investors.

3) JP will not cut rates as he did in Xmas 2018, he will reduce the RRP warchest to provide liquidity, when necessary.

4) And pray.

“The Fed cannot raise rates > 8.5% to 10% to subdue inflation, because US gov debt is to high”

As noted….ONLY new debt meets the higher rates.

Michael, you sound like you’re long…and this cant be happening. It is ..and it must.

Historicus – I was listening to a podcast. They said the Government has 6 trillion of debt coming do this year. Plus add in the normal government deficit.

Who is going to buy this debt that needs to be rolled over?

In reading the following in the NY Times, it appears that the famous economist Kenneth Rogoff that our $30 trillion in debt is not a principal problem (whatever that means)

————————————–

And some economists argue that a more recent economic phenomenon — inflation — may have a silver lining in that it could chip away at the nation’s debt burden.

Kenneth Rogoff, a Harvard University economist, said that rising prices essentially watered down the value of outstanding debt and increased tax revenue as incomes rise. He suggested that markets appeared to be largely unfazed by the possibility of higher interest rates so far and that given the other risks to the economy amid the pandemic, the scale of the national debt was not as worrying as it sounded.

“You would rather have no debt, of course,” Mr. Rogoff said of the $30 trillion total. “But compared to other issues at the moment that’s not the principal problem.”

That was from Feb 1, 2022. It looks like the markets are a bit fazed. LOL

Intellectual idiot

Oh, dear.

Rogoff is certainly an intellectual but he is not an idiot. His work with Carmen Reinhart on the debt of nations put numbers around the idea of how far the can could be kicked down the road.

The limitations of this strategy form a central pillar of Wolf’s worldview.

Google : ‘This time is Different’

Michael Engel

Mkts couldn’t tolerat rate at 2.45% in late 2018!

Now even if they can raise to 2%, I will be surprised!

And with QT, double whammy!

SOFT LANDING any one?

I am with you. Market has priced in the expected rates. Mortgages might break the housing market if they stay at 5.25% for a while. Not much need to go higher I don’t think. So much debt that a little increase will get the bubble popped.

I make the joke that when a new franchise makes it’s way to our small town of about 30,000 it’s time to sell the stock. We are now in the middle of a real estate development boom as two developers are racing to get two 50 acre housing projects built within a mile of each other close to me. One is supposed to be a four year build out. Seems like timing couldn’t be worse.

MBS and short term bonds have priced most of it in.

I think long bonds are just now starting to get the memo…

4 months ago, a house in my subdivision was about to be listed at $420k. It sold before it went on the market. Buyers didn’t even walk through the house or do an inspection. According to the sellers, the buyers peeked through the windows and made an offer for $475k to discourage them from listing and waived all contingences.

Last week a similar home went up at $495k. Open house was a circus, have seen several realtors show the house. ZERO offers and it’s been listed a full week.

What a difference a few months make. The rate jump stopped the circus.

My brother in law said it’s slowed significantly overnight.

What area?

1) The German 3M is (-) 0.72%.

2) Russia cut energy to Poland. Poland will buy from other countries, at higher prices, because have been ready. Inflation in Poland will definitely rise.

3) There is a refinery on the Polish / German border. This refinery

provide oil to Berlin. Poland will induce inflation Germany and Europe.

4) The German yield curve is hooked to (-)0.72% at the front end. The long duration will rise, until recession will cut demand.

“the housing bubble, which is leveraged to the hilt”

Wolf, this isn’t accurate and it’s worth reassuring folks that the housing market isn’t collapsing anytime soon. Everyone wants to think this is financial crisis 2.0 and to argue the housing market is overleveraged is completely false. Homeowners have more equity now than at any other point in history. Even if you bought your home 12 months ago you’ve already seen it appreciate at least 20%.

I don’t think housing is leveraged but with inflation and mortgage rate increases ( increased almost 100% in last 1.5 year or so ), the affordability of people to buy home has gone down. A lot of people have bough second/vacation home and if the yields in safe assets e.g. cds/bonds etc increases quite a lot, a lot of people would bail out. Then the psychology shifts causing more and more people to bail out.

Homeowners who have bought to live won’t sell but investors would for sure.

That concept didn’t play out from 2007 to 2009.

Uh, based on ‘current’ value?

Nonsensical argument

The reason homeowners aren’t currently overleveraged is because of the housing bubble. That’s the source for most of the equity.

So basically, you’re arguing that there isn’t a housing bubble because of the housing bubble.

just THANKS once again AF for your inputs on here, mostly supporting the very full of wonder of THE Wolf.

that he is at least trying to bring us THE best ”explanations” of what the so called Federal ”RESERVE” banksters/criminals ( thanks DC ) has done LATELY makes me want to protect him,,,

WE the PEONs can only hope that Wolf and others in his ”ILK” will prevail.

And, to be sure,, while I have never been on ”face hook” or any others of THAT ”ILK” it may not bee too late for me to ”join”,,,though not not likely that one

Rock Financial (Quicken Loans) just announced a buying out of positions in the mortgage division. 2000 people. This is in Detroit and they will also look forward to the auto meltdown in the cards.

Thanks for sharing this info. I’ve been expecting quicken to get into trouble.

I work at a financial institution and it was announced that tons of mortgage people would be laid off as well

I do closings for a living – for some time cash sales have dominated – at least three to one over lender deals.

No sign that cash sales are slowing at all – both land and housing are still in high demand – took in several new deals this week – some well over asking.

It appears the party will go on for bit longer.

David…

as long as loose money is looking for some type of return, a fair return denied by the Federal Reserve policies for 12 years….

The real estate buyer’s metric is simply….”Inflation is OVER any other return…replacement costs of these homes are skyrocketing…thus, the fruit on the low branches are harvested.”

Until this changes…more of same. I agree with you.

So you’re claming that >75% of home buyers are all cash? What market and price range, because the stats don’t back that?

Your statement about 3 to 1 cash vs loans is completely inconsistent with data that is published on this issue, which indicates that cash purchases are more like 1 in 4, or thereabouts. I suppose you could be an anomaly, but I suggest the readers here look at published data.

Seems like so much investment is recency biased. Novices are buying I think because of recent rapid appreciation which usually happens at the top.

People looking for homes will be priced out….

Corporations looking for any type of return will KEEP BUYING like it’s their job…..and it is.

Pyramiders will do the same…until they are hurt. Imagine all the “mom and pop” …”we own ten properties and are renting them out”…..are out there? And they did the right thing…but they must realize real estate is the most illiquid of markets…and you have to get out before the top is in.

Until people and corporations can make similar money in fair returns on fixed income, without the management hassles, RE taxes, etc…real estate continues in this bizzarro world. Thanks be to Fed.