Builders have abandoned the market below $300,000.

By Wolf Richter for WOLF STREET.

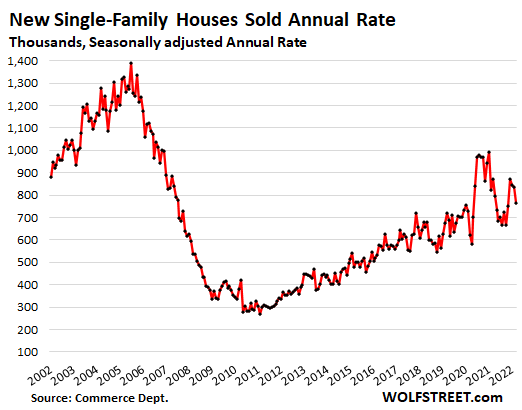

Sales of new single-family houses in March, in terms of the seasonally adjusted annual rate, fell 8.6% for the month and by 12.6% year-over-year to a rate of 772,000 houses, according to data from the Census Bureau today. Sales remain far below the boom years of 2002-2006.

Sales of new houses can serve as an early indicator of the housing market as the data are registered when sales contracts are signed, not when deals actually close, unlike sales of existing homes.

Sales by stage of construction: Houses were construction had not started yet accounted for 33% of the sales. Houses that were under construction accounted for 43%. And completed houses accounted for 23% of the sales.

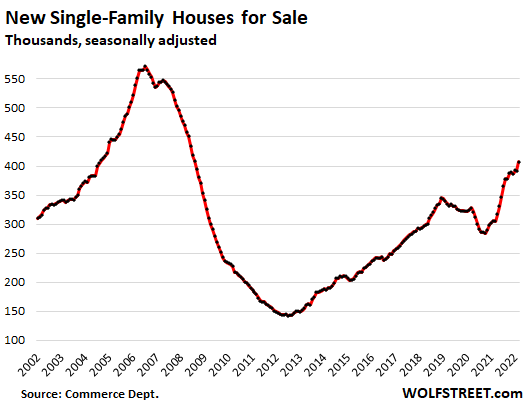

The inventory of new single-family houses for sale rose to 407,000 houses in March (seasonally adjusted), the largest unsold inventory since August 2008, up by 52% from a year ago. This amounts to 6.4 months of supply at the current rate of sales.

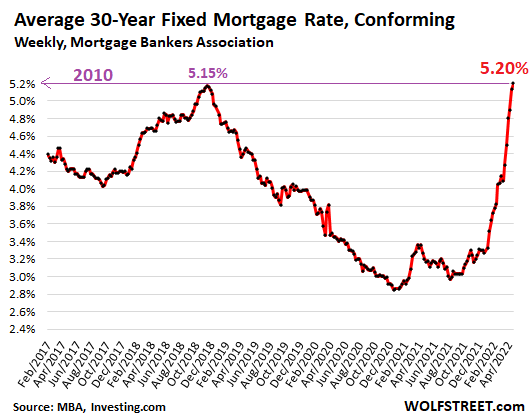

Homebuyers faced a historic spike in mortgage rates, on top of the historic spike in prices, a toxic mix that made purchases increasingly difficult or impossible for many buyers, and took them out of the market.

The average 30-year fixed mortgage rate jumped from 4.1% at the beginning of March to 4.8% at the end of the month, up by 1.5 percentage points a year earlier, according to the Mortgage Bankers Association. Since then, mortgage rates have pierced the 5% level:

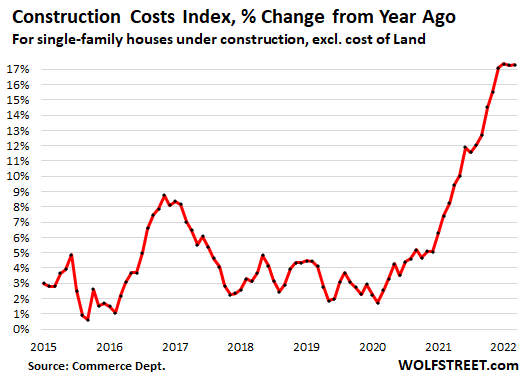

Homebuilders faced a historic spike in costs, amid shortages of materials, supplies, and labor that have been hobbling construction projects and stalled deliveries of completed houses.

Construction costs of single-family houses – excluding the cost of land and other non-construction costs – spiked by 1.5% in March and by 17.3% year-over-year, according to separate data from the Census Bureau today. This was the fourth month in a row of 17% cost spikes year-over-year, the worst in the data going back to 1964. The prior record was the 14.6% spike in July 1979. And it was the 11th month in a row of double-digit spikes:

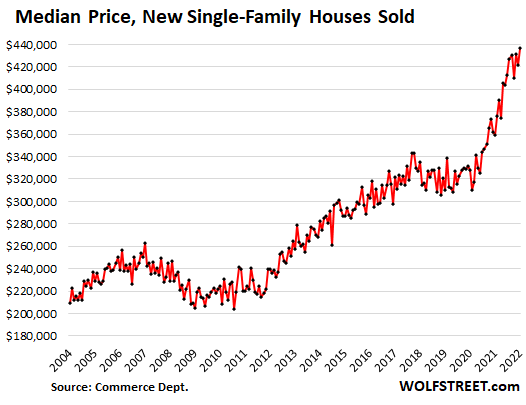

The median price of single-family houses sold is heavily skewed by the change in mix: The bottom has fallen out of the low end where now very few houses are sold. In March, only 15% of the houses sold for below $300,000. In March 2021, still 35% of the houses sold for below $300,000.

Now the bulge brackets are in the range between $300,000 and $500,000, accounting for nearly half the house sales in March.

The upward shift in price is a result of price increases and the shift by builders to go where the money is. And this caused the median price in March to jump by 21% year-over-year to $436,700. The median price means that half the homes sold were priced at over $436,700.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks Wolf. Your data blows out of the water the argument that home prices will continue to rise up because “there is a shortage.” The housing crash 2.0 is slowly building.

“Nothing goes to Heck in a Straight Line.”

I should take a copy of your article to Lawrence Yun and hit him over the head with my Wolf Street Beer Mug.

With 400K for sale and <800K annual sales rate, the "months of supply" is sort of around 6 months now, isn't it? A spike in months of supply is a harbinger of a shift from sellers' to buyers' market…

6.4 months as per data.

If you look back to 2005 you will see a pattern similar to that of today. Houses were moving pretty good in early 2005 and then they weren’t. The key indicator was the “months of supply”. Look at the graphs from back then. You could overlay the current trend lines over them and they would fit perfectly. I was there and saw the whole thing unfold. When this key indicator unravels as it is doing right now, it is GAME OVER.

I am guessing transactions will go down due to higher mortgage rates – pushing months of supply higher very soon…

Interesting observation SC. Thanks for sharing. It really does seem like things are changing.

Wolf,The inventory of new single-family houses for sale rose to 407,000 houses in March.

Sales of new single-family houses is 772,000 houses in March.

This amounts to 6.4 months of supply at the current rate of sales.

Why is 6.4 months? How is it calculated?

That sales figure of 772,000 houses is a seasonally adjusted annual rate (SAAR), to show that the whole year’s worth of sales would be like at the March sales rate. In other words, if you have 12 months like March, seasonally adjusted, you get 772,000 house sales for the 12-month period.

You cannot use SAAR numbers to calculate supply. You have to use actual monthly sales (72,000 in March) v. actual inventory at the end of the month. But this gets complicated due to seasonal adjustments. So rather than calculating the figure myself and get close, I use the supply figure as reported by the Census Bureau (6.4 months).

Yes, months of supply a good way to look at it. Bond yields are going down a little bit but that will provide no relief. Once QT starts and the Fed sells MBS I believe mortgage rates will continue to go up to 6% this year.

The herd started running toward the cliff last year since everybody wanted to lock in low mortgage rates. With 5% rates the herd has smelled the danger and slowed down, but too late for the ones running in front.

Next week will be interesting.

Currently the Fed has stopped adding to their MBS portfolio, but they are still rolling over, that is buying new MBS to replace maturing ones to keep their holdings at the current size.

Next week they’ll announce changes to that policy.

As I understand it, 3 options are on the table:

Sit on their current portfolio and wind it down “slowly” by purchasing fewer new MBS than are maturing. This still applies some purchasing pressure to the MBS market, but less than previously.

Sit on their current portfolio and wind it down “naturally”, buying no further MBS. This removes purchasing pressure from the MBS market. This takes the least effort, they just “do nothing” and see where the market goes on its own.

Actively sell from the current porfolio to wind it down “faster”. This applies selling pressure to the MBS market.

On either the first or third options, the next question is “how much, how fast”?

Wisdom Seeker,

Perhaps the Fed could step back & get the fuc# out of the MBS market. It could, repeat could, stop its controlling actions, and let free-market supply & demand take over.

Only kidding. Of course, that will not happen.

The Federal Reserve System was given immortality by Congress on 25 February 1927. It has complete, and free rein to choose how it wants to manipulate the markets, and in what manner it desires to break the Rules of Money in this land that I was born into.

As Wolf’s readers are quite aware, the Rules dictate that money should cost a hell of a lot more than it does right now.

“And there’s winners and there’s losers

But they ain’t no big deal

Ain’t that America

Home of the free, yeah

Little pink houses

For you and me”

But even that is no longer true. As, “Builders have abandoned the market below $300,000.”

My Craftsman bungalow was bought from Sears as a kit in 1919 for $600. Folks, in the day, used to know how to swing a hammer and cut with a saw. Finished & registered with Hennepin County in 1921. Hope to stay here ’till the last breath leaves my body.

“Once QT starts and the Fed sells MBS…”

I prefer to say, “if it starts”. The Fed is the Ponzi of first resort, and that can not be overemphasized.

Dan Romig,

I surfed around a little and those circa 1919 Craftsman bungalows look pretty nice!

I have a stick-built 1901 two-bedroom home in southeast Colorado that is still solid. The fireplace is gone or inside a wall, but the chimney still spirals up to the roof in the attic – bricklayer craft. I was told they did that if the desired chimney outlet was not directly aligned with the location of the fireplace.

A kitchen was added, maybe because the kitchen was originally outside. I replaced the wall insulation in the older part of the house (some type of rocky stuff). Also, I had to remove a small old dilapidated garage, which may have originally been for a carriage.

I liked the house and may have settled there for good. But I didn’t fit into the local culture.

And oh boy how it’s going to become a seller’s market. I kow you didn’t ask, but to be clear, there’s NEVER been a shortage of lumber since the pandemic started. There’s been shortages of things like cabinets and appliances due to labor and supply issues, but not lumber. That lumber at Home Depot has been stacked ceiling high for most of the last 2 years.

The entire lumber futures market is FIXED and worthy of a DoJ investigation. Congress will threaten an investigation into gasoline price fixing but not lumber. In either case, nothing happened anyway except lumber prices helping to push home prices s to astronomical / unsustainable levels.

Now, back to that seller’s market. There was a moment in time about a year ago, when the FED could have moved to start raising interest rates and to start QT. But they didn’t, why? Because of all the masking & shot mandates paralyzed the country into no doing what was needed, move quickly to intercept $11T worth of building inflation.

Now, the FED, Congress, America & the housing industry are on a collision course for a wipe out that could take 9 to 12 months to play out. Again, $11T worth of inflation doesn’t end well and could be a very hard landing indeed.

Yes, indeed. $40T printed/digitized globally in the past dozen (12) years has set the stage for what we’re witnessing today. We are running 15-20% inflation conservatively. This is the most egregious global monetary and fiscal policy in mankind.

Global assets are worth more than $550 trillion and the global money supply is tiny in comparison with the ‘value’ of assets.

Maybe there hasn’t been a visible lumber shortage in retail spots (this would be anecdotal evidence btw.) but buyers of raw lumber have been willing to pay up for the goods. My dad had a timber harvest on his property last Sept. and when all was said and done, he got over 2x what he was quoted earlier that spring. Nice payoff for him.

A family member just bought a 1m+ home in the East Bay with a 5% note and they consider themselves incredibly lucky and fortunate. That house probably would have sold for 800k 2 years ago. There is still a LOT of buying pressure here.

Goldman is not a big bank

about lumber prices…… I am rehabbing a house trailer, removing the aluminum cladding and sheeting the walls. Went for Zip system coated OSB, one half inch…..WOW 86 bucks a sheet plus tax. I am still in shock.

So as a first time home buyer, which I am and have stepped back from the Home market for now, what do you think the best plan of action is? I know it’s easy to say I should wait but if I do will there be an actual benefit

Wait and see if the Chinese driven markets go bust in Canada, Australia and New Zealand first. If they do and the Chinese areas fall hardest then wait.

I’m trying to answer this same question.

I

MO

-Timing the overlapping rise in interest rates with the cooling off of prices is next to impossible and may not even happen. IE: rates are already “high” and there’s really no telling how high they will go.

-Prices may come down. I still don’t think we’re looking at a crash, but it’s likely that there will be some kind of correction. The depths of the correction are going to depend heavily on the market.

-No one can honestly tell you whether you should wait or not, but the tipping points for me have shifted to waiting. It’s risk on either side but I would rather have the risk of getting priced out over the risk of losing 5-25% on a asset right after purchasing.

This is the first time I’ve seen current rates described as being high. Maybe I’m missing something….

Socaljohn, my lowest mortgage rate ever was 8% then refinanced to 6 1/2%. However, before that I had a 10% and an 18% in 1981.

I’m old and scarred though and I do feel for the young folks trying to deal with this mess they are in.

Anthony, I am also old and scarred, and I worry that this mess is going to hurt all of us. I think this might be worse than the last mess in 08. Hopefully it won’t be.

@SocalJohn

It will be, because the problems from 2008 and prior were never corrected. They didn’t just blow a bubble in stocks and houses this time, they blew a bubble in everything. Not to mention the US of A still had some credibility in 08. 08 did a lot to damage that, and every action we’ve taken since has only depleted that trust a bit more. What is credit? Trust! How much do you trust anything these days?

One commenter on Wolf Street once sagely stated that the answer to your question is whether you view your current residence as a house or a home — a house simply being something to be bought and sold.

No one else can answer it for you.

Only buy if you can afford to keep it under adverse economic conditions and do not mind losing most or all of your equity if prices crash.

With rents spiking, there is no good choice. It’s worse than 2006. At least rents were a lot more reasonable then.

Disclosure: I’m a renter myself but do not have the option of buying now due to non-financial factors.

I believe another axiom that has now become gold, and will be even more important. Find the cheapest residence you can stand to live in, because it will likely be very small, in the most expensive area you can afford to buy in.

The new social paradigm demands it. Marginal neighborhoods where there is more bang for the buck are no longer safe.

My advice = live in the desert in a trailer like a hermit until this crap blows up (soon), and then swoop in to buy something that was massively overpriced for 50%+ off. No joke. That’s what my wife and I and our Boston Terrier are doing and living very comfortably. We have our truck and a car & can go where ever we want. anytime we want. A house is way overrated.

We sold our house in the East Bay, CA in Sept. 2021. We cashed out $350k in equity and we’re now living in a new 2021 34′ travel trailer 125 miles south of Reno, in a nice, safe, clean, secure RV Park for $400/mo incl. all utilities. It’s quiet & everyone keeps to themselves. Perfect.

The discouraging thing is we have a building permit to build our dream retirement home, & we have enough money (even at current prices) to build it. The problem is I can’t find labor to frame it. So we’re resigned to the fact we’re just going to have to wait. But wait we will until this $hit blows up. And blow up it will. It’s 09 all over again only exponentially worse this time.

You just have to be patient, sit on your money & wait.

True story – our house in late 2007 was appraised at $735k. When the GFC hit in 2008, in less than 12 months time it was worth $260K. I lost my job & we had to foreclose on the house. We rented for 3 years to repair our credit & after I had found stable employment again we we’re able to purchase (in 2013) another house – a 3 bdr/2ba 1856 sf house with a 3 car garage for $345k. We just sold it for $690k 8 years later. So things worked out in the end, but it was a tumultuous 11 years.

Take it from from someone whose been there, done that. You want to be in the position of “opportunist”. I wish someone would have imparted that advice to me prior to 08, but no one knew the evil lurking.

Never buy into a bubble. Better to have no deal, then a bad deal. History and fundamentals tell us this is in fact a bubble, and all bubbles pop. Get some popcorn and watch the show, then pounce when the bottom falls out

Inflation is the difference. Look at median home values in 1970 vs 1980. No one “gets” inflation and its effects. Three years from now, people will finally get it, but it will be way too late for most.

Depends on where you are at. Do believe real estate will pull back but in midatlantic no more than 10% from peak but prices didn’t double either. in Miami, Phoenix and Denver expect weakening at least 20% from now. California too hard to predict as Prop 13 keeps people from moving as well as the prospect of capital gains taxes. The bigger issue for California will be if foreign money (china) disappears, if it does look out below. Would wait if you can.

don’t JA; that would be a waste of a good mug and get no or no good response from it IMO at this point in time.

It’s like when Wile E Coyote runs off the cliff and is still for a moment before gravity starts to set in.

The wealthier buyers tend to have access to larger pools of mortgage companies that will approve them and tend to be more knowledgeable about lock-ins.

This data is the last puff of sub-4% mortgage buyers desperate to buy something before they’re over 5%. That might knock the price up a bit but it’s a temporary effect; while there is nothing temporary about the growing inventory level + higher costs of building.

Might level off for a bit but parabolas don’t resolve in flat lines.

Many if not most ‘wealthier buyers’ simply pay cash.

If you want to see what wealthy people are doing look at the second home markets like Tahoe, Park City, and Sun Valley ID. They are getting rid of their properties at a rapid clip and a metro with a population of 15k (Sun Valley/Hailey) has more homes for sale than Boise, ID, population 225,000. Rick folks are taking profit right in front of our eyes.

Those are typically secondary vacation house in those areas.

Second home lakefront properties here in Northern Michigan (Traverse City, Petoskey, etc) are still in strong demand. No sign of a slowdown here yet.

Buy low and sell high.

Maybe they are smart enough to realize that owning property in a semi-arid climate, which takes lots of fuel ( gas, jet fuel) to get to, in a place where the local economy is based on snowfall in an era of higher temps and diminishing moisture is an investment that is running out of road. Kind of like selling your hot dog stand at the Roman Coliseum in AD 380, or your Disco in 1981.

As very clearly stated in this article, this information applies only to the sale of NEW HOMES, but there are very few to no ‘new homes’ here in nice areas of California where EXISTING HOMES sale prices are reach new highs every day. Earlier this month a neighbor put their house up for a very modest price of $2,150,000 and it received multiple bids in the first few days and closed at $2,650,000. The only real issue with that house is that it wasn’t a very nice house and will take a lot of work to fix.

Great for the new owners! Looking forward to a big decline in the next 12 months. We’ve moved past the FOMO stage into the looming crash, CASH or no cash.

“ Earlier this month a neighbor put their house up for a very modest price of $2,150,000 and it received multiple bids in the first few days and closed at $2,650,000”

Jeez…

I think my brain quit working circa1985…

I absolutely cannot fathom those kind of numbers….

And yet they are thrown around like it’s pocket money… and crying because they got outbid…

What the hell’s in the (lack of) water out there…

Cali is special. So special that there is no need for common sense. And no need to even think. Just follow, and share the kool aid.

California reality is becoming Oregon reality, and Texas reality. Nevada reality and Arizona reality maybe too.

I guess every area is different. I am seeing the exact opposite of what you stated. Not sure if I buy “EXISTING HOMES sale prices are reach new highs every day.” (The “every day” part of it.)

if the low end of new single family homes is vacated by builders what does market for existing homes or multi-family homes look like? Where are the incomes to support these prices? seems like it’s saying people at average incomes are going to have to find something other than new construction to buy.

Trailers?

Cardboard boxes under an overpass. In the future anyone living in a cardboard box will be seen as rich.

When I worked in Trinidad, the poor lived in cardboard shacks and the middle class had tin sheeting on their shacks replacing the cardboard.

Water supply usually consisted of a black painted 55-gallon drum on the roof. The kids wore uniforms for school. If you were fortunate to own a car, it usually had over 400,000 miles on it.

Double wide trailers start at $200k here, not including the land/plot rental. Orders are 1-2 years out. Pretty much the last or only resort for the lower/lower-middle class that can’t do a condo because of pets, the stairs, #bedrooms, etc.

I’m curious how all these big ‘luxury’ homes they are building, almost exclusively, are gonna fare in the long run if the market super crashes. 3000+ sq ft at rock bottom prices?

Around here (The Woodlands, TX) in 2010, those 3,000 sq. ft. houses were selling for way less than $100/sq. ft. We bought a nice 2,000 sq. ft. 3 year old brick ranch for $64/sq.ft. back then. Now the same house is selling for almost $200/sq.ft.

Something tells me people who’ve lived in a trailer for the past 10 years would be aghast at the cost of a new double wide.

I imagine all of the negative naysayers on here have an interest in the housing markets dropping out. Sorry to bust your bubble but a small correction is all you’re goingbto see. Shortages and overpriced new construction due to cost of goods are driving people to the existing home markets. They traditional metrics being used do not apply to the current market as will be proven out. Things will cool over the next year but prices while leveling off will hold and not drop excessively.

Median household income is slightly below $70K. Median house price sold recently I believe is $375K. At roughly 5% mortgage rates with a 5% down payment, that’s somewhat above $2K per month with taxes and insurance depending upon location.

I don’t consider these numbers affordable but its “manageable” by today’s standards, for now.

Each time rates and prices go up, you’re losing layers of potential buyers. And pretty soon, you run out of potential buyers and you cannot sell at the price you want. This is where volume declines become early indicators.

This is already happening pockets around the country. When mortgage rates hit 6% by early June, upwards of 70% of potential buyers will be sidelined. Peak insanity was in February & March of this year. Once the reported for April, May & June are in, it will be obvious that housing is in decline except for areas like AZ, NV, parts of CA and parts of Florida. Assuming the Fed is able to remain on target with QT, 90% of US real estate will be declining by Labor Day. It will start slow, 5% then build to at least a 10-15% decline over the next 18 months, unless the Fed pulls out its “PUT” bag of tricks (aka Modern Monetary Theory).

Then you do what Ford did, you stop making cars for the people cannot afford them and only make cars and trucks for the people who can.

Using your numbers, and 1.5% for properry taxes, I get $2,500. Say the number varies by $200 up or down, and that’s $2,300 to $2,700. Assume takehome pay of 80% taking into account taxes and 401k and net pay is $4,960 per month. That means this “median” imaginary person is spending 46-54% of their net income on mortgage alone. You still have to pay utilities, buy food, car expenses, etc. You still haven’t paid for “entertainment.”

If this imaginary person/household has no kids then it could be managed. But if there is one child, then additional expenses come into play and the math doesn’t work. Back in 2008 AFTER the crashing started, I bought a short sale and my max approval was 4X my income. I bought a home in December and my max approval was 6X my income. Ratios don’t line up.

@Kevin – In my city or 134k, new single family homes have to have 3 car garages. It was mandated and it also means all new homes are $500k and up. Even what would be a typical 3 bedroom starter home has to have a 3 car garage. This may change if housing slows down.

The median family income is maybe around $75k. At 5.2% mortgage and a 10% (30k) down payment they can probably afford a $250k to $320k home. With a 20% (60k) they can afford a $300k to $380k home.

Nobody is building new in this range. Maybe condos and Townhomes will be the only option for new. I am not sure where many builders can even build and be profitable in this range. In my area an empty lot starts at 90k. Can someone build a 3 bedroom house for $150k? Probably not.

So 1st time buyers need to find existing homes for sale. Remember, I am giving you the median income. So that means 50% of families (65 million) can really only afford a home below $350k. Good luck in trying to find one in a good school district.

So what does the government do? They are now giving 15k to 25k to new home buyers. You get the largest amount if you parents never owned a home. Instead of finding the solution to lower home prices, the government will give out money which ends up supporting the current house prices. There are a lot of programs for free money for low income. Low income is higher than most people think. The Government considers a family of 4 income of Long Beach, CA to be below $95k. In San Francisco low income for a family of 4 is $149k. Chicago is $83k. Omaha, NE is $63k

Here a few programs.

1) The Downpayment Toward Equity Act, also known as the $25,000 First-Time Home Buyer Downpayment Grant, will help give first-time home buyers up to $25,000 in cash towards the purchase of their new house. This can be used for closing costs, down payment, mortgage interest rate reductions, and other home purchase expenses.

The current criteria is as follows, and may change by the time this becomes a law:

Must be a first-time home buyer

2) The First Generation Down Payment Assistance is part of the Housing is Infrastructure Act of 2021. This bill is very similar to the Downpayment Toward Equity Act where it offers up to a $25,000 grant to use towards home buying expenses.

The main difference here is that you are considered a first-generation home buyer if your parents or legal guardians don’t currently own a home, which will help more people qualify for the grant.

3)The Build Back Better Act is a wide-reaching program from the Biden Administration. It aims to improve everything from education to climate change.

Similar to the Housing is Infrastructure Act of 2021, this program would offer first-time, first-generation home buyers up to a $25,000 grant to be used towards closing costs, down payment, and mortgage interest rate reductions.

4) The LIFT Act, also known as the LIFT Homebuyers Act, helps low- and middle-income people buy homes with low mortgage rates and differs from the programs above. This program allows buyers after they’ve purchased a home and can combine with many other programs.

Using low mortgage rates, The LIFT Act helps homebuyers pay off a standard 30-year mortgage in just twenty years.

5) The First-Time Homebuyer Act of 2021, also known as the $15000 First-Time Home Buyer Tax Credit, would grant first-time home buyers up to a $15,000 refundable tax credit from the federal government.

All of this is utterly disgusting. And completely stupid. Our government is killing us.

You got that right. I think Bevis and Butthead could manage the country better than Republicans and Democrats.

True, this is disgusting, but go lookup these bills. None of the, fortunately, have passed yet. Ru82 sounds like a cheerleader and probably is a real estate agent.

Money for nothing chicks for free.

The real-estate bubble is a wealth-inequality issue, and we’ve got a serious problem there (unless your end goal is a permanent under-class of renters and debt-slaves).

The housing market and its prices are a result of supply and demand.

There is going to be a permanent underclass of renters and debt slaves, guaranteed.

The end of the bond market mania means the days of artificially cheap borrowing are numbered. Same applies to the lowest credit standards in history, the ones we have now and for the last few decades.

Porous borders guarantee perpetually increasing population of low income and low wage earning consumers who will further depress wages for the working and lower economic classes.

The wealth inequality issue will be substantially solved by the upcoming historical bear market and greater economic depression. Most or all of the fake wealth from the mania (roughly last 25 years) will disappear with it.

The asset crash will make housing (somewhat) more affordable, but a weaker economy, higher mortgage rates, and (noticeably) tighter credit conditions should negate most or all of any price decrease.

Yes, but a year premature. The stock market hasn’t hit its high yet. The next wave in the bull market will start in the second half of the this year.

HaHa! Now that’s funny. So, by August, the Fed funds rate will be at or approaching 2% or more. The 10Y treasury will long since breached 3.25% and inflation will still be raging at 7% or more. The Fed QT will be full bore at $95B a month runoff. In 2018 – Sept 2019, the Fed only rolled off $600B before the repo market absolutely freaked out and over-night interest rates shot up from under 2% to over 10%. Again, this happened over night. By August, 30FRM could be at 7% given the current trajectory. The stock market has a long way to go down, and this will take time to happen. There may be a few rallies along the way, but the 12 month trajectory is DOWN, DOWN, DOWN, or at least until the FED PUT happens.

John Calvin is back and holding forth !!!!!

AF:

Re: ”There is going to be a permanent underclass of renters and debt slaves, guaranteed. ”

Please tell us when there has NOT been such classes.

Thanks

Yessirree VVN,

And a good way to glimpse the reality of that underclass / debt slave history in the U.S. is watch the free online documentary “Plutocracy” (Metanoia Films).

For so many in the U.S., historically, the old folk song is true:

You load sixteen tons, what do you get?

Another day older and deeper in debt.

Saint Peter don’t you call me ’cause I can’t go

I owe my soul to the company store.

Construction Costs VS Inflation may be a ongoing issue until extremes

are reached then inflation will take over in the short run

Existing Homes will follow the money trail Up and Down .

Short Term Interest Rates going up may have a hard time interacting .

With Savings Rates like CD’s as Banks and Credit unions try to Keep the money in house not caring about the Public.

Corruption within Various Government agencies like the Fed shall continue control

How Can Making A Market Fly with all this continued corruption ?

Timber….. Look out below.

It’s interesting how the u.s differs from the UK . Here in the uk very little is for sale and what is for sale is so ridiculously priced that it just sits there and is reduced month after month. Everyone that relies on the churn of property to make money must be taking a hammering but the question is, what is going to break first and get the market moving again ?

Longer term, probably the end of financialization which is going to probably hit the UK economy harder than any other major economy on the planet.

There is a definitely a real estate bubble in the UK and it’s noticeably worse than the US. incomes are lower yet prices are higher.

I don’t consider UK stocks to be in a mania but the market is still noticeably overpriced from artificial prosperity from the bond mania which exists there too.

Don’t know how much fake growth results from government deficit spending.

I expect the UK financial sector and real estate to get absolutely hammered when the mania ends.

As always, apparently SoCal (LA/OC/SD) didn’t get the memo or the usual disclaimer “Your result may vary” peak of Spring season is around the corner, guess we will see how this will play out or this is just a slow mo reaction for SoCal

Southern California is the most desirable housing market in the US and demand is the strongest it has ever been as are the prices for existing homes of all types throughout the area.

” historic spike in mortgage rates”… sort of a joke that mortgage rates over 5% is a shocker… when I bought my home in 1999, I thought I was getting a steal at 6.875% given that rates had been above 10% in the early 90s!

It’s not the level (5.2%), but the “spike” from 3.2% to 5.2% — two full percentage points — in just four months. In other words, over a four-month period, interest expense on a house purchase jumped by 62%.

Also, home prices are a lot higher this time, so the two percentage points make a big difference.

Sure, mortgage rates were 12% at some point but I remember being able to buy a great house for 100k.

I really resent it some times that people only think about nominal value. “Oh, my home has gone up from 100k to 1 million since I bought it 40 years ago.” Well, 1 million now is almost like 100k 40 years ago. I remember being able to buy a Camaro V6 for $2,800 and then being able to upgrade to V6 plus more options for another $400. What does $400 upgrade means now, an extra cup holder?

LOL Good points. The thing is if you rented, you did not get that appreciation? I have read different studies but sometimes renting over 30 years is better if you had put the delta into the stock market but it depends where you lived. Example LA or Cleveland.

Sometimes you get lucky too. I know a family that moved 3 times the past year because of job changes. Each time they tended to move to a hot housing market city. They lived about 3 years at each place. They are at their 4 city but are renting.

I think they have gained about $900k in all those moves just from the house appreciation.

It’s not the level (5.2%), but the “spike” from 3.2% to 5.2% — two full percentage points — in just four months. In other words, over a four-month period, interest expense on a house purchase jumped by 62%.

*****

Outstanding point :

Just think what will happen if in the next 4 months

it go’s 2 more percentage points to 7.2 The Housing Bubble may blow all to hell.

Personally I don’t really care due to already owning my home excepting , should it drop to next to nothing or close to that .

NOT IN THAT SITUATION ? THEN YOUR SET TO BURN

What I do care about rather is to see a stable Market and Economy.

What comes along with that is a 4 to 6 % interest rates .

A rational mindset overall toward the Markets and that’s whats going to save and shore up the Dollar

Whats it going to take to get the USA Market back on track ?

To Jerk and Pull Rates ?/ Stimulus was a Con ! is not going to work but rather Stability with a continued Mindset toward the Dollar and a Steady Market.

Printing Money was not a Good Idea it was a Vast Con on America

As the current and past administration has not stopped but rather enhanced and deepened the economy in exactly the wrong direction enhancing Inflation and weekend the Dollar.

Now the economy has become tied to the War and on the increase every day !

Are we to expect a War Chart with all the Variables evolved ?

What next >a NATO Non NATO housing Bubble Chart ?

Can your home be tied directly to the War Now ?

Historically, mortgages rates have been 6.5% or above, and that’s where they should be now. The depth and breadth of corruption at the Fed is inored, as people enjoy their “free money” at near 2% mortgage rates. Everyone is just looking the other way because they personally benefitted, only to find the consequence is raging inflation that won’t be “tamped down” for years, at best.

I love how you boomers are saying I remembered back in the days when my interest rate was 11-16% … LOL like you pussy Gen X and Y are crying about 5%

My uncle brought a house in the mid-80’s with similar interest rate. Do you know the price he paid? $60K

I would rather buy a house when interest rate is high vs when the interest is low. You can always refinance the rate if it drops. If you buy at bubble high prices because rate was suppressed, you are F**cked if you need to sell when rate goes back to “normal”.

Wolf,

In general there are a lot of local markets that are different than the national average date. In Glendale Burbank ( north of Los Angeles) we see last week sold houses and apartments with 18 – 25% over asking price. The prices go for $1.5m to $2-3milion , unaffordable!

Do you have a plan to show information for specific location, just like before? Such as Los Angeles, San Diego, Sacramento , etc

“Most Splendid Housing Bubbles in America” coming later today. That goes by market. But it’s an entirely different measure than these new houses here.

They arent unaffordable to the people are buying them. That’s why the prices are so high.

A new breed of innovative, disruptive home builders, eliminating debris,

– like Ukraine debris, prefab modern designs buildings, will find new markets, new customers, who cannot afford the current houses prices, with paper walls, wooden floors and Shingle roofs, for half prices.

The National Association of Realtors reported: “the inventory of unsold existing homes increased to 950,000 as of the end of March. …2.0 months (sales) at the monthly sales pace.

In spite of these inventory levels, prices have been rising. No sign of a widespread housing bust yet.

It’s really early. The Fed has done almost nothing yet. If they do anything close to what they’ve been saying the housing market will get slaughtered.

The Fed has to choose between their legislated mandate to support price stability or a continuation of their self directed effort to inflate asset prices. This is a matter of classism. They can continue to support the asset holding class at the expense of continuing inflation across virtually all goods and services, or they can do the right thing.

The US Dollar is doing superbly and is up 0.62 to 102.32 on the DXY.

We are seeing the “Melt Up” similar of 2008. We have been receiving emails from two builders for 28 months. We have seen monthly 10-30K price increases on the base price of every house since 2021. What was 215K (1/2020) for a new build is now 430K and they took away a finished basement, upgraded kitchen, craftsman front, and back yard porch. The exact same house on 1/2020 was 215k is now 700K. Much of that is due to the 100K so called “upgrades” that use to be included to be considered luxury. I have the house prices next to each other. Insane! We received our weekly email that due to supply issues they were pushing the starting price another 2K this week. Eerily like 2008!

I believe they can, since there are idiots buyers. Individual or institutional.

Which markets are these new builds.

I’ve heard some horror stories of buyers putting down huge deposits on new homes only to find the builder running into financial trouble and unable to complete the construction of the home, or worse yet filing for bankruptcy. Has this really happened before and is this in the cards this time around if interest rated keep spiking? I don;t hear many people in the crooked real estate industry talkin about it.

this has gone on in the construction biz for eva SC

used to be told that restaurants were the the only biz that went bk more than contractors, though don’t know if that’s exactly true these days, but with the lock downs and all it would appear appropriate

DO remember in 2003 when diesel, red iron, rebar, spiked hugely in the middle of a $10MM bid preparation, we were getting sub bids good for 24 hours, and those subbids WERE frequently raised before award of contract, causing a fuss, far shore

Certainly happening in China….

Off topic — the BTFD crowd is sleeping on the job today.

When the Dow (DJIA 30) drops around 90% they’ll be back to devour some of the truly amazing and excellent bargains.

The PPT were out drinking in the bar around the corner, according to sources close to the matter. They were drinking undisclosed craft-brew IPAs and chased them with undisclosed high-end Bourbon, according to one source who didn’t want to be identified because of the confidentiality of the matter. Powell showed up at the bar, agitated and flagellating the air with his arms, and tried to get these people back to the office, but failed, and then ended up staying with them, according to people familiar with the matter. Then Yellen showed up and tried to get Powell to go back to the office, and she was furious and peered at him with her predator’s eyes, and growled at him, according to the people. However, not even she could get Powell and the PPT to go back to work and save the market, and so the whole project was scuttled for the day, and they all had a good time, according to two separate sources.

Ha!!! Maybe they’ll stay comatose.

“I’ve just learned of his illness. Let’s hope it’s nothing trivial.” — Irvin S. Cobb

Powell and Yellen..almost as much drama, fury and notoriety as Johnny and Amber.

Nice action in the preposterously overpriced stock markets today!

With the stock market melting down today, looks like some buyer’s down payments are going to be vaporized before they can even get a signed contract approved. They should have thought about this before they did their house hunting based on stock prices that were out of the wazoo. Deals will be kicking out left and right. Already I see that happening in Swampland. We can’t even get paid for work that was done 2 months ago. Lenders are pocketing escrow funds and probably in financial trouble just like in 2006/2007.

No meltdown today. US stock market still at inflated nose bleed prices.

Today doesn’t even make the top 100, measured in percentages.

As prior articles here have documented, there is broad market weakness and the last few days indicate the mega caps are following the smaller stocks. NASDAQ, S&P 500, Dow, and Rusell 2000 are about to break the February 24 lows.

I concur with Augustus. We shall have a discussion about meltdown if:

1. Nasdaq composite is below 10000 (actually, I think 7000 is fair)

2. S&P is below 3000

3. DJI is below 20000

Otherwise, we just have the beginning of a financial collapse.

1) NDX is sagging. For entertainment only :

2) NDX was up 10K from 6,771.91 in Mar 2020 to 16,764.85 in Nov 2021.

3) The half line is the 12K area.

4) NDX closed May 19/20 gap.

5) If NDX close Mar 8/9 open gap it will retrace about 50% of the wave up.

6) NDX might be a waterfall chart, closing Nov 2/3 2020 gap and

Nov 3/4 2020 gap. That will be about 65% retracement.

2022 is eerily similar to 2007. Granted, the total inventory of homes, new and existing, isn’t what it was, but the prices are even worse and the inflation is horrific. On top of that, we’re unwinding from dot com bubble 2.0. We’re clearly at the end of a cycle.

If you’re a prospective home buyer right now, particularly a first time buyer with a tiny down payment, you have nothing to lose by waiting a year. Trust me as someone who in 2007 was a prospective first time buyer and luckily waited.

All the things related to owning a home is going up a lot.

Roofing, siding, painting, repairs, plumbing.

I live in flyover land and I remember in 2015 calculating my maintenance cost over 15 years versus home appreciation. My house had

appreciated $40k but my maintenance cost during that time was $46k or more.

LOL I had to put on a new roof, $16k, paint ($4.5k), later replaced the siding as it was the stuff that deteriorated ( $14k), new windows( $4k), new deck ($4k), new water heater, new fridge, new stove. New carpet ($4k). I am not including a couple of lawn mowers, all the weed and feed I spent over the years.

Now a few years later I need a new driveway ($12k), new fence (4k ), new carpet, kitchen refinish ($4k). But luckily my house added another $100k since 2015

I just looked back in time.

House ownership prior to WW2 hovered around 45%. After WW2, it increased up to the mid 60% in the 1980s and has stayed there ever since.

Very good points about costs that new home owners don’t always think about.

Also lifestyle changes like new cars, new furniture, lawn maintenance, etc. that really add up in costs. Also, property taxes since 2015?

Did you consider, in your analysis, how much the rent on a similar residence would have risen during the same period? The key benefit (at least to me) is that, as an owner, the cost of housing stays reasonably stable for as long as you remain in the house. The key variables are property taxes and insurance. The rest (utilities, insurance, etc.,) follows the same trend whether you own or rent. You also have the tax advantages of ownership, which you do not have as a renter – which can often offset the maintenance costs associated with ownership.

Our “rent” on the home we now occupy has changed about $130 a month in 5 years – most of which is from the changes in HOA assessments. Insurance is about $10 a month more, utilities went down (new solar hot water heater, “smart” irrigation, and maintenance to the HVAC systems).

The absurd change in valuation has more than made up for the maintenance costs and improvements associated with ownership. The improvements were for our comfort.

It is a wonder how these outfits like Blackrock and Blackstone can take care of all these homes they bought….properly……and economically.

And think of all the inflation increases in HOA and POA….and the new tax assessments.

This has been two crazy years……and I point to the Fed for over doing everything they touched.

You forgot tax increases and insurance increases,worse than mafia

Lots of buyers so desperate to get the offer accepted and in the door of their new home, forgetting on top of the expense of general maintenance, all the work that needs to be done on these old, fixer upper houses they waived inspections on or took on regardless of work needed, that will require inflated/unavailable materials and labor.

Lots of house poor griping in the media and online already, especially from former city renters taking on the learning curve of their first houses.

You need about 2/3 rds of that list. The rest were wants.

I would say 95% was needed. When you live in a neighborhood with HOA, they will put a lien on you house if you do not comply. Which ones were not needed? All the things on the list broke, wore out, or was plain maintenance. This house was built in the late 90s with builder grade stuff. All of that stuff wears out quickly when you have kids and a couple of dogs. Fridge, Stove and dishwasher all crapped out. I forgot I had also replaced the washer and dryer once during the past 20 years. I also forgot to mention my 24 year furnace went out last year. That was another $6.5k.

I could have gotten buy with the old windows but they were wood builders grade that had warped or rotted overtime. 1/3 would not even open anymore. I could have only replace 1/3 but they would not match and the HOA board would come calling.

$300k doesn’t even buy a lot. How could a builder enter that market?

*a lot to build on

The Fed skew all they touch

In 2006 they owned no MBSs

Now they own 2.7 Trillion worth…..lending money well below the current inflation rate for 30 yrs.

Who would do that?

That wasnt a thumb on the scale, that was an entire foot.

Real estate is going to implode end of this year…

NDX is plunging, assessments are rising.

I think another different factor this time is that if you owned rentals before the run-up, you are not as likely to sell them now in a place where rents have doubled. This takes out a lot of potential inventory for used houses below $300K. If you don’t live in one of these places, you don’t know how insane the rents have become. It would take a massive drop in rents to correct this.

Sold my rentals. Paid stupid taxes. But I know what’s coming. Got cash now. Figure I got a 3 month window to get done what I need.

Couple of things:

(1) There are only 36K completed homes for sale. Actual months supply is therefore extremrly (historically?) low.

(2) There were 667K new homes sold in March 2019, putting current sales figures 14% above pre-pandemic levels.

We are not at chicken little levels of panic, by far.

PS It lloks like I’m the only contrarian here. With CPI above 8% and mortgage rates rising, I don’t see a future where anyone will be putting their homes up for sale voluntarily. It is economic suicide on multiple counts to not keep your current residence.

I completely agree it’s a bad idea to sell now but you may be overestimating the financial savvy of the American public. A majority of people don’t really understand how mortgage interest works.

Some folks do buy or sell as a calculated financial move. More will do what they always do: wing it…follow the herd and their feelings.

People seem incapable of thinking in terms of spreads (e.g. fixed mortgage rate vs expected future home inflation). Instead , they only think in terms of payments — a human flaw which predators use to rip them off, cf Testosterone Pit.

“Sales of new houses sag”. Lots else sags, like the particle board construction of these toxic Pressed Wood Palaces. Particle board sub-floors, walls, even roof sheathing. They install 2’x8′ plywood around the roof perimeter…..the rest is glued together chips and sawdust. Any leaks or moisture and the stuff disintegrates like cardboard in a rain puddle.

nsa,

Don’t forget the Tyvek high-density polyethylene wrap that keeps condensation in the walls and creates mold/mildew issues. The newer wrap has been set up to allow some breathability.

It works very well for race bibs or race numbers. And it is also good for CD & DVD sleeves and light, short-use hazmat suits.

Nope, none in my old house though. I got that aluminum siding stuff on the outside. Seems to do the job.

Tyvek is permeable…. it’s “one way” where it repels from the outside (the side with the printing) and breathes from the inside.

The mold and mildew issues are from improperly flashed windows that allows moisture into the stud cavities, improperly installed vapor barriers (north is different than the south), lack of roof ventilation, fake stucco (plastic) exteriors that aren’t maintained properly (require constant caulking and are baked by foam boards that have metallic reflective barriers).

Tyvek ain’t the issue. Lousy builders are.

Good to know.

In Woodbury, MN a decade ago, there were a lot of poorly built homes that had mold problems related to Tyvek. The area this occurred in has peat and water issues in the ground that magnified the problems.

I stand corrected El Katz. Thank you for setting the record straight.

At least, the general conception of the problem was Tyvek related. That’s why I wrote the comment. Being accurate is something I always try to be. So, again thanks …

Yes indeed. A bit of back-checking to the Minneapolis newspaper of 24 May 2006:

“Three years ago in our (name of paper) report, building experts expressed concern that moisture generated inside tightly built, inadequately ventilated houses could be trapped, rotting walls and causing health problems. Now they point to a much bigger Threat: water that comes into the house from the outside.

That makes keeping water out more important than ever. But some proven techniques for doing that are no longer used or are used improperly.”

Yes, “Tyvek ain’t the issue. Lousy builders are.”

So if a federally insured mortgage had a cap of $950k last year when rates were 3%, will the cap be lower this year when rates are 5%?

If Fannie and Freddie don’t reduce the mortgage cap, taxpayers will be taking on significantly increased bailout risk. Is that OK with Biden? I hope not.

I don’t know about all this I’ve been around a little while and it’s the same thing over and over. Yeah there’s times you can buy a house and save money it seems interested down then housing prices are up. Interest rates go up housing prices go down. I think it’s all the same. I realized I told my son the other day that my button sold four houses in my lifetime built three of them and it the interesting thing is that I made a lot of money on all of them real estate never goes down it’s always ever gone up. There may be an adjustment in the market for a couple years but if you hang on sit tight it’ll go back up. Buying a house is still cheaper than renting in my opinion. But east to his own Each off us have to make our own decision.

A lot of this of course depends upon skill level of the buyer. Can they fix it up? Can they make repairs? Or do they have to pay? I just know that it’s always been like this and I believe it’s the bank’s manipulating money so they can make more money. The poor don’t realize but when the Fed and the US government sent out all that money out to everybody the last couple years to help everybody out they said.. that we are now having to pay for those decisions and the form of inflation. I would suggest a good movie to watch it’s called the counterfeiters. It’s based upon a true story about the Germans and world war II and how they were counterfeiting the British pound and the US dollar in order to destroy the economies. They know what caused inflation and that is printing money. But that’s a different story I’m not afraid of any of this life will always go on we just have to make right choices with the knowledge that we have. In my opinion it’s never a bad time to buy a piece of property because it will go up it always does.

Home prices are not dropping anytime soon. I suspect cash buyer percentage will increase with interest rates affecting lower / middle market buyers.

about lumber prices…… I am rehabbing a house trailer, removing the aluminum cladding and sheeting the walls. Went for Zip system coated OSB, one half inch…..WOW 86 bucks a sheet plus tax. I am still in shock.