In a number of shopping corridors, asking rents collapsed by 50% to 73%, amid a slew of vacant stores. But in one corridor, rents jumped.

By Wolf Richter for WOLF STREET.

The meltdown of street-level retail space along the 17 major shopping corridors in Manhattan – some of them world renown and immensely expensive – kicked off in 2015, and most of it happened before the pandemic. The pandemic dragged the meltdown into its sixth year. Landlords and retailers are trying to find their way in a new environment. And in the process the old sky-high rents of 2015 have collapsed.

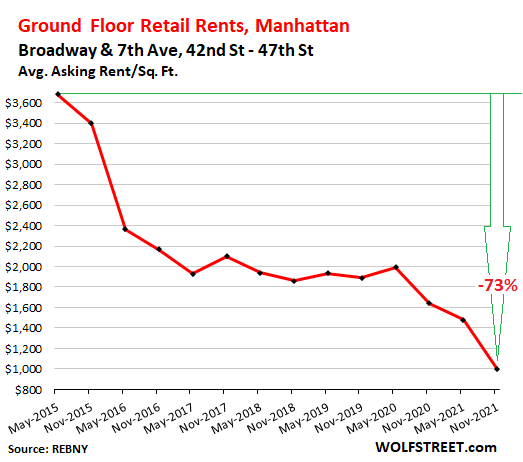

Since 2015, average asking rents in many retail corridors have collapsed by 50% to 73%, including in some of the most ridiculously expensive corridors. That 73% collapse in the average asking rent for street-level retail stores over the past six years occurred in the Times Square area – Broadway and 7th Avenue, between 42nd Street and 47th Street in Midtown – from $3,683 per square foot per year in the spring of 2015, to $998/sf in the fall of 2021, the lowest in over a decade, according to the Real Estate Board of New York’s new Manhattan Retail Report. There were 16 stores available for rent:

Despite the 73% collapse in average asking rents in the Times Square area, rents are still expensive. For example, the rent of a 2,000-square-foot store, at $998/sf per year, would amount to nearly $2 million per year. But that is down from $7.4 million per year in 2015, which is just ridiculous and had to blow up.

A global luxury retailer catering to jet-lagged tourists would treat that kind of store as a showcase of its products, and would accept losses from that store as a form of promotional expense, while relying on its other stores to make money. But even that equation got hard to work out.

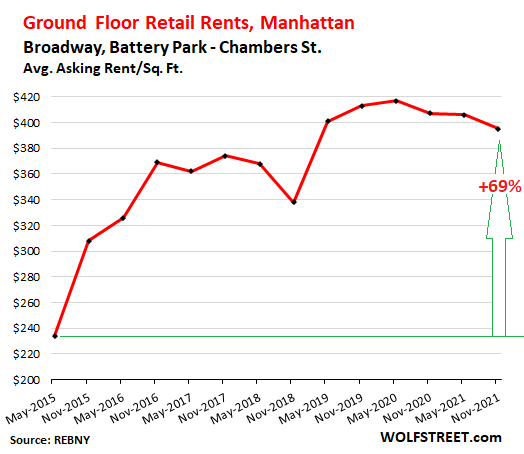

Retail rents didn’t collapse in all shopping corridors. In a few, rents sank only moderately over those six years. And in one of them, the grand exception, retail rents have soared by 69% since 2015.

Everyone is trying to sort out where to go from here. Landlords want to fill their stores, and some retailers want to open up shop, and there is enormous flexibility among landlords with rents, buildouts, and other incentives to make something happen.

And for prospective tenants, Manhattan has gotten a lot less exorbitantly expensive – though it remains exorbitantly expensive, and the classic brick-and-mortar retail that can be replaced by ecommerce is being replaced by ecommerce, and different retail models need to be found.

Manhattan’s street-level retail shops and service operations depend on a mix of residents, tourists, and commuting office workers.

Tourists are coming back to the City, but not at pre-pandemic levels. The Times Square Alliance, cited by the REBNY, reported that the number of visitors to Time Square in October was still down by 26% from the average in 2019. What is happening to asking rents for street-level stores in the area is depicted in the chart above.

Office workers are straggling back, but are still largely working from home, with office occupancy in the New York City metro still down about 65% from pre-pandemic levels, according to entry systems provider Kastle. Storefront vacancy rates in areas that are depending on office workers remain much higher than shopping corridors that service local residents.

The REBNY points at the “daunting list of obstacles” that landlords and prospective tenants face:

“Leases continue to take longer to reach completion. A small subset of retailers – primarily QSR [quick service restaurants], clicks-to-bricks and some health and wellness – are in expansion mode. Most other tenants do not have any sense of urgency. Buildout is frequently delayed by construction labor shortages, a lack of materials or even slower lender approval. Finding and training staff is a challenge. Finally, supply chain shortages can impede product offerings.”

Upper East Side.

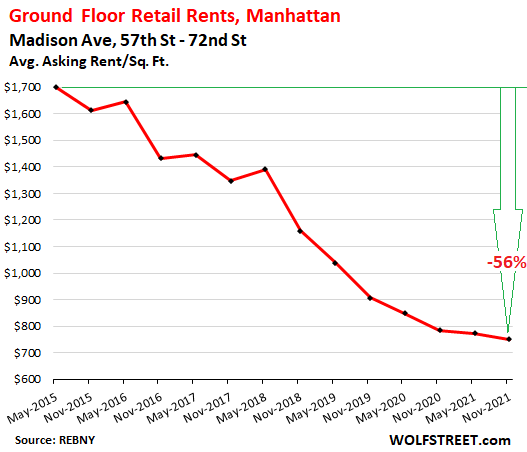

On Madison Avenue, between 57th Street and 72nd Street, the average asking rent declined to $750/sf per year, down 56% from 2015, with 47 stores available for rent:

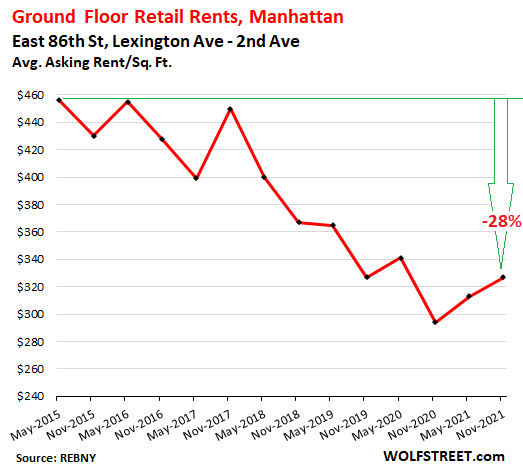

On East 86th Street, between Lexington Avenue and 2nd Avenue, the average asking rent has increased over the past 12 months to $327/sf per year but is still down 28% from 2015. There were 11 stores available for rent:

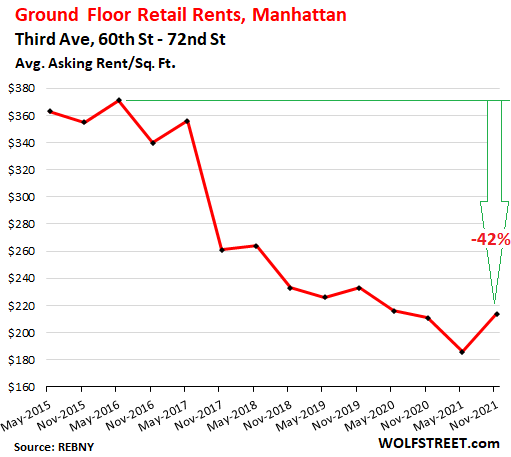

On Third Avenue, between 60th and 72nd Street, the average asking rent rose over the past six months to $214/sf, but is still down 42% from the peak in 2016. There were 24 availabilities:

Midtown

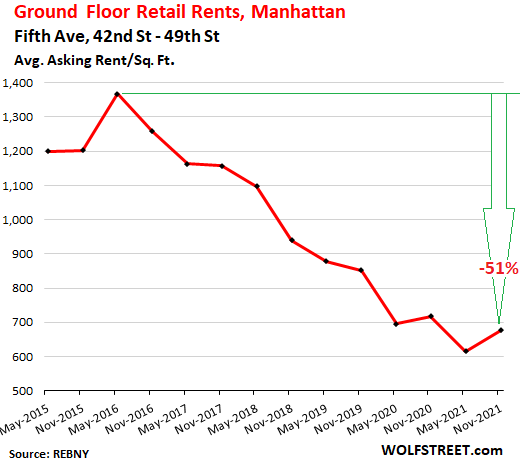

On Fifth Avenue, from 42nd Street to 49th Street, the average asking rent bounced over the past six months to $676/sf, but was still down year-over-year, and has collapsed by 51% from the peak in 2016:

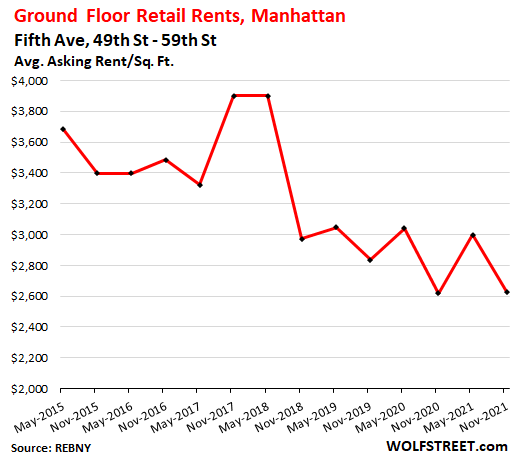

On Fifth Avenue from 49th Street to 59th Street, the average asking rent was roughly flat year-over-year, and down 29% from a strange-looking 2018, at a still enormous $2,628/sf per year:

Midtown South.

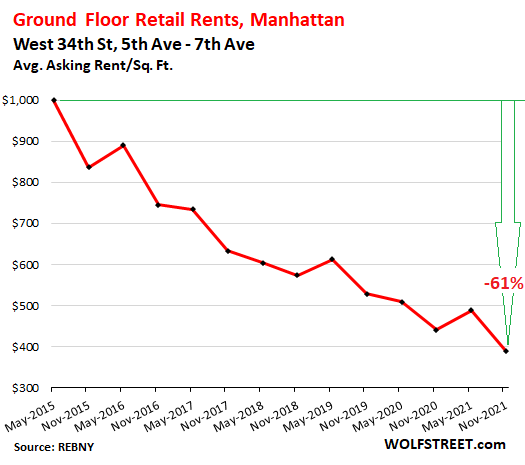

On West 34th Street between Fifth Avenue and Seventh Avenue, the average asking rent fell to $390/sf, and has collapsed by 61% from 2015. There were 17 availabilities:

Downtown.

Here’s the exception. On Broadway, between Battery Park and Chambers, the average asking rent has been ticking down for two years, now at $395/sf, but is still up 69% from 2015. Now with 25 availabilities, rents are struggling to hang on:

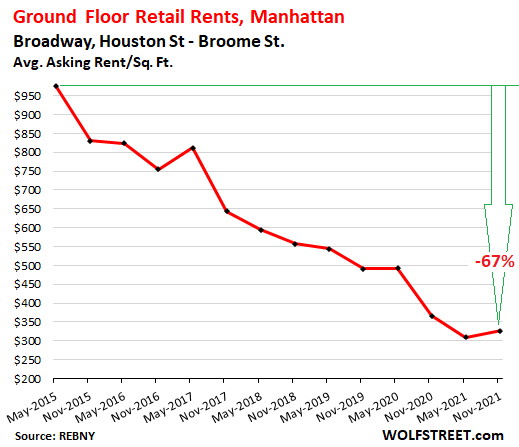

On Broadway between Houston and Broome, the average asking rent ticked up over the past six months to $327/sf, but collapsed by 67% from 2015. There were 20 availabilities:

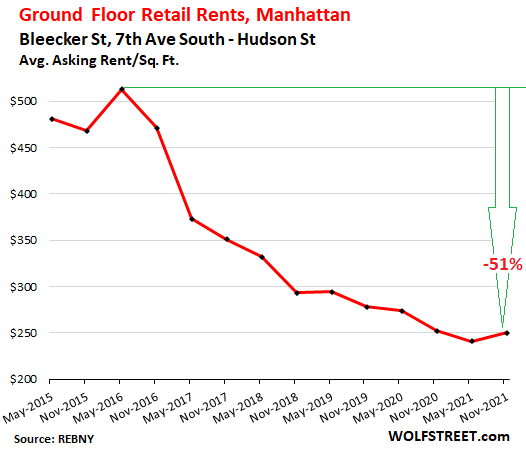

On Bleecker Street, between 7th Avenue and Hudson, the asking rent also ticked up over the past 6 months, to $250/sf, but collapsed by 51% from the peak in 2016. There are 17 availabilities:

Upper West Side.

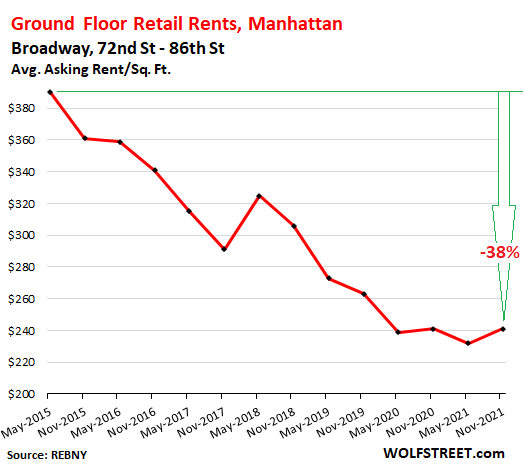

On Broadway between 72nd Street and 86th Street, the average asking rent ticked up over the past six months to$241/sf, roughly flat year-over-year, and down 38% from 2015. There were 24 availabilities:

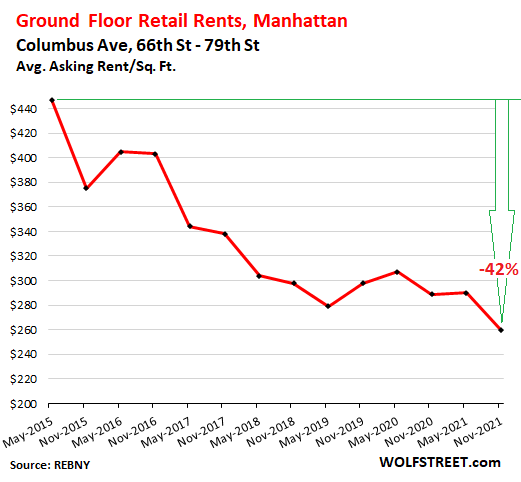

On Columbus Ave, between 66th Street and 79th Street, the average asking rent hit a new multi-year low of $260/sf, down 42% from 2015:

Upper Manhattan.

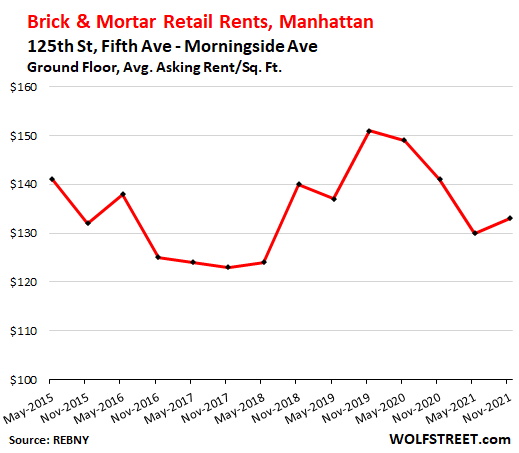

On 125th Street in Harlem, from 5th Ave to Morningside Ave, the average asking rent ticked up over the past six months to $133/sf, and was down “only” 6% from 2015 and down 12% from two years ago, amid 16 availabilities.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Since 2015, average asking rents in many retail corridors have collapsed by 50% to 73%, …”

It will be interesting how this all plays out, with things unlikely to return to old times. There is something truly Darwinian in all of this.

Interestingly, in my rural small town it is the very opposite. Rents are ever increasing. Apples to oranges, I know…

I think the same thing was said after 911.

And considering that an estimated one trillion dollars of police state enabling surveillance infrastructure has been installed in the US since then, they were correct.

The answer from bloated fedgov agencies is never, “We had everything we needed to stop this (which they did), but screwed up in a huge way.” It’s always, “We didn’t have enough people and stuff.”

You should show the decline in inflation adjusted terms .

73% down, in Manhattan, is no joke.

The Fed needs to lower the rates agressively, and restart QE. They can’t let these poor buisnesses fail thru no fault of their own. What are we, China?

“What are we, China?”

Not at all. China at least protects its citizens from its robber barons.

Here they just counterfeit currency, and pass it around to their country-club friends.

There’s a guy on YouTube who does great sidewalk tours showing all of the huge number of closed Manhattan storefronts with square foot rents he can estimate since he used to have his Apple brand electronics repair store in the area.

Even around the high traffic Times Square area, loads of places are closed and, frankly, considering what they offer as a service or for sale it’s hard for me to believe they could ever have made a profit considering the insane rental cost per square foot.

I hope you’re joking about what the Fed should do.

“I hope you’re joking about what the Fed should do.”

Yeah, was he joking or what?

W-with McQueen’s ghost. Andy simply neglected to toggle the ‘/S’ button (often necessary to appear for some here…).

may we all find a better day.

Agree… how many high-priced coffees do you have to sell to make a profit at year-end when lease is $4000/sq foot. Sounds impossible.

The rents in upper manhattan were lower to begin with but are bolstered by The big hospital ( New York Presbyterian) and twin Ivy League medical schools there, lots of customers with not much work from home possible. Rough place for internet deliveries too.

NYC chose to kill its retail businesses. The design district in Miami is booming. Almost every high end mall in Miami is doing well.

Can you imagine voluntarily signing up to be the cash cow for the local tax authorities to milk dry? Uggghh…

Landlord greed has a lot to do with it. If you charge $2,000/sf per year, or even $300/sf per year, it’s hard to make it as a retailer.

How does one bust up a monopoly? Particularly if that monopoly is over property. Rents plummet, but do we know what the costs are? I believe property taxes offer lots of deductions and tax avoidance. But how does one sort it out?

If interest rates reflected actual credit risk and the cost of capital was not distorted, much though maybe not all distortions would disappear.

Wolf,

While I know retail in NYC had been dying a slow death for decades, the city’s management of the recent crisis put retail out of its misery. It would be the last place on earth I would go to spend money, I’m not kidding.

People with money have no boundaries anymore, they can not be contained. Closing the city was a big mistake. Florida chose a different path. It allowed adults to make adult decisions, and that is reflected in the current boom it is experiencing everywhere.

NYC’s retail losses are being recaptured around the world. This is also a big hint to those mega landlords who think they have outsmarted the downtrodden masses with their upcoming rising rents. People are now highly mobile in every way. A few years exploring the world might be in everybody’s future.

Just as an aside: Manhattan luxury condo, co-op, and townhouse sales (luxury = $4 million+) had a huge massive record year in NYC. Will post an article on this shortly. Lots of these billionaire digs that have been sitting on the market for years sold this year.

Wolf,

I saw some of the huge haircuts some trophy properties got this past year.

I don’t know if you can track this at all, but NYC traditionally had many apts owned by corporate/business owners which largely remain empty most of the time. Any idea if companies are bailing out too, since there doesn’t seem to be any good reasons to go there anymore.

Yes, they came with haircuts from the aspirational asking prices. Many of those deals were by developers finally being able to sell units they’ve been sitting on for years, and there was no prior transaction.

And yes, as you point out, the participants in these deals don’t disclose the final sold prices. What we know at this point is the last asking price when the deal was signed, and by how much the asking prices have been cut over time until the deal was made.

You see this routinely: $50 million mansion sells for 30% off asking price, but it’s still up a bunch from when it sold last. These asking prices for these high-dollar homes that might sit on the market for years before they find that one buyer are very aspirational and subject to long negotiations.

I’ll have more details on those deals when I post the article. Charts too, of course :-]

When I was invested in the big outlet REIT I boned up on rents and the like. They were building out in the middle of nowhere at around $100/ sq ft, renting out space for about $30/ sq ft and stores had revenue of around $400/ sq ft. They used to remark that stores had the lowest rent to sales of any brick and mortar.

I am still interested in the company as it’s a pretty simple business to model if you can estimate future rents (not easy). Was a bargain at panic of 2020 at about 4 X cash flow. Now back at about 12 X cash flow.

It’s almost like NYC is trying to kill retail and commercial businesses with the city boundaries.

“Toughest” longest lockdowns, a certain card needed to go into nearly any business, arrests for face covering impropriety, ever changing definitions of what compliance is, and, not fake news, not so much fun camps are being debated as we speak in Albany.

Not really conducive for businesses to reopen.

The meltdown STARTED IN 2015. And the biggest portion of the rent declines came BEFORE 2020. Blame ecommerce. I have for years reported about retailer bankruptcies and mall defaults. This is just what it looks like in Manhattan.

On Friday nights my wife and I would head over to “Steward Anderson’s Black Angus” restaurant for dinner and drinks. Then we would walk next door to “Boarders Book Store” for coffee and watch an acoustic band play a few sets. Then we would drive home and stop off at “Blockbuster Video” to rent a movie.

All of those places are gone now (at least the ones that I visited).

It’s Stuart, not Steward and Borders; not Boarders. Sorry, just couldn’t let it pass

If you want to get a good idea of where all this is heading. And if you want to envision a shopping trip in Manhattan a few years from now just stream the classic 1980 motion picture “ The Warriors”

In the 1970’s, there were biker bars in Manhattan and Time Square was overrun with sexually oriented business.

Cuomo factor eh?

Actually it was Giuliani who revived the city, only to have the left lay waste to it.

Gotta agree, like totally dudes and dudettes, with the Pet on this one….

Had a really great time my first time in NYC,,, staying at a hotel, then going to the Village Gate to see Dylan and the Smothers Bros,,, and having a nickel beer in the bowery,,, early spring of 1963.

Was ”helping” a bud to drive his car, an early IH Metro, up the line, and he awarded me with visits to his clearly well known ”haunts.”

After that, clearly, Rudy and his cohorts were needed to correct the absolute abandonment of NYC, etc., especially after the NY ”World’s Fair.”

And there is a nice place on 82 West 3rd Street where a few my wife’s poems and writings have been read in PEN America celebrations. In the nineteen-forties, Thelonious Monk was the house pianist, and Frank Sinatra frequently stopped by to listen to Billie Holiday sing.

Now, Minneapolis is not far from “The Warriors” with carjackings. Over 600 so far this year. Recently, one happened a block north of my home.

When I go to my grocery store this morning, I will have a surprise ready for anyone that approaches me with bad intent. Yeah, that’s life in the city, eh?

“It helps if you dress like a detective.

Detectives dress kind of square.

If people think you’re a cop, they think you’re packing something.

Then they won’t fu#k with you.”

Never been to Philly, but evidently FDR Park in South Philadelphia ain’t the best place to be walking alone towards your Acura.

Wednesday afternoon (today), at around 2:45 pm, U. S. House member Mary Gay Scanlon was carjacked at gunpoint by two armed men in a dark-colored SUV.

Thankfully, she is physically unharmed, but as she was walking to her car after a meeting, the dudes ambushed her and took her car, phone & purse.

I started working the streets two weeks after turning 14 as a sporting event ticket broker. Been all over the USA — carrying wads of cash as a routine aspect of the business I was in. I’ve seen some weird stuff in the 43 years I had on the job, but this is getting over the top.

Before a couple months ago, going to get my groceries never had me take a piece along for safety, but, “The Times They Are A-Changin’.”

My thoughts are with Rep. Scanlon, and she did follow the Repo Code: “Only an asshole gets killed for a car.”

How’s the brick and mortar retail doing in Philly these days?

Philly was one of my favorite cities, now it breaks my heart to see the drugs and crime on the news. It was safe enough twenty years ago, the shopping was world class, and so was the restaurant scene. I doubt that is the case anymore.

Are you sure you don’t mean “Escape from NY” ?

Yeah, that’s more what I visualize NY turning into (and maybe other big cities that are going to hell right now). Great movie if you saw it in the early 1980’s. Adrienne Barbeau (wow), Kurt Russell, etc.

But now I read that many of the Woke mayors in big cities are re-funding the police so all will be good again. /s

The FED has destroyed the economy. They have created a fragile system which rewards speculators and the wealthy and destroys opportunity for the masses. High rents and high property prices dissuade small business creation and eat up disposable income. The system is rotten to the core and needs to be scrapped. We do not need the FED anymore. It should be abolished.

Banks and central banks are very much main players in a rentier economy. The trouble is that rentier activity may suffocate those they extract the rent from.

Anyway, in the end it may play out as parasites that starve to death when they have killed their host.

Like cancer.

The Fed.

The perpetrator of the greatest THEFT in the history of mankind.

And apparently they will continue, as they are not lifting a finger to tighten, but just stimulate at lower levels.

The prudent earner/worker/saver is PUNISHED for having idle cash. Deliberately punished to fluff asset prices to all time highs, not to “save the system” like in 2009.

It is unAmerican to not allow people to save. It is wrong to penalize people who wish to keep some money for rainy days and the unforeseen events, or to actually pay for a large item from their savings.

It is wrong for the Fed to FORCE investors to take greater risks just to stay in the “game”, thus fluffing the markets. Force is the word former Fed gov Fisher used to describe just that in a PBS special “The Power of the Federal Reserve”, which can be seen on the PBS web site.

It has been the largest “cattle drive” in history. And we know what happens at the end of a cattle drive. The cattle, slaughtered, cowboys eat steak and get drunk.

Depth

The “knowing” the Fed would inflate and then NOT DO A THING ABOUT IT, to any real degree, was the key to making money in these markets.

Who knew? Who got the whisper that inflation would pop, and the Fed would shirk their duties?

Many saw this inflation coming, and headed for the sidelines knowing that the duty of the Fed, as in the past 70 years (prior to 2009) was to raise rates in lockstep with inflation in order to tamp down that inflation and keep the holders of dollars whole.

But not this time…….who decided? Who knew? Who benefited? We know who got punished.

Bonds have been retreating for 40 yeare

” We do not need the FED anymore. It should be abolished.”

So what do you suggest ?

I am in agreement that Inflation and wealth for the super rich are not my Cuppa Tea

It’s easy to dislike a drastic situation But that seems to be a driving force and drastic action seems required .

A solution keeping the USA the way it should be, could be is no simple matter : Obviously we can’t count on law enforcement too much time has passed Already with no arrests Ect.

With senators , and government agencies getting rich from Inflation and no Legal action toward them the Law is out ?

I would really like to hear your plan of action ?

I’m against Smash and Grab 100% but understand the frustration. The Mindset of Politics and Police agencies to just get the Paycheck !. I tire of ” It’s a civil Matter ” wrong office

Shall we ask Nancy Pelosi what to do ? Have you ever slept on a bed stuffed with Money ? I wonder if it smells ? Perhaps AOC could post on Wolf Street and share her feelings,

Gavin Newsom wants 300 Million to fight Smash and Grab. Who gets that money anyway ? Nancy P she lives in SF perhaps Wolf street contributors can ask around who knows what they might discover ?

NYC :

The Internet has taken over and all these Huge Retail Buildings

are no longer needed for such things simple as that . Perhaps the Government could stockpile Money in them to pass out ?

So looking forward to your solution, Depth Charge and by the way I share your feelings 100 % But what’s the solution ? .

I really don’t want to just leave the USA due to lawlessness and corruption

but have no answer .

” We do not need the FED anymore. It should be abolished. ”

Replaced with what ?

PS : I want my Money Back lost to inflation but am not going to become a criminal.

Wait, you mean to tell me the government doesn’t actually care about small business?

They certainly metaphorically cry over it, like the Walrus and the fisherman in “Alice in Wonderland” after eating the happy trusting oysters.

The system is not fragile. It has been very robust ever since the ’08_’09 bailout. Absolutely and accurately helping out their precisely targeted beneficiaries. Altering financial stuff as and when required to make a lot of people multimillionaires. And to hell with the other 99%. One couldn’t get a more robust setup!

The situation in Chicago is out of control. The mayor, Lori Lightfoot, has asked Merrick Garland to send in Federal prosecutors and agents in an attempt to get the crime situation under control. Kim Foxx, the Cook County prosecutor won’t do anything, the police are fetal, its a mess. People don’t feel safe and the mayor admitted that on TV. Throw in the new Omicrom restrictions and I would imagine what Wolf’s charts would look like for the “Magnificent Mile”.

This is going on in a bunch of big cities in the U.S. (re-funding the police). There is a very good article if you search for it on the internet or just go to the UK Daily Mail online.

Tom Cotton is right.

Remove all the Soros backed DAs …. like Kim Foxx in Chicago.

She seems to refuse to prosecute….

to wit: She dropped the Smollet case (after she got a phone call).

And Dan Webb, the prosecutor, seems bent on revealing just who made that call. (ex first lady maybe?)

The Hennepin County district attorney is finally having juveniles, many with five or more priors, certified as adults for first-degree aggravated robbery charges in Court.

Crazy world when 16 year old kids are walking around with guns; after being booked and released numerous times.

“A man with a permit to carry a firearm intervened and pulled out his gun; the juveniles fled.” -from 20 December in the Minneapolis newspaper. Headline: “Three juveniles charged in carjackings in Edina and St. Louis Park that injured five. Several victims were violently attacked.”

At Cub Foods, I wasn’t the only shopper who was packing heat. Groceries are home and put away. My grocery store is across the street from the destroyed 3rd Precinct headquarters.

Downtown Minneapolis is a shell of what it was a few years ago. Buildings are still there, but people and retail stores? Not so much.

There would be plenty of room in prisons for real (violent) criminals if political criminals (like drug possession) weren’t taking up so much space.

The third largest employer in downtown, Wells Fargo with about 7,000 workers, has just announced it is postponing its planned 10 January return to working downtown. 18,000 people work for Wells Fargo in Minnesota.

“Wells Fargo employees are still welcome to come in to the office on a voluntary basis if they are vaccinated, the company said.”

About 40% of downtown workers are back according to the Minneapolis Downtown Council’s most recent survey.

I remember commenting when you first posted what was happening in your area. I told you then things would never be the same again, and they won’t be for a long time, if ever.

I saw this happen in NYC in a few places and twenty years later they were still boarded up and abandoned. It’s hard to be older in a place which is in decline and your safety is at risk every time you leave the house. You should re-evaluate your situation if you can.

Petunia,

Yes indeed, and you were correct.

As I have commented a month or so ago, some of my neighbors have sold and moved away.

My older sister and I discussed the situation last week, and she is glad that she’s retired from teaching at Bruce Vento public school in St Paul. Crime near the school is also crazy, and recently there was a gunfight in the school’s parking lot which caused damage to some of the teachers’ vehicles. Nice way to go through elementary school — not!

I will stay where I am for a while. Like Wolf said recently, his Zen happens when he’s swimming with the wildlife in the Bay & my Zen is when I’m riding my bicycle along the Mississippi and eagles are flying above me. My location and home are perfect in almost every manner.

Thank you, and you are right Petunia; I will keep options open.

One last comment I should add regarding the Twin Cities’ carjackings:

Edina is an affluent suburb with expensive homes and a prestigious school system. It’s a very desirable part of town to live in, but crime is there too.

A high-dollar location doesn’t guarantee safety.

So Chicago is really turning into Gotham City?

Manhattan: over 1.6 million people living within 23 square months. At some point people wise up and move on…especially if many of the reasons they live there are no longer available and may not be for the foreseeable future…

The banks holding the paper are broke.

but………

in this modern day world……..why be bothered by numbers. As the financial bank stocks soar to new highs.

Ain’t no damn fools left to pay $998 per foot except show off borrow N’ buyback queens buying trophy stores in the lobby of theiir castles in the sky,

Brick and mortar retail just cannot compete. Their inventories are so much less, and they have to pay those rents. This will keep adjusting until a new equilibrium is reached. Even the process of meeting people (bars) has been profoundly changed. All that “local charm” can be viewed as friction, noise, inefficiency and risk in this paradigm. One can scoff, or wax sentimental, but the numbers do not lie.

The food trucks killed Manhattan

lol, what?

Those who pushed carts early in the morning will move to the

open retail space and rejuvenate the city.

Don’t be surprise if NYC next mayor will be a guy born in Bangladesh.

Born in bangladesh. Lol

Only if wall street finances him.

The current mayor elect has a GS banker leading his transition team.

All the retail corridors look the same. The same dozen companies everywhere.

Then the regulations in place to open retail business add employee demand, e-commerce and did I mention the rent moratorium is still in place?? Not a sound place to invest hard earned capital. Only good for the dozen with printer access.

Plus everything closes so early now. Many staple restaurants are closing down or earlier. 2nd 3rd generations don’t want to take over family business. That’s an article in its self.

The city that doesn’t sleep went into hibernation.

NYC lost its flavor.

Fuel consumption numbers from Amazon running their trucks is where?

Where are the “Green” police now?

The green police are watching the peasants in western Europe gathering their pitch forks.

It’s more fuel efficient to have one cargo van deliver 50 packages on one route than it is to have 50 cars driving around from mall to mall.

Well said Wolf, especially in these days of contraction/efficiency not growth.

As goes the supply of oil, goes the rise/fall of growth.

Anyone have an idea of the sweet spot price of oil? Just right to keep the economy running and high enough to keep the populations of producing countries peaceful.

I think you need to place a call to OPEC and ask them. (1-800-OIL-4YOU)

Danno, spot-on. Corollary to how FDR’s administration looked around the world in the ’30’s and recognized that a hungry population is prone to extreme irrationality. They came up with agricultural price supports and soil conservation/Federal water projects as mitigations for food supply issues. Good faith efforts that, as humans are wont, have been hijacked or distorted by our never-ending drive to ‘game’ necessary mitigations for immediate personal/corporate gain, or worse, to embed them as subsidies/entitlements without much serious, good-faith review/modification/improvement or removal relative to the context of the present (always-moving target, i know…)

Throw in our generally poor analyses of unintended consequences (‘…we don’t know what we don’t know…’, after all) and we have a few of the many reasons governing (people or markets) will always be very hard work.

As well as an always-imperfect one.

may we all find a better day.

The short term future for brick and mortar retailing is grim. But longer term it has a bright future ( not so much for the owners of expensive retail real estate). The feds policies can only really end one way, with the destruction of the currency. This will mean , just as it has every other time in history, a return to barter. Sure, there may be a bit of crypto while the internet hangs together, or some janky replacement money from the Fed that will only be used by pensioners and unloaded as quickly as possible in exchange for a few meager goods. But real goods will be traded person to person in retail establishments of all kinds. The great trade and natural transportation hubs like NYC and SF will once again thrive ( in an 1880’s kind of way.)

“This will mean , just as it has every other time in history, a return to barter.”

I’m currently reading a book titled ‘When Money Dies’ by Adam Fergusson, first published in 1975 and fairly recently republished. It is about the government policies in the Weimar Germany that led to hyperinflation.

What is really compelling in the book is the common person’s response to their situation, where their money became worthless — especially those living in the cities. It was a tough situation.

If you fear this happening again (and I don’t, but…) I’d stock up on food and items to barter. Tobacco might be a good ‘investment.’

:)

The book does a good job of chronicling the hyperinflation, but the main point of it is lost on most readers. The end of hyperinflation didn’t end the crisis. It’s aftermath played out for years.

you could even argue that the hyperinflation of 1923 planted the seeds for hitler’s rise to power ten years later.

Return to barter…. so, are you going to barter your goods with the pointy end of a 9MM?

Hate to say it, but advertising goods in exchange for other goods probably won’t go well. Law and order is broken.

I think holding your own personal basket of multiple paper currencies will be necessary if TSHTF. This is already common around the world. I would include some official digital currencies with that as well as they become available, I don’t mean crypto.

I don’t know if you are in western world central banks all have devalued at roughly the same rate. Maybe Swiss Franc is the least dirty. Probably 50/50 by value gold and silver standard 1 oz coins held in your house is the best insurance against system failure.

You are being too myopic. I’m talking rupees, rubles, yuan, yen, everything traded by large populations. It’s not about relative valuations, it’s about acceptance.

Old school,

I’m with you: 1 oz. silver coins.

They don’t taste good might be able to trade forfood

Retail goods traded by barter?

Maybe in some 2 horse town out in Wyoming. But most retail stores are owned by Corporations. In the one I once worked at, it was a common joke among the staff that the suits in the Corporate Office did not even know what their retail stores sold.

We could not accept foreign currency, or travelers checks. They sure are not going to allow their retail staffs to trade eggs for bananas, or any other Libertarian fantasy trade item.

Technology has come a long way since Weimar Germany. If things get as bad as Germany in the 1920’s, buying and selling stuff is likely to be done by some sort of plastic card.

The scenario discussed by you and a few others is covered in an infamous book. In that source, it’s not predicted to be a plastic card.

@SC

” just as it has every other time in history, a return to barter.”

Today Sri Lanka agreed to pay Iran for oil in tea because they were in so much $ debt they could’nt get cash to settle, so your comment is spot on.

“This will mean , just as it has every other time in history, a return to barter”

Not sure what this means but I don’t know of a single example where a civilized economy has had a barter economy. Can you name one?

You’ll be waiting a long time for an answer because the archaeological record demonstrates that there is no civilization in history that relied upon barter. It’s debt and ledgers all the way down to pre-history. In fact, debt records predate writing itself.

@MSF

Yeah! it’s pretty unique that’s why I mentioned it.

David Graeber wrote chapter and verse on this subject in his great book, ‘Debt the first 5000yrs’

Does anyone follow shadowstats dot com?

Any opinion out there from anyone on what this guy’s take on inflation is?

Peanut Gallery,

It’s a joke. He said as much years ago. People need to quit taking it seriously and do the math on their own. He’s been saying double-digit inflation for over a decade.

To use a 10% example, which is lower than his numbers: If the average household had 10% inflation for 10 years, the $4,000 per month spending per household in 2012 would be $10,374 per month in 2021.

To use a 12% 10-year example: If the average household had 12% inflation for 10 years, the $4,000 per month spending per household in 2012 would be $12,423 per month in 2021.

Which means that a household making $4,000 a month in 2012 would have to make $12,423 per month in 2021 to have the same standard of living, which proves that his numbers are just stupid-ass nonsense.

Do the math yourself! It’s easy to show that shadowstats is just a joke that people take seriously.

Yes, inflation is higher than CPI but it’s not anywhere near shadowstats BS number.

Thank you Wolf for that silver bullet. That totally makes sense. I looked at his numbers and thought something was off… I just wanted to post a comment in a more…… neutral stance and gauge the position of others.

Wolf, what is your personal calculation / methodology / philosophy on measuring inflation?

A penny for your thoughts

Ultimately, your own personal inflation is what matters most, based upon the composition of your spending. The averages from any index aren’t necessarily very relevant.

@PG

I worked in indexation for years in the 70’s. It’s an intensely difficult subject, trying to catch a true representative picture of what consumers are having to pay on all the items they buy.

Statisticians are not politicians and their motivation is to get it right for professional pride.

Each sector has it’s own index team and they all feed up to the broader indicies and on up to the big one which we used to call the ‘GDP Deflator’ but I don’t know what the H they call it now.

If PR people and politicians don’t like what the raw stats say, they slant the emphasis and leave out nuances, this infuriates true statisticians because they get called crooks by people who don’t understand the process.

W does a great job of presenting data in it’s rawest form which is how true statisticians like it.

Auldyin, thanks for the comment. But with all due respect, hasn’t that ball game changed entirely since 1970s?

@PG

Maybe you’re right, but if you are, it means the world is going down the tubes.

I’m out of it for years, but the Boeing 737 story shocked me and I’m not impressed by ‘professionals?’ responses to the pandemic.

Wolf, the official CPI methodology has changed to lower the reported CPI, which hides the decline in the standard of living. Shadowstats just restores the old 1980 methodolgy and appolies it to current prices. The difference between Shadowstats figure and the official CPI is an approximation of the decline in the standard of living.

digitaldaniel,

Only people who don’t know how to do compounding math or don’t know how to use a financial calculator that does compounding math (such as net present value or future value calculations, payment calculations, etc.) believe in the bullshit that the guy posts.

Like I said, DO THE MATH!! So I did it for you above, so you don’t have to do it, and to show you in numbers that his numbers are pure bullshit.

His numbers cannot be true because the average household that got by 10 years ago with spending $4,000 per month doesn’t need to have $12,423 a month in spending now to maintain their standard of living. But that’s what his number pretend to show. And it’s bullshit.

People need to quit promoting this bullshit on my site. If you don’t know how to do math, keep that to yourself. Or learn how to do math. But don’t show the world that you cannot do math, and that instead you believe in some kind of stupid religion about inflation.

Yes, CPI understates inflation. But not by a huge amount, though it too adds up through compounding. But just because CPI understates inflation doesn’t mean I have to turn off my brain and believe in the shadowstats BS.

You can pretty much read his posts from 10-12 years ago compared to today and find they are identical (not statistically necessarily but in general outlook).

One thing he didn’t anticipate was QE and other manners of government intervention to bail out a failing economy to the extent that they did. But his outrage and outlook was something to consider back in the day.

And his conclusion that hyperinflation is the probable outcome of this mess may still be prophetic.

For years I worried retail would collapse after the onset of the internet. Yes the net is convenient and sometimes cheaper. However, the Golden Age of the Internet passed a long time ago. With state sales taxes, the lack of being able to see the item in person, and just the whole shipping mess, I’m really missing our old local retailers. They call it progress but as usual its debatable. Liner/Container shipping will get no better any time soon. Cost increases are here and will rise. Rates are looking even higher from what we are seeing with initial offers for contracts. Massive delays, congestion, etc. No, contrary to what Joe Biden claims, nothing has changed that will make a meaningful impact. The threat of more charges on top of charges that exist and have existed for 70 years will do nothing. This is evidenced by the delay in implementing these charges for the third time. If there are no trucks, you can threaten all you want but the cargo won’t move. Here’s to a better 22′ and Merry Christmas Wolf!!

Retailers WILL return to sell ESSENTIALS once the price of oil makes it even cost prohibitive for constant delivery of wants not needs.

I say within 15 years we will see a return to local shopping of select goods just like the 50’s.

Any supposed improvement is a tradeoff between turning the central shopping districts (what’s left of it) and the suburbs into ghost towns versus the maddening experience of navigating traffic congestion which sucks where I live.

In many areas within the largest cities (top 35 in US with population of 2MM+), for those who don’t mind being effective prisoners within their immediate living area much of the time, what exists now is fantastic.

I think it sucks but that’s just me.

i thought i was the only one nostalgic for places like compusa and fry’s.

1) Sadiq Khan London Mayor.

2) Eric Adams for the next downturn.

3) A Turkish senator & Bangladeshi mayor will rejuvenation NYC, to start a new cycle start.

4) The disruptive on wheels food carts, will move to vacant retail

stores, at the end of the next recession, when sq/f price will tumble below value.

5) NYC landlords will break retail stores walls. They will offer larger spaces for slightly higher prices, at the bottom, with three months for free and maintenance, to fill the empty spaces at any cost. Better them than brothels.

6) There is no different between the food carts on wheels, with their different food, music, attitude, hard work & discipline and the mini steel disruptive innovators that sent US Steel to hell, many decades ago.

Can Inflation be a Tax write off ?

Musk , Powell , Pelosi, The list could be huge. So People can get Billions back ?

Perhaps the IRS can provide an in depth answer: Not just NO NO NO !

” We do not need the FED anymore. It should be abolished.” Depth Charge Say’s.

Is it possible that Billionaires are running the economy now simply to their Own advantage,but unable to claim Inflation as a Tax Right off simply due to something that does not matter anymore Law Enforcement ?.

Perhaps to go back to the Neanderthal Early Man lifestyle , & Trade for Goods and services , carry a big Club ( Law Enforcement ) Was a Better life a good Idea .

I can just see some Senators in their Loin Cloths clutching Trade beads carrying Clubs labeled Inflation . They can live in those empty Retail Buildings in NYC like Caves.

If you remove grocery shopping out of the equation….my family does 85% of shopping online.

I read a lot of empty retail stores will be come last mile logistic centers.

Best I can dete it mine be I do 0.2% on-line, but that is mostly because I don’t like a lot of crap to organize.

determine ugh

The gravity of the situation in the big apple is w/o wall st, it more closely resembles Cleveland, another failed city of size.

Maybe it’s time to reacquaint ourselves with Henry George?