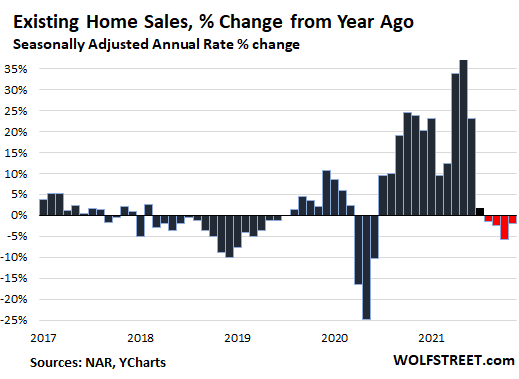

Total sales down from a year ago for the 4th month in a row.

By Wolf Richter for WOLF STREET.

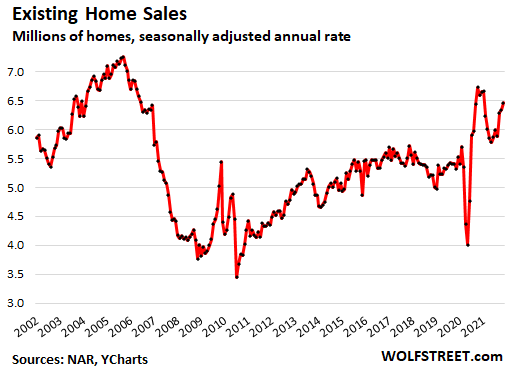

Sales of existing homes of all types – houses, condos, and co-ops – in November ticked up from October, but fell 2% from November last year, to a seasonally adjusted annual rate of 6.46 million homes, the fourth month in a row of year-over-year declines, amid tight supply, according to data from the National Association of Realtors today (historic data via YCharts):

The seasonally adjusted annual rate of sales in November of 6.46 million homes – well below the peaks during the 2004-2006 era – was composed of single-family house sales of 5.75 million (-2.2% year-over-year) and condo sales of 710,000 (unchanged year-over-year).

By Region, the seasonally adjusted annual rate of sales dropped year-over-year in three of the four regions, with the South being the exception: Northwest (-11.6%), Midwest (-0.7%), South (+1.1%), and West (-3.6%).

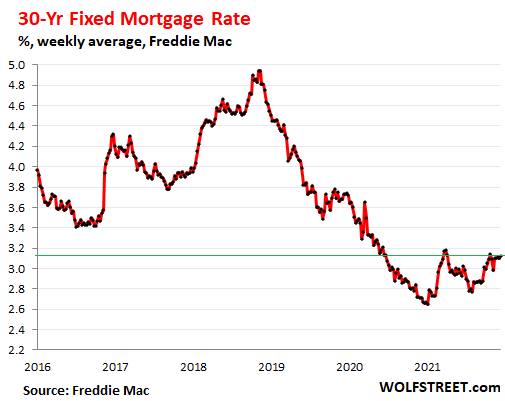

Rising mortgage rates. Part of the impetus to buy despite tight supply and ridiculous prices is the prospect of higher mortgage rates that is motivating people to try to lock in a mortgage at the current rate, no matter what the price of the home.

Mortgage rates have already risen, with the average 30-year fixed-rate mortgage rate going from 2.65% in January this year to 3.12% currently, according to Freddie Mac data. And they are expected to rise further next year. Even the NAR expects the average 30-year mortgage rate will hit 3.7% a year from now.

Buying a home “now” to lock in a lower mortgage rate is a classic reaction to rising mortgage rates, also promoted by the real estate industry. This occurs early on in the rate-hike cycle, and then after rates rise to some pain level, sales volume dries up.

Mortgage rates have risen even though the Fed is still engaging in QE (though it has cut the amount of QE and will end it entirely by mid-March) and has not yet raised its policy rates, though rate hikes are on the table for next year:

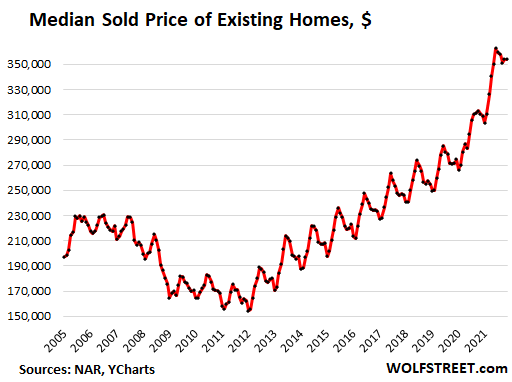

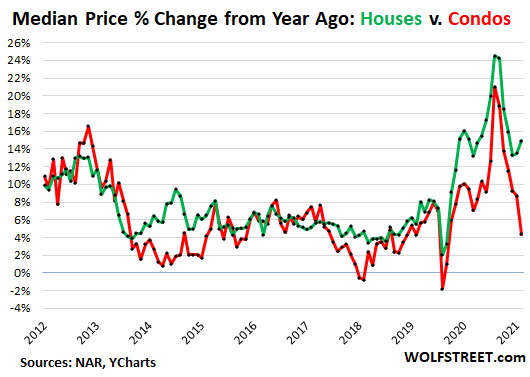

The median price, at $353,900, was unchanged from October and up 13.9% year-over-year. The year-over-year price spike had peaked in May and June at over 23%. Since June, the median price has dipped 2.5%, as seasonality has returned to the housing market.

But wait… houses v. condos.

The median price of single-family houses, at $362,600, while down 2.0% from the peak in June, was still up 14.9% from a year ago.

But the median price of condos, at $283,200, was down 8.9% from the peak in June, and up “only” 4.4% year-over-year, the slowest year-over-year increase since May and June 2020, as the heat is coming off the condo market.

This 4.4% increase is now below the 6.8% inflation, as measured by CPI. The chart shows the year-over-year price changes of houses (green) versus condos (red).

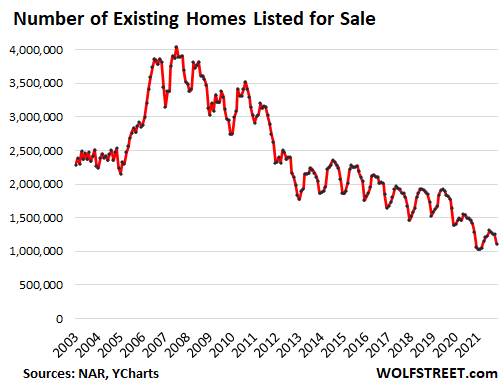

Supply of homes listed for sale declined to 2.1 months at the current rate of sales. The number of unsold homes on the market declined to 1.11 million homes, seasonally adjusted.

Supply is low not because there aren’t enough houses and condos, but because many people have bought new homes without selling their old homes, and they have bought homes as investments, and many of these homes are sitting vacant, with their owners trying to ride up the price spike all the way before selling them. When vacant homes become an investment like stocks or bonds because prices surge way beyond the carrying costs, following ferocious money-printing and interest-rate repression, then this is what you get. But those vacant homes that are not on the market can appear on the market in no time.

First-time buyers go on buyer’s strike. Home sales to first time buyers amounted to only 26% of total sales in November, down from 29% in October, and from 32% in November last year.

But investors pile in. All-cash sales accounted for 24% of total sales in November, same as in October, and up from 20% a year ago. Cash buyers include institutional investors that borrow at the institutional level and individual investors and second-third-fourth-home buyers that have the cash, or temporarily borrowed against their portfolios to obtain a mortgage later.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

i hope the “investors” get burned badly. they’re trying to profit off of america’s misery.

That is what capitalism is all about – profit. Sometimes on someone’s misery but sometimes on someone’s happiness too. Either way, in its ideal form, someone is providing a good or service that someone else wants.

i don’t know what definition of capitalism you are using, but mine doesn’t involve central banks printing free money for their cronies, manipulating the bond market and interfering with free market pricing mechanisms, and letting big corporations write laws in their own favor.

So true, Jake.

Yes. That.

And it will get worse until people have had enough and the shit hits the fan.

A Capitalist oligarchy is where political or economic power rests with a small number of people.

“An oligarchy of private capital cannot be effectively checked even by a democtatically organized potitical society because under existing conditions, private capitalists inevitably control, directly or indirectly, the main sources of information.” By Albert Einstein

True.

Concurrently, most people are in favor of activist government. However, they somehow got the idea that when government has something for sale (tax avoidance and “free” benefits), it’s for the benefit of the people.

On the contrary, it’s almost always goes to the highest bidder which is the rich. Whatever benefits the majority, it’s going to be predominantly at the expense of the middle class. So it is and so it shall ever be,

The only way to get rid of influence buying is to get rid of government selling favors.

+1. The current economic situation is “socialize the cost and capitalize the profit”. This is crony capitalism.

We don’t write the rules, if we’re smart we learn how to play by them.

Sounds like a variation on “No true Scotsman”.

I like capitalism, so the mechanitions of capitalism I like is true capitalism.

Those that I decry are a damned perversion of the true way.

Just like any other religion. Hallelujah

Suck it up. You are out-financed. Sucks to be poor.

And you are gonna do what?

True.

Any ‘insurrection’ should have been in January…2009.

Escierto

Indeed, capitalism is about profit. But for it to work properly, it must exist in a free market. This is NOT a free market with what the Fed has been doing. Last time inflation near (actually quite lower) 1999 and 2006, the 30yr was 6%. Now 3.1. And the Fed promotes this by STILL BUYING MBSs. WHY?

To get things back to normal, rates must be historically normal.

BUT, too many demand that these SPIKED prices be DEFENDED by the Fed. I don’t think that is capitalism….but rather begging and perhaps cronyism influencing Fed policy, which is off the rails.

At what point will the Fed move to control these historic interest rates? As a business owner I am looking at increased costs of 20-25% year over year. I have read their plans of Very gradual increases equaling less then 1% by the end of next year. Alas I believe the Fed has been compromised and Politicized.

Indeed, capitalism is about profit but it is also indeed that capitalism is about guts. Riding the turbulence to your favor requires judgement, action and luck. While we can’t systematically benefit from Fed’s easy-money policy in the past 2 years as all billionaires have, we shouldn’t say we had not been given the opportunity to profit from either the stock or housing market. The question is if we have been bold enough. That is my two cents.

You have read what Karl Marx said about central banks, haven’t you?

Tony – We could all be “BOLD” and support this cronyism or go on buyers strike and do what is best for our country and future generations.

Tony – yes let’s yolo everything, gme, amc…..guts right?

tony, people only had the opportunity to “profit” if they were willing to buy stocks at absurd valuations based on the idea that the fed would keep printing, inflation be damned.

it’s not really reasonable to expect that of average people with some small savings.

That sounds like something they would tell you in fifth grade.

This isn’t capitalism, this is the Marxist money at the fed fueling speculation and map investment.

Agreed. But, the investor backed purchases of homes has been going on for years, and it appears to be well entrenched. I don’t see how a significant downturn is going to root out many of these types of investors. Rather, the next downturn will simply give them ample opportunity to continue their buying binge.

it’ll root them out when they see that they’ve impoverished the entire middle and lower middle class and they can’t pay their rents.

oh yeah, and just wait until all of the renters vote enormous property tax increases onto them.

@Jake W. I wish, but what they will do instead is offer ‘rent support’ to workers. This will split the middle class, as one part is now paying the rent for the other. The real winner of course is the landlords who now collect state welfare using their properties.

Even if they brought in a property tax, by increasing the amount of rent support provided (which is always politically popular free money) they can artificially raise rents to any level they want and mitigate any effects of the tax while having the side benefit of trapping more workers in the rental market.

These guys are smart. It is sadly going to be general undirected anger that tips us over the edge and I have no idea how that will play out.

jon w, i guess we’ll see how that plays out, but at some point, the ability of owners to raise rents will be limited by the collective income of their rental pool. our economy works well for a smaller and smaller percentage every year, and they’re not all going to rent 10 places.

Raise property taxes on them? Ha ha! Of course they will raise property taxes — to force you to sell your property to the hedge funds. 2.5%/yr in Illinois already. Hedge fund property conglomerates will be taxed like farmland while you are bankrupted. You won’t even be able to sit down.

There is a flip side. You need demand to generate new construction. If an investor decides to buy a second home and use it as a vacation home or rent it out, he has generated the demand for a house. This provides about 5000 hours of work for US workers.

You see this around a lot of lake and beach areas where housing construction is a huge part of the economy.

if it’s being rented out to someone as a full time residence who would have otherwise bought one, it’s not creating extra demand. for a vacation home or airbnb, yes, i agree.

The ibuyers – whose model is to buy high and hopefully sell higher , will need to dump properties once the market stagnates or drops.

As for the investors that are buying to rent – once vancancy rates start increasing – and their profits are too lean because they were banking on rental appreciation, they will need to dump properties.

The real question is WHEN and IF there will be a market event with one or both of these catalysts… because that is when prices will really start dropping.

You must own the assets, there is no other game, cash is going to be rendered inert. Bank accounts will be frozen, and if the masses begin migrating to crypto total chaos. Fund managers must own stocks, there is no choice. Depending on whether housing provides a stream of income it is a liability. Vacant land has lost value in the last decade. Your stream of income has to exceed the loss in value of the currency, and the cost to maintain the asset, or you are nowhere. Don’t chastize those who keep trying to square this circle. The assets USG owns are a liability, cost to operate is high, and the tax revenue collected is less than the cost to collect it. Most govt assets are office buildings which have no intrinsic net worth, like a factory with equipment. Commercial RE is really in the tank. Charging people rent who are cash flow negative is like charging you for the air you breathe. The government can’t help you, issuing dollars in disappearing ink. If you are revenue positive you have to have that share of stock and everyday it costs you more. The revenue you extract from the lumpen puts you over the top, but it takes thousands of them to make one of you. Then there is a revolution and not the one you think.

Migrating to crypto?

LMFAO!

Ambrose Bierce,

This… “You must own the assets, there is no other game, cash is going to be rendered inert. Bank accounts will be frozen, and if the masses begin migrating to crypto total chaos” … is total utter mind-blowing BS all the way through, each word of it, for a lot of reasons, including that you cannot own anything other than assets, because cash is an asset too, a short-term loan to the government or a bank or a company that you would normally get paid interest on. And bank accounts will not be frozen. What kind of horseshit are you spreading here? Quit smoking so much dope.

The last sentence far shore Wolf,,,

How some ever, the main thing is to consume more alcohol or other central nervous system depressant rather than any kind of ”stimulant” what so ever!!!

Been there, wrote the book, have the TEE shirt!

They have been destroying the currency for years. Where do they stop? The US dollar is a liability, it represents a share of the national debt, debt paid to resolve other debt. Already some are talking about how the Fed might reduce the monetary base. (bail-ins?) The money supply issues create liquidity issues. The 1% don’t care, they must own these assets, which is America’s industry, at any price. They don’t care if they lose a billion. Elon Musk smokes that stuff by the way. I don’t

Ambrose Bierce said: “The US dollar is a liability,”

________________________________

Stop digging. The hole is getting deeper. Don’t buy the insightful and mysterious revelations the dipshit guru’s throw at you.

AB

Reading this crap is destroying my brain cells.

Read about Zillow if you want a good dose of schadenfreude. LOL. With the coming rise in interest rates, since houses are coming to the point where they are not affordable to most even with the ultra-low, 2020 interest rates, expect prices to plunge. Remember 2003 to 2008.

I know I sure as hell hope they did. We’ve been trying to find a house that’s worth a shit for 8 months. The only houses available are cracker boxes stacked on top of one another or the house with railroad tracks right up the road.

You can get a good deal on a townhouse here in the far Northeastern wasteland of the Swamp, if you are willing to endure a few drive by shootings once and a while, open air drug dealing, or witness some sidewalk BJs from local hookers. Every good investment incurs some short term risks.

Those investors are Chines banks buying up everything in sight.

They are not looking for a profit, they are looking to destroy the US economy and doing a damn good job.

Spotted the Marxist

The middle class is just trying to protect themselves from the government.

Good luck. Buy a congress critter and you might have a chance. Pelosi is too expensive now, but there are still some new less expensive ones.

Quit buying crap ,only purchase needs not wants,inflation disappears

lol. do you actually believe this? it’s wants that have stayed the same or gone down because of cheap crap from china. the “needs” have gone up by enormous amounts.

Yeah I stopped buying food and gas. Let’s see what happens.

From my personnal experience most every Real Estate investment is crap when you first buy it. It usually takes 10 years to break even. Then you start making money. The second 10 years you get into the black. When you sell you can cash in and start the whole process all over again. That’s why I don’t like Real Estate investing. But right now it’s the only game in town.

Hi Wolf,

Great work as always.

Do you have any data about the number of homeowners of multiple homes that have one or more of them vacant? Even with 18-20% annual price increases carrying a second mortgage payment without rent to offset is hard from a cash flow perspective. Especially given the tendencies of most Americans to buy based on the payments. I would assume its more common for people that own a property outright, such as a house they inherited from their parents.

I am also interested in data on vacancy

CTCarver

As I posted many times the figures on vacant homes are totally bogus. I would put the number of refinances/sales of vacant homes in the past year at close to an 85% to 90% of the transactions. We seldom see an occupied home anymore. This is the shadow inventory that is out there which the near zero Fed interest rates, and ulta low mortgage rates has enabled. When and if interest rates normalize this shadow inventory will explode on the market. However, I don’t see that happening anytime soon especially with the prospect of three ultra dove appointees to the Fed just around the corner.

I am hearing a different twist … the main reason people are rushing to buy now because they fear another big price jump in the spring. This is logical. What is worse:

a) 10%+ price jump by spring

b) 25bps MTG rate increase

Answer is a).

that’s a self fulfilling prophecy. if people are buying solely because they think that prices will continue to go up, that will actually cause prices to go up. but it only works until you run out of greater fools.

Jake

Watch the PBS documentary called “The Power of the Federal Reserve”

you can get to it on their web site.

In it, around the 7 min mark, former Fed Gov Fisher ADMITTED the Fed crushed the long rates to FORCE (his word) investors to take greater risk.

This was the objective of the Fed, and for the FED to FORCE investors to do ANYTHING is wrong, IMO.

And how does someone in finance and economics think that pushing investors farther out the “limb” is a good thing. Its a time bomb.

historicus,

I’ve been meaning to watch that documentary for some time and your comment provoked me to finally do it. Thanks, it was insightful (or inciteful, depending on your disposition).

Kashkari is quite smug and he keeps citing “the poor” being grateful and wanting more QE. Listen closely because he admits the only ones he hears this from are the congressquatters representing poor districts. The feel of bile rising …

Duh. Bad for you to get pushed out on risk to fund losers but good for the investors that the Fed was created to help. They needed a bigger fool to buy the bag.

It seems like they should have run out of greater fools a long time ago, yet they keep on coming. Is the Fed printing those too?

Yes. Sort of. They are supplying them. So maybe they aren’t fools because they are getting free money, but yes, all made possible by the FEDs repression of interest rates and our government’s bailouts.

Actually yes. Each month the Fed money from thin air to “buy bonds” and injects around $100B in cash into the system.

That’s the equivalent of 100,000 greater fools running around with a million bucks each month.

Even worse, no one wants to hold any of that cash right now because of inflation.

So everyone’s now a greater fool trying to find a better use of cash than just sitting on it.

Still beats deflation where everyone wants to hoard cash though.

That’s the allure of a bubble risk/ reward. A lot of the biggest gains are made very near the top. Look at housing. Biggest gains made this year. Some will get caught and homes aren’t liquid all the time.

If you have money in the bank, you are being punished by the Fed at a 7% clip.

If you have money in real estate, you made 14% this year.

That quite a swing.

People fleeing cash, but so did the Turks. Then they couldnt keep their stock market open.

The drop in sales is because of a drop in inventory. And any inventory on the market is the “Hey honey, lets put a stupid price on this and see what happens.”

h

So basically YOU misinvested.

You want it to work the LAZY way – by high bank interest rates.

You could have invested in real estate and MADE money.

Try taking personal responsibilty.

you’re either being sarcastic or you’re a troll or an idiot. which is it?

Take personal responsibility for the Fed printing money causing asset inflation?

Only JPowell can do that.

OTB, I would suggest it’s ok to have people out there who focus on other matters than committing their time and efforts to keeping up with financial markets.

The problem is the over-financialisation of our economies, and the snowballing of aggregate debt brought about through the need to obfuscate the long ongoing real decline we are actually experiencing as the average person’s life gets harder and harder. This process increasingly rewards capital and punishes labour.

Punishing those who don’t get into the rat pit to battle it out with those who are far better equipped is not a good idea in terms of maintaining societal tranquility.

Here’s the deal…..h ( hystericus)

has been screaming into the abyss in post after post after post after post…..because he cannot throw money in a bank CD and make 7 % anymore.

His personal responsibility lies in INVESTING in things that MAKE A RETURN……real estate or a business. Both of those are hard work….and he’s having none of it.

The Fed had closed ONE investment door…. not ALL of them.

Cave – Yes indeed ! Taking personal responsibility for your investing CHOICES. h wants the EASY bank CD route. Work at the investing a little, bud.

Salt – Granted those who are distracted by other life concerns make poor investors. Investing isn’t for everyone – choose your parents wisely, marry well or work until you drop. That really is…all there is.

The only houses on the market here in the Swamp are overpriced crap. Like the used cars on dealer’s lots. They are the houses that nobody wants. Meanwhile the few pristine properties that are put on the market are still going up 19% YOY. I’ll get a better idea of what’s going on here after Jan 1st when we go back to work.

Same here in the midwest SC. And the overpricing is severe enough in some cases to be humorous. Looking up the prior sale price on homes is quick and easy (using the County auditor’s web site or Zillow), and the magnitude of the difference between the current asking price and the previous sale price is (almost) funny.

I’d bet there is a small population of sellers who have said to an agent “I don’t particularly want to move, but if you can get this price for the house I’ll do it.” Sort of a “pay me enough and I’ll move” approach.

I’m sure as hell not playing that game as a buyer. I’m (eventually) looking to buy a house, not fund someone else’s retirement. Better to wait until this game of musical chairs comes to an end.

cold in the midwest, yes. it’s like people who list their overpriced crap on craigslist for months and months. they have no real intention of selling. it’s more like “if someone is dumb enough to pay me this price, i’ll sell.”

that’s what’s going on in the housing market, both for sales and rentals.

Here in small town southern British Columbia sky rocketing house prices and rents have recently (last two years), made accommodations all but unaffordable for most.

One trend I have noticed from some of my long time home owning neighbours is the impact that rapidly increasing home equity has had on their wealth perceptions. It ‘seems’ like finally winning the lottery after penny pinching for so long!

Some have quit work all together and are unlocking and spending huge chunks of that increased home equity on things like second homes, stocks, cars, motorcycles, garages, landscaping, renos and their kids concurrent inflated desires.

Others who were already maxed out on their home equity lines of credit have increased it every step of the way, confident and cozy with that ever increasing home value. Still others have used up that instant equity to add a rental suite to their home (at a very expensive time to do so).

Much of this follows from the squeeze that urban inflation, work from home and lifestyle refugees from Vancouver, Kelowna, Toronto and yes, even Idaho, have put on our ability to accommodate. (There are even a few homes on my street that were bought for ‘trust fund kids’).

The trend is your friend until it isn’t and this new increased debt in a housing downturn will, I fear, set up many of my formerly prudent neighbours swimming in insolvency.

Easy come, easy go and they’re gone!

“the main reason people are rushing to buy now because they fear another big price jump in the spring”

And they fear that because it’s the primary talking point for realtors. Alway has been.

This is my last time I will comment on the guy building tiny homes. I looked up his story. He was a developer that was worth $12 million and lost everything in GFC. All he he had left was his tools and work truck.

He has been building tiny homes for four years. He is taking preorders for a standard 8 X 16 low cost house with a living room/ bedroom, kitchen and bathroom for $20,000.

It’s ready to live in, but you will need to make it pretty. He has orders for 17 and hopes to get orders for 60. He is going to build all at one time on a production line. Takes about 2 days per house. Name of company is Incredible Tiny Homes.

Might be a piece of junk, but for person that has lost hope and feels trapped it might be an option.

The tiny home phenomena is puzzling. If you pull it around like it’s a trailer, that’s one thing. To attempt to place it on a residential lot – with the required potable water supply, sewage disposal (septic or city connection), electrical connection, zoning compliance, etc., is another matter.

Sure, you can go “off grid” somewhere. Get a composting toilet you have to dump somewhere. Haul in water. Rely on solar and batteries. But you won’t be doing that anywhere near civilization as the zoning and county inspectors will see to it that you can’t.

Then you can have your very own $20K garden shed. Or pay thousands to dispose of it at the dump.

Can’t think of too many people that aspire to a modern day Vardos for full time shelter.

Where do you put a tiny home of his if you buy one? Buy a piece of property out in the boondocks somewhere? Even that is expensive and has to have utilities. I didn’t see much mention of that on his site except for some properties that are in the wilderness and all leased out.

Lots of desperate ads in this neck of the woods pleading for somewhere to rent, buy or park something on, even though it’s illegal to pull up and ‘plop down’ anywhere in town and good luck plowing that out of the way pirated spot at the end of the disused forestry road in the winter.

According to local news articles some of these ‘camps’ have been burned out or stolen. People lost everything with no recourse to insurance or the law. Nope…you want to be legally in or very close to town.

The few I know living in tiny houses are at the good graces of parents or friends with rural home spaces, essentially a glorified tree house with resale value of…?

Some I have seen, managed by buying a lot, self building a livable garage for the first couple years, then gradually constructing a small house and renting out the vacated garage. Amazingly enough, my new neighbours went this route for under $250,000. It took over three years but the garage renters now are paying off the modest mortgage and as per rental contract…shoveling the driveway!

The stats here point to HIGHER prices, not lower prices.

1. “Inventory is low” – 2.1 months supply. This is insane! There’s NEVER been a market with such low inventory – EVER. A “balanced” market is at least 6 months’ supply and 12 months isn’t uncommon. Nothing is happening to increase inventory. On the contrary, supply disruptions & rising labor & material costs cut builder margins, resulting in FEWER homes built.

2. “Interest rates are rising” – 3.17% is historically LOW. Even if rates go to 3.7% they are still historically LOW. I have properties with mortgages at 6%, which was low at the time, but I’m not selling them.

A move to from 3.12% to 3.7% raises mortgage payments from $1,215 to $1,386. Yes it’s an increase, but at 6% it would be $2,065 – 70% higher than now. So EVEN 3.7% is CHEAP!!! and 4.7 too.

3. “24% percent of buyers are CASH investors.” Investors who buy cash don’t turn around and sell because interest rates go up 1%, or 2% or 4% because when interest rates go up, so do rents and so does ROI. Those houses are OFF THE MARKET for the foreseeable future. Result = LESS inventory.

Someone please give me a plausible, ECONOMICS BASED reason why real estate prices should crash, because based on today’s facts and even based on projected facts, I don’t see substantially lower prices, just wishful thinking.

CCCB,

You’re funny. You are a real estate broker in Florida. So “wishful thinking” — as you call it — is what you do as part of your profession, and you sell wishful thinking. That’s how you make your living. And that’s cool.

I don’t know what you were doing in 2005, but clearly, you have no memory of it or what came afterwards in Florida. Or at least you expunged that memory because it became inconvenient.

But you might want to read up on it…. rising interest rates, super-inflated prices but not as inflated as today, loosey-goosey lending just like today, huge buying by investors, just like today, that then walked away from these properties that they had in an LLC when it wasn’t fun anymore…. The parallels are all over the place.

But did I say something to the effect of “why real estate prices should crash,” as you said? No, I didn’t say “crash” all. There was not a single word of a “crash” in the article. That’s your wishful thinking or something. You’re twisting and fabricating stuff. Glad you’re not selling me any real estate.

I think the people buying in 2005 had real exposure due to taking on a mortgage with so little down or ARMs etc. Today, with nearly 25% of people paying cash, that means those people already have the money from some other investment. They won’t need to sell if rates go up or prices come down.

The supply chain issues seem valid too. In total it’s not easy to see where extra inventory is going to come from. I’m not a realtor. In fact I’d love a housing price decline, but unfortunately I don’t see any data to support that in 2022 short of a black swan event. The housing market is unreal, but here we are.

“Today, with nearly 25% of people paying cash, that means those people already have the money from some other investment”

Or that they’re borrowing it from a source other than a mortgage lender.

Pea Sea,

Maybe. I’d be interested to hear where. My impression is many people simply have the money.

in my experience, many of the people paying “cash” are borrowing the money from family as a bridge, are borrowing from a third party bridge lender, whose sole purpose is to let people make “cash” offers, or they’re people spending cash they have because they’re so emboldened by their stock gains. ifthe stock gains disappear, watch those people sell.

Jake W

Good points, especially about new services that let people offer all cash without having cash. Family money has always been a thing. Also parents sometimes take out equity loans for the kids, but that’s still a bank loan. Either way I don’t see why the parents or kids would be forced to sell if rates rise.

I think people are underestimating other factors: cash outs from stocks and stock options, people who made more money than we realize in crypto or tech, foreign investors, people selling a house in a HCOL area and moving to a LCOL area, etc.

It feels like there is more cash out there than at any time in history.

Orion,

10% of the homeowners in 2005 caused the mortgage crisis. Not the other 90%.

Wolf

I like this reminder. Thanks.

orion, what i’m talking about is not using family money to buy, but just using family money as a bridge so you can make a cash offer, waive financing contingency, and then get a mortgage a month or two later. also, if any significant number of people were selling stocks to capture those gains, the prices would plummet. it’s more the “wealth effect” we’re seeing.

Jake W

Then it’s still a bank loan, only delayed by a few months in your example. My point is 1) those people have no reason to sell when rates rise and 2) people definitely have made money in this stock rise and also crypto, and also by selling and moving, and foreign investors also bringing in cash. Even if a few people used bridge loans from family I don’t see that changing the larger dynamics.

Jake W

Also way more people are invested in the stock market than are buying houses at any given time. Two different scales. Millions of people are invested in stocks, whereas hundreds of thousands are buying houses in the US (and only 25% of those are using cash). Those capturing stock gains (or stock options) and buying houses in cash are not moving the stock market, but they are moving the housing market.

my point is that it won’t get counted as a bank loan. so the 25% is actually lower than that. that was my point.

Florida is seeing population growth, unlike California. It is not like all these are Airbnb rental projects. I did hear from someone with a contract to buy a Florida home to use as a winter residence in retirement and hoped to rent it out via Airbnb in the summer. I told him most people do not vacation in Florida during the summer. He thought people attending weddings might rent it.

China is seeing a rare housing downturn with real estate developers defaulting. They have a city of 13 million locked down over a few virus cases.

Florida is VERY popular at all times of the year these days DH, unlike ”before Mr. Carrier’s screwing up our state,” when almost all the ‘seasonal visitors’ went home at the end of March and the rest left in April.

Back in the ’40s, our family would rent a house directly on the beach in summer, and dad would show up on the weekends from ”in town” usually 20 miles away, but frequently requiring a ferry ride in those days.

BTW, many of those houses would now be in the water at every tide, some in 3 feet or more at low tide these days… Erosion is certainly part of that equation, as they were all on what are, in reality sand bars off the mainland, AKA Barrier Islands.

Florida is great until the next hurricane hits is square on. Then RE prices become attractive (once again).

CCCB may be selling Wolf, but clearly you ain’t buying!

CCCB

You sound like one of those show prep shills for Lawrence Yum of the NAR.

1) Instead of cutting their losses, those who escaped the cities and bought

a house in the suburbs, or the flyover, expect prices to recover, as the always do, as they did after the 2008/09.

2) But what if wave three is waiting for SF & NYC.

3) That’s fearmongering, conspiracy bs..

4) Condos are down in real terms. Houses are head and shoulders, at

13%, getting support from 2012 high, > the CPI.

5) Chuck days might be numbered. Squeezed by the left and by a new

Turkish threat, from his right.

Car dealers pushing 2021 models, but 2021 is gone.

ME:

Car dealers always “push” model year end products. There’s an industry term for it: Model Year-End Clearance.

In the automobile world, there’s this thing called “curtailment”. The lending institutions (floor plan) require the dealer to pay down the balance on prior year vehicles, which can ding available cash if the inventory is large enough…. so the dealers attempt to give the impression that there’s a “fire sale” at both calendar year end and model year end to stimulate demand and move the obsolete inventory that is usually made up of the cats and dogs (like 2WD SUV’s in Montana).

Happens every year.

I’ve seen in the past, Condo’s were the last to go up in price and the first to drop. Looks like this may happen again.

ridgetop

So far this has not happened yet. Condos are still appreciating here in DC though not as much as townhouses. People still need a place to live. Condos are a bargain.

Ridgetop – Yes, that’s what happened in 2005-2008. When the market turns, the bottom falls out first in condos, townhomes and duplexes.

There are always people who need a home and will buy whatever is available, but price trends are set by the marginal buyers, the ones who have a choice, and the balance between speculative buyers and sellers is a really strong function of those price trends.

When price increases stall out (as they have for condos), the flippers switch from buying to selling. That shift in demand causes prices to start falling.

Easy there, bubba…

I’m assuming a degree of morality…

Where in the definition of capitalism do you find the sidebar of morality…

You don’t….

Morality in capitalism is a sure fire way to go broke…

Escierto is correct in the basic sense of all being fair and equal……

However, many are also convinced (as am I) capitalism has been bastardized and tilted to favor a select few recipients…

Let’s encourage debate…

Sorry… was supposed to go above to the idiot comment…

The idiot comment got whacked about the same time you posted this. So by the time you hit “Reply,” the idiot comment that you replied to was gone, and your comment is now floating out there by itself :-]

My girlfriend secured a reverse mortgage in July of last year. It was appraised at $438K. She decided to refinance the loan. The same appraiser came in at $630K today. 45% appreciation in 17 mos. I did the same thing in May, but only experienced 33% appreciation over 15 mos. We are in northern California. Top anyone?

OK, now sell to see what your house is actually worth.

Wolf, She lives in Sutter Creek. The Bay Area refugees have “discovered” this tiny town. Everything sells within days for cash. I am a total housing bear. This will end in tears!

Putter, those numbers are inline with what I am seeing in SoCal beach zips as well as suburban high end east coast areas. About 40% would be the number I stick on these which is in the middle of your numbers. I guess the big gains are everywhere.

“Supply is low not because there aren’t enough houses and condos, but because many people have bought new homes without selling their old homes, and they have bought homes as investments, and many of these homes are sitting vacant, with their owners trying to ride up the price spike all the way before selling them.”

Wolf, you keep saying this but I still don’t know where you are getting the data to support this being a significant reason for low supply.

Are there any hard numbers anywhere that tell us how many houses sit vacant after their owner-occupants buy new houses and move?

If you own a vacant home in a desirable area, they are converted to short term AirBnB rentals. Unregulated and untaxed in most areas.

Ski resort towns are getting hit hard since there is a lack of long term rentals for workers due to increasing short term rentals. Why sell your second home when you can make a great return renting it to tourists?

Is this happening in big cities?

How is the hotel industry doing with this competition?

I don’t doubt that, at least in some cases.

But what I’m really wondering is how *many* people are doing what WR says they’re doing: buying new houses without–as used to be customary–selling the old ones. I don’t doubt that the number is nonzero, but is it really large enough to be depriving the market of a traditional source of supply–enough to be a significant driver of this bubble?

“Ski resort towns are getting hit hard since there is a lack of long term rentals for workers due to increasing short term rentals.”

Our local ski resort bought a former nursing home in town to house workers for that very reason. A local ‘development’ of tiny houses is supposed to be affordable housing.

Our county is attracting so many out-of-state retirees that the median age for the county has increased — it’s getting older.

Short term rentals of less than six months are taxed 7% in Florida. That is the sales tax rate.

What happens when there are more retirees in an area than workers?

Basically Naples, FL

where i live, i see tons of investors buying houses and listing them for rent, but they’re renting them for way more than they’re worth, and they see on the market for many months. i get the impression that these people don’t really have any intention of renting them out, and are only buying them for the capital appreciation.

Sounds like China.

Rut RO…

Why leave the old spare house vacant when you can rent it out for top dollar in a hot rental market where rents in many places are rising at 10%+ annually over the last year?

Earlier folks may have been concerned about eviction moratoriums but that concern seems to be in the rear-view mirror now.

“But the median price of condos, at $283,200, was down 8.9% from the peak in June..”

Condos are generally in cities. People are leaving cities for suburbs and rural areas. Is it that simple?

There was a person that went by the moniker of Big Fat B…..d that used to post on another website.

Wonder what he would think of this Condo mess ?

I have been to several national development site in SE states. What I found is that they have been releasing only 3 to 5 plots each month even when they are building a community of ~150/200 houses. First I thought this is might be due to supply chain issues but after and talking to the people working there they have already selected the colors, kitchen cabinets design, etc (no customization or selection options) and they want buyers to bit for the desired lot. It seems they are artificially suppressing the supply to get maximum profit.

Here is another crazy experience. A ~35 old house was on the market for one day and the seller agent already had multiple offers above asking price (asking price of ~500k) some without even looking at the property. The seller had no information how old/condition the roof/havc etc. This property was bought by the seller couple of months ago for 400k. There were no upgrades/renovations made to the place, was just sitting empty for last couple of months.

I have come across several such situations where some one bought it this year and then couple of months later put it on the market for ~150k more (no upgrades/renovations).

Apart from individuals doing this ever one knows Zillow/open door, etc have been doing the same.

that’s usually the sign of a top, when people are doing stupid things like that.

I now see bubbles as psychological events disconnected from economic reality. And they can go on far longer than most consider possible. That said, the condo saying of last to fly, first to die applies, and Wolf is correct to point out the cracks in the flight to the moon.

Trees don’t grow tall enough to scrape the lunar regolith, and housing is already far beyond the average ability to pay, and into the realm of stupid levels in many places.

Right now in Los Angeles, the average home is nearly $900k, and the average worker would have to devote 100% of takehome pay to cover a 30 year mortgage payment with 20% down.

So, this is now clearly impossible for most families, and will require levels of occupancy not seen since the second world war.

But hey, the market is flying and all that money is flowing here with the big cash out retirement crowd. And when it goes south, well, back to the future, again.

Lather, rinse, repeat.

We’re being lied to:

“Big banks are temporarily closing branches in the Bay Area and across the nation as they cope with labor shortages and ongoing complications from Covid-19, including the arrival of the more contagious omicron variant.

“Many of our locations may have reduced hours, alternate days of operations or may have been temporarily closed,” Bank of America (NYSE: BAC) tells customers on its website. “We are doing everything we can to reopen as soon as possible, though some locations may remain closed for an extended period of time.””

I have a nose for bullsh!t, and this reeks.

Depth Charge,

Update: Big banks have closed branches for many years. This started over a decade ago. You don’t need to go to a branch anymore to do your banking. You can do nearly everything online or at the ATM, including depositing checks. In fact, you don’t even need to go to the ATM anymore to deposit checks. You can do it with your smartphone. My branch got closed three years ago — the one where I had my safe deposit box for my data backups. Had to find a new branch that offers safe deposit boxes. That’s the only reason I go to the branch. And branches are expensive to operate: salaries, real estate costs, equipment costs, etc. There’s no reason not to shut them down when the lease expires.

Wolf, I agree with everything you said. I rarely go to the branch myself. But something about this press release and how this is being handled is suspect. I could be wrong but if you read the article there’s something not right about it.

I posted it because I think it’s pertinent to the stuff you cover. There’s more going on right now than we are being led to believe. Perhaps there are some cracks already developing in the banking system.

I rarely go into the bank, Wells Fargo, anymore. Use the ATM machine for almost everything. Have my safe deposit box for emergency cash and some valuble documents. I like the idea, Wolf posted of putting back up thumb drives in there. That’s my next big project.

I agree about the strange situation in banking. My son arrived at his new apartment in Santa Monica on a Sunday so to get the keys he had to pay with a cashiers check or cash for first month and deposit. No payment in advance was allowed and no cards. California landlords seem to be afraid of someone moving in and reversing payment then taking advantage of eviction laws. So when he went to get a cashiers check he found that over half the local (PDX) branches of one of the big 3 national banks were “temporarily” closed. Found a big branch in the burbs that was open but only a single person ( branch manager) was there. He told my son all the employees had quit, or gone for various reasons and he hoped he would get more next week. Usually a staff of 8 at this branch. Big brand new stand alone one that was built only 2 years ago. I saw the same thing at my bank yesterday Only one guy when there usually 6, but a different bank than my sons .

I don’t think they quit. They were probably fired because of the you know what. Heard this is common in CA now.

Would a postal money order work in that situation?

(Germany)

In 2009 the former industrialized states were bankrupt.

We (my wife and I) built in 2009 (Hamburg, harbour city) with 25% capital 75% loan.

I expected mortgage % 20% yearly return on my invested capital.

I advised my family/friends to do the same (which meant: not to sell anything until 2019 if they already owned something)

The funny part here : I started thinking with ‘all of us are bankrupt’

Living has become expensive in Germany for normal people.

Here is my question: is my home that much worth or is your money so worthless ?

I think it is a combination of both.

Most people in Germany seem to think that ‘we’ (germans) became richer.

(forgotten details)

starting capital: 90

if I would sell right now: 1250

repaid loan: -178

interest: -79

outstanding loan: -104

saved on rent: 136

sum: 1115

Been there lot of times, beautiful city good food, but house prices are nuts. My colleagues would usually complain worrying about how the next generation will be able to afford housing.

Most won’t be able.

In my opinion this is wanted/risked.

When EZB buys italian bonds it had to buy german (greek, french, …) bonds, too.

German banks refinance loans with (10y-)German bonds.

This means: Italy is bankrupt and ezb buys european bonds to prevent the Euro from blowing up -> german housing prices will go up because money becomes too cheap.

Everybody is screwed and the most important thing to know is how does the ezb effect reality.

In the end there won’t be any craftsmen able to find a home because italian pensions (just picking something) are unaffordable.

Time to say good-bye to the former industrialized nations and look for a better future somewhere else.

That’s what I’m telling the younger ones: gtfo ! (if you have any skills)

To get out of Germany/Europe you need some skills (and/or money).

Fed is making it hard for people to do economic calculation. If I have a million dollars and broad stock market pays 1.2% dividend, and 10 year treasury pays 1.4% and cash pays zero, I am asset rich and income poor especially if. Inflation is running hot.

A million dollars in assets might be worth only a very small real income today even if depleting the capital over 30 years. If current situation were to continue it’s nearly worthless for retiree income.

Citizen AllenM above makes the big point that everyone seems to forget: The housing market grinds to a literal standstill if people cannot afford to pay for the homes. I know investors can still buy them, and trade them back and forth for small gains, but when rents approach and surpass monthly mortgage payments (we are nearing this if not already there in many places), you end up with a lose-lose. This is basic economics. If your target market can’t afford your product, it’s too expensive. For example, I am not too far from our esteemed Mr. Wolf, and down here in my swanky part of the South Bay, homes are 2.5-5 million for something that isn’t a dump. I’m 33, I earn 150-170k in a good year. It’s beyond the realm of reality that I will be able to afford a home here. Now unfortunately silicone valley mints tech millionaires like crazy, so I’ll probably never be able to buy anything here, but this market is a great example of how an average wage earner cannot own a home right now. Last I checked I earn a decent living, but it’s no where near enough. If I were to move somewhere else, my salary would be far lower and I, like most Americans would have to deal with the same crappy ratio of income to home expense, and it’s simply not feasible. So where do we go from here? How long until wages simply will not support this insanity any longer?

In NC you still can do OK if you live 40 minutes out from Raleigh or Charlotte. My daughter and her husband are engineers in their early 40s. Bought a lovely home 2 years ago for less than 2 X income.

My friend who is 51 bought a 1400 ft higher end home for just over 2X income 4 years ago.

Houses have have shot up a lot in the last two years, so to me it’s not time to buy

Work at home money keeps moving to San Diego. Good luck finding anything in the 800’s anymore. 4 out of 5 new listings near SDSU start with a 1. Prices will keep going up here for a while even as rates go up.

Do the numbers even work in high income high tax areas if you don’t get continued appreciation? If you make $200,000 you certainly take home a lot less than that. If your house is $1 million your taxes, insurance and maintenance is a huge number.

CoreLogic released their October Single Family Rent Index (SFRI) a couple of days ago. They reported a year-over-year increase of almost 11% in single family rents nationally and a trend of accelerating rent price growth.

So the increase in singe family house prices of about 15% nationally over the same period seems to be mostly explained by changes in underlying rental earnings potential from these houses rather than a speculative bubble.

This is why cpi is going to most likely run between 5% – 10% all next year unless economy rolls over. Their stupid method under reports and lags real world housing inflation.

Yep, The rental data is completely outdated and incorrect to boot. It is designed to keep a lid on the CPI Inflation to con the SSA receipients and other Retirees of their COLA’s. I can go on my computer, the one I am using right now and get more accurate data than this bogus data that the government puts out about owner equivalent rents. Rents are going up and doing catch up. The gap shown in these charts will be closed. Anyone holding City Condos and townhouses for investment, which are in good locations and relatively good condition cannot lose by holding on. The appraised values will go up as the rents go up. Rents will drive the market values. We own one in Dupont Circle in Washington DC and that’s what is happening as we speak, in spite of the pandemic.

Rents in San Francisco are still down 25% from July 2019. In lots of big cities, rents are still down from the peak. In others, rents are surging. Nothing is that simple.

The rents went down here shortly after the pandemic broke out in March 2020. Now they are back to where they were before the pandemic in the desirable locations. Since this is a government town we are not as affected by the economic disasters in Business Centric Cities like NY and San Fran. The only direction now is up. I see rental bidding wars in the very near future.

Dazed And Confused,

This chart compares single family house price increases v. single family rent increases over time.

Wolf,

Your article is about year-over-year price increases and my comment was about this time period specifically.

I know that your chart covers this period too BUT as you and others have pointed out multiple times, the CPI “owners equivalent rent of residence” measure is a lagging indicator.

You posted some articles showing that other more timely measures of rental inflation are running at 10-15% nationally in line with the figures I quoted from Corelogic’s SFRI.

i don’t think the rent increases will stick. in my experience, the people looking to move are those with more money, and a lot are doing the wfh thing right now. but if they’re asked to come back, they’ll have to give up the apt.