The supply chain mess bogs down home construction.

By Wolf Richter for WOLF STREET.

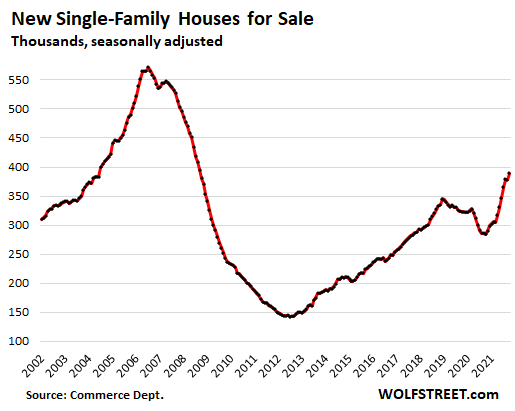

The inventory of new single-family houses that homebuilders put on the market for sale rose to 389,000 in October, the highest since September 2008, according to data from the Census Bureau:

These houses for sale are in all stages of construction. When you go to a new development, the homebuilder has already completed some houses, but others are under construction, and others haven’t been started yet. If you buy a home where construction hasn’t started yet, the homebuilder will offer the most choices in terms of the appearance and finishes of the house.

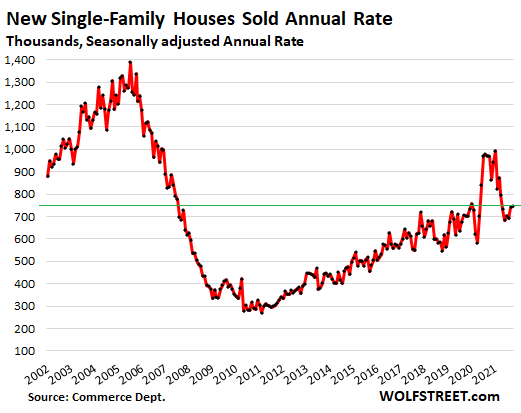

Sales of new houses at all stages of construction — not started, under construction, and completed — fell 23% from the pace at the same time last year, to a seasonally adjusted annual rate of 745,000 houses.

As the chart below shows, sales of new houses have long been far below their 2002-2007 heyday, as housing demand shifted to condos and apartments in urban cores, triggering a large-scale construction boom of towers and mid-rise buildings, that are not reflected here. Here we’re only looking at single-family houses:

Given the rate of sales in October, the supply of new houses for sale, at 6.3 months, has now remained roughly at the same high level above 6 months since June.

So what’s the deal here with this pile-up of inventory?

Homebuilders are struggling with shortages of all kinds, including shortages of windows and appliances, and completing a house has become a complex task of dodging supply-chain chaos, where builders are trying to find substitutes for the things that they cannot get. Houses remain under construction with no activity while the builders wait for supplies to come in. Other projects are being put on hold or don’t get started due to the supply shortages.

In addition, homebuilders are facing rampant price increases in materials, and they’re facing labor shortages that cause them to increase wages, and contracts can reflect the uncertainty about those price increases and could get the buyer stuck with higher costs.

Construction costs spiked out the wazoo.

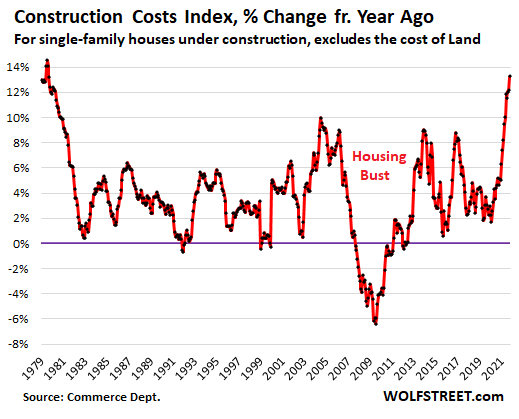

The index for construction costs of singled-family houses spiked 13.3% year-over-year in October, the worst year-over-year increase since 1979, and by 18.5% in the two years since October 2019, according to data by the Commerce Department. Construction costs have jumped year-over-year by the double-digits every month since May. This excludes the cost of land and other non-construction costs:

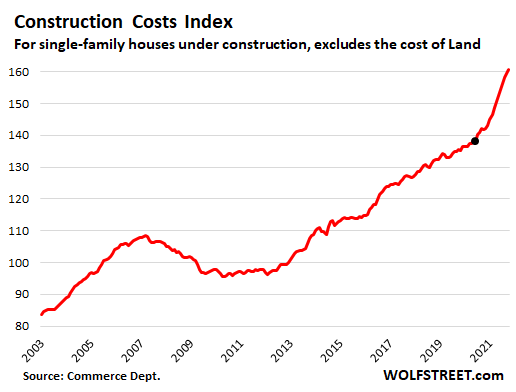

In terms of the index in the chart below, not the year-over-year percentage change, you can see the spike in construction costs taking off in June 2020 (black dot), and has been relentless ever since.

During the housing bust, construction costs fell 11.5% from the peak in April 2007 through May 2010, and then didn’t really move much for another two years. The opposite is happening now:

A peculiar effect: Inventory for sale by stage of construction.

Given the uncertainties around getting the house finished in any reasonable time frame due to the shortages, getting all the appliances installed, etc., and knowing what the final price is going to be, potential buyers are reluctant to buy a house under construction or one where construction hasn’t started yet. And that inventory sits.

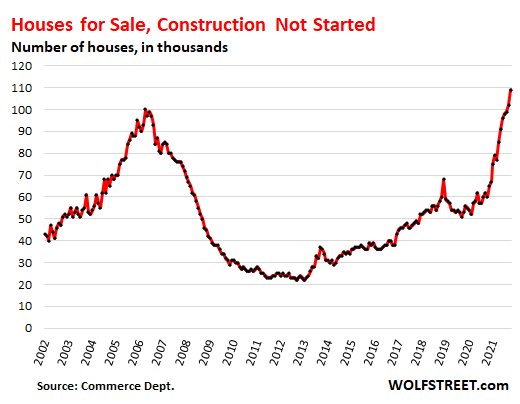

In October, a record 109,000 single-family houses where construction hasn’t started yet were on the market for sale, amid a thicket of shortages and delays. Note that in the run-up of the last housing bust, houses for sale where construction hadn’t started yet peaked in April through June 2006, just before the whole schmear came apart:

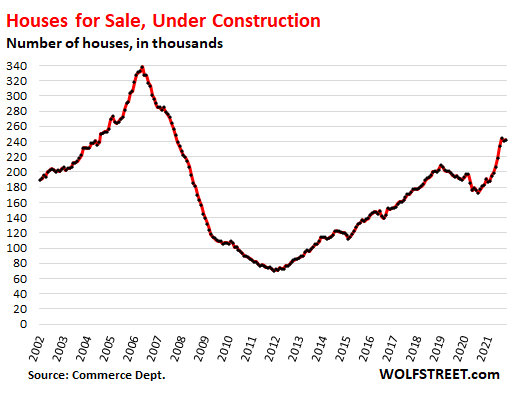

Another 242,000 houses were under construction in October, in the same range as over the past two months, the highest since the peak of the last construction bubble:

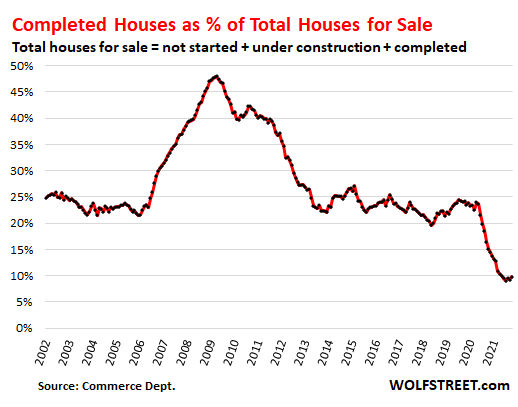

But completed houses for sale, at 38,000 houses in October, remained near record lows, beaten only by the prior months this year, and accounted for only 9.8% of total houses for sale, just a hair above the prior months, which had been record lows in the data going back to the 1970s. The 25-year average of completed houses for sale as a percentage of total houses for sale, at 28%, is nearly triple that:

There is strong demand for completed houses, and inventory of completed houses is very low because houses are now a challenge to complete, amid the supply-chain mess. But the sudden cost increases during the construction process, and the delays due to shortages, ripple through to people who’d bought an unfinished house. And that’s not good for the builder or the buyer. And that part of the market has gotten mired down.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Hurry up and buy!!! I will print more money, thus creating hyperinflation!!! Your salary will keep increasing and you will be able to pay it off in one paycheck!!! Buy!!! Buy!!! Buy!!!

Wolf showed a chart with the number of houses for sale, for which construction has not yet started. We’re at the same point now as in 2006, “just before the whole schmear came apart”.

And you know what’s to blame for that? It’s all the Schmiergeld in the economy.

Inventory is lowest at the top.

Might be a good time to consider more cost effective building approaches.

It seems unlikely that there are not significant evolutionary possibilities.

A wolf in sheep’s clothing beware

I have been looking for 2 years. I’m not enthusiastic about buying now. It took the wind out of me. I have no debt and have a down payment for a house. I came out underwater the last housing crash when we had to move for job reasons. This feels worse in other ways. I don’t care if houses keep going up. I’m staying put until things start to settle down.

And I don’t have to read Wolf Street to know that things are very very off.

Smart move, but don’t expect there to be anything like 2008 at least in the next two years. The more likely outcome is that housing peaks next summer, IF (and it’s a big if) the FED holds to its 8 month MBS taper. Then, there probably will be a 5-10% decline over the next 18 months. We’ll know more by March 2022 as if the FED will be forced to raise interest rates sooner rather than later. If you’ve waiting 2 years, one more isn’t going to hurt.

In some ways the situation is better and in some ways it is worse.

It is better in terms of less sub-prime lending, so there will be less foreclosures. Also, with the big price spike, most homeowners have plenty of equity. But the offsetting factor is that interest rates are so low that it is nearly impossible for them to go lower and very likely that at some point they will spike higher. Much higher interest rates at the tail of an increase in prices will mean much less demand and eventually, as homes come back on the market, inventories will build.

I think that we see a longer, but slower, fall in home prices than in 2008. What might continue to kill home prices is higher interest rates.

But real estate is all regional, so we will continue to see big variances in different regions.

Sounds like Jay is engaging in magical, wishful thinking. Housing prices ’round here are 50% above LAST bubble peak, and every single person I talk to tells me “it’s different this time and is not going to crash.” That furthers my belief and resolve. This pig’s going down BIGLY.

If you use a high quality rent vs buy calculator it is going to ask you for inputs regarding inflation and alternative return you are get on the money. Fed has made it nearly impossible to get a proper answer.

Now housing is mostly a highly leveraged asset market that is easy money in the boom and wipes you out in the bust.

Send it JPOW! U have a OMICRON MANDATE! Make us 409K rich!

Futures UP!

A plethora of articles have already come out saying that this new “variant” has suspended FED’s plans to taper early. You can’t make this sh!t up. Inflation doesn’t give two focks about Wall St.

Those articles are part of the Crybabies on Wall Street.

They’re not so much reporting what the Fed is doing as telling the Fed what to do.

What so much of financial journalism has devolved to.

Dear Relentless street readers,

The take home message is Prices of homes are not coming back. OTK?

1. The working class poor cannot get increase in salary by any means.

2. The house prices are not falling down because of the FED

3. These two points means, house prices cannot reduce beyond their current level. Although there might be fluctuations.

4. The prices will be, at the current level are not friendly to the poor or even the working class and increasingly the middle class.

5. The golden age of middle class in west is over. Middle class are what it means.

6. Better than poor. Cannot afford the wealth of the rich. Will not qualify for the welfare. Education means nothing.

7. At the current inflation, money printing and economy, houses will be a trading commodity. Traded between wealthy and upper middle class and investors and pension funds.

8. If you own a home, do not sell it. If you want to buy a home wait or fuggetboutit.

9. House is an empty building without any families.

On families, yes, imagine renting a 728 square foot apt for 3K and trying to have a family. This is why we need immigration as the population does not even replace itself.

Education does not mean anything and I wonder how it will continue on.

The new political/economic construct totally ignores the traditions we have all been raised with and the new motto is much like playing King of the Hill with boots in the face for those who compete with you, especially low wage people in foreign countries.

We here at the upper end of the age range have tasted of success and freedom. Now it is survival and control. The younger generation do not even know what freedom is and how it works.

“The younger generation do not even know what freedom is and how it works.”

That statement resonates, although I don’t quite know how to describe or define what provides that freedom.

I just think if the late 50s, and the early 60s when I became a teen. You could drive from San Francisco to Seattle, and almost just go off the highway and find a random place to camp, no problem. A couple decades later, everywhere I drove or visited had the primary directive of sucking money out of me and keeping me “off the grass.”

Back in the 50s and 60s, you could almost throw a dart at a map, go there, and get a job that would provide decent support and room to develop yourself if you were competent.

Maybe, all other things being equal, increasing population pressure reduces freedom.

These poor children today have abdicated and hypothecated all their existence online in emulation of their corporate gods by acting just like them and marketing themselves to where they seemingly have no identity beyond their private genital conceptions.

I feel sorry for them. They will never experience the type of freedom I did as a child. In all likelihood they would be mortified and threatened by what was normal to me.

Poor kids can’t spell, do grammar, remember a phone number or find their way home without a phone. So many normal human faculties are being replaced by a cheap smart phone abilities that structurally makes people dumber.

The slow frog boil continues. These poor children have no idea.

I remember privacy. Privacy felt good. I could walk a quarter mile as a 9 year old child and be completely alone. Yes, kids, I wandered around out in the world without a phone, alone, as a child. I pity your fears.

These poor children need to understand that every mistake they make will go down on their permanent record owned by Dorsey, Faceberg, Shmidt, Bezos, Gates, etc. The stupid things I did and the mistakes I made as a dumb kid would get me blacklisted and unemployable today. Hell, half the pranks I played would have me cancelled permanently.

Poor poor children.

I would point to the economics we were used to that create the easy time with many good career options.

I define freedom as in the Constitution and other traditions we were raised with like privacy. Now, the vaccination’s are exempt from exercise of religious convictions , taking of private property when you are a landlord, forced to accept what the government wants your children to “learn” and more….

Socialism is about who you know. Capitalism is about what you can do. Now it is about data, how you use it, and who controls it.

How it feels and explaining it seems just a fools errand but there appears to be a big reckoning coming for those who are trying to force these changes on us all….

Correct. The people are trapped physically because all the commons have been bought and sold. There is nowhere to go, so they go online. They are trapped economically because they cannot afford the down without generational wealth assisting them.

Freedom seems to mean whatever the person arguing for it means to them or plays off what others believe it means, like how a con man keeps it vague so that their message has broad appeal and buy-in.

Sometimes it is a dog whistle. Sometimes it is misguided. Sometimes it is a prop.

It is a red flag when I see it deployed in a debate.

We don’t need to import any more barbarians who will not partake in the culutre in America. Take some of the trillions wasted on wars of aggression and give a few thousand a year to any decent family to have one more kid.

that was america’s biggest mistake and the one that will end up being its undoing. not everyone is equally capable of assimilation, and believing otherwise requires a special form of ignorance and hubris.

Jake W,

I agree with you but it’s also due to a belief in cultural relativism. To the cultural relativist, all are (more or less) equal but just different. The reality is that not all are even close to being equally desirable to live under.

I have been to and lived in many countries during my life. I could live in many of these places but it doesn’t mean it makes any sense to import these cultures somewhere else.

If anyone wants to live in some culture from elsewhere, they can move.

Jake, the phrase is “Invade the world, invite the world” That’s what our global elite want…

Full assimilation takes three generations.

josap, america doesn’t have three generations to wait around anymore, even assuming that’s true

Your first paragraph makes no sense and is contradictory.

There is no shortage of people in the US. The US does not need a permanently expanding population. Growing the population to offset aging demographics is the ultimate “can kicking” exercise.

I’d be interested to know where you live, because where I do now, population has increased 4X since 1975 when I first moved here to about 6MM. US population increased over 100MM in this time with most of it concentrated in maybe two dozen metro areas. 35 metro areas in US with 2MM or more now.

Growing the population predominantly for “growth” is insane. Quality of life has already deteriorated enough due to congestion.

Can’t keep on growing population forever to keep pensions and government programs solvent.

One of the primary reasons housing is so expensive in metros is precisely because population increases are concentrated in these areas.

The quality of life in the US would be improved by a lower population, not a bigger one. Especially not with one predominantly growing from immigration where most of these people don’t even integrate. That’s a recipe for future Balkanization which is where this country is headed now.

I’m also aware there is no shortage of land, but concurrently have the sneaking suspicion that anyone who uses this as a rebuttal would never voluntarily live where they think everyone else should to reduce congestion.

As for land usage and livability, the changing climate is already throwing a proverbial monkey wrench into that one.

If the current trends continue, there will be either massive infrastructural changes needed. Way beyond this puny infrastructure bill currently passed.

We will need to not only move electrical current around the country to where it is needed but way more complicated and expensive is that we will need to move water around. Both for farms but also for human consumption.

Change is happening and we are ill prepared mentally or financially to deal with it.

Judging by some of the comments on this thread, balkanization is already happening, and it’s not the immigrants doing it; it’s the people in rural flyover country who are freaking out over immigrants coinm into this country, which is quite ironic considering about 95% of the people in America are descendants of immigrants. Also, immigration is at its lowest level in about 50 years, and the birth rate has steadily declined over the past 20 years and appears to be accelerating.

On Population/Immigration:

Parts of my family emigrated to Canada (Alberta) in 1929-1931 (4 sons coming from a farm in Germany with 6 sons. Only 1 could make a living there at that time. This means 5 sons without a perspective).

1 died in the coal mines, 1 was shot as a criminal and 2 made it as farmers under conditions where I gasped when I learned about living/working at that time.

We had a family reunion of the canadian+german branches 9 years ago.

I had the privilege to talk to the sons of those who emigrated and they said:

None of us (canadians) would have been able to get into Canada nowadays with the skills we had at that time.

Canada (at that time) wanted people to work extremely hard in places where few people wanted to live. They had to be young, strong, enduring and without diseases.

A brain/education wasn’t required.

All of the old timers strongly advised the young ones to make themselfes useful by developing our brains. Because there isn’t a huge demand for unskilled labour anymore.

That’s a big difference.

As a Gen xer I screwed myself getting a masters in social work but it finally paid off the last several years when I went into private practice. Still, it took me a long time to pay off my student loans because of cost of living. I remember you could make minimum wage in Chicago in the early 90s and be able to pay for a basic apt in the City. Not anymore. I don’t know how ppl live on 15. an hr. No one can save unless they live in a tent. It’s sad and depressing.

Start locally and push municipalities to answer hard questions. Don’t let them sell your county out to global banks. Catherine Austin-Fitts former HUD Assistant Secretary 👩💼 follow her or Solari.com :) We can do it, but need to wise up and not use the money system and/or figure ways around it and punch hard.

Completely incoherent dribble. Makes no sense at all.

It does if you are in proximity to the people described….

This “dribble” you describe is easily seen and described by those affected. I assume you economic situation is such that you can dismiss such “dribble” but if you ever lost it you will learn fast….

I have seen people with huge wealth in my years with the horse industry as this is a luxury. I worked around Los Angeles as in Malibu and around….

I have seen the super wealthy eat the big one…. not pretty….

I read Marx’s Das Kapital vis-a-vis Wealth of Nations by Adam Smith and I will never forget the one telling item I read in Das Kapital that makes me think of you. Marx said used a metaphor to describe a ship with both workers and the mega wealthy. In this metaphor the wealthy found themselves on life boats with the average joe and the average joe looked at this privileged being and saw no significant difference of worth or value other than the money owned….

My experience is many, not all wealthy are this way but those that are; are not usually quality people in any respect.

I have seen the super wealthy eat the big one…. not pretty….

??????

Dear Cobalt Programmer,

That’s not the message.

1. The data shows the lowest wage earners are seeing significant salary increases.

2. Housing prices are more complex than that due to millennial/demographic trends, but low rates for too long don’t make sense.

3. Incorrect, we may or may not see an adjustment depending on the number of rate hikes in 2022.

4. People buy monthly housing payments, which as a % of disposable income is the lowest it’s been on record since 1980.

5. Nah. The middle class is coming back, and if they learn a few skills, the opportunity is massive domestically.

6. Everything is better than poor, but education is everything.

7. Doubtful long term.

8. No one knows this.

9. ?

Overall, the world works the way it works driven by data, not the way you feel it should.

The salary increases for the lower/middle class have been completely eroded by inflation.

Regarding point 5, hahahahahahaha good one

For now, right. I’ll bet you that in the coming years,

You clearly have absolutely no idea what you’re talking about, and for what it’s worth, I always wonder why citizens bet against their own country. Idiotic.

It’s one thing to call a massive asset bubble a massive asset bubble, another to undermine the potential to heal from what ails us as a nation.

I stand by 5. It’s inflationary to restore the middle class, and it’s also a huge opportunity for those who upskill. Upskilling is smart, it pays off very handsomely today.

@Lol

Name one thing that the US has done for the middle class (those earning less than 100k, not the professional managerial class) since.. 1987. I’ll wait.

Middle class is roaring back in the trades. Plumbers apprentices making $70k a year now. Newly trained truck drivers making $80-100k. And on, and on. What you’re seeing is all these kids with anthropolgy degrees making $15 bucks an hour in retail jobs with $300k in student debt.

Middle class isn’t roaring back in trades. I’ve only worked trades.

Most I made in heavy equipment operating was 12 bucks an hour. Someone with 20 years exp. that wasn’t unionized made 17-20/hr depending on how lucky they were.

Being a machinist which is what I went to school for I made 15/hr. Someone with 10 years exp. Might break 20/hr.

Being a welder certified with 6g stainless, carbon steel, and 5g aluminum certs in tig/smaw/mig I made 14/hr. Non union welders made maybe 20 after years of exp. If they didn’t work oil field.

As an otr truck driver I made 30-35k a year working 60-80 hours a week for months on end without a day off unless I was stranded under a load. I was lucky enough to get a union job making 55k/yr with good benefits.

Am I doing better than someone with an arts degree working at Starbucks? Yeah, but only just and govt regulation on my job means I can’t enjoy it like some loser working retail who can get drunk and stoned each night before work and be 300 lbs and be home every night.

Most of what you see in trades about wages is complete and utter bullshit. most people working trades are making barely more than what people are making at Walmart now. In my area Wendy’s pays 18 dollars an hour. Walmart starts at 20 an hour. I’m sure benefits and hours suck at these places but the trades aren’t some magical way into the middle class. Hell in my experience, the blue collar world is trapped in the trailer park while the college kids are trapped in crappy apartments. big variance there eh?

Curse of the linear thinker.

Helluva way to exist.

The lowest wage earners are still poor, even with the raises. Inflation cancelled out the buying power of the added money.

Gaslighting at its best

The world doesn’t work according to your silly masturbatory list either.

1. The data shows the lowest wage earners are seeing significant salary increases.

Transitory.

Price and asset inflation will be defended at all costs.

Salary increases. Haha, that’s a good one. Our university has had no raises in three years. Our president is out of touch since just about everything in his life, housing, utilities, vehicle, etc. is paid for. He also seems to be experiencing the mental decline similarly being displayed in DC. I’m a professor in higher ed, Ph.D. in mechanical engineering. Moved from industry to academia years ago to what I thought was going to be a better lifestyle. Worst financial mistake I have ever made.

That’s interesting. Your skills are real. Engineers are in high demand. Why don’t you switch back to real life?

And leave the fake academics (in useless woke stuff) to themselves.

I can’t fathom someone smart like you having to deal with the retards on a daily basis while administration is sucking your money like everywhere else in higher ed (the parasites of parasitism).

4. People buy monthly housing payments, which as a % of disposable income is the lowest it’s been on record since 1980.

Source?

Data? LOL. See Catherine Austin-Fitts former HUD Asst Secretary and Banker. Dats is highly manipulated. You look out at the world and see what? All is well? That is a grand delusion. Ppl work 8-5 and are barely floating and you describe this data driven? I’m throwing a hodgepodge here but data is naught here. Highly highly skewed.

There were some reasonable prices on housing and stocks in the 2010 – 2015 time period. Now, not so much.

ALL of our financial problems stem from just one thing, having and using a fiat paper currency system! The very same day that a fiat paper currency system is put into play, it begins to fail! Very slowly at first, but then it speeds up faster and faster in its collapse, until one day, it just really takes off and EVERYTHING comes crashing down on our head and shoulders!! This has happened way too many times now for anyone who has studied even just a little bit of monetary history, to not see what’s going on and WHY!!

TPTB/DS know all about this, but they’re all psychopaths who really get off on ruining the life of everyone they can!

If we had a financial system of honest weights and measures, and honest men and women in positions of alleged power and authority over us, NONE of these problems would ever occur! But we get scammed into these boondoggles because we do not have control over our educational system and the facts of these debacles are kept hidden from us.

In my paper titled What is Money?, I explain all of this and how to end it.

Randy:

“If we had a financial system of honest weights and measures, and honest men and women in positions of alleged power and authority over us, NONE of these problems would ever occur!”

Makes me giggle all the way to the poorhouse!!

“Cut-throat capitalism” disallows all of the above!

And that’s basically what we have had for a number of decades especially since the Reagan years.

Humans being what they are precludes any kind of operational economic consistency. Greed being what it is we have, “what is what is”.

Our system, fiat currency or no, can never accommodate all under a protective social canopy.

The “cat” was unleashed in accepting “globalization” for American business/labor. We were (and are) no longer under any real kind of economic protection from the current and future (ravages) effects of globalized markets.

It didn’t take a genius to figure this out. Tho, millions of American workers were persuaded that globalization would be beneficial; yeah, to the capitalists who greedily exported most good middle class jobs to the lowest cost producers in other parts of the world!

Poor Karl Marx (and his sidekick Engels!) They are always derided for all the negativity of global economics’ “failures”.

We all need to wake up and smell the new smell of global economics.

As an aside, formal education thru colleges is not always the best path for all. My best education was spending so many early teen and later years in a thriving, pulsing wholesale market environment where I learned about “capitalism” and “business” and the relationships needed to thrive, make “progress”, true honesty and getting along with a myriad of cultural diversities.

We are in a new world!

“It’s different this time”

Not forever, investment money is sloshing around in the mix too, from 2nd investment homes to big corporations trying to build rent empires… when the market falls, these activities lose appeal.

The main difference between now and 2008 is that back then, the Fed was able to reduce interest rates dramatically and that stopped the decline in home prices.

This time around, we will have few foreclosures, so the market will continue to be a sellers market longer than in 2008. So once we start to see more inventory, prices will only slowly soften. This process is going to take time.

But this time around, as interest rates go up, the demand will continue to fall and so the length of the downturn will be much longer.

I am wondering if at some point, the Fed will no longer be allowed to lower interest rates to save asset prices, because we will have recent experience with inflation. Inflation had not been an issue for so long that the Fed forgot how it can get out of control. A bit of recency bias here.

Globally real estate is a bubble, where higher prices in other countries supports higher prices here, through comparative valuations.

With the Chinese bubble bursting, Chinese investors will not be buying real estate in other countries. Same thing might happen elsewhere. Not sure, but the investment cycle might turn on real estate here.

We’re toast. And that has nothing to do with anchored fleets. Internal apathy is our national demise. There’ no innoculating remedy on any radar…sorry.

My favorite product developed and sold was a “Can of WhoopAss.”

Men liked it but women bought it in bulk. I used to say “Maam, if you buy a six pack of WhoopAss I will deliver it myself -FREE”

A Can of USMC Whoop Ass would cure that apathy as the U.S. Marine Corps is who you call when you want to TAKE IT.

OK, calling them now.

I’ve been trying to buy a new dishwasher for my daughter as a Christmas gift and they are all gone in the big box stores. No idea when they will be back in stock. I guess the builders have first dibs on any that show up. Well, at least I am not trying to buy a new house.

Oh, BTW, the housing market for used homes is cooling around here (north of Houston, TX) and some homes in my neighborhood have been listed for two months without lookers.

That’s not true about builders getting first dibs. The box stores don’t care about pro business. They act like they do, but trust me, Lowes and Depot are awful…. it’s an act to get us in there, but their “pro” desks are a joke, staffed by m-f 8-4 workers that have been there 20 years and don’t care.. I have tried multiple lowes and home depots, the 6-7 of them suck….. Menards does an ok job…. but at the end of the day, pro sales they could give or take

Got appliances there cheap on clearance persiverence

Home Despot and Lowe-st are retail. Try harder not paying retail.

I don’t have access to wholesale markets. Buying used is not reliable.

Try Costco (shows them in stock) or Ikea for your dishwasher needs.

Your issue is you want a white finish. Those are low in customer demand.

I don’t want the white finish, but my daughter does and it would match the rest of her kitchen. I’ll give Costco a look see. Thanks!

Sir, Inflation factor and labor with supplies unavailable.

Here in Reno I drive by a HUGE apartment construction site with HUGE piles of lumber sitting on site with partial initial construction not moving now for a couple of months.

Compiled these articles on the inflation out there.

All the current media noise about Inflation, means what?

Get this First! The real rate of our Inflation, NOT the Government’s LIE number!

They have materials, but are short on labor. That’s a common theme amongst builders right now.

Or they didn’t get the joists due to the joist shortage and cannot move forward.

wolf,

It’s due to a shortage of horseshoe nails..

As a life long expat I have owned homes in 3 different countries. When I retired 15 years ago I did a cost benefit analysis to decide if I needed to be a home owner in my dotage.

I now live on the west coast of the Gulf of Thailand near the beach in a rural fishing village. I rent a 1,200 sq. ft. house for $125 per month plus utilities. Zero taxes, zero stress. My capital is better employed elsewhere.

Do you have running water and flush-plumbing?

Have you ever left the US? Believe it or not yes they have running water and flush toilets. The US is now the Third World s*hole. Get off the sofa and travel – you would be surprised to see what a third rate country you are living in.

Thailand is beautiful. Not only is there water and flush plumbing, but the food, country, and people are incredible. From one American to another, don’t be such an American.

Having lived here in Thailand since I retired, about 4 years, I would agree that the people are incredible. Super nice and super polite, in my experience. The thought of going back to U.S., and dealing with Americans, which I’ll have to do to renew my U.S. driver’s license next March, stresses me. I remember a Japanese description of Americans I read many decades ago: When an American walks into a room, they seem to have aggressive glowing staring eyes like a tiger.

I’m not sure how I’d feel if I was living alone in Thailand. Being non-social, it’s much better for me to have a Thai wife. She’s middle class and has a wide network of hometown friends and career acquaintances. If I didn’t have a wife, I’d probably be one of those bar-hopping condo old guys, with convenient concubines, and maybe live around a beach like BobT above.

Running water of course, but an interesting thing is that our house water (kitchen and bathing) just drops from a pipe onto a ground sandy patch which drains into an underground cement conduit, which flows from the property into an underground canal that the owners in the neighborhood built (no government, and hardly any regulations involved). A month ago we had a well dug, about 13 meters deep, only cost about $700 or so, including the pump. It provides clean water for wife’s horticulture (the property is a kind of botanical flower garden), fruit and coconut trees, and large vegetable garden.

Flush plumbing goes to septic tank.

I’m seeing a lot of oldies retiring in Japan. 1st world lifestyle for half the price. Terrible place to work for a living, great for retirement.

Just what Japan needs, more old people

Lol!!!

Good one.

can you even get a visa like that in japan if you’re not of japanese descent?

According to ”Japan Today” website, there is clear movement to allow permanent status to more folks from outside Japan.

Also reporting available very low cost or free housing, similar to Italy and Spain, likely others; does require commitment to ”fix it up” in all those places.

If not for my now clear elderly senescence, I would absolutely be chawing at the bit to take up some of the properties various local guv mints advertising in all three of those places, Portugal also IIRC…

We own an 86 sq meter (927 sq ft) 18th floor apartment in Qingdao. It is in a gated community. The beach is at the end of our street, and the mountains start a few blocks from our front door. We have 24 hour manned security, 6 fountains, playscapes for kids, walking roads for adults, and a parking garage underneath. We don’t need a car, with excellent bus and subway lines right next door. We bought our unit in 2009, but we would not be bad off if we rented. Right now, we could rent a larger unit for $300 USD a month. All utilities are cheap and provided by city or national utilities. No property tax. Expats get teaching or other jobs here just to enjoy a nice, low pressure lifestyle at a very low cost. There are a lot of places in the world that are a good alternative to life in America. I didn’t leave America. America left me.

So lovely

Nice choice, and I did look at many photos of the city and area. If I was not nearing 80 and with a sick wife, I would entertain a different lifestyle in a different country.

Wouldn’t it be an oxymoron to be a life long expat?

The term expat itself make nos sens. just a way for white people that dont like being called immigrants. They are the true aliens in search of a galaxy with inferior forms of life!

Ha-Ha-Very nice analogy-

Inferior=Much much less “hard earned” MONEY and “investments/entitlements”, so the “inferiors” eagerly tolerate you….so far.

No, wrong. A lot of us expats (of all shades and colors)( are escaping from the increasing proportion of inferior forms of life in the United States. 😀

I spent 20 years framing homes in Southern California.

100s of single family homes, condos, and apartments were built all at once with plenty of inventory for sale and it was not uncommon to get a great deal on a home of a project ended up in a recession. In 1994 I bought a 2500 square foot, NEW HOME, for $149,500.

After watching all that has happened I now believe the economic powers that be are purposely under building to make sure they never suffer major declines in the asset values of mortgages owned/sold.

Also, I see new apartments in Riverside, California at 728 square feet renting for up to 3,000 dollars not including utilities. WOW….

Homes like mine with land and in a great area are worth “gold” to people and it is amazing how aggressive buyers still are as they can see these type of homes are only built in the million plus category.

In the many decades I have been in and out of the Southern California construction industry I have never seen anything like this. This is not Capitalism at all. It is “Economic Engineering” and only those who know and who quickly figure it out will benefit….maybe…..or go bust.

It really seems this is going to be a long ride down for all of us. No one will be unscathed by the rapid economic fluctuation with money quickly losing value.

Until morale improves, the beatings will continue…..

Carry on those who still believe……

Do yourself and the rest of us a favor and actively seek legislation against mega landlords in your area and state. Start outlawing the mega landlords at the HOA level, town, county and state. Otherwise, you will land up surrounded by renters and homeless people,

that’s the part people are forgetting. 95% of the population is not going to tolerate being renters to a few big corps who own all single family houses without political blowback.

If you own a home with a walkout basement, you might be able to make it into a rental apartment and get $3000 a month. Depends on zoning and a few other things, but people are doing it.

AirbNBoomer? I’m sorry if I just don’t find your detached shed ADU appealing. I’ll just go ahead and rent a room in some small hotel that has a swank bar, K?

In SF, people pay more for less.

“This is not Capitalism at all. It is “Economic Engineering” ”

And the engineers are those who have hijacked the Fed.

Why are 30yr mortgages 3% when the last time we had inflation such as now, they were 6%? Why does the Fed buy MBSs, not in a depressed real estate market, but a WHITE HOT real estate market? Cui Bono?

The Fed skews all they touch…

and the great question now is not what “things are worth”, it is “what is money worth”? A wasting asset, wasting apparently on purposed policies from the unelected who apparently serve another master than their mandates under which they are allowed to exist, and the American earner/worker/saver.

You are late to the party…70 posts before your usual FED rant. Glad to see you are OK. :-)

Not true. What he stated is the truth. It is not a rant, it is a statement of fact. If 70 posts already stated this fact, it is not near enough.

We are living in the most overstimulated housing market in history and yet the Fed continues to create (at least) $35 billion per month and dump it into the housing market. Why are they doing this?

Cui Bono? Not me. Not the typical person joining the working class. They are creating massive piles of currency only for the benefit of those who already own assets.

What is my incentive to join or stay in the working class if there is zero hope of ever owning my residence? Tang Ping.

They are picking winners and losers. Why? Why is that ok?

For whatever reason the Fed decided to solve a debt problem with ZIRP and then QE. The side affect is massive asset inflation as the negative real rates start squeezing people out on the risk curve. Then the trend keeps the party going way too long.

It’s late to the game I think in buying risk assets. Maybe silver is an exception as it’s off about 50% from it’s all time high, but I don’t understand silver market. Supposedly there is a future shortage in it because of green energy.

As a retired designer/builder in the Pacifc Northwest, my experience was that the government has set so many requirements for land use, energy use, construction rules, environmental set asides, taxes, NIMBY, [etc] it is very difficult and expensive to build a new house.

I made my pile and quit.

I think there is no shortage of housing, but a massive surplus of people. Supply will never catch up to demand.

If somebody is really hopeless in the housing market and has poor employment prospects I would search the internet to find places where rent to income or home price to income ratios are favorable. The US is big, diverse place. Internet allows you to screen for crime and demographic data to narrow the search.

1) New Single Family Houses Sold plunged from 1400 to 300.

2) T1 38% of 1100 ==> 400 + 300 = 700.

3) T2 62% of 1100 ==> 700 +300 =1000.

4) Sales maxed at T2 and fell to T1 on the way to the lows.

5) Option #1 : wait for the lows. The next low might be a lower low.

6) Or, buy from a major co with a min down payment. Don’t increase the down payment. Give a special order to delay . When the house will be completed prices might be at or near the bottom. The construction co will adjust prices and give u a discount, otherwise they will be stuck with a special order in a bad market.

if the down payment will stay min.

Micheal,

“The construction co will adjust prices and give u a discount, otherwise they will be stuck with a special order in a bad market.”

Sorry, that’s not how it works, but you are certainly creative.

1) JM, that’s how things worked between 2007 and 2008. Delay, delay and extra capex is a surefire. Construction co are swing traders. They volunteered the discount !

2) Dishwashers shortages crybabies : move to Lebanon or Iran :

thousands of farmers protested in central Iran due water shortages. It spread to other cities like a plague. Protesters shouted : kiiilllll

the dictator. Security forces charged, shot the farmers, disbanded their tent city and arrested the “foreign agents”.

3) Within a decade IRR/USD plunged from 10 to ==> 0.0000235. Can’t do the compounding.

live pictures of Iranian protesters on U Tube from yesterday

M.E. ……I am zeroing in on a dishwasher thanks to El Katz’s Costco suggestion. Order placed, delivery date chosen, CC charged, now let’s see if it is real (12/6).

Anthony, be advised that Costco’s delivery/install service is spectacularly bad. Know upfront if delivery + install are both included as if that’s going to happen all at the same time.

If it doesn’t, the easiest solution is to get another company to do the install and ask Costco to reimburse you for it.

Costco has their own delivery/install business now, it’s new, and it’s got lots of kinks to work out.

Jeff, thanks for the heads up on this. I will be there at my daughter’s house when they show up. I paid for delivery, install, and haul away of the old unit.

I appreciate the data, but don’t see inventory piling up in my market. New homes are still turning and they’re building em as fast as they can. Lumber suppliers are struggling to keep up with demand and keeping the job sites ready and able to continue. The production builders here show no sign of letting up that I can see..

On window shortages – that’s just a bad builder not preordering his windows….. yes, there’s little stock and it takes longer to get them, but any wise builder orders them early and is ready when it’s time to put them in….

READ THE ARTICLE and not just the headline before commenting.

You missed everything.

1) The inflation : Omicron sent UK 1M to minus 0.2 on the way to test/ breach the previous low. 2) The German 3M < minus 1%.

3) JP, if u raise rates gravity will pull u down.

2) an anagram for omicron is moronic

I find the title of this article not only misleading, but contrary to the facts therein.

” … Pileup of new houses for sale” ???? WTF

Sorry, but permits to build houses ARE NOT houses for sale. For God’s sake, they haven’t even broken ground yet. And buyers are notoriously unable to visualize anything, preferring to pay more once they can see the fake wood tile floors and stainless steel appliances. And btw there is plenty of everything available, including labor. Just pay the price and it all magically appears… even dishwashers.

Wolf goes on to say that ACTUAL Completed new homes for sale are at only 1/3 their historical inventory level. That sounds to me like there’s a pileup of BUYERS waiting to give their down-payments, not a pileup of homes for sale.

Good information here. Sorry to see it clickbaited the way it was though. I expect more from Wolf Street.

On a final note, new home prices aren’t going down any time soon. Buildable lot inventories are tight and land is only getting more expensive (at least in the south). The FED can’t raise rates, for fear of crashing Wall Street. Hard assets are the place to be with low interest rates and high inflation.

The Fed can raise rates. My guess is you are too young to remember inflation. If we have inflation, the Fed will have to fight it eventually, otherwise everything crashes. When rates go up, the housing market will get completely crushed. At some point the market will crash even if they don’t raise rates, because all bubbles pop. And this is more obviously a bubble than any we’ve had in recent history.

The only comparable housing bubble in the history of the US was pre-GFC, about 156 years ago. Never heard of any national one before that (only localized) because lending standards were a lot stricter before the government guaranteed mortgages starting in the 1930’s.

We have inflation, really bad inflation, and the Fed is not raising rates. They will never raise rates. Inflation was and always has been their desired outcome. Inflation allows both the government and wealthy investors to default on their debts while forcing others to face the consequences.

Stop with the “Fed will have to fight inflation” nonsense. The Fed does not have to fight inflation. They are not fighting inflation. They are not going to fight inflation.

They might deny inflation exists but they will never “fight inflation”. Me quedo claro?

I don’t think you can be sure. The Fed may get pushed into a binary choice of maintaining reserve currency or fighting inflation. They will muddle thru and jaw bone as long as they can.

if you’re so sure, i expect you’re buying tons of cheap out of the money calls on all assets right?

CCCB,

“Sorry, but permits to build houses ARE NOT houses for sale.” Actually, with a few exceptions, most all the majors don’t pay for permits or start building unless the home is sold.

You cannot start work without permits taken after the plans have been approved….

CCCB,

Sheesh! Try to understand how the construction industry works. I explained it in the article right near to the top. It’s not for you to decide how it works. Whether YOU like it or not doesn’t matter.

Thanks Wolf, but I DO understand the construction and real estate businesses. I build homes and develop land. I own a successful RE brokerage company and have sold homes for 25+ years. I also own and manage a lot of investment properties. I work my ass off but it’s been worth it.

I know a bubble when I see one, but I’m tired of all the doomsayers who get some thrill out of ALWAYS saying we’re in a bubble and the sky is falling. They never make money because they’re always afraid and always listening to each other cackling about the next drought or famine or crash or riot or opposing political party or some other “disaster” that’s coming soon.

I put my money and hard work where my mouth is. America is still the land of opportunity and a in my opinion, the best place on earth to live and work. I’d rather live the life here and spend my free time visiting those other “first world/third world” places. I’m usually ready to come home after a month, but that’s just me.

I’ve been around long enough to know it’s not for me or you or anyone here to decide how markets work. I simply watch them closely and follow carefully.

And btw, thanks for ALL the great stats you provide us. I couldn’t do what I do nearly as well without them.

“All you need in this life is ignorance and confidence; then success is sure. – Mark Twain

CCCB,

Yada-yada-yada. You still didn’t read the article. You have NO IDEA what it’s about. And you’re talking yourself deeper into the morass of nonsense.

S0 I just one thing — I don’t have time to deal with all the rest.

In terms of this discussion here: Total new houses sold were 745,000 seasonally adjusted annual rate in October, second chart above, whose description leading to it you didn’t read, and that’s why you don’t understand a thing.

This is 745,000 houses sold is composed of (all in seasonally adjusted annual rates):

271,000 houses sold where construction has not started

291,000 houses sold under construction

183,000 houses sold that have been completed.

———

745,000 total houses sold.

If a homebuilder hasn’t sold the house by the time it’s completed, it’s a speculative (spec) house that they HOPE to be able to sell at a profitable price. These unsold newly finished houses is where a big part of the risk is for homebuilders.

Commenting guideline #2: “Do not comment on what you imagine the article says based on the headline or the first paragraph. If you haven’t read the entire article, do not comment on the article itself. It’s OK to comment about something else that is not in the article.”

https://wolfstreet.com/2017/10/07/finally-my-guidelines-for-commenting/

To the reply from Wolf….a strong case on why we need a like button in the comments section :)

CCCB

I think I get it.

First, there’s this:

“On a final note, new home prices aren’t going down any time soon.”

And Then this:

“I own a successful RE brokerage company and have sold homes for 25+ years.”

– Yep. House prices are definitely not coming down any time soon

And finally:

“but I’m tired of all the doomsayers who get some thrill out of ALWAYS saying we’re in a bubble and the sky is falling. They never make money”

I think a good many of the doomsayers here are considering where they’re going to live and if they can they afford it (especially in the long run). Not whether there is $ to be made.

This guy just got his Re-Max franchise.

Side hustle: Edward Jones, CFP.

Same address.

Well that’s just your opinion , man

Have to disagree. North port, port charolette, Punta gorda area wide range of lots for sale. 350k for canal, full sailboat access with sea wall, to east of the 75, rural at 15k for 1/2 acre. No shortage and wide range of choices. Lots of building by many builders, med size to mom and pops, figures 150 to 200 sq ft. Very custom 250 sq ft. Pools low 35k to 80k high.

South venice in island walk community 750k new build ready to occupy 2200 sq ft with pool. Lots of choices in 250 to 450k range, simple house in other newer subdivisions. Yes typical delays for windows, etc. , sub shortages, but they are getting finished and sold, because affordable and hiring signs everywhere.

So everything is local, and grand statements about lot shortages, ect., need to specify locale and real details as above.

4) Construction co rush to complete construction, before the crash.

That’s why there are labor and window shortages.

Housing is a major part of Economy virtually in all western nations! If the Economy tanks and or deaccelerationg (RECESSION) in the coming months and default in payment of mortages rise, good luck to those especially investors who bought in the last 2-3yrs or even earlier. Unless of course Mr. Powell sprinkles another 4 Trillion to bail out and more stimmy checks on the way!

My son is having a home built by one of the big 3 national builders and it and every house on the street is over a month behind due to window shortages. We call them ghost houses because they are sheathed, roofed and wrapped in tyvek with little round holes where each window goes. One street over are 5 homes being constructed by a local builder. Their prospects for getting windows were so poor they put poly sheets over all the windows and turned on the heat so they could start sheet rocking.

Strangely enough, last week I saw a pickup pulling an open trailer full of new windows going into my neighborhood of 20 year old homes. It looked like a window upgrade job, which a few homeowners have been doing with their similar house around here. I wonder where they got the windows?

I would guess it’s possible the windows were made locally here in Houston.

Why you staring at me?

Probably looking to see if there was a dishwasher tucked in there somewhere :)

COWG: (update 11/28, 12:25 PM) Dishwasher problem advancing to completion thanks to El Katz’s guidance. No new windows needed.

The high end window companies appear to have availability, but with longer lead times. Pella, Marvin, Andersen, are actively seeking sales. It might have to do with the fact that some have factories here in AZ.

The $1M++ homes being built here appear to have no problems accessing materials and labor. They move along at a reasonable pace. The tracts, however, don’t appear to be that lucky.

I’m building a custom ICF home in Minnesota and I’m doing the exact same thing while waiting for windows, foam with reflective foil covering the openings. Time to warm up the slab and work inside- whatever I can do to keep moving forward.

Seneca,

“My son is having a home built by one of the big 3 national builders and it and every house on the street is over a month behind due to window shortages”

Most people don’t know, vinyl windows take much oil to produce. The supply disruption of refined oil products is one of the primary reasons for the window manufacturing delays. It could get worse before it gets better with Biden choking off the supply.

How exactly is Biden “choking off” refined oil supply… that sounds like political BS to me.

Phil,

Not “sounds like.” But “is.”

I have no problem getting windows for my houses. Nor do the thousands of build to rent projects.

Big 3 are just waiting for the buyers to cancel their contracts (so they can sell the same houses for tens or hundreds of thousands $$ more) or they’ll just invoke their price increase clauses and buyers will have to pony up $50,000-100,000 more if they still want to close

Moral of the story is don’t buy from the big 3 or 6 or 10

I agree builders are delaying on purpose to increase profit margins. The moral of this story is only buy houses that are finished or resales.

Any stories yet about builders going bankrupt and keeping the deposits of the buyers of the unfinished homes?

This didn’t just happen. More likely it is by design. Clearly someone wins while most lose.

You will own nothing and you will be happy.

Best,

K. Schwab

yes it’s an odd time across the board. Imagine sometime next year gets more volatile from stocks to energy to housing, eventually you run out of buyers in real estate and high prices will exhaust itself. Key to life is avoid or at least limit leverage to fight another day.

Revolution s spread fast

I saw the meltdown of Seattle Real Estate from 2008 to 2010. As Mortgage Lender back then, it sucked as nothing would appraise and the 4 recent foreclosures were the only comparable sales in the neighborhood..

Third World Living can be better than First World Living – after 40 years in Seattle and now staying on the beach in Cape Town, Africa. I marvel at the low cost of living – and amazing exchange rate (Same as Mx Peso) –

From the jacuzzi tub to the pool out front to the fireplace and the Marble counters..the 10th-floor view and the sound of the waves on the miles of empty beach lulls you to sleep. $2000 a month buys a life that $8000 a month could NOT buy in Seattle. Living here gives me a life I could not afford back in Seattle.

No language issues…and a friendly open society with a sense of humor and the same jaded view of their politicians…

So I join the guys in Thailand living a first-world life …and the Philipines may be my next destination….

Admit it. You did it all for the nookie.

Cape Town … does what you save on rent make up for the added costs of bulletproof car paneling and guards with full auto?

ivanislav – Showing your ignorance and racism again – This is not Russia. My wife Ubers all over town alone to the many malls…. She likes to shop :-( ….. so YES we do not save $$

How disgusting of you. I made a comment about levels of violence and you attribute it to racism. Typical woke-Seattelite behavior.

PS – I’m not Russian and I grew up in the PNW myself. Ironically, but also to be expected of the overly-woke crowd, it is you making racist comments – this time about Russians.

I read that “South Africa has the highest rape rate in the world of 132.4. Some 66,196 incidents in per 100,000 people.” So I admit to have some prejudices, and it is interesting and somewhat positive to hear Seattle Guy’s descriptions. It’s always good to get input from an on-the-ground local source.

Regarding racism, the term loses meaning when used so ambiguously. Russians aren’t a distinct race. One could say that there is prejudice against Russians. Both racism and ethnic prejudice exist pretty strongly in many places.

It seems like people use the word racism because prejudice or communalism has less verbal attack value, although it can be just as bad. Bigotry is also a strong word, but bigotry is pretty common these days, coming from all sides.

“the added costs of bulletproof car paneling and guards with full auto?”

I think that is true for anywhere in Africa — at least those places where the locals don’t live in mud huts.

That’s also true in San Francisco, Chicago, New Orleans, Philadelphia, Detroit, New York, ….

Hahahaha, these comments are getting ridiculous.

For WR, et al:

About late 1950s-early ’60s, a lady sued successfully when the newspaper reported, incorrectly that she had been at a certain place in the city of the angels at 3 AM instead of 3 PM.

So not much has changed there of other large cities in USA, likely other places similar, eh?

When I was young and could run really fast, I loved to go to SF in the middle of the night,,, and tons and tons of fun— late ’60s/70s…

Absolutely will not do so today, though still love THE CITY!

VintageVNvet,

OK, I used to live in Tulsa, and still have lots of friends there, so I keep an eye on it. Nice Republican-run city in the nice Republican State of Oklahoma.

Tulsa population 413,000. Homicides in 2020: 78 (per Tulsa police Dept). homicide rate = 18.9 homicides per 100,000 population.

San Francisco population 874,000. Homicides in 2020: 48 (per SFPD); homicide rate = 5.5 per 100,000 population.

You see, the nice Republican-run city of Tulsa, in the nice Republican-run state of Oklahoma has 3.4 times the homicide rate of San Francisco.

In percentage terms, the homicide rate in Tulsa is 240% higher than in San Francisco.

You see, data shows that San Francisco has among the lowest homicide rates of major cities in the US.

You haven’t been to SF in ages, as you pointed out. So your fears about not being able to run fast enough in SF are just your own personal paranoia, and have nothing to do with facts. You can look this stuff up on the internet.

Not to offer TMI Wolf, but my last time in SF was June of 2019,,, in the day time was my point!

Similarly, NOT going to downtown TPA bay area cities at 0300 either,,, or any other city unless emergency, etc., etc…

VNVet

I’m 68 and walk the streets of SF any time of day or night and never feel threatened. I ran 2 bars at either end of the Tenderloin and walked between them for years. Sometimes at 2 AM.

I get why women are frightened to walk the streets at night and there is always the off chance of a confrontation. But as Wolf pointed out Tulsa OK is more dangerous than SF.

Relatively speaking SF is not dangerous. It’s a myth.

I grew up in Washington DC. Now that was a rough city back in the day. There’s not a neighborhood like Anacostia in DC or any of the other East Coast ghettos to be found in SF. Hell, the mid sized towns that dot the South and Mid West have much scarier neighborhoods from what I’ve seen.

You’re talking about Detroit and Baltimore, right?

Hey, the comment fits there too. What’s your point? Let’s engage in a little whataboutism and pretend that talking smack about Cape Town is somehow jingoistic.

Any place is better than Seattle. It was once a nice place but that was long ago, now it is just a big, expensive, ugly, noisy, traffic sewer.

I Lived in Seattle for 5 months when I was in graduate school at the UW. The place was a dump back then and is a dump right now. The best day I had was the day I left and moved to the Swamp, Washington DC

I have always thought the natural trend of things was to make your money in a high income area and retire in a low income area. Get a Blue state pension and spend it in a rural red state.

Houses cost money. Housing construction costs money. Labour costs money. Can’t we just print more money and build the house with that?

Surely more printing will help everything.

You can see that easy money like a pain killer has its place in an emergency. The idea of a pain killer is to give time to recover, but you can’t live on it. Your problems just get worse.

Dollar shortages : in 2020, when oil future plunged to minus 40, president Trump built US strategic oil reserves.

The current administration sold, exported 50M/b for $80/b to our best friends, taking profit.

Notice the strange correlation between WTIC plunge and USD weekly shooting star.

only US can save our best friends from an oil shock,

in economic war declared by OPEC.

The millenials and genX

The ladder is being pulled up…

American Dream of saving (can’t) and buying a home (very difficult) has been STOLEN by faked low interest rates. The last time inflation was in this neighborhood, 1999 and 2006, the 30yr mortgage was 6%. Now 3%. Why? Fed policy.

They lend (buy MBSs) 3% below inflation. That is a give away to the mortgage industry decided by committee. Now, Fannie and Freddie considering backing mortgages up toe $1 Million. Why? Who benefits, who needs this subisdy?

There are corporations with big real estate bets on in the markets that are, IMO, swaying Fed policy regarding mortgages. In the process, an entire generation seems to be getting locked out of owning their own home. The yield curve should be much steeper, 30yr mortgages more at historical levels. What’s the emergency now J Powell?

The Fed SKEWS ALL THEY TOUCH….and the real estate market is no different.

Own a home, cant sell it because it is your largest hard asset in an inflation. And to put the money in the bank is to go backwards. This is designed by Fed policy.

Want to buy a home, you get mortgage money BELOW the inflation rate (ever happen before?) and you are willing to chase home prices into new highs.

Why are mortgage rates below the inflation rate? Why is something that has never happened before SUBSIDIZED by the Federal Reserve? Cui Bono?

“American Dream of saving (can’t) and buying a home (very difficult) has been STOLEN…”

Historicus, you do you think that this fact — and it is indeed a fact in much of the US — would cause people to move to those states with counties that have struggled the past many decades to retain residents, e.g. Nebraska, North and South Dakota, northern Minnesota, etc.? If people can WFH, these are very affordable and friendly places. Granted, the climate takes some getting used to.

It’s more than just the climate. It’s easier to live in a wider range of places if the person has a reason to be there (job, family) since the daily routine of life occupies most of someone’s time and focus.

Otherwise, not so much. I have driven through many parts of the US but hardly all. On the route covering I-20 and I-10, there isn’t much of anything.

If I was going to live outside a city, I’d look first in college and university towns but many aren’t that cheap either.

If you borrow 1 million at 3% for 30 years it costs 1,517,774

If you borrow 700,000 at 6% for 30 years it costs 1,510,867

Not much difference even if interest rates double and house prices drop 33%. Does anyone think prices will drop 33%? Rates certainly will go up so maybe now really is the time to buy, I don’t know.

Doug,

Wealthy people don’t care… it’s of absolutely no concern to them due to the myriad of financing schemes available to them…

It’s poorer people who buy the payment… that’s your difference…

I see this logic all the time here on the bay area. Let me please point out that the taxes on a $1,000,000 home @3% apr are WAY higher than on a $700,000 home. I live in a swanky area(I only rent, too poor to own) and there are people on my street paying in excess of $50,000/yr in property taxes ALONE. Taxes never go down in the people’s republic of California, and you pay them every year for life. I almost bought outside the valley a couple years ago, but even on a cheap home here($1,300,000) the taxes @1.3% were staggering to have to pay on top of the mortgage. What this means is that mortgages aren’t any more affordable, and unless you are paying a huge down payment or all cash, you can’t do it. Good bye middle-upper class, only the Uber rich can pay cash for their homes here.

Taxes in the Bay Area are 1% with increases capped at 2% per year.

The extras, parcel taxes, bonds etc, account for the rest.

Yes, taxes are based on sales price (or appraised value by the county) but the interest rate increase is a killer still. The same 700k house at 3% for 30 years is “only” 1,062,662, a savings of 500k over the life of the loan.

Prop 13 results in property taxes much much lower on owner occupied houses than new houses.And this tax advantage can be inherited.

To pay$50,000 in taxes translates to a new house over 4m

Prop 13 applies to all homes regardless of who lives in it. Prop 19 made a mess of the ability to inherit the same advantages.

I am 65 and there have been a lot of economic ups and downs in my life. I entered college at the beginning of the analog to digital transition. Graduated into an environment not so different than today in that inflation was high and rising.

I think the key is to realize economy is constantly changing and keep trying to keep income coming and net worth growing. There are always opportunities. Sometimes they are few and far between. Life isn’t fair, but there are always opportunities somewhere and somebody is going to get them.

Sorry H, that’s just not the story for our children and all their cousins on both sides:

ALL of them, age approx 35-50, WHO HAVE WORKED HARD,,, [[consistently)) as I did on and off,,, have their own homes and are actually more successful than I was at their age…

I have told them not to ask me about finance, etc., as they are all more informed than I ever have been…

It IS the American Dream, and it IS still available for anyone who chooses to work hard for a while, just exactly as it was for those of us who did so many years ago.

IMHO, America is where most of the poor but hard working folks in the world WANT to be for very damn good reasons.

The fact is we just know a ton more about what is happening these days,,,, and many thanks to Wolf for the actual data instead of just the pontificating propaganda coming out of the media organs of the oligarchy as has formerly been the case for thousands of years…

Using an anecdote that contradicts nation wide data is the definition of not working hard.

Hey Georgist, good to see your still around. I used to think your comments were a bit harsh on the old lads; but the more I read comments like the one above, the more I think you were right all along!

There are some fantastic commenters on this site, but sometimes there are a lot of misleading anecdotes and hyperbole to wade through before we can get to the good ones. Down with anecdotes and hyperbole!

Vintage….

“age approx 35-50″………..sorry Vintage

not the age groups I referred to.

Your children likely saved for perhaps 15 to 20 years with a fair return on money over inflation. What is the situation now for savers? This is my point.

Savers regress at 6% a year, currently. As real estate rallies 15% or more a year. That’s a housing market running 21% away from savers, currently.

Those are the current conditions, and those are NOT the conditions in which your kids “saved” to buy homes. The current 20 to 30 year olds are in a much different situation now.

“That’s a housing market running 21% away from savers, currently.”

note:

It must be taken into consideration that the 6% is part of the housing inflation number.

If this time is like last time, then having a down payment stashed away will come in handy when housing market crashes and government tries to reflate housing market.

Might not happen that way, but it could. Things could crash, government credits you $20,000 to buy a house and mortgage is 2%. Certainly current situation isn’t sustainable.

I made more passive money by chance last year, without making any crazy bets, than I did my first 15 years working, courtesy of the Federal Reserve. Yes, that is crazy. Stock prices shouldn’t move that much.

In my neighborhood, a 1980s era 2700 ft home that needs new Windows an appliances and finishing sells for $1.3M. Yes, that is also crazy.

No they shouldn’t have moved that much, but in real terms stock prices are just pulling forward future returns. If you bought most stocks a decade ago you should be able to ride the roller coaster out.

You can’t spend all your money on housing, so it’s up to an individual to self limit. It’s cheaper the further out you go usually. I liked what someone said which is combine housing and transportation and try to cap that at 50% of your take home. If you are a homebody you might can let that get to 60%.

No need to complain about it. That’s what you can afford. If numbers don’t work out, you may have to go through the pain of starting a life somewhere else.

Wolf, again, has shown us it is time to sell property.

There is no doubt that we will be able to purchase property at lower prices in the not-too-distant future…

Have confidence that bust is coming.

Sell the house and get what in exchange? Worthless dollars? Worthless crypto? Worthless meme stocks? Nose bleed stocks? NFT’s. Hot potatoes and no one who has to work to earn currency wants to get burned.

If you have a productive asset there is no reason to sell if you live in a world full of worthless assets.

Am not seeing falling housing prices in my community. A home was listed and pending/under contract within a week. Some sold low, others sold high, but they are all gone.

If you buy a lot, there are builders who will build a home there for a price.

as long as people can borrow 3% for 30yrs below the current inflation rate…they will get out of cash and into something else.

Why the Fed is doing this is beyond reason, and borders on criminal, IMO.

This is a CATTLE DRIVE…..and we know what happens at the end of a cattle drive……drunk cowboys and steak dinners.

The President has much of his wealth invested in real estate. The previous President was a big real estate investor. If they kept all their money in the bank a long time, they would have been poorer for their naivety.

people likely to get taxed out of their house where I live

already high taxes…

now you sit in your house, do nothing, value of your house goes up, your cost for living there goes up, now you got to move….and nothing for sale.

h

Really now ???

Property taxes rise by only $ 500 per YEAR and that FORCES a retired part to move out of a paid for house ???

Sir, that is balderdash !

not in my state

reassesed everyfour years

A friend is selling his house at 10% below where it is assessed

He appealed his tax treatment

denied

that is who we deal with

In my state there us no limit to real estste tax increases

In Crook County it does. My whole neighborhood gentrified because of it.

Save for the house of your dream : congress.

There is 50% chance that US gov will default between X Date : Dec 15

and early Jan 2022, unless congress act.

I doubt it. Those billionaires who owns the senators won’t allow it.

I guess I am traveling in the wrong places – where RE, instead of skyrocketing, plummeted and will stay plummeted forever.

Virtual tour,anyone ?

Sampson & 8th,Muncie,IN

Abandoned Chevy plant and another manual transmission plant.Nice vegetation though…

Inspired by Socaljim posts I was thinking about buying one of those 3bd empty houses for $20K,I am still figuring out how to spent my stimulus money…

Then 2 vicious girls appeared out of nowhere and said in a shrill voice “Come play with us forever and ever and ever”.Just like in the horror movie “Shining”(1980).

And I decided to pass.

Jeff Snider sees us heading for a growth collapse, with charts of dollar value growth vs volume. At the macro level the upcoming slowdown is all about the extended policy of low interest rates. Low interest rates are appropriate during periods of slow growth. The Fed doesn’t control growth they react. If Snider is right this is one of the biggest head fakes in financial forecasting, and will catch everyone misallocated. Powell said (disingenuously) “you will never have your prepandemic economy back”, and nobody remembers what that economy was like, with the Fed under fire for pressing the gas going into a slowdown (no R word) which caused borrowers to take on new debt just as things were rolling over. (Then Covid and forebearance) Two other things which support a slowdown is weakness in the corporate bond market, and resistance to lockdown measures (despite the new variant). If you are not taking the vaccine you are not an aggressive consumer. Despite the usual MSM propaganda on xmas spending, a lot of people are not. Markets have seized on the variant news to justify selling, it’s a backdoor rationalization. Trillions in stimulus did have the effect of spiking demand, but the long term slow growth trend reasserts itself, now acerbated by supply chain problems. No specialty goods to buy, I’m okay with that. Like Wolf says, people don’t need new cars. Demand then is very transitory.

Latest numbers I saw was private economy in USA is down to 56%. In France it’s down to 37%.

You are not going to have robust long term growth when government gets too big.

Or could it be more complicated than simple material and labor shortages? What if banks are scared and have started pulling financing for builders? This may explain the abandonment of half finished housing projects, just like in 2008. There is no market for $500,000 starter homes.

your smart Bubba : just like in 2008 but its more then starter Homes as I expect you will see , a lot more

Our new house from start to finish will be in that 12-13 month time frame.

Shortages the main culprit. Had a house fire , so we did not choose to build during this mess. Live in fly over. Our 1650ft2 new build will come

in at around $180/ft2.

Our business…tied to construction…is swamped.

Nothing like the hey days of 05-07. Then again we are a grey haired, or bald group who have no desire or ability to run crew sizes necessary for that volume.

It will take time to turn that ship, and bring #’s back into the trades.

I do enjoy seeing young families moving out here…vs…grey hairs looking for a 2nd home.

This is the most volatile I’ve ever seen comments. I love it.

1) Christine Lagarde IMF denied Pakistan gov the sovereign right

to borrow from their central bank.

2) Pakistan pm blame the previous gov for raising debt ceiling x4 times

between 2008 and 2018, but his gov raised foreign debt by $30B,

from $86B to $116B, so he can blame himself.

3) Pakistan was borrowing from everybody that was willing to lend :

China, the IMF, European countries and other entities.

4) After protesting, the Pakistani PM signaled submission to Christine

Lagarde.

5) Pakistani gov will cut spending, raise taxes and pay foreign debt.

The western world is bankrupt. Unpayable government debts and unfunded liabilities to no end.

Interest rates will continue to go down to avoid default.

It all started in Japan then Europe, now soon the US.

With declining rates the price of houses goes vertical. Regardless of the underlying economy.