A look at per-worker personal income, what’s left of it after inflation.

By Wolf Richter for WOLF STREET.

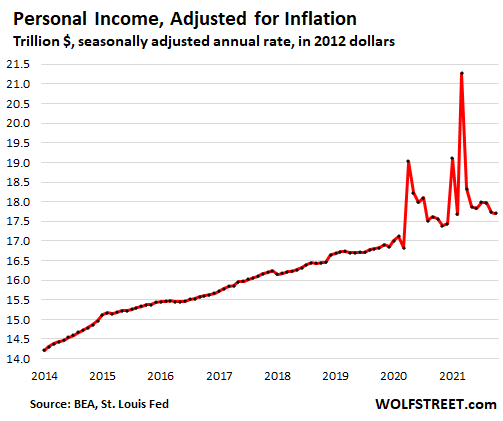

Adjusted for inflation, consumers’ personal income from all sources – from wages, interest, dividends, rental income, unemployment compensation, stimulus checks, Social Security benefits, etc. – so “real” personal income dipped by 0.2% in October from September to a seasonally adjusted annual rate of $17.7 trillion, up by only 0.8% from a year ago, according to the Bureau of Economic Analysis.

Personal income last year and earlier this year gyrated wildly and was grotesquely inflated by the various stimulus payments and special unemployment benefits. Most of the pandemic-specials have now expired:

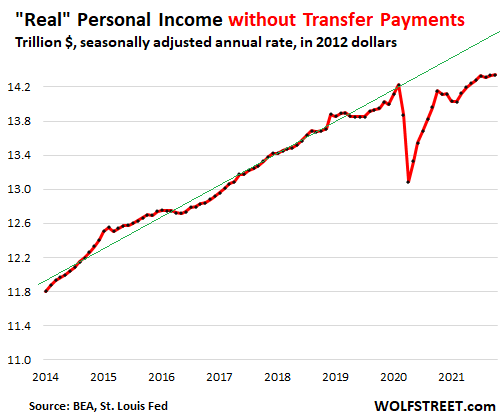

Personal income without stimulus and transfer payments, after inflation – so this is personal income from labor, interest, dividends, rental property, etc. but without transfer payments from the government, such as unemployment benefits, stimulus payments, Social Security benefits, welfare benefits, etc. – was flat for the month, at a seasonally adjusted annual rate of $14.3 trillion.

And it has gone nowhere over the past five months, with all nominal income gains getting eaten up by inflation.

But wait… More people working, each making less after inflation

This “real” (inflation adjusted) income without transfer payments is a function of two factors:

- Amount earned by each consumer

- Number of consumers who are earning money.

Real income without transfer payments has been flat for the five months through October. But in October, 2.4 million more people worked than five months earlier.

In other words, the number of workers making money with their labor grew from 151.6 million workers in June to 154.0 million workers in October, and yet all workers combined made the same amount of money adjusted for inflation over those five months. Meaning, on a personal level, on average each worker lost ground to inflation.

For the past five months, inflation as measured by the BEA has eaten up any and all income gains from promotions and hiring bonuses and higher wages paid to attract workers, and hire wages to retain workers, etc., plus some.

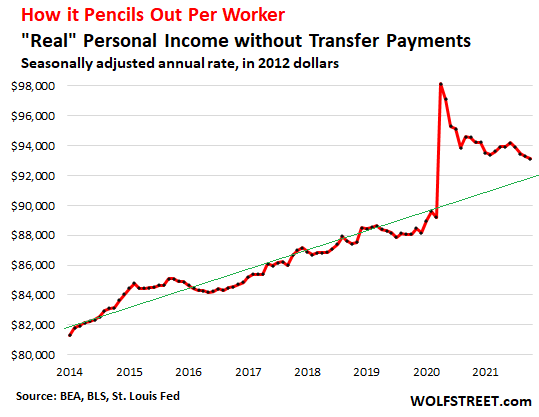

This chart shows the seasonally adjusted annual rate of “real” income without transfer payments, divided by the number of workers (Bureau of Labor Statistics household survey which I discuss here).

Bringing more people back to work increased overall income before inflation; inflation then ate all the gains in aggregate; and then on a personal level, more workers divided up the same “real” income pie, and each is getting a smaller slice.

The spike last spring was caused by 22 million workers losing their job, and income without transfer payments also plunged (as shown in the 2nd chart above), but was divided by 22 million fewer workers, and some of furloughed workers continued earning money, while income from rents, dividends, interest, farming interests, etc. continued flowing. And it also shows that this metric is returning to pre-pandemic trends:

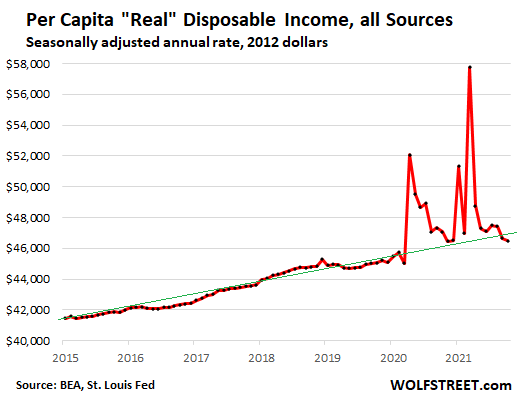

This phenomenon of how individual workers are getting shafted by inflation – despite the rise in nominal wages – also shows up in the broader metric released by the BEA: the Per-Capita “Real” Disposable Income, which takes total income from all sources, including transfer payments, minus income-related taxes, adjusted for inflation, and divided by the US population (not number of workers).

In October, it dropped to the lowest level since November last year, and has now dropped below the pre-pandemic trend:

Less real income, No Problem: Consumers spent heroically.

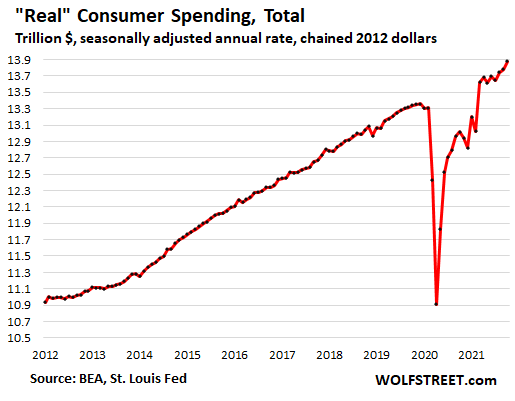

Even adjusted for inflation, consumer spending in October rose by 0.7% from September, and by 6.6% from a year ago, to a record seasonally adjusted annual rate of $13.9 trillion.

October was the first month of Q4 GDP. Consumer spending is about two-thirds of GDP. In terms of GDP, what matters is aggregate spending, not income. And spending was strong, even after inflation.

For the months, and after inflation, spending on all three major categories picked up: Durable goods (+2.0%), Non-durable goods (+0.4%), and services (+0.5%).

These are huge amounts that people spent, and they’re still flush with money from the pandemic-specials, and many have used those funds to pay down their credit cards, so now they have more room to borrow. And other people have used those funds to get caught up on their late payments and their credit score went up, and they have an easier time to borrow new money. And people are still spending the $800 billion in forgivable and by now largely forgiven PPP loans that went to just about everyone. And people are borrowing against their stock market gains and crypto gains and they’re spending this money – and they’re spending it regardless of what prices are.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Happy Thanksgiving to all Wolfstreet readers!

Nice Andy :-) …and to you Wolf

Thank you Mr. Richter for your brilliant work. And the people who follow you here are truly a reflection of your intelligence, wit and humor.

good coverage of unique stuff

it combines well with other financial info

van mises would be proud

“many have used those funds to pay down their credit cards, so now they have more room to borrow” is this the perverse intersection of macro and micro policy? The Fed raises rates so it has room to lower them later? I do wonder if the benefits in raising your credit score more than offsets the payment. Pay a hundred get two hundred in new credit? The CC company stocks are getting hammered, no doubt they do better when balances are high, and interest rates are low. Seems that the complaint the dog (inflation) ate my homework is spurious, unless we talk about consumers working in a job with no wage leverage. Christmas season spending is overhyped, including the supply chain ultimatium, buy now or be a grinch. Have watched this propaganda over the years (shop and beat the terrorists) but his year sets new records in the shameless promotion of a commerical holiday. There will be a January hangover, and not the one the CC companies were hoping for, bloated personal credit balances to buy junk for people you don’t really care about. Not enough glass for the wine bottles. That’s a downer.

It seems like we are at a medium term inflection point. Income is starting to drop. Interest rates threaten to rise. Stocks are looking very shakey with lots of fear indicators turning red. Plus, I suspect the Fed wants to see a controlled 10% stock price drop to take the edge off inflation. The quickest way to end inflation is not tapering or interest rate increases. All the Fed has to do is state that stock market gains are not required for a strong economy, and stock prices are outside the Feds mandate. Inflation would stop immediately as stock prices correct a bit.

I bought some out of money puts last week.

All of the FOMC fraudsters, starting from Powell, have millions invested in the markets. What makes you think they would do that?

Bobber

Agreed,

Now that JP has been reappointed he has a green light to take away the punchbowl. He will do just that. Interest rates are heading up even before the tapering is completed. Long term rates will go up first.

The Fed is in a trick box of their own design.

They must raise rates, but I am guessing so little and so slow that it will have zero effect on inflation…

BUT….

it may be enough to roll the stock and real estate markets over a bit.

So the scenario looks like not matter where you are, you will lose….

Stocks backwards

Cash inflation depreciation

The “magic wealth” creation will be erased a bit I suspect.

Markets this Friday morning pointing to no rate hike to 2023!!!

And only a 1/4pt! I find this remarkable….

Why is this Fed not bound to “stable prices” mandate?

Why are rates not chasing the inflation as has been the history of the DUTY of the Fed?

The Fed’s new mandate is Climate change and promoting Social Justice. The original mandates, stable prices and full employment are now on the back burner.

I don’t see how a 10 percent drop in stocks would take inflation.

I don’t think this would happen.

To take inflation FED need to hike rates and take start aggressive tapering.

Happy Thursday to all!

Income is not “starting to drop” but for union workers taking cost of living raises based on the juked numbers the govt uses real wages have been marching backward for at least the last 30 years while I worked as a union Iron Worker. Made good money when I started but by the time I retired laborers pushing brooms were making as much as I was! While the wage increases we obtained just ratcheted us into higher tax brackets the money was worth less! and both the republicans and the democrats screwed the working man the only difference was the philosophy they claimed to be using the outcome was the same!

I truly fear the FED is pushing the US to the edge of anarchy by their policies

These are people who have a strong vested interest in the status quo. They aren’t going to rock the boat very much. They don’t control the great economic cycles, but they have the powers to react to mitigate them to some degree. We saw this especially during the 2008 Great Recession, when the government put a break on the headlong plunge off the abyss.

You really think these people who operate under the Power of Positive Group Think aren’t capable of policy errors?

The real downturn in the US started with the offshoring of our mfg. We are a hollowed out angry people who found out the American Dream was sold by the people you think wouldn’t “rock the boat”?

The problem as I see it is that Congress has delegated soo much power to them. Instead of focusing on sound money which is in their control they are getting involved in things that are out of their control and political.

Congress knows whoever can print money can facilitate government policy. Is it the Fed’s job to goose the economy, control savings rates, implement economic justice, stop climate change?

It wasn’t their original job to do complicated things. It was their job to be lender of last resort to banks at penalty rate and ensure currency wasn’t devalued.

Government entities often expand their mandate. This is natural and to be expected. As long as it does not overstep SCOTUS-set bounds, I am a believer that it is usually helpful (a reaction to new changes).

Marco

The wealth disparity perpetrated by this Fed is remarkable, all while Powell feigned that he was concerned about the unemployed. Ha Ha.

Low interest rates with record job openings are a reason to keep rates at zero with a 6% inflation digging into the working and earning and saving People of this nation that make it tick?

The unemployed …the intentionally idle dont make this nation “tick”.

But Wolf’s chart of what has been happen suggest the employment concern was a gimmick to keep the big money flowing from one group of citizens to another…..intentionally.

https://wolfstreet.com/wp-content/uploads/2021/10/US-wealth-effect-monitor-2021-10-02_category-per-household.png

Not good for a society to have so much wealth moving to the “well invested”, yet the workers and toilers and the everyday citizen is going backwards by an ignited inflation, unaddressed.

The Covid market correction was a “black swan event ” and we survived it.

Looking at markets today I’m amazed things aren’t much worse.

Will 2022 be the year of THE crash?

What about 2021? The 2018 holiday crash is on everyone’s mind.

4 consecutive years of double-digit returns is very rare in stock market history. Besides 1995-1999, you’d have to go all the way back to 1949-52.

Most sell side analysts are forecasting single digit returns (~5000-5200) for next year.

If there’s any emergency – manufactured or not – that makes it politically possible for central bankers to ease again, 100% chance they would do it. If there isn’t, they’ll stay as loose as political pressure allows.

God I hope. Sooner this house of cards blows down, the better.

Like Japanese bubble, once you have blown it you can do like they did and try to work it off over 40 or 50 years or you can rip the bandaid off and see what happens.

Nope, not like Japan. Japan was the only (major) country with a bubble on December 31, 1989 when their stock market peaked.

Now the debt mania is global, there is a massive stock market bubble in the US, and a real estate bubble or mania in many local markets across the globe. Demographics are also worse or a lot worse in most and maybe all major economies.

Japan was able to “extend and pretend” since 1989 because the rest of the world bought their excess production. With all major economies either in a bubble or exposed to it, there is no one left to pick up the slack.

There is no escaping the consequences. The majority of Americans are destined to become poorer or a lot poorer for the indefinite future and the mania hasn’t even ended.

AF,

“The majority of Americans are destined to become poorer or a lot poorer for the indefinite future and the mania hasn’t even ended.”

Minimum basic income — that’ll fix it and get the votes too

Problem solved, I’m sure!

:)

The COVID correction was paved over with many, many trillions of dollars of printing – YUUUGE Federal Reserve action.

Given the inflation situation – do you still think the same will happen again?

Inflation is a political issue now.

Look out MONDAY!!!

That will be the thoughts of traders at about 30 minutes before the close.

What is making the markets drop today…and CRYPTOs……doesnt go away over a weekend, and could read much worse on Monday.

‘Fed may ramp up hawkish rhetoric’ CNBC

AI can probably produce hawkish rhetoric.

I am still pondering WR’s suggestion that Fed take policy rate currently at 0 to .25 to 4% in one year! That would kill inflation for sure. Overkill?

My suggestion was 3% – 4% (which would still be stimulative if inflation is 5%). But the Fed has routinely not done what I told it to do :-]

3-4% wouldn’t be stimulative for long, as inflation would actually be transitory after all, and go negative for once.

Bring it!

What percentage of the current 6% inflation rate do you think is attributable to temporary supply chain etc. factors vs. persistent?

If the child tax credit and other free stuff & govt handouts in BBB aren’t extended to 2023 and beyond, I think a relatively modest FFR increase to ~2% should be enough to get inflation under control by 2023?

With the real inflation at 15% to 20% I think we ought to bring back the Paul Volcker playbook. I think Fed funds were 14% or something like that. We had 18% mortgage rates and 21% prime interest rates. 14% would still be stimulative as the Fed funds rate would be below the rate of inflation. That would break the back of inflation and separate the men from the boys. Bring it on!

What you are describing with current debt levels would result in a massive deflationary depression. There is no way that most borrowers would be able to service any new or refinanced debts at anything close to those rates.

I also don’t believe the US can survive intact with your scenario. The real fundamentals are mediocre to terrible but just look somewhat to a lot better because of cheap money and the loosest credit conditions in history.

There has been a lot of social decay in this country since the late 70’s to early 80’s.

It’s my inference that at least some of the people in charge are aware of the country’s actual state. This is one reason this insanity has been pursued.

Augustus Frost

Total BS. I’ve never seen an economy worse than the one we are in now. I would take the Jimmy Carter economy over the one we are in now. And certainly the appointment of Paul Volcker who Carter appointed redeemed him in my book. I was able to buy a starter home here in suburban Maryland just outside of DC without going over my head in debt. At 10% mortgage rate to boot. If people can’t service their debt’s on overpriced crap and overpriced homes and trucks that they bought at near zero interest rates, that’s not my problem. That’s their problem.

The chance of the Fed increasing interest rates to 3% in 1 year is precisely zero.

The bankster masters of this country would never allow it.

Even beyond that, a jump like that would have a lot of effects like stopping home buying for the entire span. No one is going to buy a house (after the initial rush) when prices are falling continuously due to mortgage payments steadily increasing via higher interest rates.

Another impact would be on the US debt. What would an increase of Treasury bill and bond yields to 4% – 6% mean to the $28 trillion of federal debt? We’re talking reversion to Treasury yields from more than 20 years ago, but with $22 trillion plus more debt.

c1ue,

The impact of rate hikes on the US interest payments are fairly small. Debt that matures within a year or two would have to be replaced in that time frame, and new debt added will carry higher interest rates, the rest would not change. So it’s not $28 trillion that would go up in costs. It’s a much smaller portion.

But a good part of this maturing debt would be 7-year- or 10-year or 30-year notes and bonds that may have a higher coupon rate, based on yields in the years they were issued in, than the debt they would be replaced by. This would actually save the government some money. Other debt with lower coupon rates would be replaced by higher-coupon debt, and that would cost the government a little more in interest. And short-term bills would cost the government more. But all of these adds-and-subtracts are relatively small fry in the gigantic government budget. So the additional interest expense from higher rates is not anything I’m worried about.

But interest expense has been soaring because the Federal debt has soared by $10 trillion with a T, or by 56%, in just 10 years. That’s why interest expense is soaring.

“But the Fed has routinely not done what I told it to do :-]”

since about 2008

But the greater question is “who is the Fed listening to?”

Certainly they are not using their mandates as their guide….

Never have Fed Funds been so far below the inflation rate….

It is remarkable the lack of blowback on the Fed. Seems everyone in “power” is fully invested and dare not rock the canoe.

What dink-heads they are, Wolf. If the income side of the equation is rolling over as we head into another potential Covid variant economic decline AND the spending side is still exponentially growing, then it is more than likely knowing the American attitude toward cheap debt, THE DEBT BUBBLE AT THE CONSUMER LEVEL just keeps on growing and growing.

The old fable about the Ant and the Grasshopper comes to mind. I think price sensitivity in autos and housing is starting to take hold, Wolf, as the income side becomes more constrained by End of Freebies, inflation eating everyone’s toast, and economic activity starting to ebb due to many reasons, a burnt out rocket running out of fuel for one. New mutant strains of Covid from S. Africa don’t help.

American Consumers are like the Road Runner cartoon: keep spinning their wheels when they have already gone over the financial cliff with debt fueled spending.

OMG: woke up, Dow down 900. Maybe Powell said he likes WS?

No. Covid 6.0

In addition to the stimulus, many saved a huge amount of money during the lock-down: commuting expenses, office clothing, make-up, eating out, car maintenance, fuel, etc. now just itching to spend that money (me included, but I won’t due to the inflated prices on the items I want).

Itching to spend? :-)

What I have noticed is a permanent change in habits with reluctance to ever go back to old behaviours. (Canada) I suppose it is a difference in culture and way of doing business. There seems to be an almost irrational belief the pandemic is over in many states, without consideration that cases are once again on the rise even before this Thanksgiving holiday of gathering and close association.

I don’t see the economy returning to normal for one main reason. By the time the pandemic turns endemic, the effects of personal, corporate, and Govt debt running up against inflation and inflation’s cure of higher interest rates will ensure a large contraction.

I will be first to admit I might be wrong, but I just see almost everything these past 10 years as unsustainable. The bailouts started with TARP, were deemed necessary for the next 8 years, and debt…all debt has increased in a supposed great economy. And now people are worried about inflation? Seems a bit late to me. What did they think would happen?

If the economy is great, it does not have to be financed with QE and stimmies; then and now.

Have a great holiday you guys. Elsewhere it’s just a regular day and I am forever thankful it is that. Of course we are on flood watch and just got our power back, but whatever. Folks are quite prepared around here.

Did you look at Wolf’s chart above?

Consumers accounted for $14 Trillion in spending.That’s a lot of make-up and commuting.

A rush to consumptive buying due to inflation and shortage fears….

this may burn itself out…

Fed will jawbone and do less than they say and later than they say.

Red…

Indeed. They already have done less. Nothing. 6% inflation and they back off the stimulus…..a bit?

And the futures this Friday morning are suggesting no rate hike until 2023, and only 1/4pt? As inflation runs hot!

Where is the Sentate banking committee? Oh, they are passing Trilion dollar misnamed spending bills. Why would they want higher rates?

This will all end in tears & ruin, this is 1929, 1999 & 2008 combined, the fact total income is flat with 2.4 million additional workers is telling, this reaffirms my belief that all numbers are manipulated, either by design or by distortions from the last years policies.

I believe commercial banks are doing what they did 2008 & loaning out massive amounts that can’t be repaid, the credit scores have been artificially raised due to debt holidays, something very bad is coming I can feel it, the Fed is trapped & China is wobbling.

Fannie and Freddie to back mortgages up to $1 million

Maybe everyone should watch the movie “The Big Short” again..

Every Fed policy is designed to fluff stocks and real estate, the possessions of whom, exactly?

And as they do, the pull up the ladder on all those who CAN NOT save to buy (inflation), and have the prices run away from them (inflation) as mortgage rates are still 3% below inflation, courtesy of the Fed.

You forgot the one in between, the one where the Fed and Congress learned they could subsidize bad behavior in the lending markets. The oft forgotten Savings and Loan crisis of the 1980’s. All of these crises have been a teacher to the powers that be. They have all learned that the printing press fixes economic failures, and screw the poor, let them deal with the fallout.

Next year is going to be very bad for a lot of people with limited or no income. New medicare rates go into effect, cutting social security income for many. Student loans start up again in February. And those supposedly higher wages just don’t exist for most.

The retail crime wave going on right now is no surprise to me. I expect it to continue going forward.

Geeez Wolf, you could have at least waited unti tomorrow to tell us this so we could pretend that we had something to be thankful for today.

The attitude is we will take our medicine tomorrow, but tomorrow never comes willingly. Maybe inflation is the medicine we all are going to be forced to take. When it gets serious, you have lie. Spoken like a true government official.

Old School

Like the sign says “Free Beer Tomorrow”

Central bankers have interceded Free Markets, and have prevented corrections and cycles that flush excesses. These events of a free market serve a purpose……that is why corrections are called corrections.

The Fed has been hijacked, IMO…..and answers NOT to its mandates, instructions, and agreements that ALLOW their existence…BUT TO ANOTHER “drummer”……who? why?

100,000 deaths by Fentinal overdose is no surprise to me.What did they think would happen to the working class population when they shipped all the manufacturing overseas?

People need purpose

rank-well said. Perhaps national loss of purpose is the inevitable historic disassembler of any highly-successful empire…

may we all find a better day.

Today I give thanks for Wolf, one of the few brave voices to speak the truth against our billionaire masters and their puppets in the FED.

The demand is overwhelming support which is the so called supply imbalance. As demand lessens the supply chains should start to fill up again in the next year.

What is not stated is that the labour participation rate is still not returned as it has in Canada and if it continues slow in the USA then wage inflation combined with a better balance in supply/demand then inflation is likely to come in lower next year. In the USA it is most of the low wage service section which has lower bargaining power so wages are not likely to increase as much and that should reduce labour cost push inflation. Auto production is to increase next year so pricing will be more competitive and lower some inflation expectations. I am not an economist but if the high inflation continues it does not seem to be reflected in the bond market in the inflation protected bonds. The bond market is trying to be one step ahead of possible Fed action but it has been wrong many times. We all can see the inflation and distortion in rates at this time but predicting the future is not likely the current trend for the next year.

Bonds might be anticipating demand destruction as wages and stimmy don’t keep up with the cost of living..

You can only squeeze a finite amount out of an orange.. When there is no more, there is no more.

Major policy error over the long run. Sort of like how they managed the forest telling the loggers sustainable yield and that the trees would never run out.. Then they did. Now they call sticks trees because that’s all they have to log.

And the lack of forests contribute to fire conflagration, lack of water in the rivers and the globe heating up.

The Fed will probably start raising rates after the midterms.

Exactly why rock the boat earlier then you need to let the good times roll.

If wages fall behind inflation, inflation will rewind.

If wages match inflation, inflation will be a one-of.

If wages run ahead of inflation, inflation will increase.

Not rocket science, just math.

What’s happening now was done 12-18 months ago.

Fed and Treasury have been busy since, and what they’ve done will show up next year.

Charts above are not headed to accelerating inflation IMO but I’m not betting yet.

I found this a refreshing comment in the WSJ today 11/26

“According to St. Louis Fed data, the money supply (M2) increased by

an average rate of 20% in the two years ending this past October. It is

therefore no surprise that inflation is surging right now and that there

is more to come. Yet in all the Federal Open Market Committee statements published this year, the word “money” is not mentioned a single time. How can the Fed conduct a sensible and coherent monetary policy without ever looking at money?

ROBERT HELLER

Belvedere, Calif.

Mr. Heller was a governor on the

Federal Reserve Board (1986-89).”

People who consider debt as spendable income will not be phased initially by inflation. Pretty much the whole country.

Exactly. They get to use the checking account of the entire country plus the checking accounts of future generations. What’s not to like?

Monkey

If the millenials and genx knew the debt burden and the financial environment being created for them by these Fed policies, they would turn from “Green” concerns to Financial concerns.

It used to be incumbent on every generation to pays its debts….this Fed has tossed that all aside.

Historicus-debt is debt, be it economic or environmental. We consume more of what’s left of our species’ planetary seed corn (breathable air, freshwater, food-productive soils/oceans) with insufficient awareness/service/reinvestment every single day…

may we all find a better one.

The economics of being a full time wage earner stopped making sense a good while ago, for the capable.

I quit my profession 13 years ago, and have been building my property ever since, with about 1 year’s worth of part time work in there. I am in a better position financially (including property value) than colleagues who got promoted, stayed working for all that time, and paid a mortgage.

This is literally the death of civilization – it no longer pays a capable person to specialize, but to do almost all one’s own work, like building, repairs and growing some food. Of course, not everyone can design and build their own home, or would enjoy it like I do. However, society is stuffed because I was in a shortage profession, and the shortages and the standard of the people who now do it gets ever worse.

What I suspect is that Covid layoffs have given a lot of people the time to examine whether full time work made sense any more, and like me a fair proportion have decided it doesn’t.

Thanksgiving in 1976 (Nov 25 too) was much more cheerful.I watched 50th Macy’s Parade in NYC on b&w TV,Rod Stewart and his “Tonight’s the Night” was on every radio station…

Today not a mouse stirring.Duck & cover everybody ! And watch the stocks soar !!!

Eventually,in the long run,stock market wealth will trickle down and soak even those who dont own stocks.

Just one interesting thought. At our pawn shops we have record retail sales (IE, people are spending), and record borrowing (IE, they aren’t earning enough). In the past they would either buy thing OR borrow, not both. So, I’m seeing it a bit as a coke addict hitting peak performance before their decline sets in. You’re still upping the dose, you’re still earning, but you’re going into debt to make it happen.

At some point it falls apart. The inflation is going to keep coming, but the real economy is weak.

That’s interesting. Could you tell us in more detail?

Are they pawning jewelry and buying tools?

Only half true. Most pawn shops still have a depleted loan balance. My shops loan balance is down about 40%. My sales are up almost 50%. Industry forums claim the same thing

1) Crude oil futures price is down to $78.

2) Deflating oil prices increases the “real PCE”.

3) Oil prices are falling despite the increase in Thanksgiving travelling. Oil inventory was builtin prior to Thanksgiving. The spike might be over.

4) The real consumer spending is rising, because workers in the

black market are spending money.

5) Per Capita real disposable income is falling, because workers in the black market don’t declare their income.

6) If u add 10M-20M black market workers to the labor force it will reduce the “real” disposable income even further.

7) The real labor force will spend less, per capita, during Xmas season.

8) There are all kind of “entities” that do not “practice” Xmas. Their

number is growing.

3) oil prices are falling? $10 gas is not pumping enough to get to the station these days?

6) What do you mean by “Black market”? Employers are using labors without reporting them in the actual payrolls to evade taxes and SS? So, they are really exploiting?

8) Holiday season is for all. Xmas is one of the holidays celebrated during that period. There are 3-4 holidays celebrated in pagan traditions. If majority are atheists, why celebrate Xmas?

RE: 3) Thanksgiving Day driving has absolutely no impact on today’s crude oil price. Oil prices are set by traders buying and selling futures contracts all over the world.

Most of the world does not celebrate Thanksgiving.

Our Pres (JB) releasing 50 MM BBL crude oil out of the SPR is a political stunt. That oil, of which 32 MM BBL is loaned out, won’t see a refinery for at least a month or longer. 50 MM BBL oil is about three days needs in the U.S, and not all of it goes into gasoline and diesel.

Happy Thanksgiving! Don’t be a #Turkey. Trade those liras for dollars.

The Fed will never stop printing. Perhaps in fits and starts as they take a break here and there but long term the printing will only accelerate.

They will also raise rates a tiny amount but will immediately reverse those raises when the markets inevitably tantrum. This will allow them to say “see we tried raising them but that impacted our shadow mandate – propping up equities”. After all, equities are the new bonds, the new store of value. This dog and pony show of miniscule rate raises followed by immediate reversal will be repeated every so often as Fed theater.

This Thanksgiving I had the opportunity to visit my 3 yr old grandson near Union Station in Washington D.C. The magnificent architecural Union Station was surrounded by a homeless incampment of tent cities, It was worse than anything I’ve ever seen in the Nation’s Capitol. What a disgrace. When are these local politicians going get off their sorry a$sses and do something about this.

Something will be done about the homeless in DC just about the time something is done in the rest of the country.

What does “something” look like?

Moving the tents someplace you don’t have to see them?

Finding homes for the homeless?

Making things worse so they all starve and die off?

I think there will be many more homeless in the years to come.

“I think there will be many more homeless in the years to come” No doubt about that Happy Thanksgiving

MadMax just around the corner

Which will force people to be squatters theft rises chaos comes when no food available strong survive

City of DC mayor and governor officials makeore than president and Congressional members if I am notistaken. You can see you don’t always get what you pay for.

Yes, but congress critters get to do insider trading, so that makes up any shortfall!

Thanks Wolf for all you do to keep this place a fountain of wisdom and pursuit of the truth. Tis a treasure to be thankful for.

doug

“congress critters get to do insider trading”

don’t forget the Fed governors……who walked

Washington DC doesn’t have a Congressional representative, though that might change. Homeless problems are often a matter of pass the buck. Cities give homeless people money to leave town. The scene in DC may be allowed to continue for political benefit. FDR hired photographers to make the Depression look worse than it was. Now if you send a newsman out in the homeless crowd, where are you folks from? Now that gets interesting. If you are homeless and you want to make a statement, you could camp out next to the DC monument. When you say they ought to do something about it, you have no idea what you are asking for. Maybe someday we will have a society where everyone gets three hots and a cot, and it doesn’t involve jail time.

Sorry Wolf if I’m not ‘heroic enough’ to spend as per all the market titan$×.gov phuckwad$..

A rock can only be squeezed so hard before it metamorphosis into crumbly shitzt! ‘;]

Happy turkey D a y to u & your’s

Evening Wolf. At dinner at a friend’s, we discussed the supply chain. I told them the story of Wolf Street mugs being unavailable and the story was well received. Shortages hit in unusual situations.

Food is still plentiful around here near Chicago, prices for most goods are slowly increasing, nothing drastic however, shelves are not stocked as deep.

We’ll get through this with a few aches and pains and I have confidence in the free market, less so with the government.

beef tenderloin Costco

last year 19.99 lb

this year 29.99 lb

You can still buy pork butt roast for 99¢ per pound and sweet potatoes for 25¢ per pound at Food Lion in NC if you are there at the right time. Properly cooked pork butt is some good eating.

Donation coming 1st of the month.

Happy Thanksgiving!

No turkey for me here in Thailand. Wife made poached fish and assortment of strange weed-like vegetables. Healthy but a hedonic fail.

Same here in Turkey No Turkey or Liras for me Think I’d skip the weed like veggies though 😀

Does average person save in gold and dollars or Euros in Turkey?

All of the above I think. Real estate prices are off the charts as well

Had a great Turkey dinner, my daughter made, from Whole Foods. Need to keep Jeff Bezos (who owns Whole Foods) living in the lifestyle he is accustomed to, while the rest of the population can eat crumbs. Have enough leftovers for the next 3 days. I’m sending a small donation to Wolf to thank him for the excellent data he provides on his Website and providing a forum to vent my frustrations.

Had a quiet Thanksgiving eve with a yummy bird with tourtiere stuffing a la my Montreal granny.

BOUGHT A LITTLE GOLD AND SILVER as Biden/fed reserve vaccine.

Got plenty of .40 S&W.

The fool on the hill

My son sold me nearly last of his silver stash (about $2000 this time). We have an agreement that I will pay 4% above spot anytime he wants to sell.

I’m going to be selling some silver shortly as I have it in storage and want to have physical in my possession over here I will be in Raleigh in late December if you’re interested It’s Pan American 100 Oz bars and I purchased it in 2006

We don’t need another hero

We don’t need to know the way home

All we want is life beyond

The thunderdome

Looking for something

We can rely on

There’s gotta be something better out there

Love and compassion

Their day is coming

All else are castles built in the air

And I wonder when we are ever gonna change

Living under the fear ’til nothing else remains

If Per-Capita “Real” Disposable Income is not increasing then there is little chance of ‘cost push’ inflation?

Disposable income limiting inflation? Naaaaaa. But maybe when people’s debt limits are about to burst like an overly engorged pustule.

No wait… this is AFTER inflation. This is what you get with massive inflation, that it outruns wages gains. Large wage gains lead to even larger inflation. That’s one of the reasons why inflation is such a shitty thing once it takes off. And it propels the cycle further.

There is theory that the more the government spends the slower real growth you have because the vast majority of government spending does not generate a positive cash. Look at Japan.. Look at Europe. Super slow growth and super low interest rate.

Cost push inflation is a fallacy, used by Central banks to dupe consumers into believing that inflation is anything but a “monetary phenomenon”.

Wolf,

I’ve been reading you for years – I love your work. Thank you.

Have you had the urge recently (perhaps after a long night of drinking) to start typing in all caps that the entire thing is rigged only to go higher and the media has sold its soul to the Fed and this can go on indefinitely and cryptos are a liquidity trap?

I am “that guy” at work people ask about when they want to talk about the “market”. Its normally done via email and recently I keep having this urge, I am not sure I can control it anymore.

I disabled the CapsLock key on my keyboard for that reason ;-]

WTIC backbone #1 : Feb 18 hi/ 19 low, – 62.29/ 58.60, – led to the

buildup for China’s Oct Golden week and Thanksgiving.

BB#2 : June 16 high/ 17 low, 72.99/ 69.77, – led to BC/ AR, SOW

and the jump to 85.41 on Oct 25 2021.

notice WTIC jan/Feb 2021 Lazer.

I would agree with Wolf’s supposition that stimmie and UE benefit spending has now given way to those who got PPPs, EIDL $$$. It has been confounding me for the past several months, but that now makes sense.

I suspect those funds (PPP / EIDL) have a long way to run.

for entertainment purposes only.

DX 15min : a plunged.

DX weekly : the flip 9/20, DM #9 last week.

The current weekly DX : a shooting star with a large selling tail.

May all the decimated natives RIP. It was not personal I hope.

So this is the national high end smash and grab. I wouldn’t be suprised if these events were marketing ploys. The crooks drive around the block and put the merchandise back in stock, the company gets free advertising and sympathy. The Fed is no different. They taek back a bit of Wall St booty; zero interest rates and plenty of free cash on the books of the banks, and then put in back through the REPO window. Liquidity never ends, and cheap liquidity is the protean base of that. Are you lending it out, well of course. To our trading desks. I support institutional corruption, although the rules there are that personal greed and avarice are meant to be punished. Now that consumers are an institution we have a path to prosperity. Does the Fed really have OUR back? So far so good on inflation, wages are driving it, and labor market participation fallls in line. The Fed has hinted they understand that. Now they box Powell in, Brainerd as Vice Chair of banking regs, a Marxist running OCC, should get interesting. Regulate Crypto? Not while the ponzi gains are being recycled back into the real asset markets. Pandemic restrictions in China and Europe are weighing. Throw off your masks, and let’s see who you are? Smash and grab heist men!

Real Personal Spending y/y will be up on Mon, that’s why stocks are

down this Fri.

My wife and I went shopping for pillows on black Friday. Even down is up.

I’d like to see a graph of the politicians’ after- inflation-income.

Wolf,

Your second-last paragraph ends with a colon and a reference to a graph following, but there is no graph between the last and second-last paragraphs:

“For the months, and after inflation, spending on all three major categories picked up: Durable goods (+2.0%), Non-durable goods (+0.4%), and services (+0.5%). The green line shows the pre-pandemic trend: [sic]”

Making my annual donation to Wolf Street now… Happy holidays!

Thanks and thanks. In terms of the phrase “The green line shows the pre-pandemic trend” and the colon: clearly, I moved something around or changed something, and that line was left dangling and abandoned on its own. The “real” consumer spending chart is above. I don’t remember what I did to garble this. But it seems there is no chart missing, just a phrase that was left dangling.